T U L S I W E A L T H

T U L S I W E A L T H

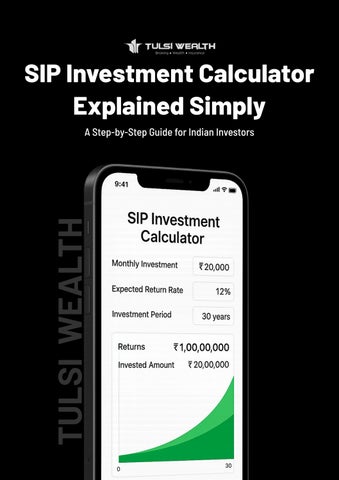

You don’t need a finance degree to plan your future wealth—you just need the right tool. That’s where the SIP investment plan calculator steps in. Imagine being able to see, in seconds, how your ₹5,000 monthly SIP could grow into ₹1 crore. No complex spreadsheets. No confusing charts. Just one click and complete clarity. Yet, most investors skip this step and blindly hope their mutual funds will “just work out.” In this guide, we’ll break down the sip calculator in the simplest terms, so you can stop guessing, start planning, and confidently track your financial goals like a pro.

A Systematic Investment Plan (SIP) calculator is a digital tool that estimates how your monthly mutual fund investments will grow over time.

You only need to enter:

SIP Amount (e.g. ₹10,000)

Duration (e.g. 15 years)

Expected Return Rate (e.g. 12%)

➡ It instantly projects your wealth accumulation.

Let’s say:

Monthly Investment = ₹10,000

Duration = 15 years

Assumed Return = 12%

Projected Maturity Amount = ₹35+ Lakhs

No need for formulas or financial jargon—just a few taps and your financial forecast is ready.

Mutual funds are booming post-SEBI regulations. SIPs are becoming the preferred investment mode. Goals are long-term and inflation-sensitive.

Indian investors are shifting from “hope” to goal-based investing. Hence, having a visual, accurate, and reliable calculator is a must.

The Tulsi Wealth App, available on Google Play & App Store, offers more than just basic SIP calculation. It transforms SIP planning into a seamless, smart experience.

✅ SimpleUI

✅ Goal-BasedTracking

✅ SmartFundRecommendations

✅ AdvancedPlanningTools

✅ VerifiedReviews

Intuitiveanduser-friendly nolearning curve

Trackprogresstowardspecificgoalslike retirementorchildeducation

Curatedmutualfundstailoredtoyour goals

Includesstep-upSIPs,delay-costanalysis, andmore

Over90%ofusersrateit5-starsforclarity andease-of-use

"Investing ₹7,000/month for my child's future became less stressful thanks to the app's goal tracker."

— A Tulsi Wealth Investor

Short answer: They are projections, not promises.

Based on fixed inputs (amount, return rate, tenure)

Doesn’t account for market fluctuations

But helps you build discipline and focus

➡ Indian users who use SIP calculators tend to invest more consistently and wisely.