Small Businesses, Big Impact

Why Georgia is Great

Georgia

Employment

Demographic Profile of Georgia

Industry

Small businesses are the heart and soul of Georgia’s economy. They spark innovation, create jobs, and enrich our communities. Across the state, they offer employment opportunities for families, first-time job seekers, and those looking for flexible work. From cutting-edge tech startups to beloved local service providers, small businesses infuse the marketplace with fresh ideas and entrepreneurial spirit. Their positive impact is felt everywhere, from the hustle and bustle of urban centers to the tranquility of rural towns, driving economic growth and opportunity throughout Georgia.

UGA SBDC CLIENT SUCCESS OVER THE PAST 5 YEARS

2,182 BUSINESSES STARTED $9.5B

15,514 JOBS CREATED $1.25B CAPITAL RAISED

TOTAL SALES

WITH 18 OFFICES ACROSS THE STATE, THE UGA SBDC PROVIDES EDUCATIONAL TRAINING PROGRAMS AND CONFIDENTIAL, ONE-ON-ONE CONSULTING TO SMALL BUSINESS OWNERS AND PROSPECTIVE ENTREPRENEURS.

Over the past five years, individuals who have sought assistance from the University of Georgia Small Business Development Center (UGA SDBC) have created more than 2,182 NEW BUSINESSES, added more than 15,514 JOBS, raised more than $1.25 BILLION IN LOAN AND EQUITY FINANCING and generated over $9.5 BILLION IN SALES.

According to the latest impact study, firms that have sought UGA SBDC assistance experienced JOB GROWTH OF 14.9% versus the 2% growth of a typical Georgia firm.

SALES AND EMPLOYMENT GROWTH

3-YEAR NEW BUSINESS SURVIVABILITY

At the UGA SBDC, we believe small is great and have produced this report to cover some of the impacts small businesses have in Georgia. This publication provides an overall look at Georgia’s small business environment and shines the spotlight on noteworthy trends happening in various regions of the state.

Most importantly, this publication helps illuminate the contributions made by Georgia’s entrepreneurs on the economic well-being of all Georgia citizens.

Sources:

1. “Top States for Doing Business 2024,” Area Development Magazine, Q3 2024.

2. “America's Top States for Business 2024.” cnbc.com, Web, Accessed 2024.

3. “2024 Impact of Women-Owned Business Report," Wells Fargo, Web, Accessed 2024.

4. "Best States to Start a Business,” Wallethub.com, Web, Accessed 2024.

#1 WORKFORCE TRAINING PROGRAMS1

#3 ECONOMIC CLOUT FOR WOMEN-OWNED BUSINESSES3

#3 ACCESS TO QUALIFIED LABOR1

#1 INFRASTRUCTURE2

#2 ENERGY AVAILABILITY & COSTS1

1.3M SMALL BUSINESSES IN GEORGIA

42.5% OF GEORGIA’S SMALL BUSINESSES ARE MINORITY-OWNED

87.3% OF ALL GEORGIA EXPORTERS ARE SMALL BUSINESSES

99.7% OF GEORGIA BUSINESSES ARE SMALL

1.7M SMALL BUSINESS EMPLOYEES IN GEORGIA

Georgia small business employment grew by 21.9% from 1997 to 2021, exceeding the national small business employment growth rate.1 The state’s unemployment rate is at 3.6%, lower than the national unemployment rate of 4.1%.2

From March 2022 to March 2023, there was a net increase of 120,147 jobs in Georgia. Small businesses contributed to 76.2% of that total.1

Small business employees make up 43.1% of Georgia’s employees, with small businesses accounting for 99.7% of Georgia businesses overall.1

1.7 MILLION Small Business Employees1

1.3 MILLION Small Businesses in Georgia1

1.

Georgia continues to exhibit a wide spectrum of diversity among the state’s entrepreneurs and small business owners. A recent study from the U.S. Small Business Administration Office of Advocacy reported that women own 47.7% of Georgia businesses. Across the state, there are 42,204 femaleowned businesses with employees (outside of the owner).1

Georgia is also home to 646,665 minority-owned businesses, accounting for 42.5% of the state’s businesses.1 Georgia ranks fifth in the nation for states with the most minority-owned businesses.2

Georgia continues to experience population growth with an estimated 11,029,227 people living in the state, according to the 2023 U.S. Census Bureau data. This 2.9% increase from 2020 is higher than the U.S. population increase of 1.0% over the same time period.3

99.7% ARE SMALL

47.7% WOMEN-OWNED

42.5% MINORITY-OWNED

10.0% HISPANIC-OWNED

6.6% VETERAN-OWNED

As Atlanta solidifies its status as a technology hub, the interplay between talent, infrastructure, and a favorable business environment will drive the region’s growth, signaling a strong outlook for 2025. Small businesses, often at the forefront of innovation, will find Atlanta an attractive and supportive ecosystem for technology-driven entrepreneurship.

One of the core strengths of Atlanta’s tech sector is its access to skilled talent. In 2023, Atlanta boasted over 138,000 tech workers with an average salary of $114,747, nearly double the earnings of non-tech employees in the area.1 Aided by a diverse academic landscape that awarded nearly 10,000 tech-related degrees in 2022, Atlanta is well-positioned to meet the industry’s rising talent demands.1

Notably, Georgia is also a national leader in cyber talent development, with 10 institutions holding designations as National Centers of Academic Excellence in Cyber Defense or Research.2 This robust talent pool, combined with a forecasted five-year wage growth of 22.1% for tech roles, underscores Atlanta’s appeal as a tech innovation center.1

Atlanta sits at the intersection of two of the nation’s largest fiber routes, enhancing its connectivity to major research and international networks.3 The presence of robust fiber infrastructure has attracted data centers and colocation facilities, positioning Atlanta as one of the fastest-growing data center markets in the country. Notably, tech giants like Google, Amazon, and Microsoft are expanding data center operations in Georgia, further establishing the state’s role in supporting next-generation technologies.4

In addition, Georgia’s energy infrastructure supports the region’s technology industry with reliable, low-cost power largely derived from natural gas and nuclear sources.5 This stable energy environment is critical for data centers, which require high power densities, especially as AI-driven demand increases.

138,000

22.1%

In cybersecurity, workforce development and defense-related investments are accelerating, responding to the increasing need for robust security in an interconnected world. Atlanta is home to over 41,723 cybersecurity professionals and more than 115 cybersecurity companies, generating nearly $5 billion in annual revenue.6,7 This sector is bolstered by the Georgia Cyber Center, a $106 million facility in Augusta aimed at advancing cybersecurity research, workforce development, and collaboration.7

The demand for data center capacity, particularly to support AI workloads, is driving infrastructure investments. Atlanta’s low risk for natural disasters, competitive energy costs, and extensive fiber network make it a prime location for data centers. With more than 80 facilities, Atlanta hosts a variety of industries, including financial services, health care, and digital media.8

The city’s data center market has transitioned from a colocation focus to a wholesale storage model, driven by increasing demand from AI, cloud computing, and IoT technologies.8 Microsoft’s planned $1.8 billion investment in the area exemplifies the sector’s growth potential.9

FinTech remains a pillar of the local economy, with rising consumer demand for digital financial services contributing to job growth and innovation. Georgia’s “Transaction Alley” processes approximately 70% of U.S. financial transactions, solidifying its reputation as a FinTech epicenter. More than 210 companies in Georgia offer services from blockchain and information security to data analytics.10

Following a near closure during the pandemic, ShareableFORMS in Bremen, led by founder Bobby Mehan and CEO Holly O’Hare, collaborated with the UGA SBDC to transform its business. In one year, the company boosted operating income by 137%, while reducing costs by 15%.

Sources:

1. "Scoring Tech Talent 2024 Report,” CBRE, Web, Accessed 2024.

2. “Georgia’s Cyber Industry,” Georgia Department of Economic Development, 2022.

3. “Why Georgia: Infrastructure,” Georgia Department of Economic Development, Web, Accessed 2024.

4. “Why Georgia: Data Centers,” Georgia Department of Economic Development, Web, Accessed 2024.

5. “Georgia State Profile and Energy Estimates, 2024,” U.S. Energy Information Administration, 2024.

6. "Cybersecurity Supply and Demand Heatmap," Cyber Seek, Web, Accessed 2024.

7. “Cybersecurity Innovation in Georgia,” Georgia Department of Economic Development, Web, Accessed 2024.

8. "U.S. Data Center Locations Map," Datacenters.com, Web, Accessed 2024.

9. “Details Emerge On Microsoft’s $1.8 Billion Investment In Atlanta Data Centers Amid Tax, Development Wrangles,” Data Center Frontier, Web, July 18, 2024.

10. “Georgia Fintech Industry, 2023,” Technology Association of Georgia, Web, Accessed 2024.

T he construction industry in Atlanta is positioned for continued growth in 2025, driven by robust population increases, job creation, and investment in diverse construction sectors. With more people relocating to Atlanta and its surrounding areas, the demand for housing, commercial spaces, and industrial facilities continues to fuel economic activity.

The construction sector in Atlanta is well-positioned for a strong 2025 and small businesses and investors can find abundant opportunities within this expanding market. As the region adapts to demographic shifts and increasing infrastructure demands, Atlanta’s construction industry will continue to play a crucial role in the economic development of Georgia.

Key Catalysts for Construction

Atlanta’s rapid population growth and job market expansion are pivotal in shaping the construction industry. According to recent estimates, Atlanta’s non-farm employment increased by over 41,000 positions from August 2023 to August 2024, surpassing job growth rates in other large metropolitan areas.1

This influx of new residents has heightened demand across the construction spectrum, from residential housing to large-scale

commercial projects. As a hub for business and innovation, Atlanta’s construction sector is essential for accommodating the population and supporting the city’s economic dynamism.

Sector-Specific Insights

While commercial construction in many U.S. cities saw a decline in 2023, Atlanta bucked this trend, with an 18% increase in project starts in the first half of the year, totaling $5.4 billion in investments. This resilience reflects the strength of Atlanta’s commercial real estate markets. Notably, large-scale developments like the $642 million first phase of the Facebook Stanton Springs data center underscore the demand for office and industrial spaces, particularly in high-growth suburban areas.2

As a major logistics hub, Atlanta has become a focal point for industrial construction. The sector saw impressive activity, with 1.7 million square feet of net absorption, or net change in demand for space relative to supply, between Q2 and Q3 of 2024 and 10.1 million square feet under development. Key projects, like the Speedway Commerce Center’s Building 6, which added 1.4 million square feet, emphasize the scale of Atlanta’s industrial

infrastructure. This thriving industrial landscape supports Atlanta’s role in global supply chains, making it an attractive location for small and large businesses alike.3

The single-family residential sector continues to expand, driven by population growth and urban sprawl. In Fulton County, new residential construction permits increased by 45% in the Q4 of 2024, while higher-value homes (above $500,000) saw notable growth in Fulton and Cherokee counties.4 Approximately 18,035 new residential construction permits were issued in Atlanta through Q3 of 2024, a 17% year-over-year rise. This growth reflects a demand for metro Atlanta homes, particularly in counties like Gwinnett, Cobb, and Forsyth.5

19.5% ATLANTA 12-YEAR POPULATION GROWTH VS NATIONAL AVERAGE6 7.7%

$5.4B Q1 INVESTMENT IN ATLANTA COMMERCIAL REAL ESTATE2 21-COUNTY ATLANTA REGION EXPECTED TO ADD 840K JOBS BY 20507

Expertise in Action

Expertise in Action CONSTRUCTION B2B MANUFACTURER EXPANDS DIGITAL MARKETING WITH HELP FROM UGA SBDC

MANUFACTURER EXPANDS DIGITAL MARKETING WITH ASSISTANCE FROM UGA SBDC

Looking to increase their online presence and expand their digital marketing efforts, the owners of Silt Saver in Covington attended a UGA SBDC class on LinkedIn strategy. Now, the company is selling its erosion control products across a wider market and continues to work with the UGA SBDC as new projects and challenges arise.

Sources:

1. “Atlanta Area Employment – September 2024,” U.S. Bureau of Labor Statistics, Web, Accessed 2024.

2. “Commercial and Multifamily Starts Declined in 5 of the Top 10 Metro Areas...,” Dodge Construction Network, Web, July 26, 2023.

3. “MarketBeat Report - United States & Georgia Industrial Q3 2024 Reports,” Cushman & Wakefield, Web, Accessed 2024.

4. “Atlanta Residential Construction Starts Strong in Q1,” Home Builders Weekly, Web, April 17, 2024.

5. “Atlanta Residential Construction Report: Q3-2024,” Home Builders Weekly, Web, October 9, 2024.

6. “Our Changing Population: Georgia,” U.S. Bureau of Labor Statistics data compiled by USAFacts, Web, Accessed 2024.

7. “Population & Employment Forecasts,” Atlanta Regional Commission, Web, Accessed 2024.

T he health care industry in South Georgia, critical to the wellbeing of its communities, faces persistent challenges shaped by a unique set of demographic, economic and logistical factors. An aging population, workforce shortages and limited access to essential services have defined the landscape in recent years.

However, innovation and new initiatives, particularly in telemedicine, present meaningful opportunities for growth, especially for small businesses looking to enter or expand in this sector.

South Georgia’s demographics reveal a significant aging population, intensifying demand for specialized healthcare services such as geriatric, chronic disease and palliative care.1 The rising senior demographic, predominantly residing in rural areas with limited health care infrastructure, underscores the need for accessible health care models like home health care, telemedicine, and mobile health units. The demand for long-term and in-home care options is projected to surge as elderly residents increasingly seek accessible and specialized care without having to travel long distances.2

The South Georgia health care sector faces formidable obstacles, chief among them being a shortage of healthcare professionals. Georgia ranks near the bottom in the nation for physician availability, with the shortage most severe in rural areas. Projections indicate a statewide deficit of 8,012 physicians by 2030, with roughly a third of current physicians nearing retirement.3

This shortage is compounded by the closure of rural hospitals and clinics over the past decade, a trend that has left numerous counties with limited access to health care facilities.4 The uninsured population in South Georgia further complicates health care delivery, as nearly 1.4 million Georgians lack health insurance, placing the state among those with the highest uninsured rates in the U.S.4

Despite ongoing challenges, innovative programs are transforming health care access in South Georgia. Telehealth has become essential, enabling virtual consultations that allow patients to access specialists, manage chronic conditions and receive mental health support without extensive travel.5

To support rural health care, targeted funding initiatives and tax incentives are attracting professionals to underserved areas and improving hospital stability. State-funded loan repayment programs also encourage new medical professionals to practice in rural communities, addressing workforce shortages in South Georgia.6

High-speed internet expansion is further boosting health care access. In 2023, Gov. Brian Kemp announced $15 million in grants to enhance connectivity in four South Georgia counties, a move that will make telemedicine services more accessible.7 Additionally, lawmakers increased the Rural Hospital Tax Credit to $75 million, enabling rural hospitals to invest in state-of-theart equipment.8

The demand for health care services in South Georgia offers significant business opportunities, particularly for small enterprises positioned to address regional needs.

1. Telehealth Services: Telehealth service platforms, which facilitate virtual consultations, offer a high-growth area for small businesses.

2. Home Health Care Services: Given the senior population’s demand for personalized and in-home care, small businesses offering home health care services and hospice care have substantial potential in this region.

3. Health Care Staffing: Staffing agencies specializing in health care can also thrive, helping to address the regional workforce gap by connecting medical professionals with hospitals and clinics.

4. Mental Health Care: The growing focus on mental health care further presents opportunities for small businesses to establish counseling practices, support groups or wellness initiatives.

Sources:

Durable medical equipment supplier Brookstone Medical in Leesburg was thriving, but owner Matt Corley saw room to grow. With UGA SBDC’s help he improved financing, resolved HR challenges, and developed a plan to add new product lines. Since then, his employee count has doubled, and sales have increased five-fold.

S outh Georgia stands at the intersection of tradition and innovation, where its historic agricultural roots are being transformed by advancements in agriculture technology (AgTech). Known for fertile lands and diverse crops, the region contributes significantly to Georgia’s $83.6 billion agricultural economy.1 From peanuts and cotton to pecans, blueberries, and Vidalia onions, South Georgia not only leads the state but also often ranks at the forefront of national agricultural production.

With approximately 80% of Georgia’s row crops grown in South Georgia, the region benefits from 2.7 million acres of arable land, a favorable climate, and growing investments in AgTech.2 By integrating innovative technologies into its diverse agricultural base, South Georgia is driving efficiencies, reducing resource use and enabling long-term sustainability.

South Georgia’s agricultural output is impressive, with 22 counties generating over $4 billion annually in Farm Gate Value (the net value of a farm product after subtracting selling costs from its market value).3 In addition to row crops, the region is a major hub for food manufacturing, with over 74 processing companies.2 The region’s agricultural infrastructure, coupled with its strategic location, make it a vital contributor to both state and national food systems.

South Georgia’s agricultural diversity is unmatched. In addition to its staple crops, the region supports extensive vegetable farming, including tomatoes, bell peppers, and watermelons.2 Poultry and cattle industries also thrive, complementing crop production and further diversifying its agricultural portfolio. With a mild climate allowing for year-round cultivation, South Georgia offers a fertile ground for agribusiness expansion and AgTech applications.2

AgTech has become a game-changer for South Georgia farmers, enabling more efficient and sustainable farming practices. Precision agriculture is transforming the industry with technologies that optimize irrigation, fertilization, harvesting, and crop monitoring. These technologies, combined with data analytics platforms, are helping farmers maximize productivity and reduce their environmental footprint.4,5

Research and development are pivotal to the sector’s growth. Institutions like the University of Georgia’s Agricultural Experiment Station in Tifton lead the charge with cutting-edge research on precision agriculture technologies. A new $3 million precision agriculture laboratory is slated for construction in 2025, featuring state-of-the-art facilities for developing and demonstrating innovative farming technologies.6

South Georgia’s AgTech industry is poised for sustained growth, driven by its agricultural diversity, research leadership, and technological advancements. As precision agriculture becomes standard practice, the region is expected to lead the charge in creating sustainable farming systems that address global food security challenges. Investments in broadband infrastructure will further enable AgTech adoption, expanding access to telecommunication-dependent tools like remote sensing and farm management software.7

This dynamic interplay of tradition and technology ensures that South Georgia remains a critical player in Georgia’s agricultural economy, offering opportunities for small businesses, investors, and innovators to thrive in the AgTech sector.

SOUTH GEORGIA FARMERS PRODUCE ABOUT 80% OF THE STATE'S ROW CROPS

FOOD & FIBER PRODUCTION (+ RELATED INDUSTRIES) CONTRIBUTED $83.6B 323K JOBS TO THE GEORGIA ECONOMY1 AND

FOOD MANUFACTURING JOBS IN SOUTH GEORGIA2 5,599

GEORGIA'S TOP COMMODITIES INCLUDE:1 BROILERS EGGS COTTON

Kelley Manufacturing Company, a Tifton-based farm machinery maker, sought to expand globally. With help from the UGA SBDC, they secured a major dealer in South Africa. Today, Kelley has seven international dealers and exports to 22 countries, while continuing to leverage the UGA SBDC’s expertise for global growth.

Sources:

1. "2024 Ag Snapshot," UGA Extension, 2024.

2. “Agribusiness & Food Processing,” Locate South Georgia, Web, Accessed 2024.

3. “2022 Georgia Farm Gate Value Report,” UGA Center for Agribusiness and Economic Development, 2022.

4. “Innovating the South’s Precision Agriculture Technology,” UGA College of Agricultural and Environment Sciences, Web, Accessed 2024.

5. “Precision Agriculture: Technology To Boost Crop Farming,” EOS Data Analytics, Web, Sept. 9, 2024.

6. “UGA-Tifton demonstration lab to fuel innovation in precision agriculture,” UGA CAES Newswire, Web, May 6, 2024.

7. “Gov. Kemp Announces Grant Funds to Expand High-Speed Internet Access in Four Counties,” Georgia Office of the Governor, Web, 2023.

MEET THE EXPERT:

Thomas Credle is a business consultant with the University of Georgia Small Business Development Center in Columbus. With over 20 years in banking and finance, Thomas has held roles that include retail banking manager, credit analyst, commercial lender, and vice president of commercial lending. His experience spans local, regional, and national banks, as well as credit unions. He also served as CFO for a multi-state hotel developer, handling complex capital structures like mezzanine and municipal bond financing. Additionally, Thomas has developed financial software for clients like Capital One and Bank of America.

Over his past five years at the UGA SBDC, Thomas has helped his small business clients secure $19 million in capital.

F or many small business owners, one of the most common challenges of applying for a commercial loan is understanding how lenders decide whether to approve or decline their application. Banking terms, such as “underwriting” and “debt service coverage,” can make the process confusing and stressful, especially for anyone who has never encountered them before. When business owners do not understand the criteria for analysis and approval, it is hard to make the prudent decisions needed to improve their approval chances. This lack of clarity can often lead to frustration, especially if a loan is declined, and some may abandon the process altogether.

Consumer loans, like mortgages or personal credit cards, are analyzed differently than commercial loans. This difference can mislead entrepreneurs, who might assume that similar principles apply to both. For example, while personal credit scores play a key role in consumer loan approvals, business credit scores are usually irrelevant in commercial loan decisions.

By understanding the three metrics banks use in commercial loan decisions – cash flow, guarantor resource, and collateral – small business owners can find the process to be shorter, less stressful, and more likely to result in a positive outcome.

The primary metric lenders consider is cash flow from your business operations. This is analyzed using the Global Debt Service Coverage Rate (GDSCR), which evaluates your cash flow compared to your debt payments. To calculate this, lenders divide your business’s yearly cash flow by its total debt payments for the same year. A GDSCR of 1.25 or higher is usually required. Think about the GDSCR this way: your business must have $1.25 in cash for every $1.00 owed to reassure your lender the business’s cash flow is enough to repay the debt.

If the business itself cannot repay the loan, the responsibility falls to the individual(s) guaranteeing the loan, typically the business owner(s). This guarantee, called recourse, means the owners guarantee to make the loan payments if the business cannot. For this reason, lenders look closely at the personal credit score of the guarantors. A credit score exceeding 650 is typically required, though a score above 700 is preferred. Additionally, any unpaid collections, judgments, or bankruptcies may disqualify a guarantor.

Lenders also consider liquidity, or any cash, investments, or readily available assets the guarantor has, to determine if there

are adequate funds to provide a down payment and pay on the loan. A higher level of liquid assets increases your chances of approval. A guarantor’s experience working in their industry or with the lender will also be considered.

If cash flow and personal guarantee are insufficient for repayment, lenders rely on a third option: repossessing and selling collateral. Collateral is any asset the borrower pledges to secure the loan. This can include real estate, equipment, or other property. Collateral strength is measured with a metric called loan to value (LTV). LTV is calculated by dividing the loan amount by the collateral’s discounted value. Collateral with a higher LTV, like real estate, is more valuable and more favorable for loan approval than property with a lower LTV, like vehicles which depreciate faster.

Knowing the main metrics in loan approval helps small business owners better prepare. Here are some steps to consider before applying:

1. Evaluate Your Cash Flow: Calculate your cash flow and GDSCR. If it’s below 1.25, you might consider ways to boost cash flow before applying.

2. Review Your Personal Credit: Ensure your personal credit score is higher than 650, with no unpaid collections, judgments, or bankruptcies.

3. Assess Liquid Assets: Make sure your liquid assets are as high as possible when you apply. Lenders want to see you have enough cash or assets available for a potential down payment.

4. Understand Your Collateral: Identify the assets you could pledge and how much the bank will discount them to determine if you have enough collateral to be approved.

Commercial loan applications can be complex, but there are resources that can help. SBDCs provide consulting services at no charge, including loan preparation and financial planning. Working with an SBDC consultant can simplify the process, ensure you meet the lending criteria, and improve your chances of approval.

As a small business owner, understanding how banks assess commercial loans, and preparing for each factor, can help reduce stress and increase your likelihood of securing the funds your business needs to grow.

FACED BY GEORGIA BUSINESSES1*

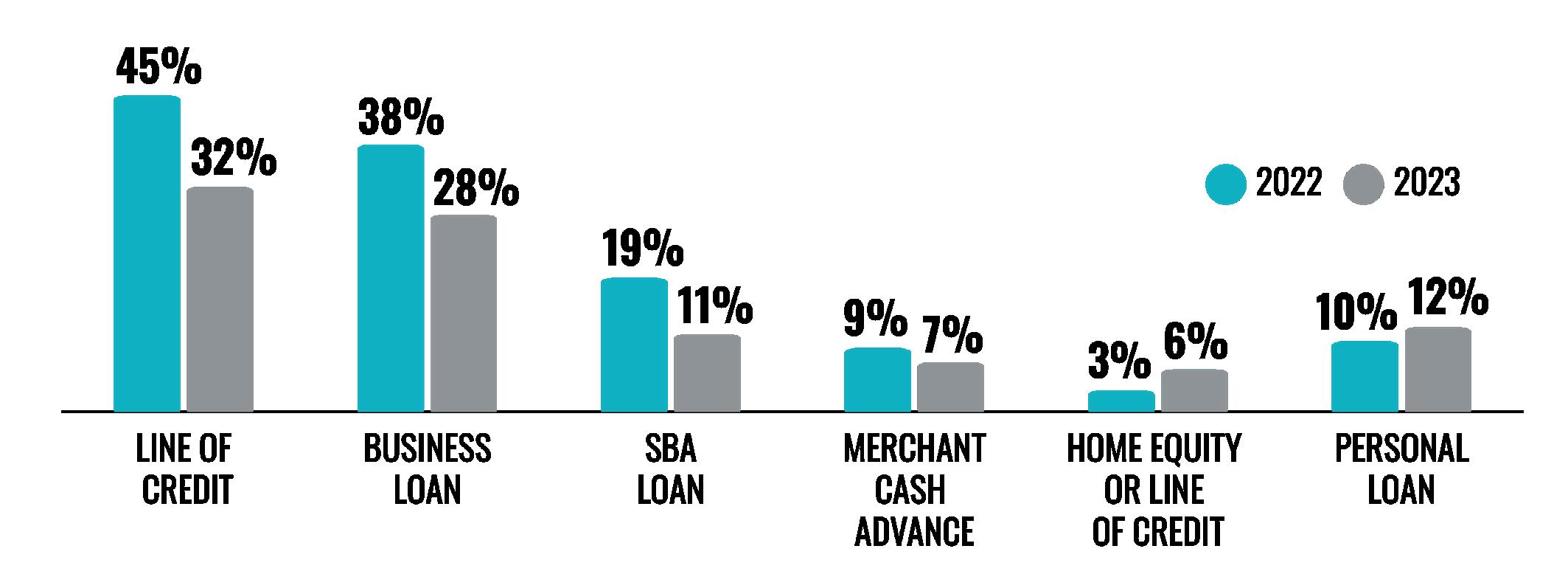

BY TYPE OF LOAN, LINE OF CREDIT, OR MERCHANT CASH ADVANCE1*

According to the 2023 Small Business Credit Survey from Federal Reserve Banks, 91% of U.S. businesses experienced one or more operational challenges, and 93% faced some type of financial challenge in the last year. Rising costs remained the top financial issue, affecting 77% of firms, down from 81% in 2022.1

Applications for loans or credit slightly decreased, but approval rates held steady. Small banks and credit unions offered the highest approval rates and customer satisfaction, while online lenders saw the lowest satisfaction.1 These insights highlight persistent cost pressures and varied borrower experiences in the small business lending landscape.

The University of Georgia Small Business Development Center (UGA SBDC) provides business training and consulting services to help small businesses grow and succeed. Working with chambers of commerce, lending institutions and other business development organizations, the UGA SBDC educates business owners on how they can grow their businesses, as well as helps aspiring entrepreneurs improve their chances for success.

Considered to be one of the state’s top providers of small business assistance, the UGA SBDC can help in the areas of business planning, market development, access to capital, record keeping and myriad of other topics through various educational and technical assistance activities.

The UGA SBDC is a Public Service and Outreach unit of the University of Georgia and is funded in part by the U.S. Small Business Administration (SBA). The University of Georgia Small Business Development Center is nationally accredited by the Association of SBDCs and SBA.

ALBANY georgiasbdc.org/albany

ATHENS georgiasbdc.org/athens

ATLANTA (2 LOCATIONS)

MOREHOUSE COLLEGE & GEORGIA STATE UNIVERSITY georgiasbdc.org/atlanta

AUGUSTA georgiasbdc.org/augusta

BRUNSWICK georgiasbdc.org/brunswick

UNIVERSITY OF WEST GEORGIA georgiasbdc.org/carrollton

COLUMBUS georgiasbdc.org/columbus

DEKALB georgiasbdc.org/dekalb

GAINESVILLE georgiasbdc.org/gainesville

GWINNETT

georgiasbdc.org/gwinnett

KENNESAW STATE UNIVERSITY

georgiasbdc.org/kennesaw

MACON georgiasbdc.org/macon

CLAYTON STATE UNIVERSITY

georgiasbdc.org/morrow

ROME georgiasbdc.org/rome

SAVANNAH georgiasbdc.org/ southern-coastal

GEORGIA SOUTHERN UNIVERSITY georgiasbdc.org/ southern-coastal

VALDOSTA STATE UNIVERSITY georgiasbdc.org/valdosta