“With all the news about the prices of our mobile devices and the way a supply chain works, technology is never a more pertinent topic today than it ever was. Welcome to our March-April issue where we spotlight on technology.

“With all the news about the prices of our mobile devices and the way a supply chain works, technology is never a more pertinent topic today than it ever was. Welcome to our March-April issue where we spotlight on technology.

The breathless pace of news and new tech things affecting the way we operation as businesses, and how we respond as professionals has been seismic. How we respond as professionals as our tools change and demands pivot affects everyone. That is the theme of this issue, where we explore innovations in technology, around supply chain and logistics

Change reveals risk, both anticipated and unintended, with the team from Moody’s Analytics, we look at this topic Value at Risk (VaR). An example to illustrate why the application of VaR is useful can be seen here. With Trump introducing tariffs at never-seen before numbers, a VaR exercise can help an auto manufacturer understand the impact on car sales from rising steel and aluminium prices due to tariffs. Understanding VaR can help a car manufacturer decide on resource investments for mitigation, such as purchasing steel and aluminium from other sources of an expected introduction of tariffs when the 90 days pause expires.

Still on the topic of cross-border trade, we take a look at Trade Compliance and its importance to businesses who operate globally, how is one to stay within the right side of all the laws and regulations, in an interview with an expert from the industry, and for professionals seeking to find a career in this field, given all the attention on trade restrictions are in the spotlight, read to get tips.

While all of us are familiar with the friendly delivery guy who hands you your shopping package or leaves them safely at your doorstep, there are also many infrastructure hurdles to a perfect last-mile drop-off. We examine how drones and unmanned vehicles might be helping players directly meet consumers’ needs in getting their shipments faster, without the limits of size and content.

The introduction of such deliveries is particularly important when the path to reach the final stop is not as accessible, so the areas currently underserved due to connectivity become addressable markets too.

Our section on Business and Economy looks at how low-cost retailer Shein upended the cycles in demand and supply through approaching it from a digital first perspective, reading about the innovative ways AI is helping retailers plan out their supply chains and logistics’ needs.

Since China invested into building the Belt Road Initiative (BRI) back in 2013, we are now seeing in Southeast Asia, a possibility of connecting cargo on rail through all the land-connected countries, giving businesses options beyond airfreight and seafreight. If anything, we know from recent years that airfreight and seafreight is too easily upended with stuck ships and weather extremities, so having rail as an option, is a good development.

In the sustainability section, we examine Malaysia’s chairmanship of the ASEAN group and what it means for green initiatives spearheaded by the group. Read about what could be expected in terms of initiatives and commitment to a greener future from the Southeast Asian countries.

On the people front, as digital twins get increasingly viewed as a step in enabling full visibility, we look at the implication of this on the supply chain worker.

Finally, the Luxury market is where the supply chain, while hidden, reveals to us how demand is changing as consumers switch up and down as the general economy slows.

For editorial inquiries, contact editor@valuechainasia.com

Sincerely,

Wee Wee Chia Co-Editor-in-Chief

Explore Asia’s Supply Chain Industry through the pages of Value Chain Asia’s digital magazine.

For ads, inquiries, and article contribution, contact editor@valuechainasia.com

FOUNDER, CO-EDITOR-IN-CHIEF AMOS TAY

SENIOR EXECUTIVE (MEDIA) MATTHEW PARRA

MULTIMEDIA ARTIST FELICE GOMEZ

CO-EDITOR-IN-CHIEF WEE WEE CHIA

STAFF WRITER TRISHA ANJANETTE BALLADARES

BERNARD RAMIREZ

TERENCE REPELENTE

GRAPHIC DESIGNER PRECIOUS ROMATICO

BY ANDREI QUINN-BARABANOV l Supply Chain Industry Practice Lead at Moody’s & VITALIANO TOBRUK l Industry Practice Lead at Moody’s

Supply chain management faces unprecedented challenges in today’s interconnected global economy. Tariffs are one prevailing issue. Rising protectionism and the imposition of tariffs and counter-tariffs – along with explicit and understated promises of asymmetrical retaliation as well as government sanctions – have the potential to disrupt supply chains.

Of course, supply chain disruptions are not new. The COVID-19 pandemic exposed the fragility of global supply chains, causing seismic disruptions, production delays and soaring demand for certain products. As businesses scrambled to mitigate these risks, the immediate steps taken were often chaotic and costly.

This chaos compelled supply chain leaders to rethink and rebuild their approach to risk management in search of greater resilience and cost-effectiveness.

How do organizations proactively manage supply chain risks in an increasingly volatile world characterized by geopolitical tensions, natural disasters and climate change? Proactive supply chain risk management can be less costly than reactive approaches – but what steps can organizations take?

Value chain resilience is a key goal of supply chain managers. When a disruption occurs, organizations must react to introduce appropriate mitigants to keep the supply chain moving. Proactive risk management allows you to handle disruptions effectively.

A key component of proactive risk management is a solid approach to calculating value at risk (VaR). Commonly used in financial modelling, the concept has proved difficult to apply to supply chain risk management. Essentially, VaR is a quantitative measure used to assess a company’s revenue that risks being lost because of supply chain problems.

The tool helps quantify an organization’s risk exposure and provides an objective measurement of how much revenue is protected by supply chain managers’ risk mitigation strategies. This enables executives to make targeted, dataand outcome-led decisions. By leveraging sophisticated enterprise-level data and predictive analytics, VaR calculations have become more reliable, empowering supply chain leaders to communicate their actions, decisions and outcomes more effectively to senior management.

Unless the brewing trade war eases, companies around the world will face significant value at risk. Tariffs are designed to affect foreign companies financially, but they also impact domestic players as increasing prices shrink demand and create other ripple effects. VaR can help companies understand the financial impact of tariffs and the consequences of asymmetrical responses (such as government sanctions or targeting of companies), which are more difficult to quantify.

For example, VaR can help an auto manufacturer understand the impact on car sales from rising steel and aluminum prices due to tariffs. When a commodity like steel or aluminum gets taxed, prices increase not only in the country imposing the tariffs but worldwide. Higher aluminum and steel prices will inflate price tags on cars, reducing demand. Understanding VaR can help a car manufacturer decide on resource investments for mitigation, such as purchasing steel and aluminum ahead of an expected introduction of tariffs.

Another risk to supply chain management that organizations in Southeast Asia face is natural disasters such as typhoons, earthquakes and floods. These events can cause significant economic losses and disrupt communities. By employing VaR, organizations can simulate various disaster scenarios, which assist in understanding the potential impact of different types of natural disasters.

For instance, VaR enables a manufacturer in the Philippines – a country that is prone to floods – to assess if the trend for flooding in the area its production facilities are located is increasing, how much time is required to get production back online with each flooding, how much revenue is lost with each closure and whether this is increasing over the coming years. If the revenue risk is increasing beyond its tolerance, managers can also apply VaR to ascertain the risk of relocating facilities versus the risk of not doing so as well as the potential areas for relocation, and then create a mitigation plan going forward.

Similarly, by simulating the financial impact of a major typhoon on a coastal city, policymakers can identify critical infrastructure that needs reinforcement and allocate resources accordingly. Such analysis helps inform the development of more effective disaster response strategies and resource allocation.

VaR can also be used to determine appropriate levels of insurance coverage for natural disasters. By understanding the potential financial losses, businesses and governments can negotiate better insurance terms and explore alternative risk transfer mechanisms such as catastrophe bonds. This ensures that in the event of a disaster, there are financial safeguards in place to support recovery efforts.

Southeast Asia is a critical hub for global trade, with major shipping routes passing through the region. The disruption of these trade routes due to geopolitical tensions, piracy or natural disasters can have significant economic consequences. VaR can help identify trade routes that are most vulnerable to disruptions. By quantifying the potential financial impact of route disruptions, businesses and governments can prioritize investments in security measures and alternative routes.

VaR can incorporate geopolitical risk factors, such as political instability or conflicts, into the risk assessment of trade routes. This analysis can help businesses and policymakers develop strategies to mitigate the impact of geopolitical events on trade. For instance, by assessing the financial impact of potential conflicts in the South China Sea, businesses can develop contingency plans to reroute shipments and minimize disruptions.

In addition, VaR can be used to assess the resilience of supply chains that rely on specific trade routes. By understanding the potential financial losses from route disruptions, businesses can develop contingency plans and diversify their supply chains to reduce risk. This might involve identifying alternative suppliers or increasing inventory levels to buffer against potential disruptions.

Climate change also poses a significant threat to supply chains in Southeast Asia, with the increasing frequency and severity of extreme weather events. VaR can incorporate predictive analytics to assess the potential impact of climate change on supply chains. By analyzing historical data and climate models, businesses can estimate the financial losses from future climate-related disruptions, allowing for more proactive risk management and better preparation for potential disruptions. Businesses can then prioritize risks and target investments into mitigation strategies such as infrastructure upgrades and supplier diversification.

VaR can also facilitate collaboration between businesses, suppliers and governments in managing climate-related risks. By sharing risk data and developing joint mitigation strategies, stakeholders can enhance the overall resilience of supply chains. This collaborative approach ensures that all parties are better prepared to respond to climate-related disruptions and can recover more quickly.

VaR is a powerful and valuable tool for quantifying and managing financial risks in various applications. In Southeast Asia, VaR can play a crucial role in natural disaster resilience planning, trade route risk assessment and managing climate change-driven supply chain disruptions. By leveraging VaR, businesses and governments can make more informed decisions, prioritize investments in risk mitigation and preparedness and enhance the resilience of their operations and communities.

Ultimately, as new data sources and technologies like AI become more accessible, companies, especially SMEs, have a growing opportunity to systematize and strengthen their approach to calculating VaR. By focusing on three key inputs; identifying critical suppliers, estimating the revenue tied to them, and applying reliable risk scores; businesses can move beyond ad-hoc assessments toward more continuous, data-driven monitoring of supply chain vulnerabilities.

Much of the foundational work begins internally, through close collaboration between supply chain and finance teams. Once these pieces are in place, AI and automation can help refresh and scale the process regularly, making revenue-at-risk assessments a proactive tool for navigating uncertainty, rather than a reactive scramble in times of crisis. V

For more detailed insights and practical applications of VaR, and to find out how Moody’s helps businesses navigate global risks, visit: www.moodys.com/maxsight

BY

E-commerce sales are expected to soar to $58.74 trillion by 2028, driving a fundamental shift in the logistics industry. As online shopping reshapes consumer expectations, the demand for faster and more efficient deliveries has reached unprecedented levels.

To meet these challenges, companies across Asia are adopting unmanned delivery systems, such as drones and ground-based robots, to redefine how goods reach consumers. However, while these technologies offer immense potential, their widespread implementation faces several significant obstacles.

Imagine you are visiting the Great Wall of China, and as you take in the breathtaking views, a drone zips by to deliver a fresh cup of coffee. This is not a sci-fi fantasy. It’s a service offered by Meituan, China’s food delivery giant. Meituan’s drones have made headlines for their novelty, but beyond the hype lies a serious innovation in logistics. By bypassing congested streets and directly navigating to customers, these drones are redefining convenience.

Unmanned delivery, or Drone Logistics and Transportation, is rapidly advancing in China, driven by its strong tech ecosystem. Innovations like drones, autonomous vehicles, and automated warehouses are transforming the express delivery industry, propelling it into a new era of smart logistics.

Hong Kong, often seen as a testing ground for emerging technologies, is following suit. Meituan plans to launch its drone services there, seeking to expand in a market where competition is fierce. South Korea has similarly embraced drones.

In August 2024, the government supported drone delivery services to remote islands, delivering essentials to residents. The program aims to expand coverage, increase payload limits, and improve the reliability of services. In Japan, where an aging population is creating labor shortages, experts see robots as a potential solution to bridge the logistical gap.

These developments are not limited to Asia. In the U.S., companies like Amazon and Zipline have begun using drones for last-mile delivery, with the Federal Aviation Administration certifying several operators.

However, Asia’s combination of bustling urban hubs, vast rural regions, and cutting-edge technology provides a distinct edge in expanding unmanned delivery systems. In fact, the region’s drone market is projected to hit $54.6 billion by 2030, largely driven by a surge in companies specializing in services like mapping, surveying, inspection, and delivery.

The e-commerce industry has been leveraging drone technology for quite some time. Amazon, for instance, began exploring drone delivery as early as 2013. By early 2022, a McKinsey & Co. report indicated that over 2,000 drone deliveries were being made daily worldwide.

Similarly, the food and agriculture sector has slowly embraced drones for years, enabling farmers to survey crops and livestock from above to detect issues and improve field management. The agricultural drone market was valued at $1.2 billion in 2020, with projections suggesting it could grow to nearly $6 billion this year.

The appeal of drones in delivery logistics is undeniable. Small, agile, and powered by cutting-edge technologies like AI and GPS, drones address many pain points of traditional delivery systems. They eliminate traffic concerns, reduce operational costs, and offer a more sustainable alternative to fuel-guzzling vehicles.

Fast delivery is no longer a luxury—it’s an expectation. According to industry surveys, 90 percent of consumers view two- to three-day shipping as the baseline, while nearly 30 percent demand same-day delivery. For companies trying to stay competitive, meeting these expectations is critical. Drones, capable of flying directly to destinations without detours or delays, provide a solution that satisfies consumers’ growing appetite for speed.

Moreover, consumers are increasingly fixated on real-time tracking. Over 90 percent actively track their packages, with many checking updates multiple times a day. Equipped with GPS systems and AI, drones can offer unparalleled tracking precision, boosting customer satisfaction and loyalty.

Cost efficiency is another key factor driving the adoption of drones. Traditional delivery systems involve substantial overhead costs, from vehicle maintenance to fuel and labor expenses. Gartner estimates that using drones for parcel delivery can cut operational costs by up to 70 percent. This is especially attractive for businesses operating on thin profit margins in highly competitive markets.

Companies using drones are going beyond simply delivering products to customers by working to standardize and streamline the last-mile delivery process. In Shenzhen, China, Meituan uses pickup kiosks near residential and office buildings instead of delivering directly to doorsteps. The kiosks, which can hold multiple packages, serve as drop-off points for drones that fly preplanned routes from launchpads to kiosks. While the process may be less convenient for customers, it simplifies drone navigation in urban areas. The company also uses recyclable cardboard packaging. In 2022, Meituan completed more than 100,000 drone deliveries in Shenzhen.

Finally, drones offer a greener alternative. They consume less energy and produce fewer emissions than traditional delivery vehicles, aligning with global efforts to reduce carbon footprints. This aligns with global efforts to combat the climate crisis. In Asia, where urban centers are actively

For

Timothy Papandreou, founder of ETA, the implications of drone delivery “are nothing short of transformative.”

“ It’s going beyond ordering hot food, groceries or other items and having them land neatly on your doorstep within minutes. It’s also about receiving life-saving medication delivered swiftly even to the most remote regions,

“This isn’t just about speed and convenience; it’s about redefining how we experience everything from shopping, working and living to healthcare and services.

Papandreou writes in an article on Forbes

While the benefits are clear, the path to widespread adoption of unmanned delivery is riddled with challenges. Chief among them are privacy concerns.

The widespread use of drones raises significant privacy issues, particularly among those already wary of data collection by corporations and governments, according to Investopedia. Since drones rely on cameras and GPS for navigation, features historically associated with surveillance, many view them as intrusive. This unease is amplified by the potential for drones to capture footage of homes or private yards, especially in less densely populated areas, making the public uncomfortable with the idea of drones frequently flying overhead.

Logistics present another set of obstacles. Urban environments, with their towering skyscrapers and congested streets, pose significant navigation challenges. Landing a drone safely in dense cities or delivering to highrise apartments remains a technical and logistical feat. In rural areas, drones must contend with wildlife, particularly birds, which can pose risks to both the drones and local ecosystems.

Regulations also complicate matters. While countries like China and South Korea have relatively drone-friendly policies, others remain cautious. Airspace ownership is a murky issue, with questions about whether drones flying over private property constitute trespassing. Compliance with safety standards and airspace management rules adds another layer of complexity. Non-compliance could result in penalties or, worse, mid-air collisions that endanger lives.

The era of autonomous ground delivery was heralded by milestones like Starship Technologies’ first delivery in Redwood City, California, back in 2016, when a Starship Robot delivered 15 chocolate cookies from Cafe La Tartine to a nearby home, marking a quiet revolution in logistics. Since then, major players like FedEx have ventured into autonomous delivery, launching ground-based delivery robots as early as 2019 and signaling a broader industry shift.

And while drones dominate headlines, ground-based delivery robots have been quietly making strides in Asia’s logistics landscape, such as in South Korea. These robots, equipped with AI and sensors, navigate streets and sidewalks to deliver goods.

In particular, these autonomous vehicles are well-suited to urban environments, operating efficiently on sidewalks or dedicated pathways. They can handle multiple orders simultaneously, function around the clock, and significantly reduce the likelihood of human error in the delivery process.

Japan presents a compelling case for the integration of unmanned robots into its logistics network. Faced with an aging workforce and declining birth rates, the nation is addressing labor shortages by incorporating ground-based robots, creating a sustainable solution to modernize its delivery systems and meet evolving consumer demands.

Despite their potential, ground-based delivery robots face unique challenges. Theft and vandalism have emerged as growing concerns, particularly in the U.S., where some businesses and restaurants report incidents involving lastmile delivery robots, including those used for food delivery. Addressing these issues will be crucial to ensuring the broader adoption and success of this technology.

Unmanned delivery represents a bold leap into the future of logistics. Asia, with its blend of technological innovation and market demand, is uniquely positioned to lead this transformation. Drones and robots offer solutions that are faster, greener, and more cost-effective, addressing the growing demands of e-commerce-driven economies.

However, the journey is far from straightforward. Privacy concerns, logistical hurdles, and regulatory barriers must be addressed for unmanned delivery to become mainstream. Companies will need to invest not only in technology but also in public trust and policy advocacy. Collaboration between governments, tech companies, and communities will be essential to overcome these obstacles.

Yet the potential benefits are too significant to ignore. From reducing emissions to streamlining last-mile logistics, drones and robots could revolutionize how goods are delivered. As Asia continues to innovate and adapt, it’s only a matter of time before unmanned delivery becomes a common sight, reshaping the logistics landscape for generations to come.

This logistics revolution is more than just a trend. It’s a glimpse into the future, where drones and robots redefine the possibilities of delivery. For Asia, the sky and the street are no longer the limit. V

BY VALUE CHAIN ASIA

Alarm bells went off in 2024 when Singapore unexpectedly emerged as Nvidia’s second-largest revenue source, raising serious questions about the global trade of sensitive technology. This fueled speculation that Nvidia’s AI chips were being channeled to China, despite U.S. export restrictions.

These concerns intensified when China’s DeepSeek turned eyes in the international AI scene, powered by Nvidia GPUs. These chips that were never supposed to end up in China. Singapore has since been working to dismantle these shadow network trafficking high-tech components.

As scrutiny tightens, the Nvidia-Singapore case highlights how trade compliance lapses can trigger geopolitical tensions, corporate fallout, and billions in market value losses overnight.

With Nvidia’s shares tumbling and governments under pressure to enforce export controls. In today’s evolving global economy, companies engaged in international trade face multiple challenges. Geopolitical issues, new regulatory compliance standards, technological trade barriers, and protectionist measures have made trade more complex than ever.

Value Chain Asia speaks to Dr KC Chang, Regional Director of Customs Brokerage & Trade Compliance, for Asia Pacific and Middle East at logistics firm GEODIS, about logistics firm GEODIS about how businesses can navigate these challenges, implement structured compliance frameworks, and leverage Free Trade Agreements (FTAs) to optimize their supply chain operations.

According to Dr Chang, global companies today grapple with key trade-related issues which create significant barriers for businesses. This is particularly important for those trying to ensure efficiency and compliance in their international trade operations.

“Geopolitical challenges such as U.S.-China trade tensions, Middle East conflicts, and the Ukraine-Russia war lead to tariffs, sanctions, and unpredictable policy shifts. It is imperative for companies to navigate changing regulations with complex restrictions when conducting cross-border supply chain activities.”

In addition to geopolitical risks, supply chain disruptions have become more common. This has led to many companies experiencing rising shipping costs, delays in receiving critical raw materials, and shortages of key components.

“ In recent years, we have all learned that challenges such as COVID-19, natural disasters, labor actions, and geopolitical conflicts have the potential to expose vulnerabilities in global supply chains. Many companies have experienced

long delays in shipping, rising transportation costs, and shortages of critical components creating production disruptions in manufacturing plants.

Regulatory compliance is another major issue, as countries around the world continue to tighten trade restrictions and increase enforcement measures.

“With rising tensions between major powers around the world, there is an increasing focus on regulatory compliance and enforcement from governments. Complying with local laws such as export control, data protection, or cybersecurity regulations requires significant investment in legal and compliance teams for all companies.”

Dr Chang says that many companies struggle with customs and trade compliance due to gaps in expertise, outdated processes, and shifting regulations. These gaps often lead to inefficiencies, increased costs, and even legal risks for these

“A

major issue is the lack of knowledge and training. Employees handling customs and trade compliance often lack professional expertise in global regulations, leading to costly errors, delays, or penalties. Some companies also rely on manual processes and outdated technology, making it difficult to track trade data, classify goods correctly, and ensure compliance with ever-changing trade laws.

Dr Chang recommends adopting a structured Internal Compliance Program (ICP), a framework originally designed for export control management but now widely applicable to all aspects of customs and trade compliance. This is to address issues such as financial penalties, supply chain disruptions, and reputational damage.

“An ICP is a set of internal procedures and controls that a company can implement to ensure adherence to export control laws and regulations. Essentially, this acts as a selfmonitoring system to guarantee that their exports comply with legal requirements regarding the trade of controlled goods and technologies.”

By incorporating automated systems, conducting regular audits, and providing specialized compliance training, companies can reduce these risks. According to Dr Chang, having a well-defined ICP ensures that businesses stay compliant with evolving trade regulations while improving efficiency in their operations.

A structured compliance program can result in cost savings and improved supply chain efficiency. For example, Free Trade Agreements (FTAs) offer companies gateways to reduce costs and expand into new markets if leveraged correctly.

“By proactively leveraging Free Trade Agreements, companies can significantly reduce costs, improve global competitiveness, and expand into new markets with fewer trade barriers. The first step is to conduct a detailed analysis of relevant FTAs that apply to their trade lanes,

identifying tariff reductions, preferential duty rates, and regulatory benefits for their products in different markets.”

However, failure to comply with trade regulations can lead to severe consequences. This includes financial penalties, legal action, and restrictions on market access. Dr Chang notes that companies that utilize ICPs can mitigate these risks by taking immediate corrective action when issues arise.

“If a regulatory non-compliance issue is identified during an internal audit, the company must take immediate and strategic actions to mitigate risks and prevent future violations. This includes assessing the severity of the problem, conducting a thorough investigation, amending incorrect documentation, and communicating with customs or relevant government agencies.”

Southeast Asia presents a unique challenge due to its diverse economic landscape and regulatory environments.

“Countries like Singapore, Malaysia, Thailand, and Vietnam offer strategic advantages, including access to major shipping routes, strong free trade agreements (FTAs), and business-friendly policies.”

Companies relocating their regional distribution centers to SEA must conduct thorough market analyses to identify optimal locations. Especially based on factors such as infrastructure, tax incentives, and trade agreements.

Leveraging agreements such as the Regional Comprehensive Economic Partnership (RCEP) and ASEAN Trade in Goods Agreement (ATIGA) can help companies optimize tariff advantages and streamline their operations.

“Regulatory compliance is another critical factor; companies must understand customs procedures, tax structures, and related import/export trade regulations in their chosen country to avoid disruptions.

As regulatory environments continue to evolve, companies operating in Southeast Asia must remain proactive in their compliance efforts. Investing in expertise, digital trade management tools, and structured ICPs will be critical in ensuring smooth trade operations.

For young professionals aspiring to enter the field of customs and trade compliance, Dr Chang highlights the growing importance of this role in today’s global trade landscape.

“Many companies are investing heavily in setting up dedicated teams globally to focus on achieving 100% regulatory compliance in their day-to-day supply chain operations.”

By embracing technology, training, and strategic compliance measures, SEA companies can navigate the complexities of global trade with confidence, ensuring longterm success in an increasingly regulated world.

BY BERNARD RAMIREZ

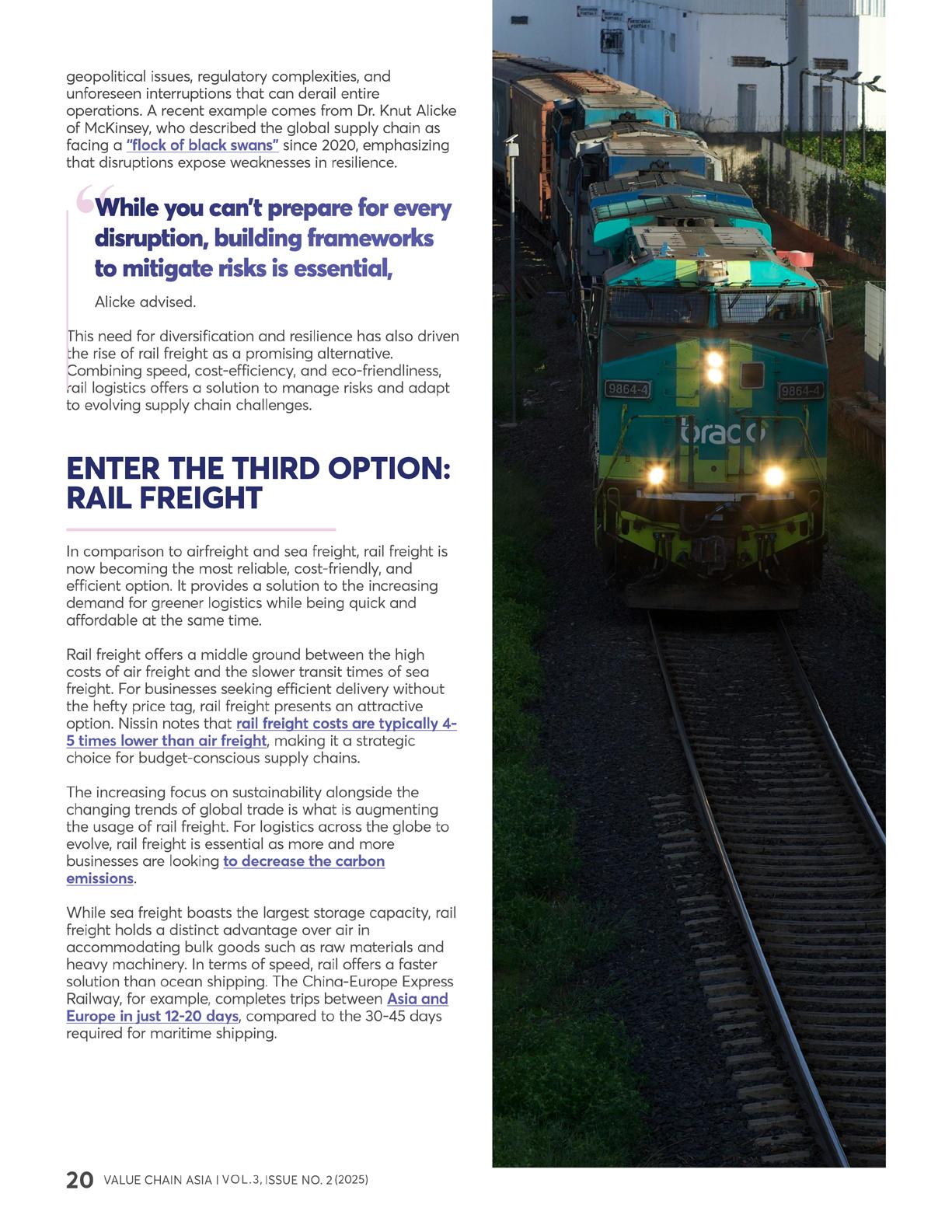

Rail freight is reshaping Asia’s logistics landscape, offering a transformative alternative to the wellestablished air and sea freight industries. While air logistics dominate for speed and safety, and sea freight excels in capacity for heavier, bulkier goods, rail is emerging as a key player bridging the gap. With its ability to combine speed, cost-efficiency, and eco-friendliness, rail freight is redefining how goods move across the continent. Could this be the future of logistics in Asia’s dynamic markets?

According to the Director General of the International Air Cargo Association (TIACA), Glyn Hughes, there’s a shift of increase to 5% demand from 2023 to 2024.

Global economic indicators appear increasingly favorable for air cargo. The Purchasing Managers’ Index (PMI) for new export orders in global manufacturing increased for the third consecutive month in April. Industrial production remains in growth territory despite modest easing.

When it comes to shipping, there is also a growing demand. For example, In May 2024, the sea freight volumes exceeded 15.94 million TEU (twenty-foot equivalent units), setting a new record, breaking the previous record that stood at 15.72 million TEU in May 2021. Additionally, Xeneta recently published their container trade figures and reported a total of 74 million TEU for the month of July in 2024. This is a 7.5% growth when compared to May 2023.

Global logistics is undoubtedly a business that poses challenging risks requiring constant vigilance against geopolitical issues, regulatory complexities, and unforeseen interruptions that can derail entire operations.

A recent example comes from Dr. Knut Alicke of McKinsey, who described the global supply chain as facing a “flock of black swans” since 2020, emphasizing that disruptions expose weaknesses in resilience.

“While you can’t prepare for every disruption, building frameworks to mitigate risks is essential,

Alicke advised.

This need for diversification and resilience has also driven the rise of rail freight as a promising alternative. Combining speed, cost-efficiency, and eco-friendliness, rail logistics offers a solution to manage risks and adapt to evolving supply chain challenges.

In comparison to airfreight and sea freight, rail freight is now becoming the most reliable, cost-friendly, and efficient option. It provides a solution to the increasing demand for greener logistics while being quick and affordable at the same time.

Rail freight offers a middle ground between the high costs of air freight and the slower transit times of sea freight. For businesses seeking efficient delivery without the hefty price tag, rail freight presents an attractive option. Nissin notes that rail freight costs are typically 4-5 times lower than air freight, making it a strategic choice for budget-conscious supply chains.

The increasing focus on sustainability alongside the changing trends of global trade is what is augmenting the usage of rail freight. For logistics across the globe to evolve, rail freight is essential as more and more businesses are looking to decrease the carbon emissions.

While sea freight boasts the largest storage capacity, rail freight holds a distinct advantage over air in accommodating bulk goods such as raw materials and heavy machinery. In terms of speed, rail offers a faster solution than ocean shipping. The China-Europe Express Railway, for example, completes trips between Asia and Europe in just 12-20 days, compared to the 30-45 days required for maritime shipping.

Across Asia, investments in rail infrastructure are driving the growth of rail freight. Key initiatives include:

1. ASEAN Express: This newly established route links Vietnam, Chongqing, and Poland, reducing transit times by 5-10 days compared to previous Asia-Europe routes. To enhance the free flow of goods across the region, Malaysian Transport Minister Anthony Loke has urged ASEAN member states to continue advancing integration efforts by connecting railway networks.

2. China-Europe Express Railway: A cornerstone of the Belt and Road Initiative, this service has facilitated over 10,000 trips annually, connecting major Chinese cities with European logistics hubs.

3. Kereta Api Indonesia: Focused on optimizing freight routes to link production hubs with export ports, this network is bolstering Indonesia’s trade capabilities.

4. State Railway of Thailand: Supporting agricultural and manufacturing exports, this system is vital for regional freight transport.

5. Trans Sumatra Railway: This Indonesian project aims to connect remote industrial areas with key markets, creating more efficient trade corridors.

Global corporations are increasingly turning to rail logistics to strengthen their supply chains. BMW and Volkswagen utilize the China-Europe Express to ship vehicles and components, cutting delivery times and carbon emissions. Amazon integrates rail freight into its European operations, aligning with its sustainability goals. Logistics giant DB Schenker leverages rail networks across Asia and Europe, offering tailored solutions for industries ranging from automotive to retail.

Rail transport has a strong position in the global movement towards greener logistics, as it presents great environmental advantages over air and marine transport. The International Energy Agency (IEA) indicates railways account for 2% of the world‘s transport energy consumption, while road transport stands at 74%. Businesses with a strong focus on green supply chain alternatives are increasingly inclined towards rail freight owing to the much lower energy and carbon outputs per ton-mile.

Dr Fatih Birol, IEA Executive Director, adds that “the rail sector is dominantly positioned to add value to the energy sector and ecosystem. Integrating the rail into the supply chain by diversifying fuel types and developing effective relocation will enable to cut down on transportation energy expenditures and subsequently lower emissions of carbon as well as other local pollutants.”

When it comes to freight, rail services stand out above air and marine services in terms of sustainability and effectiveness, as its benefits are innumerable. Rail transport remains at approximately 18 grams per ton-kilometer and is the ideal choice, whereas the fastest air transport do release an average of 500.

Rail may not be the most environmentally friendly option, but in comparison to air transport, it is a lot less dependent on fossil fuels. Integrating rail transport with electrified tram tracks has the potential to complement pace and ecofriendliness.

Despite its advantages, rail freight isn’t without drawbacks. Infrastructure limitations, high initial investments, and regulatory disparities across regions can hinder adoption. However, ongoing innovations like autonomous trains and hybrid systems aim to mitigate these challenges.

The European Union’s Horizon Europe initiative, with over €95 billion allocated to sustainable projects, underscores this progress by fostering technology adoption and crossborder rail development. Such advancements ensure rail freight aligns seamlessly with long-term sustainability goals while promoting a resilient logistics ecosystem.

Rail logistics face significant challenges due to high costs, which hinder infrastructure development and investment. The initial capital required for rail construction, maintenance, and specialized equipment is a major barrier, particularly in developing countries.

According to the World Bank, these high upfront costs and long payback periods deter private investment, while ongoing maintenance further increases expenses.

Despite ambitious plans to modernize its railway logistics infrastructure, Indonesia faces significant hurdles that continue to slow progress. Infrastructure gaps, limited funding, and regulatory complexities remain key barriers, as highlighted during the ASEAN Supply Chain Connectivity Forum in September 2024. Dr. Kao Kim Hourn, Secretary

General of ASEAN, emphasized that such challenges are not unique to Indonesia but are particularly pronounced due to the country’s archipelagic geography and diverse regulatory landscape.

“[Indonesia’s] progress is vital to regional supply chain connectivity, yet it remains constrained by systemic inefficiencies,

Dr.

Hourn noted

The development of rail freight in Vietnam faces several barriers despite the country’s push to modernize its rail system. The planned high-speed railway (HSR) projects, intended to link key regions of Vietnam with China, highlight both the potential and challenges of expanding rail logistics.

One major hurdle is the high cost and financial sustainability of these projects. High-speed rail developments often exceed budgets and miss deadlines, raising concerns about their long-term viability. This poses a possibility that if the HSR project suffers from cost overruns or delays, it could undermine the economic benefits and affect the credibility of the Vietnamese government.

While rail freight holds great promise, the broader region faces significant challenges in realizing its potential. Geopolitical tensions, particularly those linked to the Belt and Road Initiative (BRI), complicate cross-border cooperation. Southeast Asia and East Asia, central to global trade routes, must navigate a web of competing economic interests, national policies, and infrastructure priorities.

For example, nations within the Association of Southeast Asian Nations (ASEAN) often face difficulties harmonizing rail standards and logistics frameworks, slowing progress on projects meant to boost regional connectivity. Furthermore, dependency on Chinese investment through the BRI raises concerns about debt sustainability and long-term sovereignty, adding another layer of complexity.

Climate change and sustainability goals further pressure the region to balance rapid infrastructure development with environmental preservation. These factors make it clear that while rail freight has the potential to redefine logistics in Asia, its success will hinge on fostering regional cooperation, mitigating geopolitical risks, and ensuring financial and environmental sustainability.

As the global logistics industry evolves, balancing air, sea, and rail freight has become crucial for increasing demand and optimizing efficiency. Airfreight remains the fastest option for high-value or time-sensitive goods, yet high costs and capacity restrictions limit it.

According to the International Air Transport Association (IATA), airfreight contributes to around 35% of global trade by value but only 1% by volume. Conversely, in handling most global trade volumes, sea freight is more cost-effective but faces challenges like port congestion and environmental concerns. The International Maritime Organization (IMO) continues to push for sustainable shipping practices to reduce emissions.

Rail freight, though a smaller player in global trade, offers a middle ground. In regions like Europe and Asia, rail systems have become vital for transporting goods over long distances, combining the speed of airfreight with the costeffectiveness of sea transport.

Road freight remains critical for last-mile delivery and domestic logistics, ensuring seamless supply chain operations. Road transportation faces significant disadvantages compared to rail, air, and water freight, primarily due to its slower speed and lack of structure. Unlike rail and air transportation, which operate on fixed schedules and routes, road freight often encounters delays caused by traffic congestion, poor road conditions, and infrastructure limitations.

The European Commission’s Transport Strategy highlights rail freight’s potential, calling for investments in modern infrastructure to boost efficiency. However, fragmented networks and infrastructure gaps hinder its growth, especially in developing regions.

In order to encourage interrelationship between these modes, there is a need for innovation and global cooperation. Increasing the reach of rail networks, strengthening intermodal linkages, and integrating innovative technologies like autonomous vehicles will facilitate a more comprehensive logistic paradigm in which air, sea, and rail work together for greater efficiency and sustainability. This partnership will be critical in designing a logistics system that will be robust for the future. V

BY MATTHEW PARRA

Shein’s agile supply chain is its biggest mark. By leveraging a digital-first approach, Shein has established itself as a global e-commerce powerhouse, dominating the industry with speed, efficiency and consumer-centric offerings.

In 2024, it was forecasted to reach $50 billion in revenue and claimed 18.4% of the market share worldwide in the fast fashion category.

For fast fashion platforms, the question is: Is Shein’s digital-first supply chain the new blueprint for success, and can legacy retailers adapt quickly enough to follow suit? Or is Shein’s dominance a result of unique circumstances that competitors cannot easily replicate?

Shein’s supply chain model is a departure from the usual fashion retail production. They center on agility, precision and customer demand. Unlike the conventional supplydriven approach, Shein employs an on-demand business model that tailors its offerings to real-time consumer preferences.

“Since we founded Shein, our focus has been on meeting the needs of customers. We’ve

reimagined fashion from a supply-driven model to a demand-driven model

to make the beauty

of fashion more accessible to all. At

the same time, we are focused on continuing to support and empower the designers, creators, suppliers, and partners who are fundamental to our success.

says Sky Xu, Co-Founder and CEO of Shein.

At the heart of Shein’s on-demand business model is its digital supply chain technology, which tracks user engagement on its platforms to identify demand signals. This data-driven approach ensures that products align closely with what consumers want, when they want them.

According to Shein Group, initial product launches start with a limited number of batches. Initial launches usually range around 100 to 200 items. This enables Shein’s suppliers to gauge market interest and scale production accordingly. This minimizes overproduction, lowers unsold inventory rates and reduces waste.

Moreover, the technology evaluates customer feedback in real time and aids in restocking products that are in demand. This highly automated process ensures that small and medium-sized suppliers within Shein’s network benefit produce products that are in demand. This benefits suppliers in minimizing overproduction, while making prices more affordable for customers.

With access to their suite of supply chain technology solutions, suppliers have unlimited access to insights to capacity, inventory levels and other information. This can help them make better manufacturing decisions. Shein also invests in their supplier’s technology to make them compatible with their digital model.

This enables Shein’s supply chain to respond to increased demands or market changes with agility and speed. This system is the ability to perfectly match demand with supply, which reduces costs at multiple levels of the business and ultimately drives prices down for consumers. It also enables Shein to create products that stem from emerging trends in an instant.

Shein produces an average 314,877 new styles per year. By comparison, the more “traditional” fast fashion brand H&M creates an estimated 4,414 products per year.

The cross-border e-commerce and fast fashion sectors are seeing intense competition, especially with platforms like Temu and Zara making waves in contrast to Shein. While Shein has rapidly grown its global footprint, Temu and Zara offer unique advantages in supply chain operations, customer strategies and production models.

Temu’s key differentiator lies in its logistics cost optimization strategy, which combines lightweight and heavyweight goods to maximize cargo space. This helps reduce freight costs and provide more competitive pricing, especially for its low-cost lightweight products like jewelry and accessories.

As the United States is the platform’s main region, Temu’s use of tail-end flights and strategic warehouse placements in Mexico offer a cost-effective edge in cross-border logistics. This enables Temu to offer lower-cost shipping, which becomes crucial when competing with Shein.

Mexico’s tax authority, SAT, announced new tariffs on December 31 aimed at enhancing the monitoring of goods imported from Asia. This measure is expected to affect prominent online retailers such as Shein and Temu.

According to SAT, goods arriving in Mexico through courier services from countries without an international agreement with Mexico will now incur a 19% duty, as stated in a press release shared with the media.

Shein, on the other hand, has successfully leveraged rapid production and a more extensive range of fashion products. While Shein is known for its aggressive pricing strategy and quick turnarounds, Temu’s ability to mix product types beyond fashion and optimize its logistics network helps it maintain a level of agility that allows for a competitive edge in cross-border e-commerce.

Despite Shein’s well-established position in fast fashion, Temu’s strategic focus on logistics efficiency and cost optimization could help it carve out a significant niche, especially in the US market.

Both Temu and Shein also capitalize on the U.S. de minimis customs rule, which allows shipments valued under $800 to enter the country duty-free with minimal customs scrutiny. By leveraging this rule, both platforms are able to “escape” tariffs on low-value goods, further enhancing their ability to maintain competitive pricing in the U.S. market.

Zara and Shein both thrive in the fast fashion market, but their approaches diverge significantly. Zara’s supply chain model centers on just-in-time (JIT) production and in-house manufacturing, providing unmatched agility and speed to market.

By controlling a significant portion of its production and focusing on small, limited runs, Zara avoids overproduction and creates a sense of urgency among shoppers. This approach contrasts sharply with Shein’s heavy reliance on outsourced manufacturing and its ability to churn out massive quantities of styles very quickly, often with less emphasis on exclusivity.

While Shein uses advanced algorithms and a vast global network of suppliers to track trends and respond rapidly, Zara’s advantage lies in its more controlled environment, where most production is housed close to its Spanish headquarters.

Zara’s focus on a curated, trend-driven inventory and demand forecasting, enables the brand to stay ahead of trends while maintaining operational control. In contrast,

Shein’s vast range and extremely low pricing attract a broad audience but often sacrifice the control that Zara is known for.

In terms of competition, Zara’s ability to control production and introduce new styles at a faster pace than Shein has given it an edge in both inventory management and customer satisfaction. However, Shein’s massive inventory and data-driven design processes allow it to capture a large chunk of the global market, especially among younger, price-sensitive consumers.

According to letters to Tang Investment Group, Shein is planning to offer its small batch, on-demand manufacturing model as a service to other fashion retailers. This marks a pivotal shift in the retail supply chain landscape.

By leveraging its agile supply chain, Shein is able to produce fashion items in small batches, minimizing overstock and allowing for rapid production that can be closely aligned with consumer demand.

Offering this manufacturing model as a service means that other fashion brands can access Shein’s supply chain infrastructure, including its data-driven production processes and logistics capabilities.

This on-demand model reduces the risks associated with large-scale inventory and offers retailers the ability to react quickly to changing market trends, thus shortening the timeto-market for new collections.

This change highlights Shein’s growing influence in shaping supply chain operations and presents new opportunities for fashion retailers to streamline their processes and improve flexibility.

As Neil Saunders from GlobalData Retail points out, Shein is expanding its reach by evolving from just a low-price fashion retailer to an established service provider.

For smaller retailers or brands that lack the resources to manage complex supply chains, Shein’s offering becomes an attractive option to streamline operations while maintaining flexibility and responsiveness in a fast-moving market. This not only represents a new revenue stream for Shein but also positions it as a key player in the broader fashion retail supply chain.

“Shein is moving beyond being a seller of low-price fashion to one that has many strings to its bow, including marketplaces, services for sellers and now services for designers and apparel brands.

says Neil Saunders, Managing Director of Retail Consultancy

GlobalData Retail.

This shift towards a hub-and-spoke model enables Shein to consolidate various retail services under one platform.

By leveraging this ecosystem, Shein is challenging traditional retailers to rethink their own supply chain models, which could force competitors to either innovate or face the risk of falling behind in an increasingly digital-first environment.

Success in the industry is not exclusive to Shein. Competitors like Temu and Zara are also carving out paths to success, each leveraging unique strategies to enhance their supply chain operations. From Temu’s rapid growth in e-commerce to Zara’s mastery of agile inventory management, these players are shaping the industry in their own ways.

Yet, Shein’s disruptive influence reverberates throughout the entire supply chain landscape. With its ambitious plans to expand its innovative digital supply chain into a service for other retailers, the implications for the industry are huge.

The question to be asked now is this: How will competitors adapt to this new reality, and can they rise to meet the challenge posed by Shein’s bold evolution? V

BY TRISHA ANJANETTE BALLADARES

As Malaysia takes the helm of ASEAN’s Chairmanship, the region faces a defining moment in its pursuit of sustainability and inclusivity. ASEAN, home to over 600 million people, must address pressing environmental challenges while ensuring equitable and resilient economic development. Malaysia’s leadership presents an opportunity to set ambitious sustainability goals, foster cooperation among member states, and create policies that benefit all sectors of society.

With rapid industrialization and urbanization across ASEAN, there is an urgent need for green infrastructure, climate adaptation strategies, and inclusive economic policies. Malaysia has strongly advocated for sustainable development and is expected to push for a greener, more inclusive regional agenda.

As Malaysia assumes the ASEAN Chairmanship, the region stands at a critical juncture in balancing economic growth with environmental and social sustainability. Under Malaysia’s leadership, ASEAN is expected to emphasize inclusive policies and sustainable initiatives, fostering a future that integrates economic progress with ecological and social well-being.

Malaysia’s leadership comes when global attention on sustainability is increasing. Countries worldwide are shifting toward green economies, and ASEAN must align itself with these global trends. As chair, Malaysia will ensure that ASEAN member states take collective action toward sustainability goals while addressing individual national challenges.

One of the main priorities is to ensure that sustainability efforts do not come at the cost of economic growth. ASEAN is home to some of the fastest-growing economies in the world, and balancing development with environmental responsibility is a significant challenge. Malaysia is well-positioned to spearhead initiatives that harmonize economic policies with green technologies.

In the World Economic Forum (WEF) Annual Summit 2025, Prime Minister Datuk Seri Anwar Ibrahim shared,

“The consensus is to address energy pragmatically, meeting economic demands and tackling critical needs for water and electricity.

He added,

“Dealing with climate issues is essential for our future, irrespective of differing opinions. ASEAN nations must prioritize this collectively.

Furthermore, Malaysia aims to create a blueprint for ASEAN’s long-term sustainability, leveraging its expertise in green initiatives. By facilitating policy discussions, partnerships, and knowledge-sharing among member states, Malaysia can help create a framework that extends beyond its chairmanship and into the coming decades.

Malaysia has long championed sustainability within ASEAN, advocating for green technology, renewable energy, and carbon reduction strategies. With the ASEAN Community Vision 2045 in mind, Malaysia will likely push for stronger commitments to climate action, resource conservation, and sustainable infrastructure development. This will align with global environmental goals and create economic opportunities through green industries and ecofriendly investments.

Renewable energy is expected to be a major focus under Malaysia’s leadership. The country has been actively investing in solar, wind, and hydroelectric power, and its expertise in these areas could serve as a model for other ASEAN nations. Expanding regional cooperation on clean energy will reduce reliance on fossil fuels and foster a more resilient and self-sustaining energy sector.

Additionally, Malaysia is likely to promote sustainable infrastructure projects, such as green buildings and smart cities, to minimize carbon footprints in urban areas. ASEAN can reduce its environmental impact by investing in sustainable transport systems, energy-efficient public buildings, and waste-reduction technologies while maintaining economic growth.

Another critical area of focus will be sustainable agriculture. With a large portion of ASEAN’s population depending on agriculture for their livelihood, Malaysia will push for environmentally friendly farming techniques, reduction of deforestation, and responsible land use policies. The goal is to create an agricultural system supporting economic growth and ecological preservation.

The success of sustainable initiatives hinges on collaborative efforts among ASEAN member states. Malaysia’s chairmanship offers an opportunity to strengthen regional frameworks, such as the ASEAN Framework on Circular Economy and the ASEAN Energy Cooperation Plan. By fostering stronger ties between governments, businesses, and civil society, Malaysia aims to create an ecosystem where sustainable development is both practical and profitable.

in

efforts is the varying levels of development among ASEAN nations. While some countries have advanced sustainability policies, others struggle with fundamental environmental issues. Malaysia’s leadership must ensure that policies are inclusive, supporting nations that require technical and financial assistance to implement green initiatives.

Moreover, Malaysia will likely push for establishing regional sustainability funds, where ASEAN nations can collectively invest in green projects. By pooling resources, the region can accelerate the implementation of largescale projects such as renewable energy grids, transnational conservation efforts, and sustainable transport networks.

A major area of focus will be environmental education and public awareness. By fostering regional campaigns and educational programs, Malaysia can help promote a sustainability mindset among businesses and individuals. This will ensure that sustainability initiatives are governmentdriven and supported at the grassroots level.

Finally, Malaysia will emphasize digital innovation and smart technologies to achieve sustainability goals. AI-driven environmental monitoring, data analytics for efficient resource management, and blockchain for transparent supply chains are areas where ASEAN can leverage technology for a greener future.

A key aspect of Malaysia’s sustainability vision is inclusivity—ensuring that economic benefits reach all ASEAN citizens, including marginalized communities. Sustainable initiatives will emphasize equitable growth, job creation in green industries, and capacity-building programs to equip workers with skills for a low-carbon economy. This approach ensures that sustainability efforts not only widen existing socio-economic gaps but uplift communities.

ASEAN’s economic structure is diverse, with advanced economies and developing nations within the bloc. Malaysia will focus on policies that encourage fair economic distribution and social inclusion. ASEAN can ensure that economic growth is green and inclusive by promoting sustainable job creation, particularly in sectors such as renewable energy, eco-tourism, and sustainable manufacturing.

Micro, small, and medium enterprises (MSMEs) play a significant role in ASEAN’s economy. Malaysia’s chairmanship will likely advocate for sustainability policies that support MSMEs in adopting greener practices without compromising their economic viability. Access to green financing, subsidies for eco-friendly technology, and knowledge-sharing platforms will make sustainability accessible for businesses of all sizes.

Climate change poses a significant threat to ASEAN, with rising sea levels, extreme weather events, and environmental degradation impacting millions. Malaysia is expected to champion policies that enhance disaster preparedness, promote climate adaptation strategies, and accelerate regional commitments to carbon neutrality. Initiatives such as sustainable urban planning and enhanced early warning systems will be crucial in mitigating climate risks.

ASEAN is one of the most disaster-prone regions in the world. Malaysia’s chairmanship will emphasize the importance of disaster risk reduction strategies, including investment in climate-resilient infrastructure and naturebased solutions. Strengthening cooperation in regional disaster response mechanisms will also be a priority.

While ambitious policies and frameworks are essential, effective implementation and public engagement will determine their success. Malaysia’s chairmanship will likely emphasize transparency, stakeholder participation, and cross-sectoral collaborations. Malaysia aims to build a collective movement toward a more sustainable and inclusive ASEAN by engaging youth, businesses, and grassroots organizations.

Malaysia’s ASEAN Chairmanship presents a unique opportunity to drive meaningful regional change. Malaysia can set the foundation for long-term resilience and prosperity by focusing on sustainability and inclusivity. The challenge lies in policy creation and ensuring that these initiatives translate into tangible benefits for all ASEAN citizens, paving the way for a greener and more equitable future. V

BY BERNARD RAMIREZ

Digital twin technology is revolutionizing how industries train and upskill their workforce. A digital twin is a virtual model of a physical system, asset, or process, enabling realtime simulations and analytics. By integrating data from IoT devices and machine learning, digital twins replicate realworld scenarios to improve training outcomes. According to Gartner, the global digital twin market could reach $379 billion by 2034, highlighting its growing significance.

In Asia alone, Digital Twin technology is transforming supply chain management, offering virtual replicas of physical assets and processes that enhance efficiency, resilience, and workforce development. The Asia-Pacific digital twin market is projected to grow from $2.5 billion in 2023 to $256.5 billion by 2033, reflecting a compound annual growth rate of 58.64%

How can businesses leverage this innovative tool to foster a future-ready workforce while overcoming its challenges?

Digital twins are dynamic, virtual replicas of physical entities that simulate their real-world counterparts in realtime. By aggregating data from sensors, IoT devices, and analytics platforms, digital twins enable organizations to model and test processes, assets, or systems in a risk-free digital environment.

Here are some industry examples:

1. Manufacturing: Digital twins can simulate machinery performance, optimize maintenance schedules, and evaluate design changes in a risk-free virtual environment. This technology enhances decisionmaking, minimizes downtime, and promotes operational efficiency, making it an essential tool for modern manufacturing.

2. Healthcare: Digital twin technology in healthcare creates a dynamic virtual replica of patients or clinical systems using real-time data and advanced analytics. This technology gathers information from sources like electronic health records, wearables, and medical devices, offering a holistic view of the patient. It enables personalized treatment plans based on individual characteristics, medical history, and realtime physiological data.

3. Logistics: In supply chain management, digital twins offer real-time visibility by collecting data from various sources, allowing logistics operations to be monitored and optimized. They utilize predictive analytics and machine learning to forecast future events, helping businesses improve decision-making and resource allocation. Digital twins enhance efficiency by optimizing the use of resources, such as vehicles and warehouses. They also mitigate risks by identifying potential disruptions and enabling proactive responses. Furthermore, digital twins evolve with changing data sources and operational needs, ensuring logistics operations remain agile, competitive, and capable of adapting to new challenges in the supply chain.

Digital twins serve as powerful tools to simulate and visualize complex supply chain operations, providing employees with a safe and interactive environment to learn and experiment. They enable training on scenarios like demand fluctuations, inventory optimization, and transportation disruptions without impacting real-world operations.

Digital twins empower employees to bridge theoretical knowledge with practical applications. This approach accelerates skill development while reducing operational risks.

Key applications in Supply Chain Training:

1. Dynamic Scenario Simulations: Trainees can engage with real-time data to navigate disruptions such as supply shortages or logistical challenges, fostering problem-solving and critical-thinking skills. This capability is particularly beneficial in Asia’s dynamic logistics sector, where companies face complex challenges due to diverse markets and rapid economic growth.

For example, DHL Supply Chain’s implementation of the first digital twin warehouse for Tetra Pak in Singapore demonstrates the practical benefits of digital twin technology in workforce training. By creating a smart warehouse that integrates IoT and real-time data analytics, warehouse supervisors can make informed decisions to reduce congestion, optimize resource planning, and enhance safety protocols. Employees are trained to work within newly implemented safety measures while utilizing advanced tools such as proximity sensors, which minimize collision risks and reduce manual handling of heavy containers. These technologies and training practices empower the workforce to adapt quickly to disruptions and maintain operational efficiency, setting a benchmark for supply chain innovation in Asia.

2. Skill Assessment and Customization: Digital twins analyze employee performance, identifying skill gaps and tailoring training modules to address specific needs.

Additionally, a framework presented in the research paper “Transferring Digital Twin Technology on Employee Skills” demonstrates how digital twin technology can be combined with skill assessment to create enhanced skill profiles. This approach allows organizations to tailor training modules to address specific needs, thereby improving overall workforce competency.

3. Collaboration in Control Towers: Integrated with supply chain control towers, digital twins provide a centralized view of operations, enhancing crossfunctional team collaboration during training sessions.

In Asia, the Agency for Science, Technology and Research (A*STAR) in Singapore has launched the Supply Chain 4.0 initiative, aiming to develop a configurable digital twin for industry use in planning, operations, and risk management. This initiative involves collaboration with local universities and companies to co-develop solutions and implement them for end users.

Digital twins are revolutionizing workforce training in the supply chain sector, offering unparalleled opportunities for skill enhancement

Digital twins provide dynamic, data-driven environments where employees can engage in real-world scenarios without impacting live operations. This enables risk-free learning and better preparedness for disruptions. ABeam Consulting Vietnam’s work with a logistics company exemplifies this benefit, as digital twin simulations were used to optimize supply chain networks, evaluating 26 possible site and function combinations. By digitally replicating real-world constraints—such as varying temperature requirements and long-distance deliveries—the company refined its logistics strategy without disrupting actual operations.

This simulation-driven approach is transforming supply chain management in Vietnam, where businesses face mounting complexities due to shifting trade policies and increased regional manufacturing activity. According to the Vietnam Logistics Market Report, the sector is expected to exceed $52 billion by 2025, necessitating advanced technological solutions. Digital twins allow firms to test new logistics strategies in a controlled environment, ensuring they make data-backed decisions that enhance efficiency.

With detailed analytics, digital twins identify individual skill gaps and customize training modules, ensuring targeted upskilling. This personalized approach enhances learning outcomes and workforce proficiency.

For instance, the Indian Institute of Materials Management offers a course on modeling and building digital supply chain twins using anyLogistix software, which includes applications in skill assessment and training customization. This program demonstrates the practical benefits of digital twin technology in workforce training within the supply chain sector.

Interactive simulations shorten the learning curve, allowing employees to quickly grasp complex supply chain operations such as demand forecasting, inventory management, and logistics planning.

Implementing digital twin technology has been shown to significantly enhance skill development within organizations. A case study at a major automotive manufacturing facility integrated digital twins with artificial intelligence (AI), augmented reality (AR), virtual reality (VR), and robotics to create an immersive training environment. This approach led to a 65% improvement in training effectiveness over an 18-month period, underscoring the potential of digital twins to accelerate workforce skill acquisition.

By providing real-time data and predictive insights, digital twins train employees to make data-driven decisions, fostering confidence and precision in handling supply chain challenges.

enhancement and operational efficiency. Here are the key benefits:

Training via digital twins reduces downtime and eliminates expenses tied to errors in live systems, delivering long-term cost savings.

Digital twin technology has proven to be cost-effective in training scenarios across various industries in Asia. For instance, a Matterport webinar highlighted that utilizing digital twins to communicate standard operating procedures can reduce onboarding time and training costs by 61%. Matterport is the leading spatial data company focused on digitizing and indexing the built world.

Digital twins prepare employees for evolving industry demands, ensuring they are equipped to handle emerging technologies and market trends.

One instance being, the 3DEXPERIENCE platform leverages Digital Twin technology to enhance collaboration, safety, skills development, and operational efficiency, thereby creating a more engaging and connected work environment.

This innovative approach to training ensures that supply chain professionals remain agile and effective in an increasingly complex landscape.

While digital twins offer significant advantages for workforce training, several challenges hinder their implementation and scalability. Here are the key issues:

The development and deployment of digital twins require significant investments in software, hardware, and skilled personnel. For many organizations, this creates a barrier to entry.

Integrating real-time data from multiple sources such as ERP, IoT devices, and SCM systems is technically challenging. Ensuring data accuracy and consistency adds another layer of complexity.

Employees may resist adopting new technologies due to unfamiliarity or fear of change. Overcoming this resistance requires extensive training and change management strategies.

This resistance is frequently linked to a lack of understanding and insufficient training. The International Journal of Smart and Sustainable Built Environment highlights that a “low level of knowledge” and “low level of technology acceptance” among employees impede digital twin implementation.

Building and maintaining digital twins demand expertise in fields like data analytics, simulation modeling, and AI. The lack of readily available talent can delay implementation.

Digital twins operate on live data, making them potential targets for cyberattacks. Protecting these systems against breaches is a critical concern.

Implementing digital twin technology introduces significant cybersecurity challenges. A report from CSO Online highlights that without proper cybersecurity controls, digital twins can expand a company’s attack surface, potentially granting threat actors access to previously inaccessible control systems and exposing pre-existing vulnerabilities

Determining the tangible benefits of digital twin adoption for workforce training, especially in the short term, can be challenging, causing hesitation among stakeholders.

Implementing digital twin technology presents challenges in measuring return on investment (ROI), which can hinder stakeholder buy-in. Proving the value of new technologies is critical. Without clear ROI metrics, gaining stakeholder buy-in can be challenging. It’s recommendable to manage setting measurable goals and tracking performance indicators such as operational efficiency, cost savings, or enhanced decision-making to address this issue.

Addressing these challenges will require strategic planning, cross-functional collaboration, and long-term commitment to digital innovation.

As global supply chains grow increasingly interconnected, digital twin technology is reshaping workforce training, offering unparalleled opportunities for skill enhancement and operational agility. By creating virtual replicas of supply chain processes, companies can simulate complex scenarios, train employees in real-time decision-making, and cultivate a culture of innovation.

Digital twins empower SMEs to compete with larger players by enabling rapid experimentation, improved decision-making, and enhanced customer satisfaction. As the demand for dynamic supply chain professionals rises, digital twins are becoming essential tools for fostering technical proficiency and resilience.

The scalability of digital twins enables businesses to align training with real-world challenges. Platforms such as IBM’s Digital Twin Exchange provide ready-made templates that can be customized to mirror company-specific workflows.

By investing in digital twins, organizations not only enhance operational efficiency but also secure a competitive advantage, preparing their workforce to meet the challenges of modern supply chain management. V

BY TERENCE REPELENTE

Asia’s luxury market stands at a turning point, navigating shifting consumer behaviors and mounting challenges while remaining a global epicenter of high-end consumption. For decades, the region has been a powerhouse for luxury brands, fueled by rising disposable incomes, rapid urbanization, and evolving cultural aspirations. China and Japan, in particular, dominate, accounting for more than half of the region’s market value.

Yet beneath the surface, luxury brands are grappling with multiple pressures—not just managing intricate supply chains where precision and exclusivity are non-negotiable, but also contending with low consumer confidence, increased tourist spending abroad, and the rapid rise of gray markets, as more shoppers turn to second-hand luxury over traditional retail.

global logistics in an era defined by both soaring demand and supply chain disruptions. The task is anything but ordinary.

“The luxury industry is at a pivotal moment. In addition to the regional shift, there is mounting pressure from a young generation that many brands struggle to connect with, amplified by higher overall expectations and technological disruption in all aspects of the client journey,

Luxury brands must juggle consumer expectations, artisanal production processes, and the complexities of Daniel Langer, CEO of Équité, wrote in an article on Jing Daily.

At first glance, the Asian appetite for luxury goods may seem contradictory. After all, many Asian cultures are rooted in philosophies like Confucianism and Buddhism, which emphasize modesty and frugality. However, a closer look reveals a different story.

A study in the Journal of International Business Studies suggests that collectivist societies, such as those in Asia, view luxury consumption as a way to bring honor to their in-groups. Unlike in Western individualist cultures, where flaunting wealth might be seen as tacky or materialistic, in Asia, owning high-status items often signals success and social alignment.

Social media influencers have further amplified this trend. Platforms like Douyin and Instagram teem with aspirational content, from high-end fashion hauls to luxury travel vlogs, shaping consumer perceptions and driving sales. This digital influence reflects a deeper shift: Asian consumers no longer look West for luxury codes. They now assert their cultural identity, blending tradition with modernity in ways that reshape global trends.