THE PRACTITIONER’S COMPANION

Governments rally to fill cracks in house crisis plan

Ifirst bought into the property market in the late ’80s, during Paul Keating’s “recession we had to have”, when home interest rates hovered around an eyewatering 18 per cent.

Although my wife and I were well-established in good jobs, I still wonder how we did it.

Even so, life seemed a lot simpler back then, and the Great Australian Dream of home ownership was a goal that most young couples aspired to. The reality was that in the ’80s, the average price of a home was three to four times that of the average household income. In 2025, the average house price is eight to 10 times the average income.

And as demand now far outstrips housing supply, one can only think that the gap will only ever become wider.

My family is going through what many are enduring all over the country right now. Our two sons, in their

early 20s and just starting work, have aspirations for owning a brick-and-mortar business but are daunted by the prospect. The “Bank of Mum and Dad” can only take them so far.

It may not be the complete panacea, but it’s a welcome relief to know that the federal and state governments are considering financial incentives to break the deadlock and alleviate the frustration families feel.

Every dollar counts in helping us wake from the Great Australian Housing Nightmare. In this month’s edition, The Australian Conveyancer tours the states and territories to check on the incentives and their terms.

In a somewhat related piece, we explore what some innovative minds have devised to make construction faster and more cost-effective.

Is the door to home ownership opening again?

TONY GILLIES, PUBLISHER

04THE TRUMP EFFECT To say his short time in the Oval Office has been unpredictable is an understatement. US President Donald Trump is rattling cages around the world with his America-first policies impacting economies around the globe. Australia is not immune, and we are feeling it.

08BUILDING THE DREAM

How industry observers, influencers and leaders view the cash incentives to firsthome buyers. Will it really ease the crisis?

14REACH FOR THE SKY Savvy agents and cashedup buyers are recognising the value of preserving a view and purchasing the rights to the airspace above neighbours’ rooftops.

WHAT DOES POWERED BY TRISEARCH REALLY MEAN?

The Australian Conveyancer goes to great lengths to preserve its editorial independence. It engages experienced editors, journalists, and freelancers not afraid to ask the difficult questions and report without fear or favour. It all happens in the spirit of balance, fairness and accuracy. We believe we owe that to the industry. The involvement of triSearch allows this privilege by providing the resources needed – the financial and technical infrastructure. There are no free kicks or unfair blocks. If it matters to the industry and if it promotes a constructive conversation, then we will report it.

Elsewhere in your Australian Conveyancer PROFILE

Lockdown was a life-changer for all of us, but lawyer Brian Fang used the experience of the early 2020s to move from a big practice to create his own thriving conveyancing business. Along the way, he discovered the sport of bouldering and runs a business for that, too, along with his brother. Page 14

It’s all about putting yourself out there and making a brilliant first impression. One of Australia’s best practitioners of social branding, Grazina Fechner, shares her thoughts on how to present your best self.

Page 24

We put Adelaide property under the microscope to reveal the hot suburbs and all the best prospects. Page 27

We reveal all the statistics that moved the needle across the country in the past month. We examine the economy, the Housing Accord targets, costs, and population growth.

Page 28

© Copyright 2023 triSearch Services Pty Ltd. triSearch and its licensors are the sole and exclusive owners of all rights, title and interest (including intellectual property rights) of this publication including all data, information, images, commentary and content (content). All rights reserved.

By JACOB SHTEYMAN in Canberra

Arecent jump in the unemployment rate took most economists by surprise, but not the Reserve Bank, its governor says.

Tightness in the labour market was a key concern for Australia’s central bank, standing in the way of further rate cuts, but conditions were easing in line with expectations, Michele Bullock said in a speech to the Anika Foundation on July 24.

Recent figures released by the Australian Bureau of Statistics showed joblessness surged from 4.1 per cent to 4.3 per cent in June, despite a consensus of economists predicting the rate to remain unchanged.

“Some of the coverage of the latest data suggested this was a shock - but the outcome for the June quarter was in line with the forecast we released in May,” Ms Bullock said.

“That on its own suggests that the labour market moved a little further towards balance, as we were anticipating.”

Uncertainty remains over the RBA’s estimate of full employment, being its estimate of the lowest rate of unemployment that can be achieved without contributing to inflation.

The bank estimates this figure is around 4.5 per cent, meaning the labour market would still be out of balance even after the recent jump.

But in its May economic update, the RBA noted labour market conditions could be less tight than previously thought.

“The low rate of job switching may imply less upward pressure on wage growth than otherwise,” Ms Bullock said.

“Nevertheless, the risks we highlighted in May remain.”

Bullock reiterated that the RBA’s gradual monetary tightening in recent years was aimed at getting inflation under control without causing unemployment to rise excessively.

While not a major driver of inflation, a post-pandemic surge of international students did contribute to rents spiking, a report published by RBA researchers found recently.

Large swings in foreign student numbers, such as during the COVID-19 pandemic, have a powerful effect on sectors such as housing, where supply is constrained.

The international student population jumped from 357,919 in 2022 to 608,262 at the end of the 2024 financial year, following a drop in enrolments during the pandemic, according to research from conservative think tank the Institute of Public Affairs.

As a “back-of-the-envelope” metric, every 100,000 additional international students in Australia would increase rents by 0.5 per cent compared to the counterfactual, the RBA study said.

That meant rents grew about 1.25 per cent faster than they otherwise would have if the international student population had not grown by 250,000 from 2022 to 2024.

The effect might have been greater than that, given the especially tight rental market during that period, with the vacancy hitting a record low of 0.7 per cent in February 2024, according to Domain.

But it’s still a drop in the bucket compared to the overall growth in rents, which have jumped more than 40 per cent in the past five years to reach a national average of $665 per week, according to property research firm Cotality.

The RBA report found the rise in international students likely only accounted for “a small share of the rise in rents since the onset of the pandemic, with much of the rise in advertised rents occurring before borders were reopened”.

“The increase in international students was just one of many other forces at play in this time that drove demand above supply in the economy, and hence higher inflation,” the authors said.

“For instance, supply-side factors were the biggest driver of the increase in inflation in 2022 and 2023, while strong domestic demand arising from supportive fiscal and monetary policy also played an important role.” n

President Donald J Trump.

Washington versus the world

Despite the ASX closing the financial year 10 per cent higher, it’s been a rough past few months for investors and business decision-makers.

Ongoing conflict between Russia and Ukraine, Gaza, and the 12-day shootout between Israel, Iran and the US seemed at times to have the world on the brink of a third World War.

The domestic and global disruption generated by Donald Trump created global uncertainty on tariffs, travel, supply chains, military alliances, defence spending, aid programs, the environment, scientific research, health – and plenty more.

When we think we have it all figured out, things change, often daily: delayed, deferred, or quietly shelved.

In this Special Report, Australian Conveyancer looks at how the new world order is shaping to affect Australia – especially for investment, the property industry, and the work of conveyancers.

By RICHARD CUNNINGHAM

Leading economists consulted by Australian Conveyancer agree that current geopolitical uncertainty should have minimal or at least manageable effects on the Australian property market, with some important caveats.

First among those concerns is plain, old-fashioned fear.

Dr Keith Suter, managing director of the think tank Global Directions, believes Australians are apprehensive about the abrupt shifts evident in Washington.

“There are a lot of people who have fears of what Donald Trump is about,” Suter says.

“That might make people more nervous about spending, because they don’t know what Trump’s got around the corner.”

Eliza Owen, Head of Research Australia at Cotality (formerly CoreLogic) agrees. “The biggest impact we’ve seen from Trump tariff uncertainty so far is to consumer sentiment,” she says.

The Westpac-Melbourne Institute index fell 6 per cent in April, to a six-month low. It has since nudged ahead, but the overall mood remains one of “risk aversion”.

Owen says consumer sentiment is closely correlated to real estate sales volumes.

“People want to feel good about their employment status, finances, and the state of the economy before committing to big transactions,” she says.

“When consumer sentiment is low and uncertainty high, that’s generally not good for real estate sales or investment generally.”

Americans are also nervous. The US gross domestic product (GDP) declined 0.5 per cent in the first quarter compared to a 2.4 per cent increase in the last quarter of 2024. The reasons include a downturn in consumer spending.

Second is the risk that Trump’s tariffs could see higher inflation in the US, leading to higher official interest rates as a countermeasure.

Michael Yardney, founder of Metropole Property Strategists, says it’s something our Reserve Bank will be keeping an eye on.

“If Trump reintroduces aggressive tariff policies, that could stoke inflation in the US by raising the cost of imported goods,” he says.

“In response, the US Federal Reserve might keep interest rates higher for longer, which could

put upward pressure on global bond yields, including in Australia.

“While the RBA sets rates locally, international capital flows and currency volatility are part of their broader considerations.”

We might have seen evidence of the RBA’s caution with its July decision to keep our official rate on hold at 3.85 per cent.

Third, there is the spectre of a trade war between the US and China leading to a recession in one or both countries.

Suter says that blanket tariffs could lead to a significant slowdown in global trade. “My big worry is Trump triggering a global recession,” he adds.

Michael Yardney feels that if either the US or China falters, Australia could see reduced export demand and weaker business confidence.

“That said, history shows that Australia is surprisingly resilient,” he says. “We avoided a recession during the GFC while the US and Europe stumbled.”

Those concerns aside, experts agree global uncertainty often has a positive effect on real estate, with bricks and mortar seen as a safer alternative to stocks.

“Historically, investors have turned to real estate as a store of value when equity markets get rattled,” Yardney says.

“While Trump’s trade and economic policies could create global headwinds, I don’t believe they will derail Australia’s property market.”

Suter agrees, saying more foreign investors could be attracted Down Under. “We’re obviously a safe, politically stable area.”

Eliza Owen also concurs. “We could see people revert more to Australia’s residential market because it’s perceived as a good growth asset,” she says.

“It’s delivered strong returns over time, within a country that has more political stability and rule of law.”

“And so that might be attractive for foreign investors who want to buy into something as safe as houses in an uncertain era.” n

By RICHARD CUNNINGHAM

It’s not just Australian property transactions that might be affected by Trump 2.0. We are the world’s 12th-largest economy and a key player in global affairs, especially in the Asia-Pacific region.

So when the US president whips out his black Sharpie, it pays to be looking over his shoulder. Here are some of the areas commanding our attention:

A survey of 39 experts by the Economic Society of Australia found that among the most certain outcomes of the Trump Presidency were high US inflation (expected by 71 per cent of respondents), weaker Chinese growth (66 per cent) and weaker Australian growth (58 per cent).

Other outcomes included weaker US economic growth and higher US interest rates (as a counter to high inflation), each expected by 32 per cent.

The ESA panel thought higher US inflation could be mirrored in Australia, and that higher tariffs on Chinese imports could depress China’s growth and its demand for Australian resources.

Australia’s strategic alliances with the US, including AUKUS, are seen by most analysts as unlikely to change.

However, Trump has demanded that Australia increase its defence spending to 3.5 per cent of GDP, an additional $40 billion a year.

We currently spend about 2 per cent of GDP, with plans to increase it to 2.33 per cent over the next eight years.

The US argument cites what it calls a “real and potentially imminent” threat from China.

But China is also Australia’s biggest economic partner, with two-way trade of $325 billion. A trade war between the US and China could see us doing more business with Beijing.

Australia’s challenge is to find common ground with the US on key issues while promoting our own interests. We supported the US attacks on Iran’s nuclear facilities, but called for “diplomacy, dialogue and de-escalation”.

Prime Minister Anthony Albanese’s planned first meeting with Trump at the G7 was cancelled amid the Iran crisis, with the next chance said to be India in early September.

However, Foreign Minister Penny Wong met US

Secretary of State Marco Rubio in Washington on July 1, with the US hailing the opportunity to “deepen cooperation through the US-Australia Alliance to enhance security in the Indo-Pacific”.

One topic not discussed was relations between the White House and Australian Ambassador Kevin Rudd, who once described Trump as “a traitor to the West”.

Trump responded by saying Rudd was “not the brightest bulb”. Wong settled for calling Trump “a pretty robust individual” and Rudd an “outstanding ambassador”.

Travel to the US has slumped. Australian visitors were down 7 per cent in the year to March. Germany was down 28 per cent, Spain 25 per cent, the UK 18 per cent, and South Korea 15 per cent. In total, inbound tourism was down 11.6 per cent.

“We’re hearing more and more people don’t want to go through passport control,” Flight Centre chief executive Graham Turner said at the time.

Reasons include aggressive border tactics. Travellers have had digital devices checked without good reason, and some have been refused entry for having anti-Trump posts or joke memes.

Others have been arrested, detained, and deported. Australian writer Alistair Kitchen was booted after being questioned about his views on Israel-Gaza.

Trump has threatened a 200 per cent tariff on pharmaceutical imports, a trade currently worth about $2.2 billion a year to Australia. Avoiding or easing the tax would mean shifting production to the US or weakening our Pharmaceutical Benefits Scheme (PBS). Canberra, so far, has said the PBS is “not on the table”.

The Trump administration also announced

savage cuts to its public health, including Medicaid, the Centers for Disease Control, and the National Institutes of Health. The NIH is the world’s largest public funder of biomedical research, and the plan to trim its budget by $AUD6.4 billion sent a chill through several Australian laboratories.

Some researchers here depend entirely on US grants for work of global significance.

Trump also announced plans to quit the World Health Organisation (WHO) and freeze USAID funding. Those agencies are a lifeline for millions of people, especially in Africa and the Asia-Pacific region, fighting diseases like HIV, TB, malaria, polio, and managing outbreaks of Ebola and COVID-19.

USAID had a budget of US$50 billion, while the US was WHO’s biggest state donor, contributing up to 18 per cent of its funding.

Australia has pledged $100 million to WHO from 2023-27. It might be that we, and other nations, will be asked to contribute more to make up the US shortfall.

Thanks to Australian tax breaks and other financial incentives, plus modern studios, a skilled workforce, an agreeable climate and spectacular locations, Hollywood spends almost $1 billion a year making movies here.

But on May 5, Trump foreshadowed a 100 per cent tariff on foreign-made movies, declaring “WE WANT MOVIES MADE IN AMERICA, AGAIN!” But modern movies are filmed and produced all over the world.

As the BBC remarked, “What could it mean for the next James Bond movie, a franchise now owned by US giant Amazon, but based on an iconic British character who works for MI6, based in London?”

The threat, for now, however, appears to have faded to black. n

BY LEWIS PANTHER

Tackling Australia’s housing crisis is the reason Prime Minister Anthony Albanese launched Labor’s ambitious plan to build 1.2 million homes by 2029.

The Housing Accord, as it is known, has just passed its first anniversary.

It is part of a broader agenda to offer funding for social and affordable housing, as well as extra support to renters and home buyers.

Federal funding of up to $3.5 billion will be shared across states, territories and local governments as part of the initiative to build the new homes.

There is also a one-off $2 billion allocated to incentivise states and territories to increase the stock of social housing.

While the Accord has been roundly welcomed, the plans have not been without problems, especially concerning supply-side issues.

Many economists and housing industry commentators see the 1.2 million target as unachievable.

High construction costs – which have remained an issue since the COVID-19 pandemic – a lack of skilled tradies and a restrictive planning process are major roadblocks, they say.

Master Builders Australia and the Housing Industry Association have both suggested a shortfall that will result in fewer than 1 million homes being built.

The National Housing Supply and Affordability Council – an independent government advice body – warned the Accord would fall short of its goal by about 300,000 dwellings.

The Property Council has gone even further, saying the government would need to build a further 462,000 homes to meet its 2029 target.

Even Treasury let slip some home truths in documents leaked to the ABC.

It said the federal government’s promise to

build 1.2 million homes by 2029 “will not be met” and called for “additional revenue and spending reductions” to achieve a sustainable budget.

Treasurer Jim Chalmers was unruffled by the revelations, saying it was better to have ambitious plans.

Three state budgets handed down last month in SW, Queensland and the ACT offered a $1.3 billion solution to some of the problems.

Stamp duty relief, land tax discounts, support for apprenticeships, shared equity schemes and cutting planning red tape are among the measures that the federal and state governments have unveiled to tackle a problem they admit has been decades in the making.

But will it be enough?

In the following pages, Australian Conveyancer gets the thoughts of industry experts on the issue.

Property Council backs government initiatives

Buyers agents urge housing stock boost

Incentives a ‘short-live’ fix for property market

What each state is offering

PAGE 10

PAGE 11

PAGE 12

PAGE 13

By SAM McKEITH

Australia’s property industry peak body has backed the recently announced state housing initiatives as a promising response to supply barriers in the nation’s real estate market

The Australian Property Council said the raft of initiatives unveiled in recent state government budgets represented a “mix of practical incentives and systemic reforms”.

“They’re mostly positive – where they support delivery and investment confidence,” chief executive Mike Zorbas told AC.

He said the initiatives may help ease the nation’s housing crisis, but “only where they’re scalable, targeted and address the root causes of undersupply”.

“The best policies are those that unblock stuck projects, reduce red tape, and encourage capital to flow into housing delivery at scale,” Zorbas added.

“More supply is best, he said. “Demand-side stimuli should only be used where a market is genuinely becalmed in a way that might cause that state to permanently lose market capacity or large numbers of skilled workers. They’re rarely needed outside of global shocks.”

Looking state-by-state, Zorbas said NSW’s Pre-Sale Finance Guarantee, Queensland’s Boost to Buy scheme, and Western Australia’s skilled migration incentives were leading examples of recent policies.

NSW stood out for its world-first pre-sale scheme, he said, describing it as “a bold move that helps projects bring investors and banks on board”. Queensland’s reinstatement of its Property Consultative Committee and its foreign investor surcharge review also deserved credit.

The West Australian government deserved “recognition for its workforce strategy, now backed by real funding and incentives,”

Zorba said. However, there were also missed opportunities, he added, pointing in particular to Victoria, where rising property taxes and institutional investor deterrents continued to weigh on activity.

“Victoria is going in the wrong direction,” the chief executive said. “Property taxes now make up almost half of state budget revenue, two new taxes are evolving this year, and foreign investor taxes alone have driven away tens of thousands of homes.”

Zorbas urged further state and federal action on the housing crisis by getting rid of

By SAM McKEITH

Buyer’s agents say new state-based property incentives are a step in the right direction to address the nation’s housing crisis, but are calling for urgent action to fasttrack housing supply.

The Real Estate Buyers Agents Association of Australia (REBAA) welcomed the state-based initiatives, which it said aimed to make it easier for “genuine buyers” to enter the market.

However, REBAA president Melinda Jennison said it was unclear how the schemes would fit into efforts to boost housing supply –an “absolutely essential” priority at present. “The real impact of these schemes will come down to how well the supply side is delivered,” she told AC.

“The real impact of these schemes will come down to how well the supply side is delivered.”

“If we don’t see enough new housing coming to market, there’s a real risk that competition will intensify and prices will continue to rise.

MELINDA JENNISON

To be affective, the measures needed “to be backed by meaningful planning reform, timely land releases, and a clear commitment to getting more housing built,” she said.

Schemes that cut deposit hurdles or offered shared equity with governments could be positive for low-income earners and first-home buyers, but did have drawbacks, she said.

She warned such initiatives also acted as a demand-side stimulus and could push up prices in already supply-squeezed capital city markets such as Perth, Adelaide and Brisbane.

“They can unintentionally increase the risk

“self-harming” taxes on overseas institutional investment and making changes to ASIC guidelines that discourage super funds from housing. He also called for more national coordination on skilled migration pathways and workforce training.

“Particularly in Western Australia and regional areas, we simply don’t have the people to build what’s needed,” Zorbas said.

His comments follow the council’s June survey with Procore Technologies that showed steady property industry confidence, and called for decisive government action on planning

of price inflation, driving up median values and making property less affordable,” Jennison said.

NSW’s presale finance guarantee was one recently announced scheme that showed a positive shift towards supporting developer confidence and accelerating housing delivery to help bring on the supply of new housing, she said.

Also noteworthy was Victoria’s stampduty concession on offtheplan apartments and similar programs in Western Australia, aimed to shift demand towards boosting the supply of much-needed new dwellings.

The comments came after the schemes, recently rolled out in a bid to help cashstrapped buyers get a foot on the property ladder, prompted some buyer’s agents to raise concerns of distorted auction bidding and upward pressure on prices.

Jarrad McCabe, director of Wakelin Property Advisory, said in June that some grants impacted auction activity and prompted buyers to “stop dead” at a grant threshold.

In his view, grant-assisted home buyers stopped bidding at the top of a scheme’s range, while investors knew there was better value just above the limit due to less competition.

REBAA’s Jennison said there was “definitely some merit” to the view that buyer activity shifted around grant thresholds.

It happens “particularly when those incentives are significant,” she said. “In our experience, this doesn’t mean the market ‘stops dead’ but rather that buyer interest becomes much more price-sensitive around those cut-off points.” n

reform, productivity, and investment certainty.

The survey of 581 property professionals highlighted rising concern over sluggish planning systems, tax and investment settings that deterred capital. It also flagged a need for productivity-boosting reforms to accelerate housing and infrastructure delivery.

Zorbas said feasibility, planning and workforce were the big challenges for members at present.

“Even shovel-ready projects can’t move without timely approvals and enabling infrastructure,” he said.

By SAM McKEITH

New state government housing incentives will fuel a temporary pick-up in firsthome buyer activity without delivering a long-term fix to the housing crisis, according to expert opinion.

Economist Cameron Kusher, a former senior analyst with both CoreLogic and REA Group, said the state government schemes were mostly demand-side measures, and pointed to the likes of those announced in Queensland and Tasmania.

He said those types of incentives would probably put upward pressure on house prices, making the market less affordable in the long term.

“There’s been a long history over the last 25 years of grants, schemes, and initiatives to help first-home buyers,” the Kusher Consulting director told AC. “They do lead to, generally, a lift in first-home buyer volumes [but] it’s usually pretty short-lived.

“What we also know that they tend to do is push prices higher,” he added.

“You get this situation whereby you help somebody get into the market, but then you have to keep creating bigger and larger incentives for first-time buyers because the prices have gone up, and what you previously had doesn’t cut it anymore.”

Kusher said that evidence from decades of government incentives to help first-home buyers showed that they had failed to deliver lasting results on housing affordability, which continued to worsen.

a function of it being too expensive.”

In the case of Tasmania and Queensland, Kusher took aim at initiatives where buyers could get into the market with 2 per cent equity in a purchase.

The federal government has also acted in this area. Under its Home Guarantee Scheme, a key pledge made in the lead-up to the May election, in which housing was a major issue, Housing Australia guarantees lenders, so home buyers only need a 2 or 5 per cent deposit.

“If government is equity partners in these property purchases, then where’s their incentive to make housing more affordable?”

CAMERON KUSHER

While they lifted “home ownership levels or first-home-buyer activity for a short period of time it’s not addressing the problem that homeownership rates continue to fall, and that’s really

“I feel like it’s kind of a slippery slope,” the economist said, adding that such shared equity schemes led to problems in the market that would be difficult to unwind.

One issue, he said, was buyers getting on the property ladder with less and less equity.

Another risk stemmed from the government’s increasing direct role in the market.

“If the government is an equity partner in these property purchases, then where’s its incentive to make housing more affordable?”

Kusher asked. “Property prices would now actually head to the government, because they’ve invested in these companies, they’ve got the LMI

[lender’s mortgage insurance] on it.”

Kusher highlighted NSW’s Pre-Sale Finance Guarantee scheme, which aims to boost housing construction and address the state’s housing crisis, as a step in the right direction.

Under the scheme, the state acts as guarantor for up to 50 per cent of approved housing projects, allowing developers to begin construction. It will guarantee residential presales for up to $1 billion of housing projects at a time through a revolving fund, the government has said.

Kusher was upbeat on the scheme, saying, “What they’re proposing to do will certainly help more housing stock be delivered, and ultimately, that’s what we want.

“The pre-sale guarantee is going to see stock move. So, in the short term, it’s certainly going to help with developers that are struggling to get pre-sales.

“As a result, it will mean that projects get out of the ground quicker, and we start building sooner, which is ultimately what we need.”

WE HAVE seen a boatload of state budgets featuring efforts to boost new home construction and help to get young buyers into those homes.

Here’s a quick look at some of what’s on offer:

NSW

n $1 billion Pre-Sale Finance Guarantee to help developers secure funding for new projects. The state will act as guarantor on up to 50 per cent of pre-sales.

n Extension of the 50 per cent land tax discount for owners of buildings with at least 50 rental dwellings.

VIC

n Last year’s temporary cut in stamp duty for new off-the-plan apartments, units and townhouses is to be extended to October 2026.

n Boost to Buy scheme in which the government takes 30 per cent equity in new builds and 25 per cent in existing homes up to $1 million in value. First-home buyers could need just 2 per cent deposit. Capped at 1000 spots, for individuals earning up to $150,000 and couples earning up to $225,000.

SA

n $405 million to help deliver existing housing projects, plus $135 million to be spent on social housing.

WA

n $1.4 billion to boost housing supply, including stamp duty relief for first-home buyers, plus shared equity loans for new apartments, townhouses and modular homes.

TAS

n Stamp duty axed for first-home buyers on homes valued up to $750,000. Continuation of the 2-per-cent-deposit MyHome shared equity program, with increased income limits.

Brian’s perfect life balance

By LEWIS PANTHER

When Brian Fang quit his associate position at Dentons, it was to pursue a career change and set up a new business venture. It was good that he had solid contingency plans, however, as just a month later, Sydney was hit by COVID-19 lockdowns.

Now his firm, S&B Legal, is thriving, with a team of 10 conducting conveyancing transactions across all states. >>

FROM PAGE 15

The ambitious young professional shared his thoughts on the sector with Australian Conveyancer, highlighting key lessons, including how Sydney’s unaffordability has boosted interstate business, the role of technology in saving time, and the consequences of cyber scams.

“It’s the strong personal relationships that have been crucial,” Fang said.

“We need human interaction, especially when you’re dealing with large sums of money.

“When the average price is over $1 million, anyone committing themselves to that may want reassurance from another person.”

Recalling how a friend in real estate helped him on the conveyancing business journey when COVID hit, he said: “Thankfully, I had already completed all my certifications to open a practice, and so I jumped on the opportunity to start S&B Legal.”

After eight months, Fang hired his first paralegal, who is still at the firm, which now has four solicitors, two conveyancers and three paralegals.

Interstate demand drove buyers to the business during COVID as Sydneysiders left the city in search of affordable homes and the lifestyle changes that Fang had toyed with.

“Clients were purchasing houses interstate with $500,000, whereas in Sydney, you’d struggle to get an apartment close to the CBD [at that price],” he said

“Many had trouble finding a relevant solicitor in NSW to assist them with their matters in Queensland.”

Drawing on his corporate experience and legal qualifications, Fang was able to offer multijurisdictional services. Though progress wasn’t without challenges.

“Each state has its own regulatory nuances, which can be complex,” he explained.

“To manage the differences, we have checklists and legal precedents tailored to each jurisdiction.”

Speaking about the way processes vary widely between states, Fang noted that standard contracts in NSW could be upwards of 50 pages, whereas in Queensland, contracts are typically 16 pages. This is something that is set to change under the new Seller Disclosure regime.

“We need human interaction, especially when clients are handling funds from what yould likley be one of their largest purchases or sales in their lifetimes.”

BRIAN FANG

Brian Fang: climbing new heights in business.

Adapting to different working styles has been key, Fang said, adding: “Some conveyancers have worked in one jurisdiction for decades and expect deals to be handled in a specific way. We take the time to build credibility in each state by engaging with professionals on the ground.”

Building relationships is crucial, even though e-conveyancing has removed the barriers of physical transactions.

“Those on-the-ground connections pay off,”

Fang said. Looking ahead, he says AI will reshape conveyancing, but he believed it would be no replacement for human expertise.

“AI-assisted contract review is on the horizon … but it doesn’t replace professional judgment,” Fang said.

“We need human interaction, especially when clients are handling funds from what would likely be one of their largest purchases or sales in their lifetimes.”

By RICHARD CUNNINGHAM

When I joined triSearch a few months ago, I was told I’d be working for a SaaS company.

I immediately thought of SAAS, the Aussie car accessory company that makes those sporty vintage steering wheels with timber rims and alloy spokes.

In my rev-head youth, a SAAS wheel (and GT stripes) was guaranteed to turn any old bomb into a Le Mans racer. In our dreams, anyway.

How cool. But no … SaaS stands for Software as a Service. And so began a crash course in conveyancing and property acronyms and abbreviations.

AML, CTF, APRA, ASIC, AUSTRAC and PEXA soon became part of office discussions.

ELNO brought Elmo the Muppet to mind, but it stood for Electronic Lodgement Network Operator. I got that from the ARNECC (Australian Registrars’ National Electronic Conveyancing Council) website.

Pretty soon, I was throwing around MOR (Model Operating Requirements), MPR (Model Participation Rules), HLRV (Historical Land Records Viewer), and LRS (Land Registry Services) like a pro.

Then the work veered into real estate, and chats with the REIA (Real Estate Institute of Australia) and state bodies like REINSW, REIV, REIQ, REIWA, REISA and REIT.

CAPEX and CGT I knew, but a friendly CPV (Certified Practising Valuer) put me straight on LMI (Lender’s Mortgage Insurance), LVR (Loanto-Value Ratio) and EPR (Estimated Price Range).

A price that might be improved by OSP (Off-Street Parking), possibly in a LUG or SLUG (Single Lock-Up Garage). Perhaps with BIC (BuiltIn Cupboards).

Others include GRM (Gross Rent Multiplier) RTO (Rent To Own) IRR (Internal Rate of Return) DTI (Debt To Income Ratio) and LTV (Loan To Value). I guess those last two are important if you’re using OPM (Other People’s Money.)

The Big Daddy in real estate seems to be the FRCGWTCC (Foreign Resident Capital Gains Withholding Tax Clearance Certificate).

I hope I never need one, but I am sure there are many others. I’ll get onto them ASAP. n

The sky’s the limit when preserving your view

They say a picture is worth a thousand words. A view from the family home’s rooftop could be worth many thousands of dollars. According to one valuer, Australian agents should take a leaf out the books of their overseas counterparts and prosecute the worth of the space otherwise used to hide air conditioning units and basic utilities. LEIGH REINHOLD REPORTS

By LEIGH REINHOLD

Airspace entrepreneur Warren Livesey believes strata owners in our big cities should be looking skywards to reap the rewards their unutilised rooftop spaces can bring.

“Here in Australia we only use two per cent of our existing rooftops,” says Livesey, a property accountant, who saw the potential of airspace while selling it in Europe and the USA.

“And yet we have some of the most expensive real estate and some of the best weather… it doesn’t make sense. In Europe they have developed nearly 70 per cent of their rooftops.”

Airspace development is increasingly seen in the world’s highest density cities – like Paris and Tokyo, New York and Melbourne – as a solution to housing shortages, population growth and urban sprawl.

In London, where building up will satisfy 42 per cent of the city’s existing housing requirements, the value of the capital’s combined airspace is around £50 billion, while in Sydney the sector is estimated to be worth $150 billion.

“Airspace development is the fastest growing and most sustainable housing in what’s called ‘urban infill solution’ across Europe, the UK and the northern part of America,” says Livesey, founder of the Association of Rooftop & Airspace Development.

In NSW, as part of its attempts to address the housing crisis and increase density in urban areas, the government has opened up the airspace for strata buildings and other government and council-owned structures.

Announcing its $25 billion rooftop housing initiative earlier this year as part of the Low and Mid Rise (LMR) Reforms, the government earmarked around 220,000 existing buildings suitable for airspace development.

“The homes built under these reforms will be close to transport, open spaces and services that people need, creating better connected and more liveable neighbourhoods by making the most of existing critical infrastructure,” says NSW Premier Chris Minns.

Having now completed 77 rooftop conversions in Australia, mainly in Sydney’s affluent Eastern Suburbs, Livesey says that between 20-30 per cent of the current DAs lodged at Waverley Council are for rooftop conversions.

“It has become very popular because we simply need more houses,” says Livesey, who estimates there are around 30 million square metres of unused roof space in Sydney’s urban areas that could be used for housing.

Depending on where a building is located, owners can expect to command between $2,500 and $10,000 per square metre for their airspace,

CONTINUED PAGE 22

Heaven’s above: making the most of space around you

n US President Donald Trump bought the airspace of seven buildings surrounding his Trump World Tower – including above the Tiffany flagship store – to secure unobstructed NYC views.

n Australia’s most extensive air-rights development is The Glen in Melbourne’s south-east, with a $450 million three-tower luxury residential complex.

n The City of Sydney’s Heritage Floor Space Scheme allows owners of heritage buildings to earn and sell “air rights” (technically called heritage floor space). The rights can be sold to developers, who use them to increase the permitted size of new buildings in the CBD, often exceeding standard planning controls.

with the average strata rooftop measuring around 300sqm.

“The most common airspace development adds an extra one or two storeys to the existing building,” says Livesey. “The alternative is to knock it down and rebuild and we can’t be knocking down and sending everything to the tip.

“So airspace development is essentially trying to preserve our existing buildings but still add to density. It’s finding a sustainable way of building new homes.”

In its recent nine-point Sustainable Housing Plan, The Property Council of Australia highlights airspace development as a pivotal strategy for delivering green, efficient housing and maximising the use of urban land.

“The Property Council of Australia remains dedicated to championing innovative solutions like airspace development and modular housing to address the evolving needs of the Australian property market and create sustainable, vibrant communities nationwide,” says the council.

Apart from its green credentials, airspace development has other advantages for strata owners.

“It’s a quicker build because it’s modular,” says Livesey, who owns Buy Airspace, a leader in the sector. “The amount of time onsite is weeks – not months – because most of it has already been constructed offsite.

“The builders mostly use prefab panels made from cross laminated timber – it’s the most sustainable product, better for fire protection, lighter than concrete and stronger than steel.”

In NSW, legislation allows strata owners to sell airspace with 75 per cent agreement of owners while Victoria requires unanimous consent or tribunal approval for similar projects.

Livesey says the idea of selling their airspace rights is attractive to strata owners because many are living in ageing buildings requiring remediation work and fire upgrades that would usually entail expensive special levies. Airspace development therefore can be a convenient capital raising tactic for owners corporations.

“The strata owners are asset rich and money poor and they need the finances to carry out the work,” says Livesey who facilitates the deal between his clients - usually cashed-up downsizers - and a developer, who is responsible for the entire project.

“The owners don’t put any money into the project and they are financially compensated for selling their airspace.

“So basically it’s a joint venture, where the owners don’t have the time, the experience or the money, and that’s what the developer provides, the time, the experience and the money.” n

The low-rise development at 165 Bondi Road, Bondi has made the most of rooftop space available to create additional living areas.

By LEWIS PANTHER

Former Sydney Swans AFL president Peter Weinert’s purchase of the undeveloped airspace above a neighbouring apartment shines a spotlight on the value of thin air.

The businessman purchased the rights to preserve his harbour views and privacy — a tactic more typical of commercial real estate than suburban housing. But this strategy is now poised to become a lot more common amid NSW’s new planning reforms.

The development in this case is limited to four storeys, but could have risen to six or eight under the Minns government’s new density rules.

Planning documents show a vertical subdivision and caveat restrict the height, protecting Weinert’s outlook.

Such deals – potentially worth $10–$20 million in premium suburbs – are expected to rise in affluent areas like Sydney’s east.

“This is something we’re going to see more of,” said REINSW president Thomas McGlynn.

But critics argue they won’t help ease the housing crisis. “You’ve got to be uniquely wealthy,” said UDIA’s Stuart Ayres. “No one’s buying airspace in St Marys.”

As higher-density housing spreads across Sydney, the air above may become real estate’s newest frontier — for those who can afford it.

With grandstand views of Tamarama Beach in Sydney’s eastern suburbs, this formerly rundown block of eight units was in need of comprehensive repairs and rejuvenation.

In a strategic subdivision to raise the funds, the existing owners of the top floor units secured the roof space to construct two additional bedrooms, a bathroom, and a balcony, enhancing their living space and views. The ground floor units also benefited from new garages and gardens as well as a financial incentive.

Once known as one of eastern Sydney’s ugliest buildings with the world’s best views, this 78-apartment complex, designed by Harry Seidler in the 1960s, was riddled with concrete cancer, under two fire orders, and requiring $50 million to fund its renovation and refurbishment.

Securing strata finance, the owners corporation was able to construct two spectacular penthouses on top of the seven storey building, the sale of which significantly helped fund the rest of the building’s remediation, including new balconies and underground parking for all 78 units. Meanwhile the capital value of each property has gone through the roof.

By building up into the roof and building down into the basement, the owners of this dated four-unit block in Tamarama effectively doubled the building’s capacity, adding eight new bedrooms and extra living space, new balconies and four new bathrooms. Improving the quality of life for the occupants, the renovations also significantly improved the market value of each apartment.

When it comes to your personal brand, authenticity is key. Branding expert Grazina Fechner shares her insights on how to stand out, succeed and be a “dopamine” dealer.

Tell me: you’ve got just 15 seconds

Front

and Centre’s personal brand expert Grazina Fechner.

By MELISSA IARIA

First impressions count, but you have just seconds to make that impact positive. To persuade people to engage with you – no matter who they are – you need to have them at “hello,” according to branding expert Grazina Fechner.

Fechner, a communication coach from Front and Centre Training Solutions, addressed over 100 conveyancing professionals at the Beyond Conveyancing forum in Melbourne earlier this month.

“Every type of behaviour is on the other end of your phone or in your office at any one time,” she says. “We have 15 to 30 seconds for someone to decide if they want to listen to you or not.

“It doesn’t matter how great you are at questioning capabilities or handling people’s concerns and objections, because if you don’t get them at ‘hello’, you don’t even need to worry about questions – they’ve gone.”

The key is to personalise interactions and consider how the other person would like to be treated.

“Keep it simple,” Fechner says. “People love talking about themselves so ask questions about them. Be solution-focused. Stay friendly but professional. You can be friendly with just your tone.”

Making it easy to work with you and using simple language goes a long way to making interactions positive and engaging, she says.

The “rule of three” concept suggests the brain can remember three pieces of information per interaction, so the simpler the message, the greater the chance it will be understood and acted upon.

Follow up is also critical, but “not in a pesty way”. It should ensure that the customer has all the necessary information and no further questions.

Fechner says this approach helps build trusted relationships.

Withholding judgment is also to your benefit, Fechner adds. It’s said that within seven seconds of meeting, people will form around 11 judgments of you. But asking questions instead can help you better understand and deliver for your customers.

“I encourage you, no matter what, to ask questions to understand someone’s world – their needs, wants, what motivates them, what delights them,” Fechner says.

“Once you know that, you can deliver your service to motivate them and have them know they’re safe in your hands.

“Until you understand someone’s world, you cannot personalise your service and interaction. So, I encourage you not to judge and start asking lots of questions.”

Fechner invites conveyancers to consider how they make people feel during each interaction,

>>

and suggests two objectives: what do you want them to know, and how do you want them to feel?

“If you don’t have the answer to that, that’s where you are going wrong a lot of the time. People remember feelings. They don’t always remember what you said,” she says.

Taking advantage of the dopamine effect – the feel-good chemicals released by the body during enjoyable experiences – can make interactions more memorable and motivate customers to return.

“If you create a good feeling and engagement with people, it will create dopamine in their brain. No matter what they’re thinking about, if you have given them dopamine, they will remember you in a heartbeat,” Fechner says.

“Don’t underestimate the importance of dealing dopamine. It’s free, it’s legal. People won’t forget the feeling of how you have helped them, sorted them out, fixed them, answered their questions, and engaged with them on a level that makes them become emotional.

“And when you have an emotional connection and buy-in, that’s when your whole world will change.”

Finally, Fechner says trust is integral to your personal brand, and confidence is the key to earning that trust.

“People will stick with you if they trust you. How long does it take to build trust? A really long time. How long does it take to break trust? As quick as that,” she says.

The more confidently you present yourself, the more likely people will trust you. Body language

– particularly power poses, such as standing tall –can boost self-esteem and reduce stress.

“Confidence is the key to your success in branding, in social media, in conversation, in everything you do. The more confidence you ooze, the more people will trust you, the more they’ll buy in, and the more they’ll want to hang out with you,” Fechner says.

“What’s as important as all of that is people won’t always remember what you said, but they will absolutely, unequivocally, always remember the way you made them feel.” n

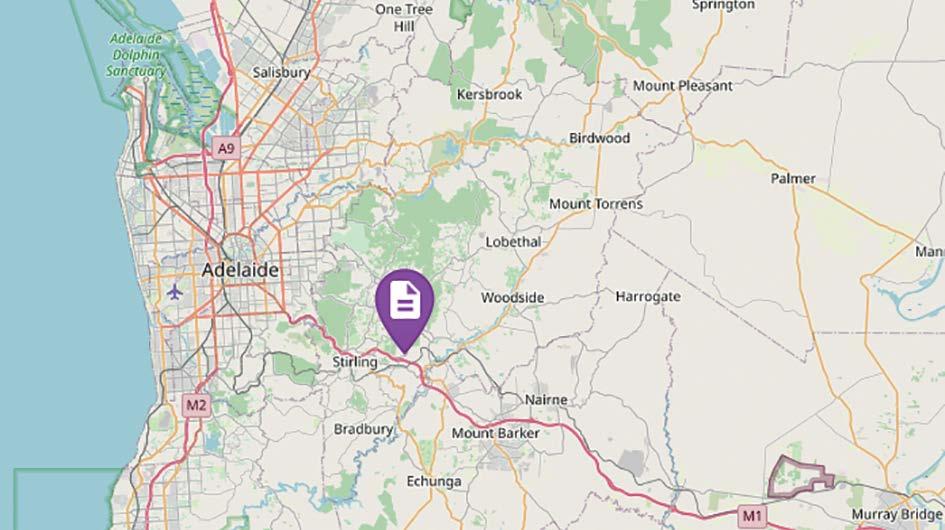

Adelaide, already famed for its food, wine, festivals and sporting events, was last year named The Most Beautiful City in the World by America’s Architectural Digest.

The magazine praised the city’s iconic buildings, fine beaches, cafes and restaurants, plus its “rolling hills lush with high-quality grapes.”

All possible reasons why real estate has been going bonkers in the South Australian capital, for at least the past three years.

Despite a recent slowdown, home values in Adelaide grew 7.7 per cent for the year to July, according to property data analyst CoreLogic (now rebranded as Cotality.)

That was the best among state capitals, with Brisbane next on 6.7%, Perth 6.6%, Sydney 1.3% and Melbourne slipping to -0.1%.

Number-crunching by REA’s PropTrack also rated Adelaide our best-performing capital, up 0.6% in June and 9.8% for the year to July.

The SA Valuer-General’s data from the June quarter showed a 10.19 per cent increase in metro Adelaide median houses prices over the same quarter in 2024.

The median metro house price was $865,000. A median metro unit was $626,500.

Top of the tree for median price growth was Blair Athol, with a median from 19 sales of $920,500. Then came Moana, Fulham Gardens, Torrensville, Somerton Park, Evanston, Magill, Grange, Eyre, and Salisbury Heights rounding out the Top Ten.

The top residential sale in recent months

Where it’s at right now in Adelaide: Bridgewater –not too far out from the action.

was Balham Ave in Kingswood for $3.4 million, followed by Toorak Gardens for $3 million, and two at Malvern for $2.858 million and $2.650 million.

Adelaide property experts feel hoped-for interest rate cuts, plus low supply and high demand from local and interstate buyers will buoy the market.

“South Australia’s real estate market continues to do remarkably well despite the low supply of housing stock and the housing affordability outlook,” the Real Estate Institute of South Australia remarked in its latest market update.

“We look forward to continuing our constructive dialogue with the Government on these important housing issues.” n

From 1 July 2026, conveyancers will be brought under Australia’s Anti-Money Laundering and Counter-Terrorism Financing regime. They’ll need to enrol with AUSTRAC, implement an AML/CTF program, conduct client due diligence, appoint a compliance officer, train staff, and report any suspicious activity.

Conveyancing is a high-risk sector Real estate transactions are a major target for money launderers. Criminals use property deals to wash hundreds of millions in dirty money. Conveyancers are on the front line — and these reforms formally recognise their crucial role in detecting and disrupting financial crime.

Non-compliance will be crippling AUSTRAC has flagged that failure to enrol or comply could attract penalties of up to $19,000 per day. Those who ignore the rules or make no genuine attempt to comply will face serious regulatory action.

The deadline is tight Conveyancers have just 12 months to get ready. AUSTRAC chief executive Brendan Thomas has made it clear: “Timeframes are tight” and “now is the time to act.” While perfection isn’t expected from day one, honest, proactive compliance is.

BOTTOM LINE:

Tranche 2 isn’t just red tape — it’s a shift in how conveyancers are being asked to be the eyes and ears of the police.

Here’s a recap of the numbers that grabbed our attention at Australian Conveyancer over the past month. From the billions earned by tradies, the fact that Brisbane homes have broken the $1 million mark and the number of Australians who declared a rental income on their tax return.

NSW recorded the strongest household spending growth in June among the states and territories, rising 0.7 per cent. Over the past year, NSW has outperformed nationally, up 8.4 per cent, resulting in a change at the top of the state leaderboard.

COMMONWEALTH BANK

The median weekly asking rent for a house in the Byron local government area jumped 15 per cent over the 12 months to June to hit its highest ever median of $1150 a week, according to the latest Domain Rent Report. DOMAIN

Annual apartment completions have collapsed from over 97,000 in 2018 to just 58,913 in 2023. There was a modest recovery to 64,869 units in 2024. But that is still 33 per cent below peak levels.

RAY WHITE

Tradies made $55.6 billion from house building and $17.0 billion from other residential construction, according to Australian Bureau of Statistics data for 2023-24. The 1.3 million workforce made $66.2 billion from non-residential construction. ABS

Australia’s rental market posted a slight uplift in vacancy rates in June 2025, rising nationally from 1.2 per cent to 1.3 per cent, according to SQM Research. But weekly rents in the capital cities are still climbing, fuelled by undersupply, making it a landlords’ market. The highest rents are in Sydney, where weekly combined rent is $852.19 – up 1.8 per cent annually. Darwin – which has the lowest vacancy rate – has seen the biggest increase over the year, up 13.9 per cent

SQM RESEARCH

Up to $10,000 for full-time apprentices and up to $5,000 for part-timers is available under the federal government’s Key Apprenticeship Program, with $2,000 handed out at 6, 12, 24 and 36 months for fulltime apprentices and $1,000 at 6, 12, 24 and 36 months for part-time employees.

KEY APPRENTICESHIP PROGRAM

National housing values rose 1.4 per cent over the second quarter of the year, with the pace of growth accelerating from the 0.9 per cent rise seen in Q1 and a 0.1 per cent decline recorded over the three months to December. COTALITY

In March quarter 2025 there were 79,890 new home loans approved, a 3.4 per cent (-2,854 loans) fall compared to the previous quarter. The total value of new home loans approved was $53.2 billion, a fall of 2.5 per cent (-$1.3 billion). The average loan size fell by $6,100 to $659,922. For the same period, there were 47,218 new investment loans approved, a 3.7 per cent (-1,821 loans) fall compared to the previous quarter. ABS

Australians can look forward to $1.2 billion in card surcharges every year if the Reserve Bank proceeds with its plan to ban EFTPOS, MasterCard, and Visa users from adding the additional fees.

RBA

Australia Institute data shows 2.3 million Australians declared rental income in 2022-23, with about 71 per cent of landlords owning only one investment property – just over 1.6 million AUSTRALIA INSTITUTE

Brisbane is now the second-most expensive capital city market, after Sydney, with median house values exceeding $1 million. House values have surged 76 per cent since 2020, coinciding with the early stages of the COVID-era housing boom. COTALITY