IT’S TIME TO SAY HI TO A.I.

Smokeball’s Hunter Steele shows how generative AI can shave 20 per cent from your daily workload

POWERED BY #8 • APRIL 2024

Conveyancer. AUSTRALIAN

COPYRIGHT

© Copyright 2023 triSearch Services Pty Ltd. triSearch and its licensors are the sole and exclusive owners of all rights, title and interest (including intellectual property rights) of this publication including all data, information, images, commentary and content (content). All rights reserved.

Solving the housing crisis: There’s no ‘silver bullet’

Australia needs to build more than one million homes over the next five years, but experts and politicians are divided on how to get there.

By KAT WONG in Canberra

Australians are searching desperately for a cureall to the housing crisis.

Low vacancy rates and high demand are driving rents through the roof, climbing interest rates are draining mortgage holders’ savings, and for many, the Australian dream is drifting out of reach as house prices continue to soar.

With the population continuing to grow, Australia needs at least 1.2 million dwellings over the next five years. Experts warn no single proposal can disentangle the planning mess overnight.

Housing is a shared responsibility between federal, state and local governments, which means there are both overlaps and limits on the measures each jurisdiction can take.

Different cohorts within the Australian population also have distinct housing needs.

NEWSROOM

Stories that moved the dial

Dr Michael Fotheringham from the Australian Housing and Urban Research Institute said there was no silver bullet. “Silver bullets kill mythical creatures, the housing crisis is real,” Fotheringham told AAP.

Political parties and the Property Council of Australia have thrown their hat into the ring with ideas inspired by history or other nations.

HELP TO BUY

Under part of Prime Minister Anthony Albanese’s plan, the Commonwealth would contribute 40 per cent of the purchase price of a new property, or 30 per cent for an existing one, allowing tens of thousands of first-home buyers to enter the market with as little as a two per cent deposit. Shared equity schemes have proven successful across the nation.

In Western Australia, nearly 2000 low-and-middleincome earners have become home owners thanks to the Shared Home Ownership Initiative – where the government funds up to 30 per cent of the purchase price of a new home.

A similar South Australia scheme helped more than 2000 people buy a house during the 2022/23 financial year.

The Greens have blocked Labor’s proposal in federal parliament, claiming the scheme would help too few people while fuelling inflation.

2 • AUSTRALIAN CONVEYANCER

But modelling done by the Grattan Institute found it would raise prices by about 0.016 per cent, which would add $113 to the purchase price of a $700,000 home.

The institute’s economic policy program director Brendan Coates said it made sense to keep the initial number of available places low while the scheme was set up. Help to Buy could be improved by better targeting those who wouldn’t otherwise break into the market, he said.

Under the proposal, individuals who earn less than $90,000 or couples who earn at most $120,000 are eligible.

These income thresholds are about $20,000 more than those outlined in similar state schemes, and mean up to 75 per cent of individuals and 39 per cent of couples could be eligible.

“The risk is it becomes a lottery because many more people are eligible than the 10,000 places available each year,” Coates said.

The government also more broadly has committed $25 billion to build tens of thousands of social and affordable housing.

PUBLIC PROPERTY DEVELOPER

The Greens have suggested establishing a governmentrun public property developer that would compete with the private market.

Under the minor party’s $28 billion policy, a public developer would oversee the building of 610,000 houses over the next decade before they are sold for just more

CONTINUED PAGE 4

BARRIER TO ENTRY

The Victorian Government has indicated it is open to reforming its stamp duty structure – a barrier for first-home buyers to enter the property market.

Page 7

GOOD WORD ON FIRST HOMES

Melbourne conveyancer

Michelle Barlas helps young Aussies realise their home ownership dream. She shares her tips for wise property investments.

Page 8

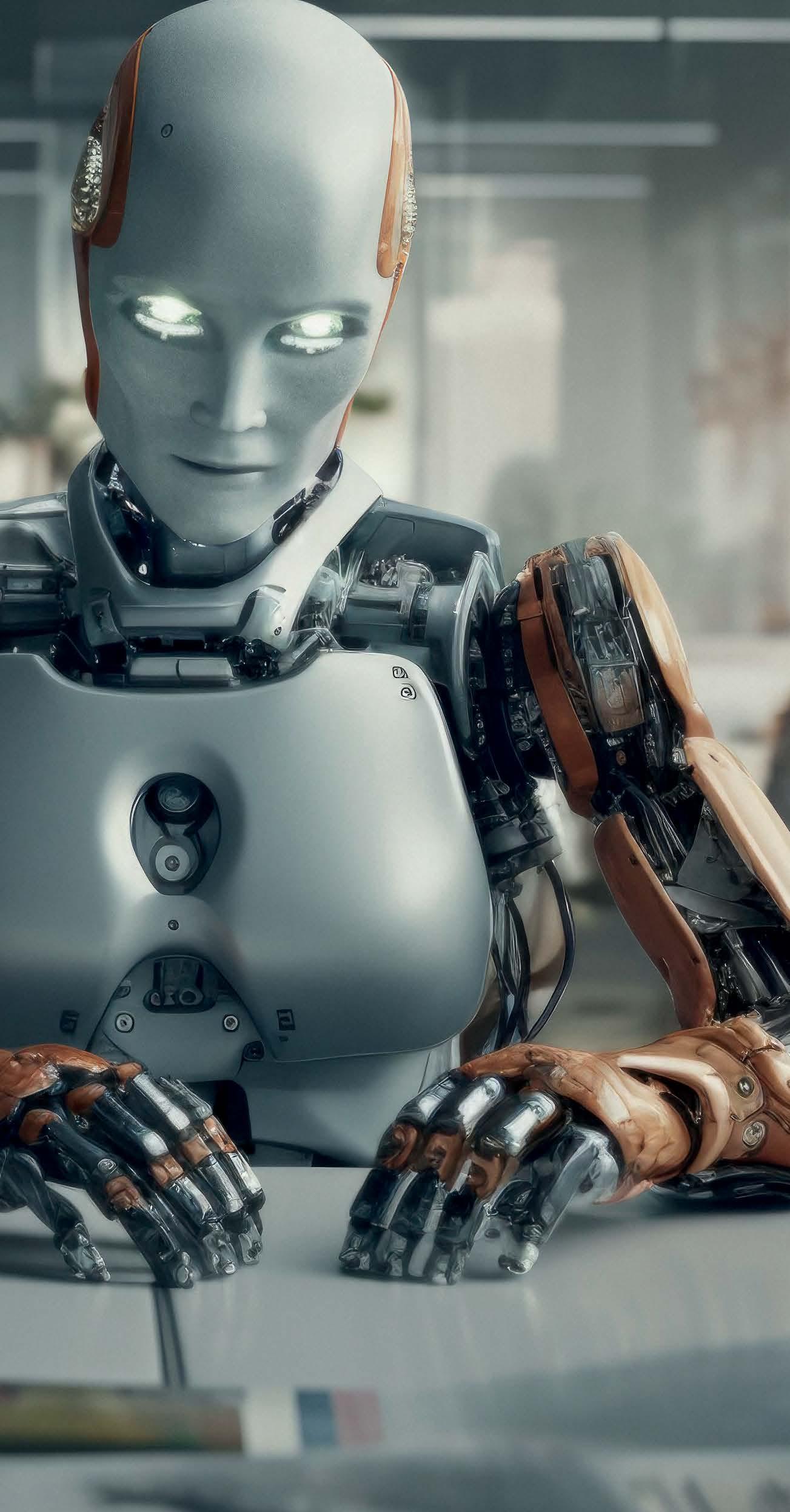

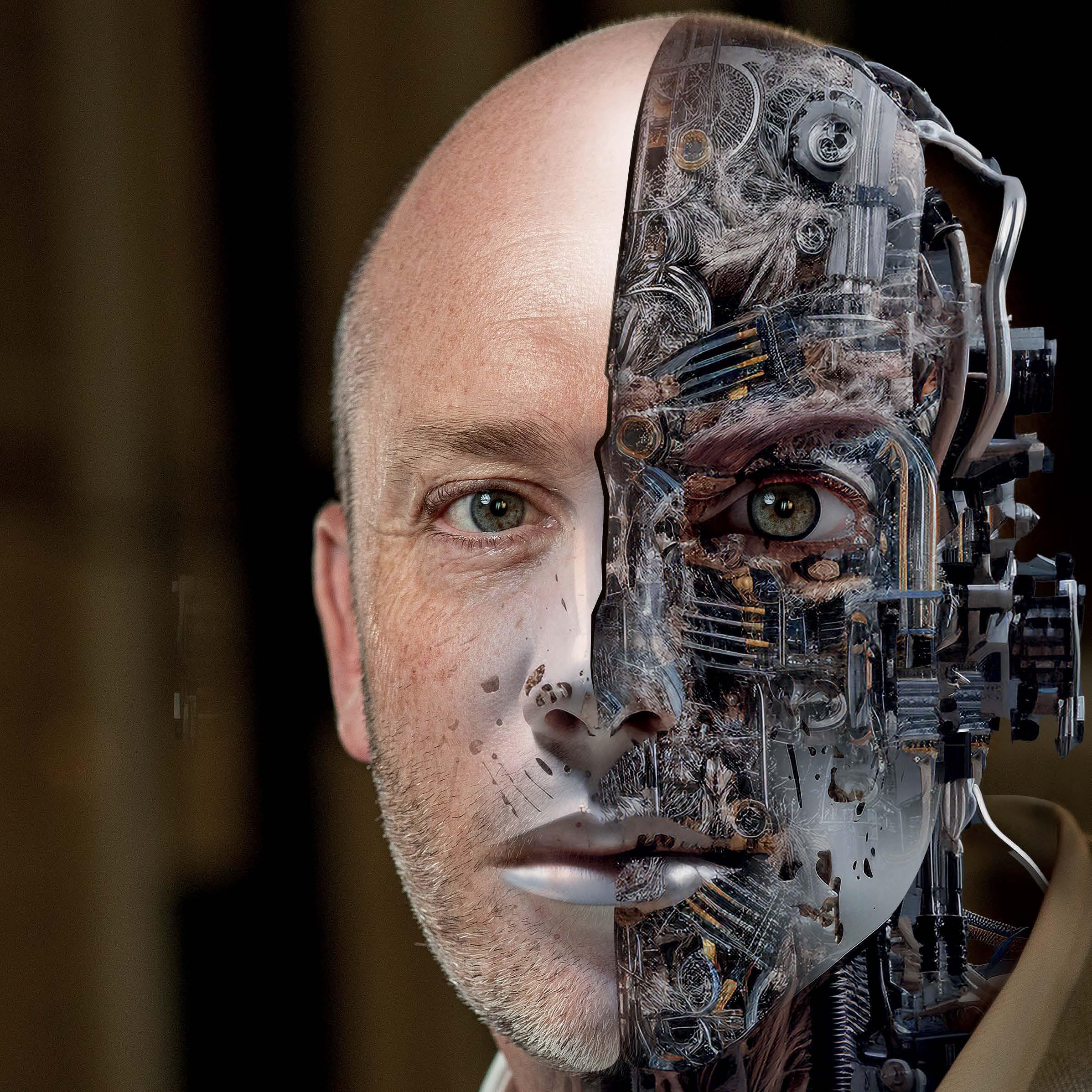

READY FOR THE AI REVOLUTION?

Artificial Intelligence in the workplace has its supporters and sceptics. But it appears gamechanging generative AI is here – ready or not. Experts say it’s time to embrace it and they tell us why.

Page 12

THE PROPERTY DATA DASHBOARD

The stats in a moveable marketplace kick up some interesting insights. See what hot right now.

Page 22

3

Prime Minister Anthony Albanese’s government is promoting a shared equity scheme.

Photo Dan Himbrechts

THIS EDITION

“Market forces can’t be relied upon to do government spending.”

Hal Pawson

Housing:

There’s

no ‘silver bullet’

than cost to first-home buyers or rented at a maximum of 25 per cent of a household’s income.

About 427,000 of the dwellings would be earmarked for the rental market, and a fifth would be allocated to the bottom 20 per cent of earners.

The rest of the homes would be available to sell and any applicants would not be means tested.

The plan was inspired by nations like Singapore, where 80 per cent of residents live in publicly owned and governed housing.

While housing experts have acknowledged the ambition of the proposal, they aren’t confident it could be replicated in Australia.

In Singapore, the government obtained land for public development through compulsory acquisition allowing them to pay cheap rates.

“You could appropriate private property and not compensate people fully,” Coates said.

“It just wouldn’t work here.”

The Greens would be paying market rates for land, making their plan significantly more expensive, and its plan could cost as much as $50 billion over a decade, Coates said.

Professor Hal Pawson from the University of NSW’s Futures Research Centre said the Australian government previously held a major role in producing housing.

After World War II, the federal government provided cheap loans to states and led to an explosion of public housing stock throughout the 1950s and 1960s.

Pawson said the government should do more to add downward pressure on rents and house prices.

“Market forces can’t be relied upon to do government spending,” he said.

SUPER HOME BUYER

The federal opposition wants to let Australians withdraw up to 40 per cent of their retirement savings –to a maximum of $50,000 – to buy their first home.

However, many young Australians do not have much money in super, so it would not benefit one of the biggest cohorts left behind by the housing crisis.

Fotheringham also warned this could push up house prices and trash retirement incomes.

As the number of people retiring with a mortgage continues to grow, they would be forced to spend more of their superannuation on paying off their houses, putting them at financial risk.

“The benefit of home ownership will be lost because they’ll be forced to sell,” he said.

“That’s when you get people selling at a loss.”

4 • NEWSROOM

FROM PAGE 3

Greens MP Max Chandler-Mather is on a mission to prove there are solutions to the housing crisis.

Photo: Mick Tsikas

According to Fotheringham, the biggest problem with the coalition’s plan is its laser focus on home ownership which omits renters.

“You’re saying a third of the population don’t matter or you’re somehow going to magically make them home owners,” he said.

PROPERTY COUNCIL PROPOSALS

While many of the political parties’ plans attempt to increase public control over housing, the Property Council of Australia prefers a different route.

Its nine-point wish list includes improvements to planning systems that prevent the construction of dense housing in desirable areas, building dwellings specifically for the rental market and addressing regional areas.

Chief executive Mike Zorbas also recommends governments “stop randomly increasing taxes” on new projects, claiming they made up 20 to 40 per cent of the cost of a home, a figure disputed by experts.

Many of the taxes that apply to property development are not built into the purchase price of a home.

Instead, they are generally borne by the landowner that sells to a developer.

INVESTMENT PROPERTY PERKS

The property council support housing tax breaks like negative gearing, which allows investors to claim deductions on losses, and the capital gains tax discount, which halves the amount of tax paid by Australians who sell assets that have been owned for 12 months or more.

Labor went to two elections promising to scrap negative gearing on properties purchased after a certain date, but the party dumped the policy in 2019 and has not revisited it.

Pawson said the “indefensible” policies benefited existing home owners at the expense of first-home buyers.

Coates agreed the tax breaks needed to be reformed and said scaling them back could boost home ownership by up to 5 per cent. This would need to be done carefully, Fotheringham said.

Scaling back taxes by the number of houses owned could force property investors to evict their tenants and sell.

Some argue renters could then buy the properties, but Fotheringham said this argument assumed the only barrier to buying a home was availability.

Instead, the government could introduce a cap on property-related tax deductions over time while reducing the capital gains tax discount to avoid a sudden change that would reduce rental supply.

The Albanese government’s 10-year housing strategy is still in the works.

Slated for release in 2024, experts will look to the government’s national housing and homelessness plan for a long-range vision.

Australian Property Council chief executive Mike Zorbas has linked the housing crisis to supply, planning laws and high borrowing costs.

Photo Mick Tsikas

Liberal home ownership spokesman Andrew Bragg has spoken before about allowing access to super.

Photo Lukas Coch

Huge investment needed to address social housing crisis

By MAEVE BANNISTER and SAMANTHA LOCK in Melbourne

Australia’s most populous state needs to invest $2 billion a year for the next five years to address a growing housing affordability crisis, analysis shows.

A leading advocacy group is calling on Premier Chris Minns to ensure social housing remains high on the agenda, while the state’s housing minister says she will advocate for more Commonwealth funding.

Almost 58,000 families and individuals are on the waitlist for social housing in NSW, the longest of any state or territory.

government to repay that trust,” CHIA NSW chief executive Mark Degotardi said.

In the first budget handed down in September, the state government allocated $224 million to help break the cycle of homelessness.

The package included $70 million to accelerate social and affordable home construction, $35.3 million for housing services for Indigenous people and families and $35 million for maintenance to existing social housing.

But CHIA NSW said a far greater injection of funding was needed to tackle the scale of the escalating social housing crisis and called on the government to partner with community housing providers.

NSW Premier Chris Minns and NSW Minister for Housing Rose Jackson visit a social housing property under going maintenance in Padstow, Sydney, in November last year.

The NSW Government announced changes to social housing maintenance.

(AAP Image/Dean Lewins/)

Figures released by the government in August showed the median wait for urgent help was three months, up from 2.4 months in 2022.

That is forcing out the average wait for applicants not needing priority assistance to almost two years.

But recent social housing funding announcements from the Queensland, WA and NT governments have pushed NSW to the lower end of the ladder, ahead of only SA and the ACT, analysis by Community Housing Industry Association NSW (CHIA NSW) showed.

“Families in NSW put their trust in the Minns government one year ago (and) it’s now time for the

The analysis found tens of thousands of social and affordable homes could be built if the government invested $2 billion per year over the next five years.

This level of funding would deliver 25,000 social and affordable homes across Greater Sydney and regional NSW and the government could save up to $1 billion by partnering with community housing providers to deliver half of these homes.

“NSW has the largest, most capable community housing industry in Australia,” Degotardi said.

NSW Housing and Homelessness Minister Rose Jackson said she would meet with state and territory counterparts at a Housing and Homelessness Ministerial Council to advocate for more Commonwealth funding and resources.

In October, Minns and Prime Minister Anthony Albanese launched the Social Housing Accelerator – a $2 billion Commonwealth fund, of which NSW gets $610 million to help the state add 1500 social homes.

But Commonwealth funding has fallen from 0.52 per cent ($2.08 billion) of the 2013-14 Commonwealth budget ($398.3 billion) to be only 0.28 per cent ($1.9 billion) of the 2023-24 Commonwealth budget ($684.1 billion), Jackson’s office said in a statement.

To retain the same relative share of the Commonwealth budget as 2013-14 for 2023-24, would require a 90 per cent increase on the 2023-24 allocation.

6 • AUSTRALIAN CONVEYANCER

Home builders want training costs reflected in pay call

Construction companies want annual wage bargaining that kicked off this week to take into the account the cost of training apprentices to avoid overburdening small businesses nurturing the next generation of tradies.

With labour shortages continuing to weigh on the construction sector, the Housing Industry Association (HIA) said the industrial umpire should factor in the cost of training skilled apprentices.

The Fair Work Commission’s annual review impacting the pay cheques of millions of workers on minimum and award wages is under way, with the independent body taking submissions from unions, employer group and governments.

The minimum wage is $23.23 per hour, or about $45,900 a year.

“Wage increases undoubtedly affect the capacity of businesses, particularly small business, to sustain the continued employment of apprentices to obtain completion status, leading to the eventual heightening of skills shortages in the industry,” the HIA’s submission says.

Attracting and retaining skilled workers is essential, the industry group says, especially when home building starts picking up to meet the federal government’s target of 1.2 million new homes over five years.

The residential construction industry has also been under pressure from prices increases, delays and material shortages.

“In light of the current landscape, HIA strongly submits that the expert panel takes a conservative approach in this year’s minimum wage review.”

Vic government admits to stamp duty hardship

By HOLLY HALES in Melbourne

Victoria’s deputy premier has recognised stamp duty is a major barrier for first-home buyers to enter the market as the state considers reforming the controversial tax.

The state government sent the strongest signal yet that it is open to major stamp duty reform, including the introduction of a broad-based land tax, in March.

It comes a month after Treasurer Tim Pallas warned Victoria’s budget bottom line would take a $30 billion hit if stamp duty was scrapped.

Deputy Premier Ben Carroll said the backflip was due to competitive property market conditions keeping many Victorians out of home ownership.

“I want to get options, and you have to add stamp duty into your price and when you’re bidding,” he said.

Mr Carroll said the state government had been presented with new evidence that supported the feasibility of stamp duty being scrapped.

“I think what’s changed is the parliament has now received a new report on stamp duty,” he said.

“We have received reports most of the year and we will, in principle, agree to many of the recommendations.

Housing Minister Harriet Shing said the government was always looking for ways to help people enter the market.

“Stamp duty distorts behaviour in the way in which it is reflected in buyer choice,” she said.

“(Housing reform) is the aggregate of this work that will continue to provide relief to people who do want to get into the housing market.”

Opposition Leader John Pesutto was not confident the state government would follow through on any hints of reforming stamp duty.

“They have never signalled any serious intention to engage in tax reform,” he said last month.

“We need to look at the inefficiencies around stamp duty, we need to look at affordability, getting the cost of living down a lot.”

7

Deputy Premier of Victoria Ben Carroll: Stamp duty plan change due to property market conditions.

Photo: Con Chronis

FACE-TO-FACE

with Conveyed for Individuals founder, MELISSA BARLAS

Easing pain points and making dreams a reality

BY SAM McKEITH

Melbourne-based conveyancer

Melissa Barlas runs the premium conveyancing service Conveyed for individuals, couples and families buying, selling or transferring property.

With more than 10 years’ industry experience, she also runs the popular The First Home Show podcast, which gives listeners tips for buying a property for the first time.

In the wake of International Women’s Day, Australian Conveyancer sat down with Melissa to find out how she juggles the demands of being a successful businesswoman and podcaster.

8 •

PHOTO: AARON FRANCES

q+a

AUSTRALIAN CONVEYANCER: How did you get into conveyancing?

MELISSA BARLAS: It definitely wasn’t something I had in mind leaving school. In fact, going into my master of laws at Monash, I was in two minds about whether I’d go into property or not. But it in my second year of law school I started working in property law and loved it.

AC: What keeps you excited about the work?

MB: I enjoy working with individuals and being able to really transform their lives through what I do. I feel that’s what I’m doing in conveyancing in the sense I’m not just doing a transaction, but I’m taking someone from never having owned a property before to finally getting an opportunity to come into the market and acquire their first home. I’m taking people on the journey into their own property where they can start an independent life.

AC: You’re also helping other conveyancers via consulting, how’s that going?

MB: It’s an early venture for me to go into a bit of consultancy, but there’s already been quite a lot of interest from conveyancers to help them scale and grow their businesses.

They want to get guidance from a person that actually does conveyancing, they don’t want to hear it from a business coach, because a business coach has no idea what they’re going through, they can’t relate. I come from a position where I can totally relate to them because I’ve done it for so long. I’ve been in the industry for 10 years now.

AC: What are the main pain points you see for conveyancers?

MB: When you go to law school, then do your conveyancing qualification, and then go on to become a licenced conveyancer, you’re taught to be a technician. You’re taught to be on the tools, to service clients and that’s where the buck stops, you’re not taught about things like marketing, which may not come naturally. You also don’t know how to scale a business and we often don’t carry a natural entrepreneurial mindset. It’s that stuff that I try to teach.

AC: What challenges do women in the industry specifically face?

MB: I certainly feel that in my time in conveyancing, I’ve dealt with many more female business operators than men, and I’ve found the industry supportive of female progression. It could be the nature of the work that plays a part. You could argue conveyancing involves a high administrative burden and women have traditionally been geared to more administrative roles within law firms or other businesses. Additionally, conveyancing involves a lot of due diligence and I know a lot of brilliant female business owners, lawyers and conveyancers who have such strong attention to detail. But then again, I’m not sure if that’s a particularly female thing or not.

AUSTRALIAN CONVEYANCER • 9

“It’s prudent to only make an offer when you’ve analysed factors such as the property’s location, its unique character, floor plan, and size

– attributes that impact its value.”

Melissa Barlas

AC: What other issues are you noticing in the industry right now?

MB: In conveyancing, everyone’s used to being in opposing positions and that can inform views about other members of the industry. I feel that we need to shift that mindset, and that’s what I try to do by bringing the community together and helping clients to see each other not as competitors but as allies who can help one another grow. Whether it’s by helping each other scale, sharing knowledge with each other so the profession becomes more educated, or through property insights or legal updates, I feel there should be a greater sense of community in the industry. That’s exactly what I’m trying to achieve.

AC: Your podcast The First Home Show is proving very popular, how’d it come about?

MB: I think a big part of the success is because the podcast centres on first-home buyers. That’s the market that really needs all the education so they can get to step into the market right now, in terms of ways to help them to lock down that first mortgage.

AC: On that, what’s the outlook like for first-home buyers right now?

MB: It’s difficult. From a finance point of view, I’m seeing a lot of people trying to access the market, but lenders have become quite conservative with their lending policies, as well as the impact of successive interest rate hikes. Lenders are offering less money, less of a loan, for first-time buyers to come into the market and buy something.

When that happens, it unfortunately can catch first time buyers by surprise. They think ‘I don’t have enough money, but now I need to put in an extra, say, 20 grand –where am I going to find that?’

AC: Given the challenges, what tips do you have for first-home buyers?

MB: In terms of strategies to try to save money, there’s a range you can consider. First off, it’s a good idea to be more conservative with your spending. It can also help to speak to a mortgage broker from close to the outset, to help you understand exactly what your budget is. Also, try to keep a flexible mindset to pivot potentially from where you want to buy. For instance, it might end

up being just a little bit further out than you’d originally thought. But, remember, if it means that you’ll be able to get into the property the market, then so be it.

AC: Saving can be tricky as living costs rise, any words of wisdom here?

MB: Sure, there are some common mistakes people make along the way here. If it’s your first home, be more conservative with your spending and track your expenses very closely because everything helps when you’re trying to access the market. What’s more, if you are going into the market, take a strategic view. A lot of first-home buyers, just for affordability reasons, tend to go for units and apartments, but they’re a dime a dozen. I see a lot of people being attracted to the high-rise apartments, the ones that have a lot of supply.

AC: What should first-home buyers watch out for with high-density?

MB: You need to be very careful because when you buy in a high-density area, like massive apartment buildings, it may not set you up properly for your next property. There may not be enough growth to continue to gain enough equity in that first property to help you for the next one, if wealth creation is your objective. If it is, try to get as informed as possible on what it means to use equity to help set yourself up for future properties, and grow wealth.

AC: What about the timing of an offer, what are some key considerations?

MB: This is a question that is front of mind for every home buyer, and I’d say being well-informed is again a powerful advantage. It’s prudent to make an offer only when you’ve analysed factors such as the property’s location, its unique character, floor plan, and size –attributes that impact its value. Critically, make sure the data you’re relying on is accurate and comprehensive. If so, it’ll put you in a good position to make the most appropriate offer. Before all this, don’t forget to go to the property’s open inspections to get a first-hand insight into the property’s pros and cons, arrange for a pest and building inspection, and thoroughly compare sale price with others in the area. Also, make sure to get a deep understanding of the property’s sales history and secure pre-approval on your finances.

10 • Q+A

AC: How about choosing a conveyancer, any words of warning?

MB: There are many brilliant conveyancers out there and my firm Conveyed really prides itself on high quality conveyancing because I think that’s the standard we need to aim at. One thing I will say is that as an industry we jeopardise that when we start charging stupidly cheap fees. A lot of conveyancers will charge under $1000, I’ve seen that many times, and clients get quite attracted to that, it looks enticing. However, with providers charging that kind of price, the work may suffer. You have to question how much is done for that price.

So, when, as a first-home buyer, you’re seeing those price tags, don’t go ‘I’m saving a buck, let’s go with it’. You have to actually probe things like ‘Am I going to be able to speak to someone in an emergency?’ as it’s likely they’re going to attract a high volume of clients. In these cases, if someone’s tracking a high number of clients, where do you think your matter is going to sit in the pile? It might sit in the middle somewhere, it might sit at the bottom.

AC: What are tell-tale signs of a good operator?

MB: For anyone looking to engage the services of a conveyancer, the right qualifications and credentials are pivotal. It’s critical your chosen conveyancer is qualified and licensed to do the job. Here, you want to ensure you’re not dealing with someone without the necessary qualifications, or who doesn’t work with conveyancers that are qualified and licensed to assist you. Conveyancers should be licensed and be members of the Australian Institute of Conveyancers. You also should make sure they’re registered with the Legal Services Board. To be extra careful, check if the firm principal has a practising certificate and if the conveyancers assisting them are relevantly licensed. Accreditations help guarantee the conveyancer is duty bound to adhere to strict ethical and professional standards.

AC: You mentioned price earlier, are good conveyancers necessarily expensive?

MB: Once you do your homework you realise it’s not about going with the cheapest, it’s about ‘what’s the best fit for me’. I educate clients about that. At the same time, it’s my view that conveyancers should really be reassessing their pricing structures and charging

more, because our work is valuable and it should not be considered cheap. If you’re charging too little, it’s sending the wrong message to the customer about your business.

From a customer’s point of view, if you’re going in looking for a conveyancer, you need to be asking ‘what value for money am I getting with this person?’ So, it’s asking questions about things like their expertise and checking to see, for instance, if it’s someone from offshore that’s answering the phone or is it someone based here? All that stuff really matters because it’s a reflection of what you’re going to get going forward.

* The interview has been edited and condensed for clarity To listen to Melissa’s podcast, go to: podcasts.apple.com/ au/podcast/the-first-home-show/id1600033984

AUSTRALIAN CONVEYANCER • 11

REVOLUTION How to win back precious time a.i.

12 • SPOTLIGHT spotlight

PHOTO: JULIAN ANDREWS

With promises that generative AI will save time, improve efficiency, impress clients and streamline workflows, some critics are worried about the ethics, privacy and accuracy of the new technology. Australian Conveyancer magazine talked to industry expert Hunter Steele to get the lowdown.

Time-poor conveyancers and property lawyers could slash their weekly work hours by up to 20 percent by implementing generative artificial intelligence (AI) and taking advantage of the largest technology shakeup in the industry since the advent of the cloud, according to an industry expert.

In what Hunter Steele, chief executive of international law-firm software company Smokeball, described as the biggest shift the profession has ever seen, conveyancers will soon have the secure and specialised tools to draft client correspondence, summaries and timelines in a “matter of seconds”.

And Steele believes this extra level of lightening-fast, AI-assisted productivity will be a game-changer for the industry, giving conveyancers more hours in their days and more options to grow their businesses.

“Conveyancers are generally ‘fixed fee’ in nature –they want to get a good job done but the less time they spend on a matter, then the more money they make,” says Steele, who, with a degree in law and computer science, has worked in the conveyancing space for more than two decades and has been at the helm of industry heavyweight Smokeball for the past six years.

“It literally comes down to economics,” he says. “These days it’s getting harder for conveyancers to put their prices up. There’s a bit of a price war out there in some places. So, if they can get that work done faster and charge a reasonable rate for it, then that’s good from a productivity perspective.

“Either the conveyancer can get more work in the door because they have more time in the day, or they can go play golf or spend the time with their kids or do whatever they want to do.

By LEIGH REINHOLD

By LEIGH REINHOLD

AUSTRALIAN CONVEYANCER • 13

“For small law firms or conveyancers, I don’t think AI will replace them, but I do think those who are using it alongside their own skills and knowledge will definitely eclipse those who don’t use it.”

Hunter Steele

“Using generative AI to get those hours back in the day, to make those matters more profitable, and put that time back in the hands of the conveyancer, I think will create major impact and be a massive change.”

With its ability to automate processes and repetitive, time-consuming tasks, generative AI has the potential to free conveyancers and property lawyers to focus on more strategic, creative and value-added work, Steele says.

Meanwhile he says generative AI’s ability to rapidly analyse large amounts of data enables faster and better-informed business decisions. It can also enhance customer experience through support and improved responsiveness and satisfaction, and enable scale and growth while giving business owners a competitive edge over their rivals.

Now in the process of fine-tuning its AI products, Steele says Smokeball this month started beta testing a group of 20 conveyancing clients from a range of regions along the east coast and in South Australia, and is on track to launch its “second-to-none” AI offerings to Australian conveyancers in July.

“We are working with our beta clients closely, watching what kinds of things they are using the AI for, the prompts they are using and how they want to build it into their workflow to be more efficient,” Steele says.

“We have a good mix of beta clients from across the country because we want to monitor different workflows, different contracts, different documents, different people,” he says.

“We’re very excited to get it in the hands of clients and see exactly how they use it because that’s the fun thing about AI. When you talk to people about how they use generative AI or ChatGPT, people are dreaming up plenty of ways to use it by utilising different questions or prompts or outcomes to see what it comes back with.”

Steele says tests have shown conveyancers using Smokeball’s AI-enhanced software will be able to draft emails and correspondence to clients in mere moments, analyse an 80-page strata report for a specific by-law in seconds, and summarise timelines in the blink of an eye.

“Over the years we have built our technology to be a productivity powerhouse that our research shows can cut between 25 to 40 per cent of time spent in a conveyancer’s day or working week,” he says.

Hunter Steele’s guide to how conveyancers should be using generative AI

1EMBRACE

IT

“Don’t be scared of AI,” Steele says.

“If you haven’t tried ChatGPT, try itwhether that’s by helping your kid with their homework, or using it to write a routine letter to a client.”

“In terms of adding generative AI to the Smokeball equation, we think it will really impact on productivity by another 10 to 20 per cent. Which means if you’re 50 per cent more efficient than someone down the street not using Smokeball with generative AI included, it’s going to be very hard to keep up.”

Last year a global survey of 1000 conveyancers and property law professionals, conducted by Smokeball, found 75 per cent of respondents were keen to learn more about AI and how they could use it in their businesses, and 25 per cent of firms had already used it in their practices; although around 70 per cent of respondents were worried about the ethics, privacy and accuracy of the new technology.

14 • SPOTLIGHT

2THINK ABOUT WHERE VALUE CAN BE ADDED

Steele says the whole point of generative AI is that it should save you time and effort. “There’s not much point if it’s disconnected from your daily workflow,” he notes.

3EXPERIMENT

“It’s very powerful, and if you put any reservations aside, you might be surprised by what it can do. You’ll also learn that the power is in your hands and it’s not going to take it away from you.”

4BE CAREFUL

Despite its potential, Steele cautions everyone to be sensible with what they share with ChatGPT or other large language models (LLMs). That’s because there is always potential for data leaks. “Don’t plug too much sensitive information into ChatGPT. Exercise the same level of caution you usually would with your client’s information.”

“When we see figures showing 75 per cent are interested, most of them are worried about it, and only 25 per cent had used it, we take that as our job to not only educate the market but to provide tools that are safe and secure and as accurate as possible to be able to help them get their work done,” says Steele, who stresses cloud software security is the number one priority for his company and its clients.

While Steele is confident AI will be a must-have advantage for conveyancers and property lawyers, he won’t go so far as to say it will completely revolutionise the industry. And he says the human element in conveyancing remains vital and AI should essentially be used by conveyancers as a “first draft” tool.

“I think what people forget about AI is that it’s not perfect and there’s a good chance that it never will be,” he says. “It’s a tool that from a productivity perspective can get things done from a business and a personal point of view, from a first draft perspective. But I don’t think it’s going to replace humans in that we need a human to make a decision or we need emotion or we need all the other things that come along with being human.”

And Steele says concerns that AI will mean the loss of jobs or lower operational standards are unfounded in his view. “For small law firms or conveyancers, I don’t think AI will replace them,” he says, “but I do think those who are using it alongside their own skills and knowledge will definitely eclipse those who don’t use it.”

AUSTRALIAN CONVEYANCER • 15

IT’S TIME TO SAY HI TO a.i.

16 • SPOTLIGHT

Over the past year, generative AI has captured the public’s imagination in a bigger way than other recent technology. And, with billions of dollars being poured into its development and take-up rates growing almost exponentially, it looks set to disrupt every industry from health to financial services and from manufacturing to logistics.

So how will it impact the conveyancing industry in the coming years? And what should your business be doing to prepare for and leverage AI? We explore.

WHAT IS GENERATIVE AI ANYWAY?

Generative AI is a form of artificial intelligence that can generate new content based on the patterns it has learned from its training data. The most prominent example is Open AI’s ChatGPT. This large language model (LLM) processes text and generates responses in a way that closely mimics human cognitive processes, which means users feel like they’re having a conversation.

However, there are also several other LLMs, including Google’s Bard and Meta’s LaMa2, as well as other forms of generative AI, such as image generators, data synthesis and augmentation tools, and even voice clones.

Generative AI’s ability to generate new information makes it very different from other technology, which tends to process or analyse existing data. It also makes it potentially more game changing because it has the ability to potentially create new information – including legal documents.

Although ChatGPT 3.5 was only launched in November 2022, it has already received widespread take up. A McKinsey study found, by April 2023, as many as 79 per cent of people working professional jobs had some exposure to it. Meanwhile, 22 per cent confessed to using the technology in their daily work.

However, while generative AI may have taken over some of the writing and administrative tasks that professionals perform, this really is just the beginning of the revolution, says Hunter Steele, chief executive of legal technology company, Smokeball.

“We’re still in that ‘test and learn’ phase,” Steele

explains. “A lot of people have already used generative AI but it’s the application to how this makes our lives better, easier or faster that everyone is scrambling to wrap their heads around right now.”

Despite this, Steele says that over the coming years, generative AI is likely to transform the way we live and work in a much more profound way. He also believes it will transform the business of conveyancing.

FROM ‘GET AND ENGAGE’ TO ‘BILL AND COLLECT’

In his analysis of how it will do this, Steele breaks the conveyancing process down into three stages. The first, he describes “get and engage” where a practice looks to take on new clients. The next is the “do” phase, where the practice carries out the conveyance and generates work. Finally, there is the “bill and collect”, where they invoice and get paid.

Steele observes that, to date, most of the action around generative AI has been in the initial “get and engage” phase.

“You can already use ChatGPT or other out-ofthe-box LLMs to carry out a lot of lead generation and marketing tasks,” he notes. “It can write basic emails or passable marketing copy, and I’d encourage firms to experiment and use it this way.”

Steele also observes that some professional service firms are using generative AI in the form of automated chatbots. These “virtual concierges” are capable of guiding clients through a relationship by onboarding them and answering common questions.

At the other end of the spectrum – the “bill and collect” – phase, Steele believes AI will have a more limited impact.

“Most conveyancers collect money at settlement,” he says. “Unlike many legal practices, fees tend to be fixed rather than based on time recording. So all they need to do is collect their money at the end of the day.”

However, he notes that there is still some room for transformation and observes that accounting software programs such as Xero already make use of AI to read documents and perform other tasks.

By RALPH GRAYDEN

By RALPH GRAYDEN

AUSTRALIAN CONVEYANCER • 17

“It won’t be as though people will decide to do their own conveyancing through AI to the exclusion of using a conveyancer.”

Hunter Steele

THE ‘DISRUPTABLE’ MIDDLE

It’s between these two ends of the process – in the main “do” part of conveyancing – that Steele sees the greatest capacity for disruption.

“Ever since the late 1990s when the conveyancing scale was taken away [in NSW], conveyancing became more competitive and efficiency became more important,” Steele notes.

“People were prepared to pay less and, as a result, from then on conveyancers needed to be able to get results in the least time possible while still using their skill to make sure the work was done to a high standard.

“That’s exactly what AI is built for – getting more done in less time,” he adds.

Steele believes that many of the processes in conveyancing have the potential to be handled, at least to some extent, by AI.

“A lot of time can be spent on ordering certificates and populating documents. There’s a whole lot of rekeying of data and research, which could potentially be done much quicker by AI – for instance, by prepopulating documents and forms,” he notes.

“We believe AI could reduce the process not just by minutes but by hours – taking away thousands of clicks and steps. It could also be used to look for that one interesting piece or number that doesn’t make sense. It could flag these anomalies and alert the conveyancer so they don’t have to read and understand every single document.”

MOVING INTO CONTRACT REVIEW

Beyond the actual conveyancing process, Queensland Law Society special counsel Shane Buddon says that another area in which generative AI will eventually apply is in reviewing, comparing and drafting property contracts. In doing so, he notes that other jurisdictions have moved further down this course.

“In the United States, AI is already being used for contract review in a bg way,” he says. “You’re seeing a lot of firms creating products that they’re selling into law firms.”

Others, Budden notes, are using products that have been built on the back of LLMs. This includes apps such as Casetext and Harvey.

However, Budden points out that, to date, most of

Common AI terms you’re likely to hear (and what they actually mean)

ARTIFICIAL INTELLIGENCE (AI): This is the technology where machines emulate human-like actions and thought processes. For instance, the recommendation systems on Netflix and Amazon, which predict your preferences based on previous choices, are classic examples of AI in action.

NATURAL LANGUAGE PROCESSING (NLP): NLP is a branch of AI that focuses on the interaction between computers and human language. It allows machines to understand, interpret, and communicate in human language. A prime example is voice assistants like Siri or Alexa, which comprehend your queries and respond in a natural, conversational manner.

CHATBOT: These are AI-driven software applications designed for text-based conversations, either through text or text-to-speech, often substituting for direct human interaction. You’ll find these frequently in customer service settings, where they promptly address common queries. ChatGPT, Bard, Jasper, and Claude are notable chatbots, showcasing the capabilities of AI in everyday interactions.

MACHINE LEARNING (ML): A critical subset of AI, ML enables computers to learn from data and make decisions. It’s the foundation of AI’s evolving writing and analytical abilities. Google’s spam filter is an excellent example of ML, where it continuously improves its ability to filter spam by learning from identified patterns in emails.

these models tend to deal with case law commercial contracts rather than property.

“Contract drafting for residential property is a little different from commercial contracts,” he explains. “Most people use a standard contract, so at the moment there is only limited utility in developing something similar for the conveyancing space.

“Where it will be valuable, though, is in its ability to generate leases and deeds, and non-standard contracts and clauses that you might find in commercial property.”

18 • SPOTLIGHT

NO WIDESPREADS JOB LOSSES (JUST YET)

Shane Budden also says that, while generative AI will revolutionise conveyancing practice, any fears of the profession being “wiped out” by technology, are premature. One reason for this is that most of the AI innovations that take place will be aimed at convincing businesses rather than the general public.

“It won’t be as though people will decide to do their own conveyancing through AI to the exclusion of using

a conveyancer,” he says. “It’s just not commercially viable to develop a model aimed at the general public, who buy or sell a property on average only a few times in their life,” he points out. “Instead, it’s more likely that AI will be developed that makes sense for conveyancers and property lawyers to invest in because it allows them to do their job more efficiently and costeffectively.”

Budden argues that there are essentially human tasks involved in the conveyancing process, including

“Ever since the late 1990s when the conveyancing scale was taken away [in NSW], conveyancing became more competitive and efficiency became more important.”

Hunter Steele

navigating things like pest and building inspections, which can’t be handed over entirely to AI.

What he believes will be interesting, however, is how the legal and conveyancing professions bring on junior practitioners when there is less of the “grunt” work to be done. This, he says, has been the traditional way new professionals learn before moving onto higher level and more value-adding work.

Joel Barolsky, managing director of Barolsky Advisors and senior fellow of the University of Melbourne says that there are already models for how technology can impact some jobs in a sector but also create new ones.

“If you look at how CAD (computer-aided design) impacted architects,” he says. “There once were rooms full of draughtspeople drawing up plans for buildings. Now they’re all made redundant.”

However, he also notes that CAD opened up new efficiencies, as well as new opportunities.

“CAD transformed the customer experience and the way architects work. They could suddenly collaborate across multiple locations and show clients 3D renderings of buildings before they’re built.

“Designing a 40-storey building used to be a timeconsuming and difficult process; now architects can do it in a day,” he explains. They can even design buildings that just weren’t possible pre-CAD.”

COMMODITISATION WORKING IN CONVEYANCING’S FAVOUR?

Barolsky believes generative AI could potentially do the same thing across many areas of the law. However, he also believes that because conveyancing has to some extent already been “commoditised”, this should help shield it from job losses. Instead, his view is that it will be the high-fee, highly specialised areas of legal practice that have the most to fear from generative AI.

In reaching this conclusion, Barolsky uses a fourpronged analysis to determine a sector’s vulnerability to AI, the first element of which is the cost of labour.

“When you compare labour costs in conveyancing, they’re nothing like the labour costs in a field like mergers and acquisitions,” he says. “The savings won’t be on the same scale.”

The second element in Barolsky’s analysis is client power when it comes to buying – something he says also makes conveyancing less disruptable than areas of

practice where large corporations tend to be the clients.

The third factor is effectiveness, or how well AI can analyse or solve a problem; and the final is regulatory constraints, or whether there are any legal hurdles to implementation.

“When these factors are taken together, I don’t think conveyancers will be losing their jobs en masse anytime soon,” Barolsky says.

20 • SPOTLIGHT

WHY YOUR PRACTICE NEEDS TO TAKE NOTICE OF AI

Still, that doesn’t mean conveyancers can afford to ignore generative AI, especially if it can help them do their jobs much more efficiently.

“It’s not about being replaced, it’s about being empowered to do the job faster,” Shane Budden says. “AI tools are more about augmenting the capabilities

of professionals rather than replacing them. The real potential lies in creating tools that professionals can use to enhance their practice.”

Meanwhile, Hunter Steele argues that, even if conveyancers don’t notice changes immediately, those who fail to keep pace with AI will find they gradually become less efficient than their competitors to the point where they can no longer compete.

“Things aren’t going to today or tomorrow,” he says. “But I guarantee in 10 years’ time we will all be using AI and it will be a central part of what conveyancers do dayto-day.

“It’s not going to replace people altogether but if you don’t adapt to it, you may be replaced and your business won’t survive,” he concludes.

CHALLENGES ALONG THE WAY

Barolsky warns that while conveyancing practices will need to move on AI, they should also keep a close eye on developments and watch the space carefully rather than jumping “all in” right from the outset.

“You don’t want to fall for the hype from either side,” Barolsky says.

After all, he points out that there are ethical and regulatory obstacles that need to be overcome before AI is widely implemented and that these may act as a “handbrake”.

“But history shows us people usually find a workaround,” he says.

Budden also observes that a final obstacle ChatGPT and other generative AI models need to overcome is a propensity to make things up – a practice that is known as “model hallucination”.

“Property law isn’t a field in which you can afford to make errors,” he observes.

However, he is confident that, as time goes by, this too will be overcome.

“As the technology matures, and with increased investment and focus on accuracy and reliability, these AI ‘hallucinations’ will become less frequent. This evolution will make AI tools more dependable in areas where precision is critical.

“The key for conveyancers will be to stay informed, adapt to new developments, and cautiously integrate AI into their workflows, ensuring they maintain high standards of accuracy and compliance.”

SOURCES

mckinsey.com/capabilities/ quantumblack/our-insights/ the-state-of-ai-in-2023-generative-ais-breakout-year qlsproctor.com.au/2023/07/ ai-a-business-imperative/ pwc.com.au/publications/ unlocking-the-benefits-of-ai. html

todaysconveyancer.co.uk/ainot-ai/

nytimes.com/2023/04/10/ technology/ai-is-coming-forlawyers-again.html

AUSTRALIAN CONVEYANCER • 21

The western suburbs get more attractive every month

NSW

In March we saw Marsden Park, Westmead and Camden all in the top five hottest suburbs.

Marsden Park

Seven out of the 10 listed on this report are also from the west. Month-on-month we see home buyers flock to the western suburbs, presumably because of the affordability factor with median prices in Western Sydney being

Hottest suburbs

The

than their eastern suburb counterparts. To put it in perspective, the median house price in Mount Druitt is $905,000 compared to $3.7 million in Bondi which is a difference of 129per cent

The attractiveness of Western Sydney goes further than price, however, with significant investment from the government being poured into infrastructure with housing, roads, public transport, hospitals and the Badgerys Creek airport. Combine the price and the government investment and it becomes clear why so many home buyers are flocking to the western suburbs.

Outside of the west, we see Wyong with strong growth, coming in at second on this list for March up from sixth place the month before. Located far north of Sydney, an estimated 80 minute drive (or 1 hour and 40 minutes via public transport), Wyong strikes the perfect balance between laid-back, beach lifestyle and the ability to access the CBD with a reasonable commute. Price could also be a determining factor here with the median house price in Wyong at $825k, almost 10 per cent lower than Mount Druitt.

For the first time we also see the first-home-buyer market dropping off in NSW, with more existing home owners purchasing their second and third homes, compared to those purchasing their first. Even with all the government assistance, this trend is a likely indicator of the cost-of-living crisis currently plaguing the state, with potential first-home buyers being priced out of entry.

Time on market

The average time a property spends on the market before being sold, compared to the same time last year, including advertising. 72

First-home buyer activity

How many first-home buyers entered the market in March 2024, compared to same time last year.

Overseas investment

Percentage of all properties sales recorded by triSearch.

Proportion of homes bought by foreign investors in March 2024

22 •

St Marys 22% 33%

Existing home owner First-home buyer 67% 78% 2023 2024 POSTCODESUBURB

NSW suburbs where the most property was bought in March 2024. 1 2765 Marsden Park 2 2259 Wyong 3 2145 Westmead 4 2570 Camden 5 2250 Gosford 6 2200 Bankstown 7 2155 Kellyville 8 2760 St Marys 9 2148 Blacktown 10 2770 Mount Druitt

3.23% 2.82% 2.2% 1.81% 1.03% 0.62% 0.54% 0.37% 0.35% 0.16% March 2023 80 70 60 50 DAYS March 2024

56

1. India 2. China 3. Nepal 4. New Zealand 5. United Kingdom 6. Vietnam

South Korea 8. Philippines 9. Indonesia 10. Pakistan

ount Druitt

7.

M

data dashboard

Melbourne shows why it’s the capital

VICTORIA

Leapfrogging Tarneit from last month, Melbourne, has taken top spot for the hottest suburb in March throughout the state of Victoria. A very timely statistic with the Formula 1 Grand Prix being hosted in the city throughout the month of March, home buyers are continuing to find reasons why living/buying in Melbourne just makes sense.

Tarneit drops a spot. A suburb known for it’s spacious and affordable living, it comes in second this month but still shows strong popularity among home buyers. Similar to its Wyong counterpart in NSW, Tarneit offers a reasonable commute to the CBD, potentially driving it’s consistent growth this year.

Missing from the list is the prestigious inner-city suburb of Hawthorn, which was the sixth hottest suburb the previous month. While rental demand hasn’t dipped in Hawthorn, property sales certainly have, with the lively postcode dropping off the list completely in March. This could be an indicator of prices outgrowing demand, with the median price growing 13.8 per cent over the past 12 months to $2.8 million

St Kilda Doncaster Chadstone

Listed in 2023’s hottest 100 suburbs, Morayfield, continues to heat up

QUEENSLAND

three. So, what is it about the Moreton Bay suburb that continues to impress home buyers?

Well, in 2023 it was nominated for realestate.com.au’s hottest 100 suburbs for it’s affordability, location, population growth and investment prospects. A large contributing factor to it’s consistent popularity is developments like Kinma Valley.

Kinma Valley is a community that finds the perfect blend of sprawling parklands, greenery and gardens with shops, schools and transport. The convenient location just 45 kilometres north of Brisbane CBD and 60 kilometres from the Sunshine Coast makes it a prime destination for people trying to get the best of both worlds. Surfers Paradise makes another remarkable appearance on the list of hottest suburbs, once again coming in at the middle of the table. However, a new suburb has cracked the list in March with Kelso – in seventh spot – listed for the first time in 2024.

Morayfield

AUSTRALIAN CONVEYANCER • 23

Disclaimers - The content provided in this publication is of a general nature and does not take into account future market conditions or your individual circumstances. You should exercise your own skill and judgment when considering investment decisions and seek professional advice where appropriate. While triSearch uses commercially reasonable efforts to ensure the content contained in this publication is current, triSearch does not warrant the accuracy, currency or completeness of the content and to the full extent permitted by law excludes all loss or damage howsoever arising (including through negligence) in connection with this publication.

POSTCODE SUBURB Hottest suburbs The Victorian suburbs where the most property was bought in March 2024. 1 3000 Melbourne 2 3029 Tarneit 3 3008 Docklands 4 3121 Richmond 5 3844 Traralgon 6 3280 Warrnambool 7 3030 Werribee 8 3500 Mildura 9 3030 Point Cook 10 3141 South Yarra POSTCODE SUBURB Hottest suburbs The Queensland suburbs where the most property was bought in March 2024. 1 4506 Morayfield 2 4113 Runcorn 3 4209 Pimpama 4 4217 Surfers Paradise 5 4702 Gracemere 6 4817 Kirwan 7 4815 Kelso 8 4510 Caboolture 9 4221 Palm Beach 10 4680 Clinton

Redcli e Melbourne

Brighton Caboolture

Brand positioning the toolbox

One of the most successful investors of the 20th century, Warren Buffett, said it takes 20 years to build a reputation and five minutes to ruin it. “If you think about that,” he cautioned, “you’ll do things differently.”

A strong brand is crucial for business success. Branding shows who you are, what you stand for, and how you’re different. It sets you apart from competitors.

For conveyancers, branding can be centred around things like services, price points, overall experience and location.

Brand positioning builds customer recognition, but it’s also important for other reasons.

MARKET DIFFERENTIATION

There are plenty of conveyancers around, but you need to show why your business is unique, why your services are better, and why you’re the obvious choice.

VALUE CONFIRMATION

A strong brand position establishes the value and quality of your services. It should make customers want to use you, no matter what.

EASY PURCHASE DECISIONS

Conveyancing may not be a widely known profession, so it’s a great opportunity to tell potential customers exactly what you do when it comes to guiding buyers through the settlement process. Property laws can be complicated and while customers can do it themselves, any mistakes or oversights can be costly. Show what you can do for customers and why choosing you early on will help achieve a successful transaction.

MAGNIFIED MESSAGING

A clear brand positioning statement can help you craft stories people relate to. Through your story, passion, and purpose for existing, customers can come to view you as the best choice. To build your brand position, HubSpot recommends these points:

Big idea: The core message that encapsulates why you exist, and makes you more identifiable to potential customers.

Value proposition:

Clearly articulate why customers should choose you over a competitor.

Target audience: Identify and understand who your target audience is and frame your messaging accordingly.

Mission statement: This action-oriented statement declares your purpose.

Tone of voice: The personality/tone your brand takes on in all communications.

Elevator pitch:

A short, memorable description of what you do and sell.

Customer touch points: Your brand’s points of customer contact from start to finish.

24 •

By LEIGH REINHOLD

By LEIGH REINHOLD

By RALPH GRAYDEN

By RALPH GRAYDEN