10 Cryptocurrencies to invest in India 2024

Cryptocurrencies continue to evolve and reshape the financial landscape in 2024, with both traditional and decentralized financial systems taking note of their impact Cryptocurrencies are digital or virtual assets that use cryptography for secure transactions, offering a decentralized alternative to traditional banking and financial systems.

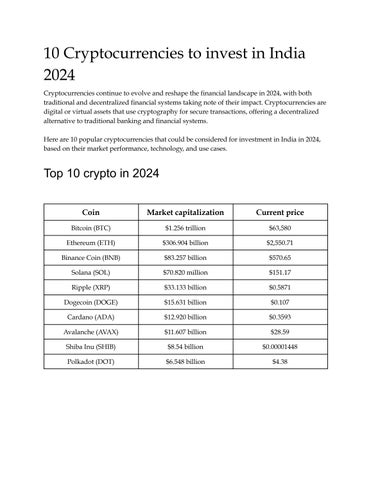

Here are 10 popular cryptocurrencies that could be considered for investment in India in 2024, based on their market performance, technology, and use cases.

Top 10 crypto in 2024

● Overview: Bitcoin remains the dominant cryptocurrency and is often viewed as a "store of value" or digital gold. It's widely accepted and has the highest market capitalization, providing it a strong position as a relatively stable investment compared to altcoins. Institutions are increasingly interested in Bitcoin, driving its value upwards

● Over plications (dAp ce (DeFi) and non- ion to Proof of Sta eeping it a top contender for long-term investment

1. Bitcoin (BTC)

2. Ethereu

● Overview: BNB is the native token of Binance, the world’s largest cryptocurrency exchange. It is used for transaction fee discounts on the platform and has various other utility cases within the Binance ecosystem. BNB’s growth is tied to the success of Binance and its adoption of decentralized finance platforms.

● Overview: Solana has gained attention due to its high-speed and low-cost transactions, making it a favorite among decentralized applications. With a focus on scalability, it’s often considered a competitor to Ethereum for decentralized finance (DeFi) and NFT markets.

3. Binance Coin (BNB)

4. Solana (SOL)

● Overview: Ripple is focused on enabling fast and low-cost cross-border payments. It has partnerships with major financial institutions globally, positioning it well for mainstream adoption However, Ripple’s ongoing legal battle with the U S SEC has caused some volatility, but if resolved in its favor, it could boost XRP’s value significantly.

● Overview: Originally created as a joke, Dogecoin gained massive popularity, especially due to endorsements from figures like Elon Musk. Despite being highly speculative, it has a strong community and has seen adoption in various real-world transactions, making it a fun, albeit risky, investment

5. Ripple (XRP)

6. Dogecoin (DOGE)

● Overview: Cardano is a proof-of-stake blockchain platform focused on providing more secure and scalable infrastructure for the development of decentralized applications. It’s recognized for its research-driven approach and has a strong academic backing. Its focus on sustainability and long-term growth makes it an attractive investment

● Overview: Avalanche is another competitor to Ethereum, offering a fast, scalable platform for dApps It is known for its low transaction fees and has gained attention as a more eco-friendly alternative to other Layer 1 solutions. It supports DeFi and NFT ecosystems.

7. Cardano (ADA)

8. Avalanche (AVAX)

9. Shiba Inu (SHIB)

● Overview: Shiba Inu, much like Dogecoin, started as a meme coin but has since grown into a serious project with its own decentralized exchange (ShibaSwap). While highly speculative, it has a strong community backing and has seen massive price spikes, making it popular among retail investors

● Overview: Polkadot is focused on enabling different blockchains to interoperate, which is crucial for the future scalability and growth of blockchain technology. Its ecosystem supports parachains, offering flexibility and innovation in blockchain development Polkadot’s strong team and technology make it one to watch in the long term

10. Polkadot (DOT)

These cryptocurrencies are some of the most promising based on current market performance and their underlying technology. However, the cryptocurrency market is highly volatile, so conducting your own research and considering your risk tolerance is crucial before investing.

How to buy cryptocurrency

Here’s a step-by-step guide on how to purchase cryptocurrencies safely and efficiently:

1. Choose a Cryptocurrency Exchange

The first step is to select a reliable cryptocurrency exchange where you can buy, sell, and trade cryptocurrencies Popular exchanges include:

Centralized Exchanges (CEXs):

● Binance: Known for its wide range of cryptocurrencies and low fees

● Coinbase: Offers a user-friendly interface and strong security features, ideal for beginners.

● Kraken: Provides advanced trading options and is known for its security

Decentralized Exchanges (DEXs):

● Uniswap: Allows you to trade Ethereum-based tokens without a centralized authority.

● PancakeSwap: A popular option for trading Binance Smart Chain tokens

● 1inch: Aggregates liquidity from various DEXs, providing better trading rates.

2. Create an Account

Once you've chosen an exchange, you need to create an account. The process typically involves:

● Sign-Up: Provide your email address and create a strong password

● Verification: Complete identity verification (KYC) by uploading a government-issued ID and sometimes a selfie This step is required by most regulated exchanges for security and compliance purposes

● Two-Factor Authentication (2FA): Enable 2FA to add an extra layer of security to your account

3. Deposit Funds

To buy cryptocurrencies, you need to deposit funds into your exchange account. Most exchanges offer multiple options:

● Bank Transfer: Directly transfer money from your bank account. This method might take a few days, depending on your location and bank.

● Credit/Debit Card: Instant deposits are possible, but they may come with higher fees

● PayPal or Other E-Wallets: Some exchanges support PayPal, Apple Pay, or Google Pay for easy and fast deposits.

4. Choose the Cryptocurrency to Buy

After depositing funds, select the cryptocurrency you want to buy. Popular options include:

● Bitcoin (BTC): The first and most well-known cryptocurrency

● Ethereum (ETH): Known for its smart contract capabilities.

● Altcoins: Thousands of other options are available, each serving different purposes, like Solana (SOL), Cardano (ADA), and more.

5. Place a Buy Order

Exchanges offer different types of buy orders:

● Market Order: Buy immediately at the current market price.

● Limit Order: Set a specific price at which you want to buy The order will only execute when the price reaches your set level.

● Recurring Purchase: Some platforms allow you to set up regular purchases, enabling dollar-cost averaging (DCA) to reduce the impact of market volatility

6. Secure Your Crypto Assets

Once you ’ ve purchased your cryptocurrencies, it's crucial to secure them:

● Leave on Exchange (Short-Term): Suitable for active trading but risky for long-term storage due to potential security breaches

● Move to a Wallet (Long-Term): Transfer your assets to a personal wallet for better security.

● Software Wallets: Apps like MetaMask, Trust Wallet, or Exodus offer convenient access to your crypto on your phone or computer.

● Hardware Wallets: Physical devices like Ledger or Trezor provide an additional layer of security by storing your private keys offline

7. Stay Informed and Monitor Your Investments

Cryptocurrency markets are volatile, so staying informed is crucial:

● Use Portfolio Trackers: Apps like CoinGecko or CoinMarketCap allow you to track your portfolio performance.

● Keep Updated with News: Follow reliable sources to stay updated on market trends, regulatory changes, and new developments in the crypto space.

8. Understand the Risks and Regulations

● Market Volatility: Prices can fluctuate rapidly, so only invest what you can afford to lose

● Scams and Phishing Attacks: Be wary of unsolicited messages and never share your private keys or passwords.

● Regulatory Considerations: Different countries have different regulations Ensure you're compliant with local laws regarding cryptocurrency purchases, taxes, and reporting.

Conclusion

Buying cryptocurrencies in 2024 is straightforward but requires careful consideration and security precautions. By choosing the right exchange, securing your assets, and staying informed, you can navigate the world of crypto with confidence. Whether you ’ re a beginner or an experienced investor, understanding the process and risks involved is key to a successful crypto investment journey

Please note that cryptocurrency investments come with high risk, and it's crucial to do thorough research and consult a financial advisor before investing.