R E C O R D K E E P E R S | A D D I T I O N A L L I S T I N G S | N A P A B L A C K B O O K 2 01 9

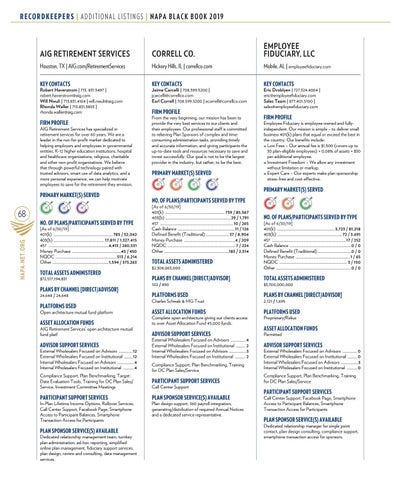

AIG RETIREMENT SERVICES

CORRELL CO.

EMPLOYEE FIDUCIARY, LLC

Houston, TX | AIG.com/RetirementServices

Hickory Hills, IL | correllco.com

Mobile, AL | employeefiduciary.com

KEY CONTACTS

Robert Haverstrom | 713. 831.5497 | robert.haverstrom@aig.com Will Nwuli | 713.831.4164 | will.nwuli@aig.com Rhonda Waller | 713.831.3803 | rhonda.waller@aig.com

FIRM PROFILE

AIG Retirement Services has specialized in retirement services for over 60 years. We are a leader in the not-for-profit market dedicated to helping employers and employees in governmental entities, K-12 higher education institutions, hospital and healthcare organizations, religious, charitable and other non-profit organizations. We believe that through powerful technology paired with trusted advisors, smart use of data analytics, and a more personal experience, we can help motivate employees to save for the retirement they envision.

PRIMARY MARKET(S) SERVED

NAPA-NET.ORG

68

NO. OF PLANS/PARTICIPANTS SERVED BY TYPE

[As of 6/30/19] 401(k) ......................................................... 785 / 52,042 40 (b) .................................................17,811 / 1,327,415 457 ..........................................................4,413 / 260,531 Money Purchase ...............................................45 / 450 NQDC ...........................................................513 / 6,214 Other ......................................................1,594 / 373,263

TOTAL ASSETS ADMINISTERED

$72,517,194,831

PLANS BY CHANNEL [DIRECT/ADVISOR]

24,648 / 24,648

PLATFORMS USED

Open architecture mutual fund platform

ASSET ALLOCATION FUNDS

AIG Retirement Services’ open architecture mutual fund platf

ADVISOR SUPPORT SERVICES

External Wholesalers Focused on Advisors .............12 External Wholesalers Focused on Institutional ........12 Internal Wholesalers Focused on Advisors ................ 4 Internal Wholesalers Focused on Institutional .......... 4 Compliance Support, Plan Benchmarking, TargetDate Evaluation Tools, Training for DC Plan Sales/ Service, Investment Committee Meetings

PARTICIPANT SUPPORT SERVICES

In-Plan Lifetime Income Options, Rollover Services, Call Center Support, Facebook Page, Smartphone Access to Participant Balances, Smartphone Transaction Access for Participants

PLAN SPONSOR SERVICE(S) AVAILABLE

Dedicated relationship management team, turnkey plan administration, ad-hoc reporting, simplified online plan management, fiduciary support services, plan design, review and consulting, data management services.

BB_WIN19_40-71_RecordKeepers.indd 68

KEY CONTACTS

Jaime Carcelli | 708.599.5200 | jcarcelli@correllco.com Earl Correll | 708.599.5200 | ecorrell@correllco.com

FIRM PROFILE

From the very beginning, our mission has been to provide the very best services to our clients and their employees. Our professional staff is committed to relieving Plan Sponsors of complex and timeconsuming administration tasks, providing timely and accurate information, and giving participants the up-to-date tools and resources necessary to save and invest successfully. Our goal is not to be the largest provider in the industry, but rather, to be the best.

PRIMARY MARKET(S) SERVED

KEY CONTACTS

Eric Droblyen | 727.324.4004 | eric employeefiduciary.com Sales Team | 877.401.5100 | sales employeefiduciary.com

FIRM PROFILE

Employee Fiduciary is employee-owned and fullyindependent. Our mission is simple – to deliver small business 401(k) plans that e ual or exceed the best in the country. Our benefits include » Low Fees – Our annual fee is $1,500 (covers up to 0 plan-eligible employees) 0.0 of assets 0 per additional employee. » Investment Freedom – We allow any investment without limitation or markup. » Expert Care Our experts make plan sponsorship stress-free and cost-effective.

PRIMARY MARKET(S) SERVED NO. OF PLANS/PARTICIPANTS SERVED BY TYPE

[As of 6/30/19] 401(k) ......................................................... 759 / 85,567 40 (b) ...............................................................29 / 1,791 457 ...................................................................... 10 / 265 Cash Balance .......................................................11 / 126 Defined Benefit (Traditional) ...................... 37 / 8,904 Money Purchase .................................................4 / 209 NQDC ................................................................. 7 / 224 Other ..............................................................183 / 2,514

TOTAL ASSETS ADMINISTERED

$2,308,063,000

PLANS BY CHANNEL [DIRECT/ADVISOR]

102 / 890

PLATFORMS USED

Charles Schwab & MG Trust

ASSET ALLOCATION FUNDS

NO. OF PLANS/PARTICIPANTS SERVED BY TYPE

[As of 6/30/19] 401(k) ....................................................... 3,723 / 81,218 40 (b) .............................................................. 72 / 3,691 457 .......................................................................17 / 252 Cash Balance ...........................................................0 / 0 Defined Benefit (Traditional) ................................0 / 0 Money Purchase ....................................................1 / 65 NQDC ................................................................. 3 / 150 Other ........................................................................0 / 0

TOTAL ASSETS ADMINISTERED

$3,700,000,000

PLANS BY CHANNEL [DIRECT/ADVISOR]

2,121 / 1,695

PLATFORMS USED

Complete open architecture giving our clients access to over Asset Allocation Fund 45,000 funds.

Proprietary/Relius

ADVISOR SUPPORT SERVICES

Permitted

Compliance Support, Plan Benchmarking, Training for DC Plan Sales/Service

External Wholesalers Focused on Advisors .............. 0 External Wholesalers Focused on Institutional ......... 0 Internal Wholesalers Focused on Advisors .................3 Internal Wholesalers Focused on Institutional .......... 0

External Wholesalers Focused on Advisors .............. 4 External Wholesalers Focused on Institutional ......... 2 Internal Wholesalers Focused on Advisors .................3 Internal Wholesalers Focused on Institutional .......... 2

PARTICIPANT SUPPORT SERVICES

Call Center Support

PLAN SPONSOR SERVICE(S) AVAILABLE

Plan design support, 360 payroll integration, generating/distribution of re uired Annual Notices and a dedicated service representative.

ASSET ALLOCATION FUNDS ADVISOR SUPPORT SERVICES

Compliance Support, Plan Benchmarking, Training for DC Plan Sales/Service

PARTICIPANT SUPPORT SERVICES

Call Center Support, Facebook Page, Smartphone Access to Participant Balances, Smartphone Transaction Access for Participants

PLAN SPONSOR SERVICE(S) AVAILABLE

Dedicated relationship manager for single point contact, plan design consulting, compliance support, smartphone transaction access for sponsors.

11/12/19 3:15 PM