Once again, the annual UTCA Convention has proven to be one of the highlights of the fall calendar. This year was no different as more than one thousand attendees from all parts of the industry gathered in Atlantic City to network, do business and socialize with our colleagues.

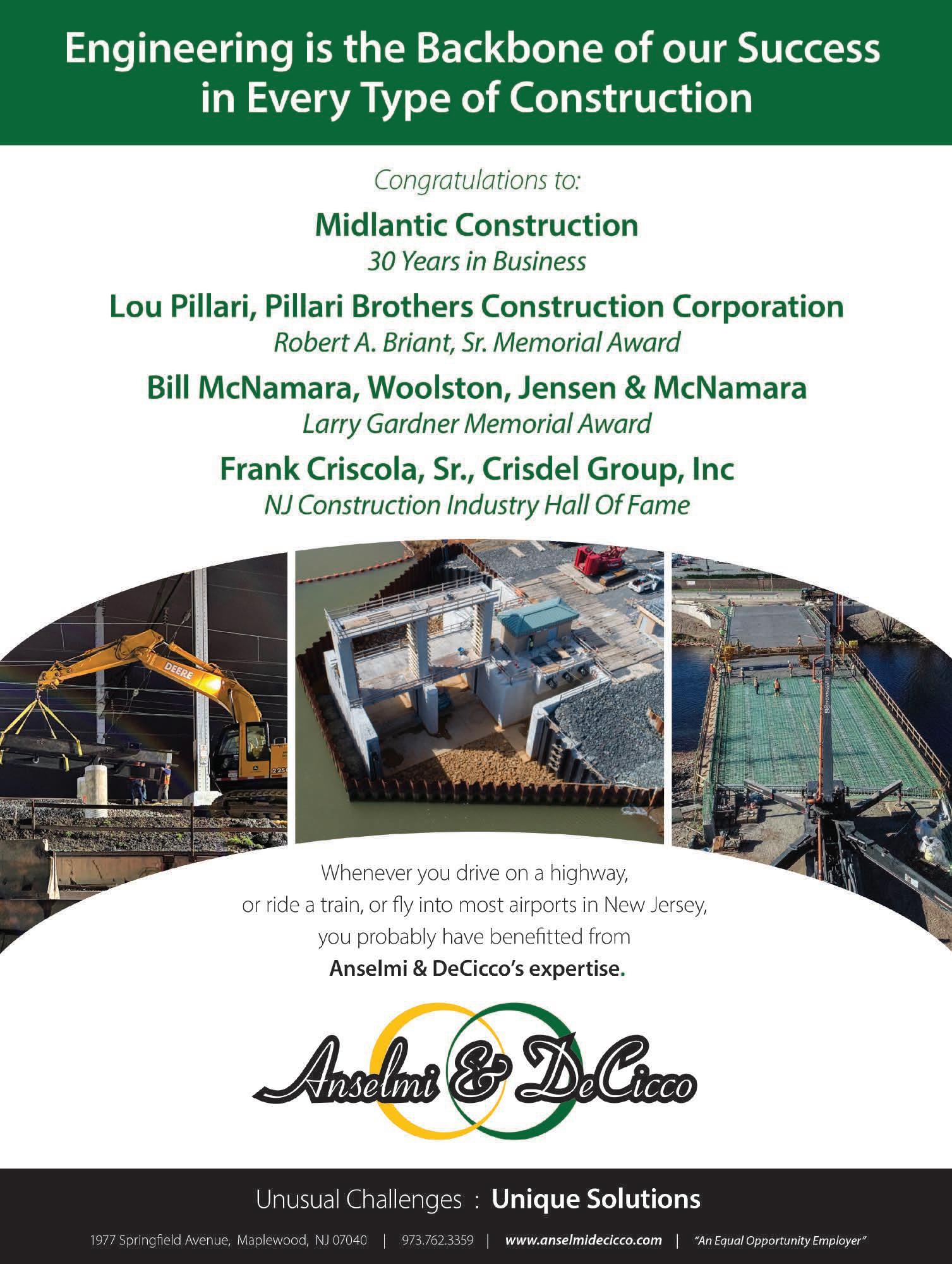

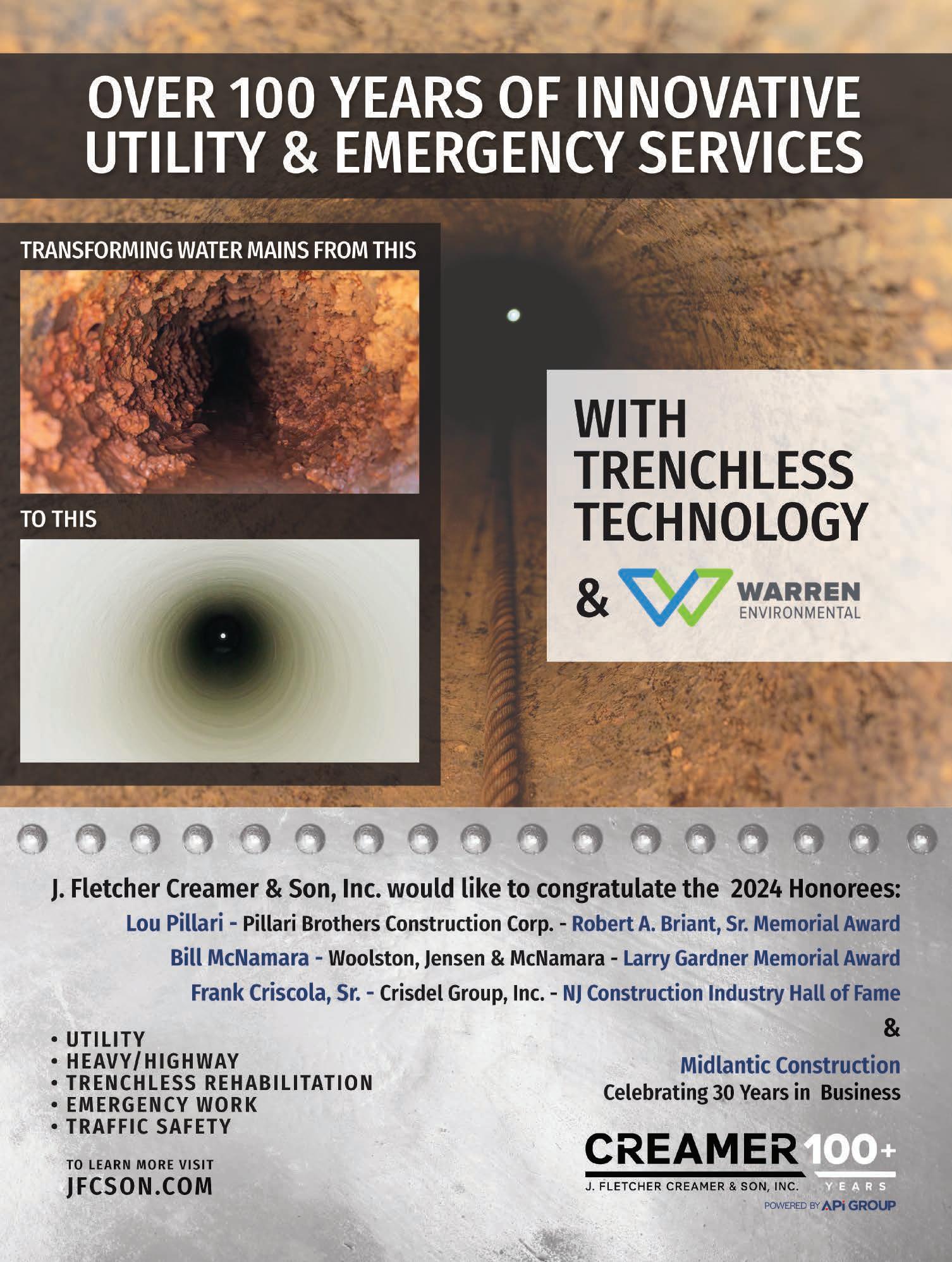

The successful convention, including two sold-out golf outings, multiple receptions, an Emerging Leaders Happy Hour and a jam-packed exhibit floor, was a wonderful showcase for our industry. I especially enjoyed the opportunity to celebrate our colleagues, Bill McNamara, Lou Pillari and Frank Criscola Sr. who were honored during the convention for their contributions to our industry. Kudos to Lauren and the UTCA team for putting on another great convention.

In addition to planning the convention, UTCA didn’t slow down through the dog days of summer, hosting a seminar on the Design-Build procurement process with the New Jersey Department of Transportation (DOT) as well as a webinar with our legal counsel on rule changes to the Davis-Bacon Act rules which govern wages on federally funded public works projects.

Another policy they tackled that would impact our industry is the establishment of heat standards that would impose various requirements on contractors during periods of high heat. UTCA is working with our federal partners at the American Road and Transportation Builders Association (ARTBA) to offer comments on a proposed national heat standard released by OSHA in September. In addition, UTCA Executive Director Dave Rible penned an excellent article for NJ.com which laid out the flaws in New Jersey legislation that would create a statewide heat standard.

submitting comments on these rules which mostly exempt transportation projects but will affect many utility-related construction activities.

In addition to all the activity in the regulatory space, UTCA has been very busy keeping members informed about frequent changes to specifications for various agencies, including the DOT, Department of Labor, and NJ Turnpike Authority. Make sure to check your emails regularly to ensure you are in compliance with the ever-changing specifications.

UTCA has also been busy promoting safety in the construction industry which continues to be our top priority. To that end, UTCA’s Dan Neville and Safety Committee Chair Gregg Johanesson have been visiting job sites to discuss work zone safety and the “Be Accountable” campaign which urges everyone on the job site to be accountable for their safety.

UTCA is also engaging on several New Jersey rules that could negatively affect the industry, including a rule that goes into effect on Jan 1, 2025 requiring truck manufacturers to sell a certain percentage of electric vehicles. As a result of this rule, some truck dealers have informed customers that they may not be able to provide them with trucks they need next year. UTCA staff met with Governor Murphy’s office and urged him to delay implementation of this rule that would have far-reaching effects on the construction industry.

Another significant rule was released in August that imposes additional requirements for construction in flood prone areas. UTCA will soon be

Speaking of UTCA staff, our association is fortunate to have added Kyle England to our team as the Director of Utility and Environmental Operations. Kyle has extensive experience in multiple organizations, including the New Jersey Concrete and Aggregate Association, and we are pleased to have him focus on these issues which are critical to UTCA members.

It’s also important to note that the race to succeed Gov. Phil Murphy has already begun and whomever wins the Governor’s race next fall will have a major impact on our industry. I recently joined with several colleagues for a “meet and greet” with Republican candidate, Jack Ciattarelli, who almost defeated Murphy in 2021. While Jack was quite impressive, UTCA is engaging with candidates from both sides of the aisle to ensure our industry continues to have a strong voice in Trenton regardless of who is successful next year.

Finally, I would like to thank everyone who participated in this year’s convention and offer my heartfelt congratulations to convention honorees, Frank Criscola, Sr., Lou Pillari, and Bill McNamara. Congratulations as well to Midlantic Construction LLC which is celebrating 30 years in business which is quite a remarkable achievement.

Gerard L. Burdi

•

by: kevin ellman & daniel tyburski - wealth preservation solutions, llc

It certainly has been a very interesting few years in the stock market. We have seen an increased level of volatility and uncertainty as to the overall health of the economy. We have seen significant growth over the past eighteen months, which is largely due to the technology sector’s “Magnificent 7” (Apple, Microsoft, Amazon, Google, Meta Platforms, Nvidia, and Tesla).

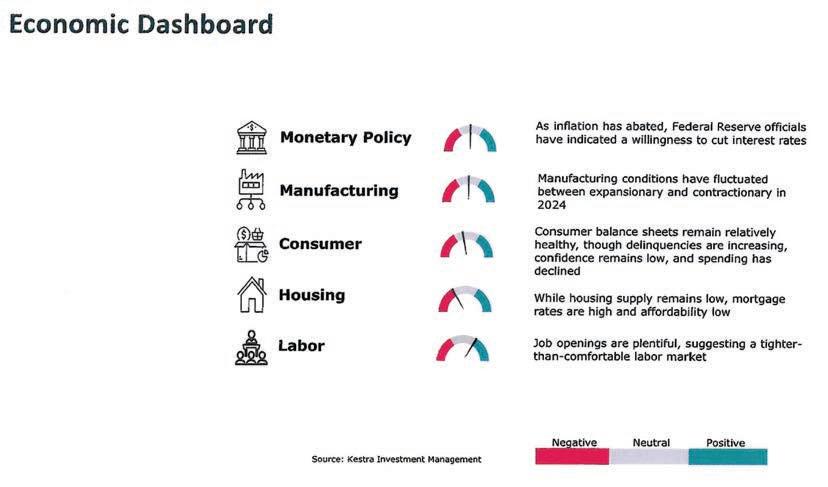

As we look ahead to the economic outlook for the United States for the rest of 2024 into 2025, several key factors will likely shape the trajectory of the economy. Here are some considerations:

1.Economic Growth: The United States economy is projected to continue its recovery from the impact of the COVID-19 pandemic, with GDP growth expected to remain strong in the coming years. Factors such as increased consumer spending, business investment, and government stimulus measures will contribute to overall economic expansion.

*We are positive on the growth outlook

2.Inflation: Inflation has been a significant concern over the past 36 months. The latest inflation data shows that inflation has decreased significantly, recently breaking the 3% level, at 2.9%. This was the lowest reported inflation reading since April 2021. This new data could prompt the Federal Reserve to begin cutting interest rates and give the consumer the long-awaited reprieve they have been looking for.

to wage inflation in certain industries if not corrected.

*We are positive on the labor market

4.Interest Rates: The Federal Reserve has signaled its intention to gradually lower interest rates once the inflation numbers begin to fall to an acceptable range. It looks as if this reduction in interest rates may happen sooner than expected. When the Federal Reserve lowers interest rates, it will make everyday things like financing a home or a new business more affordable.

*We are positive on interest rates

5.Global Factors: The global economic environment, including trade relations, geopolitical events, and supply chain disruptions, will also influence the U.S. economic outlook. Uncertainties in these areas could create challenges for businesses and impact economic growth.

*We are neutral on Global Factors

Overall, the economic outlook for the United States for the rest of 2024 into 2025 remains positive, with continued growth and recovery expected. However, we will monitor and make changes to the “Market Outlook” after carefully examining all the vital economic factors such as inflation, labor market dynamics, interest rate changes, and global uncertainties.

*We see inflation retreating to acceptable levels

3.Labor Market: The labor market is expected to continue improving, with job creation and declining unemployment rates. However, labor shortages in certain industries and challenges in filling open positions could persist. These conditions could lead

If you would like to see if your portfolio is positioned correctly for the current market landscape, please reach out to Daniel Tyburski at 201-669-0252.

By: nicholas a. sullivan, esq.

On February 23, 2024, the Office of Federal Contract Compliance Programs (“OFCCP”) published a notice in the Federal Register seeking to reinstate the filing of the Monthly Employment Utilization Report, Form CC-257, for the first time in approximately thirty years. Prior to ceasing the use of Form CC-257, Form CC-257 required construction contractors, on a monthly basis, to submit certain information to the OFCCP regarding construction employee hours worked by race, ethnicity, gender, and trade in the covered geographic area where the work was performed. Now, the OFCCP proposes reinstituting the use of Form CC-257 with additional requirements.

As proposed, Form CC-257 will require contractors working on federally funded or federally assisted construction projects exceeding $10,000.00 to take steps to ensure nondiscrimination and equal employment opportunities on such projects. These requirements include collecting and analyzing applications and personnel data and actively participating in diversity, recruitment and outreach, among other activities. As part of the implementation of Form CC-257, when a contractor is audited by the OFCCP, the OFCCP will review compliance with these requirements and will investigate potential discrimination based on the data submitted by the contractor.

The proposed additional requirements of Form CC-257 include requiring covered construction contractors to report the number of employees and trade employees’ hours worked by race and gender within each Standard Metropolitan Statistical Area or Economic Area each month for each qualifying project. They also require the contractor and subcontractor to provide its Unique Entity ID or Data Universal Numbering System, the number of covered areas with projects during the reporting period, the name and email address of the company official who will certify the information, identification of a new “foreperson” classification, and revision of the classifications for race to comply with EEO-1 race categories.

Additionally, contractors must identify a project’s “Megaproject” status. The OFCCP’s Megaproject program focuses on projects exceeding $35 million. For such Megaprojects, the OFCCP intends to be involved with covered contractors and subcontractors, including regular meetings and additional Megaproject oversight. Form CC-257 will permit the OFCCP to track the effectiveness of outreach efforts and inform decisions regarding Megaproject resource allocation, program emphasis, and training efforts.

The reimplementation of Form CC-257 requires additional federal compliance requirements that have not been used since 1995. The comment period for the proposed renewal of Form CC-257 has expired. The OFCCP has not announced an enforcement date for Form CC-257, but it is expected the enforcement date will occur in 2024 or early 2025. All contractors and subcontractors bidding on and working on federal construction projects must remain aware of the upcoming changes and reporting requirements related to Form CC-257.

About The Author . . .Nicholas A. Sullivan, Esq., is an Associate in the Cherry Hill office of Florio, Perrucci, Steinhardt, Cappelli, & Tipton, LLC. He may be contacted at nsullivan@floriolaw.com

By: salvatore schibell, cpa, cfp, cgma, ms taxation, mba

Qualifying as a small business can offer contractors significant advantages under the U.S. Small Business Administration (SBA). The SBA strongly advocates for small businesses, ensuring larger corporations don't overshadow them. Its mission is to foster innovation, create jobs, drive economic growth, and support disadvantaged groups. Through various programs, the SBA provides education, mentoring, training, and guidance on securing government contracts, instilling confidence in contractors as they plan, launch, and grow their operations.

Attaining small business status opens doors to exclusive opportunities, including lucrative reserved federal contracts. In 2023, small businesses were awarded a record 28.4% of federal contract dollars—worth $178.6 billion—exceeding the government's 23% goal. Lawmakers are advocating for raising the small business contracting goal to 25%.

The Federal Government annually awards about 10% of its contracts to Small Disadvantaged Businesses (SDBs). In 2023, SDBs received 12.1% of contract dollars, totaling $76.2 billion, while 5.1% went to service-disabled veteran-owned small enterprises. Additionally, women-owned small businesses secured $30.9 billion in federal contracts, and HUBZone (Historically Underutilized Business Zone) companies were awarded $17.5 billion.

The SBA sets size standards to define a business's maximum size to qualify as a small business. These standards differ by industry and are typically based on annual receipts, employee counts, and affiliations.

The size requirement for small businesses is determined using NAICS codes, as outlined in the North American Industry Classification Manual—United States. These codes specify a business's maximum allowable revenue to qualify as a small business. For instance, NAICS code 237310, covering Highway, Street, and Bridge Construction, has an average receipt limit of $45 million. Some NAICS codes also impose employee number limits as part of their eligibility requirements.

The SBA also uses annual receipts to determine size, as shown on the company’s tax return. For federal contracting, receipts are averaged over the last five fiscal years. If the business is under five

years old, multiply its average weekly revenue by 52 to calculate average annual receipts.

In some situations, the SBA requires the income or employee count from related businesses to be included when determining business size. The employee count is the average number of people employed for each pay period over the business’s latest 24 calendar months. Any person on the payroll must be included as one employee, regardless of hours worked or temporary status. The number of employees of an entity in business less than 24 months is the average for each pay period it has been in business.

The employees and/or receipts of all affiliates must be included when calculating a business's size. Billing for services exchanged between affiliates is excluded when calculating revenue for size determination. Affiliation is based on the power to control, whether exercised or not. Control typically exists when an external party owns 50% or more of the business but can also occur with less ownership through contractual agreements or when one party holds a significantly larger share than others.

Examples of affiliation:

• Control is established when one person or entity holds 50% or more of the voting stock. For example, if Company A owns 54.5% of Company B, 81% of Company C, and 60% of Company D, all four companies are considered affiliated. In this case, the receipts and/or employees of all these companies will be combined to determine each one's size.

• Control can exist with less than 50% of the voting stock if one person or entity holds a significantly larger share than any other stockholders. Even without majority ownership, this larger block of voting stock gives them the power to control the company, establishing affiliation.

• Common management can lead to affiliation. If one or more officers, directors, managing members, or general partners of a business concern also control the Board of Directors and/or the management of another business concern, the concern is an affiliate.

• Individuals or firms with identical (or substantially identical) business or economic interests may be considered affiliated unless proven otherwise. This presumption applies to

family members, including lineal descendants (father, mother, children, and grandparents), individuals with common investments, or firms that rely on each other economically through contracts or similar relationships. The presumption of affiliation among family members is limited to married couples, civil unions, parents, children, and siblings.

Numerous other scenarios may establish affiliation beyond what is discussed here, so it's crucial to consult the regulations and interpretive guidance to avoid costly mistakes, such as disqualification. That said, there are specific exceptions to the affiliation rules, including:

• Common administration services such as bookkeeping, payroll, recruiting, human resources, and cleaning can be reasonably pooled or handled by a holding company, parent entity, or sister business without affecting the subject company's control.

• Contract administration services that do not involve direct oversight or control of day-to-day contract performance.

• Business concerns that involve leasing employees to other businesses.

• Companies providing financial management or technical support, including venture capital, employee benefits, and investment services, that are not directly involved in contracting or contract management.

The U.S. Department of Transportation (DOT) oversees the Disadvantaged Business Enterprise (DBE) program. About 85% of DBE funding is directed toward construction projects managed primarily by three DOT branches: the Federal Transit Administration, the Federal Highway Administration, and the Federal Aviation Administration.

To qualify as a DBE, the business must meet the SBA's definition of a for-profit small business. At least 51% of the business must be owned and controlled by socially and economically disadvantaged individuals who manage the day-to-day operations.

Socially disadvantaged individuals are those who have faced racial, ethnic, or cultural prejudice in American society based on their group identity, regardless of their personal qualities. This disadvantage arises from circumstances beyond their control, such as race, ethnicity, gender, or disability, which hinder their entry or advancement in business and employment. African Americans, Hispanics, Native Americans, Asian-Pacific Americans, Subcontinent Asian Americans, and women are presumed to be socially and economically disadvantaged. Others may also qualify on a case-by-case basis, provided their personal net worth does not exceed $1.3 million.

Economically disadvantaged individuals are those whose social disadvantage has limited their access to capital and credit, affecting their ability to compete in business compared to others without such disadvantages.

The SBA's new MySBA Certifications platform, launching in September 2024, aims to simplify the federal contracting certification process. This new platform will enable businesses to apply for and manage multiple certifications in one centralized location. The certifications impacted by this upgrade include:

• Women-Owned Small Business (WOSB)

• Economically Disadvantaged Women-Owned Small Business (EDWOSB)

• 8(a) Business Development Program

• Veteran-Owned Small Business (VOSB)

• Service-Disabled Veteran-Owned Small Business (SDVOSB)

• Historically Underutilized Business Zones (HUBZone) Program

To participate in the DBE program, a small business owned and controlled by socially and economically disadvantaged individuals must receive DBE certification from the relevant state–generally through the state Uniform Certification Program (UCP).

In addition to SBA certifications, businesses can apply for Small Business Enterprise (SBE) certification issued by a state or local government. Organizations seeking SBE certification should contact the relevant government authority in their state. Certification typically involves applying and registering with the certifying agency. The requirements vary by state, so check local guidelines before applying.

Small business certification can be a game changer for companies seeking access to lucrative federal contracts. With programs like the SBA and DOT certifications, small businesses and socially and economically disadvantaged businesses can compete on a more level playing field. Understanding size standards, affiliation rules, and the certification process opens doors to substantial opportunities, including billions of dollars in set-aside contracts. Small businesses can position themselves for long-term success by meeting these requirements and staying informed. For more information on SBA programs, visit www.sba.gov.

About the Author . . . Salvatore Schibell, CPA, CFP®, CGMA, MS Taxation, MBA, is the tax partner at Lawson, Rescinio, Schibell & Associates, P.C. He is a profit improvement expert who is driven to help construction contractors make more money. Sal can be contacted at 732-539-7328 or salschibell@lrscpa.com.

President’s Club

J. Fletcher Creamer & Son

Crisdel Group

D’Annunzio & Sons

George Harms Construction

JRCRUZ Corp.

Northeast Remsco

PKF Mark III

Schifano Construction

Union Paving & Construction

Governor’s Level

Black Rock Enterprises

Montana Construction

P&A Construction

Petillo LLC

Skoda Contracting

Ambassador Level

Asphalt Paving Systems

South State Inc.

Leadership Level

Anselmi & DeCicco

Carbro Constructors

Ralph Clayton & Sons

Kiely Civil

R.E. Pierson Construction

Traffic Lines Inc.

Zone Striping

Platinum Level

B. Anthony Construction

Bayshore Recycling

Berto Construction

Diaco Contracting

Haines & Kibblehouse Inc.

M.S.P. Construction Corp.

New Prince Concrete Construction

Orchard Holdings

P.M. Construction

Pillari Brothers Construction

Pioneer Pipe Contractors

M.L. Ruberton Construction

Smith Sondy Asphalt Construction

Trap Rock Industries

Work Zone Contractors

Yonkers Contracting

Gold Level

C&H Agency

Concrete Construction Corp.

Della Pello Contracting

Eastern Landscape Contractors

Fai-Gon Electric

Lehigh Utility Association

Mathis Construction

Metra Industries

Northwest Equipment

Penn Bower Inc.

Persistent Construction

Sa & Sons Construction

Scafar Contracting

Taylor Oil Company

Waters & Bugbee

Zack Painting

Silver Level

C. Abbonizio Contractors

JA Alexander

JM Ahle

Atlantic Concrete Products

Atlantic Cordage

B&W Construction

Bil Jim Construction

Brent Material

CATS Sweeping

CRS Contractors

Caterina Supply

Concrete Cutting Systems

Edward H. Cray

Patrick DiCerbo - Northwestern Mutual

Flanagans Contracting

ICON Equipment

J.C. MacElroy Co.

Pact One LLC

Pro Tapping

Renda Roads

Ritacco Construction

Rockborn Trucking & Excavation

SJA Construction

SPA Safety Systems

V.A. Spatz & Sons

TKT Construction

Tobia & Lovelace

Trench Technologies

By: ryan sharpe, director of government affairs and communications

Over the past few years, transitioning to green energy has been a priority of Governor Phil Murphy’s Administration which has been hell-bent on addressing the effects of climate change by reducing our reliance on fossil fuels.

While the Legislature has been reluctant to enact Murphy’s aggressive clean energy goals, which lean heavily on electrification, he has repeatedly bypassed the Legislature and enacted policy through the regulatory process. Examples of this headlong rush toward clean energy include his plan to ban the sale of gasoline-powered passenger vehicles by 2035 and his Inland Flood Rules which enact stringent construction rules, including requiring higher building heights.

One policy also enacted by rule, is the Advanced Clean Truck Rule which was enacted in 2021 but goes into effect next year. Under the regulations, beginning on January 1, 2025, manufacturers of vehicles with a Gross Vehicle Weight Rating (GVWR) over 8,500 pounds must participate in a credit/deficit program designed to increase the percentage of zero-emission trucks sold in New Jersey.

Through this system truck manufacturers will earn a deficit for every non-electric truck they sell which must be offset by either selling an electric truck or purchasing a credit from a manufacturer who sold an electric truck.

Like many government programs, this is a seemingly well-meaning policy that is now having real-world effects as dealers are struggling to acquire electric trucks and some are complying with the program’s required electric to gasoline ratios by reducing the number of non-electric vehicles, they will make available in New Jersey. In fact, UTCA members have already received correspondence from truck dealers that they may not be able to meet their customers’ need for trucks in 2025.

Clearly, not being able to purchase new trucks would have a serious negative impact on the construction industry and on our economy, which is heavily dependent on trucking to provide a wide array of goods and services.

In addition to the lack of availability, this mandate creates a host of challenges for companies that will be forced to purchase incredibly costly trucks, rely on an inadequate charging infrastructure, and deal with a wide variety of operational limitations posed by these vehicles.

While the Legislature could invalidate these rules, it is unlikely lawmakers will take this step to directly oppose one of Gov. Murphy’s chief policy initiatives. With these rules right around the corner, UTCA has been engaging with various partners and policymakers to delay their implementation. In addition to working with a stakeholder coalition that is urging the DEP to pull back on these rules, UTCA has engaged with both the Governor’s Office and legislative leaders to seek an approach that would extend the upcoming deadline.

In August, the Murphy Administration yet again bypassed the legislative process in order to implement another substantial policy affecting the industry. The most recent far-reaching policy came in the form of the Resilient Environment and Landscape (REAL) rules which were officially proposed in August.

The new rules would require structures be raised by an additional five feet in areas most at-risk for severe flooding and impose additional restrictions on new construction. While existing transportation systems are largely exempted, new requirements would be imposed on underground cabling, jacking, and drilling. UTCA is currently preparing comments on the regulations that seek to minimize the impact on the infrastructure industry.

Any discussion of government policies must include the political climate which has a major impact on the decisions made in New Jersey and Washington. While elections are always important, the stakes are even higher this year with voters determining who controls both the White House and Congress.

In fact, a Presidential race that seemed headed for a landslide has now turned into neck-and-neck battle between Vice President Kamala Harris and former President Donald Trump. While these two candidates engage in an increasingly bitter race, a handful of key House and Senate races could determine which party controls Congress which is currently split between the two parties.

Speaking of Congress, New Jersey’s federal representatives have undergone tremendous changes recently with the deaths of two Congressman and the conviction and subsequent resignation of Senator Bob Menendez. Governor Murphy elected to fill Menendez’ vacant Senate seat with his former chief of staff, George Helmy, who is not expected to seek re-election. Democrat Con-

gressman Andy Kim is considered the heavy favorite to win the seat in November but must get past Republican Curtis Bashaw.

New Jersey will also have a new representative in the 10th Congressional District where Newark Council President Lamonica McIver is all but certain to be the replacement for Congressman Donald Payne who died in April. Similarly, State Senator Nellie Pou has been selected as the Democrat nominee to fill the vacancy created by the passing of North Jersey Congressman Bill Pascrell.

All of this movement at the federal level has set off a round of political musical chairs affecting our Legislature with at least three long-serving state lawmakers leaving Trenton to seek higher office. Despite the changes, there is little chance that Democrats will lose control of the Assembly which is up for election next year.

These new legislators will face no shortage of issues now that the Legislature has returned after its summer recess. The bills that are considered over the next few months will affect, and will be affected by, next year’s elections.

Also on the ballot will be the nominees for Governor which will be vacated by Gov. Murphy in early 2026. The field of candidates seeking to ascend to the Governor’s Office continues to swell

with NJEA President Sean Spiller the latest contender to declare his candidacy. As we have seen over the past seven years, the person that ultimately wins the Governor’s race will have a major impact on the polices affecting our industry.

Although UTCA will likely be forced to combat more harmful policies over the next few months, there are initiatives that we hope the Legislature will take up this fall that would support the state’s construction industry.

One bill that we are advocating for would allow Joint Ventures to bid on public works projects as long as each contractor has a valid Public Works Certificate. This bill was introduced at the request of UTCA after a court allowed a bid to be rejected because, although both contractors possessed a Public Works Certificate, the Joint Venture itself was not registered.

This ruling could disadvantage many New Jersey contractors who use Joint Ventures because these agreements are often formed close to the bid submission deadlines, and it can take weeks or even months to secure the Public Works Certificate.

While the future of this bill is uncertain, we will continue to pursue beneficial policies like this while, at the same time, we are prepared to combat the harmful policies that seem to continuously emanate from Trenton and Washington.

By: Ryan Sharpe Director of Government Affairs and Communications

The Borgata Casino and Hotel was once again the place to be for anyone involved in the infrastructure construction industry as the UTCA Convention brought contractors, vendors and others together in Atlantic City. The Convention gets bigger and better every year and this year’s gathering did not disappoint as a record-breaking crowd took part in what has become a “must attend” event for the industry.

As always, the exhibit floor was abuzz with activity with nearly 100 exhibitors from all corners of the industry offering a wide variety of products and services to the more than 1,100 attendees, representing over 200 companies.

Once again, the Fall Golf Outing served as the unofficial kick-off to the convention with over 100 golfers teeing it up at Atlantic City Country Club in Northfield and another 80-plus golfers enjoying a round at Galloway National Golf Club. Thank you

to everyone who participated in the golf outing and to our golf sponsors, Spiniello Companies and Underground Utilities Corp.

Following golf, the Opening Reception started off the festivities at the Borgata which was followed by the Awards Dinner. These again proved to be extremely popular with over 500 people attending at least one of these affairs.

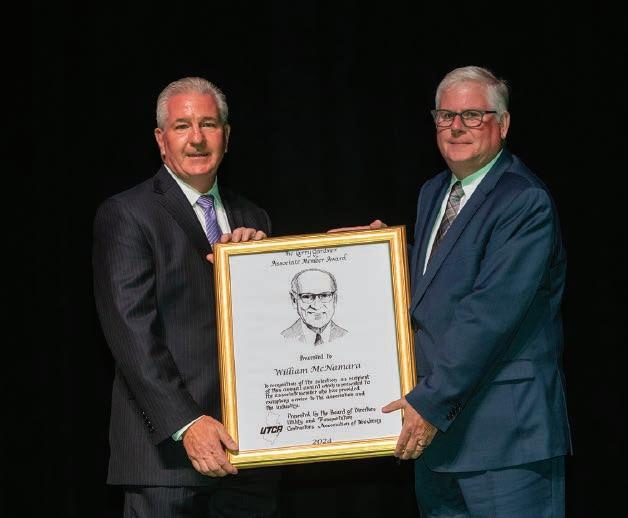

The Awards Dinner featured the presentation of the industry awards where Bill McNamara of Woolston, Jensen and McNamara, LLC accepted the Larry Gardner Memorial Award while Lou Pillari of Pillari Bros. Construction Corp. was the recipient of the Robert A. Briant Sr. Award. Thank you to everyone who took part in these events and to our reception and dinner sponsors, Jesco, Foley Inc., South Jersey Gas and Elizabethtown Gas.

Despite all of this activity, the night was still young for our Emerging Leaders who enjoyed a late-night happy hour at the Borgata Pool. Over 100 young professionals enjoyed delicious food, cocktails and football on the big screen late into the night, courtesy of the event’s sponsors, Montana Construction and the New Jersey Utility Association.

Friday morning saw the re-opening of the Exhibit Floor where vendors of all stripes interacted with contractors and industry colleagues as they displayed a wide variety of products and services, including materials, construction equipment, safety devices as well as engineering, accounting and insurance services.

UTCA Executive Director Dave Rible opened the luncheon program by welcoming everyone in attendance before beginning the awards presentation where Frank Criscola, Sr. of Crisdel was in-

ducted into the New Jersey Construction Industry Hall of Fame.

UTCA President Gerard Burdi was then administered the oath of office to serve a second consecutive term. Gerard noted the many years he has served on the UTCA Board of Directors and expressed his gratitude to his family, his employees and UTCA colleagues and staff who have helped him along the way. He also noted the accomplishments of the UTCA over the past year, including renewal of the Transportation Trust Fund, successful changes to the NJ Turnpike Authority’s “pre-qualification” rules, and helping secure record-breaking investment in the state’s infrastructure.

After Gerard’s remarks, this year’s guest speaker, Anthony Robles delivered an inspirational speech about his journey to becoming a three-time All-American college wrestler, despite being born with only one leg. Anthony’s remarkable story is the subject of a soon-to-be-released motion picture from Ben Affleck and Matt Damon’s production company and features Jennifer Lopez who plays Anthony’s mother.

Anthony spoke about the challenges he faced both in his wrestling career and in life, noting that despite a stellar high school record he was not offered a college scholarship and was forced to work nights to pay for his tuition. In addition, his family experienced a financial crisis that resulted in the loss of their home. He ultimately overcame tremendous adversity and went on to win the 2011 NCAA Wrestling Championship, by “refusing to let his challenges become his excuses”—something he believes can be carried over into other parts of life and the business world.

Thanks to our premier lunch sponsor, Komatsu and to our labor partners, the Engineers Labor-Employer Cooperative who sponsored this wonderful keynote speaker. Also, special thanks to our lunch prize drawing sponsor, Construction Risk Partners/ The Baldwin Group for continuing the traditional give away of Contractor his/her watches and the Associate prize.

The Exhibit Floor reopened after lunch and was a whirlwind of activity with the Money Booth again proving to be wildly entertaining with contestants grabbing as much cash as possible as bills swirled through the air. Other lucky winners from the day took home an iPad, Yeti Cooler, Amazon gift cards and a Kate Spade handbag. Congratulations to Sue Ryan from Northeast Remsco who won the Grand Prize—a trip to St. Maarten.

Friday evening saw the return of the always-popular PAC Auction and President’s Reception which saw attendees bid on close to 40 items, many of which were donated by our members. Win-

ning bidders took home luxury handbags, tickets to exciting sporting events, exclusive golf packages and many other magnificent products and experiences. The generosity of those who donated items and those who bid on them helped raise more than $16,000 for UTCA’s PAC, Constructors for Good Government, which helps ensure the voice of our industry is represented in Trenton.

Thank you to the sponsors of the Reception and PAC Auction, C&H Agency, Atlantic Concrete Products, Cohen Seglias Pallas Greenhall & Furman, Earle Asphalt Company, EIC Associates, Northeast Remsco, South State and M. L. Ruberton.

Finally, the traditional Saturday morning farewell breakfast, courtesy of Construction Risk Partners, was a delicious way to cap off another successful convention.

We thank everyone who participated in this year’s convention, including all of the sponsors, exhibitors and attendees. We wouldn’t be able to put on this event with the support of our members who share our commitment to strengthening the infrastructure construction industry. We can’t wait to see what’s in store for next year’s convention and we look forward to seeing everyone at the Borgata in 2025.

By: jeanette chojnacki, executive admin. assistant and jim murray, project manager

What began as an unconventional meeting on the jobsite led to the establishment of a company that has built a reputation of excellence among its peers. Owners Michael Murray and Lee Getz have dedicated themselves to creating a company that focuses on fostering growth through a genuine commitment to both their employees and their work. Their dedication has ultimately “paved the way” for Midlantic Construction LLC’s celebration of 30 years in business.

Michael Murray, President of Midlantic Construction, has been involved in the industry for nearly six decades. From starting his own fence company as a young teenager to working as a land surveyor during high school summers for Ocean County Engineering Department, the choice to pursue a degree in Civil Engineering at Farleigh Dickinson University was a natural one.

After graduating from FDU, Mr. Murray spent seven years with Conrail working his way from Field Engineer to Project Engineer and finally to Project Manager. While working at Conrail his work included various heavy civil construction projects throughout Conrail’s territory from Montreal, Canada to Washington, D.C and from the east coast to St. Louis, MO.

Following his time with Conrail he worked as a General Manager for MJ Paquet and solidified his reputation as a well-respected leader and manager overseeing all aspects of the day-to-day operations of the

company. Today Mike operates as Midlantic’s President and is responsible for bonding, banking, project estimating, and cost accounting.

Lee Getz, Vice President and General Superintendent of Midlantic Construction, started his construction career as a member of the Carpenters Union, moving up from Journeyman to Foreman in a few short years. His work with 78 Construction and Skyway Construction included all aspects of bridge work and led to his employment with MJ Paquet. Lee proved instrumental in the management and execution of contract work and during his seven year tenure with MJ Paquet, Mr. Getz was promoted from Carpenter Foreman to General Foreman and finally, to General Bridge Superintendent for all Paquet projects.

In his role as Superintendent Lee was responsible for project crews, scheduling and phasing, as well as coordination of subcontractors, suppliers, design engineers, and owner’s representatives. Currently, Lee is involved in various roles for Midlantic including estimating, scheduling, procurement, cost accounting, design of temporary structures, demolition methods, and sequencing and monitoring of production rates.

Mike and Lee crossed paths working for construction contractor MJ Paquet Inc. while Mike was operating as General Manager. Mike was on site observing the installation of concrete forms when he noticed that rather than using a rented backhoe to set the steel forms which weighed a few hundred pounds each, one of the carpenters on the project was simply carrying them around by hand and installing them on his own. This caught Mike’s attention and led to Mike and Lee’s introduction. The two quickly found common ground in their work ethic and recognizing Lee’s potential, Mike facilitated Lee’s advancement through the ranks at Paquet.

As their work began to wind down with MJ Paquet, Mike and Lee started discussing plans for their own company. After conversing with

their families, and with the encouragement of their support, they decided to take a leap of faith. The company was formed and meetings were arranged with multiple firms, banks and agencies in order to secure the bonding, insurance, financing, and required prequalifications necessary to operate a Heavy Highway Construction Company.

One of those meetings was with Ken Gelok of IOA. As Ken recalls, Mike and Lee to this day were the only people he has ever met with that showed up to an introductory meeting with a written business plan fully detailing their vision including a step-by-step plan of how they would start and operate a successful business. Ken, who has been handling Midlantic’s bonding and insurance since the company’s inception has stated that “I’ve never seen two individuals create a business plan and stick to it the way Mike and Lee did which resulted in the successes of Midlantic Construction LLC”.

Since its official formation in October 1994, Midlantic Construction LLC has established itself as a leader in heavy highway, civil, and marine construction across the state and continues to maintain its presence as a high-quality contractor known for its excellence in project execution.

The company has seen extensive growth from earlier projects valued in the hundreds of thousands of dollars to projects valued above $75 million. Midlantic’s experience working throughout New Jersey and the Mid-Atlantic region includes the successful completion of projects for the Department of Defense, US Navy and US Air Force, as well as projects for state and local agencies including the NJ Highway Authority/NJ Turnpike Authority, NJ Department of Environmental Protection, NJ Department of Transportation, and various counties and municipalities throughout the state. Operating in their capacities as leaders both in the office and in the field, Mike and Lee have spearheaded the continued advancement of the company.

In an increasingly competitive market, both Mike and Lee have succeeded in keeping Midlantic engaged in a variety of contract work including sitework, dredging, bulk heading, boardwalk construction, bridge repair and installations, and other heavy highway and marine construction.

Regardless of a project’s size, each is executed with the same level of professionalism and care that has earned Midlantic several awards for both large and small projects over the years. In 2011 Midlantic was awarded the NJACI (New Jersey Chapter of the American Concrete Institute) and NJCAA (New Jersey Concrete & Aggregate Association) Merit Award for the Ocean County Replacement of Beach Boulevard Bridge. In 2020 after completion of the NJDOT project Route 287/78, I-287/202/206 Interchange Improvements in Somerset County, Midlantic received Project of the Year from the NJ ASCE (American Society of Civil Engineers) as well as an Honor Award for from the ACEC (American Council of Engineering Companies) of NJ. Notably, despite the ongoing pandemic, Midlantic completed the NJDOT River Road Bridge Project over Raritan Valley Railroad, Emergency Bridge Replacement. Under their leadership the company was able to navigate the challenges that the pandemic posed for contractors and their employees. In doing so, Midlantic was awarded NJ ACEC’s 2021 Grand Honor Award-Small Project, ASHE NJ’s Project of the Year, and ENR’s (Engineering News Record) “Best Projects-Small Project”.

Mike and Lee have a mutual understanding of the business and what it takes to achieve and maintain success. As a locally owned business, Midlantic has proudly supported numerous charitable organizations such as Habitat for Humanity and The Tanner Edwards Foundation.

Outside of the professional operations of the company, they have created an environment that encourages growth for its employees and promotes the importance of family and work-life balance. For both owners, every sacrifice made over those 30 years has laid the groundwork for future generations. In this time they have assembled a staff that respects the core values of both owners and have inspired a loyalty that is well proven in the longevity of their office staff and field personnel.

Where most business partnerships might fail or become tenuous after 30 years, Lee and Mike have established a way of collaborating that allows them each to do what they do best and continue to “get the concrete out of the back of the truck”. In appreciating each other’s strengths and fostering those of their employees they have ensured that the company they have constructed will no doubt continue to thrive. Built on a foundation of mutual trust, respect and hard work, Midlantic Construction LLC is proud to be commemorating its 30th year in business and is looking forward to many more.

By: bradley sant, senior vice president for safety and education, artba

When you think “traffic control,” you might picture a stop light telling cars at an intersection when to stop, turn, and move forward. This guidance signals to drivers who has the right of way, preventing accidents and injuries.

Traffic control isn’t just for vehicles on the roadway. It is an important function for people and equipment on jobsites as well. Knowing when and where to move can be the difference between life and death. That is where Internal Traffic Control Plans (ITCPs) come in.

ITCPs are coordinated plans for roadway construction sites designed to protect workers on foot, aka “pedestrian workers,” who labor in close proximity to large vehicles and equipment, often adjacent to the motoring public.

Pedestrian workers are especially vulnerable for a variety of reasons:

• Construction vehicles and equipment have blind spots.

• Workers can get complacent when frequently near equipment, tuning out backup alarms.

• Operators and drivers are concentrating on their own tasks and may not be looking for pedestrian workers.

Phillip Russell, a veteran labor attorney with law firm Ogletree Deakins advises, “Employers who want to both improve safety and keep the Occupational Safety and Health Administration away should seriously consider implementing a robust ITCP. Even if tragedy strikes, it is important for employers to show they did all they could to provide a safe jobsite, including many of the elements of an ITCP.”

ITCPs are not new; in fact, they have been around for over 20 years. They are gaining wider acceptance today because the construction industry has a better understanding of them. They are growing in popularity because they function to prevent injuries and death while also streamlining construction operations by planning and controlling vehicle and worker interactions. The planning required to develop ITCPs can also streamline operations to create a more efficient site.

Other challenges include workers crossing the path of large dump trucks; equipment entering or exiting the work area; and workers taking shortcuts to latrines, rest areas, and parking areas.

ITCPs help separate workers on foot from the pathway of trucks and equipment. People are trained not to enter vehicle routes, except as planned and vehicle and equipment operations are planned and controlled to minimize or eliminate backing up. ITCPs also help coordinate the location of water coolers, latrines, employee parking, and break areas to help ensure workers are not “enticed” to cross vehicle pathways.

“Internal Traffic Control Plans provide a structured framework for managing construction traffic flow and ensuring the safety of workers, pedestrians, and motorists alike,” explains Mandy Kustra, safety director for Ajax Paving Industries of Florida. “By clearly outlining truck routes, the placement of flaggers, the location of construction equipment, and the presence of workers on foot, the risks associated with construction activities can be significantly reduced, ultimately leading to a safer working environment for all involved.” Ajax has pioneered the use of ITCPs in Florida for nearly a decade.

ITCPs may be extensive and planned well ahead of scheduled work or drafted on a clipboard at the beginning of each shift. The most important element is simply communicating the plan with workers, drivers, and operators.

Travis Parsons, director of occupational safety and health at the Laborers’ Health and Safety Fund of North America agrees. “Effective communication is crucial in road construction projects,

and ITCPs play a key role in this process. These plans are essential for contractors to convey safe movement protocols to workers during pre-construction meetings and daily safety briefings,” said Parsons.

Just like a traditional traffic control plan keeps motorists safe, ITCPs help mitigate risks, minimize disruptions, and maintain a

secure environment for workers and the public on construction jobsites. Knowing where to be, and most importantly where not to be, can save lives.

*Reprinted with permission from American Road and Transportation Builders Association (ARTBA).

By: jonathan landesman and leigh nazzario - cohen seglias pallas greenhall & furman pc

Every four years, just like clockwork, we brace ourselves for the election cycle’s wild ride. But while the campaign ads and heated debates fill the airwaves, something just as crucial is brewing in the world of labor relations—the impact of a new (or returning) administration on the National Labor Relations Board (NLRB). If you're not a legal eagle, don't worry—we're here to break it down without the jargon. Spoiler alert: the NLRB is about to get interesting.

Think of the NLRB as the referee in the arena of labor relations. It’s the body that decides the rules of engagement between businesses and unions when it comes to union organizing, collective bargaining, and worker rights. And, like any good referee, it doesn’t just enforce the rules—it also interprets them, and sometimes (depending on who's in charge), it might “adjust” those rules a bit. But here’s the kicker: the NLRB’s calls can change depending on which political party is in power. So, in an election year, businesses and workers alike must be on their toes, ready for some potential rule changes.

When Democrats lead the NLRB, the agency often focuses more on supporting unions and promoting worker rights.

• Policy Changes: Under a Democratic NLRB, there may be a shift away from policies established during the Trump administration, leading to increased support for union organizing and collective bargaining.

• Potential Legal Challenges: Courts might intervene to review and possibly challenge the NLRB’s authority to interpret labor laws, introducing an element of legal uncertainty.

If Republicans take charge, the NLRB may shift towards policies that provide businesses with greater control.

• Policy Changes: There may be a shift away from pro-union policies, giving employers more flexibility in decision-making without extensive negotiations with unions.

• Change in Leadership: A new general counsel could bring a business-oriented perspective to the interpretation of labor laws.

• Regulatory Changes: Businesses might experience reduced regulations, leading to more operational flexibility.

• Card Checks: The Cemex decision now facilitates union organizing by card check rather than requiring secret ballot elections. When a union presents signed authorization cards from a majority of employees, the employer must either recognize the union or file a petition for an election within two weeks. The decision also eliminates re-run elections, meaning a single unfair labor practice (ULP) violation can result in a bargaining order. Employers are advised to know this new timeline, focus on compliance to avoid the risk of a ULP, and train employees about what it means to sign a union authorization card.

• “Quickie Election” Rules: The NLRB has reinstated the “quickie election” rules, speeding up union elections and limiting the time employers must prepare or challenge them. These rules compress timelines for pre-election hearings, filing petitions, notifying employees, and reducing an employer’s ability to respond effectively. Employers should review their workforce in advance to analyze potential bargaining units and supervisory roles. They should train staff to meet shortened timelines, ensure compliance, and avoid missing deadlines. Additionally, management should be educated on not viewing union authorization cards.

• Fair Choice Employee Voice Rule: The Fair Choice – Employee Voice rule allows unions to delay elections through ULP charges and removes the 45-day window for employees to challenge a union's voluntary recognition. In the construction industry, unions can now secure recognition through contract language alone, without requiring a secret-ballot election. Employers should educate employees on their rights during organizing campaigns, as unions can file blocking charges to challenge a union’s majority status. Construction employers may maintain bargaining relationships after a contract expires based on the contract's language.

• Joint Employer Rule: The new joint employer rule expands the criteria for establishing a joint-employer relationship, allowing an entity to be considered a joint employer if it possesses indirect or reserved authority over employees' essential terms and conditions, such as wages, hours, and work assignments. This contrasts with the old rule, which required actual and direct control. Although the rule has been struck down by

a federal court for exceeding common-law limits, the NLRB is appealing the decision.

• Chevron Deference: The Chevron Doctrine, which required courts to defer to agency interpretations of federal statutes, was recently overturned by the Supreme Court in the Loper and Relentless cases. This limits the NLRB’s ability to make major legal changes, especially when members are politically divided, and increases the likelihood of federal court challenges to NLRB decisions. Employers should continue to follow current NLRB precedent until courts rule otherwise.

• PRO Act: The PRO Act is pending legislation aimed at overturning right-to-work laws in 26 states and banning employer anti-union tactics, such as firing workers on economic strikes, holding mandatory anti-union meetings, and preventing workers from using work computers for collective action. It also protects strikes and secondary boycotts. While not yet law, experts believe its chances of passing are slim.

The NLRB has been actively addressing several key issues:

• AI and Worker Rights: As businesses increasingly use AI for hiring and performance reviews, the NLRB is monitoring to ensure these technologies comply with labor laws and do not infringe on workers’ rights.

• Non-Solicitation Agreements: The NLRB is examining whether non-solicitation agreements, such as “no poaching” policies, may impact workers’ rights to organize and unionize.

No matter which way the election swings, it’s always good to be prepared for change. Here are a few tips to keep yourself ahead of the game:

1. Review Compliance: Make sure your practices align with current labor standards.

2. Monitor Trends: Keep an eye on NLRB rulings and how they may affect your business.

3. Consult the Experts: Whether it's legal or HR, talk to people who can guide you through these changes.

4. Stay Flexible: Be ready to adapt your policies as necessary. The one thing you can count on is that things will change.

The NLRB’s path can shift in an election year, and whether you're a business owner or an employee, it pays to stay informed.

By: dave rible, executive director

UTCA continues to educate policy makers and the public about the negative impact of legislation that would establish a workplace heat standard which would trigger multiple employer requirements, including limiting work, when the temperature reaches 80 degrees.

This measure would add to project delays, increase the cost of critical construction projects and would likely result in limiting employment opportunities for workers who are currently afforded heat protections under OSHA rules, in contract language and through Collective Bargaining Agreements.

UTCA has opposed this legislation and has engaged with lawmakers, Gov. Murphy's office and our labor partners to seek exemptions for the infrastructure construction industry.

We will continue to update you on this measure as well as the proposed federal heat standard that was announced by OSHA.

In the meantime, please take a moment to read the NJ.com article on this issue from our Executive Director David Rible.

The safety and protection of the thousands of men and women working in the construction industry is our greatest priority. Ensuring they can earn a living while not falling victim to any health hazards is what we do every day. We owe as much to our 1,100 plus members and their employees. That’s what makes proposed state legislation – S2422 – so concerning to us. It claims to protect workers when its many provisions would actually provide little that’s new in the way of safety, while possibly crippling the industry.

The bill in question would essentially force the agricultural, manufacturing, and construction industries to postpone all “nonessential” work any time the heat index rises above 80 degrees. At face value, that might sound reasonable. A deeper dive, however, reveals several flaws with the legislation.

First and foremost, there are significant differences between the agricultural, manufacturing, and construction industries as well as all other industries governed by the proposed legislation. Data from the Bureau of Labor Statistics shows that the transportation construction industry has reported few heat illnesses, injuries or fatalities over the past decade. More specifically, the BLS report-

ed only three fatalities over a ten-year period from 2011-2020 for Highway, Street and Bridge construction workers; all of these occurred in 2015.

This is not by accident, as our members and contractors in the transportation construction industry have been actively working to protect their personnel from the effects of extreme heat, even before the implementation of OSHA rules or any State standard in New Jersey. They have done this by developing heat illness prevention policies.

It makes little sense to disrupt these strategies by imposing a onesize-fits-all, indiscriminate mandate. Given the success of our industry in controlling such injuries for its workers, we believe that any legislation that is implemented to protect workers from heat hazards should be outcome based, and not prescriptive in nature, so as not to unintentionally negate some of the effective practices currently in use.

The one-size-fits-all approach is not the only shortcoming of the legislation. The proposed 80-degree standard would greatly limit utility and transportation contractors from performing their work. In 2023, every single day in July had a high temperature in excess of 80 degrees. Half of the days in June and 20 days in August experienced temperatures in excess of 80 degrees. Under this bill, contractors would be forced to postpone all “nonessential” tasks for weeks (if not months) at a time. Such a requirement would greatly delay important construction projects, including public infrastructure, roadways, and utility projects.

Other states, including California and Washington to name a few, employ higher heat indexes than 80 degrees. This is with good reason. The National Weather Service (NWS) does not initiate alert procedures unless the Heat Index reaches 105 degrees for at least two consecutive days. While no one would argue that 80 degrees is cool weather, it is barely higher than what the U.S. Department of Energy recommends setting home and business thermostats to during warm weather months.

The 80-degree threshold itself is misleading. Take the example of hot mix asphalt, which is usually between 275 and 300 degrees Fahrenheit when it is delivered to the jobsite and must be applied before it cools down significantly. Thus, even if the heat index is below 80 degrees, if contractors are monitoring environmental heat during this work as required by the proposed bill, the tem-

perature will almost always be higher than 80 degrees due to the ambient temperature of the asphalt.

Further complicating matters, the term “non-essential” is not defined in the bill. Arguably, all work performed by our members would be “essential” work. In fact, in April 2020, Governor Murphy signed Executive Order #122 during the COVID pandemic allowing construction workers to be “essential” employees. If during the pandemic, our contractors were deemed “essential” and were found to be responsible by the Governor to prevent the spread of COVID on job sites, shouldn’t they also be deemed responsible to keep their employees safe from heat exhaustion without it putting in danger the state’s infrastructure projects?

We have no question that this legislation is well intentioned. We also have no doubt that our members do everything they can to protect their construction workers. That is why the construction industry should be exempt from this legislation. It adds little to the protections our members already have in place but does much to harm New Jersey’s ability to maintain and upgrade our infrastructure.

David Rible is Executive Director of the Utility and Transportation Contractors Association of New Jersey.

By: kyle england, director of environmental and utility operations

After a brief hiatus, the UTCA is proud to reinstate our Pipeline column to the Contractor Magazine. Here, we’ll talk shop and provide updates on all things flowing underground, fueling our vehicles, and keeping the lights on.

Before we begin, where are my manners? My name is Kyle England, I’ve recently assumed the position of Director of Environmental & Utility Operations on staff with the UTCA. For those I have yet to meet, I look forward to making your acquaintance. Let’s discuss your concerns and how our Association can be the best resource possible for you.

Coming off what is sure to be one of the state’s hottest summers on record, there is little doubt that Governor Phil Murphy will use the past few months as reference point to push his aggressive agenda on climate change. It is widely accepted that a comprehensive strategy must be put in place to mitigate greenhouse gas emissions and reduce our carbon footprint as an industry. However, we must also ask, at what cost?

Several rule proposals coming down the pipe have been expedited through the regulatory process with no legislative input and little concern for the negative implications on our state’s infrastructure.

Nothing says “time to roll up the sleeves” more than a 1,000-page regulatory proposal released on your first day of employment.

As part of the Governor’s initiative to modernize the state’s infrastructure in response to the effects of climate change, New Jersey’s Resilient Environments and Landscape (REAL) rules are part of a larger package of regulations called Protecting Against Climate Threats (NJPACT) that account for warmer temperatures, rising sea levels, and stronger, more frequent downpours. Most existing transportation infrastructure will be largely unaffected by the proposed rules. However, redevelopment of existing structures and any new development will be required to account for such factors—most notably, the reported 50% probability that sea level rise will exceed 3.3 feet by year 2100 and a 17% chance that sea level rise will exceed 5.1 feet by year 2100. These projections were taken from a Rutgers study conducted in 2019 and there is little evidence that the figures were meant to be used for purpose of land-use policymaking. Other agencies including the U.S. Army Corps of Engineers, National Oceanic and Atmospheric Administration, and the UN Intergovernmental Panel on Climate Change predict a much lower baseline.

Many concerned groups have argued that this mammoth proposal goes beyond the scope of climate change mitigation and the true implications are not fully understood by its authors. The UTCA, in

partnership with other concerned stakeholder organizations, continues to lead the charge against this.

Poised to take effect at the turn of the calendar year, the NJDEP will be mandating all medium and heavy-duty truck manufacturers to participate in a credit/deficit program in which the manufacturer will be required to sell an increasing percentage of electric vehicles for each non-electric vehicle sold.

The regulation is a cut and paste of California’s EV requirements into the NJ Administrative Code to supplement the Governor’s Energy Master Plan and stands to detrimentally disrupt the operations of UTCA membership. UTCA had previously taken the position that creating a credit/deficit program to increase the percentage of battery-electric vehicles (BEV’s) sold in New Jersey is an ill-directed regulatory proposal.

The level of infrastructure required to support a mandate of this magnitude simply does not exist. How can construction companies continue building at a rate necessary for societal demand while truck manufacturers required to sell electric have neither the inventory nor capital to provide these vehicles? Once a construction company finally has their electric truck on the lot, after waiting their turn to receive one, how can they be expected to keep up with supply chain demands on critical projects if the lack of charging stations barely gets them across the state? If the expected answer to a contractor is to build their own charging station on-site, how many millions of dollars will this cost our members and how will this impact their budgets?

UTCA recommended that the DEP reconsider this regulatory approach in favor of more viable strategies for carbon reduction. New Jersey should instead focus its efforts on a rational national standard for low- or zero-carbon emission trucks and to allow alternative low-carbon fuels in the interim until availability and cost make battery-electric equipment and vehicles practicable.

UTCA has opened a dialogue with the Governor’s office to forge a more reasonable compromise.

The Murphy Administration must work with us, not against us. The transportation and utility firms that maintain and construct our state’s infrastructure deserve a seat at the table.

The UTCA will continue to operate proactively on these measures, and I am excited to have the privilege of being a voice for our members on these critical issues.

By: karen walsh, senior account executive – Employee Benefits, IOA

As we dive into the fourth quarter, the 2025 benefit open enrollment season is right around the corner for many employers. Early preparation is key to ensuring everything runs smoothly and employees have sufficient time and resources available to make a well thought out decision.

Due to increasing costs of healthcare and prescription drugs, many employers will be challenged again this year with double digit rate increases to their health benefits. This, coupled with an uncertain economy will make the process difficult.

A variety of other factors also may need to be considered, such as: How to manage a multigenerational workforce, putting a heavy focus on employees’ emotional well-being, ensuring employees have a healthy work/life balance, and adapting to the new push for hybrid work arrangements. This makes it an extremely demanding and stressful time for business owners and HR.

Below are a few items to consider for a successful open enrollment:

1) Review your current Benefit Package:

Now more than ever, employees are looking for ways they can protect themselves and their families. Health benefits are one of the top drivers of employee attraction and retention.

Is your current benefit package effectively meeting the needs of your employees? If not, now is the time to look at making some changes.

2) Expand Your Benefit Portfolio:

Think about adding supplemental benefits such as hospital, accident, critical illness, employee assistance programs, pet insurance, identity theft protection, etc. This can be set up and structured in a way that can be affordable for both the employer and their employees.

3) Employee Education:

Health benefits can be very confusing to employees. A lack of understanding can lead to uncertainty and stress during open enrollment.

Use this as an opportunity to educate employees on items such as the importance of using in-network providers, understanding how deductible, copay/coinsurance and out of pocket maximums work, and using generic medications when it makes sense.

Make sure to properly educate your employees on the benefit plans that are available to them and make sure to lay out all the value-added benefits that may be baked into those plans.

4) Creative Employee Benefits:

Consider some “out of the box” benefits to help retain and attract top talent. A few examples of this may be to offer flexible work hours, floating holidays, anniversary rewards, employee referral incentives, and spot bonuses – just to name a few.

5) Technology:

Many employers are looking for innovative solutions to help streamline new employee onboarding and open enrollment. There are a variety of modern technologies that can be tailored to fit specific organizational needs. These tools can also be used to track employee time and attendance, and store important HR documents, making them easily accessible by employees and HR 24/7.

By preparing early, employers will have sufficient time to tailor their benefits and outline all the value-added benefits being provided. Doing so will also help to educate the workforce, bolster retention efforts, and get a leg up on the competition in the challenging employment market.

Medicare Part D Changes May Impact Creditable Coverage Status of Employer Plans

The Inflation Reduction Act of 2022 (IRA) includes several cost-reduction provisions affecting Medicare Part D plans, which may impact the creditable coverage status of employer-sponsored prescription drug coverage beginning in 2025.

Employers that provide prescription drug coverage to individuals who are eligible for Medicare Part D must inform these individuals and the Centers for Medicare and Medicaid Services (CMS) whether their prescription drug coverage is creditable, meaning that the employer’s prescription drug coverage is at least as good as Medicare Part D coverage. Previously, CMS stated in its Draft Part D Redesign Program Instructions that one of the methods for determining whether coverage is creditable (the “simplified determination” method) would no longer be valid as of calendar year 2025, given the significant changes made to Medicare Part D by the IRA.

However, according to the Final Part D Redesign Program Instructions, CMS will continue to permit the use of the simplified determination methodology, without modification, for calendar year 2025 for group health plan sponsors who are not applying for the retiree drug subsidy. In future guidance, CMS will reevaluate the continued use of the existing simplified determination methodology or establish a revised one for calendar year 2026.

A group health plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS guidelines. In general, this actuarial determination measures whether the expected number of paid claims under the group health plan’s prescription drug coverage is at least as much as the expected number of paid claims under the Medicare Part D prescription drug benefit. For plans that have multiple benefits, the creditable coverage test must be applied separately for each benefit option.

Under existing CMS guidance, there are a few different ways for an employer to determine whether its prescription drug coverage is creditable:

* As a first step, employers with insured prescription drug plans should ask their carriers whether they have determined whether the plan’s coverage is creditable.

* For self-insured plans, or where the carrier for an insured plan has not made a determination about whether the plan is creditable, employers may use a simplified determination—as long as the coverage meets certain design requirements. If it doesn’t, the employer must use an actuarial determination method.

More information and resources on the IRA’s changes to Medicare Part D are available on CMS’ Part D Improvements webpage.

For more information, feel free to reach out to your preferred brokers at IOA!

This information is not intended to be exhaustive, nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. © 2024 Zywave, Inc. All rights reserved.

By: dr. josh hurwitz, senior economist, artba & dr. allison premo black, chief economist, artba

* reprinted with permission from american road & transportation builders association

(artba).

Federal investment through the Infrastructure Investment and Jobs Act (IIJA) has helped support record levels of highway and bridge construction, despite supply chain issues, rising material prices, and labor costs. As the five-year program, first enacted in November 2021, crosses the halfway point, there is strong evidence of real market growth.

Over the last 30 months, the law’s investment has helped support significant increases in major indicators, including contract awards, highway and bridge contractor employment, and construction activity. ARTBA analysis suggests that there is still a lot of IIJA funding on the horizon. Many projects supported by discretionary grants and the new formula bridge program have yet to enter the construction phase.

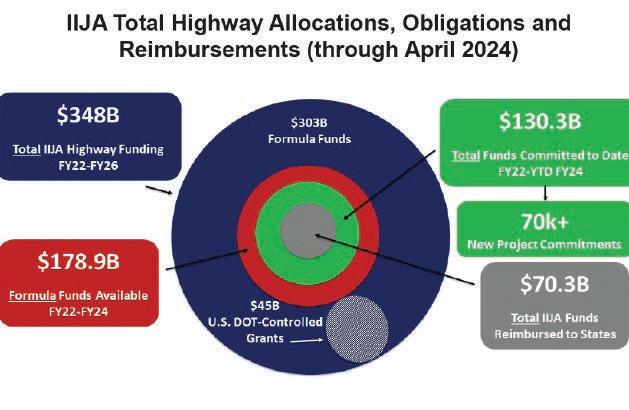

IIJA provides nearly $350 billion in federal highway and bridge funding over five years (FY 2022-2026), split between formula funds ($303 billion) and U.S. Department of Transportation (DOT) controlled grants ($45 billion). The largest step-up occurs in the first year (FY 2022), with total funding levels rising about 40 percent. This annual increase is the third largest in history, surpassed only by two years in the late 1950’s, after passage of the Federal-Aid Highway Act.

In the later years of IIJA, funding levels rise by about two percent annually, plus any supplemental funding added by Congress during the appropriations process. On average, highway and bridge funding under the new law is about $21.1 billion higher per year than in FY 2021.

To assess the market impact of this increased funding, and expected timing, it is important to decompose the underlying program details. About $9.5 billion of incremental funding per year, or 45 percent of the average $21 billion annual funding increase, represents a top-up to core highway formula programs. States have decades of experience programming these funds and flexibility over the types of projects receiving obligations. Effectively, this funding must also be obligated within the fiscal year it is apportioned, resulting in a prompt entry to the construction pipeline.

New under IIJA is a bridge formula program, which accounts for an additional $5.5 billion (26 percent) of the average annual $21 billion funding increase, and an electric vehicle (EV) formula program, which adds $1 billion (five percent) per year. Congress granted states four years to obligate funding from these programs. As a result, the pace of obligations from these programs has been much slower. At the halfway mark, only about $7 billion of $16 billion (43 percent) in available bridge formula funds and $200 million of $3 billion (seven percent) in available EV formula funds has been obligated.

Finally, the remaining $5.1 billion per year, or 24 percent of the average annual increase in funding, is controlled by the U.S. DOT and administered through a series of discretionary grant programs. This amount includes both growth in existing programs, as well as newly introduced grants.

A large share of this funding has also been slow to obligate. For example, while more than $13 billion in discretionary awards was announced during the first half of IIJA, only about $2 billion had been obligated. A primary source of this lag is the additional time often needed to reach a grant agreement, lengthened under IIJA by the rollout of new programs and learning curve for local agencies directly applying for the first time.

As of April 30, about $130 billion of total IIJA highway and bridge funds had been obligated. This accounts for 73 percent of available formula funds through FY 2024—noting the obligations also include any committed discretionary funds—and 37 percent of total funding through FY 2026.

Of this obligated funding, about $70 billion—or 54 percent—has been spent (i.e., reimbursed to states). At the IIJA halfway point, nearly 80 percent of all available funding (through FY 2026) remains to be spent.

Most obligations and outlays-to-date are from core highway formula funds, which enter the market quickly, driving significant growth. At the same time, a substantial share of the incremental funding under IIJA, including from the new formula programs and discretionary funds, is still waiting on the sidelines and expected to have a longer-term impact.

There is an obvious connection between the historic increase in federal funding under IIJA and atypical growth in major market indicators, many to record levels:

• New Federal-Aid Highway Formula Fund Projects: There have been more than 70,000 new formula project commitments under IIJA. In FY 2023, the number of new commitments (31,090) was 14 percent higher than FY 2021. Volume growth has occurred across projects of all sizes, including mega projects with federal obligations exceeding $100 million (+75 percent).

• State and Local Government Contract Awards: Both the value (+27 percent) and number (+14 percent) of highway and bridge contract awards experienced record growth in 2022. In 2023, the value and number rose an additional nine percent and four percent, respectively. For perspective, typical growth rates are about four percent and one percent.

• Employment: On a seasonally-adjusted basis, the highway, street and bridge construction industry added nearly 40,000 jobs (+11 percent) over the first half of IIJA. Industry employment surpassed record levels in 2023 and has continued rising since on a year-over-year basis.

• Value Put in Place (VPIP): Given the multi-year project pipeline, the value of construction activity lags the forward indicators (e.g., contract awards). Whereas typical growth in VPIP for

highways and bridges averages four percent per year, VPIP rose 10 percent in 2022 and a record 18 percent in 2023. While growth in contract awards has moderated in 2024, now to a significantly higher baseline, VPIP has continued to increase at a 15 percent year-to-date rate. The spend-out of IIJA funds, and related construction activity, is expected to continue rising through the life of IIJA.