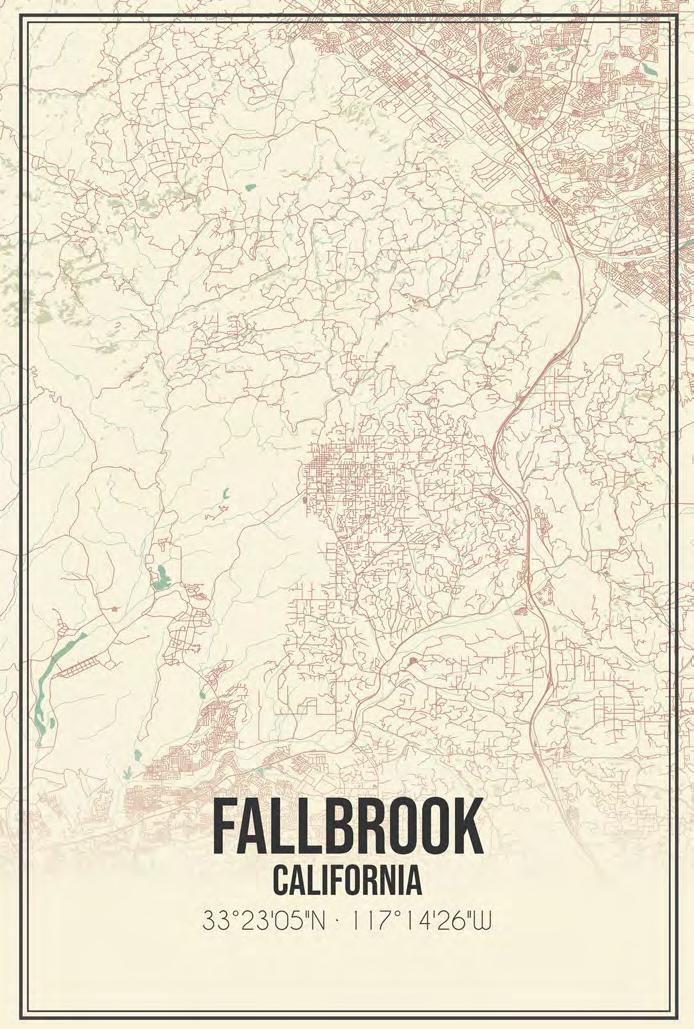

Lee & Associates NSDC, as exclusive listing broker, is pleased to present to qualified investors the opportunity to acquire Fallbrook Village Medical Center (the “Property”), a stabilized, medical-office project with significant base rent growth upside (&/or addition of NNN charges), strategically located near lively downtown Fallbrook and the Fallbrook Regional Health District, in Fallbrook, California.

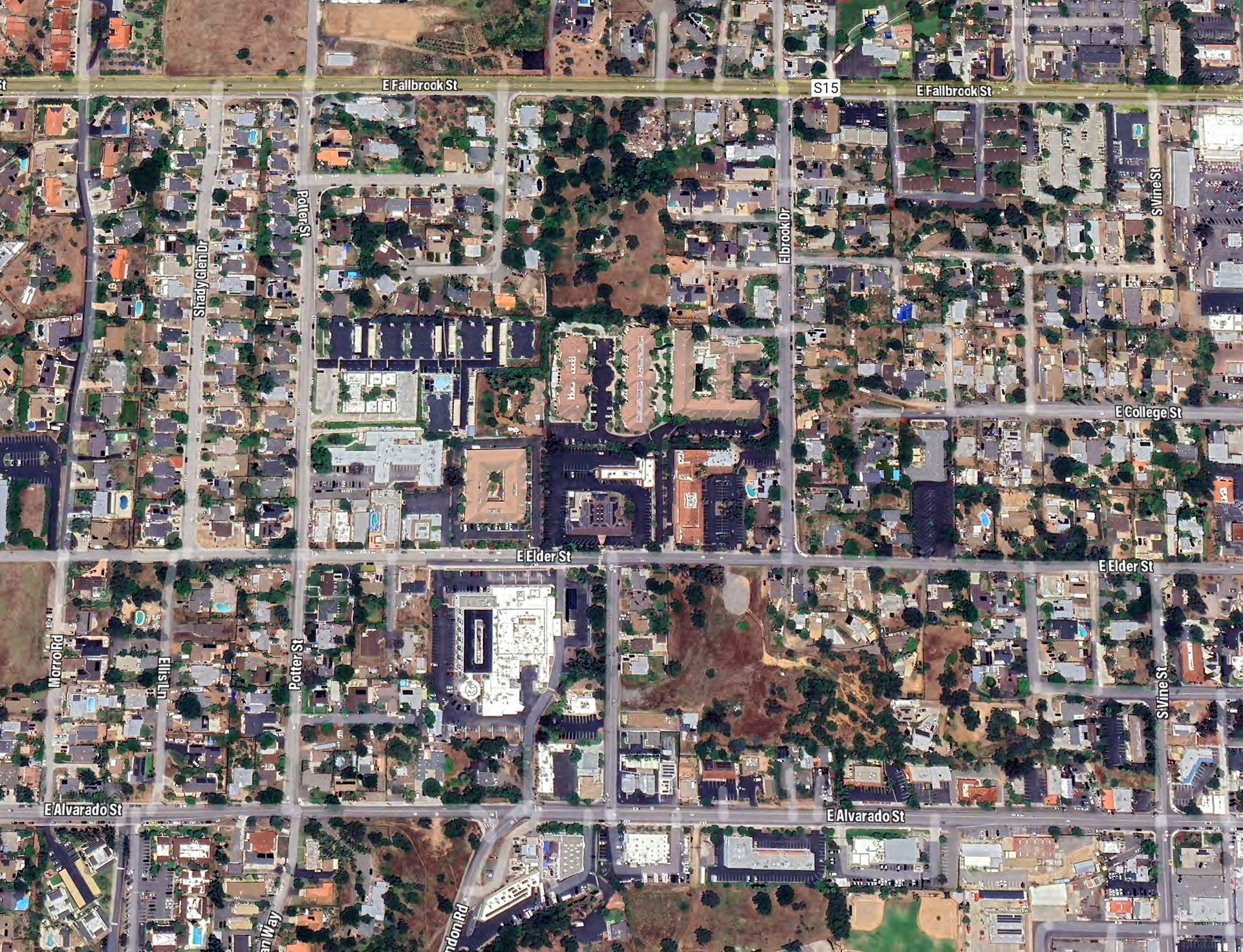

The Property consists of two (2) buildings – both medical – with walk-up, ground level access to each & every suite. The Property offers plentiful parking as well as solar paneling, assisting in the offsetting of utility expenses alongside tenant utility bill-backs. Neighboring properties consist of two (2) senior care living facilities – Silvergate & Regency Pacific, a mental health facility – Crestwood Behavioral Health and next door, neighboring multi-tenant medical-office project – Fallbrook Medical Arts – which traded for $288/SF in June 2023.

The Property is currently 96.8% occupied, with 17 of 18 suites leased to a diverse & synergistic tenant mix, offering new ownership a favorable lease rollover timeline with a 2.15 WALT, with seven (7) tenants enjoying 3-5 year lease expirations. The Property’s base rents are well below neighboring medical projects in Fallbrook and are approximately 39% ($1.19/sf/mo) lower than the direct competition, giving Investors the opportunity to increase base rents and thus, cap rates, over the next hold period.

We encourage all qualified investors to review this stabilized, value-add opportunity as the next addition to their portfolio.

Disclaimer

The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable. However, Lee & Associates has not and will not verify any of this information, nor has Lee & Associates conducted any investigation regarding these matters. Lee & Associates makes no guarantee, warranty or representation whatsoever about the accuracy or completeness of any information provided.

As the Buyer of real estate, it is the Buyer’s responsibility to independently confirm the accuracy and completeness of all material information before completing any purchase. This Marketing Brochure is not a substitute for your thorough due diligence investigation of this opportunity. Lee & Associates expressly denies any obligation to conduct a due diligence examination of this Property for Buyer. Any projections, opinions, assumptions or estimates used in this Marketing Brochure are for example only and do not represent the current or future performance or value of this property. The value of the property to you depends on factors that should be evaluated by you and your tax, financial, consultants and legal advisors. Buyer and Buyer’s tax, financial, legal, consultants and all advisors should conduct a careful, independent investigation of any property to determine to your satisfaction the suitability of the property for your needs.

Like all real estate, this property carries significant risks. Buyer and Buyer’s consultants, legal and financial advisors must request and carefully review all legal and documents related to the property. Any info provided including fees and costs are not guaranteed and should be verified by Buyer. These figures are subject to change at any time based on market, economic, environmental or other conditions. Buyer is responsible for conducting his/her own investigation of all matters affecting the intrinsic value of the property and the value of any potential development or use of the property.

By accepting this Marketing Brochure you agree to release Lee & Associates and hold it harmless from any kind of claim, cost, expense, or liability arising out of your investigation and/or purchase of this property.

+ IDEAL 1031 Replacement Property

+ Current NOI - $367,103.00

+ 7.40% AVG Cap Rate over 5-Year Hold Period

+ 96.8% Occupied with 10-Year Average Vacancy Less Than 5%

+ Offered Significantly Below both:

+ Replacement Cost of $10,422,400 ($400/SF)

+ Recent (Neighboring Property) Sales Comp of $288/SF

+ Two(2) Free-Standing, Multi-Tenant Medical Office Buildings Consisting of 26,056 SF RBA

+ Diversified Tenant Mix of Medical, Dental, Therapy, Lab & Pharmacy

+ $1.4M+ in Capital Expenditures includes: Installation of Solar Paneling, Interior Tenant Improvements, LED Lighting (Exterior & Interior) & Resurfacing/Striping of Parking

+ Well Maintained, Pride of Ownership Asset

577-A: 835 SF (currently dental suite)

» Lease Rate: $1.75/SF + $0.15/SF Utilities

521 E Elder, Fallbrook , CA 92028

Sale Price: $9,700,000

Close of Escrow: June 20, 2023

Asset Type: Multi-Tenant Medical Office

Rentable SF: 33,643 SF

Price/SF: $288.32

Year Built: 1988

Occupancy: 90%

Parking Ratio: 5.00/1,000

Notes: Neighboring Property to Subject Property, History of High Vacancy

3998 Vista Way, Oceanside, CA 92056

Sale Price: $12,500,000

Close of Escrow: October 2, 2023

Asset Type: Multi-Tenant Medical Office

Rentable SF: 37,488 SF

Price/SF: $333.44

Year Built: 1989

Occupancy: TBD

Parking Ratio: 3.87/1,000

Notes: Buyer was TrueCare (Owner-User)

161 Thunder Drive, Vista, CA 92083

Sale Price: $8,300,000

Close of Escrow: December 20, 2021

Asset Type: Multi-Tenant Medical Office

Rentable SF: 33,914 SF

Price/SF: $244.74

Year Built: 1980

Occupancy: 59%

Parking Ratio: 6.3/1,000

Notes: High Vacancy Property at Time of Sale

440 S Melrose Drive, Vista, CA 92081

Sale Price: $4,000,000

Close of Escrow: September 7, 2022

Asset Type: Multi-Tenant Medical Office

Rentable SF: 24,722 SF

Price/SF: $161.80

Year Built: 2000

Occupancy: 37%

Parking Ratio: 4.00/1,000

Notes: High Vacancy Property at Time of Sale

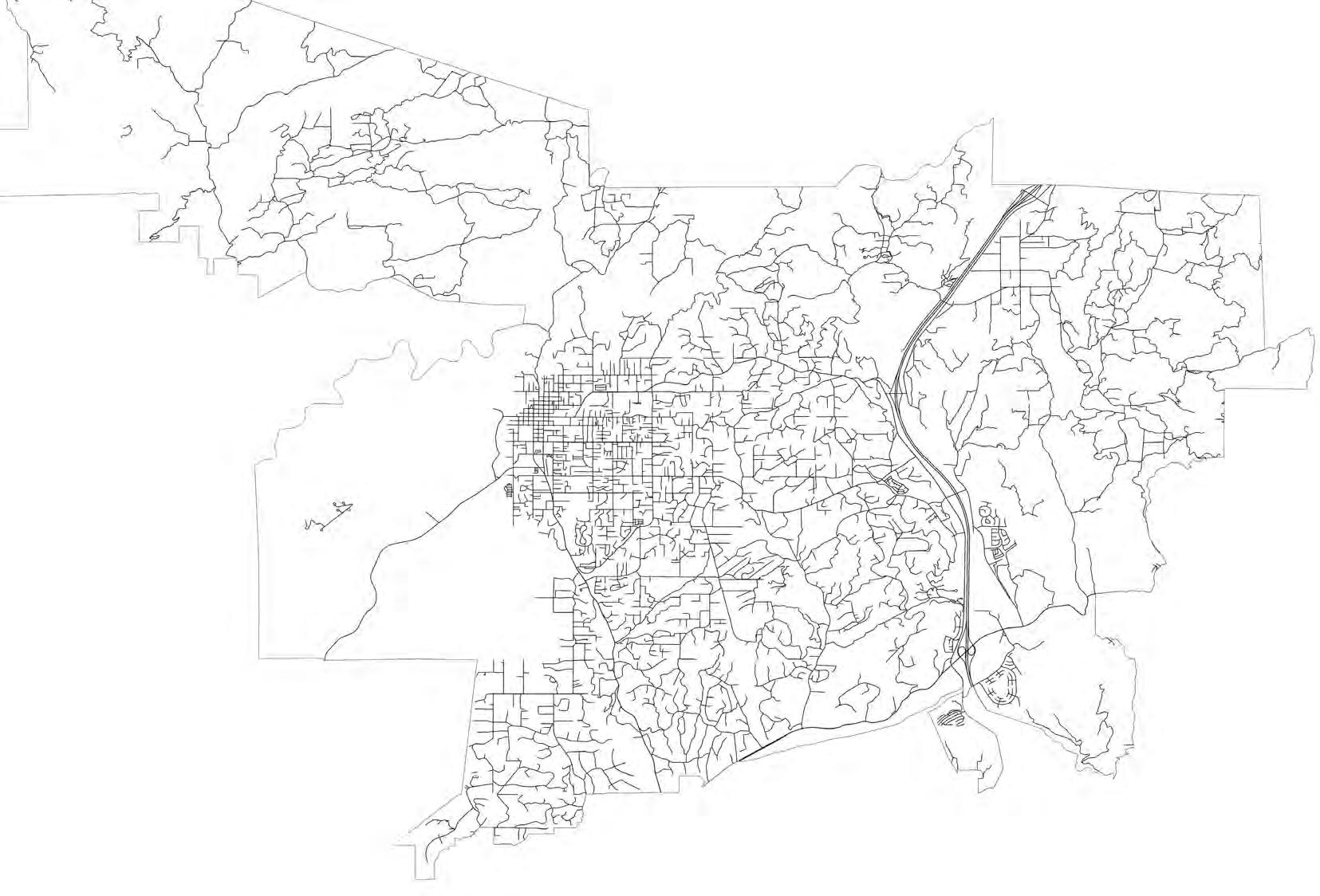

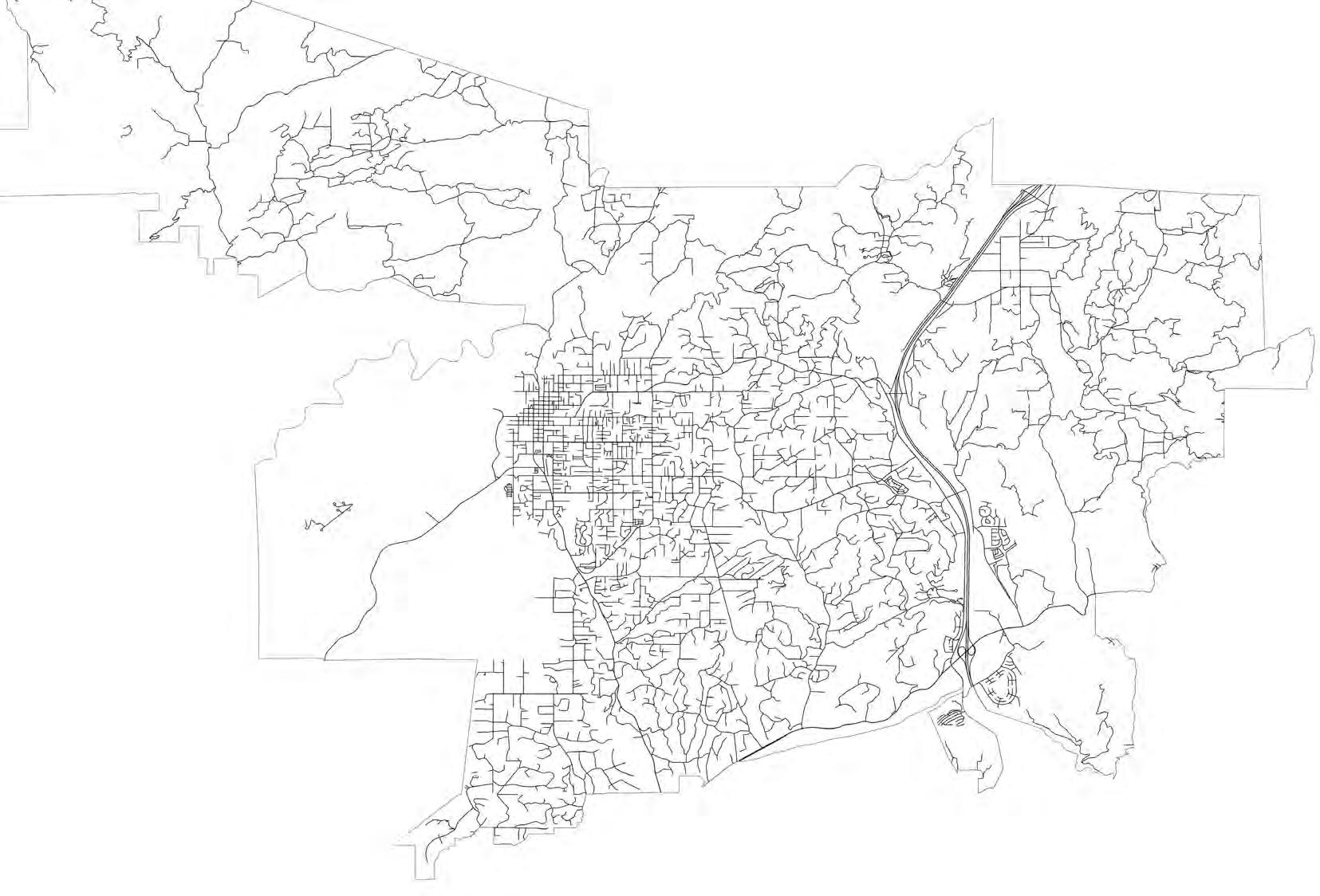

Located in the heart of Fallbrook’s medical zone, home to a diverse mix of medical practitioners & senior care facilities.

Behavioral Health

32,359 Population

0.5% Population Growth

35.2 Average Age

$83,362 Household Income

10,134 Households

$848,389

Median Home Value