OUR MISSION

To create a world where people matter more than numbers.

OUR VISION

By adding soul and simplicity to the financial experience, we will create fiercely loyal members, deeply engaged employees, and thriving communities.

To create a world where people matter more than numbers.

By adding soul and simplicity to the financial experience, we will create fiercely loyal members, deeply engaged employees, and thriving communities.

This compiled history of our great Credit Union, from Albuquerque U.S. Employees Federal Credit Union, to U.S. New Mexico Federal Credit Union, to U.S. Eagle Federal Credit Union, is dedicated to:

Our Founders in 1935;

The many generations of our members;

The decades of staff; and

All the selfless Board Directors and volunteers.

Together, you have evolved with this great credit union to make it a vital and contributing institution for our communities. May the future decades see us grow and prosper to make those who came before us proud.

Marsha Majors, President and Chief Executive Officer

I entered the credit union world by pure happenstance and knew very little about the “Credit Union Difference,” but I was quickly influenced by the authentic way in which it helped members. My motivation for starting this project was to celebrate our proud credit union heritage and to provide a fuller appreciation for our unique mission.

U.S. Eagle has been providing value and financial stability for more than 80 years and this accomplishment can be attributed to the expertise and passion of past and present members, volunteers, and employees. And, each one of the events shared here has enabled the credit union to grow and serve.

By sharing our story, it is my hope that others might be inspired by the rich history and culture of U.S. Eagle and this great industry.

Marsha Majors, President and Chief Executive Officer

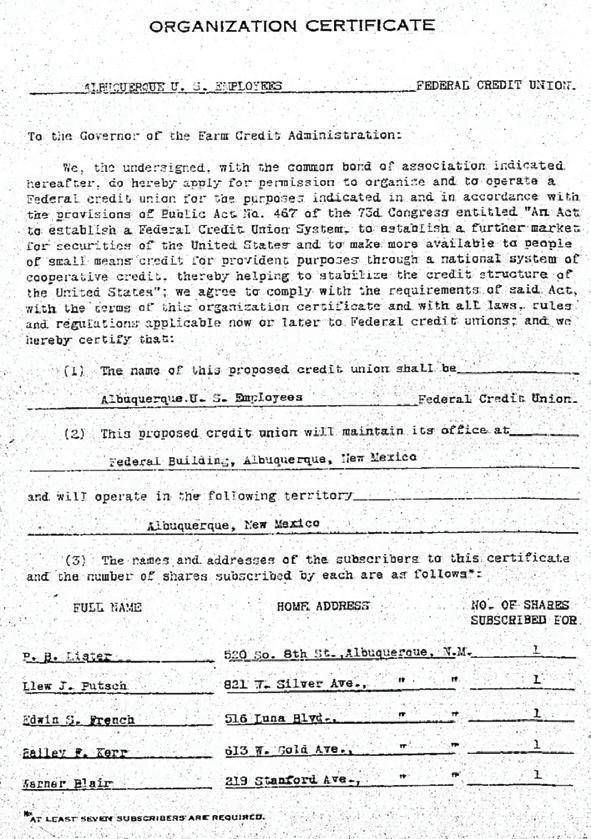

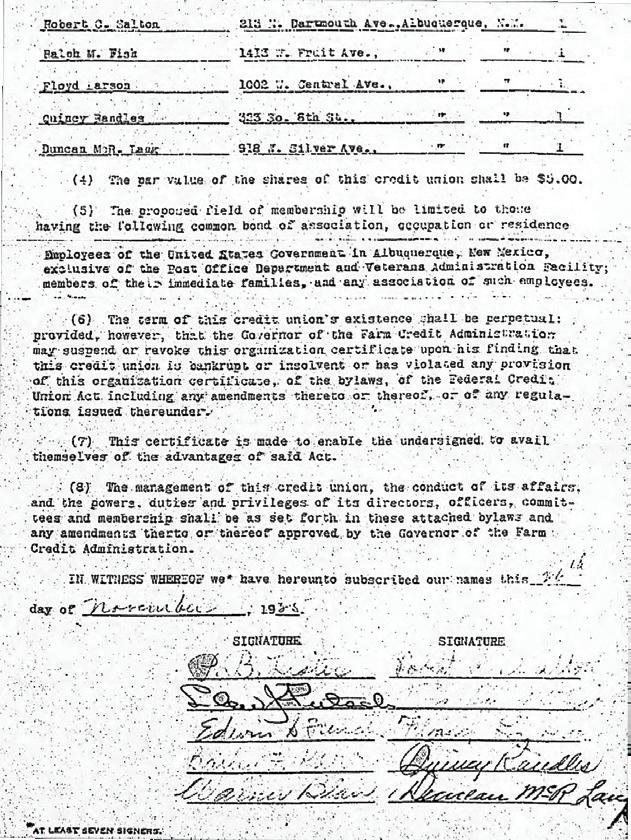

U.S. Eagle was founded in 1935 in Albuquerque, New Mexico as Albuquerque U.S. Employees Federal Credit Union, making it the oldest credit union in the state. The ten founders gathered with the intent on creating a safe place to pool their finances and to provide low-cost loans. In the original charter language, credit union services could be offered to: “Employees of the United States Government in Albuquerque, New Mexico, exclusive of the Post Office Department and Veterans Administration Facility; members of their immediate families, and any association with such employees.”

In 1982, the Credit Union amended its charter to allow Select Employer Groups (SEGs) to join the field of membership, which allowed the Credit Union to offer services to those SEGs’ employees and their families. The Golden Eagles Association was established as a SEG in 1986 to serve members over 55 years of age. To reflect our expanded membership, in 1990 the Credit Union’s name was changed to U.S. New Mexico Federal Credit Union.

In 1996, the U.S. District Court issued an injunction stating that federal credit unions can serve existing members and add only members associated with the original charter. However, that limitation was soon lifted in 1999.

In 2000, the charter grew again with the addition of Keep New Mexico Beautiful (KNMB) into our field of membership. Members could join KNMB and be eligible for credit union services. KNMB is a non-profit that supports sustainable beautification efforts in New Mexico.

In 2000, the county of Sandoval, NM was added to our field of membership. In 2013, San Juan County, NM, was added, enabling the Credit Union to expand services to anyone who lives or works in those counties. New branches were opened in both counties to support current and future members.

In 2015, the name was changed to U.S. Eagle Federal Credit Union to better capture the expanded geographic area served by the Credit Union.

U.S. Eagle has been improving the lives of our members and communities for more than 80 years. As of the publication date of this history (2019), U.S. Eagle has more than 80,000 members throughout the country, and the world! We look forward to building on our legacy of service and making dreams come true for many generations to come.

The principal role of the Chair of the Board is to manage and to provide leadership to the Board of Directors of the Credit Union. The Chair is accountable to the Board and acts as a direct liaison between the Board and the management of the Credit Union, through the Chief Executive Officer.

Ashley III, Charles*

Bennett, W. Charles

Blair, Warner Blunt, Robert F. Dundley,

Bob Fish, Ralph M.

Flohr, Ann Eggert

French, Edwin S.

Gilbert, Linda

Gilbert, Tony J.

Greiner, Lawrence

Herrera, Ken

Hicks, Brad

Kathrein, Joseph

*served as Advisor to the Board

Kerr, Bailey F.

Laney, Kathy

Larson, Floyd

Lister, P.B.

McKim, James R.

McR. Lang, Duncan

Navarette, Joseph

Palmer, Donald

Palmer, Harry Don

Putsch, Llew J.

Randles, Quincy

Rocco, Jim

Salter, Roger

Salton, Robert

Sampson, W.T.

Sanchez-Davis, I.L.

Stewart, Cecil

Taylor, Curley

Vale, John

Werner, Lee

Wherley, Floyd

U.S.

Our Managers and CEOs have provided excellent leadership and guidance as the Credit Union has grown to serve more members. They’ve been the voice of the member and helped us through mergers, acquisitions, and name changes. Thank you to our leaders who have helped shape the Credit Union into what it has become.

Marsha Majors President and Chief Executive Officer

Sam Johnson Chief Information Officer

Maggie Tannen Chief Human Resources Officer

Mike Moore EVP/Chief Financial Officer

Steve Schreiner Chief Digital Officer

Ross Busby Chief Lending Officer

Justin Breen Chief Risk Officer

The Supervisory Committee

The Supervisory Committee is established by the National Credit Union Administration. The primary role of this committee is to independently evaluate the overall performance and operations of the credit union to ensure operational accuracy and regulatory compliance. Internal controls are evaluated to determine that controls are in place and are functioning as intended to protect members’ assets, management, and the employees.

Armijo, Henry

Bennett, W. Charles*

Boyce, Douglas C.

Bruner, Todd

Castelbaum, Lynn

Chamberlin, Steven R.

Chenoweth, Ken

Cole, Sharon

Crespin, Loretta L.

Detrow, Thomas

Duran, Mary A.

Engle, Tom

Galves, Gus

Gateley, M. Reese*

Gitajn, Elizabeth D.

Haines, Brandon Hill*

Handing, Bryan E.

Herndon, Pamelya

Herrera, Ken*

Jollensten, Gordon*

*Served as chair of the Supervisory Committee

Kraft, Margaret L.*

Kusnetz, Norman

Laney, Robert G.*

Martinez, Lori A.

Moore, Fred E.

Mosher, Charles*

Neudecker, Lou

O’Hare, Thomas

Przekurat, Emil

Romero, Alfredo T.

Sacoman, James R.

Self, Don

Serencha, Paul

Umbrage, Don H.*

Valles, David

Weiss, Dr.Steven

Wenzelburger, Emily

This committee functions as an advisory group to the Board and to promote training to ensure the effective use of volunteers. The committee facilitates the recruitment of qualified volunteers.

Antrom, Barbara A.

Duran, Mary A.

Espinosa, Judith

Gillispie, Daniel

Herndon , Pamelya

Hope, Theresa

Technology Committee

Johns, Douglas A.

Lucero, John R. Mariani, Holley

McMahon, Kevin

Sandoval, Robert Stromei, Linda

Weeks, Geri Wenzelburger, Emily

The Technology Committee assisted the board in fulfilling its oversight responsibilities in respect of the overall role of technology and its use throughout the Credit Union.

Bond, D. Eric

Bruce, Kerry A.

Marketing Committee

Johns, Douglas A. Navarette, Joseph

Orgill, Kevin M.

Raquet , James E.

Rietz , Lee E. Werner, Lee

This committee was established to the Board and Management to develop a Marketing Strategy for the Credit Union. It worked closely with management to identify and analyze market opportunities.

Abeita, Pauline Jo

Barsky, Ben

Martinez, Lynn

Montoya, Mary Ann

Salter, Roger Shearer, Harold

Stabler, William

Todd, Sr., Jerry E.

Wenzelburger, Emily

This committee was established as an advisory group to the Board and Management in member education. It worked closely with management in identifying, analyzing, and providing education to its members.

Chavez, DorettaDuran, Mary A. Johns, Douglas A. Salter, Roger Stromei, Linda

Growth Mergers & Acquisitions Committee - The GM&A Committee of the Credit Union was appointed by the Board of Directors to review and assess growth plans, potential mergers, and acquisitions consistent with the Strategic Plan.

Strategic ALCO - The asset liability management committee is named to provide decisions within limits prescribed by the board and to provide oversight of the staff Operational ALCO Committee.

Policy/Bylaws Committee - The Policy/Bylaws Committee serves the Board of Directors and Administration by periodically reviewing policies, procedures and Bylaws.

Governance Committee - The Governance Committee functions as an advisory group to the Board to facilitate succession plans, programs and activities necessary to ensure the credit union has well qualified volunteers and staff available in the future.

Finance Committee - The role of the finance committee is primarily to provide financial oversight and is responsible for monitoring and communicating to the board the organization’s overall financial health.

Employee Engagement Council - The purpose of the Employee Engagement Council is to be an advocate and to amplify the voice of all employees to foster employee engagement, encourage a spirit of unity, and become a positive influence to fulfill our Brand promise.

The Junior Board of Directors at U.S. Eagle Federal Credit Union functions as a part of the Volunteer Development Committee and contributes to the overall strategy of developing volunteers to support the mission and goals of the credit union. The Junior Board of Directors serves the growth and development of youth and young adult members of the credit union. The three focused objectives of the Junior Board are: (1) aid in community service; (2) development of products and services targeted for members in the 16-24 age group; and (3) support and advance youth entrepreneurship.

Alfaro, Mariah

Andrada, Julianna

Damianov, Rosemary

Filatova, Viktoria

Franco, Ryan Fritz, Erin Gonzalez, Myrella

Gutierrez, John Gutierrez, Michael

Hernandez-Sanchez, Alez

Hernandez-Sanchez, Ivon

Ortiz, Alyssa

Prasek, Kylan

Ramos, Miranda “Nanda”

Sandoval, Jessica “Betty”

Sena , Dominic

Sucet, Leandra

Thornton, Renata

Vigil, Jadyn

International Credit Union Day celebrates the spirit of the global credit union movement. The day is recognized to reflect upon the credit union movement’s history, promote its achievements, recognize the hard work, and share member experiences. International Credit Union Day has been celebrated on the third Thursday of October since 1948.

The philosophy of “People Helping People” is in U.S. Eagle’s DNA. One of the ways we demonstrate this way of thinking is through community giving. The Philanthropy Committee was initially established by employees who wanted to make a positive impact through volunteerism and charitable giving. Employees embodied the spirit of giving, and they established guidelines to help the sustainability of the credit union’s philanthropic efforts.

Our Community Involvement Committee was a natural evolution of the Philanthropy Committee, and works to provide financial and volunteer support to non-profit organizations that have a positive impact to the communities we serve.

Each year, the Board of Directors holds an Annual Meeting for members and employees to learn about the credit union. The Board Chair presents the strategic direction of the credit union, the financial statements for the reporting year, and milestones reached during the past year. The CEO presents an update on the credit union’s operations. The Annual Meeting also provides a forum for our members to ask questions of the Board and Executive Team.

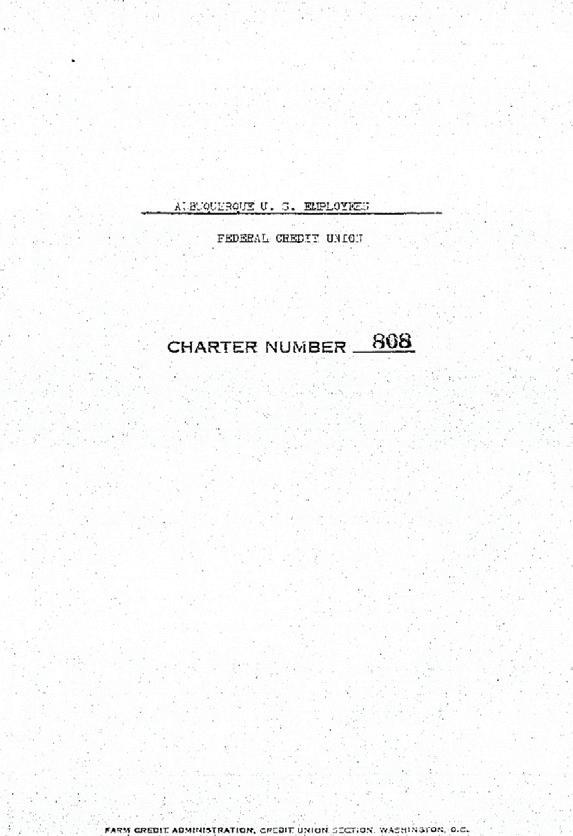

1934

President Franklin D. Roosevelt signs the Federal Credit Union Act, which authorizes federally chartered credit unions in all states. The FCU Division is placed within the Farm Credit Administration. 1935

The original charter (#808) is executed for Albuquerque U.S. Employees Federal Credit Union on December 5, 1935.

Assets - $192,000 | Members - 350 | Employees - 1 q

1940

By the end of 1940, there are 3,756 federal credit unions in the United States.

1940

The first four-wheel drive, all purpose vehicle is designed. It becomes known as the Jeep. q q

1948

In 1948, the first Credit Union Day is celebrated on the 3rd Thursday in October. This observance grew into International Credit Union Day.

1942

Federal supervision of credit unions is transferred to the Federal Deposit Insurance Corporation (FDIC).

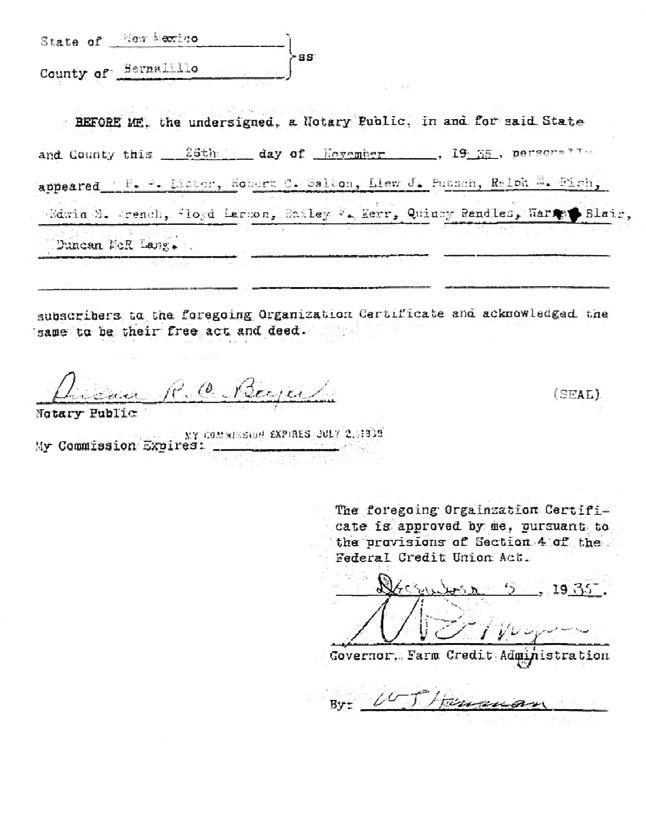

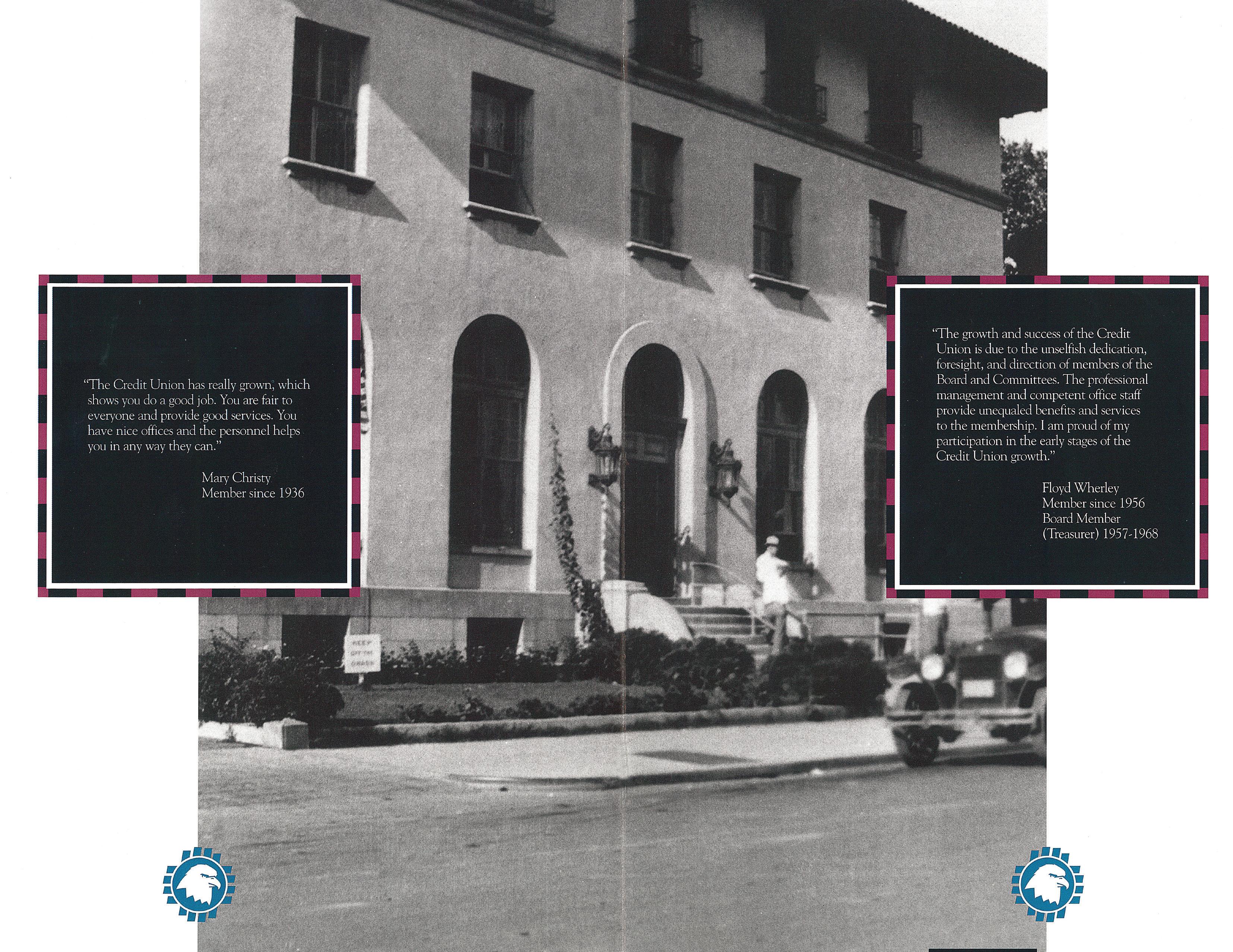

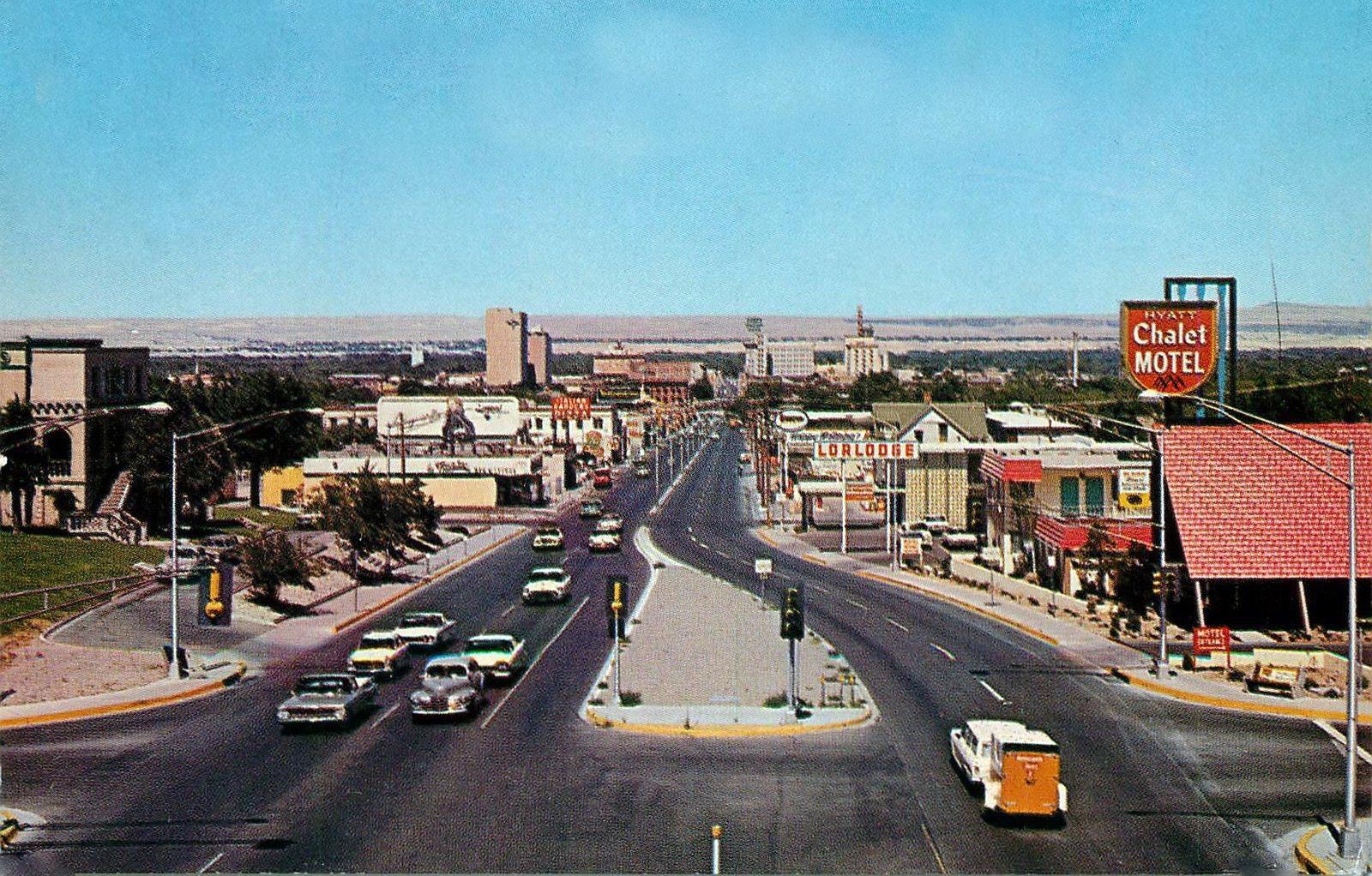

The Credit Union’s original location was centrallylocated in the heart of the thriving financial district.

1940

1948

The Federal Credit Union Division is renamed the Bureau of Federal Credit Unions, and is moved from the Federal Deposit Insurance Corporation to the Federal Security Administration.

- $385,000 | Members - 520 | Employees - 2

1952

By 1952, the number of federal credit unions in the U.S. grows to nearly 6,000 with more than 2.8 million members nationwide.

1953

1956

The Interstate Highway Act creates a network of highways which connects all parts of the United States.

J. Dean Gannon becomes director of the Bureau of Federal Credit Unions as it moves to the new Department of Health, Education, and Welfare.

1957

Our credit union has come a long way from using manual machines like this device to create cashier’s checks and money orders.

1959

30-year fixed rated mortgages become widespread as rates reach all-time lows.

Ledgerbooks were used to manually track deposits and loan balances.

Book 1950s

1960

- $770,000 | Members - 1,500 | Employees - 4

By the end of 1960, there are 9,905 federal credit unions with 6.1 million members and $2.7 billion in assets

1965

The Credit Union celebrates its 30th anniversary.

1963

The fate of Central Albuquerque is in question as shoppers looked elsewhere for better deals. Vacancies and deteriorating buildings were common in the downtown area.

1967

In 1967, the average cost to buy a new house was $15,500.

1968

The Truth in Lending Act becomes law. This standardized the way costs and terms are disclosed. The Act introduced the calculation of the Annual Percentage Rate, which incorporates all costs and fees, not just interest.

1967

Most mortgages were at 5-6% interest rate, and were funded by large Commercial Banks or Savings and Loans Associations (S&L’s) which were insured by the FDIC (Federal Department Insurance Corp).

Assets - $6,200,000 |

- 3,200 | Employees - 10

1970

1971

The Gold Branch opens at 616 Gold Avenue SW. This branch replaces the original location.

Congress creates the National Credit Union

Administration as an independent agency to charter and supervise federal credit unions.

1971

With the signing of Executive Order 11580 on January 20, 1971, President Richard Nixon establishes the NCUA seal.

1978

Maximum cash withdrawal is $300. Any amount over required an issuance of a cashier’s check to be taken to Albuquerque National Bank for cashing. All statements are issued quarterly.

1979

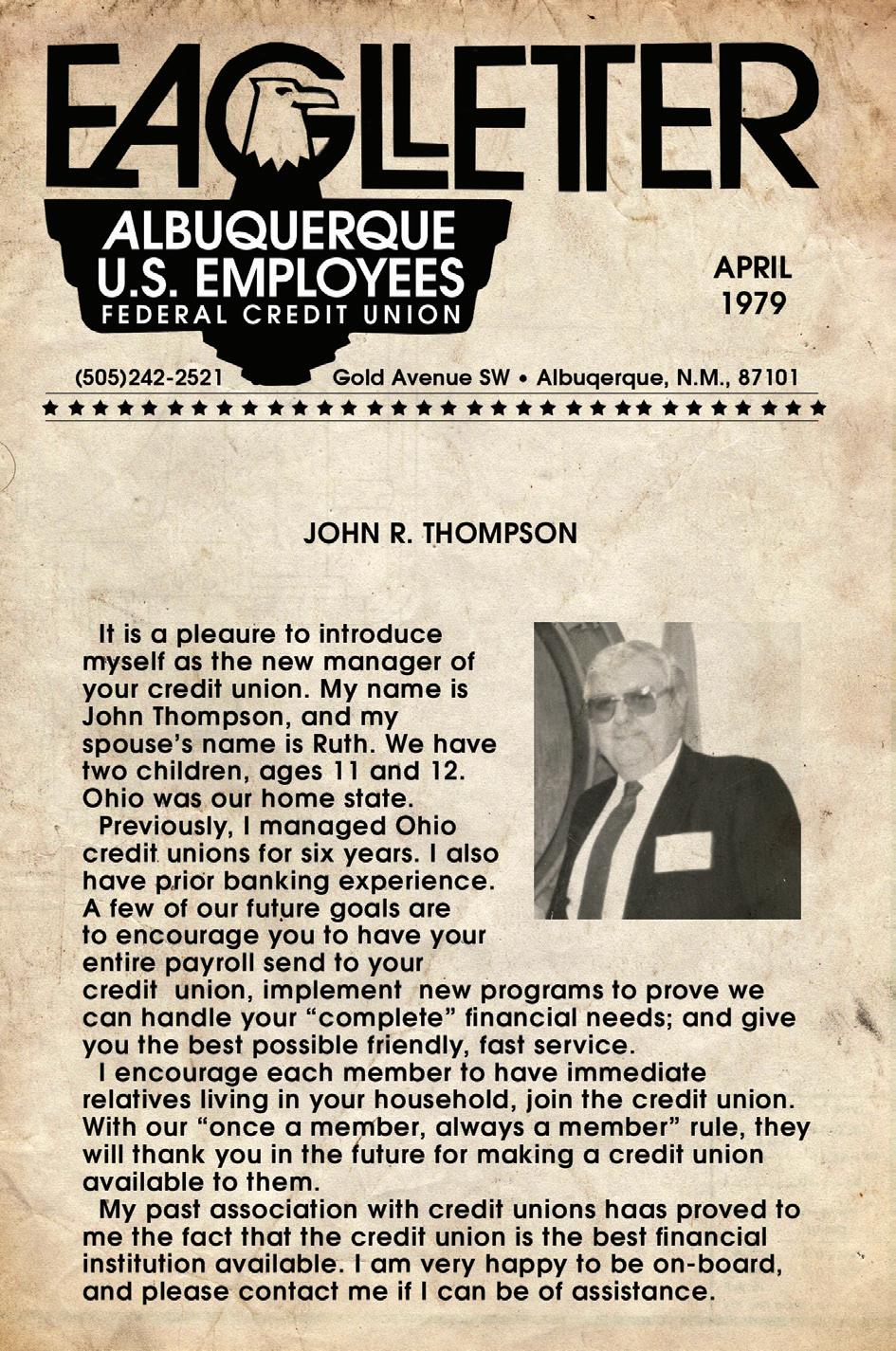

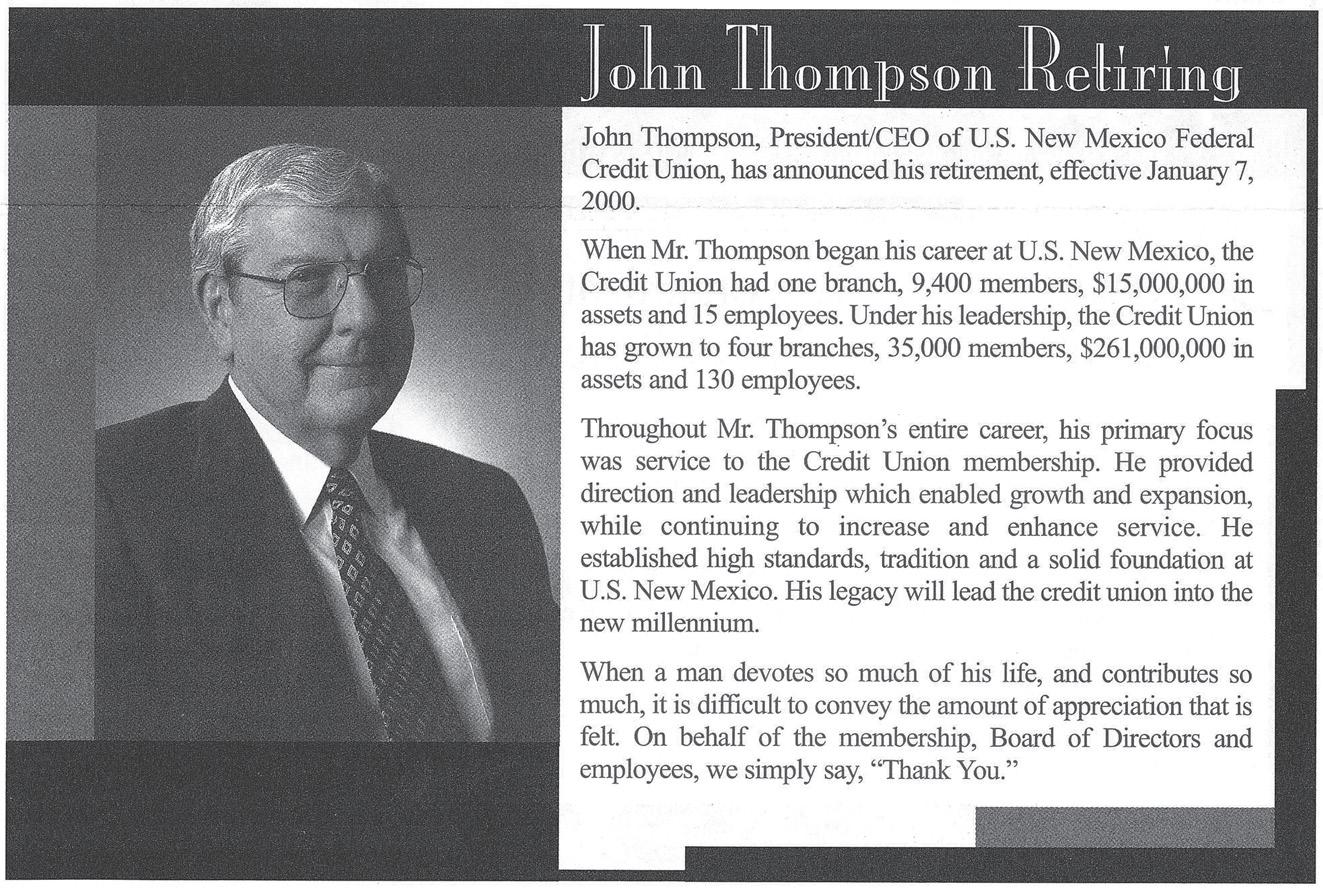

John R. Thompson begins his career with Albuquerque U.S. Employees Federal Credit Union.

1978

Share insurance coverage increases to $100,000, making it equal to the amount of deposit insurance coverage for banks provided by the Federal Deposit Insurance Corporation.

Assets - $16,873,457 | Members - 10,266 | Employees - 15

1980

Albuquerque U.S. Employees Credit Union is the first credit union in the state to offer Visa Credit Cards. The approved limit was quickly reached and new cards had a reduced maximum credit line of $500.

1984

The U.S. Postal Service issues a commemorative stamp recognizing the 50th anniversary of the Federal Credit Union Act.

1980

Share Certificates are introduced. Certificates are manually typed when issued.

1982

The Credit Union’s second branch opens at 2608 Tennessee Street NE.

1985

The Credit Union celebrates its 50th Anniversary.

1985

World Computer System is installed as the first centralized computer system.

1986

Audio response telephone (ARTEL) is introduced.

1986

The Golden Eagles Association begins to hold informative meetings for its members, and plan financial education for credit union members.

A Home Equity Line of Credit (HELOC) is offered to members. The Tax Reform Act of 1986 enables the Credit Union to become a leader in HELOCs.

The Visa Gold Card is introduced. The card has a credit line of up to $5,000 and offers features such as legal assistance, medical assistance, and travel accident insurance of $400,000.

The Credit Union Auto Services program forms. The program helps credit union members select their dream car at a low price and a hassle-free sales environment.

Presbyterian Credit Union is acquired, and its members join Albuquerque U.S. Employees Federal Credit Union.

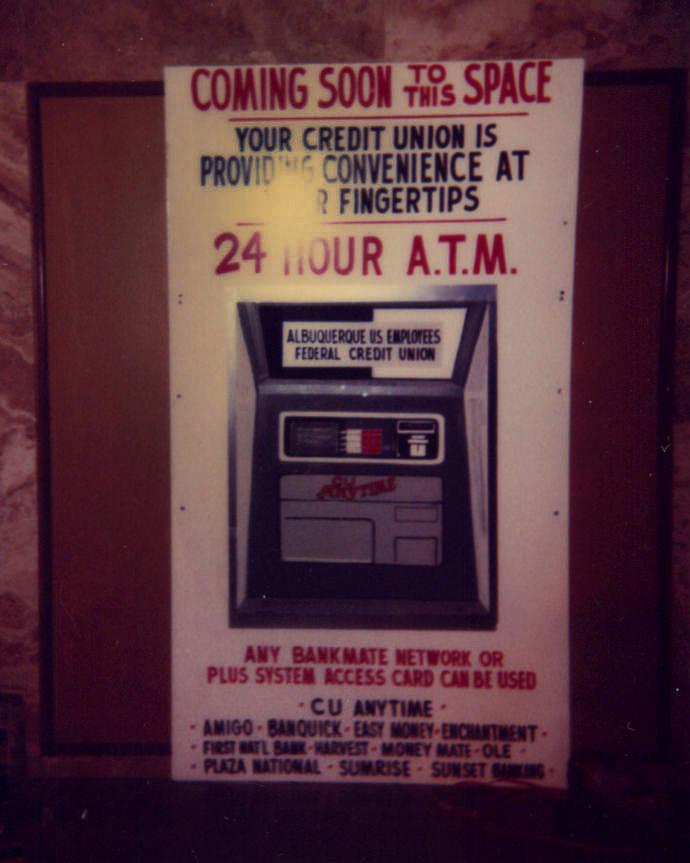

Automated Teller Machines (ATMs) are installed on the west side of Albuquerque for member use.

The Tennessee Branch undergoes remodeling to accommodate members, and create more office space.

The CU Travel program is introduced. This program offers low prices and travel assistance around the world, all at no cost to the member. Members receive help with passports, reservations, and parking, along with many other benefits.

Assets - $111,384,807 | Members - 21,701 | Employees - 88

1990

Albuquerque U.S. Employees Federal Credit Union becomes U.S. New Mexico Federal Credit Union.

1990

Plan America, a financial planning program, is launched, providing members with money management and retirement planning services.

1992

1992

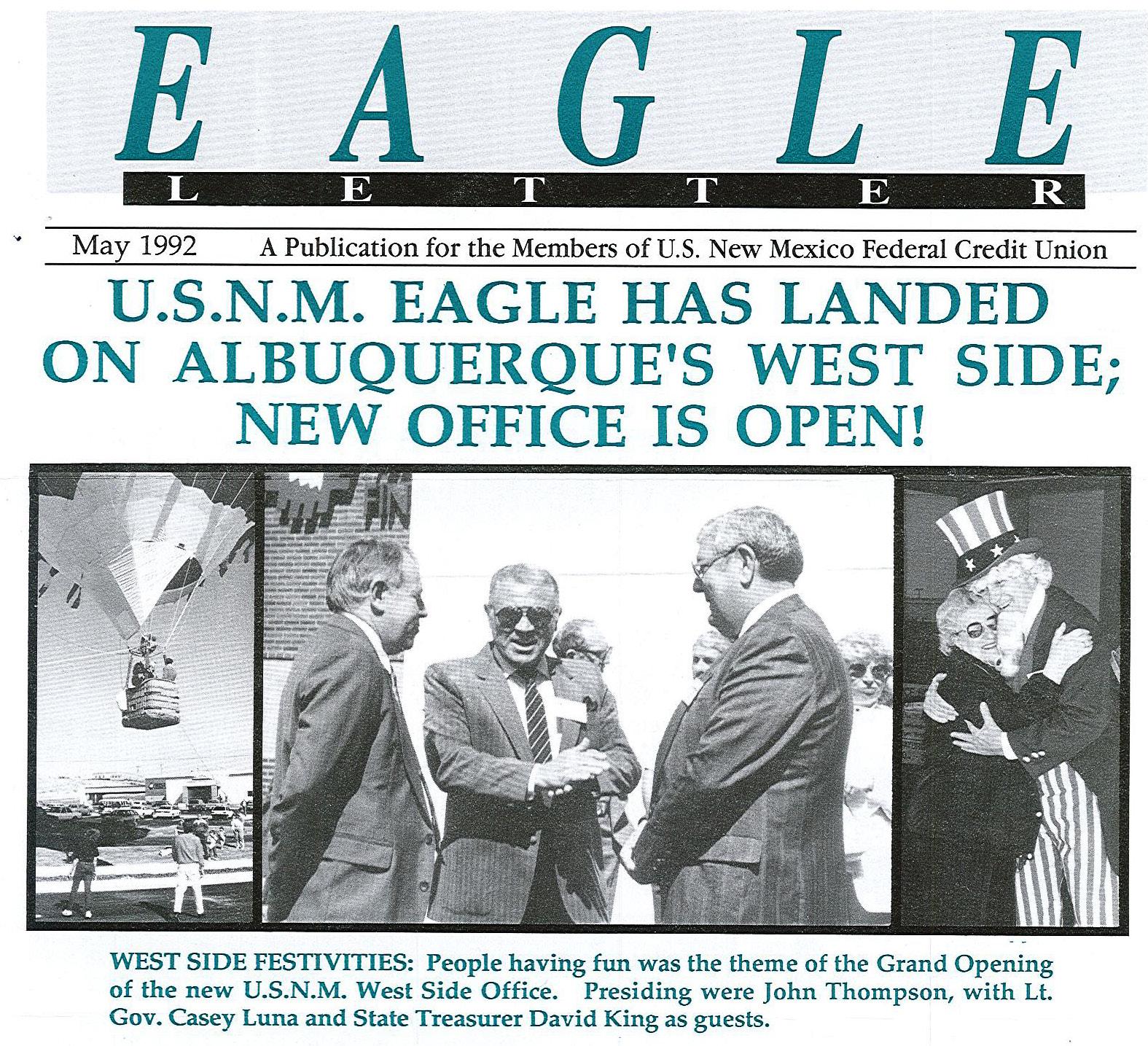

The Credit Union’s third branch opens at 4411 Irving Boulevard NW.

1992

Several new and attractive loan products are introduced, including the 30/30 new vehicle loan at 7.1% APR.

New Mission Statement: USNMFCU provides financial services featuring benefits and advantages to help Members attain personal financial success.

1994

The Credit Union makes a major upgrade to its technology, replacing the World Computer Systems with a new system from Aftech.

The Osuna branch opens as the main administration center at 3939 Osuna Road NE.

John Thompson retires as CEO.

The Credit Union’s indirect lending program begins, enabling more members to have convenient access to low auto loan rates.

The Credit Union launches its first membership loyalty program called Benefits Plus, providing members with rate improvements on select deposits and loans.

VISA cards can now be used to make purchases at retail stores around the nation.

To meet the growing housing demand in Albuquerque, the Credit Union offers a new 30-year fixed rate mortgage.

Assets - $264,085,261 | Members - 34,819 | Employees - 124

2000

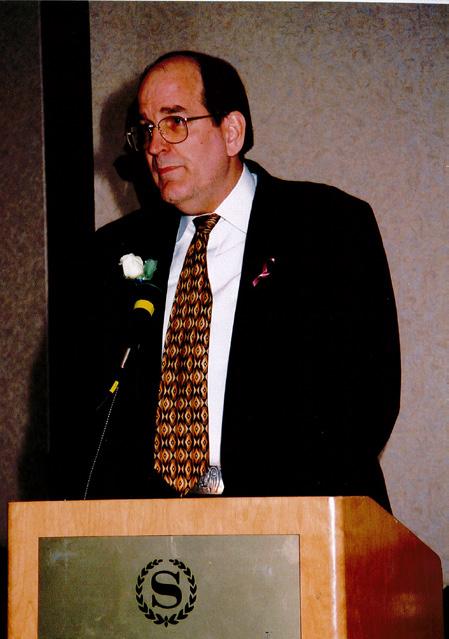

James E. Raquet is named President and CEO.

2001

The Credit Union starts offering Commercial Lending services, designed to help members with business loans for property, equipment, and inventory.

The Santa Ana branch opens in Bernalillo. This is the Credit Union’s fifth branch.

The CU Succeed and Member Education programs are introduced.

The credit union’s automated phone banking system is renamed “CU by Phone.”

Steve Marcum named President and CEO.

The Credit Union joins the CO-OP ATM Network, providing our members with free access to thousands of ATMs across the United States and Canada.

The PRIMO Home Equity product is introduced.

2001

The par value of one Credit Union share changes from $100 to $5.

2001

Developed to help children learn the value of saving money, the Coyote Kid Savings Program is introduced.

The Credit Union is awarded Pinon level recognition by Quality New Mexico.

2006

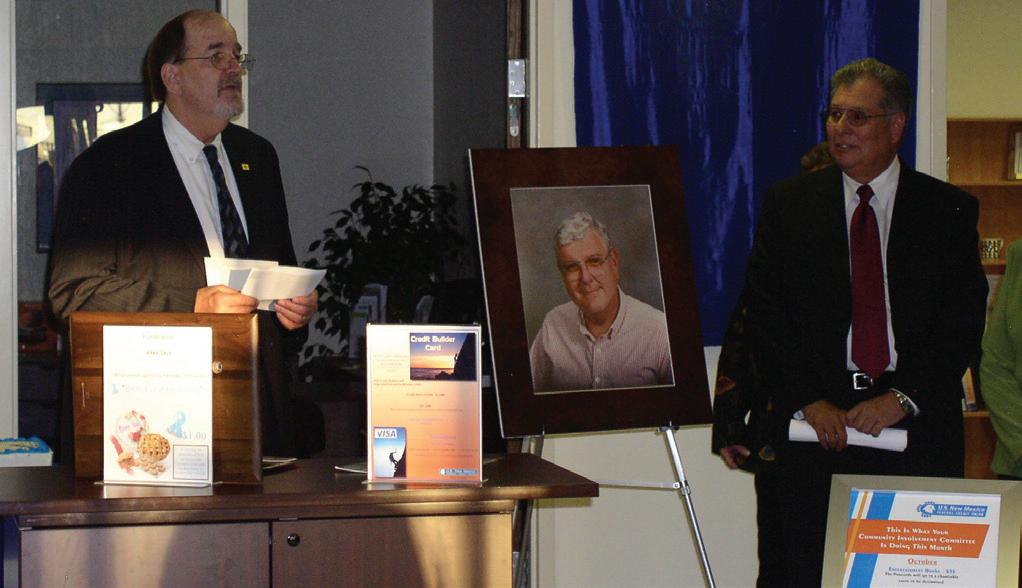

Jim Raquet returns as CEO.

Small Business Administration loans are offered, providing business members with opportunities to borrow money for capital, equipment, and other items to help ensure success.

2006 Kirby Kangaroo, a youth savings program, arrives to the credit union.

The new Membership Plus Incentive program provides greater incentives for loyalty and product use by members.

The credit union offers financial services to immigrants through the SAFE account program, providing this under-served community a safe place to conduct their banking

The Credit Union sponsors the University of New Mexico’s Children’s Hospital Pediatric Emergency Room Unit.

USNMFCU launches an initiative to help Members of Modest Means (MOMMs) by developing affordable loans and savings products.

New Online Banking and Mobile Banking are offered. E-statements now available.

In commemoration of its past president, the Tennessee branch is renamed the John R. Thompson Branch.

U.S. New Mexico becomes a CU Service Center, joining a national network of credit unions that share facilities to give members thousands of convenient locations to perform transactions just as if they were at their home credit union.

Assets - $603,064,200 | Members - 57,947 | Employees - 174

USave checking account service launched.

2010 CourtesyPay, an overdraft protection program, is launched.

USNMFCU receives recognition from CUNA Mutual Group’s Excellence in Lending Awards for our MOMMs program. The group cited our product suite designed to address the needs of members with Low-to-Modest Means

U.S. Eagle, New Mexico’s oldest credit union, turns 75 years old. CU-wide celebration attracts over 500 members to join festivities at the Irving Branch.

The Farmington branch opens as our sixth branch. The Four Corners area has access to the Credit Union’s financial services.

2013

Majors named President and CEO.

The west side gets a new branch at 5201 Antequera Road, making it our seventh branch.

Motor Branch opens at 7201 Menaul Boulevard. This is our eighth branch.

The Credit Union establishes the Junior Board of Directors, an innovative program designed to immerse local youth ages 16-24 years old into the business of the credit union, leadership, and community service.

Assets - $1,037,246,000 | Members - 77,378 | Employees - 249

USNMFCU receives Roadrunner recognition by the New Mexico Performance Excellence Awards administered by Quality New Mexico.

2015

The Santa Fe branch opens at 559 West Cordova Road, making it our ninth branch.

Merger with New Mexico Correctional Employees Federal Credit Union finalized, bringing hundreds of its members into the fold.

U.S. New Mexico Federal Credit Union undergoes rebranding and is renamed U.S. Eagle Federal Credit Union, positioning it for increased awareness and services.

2016

New Regional Branch in Farmington opens, replacing the previous branch, and extending service into Colorado and Arizona.

Three scholarships, valued at $1,000 are offered. These are the first scholarships offered.

Gold Avenue branch operations moved to downtown location inside Albuquerque Plaza on 3rd Street. U.S. Eagle logo installed on tallest building in New Mexico.

New website and new Online banking is designed and launched, allowing the credit union to provide better technology services for our members.

2018

MemPerx, an enhanced member loyalty benefits program launches.

2018

*As of July 2018, the credit union has 479 Select Employer Groups, and over $1 billion in assets.

“I have been with U.S. Eagle for 25 plus years. I love working for the credit union because I love helping our members with their financial needs. I have built relationships and trust with our members. I have a true passion for also helping my employees grow as they are our future. U.S. Eagle has a special place in my heart.”

- Lara, Assistant Branch Manager

“I remember when I started at the Credit Union in September of 1998 - I was one of the youngest employees! The Credit Union has always seemed like a family to me, which is awesome! I believe the only way to do great work is to love what you do. The end of each day is rewarding because I know I turned a negative fraud experience into a positive outcome by listening to a member or co-worker and reassuring them that I will take care of their needs.”

- Tina, Fraud and Security Lead

“It has been an honor and a privilege to work at U.S. Eagle for over 30 years.

During these years, the employees have been like my extended family, sharing lots of laughter and even some tears, and every emotion in between. In addition to seeing many changes made to the Credit Union such as name changes, technology improvements, personnel, facilities, growth, and government regulation, the one factor that continues to remain constant is the commitment to “Serving the Member.”

- Dwayne, Internal Audit Manager

“In July of 2013, tragedy hit my family in a way that we will never recover from and this is where the true meaning of the credit union philosophy of “People helping People” really became evident to me. During these past years, my U.S. Eagle family has stood side by side with me, helping me every step of the way. We treat every member as part of our family and offer the best financial guidance we can to improve the lives of our members and that is what makes my job so rewarding. I have learned a great deal from the staff I

oversee and the members of management that continue to challenge me every day. “

- Jacqueline, Card Services Manager

“I am proud to be an Eagle. Once I graduated, my father was in the Credit Union conducting business and noticed there were job openings so the next day he brought me in to fill out an application. I have been with the Credit Union for 35 years. I have enjoyed working for the Credit Union and serving the membership and have made many friendships both internally and externally over the years.”

- Frances, Consumer Loan Underwriter

“As the longest term employee soon to be 41 years with U.S. Eagle it still amazes me at how quickly time has gone by. It could be said that my college education was with the credit union, as I could not have learned a quarter in a formal setting as I have here. I am humbled and blessed to continue to be part of the credit union’s future and success. “

- Lorri, Mortgage Loan Officer

“I joined the credit union as a federal employee. The team at U.S. Eagle has gone above and beyond to help me. I enjoy the perks of being a member, such as free use of the coin machine, remote deposit capture, online banking, and more. Most of all, I enjoy the perk of member service. All my interactions with the team at the credit union have been positive and pleasant which makes a difference!”

- Tom M., member since 1996

“The U.S. Eagle team is such a pleasure and everyone is so helpful and loving. We feel very welcome to conduct our business with U.S. Eagle. We enjoy attending the Annual Meeting where we learn more about the credit union.”

- Mary A., member since 1982

“U.S. Eagle was the financial institution my fiancé belong to, and he was introduced to the credit union thanks to his father, a federal employee. We opened up several accounts for savings,

Christmas, and checking. Later on, the credit union helped us finance our first vehicle we purchased as a married couple. Then, we had our first daughter, and we opened up a Coyote Kid account for her, as well as our other two daughters who followed years later. All three are still credit union members. My favorite branch is the Irving branch because of the familiar faces I see every week. When I walk in, they always greet me by name, and help me with my deposits and transfers. The entire U.S. Eagle team is extremely helpful and informational.”

- Michelle S., member since 1985

“I have been a member since I was one year old – my entire life. The credit union has had a very significant role in my personal life as well as in my business career. I purchased my first vehicle with the help of U.S. Eagle. Shortly after, the credit union provided a loan so my wife and I could finance our wedding. I reacquainted myself with a former

classmate in the parking lot of the credit union who would become my business partner for the past 30 years. My banking relationship with U.S. Eagle is something I truly value and I am grateful for the support I have received from U.S. Eagle, throughout my life.”

- Jim L., member since 1984

“I joined the credit union in February 1977. Because I spent a lot of time in Colorado, I would call and speak with people at U.S. Eagle and they were always so friendly; no one was ever too busy to talk to me on the phone or in person. They offered me advice that would truly benefit me.”

- Drexel D., member since 1977

“I have been a life long member of U.S. Eagle thanks to my parents. They opened up a share certificate for me when I was young. I have continued to use U.S. Eagle for all of my banking needs because of their great rates and excellent member service.”

- Shane S., member since 2001

Friendships at U.S. Eagle can last lifetimes. It makes our credit union a better place to work and helps us work towards one goal: establish a culture where people matter more than numbers.

We recognize the many different backgrounds of our employees and strive to maintain a diverse culture.

We honor our service men and women, those who serve in the armed forces, as first responders, and as civil leaders, when we wear our Patriotic shirts with the message, “Thank You For Your Service” on national holidays that pay tribute to those who serve and have served.

Women and men in the Credit Union celebrate Women’s Equality Day on August 26 to commemorate the 1920 adoption of the Nineteenth Amendment, granting American women the constitutional right to vote. It was first celebrated in the U.S. in 1973 and is proclaimed each year by the President.

U.S. Eagle provides free financial literacy classes throughout New Mexico. Class subjects include saving, budgeting, and the credit union difference. Our most popular class is Mad City Money, a real-life simulation that gives students a sense of adulthood with income and bills to pay.

We love to celebrate! And we’ve had great reasons including anniversaries, name changes, and community recognition.

Recognition from our community leadership organizations and from our peers is validation of a job well done. Our Credit Union is a leader in the communities we serve!

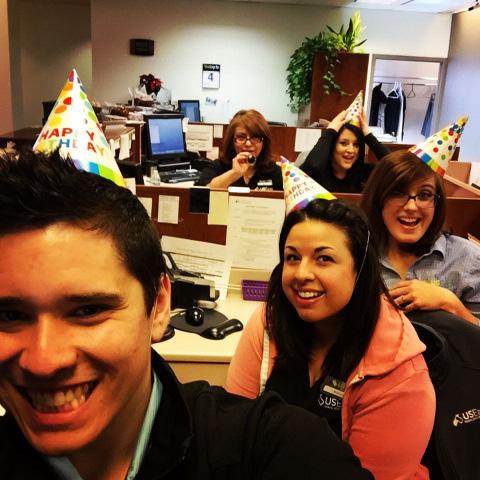

Company picnics, holiday parties, anniversaries, birthdays, and many other life events provide our staff the opportunity to celebrate with each other.

We don’t take ourselves too seriously as our staff loves to celebrate Halloween in our unique fashion. Whether it’s a silly costume or a scary haunted house, we definitely get in the spirit!

The creation of this historical record of our credit union started many years ago. While, for years, I have had a great passion to get this all down on paper, or more accurately on bytes, it has taken the hard work of many people to make it happen.

The credit union history committee was started in 2016 to research, compile, review, chase down people and papers, and generally look in every corner for pieces of our history. That group of employees include the following “historians”:

Danielle Silva

Lorri Clifton

Denise Buchner

Frances Taylor

Dwayne Neil

Yvette Valdez

Mary Alice Valdez

Richard Tapia

Monica Sena

This group of historians also enlisted many past employees (including Theo Yeitrakis, Betty Saiz, Lena Mumme, Ron Montoya, and many others) who rattled their brains to provide dates, names, events and other anecdotes that helped provide the much-needed details.

Alongside our members, this credit union’s strength has always been the dedication of its employees, and this project used a great deal of that strength, and patience! I personally thank each of our historians who answered the call to make this history project a great asset to the legacy of our credit union!

Marsha Majors, President and CEO