A companion to the Child-Lens Investing Discussion Paper, the Child-Lens Investor Toolkit (the “Toolkit”) is designed to help private investors – both asset owners and managers – operationalize the child lens. Applicable to a range of capital types and sectors, it facilitates use of the child lens to form new strategies or enhance existing ones. The Toolkit may be used on its own or in combination with other investment approaches or “lenses” (e.g., gender, racial equity, and climate) to deepen or differentiate investors’ desired impact.

The Toolkit empowers investors to implement the child lens in the near-term, while also serving as a foundation on which additional market infrastructure can be created. Recognizing the nascency of the child-lens investing field, investors are invited to tailor the tools to meet their unique needs and to contribute to enhancing them over time. Additionally, investors are encouraged to exchange best practices and lessons learned in utilizing the tools. It is through these collective efforts that the field can mature and other investors can awaken to the opportunity for significant impact and commercial returns through making investments that help enable positive outcomes for all children globally.

The Toolkit’s five component toolset – the Impact Strategy Guide, Contribution Framework, Impact Assessment, Risk Inventory, and Measurement Approach – were designed to be in alignment with industry-leading impact investing, ESG, and child rights standards. This initial set of tools helps investors to implement five of the nine Operating Principles for Impact Management (OPIM) – a widely adopted standard for integrating impact considerations into investment processes – with a child lens. In doing so, it incorporates impact investing frameworks from the Impact Management Project (IMP) – a global impact investing practitioner community supporting consensus on norms – and SDG Impact Standards – a UNDP-led initiative to accelerate private investor contributions to achieving the Sustainable Development Goals (SDGs). Additionally, child rights considerations were drawn from UNICEF, Save the Children, and the U.N. Global Compact’s Children’s Rights and Business Principles, as well as other derivative standards and frameworks.

*The number of standards to which the Toolkit is aligned will likely grow over time, concurrent to the child-lens investing field.

The Toolkit was designed for use by both asset owners and managers implementing either direct or intermediary investment strategies, now and in the future. The Toolkit applies broadly to strategies spanning the child-lens taxonomy, and is not just for child-centered investors or established practitioners. The Toolkit is thus for all investors who seek to create impact for children by sharpening their intentionality, strengthening their investor contribution, and expanding their capacity for effective measurement.

Implementing each of the five toolsets in sequential order enables the most robust implementation of the child lens, supporting investors across the taxonomy to design and/or augment impact strategies and investment processes that better promote children’s well-being. As some tools may be better suited for certain investors than others (depending on their position within the child-lens taxonomy), the table on pg. 6 provides a tactical overview of the order by which different investors may sequence the tools.

The five toolsets comprise the following components:

Toolset overviews, which summarize the toolsets’ purpose, standards alignment, and component tools;

Tool pages, which introduce the component tools and provide implementation guidance for investors across the child-lens taxonomy;

Resources for advanced practitioners, which provide guidance on certain tools’ more sophisticated application; and

Case studies, which demonstrate how tools can be implemented through use of real examples.

The Toolkit comprise of the following toolsets and components:

Self-classification

Matrix supporting investors in determining where they fall in the child-lens taxonomy

1. Child-lens impact strategy guide

A sequence of tools to support investors in designing a child-lens investment strategy aligned to their impact goals, capacities, and capabilities

1.1. Goals and parameters exercise

1.2. Impact thesis templates

1.3. Whole child work-sheet

2. Child-lens contribution framework

Guide to developing a child-lens investor contribution strategy to enhance investments’ efficacy and support the growth of child-lens investing

3. Child-lens impact assessment

Tools to support investors in conducting rigorous assessments of potential impact for children during the screening and due diligence phases

4. Child-lens impact risk inventory

Tools to support holistic assessment of ESG and impact risks specific to child and caregiver rights during the due diligence phase

5. Child-lens measurement approach

Guide to the selection of metrics to measure child-relevant outcomes during strategy design and all phases of the investment process

2.1. Contribution worksheet

3.1. Simplified impact assessment

3.2. Impact assessment framework

4.1. Risk questionnaire (Excel-based)

4.2. Impact risk matrix

5.1. Metrics bank (Excel-based)

5.2. Measurement principles

The following table outlines the suggested steps that investors may take to implement the child lens within new and/or existing strategies and investment processes:

Step 1: All investors should first utilize the Child-Lens Taxonomy Matrix (pg. 7) to self-classify as child-screened, -adjacent, -integrated, or -centered. Afterwards, follow the steps under the appropriate child-lens investor classification.

Child-screened

Funds and investments adopting best-in-class ESG practices that pay special consideration to the effects that business operations may have on children globally

STEP 2: Risk questionnaire

Optional steps:

•Metrics bank and measurement principles

Child-adjacent

Funds and investments that strengthen social systems vital to children’s well-being without directly considering them as a discrete impact theme in strategy formation

STEP 2: Goals and parameters exercise

STEP 3: Impact thesis template

STEP 4: Simplified impact assessment tool

STEP 5: Risk questionnaire impact risk matrix

Optional steps:

•Whole child worksheet

•Contribution worksheet

•Metrics bank and measurement principles

Child-integrated

Funds and investments targeting child outcomes as a discrete impact theme contributing to the achievement of broader portfoliolevel impact objectives

STEP 2: Goals and parameters exercise

STEP 3: Impact thesis template

STEP 4: Contribution worksheet

STEP 5: Simplified impact assessment tool OR impact assessment framework

STEP 6: Risk questionnaire impact risk matrix

STEP 7: Metrics bank and measurement principles

Optional steps:

•Whole child worksheet

Child-centered

Funds and investments centering children as the organizing theme for investment strategy setting and decision making

STEP 2: Goals and parameters exercise

STEP 3: Impact thesis template and whole child worksheet

STEP 4: Contribution worksheet

STEP 5: Impact assessment framework

STEP 6: Risk questionnaire and impact risk matrix

STEP 7: Metrics bank and measurement principles

Investors seeking to apply the child lens to existing funds should select answers that most closely describe their current or desired approach to arrive at the most appropriate classification. Where applicable, consider how current or intended use of other investment lenses (e.g., gender, racial equity, climate) can contribute to child outcomes.

Investors seeking to apply the child lens to new funds should select answers that most closely align with their investment goals and investor capabilities.

Investors should average their scores to arrive at an appropriate child-lens classification, e.g., 2 adjacent and 1 integrated response would result in a “child-adjacent” classification. 1 centered, 1 integrated, and 1 adjacent would result in “child-integrated”

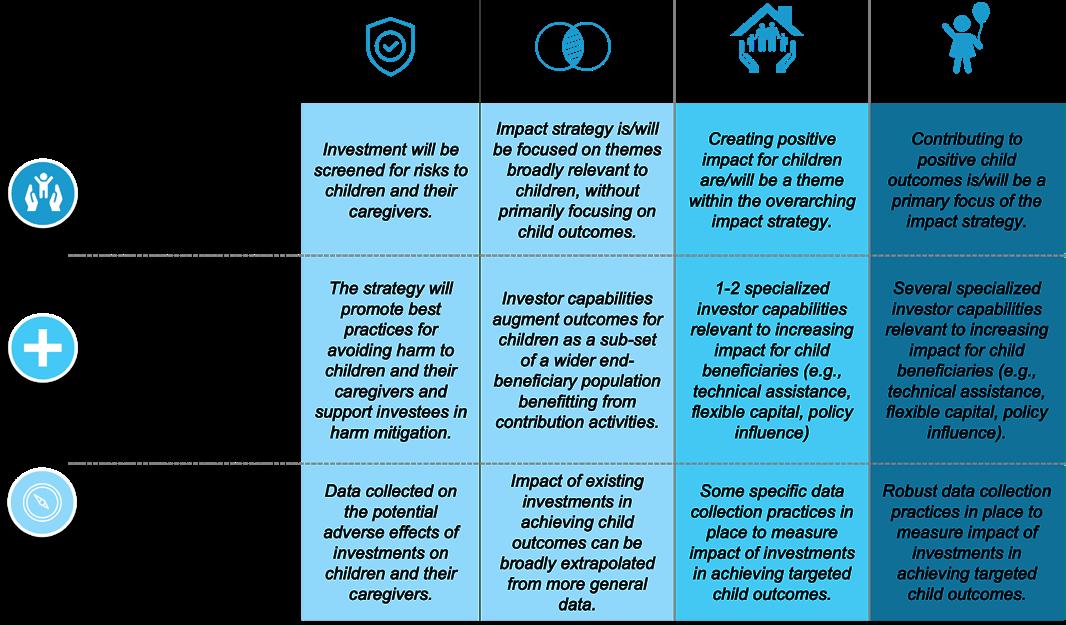

The Child-Lens Taxonomy Matrix consists of a series of questions designed to support investors in identifying where in the child-lens taxonomy their current or prospective strategies may lie. All investors should complete this exercise prior to utilizing other tools in the Toolkit. This matrix supports investors in answering the question, “To what extent does or can the investment approach directly focus on child outcomes?”

*Please refer to Tool No. 2 for additional guidance on assessing investor contribution.

To support the development and articulation of an intentional child-lens investment strategy through a methodical, multi-step process to identify clear impact goals, actions, and intended outcomes.

Child-lens goals and parameters: Prompts to support investors in identifying appropriate child-relevant impact goals

- Case study: Rethink Capital Partners, Rethink Education Fund (child-integrated)

Child-lens impact thesis template (child-adjacent and -integrated; child-centered): Templates with prompts to support creation of compelling child-lens impact theses

- Case study (child-adjacent): BlueOrchard and KfW Development Bank, InsuResilience Private Equity Fund II

- Case study (child-adjacent): Elevar Equity, India V Fund

- Case study (child-integrated): BlueOrchard and KfW Development Bank, Regional Education Finance Fund for Africa

- Case study (child-centered): Cross-Border Impact Ventures, Women’s and Children’s Health Technology Fund

(For advanced practitioners) “Whole child” worksheet: Supplementary resource to support organization of structured and holistic investment activities.

- Case study (child-adjacent): BlueOrchard and KfW Development Bank, InsuResilience Private Equity Fund II

- Case study (child-centered): Cross-Border Impact Ventures, Women’s and Children’s Health Technology Fund

Additional resources

GIIN, “A Guide for Impact Investment Fund Managers: Creating a Strong Investment and Impact Thesis”

UNICEF, “Engaging Stakeholders on Children’s Rights: A Tool for Companies” (2014)

UNICEF and Global Child Forum, “Child Rights and Business Atlas”

UNICEF DATA – UNICEF Data Warehouse, “Using data to achieve the SDGs for children”

Tideline, “Truth in Impact: A Tideline Guide to Using the Impact Investment Label”

Aligned standards and frameworks

In establishing an appropriate child-lens goal, investors should consider the SMART goals framework – ensuring that resultant statements are specific, measurable, achievable, relevant, and time-bound.

Responses should be substantiated with relevant data to the extent possible.

Investors may more comprehensively analyze their contribution by utilizing the tools under Toolset No. 2: Child Lens Contribution Framework.

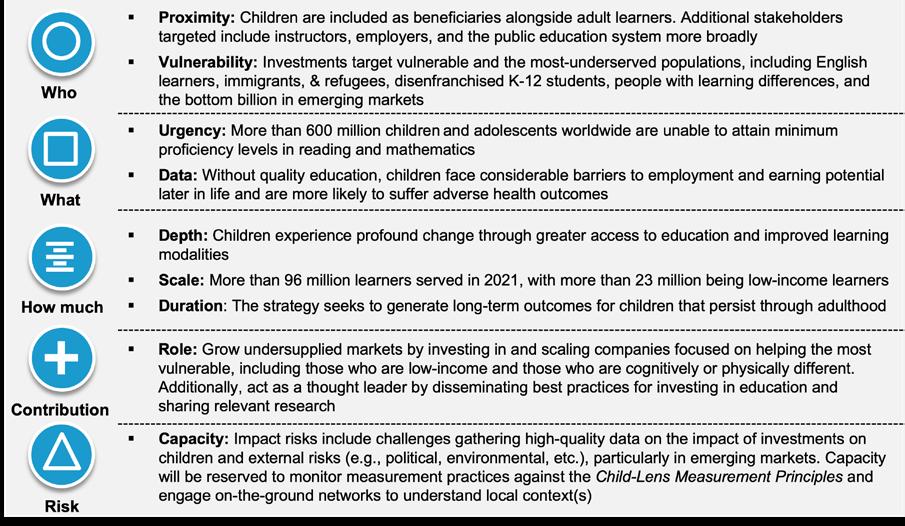

Following self-classification, investors should look to clarify the impact goals and parameters underpinning their child-lens strategy – answering the core question, “What are the strategy’s impact goals and parameters as they pertain to children?” Following the IMP’s Five Dimensions of Impact, each prompt in the Child-Lens Goals and Parameters Exercise supports investors in more intentionally considering the impact they wish to create, how it will be created, whom it will affect, and what the associated risks of any approach may be. TIP

Additional information on the five dimensions can be found in Impact Frontiers’ “Five Dimensions of Impact.”

Fund overview: Rethink Education invests early-stage capital in education technology companies helping those who have been underserved to unlock their full human potential. Aiming to effect large-scale systems change, the fund invests in catalysts that transform institutions and communities to enable people to learn in a kinder, more interesting, more effective, and more inclusive way. Embodying their commitment to social equity, Rethink maintains a 75 percent Black and 50 percent women team and a portfolio of 21 percent Black- and/or Latinx-led and 38 percent woman-led companies.

Areas of investment:

Pre-K-12: Building a foundation for life long learning and skills development;

Making post-secondary pathways more accessible and outcomes-oriented; and

Workforce + lifelong learning: Upskilling critical workers

Demographic/geographic focus: Marginalized or underserved populations; 80 percent domestic opportunities/20 percent emerging markets.

Impact goals: To improve learning outcomes and catalyze economic mobility for the most underserved

NOTE: Rethink Education does not currently identify as deploying a child lens; this is an illustrative case study showing how Rethink Education could apply the child lens to the existing strategy.

Illustrative Taxonomy:

Child-integrated

Intentionality:

Impact goals include improving learning outcomes for children

Contribution: Deploying capital to expand EdTech solutions for the most vulnerable; issuing thought leadership to support other actors in the market in creating impact for children

Measurement:

Directly measure number of children reached

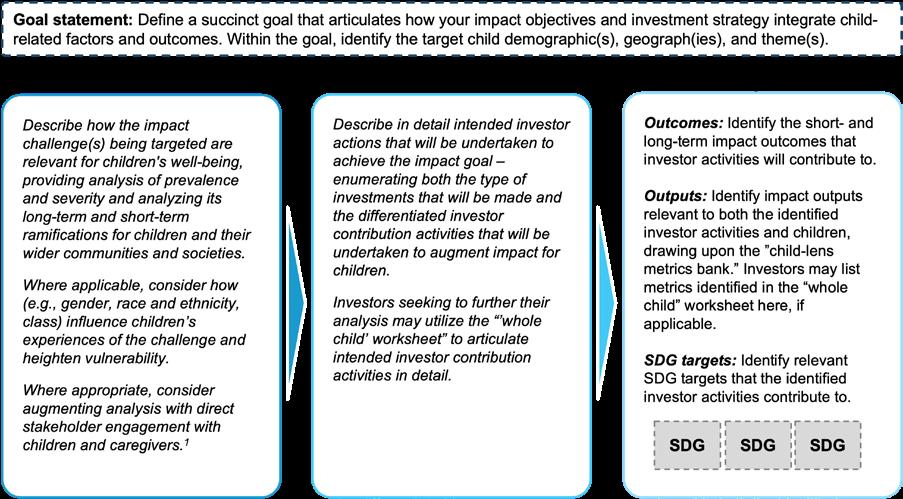

Investors should respond as completely as possible to the prompts under each section. Draw upon responses to the Child-Lens Goals and Parameters Exercise (pg. 9) to draft responses.

Within the “Challenge” section, supplement responses with additional external research. Within “Activities,” investors may also draw upon responses to the Child-Lens Contribution Worksheet (pg. 21). Investors may also refer to Toolset 5: Child-Lens Measurement Approach, to identify relevant indicators.

Child-adjacent investors should describe how children will specifically benefit from more general investment activities. Child-integrated and -centered investors should identify discrete child outcomes that will contribute to broader, portfolio-level objectives.

The thesis template may also be adapted to analyze the expected impact of a specific investment on children.

The Child-Lens Impact Thesis Template helps investors across the child-lens taxonomy define how their activities relate to child-related factors and outcomes. It can be used to create a new child-lens impact thesis or to augment an existing impact thesis with supplemental child-lens analysis – allowing investors to answer the following questions: “What challenge is the strategy addressing?” “How is it being addressed?” “What are the desired outcomes for children?”

For further guidance creating an impact thesis based on a theory of change, see GIIN’s “A Guide for Impact Investment Fund Managers: Creating a Strong Investment and Impact Thesis.”

Fund overview: IIF II is a blended finance fund with the mission to improve access to insurance for poor and vulnerable households, as well as micro, small and medium enterprises (MSMEs) in developing countries to reduce their vulnerability to climate change. IIF II has a strong focus on technology to drive accessibility to climate insurance by providing growth capital and technical assistance to investees. Backed by KfW Development Bank, IIF II’s blended finance structure includes de-risking mechanisms, such as first-loss protection.

Areas of investment:

Qualified insurance and reinsurance companies, as well as other companies active in insurance and reinsurance value chain.

Demographic/geographic focus: Target clients for the fund include lowincome, poor, and vulnerable households, as well as MSMEs based in official development assistance countries and exposed to extreme weather conditions.

Impact goals: Contribute to reduced climate change vulnerabilities in poor and vulnerable individuals, as well as to micro, small and medium enterprises in developing countries.

§ Each year, 26 million people are impoverished by natural disasters.

§ Natural disasters have resulted in global losses of $2 trillion over the last decade, with only 6% of these losses covered by insurance in emerging economies.

§ 774 million children (a third of the child population) face the dual impacts of poverty and high climate risk. An estimated 80% of children are affected by at least one extreme climate event per year.

§ Children are physiologically more vulnerable to extreme weather events, with child vulnerability particularly heightened in developing contexts where agriculture is families’ primary source of food and income.

§ Invest in tech-driven solutions driving more inclusive access to climate insurance.

§ Signal: Leverage BlueOrchard’s reputation as an impact pioneer to underscore the importance of climate insurance for children’s well-being and development.

§ Engage actively: Provide tailored technical assistance to investees (e.g., for product design and development) to enable growth and accelerate access.

§ Provide flexible capital: Support subsidies to reduce the premium payments for lesser resourced end-users, further expanding access and affordability.

Outcomes

§ Primary: Increased resilience to extreme weather events for micro, small and medium enterprises (MSME), and low-income households.

§ Ancillary: Reduced vulnerability of children, families, and communities to extreme weather events.

Outputs

§ New low-income individuals insured

§ Amount of insurance benefits ($) distributed for disaster relief

§ Number of households with children reached as beneficiaries

SDG Targets

1.5 - Build the resilience of the poor and reduce their vulnerability to climate-related extreme events

13.1 - Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters

NOTE: IIF II does not currently identify as deploying a child lens; this is an illustrative case study showing how IIF II could apply the child lens to the existing strategy. IIF II may be seen as indirectly adopting the child lens based on its climate insurance focus on and the provision of technical assistance services to its portfolio companies, which operate in communities with large populations of vulnerable children and/or households with children.

Climate resilience and poverty reduction, which have direct relevance to children’s futures, are primary goals of the fund

Contribution:

By providing technical assistance and flexible capital in the climate insurance value chain, IIF II’s contribution strategy provides ancillary benefits to children

Measurement:

Reduced vulnerability of children can be extrapolated from primary outputs

Fund overview: Elevar Equity is an emerging markets impact investment asset manager connecting low-income communities to the global capital markets. Through the India V Fund, Elevar invests early-growth capital in enterprises that have the potential to deliver essential products and services to millions of underserved customers across India. Elevar has a natural gender lens to the way it drives impact, with a majority of women in its leadership and investment teams, and solutions that empower households and women throughout the business value chain.

Demographic/geographic focus: Target markets include micro, small, and medium enterprises (MSMEs), individuals in low-income communities, affordable private schools, and smallholder farmers across India, with an emphasis on solutions that benefit households and, therefore, women.

§ India is the world’s fastestgrowing economy with 1.4 billion people. However, the market is presently not meeting 60% of this population’s – representing over 10% of the global population –needs for essential products and service, and particularly those in low-income communities.

§ 45% of the population lacks access to basic financial services.

1 in 4 persons classified as undernourished resides in India, with 53% of women in India suffering from anemia and 17.3% of children classified as severely undernourished, among other alarming statistics.

§ Grow undersupplied markets: Invest in scalable MSMEs with a primary focus on increasing affordability and access to essential products and services that are core drivers of children’s vulnerability, specifically with a gender lens.

§ Signal: Leverage Elevar’s reputation as an impact pioneer to highlight the impact and financial opportunities of investing in essential products and services relevant to children and the intersectionality of gender- and child-lens investing.

§ Engage: Deep immersion in lowincome communities to understand the needs and aspirations of end beneficiaries and drive Customer Business Value.

Areas of investment:

Financial health and inclusion of households (HHs) and MSMEs

MSME productivity solutions and market linkages

Maximizing access to affordable, quality education, skilling, and income-generating opportunities

Smallholder farmer and food producer solutions and access to quality, affordable food to end consumers

Health care access and affordability

Impact goals: To increase the economic resilience and vibrancy of low-income communities by democratizing access to essential products and services.

Outcomes

§ Expanded access to basic financial services

§ Increased availability of affordable, quality education

§ Improved agri-supply chain expanding access to nutritious food

Outputs

§ Low-income households served

§ Small-scale farmers served

§ MSMEs served

§ Low-income students served

SDG Targets

1.4 – Ensure all, particularly poor and vulnerable, have equal access to economic resources

2.3 – Double productivity and incomes of small-scale food producers, particularly women

4.3 - Equal access to affordable and quality technical, vocational and tertiary education

NOTE: Elevar India V does not currently identify as deploying a child lens; this is an illustrative case study showing how Elevar India V could apply the child lens to the existing strategy. Additionally, some specific India V investees collect data on child beneficiaries.

Intentionality:

Economic resilience and access to education, health care, and food, which have direct relevance to children’s survival and development, are primary goals of the fund

Contribution:

Elevar’s deep engagement with investees and their targeted communities enable investees to serve low-income HHs, which include children, more effectively

Measurement:

Reduced vulnerability of children can be extrapolated from HH-level data

Building on Rethink Education’s Child-Lens Goals and Parameters (pg. 10), the Impact Thesis further defines how the fund’s activities lead to desired impact outcomes, including those relevant to children.

§ There is a systematic mismatch between what students are learning and the skills they need to be successful, with the current education system focusing on college readiness over teaching critical human skills needed to navigate the modern world.

§ More than 600 million children and adolescents worldwide are unable to attain minimum proficiency levels in reading and mathematics.

§ 48 percent of employers in the U.S. say that candidates lack the skills needed to fill open jobs. The problem is likely to worsen with a projected talent shortage of more than 85 million people by 2030, which would lead to $8.5 trillion in unrealized economic value.

§ Invest early-stage capital in EdTech companies targeting underserved students and learners.

§ Engage actively: Leverage Rethink’s extensive network, education market experience, and board seat positions to help scale portfolio companies while maintaining mission and impact focus.

§ Grow undersupplied markets: Provide first institutional investment and/or financing terms otherwise unavailable to companies serving vulnerable populations.

§ Field building: Thought leadership through research, articles, and podcasts to augment impact of the EdTech market.

• Expanded access to education and professional training for the most underserved populations, including the bottom billion in emerging markets.

• Improved quality and inclusiveness of education and training globally.

• Number of students reached

• Number of low-income learners reached

• Number of communities reached

SDG Targets

4.4 – Increase the number of youths and adults who have relevant skills for decent jobs

4.6 – Ensure all youths achieve literacy and numeracy

NOTE: Rethink Education does not currently identify as deploying a child lens; this is an illustrative case study showing how Rethink Education could apply the child lens to the existing strategy.

Fund overview: REFFA is a blended finance debt fund focused on improving the quality and affordability of education across Africa. Flexible debt financing and technical assistance is provided to investees with the aim of providing equal access to education, as well as vocational training. Investors are offered risk-adjusted returns with senior tranche investors being protected by the first loss capital of the junior tranche.

Areas of investment:

Organizations providing loans to employees or MSME owners to finance primary, secondary education, and/or technical and vocational education and training (TVET) opportunities for themselves or their families.

Demographic/geographic focus: Target beneficiaries for the fund include low- and middle-income households and learners across Africa, with an increasing focus towards being more inclusive of women.

Impact goals: Contribute to expansion of education (i.e., allow more students to pursue studies), higher quality of education, and better accessibility and affordability of education (i.e., for students from vulnerable backgrounds).

§ More than 50 million children in Africa remain out of school, representing 45 percent of out-ofschool children globally.

§ 75 percent of second grade students in several sub-Saharan African countries could not count beyond 80, and 40 percent could not do a one-digit addition problem.

§ Children who enroll in low-quality schools with limited health resources, safety concerns, and low teacher support are more likely to have poorer physical and mental health.

§ Provide debt to financial institutions creating education finance solutions for underserved students and learners in Africa.

§ Engage actively: Leverage BlueOrchard’s dedicated technical assistance facility (TAF) to enhance institutional capacity of investees and foster innovation.

§ Grow undersupplied markets: Blended financing solutions in terms and amounts that investees otherwise would not have access to.

§ Flexible capital: Invest in junior and mezzanine tranches to incentivize institutional capital flows into protected senior tranches.

Outcomes

§ Expansion of education, allowing more students to pursue studies

§ Higher quality of education

§ Increased accessibility and affordability of education, particularly for vulnerable students

Outputs

§ Number of low-income borrowers

§ Number of education providers reached

§ Amount ($) of education financing provided to learners

SDG Targets

1.4 - Ensure all, particularly poor and vulnerable, have equal rights to economic resources

4.5 - Ensure equal access to all levels of education for vulnerable populations

NOTE: REFFA does not currently identify as deploying a child lens; this is an illustrative case study showing how REFFA could apply the child lens to the existing strategy. The definition of quality of education refers to the five education quality dimensions as defined by UNICEF: learning environment, enabling inputs, teaching content and process, learning characteristics, and learning outcomes. Please see the corresponding case study in Toolset 5 for illustrative metrics that may be utilized to measure individual investments’ child impacts.

Illustrative Taxonomy: Child-integrated

Intentionality:

Impact goals include increased access and quality of education for children

Contribution:

Technical assistance and flexible capital are provided to investees, directly promoting positive child outcomes

Measurement:

Number of families reached with education finance loan will be measured as well as improvement on key education quality dimensions (learning environment, enabling inputs and learning outcomes)

Fund overview: Through the Women’s and Children’s Health Technology Fund, CBIV invests in companies that commercialize health technologies benefiting women, children, and adolescents globally, with a focus on inclusion. The fund seeks to address funding and access gaps for womanand child-focused health solutions in emerging and developed markets.

Areas of investment:

Sexual & reproductive health; maternal, newborn & child health; non-communicable & chronic diseases; and health infrastructure software.

Digital, diagnostics, medical devices, and therapeutics.

Improving health access for underserved populations.

Geographic focus: CBIV primarily invests in companies headquartered in North America, Europe, and Israel with cross-border strategies to expand to new international markets, including in high-income countries and LMICs.

Impact goals: 1) 400,000 women’s, children’s, and/or adolescents’ lives saved, and 8,000,000 lives improved in LMICs;

2) expanded access to high-quality health care for women, children, and adolescents in Canada, the U.S., and Europe.

§ Each year, 6.3 million children die before the age of 5 and 289,000 women die in pregnancy and childbirth.

§ Children in sub-Saharan Africa and southern Asia account for 80 percent of under 5 deaths.

§ Lifetime risk of maternal death in low-income countries is 1 in 49, which is more than 108 times higher than in highincome countries (1 in 5,300).

§ Women’s, children’s, and adolescents’ health innovations have historically received only a fraction of investment capital compared to those focused on men’s health.1

§ Signal: Invest in women’s and children’s health technology companies that have growth objectives in LMICs.

§ Engage: Utilize extensive global network to connect investees to medical professionals, health technology experts, donors, funders, and impact experts to drive innovation and augment positive outcomes for women and children.

§ Grow undersupplied markets: Leverage on-the-ground network of governments, NGOs, and private-sector actors to scale women’s and children’s health solutions for vulnerable populations globally.

Outcomes

§ 400,000 women’s, children’s, and/or adolescents’ lives saved, and 8,000,000 lives improved in LMICs

Outputs

§ New women and child-focused health technologies

§ Improved affordable health care access for women and children

§ Enhance software infrastructure for women’s and children’s health tech

SDG Targets

3.1 – Reduce global maternal mortality ratio

3.2 – End preventable deaths of newborns and children under 5 years of age

5.6 – Ensure universal access to sexual and reproductive health and reproductive rights

NOTE: Please see the corresponding case study in Toolset 5 for illustrative metrics that may be utilized to measure each individual investment’s child impacts.

1Women’s Health Access Matters (WHAM), “The Case to Fund Women’s Health Research” (2022).

Illustrative Taxonomy:

Child-centered

Intentionality:

Child needs and outcomes are a primary focus among all the investment areas of the fund

Contribution:

In addition to addressing the funding gap in women’s and children’s health care, CBIV leverages its extensive network to scale solutions and increase reach to vulnerable populations

Measurement:

Reduction of child mortality and improved child health are outcomes that are routinely measured and monitored

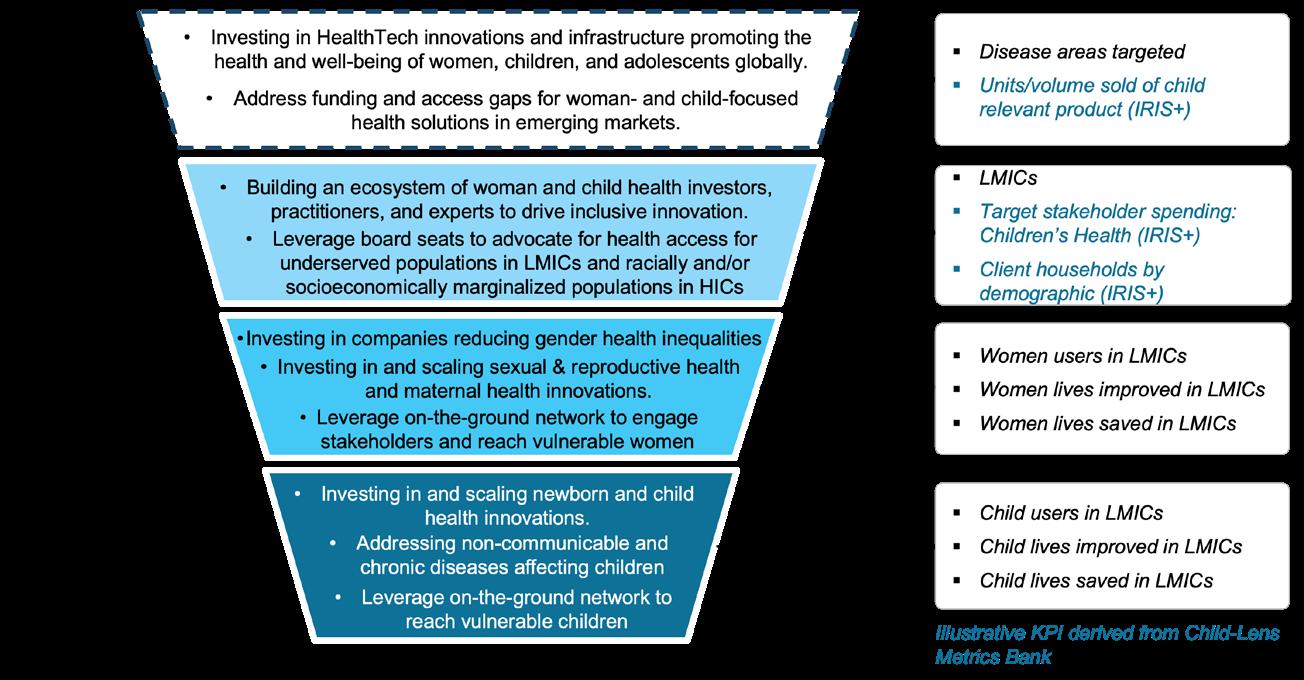

The Whole Child Worksheet supplements the Child-Lens Impact Thesis Template. Grounded in child-lens investing’s whole child principle –as described in the companion Discussion Paper – this worksheet supports investors in identifying relevant activities (both investments and/or other investor contribution activities) connected to various systems that support children’s well-being. It allows investors to answer the question, “How does the strategy support the wider ecosystem that influences child well-being?”

Investors should identify both potential investible opportunities and investor contribution activities relevant to addressing the impact challenge and achieving the impact goal identified in the child-lens impact thesis (pg. 9, 11) at each level of the Whole Child Worksheet. Investors are not expected to address all levels of the worksheet and are encouraged to list activities commensurate with their characteristics and capabilities. After identifying activities, enumerate accompanying impact outputs, and/or near-term impact outcomes tied to each.

Expanding on Cross-Border Impact Ventures’ Child-Centered Impact Thesis (pg. 16), the “Whole Child” Worksheet allows for a deeper assessment of the strategy’s impact on the various systems that affect children’s well-being. Additionally, metrics from the Child-Lens Metric Bank were used to identify relevant impact outputs for each level of the worksheet. [See pg. 39 for a larger list of metrics applicable to investments under the fund.]

Please note that while this example demonstrates how a strategy can address each level of the “whole child” – policy and wider society, communities and social infrastructure, families and caregivers, and the individual child – concentrating activities on one to three levels of the worksheet can be equally effective in promoting child outcomes.

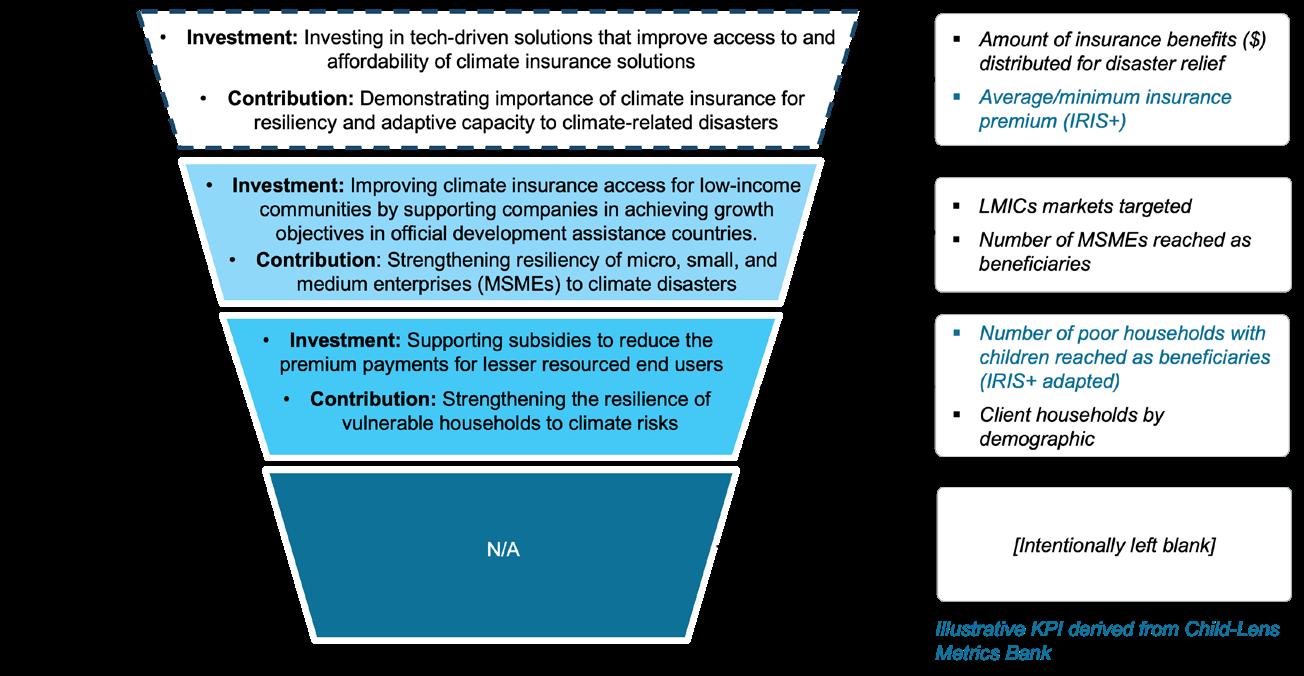

Expanding on BlueOrchard’s IIF II’s Child-Adjacent Impact Thesis (pg. 12), the Whole Child Worksheet allows for a deeper assessment of the strategy’s impact on the various systems that affect children’s well-being. Additionally, metrics from the Child-Lens Metrics Bank were used to identify relevant impact outputs for each level of the worksheet. [See pg. 37 for a larger list of metrics applicable to investments under the fund.]

Please note that the individual child level of the worksheet is intentionally left blank. This example demonstrates how a strategy can address only some levels of the worksheet –i.e., policy and wider society, communities and social infrastructure, and families and caregivers – but still be effective in promoting child outcomes.

To develop well-defined investor contribution approaches enhancing the impact of child-focused investments and supporting the growth of the childlens investing field and market

Child-lens contribution worksheet: Tool for investors to clarify their level of and approach to contributing to positive child outcomes, including example investor contribution activities derived from global market landscaping findings explored in the companion Discussion Paper

Additional resources

Impact Management Project, “Investor contribution in public and private markets: Discussion document”

Impact Management Project, “A guide to classifying the impact of an investment” Brest, P; Gilson, Ronald, Wolfson, M., “How Investors Can (and Can’t) Create Social Value” (2018)

Aligned standards and frameworks

Child-lens investors’ contribution strategies do not have to address all four of the strategies described below. They may utilize any combination of contribution strategies – drawing from responses to the Child Lens Goals and Parameters Exercise. Example activities were derived from global market landscaping findings covered in the companion Discussion Paper and are for illustrative purposes only.

Adapted from the Impact Management Platform (IMP)’s four primary investor contribution strategies, this worksheet helps to clarify and organize investor contribution activities. It supports investors in answering the following question, “How will the investment create positive child outcomes that otherwise would not happen?”

For additional resources regarding investor contribution, see the IMP’s Investment Classifications.

Fund overview: Save the Children Australia Impact Investment Fund (SCA IIF) provides private equity and loans to startups and social enterprises aligned to Save the Children’s mission of ensuring that all children are able to exercise their right to grow up healthy, educated, and safe. Capital, as well as an extensive on-the-ground network, is deployed to scale up revenue-generating solutions with positive child impact at the core of their missions.

Areas of investment:

EdTech, E-health, and Child Protection

Demographic/geographic focus: Global, with an emphasis on Australia (where the fund is domiciled); targeting underserved children and families

The role of QBE Insurance: QBE Insurance is the anchor investor in this first-time, child-centered fund – providing catalytic capital to launch a new child-lens fund. In addition to investing this capital, QBE has taken an active role as an investor in the fund by providing SCA IIF staff commercial investment expertise through an investment committee seat.

Illustrative Taxonomy: Child-centered

Intentionality:

Enabling underserved children to grow up healthy, educated, and safe is the primary focus of the fund

Contribution:

SCA IIF supplies capital to child-focused enterprises that may otherwise be overlooked by the market; tailored technical assistance and access to Save the Children’s global network further augments impact

Measurement:

COMMENTS:

The Contribution Worksheet describes QBE’s investor contribution – not Save the Children’s – while the taxonomy describes the SCA IIF fund.

Following the success of SCA IIF, Save the Children launched a Global Ventures arm and is currently raising capital for two larger funds with a target size of USD $40 million. The ambitious new funds are largely made possible by the demonstrated commercial viability of SCA IIF, highlighting the outsized impact possible for investors to have when supporting emergent child-lens strategies.

Tailored impact measurements include improved access to child health and learning outcomes, which are routinely measured and monitored

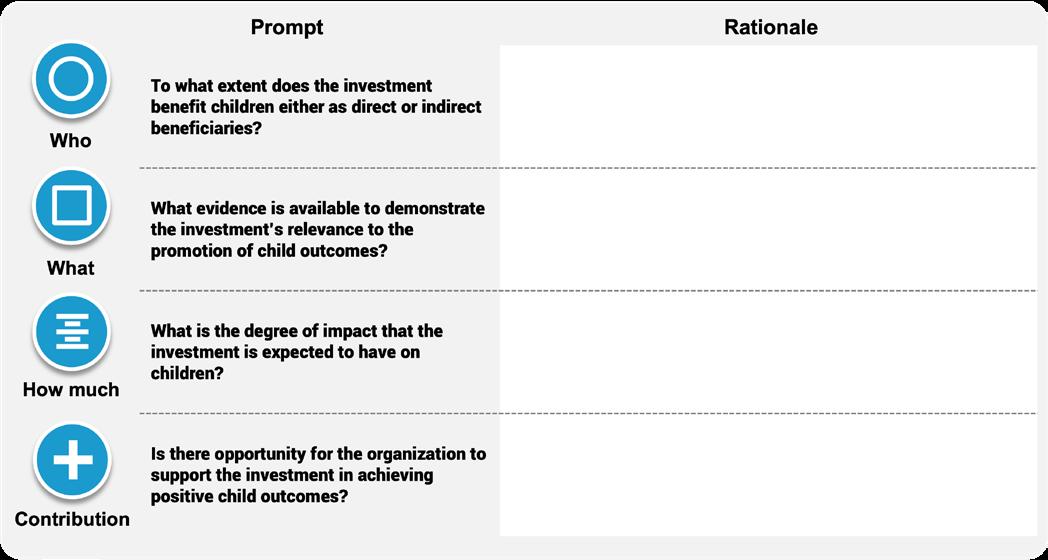

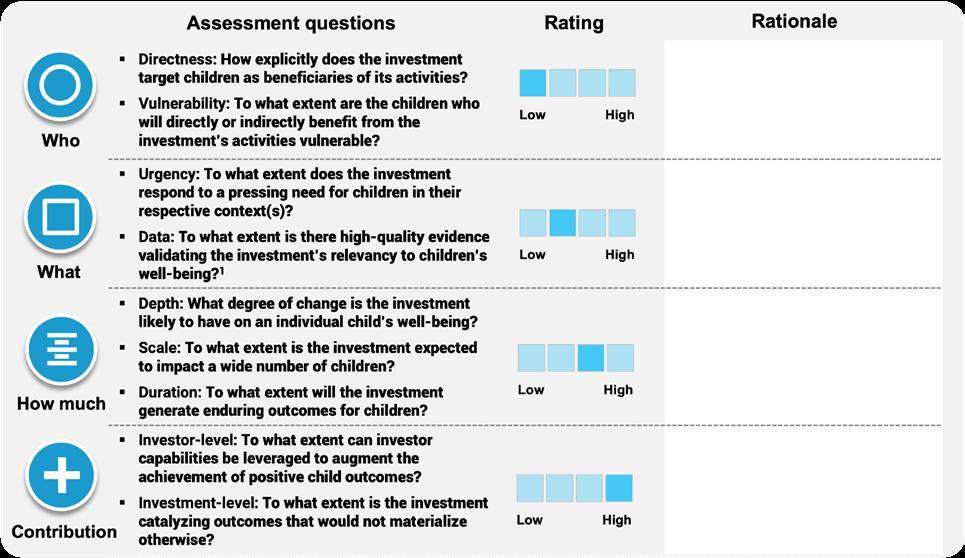

To enable systematic, ex-ante assessment of an investment’s potential impact for children during due diligence

Note: While some tools include rating systems, ratings do not represent a definitive judgement on a transaction’s quality. They instead allow investors to more precisely and consistently articulate how an investment is anticipated to achieve targeted outcomes for children.

Simplified child-lens impact assessment tool: Series of four prompts to support due diligence of prospective investments’ likelihood to deliver impactful child outcomes and how they will accomplish this

- Case study: Sample anonymized climate investment

(For advanced practitioners) Child-lens impact assessment framework: Series of nine prompts with a rating system to support deeper diligence of how prospective investments may produce child outcomes in a manner that is comparable across transactions

- Case study: Sample anonymized education investment

Additional resources

Impact Frontiers, “Norms: Five Dimensions of Impact”

UNICEF Publications

The Lancet, Child & Adolescent Health

Harvard University, Center on the Developing Child

Aligned standards and frameworks

Implementation guidance

Answer each prompt using available materials (e.g., pitch decks, impact reports) and responses from the Child-Lens Risk Due Diligence Questionnaire in Toolset 4. Supplement analysis with additional research as needed. Once completed, crossreference responses with the Child-Lens Impact Thesis and answers to the Child-Lens Goals and Parameters Exercise in Toolset 1 to ensure the investment’s strategic alignment. Note that Toolset 4 facilitates separate assessment of impact risks.

Principally for use by child-adjacent and child-integrated investors, the following prompts can be used during the stages of investment screening and/or due diligence to assess 1) how a prospective investment may benefit children and 2) its broad alignment with the established Child-Lens Impact Thesis. Conducting the child lens impact assessment will allow investors to answer the question, “To what extent does the investment align with the strategy’s impact goals and parameters?”

Company overview

SASB sector classification: Renewable Resource and Alternative Energy

Geography: India, South Asia, Southeast Asia

Product/service description: Turnkey rooftop solar energy solutions for commercial and industrial businesses, helping companies offset almost 100 percent of their energy requirement through clean and green energy while ensuring 30-60 percent cost benefit on electricity

Investment goal: Enable cost-efficient renewable energy solutions to accelerate corporate decarbonization and mitigate climate change

Target beneficiaries: Global environment (emissions and pollution reduction); corporate sector (reaching emissions targets and cost savings)

Outcomes: Facilitation of renewable energy produced, reduced GHG and CO2 emissions, creation of green jobs

Outputs: GwH of clean energy produced, metric tons CO2 reduced, number of green jobs created, liters of water saved

Prior to assessment, investors should define for themselves what characteristics merit a high/medium/low scoring in each dimension and subdimension. Investors may decide on minimum aggregate or individual dimension-level thresholds to qualify or disqualify investments.

Investors should rate investments against each sub-dimension and aggregate them to produce a dimensionlevel score. Investors may also aggregate dimension-level scores into a single transaction-level score based on equal or tailored weighting. Provide rationale, supplemented with external evidence, for each score.

Note that impact risks are assessed separately via Toolset 4.

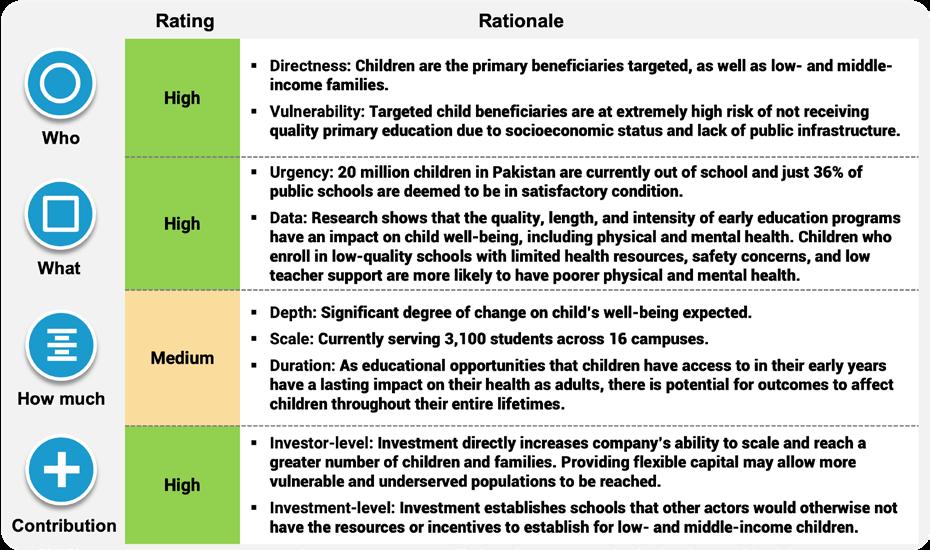

During the due diligence stage, child-centered and child-integrated investors may utilize the following assessment framework to systematically analyze how individual transactions may achieve positive child outcomes. Analysis and scoring along each dimension of impact will clarify the following question,: “Does the investment meet or exceed the minimum threshold for impact?”

Company overview

SASB sector classification: Services, Education

Geography: Pakistan

Product/service description: Build and scale affordable quality K-10 schools for low- and middle-income families across Pakistan – ensuring that each facility is modernized to foster a nurturing environment for students to develop academically and personally

SDG 4.1 Ensure all girls and boys complete equitable and quality primary and secondary education

Impact thesis and strategy

Investment goal: Help children reach their full potential by providing affordable and accessible quality education to K-10 students in Pakistan

Target beneficiaries: Low- and middle-income families and children in Pakistan

Outcomes: Expanded access to quality education, increased participation rate in organized learning

Outputs: Number of children enrolled, primary education completion rate, families reached

Comments

The “medium” rating in the How Much dimension was derived from averaging the “low” score in Scale and “high” scores for Depth and Duration

The Contribution score is the indicative average of a “medium” investor-level score and a “high” investment-level score. The former score is a placeholder, with scoring ultimately depending on the investor’s own capacity to augment the investee’s impact and the nature of their contribution strategy, as identified in Toolsets 1 and 2.

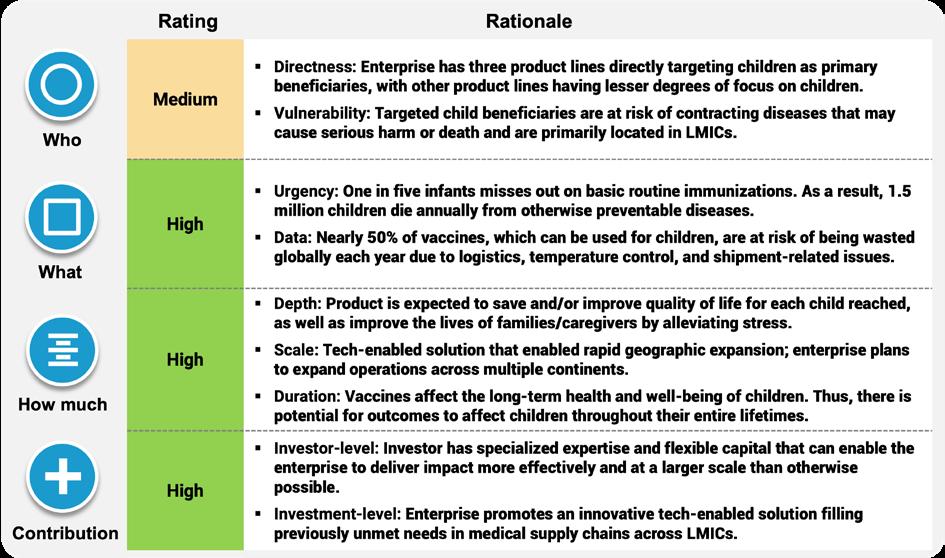

SASB sector classification: Medical Technology

Geography: LMICs; primarily Latin America and Asia

Product/service description: Develop blockchain solutions that track data across supply chains – enabling improved efficiency of pharmaceutical and vaccine supply chains; trustworthy and transparent tracking of child vaccine information, needs, and services for caregivers

SDG 3.2 End preventable deaths of newborns and children under the age of 5

Investment goal: Reduce preventable child deaths by improving vaccine supply chains and providing caregivers with vital information on their children’s vaccines

Target beneficiaries: Children and caregivers in LMICs

Outcomes: Expanded access to quality health care, increased participation rate in vaccination campaigns

Outputs: Number of children vaccinated (by disease); families/caregivers reached; number of vaccines tracked

This enterprise scored a “medium” rating in the Who dimension due to an overall focus on blockchain developments across multiple industries targeting a more general population, which detracted from the Directness score. Only certain product lines are focused on children as beneficiaries.

The Contribution score is the result of a “high” investor-level score and a “high” investment-level score. The former score is a placeholder, with scoring ultimately depending on the investor’s own capacity to augment the investee’s impact and the nature of their contribution strategy, as identified in Toolsets 1 and 2.

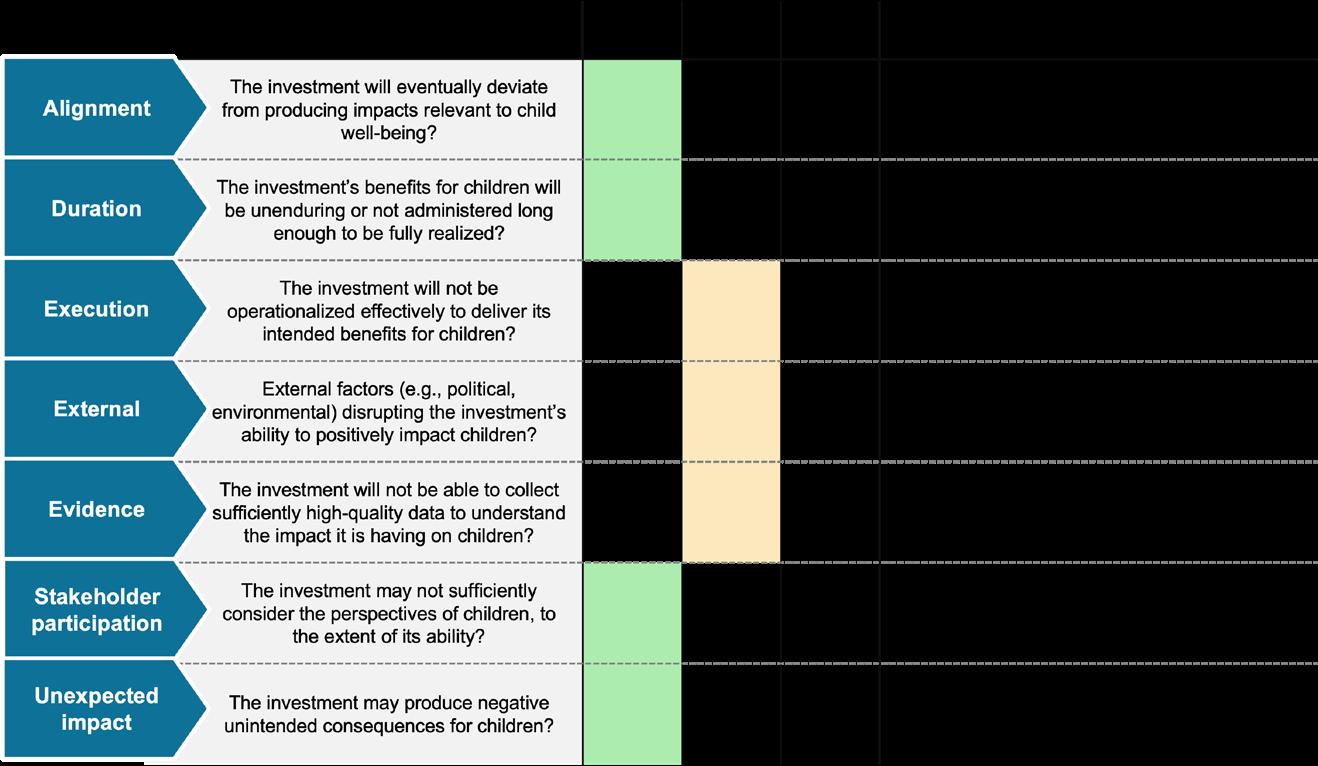

To support holistic pre-investment assessments of ESG and impact risks to achieving targeted child outcomes

Note: Findings arising from the Child-Lens Risk Inventory can be used to conduct due diligence on prospective investments, support investors’ self-assessment of their own performance vis-à-vis child and caregiver rights, and engage actively with portfolio investments as part of a child-lens investor contribution strategy (see Toolset 2).

Child-Lens Risk Due Diligence Questionnaire (Excel-based): Ready-to-use child- and caregiver-focused questions to incorporate within existing investor due diligence questionnaires to support rigorous child-related ESG and impact risk assessments

Child-Lens Impact Risk Matrix: Tool facilitating holistic assessment of transactions’ impact risks as they specifically pertain to children’s outcomes

- Case study: Sample climate example (continued from Toolset 3)

- Case study: Sample education example (continued from Toolset 3)

Additional resources

Sustainalytics and UNICEF, “Investor Guidance on Integrating Children’s Rights into Investment Decision Making”

Global Child Forum, “A Workbook for Business: How to Implement a Children’s Rights Perspective”

United Nations Global Compact and UNICEF, “Family-Friendly Workplaces: Policies and Practices to Advance Decent Work in Global Supply Chains”

Impact Frontiers, “Five Dimensions of Impact: Risk”

Aligned standards and frameworks

Investors across the child-lens taxonomy should download the Excel tool and append the questions to their existing DDQs. Mark “may not be relevant” for questions that may not be relevant to the prospective investee and consider supporting investees in filling out the remainder of questions with materials that are already on-hand (e.g., investor pitch decks).

Inform prospective investees that “N/A” answers are not grounds for rejection. Also inform investees that they may choose to elaborate on plans to implement policies and procedures inquired of by the DDQ in the event that they are not currently in place.

Used in conjunction with other tools (e.g., the Child-Lens Contribution Strategy, Impact Thesis), investors may use the DDQ to develop transactionspecific value-creation plans, enhancing their overall child-lens impact contribution.

The Child-Lens Risk Due Diligence Questionnaire (DDQ) supports investors in assessing prospective investments’ practices, policies, and procedures as they relate to child outcomes. Designed to be readily appended as additional sections to existing impact and ESG due diligence questionnaires, this tool supports investors in answering the question, “How may the prospective investment positively or negatively contribute to the advancement of child outcomes?” Note that this list is not exhaustive of the full extent of diligence considerations that are material to the child lens.

Instructions: The following child and caregiver rights questions may be appended to existing investor due diligence questionnaires to support comprehensive child-lens impact and ESG assessment of and active engagement with investees. Note that some questions may only be relevant to certain investees. Therefore, investors may exercise discretion in excluding questions. Investees' inability to answer questions in this questionnaire is not intended to disqualify investment, but instead spur follow-on conversation and the extension of investor support to implement appropriate policies, processes, and procedures promoting positive child outcomes. Additionally, investees can elaborate on plans to implement policies and processes if not currently in place.

Management strategy, governance, and corporate leadership

1. Does your company pledge to respect child-related standards or key international conventions and instruments related to children when conducting business operations?

2. Has your organization issued a corporate commitment promoting child rights and well-being?

3. Are children enumerated as key stakeholders in other company policies (e.g., code of conduct, marketing policies)?

4. Please describe whether you have integrated child rights’ considerations into your overall business strategy and processes.

5. To what extent do your overall business strategy, policies, and processes consider and reference key international conventions and instruments related to children?

6. Who or what entity within your company serves as a point of contact for child-related matters? Are they partially or fully dedicated to this issue area?

7. Are child-related topics regularly reviewed by your company's management and leadership? If so, please describe what specific issues are discussed.

Assessment, management, transparency, and reporting

1. How do your company's products or services benefit children? To what extent are these children vulnerable or underserved?

2. Please describe the ways by which your company and its operations may impact children. What specific stakeholders may be affected, and in what areas?

3. Has your company formalized an impact policy? If so, then please enumerate the key SDGs (and where possible, SDG

Implementation guidance

Utilizing the responses to the Child-Lens Due Diligence Questionnaire in the same toolset, as well as results from the Child-Lens Impact Assessment Framework and other due diligence activities conducted, rate the likelihood of each of the following nine impact risks materializing as low (immaterial), medium (material but readily mitigated), or high (material with mitigation strategy needed). Provide detailed commentary in support of the risk rating and steps for mitigation for scores less than or equal to “medium.”

The Child-Lens Impact Risk Matrix facilitates systematic assessment of investments’ potential impact risks. Adapted from the IMP’s nine types of impact risks, the matrix supports investors in answering, “What is the risk that the investment may not achieve its intended impact on children?”

To support the selection of, monitoring on, and reporting on metrics relevant to the assessment of child outcomes, leveraging insights from existing best practices in impact investing and the design of interventions in support of child outcomes

Child-lens metrics bank (Excel-based): Ready-to-use metrics aligned to the SDGs identified as most material to child outcomes, as delineated in the companion Discussion Paper

- Case study (child-adjacent): BlueOrchard and KfW Development Bank, InsuResilience Private Equity Fund II

- Case study (child-integrated): BlueOrchard and KfW Development Bank, Regional Education Finance Fund for Africa

- Case study (child-centered): Cross-Border Impact Ventures, Women’s and Children’s Health Technology Fund

Child-lens measurement principles: Overarching principles to guide investors in developing a child-lens measurement approach and creating bespoke metrics

Additional resources

White, H. and Sabarwal, S., “Developing and Selecting Measures of Child Well-Being”

UNICEF, “Measuring and Monitoring Child Poverty”

U.S. Department of State, “A good start with S.M.A.R.T. (indicators)”

Aligned standards and frameworks

Investors may refer to the ChildLens Metrics Bank at various stages of the investment process. When constructing a child-lens impact thesis, investors may reference the Metrics Bank to identify indicators that logically flow from the defined investor activities and are connected to the larger impact goal. If utilizing the Whole Child Worksheet, identify appropriate indicators calibrated to each activity level.

In the context of investment-level monitoring, collaborate with the prospective investee to identify child-lens indicators that are relevant and measurable, utilizing the Metrics Bank as a reference.

The Child-Lens Metrics Bank compiles existing child-relevant metrics from leading impact investing and child advocacy sources to support child-lens investors in identifying appropriate key performance indicators (KPIs). While a non-exhaustive list, the Metrics Bank serves as a starting point for investors to answer the question, “Are investor activities achieving their targeted child outcomes?”

Investors may use the following metrics, aligned to 1) the Sustainable Development Goals (SDGs) most directly material to child and caregiver outcomes and 2) various impact investing and child technical standards, to develop a robust child-lens measurement strategy. Note that investors may also draw upon other sources for child-relevant metrics, referencing the "Child-lens measurement principles"

Leveraging the Excel-based Child-Lens Metrics Bank along with supplementary metrics adapted from reputable sources – including IRIS+, UNICEF’s Children’s Climate Risk Index (CCRI), and bespoke metrics relevant to the specific impact priorities of IIF II – the following list is illustrative of the metrics that IIF II can use to monitor and measure individual investments’ impacts on children, as well as portfolio-wide impacts.

Leveraging the Excel-based Child-Lens Metrics Bank along with supplementary metrics adapted from other sources – including IRIS+, Edutracker, and bespoke metrics relevant to the specific impact priorities of REFFA – the following list is illustrative of the metrics that REFFA can use to monitor and measure individual investments’ impacts on children, as well as portfolio-wide impacts.

Leveraging the Excel-based Child-Lens Metrics Bank along with supplementary metrics adapted from other sources – including IRIS+, UNICEF’s Children’s Climate Risk Index (CCRI), and bespoke metrics relevant to the specific impact priorities of the fund — the following metrics are illustrative of the metrics that the fund can use to monitor and measure each individual investment’s impacts on children, as well as portfolio-wide impacts.

Understanding that a range of KPIs may be applicable to diverse child-lens strategies, the following Child-Lens Measurement Principles were designed to support selection of appropriate metrics, as well as to develop robust monitoring, measurement, and reporting approaches. These Principles are in addition to widely accepted guidance on creating SMART KPIs. They help investors answer the question, “To what extent will the measurement approach effectively and ethically measure child outcomes?”

Alignment

Prioritize metrics widely accepted in impact investing (e.g., IRIS+) and child-relevant indicator catalogs (e.g., UNICEF, WHO, UNFPA).

Proximate

To the extent possible, establish indicators that directly measure outcomes for children. However, recognizing the challenges in doing so, investors may also select output and outcome measures (e.g., community pollution density, weighted for children) to capture indirect child impacts.

Transparent

Document data sources and calculation methodologies, including underlying assumptions, relevant time horizons, and geographic information.

Participatory

Prioritize data transparency with participating stakeholders and other ethical stakeholder engagement practices –particularly of youth. Engage stakeholders in the selection of KPIs, inviting meaningful collaboration.

Equity and Inclusion

Disaggregate child-relevant metrics to the extent possible – accounting for geographic, social, ethnic, gender, and other identity-based and contextually specific factors. Disaggregation is essential to ensure measurement is as objective as possible, pinpoint inequities, and avoid the exclusion of particularly underserved and vulnerable child populations.

Protection

Take precautions to ensure the safe, confidential, and ethical collection and safeguarding of child data, including setting a high bar for ethical measurement of child outcomes.