[Type here]

Town Centre Assessment Study

Lewisham Shopping Centre and adjacent land

OCTOBER 2024 Q210074

[Type here]

Town Centre Assessment Study

Lewisham Shopping Centre and adjacent land

OCTOBER 2024 Q210074

1.1 This Town Centre Assessment Study (‘TCAS’) has been prepared by Quod in support of proposals submitted by Landsec Lewisham Limited (‘Landsec’) (‘the Applicant’). The proposals seek the comprehensive redevelopment of Lewisham Shopping Centre and adjacent land, Lewisham, London (‘the Application Site’).

1.2 The TCAS should be read alongside other documents submitted in support of the planning application, including, but not limited to, the following:

Planning Statement prepared by Quod; and

Design and Access Statement.

1.3 The TCAS concentrates specifically on the retail and town centre planning policy issues associated with the ‘main town centre uses’ proposed by this application. As such, it provides justification for this element of the overall scheme.

Location and Context of the Application Site

1.4 The Application Site extends to 6.93 hectares and is located within Lewisham town centre (as defined by the adopted Development Plan). It comprises the existing Lewisham Shopping Centre, which was built in 1977 and includes a range of retail units, a multi-storey car park, an 18-storey office building (Lewisham House), the vacant leisure box and Riverdale Hall, together with existing commercial properties fronting Lewisham High Street.

1.5 The Application Site is bound to the west and south by Molesworth Street (A21), to the east by Lewisham High Steet and to the north by Rennell Street (A20). West of Molesworth Street is the railway line and Ravensbourne River as well as a mix of green space, residential and commercial buildings. The Application Site benefits from the highest Public Transport Accessibility Level (PTAL) rating (i.e. 6b (excellent)). The closest London DLR station is Lewisham, approximately 170 metres north of the Application Site, and the nearest National Rail station is Lewisham, around 240 metres to the north.

1.6 The Application Site comprises an ‘in centre’ location in planning policy terms falling within the defined town centre boundary of Lewisham town centre. It also located within the defined Primary Shopping Area (PSA) The National Planning Policy Framework (‘NPPF’) (2023) defines the PSA as follows:

“Defined area where retail development is concentrated.”

1.7 Reflecting this, the Application Site comprises a wide mix of town centre uses, including retail, services and other commercial operations, extending to approximately 73,483 square metres (gross).

1.8 Full details of the application proposals are provided in the supporting Design and Access Statement and Planning Statement.

1.9 The Proposed Development is for mixed-use development to deliver new homes, student accommodation, public realm and open space, community and cultural uses alongside a wide range of main town centre uses. Planning permission is sought for the following:

“Hybrid planning application for the comprehensive, phased redevelopment of land at Lewisham Shopping Centre and adjacent land, comprising:

Ful planning application (within Phase 1a) comprising the demolition of existing buildings, structures and associated works to provide a mixed-use development including the erection of a Co-living building (Suo Generis) up to 23 storeys in height (Plot N1), and a residential building (Class C3) up to 15 storeys in height (Plot N2), associated residential ancillary spaces as well as town centre uses (Class E (a, b, c, d, e, f, g (i, ii)); and Sui Generis) together with public open space, public realm, amenity space and landscaping, car and cycle parking, highway works and the formation of new pedestrian and vehicle accesses, existing shopping centre interface works (the ‘Phase 1a Finish Works’), service deck modifications, servicing arrangements, site preparation works, supporting infrastructure works and other associated works.

Outline planning application (all matters reserved) for a comprehensive, phased redevelopment, comprising demolition of existing buildings, structures and associated works to provide a mixed-use development including:

The following uses:

o Living Uses, comprising residential (Class C3) and student accommodation (Sui Generis);

o Town Centre Uses (Class E (a, b, c, d, e, f, g (i, ii)) and Sui Generis);

o Community and Cultural uses (Class F1; F2; and Sui Generis);

Public open space, public realm, amenity space and landscaping works;

Car and cycle parking;

Highway works;

Formation of new pedestrian and vehicular accesses, permanent and temporary vehicular access ramps, service deck, servicing arrangements and means of access and circulation within the site;

Site preparation works;

Supporting infrastructure works;

Associated interim works;

Meanwhile and interim uses and

Other associated works.”

1.10 In terms of the main town centre uses proposed 1 , up to a maximum of 49,442 square metres (gross external area) of floorspace is proposed over both the detailed and outline elements. This includes up to 2,776 square metres at the detailed stage and 46,666 square metres (gross external area) as part of the outline element of the planning application This compares to 55,958 square metres (gross external area) of existing town centre floorspace (much of which is vacant or on short-term lets - c. 29,275 square metres) that will be demolished as part of the development proposals.

1.11 As outlined in the supporting Development Specification, of this floorspace, provided as part of the element stage at least 50% of the town centre uses floorspace is intended to be used for retail (Class E(a)) floorspace, and at least 1,751 square metres will be used for community and cultural uses (i.e. Class F.1/F.2, and / or Sui Generis).

1.12 The residual floorspace will comprise a mix of main town centre uses. This could include a mix of uses, including further retail together with food and beverage (‘F&B’) and leisure uses. A mix of uses is proposed to reflect the changing retail sector and the need for a wider offer for Lewisham Shopping Centre, and the wider town centre, to be successful and competitive – as advocated by planning policy at all levels.

1.13 In addition to the commercial floorspace, the proposals also include up to 1,719 homes (Class C3), up to 661 student beds (Sui Generis) and 445 co-living homes (Sui Generis) in line with aspirations for the New Cross / Lewisham / Catford Opportunity Area.

1.14 In addressing relevant retail and town centre planning policy and detailed justification for the application, the following sections are provided:

Section 2 – sets out the relevant retail and town centre policy context against which the proposals need to be assessed;

Section 3 – consider the proposal’s conformity against the sequential approach to site selection;

Section 4 – assesses the trading effects of the proposal; and

Section 5 – draws the report’s conclusions.

1 Main town centre uses are defined in the National Planning Policy Framework (Annex 2) as: “retail development (including warehouse clubs and factory outlet centres); leisure, entertainment facilities the more intensive sport and recreation uses (including cinemas, restaurants, drive ‐through restaurants, bars and pubs, night ‐clubs, casinos, health and fitness centres, indoor bowling centres, and bingo halls); offices; and arts, culture and tourism development (including theatres, museums, galleries and concert halls, hotels and conference facilities).”

2.1 A full planning policy overview is provided within the supporting Planning Statement. For the purposes of this report, the retail and town centre policies are relevant, and these are summarised below

Development Plan

2.2 The adopted Development Plan for the Application Site comprises the London Plan (March 2021), the Lewisham Core Strategy (June 2011), the Lewisham Site Allocations Local Plan (June 2013), the Lewisham Town Centre Local Plan (February 2014) and the Development Management Local Plan (November 2014).

London Plan

2.3 With respect to retailing and town centres, Policy SD6 (‘Town centres and high streets’) outlines that the vitality and viability of London’s varied town centre should be promoted and enhanced through:

“1) encouraging strong, resilient, accessible and inclusive hubs with a diverse range of uses that meet the needs of Londoners, including main town centre uses, night-time economy, civic, community, social and residential uses

2) identifying locations for mixed-use or housing-led intensification to optimise residential growth potential, securing a high-quality environment and complementing local character and heritage assets

3) delivering sustainable access to a competitive range of services and activities by walking, cycling and public transport

4) strengthening the role of town centre as a main focus for Londoners’ sense of place and local identity in the capital

5) ensuring town centres are the primary locations for commercial activity beyond the CAZ and important contributors to the local as well London-wide economy.

6) supporting the role of town centres in building sustainable, healthy and walkable neighbourhoods with the Healthy Streets Approach embedded in their development and management.” (our emphasis)

2.4 This Policy also recognises that the “adaption and diversification of town centre should be supported” in response to changing consumer behaviour.

2.5 The Policy goes on to acknowledge, at Criterion F, that the “management of vibrant daytime, evening and night-time activities should be promoted to enhance town centre vitality and viability” The supporting text to this Policy (at Paragraph 2.6.4) recognises that:

“Over the years, town centres have absorbed change and new technologies. To continue to thrive they will need to evolve and diversify in response to current and future economic trends, technological advances, consumer behaviours, and the development of the 24-hour city. This need for adaptation and diversification, together with their good public transport accessibility, makes many town centres appropriate locations for residential-led intensification or mixed-use development that makes best use of land. Bringing new residents into town centres can enhance their commercial role, increasing footfall, particularly to support convenience retail, leisure uses and the evening and night-time economy. Town centres will also need to diversify the range of commercial uses, particularly smaller centres and those with projected decline in demand for retail floorspace. Boroughs and others should ensure their strategies, policies and decisions encourage a broad mix of uses while protecting core retail uses to meet demand.” (our emphasis)

2.6 Policy SD7 (‘Town centres: development principles and Development Plan Documents’) reflects Policy SD6 in highlighting that when considering development proposals, boroughs should take a ‘town centre first approach’

2.7 This Policy also goes on to note that Boroughs should develop policies to meet the objectives for town centres set out in Policy SD6 to support development, intensification and enhancement of each centre.

2.8 Policy SD8 (‘Town centre network’) identifies Lewisham as a ‘Major’ centre, with the future potential classification of a Metropolitan centre.

2.9 The Application Site falls within the New Cross / Lewisham / Catford Opportunity Area, which identifies the potential for 13,500 homes and 4,000 jobs by 2041. It is identified as a location with significant development capacity to accommodate new housing, commercial development and infrastructure (of all types), linked to existing or potential improvements in public transport connectivity and capacity.

Lewisham Core Strategy

2.10 Policy 6 (‘Retail hierarchy or retail development’) sets the following retail hierarchy in the Borough:

Major town centres: Lewisham and Catford

District centres: Blackheath, Deptford, Downham, Forest Hill, Lee Green, New Cross and New Cross Gate, Sydenham

Neighbourhood local centres: Brockley Cross, Crofton Park, Downham Way, Grove Park, Lewisham Way

Out of centre: Bell Green and Ravensbourne Retail Park, Bromley Road

Parades: there are over 80no. parades

2.11 This Policy goes on to state that the Council will expect major retail development, leisure and related town centre uses to be located within the major and district centres.

2.12 Policy HC6 (‘Supporting the night-time economy’) outlines that Development Plans, town centre strategies and planning decisions should promote the night-time economy. The

supporting text to this Policy (paragraph 7.6.1) identifies night-time economy to include eating, drinking, entertainment and shopping.

2.13 The Application Site is not allocated for any specific use, but the Site Allocations Local Plan does define the primary and secondary frontages of existing centres, including Lewisham town centre.

2.14 DM Policy 13 (‘Location of main town centre uses’) identifies that the location of main town centre uses needs to be in accordance with Policy 6 of the Core Strategy and repeats the ‘town centre first’ approach.

2.15 The supporting text (paragraph 2.90) states that:

“One way of positively contributing to town centres is by encouraging major development within the centres…”

Lewisham Town Centre Local Plan

2.16 The Lewisham Town Local Plan identifies a detailed vision for the town centre. This includes transforming Lewisham town centre into a shopping and leisure destination of exceptional quality, delivering new commercial, retail and residential development, with the latter acknowledged to help increase the number and diversity of people using the centre.

2.17 Alongside this vision, nine objectives are identified. This includes Objective 1, which seeks to support and improve the vitality and viability of Lewisham town centre.

2.18 The Application Site falls within one of six policy areas, specifically the ‘Central Policy Area’, which includes Lewisham Shopping Centre.

2.19 Policy LTC2 (Town centre boundary’) outlines that all new development will need to contribute positively to the delivery of the vision and the objectives. To achieve this, the Policy states that the applicants will be required to:

“(a) demonstrate how the proposal will support the delivery of the town centre vision and objectives of both the town centre and the individual Policy Areas,

(b) demonstrate how the proposal for a site has been informed by the current, emerging and future context of the site and surrounding area,

(c) ensure that the proposal is in no way detrimental to the successful current or future implementation of other nearby sites of their ability to meet the LTCLP vision or objectives.”

2.20 With regard to the Central Policy Area, where the Application Site is located, this is identified by the LTCLP as the core shopping area of the town and includes the Lewisham Shopping Centre and market. This Policy Area also comprises land directly adjoining the north and south of the Lewisham Shopping Centre, Molesworth Street and Lewisham High Street.

2.21 Paragraph 5.47 states that:

“The Lewisham Shopping Centre dominates the primary shopping frontage and the owners are keen to develop and improve the offer available.”

2.22 The key area objectives are identified to include, inter alia:

Support and improve the vitality and viability of the Lewisham Shopping Centre.

Encourage a sustainable form of development, including an increase in centrally located housing.

Attract investment to Lewisham High Street.

2.23 The Central Policy Area is identified to have an indicative capacity for 200 homes and 10,000 square metres (net) of retail and leisure space.

2.24 Policy LTC8 (‘Lewisham Central Policy Area’) identifies the following key principles within the Central Policy Area:

“(a) as the Lewisham Shopping Centre is managed, refurbished and redeveloped over time, ensure every opportunity is taken to improve the number and nature of the east – west connections across the Lewisham Shopping Centre area,

(b) create a more coherent and pleasant environment which meets the needs of both pedestrians and vehicles,

(c) secure investment in the Waterlink Way alignment along the course of the River Ravensbourne,

(d) create an active frontage to Molesworth Street,

(e) working in partnership with market traders and other stakeholders achieve environmental improvements to Lewisham High Street and street market area.”

2.25 The Central Policy Area also includes additional sites ‘Site 9’ (Land north of the Lewisham Shopping Centre) and ‘Site 10’ (Land south of the Lewisham Shopping Centre). Policy LTC8 identifies specific requirements for these sites. For both these sites a number of key principles are identified that will be applied for future redevelopment. These include providing the provision of retail (identified as Class A1/A3) or leisure uses on the ground floor and the provision of active frontages.

2.26 Policy LTC9 (‘Growing the local economy’) requires all proposals to contribute towards the successful and sustainable growth of the local economy. This includes through providing a greater component of residential development in the town centre within the overall mix of uses, the delivery of retail and mixed-use allocations on key development sites and the provision of community and leisure facilities.

2.27 The rational for this Policy (as set out at Paragraph 6.4) states that:

“The health of the town centre and it’s ability to develop and grow is a major strategic planning priority for Lewisham town centre, as detailed in the Core Strategy spatial strategy and the vision for the LTCLP. In order for this to happen, a wide mix of uses is required to create a town centre with a number of strengths that support each other.” (our emphasis)

2.28 Policy LTC14 (‘Town centre vitality and viability’) identifies that:

“1. Development will need to sustain and enhance the viability and vitality of the town centre through:

(a) a greater mix of ground floor uses which may include cafes, bars and other evening economy uses (in conformity with policy LTC17),

(b) incorporation of design principles such as a mix of uses, active frontages and effective street lighting with a view to making the town centre a safer place,

(c) shopfront improvements and funding programmes…”

2.29 Policy LTC17 (‘Evening economy uses’) outlines that the Council will encourage proposals for new uses that would positively contribute to the evening economy of the town centre where certain criteria is met.

2.30 The supporting text to this Policy (Paragraph 6.47) goes on to state that:

“The evening economy means those uses that provide leisure, entertainment and social meeting places in the evening (normally A3, A4 and D uses). The Council is keen to stimulate the evening economy and assist in the provision of an active and vibrant town centre in the evenings. A strong evening economy alongside successful evening leisure uses would improve the image of the town centre and increased activity would help reduce the fear of crime.”

2.31 Paragraph 6.48 acknowledges that currently the town centre is lacking in both volume of outlets and geographical focus of evening economy uses.

Material Considerations

National Planning Policy Framework

2.32 In terms of retail and town centres, the NPPF also supports the ‘town centre first’ approach for retail and main town centre uses. Paragraph 90 states that planning policies should:

“define a network and hierarchy of town centre and promote their long-term vitality and viability

– by allowing them to grow and diversify in a way that can respond to rapid changes in the retail and leisure industries, allows a suitable mix of uses (including housing) and reflects their distinctive characters”

2.33 Paragraph 91 goes on to identify that main town centre uses should be located in town centres in the first instance.

2.34 With regard to the impact test, Paragraph 94 states that an assessment is only required for retail and leisure development that is not in a defined centre.

2.35 Although a number of reforms to the NPPF are proposed following the change in Government in July 2024, at this stage these do not impact upon relevant town centre and retail policy.

2.36 The London Borough of Lewisham (‘LBL’) is well advanced in progressing a new Lewisham Local Plan, which has recently been through Examination in Public. Subject to the findings of the Local Plan Inspector’s findings, adoption is now expected in 2024/2025

2.37 Draft Policy EC11 (‘Town centres at the heart of our communities’) is clear in stating that town centres should remain at the heart of Lewisham’s neighbourhoods and will be the focal point for retail, commercial, cultural and leisure, community and civic activities. This Policy also acknowledges that town centres will be “managed positively” and are “more resilient and adaptable” to future changes in consumer behaviour.

2.38 Reflecting this, this Policy goes on to state that “Development proposals should support and help to secure the long-term vitality and viability of Lewisham’s town centres”.

2.39 This Policy also identifies that proposals should support an appropriate mix and balance of residential and main town centre uses and ensure town centres function as vibrant places of daytime, evening and night-time activities.

2.40 Reflecting this, the supporting text to this Policy (Paragraph 8.61) identifies that:

“The Local Plan provides support for a wide range of uses to locate within town centres as diversification is vital to their revitalisation, adaptability and long-term resilience.”

2.41 Consistent with adopted local planning policy, draft Policy EC12 (‘Town centre network and hierarchy’) identifies Lewisham, along with Catford, as a ‘Major town centre’. Table 8.4 which supports this Policy defines the role and function of such centres as follows:

“These are Lewisham largest and most well connected centres with a high PTAL score meaning that their catchment goes beyond Lewisham into neighbouring boroughs. They provide the highest proportion of comparison retail compared to convenience retail alongside hosting a range of uses such as offices, civic functions, culture, leisure, entertainment and services.”

2.42 This Policy also reiterates national planning policy and the London Plan in applying a ‘town centre first’ approach for proposals for main town centre uses. Specifically, Criterion A states that:

“Development proposals must support and reinforce Lewisham’s town centre network and hierarchy. They must demonstrate how the development will maintain and enhance town centre vitality and viability commensurate with the role and function of the centre…”

2.43 In terms of development proposals within town centres, Criterion F of this Policy states that:

“Development proposals within town centre should contribute to the delivery of and support the appropriate distribution of retail uses to help ensure the Borough’s future need for 8,400 additional gross square metres of retail floorspace up to 2035 is met. Proposals for new major Use Class E(a) retail development should prioritise Lewisham and Catford Major Centres in the site selection process before considering other appropriate locations, including District Centres.”

2.44 Criterion G goes on to identify that development within Lewisham town centre and its surrounds should be proactively managed to secure its future reclassification as a Metropolitan town centre. Specifically, it states that development proposals should direct new investment to ensure the centre can effectively serve a local and wider sub-regional catchment.

2.45 With regard to the identified need for 8,400 square metres of additional retail floorspace referred to within Policy EC12, paragraph 8.70 confirms that this has been derived from the Lewisham Retail Impact Assessment and Town Centre Trends Report (2021) (RIATCTR) and comprises +10,641 square metres for convenience goods, -3,651 square metres for comparison goods and +1,407 square metres for F&B retail. Furthermore, the Local Plan (at footnote 90) highlights that this floorspace requirement should be used as a broad guide rather than a rigid target. The emerging Local Plan identifies an oversupply of comparison retail floorspace in the Borough of more than 3,600 square metres.

2.46 Draft Policy EC13 (‘Optimising the use of town centre land and floorspace’) states that

“A. Development proposals should optimise the use of land and floorspace within town centres and at edge-of-centre locations by:

a. Delivering new mixed-use schemes on individual sites and through comprehensive redevelopment of multiple sites, where appropriate;

b. Investigating opportunities for the reuse and reconfiguration of existing space, or the provision of new additional space above or below commercial units; and

c. Avoiding designs that comprise of single-storey development.

B. Within town centres and edge-of-centre locations, mixed-use development proposals (including the expansion, reuse or reconfiguration of existing floorspace) will be considered having regard to:

a. The role and function of the centre;

b. Impact on town centre vitality and viability;

c. Compatibility of the proposed use with adjoining and neighbouring uses, both in terms of land use and character; and

d. Compliance with other policies.

C. Subject to (A) and (B) above, where development proposal includes a residential use the development must:

a. Not adversely impact on the function, appearance and character of the town centre, including its shopping and other frontages; and

b. Provide adequate access arrangements for all of the building occupiers including separate secured access for the residential element.

D. Development proposals affecting an existing commercial unit must ensure any ancillary floorspace that is integral to business operations and viability of the unit is not compromised or lost.”

2.47 Draft Policy EC14 (‘Major and District Centres’) states that:

“Development proposals within and at the edge of a Major or District centre must demonstrate how they will support the vitality and viability of the town centre and make a positive contribution to its local character…”

2.48 This Policy also addresses PSAs and identifies that retail uses are and should be concentrated within the PSA. Specifically, Criterion C states that with the PSA:

“Development proposals for Class E and main town centre uses which do not contribute to the retail function of the PSA at the ground floor level must submit a Shopping Area Impact Statement. The statement must demonstrate that the development, whether individually or cumulatively with others, will support the retail function of the PSA and will not result in an inacceptable adverse impact on it by:

a. Contributing to the vitality, viability, vibrancy and character of the PSA, including by ensuring that a range of consumer goods remain available within it, taking into account the role and function of the centre in the hierarchy;

b. Providing an appropriate main town centre use at the ground floor level that will attract visitors and generate footfall within the PSA;

c. Providing a positive frontage along with an active ground floor frontage in order to ensure that there is no excessively harmful break between retail uses and the continuity of the active frontage; and

d. Ensuring local amenity is not unreasonably harmed by increased noise, odour, fumes and other nuisances.”

2.49 For Lewisham Major Centre, Criterion D states that:

“…development proposals should support the role and function of the centre by contributing to the target for the PSA to maintain a minimum of 50 per cent of retail uses as a proportion of all units. Development proposals that will result in the percentage of retail uses in the PSA falling below this threshold target will only be supported where the retail function of the PSA will not be adversely impacted, with reference to (C) above.”

2.50 Within the wider town centre area (i.e. outside the PSA), Criterion F goes on to state that:

“Within a Major or District town centre development proposals for main town centre uses will be supported where:

a. The use will not result in a harmful overconcentration of similar uses, having regard to Policy EC17 (Concentration of uses);

b. They provide a positive frontage including an active ground floor frontage or if it can be suitably demonstrated that this is not possible a window display or other appropriate positive frontage at the ground floor; and

c. they comply with other Local Plan polices.”

2.51 Paragraph 8.80 goes on to note that:

“Where non-retail uses are introduced in the PSA they must be appropriate main town centre uses, be designed with positive frontages and maintain a contiguous active ground floor frontage with adjoining units. This will help to attract visitors and generate footfall which in turn can support the viability of existing retail uses and the PSA more generally.”

2.52 Draft Policy EC18 (‘Culture, creative industries and the night-time economy’) outlines that development proposals for evening and night-time economic activities should be directed to appropriate town centre locations, giving priority to the following designated areas of night-time activity:

Areas with more than local significance:

- Major centres of Catford and Lewisham;

- District centres of Blackheath, Deptford and New Cross Gate; and

- Local centre of New Cross Road.

Areas with local significance:

- District centres of Deptford and Forest Hill.

2.53 Draft Policy LCA2 (‘Lewisham major centre and surrounds’) outlines that continued investment in Lewisham Major Centre to enable its future designation as a Metropolitan Centre of sub-regional significance in London is a strategic priority. To achieve this objective this Policy states that development proposals should deliver a complementary mix of main town centre uses along with new housing, whilst ensuring that the centre’s predominant commercial role is maintained and enhanced.

2.54 This Policy (at Criterion H) goes on to state that:

“Within the designated town centre area and at its edges, development proposals must provide for an appropriate mix of main town centre uses at the ground floor level. Retail uses should be concentrated within the Primary Shopping Area, forming the main use across the shopping frontages, and supported with a wide range of complementary commercial, leisure and cultural uses elsewhere. Evening and night-time economic activities will be supported where they contribute to the local area…” (our emphasis)

2.55 The Application Site forms part of a wider site allocation (referred to as Lewisham Shopping Centre, Site 2). Specifically, the Application Site is allocated for the following:

“Comprehensive mixed-use redevelopment comprising compatible main town centre, commercial, community and residential uses. Redevelopment of existing buildings and reconfiguration of spaces to facilitate a street-based layout with new and improved routes, both into and through the site, along with public realm and environmental enhancements.”

2.56 The site allocation identifies that the indicative development capacity to be 1,579 met residential units, 20,097 square metres (gross) of employment floorspace and 60,291 square metres (gross) of main town centre uses.

Summary

2.57 Adopted planning policy at all levels is clear in seeking to focus retail and other main town centre uses within existing centres – as proposed

2.58 Planning policy also recognises the need for Lewisham town centre to diversify and widen its existing offer to maintain its long-term success. Planning policy also recognises the important role new residential development in town centres can play in generating footfall and activity.

2.59 Planning policy is supportive of the application proposals, which recognises the need for town centres to diversify and respond to changing consumer patterns. The Application Site comprises a town centre location where planning policy at all levels supports main town centre uses in such locations

2.60 Both adopted and emerging local planning policies identifies the strategic objective of LBL to alleviate Lewisham to a metropolitan centre. Emerging local planning policy identifies this will only be achieved where proposals deliver a complementary mix of main town centre uses along with new housing, whilst ensuring that the centre’s predominant commercial role is maintained and enhanced.

2.61 Furthermore, the Council’s latest evidence base identifies that there is an oversupply of comparison retail floorspace in the Borough, but there is a need for substantially more F&B floorspace.

2.62 It is against this policy background that the application proposals have been assessed. The need for flexibility within town centres is particularly significant for Lewisham town centre given the identified oversupply of retail floorspace and the substantial quantum of existing vacant floorspace.

3.1 National, strategic and local planning policy only requires the sequential approach to site selection be applied for main town centre uses that are not in an existing centre and not in accordance with an up-to-date development plan. The sequential approach seeks to focus new retail development and other main town centre uses in defined centres.

3.2 In this context, the Application Site comprises an ‘in centre’ location and is allocated for comprehensive mixed-use development within the emerging Local Plan.

3.3 Against this background, the application proposals fully accord with the ‘town centre first’ approach advocated by planning policy at all levels. It is not necessary to apply the sequential approach in the consideration of the application proposals.

4.1 Planning policy at all levels support retail and town centre uses within defined centres (as proposed). Furthermore, an assessment of the likely trading effects of such proposals is not necessary for sites within defined centres. As such, in line with the adopted development plan, there is no policy requirement to address the ‘impact test’ in the determination of the application proposals.

4.2 Despite this, it is acknowledged that draft Policy EC14 of the emerging Lewisham Local Plan, which is at an advanced stage, does refer to a ‘Shopping Impact Study’ to be undertaken for proposals within the PSA that provide wider retail uses. This Policy also refers to where proposals will result in the number of units in the PSA falling below 50% it will be necessary to demonstrate that the retail function of Lewisham town centre is not adversely impacted.

4.3 In this respect, it is useful to understand the existing mix of uses within the PSA – as defined by the emerging Local Plan. Table 4.1 provides a summary of the existing mix of uses within the emerging PSA.

Table 4.1: Diversity of Uses within the PSA (as defined by the emerging Local Plan)

Source: Experian Goad and Quod site visit (August 2024)

4.4 Within the PSA identified by the emerging Local Plan already less than 50% of all units are non-retail.

4.5 Whilst this excludes the proposed extension of the PSA outlined in the emerging Local Plan to include the Lewisham Gateway site, which is still being delivered, this position will not change. The baseline permission for this scheme 2 permits a mix of town centre uses including up to 7,725 square metres of shops and financial & professional services. As the latter phases come forward there is no control requiring that at least 50% of the units will be retail. There is no requirement for 50% of units to be for retail (Class A1, now Class E(a)) purposes. Instead, the

2 DC/18/105218

units will come forward to reflect market demand within a wide range of uses and not necessarily achieving 50% retail uses.

4.6 Consequently, the current position in the PSA (as defined by the emerging Local Plan) is that already less than 50% of units comprise retail uses. Consequently, the application proposals (which will provide 50% of the floorspace to be delivered under the outline element of the overall scheme for retail (Class E(a)) purposes) will not result in the percentage of retail units falling below the 50% threshold – this is already the case. It is in this context that the requirements of emerging local planning policy need to be considered, and policies within the Development Plan (both existing and emerging) need to be taken as a whole. In this respect, local planning policy is fully supportive of diversifying and improving Lewisham town centre’s overall offer – as proposed

4.7 Notwithstanding this, for completeness and to provide a robust approach, a Shopping Impact Study has been provided in support of the application proposals.

Current Role and Function of Lewisham town centre

Retail Capacity / Need in Lewisham

4.8 Before considering the likely trading effects of the application proposal, it is important to outline the changes in the retail sector in recent years, and in particular retail ‘need’. This provides useful context when considering the application proposals now being advanced.

4.9 In recent years there has been a significant shift in the retail sector that has had implications on the need / capacity for Lewisham and the local area. This shift, which has partly been recognised in the latest retail evidence published on behalf of LBL 3, has implications when considering future development proposals in Lewisham town centre.

4.10 Since 2009, retail evidence published by LBL has consistently shown declining retail capacity. The latest evidence 4 suggests an oversupply of comparison retail floorspace of more than 3,650 square metres by 2035. This decline has been, in part, as a result of online shopping. The emerging Local Plan (at paragraph 36) states that:

“Covid-19 has also accelerated the growth of online shopping and this is likely to have implications for town centres, particularly the future of traditional bricks and mortar retailing.”

4.11 In addition to growth of online, further expenditure estimates and forecasts have been published that have also impacted on available expenditure to support further retail floorspace. Collectively, these factors have had a significant influence on the level of retail capacity identified by LBL’s retail evidence since 2009.

4.12 By way of an example, this change in available capacity for comparison retail floorspace is illustrated at Figure 4.1 overleaf

3 RIATCTR

4 Ibid

4.1: Comparison Goods Capacity for Lewisham Borough identified by Existing and Past Retail Evidence published by LBL

Study

Study

Update

Notes: Derived from LBL’s retail evidence. 2009 Study only assessed capacity up to 2025

4.13 The above analysis illustrates that since 2009, subsequent updates of LBL’s retail evidence have consistently identified a reduction in comparison retail capacity in Borough. To this extent, the latest evidence published on behalf of LBL (the RIATCTR) identifies an oversupply of comparison retail floorspace – as acknowledged by the emerging Local Plan 5

4.14 This reduction in capacity is also reflected for Lewisham town centre. The 2009 retail evidence base published by LBL 6 identified comparison goods capacity available to support additional retail floorspace in Lewisham town centre to be in the region of £187 million by 2025. This compared to £90 million as identified by retail evidence published by LBL in 2017 7 (Albeit for 2026), £21 million identified by the 2019 retail evidence base published by LBL 8 and an oversupply of more than £6 million by 2025 identified by the RIATCTR 9

4.15 In comparing the retail evidence prepared between 2009 and 2021, the Capacity for Lewisham town centre is identified to have reduced by more than £193 million – a substantial change. Furthermore, updated expenditure estimates / forecasts published since the RIATCTR indicate that the lack of capacity (or oversupply) is now even greater.

5 Paragraph 8.70

6 London Borough of Lewisham Retail Capacity Study (2009)

7 Lewisham Retail Capacity Study (2017)

8 Lewisham Retail Capacity Study Update (2019)

9 Before taking into commitments identified at the time

4.16 The overarching message arising is that capacity for further comparison retail floorspace, which is the focus of the retail offer of Lewisham town centre has dramatically reduced due (in part) to growth of online shopping.

4.17 It is expected that this decline in demand for traditional ‘bricks and mortar’ retail floorspace is likely to continue as online shopping continues to increase in popularity, which was accelerated by the Covid-19 pandemic, and the retail sector (particularly the comparison retail sector which is the focus of higher order centre such as Lewisham) continues to contract. The latest estimates published by Experian 10 identifies that online shopping now accounts for 31.5% of total comparison retail expenditure. This compares to online shopping accounting for 23.4% of expenditure at the time of the RIATCTR 11 - an increase in the online market share of almost 35%.

4.18 This position is not unique to Lewisham town centre but is reflective of the changing retail market throughout the UK. Experian 12 estimates that comparison retail floorspace in the UK will decline by more than 353,000 square metres between 2022 and 2025.

4.19 In light of the changing retail sector, it will be inappropriate to continue to deliver development proposals where there is no / limited demand at the expense of wider main town centre uses that can make a positive impact on the role and function of Lewisham town centre and where there is pent up demand. The restructuring of the retail sector means that a continuation of a retail only focus in the long term is not a sustainable solution for Lewisham town centre. Covid19 has created a greater issue by accelerating the structural change in retail, and through the loss of many high street retailers has removed current and future tenants. There simply are not the quantity and quality of tenants available to occupy high levels of retail floorspace in a way which benefits the town centre in the long term.

4.20 In addition to an identified oversupply of retail floorspace, there is also substantial vacant or underutilised space within Lewisham town centre. The latest Goad Report (February 2024) identified vacancies to account for approximately 10,656 square metres of floorspace at ground floor only within the Town Centre 13 .

4.21 This high quantum of vacant floorspace is not a recent development but represents a longstanding issue in Lewisham town centre. Historically, there has been a significant level of vacant floorspace within the town centre as illustrated at Figure 4.2.

10 Experian Retail Planning Briefing Note 21 (February 2024)

11 The RIATCTR utilised Experian Retail Planning Briefing Note 18 (October 2020)

12 Experian Retail Planner Briefing Note 21 (February 2024)

13 Based on the town centre boundary defined by Goad

Source: Experian Goad

4.22 The pattern of high vacant floorspace is reflected within Lewisham Shopping Centre and the wider Application Site There is currently 25,445 square metres of existing floorspace (on all floors) that is currently vacant with a further 3,830 square metres (or 5%) on temporary lets 14 . Collectively, this equates to a third (33%) of the total floorspace on the Application Site

4.23 Consequently, within the Application Site some 45,261 square metres of floorspace (excluding vacant and short term lets) is occupied by main town centre uses. This is comparable to the level of floorspace being proposed / retained for main town centre uses as part of the application proposals – up to 49,404 square metres.

4.24 Accordingly, whilst the scheme results in a reduction in floorspace for main town centre uses within the Application Site (of 24,079 square metres) this is comparable to the existing vacant and short-term lets (24,538 square metres) on the Application Site

4.25 Furthermore, in considering the 49,404 square metres of floorspace to be retained / provided within the Application Site together with retained floorspace outside the Application Site but within the wider Site allocation boundary (13,214 square metres) equates to 62,618 square metres. This is very comparable with the indicative site allocation capacity for town centre floorspace in the emerging Local Plan (60,291 square metres). Within this context, as a result of the application proposals being advanced, the indicative capacity for main town centre use identified for the wider allocation will be delivered.

4.26 Whilst Lewisham town centre comprises a number of national retailers, a number of these are trading from oversized units. For example, some of the upper floors of existing retailers (such

14 Derived from Landsec and defined as let for 24 months or less

as M&S and Primark) are not being utilised. This underutilised space is in addition to the ground floor vacant floorspace referred to above.

4.27 Likewise, drawing on CACI transactional data 15 and / or data provided by Landsec a number of existing retailers within Lewisham town centre (including in Lewisham Shopping Centre) are trading well below expected levels. This again demonstrates that their retail units are oversized and could trade successfully and viably from smaller premises. A number of retailers are reducing their floorspace requirements as there is no longer a need to provide the full product range within stores as this is available to view online. Some retailers seek to maintain a physical presence (albeit from smaller stores) to also serve their growing online customer base (e.g. click and collect, returns, etc.). It is entirely viable and appropriate for such retailers to downsize to smaller premises than they have currently. The key is to maximise the space available rather than have large areas of underutilised space – as is currently the case for some retailers in Lewisham town centre (e.g. M&S and H&M).

4.28 This potential rightsizing of retail floorspace of existing retailers in Lewisham provides a further factor when considering the future need for retail (Class E(a)) floorspace in Lewisham town centre and the acceptability of wider town centre uses being proposed.

Current Role and Function of Lewisham Town Centre

4.29 In addition to considering the significant reduction in demand for physical floorspace, it is also important to consider the current vitality and viability of Lewisham town centre.

4.30 Lewisham is the largest town centre in the Borough, being defined as a ‘major town centre’ alongside Catford, offering a wide range of retail and commercial uses. The town centre (as defined by Experian Goad) comprises approximately 91,400 square metres (at ground floor) within a total of 365 units.

4.31 Table 4.3 provides a breakdown of the diversity of uses within the Town Centre (again derived from Experian Goad) and compares this to the national average.

Experian Goad (2024)

4.32 Table 4.3 illustrates that the town centre has a relatively strong retailer sector, representing more than half of existing units (53.4%). This compares favourably to the national average (35.6%).

4.33 In contrast the wider ‘offer’ of the town centre is much more limited. For example, within the ‘Leisure Services’ sector, which includes cafes, restaurants and bars is notably below the national average both in terms of the proportion of units and floorspace.

4.34 Within Lewisham Shopping Centre the diversity of uses is even more limited, and the shopping centre fails to provide a mix of uses expected by customers to attract footfall and importantly increase dwell time As outlined in the Lewisham Retail Report, contained at Document 2, prepared by Landsec’s and provided in support of the application, there is a major opportunity to improve the F&B and leisure offer in Lewisham.

4.35 To further understand the role and function of Lewisham town centre, the Applicant instructed an in-centre survey (completed July 2024). A copy of the results of the survey is contained at Document 1

4.36 The main findings of the in-centre survey can be summarised as follows:

Almost two thirds (63%) of visitors identified the main purpose for visiting Lewisham town centre was to shop – 49% for food shopping and 14% for non-food shopping.

The main reason for visiting Lewisham town centre was its food retail offer (69%), which was followed by accessibility by public transport (17%) and currently work in the town centre (8%). Notably, just 2% of respondents indicated because it was due to the choice of shops with less (c. 1%) identifying the choice of leisure facilities as a reason for visiting Lewisham,

In terms of measures to encourage respondents to visit Lewisham town centre more often, the most popular were improved quality / choice of shops (45%), improved

environment (13%), more entertainment / leisure facilities (8%) and more / improved places to eat / drink (7%).

The quality of shopping environment of Lewisham town centre was identified as the single most cited dislike about Lewisham town centre (identified by 12% of respondents). This was followed by choice and range of shops (10%), choice of leisure and cultural facilities (9.3%), lack of food and drink outlets (2.7%).

In considering the specific role of Lewisham Shopping Centre, the in-street survey identified that the main area of improvement would be more greenery / better shopping environment / regeneration, (cited by 33.4% of respondent) followed by reducing the number of empty shops (citied by 32.7% of respondents). The application proposals will assist in addressing both these issues.

4.37 Currently, the F&B sector in Lewisham Shopping Centre and the wider town centre is very weak. There are no restaurants within the Shopping Centre. This lack of offer is despite there being a high F&B potential spend in the area with restaurants, pubs and bars being +165% above the national average 16 Indeed, Lewisham is ranked 8th out of 236 Inner London Centres, placing Lewisham inside the top 4% 17 Likewise, the Council’s retail evidence base 18 recognises that the night-time economy is “under-provided”.

4.38 Other uses are also lacking in Lewisham town centre, such as leisure. Again, the application proposals provide the opportunity to address this deficiency.

4.39 As reflected by planning policy at all levels, and acknowledged by LBL, there is a need to diversify Lewisham’s offer to maintain the centre’s long-term vitality and viability. It is within this context, and the wider acknowledged need to diversity and improve Lewisham town centre, that the likely trading effects of the application proposals needs to be assessed.

4.40 The current role and function of Lewisham town centre suggests that there is a need to consolidate and rationalise the existing retail offer and provide a wider mix of uses – as encouraged by both adopted and emerging planning policy.

4.41 Lewisham town centre, in particular Lewisham Shopping Centre, is currently heavily focused on the retail sector, with very limited wider town centre uses (such as an evening economy), underperforming big box retailers and longstanding vacancies This is reflected by the use of the Shopping Centre – as identified by the findings of the recently completed in-street survey.

4.42 The need to improve Lewisham town centre, including providing an improved evening economy has long been recognised by LBL. This was highlighted as a specific area of improvement in the recent successful Levelling Up bid. The submitted bid prepared by LBL stated that:

“Lewisham Town Centre is a retail and community space at the heart of our borough. It is in poor condition and failing residents, particularly those that experience acute deprivation and depend on the local economy. Investment will revitalise the marketplace, create a flagship

16 As identified by the Lewisham Retail Report submitted as part of the application submission

17 Ibid

18 Paragraph 4.14, RIATCTR

Culture and Business Hub, and connect the town with better, safer walking and cycling infrastructure. This will transform economic and community activity, through opportunities for local businesses, increased cultural activity, and by stimulating the night-time economy. It will increase footfall and consumer spend, unlock private investment, create jobs, and give residents a place to be proud of.”

4.43 This position is equally applicable when considering the benefits associated with the application proposals.

4.44 LBL’s Levelling Up Bid also went on to highlight that:

There is reducing football in Lewisham town centre. Visitors fell 29% between May 2021 and May 2022 and footfall in 2022 is less than 70% the level achieved in 2019. Furthermore, it was notated that high street businesses identified that footfall was their greatest challenge.

Identified a limited night-time economy with 84% of respondents surveyed on the High Street stating that there is no offer for them in evening, with 83% wanting more restaurants.

4.45 The proposals by Landsec were specifically cited in the Levelling Up Bid representing £1.5 billion of investment, and Landsec was a key partner and supporter of the bid. Consequently, this planned investment will have a positive impact on improving the role and function of Lewisham town centre and assisting in meeting LBL’s aspirations to deliver a vibrant metropolitan centre.

4.46 Landsec fully supports LBL’s objectives for Lewisham town centre and will be a major player in achieving these.

4.47 With regard to the requirement to undertake a Shopping Area Impact Statement, the supporting text to draft Policy EC14 (at Paragraph 8.80) advises that:

“Shopping Area Impact Statements are an important tool to assess the impact of a development proposal on the retail function of the PSA. They must be submitted with all applications for uses that do not contribute to its retail function (i.e. uses which are not Class E(a) uses). The level of detail included within a statement should be commensurate with the nature and scale of the development proposed. When assessing impacts on the PSA consideration will be given to the existing mix of uses within the PSA to establish whether the development will significantly diminish the availability of retail uses and people’s access to consumer goods.”

4.48 This supporting text suggests that there are two key aspects to consider:

The contribution of the proposal to Lewisham’s retail function; and

Whether the proposals will diminish the availability of retail uses.

4.49 We consider each matter in turn below.

4.50 The application proposals seek to deliver a comparable level of floorspace for main town centre uses that is currently provided 19. Furthermore, at least c. 50% of this floorspace will comprise retail (Class E(a)) floorspace. The proposals will contribute to the continued retail function of Lewisham town centre by providing modern retail floorspace appropriate for the changing requirements of modern retailers. The scale of retail floorspace reflects the retail market and demand from retailer for ‘brick and mortar’ stores. By providing too much retail floorspace where there is insufficient demand will lead to continued vacancies and fail to make the positive change for Lewisham that the development proposals seek to address.

4.51 In addition to providing retail uses (occupying at least c. 50% of the floorspace for main town centre uses), the scheme will also deliver a mix of wider main town centre uses – as recognised as essential for town centres by national, strategic and local planning policies. This will have a positive impact on the long-term vitality and viability of Lewisham. LBL has long recognised that there is a need to diversity Lewisham’s offer to increase dwell time, footfall and activity in the evening. The acknowledgement for a more diverse town centre underpinned the successful Levelling Up Bid submitted by LBL. The application proposals will help to achieve LBL’s objectives

4.52 The London Plan also recognises the need for diversification. Policy SD6 states that:

“…the adaption and diversification of town centre should be supported in response to the challenges and opportunities by multi-channel shopping and changes in technology and consumer behaviour, including management of servicing and deliveries.

4.53 National planning policy 20 also recognises that town centres should grow and “diversify in a way that can respond to rapid changes in retail and leisure industries allowing a suitable mix of uses”

4.54 This includes housing. National policy 21 highlights that “residential development often plays an important role in ensuring the vitality of centres”

4.55 The introduction of residential uses on the Site (as proposed) will also have a positive impact on the long-term vitality and viability of town centre through increased footfall and activity throughout the day.

4.56 Overall, the application proposals will have a positive impact on the role and function of Lewisham town centre. The development also has the potential to assist in meeting LBL’s longstanding aspiration to elevate Lewisham to a Metropolitan Centre. By providing a diverse mix of uses this will support and intensify the high street and enhance Lewisham town centre. The proposals also assist in providing a mix of units within the town centre that will improve the competitive function of Lewisham within this part of London.

4.57 In addition, the proposals will deliver the comprehensive redevelopment of an out-dated shopping centre into one of the best retail destinations in south London. The development proposals will deliver open spaces, parks, opportunities for high street retail, more diverse town

19 Excluding short term lets and vacancies

20 Paragraph 90 a)

21 Paragraph 90 f)

centre uses, including the F&B offer, and the more diverse / independent retailers on the south part of the masterplan around the music venue. The application proposals will deliver the ‘sea change’ in Lewisham to deliver a vital and viable town centre over the long-term. Significantly, town centre visits for a wider range of purposes and the associated increase in ‘dwell time’ will improve the vitality and vibrancy of the Town Centre.

4.58 The London Plan (at Annex Two) defines metropolitan centres as serving wide catchments typically with at least 100,000 square metres of retail, leisure and service floorspace with a significant proportion of high-order comparison goods relative to convenience goods. The London Plan recognises that a successful metropolitan centre is not just a retail destination but provides a substantial quantum of floorspace for a mix of uses – the applications proposals are entirely consistent with this metropolitan centre definition.

4.59 In addition, the application proposals provide a comparable level of floorspace to that which currently exists on the Application Site. Likewise, as outlined above, the quantum of floorspace that is delivered on the Application Site, coupled with that retained within the site allocation (as identified by the emerging Local Plan) but outside the red line, is entirely consistent (and greater than) the indicative capacity for main town centre uses being suggested in this location.

4.60 Against this background, the application proposals will not adversely impact on Lewisham’s retail function.

4.61 The proposals will not adversely impact on the availability of retail uses. The need for additional comparison retail floorspace in Lewisham (which is the focus of higher order centres) has substantially contracted in recent years. This is demonstrated by LBL’s own retail evidence – as outlined above. The latest assessment 22 identifies that there is an oversupply of comparison retail floorspace in the Borough.

4.62 Furthermore, the recently completed in-street survey identified that one of the most popular issues that could be improved in Lewisham Shopping Centre would be reduce the number of empty shops – the application proposals will address this specific matter

4.63 Critically, the application proposals will continue to provide opportunities for retailers to be represented in Lewisham town centre through providing modern floorspace better suited to meet the requirements of retailers (this includes the right sizing of existing retailers), supported by wider uses that will improve dwell time, footfall and the overall attraction of Lewisham.

4.64 Alongside the provision of retail floorspace the proposed development will deliver wider main town centre uses typical of major, and importantly metropolitan centres, across London, which is currently lacking in Lewisham.

4.65 The delivery of a wider range of range uses will have the positive impact in terms of making Lewisham a more attractive town centre for visitors and potential tenants / private sector investment. The main town centre uses proposed are flexible in terms that if demand exists for substantial retail floorspace the level of retail floorspace does not need to be limited to c. 50% of the floorspace. The proposals do not diminish the availability of retail uses or people’s

access to consumer goods. Instead, it provides modern retail floorspace better suited for the requirements of modern retailers and will provide an improved town centre for Lewisham residents and visitors.

Summary

4.66 Planning policy at all levels supports the ‘town centre first’ approach when considering proposals for main town centre uses. The application proposals fully comply with this wellestablished principle by strengthening and improving Lewisham town centre’s overall offer. The Application Site is also allocated for mixed-use development (as proposed) in the emerging Local Plan.

4.67 Against this background the application proposals fully comply with relevant adopted retail planning policy and importantly will diversity Lewisham overall offer, alongside improving the appearance of Lewisham town centre.

4.68 The need to improve and diversity Lewisham town centre has been long acknowledged by LBL – as reflected by current adopted local planning policy and the recent Levelling Up Fund bid It is possible to maintain and enhance footfall through intensification and a mix of uses, such as contributing to the missing offer of a nighttime economy in Lewisham.

4.69 We question the need to undertake a Shopping Area Impact Statement, given the need to diversify Lewisham’s retail offer – as supported by national policy, the London Plan and local planning policy. However, an assessment of the impacts of the proposal on the two key strands of the Shopping Area Impact Statement has been undertaken. This demonstrates that in light of the changing retail sector, the redevelopment of the Application Site, which trades below company average levels, has long-term vacancies and lacks diversity, will have a positive impact on the long-term vitality and viability of Lewisham town centre.

4.70 The development of the shopping centre is an opportunity to provide a mix of uses that support the transformation of Lewisham into a high performing and vibrant retail hub. It is the performance of retail space and the vibrancy of the town centre that should inform the future plans for the town centre, not simply the quantum of floorspace.

4.71 In this context the proposals re entirely acceptable in meeting the wider objectives of planning policy and should be supported.

5.1 This Town Centre Assessment Study has been prepared to support the proposals by Landsec Lewisham Limited for the redevelopment of Lewisham Shopping Centre and adjacent land in Lewisham town centre.

5.2 The application proposals represent significant private sector investment that will greatly improve the long-term vitality and viability of Lewisham town centre – in line with the objectives of LBL. The proposals will continue to provide substantial retail floorspace alongside wider uses, resulting in a diversity of Lewisham’s offer and a stronger town centre, and the best town centre in south London

5.3 It has long been acknowledged that there is a need to diversify Lewisham’s overall ‘offer’. This is recognised by the London Plan and adopted and emerging local planning policies. LBL has also acknowledged the need to diversity Lewisham town centre, including greatly strengthening its evening economy – as reflected by LBL’s recent successful Levelling Up bid submission.

5.4 The role and function of town centres is changing. For a town centre to be successful it needs to provide a diverse offer that attracts customers and encourages them to undertake a range of activities. The redevelopment of Lewisham Shopping Centre provides an opportunity to move away from oversized big box retail focuses outlets within covered shopping malls, which provide a poor town centre environment, trade below company averages and has long-term vacancies to provide a mix of town centre uses that meet a local need

5.5 The proposed improvement in Lewisham town centre’s offer will draw consumers in from a wide catchment and importantly fully support LBL’s objective for Lewisham to achieve metropolitan centre status.

5.6 Overall, the proposals will have a positive impact on Lewisham town centre and there is no retail or town centre policy why the application proposals cannot be supported.

NEMS market research

22 Manor Way

Belasis Hall Technology Park

Billingham TS23 4HN

Tel 01642 37 33 55

www.nemsmr.co uk

Job Ref: 043L24

This market research and the design of material used to obtain this survey information have been originated by and belong to NEMS market research, and may not be used or reproduced in whole or part without the company's written consent, or that of the Client

To conduct an independent face to face survey amongst a sample of visitors to Lewisham Town Centre

The main aims and objectives of the study were as follows:

To find out respondents’ reason/s for visiting;

To find out how often respondents visit, length of time and amount of money spent in the town centre; Mode of transport used to reach the town centre;

Likes, dislikes and suggested improvements for the town centre;

Usage, likes, dislikes and suggested improvements for the Lewisham Shopping Centre;

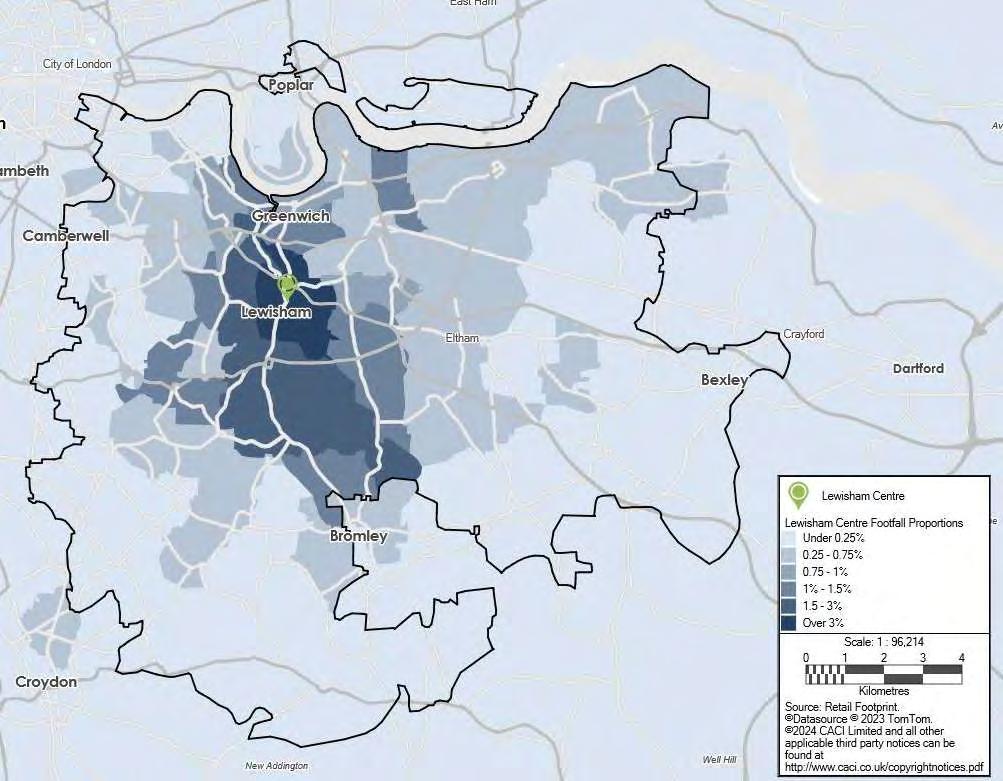

In addition, respondents’ postcodes were captured to establish the catchment of town centre.

A total of 150 face to face interviews were conducted in Lewisham split between three locations, namely, on the High Street outside TK Maxx / H&M, at the junction of High Street / Lee Bridge, and within Lewisham Shopping Centre (outside Sainsburys).

Fieldwork was carried out between Wednesday 26th June and Friday 19th July 2024

Interviews were conducted using NEMS field interviewers. We engaged our resident professional field market researchers on this project, virtually all of who possess substantial experience in visitor research studies

The interviews were subject to a 10% random back check to ensure the survey was being conducted to the required standard

As with any data collection where a sample is being drawn to represent a population, there is potentially a difference between the response from the sample and the true situation in the population as a whole Many steps have been taken to help minimise this difference (e g random sample selection, questionnaire construction etc) but there is always potentially a difference between the sample and population – this is known as the standard error

The standard error can be estimated using statistical calculations based on the sample size, the population size and the level of response measured (as you would expect you can potentially get a larger error in a 50% response than say a 10% response simply because of the magnitude of the numbers)

To help understand the significance of this error, it is normally expressed as a confidence interval for the results. Clearly to have 100% accuracy of the results would require you to sample the entire population. The usual confidence interval used is 95% - this means that you can be confident that in 19 out of 20 instances the actual population behaviour will be within the confidence interval range. For example, if 50% of a sample of 150 answers “Yes” to a question we can be 95% sure that between 42 0% and 58 0% of the population holds the same opinion (i e +/- 8 0%).

Tables are presented in question order with the question number analysed shown at the top of the table Those questions where the respondent is prompted with a list of possible answers are indicated in the question text with a suffix of [PR]

The sample size for each question and corresponding column criteria is shown at the base of each table. A description of the criteria determining to whom the question applies is shown in italics directly below the question text; if there is no such text evident then the question base is the full study sample If the tabulated data is weighted (indicated in the header of the tabulations), in addition to the sample base, the weighted base is also shown at the bottom of each table

Unless indicated otherwise in the footer of the tabulations, all percentages are calculated down the column. Arithmetic rounding to whole numbers may mean that columns of percentages do not sum to exactly 100%. Zero per cent denotes a percentage of less than 0.05%.

Percentages are calculated on the number of respondents and not the number of responses This means that where more than one answer can be given to a question the sum of percentages may exceed 100% All such multi-response questions are indicated in the tabulated by a suffix of [MR] on the question text.

Where appropriate to the question, means are shown at the bottom of response tables These are calculated in one of two ways: if the data is captured to a coded response a weighted mean is calculated and the code weightings are shown as a prefix above the question text; if actual specific values were captured from respondents these individual numbers are used to calculate the mean

Appendix 1:

Q02 What else, if anything, will you be doing in Lewisham town centre today? [MR]

Q02X Lewisham town centre activities (Any mention) [MR]

Q03

Q04 How did you travel to Lewisham town centre today for the bulk of the journey?

Q05 Where did you park today?

Those who travelled by

Meanscore: [Time in minutes]

Meanscore: [Number of visits per week]

Q08 How often do you visit Lewisham town centre?

Q09 Are you visiting Lewisham town centre more, less or broadly the same since lockdown for Covid-19?

know)

Q12 Do you ever visit, or have you ever visited, Lewisham Shopping Centre?

Q13 Are you visiting Lewisham Shopping Centre today?

Those who visit Lewisham Shopping Centre at Q12

Meanscore: [£]

Q15 How often do you visit Lewisham Shopping Centre? [PR] Those who visit Lewisham Shopping Centre at Q12

Q16 How often do you visit Lewisham Shopping Centre when compared to 2 years

Q17A What are the main shops you visit in Lewisham Shopping Centre? (First mention) Those who visit Lewisham Shopping Centre at Q12

Q17B

Q17C

Q17X

Q19

Q21 Why do you not visit Lewisham Shopping Centre [MR] Those who don't visit Lewisham Shopping Centre at Q12

Q22B

Q22C Which leisure operators would encourage you to visit Lewisham Shopping Centre more often? [MR]

Q23 Do you ever use any of the following in Lewisham Town Centre? [MR/PR]

Q24

DIS

AGE Age of respondent

ETH Ethnicity of respondent

SEG Socio-economic grouping

Appendix 2: Sample Questionnaire

INTRODUCTION: Good morning / afternoon I am carrying out a survey of how people are using Lewisham Town Centre and wonder whether you would mind answering some questions. The interview will only take a few minutes.

ASK ALL:

Q A So that we know where people are coming from could you tell me your home postcode, please, but not the last two characters? INTERVIEWER, PLEASE WRITE CLEARLY AND IN CAPITALS.

Home Postcode:

(Refused / Don’t know)

ASK ALL:

Q 1 What is your main purpose of your visit to Lewisham town centre today? DO NOT PROMPT. ONE ANSWER ONLY

ASK ALL:

Q.2 What else, if anything, will you be doing in Lewisham town centre today? DO NOT PROMPT. PROBE FULLY: What else ? CAN BE MULTICODED

ASK ALL:

Q.3 Why did you choose to come here today? DO NOT

Q.4 How did you travel to Lewisham town centre today for the bulk of the journey? DO NOT PROMPT. ONE ANSWER ONLY

Q.5 Where did you park today? DO NOT PROMPT. ONE ANSWER ONLY

Q.6 Where did you start you journey from?

Q.7 Approximately how much time will you spend in Lewisham town centre today? DO NOT PROMPT. IF UNKNOWN PROBE FOR BEST GUESS OR RECORD AS ‘DK’ PLEASE WRITE IN APPROXIMATE

Q.8 How often do you visit Lewisham town centre? DO NOT PROMPT. ONE ANSWER ONLY

ASK ALL:

Q.9 Are you visiting Lewisham town centre more, less or broadly the same since lockdown for Covid-19? ONE ANSWER ONLY

Q 10 Are there any measures that would make you visit

ASK

Q 11 What do you dislike about Lewisham town centre?

Q

Q13 – Q21 ARE REFERING TO THE SHOPPING CENTRE IN LEWISHAM NOT

TOWN CENTRE, PLEASE CLARIFY THIS WITH THE RESPONDENT

ASKED TO THOSE WHO VIST LEWISHAM

Q 13 Are you visiting Lewisham Shopping Centre today? ONE ANSWER ONLY

GO TO Q 15 (Don’t know)

ASKED TO THOSE WHO ARE VISTING LEWISHAM SHOPPING CENTRE TODAY AT Q 13:

Q 14 How much do you typically spend at Lewisham Shopping Centre? DO NOT PROMPT

(Don’t know / varies)

ASKED TO THOSE WHO VIST LEWISHAM SHOPPING CENTRE AT Q 12:

Q 15 How often do you visit Lewisham Shopping Centre? READ OUT. ONE ANSWER ONLY

ASKED TO THOSE WHO VIST LEWISHAM SHOPPING CENTRE AT Q 12:

Q.16 How often do you visit Lewisham Shopping Centre when compared to 2 years ago? READ OUT. ONE ANSWER ONLY

ASKED TO THOSE WHO VIST LEWISHAM SHOPPING CENTRE AT Q 12:

Q 17 What are the main shops you visit in Lewisham Shopping Centre? DO NOT PROMPT. RECORD UP TO 3 ANSWERS 1st mention (PLEASE WRITE IN)

nd mention (PLEASE WRITE IN)

18 )

19 ) 3rd mention (PLEASE WRITE IN) ( 20 )

Q 18 What do you like about Lewisham Shopping Centre? DO NOT PROMPT. PROBE FULLY: What else ? CAN BE MULTICODED ( 21 )

Attractive environment / nice place 001

Can get everything you need there 002

Clean / litter free 003

Close to friends / relatives 004

Close to home 005

Close to school / college / university 006

Close to work 007

Compact / easy to get around 008

Feel safe / good security 009

Has undercover shopping 010

Good cafes / restaurants 011

Good food offering (Model market) 012

Good disabled access 013

Good facilities (e.g. seating, toilets) 014

Good foodstores 015

Good for a day out 016

Good for financial services (e.g. banks / building societies) 017

Good layout / shops close together 018

Good public transport access 019

Good range of other services 020

Not too busy / crowded 021

Parking - it is cheap 022

Parking - its easy to find a parking space nearby 023

Pedestrianised area 024

Shops - good opening hours 025

Shops - good range of affordable shops 026

Shops - good range of foodstores / supermarkets 027

Shops - good range of clothes shops 028

Shops - good range of 'high street' retailers 029

Shops - good range of independent shops 030

Shops - good range of non-food shops generally 031

Shops - goods range of quality shops 032

Community events 033

Other (PLEASE WRITE IN)

(Don't know)

(Nothing in particular) 509

ASKED TO THOSE WHO VIST LEWISHAM

Q 19 What do you dislike about Lewisham Shopping Centre? DO NOT PROMPT. PROBE FULLY: What else ? CAN BE MULTICODED ( 22 )

Poorly maintained 001

Lack of security / don't feel safe 002

Needs an update / revamp 003

Needs more / better cafés 004

Needs more / better pubs / bars 005

Needs more / better restaurants 006

Needs more public toilets 007

Needs more seating areas 008

Not attractive / poor environment 009

Not enough financial services (e g banks / building societies) 010

Not enough leisure facilities (e g leisure centres, cinema, health and fitness clubs, etc) 011

Not enough supermarkets / food shops 012

Parking - expensive parking 013

Parking - no free parking 014

Parking - not enough spaces available 015

Poor atmosphere / unfriendly people 016

Poor disabled access 017

Poor layout / shops too far apart 018

Poor nightlife 019

Poor public transport access 020

Shops - need longer opening hours / more open on Sundays 021

Shops - need more / better clothes shops 022

Shops - need more / better range of non-food shops generally 023

Shops - need more / better range of supermarkets 024

Shops - need more affordable shops 025

Shops - need more 'high street' retailers 026

Shops - need more independent shops 027

Shops - need more quality shops 028

Too busy / crowded 029

Too many charity shops 030

Too many empty shops 031

Lack of community outlets / events 032

Other (PLEASE WRITE IN) 500

(Don't know) 505 (Nothing in particular) 509

Q 20

Better

Better

Discount

Improved

Improved

Improved

Improved

Increased

Increased

Less

More

More

More

More

More

More

Parking

Parking

ASKED TO THOSE WHO ANSWERED NO AT Q12:

Q 21 Why do you not visit Lewisham Shopping Centre?

ASK ALL: