UCN Used Car News

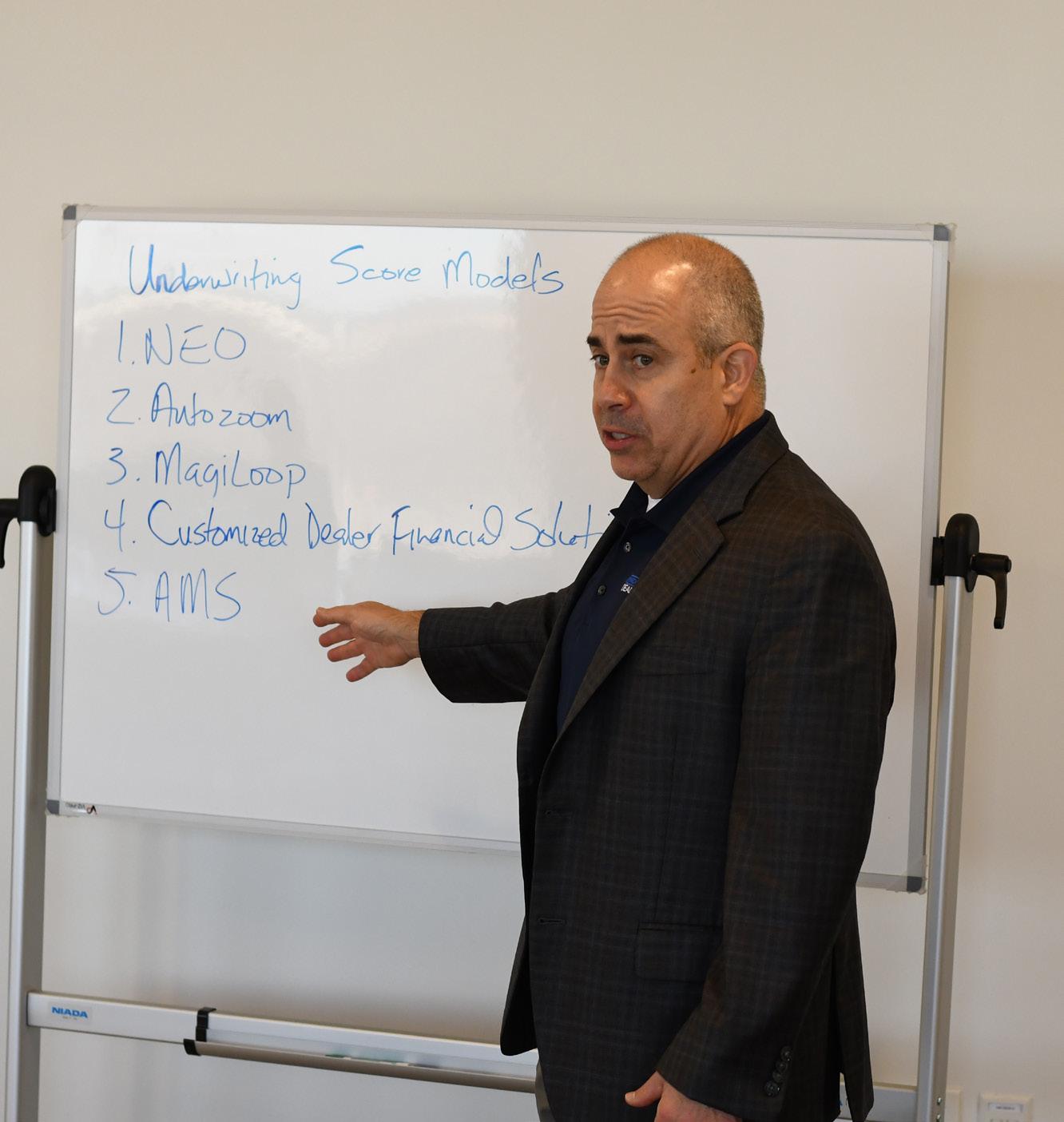

BHPH Class Offers Game Plan for Dealers

By Jeffrey Bellant

Auto dealers seeking education on the buy-here, pay-here industry spent a couple days in Dallas last month for the National Independent Automobile Dealers Association’s Buy-Here, Pay-Here Academy.

NIADA’s Senior 20 Group moderators Bill Elizondo and Ben Goodman led the teaching, which drew dealers from various backgrounds and different areas of the industry.

Elizondo spoke with Used Car News by phone shortly after the event ended.

“We had a great group of individuals ready to learn, understand and get more knowledgeable in this business,” Elizondo said.

One attendee had been in the auto business for a long time but was new to BHPH. Another individual came from the franchise side and wanted to understand what this BHPH segment was all about.

Another person had been in BHPH for a decade but still took back a lot of new information that she didn’t know.

The academy even drew a vendor who brought along two people to the event. Elizondo knew the vendor from previous training events he had done separate from this academy. The vendor’s past experience at the previous sessions convinced him that the education and information from this academy would be valuable to their business, Elizondo said.

“At the end of the day, if they can understand the buy-here, pay-here industry well enough, they’re going to be able to help the people they’re doing business with who are doing buy-here, pay-here today,” he said.

It also helps them speak the BHPH language to their dealer clients and give them better insight into their customers and know best how to

provide them the right products and tools that boost their business.

The group’s instructors were men who’ve been around the business for a longtime.

“Between Ben Goodman and I, we’ve got over 60 years of experience,” Elizondo said.

The academy presented a big overview of the BHPH business and discussed how to navigate the various parts of the business that help make a BHPH dealer successful.

Sessions on sales, operations, collections and benchmarks were some of the topics.

At the start of the two-day session, Goodman and Elizondo covered recent economic trends, pointing to

growth in the BHPH segment.

According to data from Experian and the U.S. Bureau of Labor Statistics, bankruptcy petitions increased by 7 percent in September 2022. “Filings are going up because people can’t afford payments,” Elizondo said.

Even as finances are tightening, the labor market remains strong. Unemployment is still at a 50-year low and people still need transportation to get to work. This is creating additional opportunities for BHPH dealers.

“This is the absolute best time to get into buy here-pay here,” Goodman said.

Continued on page 5

RushDated Material

3/6/2023

IN THIS ISSUE: • Regulations • Wholesale Markets • Moorby

FINANCE YOUR DEALERSHIP WITH WESTLAKE $500,000 Minimum Loan Pre-approval in 48 Hours* Fund your Next Purchase, Refinance, or Renovation Project with WCF: 855.426.7450 westlakefinancial.com/wcf *Preapproval and funding times based on average timing. 1-5 Year Terms 45-Day Funding* 520WCFP1

3/6/2023

Compliance States, Feds Continue Scrutiny of Retail Auto Industry

By Jeffrey Bellant

As 2023 kicks into high gear, industry experts continue looking at the challenges of the regulatory environment.

Ignite Consulting’s Steve Levine, partner and chief legal officer, said he’s a seen a “definite, appreciable uptick in regulator issues.”

Things seemed to end quietly on the regulation front at the end of 2022 – “almost too quiet,” Levine said.

Levine heard about a complaint against a leasing company accused of making deals that were retail installment contracts, not leases, and another situation where regulators were picking apart convenience fees.

Concerns over regulatory issues typically relate to federal agencies like the Federal Trade Commission, the Consumer Financial Protection Bureau and the Equal Employment Opportunity Commission.

But Levine said the issues he sees popping up are coming from the states.

“We’re slowly seeing an uptick in regulatory” activity, he said.

On the federal side, the elephant in the room is the Motor Vehicle Dealers Trade Regulation Rule proposed by the FTC last summer.

“If it goes through as proposed, it would be the biggest change I’ve ever seen,” Levine said.

It’s an issue that would be a prime topic for Ignite Consulting’s Compliance Unleashed conference May 22-24 in Dallas, but if the issue re-

mains up in the air, Levine is reluctant to make it a topic.

“I don’t think people come there to hear my conjecture,” he said.

Levine said he went to an event where the issue was discussed for an hour, but since the rule hasn’t been codified, the discussion seemed like a waste of time.

Another notable issue on the regulatory front does come from the federal side.

It involves the resignation announcement of the FTC’s only Republican member. Christine Wilson said in February she would be stepping down, calling it a protest against FTC Chairwoman Linda Khan, over her “disregard of the rule of law and due process” as she stated in a Wall Street Journal op-ed.

Eric Johnson, a partner at the law firm Hudson-Cook, responded to the news and its negative impact on the regulatory environment.

He said the lack of a bipartisan commission limits differing opinions.

“A few of us were just talking about the resignation this morning,” Johnson said. “I think it’s bad news for all of the industries that the FTC regulates. The FTC Commission is supposed to have differing voices and opinions (hence the party split requirement) and without those differing voices/opinion, I’m concerned that it’s just a big echo chamber now. Whether it’s a (Democrat) or (Republican) in majority of the Commission, it’s important to have robust discussions and differing opinions about the FTC’s proposed

actions, consent orders, rules, etc.”

The effect on the auto industry and other businesses will not be positive, he added.

“I don’t think this is a positive development at all for the businesses and dealers that the FTC regulates,” Johnson said. “I haven’t heard anything re:proposed new Commissioners (Republican) either by the White House so that’s a concern as well regarding timing.

“Not a positive development at all for many different industries, including dealers.”

There are two other things on Levine’s radar as he prepares for the compliance conference.

One of those involves a lawsuit by the New York Attorney General and the Consumer Financial Protection Bureau against Michigan-based Credit Acceptance Corporation.

In the complaint, the two parties called Credit Acceptance “a predatory auto lender,” and accused it of “misrepresenting the cost of credit and tricking its customers into highcost loans on used cars.”

The plaintiffs accused Credit Acceptance of “hiding the true cost of credit” and “setting up customers to fail.”

Levine said this is another case of regulators going after the issue of “ability to repay.”

CFPB and the state of New York are basically saying that lenders can’t just look at a customer’s income, Levine said.

“You have to look at their ability to repay the obligation,” he said. “I think everybody’s going to have to

pay attention to that,” Levine said. Saying you will “approve everybody” can be risky.

“According to regulators, you can’t say that,” he said. “Because it all has to do with the ability to repay and it’s not just the down payment. It’s whether they can come up with the money every month or are they, in effect, just renting a car.”

Levine said regulators want creditors to know whether their customer can actually afford the payment over time. It’s not about down payment as much as it is about weekly or monthly living expenses.

The other proposed rule that Levine blasted was the FTC’s proposal to ban non-compete clauses, which it claims present an unfair method of competition.

Levine said it’s so broad there’s no “carve out” for the sale of businesses.

Levine had a real-life example of why this is a bad proposal. A dealerclient of his had a general manager who had worked for the dealer for over eight years. But the dealer never required a non-compete clause.

“The GM leaves the dealer, opens up two blocks away and basically uses everything he learned and every relationship he developed against the dealership he left,” Levine said.

A recent public hearing on the rule heard from people both opposed and in favor of the rule.

The regulatory environment is a battlefield for dealers.

“The stakes have been raised,” Levine said.

3

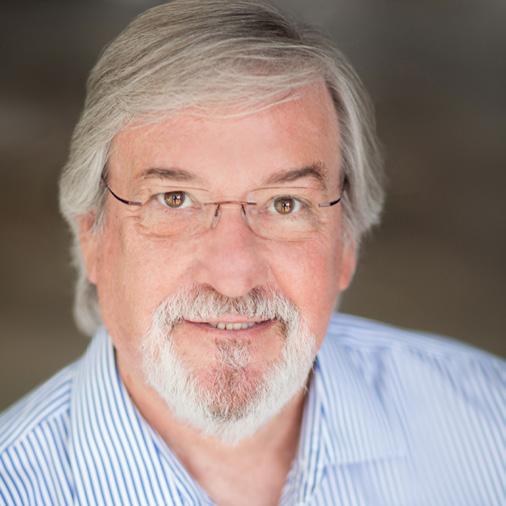

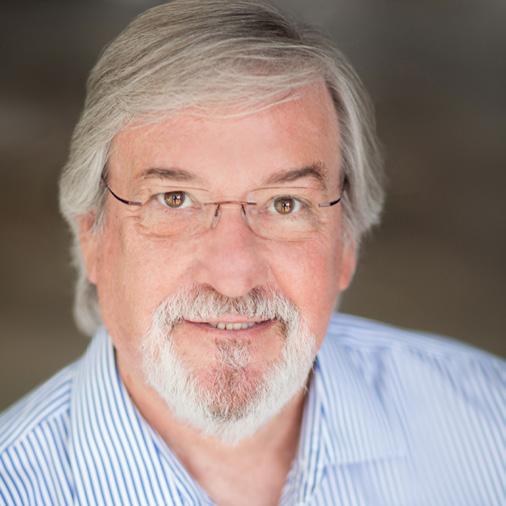

Photos Courtesy of Ignite Consulting

TEACHING COMPLIANCE: Ignite Consulting’s Richard Hudson, managing partner (left), and Steve Levine, partner and chief legal officer (right), lead sessions at a past version of the firm’s Compliance Unleashed conference. The company is holding its 2023 conference in Dallas-Fort Worth, May 22-24.

News Briefs

CFPB Drops Heavy Penalities on TitleMax

The Consumer Financial Protection Bureau (CFPB) took action against a web of corporate entities operating under TMX Finance, broadly known as TitleMax, for allegedly violating the financial rights of military families and other consumers in providing auto title loans.

The CFPB found that TitleMax violated the Military Lending Act by extending prohibited title loans to military families and, oftentimes, by charging nearly three times over the 36% annual interest rate cap. The CFPB’s news release stated TitleMax tried to hide its unlawful activities by, among other things, altering the personal information of military borrowers to circumvent their protected status. The CFPB also found that TitleMax increased loan payments for borrowers by charging unlawful fees. The CFPB’s order requires the company to pay more than $5 million in consumer

relief and a $10 million civil money penalty.

“The CFPB’s order stops TitleMax’s illegal predatory lending to military families – sometimes even taking steps to hide evidence of its wrongdoing,” said CFPB Director Rohit Chopra. “Our legal action is the CFPB’s first against a nonbank lender for providing title loans to military families.”

TitleMax is made up of TMX Finance LLC and numerous subsidiaries across the United States with both in-person and online locations. TitleMax’s headquarters is in Savannah, Ga., and it is engaged in the business of extending shortterm, high-cost consumer loans that are secured by borrowers’ vehicle titles. According to TitleMax, consumers can receive a title loan of up to $10,000. TitleMax is privately owned, and currently has more than 1,000 locations in 18 states: Ala-

Put the power of Chase Auto to work for you

bama, Arizona, Delaware, Florida, Georgia, Idaho, Illinois, Kansas, Mississippi, Missouri, Nevada, New Mexico, South Carolina, Tennessee, Texas, Utah, Virginia, and Wisconsin. TitleMax claims to have almost 4,000 employees and to serve thousands of people every day.

TitleMax is a repeat offender. TitleMax has been under a CFPB Order since September 26, 2016, for its lending and debt-collection practices. At that time, the CFPB ordered the company to pay a $9 million penalty.

Between Oct. 3, 2016, and Sept. 17, 2021, TitleMax made at least 2,670 prohibited auto title loans to borrowers covered under the Military Lending Act. It also charged borrowers unlawful fees on about 15,000 loans. Specifically, TitleMax and its subsidiaries harmed military families and other consumers by, among other things:

Making illegal loans at unlawful rates and covering up their behavior: TitleMax made illegal auto title loans to military families at annual interest rates over 36% and many times over 100%. TitleMax offered the loans while withholding information about military families’ rights under the Military Lending Act – under which both title loans and annual interest rates above 36% are illegal. Its loans also included mandatory arbitration clauses and unreasonable notice provisions that the Military Lending Act prohibits. TitleMax covered its tracks by, doctoring personally identifiable information so borrowers would not be identified as service members.

TitleMax charged fees for a useless product on thousands of loans. The company claimed the fees were for an insurance product to protect the company against potential losses, but the product did not provide any coverage for these loans. The company also charged fees for this product on loans that did not qualify for coverage. In addition to ending its illegal lending practices, today’s order requires TitleMax to:

• Pay $5.05 million to consumers: for being wrongfully repossessed. Consumers are not required to take any action to get the money to which they are entitled.

• Stop illegal lending practices:

• Pay a $10 million fine: TitleMax will pay a $10 million penalty, which will be deposited in the CFPB’s victims relief fund.

Writer

Advertising: Shannon Colby, Account Manager Tony Moorby Columnist: Circulation: subs@usedcarnews.com

Production: Tom Savage, Production Manager Cee Lippens, Web Master

Used Car News is published every third week.

Subscribers: We print advertisements as sent to us by auctions and other advertisers. It is not possible to verify the correctness of listed vehicles in auction ads. Most lists are partial and all lists are subject to last minute changes by auto auctions, so before travelling a long distance for a particular auto auction event, contact the auction by telephone for a fax of vehicles in the sale.

Used Car News assumes no guarantees or liabilities concerning the accuracy of any advertisements. All Rights Reserved. Reproduction in any form is prohibited without the written consent of the publisher.

OUR ADVERTISING APPROVAL POLICY

Payments from first time advertisers must accompany the insertion order. Distribution is guaranteed by the USPS. The advertising reservation deadline is 12:00 noon Thursday, 11 days prior to the issue cover date.

Ad materials are due by 5 pm Friday, 10 days prior to issue cover date. For advertising specifications please email colleen@usedcarnews.com.

1 2 1 The tradename Subaru Motors Finance (SMF) and the Subaru logo are owned by Subaru of America, Inc. (Subaru) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. 2 The tradename Maserati Capital USA and the Maserati logo are owned by Maserati North America, Inc. (Maserati) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. 3 The tradename Aston Martin Financial Services and the Aston Martin logo are owned by Aston Martin Lagonda of North America Inc. (Aston Martin) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. 4 The tradenames Jaguar Financial Group and Land Rover Group and their respective logos are owned by Jaguar Land Rover North America, LLC (JLR) or its affiliates and are licensed to JPMorgan Chase Bank, N.A. (Chase). Auto finance accounts are owned by Chase. Neither JPMorgan Chase Bank, N.A. nor any of its affiliates are affiliated with ADESA, Inc. or Manheim, Inc. Each auction is solely responsible for their website content, sales events, promotions, fulfillment and operation of the auction. Dealer communication only; not intended for retail purchaser. ©2021 JPMorgan Chase Bank, N.A. Member FDIC 21-014 (2021) Your customers want to choose from quality vehicles, so you need a national industry leader who can deliver. That’s Chase. We offer: • A broad range of vehicles — from economy to luxury — upstream and through auctions nationwide • Convenient online and in-lane vehicle availability with on-site Chase remarketers Choose Chase owned vehicles at ADESA.com and Manheim.com Your clear choice for quality

4 4 3

CR R O O S S W D PAGE 14

3/6/2023 Volume 28 | No.15 Join the Conversation! Visit Used Car News online at www.usedcarnews.com or scan this QR code with your smartphone to be taken directly to the website. 4 Published By General Media LLC USED CAR NEWS (ISSN 1555-7413) is published at : Used Car News P.O. Box 80800 St. Clair Shores, MI 48080 Phone: 586-772-5200 or 800-794-0760 Fax: 586-772-9400 www.usedcarnews.com Charles M. Thomas Founder (1947-2002) Lynda R. Thomas, Publisher Emeritus Colleen Fitzgerald, Publisher

Editor

Editorial: Jeffrey Bellant, Managing

Ed Fitzgerald, Staff

Used Car News

BHPH Academy – Continued from page 1

From the start, Goodman and Elizondo framed that this model is a finance and collections business, with the vehicle being the commodity.

“Also, what kind of relationship are you building with your customers?”

Elizondo said the biggest part of everything we do is all about understanding that BHPH is a relationship business.

“At the end of the day, it’s all about collecting your money,” he said. “People think, ‘I’m selling a car.’ You’re not. You are building a relationship.”

It was a key concept that Elizondo hammered home time and time again – building a relationship business and collecting money.

“At the end of the day, I’ve got this person on my books for two, three or four years,” Elizondo said. “If I’ve got them for that long, but I’m only thinking to get them in and out and sell them a car, they’re not going to pay for it.

“They might spend 60 or 90 or 120 days in that car, but then say, ‘Eh, I’m tired of this car or I’m having issues’ and they’re going to get out of the deal.”

It’s important to talk to the customer up front to explain the program right away. You’re trying to get the customer approved for a vehicle that’s going to get them to work, from Point A to Point B, and be successful, or even building their credit.

The academy offered guidelines on how to staff the operation, the number of people needed to run a BHPH operation.

“We give you the parameters (showing) that if you have this type of operation and you’re doing this amount of volume, then you’re probably going to need people like this,” Elizondo said,

Cash flow is critical though. Another part of BHPH is the pitfall of selling too many cars without doing the proper underwriting and collections.

“You have to make sure you don’t run out of money,” Elizondo said. That means understanding the structure of your business, knowing how you’re going to work a deal from month 1 to month 36. It’s knowing if you sell a certain number of cars, for a certain amount of money and a specific payment and down payment on a certain balance, this is what you should be collecting.

“It’s not always going to be perfect, and you’re going to have to tweak it,” Elizondo said. “But at the end of the day, that’s going to be the model of

what you’re trying to accomplish.”

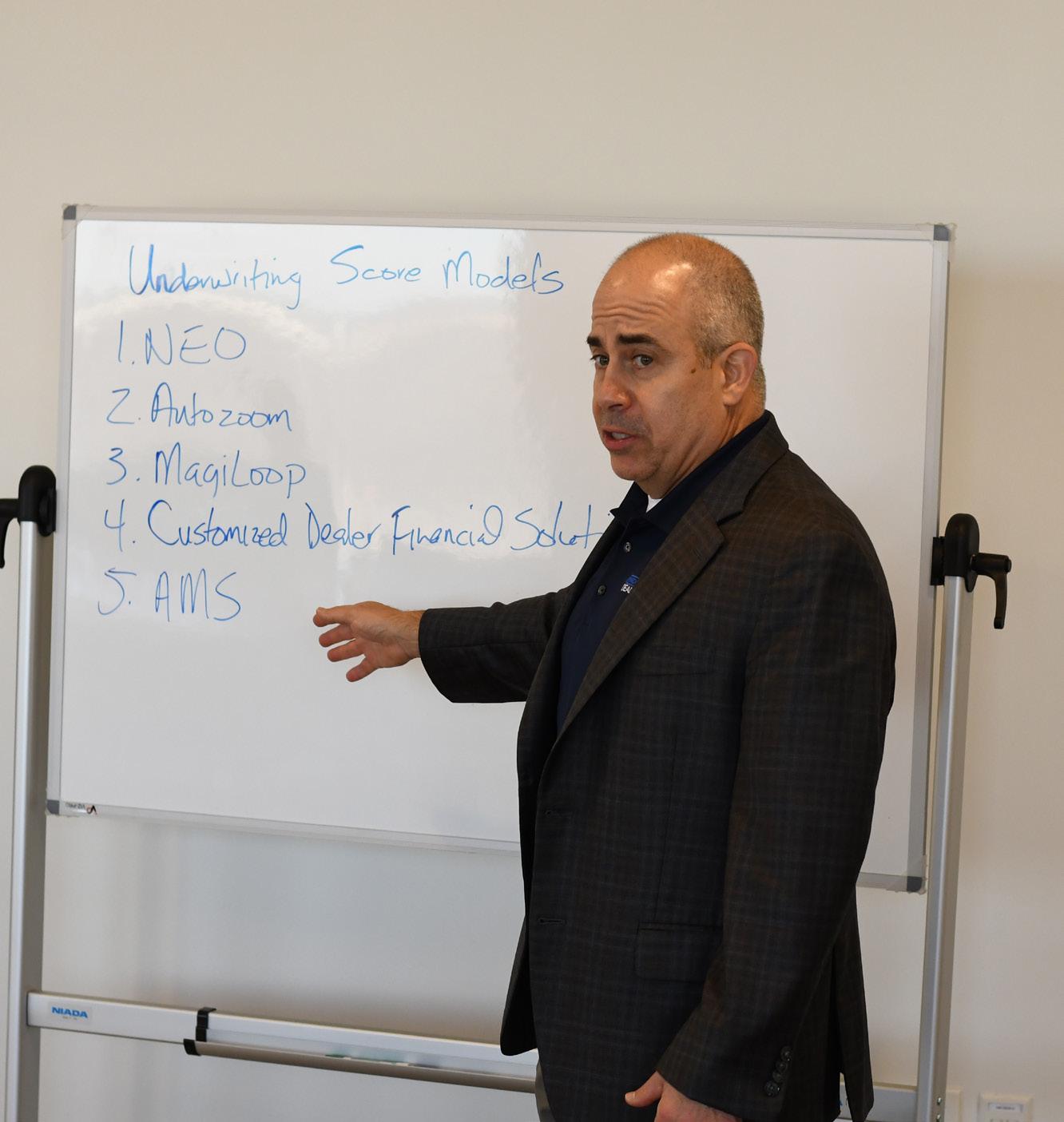

Underwriting is vital. While people will talk about formulas and complicated schemes, Elizondo simplified the goal.

“Verifying is underwriting and underwriting is verifying,” he said.

“That’s the biggest thing.”

One benefit of the buy-here, payhere model stands out especially in tough economic times like today.

“I would say this is a recessionproof business,” he said.

the buy-here, pay-here market.

“We started thinking about BHPH. A lot of leads are asking if we do inhouse financing,” Khumarov said. “It’s made us understand it’s popular in this market with this price range.

Dealers cannot just gather the stipulations and references – they need to verify them.

“It’s not very hard to gather the information,” Elizondo said. “But when you get these things, do you actually do anything with them?”

Without verifying the customer’s information, it won’t matter if you get a large down payment, the deal will not succeed.

Acquiring inventory will require going to the usual sources like auctions, but BHPH dealers should also look at private sellers, Facebook or other alternative sites.

If possible, find a car that’s affordable and won’t require a ton of recondition to get it on the road.

“You don’t want project cars,” Elizondo said.

Also, if dealers have a service shop where they can do the work themselves, it will save the time and money of subletting it out.

Getting a vehicle that will run the length of the contract is the main thing.

One of the encouraging things that comes out of these types of events are the “Aha!” moments, Elizondo said.

It’s when the attendee realizes the key is to close a customer today, keep them on the books for the length of the installment contract, then get them to buy another car or to bring a family member in to get a car.

“Customers for life,” Elizondo said.

If the dealer can do a good job of underwriting and maintaining and building a customer relationship, then there can be success.

Elizondo said there’s one type of person who benefits most from this type of training.

“The one thing that excites me the most is someone who is a sponge, someone who is ready and willing to understand and learn all about this business,” he said.

The attendee gets a thick book of information that talks about models, processes, policies and procedures that can help open up a dealer’s mind to different ideas and concepts that can help them learn.

One Texas dealer came to the event to explore expanding into BHPH.

Since opening the Mars Dealership in Dallas in 2021, George Khumarov has become increasingly aware of

“We knew nothing about it. We decided to get information from the industry leaders.”

Khumarov, who is new to the model and veteran Rosie Johnson, vice president of R&D Motors, who has been in the business for 28 years, each took away many lessons from the two-day session.

“I got a lot of new ideas to take back,” Johnson said. “I was able to take away something for every department. Specifically with collections, we’ve been collecting monthly and we may switch to pay day.”

Khumarov added: “This was good training. It was good to have people with 30 years of experience teach-

ing. It was very personalized. You were able to ask questions.”

The hardest part goes back to helping dealers understand the relationship concept of BHPH that goes past simply closing a car deal.

“This a long play business,” Elizondo said.

The two-day event is similar to a 20 Group in which the attendees had the chance to interact and bounce ideas off each other.

NIADA also provides companies information on sources so attendees can get find some tools and help for their businesses. This was the second time NIADA has held this particular BHPH Academy and it’s going to hold three to four this year.

“Each time, we get individuals who walk away with good information,” Elizondo said.

5

3/6/2023

State News

3/6/2023

AG Busts Odometer Scheme

Ohio Attorney General Dave Yost has filed lawsuits seeking to dial back odometer-tampering schemes at two Columbus-area used-car dealerships.

The lawsuits against S Automotive and its owner, Simon Nwaru Jr., and Kalango Links and its owner, Korite Michael Kalango, also accuse both dealerships of failing to inform consumers when they were buying rebuilt salvaged vehicles.

“These dealers went out of their way to make sure that customers had no idea what they were actually buying,” Yost said.

“Consumers didn’t realize their car would come fully equipped with buyer’s remorse.”

The Attorney General’s Office received 57 consumer complaints about the dealerships, prompting Yost to file suit in Franklin County Common Pleas Court, according to Yost’s office.

Thirty-nine complaints were about S Automotive, currently operating in Whitehall. Of those, 33 were about the dealership’s failure to deliver titles, three were about misrepresentations, and three were about odometer discrepancies, according to Yost.

Twenty-six of the consumers who filed complaints about title issues were not aware that the vehicles they bought had odometer discrepancies.

In the Kalango Links case, the Attorney General’s Office received 18 consumer complaints, most alleging odometer tampering.

The dealership operates on Cleveland Avenue in Columbus.

Yost’s investigation of S Automotive and Kalango Links found in some cases that the dealerships had been selling cars with rebuilt titles but did not disclose the information in writing to consumers.

A rebuilt title is issued to vehicles that have been repaired after having been declared a total loss by an insurance company as a result of collision damage, fire or flood, or even because of a manufacturer’s buyback due to a lemon law claim.

The lawsuit accuses S Automotive of violating the Ohio Consumer Sales Practices Act, the Certificate of Motor Vehicle Title Act, and the Odometer Rollback and Disclosure Act, including:

• Failing to file applications for certificates of title within 30

days after the assignment or delivery of motor vehicles.

• Selling motor vehicles to consumers and then failing to obtain certificates of title on or before the 40th day after the sale.

• Failing to disclose to consumers that they were purchasing a rebuilt salvaged vehicle.

• Dealers were misrepresenting the odometer disclosure statements.

• Failing to provide true and complete odometer disclosures.

• The dealers were adjusting, altering, changing, tampering with or setting back an odometer of a motor vehicle.

Yost is demanding that Nwaru reimburse consumers for the vehicles they bought and recover the amount of money the Title Defect Recision Fund paid to resolve the consumer complaints.

Additionally, the complaint asks the court to impose civil penalties and prohibit Nwaru from maintaining or applying for auto-dealer or salesperson licenses.

Likewise, the lawsuit against Kalango Links accuses the dealership of violating the Ohio Consumer Sales Practices Act and the Odometer Rollback and Disclosure Act.

In that case, Yost is demanding Kalango reimburse consumers for the vehicles they bought and pay civil penalties and court costs.

The suit also seeks to prohibit Kalango from maintaining or applying for auto-dealer or salesperson licenses.

Yost’s Consumer Protection Section urges consumers to take the following steps when buying a used car:

The office tells customers to check for any complaints against the dealership with the Ohio Attorney General’s Office and Better Business Bureau.

The AG suggests consumers ask for everything in writing and read the fine print and to take the vehicle for an extended test drive.

Ask about prior damage, defects and repair history.

Check out the vehicle’s history through the National Motor Vehicle Title Information System at nmvtis.gov

Ask a trustworthy mechanic to check the car for problems.

If a dealer does not provide the title within 30 days of the purchase date, contact the Ohio Attorney General’s Office.

6

• Local Point of Service in YOUR market

• Bulk Purchase Program

• Payment Stream Advances (6-15 months)

• Aged Pay Share Program that gives you Capital and Cash Flow!

• Floorplan for select BHPH Dealers

• Servicing for all types of Auto Receivables

1.877.570.8857 for all your dealership needs!

Retail Markets

WASHINGTON

Wasim Azzam, owner, All Right Auto Sales, Federal Way, Wash

“I have been in the auto industry since 1992. I earned an associate degree in automotive technology and a bachelor’s degree in business management.

“I worked as an ASE certified technician for several years and later owned a shop for 12 years. I started my own used car dealership, All Right Auto Sales in late 2008 and joined the Washington State Independent Auto Dealers Association in 2009. I am now the president of the association board.

“First, a lot of dealers lost employees during COVID. No. 2, we were affected by the car prices. This is a supply and demand economy. We were very short on supply due to the closure of auto plants. When people don’t

buy new cars, they don’t trade in used cars. The prices then go higher and people walk away from the decision to buy a car.

“Adding insult to injury, there were hikes in the interest rates as the government tried to put the brakes on inflation.

“It’s also been very difficult to find good mechanics and people who want to work. I have been paying a mechanic double. When I was a shop owner, I had six mechanics working for me. Parts were expensive in the early ‘90s to mid-2000s, but now parts are even more expensive, almost to the point where it’s not affordable.

“Another problem has been vandalism. I’m not blaming the police; I think they do a fantastic job. But I think every police department in the country is shorthanded. That leads to them

prioritizing the calls. They don’t answer to a car dealer if someone is stealing a car.

“It’s been very difficult to be in business and find inventory. And when we find a vehicle it’s very expensive and we still have to recondition them. Some banks won’t finance a car purchase today.

“Some people don’t have the extra money. They used to pay $1,000 a month for rent, now that’s $1,500. People also have to prioritize. They don’t want to pay extra for a warranty, they need to feed their children.

“I know a good car when I walk by it. I don’t want to buy beat-up cars. I don’t want the complaints. When I go to the auctions, I take my mechanics with me and we inspect those cars. So, the cost of my reconditioning is less than someone who doesn’t know anything about mechanics. But these

days, on average, if you buy a decent car, you’ll spend $500 minimum on reconditioning.

“Every car has some issues. If I was to buy a used Kia Forte, 90 percent of those need a new engine. Same thing goes with the Hyundai Sonata. Certain Audis, some BMWs, have problems, too.

“People tend to blame the dealer, but it’s the manufacturer. We cannot predict what will happen to the car six months after we sell it. Or talk to the people who owned this car for 10 years before you and didn’t maintain it. You can’t keep the same fluid in the transmission for 90,000 miles.

“We have what’s called an implied warranty, meaning the car has to be safe to be on the road and free of any emission defects.

“When people have problems with a car, they might

Compiled by Ed Fitzgerald

contact the attorney general’s office. In a recent 18-month period the Washington AG office received 557 major complaints with implied warranties on used cars. Dealers in 12 of those months sold 424,000 vehicles. They’re selling 1,160 cars a day. That translates to just one complaint per day. I wish the number was zero, but that’s not reality. And some of these complaints are against dealers who keep doing the same thing over and over.

“We have to go after the dealers who are the bad apples, I’ve been saying that for years. You cannot penalize all the other dealers who are doing a fantastic job.

“I do not do any buy-here, pay-here.

“The last car I sold was a 2017 Subaru Impreza allwheel-drive. It had 128,000 miles and it sold for $16,990.”

3/6/2023

Wholesale Markets

GEORGIA

Corey Sanford, general manager, America’s Auto Auction-Atlanta, Cartersville, Ga.

“Year-to-date, we’re up more than 400 sold over last year. We sold 2,368 (units) in February.

“January was kind of flat but February was a home run.

“We’re averaging 1,000 (units) and if it drops, it drops to 950. Last year it was about 800.

“We’ve picked up some new accounts. We just have an aggressive sales team that does a wonderful job for me. They just picked up two dealer groups, one with four stores, one with five stores. That’s made up the (additional) volume.

“But fleet’s down for us. We were right about 10% fleet and 90% dealer volume last year. I just looked at the

numbers and this year we’re at 6% fleet and 94% dealer cars this year. Part of it was because we lost the Nicholas Financial account after Westlake Portfolio Management (began servicing those loans).

“We draw an average of 500 bidders in the lanes and 400 online.

“If you go back to five years ago, we were selling about 10% online. Right now, we’re selling about 30% on simulcast.

“Our average price coming across the block is $12,000. That’s flat from last year. I have an in-op sale twice a month and that brings that average down. We’ll run 100, twice a month, after the auction.

“Our last two sales were 62%.

“In December, we were No. 2 for independent auctions for OVE sales.

“I do hear from dealers that trucks are down and diesel trucks are way down.

“I’m not worried in the least. I feel like we’ll have another record year. We have a great, aggressive sales team.”

MONTANA

Jake Gertsch, sales manager, Auto Auction of Montana, Billings, Mont.

“We’ve owned the auction close to 20 years now.

“We have four lanes with the ability to double-block and run six lanes.

“This year has started out good. In mid-to late January, it started to take off and February has been good.

“Lately, volumes have been between 400 and 450 cars.

“We’ve always been used to selling 2-year-old vehicles and you look back two years and you’re in ’20 and ’21 and they were selling many.

Compiled by Jeffrey Bellant

“(For conversion rates) in December it was slower but in the last few weeks we’ve been above 70% – 70% to 80%.

“It seems like $25,000 to $30,000 stuff is what is really hot here.

“Our average price in the lanes is just over $30,000. It’s a definite increase over the past three years.

“The majority of our volume is trucks and SUVs. I’d say easily that 90% of our vehicles are trucks and SUVs.

“We sell lots of dealer cars. We’re probably 70% to 80% dealer cars. We used to have a higher number of fleet back when there was a lot more fleet.

“We also sell a lot of Canadian imports and it’s been that way for the last six or seven years. That makes up probably 50% of our volume.

“We also do a GSA sale that typically runs once a month.

We’ll average 20 to 30 per month.

“For auctions, it’s all about volume. So, I think this year is going to be a fight to find inventory.

“But we think sales percentages will stay high because demand will stay high. The price of new vehicles has increased substantially, so I think that will keep the used sector in business. That’s especially true when you get into that $20,000 to $50,000 range. Also, with the chip shortage, a lot of the new vehicles don’t come with all the options they once did.

“But the franchise dealers are saying they’re seeing more new cars on the ground.

“Heavy duty trucks are in short supply. You know, diesel trucks, especially with the long box. Those vehicles are still hard to come by.”

10

3/6/2023

Where Consignors and Auctions Connect.

The Conference of Automotive Remarketing (CAR) connects the remarketing community, with more consignors in attendance than any other event of its kind.

From networking to an array of innovative sessions ranging from the state of the auction industry to adapting to EV’s, CAR 2023 delivers what your business needs to look towards the future, during a time of consolidation and change. March

2023

Vegas,

23-3248

28-30,

Las

NV

PRODUCED BY:

be left behind! REGISTER NOW carconference.com

Don’t

Source: Black Book

Actual Wholesale and Projected Residual Values 3/6/2023

Wholesale Numbers my seg_type make_model_name 2022-03-01 2022-09-01 2023-03-01 2024-03-01 2025-03-01 2018 Car Toyota Camry 20150 19075 15400 13000 11275 2018 Car Honda Civic 17150 17750 14775 11750 9675 2018 Car Honda Accord 20300 20300 16125 13400 11675 2018 Car Toyota Corolla 16325 16075 13200 10700 9050 2018 Car Nissan Altima 15850 14875 10950 9125 7925 2018 Car Chevrolet Malibu 17725 16050 12175 9275 7375 2018 Car Hyundai Elantra 14450 14400 10725 8300 6675 2018 Car Nissan Sentra 14575 13975 10175 7875 6500 2018 Car Ford Mustang 21125 19175 16875 14025 11800 2018 Car Hyundai Sonata 17125 15625 11625 9300 7775 2018 Truck Ford F150 32000 29700 25600 22925 20300 2018 Truck Chevrolet Silverado 1500 35200 32250 28100 24575 21100 2018 Truck Toyota RAV4 22300 20175 17275 15050 13325 2018 Truck Honda CR-V 25075 22925 19575 17100 15125 2018 Truck Toyota Tacoma 33150 30450 26975 24700 22400 2018 Truck Jeep Grand Cherokee 25625 24625 19250 15250 11900 2018 Truck Ford Escape 17875 16175 12350 10175 8550 2018 Truck GMC Sierra 1500 33700 32200 28200 24875 21450 2018 Truck Nissan Rogue 19775 18025 13200 11150 9350 2018 Truck Toyota Highlander 28475 26050 20750 17725 14950 2019 Car Toyota Camry 22075 21700 17500 14775 12800 2019 Car Honda Civic 19000 19200 16075 13025 10875 2019 Car Honda Accord 22750 22725 18525 15350 13325 2019 Car Toyota Corolla 18450 18350 15375 12425 10450 2019 Car Nissan Altima 20300 19450 14675 12050 10275 2019 Car Chevrolet Malibu 20000 18675 14275 11025 8900 2019 Car Hyundai Elantra 16800 17000 13500 10425 8300 2019 Car Nissan Sentra 17450 17900 13600 10375 8325 2019 Car Ford Mustang 23625 22025 18100 15150 12800 2019 Car Hyundai Sonata 19775 18825 14500 11450 9425 2019 Truck Ford F150 36900 34700 30900 27550 24200 2019 Truck Chevrolet Silverado 1500 39500 34500 29550 26250 22925 2019 Truck Toyota RAV4 25900 24750 21575 18725 16450 2019 Truck Honda CR-V 28000 25250 21275 18750 16825 2019 Truck Toyota Tacoma 34950 33375 28275 26200 23850 2019 Truck Jeep Grand Cherokee 28375 27300 22325 17825 14075 2019 Truck Ford Escape 20400 19300 15150 12550 10550 2019 Truck GMC Sierra 1500 40000 37200 31500 27900 24325 2019 Truck Nissan Rogue 21850 20200 15700 13175 10925 2019 Truck Toyota Highlander 31050 28100 23125 19850 16825 2020 Car Toyota Camry 24500 23775 19025 16275 14325 2020 Car Honda Civic 21000 21950 17800 14600 12325 2020 Car Honda Accord 25050 24875 20425 17000 14800 2020 Car Toyota Corolla 20500 21250 17650 14425 12275 2020 Car Nissan Altima 22250 21825 16600 13750 11800 2020 Car Chevrolet Malibu 22200 21525 16175 12625 10300 2020 Car Hyundai Elantra 19075 19325 15375 12150 9900 2020 Car Nissan Sentra 20225 19825 16225 12950 10650 2020 Car Ford Mustang 25400 23950 19875 17125 14900 2020 Car Hyundai Sonata 23900 20900 16450 13225 11075 2020 Truck Ford F150 40000 38500 34500 31175 27725 2020 Truck Chevrolet Silverado 1500 42700 39950 35150 31000 26950 2020 Truck Toyota RAV4 28625 27750 23325 20500 18225 2020 Truck Honda CR-V 30800 27875 23575 20875 18825 2020 Truck Toyota Tacoma 36825 36650 30425 28050 25575 2020 Truck Jeep Grand Cherokee 32425 30925 25300 20625 16575 2020 Truck Ford Escape 24675 22875 18000 15150 12900 2020 Truck GMC Sierra 1500 41800 39000 33500 30000 26425 2020 Truck Nissan Rogue 24100 22650 17550 14975 12550 2020 Truck Toyota Highlander 34850 33450 27425 24075 20875 2021 Car Toyota Camry 25800 26750 21200 18225 16100 2021 Car Honda Civic 22525 24275 19375 16100 13800 2021 Car Honda Accord 26775 26800 22650 19275 17175 2021 Car Toyota Corolla 21700 22250 18950 15700 13550 2021 Car Nissan Altima 23450 23550 17850 15100 13225 2021 Car Chevrolet Malibu 23400 23100 17700 14150 11800 2021 Car Hyundai Elantra 21325 20675 16625 13550 11375 2021 Car Nissan Sentra 22275 21175 18050 14500 12050 2021 Car Ford Mustang 28400 27250 23150 20300 17950 2021 Car Hyundai Sonata 24700 22975 17950 14625 12400 2021 Truck Ford F150 47300 46000 39700 36050 32225 2021 Truck Chevrolet Silverado 1500 45500 41500 36800 33275 29650 2021 Truck Toyota RAV4 31075 29725 24850 22175 20050 2021 Truck Honda CR-V 32650 30100 25400 22650 20600 2021 Truck Toyota Tacoma 40250 37575 32475 29950 27300 2021 Truck Jeep Grand Cherokee 35675 33550 27850 23275 19150 2021 Truck Ford Escape 27450 25325 20225 17250 14850 2021 Truck GMC Sierra 1500 45800 40200 37000 33600 29975 2021 Truck Nissan Rogue 31050 29700 22375 19050 15925 2021 Truck Toyota Highlander 37275 36550 29850 26650 23475

Tony Moorby Disconnected Jottings From

I occasionally have lunch with Cassie Fennell of Designworks AMG, an industry colleague of such long-standing that our friendship has survived our going separate ways; she still works and I’ve been retired for almost longer than ADT Automotive was in existence.

As a creative consultant she helped steer our young company’s path through all kinds of marketing tactics, designing the merchandising methods that set our firm aside from others. Her insights helped guide our advertising and promotional activities on both local and national scales.

A parallel sense of humor and an admiration for family values has driven an enjoyable connection through conversations that cover the ‘soup to nuts’ category. We invariably start talking about the car industry, toss-

ing opinions around like confetti and of course we observe the various personalities that make the business so vibrant and interesting.

An early get-together took place one mid-morning at a local Starbucks. It was late spring so we sat at a table outside among about six others, umbrellas offering a little shade in the warm sunshine. A young lady at an adjacent table had a toddler, fast asleep in a stroller, allowing a little selfish respite over a caramel macchiato.

We chatted about everything from school days and the foibles of our teachers to travels with family and Harley rides from one side of the country to the other. We talked about careers and what had brought us to the present moment. Before we knew it, an hour had passed. The lady with the toddler, who by now was stirring

By Myles Mellor

and demanding her attention, was getting up to leave. She looked over and smiled like a Cheshire cat. “I have

ing.” With that, she casually left with a little wave. We’ve now graduated from Starbucks to a regular haunt at a restaurant in what was once an estate house, nowadays surrounded by modern office blocks (some of which still stand empty, post pandemic). It’s like an oasis, standing separate, swathed in Southern charm and porches. There’s a glazed garden room at the rear of the house, our preferred venue – it’s light, airy and cheerful. Attentive service is quiet and understated, leaving us to chat at leisure, without the pressure of ‘table-turn’.

One of the most attractive things about the place is that they display fabulous artwork – something that appeals to both Cassie and me, fueling more discussion and comment.

to tell you that I couldn’t help but eavesdrop all the time we’ve been sitting here and I’ve never been so entertained. Thank you for a the most interesting morn-

The food is typically Southern – shrimp and grits being a regular staple along with Maryland She-crab Bisque but stabs at modern trends are often quite successful; crispy squid with a sweet and spicy Thai sauce is a favorite.

We were leaving after our last lunch and had to walk through the bar – a warm, cozy setting but the back bar is dramatically lit from the bottom, occasioning the most lustrous, glimmering display of the colored contents of the bottles. It was a photo op not to be missed. I thought it would make a terrific painting. I got home and quickly did a watercolor sketch and later, an acrylic rendition of the scene.

They provide a nice reminder of time well spent and Cassie made a triptych of the photo and two paintings…

A toast to celebrate a warm friendship.

MI LA NO J AG UAR S A O I R E M D O LOT US AV E NTA DOR S N P N E BE NTA YG A CA YM AN U I N E M C T UT E P RIU S EXP O R S LA W GHO ST MA SE RA TI E PU T A A RNA NI CAD FI NAN CIN G E A GA NA G B R SUPR A STE AL US E RON T E TI E SC IO N CHAR GE R 123 4567 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 Solution to the 2/13/2023 puzzle Solution to this puzzle in the 3/27/2023 issue. Call 1.800.794.0760 for a FREE subscription. Play Online at UsedCarNews.com

Across 1. Hyundai SUV 5. Car in a Beach Boys song, 2 birds 9. Maxima and Sentra 11. Nash model 12. BMW sports car, 2 words 15. Bentley SUV 18. In times past 19. Current measurement 20. Nissan truck 21. Flurry 24. Expert adviser 25. Put money in the pot 26. Slow the car 27. Land Rover model 29. Isuzu SUV 30. Kia minivan 33. Through, on routes 34. Small floor cover 35. Alien movie 36. Fearlessness 39. Car details 42. Historic time period 43. Grammy category 45. Electric Chevy car 46. Parking places at home Down 1. ____ Esperante sports car 2. Weight abbr. 3. Green color 4. Instrument panel 5. Florida seaport 6. Under the weather 7. Dodge compact 8. Old Ford SUV 10. Old French money 13. Mitsubishi model 14. British brand of 4 wheel drive vehicles, 2 words 16. Savannah’s state 17. Traffic light color 20. Sports coupe from Hyundai 22. Going to happen 23. Customize a vehicle 25. Test period 28. F-430 makers 30. Half-__ (coffee order) 31. Tighten when needed 32. ___ Miserables 37. Pride 38. Doggy doc. 40. Not trained 41. Environmental watchdogs 44. Lexus __ 330 14

3/6/2023

GREAT LAKE S AU TO A UCTION ServNetAuctions.com AKRON AUTO AUCTION akronautoauction.com BSC AMERICA BEL AIR AA bscamerica.com CAROLINA AA carolinaautoauction.com CORPUS CHRISTI AA corpuschristiautoauction.com AA OF NEW ENGLAND aane.com DAA OF IDAHO daaofidaho.com DAA LAS VEGAS magauctions.com DAA NORTHWEST magauctions.com DAA SEATTLE magauctions.com DAA OF OKLAHOMA CITY daaokc.com GREATER ROCKFORD AA graa.net NORTH BAY AA nbauto.com GREENVILLE AA greenvillencautoauction.com SAN ANTONIO AA sanantonioautoauction.com INDIANA AA indianaautoauction.net STATE LINE AA statelineauto.com MID-STATE AA msaanym.com TALLAHASSEE AA bscamerica.com MISSOURI AA missouriautoauction.com VALUE AA valueautoauction.com GREAT LAKES AA greatlakesaa.com SERVNET AUCTIONS WELCOME NEW SERVNET MEMBER AUCTIONS Meet our newest member auctions, offering the full Servnet experience and ready to handle your business needs. SERVICE SUPPORT SOLUTIONS AVDAA LOS ANGELES avdaauction.com Fresh New Look, Same Great Servnet Service!