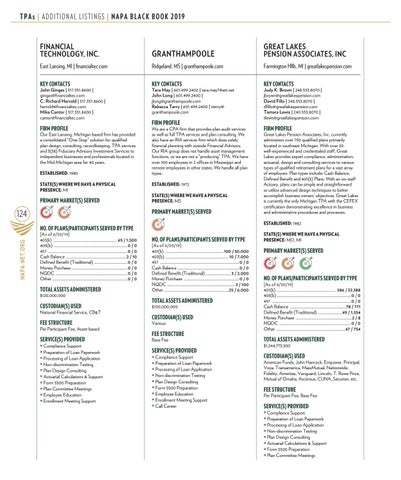

T P A s | A D D I T I O N A L L I S T I N G S | N A P A B L A C K B O O K 2 01 9 FINANCIAL TECHNOLOGY, INC.

GRANTHAMPOOLE

GREAT LAKES PENSION ASSOCIATES, INC

East Lansing, MI | financialtec.com

Ridgeland, MS | granthampoole.com

Farmington Hllls, MI | greatlakespension.com

KEY CONTACTS

KEY CONTACTS

John Gingas | 1 . 1. 00 | gingas financialtec.com C. Richard Herrold | 1 . 1. 00 | herrold financialtec.com Mike Cantor | 1 . 1. 00 | cantor financialtec.com

Tara May | 01.4 . 400 | tara.may7@att.net John Long | 01.4 . 400 | jlong@granthampoole.com Rebecca Terry | 01.4 . 400 | rterry@ granthampoole.com

FIRM PROFILE

We are a CPA firm that provides plan audit services as well as full TPA services and plan consulting. We also have an RIA services firm which does solely financial planning with outside Financial Advisors. Our RIA group does not handle asset management functions, so we are not a “producing” TPA. We have over 100 employees in offices in Mississippi and remote employees in other states. We handle all plan types.

Our East Lansing, Michigan based firm has provided a consolidated One-Stop solution for ualified plan design, consulting, recordkeeping, TPA services and ( ) Fiduciary Advisory Investment Services to independent businesses and professionals located in the Mid-Michigan area for 40 years. ESTABLISHED: 1 0 STATE(S) WHERE WE HAVE A PHYSICAL PRESENCE: MI

PRIMARY MARKET(S) SERVED

124

FIRM PROFILE

ESTABLISHED: 1 STATE(S) WHERE WE HAVE A PHYSICAL PRESENCE: MS

PRIMARY MARKET(S) SERVED

NAPA-NET.ORG

TOTAL ASSETS ADMINISTERED 1 0,000,000

CUSTODIAN(S) USED

National Financial Service, CB&T

NO. OF PLANS/PARTICIPANTS SERVED BY TYPE

[As of 6/30/19] 401(k) ........................................................100 / 30,000 40 (b) .............................................................10 / 7,000 457 ............................................................................0 / 0 Cash Balance ...........................................................0 / 0 Defined Benefit (Traditional) ........................ 3 / 2,000 Money Purchase .....................................................0 / 0 NQDC ................................................................. 2 / 100 Other ..............................................................25 / 6,000

TOTAL ASSETS ADMINISTERED 100,000,000

CUSTODIAN(S) USED

FEE STRUCTURE

Various

SERVICE(S) PROVIDED

Base Fee

Per Participant Fee, Asset-based » Compliance Support » Preparation of Loan Paperwork » Processing of Loan Application » Non-discrimination Testing » Plan Design Consulting » Actuarial Calculations & Support » Form 5500 Preparation » Plan Committee Meetings » Employee Education » Enrollment Meeting Support

BB_WIN19_108-133_TPAs.indd 124

FIRM PROFILE

Great Lakes Pension Associates, Inc. currently administers over 0 ualified plans primarily located in southeast Michigan. With over 20 well-experienced and credentialed staff, Great Lakes provides expert compliance, administration, actuarial, design and consulting services to various types of ualified retirement plans for a vast array of employers. Plan types include: Cash Balance, Defined Benefit and 401(k) Plans. With an on-staff Actuary, plans can be simple and straightforward or utilize advanced design techniques to better accomplish business owners’ objectives. Great Lakes is currently the only Michigan TPA with the CEFEX certification demonstrating excellence in business and administrative procedures and processes. ESTABLISHED: 1

NO. OF PLANS/PARTICIPANTS SERVED BY TYPE

[As of 6/30/19] 401(k) ............................................................. 65 / 1,500 40 (b) .......................................................................0 / 0 457 ............................................................................0 / 0 Cash Balance ..........................................................2 / 10 Defined Benefit (Traditional) ................................0 / 0 Money Purchase .....................................................0 / 0 NQDC .....................................................................0 / 0 Other ........................................................................0 / 0

KEY CONTACTS

Judy K. Brown | 248.553.8070 | jbrown@greatlakespension.com David Fillo | 248.553.8070 | dfillo greatlakespension.com Tamara Lewis | 240.553.8070 | tlewis@greatlakespension.com

FEE STRUCTURE SERVICE(S) PROVIDED

» Compliance Support » Preparation of Loan Paperwork » Processing of Loan Application » Non-discrimination Testing » Plan Design Consulting » Form 5500 Preparation » Employee Education » Enrollment Meeting Support » Call Center

STATE(S) WHERE WE HAVE A PHYSICAL PRESENCE: MD, MI

PRIMARY MARKET(S) SERVED

NO. OF PLANS/PARTICIPANTS SERVED BY TYPE

[As of 6/30/19] 401(k) ......................................................... 586 / 32,388 40 (b) .......................................................................0 / 0 457 ............................................................................0 / 0 Cash Balance ......................................................78 / 771 Defined Benefit (Traditional) ....................... 49 / 1,354 Money Purchase ......................................................2 / 8 NQDC .....................................................................0 / 0 Other .................................................................. 47 / 754

TOTAL ASSETS ADMINISTERED 1, 44,

, 00

CUSTODIAN(S) USED

American Funds, John Hancock, Empower, Principal, Voya, Transamerica, MassMutual, Nationwide, Fidelity, Ameritas, Vanguard, Lincoln, T. Rowe Price, Mutual of Omaha, Ascensus, CUNA, Securian, etc.

FEE STRUCTURE

Per Participant Fee, Base Fee

SERVICE(S) PROVIDED

» Compliance Support » Preparation of Loan Paperwork » Processing of Loan Application » Non-discrimination Testing » Plan Design Consulting » Actuarial Calculations & Support » Form 5500 Preparation » Plan Committee Meetings

11/11/19 2:07 PM