Trivium Real Estate Group (“Trivium”) is a real estate development and private equity firm uniquely positioned to add value to investments through development and opportunistic investments across the real estate spectrum and throughout the capital structure. Headquartered in Logan, Utah, Trivium develops across a diverse set of asset classes to ensure fungibility to micro and macro markets –including mixed-use, multifamily, and industrial. This diversity enables flexibility to market conditions and economic cycles.

Michael D.

• Partner, Chief Executive Officer

Michael leads the firm’s strategic direction and investment focus In addition to leveraging his legal, development, and investment experience, he has worked to position the firm to capitalize on opportunities in both debt and equity across market segments and cycles Michael graduated from Utah State University and earned a juris doctor from the University of San Diego School of Law .

Nic oversees all land development and construction activities at Trivium . Leveraging decades of development and construction experience, Nic guides the firm’s strategic planning and decisionmaking, ensuring efficient resource allocation and quality throughout the development lifecycle Nic graduated from the University of Utah

S. Craig Adams • Partner

Craig has 25 + years of experience working at major financial advisory firms and developing real estate . As a partner at Trivium, Craig provides strategic oversight and investment management expertise Craig is a certified financial planner and graduated from Utah State University with a degree in Finance

Jon is a seasoned business owner and investor with a strong track record of entrepreneurial leadership and real estate development and investment As a partner at Trivium, he leverages his diverse industry experience and extensive network to identify and drive strategic investment opportunities Jon’s career is characterized by his ability to blend handson management with thoughtful capital deployment .

Erik oversees all financial functions for Trivium, including reporting, investment management, financial modeling, debt financing, and general accounting operations Erik brings extensive experience from his work with large real estate investment groups and regional accounting firms for real estate operators . Erik graduated from Utah State University with a degree in Accounting before receiving a master’s degree in accounting from Southern New Hampshire University

Tiffany Meyer • VP of Property Management

Tiffany leverages her 15 + years of experience in property management to maximize value for each project through operational management, employee relations, customer service, and training and hiring the right team members Tiffany’s experience covers a broad spectrum of expertise including market rates, lease ups, rehabilitation, and stabilized properties

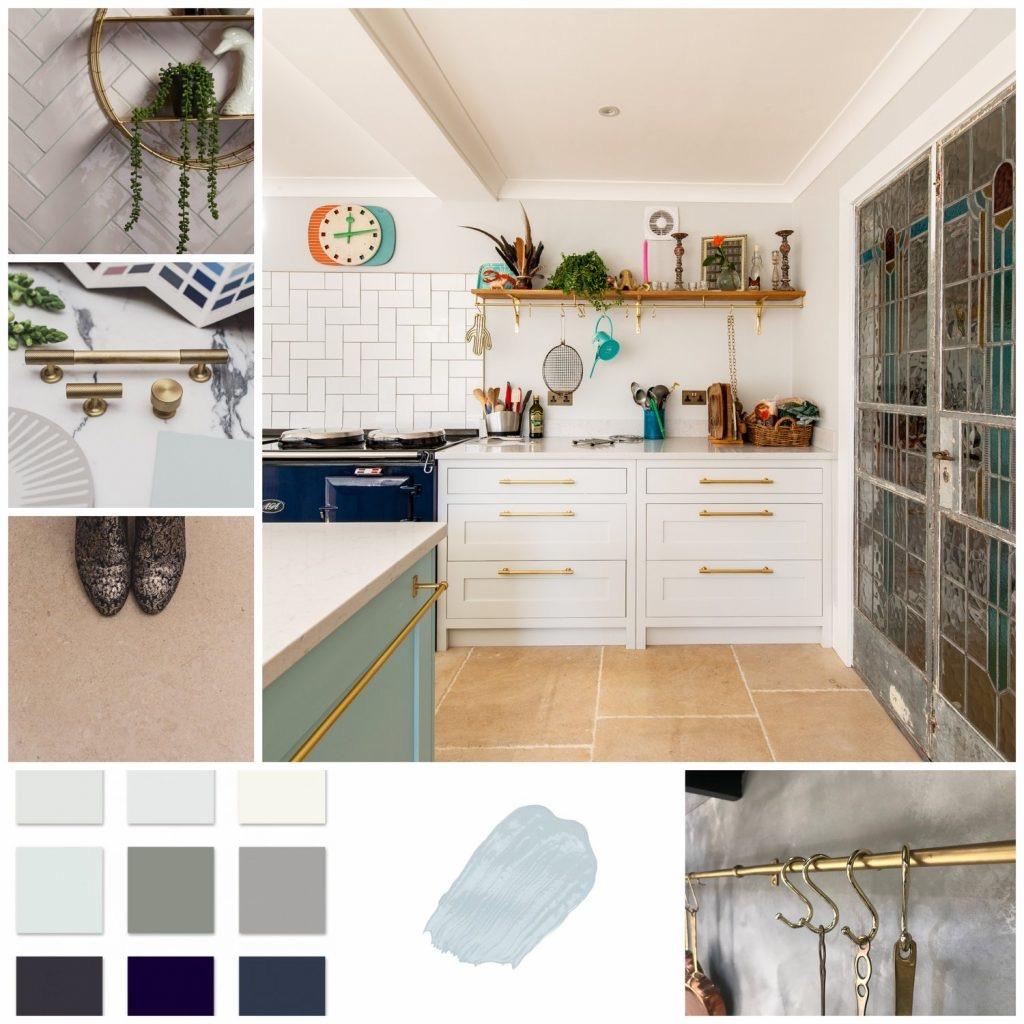

Thematic Design. Our products are thoughtfully designed and created to generate the highest levels of activation, driving premium rents and asset values in the region.

Strategic Versatility. We adapt our strategy and approach to tailor our projects to the needs of specific markets. Flexibility and responsiveness allows us to achieve our goals in a dynamic real estate environment.

Growth Markets. Trivium targets:

• Substantial Growth in the Mountain West real estate market, driven by a growing population, robust economy, and a focus on urban revitalization.

• Stable Investment Profiles due to a strong, diversified economy, steady economic expansion, stable growth, and low cost of living and unemployment rates.

• Prime Locations with low cost of entry and superior transportation infrastructure to drive investment returns.

Long-Term Holds with Cash Flow Priority. All Trivium projects assume a 10-year minimum hold period with an expectation to hold assets indefinitely.

“[An area] where you can live and work and play, all within two or three blocks … is extremely attractive to the workforce today and something that investors have to take note of.”

Kimberly Adams, managing director at J.P. Morgan Asset Management (via Kellog Institute)

“Real estate is extremely attractive today relative to other asset classes. It is a natural inflation hedge because you’re consistently capturing the rise in cost by increasing rents. I think that’s what is most attractive right now, particularly for shorter-term-lease-type products [like multifamily].”

Logan, UT

• Project Value: $23.7m

• 10,000 SF retail/flex commercial (fully leased; tenants include Kilgore Companies, The Elite Collective, and Potholes Sweet Shop)

• 69 apartment units

Logan, UT

• Project Value: $24.3m (total phase)

• 19 luxury townhomes (total of 68 townhomes planned for Phase A1)

Preston, ID

• Project Value: $6.2m

• 20 premium townhomes

Utah

#1 in Best States Overall

#6 in Growth

#7 in Economy

#4 in GDP Growth

#5 in Growth of Young Population

Idaho

#3 in Best States Overall

#4 in Growth

#4 in Economy

#6 in Net Migration

#8 in Growth of Young Population

“When it comes to population growth and the economy, the Mountain West region – quite literally and figuratively – towers over the rest of the country. The trend of positive migration shows no sign of ending.”

Soren Halladay, Strategic Advisor at PEG Companies (via Regius Magazine, Modern-Day Migration to the Mountain West (2023))

Fastest Growing State Since 2010 – World Population Review

2nd Highest Growth in Labor Force in U.S. – U.S. BLS

Strong Economics

Ranked #1 Best State Overall – U.S. News & World Report 2025

Ranked #3 Best State Economy – U.S. News & World Report 2025

Ranked #1 Best Economic Outlook – Rich States Poor States

Housing deficit of approximately 44,000 units – Kem C. Gardner Institute

Utah’s notable attributes – including a booming economy, advanced infrastructure, and quality education – make it a well-rounded state that offers opportunities to thrive in different aspects of life. Utah’s consistency and well-rounded nature allowed Utah to maintain it’s spot as the No 1 state in America in the U.S. News & World Report’s Best States rankings for 2025 (the rankings analyze more than 70 metrics across eight categories, including fiscal stability, health care, infrastructure, and crime and corrections).

Strong year-over-year growth: 7.3% average annual growth since 2020 – Tremonton City

Crime is 1.8x Lower than the National Average – City-Data.com

Notable Employment and Expansions

Procter & Gamble, a consumer goods manufacturer, is expanding its Tremonton facility and is anticipated to triple in size in the next 10 years.

Tremonton is one of Northrop Grumman’s four major operational sites in Utah. In 2024, Northrop announced expansion plans to add 1,206 jobs ($2.74b in wages over 20 year with an average wage of $118k/year) to its Utah sites.

Post Consumer Brands, a food manufacturer, produces 1.7 billion servings per year and employs 220+ in the Tremonton area.

Great Job Market, 2.6% Unemployment Rate – FRED

West Liberty Foods, a meat processing plant, opened its $50m plant in Tremonton in 2006. The plant currently produces 175 million pounds of finished sliced meat products per year, becoming the flagship of the company.

Location: 900 E Main Street

Tremonton, Utah 84337

Status: Pre-Construction (Phase 1)

Key Strategic Features:

o 203 townhomes, and 228 apartments with green space and park amenities along with direct to the Malad River walking and biking trails.

o 24,000 SF retail – offering premium locations thoughtfully curated retail, restaurants, and wellness

o 256 single family residential lots – horizontal improvements of the first 2 phases are complete, with the first phase completed and occupied.

Groundbreaking (Phase 1): Q3 2025

Completion (Phase 1): Q1 2027

LP Investment Opportunity (Phase 1): $4.5m

Total Development Costs (Phase 1): $14.8m

The River’s Edge master planned community is already the premier living destination in Tremonton, Utah, with two phases of single-family residential lots finished and a third phase underway. As the retail projects, multifamily, and additional amenities are constructed –including a 7-acre city park and associated biking and walking paths –its popularity can only increase.

• 203 townhomes, and 228 apartments with 7 acres of green space and park amenities along with direct access to the Malad River walking and biking trails.

• 24,000 SF retail – offering premium locations for thoughtfully curated retail, restaurants, and wellness.

• 256 single family residential lots – horizontal improvements of the first 2 phases are complete, with the first phase completed and occupied.

SFR Phase 1 & 2 (complete)

• 36 single family lots completed and sold, bringing energy to the area

MFR Phase 1 (pre-construction)

• 18 premium townhomes

• 36 premium apartments

• Premier location just off Main Street in Tremonton City near shopping, restaurants, and grocery.

Future Development

• 24,000 SF retail

• 220 single family lots

• 185 premium townhomes

• 192 premium apartments

• Premium clubhouse with pool area.

• 7-acre park, highly amenitized with active green space, sport courts, gathering areas, and walking trails.

Financial Overview; Underwriting Overview

Timing & Market Assumptions

Market Timing & Assumptions

Development Budget

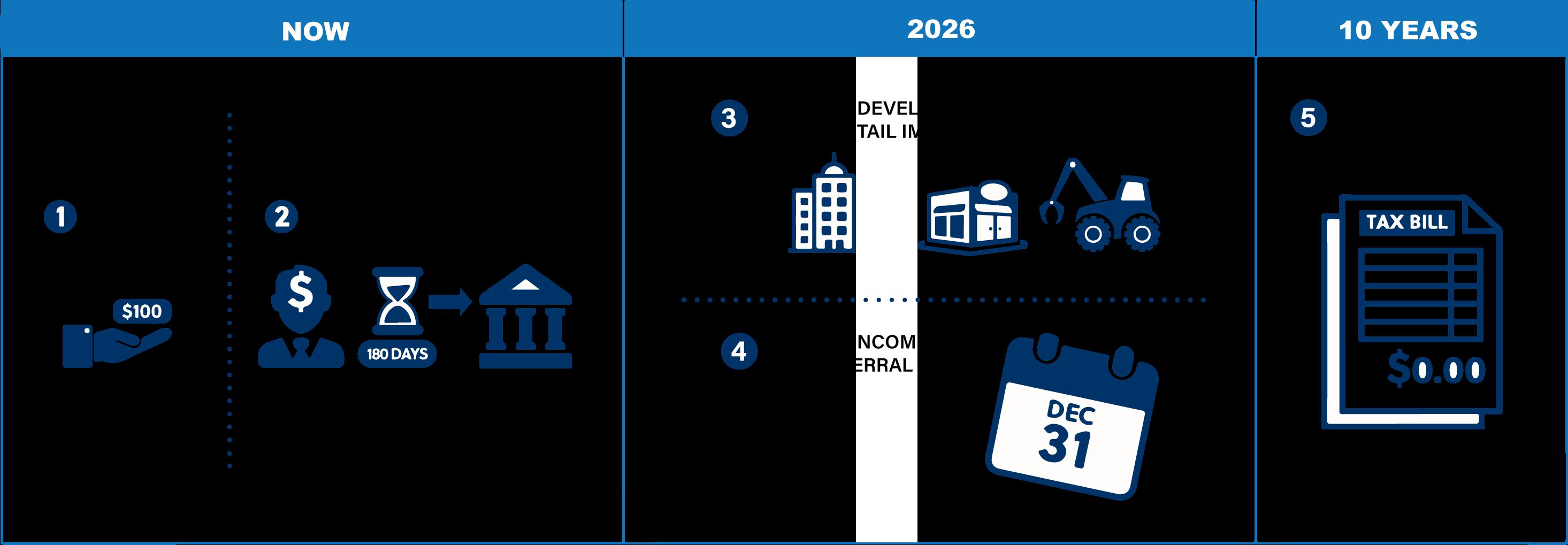

Rivers Edge is located in an area designated by the federal government as an Opportunity Zone (an “OZ”). Placing investment capital in an OZ provides significant tax incentives if an investor’s capital consists of qualified capital gains contributed within 6 months of recognizing the gain.

If you invest a qualified gain into an OZ investment, the tax due from the gain will be deferred until the 2026 tax year (payable in 2027). In addition, if you keep your OZ investment for 10 years the internal gain on your investment is permanently excluded (no tax!).

The information contained herein includes confidential information regarding Trivium Real Estate Group and its affiliates (referred to herein as “Trivium”). By accepting this document, the recipient agrees that it will cause its representatives and advisors to use the information only to evaluate its relationship with Trivium and for no other purpose and will keep confidential and not divulge any such information to any other party. Any reproduction of this information in whole or in part is prohibited.

This document is for informational purposes only. Trivium does not make any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance of Trivium. Any prior investment results of Trivium or any of its affiliates and any hypothetical information are presented in this document for illustrative purposes used herein, no representations are made as to the accuracy or completeness thereof and neither Trivium nor its affiliates take any responsibility for such information.

Certain information contained in this presentation has been obtained from sources outside Trivium. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and neither Trivium nor its affiliates take any responsibility for such information.

Past performance is not necessarily indicative of future results. Actual realized returns on unrealized investments will depend on, among other factors, future operating results, the value of the assets, market conditions at the time of disposition, any related transaction costs, and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the valuations used in the performance data contained herein are based. Accordingly, the actual realized returns on the unrealized investments may differ materially from the returns indicated herein. The offering described herein differs from other investments in that, among other reasons, it consists of actively managed entities and uses leverage.