For Defined Contribution Plan Sponsors

For Defined Contribution Plan Sponsors

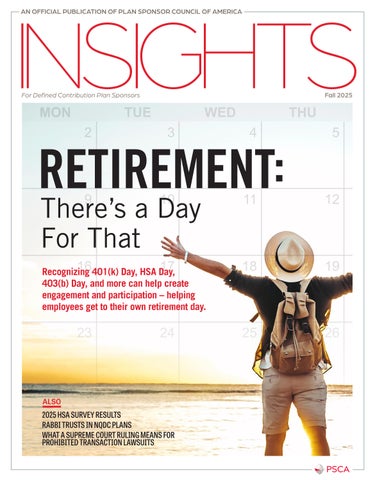

Recognizing 401(k) Day, HSA Day, 403(b) Day, and more can help create engagement and participation – helping employees get to their own retirement day.

ALSO

2025 HSA SURVEY RESULTS RABBI TRUSTS IN NQDC PLANS WHAT A SUPREME COURT RULING MEANS FOR PROHIBITED TRANSACTION LAWSUITS

18

Retirement: There’s a Day for That

Leveraging special awareness “days” such as 401(k) Day, can increase engagement and outcomes when paired with ongoing communications and easy calls to action. by Hattie Greenan

What a Supreme Court Ruling Means for Prohibited Transaction Lawsuits

‘Fishing expeditions’ and ‘cookie-cutter cases’ are just two phrases used to predict coming litigation in the wake of Cunningham v. Cornell University. Here’s what plan fiduciaries need to know.

by Judy Ward

UPCOMING

PSCA National Conference May 4-6, 2026 Saint Louis, MO

Upcoming Webcasts: Impacting Retirement Outcomes: Lifetime Income and Beyond October 7, 2025

Retirement Readiness: Key Trends and Insights for Plan Sponsors October 21, 2025

Insights is Published by

National and regional conferences designed for defined contribution plan administrators and sponsors.

Our must-attend events provide education from industry leaders and peer networking.

Signature Awards

Peer and industry recognition for employee communication and education.

Recognizing outstanding defined contribution programs implemented by plan sponsors, administrators, and service providers.

PSCA surveys: Most comprehensive and unbiased source of plan benchmarking data in the industry.

Annual surveys of profit sharing, 401(k), 403(b), and NQDC plans, as well as HSAs, created by and for members. Current trend and other surveys available throughout the year. Free to members that participate. Surveys currently available include:

• 6 7th Annual Survey of Profit Sharing and 401(k) Plans

• 2024 403(b) Plan Survey

• 2024 NQDC Plan Survey

• 2025 HSA Survey

A monthly electronic legislative newsletter.

Providing concise, current information on Washington’s most recent events and developments.

PSCA works to ensure fair coverage of the DC system in the media.

PSCA continually speaks to reporters to provide and promote accurate, concise, and balanced coverage DC plans and responds to negative press with editorials and letters to the editors. PSCA is also active on social media — follow us on twitter at @psca401k and on LinkedIn.

Washington Representation

Your direct connection to Washington DC events and developments affecting DC plans.

PSCA works in Washington to advocate in the best interests of our members and bring you the latest developments that will impact your plan. PSCA is a founding board member of the Save Our Savings Coalition that is currently working in Washington to preserve plan limits amongst tax reform.

Quarterly Magazine, Insights

An award-winning and essential 401(k) and profit sharing plan resource.

Featuring nationally-respected columnists, case studies, the latest research, and more. Providing practical and constructive solutions for sponsors.

Professional Growth — Join a Committee! For plan sponsors, administrators, and service providers.

Many opportunities for PSCA members to serve on committees, speak at regional and national conferences, and write articles for Defined Contribution Insights.

PSCA Mission Statement

The Plan Sponsor Council of America (PSCA) is a broadly based association of diverse businesses which believe that profit sharing, 401(k), and related savings and incentive programs strengthen the free-enterprise system, empower and motivate the workforce, improve domestic and international competitiveness, and provide a vital source of retirement income.

PSCA Competition Law Statement

The Plan Sponsor Council of America (PSCA) is committed to fostering a best practices environment for profit sharing, 401(k), and other employer-sponsored defined contribution retirement programs. PSCA adheres to all applicable laws which regulate its activities. These laws include the anti-trust/competition laws which the United States has adopted to preserve the free enterprise system, promote competition, and protect the public from monopolistic and other restrictive trade practices.

Editor, Director of Research & Communications Hattie Greenan hgreenan@usaretirement.org

Advertising Sales Thomas Connolly TConnolly@usaretirement.org

PSCA STAFF

Executive Director Will Hansen whansen@usaretirement.org

Senior Manager, PSCA Membership & Operations LaToya Millet lmillet@usaretirement.org

PSCA Leadership Council

OFFICERS

President Brandon Diersch, Global Financial Benefits Manager, Microsoft

Immediate Past President Diane Garwood, Horizon Bank

Directors

Joyce Anderson, GE; Davis Blier, United Health Group; Ann Brisk, HSA Bank; Dena Brockhouse, Kent Corporation; Chris Dall, PNC; Yvette George, Henrico County Government; Scott Greenman, The Principia; Teresa Hassara, Principal Financial Group; Sheri Melvin, Union of Concerned Scientists; Michelle McGovern, American College of Surgeons; Tom Moore, Thryv; Rose Murtaugh, International Motors LLC; Cynthia Oberland, Precision Medicine Group; Maria Quintiguia, Public Employee Retirement System of Idaho; Alexandra Richardson, Mercer; Laura Stamps, Financial Finesse; Malika Terry, NCR Atleos; Tracy Tillery, GM

Insights is published by the Plan Sponsor Council of America , 4401 N. Fairfax Drive, Suite 600, Arlington, VA 22203. Subscriptions are part of PSCA membership. Opinions expressed are those of the authors. Nothing may be reprinted without the publisher’s permission. Information contained in Defined Contribution Insights is for general education purposes only and should not be relied upon as legal advice. Contact your legal advisor for advice specific to your plan. Copyright ©2025 by the Plan Sponsor Council of America

by Hattie Greenan

Perhaps Internal Revenue Code references are not the best way to talk to employees about retirement planning…

“A ROSE BY ANY OTHER NAME WOULD SMELL JUST AS SWEET.” This may be true, but Kumquat just doesn’t quite have the same ring to it, does it? Much in the same way that 401(k) to someone outside of the industry doesn’t have the same ring to it as savings account, or even tax free savings account, retirement savings account – just about anything else sounds better, though they are all inherently the same thing. Education is an ongoing challenge plan sponsors have faced since the beginning – perhaps the fact that we are very literally talking in code is part of the problem.

Not only have we been discussing the educational challenge forever we’ve also been talking about how we should change how we talk about it forever, and yet the lingo persists. Why? I don’t actually have an answer for that. I do think it is worth considering the words we use, and how we frame them.

In this issue’s communication piece, Keith Mayfield lays out his vision of a reframe, that all eligible employees are already participants in the plan, even if their deferral rate is zero. This small shift in perspective is more inclusive and can increase engagement by employees, diving them to increase their deferral rate from zero rather than “enrolling in the plan.”

In Retirement Read(y) Nevin Adams discusses the framing of dollars needed for healthcare in retirement – expecting to pay nearly $200,000 in retirement is equivalent to the much less scary and less headline grabby number of around $8,000 a year. If you’re framing something for clicks, you’re looking for the highest, scariest number. And we even sometimes use these scare tactics with participants, and though fear can certainly be a short term motivator, from a behavioral perspective it is not as effective for long term behavior change. If you’re framing the need for retirement planning purposes, looking at realistic annual numbers that feel attainable is a better bet.

In the cover story and in Plan Sponsor Perspectives, we consider the framing of retirement “holidays” such as 401(k) day, to create engagement with employees and motivate them to actively participate in retirement planning. (Though now that I’m writing this, perhaps 401(k) Day needs a rebrand too, but it does rhyme and rolls off the tongue better than Retirement Savings Plan Day so…) Some members tell us that they do recognize these holidays and push out communications about their plan – and they say they do find them effective while others simply do not have time or weren’t aware of all of the options.

There are lots of ways to try and break through the clutter, and the Code references, to help engage and motivate employees, whether its through retirement holidays, communications from your advisor, or a multi-prong financial wellness program. Rethinking the words we use and the tactics used to communicate the information might be worth considering. PSCA strives to provide resources to help with this when possible and I am hearing from members that they want more ready-to-use participant communications that they can quickly customize and distribute –we’re on it with expanded materials for our “days” and look for new participant materials in the redesigned Plan Sponsor Tool(k)it, coming soon.

Together we will strive towards breaking the code and cutting through the clutter to improve outcomes for all employees.

Editor

Hattie Greenan is the Director of Research and Communications for PSCA.

Alan Abrams Actus Nutrition

Albana Adili Western Towboat

Casondra Aleman Penske Truck Leasing

Chris Allen Prism Bank

Stephanie Altamirano SWBC PEO

Nina Alvarado SchoolsFirst Federal Credit Union

Blanca Alvarez DGM Services Inc

Miranda Anderson The Villages

Mark Andrews Cimarron Electric Cooperative

Liliana Arenas El Rio Health

Shari Arnold Sunflower Bank

Jason Arnold Birchall and Hampton, LLC

Christopher Ashton General Atomics

Elaine Autus Ninyo & Moore

Jill Aylward Gemline

Jennifer Barnes Stewart & Company

Kelly Barry Bellwether Community Credit Union

Brenda Bascom EJ

Davindra Basdeo EnTech Engineering PC

Sandra Bates Acutec Precision Aerospace, Inc

Nicholas Bauer Penske Automotive Group

Lisa Beckman Cleveland-Cliffs

Tiana Belton HIAS Pennsylvania

Jillian Benson OSG USA, Inc

Juliet Bishop Origin Bank

Maria Blochowiak Team Industires, Inc

Lindsey Blodgett First Breckinridge Bancshares

Sarah Boggs The Iowa Clinic

Sarah Boggs The Iowa Clinic

Nicole Bolte KFM Enterprises, LLC

Kevin Bonnewitz MasterCorp, Inc.

Lindsay Borden American Association for Justice

Regan Boyn Maple Leaf Farms

Shannon Brangan Exo Group, LLC

Donna Brezw Msupply

Shellie Brighton New Era HR Solutions

Kendra Bristol New Tech Global

Tammy Broadhurst MaineHealth

Gary Brown AGA

Belinda Brust

Magna International

Hans Buhts Norton Healthcare, Inc.

Alissa Burroughs United Rentals

Brooke Bury Northeast Kingdom Human Services, Inc.

Christine Caldwell Garnet Health Medical Center

Brittney Campbell Sunmark Credit Union

Dennis Canalini Association of Diabetes Care & Education Specialists

Lydia Caraveo Grinnell Mutual

Renee Card Comprehensive Care Services

Robin Carroll Superior Construction Services

Amanda Caruso US Medical Staffing

Claudia Casarez

Gothic Landscape Inc

Claudia Casarez

Gothic Landscape Inc.

Racheal Cash Tiger Vision LLC

Taylor Cashwell

The Paramount Theater of Charlottesville, Inc.

Michael Castronovo American Transit Insurance Company

Alondra Cervantes

Golden West Packaging Group

Beck Chambers SageView

Jennifer Chavez DAI

Meagan Cheney Cody Regional Health

Shelby Christian Atwell, LLC

Rachel Christman ANTHC

Rhonda Clanton DS Admiral Bidco

Terry Clough The Parish School

Teresa Clouser Ahold Delhaize USA

Stacey Cockrell ALFA Insurance

Cecily Coe

D&H United Fueling Solutions

Brett Coffee SourceAmerica

Erica Comley

Baptist Senior Family

Michelle Contreras

Driven Brands LLC

Bridgett Cooley

True Mfg.

Meredith Cornish KLR

Sheila Cornyn ACS

Karina Correa Dewberry

Lisa Cote Ahold Delhaize USA Services

Melinda Coulter Gothic Landscape, Inc

Agnes Covell Hudson Valley Credit Union

Brianna Crowe Mesa Associates, Inc.

Britini Cummings North Country Health Consortium

Jennifer Currie Maxwell Group Inc

Melissa Curry Mason Road Sheet Metal, Inc.

Cheryl Dailey Adams and Associates, Inc.

Amber D’Angelo HTT, Inc.

Karen Davis

The Harford Mutual Insurance Group

Nicole Davis-Moss LKQ Corporation

Melinda De Leon

James Avery Craftsman, Inc.

Jodi Dedrick CARF International

Holly Delamater Meadowood Corporation

Miranda Demos Foxen

Michael Denson CKE Restaurants Holdings, Ince

Carrie Derby East-West Gateway Council o Governments

Susan DeRubeis The Jones Payne Group, Inc.

NaKwai DeShields Comoto Holdings, Inc.

Amy DeWallace David Evans and Associates, Inc.

Laura Dillon Pitzer Tecomet

Lucy Dio Lake Management Services

Mary Dionisi First Command Financial Services

Racquel Dirden Edw. C. Levy Co.

Christy Dirk-Senn Knife River Corporation

Maura Dodson Favorite Healthcare Staffing/ Acacium Group

Lisa Doland Dexian

Lisa Doland Dexian

Stephanie Doty Columbia Southern University INC

Rebecca Dudziak Southwest General Health Center

Amanda Duerre

Kawasaki Motors Manufacturing Corp., U.S.A.

Sarah Erwin Hattiesburg Clinic, PA

Ali Espinosa

Thompson Machinery Commerce Corporation

Joseph Fabro First International Bank & Trust

Shauna Fickes PDG, Inc dba PDG Architects

Ashley Fillinger BEDGEAR LLC

Alyssa Fimbres Tucson Electric Power

Troynell Fisher

Johns Hopkins Health System

Ryan Fisher Biomerics LLC

Ronna Flanagan Illinois Central School Bus

Stephanie Ford James Doran Company

Elizabeth Foronda First County Bank

Michelle Foust FSAFederal

Kimberly Fox Brinkmann Constructors

Don Frisbie

Building Material Distributors, Inc.

Veronica Fuentes PDG Architects

Jill Gaitz

RSF Wealth Management

Beata Galka Polish & Slavic Federal Credit Union

Lindsay Gamboa Ascent Resources

Kellee Garcia Omni Hotels and Resorts

Nicole Garcia HSL Asset Management, LLC

Marisa Garcia P. Terry’s Burger Stand

Ken Gardner

Greater Texas Credit Union

Tina Garner

Courtesy Automotive Group

Stephanie Garza Nova 401k Associates

Melanie George Lowe’s Companies, Inc.

Gabriella Giaquinto Swire Coca-Cola

Krysti Giese Foundation for Human Enrichment

Aimee Giles Lockton Inc.

Bogomir Glavan American Airlines

Leah Gleason APFS LLC

Rachel Godwin P. Terry’s Burger Stand

Diana Gonzalez

Emerald Packaging

Elizabeth Graf Little Giant Ladder Systems, LLC

Michele Granitz National Life Group

Alexandra Grasso AT Cross

Elizabeth Green

Mueller Industries, Inc.

Melissa Greene Union Bank

Judith Griffin Publishing Concepts, LP

Stephanie Griffin The Coca-Cola Bottlers’ Association

Lindsey Growette Stingle National Bank of Commerce

Autumn Guarnieri Edw C Levy Co

Geovannya Gutierrez American Engineering & Development Corporation

Ken Gwynn Gantry, Inc.

Anna Haddad The Cleveland Foundation

Miquel Hadsall Graham Construction Company

Tate Hager Micron Technology, Inc.

Leah Halstead Chapin Hall Center for Children

Tereshia Harper Nova Pension Valuations

Tracey Harriette The RMR Group

Alissa Harrington Absher Construction

Becky Harris School Specialty

Kari Harwood ReUp Education

Kimberly Hauge Pathward, National Association

Erik Hayes Gulf Winds International

Susan Hayes Sonic Automotive

Wendy Heiliger Barclay Enterprises, Inc.

Lucas Hellmer Salas O’Brien, Inc.

Sarah Henderson The Biltmore Company

Cynthia Henexson SEC Clinical Research

Kristen Hermanson Monarch Healthcare Management

Daniel Hernandez Exo Group, LLC

Jon Hiivala WESCOM INC

Kim Hillman Mesa Associates, Inc.

Catherine Hodges American Excelsior Company

Luke Hodnett Lumen

Kimberly Holewinski BEDGEAR LLC

Tina Hood United Way of Greater Houston

Sharon Hooker Boyd & Jenerette, P.A.

Christina Hooks The Stratford

Angie Hoovre Rayser Holdings, Inc.

Teah Hopkins Salt River PimaI-Maricopa Indian Community

Mike Hopkins PwC

Cole Horton OneroRx

Anika Hossain American Association for Justice

Shawna Houser GCON Management Company

Donna Howard Palmetto Community Care

Monica Hubbard Branch Group

Ayanna Hughey Cleveland Foundation

Ashley Huibregtse Rockline Industries

Logan Hundley BV Hedrick Gravel & Sand Co

Jennifer Inboden Town of Oro Valley

Ilona Indenbaum American Regent

Hashim Iqbal Four Seasons Hotels and Resorts

Richard Jackson Children’s Miracle Network

Erin Nicole Jaurigue Tucson Federal Credit Union

Nahtahna Jensen Landmark Landscapes

Heather Jipson Chipotle Mexican Grill

Shelissa Jones CKE Restaurants Inc

Romina Kadiwal GHRA

Jennifer Keary Pepperl+Fuchs, Inc.

Natasha Keith Steel Painters LLC

Leanne Keller Kwik Trip, Inc

Amara Kennedy KeHE Distributors

Brendan Kennedy Groundswell Corporation

Tara Kennedy SecTek

Debbie Kidwell

North Texas Lung & Sleep Clinic

Ashley Kilian Boise Cascade Company

Sarah Kimrey International Society on Thrombosis and Haemostasis, Inc.

Kevin Kirkle Tabor Street Group

Jennifer Krugel Rockline Industries

Seth Kunz Atwell LLC

Jennifer Kurihara Cohu, Inc.

Shannon Lane Cohu

Rachel Lathy Third Coast

Julie Laufenberg Viaflex.com

Rachel Leavens AmeriLife US, LLC

Sardo Lebron HVCU

Jamie Lerner Toole Design Group

Martha Leyva Salt River Pima-Maricopa Indian Community

Marisa Liedeke NuStep LLC

Kylee Lietzke Bowling Green State University

Alexis Lilly Santa Cruz Bicycles

Chelsea Lohmann First Bank

Andrea Lord Stewart & Company

Stacy Lowry Waterford Country School

Christy Ludwig First Financial Bank

Holly Lyons Samaritan’s Purse

Emily Macedo Stratus Team LLC

Renato Macedo American Retirement Association

Natividad Macias-Torres CommuniCare+OLE

Jane Maggay

Architectural Glass & Aluminum Co., Inc.

Amy Maguire

Coca-Cola Bottlers’ Sales and Services

Annalee Malone

Total Safety U.S. Inc

Tyvarion Malone Janissary LLC

Adriane Maluf Alcoa

Michael Mans

Monarch Healthcare Management

Maria Marin National Life Group

Juanita Marrero In Touch Ministries, Inc.

Lori Martin HealthWell Foundation

Janet Martinez Brunel Energy

Christina Marvel GLOBAL ASSET

Mario Matesic Penske Transportation Solutions

Cortney May Discovery Lab

Tim McKeown Medable

Andrea McNeill DuCharme, McMillen & Associates

Monica Means Richardson Properties LLC

June Meeker HAMILTON CAPITAL

Stephanie Mejia J.L. Proler Iron and Steel Company

Santana Mendez

Central Arizona Shelter Services (CASS)

Luis Mendoza SuperbTech, Inc

Sara Mendoza K-Swiss Inc.

Ana Menjivar Dandelion Payments, Inc.

Brenda Milian Cirque Corporation

Heather Miller Mickey Truck Bodies, INC

Sarah Miller LivWell Planning

Diana Davis Miller

Jefferson Central Appraisal District

Angie Mills Creighton University

Kathy Minter Biltmore

Jen Minute Genuine McCarthy Enterprises, Inc.

Rachel Mitchell Tecsys

Theresa Montez Your People Professionals/ HR Your Way

Rochea Moorer Encompass Health, Inc.

James Morin Compliance 401k

Koji Moriyama ENEOS USA, Inc.

Rose Murtaugh International Motors, LLC

Sonia Nash Omni Hotels

Jason Neifield Plexus Worldwide

Jennifer Neubert Forbright Bank

Sheryl Neuman Plastic Products Company, Inc.

Mary Neve Cody Pools

Phannary Nhem PDS Health

Kari Anne Nickman The Buckle, Inc.

Joni Ninedorf MAT Holdings Inc

Valerie Nivens

Ozarks Federal Savings and Loan Association

Lisa Noonan All Star Incentive Marketing

Kristen Norris West Brazos Animal Center

Carla Norton Wells Vehicle Electronics, L.P.

Curt Novotny TruGreen

Nicki Ogle Lumen Technologies

Jodi Olinsky

IBM

Sherrie Ondash Goodwill Industries- Suncoast, Inc.

Seth Orban

Chas Roberts Air Conditioning, Inc.

Judith Oswald Fallbrook Regional Health District

Briana Overholt

MJR Group

Tracy Page North Country Health Consortium

Tiffinay Pagni Adams and Associates, Inc.

Hilda Palacios Jimenez Polycraft Products Inc

Robert Parnis

Magna

Shirlene Patnett

Herbalife International of America, Inc.

by Brandon Diersch

Since July, I’ve been deeply honored to serve as President of the Plan Sponsor Council of America. For the past 78 years, PSCA has protected America’s retirement system, supporting more than six million plan participants through education, advocacy, and best practices. I’m thrilled to partner with Michelle McGovern as President-Elect in advancing PSCA’s mission for the upcoming year!

PSCA has vast educational resources for our members, ranging from toolkits to surveys to meetings. I’d like to highlight a couple top resources to utilize this fall.

Webinars: Take advantage of our extensive webinar series offering free sessions throughout the year. Topics range from “Recession Proofing Retirement Plans” to “Navigating the New Retirement Plan Landscape.” These sessions provide continuing education credits for CPSP, SHRM, and HRCI certifications. Best of all, recordings are available if you miss the live session. Participate in our upcoming webinars to stay current on industry trends!

The CPSP Credential: If you haven’t earned your Certified Plan Sponsor Professional credential, make 2026 your year! The CPSP certifies comprehensive knowledge and skills needed to evaluate, design, implement, and manage employer-sponsored retirement plans. Members report promotion opportunities, pay increases, and enhanced professional recognition after certification. Our community has grown to nearly 2,000 CPSP-certified professionals!

National HSA Awareness Day (October 15th) brings awareness to the power of Health Savings Accounts. PSCA offers a comprehensive toolkit including customizable flyers, presentations, and digital ads to help educate your participants about this powerful savings vehicle for current and retirement healthcare expenses.

Your input shapes industry best practices! We currently have four annual surveys – members can participate and receive CE credit for your CPSP credential. Participation also helps us provide critical benchmarking data that benefits our entire community. The annual HSA survey was recently published and the 2025 401(k) and 403(b) Surveys are currently closed and will be published later this year. The 2025 NQDC survey is still open for participation.

One of our most exciting developments is partnering with Knowa to bring AI-powered governance solutions to U.S. retirement plans. Having spent countless hours searching through email folders for plan documents, I understand the operational nightmare many of you face daily.

Knowa, powered by PSCA’s 78 years of expertise, revolutionizes plan governance:

• Every plan document instantly searchable with AI-powered precision

• Meeting minutes completed in minutes, not days

• New committee members receive effective onboarding from Day 1

• PSCA’s educational content integrated alongside your plan-specific information

This solution was built by listening directly to plan sponsors like you, addressing real challenges in committee meetings, audit preparations, and regulatory compliance. Schedule a demo of Knowa to see how it can transform your plan governance processes!

Through our partnership with the American Retirement Association (ARA), PSCA actively advocates with industry stakeholders and lawmakers to protect the 401(k) system for our employees. Your membership strengthens our collective voice in Washington, ensuring that the private retirement system continues to serve millions of American workers effectively.

Everything we do at PSCA is designed to help you be a better plan sponsor in our ever-changing environment. Becoming more involved with PSCA has been one of the most valuable experiences of my career. The knowledge gained, relationships built, and collective impact we make on millions of participants’ retirement security — this is what makes our community special.

Our 2,000+ CPSP-certified members support each other, celebrate successes, and work together to overcome challenges. Let’s keep driving progress — together!

Warm regards, Brandon Diersch is a Director of Global Financial Benefits at Microsoft and PSCA’s current President.

by Will Hanson

Innovative new technology paired with PSCA expert knowledge combines for a groundbreaking new tool for plan sponsors.

partnership that addresses persistent challenges facing retirement plan sponsors today: information overload and governance complexity.

After nearly eight decades of serving plan sponsors, we understand the mounting pressures you face. Scattered documents across file drawers and email chains. Decades of plan amendments and compliance documentation. Constant regulatory changes from PPA to SECURE 1.0 and 2.0. Rising litigation risks. Personnel turnover that erodes institutional knowledge. These challenges create what I call the “retirement plan operational nightmare”—where routine administrative tasks consume valuable time that should be spent on strategic decision-making.

That’s why PSCA has partnered with Knowa, the UK’s leading AI-powered board governance platform trusted by hundreds of pension boards and thousands of users. Together, we’re bringing this innovative technology to American 401(k) and 403(b) plan sponsors, creating Knowa powered by PSCA.

This isn’t another document management system. Knowa powered by PSCA serves as a single intelligent hub that transforms how you manage retirement plan governance. The platform features several integrated tools designed specifically for plan sponsors:

• The Plan Vault provides next-generation document storage that organizes, preserves, and tracks all critical plan documents with military-grade security—ISO 27001 certified with robust encryption that keeps your data protected.

KNOWA Q REPRESENTS THE FUTURE OF PLAN ADMINISTRATION. THIS ADVANCED AI INSTANTLY ANSWERS QUESTIONS ABOUT YOUR SPECIFIC PLAN INFORMATION AND PROVIDES IMMEDIATE DOCUMENT SUMMARIES, ELIMINATING HOURS OF MANUAL RESEARCH.

• Knowa Q represents the future of plan administration. This advanced AI instantly answers questions about your specific plan information and provides immediate document summaries, eliminating hours of manual research.

• PSCA Knowledge integration gives you fingertip access to retirement plan best practices, fiduciary checklists, and regulatory updates that complement your plan-specific information—essentially putting PSCA’s educational resources directly into your workflow.

• Knowa Verse revolutionizes meeting documentation, producing comprehensive meeting minutes in days rather than weeks, while Discussions enables secure team collaboration that preserves institutional knowledge.

Early users report transformational results: “Instant summaries let me prepare efficiently,” notes one plan sponsor. Another shares, “Massively reduced our time on decisions.” The platform

provides seamless access for all stakeholders—plan administrators, committee members, advisors, recordkeepers, and auditors— while integrating with existing dashboards and tools.

As a PSCA member benefit, you’ll receive a 30 percent discount on Knowa powered by PSCA. This significant savings reflects our commitment to making advanced governance tools accessible to plan sponsors of all sizes.

The platform requires no technical skills for setup and offers affordable pricing with seamless integration capabilities. From day one, you’ll experience measurable governance improvements that free your team to focus on what matters most — serving your plan participants.

The retirement plan landscape continues evolving rapidly. With Knowa powered by PSCA, you’re not just keeping up—you’re staying ahead. Reach out to me to learn how this partnership can transform your plan governance or visit www.knowa.co.

Will Hansen is the Executive Director for Plan Sponsor Council of America.

by Sheri Melvin and Colleen Windham

PSCA matches new CPSPs with experienced professionals through the ARA mentoring program “Thrive.”

I NERVOUSLY CLICKED “SUBMIT” FOR MY ONLINE APPLICATION, CLOSED MY LAPTOP AND TOLD MY HUSBAND, “I’M NOT EXACTLY SURE WHAT I DID, BUT I HOPE IT WORKS OUT.” I was new to the American Retirement Association, knew virtually no one in our community, and had just applied for the Thrive Mentoring Program. I felt like I had launched myself into a giant black hole and hoped that things would work out on the other side. Well, even though I wasn’t sure what would happen at the time, the path I walked down by choosing to intentionally engage in a professional mentoring relationship has been an absolutely enriching experience. Now, as co-chair of the Thrive Mentorship Committee, I am passionate about fostering mentorship within the retirement plan industry and giving everyone the opportunity to participate — whether it is to grow their own skills or invest in the life of someone else. Of course, we are all aware that mentorship (done correctly) is important and beneficial to our organizational culture and even our personal performance, but what does an effective mentoring relationship really look like?

First of all, a wise mentor once told me that the mentee drives the relationship by creating its content and general direction. Though the mentor wants to help the mentee grow and expand his or her horizons, the mentor will still need some direction as to what the goals are and what the mentee wants to gain or achieve. In my original ARA Thrive Mentorship application from years ago, I had written, “I understand that I don’t have all the answers and would like

to listen, learn and engage with someone who can give me wisdom and help me be a more effective retirement industry professional.” While it was a good goal, it needed specificity. What was I looking to gain from the experience itself? As part of the overall process, I expanded the general phrasing into more specific and precise goals to help both me and my mentor be successful in our relationship together. Of course, everyone is busy, and having those specific goals helps with communication between the mentor and mentee. It creates a roadmap and helps the mentor suggest next steps for the mentee to take before the next meeting. Now, when scheduling the next meeting in my formal mentoring relationships, I have stuck closely to a practice of setting the next meeting time during the current meeting time, which helps safeguard that mentorship time from the other demands of life vying for a spot on the next month’s calendar. As the old adage says, “Consistency is key!” It saves quite a few backand-forth emails, too. Granted, some mentorship relationships might last for months or years — or even your whole career — but for new mentor/mentee relationships, it can be helpful to take some of the pressure

THOUGH MENTORS AND MENTEES DO ENDEAVOR TO SHOW UP AS THEIR BEST SELVES, RECOGNIZING THAT THINGS CAN AND DO CHANGE OVER TIME IS A HALLMARK OF A SUCCESSFUL AND ENGAGING MENTORING RELATIONSHIP.

off by setting an overall time window for the number of meetings (i.e., one year) and the number of times to meet within that period (i.e., once each month for 45 minutes). This can help transform a very nebulous statement such as, “My mentor and I are going to set up meetings for the future,” to, “My mentor and I are going to meet once every two weeks for 30 minutes each for the next six months,” which is less overwhelming and more manageable. Then, at the end of the time period, it gives both mentor and mentee an opportunity to reassess their availability and the overall status of their relationship to see if they would like to continue the ongoing mentorship or pursue a different direction for the future.

During the February 2025 Women in Retirement Third Thursday Virtual Forum, one of the topics explored was that though the mentor is endeavoring to help the mentee grow, the mentor does not have to be an absolute expert in the retirement industry. With all of the rules and regulations surrounding retirement plans, nobody can know every single detail. From my vantage point, it’s absolutely OK to say, “That’s a great question! I need to do a bit more research to get you the answer, but I’ll get back to you by our next meeting.”

Sharing an article, a resource or a connection can sometimes be the best way to help a mentee grow. I made the comment during the forum that “I’m not a vending machine.” I truly don’t have to have all the answers at my fingertips, but needing to get additional resources or support shows I’m human — just like everyone else. In a nutshell, mentoring is about caring for the other person and being vested in their success, and there’s no age limit or amount of experience needed for that type of relationship.

Now what happens when a mentee and mentor begin a relationship and decide it’s not a good fit? This can always be hard to manage. Though everyone means well, sometimes the relationship just doesn’t work out. There could be a personality difference, a recurring scheduling conflict or the mentee’s goals might simply change. Addressing this potentially awkward situation involves courage on the part of both the mentor and mentee to have an honest discussion about how the relationship is actually going (not how they would like it to be) and their associated feelings about the relationship — though this part can be harder than discussing the actual problem itself.

Sometimes, it’s a bit easier to set regular check-in points where the mentee and mentor both know they are going to be assessing the health of the relationship, which can help alleviate pressure. For this type of reflection, it can be helpful to ask questions such as: “Do I still feel engaged and excited about this relationship? If not, why not?”

“Am I still growing as a mentee, or am I still able to help the mentee? If not, is there another mentor/mentee relationship that I’m better suited for?” Though mentors and mentees do endeavor to show up as their best selves, recognizing that things can and do change over time is a hallmark of a successful and engaging mentoring relationship.

During the virtual forum, one of the resounding mentoring myths that rose to the surface multiple times was the idea that each of us doesn’t have something of value to give in a mentoring relationship; many professionals have faced a feeling of inadequacy. However, though it may feel that way at times, we are all gifted with our own unique experiences and perspectives. No one has ever quite walked the same road that we have, and we all have value to share with others. I would encourage everyone to consider their strengths and abilities to see how they can encourage and uplift those around them in our community. For companies that have in-house formal mentorship programs, that is a great place to start.

For those companies where an in-house mentorship program is not an option at this time, the American Retirement Association has two avenues for participating in a formal mentorship program — the Thrive Mentorship Program, which is for women in all five sister organizations within the ARA, and the NOW (Nourish Our Wealth) Mentorship Program, focusing on promoting racial and ethnic diversity throughout the retirement industry. And even if you aren’t quite ready to sign up for a formal mentorship program, another great option is the quarterly Women in Retirement’s Third Thursday Virtual Forum where you can gather with like-minded individuals who share your interests and want to help you reach your professional goals. So whether you are new to the retirement plan industry or a seasoned professional, I invite you to consider what could be your next step on your mentorship journey — either as a mentee to expand your skill set or as a mentor to give back to our community.

Sheri Melvin is the People and Culture Advisor for the Union of Concerned Scientists.

Colleen Windham, CPC, QPA, CBS, QKC, QKA, TGPC, is a Relationship Manager & CPA, RPSI-Retirement Plan Solutions Inc.

by Hattie Greenan

Leveraging special awareness “days” such as 401(k) Day, can increase engagement and outcomes when paired with ongoing communications and easy calls to action.

Day often goes by another

–

but January first is also National Bloody Mary Day (possibly related?), National Ellis Island Day, and National Ice Skating Day.

Don’t forget National Sibling Day in April and International Dog Day in August – two that seem increasingly prevalent on social media in recent years. If there is a topic, there is a day to recognize, celebrate, and increase awareness about it.

As the retirement industry is no stranger to a bandwagon, there are numerous (at least a dozen I have come across so far) financial or savings related “days.” And in fact, PSCA established one of the earliest (possibly the first, can’t verify) of the retirement-related days nearly 30 years ago with the creation of National 401(k) Day in 1996, designating it to fall annually on the Friday after Labor Day (as a nod to the notion that retirement follows work). PSCA…always the trendsetter!

Not to be outdone, there are also retirement-related recognition weeks and months – some federally created. National Retirement Security Week was established by Congress in 2006 to be the third week in October through a bipartisan Senate resolution to raise awareness about retirement saving and participation in employer-sponsored plans. The initiative was expanded to the full month of October as National Retirement Security Month in 2020. Indeed October, also known as “open enrollment season” for many benefits professionals, has as least four different retirement/ financial “holidays.”

Is recognizing these “holidays” with employees effective? They certainly can increase initial awareness and engagement in the moment, but long term behavior change often needs multiple touchpoints combined with calls to action. Combining

the recognition of 401(k) Day, for example, and a simple call to action with additional touch points throughout the year can help carry that engagement and excitement forward, helping employees feel more connected to their benefits and secure in their retirement planning and financial futures.

Plan sponsors wear many hats, and if you are thinking, “that’s great, but I don’t have the time or resources for that” – we got you! PSCA strives to provide the education, research, and resources members need and want to help them execute the things they must do, but also the things they would like to do but don’t have time for. As such, PSCA has expanded its library of

participant resources with the addition of HSA Day (October 15th annually) in 2024, and 403(b) Day (April 3rd annually) earlier this year.

Whether you have had a chance to “celebrate” already, are looking for specific communication piece to supplement a current education goal, or you would like to provide education pieces at a time that better aligns with your organization’s schedule and culture, PSCA’s resources are customizable and available to members anytime. Below is description of the 2025 campaigns – open enrollment is a great time to grab a beneficiary flyer or a readiness checklist to quickly customize and add to your materials.

NATIONAL 401(K ) DAY – SEPTEMBER 5, 2025

PSCA’s 2025 401(k) Day campaign theme is “Step Up to Retirement.” The campaign is designed as a month-long series of events and educational challenges to promote financial wellness and retirement planning.

The campaign is designed to launch with a kickoff event and carry through one month with four weekly challenges, each focused on a critical aspect of retirement readiness. The initiative fosters momentum by combining incremental savings actions with engaging wellness activities.

• Week 1: Boost Your Momentum – Employees are challenged to increase their 401(k) contributions by one percent, kickstarting progress toward their retirement goals.

• Week 2: Balance Your Stride – Participants review and refine their asset allocation for a well-balanced retirement strategy, with support from HR and digital tools.

• Week 3: Build Your Endurance – The focus shifts to establishing automatic contribution increases, reinforcing consistency in savings growth.

• Week 4: Visualize the Finish Line – Employees use retirement calculators to assess progress and celebrate how their choices advance their financial future.

One highlight is the “4.01k Fitness Challenge”, a 2.5-mile run or walk where employees are encouraged to pair physical movement with the one percent contribution challenge, supporting both financial and physical health. The event invites participants to share

photos and milestones on company channels and social media, fostering camaraderie and motivation.

The campaign incorporates recognition for participation, including a “Retirement Champion” badge for those who complete all four steps. The activities, both in-person and virtual, are designed to build community, celebrate personal victories, and reinforce the importance of ongoing financial wellness.

Although 401(k) day is observed on the Friday after Labor Day, PSCA’s 401(k) Day materials are available yearround, allowing organizations to choose the timing that best fits their workforce. This flexible approach reflects the growing emphasis on comprehensive financial wellness, rather than a onetime event.

• Financial Wellness Month – January

• Financial Literary Month – April

• National 403(b) Day – April 3rd

• America Saves Week – April (First or Second Full week)

• National 529 College Savings Day (May 29th)

• National Financial Awareness Day: August 14th

• National 401(k) Day: Celebrated on the Friday after Labor Day

• National HSA Awareness Day: October 15th

• National Retirement Security Week: Third week in October

• National Savings Day: Second Sunday in October

• Retirement Security Month: October

• World Savings Day: October 31

Plan sponsors can choose to implement the full program or parts of it as desired. The weekly flyers can be standalone pieces or distributed once a month over four months –customize it as you see fit. For organizations with lower-paid employees who may be financially struggling right now, the onepercent challenge may not resonate so you may choose to use materials from previous campaigns such as beneficiary flyers or budgeting. PSCA members have full access to the archives at any time.

Though there have been a few instances of financial organizations celebrating 403(b) plans on April 3rd in the past, this year PSCA formally established the creation of 403(b) Day and will provide campaign materials annually specifically for nonprofit organizations. Though some 401(k) Day campaigns in past years also had 403(b) versions, PSCA wanted to give 403(b) plan sponsors their own day and specially designed materials.

Nonprofits play a critical role in our communities, and ensuring their employees have access to secure and effective retirement plans is essential. 403(b) Day will serve as an opportunity to spotlight the importance of these retirement plans and empower nonprofit leaders to support their employees’ financial futures.

NONPROFITS PLAY A CRITICAL ROLE IN OUR COMMUNITIES, AND ENSURING THEIR

EFFECTIVE

This year’s 403(b) Day campaign includes a “fact or fiction” slide deck that addresses common barriers to retirement plan participation. Organizations can customize the slides with their contribution formulas and benefits links. There are also promotional ads and banners available to be used in email or social media campaigns. More information is available at: https://www.psca.org/403bday/

HSA DAY: OCTOBER 15, 2025

National HSA Awareness Day was created in 2019 to bring awareness to the power of a Health Savings Account (HSA) to help employees save for both immediate and future health care expenses. Recognizing the power of the HSA as not only a healthcare savings tool, but also a retirement planning tool, PSCA created an HSA-focused committee in 2017 to begin providing resources and research to members.

One of the most consistent findings in PSCA’s annual HSA survey is the challenge of educating employees about HSAs and their benefits. The HSA can be a powerful tool, but it can also be a bit complicated and explaining them to employees can be a challenge. To help members

with this challenge, PSCA’s HSA Committee created free materials for plan sponsors to use with participants in recognition of annual HSA Day starting in 2024.

For 2025, PSCA created two participant materials that can be customized and distributed to employees on HSA Day or anytime during the year. The first is a beneficiary flyer, explaining the need to add a beneficiary to your HSA. This can be customized with links to your benefits page or with other calls to action.

The second is a PowerPoint that includes things to think about with HSA contributions throughout one’s career, from entering the workforce to retirement. This can also

be customized to include your organization’s contribution information and links to website(s).

Email and web banner ads are also available in various sizes to make it easy to spread awareness of contributing to an HSA on HSA Day, or anytime that works for you!

With education such a challenge for plan sponsors and breaking through the email clutter with retirement education nearly impossible, does making an event out of it, on a “holiday” help increase engagement? It can, but the downside of recognizing “days” is that they are one-and-done and

AWARENESS DAYS CAN GET PEOPLE TALKING ABOUT A TOPIC THAT ISN’T TYPICALLY TOP-OF-MIND, BUT THEY NEED TO BE PAIRED WITH SIMPLE STEPS EMPLOYEES CAN TAKE, AND ONGOING REMINDERS.

without ongoing education and follow-up, the impact can be limited. Their effectiveness depends on whether they are part of a broader, sustained strategy that includes targeted messaging and concrete calls to action. Awareness days can get people talking about a topic that isn’t typically top-of-mind, but they need to be paired with simple steps employees can take, and ongoing reminders.

Don’t let your 401(k) Day be a one-hit wonder! Following it up with monthly touchpoints with simple calls to action, perhaps alongside advisor or provider created materials, and maybe paired with other recognition days such as financial wellness month in January or HSA Day in October can help keep financial planning and savings top of mind for employees – and help increase the value of the benefits your organization is already providing.

Hattie Greenan is the Director of Research and Communications for PSCA.

by Judy Ward

‘Fishing expeditions’ and ‘cookie-cutter cases’ are just two phrases used to predict coming litigation in the wake of Cunningham v. Cornell University. Here’s what plan fiduciaries need to know.

A recent U.S. Supreme Court ruling makes it easier for plaintiffs to bring a prohibited transaction lawsuit against retirement plan fiduciaries, and it hasn’t taken long for the impact to be felt.

“I am already seeing it: Because of this ruling, some plaintiffs’ attorneys are now adding allegations of a prohibited transaction to cases that just alleged a fiduciary breach before,” said Lindsey Camp, a partner at law firm Holland & Knight in Atlanta and West Palm Beach, Florida.

The April 17 Supreme Court ruling in Cunningham v. Cornell University said that to bring a claim, plaintiffs only need to plausibly allege that a plan engaged in a prohibited transaction, and don’t have to also allege that the plan didn’t qualify for any prohibited transaction exemption.

“I think that going forward, complaints will be far more bare-bones, and many plaintiffs’ attorneys won’t even try to flesh out their prohibited transaction allegation,” said Alden Bianchi, Boston-based counsel at law firm McDermott Will & Emery.

“The plaintiffs’ bar can just cut and paste and roll out the same complaints against fiduciaries of more plans.”

ERISA’s Section 406, which establishes the prohibited transaction concept, prohibits plan fiduciaries from entering into a transaction with a service provider for several scenarios, including the “furnishing of goods, services, or facilities between the plan and a party in interest.” A different part of ERISA, Section 408, lists the exemptions to that rule, including one allowed for services “necessary for the establishment or operation of the plan, if no more than reasonable compensation is paid therefor.”

Employers have relied on that exemption to hire administrative service providers while remaining in compliance with ERISA’s prohibited transaction rules. However, when participant lawsuits have been filed alleging a prohibited transaction in hiring a service provider, results have varied due to the ambiguity in the ERISA rules.

“It’s not even that the rules are unclear: They are badly drafted,” said Carol Buckmann, founder and partner at New Yorkbased law firm Cohen & Buckmann, P.C.

Section 406 is written so broadly that it essentially includes any service provider relationship a plan might have, she said. Section 406 mentions exemptions but doesn’t specify what they are. Specifying the exemptions in a different section, Section 408, left a key question open to legal interpretation: Did plaintiffs filing a prohibition transaction claim under Section 406 also need

to allege that a plan did not meet the qualifications under Section 408 for any of the exemptions, or not?

U.S. Circuit Courts have interpreted the prohibited transaction provisions differently: Some required the plaintiff to allege that a prohibited transaction existed and that the transaction with an administrative service provider did not meet additional standards related to the exemption, while other courts required only that plaintiffs plead that a prohibited transaction existed, and not that the plan didn’t meet any exemption standards. Where the latter standard has prevailed, it’s a low bar for plaintiffs to clear.

The Cunningham v. Cornell lawsuit focused on two defined contribution plans maintained by Cornell University. Since 2011, Cornell has retained two recordkeepers for the plans, with the providers also offering investment options to participants, and the recordkeepers received asset-based fees.

In 2017, a group of current and former Cornell employees filed a classaction lawsuit, alleging that the plan fiduciaries had

violated ERISA S ection 406 by causing the plans to engage in prohibited transactions for recordkeeping services.

The U.S District Court for the Southern District of New York dismissed the claim, finding that the plaintiffs, in addition to pleading that a prohibited transaction occurred, also must allege some evidence of self-dealing or other disloyal conduct.

The Second Circuit Court of Appeals affirmed the dismissal, but on different grounds, ruling that the plaintiffs must also allege either that the services were unnecessary or involved unreasonable compensation. That court viewed the exemption conditions as part of the Section 406 definition of a prohibited transaction, Buckmann pointed out.

The Supreme Court adopted a lower pleading standard, similar to that used by some Circuit Courts. To state a claim under the Section 406 prohibited transaction provision, a plaintiff must plausibly allege the elements contained in that provision, without addressing a potential Section 408 exemption.

“People had thought, it’s not possible that Congress intended that the run-ofthe-mill service provider

agreements needed to run a plan are, in fact, prohibited transactions,” said William Delany, principal and litigation co-chair at Groom Law Group in Washington, D.C. “But that’s basically what the Supreme Court ruled. Effectively, what the Supreme Court held is that the only thing a plaintiff needs to plausibly allege is the existence of a transaction with a ‘party in interest.’ That’s not difficult to establish.”

That may seem like a technical point, but it actually shifts the burden of proof during the crucial phase of a lawsuit when a court considers a defendant’s motion to dismiss the suit. The Supreme Court ruling means that plaintiffs nationwide aren’t required to assert that an exemption does not apply for that plan, Buckmann said.

“That opens the door to a lot of ‘fishing expeditions’ by plaintiffs’ attorneys,”

Buckmann continued. “Because now, as a plaintiff you just need to make a bare-bones allegation of a prohibited transaction, without having to plead (at the motion-to-dismiss phase) that the plan fiduciaries actually did anything wrong.”

Camp said that ultimately, the question before the Supreme Court was this: Who has the burden of proving the reasonableness or unreasonableness of a service provider’s fees, the plaintiff or the defendant? If the plaintiff has the burden of proof to show that the plan’s administrative fees are unreasonable, then a defendant can more easily succeed on its motion to dismiss, she said. If the plaintiff doesn’t have to prove the fees’ unreasonableness at that point, it’s much harder for the defendant’s motion to dismiss to succeed.

In the wake of the Supreme Court’s ruling, the number of lawsuits filed by participants against plan fiduciaries may jump, said Gina Alsdorf, an attorney who is a shareholder at law firm Carlton Fields in Washington, D.C. If plaintiffs alleging a prohibited transaction initially don’t have to show anything stronger than that a transaction with a service provider happened, there likely are going to be a lot of “nuisance” cases filed, she said.

Plaintiffs’ law firms have a clear financial incentive to ramp up the number of lawsuits filed, Alsdorf said. When a class-action suit settles, the plaintiffs’ law firm often can make more money than any individual plaintiff, since it’s common for the plaintiffs’ attorney to receive one-third of the settlement amount plus expenses. It’s eye-opening to look at what individual plaintiffs make from these settlements, versus what plaintiffs’ attorneys make, she added.

And Matthew Eickman, chief legal officer at the Fiduciary Law Center in Omaha, Nebraska, anticipates that more fee lawsuits alleging fiduciary breach will also focus on prohibited transaction claims. “Over the past decade, many fee lawsuits rested solely on fiduciary breach claims, and not on prohibited transaction claims,” Eickman said. “That will change.”

Pursuing both a fiduciary breach allegation and a prohibited transaction allegation is more likely, now that the burden of proof has shifted away from the plaintiff, Camp said. Plaintiffs may be able to prevail over a prohibited transaction allegation while failing to prove a fiduciary breach.

With plaintiffs alleging a prohibited transaction now very likely to survive a motion to dismiss, Alsdorf thinks that will increase pressure on plan fiduciaries to settle early in the lawsuit process.

If a defendant loses a motion to dismiss, a lawsuit moves on to the expensive discovery phase, which includes taking depositions and gathering documents, and then can go to a trial.

For a defendant, the cost for attorneys and other experts in the discovery and trial phases can run $1 million or more, so many opt to settle instead. The motion-to-dismiss phase “used to be a sort of gatekeeper in these cases: If plaintiffs couldn’t get through there, they couldn’t get a settlement with the defendant,” Alsdorf said. “Now, all the plaintiffs will have to do is show that a transaction happened to get past the motion to dismiss. And because of the high cost of litigation, I think we’re going to see people settle a lot of these cases, even if they are not meritorious.”

Risk mitigation focuses on having the documentation to mount a good defense if a prohibited transaction lawsuit does move forward to the discovery and trial phases. At that point, whether a plan met the exemption requirements, and whether participants experienced harm if it didn’t, would come into play as key factors in a lawsuit’s fate.

Since plan fiduciaries can’t realistically opt out of having any third-party administrative service agreements, Buckmann said, they need to make sure that they’ve documented the reasons why they believe the plan meets an exemption’s requirements for any provider relationships that it does have. A plan’s fiduciaries could ask the plan’s legal counsel to review existing third-party provider arrangements and produce a memo on the reasons why a plan meets an exemption’s standards.

“The plan fiduciaries really need to make sure that they are using an exemption correctly,” Buckmann said.

Mitigating the risk of a prohibited transaction with a provider starts with clearly identifying all of the compensation that a plan’s recordkeeper receives under its contract, Eickman said.

Second, plan fiduciaries should be able to identify and list all the specific services a recordkeeper provides under that agreement.

Third, he recommended doing a periodic audit of the recordkeeper’s actual revenue received from its relationship with that plan, to ensure that the recordkeeper got no more in compensation than what the service agreement said it would receive.

“We’d love to think in 2025 that there is so much transparency in how money flows in and out of retirement

plans. But it may be a situation in which more money flows to the recordkeeper than what the plan sponsor thinks,” Eickman said. Recordkeepers might not readily hand over the data about their indirect compensation to a plan sponsor, he said. Still, a plan’s attorney or advisor can be in a pretty good position to ask the right questions, to get that information.

And fourth, Eickman said, a plan’s fiduciaries need to do ongoing due diligence to make sure that the services received and the fees paid remain reasonable, whether that’s through third-party benchmarking, an RFI (request for information), or an RFP (request for proposal).

The courts often have said that benchmarking ought to occur at least every three years, but some have said that it should happen more frequently, and some have said that it could appear less often, he said.

“The good and bad answer is that we don’t have a black-and-white rule from the courts for the frequency of benchmarking, and the method for doing that,” Eickman added.

Review and Document

Plan fiduciaries who haven’t closely reviewed their service agreements in many years risk being among the next targets for a prohibited transaction lawsuit, Alsdorf said. They’re going to be the “low-hanging fruit” for plaintiffs’ law firms,

IN TERMS OF IMPLEMENTING PRACTICES, PLAN FIDUCIARIES NEED TO MAKE SURE THAT THEY ARE FOLLOWING A REASONABLE PROCESS TO SELECT A SERVICE PROVIDER, AND MAKE SURE THAT THE OUTCOME IS MARKET-REASONABLE.

she predicted. It’s essential for fiduciaries to review service provider contracts periodically, she said, and make sure that, at a minimum, providers actually are performing all the services they agreed to provide in the contract.

“In terms of implementing practices, plan fiduciaries need to make sure that they are following a reasonable process to select a service provider, and make sure that the outcome is marketreasonable,” Delany said. “They need to understand how the fees, when married with the

services that the participants and plan receive, compare to the external environment.”

And plan fiduciaries should document their ongoing process for ensuring the reasonableness of administrative services and fees. Bianchi feels passionately about carefully taking committee-meeting minutes, and he thinks the Supreme Court’s decision makes that even more crucial, now that the bar for a plaintiff’s prohibited transaction pleading is so low.

People often don’t give committee meeting minutes a second thought and may even have a junior employee take the notes during a meeting, and then those notes become the official minutes. That’s going to potentially increase the risk exposure if those plan fiduciaries subsequently face a prohibited transaction lawsuit, Bianchi said, since minutes from committee meetings will become part of the discovery process.

Meeting minutes need to demonstrate how committee members are consistently prudent in making their decisions about service agreements and fees, with particular attention to the reasonableness of fees. Bianchi suggested either that the plan’s attorney take the minutes or, if someone else takes the minutes, that the attorney always reviews the minutes before they become finalized.

“Minutes,” Bianchi said, “are not for amateurs.”

Judy Ward is a freelance financial writer.

NQDC

by Monte Harrick

A NONQUALIFIED DEFERRED COMPENSATION PLAN INCLUDES MANY ATTRACTIVE FEATURES FOR THOSE ELIGIBLE TO PARTICIPATE. HOWEVER, ONE OF THE MAIN RISKS ASSOCIATED WITH PARTICIPATION IN A NONQUALIFIED BENEFIT PLAN IS THAT ACCOUNT BALANCES ARE SUBJECT TO FORFEITURE.

If an organization incurs a bankruptcy or insolvency, plan participants are not guaranteed to receive their account balances.

This is an important distinction that separates nonqualified benefit plans from other qualified plans

Rabbi trusts can offer additional protections for participant NQDC account balances – here are some considerations for plan sponsors. withholds the elected deferrals, those dollars can be specifically transferred to a trust earmarked for payment of the future obligation. The good news for the participant is that these assets are no longer

and welfare benefit plans. But there are a few design features that can be utilized to help soften the risk of a bankruptcy. Benchmark data indicates that 84 percent1 of companies who implement or maintain nonqualified benefit plans utilize a grantor trust,

commonly called a rabbi trust, to help secure benefits.

A rabbi trust can provide a number of features that will help bring a level of comfort to those participating in such plans, namely:

1. Segregating the assets: Once the employer

ONCE ASSETS ARE PLACED IN TRUST THEY ARE IRREVOCABLE, MEANING THE COMPANY CANNOT ACCESS THOSE DOLLARS EXCEPT FOR THE EXPRESS PURPOSE OF MAKING BENEFIT PAYMENTS TO PLAN PARTICIPANTS. THIS ARRANGEMENT PROVIDES AN EXTRA LAYER OF PROTECTION FOR THE PARTICIPANTS, SHORT OF BANKRUPTCY.

part of the employer’s operating funds reducing the risk of those dollars being utilized for other business needs.

2. The irrevocable nature of the trust: Once assets are placed in trust they are irrevocable, meaning the company cannot access those dollars except for the express purpose of making benefit payments to plan participants. This arrangement provides an extra layer of protection for the participants, short of bankruptcy.

3. Minimal Employer Access: The company has no direct access to the trust assets to utilize for company purposes, which helps ensure that the dollars are used to pay balances under the plan.

4. Distribution related triggers: As with any ERISA based plan or nonqualified plan, the plan document, or in this case, the trust document, dictates conditions on which payouts can occur, which can be made from the trust, such as at, retirement, termination, or a change of control. The plan document can help provide clarity and direction on how payouts should be made.

There is no Silver Bullet As with any benefit, there are certain issues that should be considered when utilizing a rabbi trust:

1. Bankruptcy risk: Trust assets associated with the rabbi trust cannot be segregated or walled off from the creditors of the organization. If

the company becomes insolvent, the assets in the rabbi trust remain accessible to general creditors. Participants in nonqualified benefit plans are unsecured general creditors to the company and are secondary creditors behind the preferred creditors of the organization.

2. Not protected by ERISA: SInce nonqualified plans are exempt from ERISA, participants in these plans do not benefit from the same fiduciary safeguards or insurance protections as qualified benefit plans.

3. Adherence to IRC 409A: The trust must comply with IRS rules around Internal Revenue Code 409A in order to ensure that all features of the

Plan meet the conditions of tax deferral. Any violation of this code section could result in taxation and penalties. Although there are limitations to a rabbi trust, this device is often seen as a safe haven for executives and highly compensated employees who participate in these programs. Rabbi Trusts provide an additional layer of protection from the unsecured promise to pay by employers even though it’s less secure than a qualified retirement account. In most cases, the features of a nonqualified benefit plan and the ability to save in a high tax preference vehicle outweigh the security risks associated with with the Plan.

Monte Harrick is the SRVP, Retirement/Executive Benefits, for OneDigital and a member of PSCA’s NQDC committee.

by Hattie Greenan

Employee Health Savings Account balances grew for the third straight year buoyed by increased participant contributions and in increase in participants investing their assets.

THE PLAN SPONSOR COUNCIL OF AMERICA’S (PSCA) 2025 HSA Survey shows employees are increasing contributions to their health savings accounts, and more are investing those assets when given the opportunity, leading to an increase in average account balances for the third consecutive year.

The latest survey shows that 20 percent of participants now invest their HSA savings, up from 18 percent the prior year. (See Figure 1.) Also, two-thirds of employers now offer investments, a 12 percent increase over a two-year period.

PSCA’s seventh annual HSA survey, sponsored by HSA Bank, was conducted in the summer of 2025 and reflects responses from nearly 600 employers with an HSA program. The survey tracks employee and employer HSA trends from 2024.

Additional findings from the 2025 HSA Survey include increased use of automatically enrolling eligible participants in an HSA, most employers make contributions, and an increase in large organizations rewarding employees for health and wellness program participation with HSA contributions.

More than half of employees enrolled in the HSA-qualifying health option when offered the opportunity. Of those that did, 87.3 percent had an HSA in 2024 and nearly three-fourths made contributions to their account. (See Figure 2.) Employees contributed an average $2,802 in 2024 (up from $2,609 in 2023 and $2,323 in 2022) and had an averaged account balance of $2,802 (up from $6,165 in the prior year, and $6,130 in 202).

More than forty percent of organizations are automatically enrolling employees in the HSA if they enroll in the HSA-qualifying health option. (See Figure 3.)

Three-fourths of employers contribute to the HSA – of those that do, more than half provide a set dollar amount based on the coverage level (single or family) while less than ten percent match employees’ contributions to the accounts.

Nearly a quarter of employers “front-load” contributions at the beginning of the year while 44.0 percent make contributions each pay period.

Nearly 90 percent of respondents offer mutual funds to respondents and half offer a brokerage window. Most respondents (89.4 percent) stated that they do not try to mirror the HSA investment lineup with their 401(k) lineup and that doing so is not a goal.

Explaining the complexities of the HSA to employees remains the most common concern among employers. The survey found:

• Among 62 percent of employers that provide HSAs, almost the same number who offer education on these accounts do so only once a year during open enrollment periods

• Only one-third of employers communicate with employees about the benefits of using their HSA as a retirement planning tool.

• Less than one-in-three HSA plans enable participants to view their balances alongside retirement accounts.

The full survey report can be accessed at www.psca.org/ research/HSA

Hattie Greenan is the Director of Research and Communications for PSCA.

by Keith Mayfield

Reframing the way we speak to employees about saving for retirement can increase engagement and plan participation.

MANY STILL BELIEVE RETIREMENT PLANNING STARTS AGAIN WITH EACH NEW SIGN-UP FORM, YET EVERY WORKER IS ALREADY ON A LIFELONG RETIREMENT PATH.

From their first paycheck, every pay period is a decision whether to save ten percent, six percent, or zero percent, with every choice balancing current income needs with future income goals.

Open enrollment, then, is not about convincing people to join the plan but about reinforcing your employees ongoing retirement journey. Each year brings employees

closer to retirement and shortens the time available to save. Their actions, or inaction, become their real retirement plan. Shifting the question from ‘Will you join?’ to ‘You are already a participant, how will you personalize your deferral” reframes retirement saving as a natural, continuous part of earning a paycheck. A zero percent deferral becomes a valid choice that keeps

employees engaged and connected to your company plan.

For sponsors, this reframing pays dividends. Recognizing 100 percent participation from day one strengthens the perceived value of the benefit and maximizes the positive impact of employer contributions, plan resources, and administrative investments. Employees who feel included and informed credit the company for helping them build long-term wealth, creating deeper loyalty and a

stronger benefit culture.

With that foundation in mind, the following playbook outlines practical steps to embed 100 percent participation into your plan communications.

100% Participation

Every 401(k) and 403(b) legal plan document defines a participant as: 100 percent of employees who meet the plan eligibility and entry date

EVERY EMPLOYEE WHO MEETS YOUR PLAN’S ELIGIBILITY AND ENTRY REQUIREMENTS ARE, BY DEFINITION, ALREADY A PARTICIPANT WITH NO NEED TO “ENROLL” OR “SIGN-UP” OR “JOIN.” THOSE WHO WE MISLEADINGLY CLASSIFY AS “NON-PARTICIPANTS” ARE PARTICIPANTS WHO ARE DEFERRING ZERO PERCENT.

requirement. Every employee who meets your plan’s eligibility and entry requirements are, by definition, already a participant with no need to “enroll” or “sign-up” or “join.” Those who we misleadingly classify as “non-participants” are participants who are deferring zero percent.

Industry slang terms like “opt-out” and “nonparticipant” create the false impression that employees can decline participation or leave the plan. This detrimentally impacts

employee engagement with your company benefit.

Replacing these phrases in all plan communications ensures that employees—and management—understand the true reach of the benefit.

A zero percent deferral is still an active participant choice. It simply reflects the employee’s current balance between immediate needs and long-term savings. Recognizing a zero percent deferral as a valid participant choice keeps every employee engaged in the company’s retirement

program. A clear message such as, “All eligible employees are participants in the plan and may choose any deferral rate— from zero percent upward—at any time,” invites inclusion and reinforces that every paycheck decision is part of an ongoing retirement journey.

By adopting this language, sponsors highlight the full value of their retirement plan and strengthen overall benefit culture. Accurate terminology builds trust, demonstrates 100 percent coverage, and positions the company as a

proactive partner in employees’ long-term financial success.

100% Welcome

The way you welcome newly eligible employees sets the tone for their engagement and determines how much value your company gains from the retirement plan. Replace optional language such as “Do you want to join?” or “Enroll now” with inclusive messaging. For example: “Welcome—we value the opportunity to help employees build retirement income and are excited that

you are now a participant in XYZ’s company retirement plan. Now please personalize your deferral amount from zero percent and up.” This approach makes every employee feel included, even those who will initially choose a zero percent deferral, and reinforces that they are an ongoing active member of your company benefit offering.

Shifting to this welcoming, inclusive language elevates employees’ perception of the benefit, keeps 100 percent of your workforce engaged, and does engage more employees to contribute.

100% Auto-Enrollment or More Accurately, AutoDeferral

By plan document definition, for 100 percent of retirement plans, every employee who meets your plan’s eligibility and entry requirements is already auto-enrolled as a participant. The true “auto-enrollment” question is not whether they are enrolled as a participant, but what their starting “autodeferral” rate will be.

While we label this feature “auto-enrollment,” the real mechanism is “auto-deferral” – your plan auto-deferral choice determines the preset percentage of pay directed into the plan unless the employee chooses a different amount. If the preset is 0%, you still have auto-enrollment—just with an auto-deferral of 0%.

Recognizing this distinction helps sponsors focus on one of the most impactful levers that drives stronger retirement outcomes: setting an effective auto-deferral rate.

All plans count every employee who meets eligibility and entry as a new participant, no enrollment or sign up needed. “All eligible employees are automatically enrolled as participants in our plan.” This is true for every sponsor and accurately reflects the plan’s true reach.

B. Choose the Right AutoDeferral

Setting a thoughtful starting auto-deferral can dramatically raise engagement, contribution rates, and retirement readiness across the workforce. Evaluate options from zero to ten percent or higher and decide whether the default should be pre-tax or Roth based on your plan’s goals and demographics. Even a modest default of four to six percent often doubles average contributions compared to a zero percent setting. Remember, it is extremely easy for employees to override the plan auto-deferral rate at any time with a simple one-time salary deferral change, but a well-chosen starting rate nudges them toward healthier saving habits from day one.

C. Welcome New Participants with Auto-Enrollment and Auto-Deferral Clarity

Use inclusive and accurate language such as: “Welcome— we’re excited that you are now a participant in the XYZ Company Retirement Plan. Your preset auto-deferral is zero percent (or four percent pre-tax, six percent Roth, etc.). We ask that you please

personalize your deferral to fit your goals from zero percent or more.”

of “Opt-Out”

Once an employee meets eligibility and entry requirements, they are a participant—period. The industry’s misleading use of the slang opt-out has blurred that truth and insinuates that participants are stepping away from the plan altogether, which is inaccurate and undermines engagement.

What opt-out actually means is far simpler: For plans with an auto deferral rate (auto-enrollment as it is commonly called), a participant is only “opting out” of the plan’s auto-deferral default, with the “opt-out” decision oddly guided towards a choice of zero percent deferral when it could easily be guided towards asking participants to “choose your own deferral.” “Opted-out” participants remain fully enrolled as a participant, retain all rights and benefits, and can choose any contribution rate at any time.

To avoid confusion and keep employees positively engaged, replace “opt-out and walk away” language with inclusive language to personalize their deferral: “As a participant in the XYZ Plan, you may select any deferral rate—from zero percent upward—whenever you choose.” This accurate wording reinforces that everyone remains in the employer benefit, removes the false in-or-out choice, and keeps the focus where it belongs—asking participants

to actively choose their preferred contribution rate for their financial goals.

During a 40-year retirement journey, many employees will face times when pausing contributions makes financial sense. Choosing a zero percent deferral doesn’t mean they’ve left the plan or stopped participating—it simply reflects their preferred balance between current financial needs and future income goals.

Recognizing zero percent as a valid participant decision keeps employees connected to the benefit and makes it more likely they will continue to review their contribution amount. By presenting zero percent as a legitimate option, HR reinforces that every eligible worker remains a participant regardless of deferral rate.

Communicate this clearly in onboarding and ongoing messages: “As a participant, you may choose any deferral rate— from zero percent upward—and adjust it whenever your circumstances change.” This framing removes the false “in-or-out” choice, sustains engagement, and encourages employees to re-engage quickly when they are ready to save more.

1. Adopt the 100 % Participation Mindset Recognize that every