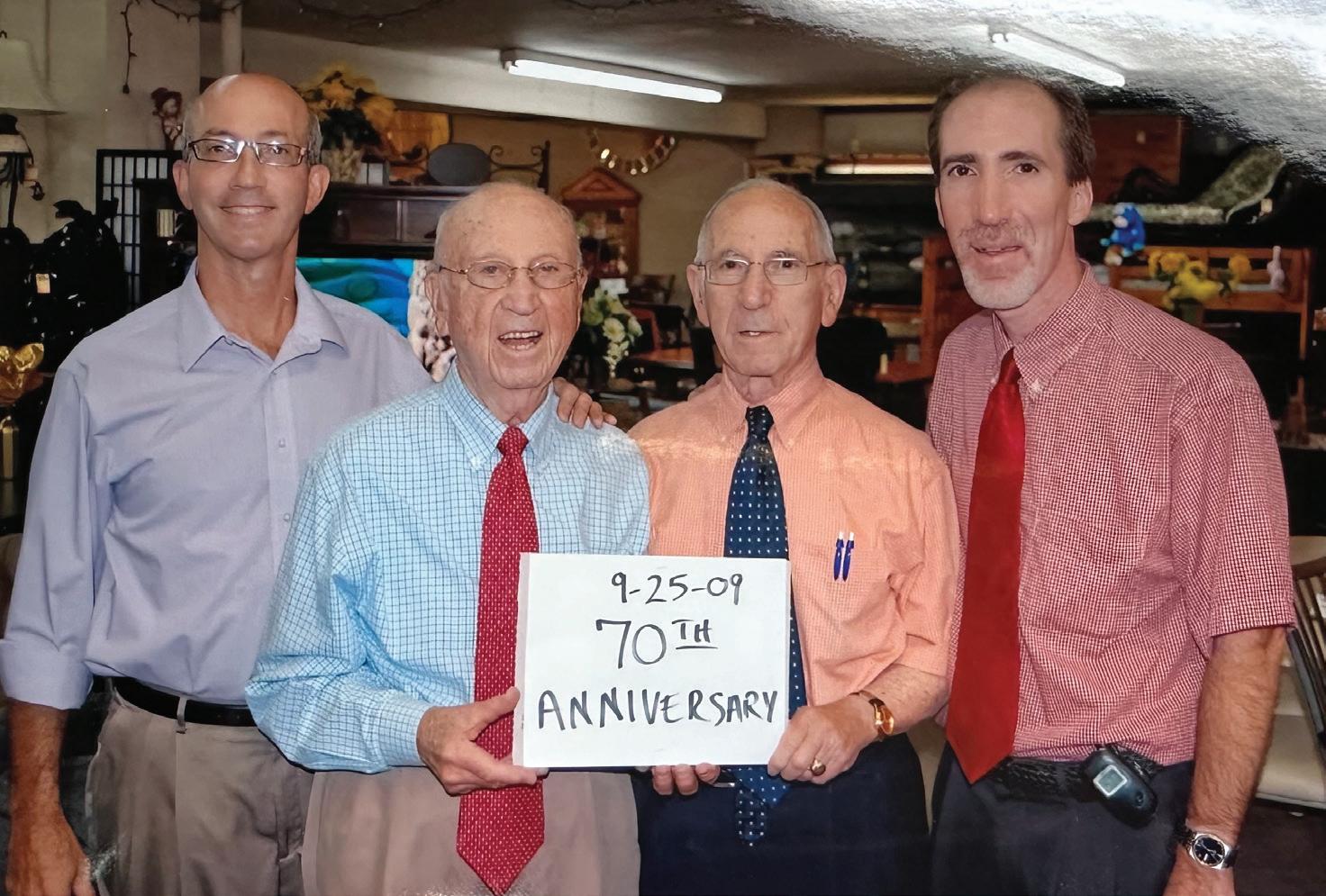

Beloved family business closes its doors after 86 years

Stephanie Peck

Since 1939, inventions such as nylon stockings, twistie ties, and microwave ovens have entered everyday life, not to mention cell phones and the internet. Fifteen presidents have resided in the White House and men have landed on the moon and spent months in space. And it was in 1939 that Harry and Leonard Laibstain established Virginia Furniture Company, a furniture store that would feature prominently in Norfolk for nearly nine decades. The store’s current location is on Granby Street in the NEON District in downtown Norfolk.

After working for 80 years, Leonard retired from the family business at age 95 due to the COVID pandemic. He passed away three years later. His brother, Harry, worked until six weeks before his passing in 2012 at the age of 91.

Second generation Laibstains and first cousins David and Jeff, recently made the decision to close the store’s doors after this successful, 86-year run.

“Jeff and I have been in the business for 40 years,” says David Laibstain, who says he had the good fortune of working alongside and learning from his dad and uncle for more than half that time.

In addition to being grateful for those years with his mentors, David says he’s also appreciative of his wife, Jody, who along with Jeff’s wife, Bonnie, supported them during their entire careers. “They were ‘Saturday widows,’” he says. “Jody’s family was in retail, so she understood, still it was tough when I wasn’t able to join her with friends for Saturday activities.

“She was understanding of all the long hours we worked.”

Bonnie Laibstain, Jeff’s wife, shares the history of Virginia Furniture Company and what the store has meant to generations of customers.

Jewish News: Virginia Furniture Company has been in business for many decades.

Do you know what inspired Harry and Leonard Laibstain to start it?

Bonnie Laibstain: Harry, David’s father, was 19 years old and Leonard, Jeff’s father, was only 15 years old when they started Virginia Furniture Company in 1939. They were inspired by cousins in the family who were already in the furniture business and knew it was a good business to get in to.

Have other family members worked for Virginia Furniture Company?

Several cousins worked at the store in their younger years on occasional Saturdays as teenagers for extra pocket money. Richard Miles, who has been retired for a while now, worked for our family business for about 40 years and was like family. He did a terrific job and the customers loved him. I started working at Virginia Furniture at the start of COVID in 2020. It was an extremely busy time because people were home, receiving stimulus checks, and wanted to make changes in their home decor and purchase new furniture. David was out of the store for about four months for health reasons. I

jumped in and learned the family furniture business very quickly to help Jeff in David’s absence. I have enjoyed selling and stayed on for nearly six years now.

When did Jeff and David start working for the business?

David and Jeff have both been in the family business full time since 1986 –nearly 40 years.

How did Harry and Leonard share the responsibilities of the business?

Harry did more of the merchandising, while Leonard took care of the financing, accounting, and record keeping.

How have David and Jeff divided up

the workload?

The apples don’t fall far from the trees–David took after his father and was sales and merchandising focused, while Jeff took after his father doing all the financing, accounting, and record keeping for the business.

The company has a 4.9-star rating on Google. How have you managed to keep customers so happy?

We have 160 reviews on Google. It’s really not rocket science. Honestly, we just treat people the way we would like to be treated. Customer service is hard to find these days. We truly pride ourselves on excellent customer service!

How have changes to the economy impacted furniture sales? Have you felt the impact of tariffs on business? Inflation has made it more difficult for our customers to make purchases and make payments. In addition, people buying online from competitors has also made an impact on our business.

What prompted the decision to close the store?

After 86 years as a family business, and working six days a week, we have decided now is a good time to retire. We all have many plans to look forward to in the future.

What are David’s and Jeff’s plans for the future?

David has turned a hobby of refurbishing and

refinishing vintage furniture into a business. Jeff and I are looking forward to traveling and doing many things that we haven’t had the time to do before now.

Anything else you’d like to share with the readers of Jewish News?

We have been serving the community for over eight decades. Several generations of families have been with us for many years. We know Harry and Leonard would be very proud of us for all we have done to carry on the family legacy into our 86th year.

MACCABI MEDIA IN ISRAEL – SUMMER 2026

A career-development program for Jewish media students

Maccabi Media is recruiting Jewish media, broadcasting, and communications students, as well as recent graduates, ages 18-25, to cover more than 35 sports during a three-week Olympic-style international competition in July 2026. Applications will be accepted through late-November.

The most recent student media team trained extensively to cover the 1,250-member delegation at the Maccabiah this summer until the conflict in Israel postponed the trip until next year.

The new student group will perform a variety of roles, including play-byplay, color analysis, sideline reporting, live game streaming, video production and editing, photography, and sports reporting for web/social media. Before leaving for Israel, students will undergo more than six months of training under the guidance of veteran media mentors, including MMP chair and former 76ers play-by-play voice Marc Zumoff. They will also learn from industry professionals during sessions with notable guest speakers. Following the trip, students will receive long-term assistance with resumes, demo reels, and career networking. For more information or to set up a phone or Zoom meeting, contact Neal Slotkin, Maccabi USA digital media director, at nslotkin@maccabiusa.com.

To learn more about Maccabi Media, visit https://maccabiusa.com/maccabi-media/. To apply, visit https://maccabiusa.com/22nd-maccabiah-sports-2025/.

RESOURCES FOR

ADVISORS

Since 1984, Tidewater Jewish Foundation has partnered with professional advisors to help fundholders direct more than $260 million to causes they care about.

Working closely with advisors from the legal, accounting, insurance, wealth management and investment fields, Tidewater Jewish Foundation helps individuals and families reach their charitable goals, all while enjoying significant tax benefits, and at no cost to you or your client.

We are here to make giving easy.

If you are a professional advisor, we encourage you to explore all the tools and resources available on our website, and welcome the opportunity to connect to discuss more ways we can help you serve your clients in the Tidewater Jewish community.

more at

New Hebrew University study shows AI can help consumers curb overdraft costs business

AI-powered email reminders can significantly reduce costly overdraft fees by helping users pay closer attention to their finances, according to a new study by researchers at the Hebrew University of Jerusalem.

The study, published in Management Science, included 39,000 users of the Mint personal finance app and found that simplified and strategically framed messages—especially those emphasizing loss avoidance—were the most effective.

While users with higher income and credit scores were more likely to act on the alerts, the findings highlight both the potential and limitations of AI-based financial nudges. Overdraft fees remain a costly burden, and according to the Consumer Federation of America, U.S. banks collected nearly $5

billion in overdraft fees in 2024.

“Our randomized study provides evidence that AI-based, tailored communication can positively influence financial behavior—but it must be accessible and actionable,” says Prof. Orly Sade, dean of the Hebrew University Business School.

“Simple, timely messages have the power to help people make better decisions, but we also need to consider broader systemic barriers for those in more challenging financial situations.”

AI-driven financial tools are transforming the way people manage their finances, offering real-time support that surpasses traditional budgeting. From predictive alerts that flag potential overdrafts to systems that automatically transfer funds to prevent shortfalls, these

technologies offer practical solutions for everyday financial challenges. While they hold promise in helping users avoid unnecessary fees and build better habits, their impact depends on understanding what motivates individuals to use them and follow through on the guidance they provide.

The AI system used in the study predicted when users were likely to incur overdraft fees and sent email reminders accordingly.

Key findings include:

• Any reminder helped: Users who received an alert were less likely to incur overdraft charges.

• Simplicity matters: Clear, concise messages were significantly more effective than complex ones.

• Framing counts:

o Messages framed negatively (e.g., “Avoid overdraft fees”) led to a 9% reduction in overdrafts the following week.

o These users saved an average of $25 over four months.

o Positively framed messages (“Save money”) also worked but were slightly less effective.

• Who responded best: Alerts were most effective for users with fair-to-good credit and mid-to-high incomes—those who were more likely to act on the information.

• Limits of nudging: Financially vulnerable users, such as those with low liquidity or credit limits, were less able to benefit from the reminders, indicating that behavioral nudges alone may not be sufficient.

business Planning with purpose: Estate Planning matters more than you think

October is National Estate Planning Month and marks

Donor Advised Fund Day — an ideal time to begin planning

TJF staff

Estate planning is one of those tasks people tend to put off — until life reminds them why it matters. That’s why Scott Alperin, J.D., founder of Alperin Law & Wealth, says the right time to plan is before a crisis happens. “Estate planning isn’t just about what happens when you die,” he says. “It’s also about what happens if you become ill or incapacitated.

“If a sudden illness or accident leaves you unable to speak for yourself — even temporarily—it is critical to make sure that your loved ones not only know what to do, but more importantly, that they have the legal authority and guidance you’d want for your care, your finances, your home, and even your online accounts,” he says. “Without a proper incapacity plan in place, your family may be forced to go through an expensive and stressful court process known as guardianship and conservatorship in which the court decides your decision maker.”

Building the foundation of a comprehensive plan

Alperin, who practices both estate planning and elder law, explains that every thoughtful plan begins with two key questions: “What happens if I pass away?” and “What happens if I can’t make decisions for myself?” A comprehensive plan answers both, combining legal structure with practical foresight.

The first step is determining whether one’s foundational plan will be based on a Last Will and Testament, a Revocable Living Trust, or involve other planning techniques. From there, a complete plan includes essential ancillary documents such as a General Durable Power of Attorney, Health Care Power of Attorney, Advance Medical Directive (Living Will), HIPAA Authorization, and Tangible Personal Property Memorandum to ensure that

every aspect of one’s legal and personal affairs is covered.

“The earlier you start, the more options you have,” Alperin says. “You can explore tools that protect assets, provide for long-term care, and reflect your values, not just your valuables.”

Integrating charitable planning

“Many of my clients give generously during their lifetime,” Alperin notes, “but they don’t always realize how easily they can make lifetime gifts that benefit charities while at the same time reduce their tax burden. My clients are also sometimes surprised to learn that they can structure their estate plans in a way that will provide meaningful gifts to charity without sacrificing the legacy they want to leave for their families.”

That’s where the Tidewater Jewish Foundation becomes a key partner. TJF works side-by-side with professional advisors such as Alperin to help individuals align their estate plans with their charitable and family goals. Through donor education, personalized guidance, and charitable tools such as Donor Advised Funds (DAFs) and endowments, TJF makes it easy to

integrate philanthropy into a comprehensive financial and legacy plan. TJF also manages the administrative side — handling grant distributions, fund compliance, and long-term investment management— so donors can focus on what matters most: the impact they want to leave on their community.

Four actions to take today to prepare

1. Gather key documents — Collect account statements, deeds, insurance policies, and beneficiary forms.

2. Assess goals — Identify priorities such as caring for family, protecting assets, and giving back to community.

3. Consult a professional — Work with an experienced estate planning attorney to ensure documents comply with state laws and reflect personal wishes.

4. Incorporate Charitable giving — Partner with TJF to explore options such as Donor Advised Funds, legacy estate bequests, trusts, or IRA Charitable Rollover distributions to establish Restricted Funds that offer immediate tax benefits and long-term community impact.

“Crafting a thoughtful estate plan is a gift to your loved ones,” Alperin says. “It protects your family, preserves your values, and gives you peace of mind knowing your legacy will continue for generations.”

To learn more about integrating charitable giving into an estate or trust plan, contact Tidewater Jewish Foundation at www. tidewaterjewishfoundation.org or 757-965-6100.

Scott N. Alperin, J.D., is the founder of Alperin Law in Virginia Beach and an Estate Planning Law Specialist and Accredited Estate Planner.

Next Gen Engagement Coordinator Employment Opportunity

United Jewish Federation of Tidewater is seeking an energetic and relationship-driven Next Gen Engagement Coordinator to connect Jewish young adults (ages 22–40) with meaningful community experiences, Jewish life, leadership opportunities, and philanthropy. This role may be structured as one full-time or two part-time positions.

Responsibilities include

•Building authentic relationships with young adults

•Planning and leading social, cultural, and service programs

•Developing young adult leadership opportunities

•Growing participation in Federation campaigns

Qualifications include Bachelor’s degree preferred; experience in community engagement, Jewish programming, or young adult initiatives a plus. Must be a strong communicator, creative planner, and available some evenings/weekends.

Complete job description at www.jewishva.org

Submit cover letter, resume, and salary requirements to: resumes@ujft.org

Equal Opportunity Employer

Local firm has wide reach when purchasing investment properties business

Cohen Investment Group (CIG) is a privately owned commercial real estate investment firm specializing in multifamily apartments and self-storage properties.

The firm’s strategy is to identify and acquire well-located real estate assets below replacement cost while engaging the firm’s third-party property managers to improve operational efficiencies. This practice is continuously implemented to increase net operating income in order to best time a disposition event with optimal risk-adjusted returns.

Founded in late 2013, Norfolk-based Cohen Investment Group began acquiring assets in 2014. Since its inception, the company has transacted on almost $1 billion in capital activity, which is acquisitions and dispositions combined. The company currently owns 60 properties in 13 states across the U.S.

“We work primarily with accredited investors, single and multifamily offices, ultra-high net worth investors, registered investment advisors, and private equity,” says Hugh Cohen, president of the firm.

“Our investment thesis is simple, to acquire investment-grade real estate, ideally below replacement cost in the Southeast, Southwest, Midwest, and Mountain range. We are continuing to underwrite and evaluate properties across the country in an ever-changing economic climate. Our investments are an excellent recessionary hedge and offer diversification from a challenging and fluctuating stock market environment.”

TowneBank: Conducting business and building relationships in Tidewater for more than a quarter of a century

As this community’s bank for more than 25 years, TowneBank offers exquisite service to meet the complete financial needs of individuals and organizations.

The bank is dedicated to being the bank of choice for nonprofits and associations, local businesses, and professional practices. Through the Towne family of companies, financial professionals provide expertise in realty and mortgages, insurance and employee benefits, wealth management and succession planning, and 1031 exchanges.

Whatever the need, TowneBank is here for its clients and community. Visit the bank at TowneBank.com.

Member FDIC | Equal Housing Lender | NMLS# 512138 Towne 1031 Exchange does not provide tax or legal advice. Please consult an accountant and/or attorney. Insurance and investment products are Not bank deposits or obligations, Not FDIC-insured, Not guaranteed by TowneBank, and may go down in value.