1 Executive Summary

1.1 Lewisham Town Centre is the heart of the Borough. Since its opening in 1977 Lewisham Shopping Centre has been its major shopping and leisure destination. Its design, as a selfcontained, car orientated ‘island’ reflects the period that it opened. However there is an opportunity for the centre to play a far greater role in a modern, integrated town centre, with a transformed environment and wider range of uses

1.2 This will support the Government’s objectives to “get Britain building again, to build new homes, create jobs, and deliver new and improved infrastructure”, the Mayor of London’s emerging Growth Plan including a focus on the foundational economy and town centres, and Lewisham Council’s long term investment and vision for the Town Centre to be “restored as the heart of South East London” including planned investment in the market and a Cultural and Business Hub in the current library.

1.3 The site is part of Lewisham’s ‘Central Growth Corridor’, a designated ‘Town Centre’ and an ‘Opportunity Area’ Intensifying the use of such scarce brownfield land, by having shops, services and active uses at ground floor level with residential space above, is absolutely critical to ensuring its economic success, at the same time providing much-needed new homes. This is all the more important given London’s significantly increased housing target and the ‘brownfield first’ approach. It is one of the key locations for investment which can bring new homes, jobs and economic activity to Lewisham and its residents.

1.4 LandsecU+I, the owner of the Centre, has a track record of unlocking complex regeneration sites. Their vision is to create a new centre for Lewisham, helping re-define the town centre offering everyone better choices and new experiences that are firmly rooted in Lewisham's people and culture.

1.5 The Lewisham Shopping Centre development will deliver new homes, new open space and new leisure facilities to support the town centre, including bringing back a new Model Market and creating a new cultural venue and community space It will revitalise the retail environment, tying together the high street, market, station and open space with new convenient and attractive links.

1.6 These proposals come at a time when the Government, has called for Britain to get building. Delivering economic growth is the number one mission for our country, and the planning system is central to achieving this This is an opportunity for Lewisham Town Centre to play its part, securing its own economic growth for the borough and beyond.

1.7 This statement sets out how the Application supports this economic growth ambition, including:

▪ The biggest investment in the town centre for nearly 50 years, securing its future and growth with more than £1bn in investment

▪ Widening the offer in the town centre, with more and better places to eat and drink, new leisure and cultural attractions, improving Lewisham’s place as one of South London’s best town centres

▪ Reconnecting and tying together the town centre with new pedestrian and cycle routes, removing severance and fragmentation

▪ The delivery of significant publicly accessible open space, including The Park, Northern Square, Eastern Terrace and New Model Market

▪ Construction employment of c. 770 jobs over the ten-year construction period on site, with a further c. 510 jobs offsite1

▪ A net increase in employment of up to 1,910 FTE jobs, once the development is complete

▪ The delivery of up to c. 1,719 homes, 445 co-living homes, and up to 661 student bedspaces, contributing 13% of the ten-year London Plan target for LBL

▪ New homes for households on the council’s waiting list, intermediate homes to rent for key workers, family homes, and homes for students, supporting the higher education sector in the borough, and developing skills locally

▪ The development provides a new place for up to around 4,350 people to live in the town centre

▪ These homes would generate up to £3.8m in New Homes Bonus for local priorities

▪ This increase in employment will generate gross value added (additional economic activity) of up to £160 million per year

▪ Securing business rates revenue for the council

▪ Delivering an estimated £27 million in CIL payments to Lewisham and the Mayor to fund local priorities2

▪ An increase in resident and employee spending of around £30 million annually

1.8 Together, these effects, and the transformation they represent, will help Lewisham town centre grow to be an exemplary integrated town centre of Metropolitan significance. It will preserve the great character of the area and existing assets such as the market; it will build on improvements and developments the council has already overseen; it will integrate and connect communities, facilities, and transport; and it will invigorate the town centre with high quality public realm, greater quality and variety of town centre uses including leisure, and enable more people to live in the heart of Lewisham.

1 Full Time Equivalent

2 Subject to calculation at the time planning permission first permits development for each phase, and subject to eligibility criteria

2 Introduction

2.1 This Economic Growth Statement has been prepared and submitted by Quod on behalf of Landsec Lewisham Limited (“Landsec”), to support an Application for Hybrid Planning Permission (part detailed and part outline, the ‘Application’) for the redevelopment of Lewisham Shopping Centre and adjacent land (the “Site”) within the London Borough of Lewisham (‘LBL’).

2.2 Landsec’s vision is to shape a new centre for Lewisham as part of the wider rejuvenated Town Centre Delivery of this mixed-use development will bring with it a wide range of public benefits as each phase comes forward and brings new residents, workers and visitors to the area. This is a significant opportunity for the London Borough of Lewisham, the Lewisham community, as well as London more widely.

2.3 The Application is for a phased development to come forward over ten years. Phase 1a includes the Detailed component of the planning application (as well as outline components), whilst Phases 1b, 2a, 2b, and 3a and 3b are applied for in outline.

2.4 Phase 1a comprises demolition of existing buildings, provision of a mixed-use development including a Co-Living building (Plot N1), a residential building (Plot N2), town centre uses, public open space, public realm, amenity space and landscaping, car and cycle parking, and other associated works.

2.5 Outline planning permission is sought for the rest of the Site, with all matters reserved, for a comprehensive, phased redevelopment, comprising demolition of existing buildings, structures and associated works to provide a mixed-use development including:

▪ The following uses:

▪ Living Uses, comprising residential (Class C3) and student accommodation (Sui Generis);

▪ Town Centre Uses (Class E (a, b, c, d, e, f, g (i, ii)) and Sui Generis);

▪ Community and Cultural uses (Class F1; F2; and Sui Generis);

▪ Public open space, public realm, amenity space and landscaping works;

▪ Car and cycle parking;

▪ Highway works;

▪ Formation of new pedestrian and vehicular accesses, permanent and temporary vehicular access ramps, service deck, servicing arrangements and means of access and circulation within the Site;

▪ Site preparation works;

▪ Supporting infrastructure works;

▪ Associated interim works;

▪ Meanwhile and interim uses; and

▪ Other associated works.

2.6 The purpose of this Economic Growth Statement is to consider how the various elements of the Lewisham Shopping Centre Development will deliver benefits tothe public and is structured as follows:

▪ Section 3 – The Current and Future Role of the Centre – provides an overview of the Site;

▪ Section 4 – Lewisham as Southeast London’s Premier Town Centre – provides an overview of the town centre, identifying opportunities and challenges for the future;

▪ Section 5 – Development Impacts and Benefits – identifies key themes from the proposals and their impacts against them; and

▪ Section 6 – Students in Lewisham – looks at the benefits of the delivery of PurposeBuilt Student Accommodation

3 The Current & Future Role of the Centre

3.1 Lewisham Shopping Centre has been at the heart of the town centre for nearly fifty years and is in need of renewal. Since opening in 1977 as the Riverdale Centre, it has provided attractive shops and services for the people of Lewisham.

3.2 The 6.3 hectare is the largest in the ‘Central Area’ in the draft Local Plan, nearly twice as big as the next site. There has been considerable development and intensification around the station since the opening of the DLR in 1999, including a new leisure centre, homes and open spaces including the opening up of the river.

3.3 But fundamental and permanent change requires the re-development of the shopping centre It forms a barrier for movement to and through the area, and falls short of its potential to attract visitors, due to its relatively limited food and leisure offer.

3.4 A successful town centre, one aiming to achieve Metropolitan significance, is about more than just retail, it is an irresistible mix of many different ingredients. And it is more than the sum of its parts. But to achieve that it needs to be open, connecting the different elements – transport hubs, shops, restaurants, leisure, high street, market, open spaces and places to live –connecting them all together accessibly into a whole offer for residents, workers and visitors.

3.5 National policy puts Growth as the number one mission for the Government. Proposed updates to the National Planning Policy Framework set objectives including:

▪ Get Britain building again – new homes, jobs and infrastructure

▪ A brownfield first approach – ensuring sites like Lewisham town centre deliver their share of growth

▪ Support the development needed for a modern economy – preparing the way for a modern industrial strategy

3.6 The London Plan too prioritises good growth, now supported by the London Growth Plan consultation. This includes an emphasis on the Foundational Economy – the jobs that underpin thriving local growth, including town centre uses, high streets and small businesses.

3.7 Lewisham has a housing target of 28,460 new homes over 15 years – an important contribution to London’s growth, and within that Lewisham shopping centre is an important component. And the drive to deliver will only increase – proposed national targets for London are over 80,000 homes a year, more than double the capital’s current rate of housing delivery.

3.8 The Draft Local Plan3 states that the Site ‘is noteworthy given its scale and prominent position at the heart of the centre. Its redevelopment is essential to improving accessibility and

3 London Borough of Lewisham (2021). Lewisham Local Plan – Regulation 18 Stage “Main Issues and Preferred Approaches” document.

circulation within the centre as well as to enhance the amenity of Lewisham Market, an important visitor destination in its own right’.

3.9 The Site has been allocated in the Draft Local Plan (Site 2) as a comprehensive mixed-use development including commercial, community and residential. The allocation highlights the opportunity to enhance the quality of the town centre and help it achieve metropolitan status, including the following requirements:

▪ The need to ensure that the Site is reintegrated with the current street network to improve access and permeability through the town centre;

▪ Delivery of improved public realm (e.g. improvements to Lewisham High Street, a central landscaped open space and a network of connections linking to the wider town centre area);

▪ Protecting and enhancing Lewisham Market;

▪ Positive frontages within the Primary Shopping Area and along key areas routes, in addition to active ground floor frontages; and

▪ Provision of dedicated public toilets that are appropriate to the development.

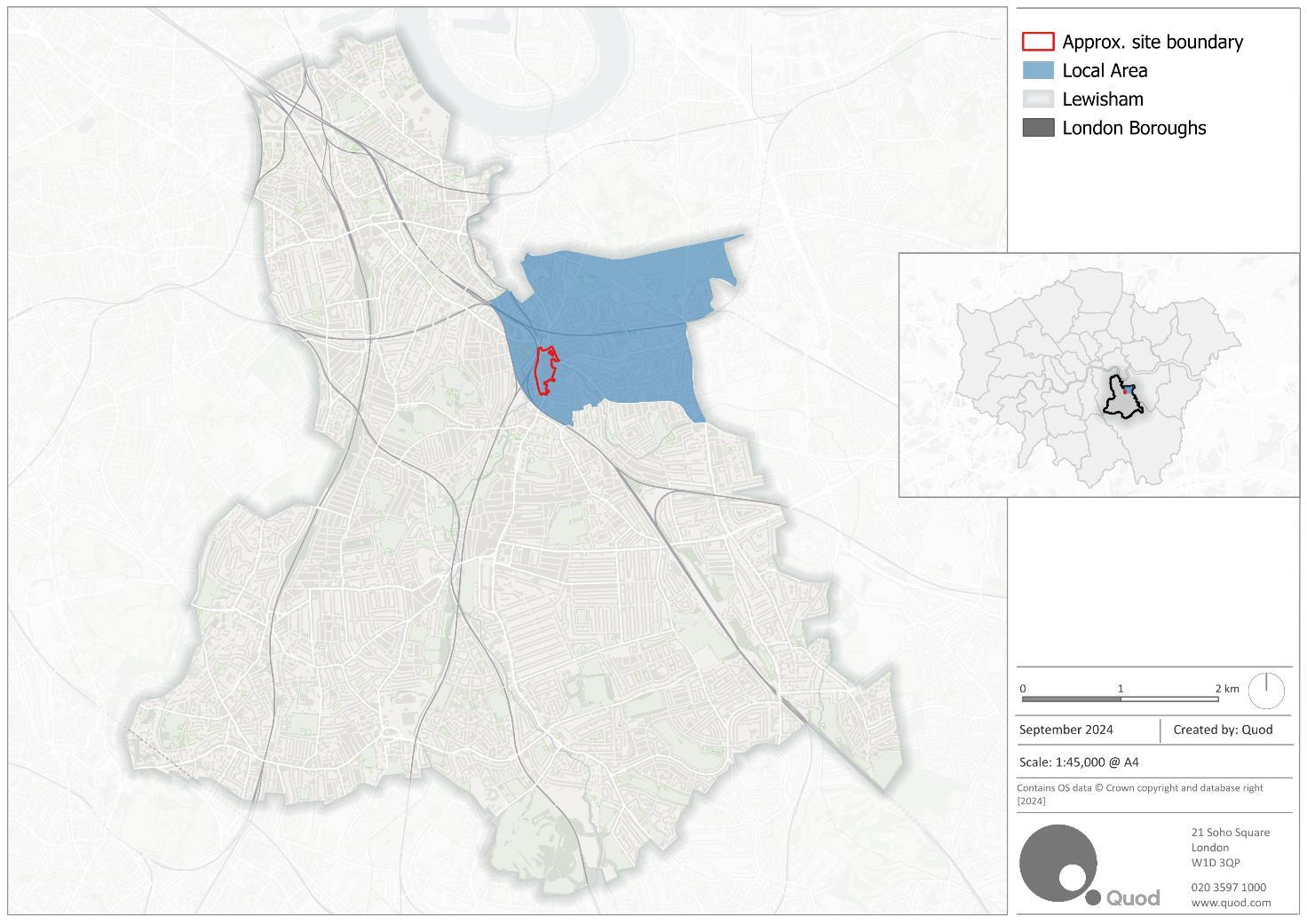

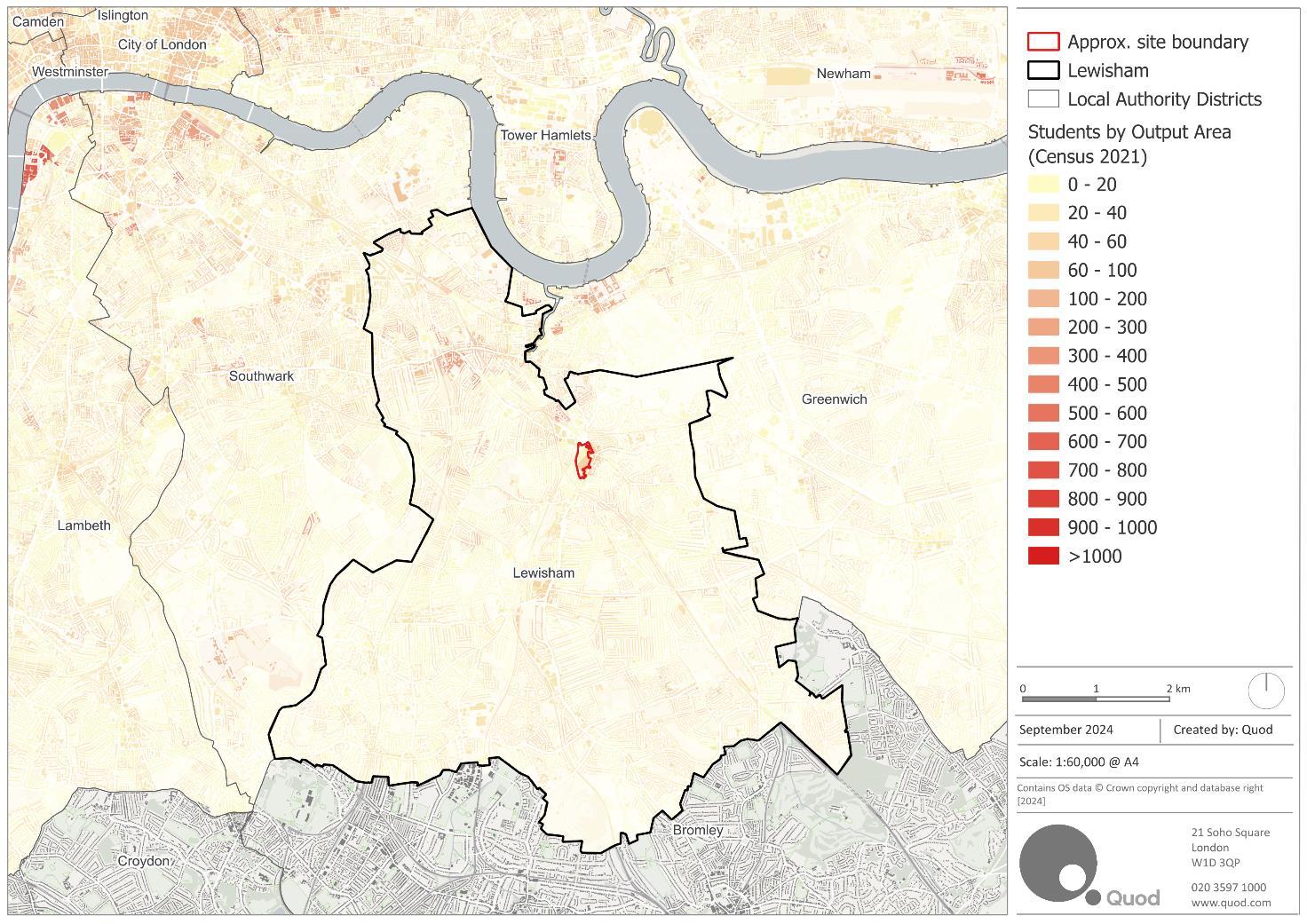

3.10 The Site is in Lewisham Central ward in the east of the London Borough of Lewisham (LBL), as shown in Figure 3.1. The baseline assessment – extensively featured elsewhere in the Application4 and summarised below - considers Site level data where available, with data from Lewisham Central and Blackheath wards representing the Local Area

4 Volume 1: Environmental Statement – Main Text - Chapter 15: Socio-economics.

Figure 3 1 - Site Context Map

Baseline summary

3.11 Within the Shopping Centre, there are 52 leased retail units, including shops and other smaller kiosks. There are five food and beverage units, and three units used for community & culture, which include the Bank of Things, the Migration Museum and the Toy Library. In addition to the shopping centre, the Site also includes retail units along the high street. It is estimated that there are c. 1,000 FTE employees currently located within the redline boundary, of which c.690 are located within employment floorspace to be demolished at the Site.

3.12 In 2021 the resident population of the Local Area was 24,600. A high proportion of Local Area residents (80%) are of working age, greater than LBL (76%) and London (75%). Children aged 16 and under accounted for 16% of the Local Area population, lower than proportions across LBL and London (both 19%).

3.13 In 2021 the economic activity rate within the Local Area was 77%, which is greater than Lewisham (70%) and London (66%). The Local Area unemployment rate was 9.6%, higher than unemployment rates in Lewisham (8.2%) and London (7.3%). In July 2024 the claimant count rate within the Local Area (6.4%) was lower than the rate In Lewisham (7%), but higher than the proportion in London (6%).

3.14 The Local Area has a higher proportion of people above the age of 16 with higher education qualifications (59%) when compared to Lewisham (50%) and London (47%). Approximately

66% of the Local Area’s employed population had managerial, technical or professional jobs compared to proportions of 57% and 56% in LBL and London, respectively.

3.15 In 2022 there were 11,300 jobs in the Local Area and 71,800 in LBL. The largest employment sector in the Local Area is ‘Retail’ which accounts for 18% of jobs, higher than proportions in LBL (11%) and London (8%).

3.16 In 2021 there were 11,190 households within the Local Area, this comprised of 76% flats and 24% houses, with the proportion of flats higher than in LBL (58%) and London (54%). 37% of households were private rented, higher than LBL (27%) and London (30%). The Local Area has a lower proportion of social rented households (26%) than LBL (29%), but a higher proportion than London (23%). 9% of all Local Area households are overcrowded, which is lower than rates in LBL and London (both at 11%).

4 Lewisham as Southeast London’s Premier

Town

Centre

4.1 The ‘Central Area’ of Lewisham is at the heart of the Borough’s spatial strategy for Good Growth. Including Lewisham Town Centre to the north, and Catford to the south it is connected by the A21 and the parallel Waterlink Way through Ladywell Fields. It contains many of the Borough’s major Civic and Public services including the Town Hall, Lewisham Hospital and Lewisham Police Station.

4.2 Lewisham Council has already invested considerable time and resources in planning and delivery the development and improvement of the town centre. The first stages of new development have already taken place to the north and west of the shopping centre. The council has also led successful Levelling Up bidding to invest in the public realm, support the market, and create a flagship Culture and Business Hub.

4.3 Lewisham Town Centre is a successful centre that serves a diverse range of individuals from various different backgrounds. Its retail offer is extensive, including some of the largest retailers in the UK - such as Tesco, Sainsburys, Primark and H&M - alongside independent stores and market stalls.

4.4 The retail offer is also dominant, being the largest sector in the Local Area (18%) – there is a clear lack of diversity within the town centre, with only 2% of employment in the Local Area in the arts, entertainment, recreation and other services. Town centres and the way we shop have been rapidly changing due to the growth of online shopping, a shift accelerated by the pandemic. Whilst the retail led model has worked for the last 45 years, it needs to be reinvented into something fit for the next 40 years in order to maintain the vitality and viability of Lewisham Town Centre.

4.5 In particular, there is a lack of nighttime economy attractions. Even more so since the closure of the Model Market in September 2021 due to the pandemic, a popular space where individuals congregated to enjoy bars and street food. A New Model Market is included in the proposals.

4.6 Landsec’s proposals include a diverse mix of uses to support and enhance Lewisham Town Centre, helping the Council realise it’s ambition for growth and renewal with Lewisham becoming an exemplary integrated Town Centre of Metropolitan significance

4.7 This includes the introduction of new forms of living into the town centre, diversifying the High Street beyond the retail and ensuring pedestrian activity throughout all hours of the day, supported by a new food and beverage street and cultural quarter. This is incorporated whilst maintaining and consolidating an attractive retail offer along Lewisham High Street to tie the place in with the rest of the town centre. Behind the High Street, uses will include commercial, community and culture, further enhancing town centre renewal.

4.8 New housing is vital to the future of town centres. As well as providing desperately needed homes and helping meet housing targets, it also strengthens the town centre itself. People

living right in the heart of Lewisham will spend money there, particularly with the rise of working-from-home. But it also supports a culture of enterprise and start-ups – the future of work is more dispersed, with people working or starting businesses all over the city, where they live.

Retail in decline – a national story

4.9 Despite the strong retail base in the town centre, a sectoral decline in retail is taking place. Between 2015 and 2020, retail employment in London grew at just 1% compared to 4% across all sectors. Retail growth that has occurred has been in central boroughs north of the river (Westminster, Hackney, Tower Hamlets, and Camden).

4.10 The GLA (2022) forecasts that peak retail employment will occur between 2031 and 2033. These are interim forecasts with greater uncertainty given the impact of the pandemic which accelerated retail decline. This may mean the peak in retail employment will come sooner than that, or may even have already happened. This is presented in Error! Reference source not found.

London - all sectors (forecast)

Lewisham - all sectors (forecast)

London - Retail (forecast)

4.11 Retail centres across London are going to support less retail employment – some will be hit harder than others. As demonstrated by recent employment growth (and decline), central London centres with new shopping centres are likely to fare better – high quality environments and variety of offer will win out over older traditional shopping areas.

4.12 The challenge in Lewisham is acute. It is the local authority with the lowest job density in London in 2019 (see Figure 4.2) with only 0.4 jobs per resident5. With overall employment in Lewisham staying the same between 2015 and 2021, compared to growth of 5.5% in London.

4.13 Policy OL1 in the Draft Local Plan highlights the importance of promoting a vibrant and diverse multicentred Lewisham through directing new commercial as well as residential, community,

5 ONS, 2019. LI01 Regional labour market: Local indicators for counties, local and unitary authorities

Figure 4.1 - GLA Employment Forecasts (2022)

leisure and cultural development to Lewisham Town Centre, enabling the town centre to achieve metropolitan centre status.

4.14 A new approach is needed to support employment in the borough – and in particular in the town centre. This cannot rely on the continuation of a retail model that is outdated and declining. The counterfactual for the shopping centre, and indeed for the wider town centre, is not a continuation of the current snapshot. It is a decline in employment.

4.15 The reimagined town centre must look to diversify its offer and capture more of what people spend in person, including on experiences and leisure.

4 2 – 2019 Job density in London (jobs per person) (exc. City of London)

Barking and Dagenham Redbridge Waltham Forest Haringey Lewisham

Brent Ealing Barnet Wandsworth Bromley Sutton Enfield Havering Bexley Croydon Harrow Greenwich Newham

Hammersmith and Fulham Hillingdon Hounslow Richmond upon Thames Kingston upon Thames Hackney Lambeth Merton

Tower Hamlets Southwark

Kensington and Chelsea Islington

Westminster Camden

Diversification of the Town Centre and the nighttime economy

4.16 The role and function of town centres is changing – the redevelopment of the shopping centre is an opportunity to move away from big box retail and a failed leisure offer to provide a mix of town centre uses that meet a local need.

4.17 This means capturing more of what people spend in person – including importantly on leisure, food and beverage (F&B) and evening economy. Data from the 2017 GLA Health Check also

Job Density

Figure

highlights the lack of nighttime economy attractions Lewisham has compared to some of London’s most successful town centres. This is presented in Figure 4.36

Restaurants

4.18 There is comparatively little nighttime economy floorspace in Lewisham town centre, with no hotels or theatres, limited F&B and an overprovision of hot food takeaways. Catford has more floorspace to support its nighttime economy than Lewisham, owing to its theatre.

4.19 Improving Lewisham’s nighttime economy would also help the borough achieve the strategic objective of strengthening Lewisham’s role in the wider London economy by expanding the local business base.

4.20 With a view to addressing this, the Application includes specific areas focused on restaurants, bars and event spaces to amplify the leisure offer as well as a new community music venue and the New Model Market that will anchor an evening economy. It also seeks to bring forward meanwhile uses across the Site to ensure benefits are felt sooner, including the possibility of reusing the car park’s rooftop.

Homes at the heart of the Town Centre

6 GLA, January 2018. 2017 London Town Centre Health Check Analysis Report.

Figure 4 3 - Nighttime economy in London

4.21 The introduction of new homes and residents to the area will bring benefits to the wider economy – such as those quantified later in this Statement – that are key to establishing a successful Major Town Centre.

4.22 This Application includes a wide range of quality housing – up to 1,719 homes, 445 co-living and 661 student accommodation units – which are expected to be home to up to 4,355 residents. These residents will increase footfall and vibrancy of the area, whilst making sure more spending is captured within the Town Centre. This will be key to supporting the new leisure offer, for example, by ensuring that the New Model Market can survive viably where the old one could not.

4.23 Given more people will be living at the heart of the Town Centre, the Site has been planned to ensure permeability for pedestrians. The street level areas have been designed to minimize vehicles and support pedestrians (and cyclists) moving around the Site, with active frontages further contributing to an attractive public realm. There is a north-south pedestrian route through the Site, enabling shoppers, residents, employees and visitors to travel from Lewisham station and Lewisham Gateway to the north, through the centre of the Site, towards Lewisham High Street. Making each of these areas more accessible to each other, whilst enhancing the offer at the Shopping Centre, is key to ensuring Lewisham’s status as a successful Major Town Centre

Lewisham Street Market

4.24 Lewisham Street Market (outside the application boundary) is also an integral part of the Town Centre, selling a range of items including fresh fruit and vegetables, flowers, clothing and other household items. The market has existed since 1906 and one of the few remaining markets that operates for 6 days a week within London. Proposals to renovate and upgrade the market are being prepared by LBL and a planning application (LPA ref. DC/24/136236) was approved for the upgrade works in July 2024.

4.25 Although not part of the Application, Landsec’s proposals aim to respect the Site’s history and ground any proposal in its vibrant community, including Lewisham Market. Landsec has liaised with Lewisham Council, Lewisham Market, and its traders to discuss, how as a neighbour, any future development can enhance its operation in acknowledge for the key role it plays in the success of Lewisham Town Centre.

5 Development Impacts and Benefits

5.1 These proposals are the biggest single investment in the town centre in nearly 50 years, and improvements on this scale will bring multiple benefits to the town centre, the borough and beyond. This section sets out and quantifies some of these benefits.

Delivery of new housing

5.2 New housing is one of London, and the nation’s highest priorities, and tackling the housing crisis will reap multiple economic and social benefits. The London Plan 2021 sets LBL a housing target of 16,670 new homes to be provided between 2019/20 and 2028/29; equivalent to 1,667 homes per year. LBL met their housing target once in the last 5 years (2018/19) and total yearly completions as a percentage of yearly housing targets has steadily declined since 2021/22.

5.3 The Proposed Development includes the delivery of 119 homes and 445 co-living units as part of the Detailed Proposals and up to 1,600 and 661 student accommodation beds as part of the Outline Proposals, contributing to the delivery of Borough housing targets for LBL.

5.4 The 445 co-living homes are “equivalent” to 247 homes with respect to housing targets at a ratio of 1.8:1 and 661 student accommodation beds are “equivalent” to 264 homes at a ratio of 2.5:1. When combined with the maximum of 1,719 homes set to be delivered as part of the proposals, this equates to 13% of the ten-year London Plan target for LBL.

Construction Employment

5.5 The proposed demolition and construction works for the Development will generate a significant number of jobs in construction. The number of jobs on site will vary over the period, and the trades involved will also be very varied, offering both entry-level opportunities, as well as highly skilled and specialised roles.

5.6 The CITB’s Labour Forecasting Tool7 provides an estimate of the number of jobs that will be needed for the demolition and construction works. This is estimated as an average of c. 770 FTE jobs over the ten-year construction period.

5.7 The figure above only considers direct, on-site construction employment. When considering off-site occupations, it is estimated that the scheme could generate a total average of over c.1,280 FTE construction roles over the construction period8

Operational Employment

5.8 The Development will provide a range of non-residential floorspace that will provide employment opportunities. The non-residential floorspace includes the provision of some flexible retail, commercial, community and cultural spaces. The assessment of the number of

7 Construction Industry Training Board (CITB), online: www.labourforecastingtool.com

8 These roles are likely to be based over a wide area, in some cases nationally, and have therefore not been included within the consideration of local benefits.

jobs expected to be accommodated by the Proposed Development has been calculated by using standard employment densities as set out within the HCA employment density guide.

5.9 Due to the flexibility of the proposals the detailed components of the Proposed Development could accommodate 145 to 195 jobs (FTE) and the outline components could accommodate between 1,445 and 2,405 jobs (FTE). When taking the estimated existing jobs into consideration, the Proposed Development could generate up to 1,910 net additional jobs which will positively contribute towards the economic growth of Lewisham, pushing the borough closer to being recognised as a Metropolitan town centre.

5.10 The proposals will also diversify the town centre and act as an improvement on the current town centre offer, making Lewisham a more popular destination for people to reside and spend time in.

Employee and Household Spending

5.11 Both residents and employees that are generated from the Proposed Development are likely to spend money in the Local Area and the wider LBL area. An assessment of the level of spending likely to occur once the Proposed Development is operation has also been carried out. This includes an assessment of:

▪ Household expenditure generated by the new households living within the new homes who may buy goods and services locally. This assessment was based on the Regional average household expenditure of £210 per week for London (ONS Family Spending Survey 20239);

▪ Calculation of spending by residents in co-living homes has been based on the average person expenditure of £85 per week derived from the from the (ONS Family Spending Survey 202310); assuming average occupancy of co-living homes of 1.25 (assuming one unit in every four occupied by two people); and

▪ Spending by students has been based on an average annual spend of £8,673 on goods and services. This is based on a data from the Student Income and Expenditure Survey and adjusted for inflation11 .

▪ Local expenditure by net additional employees. An average spend per day of £14.62 per employee has been applied, based on survey information carried out by research agency Loudhouse for Visa Europe (2014)12 and adjusted to account for inflation13

5.12 The operational employees will spend a portion of their wages in the local economy, such as picking up items before or after work, or going for lunch. Workers in the UK spend an estimated £14.19 per day in the local area around their place of employment14. Table 5.2 breaks down

9 Office for National Statistics, (2024). Household Expenditure Survey 2021-2023.

10 Office for National Statistics, (2024). Household Expenditure Survey 2021-2023.

11 Department for Education, 2023. Student Income and Expenditure Survey 2021 to 2022

12 Visa Europe, (2014). UK Working Day Spending Report.

13 Bank of England, (2021). Inflation calculator. Available online: https://www.bankofengland.co.uk/monetarypolicy/inflation/inflation-calculator

14 Visa Europe, 2014. UK Working Day Spending Report. (Daily spending rate has been adjusted to account for inflation based on Bank of England inflation rate change since 2014).

the total spending set to be generated as a result of the Proposed Development by use (household, co-living, student and employee).

5.13 As shown in Error! Reference source not found., gross annual spending by new residents (including students) and employees accommodated by the Development would total approximately £30.8 - £34.0 million. A proportion of this is expected to be spent on local goods and services. When looking at the net employee spending (taking the existing employee spending into account), the total expenditure is expected to be between £28.7 - £31.8 million

Table 5 1 - Estimated Household, Student and Employee Spending

Productivity Benefits

5.14 In 2021, the construction sector generated Gross Value Added (GVA) in the region of £20.6bn in the London region in 202115, resulting in an estimated GVA per construction worker of around £61,535 (applied to the estimated figure of construction jobs in London from CITB16). The on-site construction employment would generate around £106.3 million in GVA within the regional construction economy (based on average GVA per head in the construction industry).

5.15 The increase in employment will make an economic contribution in terms of Gross Value Added (GVA). Using data at the local authority level17, the new operational jobs are estimated to generate gross values of between £30 million and £160 million per year.

New Homes Bonus

5.16 New homes on this Site will increase council tax revenue collected by LBL. Based on the likely council tax rates of either band D or band E for 2023/24 in LBL, the maximum of 1,719 homes would generate between £3.5 million to £4.3 million in council tax each year.

15ONS (2023) Regional gross value added (balanced) by industry: all International Territorial Level (ITL) regions in 2021. Available: https://www.ons.gov.uk/economy/grossvalueaddedgva/datasets/nominalandrealregionalgrossvalueaddedbal ancedbyindustry [01/09/2024]

16 CITB (2022) The skills construction needs. London, Five Year Outlook 2023-2027. Available: https://www.citb.co.uk/media/z5wocgqw/csn-lmi-greater-london.pdf [01/09/2024]

17 ONS, 2022. Regional gross value added (balanced) by industry: local authorities by ITL1 region: TLI London, current prices, pounds million (1998 – 2022).

5.17 The Proposed Development would also generate up to £3.8 million in New Homes Bonus, which is a grant paid to local authorities by the Government to top up the council tax collected on new homes in the first year. Local Authorities can choose which priorities to spend their New Homes Bonus on.

Business rates

5.18 Business rates make up a significant proportion of the borough’s income, enabling spending on important local priorities. The proposed development retains a significant amount of town centre floorspace in the shopping centre and the investment will strengthen the town centre’s growth.

5.19 The creation of higher quality spaces, improved footfall, more successful businesses and reduced vacancy as a result of the Application will all in turn bring further benefits to business rate income for the borough, protecting future funding.

Improved provision of open space and public realm

5.20 The Site is currently unattractive, and the busy surrounding roads create a harsh environment for pedestrians. The Proposed Development will deliver substantial publicly accessible open space, including at least:

▪ The Park – 5,255 sqm;

▪ Northern Square – 3,360 sqm;

▪ Eastern Terrace – 1,970 sqm; and

▪ New Model Market – 1,300 sqm.

5.21 The open space provision is in line with both Policy 12 ‘Open space and environmental assets’ in the Lewisham Core Strategy which requires on-site provision of public open space as part of new development, and Policy GR2 of the Reg 19 LBL Local Plan which states that development proposals should maximise opportunities to include new public open space and improve connections to green space, while major developments will be required to incorporate new public space unless it is not feasible.

5.22 The provision of these spaces will address the area’s current deficiencies in local, small and pocket parks. The Site will also encompass a holistic green approach which references the historic landscape character of the area and creates important links between open space and public realm spaces.

5.23 As detailed within the Masterplan Design & Access Statement, new routes through the Site will have public spaces at their intersections, while the multi-level, public nature of Lewisham meadows, along with the dramatic meadow plating approach, will create a unique and dynamic experience. The Site will also create links between new open spaces and existing local infrastructure such as Lewisham Gateway, the Sculpture Park, Cornmill Gardens and Lewisham High Street.

5.24 Improved connectivity to and within the town centre is what helps make it more than just the sum of its parts. Retail, employment and leisure; the shopping centre, market and high street; transport hubs, open space and new homes – each of them bring footfall, but it is when people

can flow freely and easily between them that they create the critical mass that a truly successful town centre needs. The redevelopment of the shopping centre is the key to unlocking this.

6 Students in Lewisham

6.1 Lewisham is home to a number of further and higher education institutions including Goldsmiths College, Trinity Laban Conservatory of Music and Dance and Lewisham College. To support these institutions, Lewisham’s student population needs to be able to access affordable accommodation, ideally close to places where they study.

6.2 Addressing the demand for housing is a significant challenge facing the UK and London in particular. Policy HO7 ‘Purpose built student accommodation’ of the Draft Lewisham Regulation 19 Local Plan also highlights the need for high-quality Purpose Built Student Accommodation (PBSA), with proposals for PBSA where they will help meet an identified need, be appropriately located at well-connected sites that are within or at the edge of town centres.

6.3 Without a suitable stock of student accommodation, pressure will be placed on the private rented sector which will in turn, have knock on impacts for supply and affordability within the wider housing market, including family housing.

Delivery of PBSA

6.4 There is a need for 88,500 additional PBSA bed spaces between 2016 and 2041 in London, equivalent to 3,500 per year18. Between 2016/17 and 23/24, London has averaged 2,060 bed spaces per year of delivery, 59% of the annual target for student bedspaces, highlighting the need for a significantly increased delivery of PBSA within London. This is shown in Figure 6.1.

1,000 2,000 3,000 4,000 5,000

6.5 18 Mayor of London, 2017. London Strategic Housing Market Assessment.

Figure 6 1 - Completed London Student Bedspaces in London between 2016/17 and 2023/24

6.6 Figure 5.2 highlights that student numbers have increased rapidly in recent years – with growth of 20% between 2018/19 and 2022/23.

6.2 - Higher Education Students in UK (HESA)

2,200,000 2,300,000 2,400,000 2,500,000 2,600,000 2,700,000 2,800,000 2,900,000 3,000,000

6.7 London is home to 19% of the UK student population and is experiencing particularly high growth – the Higher Education Policy Institute (HEPI) forecast that by 2035 London will need more than 23,000 further higher education places to satisfy demand.

6.8 The Housing Statement highlights that London is recorded to have the second highest student to bed ratio19 at 3.6:120, just behind Glasgow. This suggests that London-based students are currently unable to access purpose-built accommodation and, combined with wider economic factors, contributing to unprecedented levels of rental growth for student bedspaces: rents in London increased by 11.2% between March 2023 and March 202421

PBSA supporting mixed and balanced communities

6.9 Figure 6.3 shows the distribution of student residents within Lewisham, with there currently being a high concentration of students around Goldsmiths College but relatively low concentrations in the rest of the borough when compared to local authorities such as Lambeth and Southwark.

19 The number of students competing for each available bed offered by universities or private providers.

20 UK cities need much higher rates of student housing delivery, Savills, 8th April 2024 (https://www.savills.co.uk/blog/article/358493/commercial-property/uk-cities-need-much-higher-rates-ofstudent-housing-delivery.aspx)

21 ONS, 2024. Private rent and house prices, UK: May 2024

Figure

6.10 Students form an important part of London’s communities, supporting local shops and amenities, and contributing to local life. It’s therefore important that that housing for students forms part of the mix of housing delivery within an area to ensure mixed and balanced communities are maintained.

6.11 Unmanaged concentrations of students may historically have been associated (often unfairly) with heavy drinking, but this culture has shifted markedly in recent years, with young people drinking far less and placing a greater emphasis on their health and wellbeing, their studies and integrating with their local communities in a positive manner.

6.12 Many of the problems and concerns associated with students arise as a consequence of unplanned and unmanaged Houses in Multiple Occupation (HMOs). This can lead to inadequate living conditions for students and higher rates of noise disturbances for local residents living in these areas.

6.13 In contrast, well managed PBSA addresses these issues through providing a purpose-built environment with appropriate sound insultation, enforced rules of conduct, CCTV and dedicated management teams to swiftly address any issues.

Figure 6 3 - Distribution of Students

PBSA contribution towards housing delivery targets

6.14 The London Plan sets a requirement for 3,500 PBSA bed spaces to be delivered in London each year – a target which has not been met for four of the previous five years. The Proposed Development would deliver up to 661 student bedspaces, contributing 19% towards this annual target.

6.15 The London Plan states that accommodation for students should also count towards meeting housing targets on the basis of a 2.5:1 ratio, with two and half bedrooms/units being counted as equivalent to a single home. The London Plan 2021 sets Lewisham a housing delivery target of 16,670 homes to be delivered between 2019/20 and 2028/29 which equates to 1,667 homes a year. The PBSA element of the Proposed Development alone would therefore also contribute 16% towards the borough’s annual housing target (the equivalent of 264 new homes).

6.16 Increasing the supply of affordable housing is a key priority for Lewisham as shown in Policy HO3 ‘Genuinely affordable housing’ – the Development’s level of affordable provision is therefore a significant opportunity to contribute towards this.

Student spending

6.17 Student spending can also be an important local economic impact of resident student populations. New student residents will generate spending in the surrounding area. Whilst student income is generally low, student spending is less so. Students can be supported by a number of resources including bursaries, grants, parents and part-time employment. Their spending is also disproportionately local.

6.18 Excluding the costs of accommodation and tuition, students in London spend an average of over £8,673 per year on goods and services. Spending by students has been based on an average annual spend of £8,673 on goods and services. This is based on a data from the Student Income and Expenditure Survey and adjusted for inflation22

6.19 Overall, spending by new students is estimated to generate an uplift of approximately £5.5 million per year. Such spending is expected to help support the viability and vitality of shops and services within the surrounding area.

6.20 A significant proportion of students spending would be expected to be captured, with a survey of students in London suggesting that 67% of residents travel less than a mile to buy groceries and up to 70% purchase other goods such as stationery, clothing and electronics locally.

Student laying down roots locally

6.21 The economic contribution of students extends beyond their period of study. London’s economic future depends on high skill, high value-added sectors. Higher education is vital for these sectors to grow. Universities bring people from around the country, and beyond, and the graduates from these universities are essential to the knowledge economy with many staying on seeking employment after graduation. This is particularly the case in London given its world

22 Department for Education, 2023. Student Income and Expenditure Survey 2021 to 2022

city status. Across London as a whole, 71% of UK graduates who studied here subsequently found work in the capital23

6.22 This effect can be quite localised, and in a large city like London students are more likely to settle in areas they are familiar with. A survey of two comparable student accommodation facilities found that up to 61% of its residents would consider or already have committed to remaining in the locality post-graduation. Purpose-built accommodation in Lewisham will draw students from around the country, and beyond, and encourage them to put down roots locally, staying on here when they start work after graduation, rather than elsewhere in London, allowing the borough to retain their skills.

23

London Higher (2010) London Higher Fact Sheet 2010 - Destination of Leavers from Higher Education Institutions 2008/2009