2024 Proof Points –Investor Update

Building Partnerships to Scale and Reduce Risk

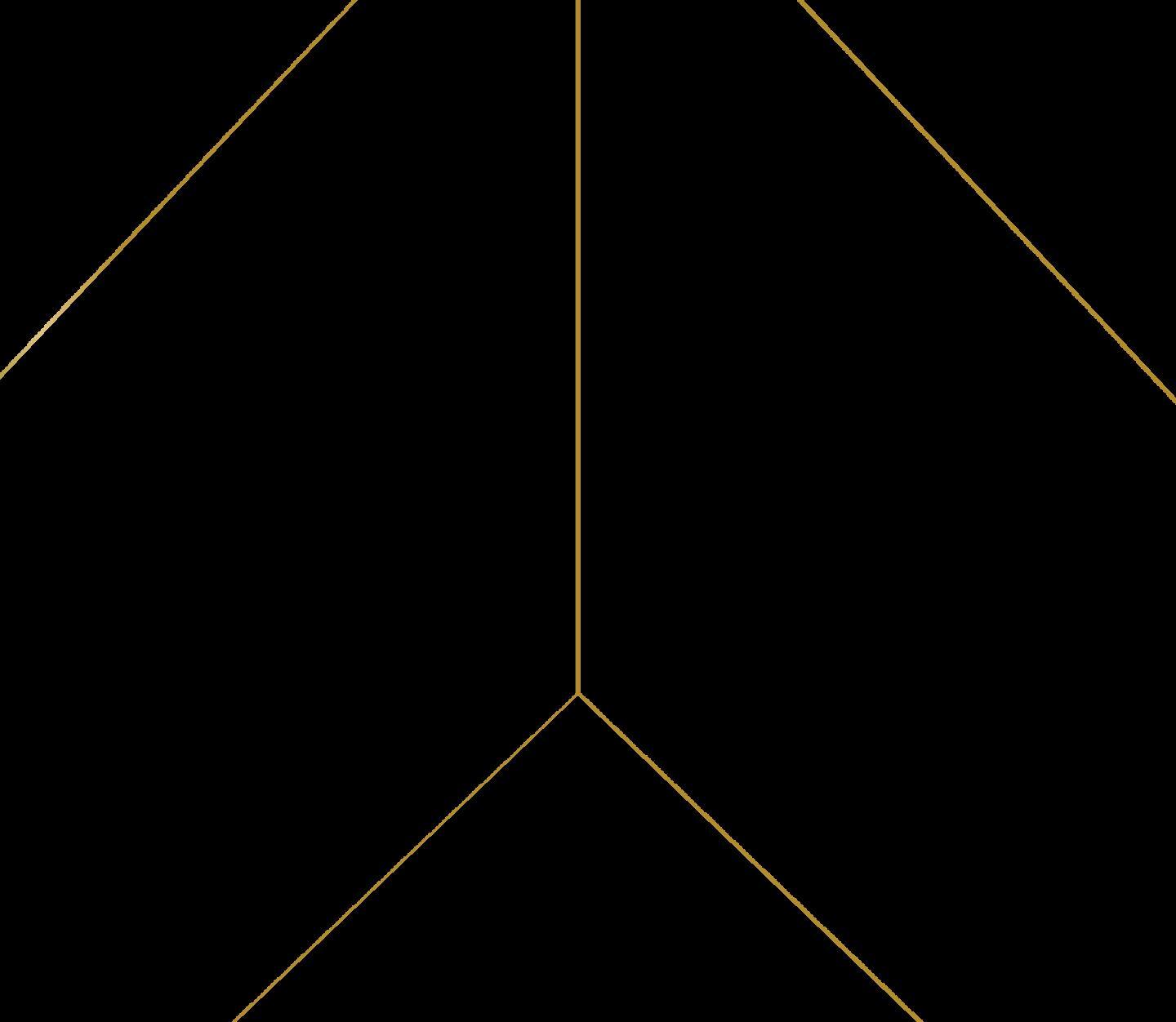

Parent Company Ownership & Contract/Partnership

Commercial Property Ownership (100%)

Housing Technology (100%) Ownership Marketing (100%) Ownership

Smart Home Tech

Ascend2Housing Development Contracts

Ascend2Laramie-WY 4 homes

Housing Development Services (100%) Ownership

Ascend2Arvada-CO 4 homes

Dealerships Ownership & Branch Office Realtor Team (100%) Ownership

Ascend2Englewood-CO 4 homes

Ascend2Denver-CO 6 homes

Ascend2Granby-CO

homes

Class A GC-2 Busy Guys

Ascend2Lakewood-CO

Coffey Civil Engineering (50%)

Nehemiah Project Management (19%)

Ascend2Bennett-CO 400 homes

American Sky Financial

AscendBranchOffice(50%)

This material has been prepared by Ascend Nõvus, Inc. (“ANI”). This material is subject to change without notice. This document is for information and illustrative purposes only. It is not and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation. This information is provided with the understanding that with respect to the material provided herein (i) ANI is not acting in a fiduciary or advisory capacity under any contract with you, or any applicable law or regulation, (ii) that you will make your own independent decision with respect to any course of action in connection herewith, as to whether such course of action is appropriate or proper based on your own judgment and your specific circumstances and objectives, and (iii) that you are capable of understanding and assessing the merits of a course of action and evaluating investment risks independently. ANI does not purport to and does not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services. You should consult your advisors with respect to these areas and the material presented herein. You may not rely on the material contained herein. ANI shall not have any liability for any damages of any kind whatsoever relating to this material. No part of this document may be reproduced in any manner, in whole or in part, without the written permission of ANI, except for your internal use. This material is being provided to you at no cost and any fees paid by you to ANI or its affiliates or assigns are solely for the information updates of ANI to it current investors and subject to a written agreement in your stock ownership agreement. All of the foregoing statements apply regardless of (i) whether you now currently or may in the future become a client of ANI and (ii) the terms contained in any applicable agreement or similar contract between you and ANI. ANI is not guaranteeing any return or interest on the monies provide. Investing in ANI may result in the loss of your investment.

John Vasquez

CEO

• 20 years-experience in housing sector

• Owner/ Operator Debt and equity specialist funds

• Anchor Investor for Re-start HUD program

• Successful GP/LP delivery and execution

• 25 years in building Acquisition Platforms for

• accelerating growth.

• Capital Markets mentor and co-author for the Stanford Latino Entrepreneurial Initiative.

• Co-sponsor for Innovation hubs for Regis University and Denver University (DU) Daniels College of Business.

Jeff Halverson

Executive VP Finance

• Sr. Financial analyst for $100M nationwide real estate fund.

• 24 years of Commercial banking with Community Banks, Millennium Bank, Colorado Capital Bank, Solera Bank and Evergreen Bank

• MBA Minnesota State University Moorhead

• Developed Origination Platform American Sky to provide loan origination for community banks that lack the human capital talent or underwriting experience to originate Construction loans.

Alan Eisenstein

• 30+ years-experience in the design and build of residential and commercial developments

• Built and operated a $25M+/year nationwide manufacturing and distribution business

• Specializes in manufacturing and efficiency refining and development

• Managed luxury retail design and development for $2B casino project in Manila, Philippines

• University of Florida, College of Architecture

• Operated/Practiced in New York, Miami, Hong Kong, Denver

Patrick Wieland

Head of Human Capital

• 25 years of human capital experience

• Managed benefits programs for over 4000 employees

• Worked with a variety of small to medium size businesses to develop strategic plans

• Mentored CEO’s and management teams of small to medium-sized businesses to execute strategy.

• Developed and implemented recruiting strategies in many industries.

• Successfully executed many post-merger integration transactions.

• Have led teams involved in the full life cycle of human capital inside a variety of organizations

Partnerships in Building Attainable Housing Communities

As investment development owners, avid educators, and with over 23 years of experience in the mortgage industry we understand the Real Estate market lending.

As owners of over 10 master plan development communities, and with over 1500 homes developed over the last 35 years of industry experience we understand underwriting risk.

Financial Lenders Master Plan Developers

As Principals in funding our own development risk with equity and debt instruments, since 2004, we have over 20 years of managing our capital generating IRR for investors.

Fund Management

As business owners of 4 Modular Housing dealerships, Civil/Structural Engineering, Architectural firm & General Contracting Class

A licenses with an average of 28 years of industry experience we understand process.

As Partner level experience practice with an emphasis on Banking, Real Estate, corporate and general transaction law, we have over 30 years of legal experience in legal structuring.

Legal Manufacturing

Partnerships with Contractors, Realtors & Lenders

Nick

Nehemiah GC-PM Team

Jack TRC-Land Development

Joella Ascend-Coldwell Banker RE Agent

Stuart Alpine Market RE Agent

Nicole Principal Lender Team

Alicia Lender Team

Jeff Construction Loan Origination

Introduction to Single Family Home Development

01 Market Research

Building from empirical market data to determine the existing market conditions, before entering into new market opportunities.

02 Project Planning

Utilizing multiple touchpoints for Strategic Business Units (“SBU’s”) to accelerate execution as discussed in the following Ascend details.

03 Partnership Building

Working with both internal SBU’s and large platform national partnerships, will permit best execution for multi-site development and delivery.

Vision

Company Mission and Vision

To transform communities by providing innovative and sustainable housing solutions for every family.

Mission

We aim to build lasting partnerships while delivering exceptional homes that cater to diverse market needs.

Values

Our commitment to quality, sustainability, and community development drives our approach in every housing project.

Market Overview and Target

Single-family homes in high-demand

Focus initially on workforce housing and first-time homebuyers, with expansion to address Developers of all buyer's financial ability and market demands.

Utilization of proven technology platforms to improve all aspects of full cycle housing deliver to support customer engagement.

Diverse initial offerings including single-family homes, duplexes/townhomes and ADU’s. Growing into higherend and Luxury and Multi-family products.

Target initial housing units to include young families and professionals seeking attainable and affordable housing options. Growing into products to accommodate demand.

Strategic plan aims to execute on contracted opportunities to lower risk and for significant sales increases over next three years.

Strategic Business Units (“SBU’s”) Execution

Builder Proof Of Concept and Project

Targeted sale price of $450,000 with $75,000 margin. Using Proof of Concept (“POC”) to target sale to local Developer or Larger Platform Developers.

Diverse housing models for workforce and first-time homebuyers. Using scattered site Proof of Concept (“POC”) to build sales for one off units for Direct to Consumers.

Community-oriented designs promoting social interaction and engagement. Using Proof of Concept (“POC”) to target both local Developers and Direct to Consumers.

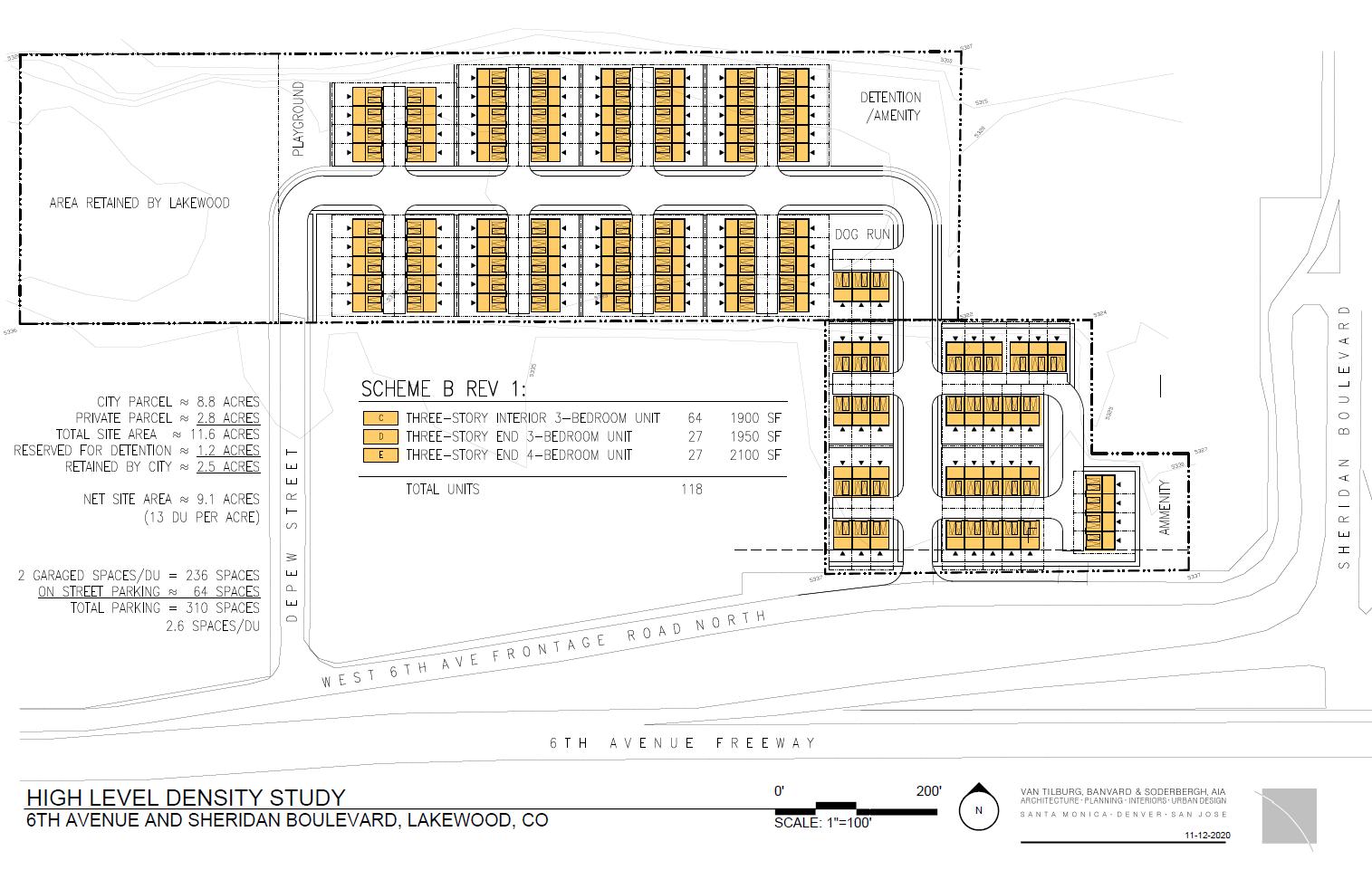

Multiple development phases aligned with market demand and timelines. Using POC to work with the City of Lakewood for Land Bank to align Municipalities efforts to promote workforce demands.

Partnerships with large Developers to provide speed and improved cost of builds. Using POC to target Developers or Larger Platform Builders, Direct to Consumers and Municipalities as our proof points.

Granby

Location-based POC Developments in Laramie

Pricing

Estimated sales price of $450,000 per home with a targeted profit margin of $75,000.

Phased Development

Implementing multiple phases of construction with specific timelines TIED to market absorption showing empirical data to ensure project completion as the Builders working with Developers.

Community Focus

Designs tailored to meet market pricing for workforce housing needs in collaboration with the Economic Development Office and catered towards students and faculty homebuyers of Wyoming Technology Institute’s growth directly across the street.

Location-based POC Developments in Arvada

Focus on developing customer product that can be proof points for our master-planned communities, alignment with local political push and add to variety of housing options. Execution specifically designed for workforce housing and first-time homebuyers, ensuring communityoriented designs that support adoption into neighborhoods that will help foster inclusivity and education on Modular Housing Design and Products that will generate neighborhood excitement and provide accessibility to buyer interest.

Gov. Polis Announces Upcoming Proposition 123 Funds Will Prioritize

Modular and Innovative Housing Projects:

Today, at the Housing Innovation Summit, Gov. Jared Polis, the Colorado Office of Economic Development and International Trade (OEDIT), and the Department of Local Affairs (DOLA) announced that 2025 Proposition 123 funding will prioritize cost-effective modular housing projects. With state support, modular and innovative housing manufacturers across Colorado are developing and advancing innovative construction methods that can help make housing quicker to build, more cost-effective, and more sustainable.

Location-based POC

Developments in Englewood

Market Research

Analyze local demographics and housing demand trends in Englewood to address House Bill hb24-1152 adoption of Accessory Dwelling Units (“ADU’s”), under 800 sq ft each.

Identify optimal locations for new developments based on zoning regulations to provide POC with City Municipality approval and adoption of 1152.

Create mini-master plan focusing on proof points that build product diversification of ADU/Micro Homes as market adoption for solutions providing alternative single-family homes and community features that simulate into the local neighborhoods.

Engagement with Developer on first of its kind courtyard for ADU/Micro homes. Providing municipalities experience for project execution and future growth of housing communities.

Location-based POC Developments in Lakewood

Incorporate

Work with city council-manager for clear project goals and benefits for development of Land Bank use.

Location-based POC Developments in Granby (Eagle Ridge)

Large Developer family office engagement of Ascend to step in to multiphase development of multi-family homes, as shown in picture

The Village at Eagle Ridge, In Grand Elk Golf Club, with full club membership, pool and spa amenities.

Starting with

Collaborate with Developer to assist with taking over entire phased development. Currently using Heritage Manufacturing to provide modular housing units as one-of-a-kind turn-key Developer opportunity

Future Markets Approach

1. :Colorado-Multiple proof points and Corporate design Center in Golden.

2. Wyoming – 200 master plan development in Laramie with proof points on product sales.

3. Arizona – 80 master plan development with Micro homes and ADU communities.

4. Utah – 35K “starter-home” goal, fueled by Governors’ housing goals with investment behind it.

5. Idaho – Boise Investors provide experience and capital for entry into master plan development.

Arizona Passes House Bill 2720

House Bill 2720 legalized casitas or accessory dwelling units, to quickly meet immediate shortage of 270,000 (Source: Affordable housing arizona bipartisan law)

Utah Governors propose $150M into starter homes

To meet demand and goal of building 35,000 starter homes, Gov. and Lt. Gov propose $150M investment to achieve this ambitious 5-year goal (Source: Govnors starter-homes goal)

Idaho's housing market is in high demand

Housing demand fueled by lifestyle and adorning landscapes support housing investors continued development to meet the needs of the Housing market and backed by trends that support its growth. (Source: Investor Demand for Housing growth)

Scale Proof Points from POC’s

Project Management

Building from past POC lessons learned to establish a proven Project Management team with ownership in Nehemiah to address delivery bottleneck.

Macro-Economic Changes

Learning from experience and empirical data to minimize future risk as a Developer to market “Pivot” position of a Builder.

Alignment with Manufactures

Production

Communicate with Manufactures to ensure market “Pivot” aligns with their production capabilities to meet increased demand for Developer channel sales.

Performance Metrics

Establish measurable performance metrics for Developer sales commitment for obligations to deliver minimum yearly production per contract.

Milestone Tracking

Define key home sales milestones that must be met throughout the project lifecycle with Developers as Builders.

Financial Partnership Management

Implement all necessary co-marketing with PE Partners for Developer channel sales marketing.

Proof-up Scale and Build Team

Experience

Outline clear Scale Matrix and Team

Responsibilities to allow reduction of risk while building during Market recovery.

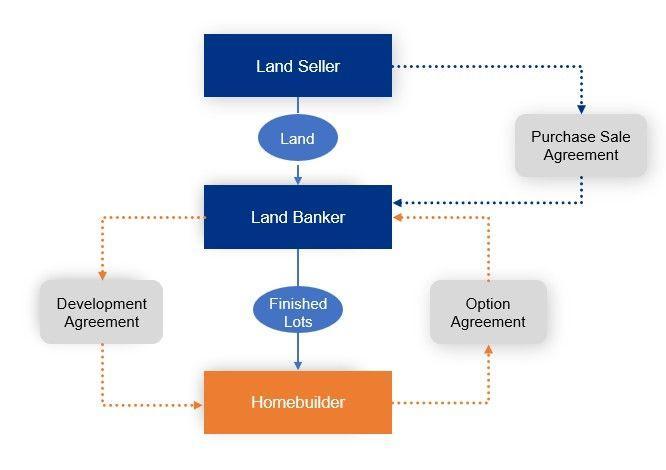

As the "land-light" model continues to gain traction, and as traditional sources of land development loans remain scarce, land bankers’ creative off-balance sheet strategies are becoming increasingly significant.

����������������������������������?

Land banking involves acquiring and holding land for future construction, providing builders with capital and an off-balance sheet vehicle. Land bankers act as capital partners, offering a debt-like instrument with two primary purposes:

1. Acquiring paper lots and funding land development

2. Holding finished lots

Typically, the builder sources land for future development, securing zoning and entitlement. Prior to or upon closing of the land parcel, the builder and land banking partner agree on a development budget, takedown schedule, and price per finished lot. The land banker holds title to the land and earns fees until all finished lots are purchased.

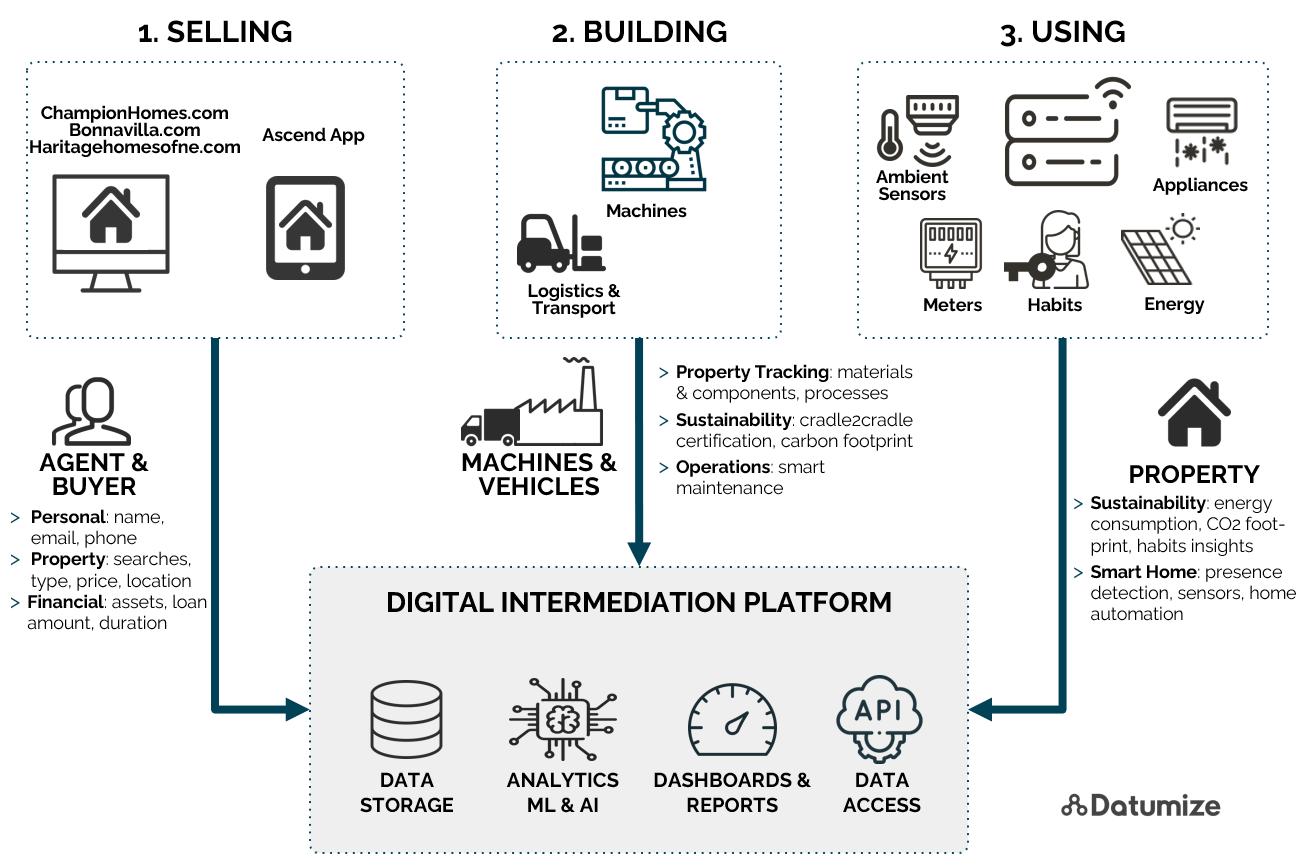

Data Collection and Analysis Importance

Market Trends

Analyzing real-time data on market trends allows for informed decisionmaking regarding pricing strategies, target demographics, and overall project viability within different regions. While building our cash flow to prepare to pounce with reduced risk.

Developer and Scale Experience

Analyzing Home sales and becoming experts on every aspect of our delivery while taking out risk with delays and uncertainty of product absorption in the market. Allowing our Team to scale from experience with Developers.

• ����������������������������������: Land banking offers greater advance rates compared to traditional A&D loans. It allows builders to control land positions with less capital, freeing up funds to invest in additional land opportunities. Financing is non-recourse, and the takedown obligations are not considered debt by banks, nor are they typically included in credit ratios.

• ����������������������������: The flexibility of land banking reduces builder risk in fluctuating market conditions. Builders can opt out of the deal by forfeiting the deposit placed with the land banker, minimizing exposure.

• ������������������������������������������������: Predefined schedules and pricing ensure cost transparency with lot takedowns matching planned starts.

Source: Whelan Advisory Capital Markets

Example Structure for Land-Light Approach:

Manufacturing

Cost-effective production of housing units.

Developer Integrated Housing Model

Current Key Components

Design

Innovative strategies for diverse housing solutions.

Sales

One sales point to Developers vs. multi-sales to customers.

Financing

Integrated PE programs to enable Developers a better COF @ 65% LTV.

General Construction Workflow For Developers

Define project scope, timelines, and budget allocations for construction with Developers.

02 Execution

Planning

Begin physical construction activities adhering to timelines and plans with In-house Class A GC for Developers.

Regularly assess progress, quality, and safety throughout the building process with In-house PM teams.

03 Monitoring

04 Completion

Finalize construction, conduct inspections, and prepare for title closing with In-house Superintendents.

Project Manager Interactions

Realtor Engagement and Construction loan Process

In-Flight Proof Points for Ascend Building

Key Components

Proven Technology and Partnership Support

01

Digital Outreach

Utilize targeted online Unique advertising campaigns to engage potential homebuyers, focusing on demographic data to enhance reach and generate quality leads through social media channels. To provide value add to support.

Builders Trend

02

Utilizing fully integrated builders' technology with both Developers and Housing Services providers that supports delivery and scale to reduce the time in the learning curve for our Team.

03 Strategic Software

Permits time to design and build the Ascend Strategic Software from a position of strength in both cash flow and experience prior to launching our Go-To-Market (GTM) strategy.

Building Consumer Acquisition through Technology

Defining the Customer Journey Overview

Fully Integrated Home Selection and Material Experience

Design Preferences

Identify architectural styles and design features that appeal to the customer utilizing Strategic Designers Arizona Tile ® .

Interior Finishes

Select flooring with Lauzon Flooring, cabinetry, and countertops from Architectural Surfaces® in our Design Center.

Appliance Selection

Discuss options for energy-efficient appliances that fit the budget with Appliance Factory ® /Fine Lines ® contracts.

Project Management

Conduct a final review with customers before materials are ordered with internal PMs from Nehemiah Team.

Manufacturer

Dealerships

Established Dealership structure to offer available floor plans and customize to meet customer.

Land Development

Partnering with TRC Companies, for land development and engineering, procurement and construction (EPC) team.

Lending Services

In-house turnkey lending with The Rueth Team, providing Conventional and FHA loans with Hero products of Down Payment Asst and Credit Repair products.

Upgrades and Options

Present available upgrades that enhance functionality and appeal with SmartPads ® designs and modern sophistication.

Proof Up Loan Programs and Financing Solutions

Building and Planning are keys to Success

Building Shareholder Value

5 Year Overview & Projection

for the first two years Each year, we have consistently grown revenue while strengthening our organizational foundations and teams, strategically reinvesting earnings into infrastructure and acquisitions to drive long-term success.

and Ready to Execute

Prioritizing the development of robust processes and systems will position us to capitalize on favorable market dynamics and accelerate scalable growth.