Power of partnership

Grow your business with CrossCountry Mortgage

America’s #1 Retail Mortgage Lender

Thanks to our industry-leading loan officers and team, we’ve achieved a lot in a short time since 2003. We’re constantly finding new ways to win by building strong partnerships, innovating with cutting-edge products, and creating proprietary technology

MERCER COUNTY

COUNTY

HUDSON COUNTY

COUNTY BERGEN COUNTY MONMOUTH COUNTY

OCEAN COUNTY

$15,000

PASSAIC COUNTY

Buying a home can be stressful and expensive for your clients

but it doesn’t have to be!

Overview:

•

•

•

•

•

620 minimum credit score

• First-time homebuyer primary residence purchase

Loan is 100% forgiven if they live in the home at least 5 years without selling, refinancing, or defaulting

Available for new construction

DPA must be paired with a conventional, FHA, VA, or USDA first mortgage obtained from an NJHMFA participating lender (like CCM!)

Income and purchase price limits apply

CrossCountry

Mortgage has more products for more buyers

NON-QM

Full Doc

(CCM SIGNATURE EXPANDED)

Financing beyond traditional guidelines for those in unique financial situations

Bank Statement

Self-employed borrowers qualify using bank statement in lieu of tax returns

Investor Cash Flow (DSCR)

Qualify using solely rental income to finance an investment property

Asset Qualifier

Qualify for a mortgage solely using your assets

Foreign National

Financing for a vacation or investment property in the US without living or working in the US

1099

Secure a home loan using your 1099 income forms

Profit & Loss (P&L)

A solution for business owners to qualify using professionally prepared P&L statements

Written Verification of Employment (WVOE)

Qualification using only a written verification of employment

NON-TRADITIONAL PRODUCTS

Bridge Loan

Carry equity from current property toward new purchase, 4-month interest only with no payments collected

ADU

Allows ADU rental income to help qualify or to consolidate ADU construction costs with a rate and term refinance

LLPA Waivers

More affordable loan options for qualified first-time homebuyers, those buying manufactured homes or in designated rural areas, or those making energy-efficient upgrades

RENOVATION

FHA 203K

Buy a home and borrow additional funds to add on or improve property

VA Renovation Loan

Homebuyers can make repairs or improvements to their property that includes up to an additional $50,000 in funds for renovations

USDA Renovation Loan

Buy a condo, townhouse, or single-family property in a rural area with 0% down

Renovation HELOC

A home equity line of credit for home

renovations that allows you to borrow based on the post-renovation value of your home

NEW CONSTRUCTION

FHA Construction

Build a new home with as little as 35% down and standard FHA guidelines

Conventional Construction

Combine the purchase of a lot and building costs into one transaction, with the rate locked up front and interest reserve options available

VA Construction

100% financing for qualified Veterans and no payments during construction, with loan amounts up to $2 million

Investment and Second Home Construction

Single-close construction loan options available for single-family homes, income-generating investment properties, or vacation/second homes

STANDARD PROGRAMS

Conventional Fixed and adjustable-rate mortgages with flexible terms; best for those who can pay 3% or more in down payment

FHA

With down payments as low as 35% and higher DTI limits, this loan option is great for borrowers with less than perfect credit

VA

100% financing with no down payment requirement available for Service Members and Military Families

USDA

Offers rural homeowners up to 100% financing Jumbo

With as little as 10% down and no mortgage insurance, we offer flexible jumbo options for high-cost homes

SPECIALTY GOVERNMENT PROGRAMS

FHA HUD $100 Down

Put as little as $100 down to purchase HUD-owned homes

FHA Good Neighbor Next Door

Hero program for HUD-owned properties allowing eligible borrowers to purchase a home in revitalized areas at a 50% discount

Section 184

Special financing for properties on Native American land for enrolled members of a federally recognized tribe

UNIQUE FEATURES

Temporary Buydowns

Gives buyers a lower rate and lower monthly payments at the start of their loan

Down Payment Assistance Programs

Helps buyers get into their dream home with little money down

Buy Now, Sell Later

For those looking to buy a new home before the sale of their current property

Delayed Financing

Buy a house with cash, then finance it after

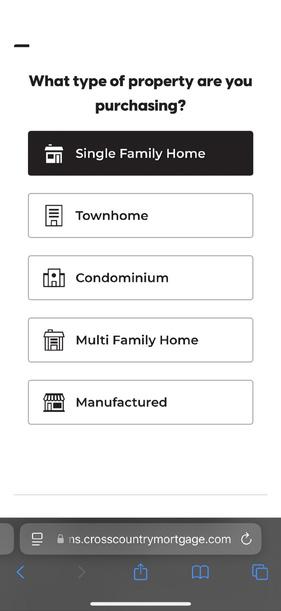

Getting pre-approved

Your clients’ first step to homeownership

What is a pre-approval?

A pre-approval letter sets your clients apart from the competition When they’re pre-approved, they have an advantage over other home shoppers and if they put in an offer immediately, it could get accepted faster.

Don’t be an expert — Be a TOTAL EXPERT

Amp up your marketing

Make Total Expert your source for easy co-branded marketing materials between you and CCM In just a few minutes, you can:

• Create marketing collateral for print, web and social media

• Market to potential clients from events with our lead capture apps Set up property flyers to use at your open houses

•

• Create single property websites to market your listings online

• Target specific neighborhoods with our EDDM postcards

Selling your listings just got easier

TE is a complete marketing operating system

Here’s what’s possible:

• Single property sites showcase the logistics of a home, including dimensions, purchase price, detailed images and locations all in a live website.

• Printed flyers describe a home, various financing products and programs, and the homebuying and mortgage processes to inform your buyers of what we can offer them.

• Lead capture apps allow us to gather information from open house visitors so we can follow up with them afterward to gauge their interest

CCM Marketing

Where innovation meets execution

As a partner, you get more than just a powerful array of products at your fingertips. You’ll also have our full-service, in-house marketing team to help you get the word out.

What you get:

Full-service team Design, video, copy, strategy, media we have your marketing needs covered!

Breakthrough campaigns Our expertise helps you stand out in the competitive market

Seamless collaboration Tailored marketing support specifically focused on the success of our partnership, bringing your vision to life

Proven results We track and measure our impact to ensure successful results

What we do:

•

•

•

•

• Digital (web, CRM application, co-branding portals, email)

Lead generation & direct-to-consumer

Events & experiential marketing

Social media campaigns

PR & community relations

eting pliance

Creative: Design, Copywriting & Video

Digital: Web, CRM Application, Co-branding portals, Email

Lead Generation & Direct-to-consumer

Events & Experiential Marketing

Home sweet home

Why work with CCM?

We’re committed to making home financing simple, personalized, and accessible

Here’s how we stand out:

Wide range of loan options

We offer over 120 mortgage solutions to fit your unique client needs

Personalized, hands-on service

We pair your client with a local loan officer who provides one-on-one guidance

Flexible qualifications for all financial situations

We work with borrowers with complex financial situations, low credit scores or non-traditional income sources

Streamlined process with minimal overlays

Our in-house underwriting, appraisals, and condo assistance ensure faster approvals and fewer delays

Zero down payment options

We make homeownership more affordable for more of your clients.

CCM team

Nick Mink

Originating Branch Manager

NMLS112903

M:856.465.7389

Enick.mink@ccm.com

W: ccm.com/Nick-Mink 306 W Cuthbert Blvd,Suite 201 Haddon Township, NJ 08108

Megan De Tore McDermott

Originating Branch Manager

NMLS90194

M:973 534 3409

E:megan@ccm com

W: ccm com/Megan-McDermott 5 East Main Street, Suite 28-B Denville, NJ 07834