Palm Beach County

Tourist Development Council Board Book

June 8, 2023

1

Table of Contents

1. TDC Attendance

2. TDC Agenda June 8, 2023

3. TDC Board Minutes May 11, 2023

4. CONSENT ITEMS

4.A. DTPB Activity Report

4.B. Cultural Council Activity Report

4.C. Sports Commission Activity Report

4.D. Film & TV Monthly Newsletter

4.E. Film & TV Production Report

4.F. Convention Center Income Statement & Financial Operations Analysis Compared to Budgey & Prior Year

4.G. Convention Center Marketing Update

4.H. Convention Center Pace Revenue Report

4.I. ERM Project Status Report

4.J. PBI Traffic Report

4.K. Contract Tracking Report

5. OLD BUSINESS

5.A. - 1. TDC Dashboard Current Month & FY2023

5.A. - 1.a. Bed Tax Collections

5.A. - 1.b. Report Out Metrics

6. NEW BUSINESS

6.D. - 1. Category B & CII FY2024 Grant Awards

(Seat)

(1)Vice Mayor Maria Sachs, Chair (1/14/21)

(4) Jim Bronstien, Vice Chair(9/30/26) Appt(3/1/95) ReApp(9/18/18) Dis.3

(2)Roger Amidon Appt(9/30/25)Dist. 1

(3) Jim Mostad (9/30/20) Appt (10/16/19), Dis. 2, St 3

(5)Daniel Hostettler(0930/23) Appt (05/18/21). Dis 4.

(6)Commissioner Adam Frankel (9/30/24) Appt (03/08/22)[Dis.5]

(7)Don Dufresne (9/30/23) Apt(6/5/12) ReAp(5/3/16)&(8/20/19) Dis6

(8) Davicka N. Thompson (9/30/2024) Appt(12/6/16)RdAppt(8/25/20) [Dis.7]

(9) Commissioner Christina Lambert Appt (10/01/22)- (9/30/26) At-Large

STAFF

Verdenia C. Baker, County Administrator

Liz Herman, Assistant County Attorney

Dave Lawrence, Culture

George Linley, Sports

Michelle Hillery, Film & TV

Jorge Pesquera, Discover

Deborah Drum, ERM

Dave Anderson, PBCCC

Kathy Griffin, PBCCC

Emanuel Perry, TDC

Joan Hutchinson, TDC

Vannette Youyoute,

O:\TDC MEETINGS\TDCMtgs2023\Generic Pages for Board Book\attendnc

** Reappointment during current year

NA- Does not count towards attendance.

P/W - Workshop P/S - Special Meeting

TDC BOARD

June 8, 2023

MEETING ATTENDANCE SHEET

12-Jan 9-Feb 9-Mar 14-Apr 11-May 8-Jun 13-Jul 10-Aug 14-Sep 12-Oct 9-Nov 14-Dec P P N/A P P N/A P P N/A P A N/A P P N/A P P N/A P P N/A P P N/A P A N/A A A N/A P P N/A P P N/A P P N/A P P N/A P P N/A P P N/A P P N/A P P N/A P P N/A P/Phone P N/A A/Video Conf. P N/A P A/Phone N/A P P N/A P P N/A P P N/A P A/Phone N/A P P N/A P P N/A P P N/A P A N/A P P N/A P P N/A P P N/A P P N/A P A N/A P P N/A P P N/A P P N/A P P N/A P A N/A P P N/A P P N/A

TDC

TOURIST DEVELOPMENT COUNCIL

Thursday, June 8, 2023 – 9:00 A.M.

2195 Southern Boulevard

West Palm Beach, Florida 33406

AGENDA

1. ROLL CALL*

2. MOTION TO APPROVE AGENDA ADDITIONS AND DELETIONS*

3. MOTION TO APPROVE MAY 11TH TDC MEETING MINUTES*

4. MOTION TO RECEIVE AND FILE CONSENT ITEMS FOR JUNE 2023*

MARKETING AGENCIES REPORTING

A. DTPB ACTIVITY REPORT*

B. CULTURAL COUNCIL ACTIVITY REPORT*

C. SPORTS COMMISSION ACTIVITY REPORT*

D. FILM & TV MONTHLY NEWSLETTER*

E. FILM & TV PRODUCTION REPORT*

PBC CONVENTION CENTER OPERATING REPORTS

F. CONVENTION CENTER INCOME STATEMENT & FINANCIAL OPERATIONS ANALYSIS COMPARED TO BUDGET & PRIOR YEAR*

G. CONVENTION CENTER MARKETING UPDATE*

H. CONVENTION CENTER “PACE” REVENUE REPORT*

OTHER TDC-SUPPORTED AGENCY/DEPARTMENTS REPORTS

I. ERM PROJECT STATUS REPORT*

J. PBI TRAFFIC REPORT*

K. CONTRACT TRACKING REPORT*

5. OLD BUSINESS – DISCUSSION ITEMS

A. TDC TOURISM PERFORMANCE METRICS

1. TDC DASHBOARD CURRENT MONTH & FY2023* - Emanuel Perry

a. Bed Tax Collections*

b. Report Out Metrics*

B. PBI UPDATE – Joe Harrington

6. NEW BUSINESS – DISCUSSION ITEMS

A. ERM

1. Update – Deb Drum

2.

B. DISCOVER

1. 2023 Summer Market Assumptions/Plan Highlights –Weibull/Segarra/Cavers

2. Update – Jorge Pesquera

C. SPORTS COMMISSION

1. Update – George Linley

D. CULTURAL COUNCIL

1. Category B and Category CII FY2024 Grant Awards - MOTION TO APPROVE

2. Update – Dave Lawrence

E. FILM & TV

1. Update – Michelle Hillery

F. CONVENTION CENTER

1. OVG Venue Management

a. Update- Dave Anderson

2. OVG Hospitality

a. Update – Kathy Griffin

7. BOARD COMMENTS

8. PUBLIC COMMENTS

9. ADJOURNMENT

The next Meeting will be on July 13, 2023.

*Attachment included.

Tdc/tdcmtgs2023/Agenda 6 08.2023

2

TOURIST DEVELOPMENT COUNCIL

Thursday, May 11, 2023 – 9:00 A.M.

MINUTES

1. ROLL CALL*

Present Absent

Vice Mayor Maria Sachs, Chair Jim Bronstien, Vice-Chair

Roger Amidon Daniel Hostettler

Jim Mostad

Commissioner Adam Frankel

Don Dufresne

Davicka Thompson

Commissioner Christina Lambert

STAFF

Verdenia C. Baker, County Administrator

Liz Herman, Assistant County Attorney/Phone

Emanuel Perry, TDC

Vannette Youyoute, TDC

Patricia Ramirez, TDC

Dave Lawrence, Cultural Council

Jennifer Sullivan, Cultural Council

George Linley, Sports Commission/Phone

David Fontanarosa, Sports Commission

Michael Zeff, Sports Commission

Michelle Hillery, Film & TV Commission

Evan Lomrantz, Discover The Palm Beaches

Gustav Weibull, Discover The Palm Beaches

Milton Segarra, Discover The Palm Beaches

Kelly Cavers, Discover The Palm Beaches

Bryan Glynn, Discover The Palm Beaches

Deborah Dr, ERM

Matt Mitchell, ERM

Dave Anderson, Convention Center/Spectra Venue Management

Kathy Griffin, Convention Center/Spectra Hospitality

Joe Harrington, PBI Airports

Nichole Hughes, PBI Airports

Other Diane Quinn, Kravis Center Performance Arts

Chris Inman, Hilton West Palm Beach

Derrick Steinour, Hilton West Palm Beach

2. MOTION TO APPROVE AGENDA ADDITIONS AND DELETIONS*

3.

Motion to approve TDC Board Meeting Agenda was made by Davicka Thompson and seconded by Roger Amidon. Motion carried 7-0 with Jim Bronstien and Daniel Hostettler absent.

3. MOTION TO APPROVE APRIL 13TH TDC MEETING MINUTES*

Motion to approve the April 13th, TDC Meeting Minutes was made by Commissioner Adam Frankel and seconded by Roger Amidon. Motion carried 7-0 with Jim Bronstien and Daniel Hostettler absent.

4. MOTION TO RECEIVE AND FILE CONSENT ITEMS FOR MAY 2023*

MARKETING AGENCIES REPORTING

A. DTPB ACTIVITY REPORT*

B. CULTURAL COUNCIL ACTIVITY REPORT*

C. SPORTS COMMISSION ACTIVITY REPORT*

D. FILM & TV MONTHLY NEWSLETTER*

E. FILM & TV PRODUCTION REPORT*

F. FILM & TV COMMISSION PRODUCTION HISTORY*

PBC CONVENTION CENTER OPERATING REPORTS

G. CONVENTION CENTER INCOME STATEMENT & FINANCIAL OPERATIONS ANALYSIS COMPARED TO BUDGET & PRIOR YEAR*

H. CONVENTION CENTER MARKETING UPDATE*

I. CONVENTION CENTER “PACE” REVENUE REPORT*

OTHER TDC-SUPPORTED AGENCY/DEPARTMENTS REPORTS

J. ERM PROJECT STATUS REPORT*

K. PBI TRAFFIC REPORT*

L. CONTRACT TRACKING REPORT*

M. SEMIANNUAL PERFORMANCE MEASURES*

N. AGENCIES QUARTERLY REPORTS 3.31.2023*

Motion to receive and file Consent Items for May 2023, was made by Commissioner Adam Frankel and seconded by Commissioner Christina Lambert. Motion carried 7-0 with Jim Bronstien and Daniel Hostettler absent.

5. OLD BUSINESS – DISCUSSION ITEMS

A. TDC TOURISM PERFORMANCE METRICS

1. TDC DASHBOARD CURRENT MONTH & FY2023* - Emanuel Perry

a. Bed Tax Collections*

b. Report Out Metrics* Perry

2

Bed Tax Collection – March 2023 collected in April was $12M compared to the same month last year at $11.4M, a 6% increase. Actual March was 11% above budget and 7% above the prior month at $11.2M. Actual March was 53% higher than 2019, a new record for any March since reporting started.

FYTD 23 Collections at $56.5M, was higher than last fiscal year to date at $50M by 13%, reflecting a strong recovery from the pandemic. FYT collections are pacing 10% ahead of the Approved Budget and 55% higher than our record in 2019.

The Rooms sold for March were 485,899, 3% higher than last year. Rooms available for March at 588,969 are 3% higher than last year. Hotel Rooms Active today in the County 18,999

Occupancy for March 2023 was 82 5%, 0.1% over last year. Occupancy for March 2022 was 82.4%. March 2019 was 86.1%. The average daily rate for March was $365 21, 3% higher than last year, and 35% higher than in 2019. The Revenue/Available Room for March 2023 was $301.47 higher than the prior March by 3%.

Hotel room net sales FY23 year over year March increased 5% at $171M compared to $164M. Non-hotel room sales FY23 year over year March increased 25% at $30M compared to $24M. Hotel room net sales FYTD 2023 increased 13% at $785M compared to $695M. Non-Hotel room sales FYTD 2023 increased 16% at $151M compared to $130M. FYTD 2023 Taxable Revenues Fiscal Year over FY2022 increased 13% at $937M compared to $825M. FYTD 2023 Taxable Revenues Fiscal Year over FY2019 increased 57% at $937M compared to $597M.

Airport passengers for March 2023 were 858,086, 12% higher than in March 2022, and the Total Estimated Seat Capacity at 1% higher than last March 2022 with 880,350 seats. PBI Passenger 12-month rolling is a 14% increase at 6,994,643 over last year.

Leisure & Hospitality Employment for March, at 96,000, increased 5% over the same month last year. Accommodation employment went up 11% higher over last year at 11,600 employees. F&B was up 6% at 62,400 employees. Arts & Entertainment employment is 1% lower than last year at 22,000 employees.

I am Joe Harrington, the new Director of Marketing Communications for the Department of Airports. I worked for the past six years for Palm Tran, which is of course the County's Transit Department, and before that, I handled public relations for Roads Planning and Transit in another community. Aviation's a passion of mine and airports were a natural transition. As you can see from your dashboard report, during the last 12 months, we had 6.99M travelers, through Palm Beach International Airport which has recovered to pre-pandemic levels. For March, we had another great month, total passengers were up 11.5%, year over year with 858,000 passengers. Seating capacity was slightly up 0.5%. We are very excited that air carrier operations increased year over year in March by double digits, 18.2%.

3

B. PBI UPDATE – Joe Harrington Harrington

General Aviation was down about 8%. This is due to a reduction in private jets coming into the airport, which kind of surged during the Covid era and was occurring at higher rates in our community.

Total operations were at (0.4%) for the month of March compared to March of 2022. January was kind of a blockbuster month for us with the number of passengers, 32% year over year, and seating capacity, up 15%.

C. AGENCIES AND CONVENTION CENTER FY2022 AUDIT REPORTS* -

Emanuel Perry - MOTION TO APPROVE

Perry

The Finance Committee met and reviewed the financial audits with Mark Escoffery and Holyfield & Thomas, they went through and gave a detailed analysis of what each agency's audits look like. Everything came back clean. There were no issues with management.

Motion to approve was made by Roger Amidon and seconded by Davicka Thompson. Motion carried 7-0 with Jim Bronstien and Daniel Hostettler absent

D. AGENCIES FY24 ORGANIZATIONAL CHARTS* -

Emanuel Perry – MOTION TO APPROVE

Perry

We are seeking a motion to approve FY2024 organizational charts for each agency. Each agency gave us a brief understanding of what would be best suited Included in your book is a detailed outline of each agency's organizational charts.

Lomrantz

We have three new positions going into FY2024. we have a Manager Destination Service to help support the increased number of groups coming into the County. We have a Marketing Technology Manager position to help us move forward with advances both technologically, but also from a regulatory compliance perspective with data privacy issues, and we have a second Marketing Manager position to help us with our digital purchases We have grown significantly over the past couple of years and need additional support staff to help execute the strategic plan that TDC has approved.

Lawrence

We are not seeking any new positions. We have three frozen positions from Covid time that we have reallocated into support for our grants team. Two employees and the Director of Community Engagement will help us with ourDEIA and activations for cultural tourism activity. Our numbers are staying the same.

4

Fontanarosa

We are seeking no new position. We have three previously approved positions, one in finance and two in marketing. We have lost our Sports Development Head and have two proposals for the Marketing Department.

Hillery

We are not seeking new positions. We are kind of doing a bit of a reorg with what we have.

We are freezing a few positions and replacing them with a marketing and oversight position, and we are changing the name of our administrative assistant position.

Motion to approve the Agencies FY2024 Organizational Charts was made by Commissioner Adam Frankel and seconded by Don Dufresne. Motion carried 7-0 with Jim Bronstien and Daniel Hostettler absent.

6. NEW BUSINESS – DISCUSSION ITEMS

A. TOURISM MASTER PLAN UPDATE – Emanuel Perry

Perry

I want to provide the council with an update about Tourism Master Plan. I met with the OEBO Goal Setting Committee of Palm Beach County. We went through the RFP and determined that the 15% SBE goal was mandatory, and a 5% local preference goal was mandatory as it relates to the RFP itself.

The agency heads will meet at the end of the month to decide what we want to do with the remaining allocation of 80%. We will solicit this RFP at the start of June. We will have the RFP out for at least 30 days because we want to invite everyone to be able to compete.

B. ERM

1. Update – Deb Drum Drum

We are going to be hosting guided sea turtle nesting walks throughout the month of June. We will send an email out to all of you on the TDC to have the opportunity to join one The number of people is limited due to the permit that we have. I would want to give you all an opportunity to get out there with our staff to enjoy that educational presentation and hopefully see some sea turtles nesting.

We have on our beaches the Sargassum issue nothing unusual is happening You have a little bit of an accumulation but is normal for this time of year.

5

We have an island restoration project going on in Jupiter. We are about to complete that project and it was designed specifically to have an ecotourism draw It was designed with a kayaking paddling trail that goes through the width of the mangrove canal area and then turns into a tunnel. It will be maintained like that tunnel mangrove that you can see. Once things start growing, we will host you out there for those of you who might want to go on a paddling trip to check it out. It will take a little time to grow and become what it is going to become.

C. DISCOVER

1. Update – Evan Lomrantz/Gustav Weibull

Lomrantz

Hopefully, we will see you tomorrow morning for our annual Travel Rally Day at 9:00 A.M. at Loggerhead Marine Center. We have Gustav Weibull, who is our research guru, who is going to share the results of the most recent Portrait of the American Traveler which I think will provide valuable insights into where we are going in our industry.

Weibull

The Portrait of American Travelers is a national study of American travelers that we subscribe to, and it is done every quarter. This survey was filed at the end of February. There were 4,500 US adults, and almost 70% said they were going to travel this year.

That is a positive sign. We pull out who is interested in Palm Beach, and who is not. 36% of Americans are interested in traveling to The Palm Beaches. That is about 93M of US adults and 45M households that are interested in coming here this year. They plan on taking 5.3 trips this year, which is up from 4.6 trips last year. There is more enthusiasm for travel in 2023. They plan on spending nearly $4,200 total on travel this year, which is up from $3,000 last year. With inflation and prices increasing, they are adjusting their budgets and prioritizing travel.

This year, we can get breakdowns of the different targets that we are advertising and trying to attract. I want to highlight boomers are the highest with $6,000. Luxury travelers obviously are very high, but also outdoor nature experiences a much higher budget on average, beach lovers and then, Gen X and Gen Z have a higher budget than the average traveler. We are doing accessibility travel, an initiative this year. They are planning on taking nine trips this year. Same thing with Hispanic travelers. 8.5 trips this year. Millennials with 6.5 trips this year. Wellness travelers with 5.3 trips this year, travelers that are interested in The Palm Beaches. Where else are they interested in traveling to? 5.2 trips are dispersed potentially throughout the year. We are up against Honolulu, Nashville, New York City, San Diego, Los Angeles, New Orleans, Niagara Falls, and Myrtle Beach. There is a lot of competition. Everywhere is open for business and looking to attract travelers. We have about one in five travelers interested in The Palm Beaches.

6

And lastly travel motivations, this is what motivates travelers that are particularly interested in The Palm Beaches. We are already doing family travel, exploring nature outdoors, culinary travel, visiting friends and family, participating in sports, and pursuing wellness. We have initiatives to target each one of these motivations.

We are going to be doing a study on emerging technology. We are going to look at three parts of the study. One is the metaverse and all these new technologies How is that going to affect travel in the future? There are three parts to the study. First, we are going to go out to leaders of the industry, about 500 companies. Tech leaders and get their thoughts on what all these new technologies are. Then, we are going to survey US consumers and travelers about how they would use these technologies, and potential technologies, and lastly, go out to DMO and see what they are going to do and how they are going to engage this.

This study will help us to prioritize what technologies we should be investing in in the future. Here is a list of 19 technologies we have been playing around with and what is going to be in the final study. We are one of five sponsors in the US that are going to be conducting this study.

Dufresne

Who are the other four participants?

Weibull

Ann Arbor. There is one in California. I can get you a list of who they are.

Mostad

Is there any year-over-year imperative data or is this MTY? Is this a new concept?

Weibull

We have year-over-year data on the overall results. We saw the travel budget was $4,200 this year versus $3,000 last year. The number of trips was 5.3 versus 4.6 last year.

Mostad

We saw more interest in the comparative’s targeted marketing initiatives. It is valuable information.

Lambert

Is this information provided to other stakeholders in Palm Beach County? How can we access it? Do you share it with organizations you work with regularly?

Weibull

7

It is a national survey that anyone can purchase. We are just one of many destinations that purchased It. We can send out it to our partners.

Segarra

How are we going to improve our results? One of the answers is technology.

In technology, if we go 26 years back in time, we had a group that came to the industry. It was called Expedia; they were using technology and changed a 100-year practice into a booking platform. Now, 14 years ago, Uber came up with a transportation platform technology. Now most of you have an icon on your cell phone with Uber. In our case, that will be the next level to make sure we can create a digital platform of a destination.

Brian Glynn will take you through our proposal and show how we are going to take our destination and maximize the market. “Marktech” is the terminology, and make sure we beat the results every single year.

Glynn

Marketing technology is all the technology that we use, it is everything we do day to day. We have over 30 pieces of software we use daily to support everything from a marketing standpoint within our organization.

At the top is marketing, the technology and software that underpins it, and how those two communicate with each other. It is all the data that we have from all the platforms And then our processes. We have a lot of projects; a lot of inter-department plans, and how we are supporting our processes, our workload is very important to make sure we are achieving our goals. We have over 30 partners that we work with from technology to software perspective. There are over 11 thousand pieces of software in the industry right now. This was updated and released two weeks ago at Martechmap.com

And it divides things into advertising and content from a data perspective and making sure that we have the right partners in place and that the technology is working in concert to make sure we are extrapolating the most we can out of anything we are doing and building a strong foundation to take us through the next couple of years. The first one is data deprecation. When you download a new app it asks, do you want to allow tracking to use ad blockers, or clear your browser We have different changes in technology, things that Apple's rolling out, Firefox, and we have Microsoft trying to push privacy forward. No one wants to be tracked

The next thing is privacy regulations. Europe and California had them for years and the other five states rolled out privacy regulations. California updated theirs, as are Colorado, Utah, Verdenia, and Connecticut. Florida is trying to push legislation through on State-level privacy regulations and New York is doing the same.

8

2. MARTECH Presentation – 5 Minutes – Bryan Glynn

And then the Walled Gardens, like Meta -Facebook, IG, and Google. They do not play well with others. And we are looking at a solution that is called a Customer Data Platform (CDP). It takes all the information that we have and marries it with data from a large provider. A big CDP in the space is TransUnion. They have a treasure trove of data. They would say, we can see someone is interested in golf but then understand 10 other characteristics. It marries our data with another party's data. It becomes our data, and then we can push this into our digital platforms that are endpoints to target people more effectively.

The next one is a kind of data fragmentation. We have over 30 platforms regularly. We have a ton of information and data points coming in especially if you look to the research information. There is a lot of fragmentation with data, it lives in multiple sources. We are going to implement what is called a data lake. A data lake is taking all the data sources that we have across the entire organization and pushing them into one spot. It flattens the information for us to be able to pull things out from a metric standpoint, from a digital advertising perspective, understand our customers better, and understand the impact from an economic standpoint, it puts everything in one spot. It creates a lot more ability for stronger data governance and the ability to comply with everything, and from a privacy regulation standpoint as well.

There are tons of laws. There are the ones in Europe, the UK has a separate one, Canada has one, then all the States are rolling out their own privacy laws. There will be United States Federal legislation in the future. There are a lot of acronyms in this space as far as a compliance standpoint that we have to make sure we are in line with, and this is going to be a big focus of ours over.

Gustav has built a great model looking at how we are forecasting future occupancy in the destination. We have initiatives and have been working on them since December to look at occupancy farther out and be able to activate campaigns to help in need periods. It is a model based on different data sources. We are going to be implementing this data and this will allow our hotel partners to anonymously push occupancy data into our system. We have had about six or seven conversations with different hotels in the destination to discuss this. We will forecast what is happening in the destination and be able to initiate campaigns for those need periods.

And the last two things, one is the kind of evolution. Milton alluded to this with Uber, with Expedia, there are a lot of changes when it comes to the digital platforms that people are engaging with.

We have to look at how are consumer expectations going to change. How is generative AI going to impact this? Our new website will launch in July. Hopefully, by the end of the year, we will have generative AI incorporated into our website as well, to help people plan for their travel to the destination, as well as engage with future generations and how we are going to support visitors when they are in the destination.

9

We are going to make sure we are personalizing and layered into how we personalize content to potential travelers into the destination. How we are leveraging generative AI to make sure that a consumer has their expectations met for how they want to travel and plan to travel into the future.

We are kind of working through all these pieces of technology. There is an organization or enterprise-wide impact of these technologies. There is an impact to even community engagement as far as how we are interacting with our partners, how we are reporting back to them, and how we can help drive business into them. There is an impact on our sales side of the organization as far as the technologies that we can leverage, how we can better target meeting planners, and how we can better leverage our CRM and our data there. Within our CDP there is an impact on revenue generation We are generating more revenue to help push these initiatives as well as our workflow, I mentioned we are a very process-dependent organization and there is a technology that we use that underpins this

Commissioner Lambert

The data lake seemed very interesting. We were collecting all the data before, but it was just more segmented. Is that the case?

Glynn

We have it all centralized, a lot of information on our server in spreadsheets, from a marketing perspective, we have like a visualization tool that kind of serves as a data lake, but it is not sitting in there. It is not like it is out in the middle of nowhere, but this will create a repository for us to have for many years and it will backdate from a marketing data standpoint, it will go back a couple of years. We have data going back probably 10, or 12 years at this point. We will have a strong foundation moving forward

Segarra

Two years ago we started with the digital center of excellence. We brought in-house many important components of ACC access to the market, buying, and planning. The benefits will be tremendous between Culture, Film, and Sports. Having the technology available to make other collaborative initiatives will take the entire tourism component to the next level.

Mostad

You use an old-fashioned Tableau concept to report out of it.

Glynn

Gustav uses Power bi. I do something different, but I think we will kind of flatten that and see what makes the most sense for us to visualize things moving forward. We are going to tie that together and make sure it will enable us to make better decisions.

10

Mostad

How much of a threat is the new legislation related to the privacy policy? We all receive certain information, and you can decline or not. Is that a big threat going forward?

Glynn

It is a threat to the extent that it is removing data from the environment. We have to be compliant if someone wants to opt out, we have to do that, it is the right thing to do, but then from a legislative standpoint, we are going to be required to do it. But the bigger threat is just pulling data out of the ecosystem, which is why CDP is going to be incredibly important moving forward.

Mostad

From the hotelier’s perspective, we have an international group in-house, and those attendees are making their reservations and we market back to them by their email. We have very restrictive policies to remove that data because it said GDPR. To market to somebody in the UK was a tough thing.

Right now one of the challenges is to get approval for access. I think that is critical to keep focusing on that.

Vice-Mayor Sachs

Jim, could you describe that a little bit in terms of the, you said there is pending legislation.

Mostad

My ability to go out and blast market data directly to someone who may not opt into that. Or you go on a website, and suddenly on your Facebook page, you might get an advertisement that comes in. There are a lot of things behind the scenes. Scary technology. But at the point of sale, our ability to go out and market to those guests, the legislation is out there too

It is not free reign to go and market to those individuals. You cannot buy a list of a million email addresses. I cannot do that anymore. It was probably a trend. See what would stick, it was affordable. There is a real science behind it and that is why you guys are ahead of the game by thinking of this strategy built, pulling all this together, and being able to extract what makes sense.

Glynn

Europe has had one since 2016. California rolled one out in 2018. They updated in January. Colorado and Utah rolled one out for January. Connecticut and Virginia in July And we did have, in Florida, it died in a session one or two They were trying to

11

push legislation. It will come back up. New York is the same thing it died in their state legislator as well, but they just have to redo it. It is a matter of time.

D. SPORTS COMMISSION

1. The Category “G” Grant Agreements* - MOTION TO APPROVE

12

Grant Amount Room Nights

Prospect Select World Invite / Crossroads Florida Open (September 8-11, 2023) –Ballpark of the Palm Beaches, Santaluces Athletic Complex, Roger Dean Chevrolet Stadium – NEW $12,500 945

Perfect Game Palm Beach Gardens Open (September 22-24, 2023) Gardens Park - NEW $18,000 570

Perfect Game WWBA World Championships / Perfect Game WWBA 13U & 14U World Championship (October 5-16, 2023) - Ballpark of the Palm Beaches, Santaluces Athletic Complex, Roger Dean Chevrolet Stadium $107,000 12,502

Columbus Day Discovery Showdown (October 5-8, 2023) – Palm Beach Skate Zone & Palm Beach Ice Works $8,000 800 e. USTA Columbus Day Open (October 7-9, 2023) - Boca West Country Club, Boca Lago Country Club, Delray Beach Tennis Center, Seven Bridges Tennis Center, Palm Beach Gardens Tennis Center $7,500 500 f. World Comes to the Palm Beaches (October 25-29, 2023) - Ballpark of the Palm Beaches & Santaluces Athletic Complex $17,500 1,650

TimberTech Championship

$50,000 2,500

Men’s Senior Baseball

(November

Palm Beaches

Roger Dean Chevrolet Stadium $68,000 6,480

Equestrian Holiday and Horses Circuit (November 29 – December

2023) Wellington Interna $20,000 12,375 j. “Little Mo” Internationals

Florida

December 1-6, 2023) Palm Beach Gardens Tennis Center $15,000 1,500

(December 9-10,

Park Amphitheatre $25,000 2,160 Total $348,500 41,982 Average Historical ADR - $223.09 ROI - $561,945.86

a.

b.

c.

d.

g.

(October 30 –November 5, 2023) Old Course at Broken und

h.

League Fall Classic

4-18, 2023) - Ballpark of the

&

i.

31,

in

(

k. Garden of Life Palm Beaches Marathon

2023) Meyer

Fontanarosa

In front of you is the list of grants we are requesting a motion to approve. There are several baseball events, two tennis and an equestrian sports, and a marathon.

These events are taking place in September, which is a slower month and is projected to generate 41,982 room nights with a room night acquisition cost average of approximately $8.

Dufresne

I would like it to be noted that I will be abstaining on that particular matter. My firm is affiliated with the Equestrian Holiday and Horses Circuit.

Motion to approve The Category “G” Grant Agreements was made by Commissioner Adam Frankel and seconded by Jim Mostad. Motion carried 6-0-1 with Jim Bronstien and Daniel Hostettler absent and Don Dufresne abstained.

2. Update – David Fontanarosa

Fontanarosa

George is out at the Sports ETA, which is a trade association for education networking. Later this month we are going to have the Florida Sports Summit. And we have the Teams conferences, which is the largest associate trade conference in our industry. Those will drive a lot of future business for our organization.

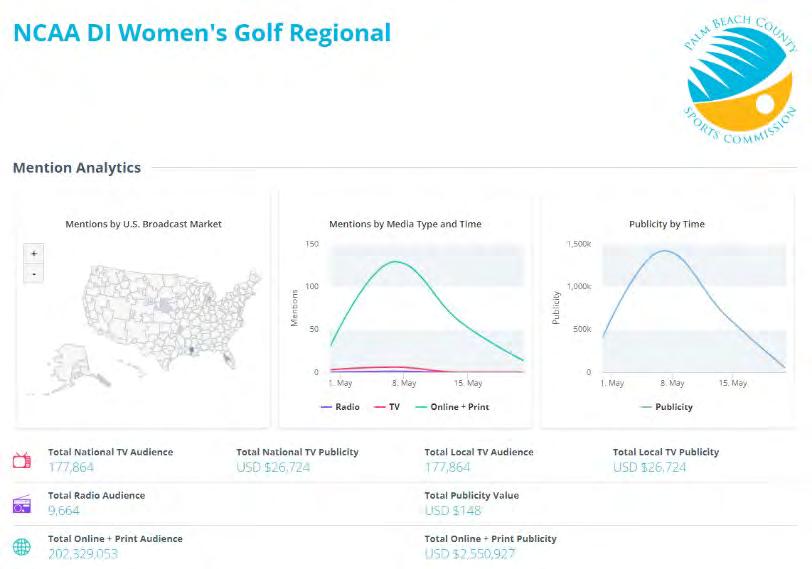

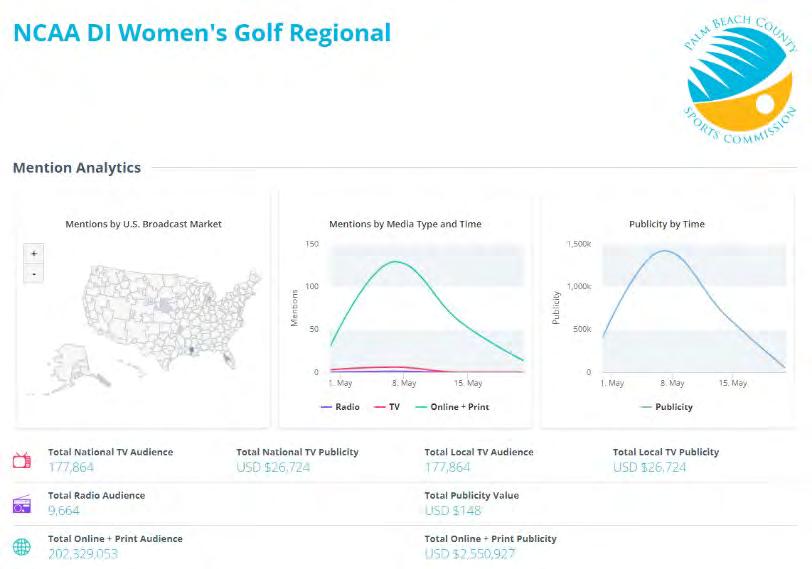

We highlighted the NCAA Collegiate Women's Golf event that was out there this week through Wednesday and the FAU team players were at the BCC meeting

On the performance measures side, we have 96 events with 184,554 room nights, which generated estimated revenue of $44M in hotel revenue, and $2.6M in bed taxes. We are on pace to meet or exceed our performance measures expectations.

Dufresne

All the Palm Beach County Sports Commission is up for Commission of the Year at ETA.

Commissioner Lambert

Did we have the pickleball tournament?

Perry

Starts tomorrow

Vice-Mayor

13

Is there an American Pickleball Association where we could have a championship here in The Palm Beaches?

Zeff

There is an Association of Pickleball Professional Tour, which we have hosted three times now in the last two years. Which is a national tour of professional pickleball and the organization that puts that tour on is the same one that is putting on Delray Beach Pickleball Open.

E. CULTURAL COUNCIL

Sullivan

This month is when we celebrate culture in The Palm Beaches. It is a Month of Shows, Art, Ideas, and Culture and it is a cultural discount and experience promotion. We have 25 organizations that are participating in Mosaic this year with 27 different offers. We added new elements this year.

We do custom artwork every year for MOSAIC and this year’s art is by a Boca Raton artist named Tiffany Biasi and it is called the Palm Beaches in Bloom. Our cultural organizations are highlighted there. And I loved seeing Gustav's data because this promotion aligns well with the data that we are seeing. It is a drive market promotion, we are hitting people throughout the state of Florida, inviting them to come in for the month of May. We are inviting them through the Culture to experience the outdoors and bring their families, which is all of the data points that Gustav provided

A lot of work has gone into this campaign with a lot of great results. First, on the PR side, a lot of this ramps up in April. Stories like Weekly Florida, South Florida on the Cheap, and Sun Sentinel, led with Sun Fest because Sun Fest offered a discount for us this year for Mosaic, which was extremely popular. We brought in Sarah Liss freelance journalist. And a lot of times these Mosaic Fam Tours all result in other stories after May. We tried to showcase the County These were broadcast on NBC, in Miami, Orlando, and Tampa Bay. We ended up doing the segments at In Palm Beach Drama Works on stage so that we could show off another one of our cultural institutions.

Influencer partnerships are an important part of our marketing program. We hosted a few of our influencers. This one's Ultimate Girl Mom has triplets for the family market. She has already been here to promote our event. We have them promoting Mosaic all month long, even though they visited in April, we have them hold their content until May. We had another influencer, Stella of Our Peachy Home from Tampa. She took her family to visit and showed our organizations on her social media. And we have a new ambassador program. This is our second year working with Nick Mele as our mosaic ambassador. We are putting together something for an annual partnership that would be a cultural ambassador for the month of next year with Nick Mele He is a noted photographer. He

14

1. MOSAIC Update – Jennifer Sullivan

has an exhibit right now with Bergdorf Goodman. He travels from Cape Cod and the Hamptons to The Palm Beaches. And he writes for Town and Country and other major lifestyle publications. He took over 70 new photographs, amazing of him and his family, experiencing culture in The Palm Beaches. He helped us write a blog and shared it on his social media. We went back to our old influencers, and they still have content and information that we just asked them to repurpose for Mosaic with just a couple of hundred dollars and they all accepted, and we got additional coverage from people that visited in the past.

On our landing page, you can see we are promoting our Signature Art Week and our artwork. It is mosaicpbc.com where all of the offers live. All of our information on Open Studios as well as links to find the Perfect Hotel, that links over to Discovers Florida Resident and summer savings page.

We had an activation at the Hilton. You can see our ads, our agency took that larger mural and created our mosaic treatment, which is the letters. And we were using the shirt as a form of ad. During our activations, I talked about the Hilton. We had their staff members wearing our shirts. And That is our fun little pop-up display.

We are in Brightline station now. We are doing a lot of digital; we have a video of 15 seconds. For the t-shirts, we made headbands, shades that everyone loves, and then the pin you all have an M. But now I challenge you to go out and find the rest of the letters because our organizations have a letter, if you want to find them you could go on our social media. We have clues on where to find a or the s, etc. We are trying to encourage people to go out and get their hints.

At The Square, they allowed us to have our big Shades of Culture for all of April and all of May. You can see that was a little screen grab of an Instagram post. That is one of the stars of the Ain't Too Proud Show, took a photo in front of glasses and he got a lot of great engagement on social media. They will be up until the end of May as well.

And the last thing I wanted to mention is our Open Studios, which I provided you all with a brochure. This was a way for us to incorporate artists into Mosaic. We have been focusing on organizations and artists that are important to the tourism economy as well. We came up with this concept and we did not know how it was going to go, but I can tell you that the artists are super excited. We ended up getting over 65 artists who wanted to participate in our first Palm Beach County Open Studios. All the studios will be open from 12:00 to 5:00 on May 20th. They will all have champagne or cookies or refreshments, and you get a little behind-the-scenes tour of how their work, how they do their artwork, and you could buy their art, you can talk to them. There are a lot of art spaces. with Zero Empty Spaces has a few spaces where there are multiple artists.

Arts Garage, or Arts Warehouse, for instance, all participating. They have 10 artists there. Another place we think people will travel to is this. There are open studios in other markets across the country. One is in Miami. We know many people from Palm Beach who want to hop on Brightline and spend the day in Miami exploring the studios.

15

We think that they will come up to Palm Beach for this as well. I invite you all to get your friends together and make a day out of it. There are clusters of galleries, but they are all over the County. On the Mosaic PBC page, you can see a Google map, you can map them out. We are partnering with Zero Empty Spaces which has two spaces at Legacy Place and then at the Brick Down on Boca, where they have multiple artists. We did a podcast with them and WLRN is our other partner. Hoping that maybe this expands to two days in the future, but we will see how it goes this first year.

2. Update – Dave

Lawrence

Lawrence

The Category D and CII Grants are being adjudicated this week. We will start on Tuesday, reviewing Category CII These are mid-size organizations.

On Thursday we will meet about Category B, which are major cultural institutions at our headquarters in Lake Worth Beach. If you have not come and witnessed the process, please do so. The scores determine the funding amounts. At our June meeting, we will bring those funding recommendations for the cultural organizations back to you. I want to thank Emanuel and the TDC board members that are participating in the panel process.

Registration opened for the second Art and Tourism Summit on Diversity, Equity, Inclusion, and Access. This is a collaboration amongst all of the TDC agencies. Discover has done a tremendous job putting this together in terms of the actual registration and conference style. The Summit will be on August 30th and 31st at the Convention Center, it is free, and we are going to have new aspects this year.

On day one, will be a small business fair, in the afternoon the participants can engage directly with SBE organizations and see how they can utilize their programs and services. On day two, there will be a multicultural artist fair where artists can share their works and be able to sell them. We partnered with Barry University to provide CEU and SHRM credits. There will be a certification at the end of the second day. If people go on day one and day two, they can get a certification for having participated in this process. It is something we can all be proud of, hope you all will join us.

You all have received our latest issue of Art and Culture Magazine. We published this three times a year in partnership with Palm Beach Media Group. This is a true arts tourism publication and there is a lot of great information, a gallery guide that includes minority-owned galleries and women-own galleries. It is a great way to take a deeper dive into arts and culture, and it is up for several awards, including Best Overall magazine for the State of Florida.

F. FILM & TV

1. Update – Michelle Hillery

Hillery

16

I wanted to give you an exciting update about The Palm Beach's TV and a wonderful collaboration with our airport, you may have seen two monitors at that airport that streams The Palm Beach's TV. We have four more monitors that are up and running right now broadcasting The Palm Beach's TV channel. A two-hour loop that shows segments of each of the programming that is on the channel. Now we have another monitor on the inside of baggage claim, you can see the programming while you are standing there. Thanks to TDC and the airport for making that happen for us. A 20-year effort. Yes.

On The Palm Beach's TV, this summer is going to be busy with brand new programming that is going to hit the original distribution of these shows. Then we have over 20 hours of brand-new Family Friendly Tourism, branded diverse programming. A huge focus is on the Western communities. On diversity. We have On The Town around the world. We have a Latin-style show. We have a gay polo show.

I did want to go back to the consent agenda, not that you have to go there, but just to bring a little attention to our production history. This is a huge effort, and it is a big survey. This year we surveyed over 168 of our local indigenous production companies. We were able to identify the $238M of revenue that is being spent in the County as a result of the Film & TV efforts. We did not get in touch with 70 of them, and we think another $18M is left on the table. we only identify and report what we can confirm. This is from 1991 through 2022. This is something Chuck started years ago that encompasses what our industry looks like, breaking it down from television to feature films to the commercial industry, what it looks like. There is a page that talks about our ROI which is $192 Return On Investments.

We had a very successful 28th Annual Palm Beaches Student Showcase of Films again, Which is very near and dear to our hearts I want to thank Verdenia Baker for presenting the first award of the day to our students. We had over 650 high school and college students from around the state of Florida join us at the Maltz Jupiter Theater. We gave over $20,000 in scholarships and awards. $1.6B in scholarships and awards throughout its history. We want to keep that talent here. We have wonderful education programs, some of the best in the country for Film & TV Production. But the competition is stiff in places like California, Georgia, and Louisiana. They have incentives to attract business.

We are one of 17 states that do not have any type of program. We were the third-largest Film & Television Production State in the country. Possibly we could make that available to our state legislators.

Youyoute

Regarding the Showcase for the students. We were in attendance, and we enjoyed it. There was a concern about the space. I just wanted to know if anybody provided any feedback asking to get a bigger place because the audience was huge. But someone mentioned to us maybe a bigger space because every year it is growing. So I just wanted to know if you have any concerns.

17

Hillery

Yes, that is a nice problem to have. We have 659 seats in that theater, and we had 600 RSVPs this year. We did have enough availability this year, and we do take the RSVPs, but sometimes we will have a bus that shows up and they did not let us know that they were coming.

But we can look at expanding that program and years to come. Going back to The Maltz where Burt Reynolds started, that was the original dinner theater for Mr. Reynolds, and we continued to give the Burt Reynolds scholarship out every year. There is meaning behind being there. But I thank you for that feedback. Last year did not seem as full obviously as this year. There was a much bigger turnout, and we had a record number of submissions. This year, 528 submissions from around the state. We are getting out there.

G. CONVENTION CENTER

This may be going to be the perfect month for us. When I started 20 years ago before the connected hotel was built, we were primarily supported by local businesses and organizations, then we finally got the new hotel breaking ground. I remember when Maria Walker and I, my director of sales, had to change the booking policy. And we had to take the window for the short-term pieces of business, and we had to narrow it back for how far they could book out. Because the goal was really to book business. And that was the priority. When we released it, we were a little nervous because these clients had supported us for all of these years and the effect was few people had to have certain dates. But at the end of the day, the majority of our short-term business stayed with us. Then the hotel opened, and our business has just been crazy. The great thing is we are probably 70 long and 30 short, the majority of our long, our short-term clients have stayed with us, our annual clients.

In the month of May, we are running 24/7 for 31 straight days. We started with college graduations. We currently have the Governor's Conference in driving room nights

Then we go into Vertical Flight which is coming back to a great conference. Friday, we have the Urban League 50th anniversary dinner, hosted by Legal Aid. I think it is the 20th year of the dinner at the building. The mix is phenomenal. It is just proof that we are a building for our community, and we can drive the revenue and keep the operating deficit down. We do not have any deficit anymore. We can drive the room nights and can offer opportunities to all of these local groups. Thank you Verdenia for coming over yesterday.

I wanted to introduce one of our great partners with the connected Hilton Hotel Derrick Steinour, who is the Director of Sales.

18

1. OVG Venue Management

a. Update- Dave Anderson Anderson

Steinour

Our great partnership with Convention Center continues to grow, which we are very excited about, but more importantly, we have a new fearless leader Chris Inman joining us from Santa Barbara as our General Manager,

Inman

I have been here for about three and a half months. I was four and a half years in Santa Barbara, but my home is in South Florida. It is great to be back with you. I am looking forward to working with all of you and thank you for making me feel welcome.

We are running strong. It is 24/7 right now. We have events where Dave has a crew that is in overnight flipping the ballroom from one setup to the other for us to hold a function the next morning where I have staff coming in at two o'clock in the morning to start setting the room.

It is wonderful. It is crazy. It is busy. In June we get a little bit of relief. I have staff That are taking a vacation, but I have a large staff that are part-time employees, part-time hourly employees, and a lot of them live paycheck to paycheck. And I want to keep them employed, but the last couple of weeks were slower.

I am working with some of the other OVG hospitality accounts in the area to provide them with work opportunities. They have bills to pay and families to support, and I am selfish, I do not want them to go and get a job elsewhere. We are sending our full-time staff to other accounts so that we can relieve our budget a little bit of that expense in June to save a little bit of money.

Peter yesterday, a prominent member of the Discover Board, has taken on the role of the search committee chair for Jorge’s replacement when he retires, which is sometime this summer. They are following their bylaws impeccably and have opened it up. I know members of the committee include several members of the Discover Board, Verdenia, Emanuel, and Roger are on that due to his expertise, having had that position many years ago, myself, and a few others.

We went through a whole RFP process relative to getting a search firm and things are underway right now. It is worth mentioning to everyone that the process is underway and

19

2. OVG Hospitality a. Update – Kathy Griffin Griffin

7. BOARD COMMENTS Mostad

with the greatest of transparency. I think Roger probably wanted to make sure that we disclose to this board today that it is underway.

Lambert

Can we have an update on the TDC Executive Director?

Baker

Happy to report that we have gone out twice, on a national search. I have narrowed that down to one person, but I need to make sure all my board members are aware of it. And as I do that, I will be sending something out to this board. For all of my department heads, I select them, but my board has to ratify them. And that process will be completed this week so that I will be able to take something to the board for their consideration on Tuesday.

Vice-Mayor Sachs

Do you think that will be on the June 8th , agenda or possibly before?

Baker

My goal is to have it on Tuesday.

Commissioner Lambert

I was pleased to see it on the back of this. Regarding the comment that you all added about our County being large, please plan for travel time. I thought that was nice because Michelle, Sergio from Discover, and myself had the opportunity to speak yesterday to Leadership Palm Beach County and their recent class about tourism. And they were especially interested in making sure that we do not forget about our friends in the Glades area. I think things like this that help remind folks about how large our County is very helpful.

Baker

Large and diverse.

Hillery

And if I may add, she was a wonderful ambassador on behalf of the TDC.

Commissioner Lambert

I stepped in because there was no executive director,

Baker

20

Believe it or not, I am posing as that with Emanuel's help. I was not aware that was going on. I would have been extremely pleased to have spoken to Leadership Palm Beach County, which I often do as the County Administrator. That is not an issue. We have not missed a beat as a result of that position being vacant. Between the two of us, have been covering as long as we are aware of it.

8. PUBLIC COMMENTS

No public comments.

9. ADJOURNMENT

The meeting was adjourned at 10:20 A.M.

Next TDC Board Meeting will be on June 8, 2023.

*Attachment included.

Tdc/tdcmtgs2023/Minutes.5.11.2023

21

4. CONSENT ITEMS

TO: Tourist Development Council

FROM: Jorge Pesquera, President/CEO

DATE: May 31, 2023

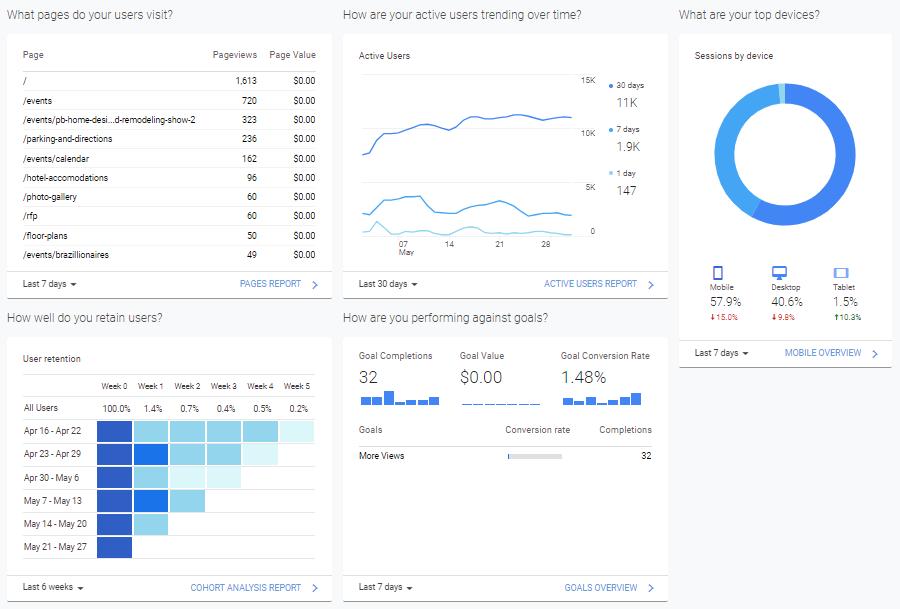

RE: Discover The Palm Beaches Monthly Activity Report May 2023

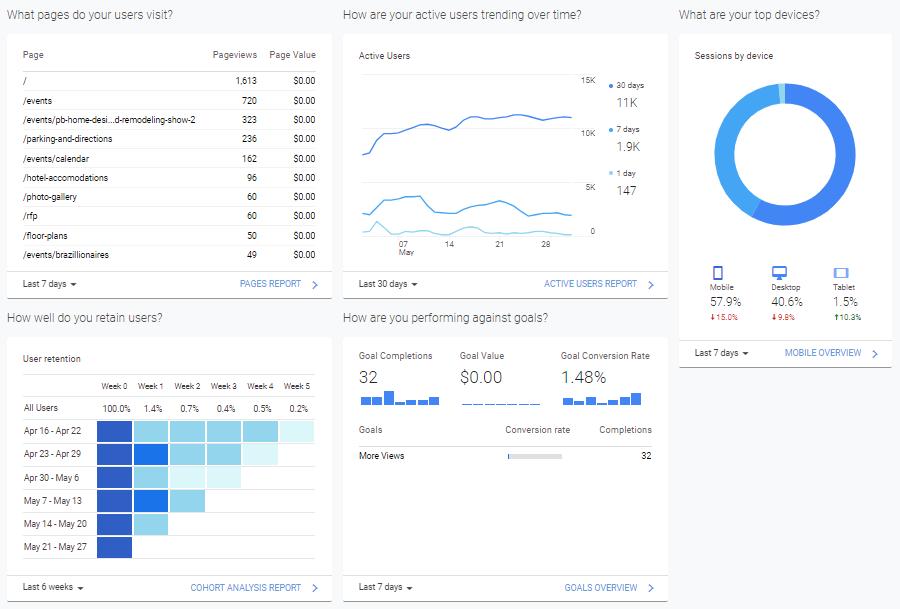

The following is a summary of DTPB activities in support of TDC Performance measures for the month of May 2023. This report demonstrates positive trends relative to owned visitor digital footprint, advertising impressions, social media engagement, and booked room nights for the Month of May.

April 2023 Performance

Visita�on

2.8 million visitors, up 8.5% from last year driven by record interna�onal visita�on

o Interna�onal by 25% to 268,000

A record 153,000 Canadians visited in Q1-2023, 28% more than 2022 and 16% more than 2019

Visita�on from Germany was also a record at 5,200, up 48% from 2022 and 23% from 2019

Mexico which recovered in 2021 reached a new record over Q1-2023 with 3,300 visitors up 32% over 2022

The UK and Brazil both returned to 2019 levels

Colombia decreased 14% to 4,200 back to 2019 levels

o Visita�on from Out-of-State increased by 5% to 1.68 million

Visita�on from New York City Area was flat at 380,000

Washington DC & Bal�more up 14%

Boston was flat at 102,000

Philadelphia up 3% to 60,000

Houston up 25% to 35,000

Atlanta and Detroit were both up 13% to 57,000 and 39,000

o In-State increased by 10% to 821,000 likely due to more new residents and full schedule of events

Spending

$2.2 billion up 10% from last year

o $664 million in F&B spend up 10%

o $740 million on total lodging spend (including ancillary) up 17%

o $254 million on recrea�on up 3%

o $411 million on retail down 1%

o $161 million on transporta�on with The Palm Beaches up 25%

Total economic impact from tourism over Q1-2023 was $3.2 billion

4-A

Occupancy and Demand

Hotel Occupancy for April decreased by 2.5% to 83.4%, selling 1.3% less hotel rooms than last year.

Shared lodging occupancy sold 19% more room nights compared to last year, but with a 2.4% decline in occupancy due to an increase of room inventory.

Total room nights sold from hotels and shared lodging increased 4.3% to 598,000.

ADR and Revenue

Hotel rates were down 1.8% to $289.

Shared lodging rates were down 3.5% to $358, the per room equivalent was down 7% to $156.

With shared lodging selling more rooms and lower rates across all lodging overall revenue is flat yearover-year at $149M

Bed taxes are expected to be near $9M.

Key Performance Trends

Hotel room nights decreased by 5.3% across Florida, The Palm Baches declined the least ranking 1st in growth of room nights sold.

Rate in The Palm Beaches also declined less than any other Florida destination and commanded the 3rd highest rate in the State, behind Naples and The Keys

Luxury rooms sold were up 8.4% but at an 8.5% lower rate ($708)

Demand was strong at Beaches up 2.9% and Downtown districts with West Palm Beach up 3.4% and Delray Beach up 1.7%

Performance was driven down by I-95 and Budget properties down 3.2% and 10% in room nights sold.

2

Table of Contents MAY 2023 MONTH END 2 1 PERFORMANCE MEASURES - TDC 4 PERFORMANCE MEASURES DETAIL 5 1 Advertising/Paid Media Impressions 5 2 Owned Views Digital Footprint 5 3 Consumer & Travel Industry Database 6 4 Earned Media Impressions - Public Relations 6 5 Social Media Engagement 7 6 Marketing Overview by Month FY 2022 - 2023 7 7 Booked Room Nights - Hotel Lead Program 8 8 Group Level Booked room Nights (CC Shared) 8 9 Citywide Actualized FY Room Nights (CC Shared) 9 10 Destination Reviews 9 11 Site Participation 10 12 Group Sales & Destination Services Overview by Month FY 2022 - 2023 10 HOTEL & SHARED LODGING PERFORMANCE 11 1 The Palm Beaches Hotel Performance - April 11 2 The Palm Beaches Shared Lodging Performance - April 11 3 The Palm Beaches Total Lodging Performance - April 12 4 The Palm Beaches Hotel Performance - April CYTD 12 5 The Palm Beaches Shared Lodging Performance - April CYTD 13 6 The Palm Beaches Total Lodging Performance - April CYTD 13 SUCCESS CONTINUATION PLAN - JUNE 2023 14 1 Marketing 14 2 Sales 16

Performance Measures - TDC

DTPB OBJECTIVES 2022 – 2023

Leisure/Consumer

Increase Consumer and Travel Industry database to 410,000

Generate 14,000,000 in Owned Views Digital Footprint

Generate 7,000,000 Social Engagements

Generate 700,000,000 Advertising Impressions

Generate 250,000,000 Earned Media Impressions

Meetings & Conventions

Book 110,000 DTPB only room nights (Hotel Meetings Leads)

Generate 50,000 Group Level Booked Room Nights Convention Center Shared

Generate 40,000 Group Level Actual FY Room Night for Convention Center Shared

Generate 80 participants in Destination Reviews

Generate 110 Destination Site Participants

3

PERFORMANCE MEASURES Target Actual Year End Target Current Month MAY YTD % of Annual Target Advertising Impressions 600,000,000 1,402,602,058 700,000,000 215,652,627 2,442,004,949 348.9% Owned Views Digital Footprint 18,000,000 15,291,492 14,000,000 1,498,316 12,391,974 88.5% Consumer & Travel Industry Database increase 405,000 419,118 410,000 401 426,167 103.9% Earned Media Impressions 200,000,000 253,318,230 250,000,000 31,552,899 237,004,709 94.8% Social Engagement 1,400,000 14,885,913 7,000,000 1,159,547 17,508,828 250.1% Booked Room Nights - Hotel lead Program 90,000 130,562 110,000 14,624 136,403 124.0% Convention Center Booked Room Nights (Shared w/CC) 40,000 44,697 50,000 8,798 25,971 51.9% Convention Center Actualized FY Room Nights (Shared w/CC) 30,000 33,195 40,000 4,522 25,403 63.5% Destination Reviews 70 94 80 0 79 98.8% Destination Site Participation 90 101 110 13 80 72.7% FISCAL YEAR 2021 - 2022 FISCAL YEAR 2022 - 2023

Power BI Desktop Percentage of Target Achieved - FY2023 100.0% 0 0% 100 0% 348.9% FYTD 0 1,000,000,000 2,000,000,000 676,713,218 2,442,004,949 FY 2022 2023 Digital and Traditional Impressions - Month/Month 0 50,000,000 100,000,000 150,000,000 200,000,000 2022 2023 60,689,638 182,756,888 32,895,739 78,112,075 215,652,627 Digital Impressions Traditional Impressions Month May Digital and Traditional Impressions - FYTD 0 1,000,000,000 2,000,000,000 2022 2023 475,702,307 1,982,819,051 459,185,898 676,713,218 2,442,004,949 YTD Digital Impressions Y TD Traditional Impressions % of Annual Target Achieved

Media Impressions Year End Target 700M FY Multiple selections Month / Month 0 50,000,000 100,000,000 150,000,000 200,000,000 78,112,075 215,652,627 FY 2022 2023 Power BI Desktop Percentage of Target Achieved - FY2023 100.0% 0.0%

FYTD 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 9 , 3 0 0 , 2 7 9 1 2 , 3 9 1 , 9 7 4 FY 2022 2023 Month / Month 0 500,000 1,000,000 1,500,000 9 8 7 , 7 1 6 1 , 4 9 8 , 3 1 6 FY 2022 2023 Month May % of Goal Achieved YTD

Year End Target

Owned Views Digital Footprint FY Multiple selections

348.9% Advertising/Paid

100.0% 88.5%

88.5%

14M

94.8%

Power BI Desktop Percentage of Target Achieved - FY2023 100.0% 0.0% 100.0% 103.9% Month May Percentage of Target Achieved 103.9% Year End Target 410K Consumer & Travel Industry Database FY Multiple selections Sum of Target and YTD by Month 0.0M 0.1M 0.2M 0.3M 0.4M Sum of Target and YTD Month May 410,000 426,167 Sum of Target YTD Power BI Desktop Year End Target 250M Month/Month 0 5,000,000 10,000,000 15,000,000 20,000,000 25,000,000 30,000,000 1 7 , 6 7 7 , 6 3 3 3 1 , 5 5 2 , 8 9 9 FY 2022 2023 FYTD 0 50,000,000 100,000,000 150,000,000 200,000,000 250,000,000 1 4 1 , 9 5 6 , 7 3 2 2 3 7 , 0 0 4 , 7 0 9 FY 2022 2023 Percentage of Target Achieved - FY2023 100.0% 0 0% 100 0%

Month May Percentage of Target Achieved

Earned Media Impressions - Public Relations FY Multiple selections

94.8%

Power BI Desktop FYTD 0 5,000,000 10,000,000 15,000,000 6 , 3 0 4 , 1 5 9 1 7 , 5 0 8 , 8 2 8 FY 2022 2023 Month/Month 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 5 8 9 , 9 1 6 1 , 1 5 9 , 5 4 7 FY 2022 2023 Percentage of Target Achieved - FY2023 100.0% 0.0% 100.0% 250.1% Month May Percentage of Target Achieved 250.1% Year End Target 7M Social Media Engagement FY Multiple selections Power BI Desktop Advertising/Paid Media Impressions 0 0bn 0 1bn 0 2bn 0 3bn 0 4bn Month Current Month 121M 421M 396M 414M 328M 315M 232M 216M October November December January February March April May Owned Views Digital Footprint 0 0M 0 5M 1 0M 1 5M 2 0M Current Month 0.92M 1.44M 1.68M 1.60M 1.72M 1.68M 1.84M 1.50M October November December January February March April May Earned Media Impressions 0M 20M 40M Current Month 16M 24M 21M 17M 43M 37M 48M 32M October November December January February March April May Social E ngagement 0K 2,000K 4,000K 6,000K Current Month 349K 1,286K 2,043K 2,348K 1,860K 3,104K 5,358K 1,160K October November December January February March April May Marketing Overview by Month FY 2022 - 2023

51.9%

50K

Power BI Desktop FYTD 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 8 1 , 8 4 7 1 3 6 , 4 0 3 FY 2022 2023 Month/Month 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 8 , 5 9 4 1 4 , 6 2 4 FY 2022 2023 Month May Percentage of Target Achieved - FY2023 100.0% 0.0% 100.0%

Percentage of Target Achieved 124.0% Year End Target 110K Booked Room Nights - Hotel Lead Program FY Multiple selecti * Power BI Desktop FYTD 0 5,000 10,000 15,000 20,000 25,000 30,000 2 7 , 7 7 8 2 5 , 9 7 1 FY 2022 2023 Month/Month 0 2,000 4,000 6,000 8,000 8 , 7 9 8 FY 2022 2023 Percentage of Target Achieved - FY2023 100.0%

Month May Percentage

Target

Year End

FY Multiple selections *

124.0%

0.0% 100.0% 51.9%

of

Achieved

Target

Group Level Booked Room Nights (CC Shared)

Citywide

98.8%

98.8%

80

Power BI Desktop FYTD 0 5,000 10,000 15,000 20,000 25,000 2 1 , 5 9 6 2 5 , 4 0 3 FY 2022 2023 Month/Month 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 7 , 2 6 5 4 , 5 2 2 FY 2022 2023 Percentage of Target Achieved - FY2023 100.0% 0.0% 100.0% 63.5% Percentage of Target Achieved 63.5% Year End Target 40K Month May

Actualized FY Room

FY Multiple selections Power BI Desktop FYTD 0 20 40 60 80 9 1 7 9 FY 2022 2023 Month/Month 0 5 10 15 16 FY 2022 2023 Month May Percentage of Target Achieved - FY2023 100.0% 0

0%

Percentage of Target Achieved

Year End Target

Destination Reviews FY Multiple selections

Nights (CC Shared)

0% 100

Power BI Desktop FYTD 0 20 40 60 80 62 80 FY 2022 2023 Month/Month 0 2 4 6 8 10 12 14 7 13 FY 2022 2023 Month May Percentage of Target Achieved - FY2023 100.0% 0 0% 100 0% 72.7% Percentage of Target Achieved 72.7% Year End Target 110 Site Participation FY Multi Power BI Desktop Booked Room Nights - Hotel lead P rogram 0K 10K 20K 30K 40K Current Month 15,708 10,314 37,479 11,234 17,839 15,939 13,266 14,624 October November December January February March April May Group Level Booked Room Nights (CC Shared) 0K 2K 4K 6K 8K Current Month 3,106 50 1,475 4,373 0 560 1,234 8,798 October November December January February March April May Group Level Actual FY Room Nights for CC Sha red 0K 2K 4K 6K 8K Current Month 8,712 1,078 0 5,965 2,318 215 2,593 4,522 October November December January February March April May Destination Site Participation 0 20 40 Current Month 17 52 14 10 20 23 10 13 October November December January February March April May Group Sales & Destination Services Overview by Month FY 2022 - 2023

11.5%

Power BI Desktop Hotel ADR $0 $100 $200 $300 2022 2023 $295 $289 Hotel Occupancy 0% 20% 40% 60% 80% 2022 2023 75 2% 73.4% Hotel RevPAR $0 $100 $200 2022 2023 $222 $212 The Palm Beaches Hotel Per formance - April Hotel Rooms 0K 5K 10K 15K 20K 2022 2023 18,686 18,991 Hotel Room Nights Sold 0.0M 0.1M 0.2M 0.3M 0.4M 2022 2023 422K 418K Hotel Room Revenue $0M $50M $100M 2022 2023 $124.2M $120.9M *Source: STR, INC. REPUBLICATION OR OTHER RE-USE OF THIS DATA WITHOUT THE EXPRESS WRITTEN PERMISSION OF STR IS STRICTLY PROHIBITED Research compiled and pub ished by Discover The Palm Beaches (DTPB) can on y be reproduced through expressed written approval from the DTPB Research Department For questions p ease contact research@thepa mbeaches com Market The Palm Beaches % Chg '22 to '23 -2.5% % Chg '22 to '23 -1.8% % Chg '22 to '23 -4.2% % Chg '22 to '23 -1.3% % Chg '22 to '23 1.2% % Chg '22 to '23 -3.1% Navigation (select page and click go) Shared Lodging Monthly Power BI Desktop Shared Lodging ADR $0 $100 $200 $300 $400 2022 2023 $371 $358 Shared Lodging Occupancy 0% 20% 40% 60% 2022 2023 66.1% 64.5% Shared Lodging RevPAR $0 $100 $200 2022 2023 $245 $231 The Palm Beaches Shared Lodging Per formance - April Listings / Rooms 0K 5K 10K 2022 2023 4,935 5,908 10,834 13,478 Sum of Shared Lodging Listings Sum of Shared Lodging Rooms Shared Lodging Room Nights Sold 0K 50K 100K 150K 200K 2022 2023 151K 180K Shared Lodging Room Revenue $0M $10M $20M $30M 2022 2023 $25 2M $28.1M *Source: Airdna. REPUBLICATION OR OTHER RE-USE OF THIS DATA WITHOUT THE EXPRESS WRITTEN PERMISSION OF Airdna IS STRICTLY PROHIBITED Research compiled and pub ished by Discover The Palm Beaches (DTPB) can on y be reproduced through expressed written approval from the DTPB Research Department For questions p ease contact research@thepa mbeaches com Navigation (select page and click go) Hotel Monthly % Chg '22 to '23 -2.4% % Chg '22 to '23 -3.5% % Chg '22 to '23 -5.8% % Chg '22 to '23

% Chg '22 to '23

18.9%

Power BI Desktop Total Lodging ADR $0 $100 $200 $300 2022 2023 $305 $300 Total Lodging Occupancy 0% 20% 40% 60% 80% 2022 2023 73.8% 71.8% Total Lodging RevPAR $0 $100 $200 2022 2023 $225 $216 The Palm Beaches Total Lodging Per formance - April Hotel Rooms + Shared Listings 0K 10K 20K 30K 2022 2023 29,520 32,468 Total Lodging Room Nights Sold 0.0M 0.2M 0.4M 0.6M 2022 2023 573K 5 98K Total Lodging Room Revenue $0M $50M $100M $150M 2022 2023 $149.4M $149.0M *Source: STR, INC.and Airdna REPUBLICATION OR OTHER RE-USE OF THIS DATA WITHOUT THE EXPRESS WRITTEN PERMISSION OF STR IS STRICTLY PROHIBITED Research compiled and pub ished by Discover The Palm Beaches (DTPB) can on y be reproduced through expressed written approval from the DTPB Research Department For questions p ease contact research@thepa mbeaches com Navigation (select page and click go) Hotel Monthly % Chg '22 to '23 -2.7% % Chg '22 to '23 -1.7% % Chg '22 to '23 -4.3% % Chg '22 to '23 10.0% % Chg '22 to '23 4.3% % Chg '22 to '23 -0.3% Power BI Desktop Hotel ADR $0 $100 $200 $300 2022 2023 $321 $332 Hotel Occupancy 0% 20% 40% 60% 80% 2022 2023 76.0% 78.1% Hotel RevPAR $0 $100 $200 2022 2023 $247 $259 The Palm Beaches Hotel Per formance - April CY TD Hotel Rooms 0K 5K 10K 15K 20K 2022 2023 18,686 18,991 Hotel Room Nights Sold 0.0M 0.5M 1.0M 1.5M 2022 2023 1,699K 1,775K Hotel Room Revenue $0.0bn $0.2bn $0.4bn $0.6bn 2022 2023 $545 2M $588.8M *Source: STR, INC. REPUBLICATION OR OTHER RE-USE OF THIS DATA WITHOUT THE EXPRESS WRITTEN PERMISSION OF STR IS STRICTLY PROHIBITED Research compiled and pub ished by Discover The Palm Beaches (DTPB) can on y be reproduced through expressed written approval from the DTPB Research Department For questions p ease contact research@thepa mbeaches com Market The Palm Beaches % Chg '22 to '23 2.8% % Chg '22 to '23 3.4% % Chg '22 to '23 6.3% % Chg '22 to '23 0.8% % Chg '22 to '23 3.6% % Chg '22 to '23 7.2% Navigation (select page and click go) Hotel Monthly

Power BI Desktop Shared Lodging ADR $0 $100 $200 $300 $400 2022 2023 $391 $392 Shared Lodging Occupancy 0% 20% 40% 60% 2022 2023 70.8% 70.0% Shared Lodging RevPAR $0 $100 $200 $300 2022 2023 $276 $274 The Palm Beaches Shared Lodging Per formance - April CY TD Shared Lodging Rooms 0.0M 0.5M 1.0M 2022 2023 0.7M 0.9M Shared Lodging Room Nights Sold 0.0M 0.2M 0.4M 0.6M 2022 2023 518K 637K Shared Lodging Room Revenue $0M $50M $100M 2022 2023 $93.7M $111.0M *Source: Airdna. REPUBLICATION OR OTHER RE-USE OF THIS DATA WITHOUT THE EXPRESS WRITTEN PERMISSION OF Airdna IS STRICTLY PROHIBITED Research compiled and pub ished by Discover The Palm Beaches (DTPB) can on y be reproduced through expressed written approval from the DTPB Research Department For questions p ease contact research@thepa mbeaches com Navigation (select page and click go) Hotel Monthly % Chg '22 to '23 -1.1% % Chg '22 to '23 0.2% % Chg '22 to '23 -0.8% % Chg '22 to '23 23.8% % Chg '22 to '23 22.8% % Chg '22 to '23 18.4% Power BI Desktop Total Lodging ADR $0 $100 $200 $300 2022 2023 $330 $340 Total Lodging Occupancy 0% 20% 40% 60% 80% 2022 2023 75 4% 76.9% Total Lodging RevPAR $0 $100 $200 2022 2023 $249 $261 The Palm Beaches Total Lodging Per formance - April CY TD Total Lodging Room Nights 0M 1M 2M 3M 2022 2023 3.0M 3.2M Total Lodging Room Nights Sold 0M 1M 2M 2022 2023 2,214K 2,411K Total Lodging Room Revenue $0.0bn $0.2bn $0.4bn $0.6bn 2022 2023 $639.5M $699.6M *Source: STR & Airdna. REPUBLICATION OR OTHER RE-USE OF THIS DATA WITHOUT THE EXPRESS WRITTEN PERMISSION OF Airdna IS STRICTLY PROHIBITED Research compiled and pub ished by Discover The Palm Beaches (DTPB) can on y be reproduced through expressed written approval from the DTPB Research Department For questions p ease contact research@thepa mbeaches com Navigation (select page and click go) Hotel Monthly % Chg '22 to '23 2.0% % Chg '22 to '23 2.9% % Chg '22 to '23 5.0% % Chg '22 to '23 7.3% % Chg '22 to '23 8.9% % Chg '22 to '23 9.4%

Success Continuation Plan

FY2023

PROJECT DATES LEAD MARKETS STATUS

Marketing

Broadcast TV Buy January 16 - April 16 Brand/Media

Chicago, Washington DC, Boston, New York

• Compiling final wrap reports

• Chicago - NBC & CBS - 9.9M est. impressions

• Boston - NBC, CBS, ABC - 10.4M est. impressions

• Washington DC - NBC & CBS - 13.3M est. impressions

• New York - NBC & CBS - 16.1M est. impressions

• Confirming summer broadcast opportunities in Orlando, Tampa, Miami, Atlanta with a shift in funds from Accessibility and Sustainability

• #LoveThePalmBeaches campaign launched May 1

• Digital toolkit available at ThePalmBeaches.com/Love

• Full media plan across TV, radio, print, out of home, social media, digital audio

Community Outreach Toolkit March 1 - June 30

Social/Brand

Palm Beach County Residents

• Hosted media event on May 2 to launch the campaign in partnership with SunFest

• Brand activation at SunFest to engage residents and encourage the power of personal invitation

• Presenting campaign to city boards and chambers to encourage engagement throughout the county

• 2,000 giveaway entries on facebook, instagram and website

• Gay Polo partnership on April 8, hosting media, influencers and clients

• Partnership with Sports Commission for any support with RFPs or events for FIFA World Cup and College Football Playoff 2026

TDC Collaboration: Signature Events January - September Brand/PR/Social Varies

• Partnership with Cultural Council to promote Mosaic Open Studios, from content creation to social media posts

• Aug 30-31, Partnership with Cultural Council to prepare a highlight reel for the "Arts and Tourism Summit on DEIA" to be posted on LinkedIn

TDC Collaboration: Film Studio Planned Completion: March 31, 2023

• Requesting proposals to build out additional assets in Film studio space for video and podcast recording; will gather potential capabilities and discuss with TDC Partners for next steps

N/A

Social/Digital/ PR/Brand

PROJECT DATES LEAD MARKETS STATUS

TDC Collaboration: Airlift January - September Digital/Brand/Media Fly Markets (TBD)

• Campaigns continuing with Avelo on launch of new Wilmington, NC and Raleigh-Durham; promoting BreezeCharleston route

• Launching Asheville campaign with Allegiant

Destination OTA Co-Op January - September Digital

Chicago, Washington DC, Boston, New York, Philadelphia

• Continuing to customize creative with specific call to action to book within certain time frames with lower demand forecasted. Majority of campaigns running Florida markets plus Atlanta.

• Booked campaigns for July, August, September for $153,000 with reallocation of some Metaverse funds.

International Strategy: Traditional January - September Brand/Sales/Media

Canada, Mexico, Colombia, Brazil, UK, Germany

• Finalized media plans across Canada, UK, Mexico, Colombia and Germany. Media running February - September 2023

• Placements include Robb Report & Forbes MX; Elle & InStyle Mexico and a sponsorship of the Toronto Polo Club season

• Campaigns running in Mexico (Mexico City & Guadalajara), Colombia (Bogota, Medellin, Baranquilla), Canada (Toronto & Montreal), and Brazil (Sao Paolo).

• Launching campaigns in the UK on June 1, shifted $60,000 from Metaverse funds.

International Strategy: Digital January - September Digital

Canada, Mexico, Colombia, Brazil, UK, Germany

• Hosted Brazilian influencers @vazaonde and @ines.lafosse, combined following of 576k followers. Hosted @jujunatripblog 219k followers

• Hosted Toronto's top influencer and leading media @blogto (2.5 million followers) in partnership with Visit Florida

• Hosted Canadian influencer @luxe.tourista (183k followers)

• Boosted posts in target markets, 56m reach YTD

• Launched March 30 at Global Meetings Industry Day

Destination Podcast March 1 Launch Brand/Media

Family Activation May - September

PR/Brand

NationalTargeting Meeting Planners in Key Industry Segments

• Owned & Paid Media plans in place, content being created, PR support

• Episodes:

1: Global Meetings Industry Day

2: Citywide Meetings with Smithbucklin

3: Sourcing Trends with Cvent

4: The Future of Meetings & Industry Trends with PCMA (5/11)

• Zimmerman presented partnership with Vilebrequin luxury swim wear

Florida Drive Markets, Key Fly Markets

Activation

• Evaluating opportunities with Alliance Connection for highimpact partnerships with family brands

• In discussion with Saks 5th Avenue for high-impact brand partnership in Aug/September along with NYFW collaboration

Brand

August/September PR/Brand New York

PROJECT DATES LEAD MARKETS STATUS

Metaverse & MarTech Transition

September Digital National

• Per our prior notes on investing in some infrastructure marketing technology projects prior to building out the Metaverse platform, we have three projects we will begin using these funds for: 1) data lake, 2) customer data platform (CDP), 3) data clean room. We are also in preliminary conversations with a consultant to help advise and guide these projects.

• Reallocated $153,000 of this budget to OTA campaign portion to cover July, August, September.

• Reallocated $60,000 of this budget to digital international strategy to launch in UK.

• Plan approved for:

• Joining Travelability's Destination Ally Club

• Enter into Partnership with Travelability for writing an Accessibility Strategic Plan and for Travelability to work with The Palm Beaches in an advisory capacity

• Confirmed accommodation and non-accommodation partners for Wheel The World Assessments, to include 30 partners + PBIA and PBCCC

Accessible Travel January - September PR/Brand/Social All Target Markets

• Training has begun to become a Certified Autism Destination and have staff go through accredited training; completion goal 6/5

• Press release in draft for Certified Autism Destination and accessibility program announcement; distribution date late June

• Research and questions answered for Travelabilities initianl assessment to help with stragtegic plan

• Hosted accessibility influencer @justcpnotspecial with 63k followers. She also wrote 2 blogs for us, one in Spanish

• $168K to be allocated to summer drive market broadcast

Sustainability June - September Brand/PR/ Community Engagement

Sales

Palm Beach County Residents; Drive Markets & Fly Markets

• Sea to Preserve campaign creative concept approved, moving forward with build out of additional assets

• $75K reallocated to drive-market broadcast for summer

• Media to begin in August/September as a follow-up to Love The Palm Beaches residents campaign

Countywide

Incentive Fund DecemberSeptember Sales Targeted Markets & Industries

• Launched marketing promotions to databased and additional distribution channels such as Cvent and 3rd party partnerships. Executed on PCMA and trad experience and received new lead opportunities and contracts to utilzing incentive dollars. Secured 40,000 plus room nights with incentive dollars and aquired two industry events - confidential and Smart meetings national meeting

• Initiated new convention center focused promotion to become more competitive Nationally for 2024 adn beyond.

* Finalizing Short Term PBCCC promotion for 4th Trimester 2023 period over need dates targeted for short term corporate business.

PROJECT DATES LEAD MARKETS STATUS

Multicultural Market

Expanded Representation Firms

January - September Sales/Marketing

BIPOC, Hispanic, LGTBQ+

• Commenced planning process for enhanced participation multicultural trade events and marketing partnership agreements. Signed marketing partnership with National Coalition of Black Meeting Planners ,LGBTQ's annual PROUD event in Los Angeles, and Connect Diversty, Faith and Specialty Markets

•Confirmed ConferenceDirect DEI Focused commitment$12,750.00