Progress Requires Change

THE ONLY ACCESS CONTROL SYSTEM

DESIGNED FOR THE UNIQUE NEEDS OF YOUR ASSOCIATIONS.

• Delinquent Sensitive Doors – One Click delinquent control – If units are delinquent you can immediately limit access to select doors, not affecting others. Get your money.

• All Tags* are associated with a unit. Look at your system’s list of Tags*. In most systems 10% the Tag* Holders cannot be positively identified. This means you do not know who has access to your property. Stay Secure.

• Put in a Tag* to turn off in the future. Owner, Just bought a new car and need an access Tag*, but they do not have a new license plate yet. No Problem, here is your access Tag. It will stop working in 30 days if you do not bring us your Vehicle License Tag Info. Know the vehicles on your property. Stay in control.

• We specialize in Face Id readers to protect your community from copied FOBs and unauthorized rentals

Door Configuration

Unit Information

* Tags – Are the devices used to open a door or gate, FOB, RFID, EGO…

• Simple to us e Browser interface

• Tightly Integrated with management system

• Cannot delete a person who has a Tag*. No leftover Tags* when people move out

• Multiple Communities and Building all on one system with location and permission separation

• App Controllable and Status monitoring

Phone: 866-929-3511

Email: info@AsterixHardware.com

Website: www.AsterixHardware.com

• Intelligent Independent Cloud controller

• Internet not required to operate, only update

• Never obsolete-Over-the-air updates

• Simple-One door/ Gate -one controller

• Wired or Wi-Fi

• On screen status monitoring for easy support

Journal Notes

Condominiums, cooperatives, and homeowners’ associations have to be maintained, repaired, and renovated, and this means spending a good deal of cash. Boards of directors should want to spend the association’s money appropriately and wisely. Therefore, the August issue is replete with articles that seek to help boards in this endeavor.

On page 34 there are multiple tips for managing a community’s money, spending money to save the community money and headaches, budgeting best practices, and mitigating financial risk, to name a few.

Turn to page 46 to see what advice Lisa Elkan with Alliance Association Bank offers for preventing common mistakes that lead to financial frustration. She recommends the following: accurate recordkeeping, realistic budgeting, completion of a professional reserve study, restraint in cutting corners to cut costs, and having a team of experts.

On page 52 Sundeep Jay, RS, PRA, with J.R. Frazer shares the actions associations should be taking as the structural integrity reserve study (SIRS) deadline approaches on December 31, 2024. He recommends that the association provide a copy of any engineering inspection report completed on any of the community buildings in the last five years. He also encourages boards and current owners to fund the necessary updates to their aging buildings.

When you flip to page 56 you will find an article by Kathy Naughton of Centennial Bank addressing the issue of how to determine if the association’s bank is safe and in good financial condition.

Turn to page 62 to read about proper budgeting for your 2025 condominium association insurance renewal from Star Herbig with Florida Community Association Insurance. She provides helpful counsel to ensure adequate insurance coverage and appropriate limits so the community isn’t left in a bind.

On page 68 Julie Celozzi with Cogent Bank shares several ways associations can protect themselves against financial fraud. Two of her recommendations are to receive secondary statements, which is a monthly report from the association’s bank that can be used to cross reference your association’s internal records, and to bring outgoing mail directly to the post office and not risk it being stolen from the mailbox.

FLCAJ hopes that the remainder of 2024 and all of 2025 will see your community association establish itself on sound financial principles.

Editor

Publishers Richard Johns Dana Johns Editor Michael Hamline

Art Director Nick Walker

Graphic Designer Jennifer Godwin

Advertising Sales

Phone: (800) 425-1314

Email: info@fcapgroup.com

Circulation/Accounting Tammy Hanner

Phone: (800) 443-3433 Fax: (501) 280-9233

Editorial Phone: (800) 443-3433 Fax: (501) 280-9233

FCAP Coordinator Dana Johns Phone: (800) 443-3433

Email: djohns@fcapgroup.com

Florida Community Association Journal is published monthly by True Source Publishing LLC 1000 Nix Road Little Rock, AR 72211-3235

Email: info@fcapgroup.com Website: FCAPgroup.com

Copyrighted by Florida Community Association Journal. Reproductions of any part of this publication without written permission of the publisher are prohibited.

Subscription Rates

$24 for one year, $48 for three years. Back issues are $5 each plus postage. Group rates for 3 or more people are available at $12 per person.

The publisher and editor(s) of this magazine do not accept responsibility for the content of any advertisement, including statements made by advertisers herein, or for the opinions expressed by authors of by-lined articles. The publisher and editor(s) also reserve the right to reject any ad or article for objectionable content in verbiage or images. The intent of this publication is to provide general information only and is not intended to provide specific advice or recommendations. Appropriate legal, financial, or engineering advice or other expert assistance should always be sought from professionals.

Postage paid at Little Rock, AR and additional offices (permit #1085).

Postmaster Send address changes to: Florida Community Association Journal 1000 Nix Road Little Rock, AR 72211-3235 or email info@fcapgroup.com

Ansbacher Law, with board certified partners, 11 attorneys and over 30 professionals, is available to serve your community throughout Florida.

• Full service law firm for your Condominium or Homeowners Association.

• Florida’s leading construction defect team - Full contingency available, no fees or costs unless you win.

• Collections handled on deferred and contingency fee arrangement.

Ansbacher; Real Estate: Ansbacher & Roth; Construction: Ansbacher

NOW OPEN IN TAMPA &

Hannah Rullo

Zach Roth

Alejandra Gonzales

Barry Ansbacher

REMBAUM'S ASSOCIATION ROUNDUP

BY JEFFREY

A. REMBAUM, ESQ.

THE FLORIDA LEGISLATURE IS CALLED UPON TO ACT TO PUT A STOP TO DEVELOPERS WHO REQUIRE HOA MEMBERS TO PURCHASE THEIR COMMUNITY CLUBHOUSE AND/OR CLUBHOUSE OPERATIONS AFTER TURNOVER

Photo courtesy of Kaye Bender Rembaum

Building property subject to a homeowners’ association (HOA) should not entitle a developer to be in a position to financially gouge the association’s members month after month by using the assessment regime to continually line its pockets. Essentially, that is what association member Gundel argued in court against his association’s developer, Avatar Properties, who built out the Solivita Homeowners’ Association. In this HOA the club facilities, including a spa and fitness center, dining venues, indoor and outdoor pools, parks, tennis courts, and more, were not subjected to the declaration, but rather remained under the exclusive ownership and control of Avatar, the developer, and therefore were not a part of the common areas. This means that

JEFFREY REMBAUM, PARTNER, KAYE BENDER REMBAUM

Attorney Jeffrey Rembaum has considerable experience representing countless community associations that include condominium, homeowner, commercial, and cooperative associations throughout Florida. He is a board-certified specialist in condominium and planned development law and is a Florida Supreme Court circuit civil mediator. Every year since 2012 Mr. Rembaum has been inducted into the Florida Super Lawyers. He was twice awarded as a member of Florida Trend’s Legal Elite. Kaye Bender Rembaum P.L. is devoted to the representation of community and commercial associations throughout Florida with offices in Palm Beach, Broward, Hillsborough, and Orange Counties (and Miami-Dade by appointment). For more information, visit kbrlegal.com

as a part of the turnover process, the developer was not required to turn over the club facilities and operations to the now member-controlled HOA but rather retained ownership and control of those facilities. Can you imagine paying hundreds of thousands of dollars for a beautiful new home in a gorgeous community, which includes access to a sprawling clubhouse with dining rooms, spas, and all of the amenities and yet, even though those club amenities are in the middle of the community, they are owned by a corporation not subject to Chapter 720, Florida Statutes, in any fashion, with the intent being that such club amenities will never be under the control of the HOA’s members?

In the case, Avatar Properties Inc. v. Gundel , Case no. 6D23-170,

Julie Jaram, MBA

360 Central Avenue, Suite 800

St. Petersburg, FL 33701

727.290.2578

• www.devinandco.com

Frazer, Inc.

561-488-3012 JRFrazerENT@aol.com www.JRfrazer.com

CAN YOU IMAGINE PAYING HUNDREDS OF THOUSANDS OF DOLLARS FOR A BEAUTIFUL NEW HOME IN A GORGEOUS COMMUNITY, WHICH INCLUDES ACCESS TO A SPRAWLING CLUBHOUSE WITH DINING ROOMS, SPAS, AND ALL OF THE AMENITIES AND YET, EVEN THOUGH THOSE CLUB AMENITIES ARE IN THE MIDDLE OF THE COMMUNITY, THEY ARE OWNED BY A CORPORATION NOT SUBJECT TO CHAPTER 720, FLORIDA STATUTES, IN ANY FASHION, WITH THE INTENT BEING THAT SUCH CLUB AMENITIES WILL NEVER BE UNDER THE CONTROL OF THE HOA’S MEMBERS?

decided June 22, 2023, by Florida’s Sixth District Court of Appeal, the Court (which, in our opinion, was the correct decision) explained that within the Solivita Declaration, the developer included language for each association member to pay as a part of the annual assessment a sum of money unilaterally determined by the club operator for both club operations and what also was just pure profit as argued by owner Gundel.

The Court explained that the assessment imposed by Avatar (the developer) for the mandatory club membership had two components. One component was the amount required for club expenses to be shared proportionately by each resident. The second component was for a membership fee that represented, according to the Court, an annual profit charge to each owner that was due and payable to Avatar. In fact, if a member did not pay, then their home could even be subject to the lien and foreclosure process by the association.

In the trial court’s summary judgment hearing, the Court ruled in Gundel’s favor, finding that assessments for the club, which constituted profit, were improper because pursuant to Section 720.308 of the Florida Statutes, assessments cannot be levied for profits, but only for expenses.

In response to this case and possibly for other reasons, at least one developer designed a new HOA community with a big difference: it made the clubhouse building and the dirt upon which it was constructed to be a part of the common areas of the HOA. Then through a complicated process laid out in the declaration, the developer provided that the clubhouse operations were not owned by the HOA and that after turnover of control of the HOA to the members, the members must purchase the “operations” of the club at what many consider a grossly inflated price. Should the association members decide not to make the purchase, then the developer maintains the right to sell the club operations to a third party for which the assessment paying members will be at the financial mercy of the club operator forever. No doubt the association membership is already paying for the clubhouse operations through their monthly assessments, and in our opinion to now require the membership to spend millions of dollars to buy those clubhouse operations is just plain wrong!

Let’s break this alternate scheme down. Although previously disclosed in the declaration and its attached club plan, either i) the association membership agrees to purchase the club operations at an inflated price for millions of dollars (and for what—the right to operate their own clubhouse?); or (ii) the developer retains the right to sell the club operations to a third party who will then be entitled to charge members assessments to both fund the operations and, like any business, earn a profit for doing what should have been handed over to the membership as a part of the turnover process. After all, what clubhouse operator is going to operate at cost and not expect a profit? Either way, the members lose, lose, and lose.

This type of plan ultimately hurts owners as it will likely create a five figure per member assessment obligation either in the nature of paying back the loan necessary to purchase the clubhouse operations or to be forced to pay a new clubhouse operator. The only money a post-turnover association member should have to pay for their clubhouse operations are the actual money expended for operations (i.e., what it costs to provide the restaurant, spa and pool services, etc.). Common area facilities were never designed or even contemplated to be a continual profit center for a developer or developerrelated entity.

Worse still, it appears that these types of schemes have no room for negotiation. The purchase price has been predetermined by the developer years ago when it initially recorded the community’s governing documents. While the developer can argue it is all disclosed in the governing documents (and therefore proposed buyers/future members have notice of this issue), it takes a fairly sophisticated legal mind to understand how this process is going to work. In this author’s experience, the financial obligations associated with either having to buy the clubhouse and/or the clubhouse operations is often quite a surprise to the members.

In short, requiring the membership to purchase the clubhouse operations based on an unreasonable financial

formula requires that the association borrow the millions of dollars necessary to pay the developer. In the end the obligation to pay the loan will be wrapped up in the assessment regime which means, once again just like in the Avatar case, the developer is improperly requiring the association to levy assessments for the developer’s (or third-party club operator’s) gross profit rather than only the legitimate expenses as contemplated by Section 720.308 of the Florida Statutes.

In our opinion, it is evident the Florida legislature needs to protect the citizens of the State of Florida by declaring such schemes unlawful. Clearly, the clubhouse operations should be turned over to the association membership as part of the turnover process, and the membership should not be charged for that which they should already own. If it is the clubhouse structure issue which needs to be purchased because it was not included in the overall purchase price of the houses within the community, then certainly the developer is entitled to recoup its legitimate expenses associated with the buildout; but post turnover the developer should not be entitled to profit at the expense of the association membership. If the developer wants to profit from the clubhouse in the clubhouse operations, then certainly the developer could have included those sums within the purchase price of each member’s home. Their decision not to do so and to artificially deflate the price of a home as a result thereof should not be allowed.

One cannot help but wonder if these types of clubhouse schemes could rise to the level of violating Florida’s Deceptive Trade and Practices Act as set out in Chapter 501, Fla. Stat. In fact section 501.24, Fla. Stat., provides in relevant part that unfair methods of competition, unconscionable acts or practices, and unfair or deceptive acts or practices in the conduct of any trade or commerce are hereby declared unlawful. While the developer can argue that the clubhouse scheme is fully disclosed, it is our opinion the owners can certainly argue that this practice is, at best, unfair and at worst unconscionable.

Board members and members who live in an association with these types of obligations are strongly urged to discuss their options with competent legal counsel so as to make informed decisions whether to buy the clubhouse and/or the clubhouse operations or consider filing a lawsuit against the association’s developer, arguing as Gundel did in the Avatar case, that this type of profit making activity is unlawful. Also, it must be noted that while the Sixth District Court of Appeal fully agreed with the outcome of the trial court, it certified a question to the Florida Supreme Court regarding the matter. However, the Florida Supreme Court declined review. Therefore, it appears the Gundel opinion remains valid. Nevertheless, it does not go far enough to protect association members from having to purchase their clubhouse and/or clubhouse operations after turnover. Therefore, the Florida legislature needs to do its job and protect the citizens of the state by outlawing this process altogether and requiring an HOA developer to turn over the HOA clubhouse and all of its operations to the association as a part of turnover process. n

Exactly What Must Be Included in the Notice of Late Assessments?

BY CAROLYN C. MEADOWS, ESQ.

A

s most of us are by now familiar with, in 2021 the Florida legislature enacted significant statutory changes to Chapters 718, 719, and 720, requiring a new notice to delinquent owners that must be mailed by an association before demanding payment of attorney’s fees related to the collection of unpaid assessments. Since July 1, 2021, the effective date of the legislation, most associations and management companies have experienced preparing and sending the Notice, or “NOLA.”

However, some questions remain which create a gray area

Photo by iStockphoto.com/Deagreez

and which leave association boards and managers to navigate the potential risk of failing to strictly comply with the content requirements of the statute as no case law currently provides guidance.

So, this question from boards and managers frequently arises, “We prepared and mailed this notice; does it comply with the statute?”

Properly preparing and mailing the NOLA saves time and money as well as reduces the risk that an owner can effectively and successfully challenge the association’s compliance with the statute. If a NOLA does not comply with the statute, at best it must be re-sent prior to demanding payment for attorney’s fees incurred in collections, resulting in at least a 30-day delay. A NOLA which does not

CAROLYN C. MEADOWS, ATTORNEY, BECKER

Carolyn Meadows focuses her practice on condominium, homeowner, and cooperative associations, assisting board members with their day-to-day operations, budget, corporate governance, contracts, enforcement of association covenants, and management issues. She represents all types and sizes of community associations throughout Florida, handling such matters as collections and foreclosures and other association-related matters in arbitration and court. She was recognized as a 2021 Super Lawyers, Rising Star, and is also a member of the Florida Bar’s Real Property, Probate, and Trust Litigation Section and the St. Petersburg Bar Association. For more information call 813-527-3900, cmeadows@beckerlawyers.com, or visit www.beckerlawyers.com

comply with the statute could be the basis for an owner making a claim that the association violated fair debt collection laws by attempting to collect a debt which was not actually owed or slander of title if a claim of lien has been recorded based on a noncompliant NOLA, among other possible claims.

Fortunately, Sections 718.121(5), 719.108(3)(c), and 720.3085(3)(d) Florida Statutes, provide the same form and state that the Notice “must be in substantially the following form”; however, there is still room for interpretation.

THE NOTICE OF LATE ASSESSMENTS MUST INCLUDE THE FOLLOWING INFORMATION:

NOTICE OF LATE ASSESSMENT

RE: Unit of (name of association)

The following amounts are currently due on your account to (name of association), and must be paid within 30 days of the date of this letter. This letter shall serve as the association’s notice to proceed with further collection action against your property no sooner than 30 days of the date of this letter, unless you pay in full the amounts set forth below:

*Interest accrues at the rate of percent per annum.

Although required in the form, many associations neglect to include the due dates for the maintenance or assessments being demanded. We advise that an association must include the due dates for the “maintenance” (or “assessments”). Although there is no case law addressing this issue, many associations choose to attach an accounting ledger to the NOLA, providing the due dates, description, and amount due for the assessments. We also recommend distinguishing “regular” assessments from “special assessments” as separate line items as applicable. Late fees may be included if the governing documents for the association authorize late fees. We recommend reviewing the declaration and bylaws for the association to confirm entitlement to charge late fees before including them in the NOLA. Late fees must also be no greater than the maximum allowed by the applicable statute. Interest may be calculated and included to the extent the association chooses to do so. The rate may be designated in the association’s governing documents or may default to the statutory 18 percent per annum if no rate is specified. If the association chooses to not include an interest total, we recommend the

Late fees may be included if the governing documents for the association authorize late fees. We recommend reviewing the declaration and bylaws for the association to confirm entitlement to charge late fees before including them in the NOLA.

Late fees must also be no greater than the maximum allowed by the applicable statute.

association must include the rate of interest as required by the form, “Interest accrues at the rate of ____ percent per annum.” In the absence of case law on this issue, we recommend adhering strictly to the form, language, and types of charges allowed in the statutory form. Although arguments may be able to be made for variation in the language and inclusion of other charges such as administration fees, following the statutory form as closely as possible will most effectively reduce the risk of an owner successfully challenging your NOLA. n

Preparing for a Complicated Budget Season

BY JONATHAN S. GOLDSTEIN

The upcoming budget season will not be a typical one for condominiums with buildings that are three stories or more because associations must obtain their structural integrity reserve study (SIRS) if they have not already done so and then grapple with the question of how to implement the requirement to fully fund the structural integrity reserves. In particular, associations must work with legal counsel to determine requirements for a budget voted on and “adopted” before December 31, 2024. On the one hand, it is arguable that Section 718.112(2)(f)(2)(a) requires structural integrity reserves to be maintained in the upcoming budget, regardless of when it is adopted; however, it is also arguable that unless a budget is adopted “on or after December 31, 2024,” the members

Photo by iStockphoto.com/diego_cervo

can still waive or reduce structural integrity reserves through an appropriate vote of the membership. Whether the Division of Florida Condominiums, Timeshares, and Mobile Homes would agree with the latter interpretation is still undetermined, and this is just one of various issues that would benefit from Division rulemaking.

A similar issue that would benefit from Division rulemaking and that boards should consult with legal counsel about is whether structural integrity reserves can be funded using the more flexible cash flow (pooled) method versus the straight-line method, in which every reserve component must be funded individually and should be presented as a distinct line entry in the reserve schedule included within the budget. Straight-line funding eliminates the flexibility to use those allocated funds for another reserve component. Associations should also consider whether to seek member approval (a majority of the membership voting interests) to transfer preexisting reserve beginning balances from one reserve account to another reserve account as part of the adoption of a post-SIRS budget. This may be an integral part of reserve planning if reserve schedules are incorporat -

JONATHAN S. GOLDSTEIN, EQUITY PARTNER AND CO-CHAIR OF THE CONDOMINIUM AND HOA PRACTICE GROUP

Jonathan S. Goldstein is a Martindale Hubbell “AV” rated partner at Haber Law. His practice areas include condominium and homeowners’ association (HOA) law, commercial litigation, and construction litigation. He is board-certified in condominium and planned development law. Mr. Goldstein has represented community associations in all facets of general representation and collections, including but not limited to turnover and construction-related disputes, covenant enforcement, amendment drafting, meeting attendance, arbitration before the the Division of Florida Condominiums, Timeshares, and Mobile Homes, lien foreclosures, and corporate governance. For more information about Haber Law, call 305-379-2400 or visit www.haber.law

ing the use of pre-existing balances for pooled reserve components to which such balances were not previously allocated. Similarly, given that nonstructural reserves can still be waived or used for alternative purposes with a membership vote, thought can be given as to whether to seek a vote to apply non-SIRS preexisting balances to the SIRS account or to seek their waiver. Similarly, many associations voluntarily reserve for certain nonstructural reserve components in the aggregate and may wish to revisit such practice with their reserve specialist, legal counsel, and management team. Since 2023 the membership vote required to use reserves for an alternative purpose (including to use them for other items in the pool) is a majority vote of the total eligible voting interests of the association.

THE INFORMATION CONTAINED IN THIS ARTICLE HAS BEEN PREPARED FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE PROFESSIONAL ADVICE. YOU SHOULD NOT ACT UPON THE INFORMATION CONTAINED IN THIS ARTICLE WITHOUT OBTAINING SPECIFIC PROFESSIONAL ADVICE. n

Understanding the New Law on Hurricane Protections for Homeowners’ Associations

BY MICHAEL TOBACK, ESQ.

I

n late May Florida’s governor signed House Bill 293 into law, which addresses hurricane protections for homeowners’ associations. Association directors, committee members, and property managers should review and, if necessary, revise their current approval policies to ensure compliance.

HOUSE BILL 293: HURRICANE PROTECTIONS FOR HOMEOWNERS’ ASSOCIATIONS

Specifically, the new law states that all Florida homeowners’ associations, regardless of when they were first established, must adopt hurricane protection specifications for all of the structures and types of improvements located on a parcel within their community. The law details that “hurricane protection” includes, but is not limited to, roof systems that comply with the Florida Building Code and meet ASCE

Photo by iStockphoto.com/Bilanol

7-22 standards, permanent fixed storm shutters, roll-down track storm shutters, impact-resistant windows and doors, polycarbonate panels, reinforced garage doors, erosion controls, exterior fixed generators, fuel storage tanks, and other hurricaneprotection products.

The hurricane protection standards that an association board (or applicable committee) must adopt may cover the color, style, and other factors deemed relevant by the board, though adopted standards must comply with all applicable building codes.

With such approved specifications in place and notwithstanding any other provision(s) in an association’s governing documents, HOA boards and architectural review committees are barred from denying owners’ applications for the installation, enhancement, or replacement of hurricane protections that conform to their community specifications.

“The board or committee may require a parcel owner to adhere to an existing unified building scheme regarding the external appearance of the structure or other improvement on the parcel,” reads the new legislation.

MICHAEL TOBACK, ATTORNEY, SIEGFRIED RIVERA

Michael Toback joined Siegfried Rivera as an attorney in 2015. He concentrates his practice in the areas of condominium and community association law, with matters including but not limited to drafting and negotiating contracts; providing opinion letters on a wide range of community association topics; drafting, interpreting, and amending governing documents; litigating enforcement actions in court and/or with the Department of Business and Professional Regulation’s Division of Florida Condominiums, Timeshares and Mobile Homes; preparing for and attending both board and membership meetings; and assisting in the recovery of delinquent assessments. Additionally, he assists the firm’s construction litigation practice group in handling construction defect cases. For more information call 561-296-5444, email MToback@siegfriedrivera.com, or visit www.siegfriedrivera.com.

CONSIDERATIONS FOR HOMEOWNERS’ ASSOCIATIONS

Given that this law has already gone into effect upon its gubernatorial approval, homeowners’ associations that require prior review for owners’ storm-hardening property improvements should immediately review and address their policies and standards. Questions regarding the adoption of such specifications and how they will be enforced via an application and review process should be referred to highly qualified and experienced association legal counsel.

This new law is aimed at protecting the health, safety, and welfare of the people of the state of Florida while also enabling associations to help ensure uniformity and consistency in the hurricane protections installed by owners in their communities. Given its plain language, HOAs and their boards of directors would be well advised to develop and utilize clear specifications for all such improvements, focusing only on their aesthetic qualities to maintain uniformity. Please contact us with any questions on this new law. n

Slippery Algae and Pre-suit Mediation

BY MICHAEL J. GELFAND, ESQ.

SLIPPERY ALGAE SLIDES YOU INTO COURT

Here in Florida, everyone knows that the climate we love also loves something we usually do not love. Algae grow everywhere—on the ground, on sidewalks, on walls, and even on decks. And algae grow like wildfire!

What are the duties of community associations to stop the slime? Of course, there is the flip side: what happens when someone slips and falls on the algae

Photo by iStockphoto.com/Zinkevych

that was not cleaned? Will the property owner be liable for negligence?

A recent Florida appellate court decision provides guidance and warnings for Florida community associations as well as for all who own or control Florida real property. In Williams v. Weaver , 49 Fla. L. Weekly D 610 (Fla. 5th DCA, March 15, 2024), the decision indicated that Williams went to Weaver’s house to perform lawn services. While walking onto a deck located on the front lawn before beginning his work, Williams slipped on a dark area covered in algae, fell, and injured his back.

Williams sued Weaver for negligent maintenance of the property. Weaver testified that he cleaned the deck annually, but he also said that it had not been cleaned for several

MICHAEL J. GELFAND, ESQ., SENIOR PARTNER, GELFAND & ARPE, P.A.

Michael J. Gelfand, Esq., the senior partner of Gelfand & Arpe, P.A., emphasizes a community association law practice, counseling associations and owners how to set legitimate goals and effectively achieve those goals. Gelfand is a dual Florida Bar board-certified lawyer in condominium and planned development law and in real estate law, a certified circuit and county civil court mediator, a homeowners’ association mediator, an arbitrator, and parliamentarian. He is a past chair of the Real Property Division of the Florida Bar’s Real Property, Probate & Trust Law Section, and a Fellow of the American College of Real Estate Lawyers. Contact him at ga@gelfandarpe.com or 561-655-6224.

months. When shown a photograph of the deck taken at the time of the incident, Weaver admitted that the deck needed to be cleaned at that time.

One might think that was it. The failure to clean would have meant automatic liability for property owner Weaver, but that was just one factor for analysis. The trial court determined that the algae on the deck was “open and obvious” and that it was “common sense” that one could fall on the deck. Thus, the trial court granted a summary judgment for Weaver, concluding that a trial was not necessary because a reasonable jury could not find otherwise.

The Florida appellate court disagreed with the trial court’s decision

not to hold a trial and reversed the trial court decision. The appellate court’s analysis began with recognizing the age-old precept that a property owner owes a duty of care to a business invitee such as Williams and that the owner must maintain their property in a reasonably safe condition.

This gives rise to two distinct duties of a property owner: (1) give warning of concealed perils, which are known or should be known to the property owner but are not known to the invitee, and (2) maintain the premises in a reasonably safe condition.

The appellate court then explained a critical distinction. Whether a danger is open and obvious is not the question of whether the object, in this case the algae on the deck, is obvious. Instead, the question is whether the dangerous condition of the object is obvious. In addition, the property owner still has a duty to maintain the property in a reasonably safe condition.

This decision will likely be a warning for Florida associations that actually own property, such as cooperative and many homeowners’ associations, as well as condominium associations that administer common elements and association property. A belief that a dangerous condition is open and obvious may not protect an association from claims and trials.

Returning to the beginning, this decision reinforces the need for most Florida associations to properly inspect their premises and make timely efforts to maintain their premises. Perhaps in Florida this also means, as a practical matter, once a year cleaning of a deck may not be often enough!

FAILURE TO COMPLY WITH PRE-SUIT MEDIATION REQUIREMENTS CAUSES PROPERTY OWNER’S LAWSUIT AGAINST ASSOCIATION TO BE TOSSED

Do NOT Go Directly to Court! It is not Monopoly®, and the money is not pastel play dollars. For quite some time laws have required Florida community association litigants to air many disputes in mediation or arbitration before going to court and filing a lawsuit. The process is referred to as mandatory presuit arbitration or mediation or alternative dispute resolution. What is the consequence of not complying? It can be very costly, both in terms of money and losing face!

Recently a Florida appellate court ruled, in a decision that will impact owners in Florida condominium, cooperative, and homeowners’ associations, that a property owner’s lawsuit against her association must be dismissed because the owner failed to comply with the Homeowners’ Association Act’s mandatory pre-suit mediation requirements. In Dunmar Estates Homeowner’s Association, Inc. v. Rembert , 49 Fla. L. Weekly D 502 (Fla. 5th DCA, March 1, 2024), Rembert, a property owner, requested records from the association.

Having decided that she was denied access to all of the requested records, Rembert sued the association for failing to provide her with timely access to records. However, Rembert did not first comply with the Act’s mandatory presuit mediation requirements. The trial court denied the association’s motion to dismiss.

The Florida appellate court disagreed with the trial court’s denial, finding that Rembert’s case must be dismissed. The court pointed out that the Act, Section 720.311(2)(a), Fla. Stat. (2021), specifically provides that an “aggrieved party,” Rembert, is required to serve a demand for pre-suit mediation before filing a lawsuit if there is a dispute between the parcel owner and the association about any of the following:

• Use of or changes to owner’s parcel, common areas

• Covenant enforcement

• Amendments to association documents

• Board and committee meetings

• Access to official association records.

Therefore, because Rembert failed to comply with the Act’s requirement of mediation before filing her lawsuit, the lawsuit should have been dismissed.

This decision reinforces the significance for both Florida community associations and their owners/members to comply with mandatory arbitration and mediation pre-suit requirements, “pre” meaning before filing a lawsuit! Failure to comply requires dismissal of the lawsuit, so the defendant wins. There is no do-over in that lawsuit.

The kicker is that after a dismissal, usually the defendant can collect attorneys’ fees and costs from the plaintiff! Further, the plaintiff cannot proceed with a new case until paying the costs assessed in the first case. n

Community Community

Florida Community Association Professionals’ (FCAP) training is offered on two levels. Level one consists of courses meeting Florida’s continuing education requirements for CAMs, and level two is the Florida Advanced CAM Studies (FACS) course. For further information about the more than 31 online continuing education classes available or to pursue the Certified Florida Community Association Manager (CFCAM) designation, please visit www.fcapgroup.com/membership/education-training/ .

BECAUSE YOU ASKED

By Betsy Barbieux, CAM, CFCAM, CMCA

Betsy,

There were a few takeaways that were eye-opening to me. I believe the presentation emphasized that the association operates like a business even though it is not for profit, but there are certain distinguishing factors and privileges granted to its members that are not afforded to shareholders of a company. For example, boards can encourage members (who are akin to shareholders) to attend, listen, and provide comments on the agenda items at board meetings. However, I did not know that meetings were not intended as Q&A sessions, which is how I have seen them conducted in the past. I also was not aware that the board did need to give a response to those owners’ comments.

I am not an association attorney, so while we are familiar with the entirety of Chapters 718 and 720, we focus on the sections that we typically raise during litigation. Learning that the board does not have to be held hostage by the membership answering every question they have about agenda line items, as I have seen done in other communities, was eye-opening.

I will be sure to share your YouTube channel. Thank you for reaching out.

- Amber

Amber,

It was a pleasure to meet you, and thank you for your kind comments! You said you learned something new. Would you mind sharing that with me? I’d like to make sure I always include it when I give the presentation on angry owners.

- Betsy Betsy,

I have questions about HB 1203. We are an HOA with 32 villas with no common areas. We do not have a management company. We are a three-member board; I am from the UK, another is from Norway, and the third lives in Florida.

Completing four hours of education annually is going to be very difficult for us, especially since English is not the first language of our Norwegian member. How are the hours reported? To whom? How does the DBPR know who all the board members are in the state of Florida? If required for reporting purposes, two of us do not have social security numbers.

And to make matters worse for me, I am a practicing lawyer in the UK and required to selfreport if I break the law in any way. The UK penalties for breaking the law or failing to report are severe. If I am unable to complete the Florida training in a timely manner, am I breaking the law?

It’s difficult enough to get board members, but now it may be impossible with this new law.

- Dennis

Dennis,

The processes and systems are not in place and I’m sure will not be in place for months to know whether a board member is in compliance with these new laws. I don’t see a compliance date mentioned in the legislation.

I am not aware of a social security number being required for board members. If that is the case, half the board members in Florida don’t have one since they live out of the country.

Betsy Barbieux

There is no indication of how or when the Division of Condominiums will develop the syllabus for the providers (like me) to expand/change our existing board course materials. It also appears from the legislation that the Division is to provide a standardized certificate of completion.

There is no system in place to track a board member’s compliance with CE hours since board members do not have a license. That system will have to be developed. There is not a complete HOA registry for the Division to know if an HOA association has more or less than 2,500 parcels.

Similarly, there is no way to track the required CE hours for CAMs of HOAs. There is no system in place to know who manages an HOA versus a condominium/co-op, and it will likely take forever for the Regulatory Council to develop a curricula syllabus.

Both HB 1021 and HB 1203 are a mess and do not dovetail with any other required curricula or existing electronic reporting systems. I have written to the governor twice and asked him to veto these two bills.

The CAM Matters™ show is out now, and you can see my frustration with these two bills.

- Betsy n

MASTERING COMMUNITY MANAGEMENT: A ROADMAP TO EFFECTIVE TASK MASTERY

By Marcy Kravit, CMCA, AMS, PCAM, CFCAM, CSM Director of Community Association Relations

Hotwire

Communications

FCAP Education Program

Coordinator

Marcy L. Kravit

In the dynamic realm of community associations, community association managers are the key that holds communities together.

Tasked with executing board decisions, meeting directives, and ensuring vendor accountability, CAMs play a vital role in shaping the success and harmony of the communities they serve. In this guide we will delve into the importance of CAMs attending to assigned tasks, executing them effectively, following up with diligence, and fostering strong partnerships to ensure community prosperity.

THE FOUNDATION—ATTENDING TO BOARD DECISIONS AND DIRECTIVES

At the heart of community management lies the duty of CAMs to attend to tasks assigned as a result of board meeting decisions and directives. Whether it involves implementing new policies, overseeing community projects, or managing financial matters, CAMs are entrusted with bringing the board’s vision to fruition. By understanding the board’s objectives and priorities, CAMs can align their efforts to support the community’s strategic goals and enhance its overall well-being.

THE JOURNEY—FROM EXECUTION TO FOLLOW-UP AND COMPLETION

While executing tasks is essential, the true mastery of community management lies in the art of follow-up and follow-through. CAMs must go beyond the mere task completion and ensure that every initiative is seen to, through attending to the details and its conclusion. By maintaining a proactive approach, tracking progress, addressing challenges promptly, and providing regular updates to the board of directors, CAMs can foster transparency, accountability, and trust within the community. This commitment to thoroughness and communication not only ensures the successful implementation of projects but also instills confidence in community stakeholders.

THE SECRET WEAPON—VENDOR ACCOUNTABILITY AND PARTNERSHIP

In the intricate ecosystem of community management, vendors play a crucial role in delivering essential services to residents. CAMs must act as vigilant guardians, overseeing vendor performance and ensuring compliance with contractual obligations. By establishing clear expectations, monitoring service quality, and fostering open communication with vendors, CAMs can uphold standards of excellence and ensure that the community receives top-notch services.

Strong vendor partnerships built on mutual respect and accountability are the key to creating a thriving community environment.

AN AWARD-WINNING & INNOVATIVE LEGAL TEAM INSIGHTS, TIPS, AND TRICKS FOR SUCCESS

1. Effective Communication—Clear and open communication is the cornerstone of successful community management. Regular updates, transparent reporting, and active engagement with stakeholders enhance collaboration and build trust within the community.

2. Organization and Task Management—Utilize tools such as project management software to streamline task management, set priorities, and track progress. Establishing clear timelines and milestones helps to ensure that tasks are completed on schedule.

3. Proactive Problem-Solving— Anticipate challenges, address issues promptly, and seek creative solutions to overcome obstacles. Proactive problemsolving demonstrates leadership and drives positive outcomes for the community.

4. Continuous Learning and Development—Invest in ongoing professional development to stay abreast of industry trends, best practices, and emerging technologies. Networking with peers and industry experts provides valuable insights and resources for personal and professional growth.

Community association managers hold a position of immense responsibility and opportunity to shape the success and vibrancy of the communities they serve. By attending to tasks with dedication, executing them effectively, following up with diligence, and fostering strong partnerships with vendors and stakeholders, CAMs can create a community environment where residents thrive and harmony prevails. Embracing the principles of transparency, accountability, and collaboration, CAMs can lead their communities to greater success! n

COMMITTED TO HIS COMMUNITY—THOMAS A. NEWGENT, CFCAM

Thomas Newgent is currently the property manager for Beach Woods Property Owners Association in Melbourne Beach, Fl. He comments, “I took this position after being with the Bluffs of Sebring Condominium Association for five years, where I started as an irrigation technician and worked my way up to assistant manager. I felt that it was time for a change, and Beach Woods at Melbourne was the perfect fit for me and my family.”

Newgent was born and raised in Avon Park, a small town in Central Florida that is mostly known as the town north of the Sebring International Raceway where the ISMA 12 Hours of Sebring is held. After different jobs in various fields, he started in golf course maintenance and worked his way up to superintendent before moving on to the Bluffs. He remarks, “I attended Florida Gateway College for horticulture and am getting ready to start another path with Eastern Florida State College for business management.”

When asked what led to his decision to pursue his CAM license, he notes, “I always enjoyed the big projects, from the planning to execution, so it was natural to take another step in the direction of community management and obtain my CAM. Now there is no shortage of projects to plan and execute.”

In terms of pursuing the CFCAM designation, Newgent comments, “I wanted to show my community the commitment that I have to the residents and the board of directors to do what is absolutely in their best interest—even though we all know not all residents think that is the case all the time.”

Newgent shares, “The biggest issue facing communities right now is Amazon. Post-COVID everyone lives in a world of next-day delivery, and unfortunately the community projects and needs are not always that easily available. It may work for a time, but how well and for how long? The next issue is education. I encourage everyone—even my maintenance staff and board members—to take the time to educate themselves as much as possible. The last issue is focused on support. Managing a community of any size has its challenges. Unfortunately, some people don’t know where or to whom to turn. Reach out and make professional connections with people in the same field. Between trade shows, LinkedIn, or the FCAP Directory, reach out and make those connections with like-minded people who may have already gone through the problems you’re facing now.”

When Newgent is asked what professional achievement he is proudest of, he shares, “Honestly, doing what I am doing now makes me the proudest. I overcame a lot of personal doubts about the profession to be where I am. It also makes a big difference to hear residents say ‘thank you’ occasionally.”

His biggest influences have been past managers. He has had the opportunity to work for some great people who have taught him a great deal not only professionally but also personally. They have also taught him how to push himself to be a better manager of properties and personalities.

When not managing, Newgent shares how he spends his time. “I am a husband and a father of three. We enjoy trips to Disney as a family, and personally I enjoy pretty much any activity outdoors to get the mental reset that is something everyone in this industry needs.”

FLCAJ would like to congratulate Thomas Newgent on becoming the most recent CAM to obtain his CFCAM designation! n

Celebrating 40Years

An Association property loss claim can become a complicated and time-consuming challenge for even the most experienced board and property manager. It can take them away from managing the day-to-day responsibilities of the community and can also sow discord and mistrust amongst community members. Add the technicalities of your insurance policy and the insurance co-negotiated settlement. At Tutwiler & Associates, we’ve been through the drill and understand the value of clear communication with the board and association members to set realistic expectations. And with recent Florida legislative changes, an insurance appraisal may be a path to a quicker settlement without litigation. Our experience handling condominium, apartment, and homeowner association claims in Florida is unmatched. We invite you to call us to discuss becoming part of your team.

Save Your Association Some Money

Boards of directors have a fiduciary duty to the community associations they serve. The following tips are provided as a beginning place for directors to begin to carry out these duties responsibly.

FINANCIAL STRATEGIES FOR BOARD MEMBERS

By Ana Rivero

Managing an association›s money is an important facet of being a board member. Here are some pro tips for making it more manageable!

Keep Track of Everything—While your property management company will be collecting funds, monitoring is still essential. Accounting software can streamline your process, reduce errors, and help ensure precise recording keeping, necessary for compliance.

Conduct Regular Financial Audits— Reviews are essential to identify discrepancies and prevent fraud. The board should maintain meticulous records of all financial transactions.

Stick to Your Annual Budget—Creating multiple budgets based on different scenarios can help prepare for various market conditions and keep your

Photo by iStockphoto.com/artisteer

completed—the original work was ripped out and redone and the area was still falling apart! The board member didn’t want to be honest with me, however, when I jokingly stated, “What did you do, hire the guy you met in the parking lot at the local do-it-yourself store?”

No true Floridian contractor will buy their supplies from the local retail stores as it’s not cost effective for us. We buy from suppliers that approve us for distribution and application of their products. Because of Florida being so transient, a lot of our suppliers will not sell to the contractors that come down during the winter months.

Support your local businesses! The sweet taste of a low price is far outweighed by the bitter taste of a poor-quality project!”

Connie Lorenz is president of Asphalt Restoration Technology Systems. For more information, call 800-2544732, email connie.lorenz@asphaltnews.com, or visit www.asphaltnews.com

THE HELPING HAND OF A GOOD COMMUNITY MANAGEMENT SYSTEM

By John More

association on track.

Rely on the Experts—Whether it’s your property management company, a professional accountant, or legal counsel, they are experts for a reason.

By adhering to these practices, boards can optimize their financial operations and make informed decisions for long-term success.

For more information on Allied Property Group, call 305-232-1579 or 239-241-6499 or visit www.alliedpropertygroup.net.

HOW IT’S DONE IN FLORIDA

By Connie Lorenz

While working with a community for six months, getting them prepared to move forward with a rejuvenation program utilizing Pavement Dressing Conditioner (PDC), I hosted a “What to Expect” meeting and discovered that an area we had quoted to be repaired had been repaved by another company. I was upset about the poor quality of the project and was going to help the board get the proper paving by reaching out to the contractor and educating the contractor about how we do things in Florida.

Why educate a Florida contractor? Because it wasn’t. How did I know that? Because the board paid the contractor within 24 hours of the work being

Good community management systems help in all facets of an association’s business. People often buy into associations for the amenities, like tennis courts, spa, gym, and pool, which are ready to use without owner maintenance. However, these come at a cost to the association.

Owners agree to pay for maintaining common areas and amenities when joining an association. Failure to pay means losing access to these areas. It’s frustrating to pay fees on time while others, who don’t pay, use the amenities. Restrictions must be applied based on association rules, but blocking all doors is illegal and difficult with commercial access systems.

The right management system allows easy barring of non-paying units from certain areas. Once fees are updated, access should be easily restored. A proper management system with a built-in access system helps collect owed money effectively.

John More is the owner and president of Asterix Software and Asterix Hardware. For more information, visit www.asterixsoftware.com.

Photo by iStockphoto.com/felixmizioznikov

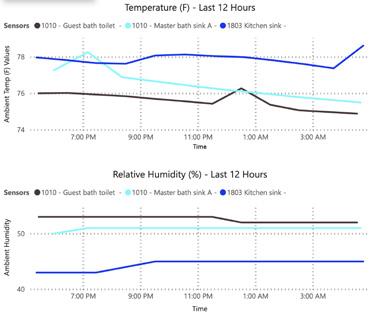

MINIMIZE DAMAGE—DETECT WATER LEAKS

By Beatriz Eguaras

Water damage is the leading cause of insurance claims in residential buildings. The costs and deductibles for water damage coverage are skyrocketing. Buildings with a history of significant water claims may find it difficult to obtain insurance and may need to consider self-insuring. Fortunately, there is a better way to manage water leak risks. We believe that Aware Building’s “Whole-Building Leak-Detection” wireless solution is the answer. Detecting water leaks early is crucial for minimizing damage.

Where does your building incur its water damage? Our wireless leak sensors can be placed anywhere—in bathrooms, underneath sinks, near dishwashers and washing machines, in PTAC units or water heater closets, and in mechanical rooms. Our sensors can monitor and alert you to the presence of water as well as changes in humidity, temperature, and more!

We are here to help you take proactive measures rather than reacting to unexpected situations. Aware Buildings is excited to work with you to keep your risk profile in good shape!

Beatriz Eguaras is a senior account manager for Aware Buildings. For more information contact Aware Buildings at info@awarebuildings.com.

REVENUE AND SAVINGS FOR YOUR COMMUNITY

By Keith Minarik

One of the many advantages of a bulk telecommunications agreement is the potential for a telecom service provider to offer a door fee to the homeowner association (HOA) or condominium association (COA) upon contract execution. This one-time per-door payment provides a valuable opportunity for communities to bolster their reserves or fund neighborhood projects. For HOAs and COAs, these door fees can significantly improve financial flexibility. The additional funds can be allocated to various initiatives, such as upgrading amenities, enhancing security systems, or offsetting the costs of large assessments. Furthermore, these agreements ensure residents receive fast, high-quality, and reliable internet services, fostering a more connected and

appealing community environment along with significant savings compared to retail pricing.

Ultimately, incorporating door fees into bulk telecom agreements not only supports financial stability but also promotes continuous community improvement, benefiting both communities and their residents.

Keith Minarik is vice president of community development with Blue Stream Fiber. To find out more about how Blue Stream Fiber can help support your communities’ projects, visit https://www.bluestreamfiber.com/partner

THE IMPORTANCE OF A PREVENTIVE MAINTENANCE PLAN

By Ashley Dietz Gray

Maintaining condominium or HOA common elements is vital for the seamless operation of any community. Creating a comprehensive preventive maintenance plan is not just about ensuring the smooth functioning of common elements; it is also about prioritizing the safety and comfort of all community members. By proactively addressing maintenance needs, communities can prevent potential safety hazards, minimize disruptions to daily operations, and save on costly repairs. Regular maintenance also contributes to the preservation of property values, ensuring that investments in the community remain sound and stable.

Neglecting maintenance can result in issues like elevator malfunctions, air conditioning problems, and unexpected equipment breakdowns. To prevent such problems, it’s crucial to establish a proactive maintenance schedule that identifies all common elements in need of upkeep.

For condominiums, outside professionals should handle roofs, elevators, cooling towers, generators, and alarm systems while in-house staff can take care of tasks like air filter replacement, touch-up painting, and cleaning. HOAs should entrust professionals with maintaining trees, electrical systems, lakes, and pools while in-house staff can handle pressure washing, minor repairs, and basic maintenance duties.

Prioritizing preventive maintenance is a fundamental aspect of responsible community management that benefits everyone involved.

Ashley Dietz Gray is vice president of marketing for Campbell Property Management. For more information, call 561-704-4042, email adietz@campbellproperty.com, or visit www.campbellpropertymanagement.com.

BASIC FINANCIAL STATEMENTS

By Julie A. Jaram, MBA

Reading and interpreting financial statements for your community association is an integral part of the community’s success. Often, it may seem as though accountants speak a different language. Below is an overview of the basic financial statements with a brief description to clarify the purpose of each report.

Income Statement

The purpose of the income statement is to keep track of income and expenses over a specific period of time (for the six months ended June 30, 2024). This statement should contain a couple of key columns—actual amounts and budgeted amounts for income and expense categories. This allows the reader to assess where they stand for a specific period of time, and whether they are within or outside of budgeted amounts for each category. Net income/loss is listed at the bottom of the income statement and overall states if the association has a surplus or deficit for the period stated.

Balance Sheet

The balance sheet depicts a snapshot of the association’s financial status at a given point in time and is made up of three sections: assets, liabilities, and members’ equity/fund balances.

Assets are items that the association actually owns. Assets consist of items such as cash, accounts receivable (assessments due from owners not yet paid), prepaid expenses, and deposits (money held by the association that will eventually be returned).

Liabilities are amounts owed by the association (most likely payments due to vendors for products or services).

Members’ equity/fund balances state the current balance in the operating and reserve funds and the current period’s net income or loss.

These basic reports are typically prepared on a monthly basis and sent to board members for review. A few key things to consider when reviewing include the following:

• Compare cash balance on balance sheet to bank statements to ensure balance ties out

• Review accounts receivable—specifically, if the amount is continually increasing

• Compare budgeted expenses to actual figures

• Confirm reserve expenses are paid from a reserve fund

Julie Jaram, MBA, is a partner for Devin & Associates. For more information, call 727-290-2578, email jjaram@devi nandco.com, or visit www.devinandco.com.

BUDGETING TIME

By Ed Williams, RRC

So, it is budgeting time. This is just a reminder not to forget about your roof(s). Most manufacturers require that the roof be inspected at least once a year by a competent professional in order to maintain the warranty. In addition to this once-a-year timetable from the manufacturer, we recommend that inspections be done before and after any significant damaging weather, like a hurricane, occurs. Small repairs may mean the difference between a complete loss of the roof or little to no damage.

In addition, insurance companies are requiring replacement of roofs when they are 20 years old. If your current budget assumes the roof will last longer than 20 years, then adjustments will need to be made. This applies mostly to flat roofs. If you have tile, metal, or shingles, you should check with your agent to find out what their companies require.

Ed Williams is the owner of Ed Williams Registered Roof Consultant. For more information, call 772-335-5832 or email EdWilliamsRegisteredRoofConsultant.com.

BUDGET PREPARATION CHECKLIST—KEEP IT SIMPLE

By Lauren Chieffo, LCAM

As associations gear up for budget season, it’s crucial to navigate the process with strategic planning to ensure financial stability and address the unique needs of your community. To keep the budgeting process straightforward, focus on clear, consistent communication, prioritize essential expenses, and use historical data to guide your projec-

tions and decisions. Here is a checklist of our best practices for preparing your budget.

• Set a Budget Meeting Date—Remember to post/ provide notice properly and consider if a workshop is desired.

• Reserve Study—Does the association have an updated reserve study? Are SIRS required?

• Vendors & Contracts—Check contracts and reach out to vendors to review potential contractual updates.

• Projects—Go over projects the association would like to complete in the next year and request bids for proposed work.

• Review Trends & Data—Use the previous year’s budget, current financials, and yearly trends to estimate costs.

• Plug in Your Assumptions—Plug the estimated numbers into a budget spreadsheet and calculate Association dues.

• Lauren Chieffo, LCAM, is a Regional Director with GRS Community Management. For more information, call 561-641-8554, email residentservices@grsmgt.com, or visit www.grsmgt.com

FINANCIAL BEST PRACTICES FOR COMMUNITY ASSOCIATIONS

By Marcy Kravit, CMCA, AMS, PCAM, CFCAM, CSM

Effective financial management is essential for community associations. Key practices include transparent budgeting, regular financial reviews, and proactive risk management. Specialized accounting software can streamline tracking and ensure accurate reporting. Regular financial audits build trust among residents. Implement fraud prevention measures and train board members in financial management to safeguard community assets. Establishing reserve funds and appropriate insurance policies protects against unexpected challenges.

Additionally, incorporating bulk television and internet services from providers like Hotwire Communications is cost effective. By negotiating bulk service agreements, associations can secure lower rates than individual residents would pay. This not only saves residents money but also enhances the overall value of living in the community by providing high-quality, reliable service at a fraction of the retail cost.

Marcy Kravit, CMCA, AMS, PCAM, CFCAM, CSM, is director of community association relations. For more information visit www.hotwirecommunications.com.

PLAYBOOK FOR COMMUNITY FINANCE SUCCESS

By Suzel Broe, CFO

compliance deadlines, do not lose sight of fundamental budgeting and finance best practices. Sound financial health ensures a community’s stability amid any broader shifts.

There are certain “musts” for every association during budget season, including the following:

• Conduct a transparent budgeting process with regular reforecasting

• Prevent financial mismanagement through the segregation of duties, strong internal controls, and employee training

• Diversify association investments.

• Implement economic safeguards such as reserve funds and robust insurance coverage, engaging legal professionals to ensure compliance and a professional management team

These strategies bolster an association’s financial well-being and lay a secure foundation for long-term success. Stay proactive and informed, and empower your community for a brighter financial future.

For more information on KW PROPERTY MANAGEMENT & CONSULTING, contact Suzel Broe chief financial officer—financial services at 305-476-9188 or sbroe@kwpmc.com, or visit www.kwpmc.com

BENEFIT FROM COST SAVINGS AND EFFICIENCY

By Stephen J. Kirschner, CPA

My HOA in Boynton Beach can serve as an example of how your association can benefit from cost savings and efficiency. We utilize multiyear contracts that are mutually cancellable on 60-day notice without cause. For cable and internet service, we use a consultant at a reasonable fee. We have the same vendor over several contracts, including wiring the homes for fiber optic.

Management is for a fixed fee, with salaries included and reasonable annual compensation increases. Our property manager does the books on site reviewed monthly by a management company controller.

In a time when Florida community managers and association boards are navigating significant changes in the insurance landscape and upcoming state law

Billing is monthly, so delinquencies show up faster. And we accelerated the due date from 30 to 15 days. In addition to the 18 percent APR (annual percentage rate), we added a $25 administrative fee for every month payment is late.

We screen both buyers and renters, and renters require a $1,000 security deposit against any damages. However, the owner is still responsible for the maintenance. Create a realistic budget and watch for variations,

which is where you see if you have a problem.

Steve Kirschner is a Florida Supreme Court certified mediator for Lasula Consulting & Mediation. For more information, call 561-840-9798, email stevekirschner@mediatorcpa.com, or visit mediatorcpa.com.

MAIN INGREDIENT FOR A HEALTHY COMMUNITY

By Ryan Clifton

The main ingredient for a healthy community is proper budgeting. A proper budget will cover all required operating expenses to maintain the community while fully funding reserves.

A best practice for budgeting is to adequately fund the irrigation system budget line to optimize its performance. Your expensive landscaping thrives, survives, or dies mostly based on the performance of the irrigation system. Consider a preventive maintenance program or independent inspector for your system.

Also, create a project list. Prioritize the order of your list first by association needs and then association wants. Each budget year, add the appropriate number of projects from this list. This list will provide better management of the projects and proper communication of project completion to membership.

The best way to manage reserves is to obtain and update your reserve study. It is essential to follow the reserve study’s funding and project schedules and to obtain an updated study every three years. The simple remedy to avoiding special assessments is to follow the reserve study plan!

A proper budget will enhance the beautification of the community for families to enjoy while avoiding financial hardship for the members.

Ryan Clifton is vice president of developer operations, CMCA, with Leland Management. For more information call 888-465-0346 or visit www.lelandmanagement.com.

HOW TO BUILD AND MAINTAIN A FINANCIALLY HEALTHY COMMUNITY ASSOCIATION

By Camille Moore

Maintaining a financially healthy community association ensures that your community remains attractive, well-maintained, and valuable. A financially sound association can adequately fund maintenance, improvements, and unexpected expenses, benefiting all

residents. Here’s how to build and maintain a financially healthy community association.

Establish a Clear Budget—Assess community needs, prioritize essential expenses, and include a reserve fund for unexpected repairs.

Accurate Financial Records—Maintain transparent accounting and conduct regular audits to ensure accountability.

Fair and Consistent Fees—Review and adjust assessments annually and enforce timely payments to prevent delinquencies.

Cost-Effective Vendors—Obtain competitive bids for services and invest in preventive maintenance to avoid costly repairs.

Engage and Educate Homeowners—Communicate regularly about the association’s financial status and offer financial education related to the association. Consider having your auditor present annually at the annual meeting.

Professional Management—Hire experienced managers, provide ongoing training for board members, and seek out industry best practices.

Camille Moore is a creative content writer for RealManage. For more information email camille.moore@ realmanage.com or visit www.realmanage.com.

MITIGATING FINANCIAL RISK: RESERVE STUDIES, LENDING, AND INSURANCE

By Matt Kuisle

Traditionally used as an internal planning tool, reserve studies are increasingly capturing the external attention of lenders and insurers. Neglecting to conduct or follow a reserve study can have significant financial repercussions as associations that fail to adequately budget for necessary repairs and maintenance often face costly surprises down the line.

Lenders have begun scrutinizing structural integrity and requiring greater transparency from associations. Recently Fannie Mae and Freddie Mac released a list of

blacklisted properties that are ineligible for lending due in part to structural issues, deferred maintenance, and failure to conduct reserve studies and fund reserves properly.

Insurance companies are also utilizing reserve studies when assessing risk and gauging the association’s ability to cover potential claims without resorting to special assessments or loans.

The growing focus on reserve studies reflects a broader shift toward risk management and financial diligence. Boards and managers must adapt by prioritizing proactive maintenance and budgeting practices through conducting regular reserve studies.

Matt Kuisle, PE, PRA, RS is regional executive director with Reserve Advisors. For more information, call 813-536-7201, email matt@reserveadvisors.com, or visit reserveadvisors.com.

BUDGET FOR CHUTE REPLACEMENT

By Joanna Ribner

Trash chute maintenance and replacement is a relatively new area of concern, but chutes do have a life expectancy. Most budgets do not have chute replacement in their reserves, but they should. The cost of replacing a chute, or part of a chute, averages $8,500 per floor when you add in permits and fire sprinklers! In taller buildings this adds up quickly!

Florida’s humid, salty air escalates metal erosion, reducing the life of your chute. Annual maintenance certainly helps to extend it, but rust and age will win out. Annual inspections can monitor rust areas and tears, so we can put an association on notice that the chute has one or two years left. The last thing you want is a chute collapsing and having to be closed down for months while permits are obtained and a replacement is fabricated—on top of not having a plan for the expense!

Joanna Ribner is president of Southern Chute. For more information call 954-475-9191 or visit www.SouthernChute.com or www.TrashChuteParts.com.

fulfill its fiduciary duty. Don’t let insurers or vendors control the process as this can lead to disputes and delays.

Instead take the following steps:

1. Assign a point person or subcommittee to manage all aspects of the claim. This ensures organized communication and prudent decision making.

2. Don’t be in a hurry to fix everything, but do mitigate any further damage. Get multiple quotes, communicate with your insurer(s), and ask lots of questions. Document everything and leave nothing to misinterpretation.

GET YOUR INSURANCE CLAIM OFF TO A GOOD START

By Rick P. Tutwiler, CPIA, PCLS

After a major property loss, your association should take charge of the insurance claim process to

3. Associations seeking expert claim handling have the option of hiring a public adjuster experienced in association losses. Licensed adjusters have expertise in policy interpretation, claim presentation, and negotiation. This takes the burden off your board to self-educate and ensures the claim submission aligns with the policy contract.

By taking these steps, your association can protect its interests, ensure a smoother claims process, avoid costly mistakes, and return to normal operations faster. Remember, your association’s financial well-being depends on a successful claim resolution.

Rick Tutwiler, CPIA, PCLS, is president and CEO of Tutwiler & Associates Public Adjusters. For more information, call 800-321-4488 or visit publicadjuster.com.

Photo by iStockphoto.com/nathaphat

Devin & Associates

360 Central Avenue, Suite 800 Saint Petersburg, Florida 33701

727-290-2578

jjaram@devinandco.com devinandco.com

Cogent Bank

407-545-2662

www.cogentbank.com

Moving You Forward

Popular Association Banking 7920 Miami Lakes Drive W. Miami Lakes, Florida 33016 800-233-7164

www.popularassociation banking.com Serving the community association industry exclusively.

5830 142nd Avenue N. Clearwater, FL 33760 888-722-6669 www.Truist.com/ AssociationServices

INSURANCE VALUATIONS

Expert Reserve Services Inc.

433 Silver Beach Ave., Suite 104 Daytona Beach, FL 32118

866-480-8236

www.expertreserveservices.com Covering Florida's Insurance Valuation Needs

PUBLIC CLAIMS INSURANCE ADJUSTERS

Five Star Claims Adjusting 2950 W. Cypress Creek Road, Suite 125 Fort Lauderdale, Florida 33309

Herbie Wiles Insurance Agency

400 N. Ponce de Leon Boulevard St. Augustine, Florida 32084 800-997-1961

www.herbiewiles.com

Insuring over 100 FL condo associations and HOAs.

Rick Carroll Insurance 2160 NE Dixie Highway Jensen Beach, Florida 34958 800-290-3181 or 772-334-3181 www.rickcarroll.com

The Turner Insurance Advisor Group 2121 NE Coachman Road Clearwater, Florida 33765 www.turnergroupfl.com

561-677-9327

Travis@fsclaims.com onetapconnect.com/five starclaimsadjusting-travis baldeo/

PUBLIC INSURANCE ADJUSTERS

Hunter Claims LLC 4613 N. Clark Avenue Tampa, Florida 33614 813-774-7634 www.hunterclaims.com

Tutwiler & Associates Public Adjusters, Inc. 4300 W. Cypress Street, Suite 780 Tampa, Florida 33607 813-287-8090 publicadjuster.com

RESERVE ANALYSIS

Sundeep Jay, RS, PRA 561.488.3012

• jrfrazerent@aol.com www.JRFrazer.com

Avoiding Financial Frustration in Communities: How to Prevent Common Mistakes

BY LISA ELKAN

Community management companies and their local community boards are known for working together to create exceptional residential experiences. From maintaining landscaping and amenities to ensuring critical repairs and undertaking capital projects, there is a significant onus on them to not only ensure that resident assessments are well managed but also to ensure the communities are ready to weather any storm.

An association’s finances provide a snapshot into its health, its ability to rise and meet challenges, and ultimately its ability to function to its full—and often legal—potential. Unfortunately, there are

Photo by iStockphoto.com/champpixs

instances where the financial health of the communities may be at risk or compromised. Among the most common best practices to avoid financial frustrations are the following:

ADEQUATE BOOKKEEPING

Keeping an accurate record of financial transactions is a critical component of successfully managing a healthy community association. Not only does it help leadership keep an eye on cash flow, but it also determines where the money is being spent. Accurate bookkeeping also prevents fraudulent activity among individuals who may have access to the community’s funds. Similarly, property managers compare what they budgeted for expenses with actual expenses, which will allow a better understanding of the impact on the association’s bottom line. In the same vein, identifying potential issues with homeowners defaulting on payments and working with those homeowners will help prevent a shortage of operating funds.

LISA ELKAN, VICE PRESIDENT, GREATER SOUTH FLORIDA REGION, ALLIANCE ASSOCIATION BANK