By Matt Coffina, CFA ®

By Matt Coffina, CFA ®

©2025. All rights reserved.

You’ve worked hard your whole life. You’ve saved and invested responsibly. Now you’re ready for a comfortable and (we hope) long retirement. But how do you make sure your money will last? At

Important Notice:

The following information is not intended as investment advice, nor is it an offer to buy or sell any security. Please consult your financial advisor for questions about your personal financial situation. All investments involve risk, including the potential for loss. Historical results may not be indicative of future performance. Data provided does not reflect the impact of advisory and other fees. If such fees were included, returns would be lower. Data from third-party sources is not guaranteed to be accurate, timely, or complete.

Source data last updated in February 2025 unless otherwise stated.

First, we need to figure out where you stand. We’ll make use of two tools from the business world: A balance sheet and income statement.

Your balance sheet is a snapshot of what you own (Assets) and what you owe (Liabilities). The difference between assets and liabilities is your net worth.

Below are some common personal assets and liabilities. For financial planning, we’re primarily interested in your investment accounts, as well as assets that generate income (such as rental properties) or assets that could be liquidated to fund future living expenses. Don’t forget about old 401(k) plans and rollover IRAs from former employers! These accounts are frequently neglected or forgotten about.

• Primary Home

• Other Real Estate

• Checking & Savings Accounts

• Employer and/or Individual Retirement Accounts

• Brokerage Accounts

• Business Interests

• Annuities

• Life Insurance

• Collectibles, Gold, Cryptocurrency

• Vehicles

• Mortgages

• Student Loans

• Vehicle Loans

• Credit-Card Debt

• Personal Loans

Your income statement shows how much you make (income) and how much you spend (expenses). If you’re still working, you may need to construct two income statements: One for your current lifestyle and one that shows your expected income and spending in retirement.

Now we’re ready to determine your target withdrawals in retirement. Start by adding up your expenses. These might be higher or lower than when you were working. For example, you’ll save on gas by not commuting to work, you may cook more instead of going to restaurants, or perhaps you’ll have paid off your mortgage. On the other hand, you might be planning to travel more frequently in retirement, buy a boat or RV, or try a new hobby.

Next, subtract your retirement income from your total expenses. Retirement income includes Social Security, pensions, annuities, income from rental properties, salary from a part-time job, or any other income you expect (not counting dividend or interest income from your investment portfolio). The difference between your expenses and your income is your target annual withdrawal—the amount of your retirement spending that will need to be funded from your investment portfolio.

• Home Maintenance

• Property Taxes

• Utilities

• Mortgage Payments

• Transportation

• Healthcare

• Insurance

• Food

• Clothing

• Travel

• Recreation

• Subscriptions

• Charitable Contributions

• Social Security

• Pensions

• Annuities

• Part-Time Work

• Rental Properties

This is one of the most difficult steps in the financial planning process. It’s so important, yet unknowable: How long can you expect to live?

The best we can do is look at averages. The chart below shows remaining life expectancy depending on your current age, according to the Social Security Administration. For example, a 65-year-old male can expect to live 17 more years, on average. That means about half of 65-year-old men will live past age 83, while half will die sooner. For 65-year-old women, remaining life expectancy is 20 years (half will live to age 85 or beyond).

A common mistake for recent retirees is to be too conservative with their asset allocation. Yes, you need to fund near-term living expenses and can’t take as many risks as when you were 40. But you also need to plan for a retirement that could last 20-30 years or longer.

Here’s another perspective on the same data. It shows the probability of living at least 20 more years. For example, a 65-year-old man has a 39% chance of living at least 20 more years, while a woman has a 52% chance. For a 65-year-old husband and wife, there’s a 71% probability that at least one partner will make it to age 85 or beyond.

Of course, your own life expectancy will vary depending on your current health, lifestyle, genetics, and many other factors.

You’ve probably heard of the “4% Rule.” It’s a handy rule of thumb that says it’s generally safe to withdraw 4% of your portfolio in the first year of retirement, then increase that amount by inflation in each subsequent year.

The 4% rule comes from studying historical stock and bond market returns. Say an investor held a portfolio with 60% stocks (the S&P 500 or equivalent) and 40% bonds (the 10-Year Treasury). The investor started with $1 million and withdrew 4% of their portfolio in the first year of retirement ($40,000), increasing that amount by inflation in each subsequent year. What’s the likelihood this investor would run out of money within 30 years?

We looked at every 30-year period (using monthly data) between 1900 and 2024. The chart on the next page summarizes the data into deciles. For example, in 10% of historical periods, an investor using the 4% rule would have been left with less than $697,860 at the end of 30 years (the 10th Percentile). In another 10% of historical periods, the investor would have been left with more than $9,896,550 (the 90th Percentile).

In the very best historical 30-year period, the investor would have been left with more than $15 million! On the other hand, in 3% of historical periods, the portfolio would have been totally depleted. The worst of these saw portfolio depletion after a little more than 26 years. In other words, if history is any guide, a 65-year-old retiree following the 4% rule can expect their portfolio to last at least to age 91, but probably a lot longer.

Note that the 4% rule is a conservative withdrawal strategy. There’s only a 3% probability of running out of money within 30 years. In the median historical scenario (i.e. half of 30-year periods were better, half were worse), the investor would have been left with $3.5 million—3.5 times their original principal. In fact, investors would have been left with more than their starting principal 85% of the time, despite making withdrawals for 30 years!

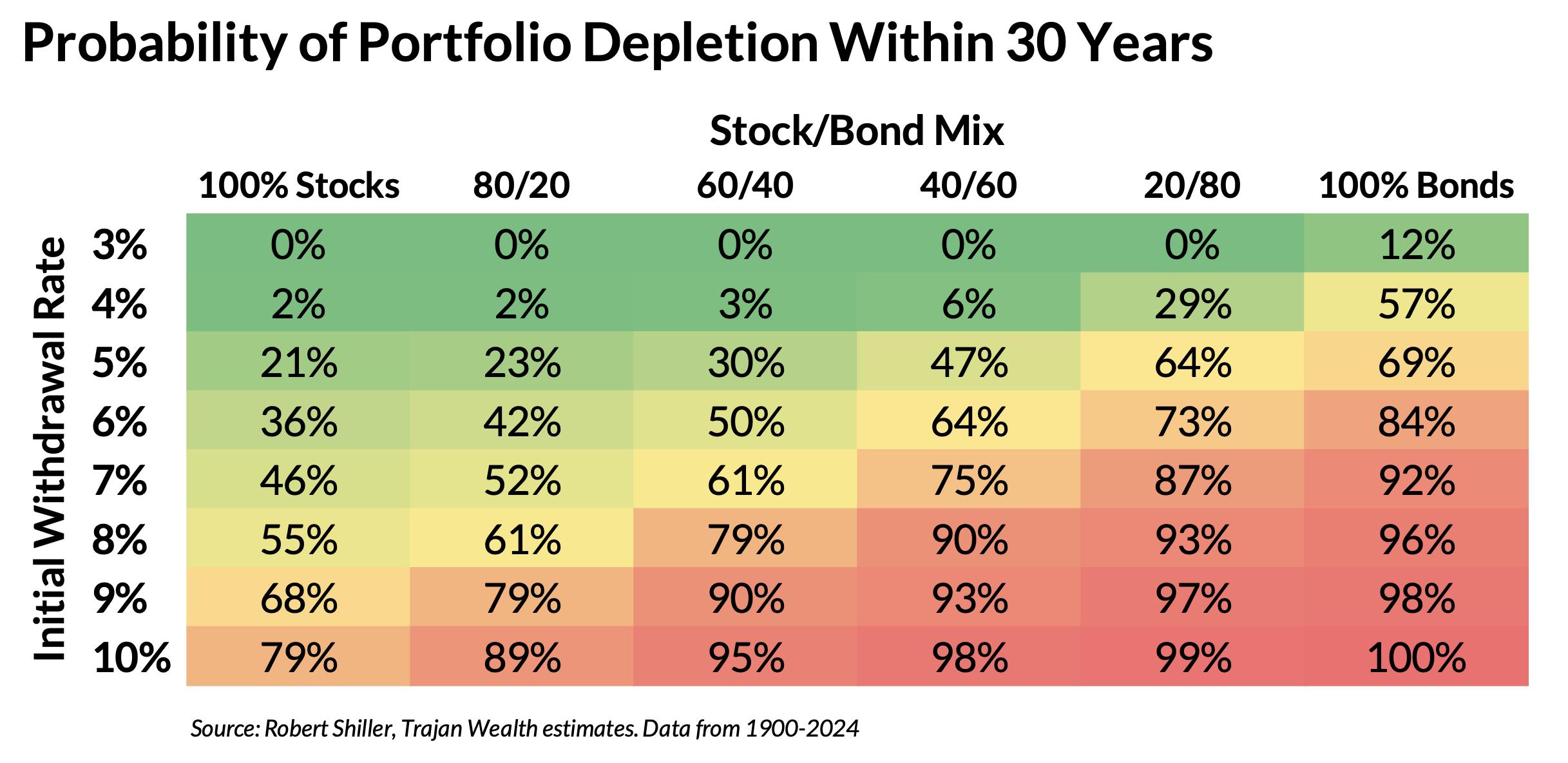

However, that doesn’t mean you can (safely) take out a larger portion of your portfolio in the first year of retirement. The table below shows the historical probability of an investor running out of money within 30 years, using different assumptions for the initial withdrawal rate and the stock/ bond mix. As described above, the 4% rule with a 60/40 portfolio had only a 3% probability of portfolio depletion. Unfortunately, increasing the initial withdrawal rate to 5% causes the risk of portfolio depletion to jump to 30%.

If your target withdrawal exceeds a level you and your advisor consider to be safe, it may be necessary to adjust your retirement spending plans or look for additional sources of income. The good news is that financial plans aren’t set in stone. In consultation with your advisor, you can update your withdrawal strategy over time depending on market conditions.

Another interesting takeaway from the previous table is that a stock-heavy asset allocation isn’t necessarily riskier—if the risk we’re worried about is running out of money in retirement. It’s true that stocks are more volatile than bonds. From year to year, a portfolio with a high stock allocation will experience more extreme ups and downs. But over a 30-year investment horizon, the near-term volatility is more than offset by stocks’ superior returns.

For example, using the 4% rule, an all-stock portfolio only ran out of money in 2% of historical 30-year periods. That compares to 3% for the 60/40 portfolio (as discussed earlier), 29% for a 20/80 portfolio (20% stocks/80% bonds), and 57% for an all-bond portfolio. Being too conservative in the short term can increase risk in the long term!

Choosing the right asset allocation and investment strategy depends on the unique circumstances of each client. Your advisor will get to know you by asking lots of questions before making a recommendation. The advisor will be gauging your ability to take risk and your willingness to take risk. Ability is based on objective factors like your age and health. Willingness is subjective and depends on your personality and experience as an investor.

After helping you choose an asset allocation, your advisor will present various investment options.

At Trajan Wealth, we have a wide range of strategies from aggressive to conservative, from growth-oriented to income-oriented, and from active (individual stocks) to more passive (ETFs).

Whether you’re still in your prime earning years, getting close to retirement, or already retired, you’ll benefit from professional guidance about your finances. Working with an experienced fiduciary advisor can help minimize the risk of running out of money, while also ensuring you enjoy your retirement to its fullest.

Give us a call at 1 (800) 838-3079 to schedule your free consultation!

Matt Coffina, CFA®, is the portfolio manager for Trajan Wealth’s Expanding Moat and Defensive Moat strategies. He seeks to invest in companies with strong and improving competitive advantages, above-average revenue and earnings growth, and reasonable valuations. Matt has more than 17 years of experience as a portfolio manager and analyst. Even if it weren’t his job, he would happily spend all day learning about businesses and trying to identify stocks with a favorable risk/reward tradeoff.

Disclosures: Advisory services are offered through Trajan® Wealth, LLC, an SEC-registered investment advisor. Legal services are offered through Trajan® Estate, LLC in Arizona and Utah, and independent law firms in other states. D.B.A in most states as Trajan® Wealth Insurance Solutions. Tax services are offered through Trajan® Tax, LLC.