Palm Beach County

Tourist Development Council Board Book

September 14, 2023

September 14, 2023

September 14, 2023

(1)Vice Mayor Maria Sachs, Chair (1/14/21)

(4) Jim Bronstien, Vice Chair(9/30/26) Appt(3/1/95) ReApp(9/18/18) Dis.3

(2)Roger Amidon Appt(9/30/25)Dist. 1

(3) Jim Mostad (9/30/20) Appt (10/16/19), Dis. 2, St 3

(5)Daniel Hostettler(0930/23) Appt (05/18/21). Dis 4.

(6)Commissioner Adam Frankel (9/30/24) Appt (03/08/22)[Dis.5]

(7)Don Dufresne (9/30/23) Apt(6/5/12) ReAp(5/3/16)&(8/20/19) Dis6

(8) Davicka N. Thompson (9/30/2024) Appt(12/6/16)RdAppt(8/25/20) [Dis.7]

(9) Commissioner Christina Lambert Appt (10/01/22)- (9/30/26) At-Large

Verdenia C. Baker, County Administrator

Liz Herman, Assistant County Attorney

Dave Lawrence, Culture

George Linley, Sports

Michelle Hillery, Film & TV

Jorge Pesquera, Discover

Deborah Drum, ERM

Dave Anderson, PBCCC

Kathy Griffin, PBCCC

Emanuel Perry, TDC

Joan Hutchinson, TDC

Vannette Youyoute, TDC

O:\TDC MEETINGS\TDCMtgs2023\Generic Pages for Board Book\attendnc

** Reappointment during current year

NA- Does not count towards attendance.

- Special Meeting

Thursday, September 14, 2023 – 9:00 A.M.

2195 Southern Boulevard

West Palm Beach, Florida 33406

AGENDA

1. ROLL CALL*

2. MOTION TO APPROVE AGENDA ADDITIONS AND DELETIONS*

3. MOTION TO APPROVE JULY 13TH TDC MEETING MINUTES*

4. MOTION TO RECEIVE AND FILE CONSENT ITEMS FOR AUGUST 2023 emailed to the Board and SEPTEMBER 2022 included under this Agenda*

MARKETING AGENCIES REPORTING

A. DTPB ACTIVITY REPORT*

B. CULTURAL COUNCIL ACTIVITY REPORT*

C. SPORTS COMMISSION ACTIVITY REPORT*

D. FILM & TV MONTHLY NEWSLETTER*

E. FILM & TV PRODUCTION REPORT*

PBC CONVENTION CENTER OPERATING REPORTS

F. CONVENTION CENTER INCOME STATEMENT & FINANCIAL OPERATIONS ANALYSIS COMPARED TO BUDGET & PRIOR YEAR*

G. CONVENTION CENTER MARKETING UPDATE*

H. CONVENTION CENTER “PACE” REVENUE REPORT*

OTHER TDC-SUPPORTED AGENCY/DEPARTMENT REPORTS

I. ERM PROJECT STATUS REPORT*

J. PBI TRAFFIC REPORT*

K. CONTRACT TRACKING REPORT*

L. AGENCIES QUARTERLY REPORTS 06.30.23*

5. OLD BUSINESS – DISCUSSION ITEMS

A. TDC TOURISM PERFORMANCE METRICS

1. TDC DASHBOARD CURRENT MONTH & FY2023* - Emanuel Perry

a. Bed Tax Collections*

B. Roger Amidon Resignation*

C. Tourism Master Plan Update – Emanuel Perry

D. PBI UPDATE – Joe Harrington

A. ERM

1. Update – Deb Drum

B. CONVENTION CENTER

1. OVG Venue Management

a. Update Dave Anderson

2. OVG Hospitality

b. Update Kathy Griffin

C. SPORTS COMMISSION

1. The Category “G” Grant Agreements* - MOTION TO APPROVE

DISCOVER

1. FY24 Marketing Plan* (25 Minutes) - Jorge Pesquera –MOTION TO APPROVE

1. FY24 Marketing Plan * (20 Minutes) - Dave LawrenceMOTION TO APPROVE

F. SPORTS COMMISSION

1. FY24 Marketing Plan* (20 Minutes) - George Linley –MOTION TO APPROVE

G. FILM & TV

1. FY24 Marketing Plan* (20 Minutes) - Michelle Hillery –MOTION TO APPROVE 7.

The next Meeting will be on October 12, 2023.

*Attachment included. Tdc/tdcmtgs2023/Agenda 9 14.2023

Thursday, July 13, 2023 – 9:00 A.M. MINUTES

Present

Vice-Mayor Maria Sachs

Absent

Seat 5 Vacant

Roger Amidon Jim Bronstien

Jim Mostad

Commissioner Adam Frankel

Davicka Thompson

Don Dufresne

Commissioner Christina Lambert

Staff

Dorritt Miller, Assistant County Administrator

Liz Herman, Assistant County Attorney

Emanuel Perry, TDC

Vannette Youyoute, TDC

Joan Hutchinson, TDC

Dave Lawrence, Cultural Council

Jennifer Sullivan, Cultural Council

Lauren Perry, Cultural Council

George Linley, Sports Commission

David Fontanarosa, Sports Commission

Michael Zeff, Sports Commission

Michelle Hillery, Film & TV Commission

Alberto Jordat, Film & TV Commission

Gustav Weibull, Discover The Palm Beaches

Milton Segarra, Discover The Palm Beaches

Erika Constantine, Discover The Palm Beaches

Kelly Cavers, Discover The Palm Beaches

Beril Gutierrez, Discover The Palm Beaches

Matt Mitchell, ERM

Dave Anderson, Convention Center/Spectra Venue Management

Kathy Griffin, Convention Center/Spectra Hospitality

Joe Harrington, PBI Airports

Paul Connell, Parks & Rec.

Other

Leigh Bennett, Visit Florida

Derrick Steinour, Hilton West Palm Beach

Jennifer Claesen, Marriott Singer Island

2. MOTION TO APPROVE AGENDA ADDITIONS AND DELETIONS*

Motion to approve July 13, TDC Board Meeting Agenda was made by Roger Amidon and seconded by Jim Mostad. Motion carried 7-0 with Jim Bronstien and Seat 5 vacant.

3. MOTION TO APPROVE JUNE 8TH TDC MEETING MINUTES*

Motion to approve June 8th TDC Meeting Minutes was made by Jim Mostad and seconded by Davicka Thompson. Motion carried 7-0 with Jim Bronstien absent and Seat 5 vacant.

4. MOTION TO RECEIVE AND FILE CONSENT ITEMS FOR JULY 2023*

MARKETING AGENCIES REPORTING

A. DTPB ACTIVITY REPORT*

B. CULTURAL COUNCIL ACTIVITY REPORT*

C. SPORTS COMMISSION ACTIVITY REPORT*

D. FILM & TV MONTHLY NEWSLETTER*

E. FILM & TV PRODUCTION REPORT*

PBC CONVENTION CENTER OPERATING REPORTS

F. CONVENTION CENTER INCOME STATEMENT & FINANCIAL OPERATIONS ANALYSIS COMPARED TO BUDGET & PRIOR YEAR*

G. CONVENTION CENTER MARKETING UPDATE*

H. CONVENTION CENTER “PACE” REVENUE REPORT*

OTHER TDC-SUPPORTED AGENCY/DEPARTMENTS REPORTS

I. ERM PROJECT STATUS REPORT*

J. PBI TRAFFIC REPORT*

K. CONTRACT TRACKING REPORT*

L. MARKETING AGENCIES & CONVENTION CENTER DIVERSITY REPORTS 05.31.2023*

Motion to receive and file Consent Items for July 2023 was made by Commissioner Adam Frankel and seconded by Davicka Thompson. Motion carried 7-0 with Jim Bronstien absent and Seat 5 vacant.

5. OLD BUSINESS – DISCUSSION ITEMS

A. TDC TOURISM PERFORMANCE METRICS

1. TDC DASHBOARD CURRENT MONTH & FY2023* - Emanuel Perry

a. Bed Tax Collections*

b. Report Out Metrics*

Perry Bed Tax Collection – May 2023 collected in June was $5.9M compared to the same month last year at $6.2M, a (4%) decrease. Actual May was 29% above budget and (27%) below the prior

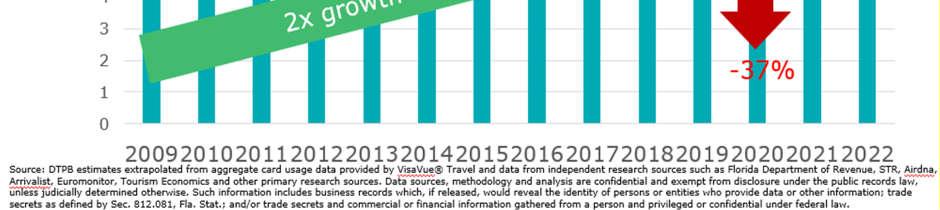

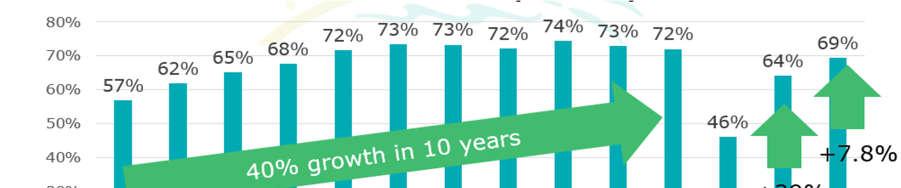

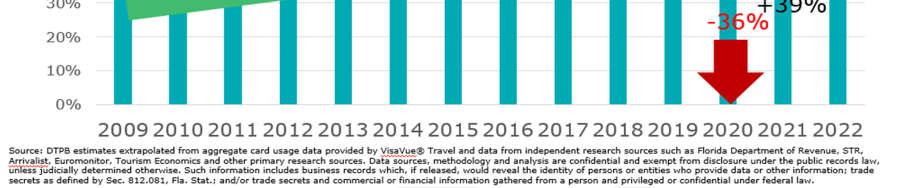

month at $8M. Actual May was 62% higher than in 2019. Revenue from non-hotels continues to support bed tax collection during the off-season

FYTD 23 Collections at $70.6M, was higher than last fiscal year to date at $64.8M by 9%, reflecting a strong recovery from the pandemic. FYT collections are pacing 15% ahead of the Approved Budget and 55% higher than our record in 2019.

The Rooms sold for May were 388,682, (3%) lower than last year. Rooms available for May at 592,503 are 4% higher than last year. Hotel Rooms Active today in the County 19,113

Occupancy for May 2023 was 65.6%, (6%) over last year. Occupancy for May 2022 was 69.8%. May 2019 was 70%. The average daily rate for May was $221 50, (3%) lower than last year, and 43% higher than in 2019. The Revenue/Available Room for May 2023 was $145.34 lower than the prior May by (9%)

Hotel room net sales FY23 year over year May decreased (7%) to $82M compared to $88M. Non-hotel room sales FY23 year over year May increased 21% at $14M compared to $12M. Hotel room net sales FYTD 2023 increased 9% at $984M compared to $903M. Non-Hotel room sales FYTD 2023 increased 14% at $183M compared to $160M. FYTD 2023 Taxable Revenues Fiscal Year over FY2022 increased 10% at $1.1B compared to $1B. FYTD 2023 Taxable Revenues Fiscal Year over FY2019 increased 57% at $1.1B compared to $743M.

Airport passengers for May 2023 were 640,507, 16% higher than in May 2022, and the Total Estimated Seat Capacity at 22% higher than last May 2022 with 788,145 seats. PBI Passenger 12-month rolling is an 8% increase at 8,354,359 over last year.

Leisure & Hospitality Employment for May, 95,500, increased 6% over the same month last year. Accommodation employment went up 6% higher over last year at 11,600 employees. F&B was up 5% at 61,600 employees. Arts & Entertainment employment is 6% lower than last year at 22,300 employees.

B. PBI UPDATE – Joe Harrington Harrington

PBIA had 7.22 million travelers to the airport in 12 months. That is a record for the airport, and It is only the third time we have hit 7M or more in 12 months For the month of May, total passengers were up more than 16% year over year, a 22% increase. A 14% increase in air carrier operations. Weight landed, air cargo, and load factor were all down slightly, as well as general aviation activities. Just people shifting travel patterns back to commercial, from private aviation after the pandemic. For the 7th consecutive year, PBI was named among the top 10 domestic airports.

This is a great accomplishment. We were recognized by Travel and Leisure Magazine. We encourage you to share it on social media and get the word out about it.

A. FIRST AMENDMENT OF FIVE YEARS AGENCY CONTRACT & EXHIBITS* – Emanuel Perry – MOTION TO APPROVE

Perry

This is the first amendment to the agency's five-year contracts. It is just updating the schedules that we brought to this board prior, which were included during the finance meeting and also the TDC meeting, their exhibits include, diversity reports, performance measures, and things like that. We are bringing this to the board to ask for a motion to approve so we can take it to the Board of County Commissioners on September 12th.

Motion to approve First Amendment of Five Years Agency Contract & Exhibits was made by Commissioner Adam Frankel and seconded by Roger Amidon. Motion carried 7-0 with Jim Bronstien absent and Seat 5 vacant.

Linley

At the last TDC board meeting, we wanted to invite the leadership for our PGA Tour event, Andrew George, to give us an update. Andrew is the Vice President for golf events at IMG and the Executive Director of Palm Beach County's PGA Tour Event. Andrew worked with Ken Kennerly for a long period.

It feels like it is the world's biggest reality TV show right now in golf, every time I talk to George L. there is something new happening and I am sure a lot of you guys saw the hearings that went on earlier this week.

I would like to step back to 2023 because many of you were instrumental, in what happened at the last Honda Classic. It was the 42nd and final Honda Classic at PGA National. We raised $7.2M for charity. With the economic impact of over $70M, we had almost 200,000 people at the event again. I want to say thank you to everybody for opening up your doors to hotels and restaurants and our community.

It is not hard to recruit fans into Palm Beach County. We have a special relationship with NBC. Every year there are 60 minutes highlighting the county. They go above and beyond to make sure they are not just showing the golf courses, but also the beaches and the weather and everything that those are sitting in New York or the Midwest that are staring outside the windows at the snow can feel the impression.

Passing the baton from Honda on to what a new title sponsor will be challenging I would like to highlight the three different parts. There is an agreement between the management team and Ken. He has turned into a board member for us. He is an advisor and a mentor to me. I have been with him for about 15 years. He is going to stay involved in the tournament in an advisory committee role. But the management contract

is secure between the PGA Tour and our event. I think that is something to highlight again to the credit of this room and everyone in Palm Beach County.

We do not have a title sponsor at this point, and they have locked in the 2024 date for February 26th to March 3rd. That is the only thing I know of maybe one other time in 25 years for the PGA Tour. It shows what they feel about this community, about PGA National Resort, the competition side, and just what we have built over the last 30 years.

The next step is the resort and our host site. We locked up through 2028.

It is a good recruitment tool for us and of course, having a lot of those players live locally. Now the other part of that is working out the schedule. The plan is to announce the next 2024 schedule in totality here in the next month. Our date is going to be mitigated this year around some of the bigger events.

The last piece is the title, Honda had given us a bit of prep for this. They had some changes in strategy, and I think they got to the point where each president had said, I do not want to be the one to let it go.

But they finally needed to make a move. It allowed us to build 42 years of history with them in this county. George and I are having conversations every day with Emmanuel to make sure we keep it in Palm Beach County.

I think there are a lot of events. around the country and we want to make sure that we keep this here for the next 40 to 50 years in Palm Beach County.

The title search is ongoing. They ask for a substantial up-front commitment, where they started with $15M times 10 years Right now each of the title sponsor prospects has asked for the tour.

We are getting a little bit more of that from the news, while there is still a lot to this agreement on what people are calling a merger but is more of a partnership. The good part is that allows us to keep this going in the charity realm, in the economic impact realm, and if we can get the players back together where we do not have this tension that we have kind of had exhaustion for two years of this side versus this side, I think is a win.

With about six months to go before the event, it is going to be challenging for us in year one, as I kind of watch along with the PGA Tour leading the discussion around the title sponsor. We are going to have to make up the difference that they have, especially in the first year, to get us to year two and year three where they are going to step up their sponsorship fees.

The other thing that coincides and where we have had some conversations that could be an opportunity is to bring in the tourism groups. The PGA Tour would allow two commercial entities,

You would not see the Coca-Cola Classic and then presented by another commercial brand. Where they have integrated now and kind of changed their bylaws is to have tourism groups or location-based branding.

Bermuda has a championship over there, the Butterfield Bermuda. There is an opportunity for us, either short and/or long-term, to take on a bigger stake, with Palm Beach County and talk about not just taking that 60 minutes on air, but taking it beyond that in the branding aspects, in the logo aspects.

One part of our new agreement with PGA National is we would take back over merchandise. For those that do not know, they have always handled the merchandise onsite, for all of our logos, for the Honda Classic. We would take control of that and would have the ability to do some branding year-round.

In the community and around the world as well. There are some upcoming opportunities, there are some numbers that we are still getting back from the tour. This last year was $219M in total earned media.

The player’s deal was the highlight on the media side, but the fact that we were flat year over year on linear TV, and then our total earned media was up about 30% year over year, shows that things are going in the right direction. People are watching this county, watching golf, and paying attention.

It is important to note that over the last 10 years, we have tracked about 100,000 room nights from the Honda Classic from direct hotel room blocks. It is players, sponsors, exhibitors, and whatever travel groups we can track. It is not necessarily capturing all of the day visitors or the overnight stays that would happen from golf fans, and enthusiasts that are coming in.

Attendance numbers have grown five or six years ago. It surpassed the 200,000 mark of unique visitors to the grounds of the PGA tournament The peak was at about 220,000 in total attendance and maintained it consistently. When you look from the tourism standpoint, it ranks as the highest golf event from room nights, media value, and total attendance compared to any other golf event that takes place annually, and any other sporting event in terms of total attendance. And not necessarily room nights, but total attendance.

The room night numbers are very powerful. We probably need to do some kind of analytics to see what those visitors, or spectators, what kind of overnight stays would be happening from those that we really cannot get our arms around.

The other key factor for a tourism benefit is the only sporting event that consistently delivers network TV. We do have other events that are on cable, ESPN. But this is two days on the Golf Channel and two days on NBC.

I think as Andrew alluded to, our Sports Commission and Discover The Palm Beaches had several conversations and had a meeting not too long ago with Culture and Film. We talked about the potential partnerships with the PGA Tour event. I think there is a chance this year to accomplish two items. One would be to seize a great marketing opportunity for the county, and that would be adding to the title somewhere, whether it is The Golf Classic of the Palm Beaches that would allow you at some point if you do find a title to put that in place with golf. But if you only mentioned the Palm Beaches Classic that would be a much greater stretch. We have inquired about what it would cost to put the Palm Beaches’ name in it.

Amidon

What would the potential investment be?

Linley

Andrew, you could speak to it with more confidence. If we go to the Golf Classic of the Palm Beaches.

George I think you are trying to look at comp sets for the other events.

They are starting at the two million range. But it is primarily the TV part. The assets on site can be customized as you know. It is the TV piece of this. The other part does not always happen where you have an opportunity to kind of leverage it, especially in year one. They do not have any leverage, but the fact that there is likely going to be a bit of a reduction gives us a chance to put the name Palm Beach and the Palm Beaches into the title.

And I think this county versus anywhere else, is a little bit more prestigious. I am from Iowa, and I do not know if a title called Iowa Classic would be attractive. But being in Palm Beach has prestige and some value too for an entitlement company as well

Amidon

Did you already state the economic impact?

George

We were about $70M and are growing. And thank you to everyone here for helping us try to capture as many hotel room nights as we can. This was a record year 2023 for hotel room nights, and that is still probably a snippet of it. I know everybody here tries their best to capture that tourist crowd. But it is a bigger number, about 12,000.

Thompson

Linley

It has grown over the years. When we first started, we were just over $100,000 We support both the tour event and the Honda, the IMG, through the presence of our PGA event for the Honda. Also, host two other amateur tournaments. There is a high school invitational for high school teams around the state and the county. And then there is a junior, classic.

And those happen at separate times. And we also support those events. But we are over $100, 000 now. We were already prepared this year to increase our level of support directly from the Sports Commission. We did have a conversation with our Executive Committee. If this comes, we will come and do a full presentation.

We were talking about how we could get there. If there was ever a time with our budget being strong with reserves, looking at angles, this would be the time. I kind of liken this to what happened to the PGA Tour Champions event several years ago when they lost their title sponsor You cannot compare that event to the Tour event. There are TVs, it is not network TV, the attendance is just a fraction, but it is good attendance. It is a great event, and the overnight accommodations are 20% of what the PGA Tour event creates.

But they lost their title. But the City of Boca and Sports Commission stepped up significantly. We went from a traditional $30,000 grant to providing $200,000 in a year of need was our best effort to save the event. The City of Boca Raton stepped up. Their actual beach, their parks, and the beach taxing district stepped up

And so if there was ever a time to step up and support this event that has been with us now for two decades. This would be the year to do it, in my opinion. Our Sports Commission is prepared to do that. We are working right now as fast as we can to get as much information because it changes every day.

Would this board be willing to have a full presentation?

Perry

Yes. The presentation will start with the Finance Committee. We are working with all the agency heads, and they are willing to contribute to this cause to make sure that we keep Golf in Palm Beach County.

If we have full support from all of the agency heads and the Finance Committee, I will ask if they will be willing to touch special projects, and we will just do a full overview of the importance of keeping golf in Palm Beach County. The timeline will be once we get the confirmed numbers from Mr. George, then I will schedule a special finance meeting, and then we will act swiftly.

Mostad

How many of the significant portions do you foresee coming from special projects?

Perry

We are going to allocate it amongst all five funds, that way it is not a major blunt to any agency.

Mostad

That is healthy. I think we need to think not just one year, but if we do this once, then it is hard to go backward Andrew, we should not think about this as a one-year bridge but is this something sustainable for some time as well, and what is our threshold to measure it with?

Amidon

I would be curious to see comp set information about what that ROI and for those tournaments to be

Mostad

It has everyone's support, and to continue to know that George, you have done a wonderful job for the community, there is no question about that. I do not think we should be thinking one year, we can layer this in and plan for it. It is a huge difference for George and Dave and everyone else to kind of know that this is coming on the pike.

Segarra

This is an opportunity to plan and elaborate a two or three-year plan, for two reasons.

Number one, golf is one of our top sports, with 160 golf courses, important to the local community, and important to the visitors. This tournament is the top event that we have that projects this destination to other markets. This is an opportunity for us to start developing a plan Discover is fully on board with this. We hope we can make it happen.

Linley

I will give you a summary of some of the initiatives that we have implemented this year. Our sports commission is part of the leadership board for an organization called Compete Sports Diversity. It is an organization that tries to inspire sports organizations, community leaders, and nonprofits, within the tourism space, particularly sports tourism

space to promote diversity, both from internal and external points., We work closely with this organization, as members, and we have a presence on the board.

We attended their winter and summer meetings, and we are looking to host to bring the event to the Palm Beaches within the near future. During the Billie Jean King Cup, formerly the Federation Cup, a world-class tennis event the United States played Austria here and they won.

We worked with the USTA, which has a diversity division, very strong, and created an event for diversity during the actual event, something that Michael Zeff spearheaded it. It was activated right before the opening of the Billie Jean King Cup competition on Saturday.

C.Y.G. also produces the African American Golfers Hall of Fame. It has now been in our community since 2004 and we are a major sponsor. We have even taken some of the awards from our Palm Beach County Sports Hall of Fame and we are now presenting those awards at the African American Golfers Hall of Fame.

We helped create an event, called the Florida Shine Classic. The inaugural event in January took place at the Ballpark of the Palm Beaches. We provided funding, it is an event for minority baseball high school players in Florida to have an all-star game.

It is an event that we believe can grow. The Palm Beach Lakes High School Baseball Coach partnered with us to help establish this. He has his nonprofit organization, and this was year one.

Also, within our diversity plan, we partner with Discover and the Cultural Council on the Gay Polo Tournament, which takes place every year now. It has become an annual event and a mainstay at the National Polo Center.

We will be supporting Discover and the Cultural Council with the Arts and All Access Summit coming up this year. We have two unique speakers from the sports industry, I think it will be fascinating presentations from that realm.

And of course, our office must reflect the industry we support. We are going to be bringing on more individuals. We have two hires that should happen shortly, and diversity is at the top of my mind.

3. Update – George Linley

Linley

We talked about our PGA Tour event. Golf is a major tourism driver, we sell the fact, that the PGA Tour, the Champions Tour, and the LPGA Tour have been here for two of the last three years.

It is a big selling point when we are recruiting for golf events like Optimus International Junior Golf Championship or American Junior Golf Association, Florida Youth, and the Florida Youth Golf Association. these are sanctioned events and NCAA events. We have hosted four NCAA championship events, two nationals, and one regional.

We are going to host two more, in 2025 and 2026, for a total of six over the last eight years, and this August we are traveling to Indianapolis, the headquarters for the NCAA There is a big portal that is coming out and we are going up there to meet with the committee chairs for different sports. Golf is going to be a big sport we are pursuing.

We have a quick video just to kind of summarize what we have been doing on the NCAA D1 level.

We just hosted the Women's D1 Golf Regional. They are going to play for the National Championship and our goal is to bring the National Championship here to the PGA National Resort which is the best venue at the moment.

We are hoping we can still use them to bid, but we look countywide for other options when we are pursuing those golf events.

I think there is an indirect impact because it is a selling point for us when we are trying to bring other golf events here.

We have Perfect Game, Prospect Select, and a few other organizations. June is probably one of the biggest months. August will slow down, and we will be back at it in October before Spring Training,

The last item I will say in an update, there is a lot of information in your packet. It has a tourism update, where we are at in-room nights through the first three quarters.

If you are watching TV, you might see The Confederation of North, Central and Caribbean Association Football (CONCACAF) Gold Cup, which is a major international soccer event that is taking place where Inter Miami plays in Fort Lauderdale, we have partnered with CONCACAF and organizations that work with them. This June, we hosted six, national teams that, trained in Palm Beach County on their way to the Gold Cup, which is now in Fort Lauderdale.

They stayed for a couple of weeks. That is probably a couple of thousand room nights. Team Haiti is one of the teams that was here. We had a dinner for the entire team and their coaching staff and their personnel. They have become a very competitive team. Saint Kitts, Martinique, and Trinidad. There are six total teams. The list is in your packet that is here for training.

In 2026 the World Cup, arguably the most recognizable sporting event on the globe, is coming to South Florida. And over this last month, we did make contact with FIFA directly. We are hoping to be able to do something similar, which would be on a much larger scale. We would love to position ourselves as a team base camp. Had many

conversations also with Milton about it. A team would live with us, and it would not just be the team, if you get them, depending on the nation, their fans will come and descend upon us because their team is here. It is an atmosphere that is hard to replicate. Is 2026, but the work would begin now to do something like that.

How do you select the country? Or the country selects where they want to live for the World Cup?

Linley

I am still learning the whole process. Part of it is working with FIFA over the last couple of years, there is a lot of information that is coming our way.

They will place teams in different areas. And it could be a team base camp anywhere from a major stadium to a college or university to a parks and rec field. And each nation might have its own needs. A team that is ranked in the top ten going to probably require a lot more than a team that is not as highly ranked because they can demand it.

They do seek, if they can, four and five-star hotels for all teams. Whether or not that is going to be possible. I might be knocking on some of your doors just to see. I know there will be significant funding required, but I am not sure who pays for all of it.

Whether it pays for hotels, or the teams do, or how it works. But it is something that we cannot ignore when it is coming to South Florida. And this Gold Cup is a good test run.

In 2026, hopefully, the Palm Beaches will be part of the World Cup in some way.

Segarra

We should know a year ahead about which ones are assigned to Miami. FIFA does a draw and creates eight groups of four teams each. And they will assign, Group H will play in Miami, Group A will play in Chicago. And then we will know, and then we can go ahead and let's say they have Brazil, Mexico, Italy, and some others. We can promote those destinations to attract those residents to come here.

A Sargassum update, there is not a lot of it. We had a regional forum meeting last week, and the state reported that there was a 75% decrease in the amount of Sargassum that they were expecting in June. That kind of echoes what we have said, we are seeing regular, typical accumulations of Sargassum. Not a lot of impacts on the region.

For the beaches, we did wrap up a successful season of sea turtle walks last month. We did have a VIP night where we had some TDC participation, Commissioner Woodward joined us. That is one of our most popular public events where we get visitors to connect with the resources.

It is really special we can share that with our partners and with our elected officials. A couple of outreach items, season two of the Wild Palm Beaches began airing this month on the Destination America channel. Six new episodes, a lot of them are very urban and environmental-centric, focusing on our Pine Glades Natural Area, the county's Natural Areas Festival, and some ongoing restoration projects that I have going in Lake Worth again. some good TV coverage there.

And, last but not least, since we do not have a meeting next month, I hope to see everybody at our 8th annual Night for the Natural Areas at the Twisted Trunk Brewery in Palm Beach Gardens. Proceeds from the event go towards education and exploration of our natural areas.

And they do release an annual drink in our honor, Loxahatchee Water. It should be a neat event. Hope everybody can come out on Saturday the 19th from 2 to 7 p m.

1. Agency Diversity Report Update – Milton Segarra

Segarra

I can tell you that diversity, equity, and inclusion are part of the strategic pillars of Discover the Palm Beaches. Promoting the destination, as well as hiring and retaining employees, under this diversity and inclusion, and accessibility concept.

Just to validate that, from our 49 total full-time equivalents in this fiscal year, 30 of them, or 61% are white, 6 or 12% black, 20% Hispanic, 2% Asian, and 4% other. We have 34 females and 15 males in our total team. We have made efforts across the board. In sales, we have a multicultural, specific sales manager that is taking care of those particular markets. Also, we participate and are part of national-specific associations in black LGBTQ. And we have a very active role on those particular national boards and associations.

In terms of social media between 40 to 50% of all the influencers that we bring to the destination represent diversity, equity, and inclusion. For the marketing budget, we do allocate funding for print and digital advertising in those specific markets.

From a destination standpoint of view, not only hiring and retaining, but communicating how important diversity, equity, and inclusion are for us. We are sending this message to our main market.

2. Update – Milton Segarra

Segarra

We saw a downtrend in April and May. Also, 4,500 hotels in Florida saw the same trend. Is this competition slash Florida fatigue, as some people have called this? Is a consequence of the political events that are happening right now.

We are in a good position. Because of the preliminary numbers for June, occupancy will be 1% up from last year. And last year we had a very good occupancy for the month of June, ADR is pretty much flat at $183, only 1% down.

REV PAR is going to be flat at $116, which is competitive for the month. And hotel room nights were up 2.8%, and room night revenue was 3.5%. We should see an immediate turnaround from April and May’s downturn. And we should expect something similar in July.

We feel very confident that will happen. Solidifying the last quarter of our fiscal year. How are we going to do that? Beryl, Erika, and Kelly will give you a recap of some specific activities we are doing now in the summer.

Constantine

We are not taking our foot off the gas from July through August. Great things we have upcoming, and we have even more.

We still have a full suite of media running, broadcast, print, out-of-home, radio, display, and social media In our top markets, Orlando, Tampa, Miami, and Atlanta. We have some digital in Jacksonville, Fort Myers, and Naples. And we have media running in the Hamptons and New York City.

We are going in full force with a media plan to impact visitation. International is still on fully in Toronto, Montreal, Mexico, Colombia, the UK, Germany, and Brazil. We have many different print placements. We have a big partnership with Brand USA in the UK. A ton of digital running It is a 360 approach in those markets as well.

And then a full suite of events coming up. We have a new website launching soon. We are partnering with the Historical Society of Palm Beach County on their endless summer events in the Hamptons, Beryl will be attending, and we will have a ton of media and influencers there.

We have got a James Beard Foundation dinner coming up, Taste of the Palm Beaches, right in New York City where we are taking over their space for four nights and hosting ticketed dinners, bringing our chefs up there to cook and represent their restaurants. We have Pushkar from Stage, Clay Conley from Buccan, and Lindsay Autry, a great suite of chefs.

Our Shopping Soiree is coming up. We have got journalists and fashion designers working together to see all the great shopping that we have in the destination. Our Love

the Palm Beaches Savings Pass encourages visitors to come to visit and enjoy savings at over 20 attractions in the destination.

A good push for those families and drive market visitors looking to take that last trip before school starts. We have got a partnership with Saks Fifth Avenue coming up with a window display during New York Fashion Week. Put the Palm Beaches on the map.

And then, our Love the Palm Beach's Residents campaign has been going strong all summer. It is a 360-approach to reaching our top drive markets and reaching our top fly market, and then we are also reaching the residents because we know it is important that they invite their friends and family down to come to visit, as that is, 40% of our visitors, Love the Palm Beaches residents campaign is still going strong as well

Gutierrez

As you know, Mark Zuckerberg, who owns Instagram and Facebook, all of a sudden last week, right after Fourth of July, decided to launch a brand-new platform for all of us. It is called Threads, and it has taken the world.

In five days, they have gained 100 million followers. And this has not been launched yet in European Union or Brazil and many other Asian countries. We predicted that it was going to be a highly successful, platform, and we launched it on the first day, which gave us a tremendous competitive advantage.

We are the second most followed destination in Florida after Orlando. Congratulations to Hilton, West Palm Beach. They also launched it and PBI as well. If you have launched it and I am not aware of it, please let me know because we are getting ready to shout out to all our partners.

And on the social media front, we hired a videographer in January. His name is Isaiah. I wanted him to come here, but his best friend is getting married, so he couldn't make it. Since January, we have been producing tons of videos. You are going to see a recap of the videos that we have worked on.

Starting with Love the Palm Beaches campaign, which has been successful. We have about 7, 000 entries through social media and on our website as well. Now, in the Love the Palm Beaches campaign, we did ask our mayors to participate as well. The mayor of Palm Beach Gardens and Mayor Scott Singer from Boca Raton as well.

They created videos asking their communities to tag us on social media to share their love for the Palm Beaches. You are going to see the Palm Beach mayor, the Palm Beach Gardens mayor, who did a fantastic job. After that, we are going to go to our celebrity series. There will be some examples of the celebrities with whom we have built relationships.

Then we are going to see Only in the Palm Beaches series, which highlights all the top destination attractions. We also started highlighting our cities. We started with Lake

Worth Beach, and to the pleasant surprise of everyone, we broke not only our record but many records in the state of Florida, with 10 million views on our video. We will be filming every single city in Palm Beach County.

This summer has been very busy. We just launched our new Mobile Visitor Information Center that is at the Convention Center. Not only is it encouraging those visitors and attendees to spend a little bit more money, go out to our restaurants, and maybe extend their stay because they are enjoying themselves so much, but it is also a place where everyone wants to take a picture.

It becomes a great social media opportunity. We will have it at Florida Airports Council. We have a list of meetings that want to have it pop up at their event. The Pink Retreat concluded in June of this past year at PGA National. Within 48 hours, the room blocks sold out when they launched.

The Pink Retreat is happening, and they will be coming again next year. It is a great way to show the diversity of our community. This was started by a female black woman that was an art therapist that was inspired by the colors of Lilly Pulitzer. It is an event that allows people, women, to come to fill their cups, focus on wellness, and uplift everyone.

Seven hotels within the room block. We are excited to bring them back next year. Not only is it an opportunity to have the meeting here, but we had Travel Trade that wanted to come and visit the Pink Retreat. What they say is that in the summer, rather than sending everyone up north to cooler environments, this is an event that people want to come down and attend.

We had 10 travel trade agents come to join us for the event. It is a busy summer for us. On top of Jehovah’s Witness coming to the destination. We have Turning Point at the Convention Center. What is it, 4,700 of our closest friends will be here. Tony Robbins is coming here in August.

And then Florida Airports Council and I cannot thank the airport enough, they are doing a lot of the heavy lifting along with our marketing and sales team and our board members.

Peter Yesawich will be the speaker at the event, he is one of our board members. Smart Medians, which is a trade publication, will be at PGA National in September.

Another industry trade publication that creates events throughout the year will be happening at Tidelines. We are capturing some of that low-hanging fruit from the international market. IPW is a trade event that happened in San Antonio, in which we capitalized on a lot of that travel trade.

The Canadian market is some low-hanging fruit, especially from the incentive, a market where we can capture some of those groups that are looking to book incentive trips here to the palm beaches. And then we are just in the UK and Germany on some sales missions

and with our brand USA we have a lot of the taxis wrapped in the UK where you can see our brand throughout the streets of London.

Thompson

In the advisory group with Sergio, we discussed some of the responses that Sergio and Jorge were working on crafting about the travel advisories. Where are they with that? Has there been any feedback from the community when you all go out with them?

Cavers

We are focused on creating welcoming environments. That is where our focus is, not leaning more into the political play, but more toward being a very diverse destination. Showcasing the events that we support that are diverse and focused more on that welcoming environment.

Dave, thank you for the support.

Segarra

Tomorrow, we have a meeting with the rest of the TDC agency. As part of the meeting, we will discuss a more unified collaborative approach to this particular position. We had a training session with our sales and all the staff that is facing the customer to prepare us to properly handle any particular request for conversation.

Cavers

We have also elevated our presence in various industry organizations. We will be the keynote sponsor for the National Coalition of Black Media Planners which will happen in September in Atlanta, where we can showcase the diversity of our community. And we are out in the market making sure that we are present, continually highlighting the welcoming environment and the diversity of our destination.

Amidon

Are you all getting any specific feedback from any groups? Are you collecting the information? You’ve got to be careful about a message, but is there anything specific?

Cavers

we are getting questions like, How do you feel about this, what is your opinion on this? It is a lot of things of that nature that we have to focus back on the business aspect of what the event is. What is your goal for the meeting? And then we lean more into solving for that goal of the meeting, which a lot of times for associations, their meeting is their largest revenue generator for them.

Anderson

It is extremely important that we are having a lot of success locally now, and we need to be able to pull it all together.

We need to show the people that are asking questions about what we are doing now. Coming out of COVID, we started doing those small events, but then we all kind of started showing the industry that we were back. We must be doing stuff right now. We need to make sure that all those planners see that.

Vice-Mayors Sachs

Is there another location that is taking some of our business away?

Cavers

Specifically, no, I would not say that there is but, we have to stay competitive. I think California is popping up more and we are seeing more of California that we didn't see.

Segarra

We need to focus right now on summer, but also on the upcoming high season. And for that, we need to start planning, right away. And Gustav is going to be doing a few surveys on the market. We need to know consumer sentiment. To see exactly what the expectations or likelihood of engagement are and coming and visiting in our top prime season. We are going to get that, and we will have the opportunity to adjust any specific marketing or sales, or any branding effort for a partnership to make sure that we can come up with a viable plan to make sure our high season is successful.

Amidon

With the West Coast and the impact from Hurricane Ian, any impacts from those typical midwestern visitors to the west coast, are we seeing any more of them over here?

Cavers

We are. I think that has been a combination of the impact of getting a taste of what it is like over here and enjoying it and coming back for repetitive business promotions for keeping that repeat business.

To the businesses that have moved down here or relocated down here or leadership that is now working remotely. American Academy of Orthopedic Surgeons does 2,000 meetings a year. Their executive director, headquartered in Chicago, now lives down here. So, you know, we are capitalizing on those types of opportunities that help us.

Amidon

I interacted with several guests at the resort, but I was expecting more. And maybe it is happening, maybe along the highway where maybe the rates are more comparable to over on the west coast.

Mostad

There is some impact, like some of the properties are just now reopening. Ritz Naples opened a week ago. That is the main, that is one of the main competitors for beachfront here. I think you are right; it was really hard to quantify that.

It would be a cumulative effect of still trepidation with the islands. It is the hurricanes in the last few years, international, you know, trepidation traveling to Europe, which has changed significantly, outbound to the UK and other destinations in Europe is way up, and so it is a cumulative effect, that impacted us, when you look at the bed tax for May, you see that it is down for June compared to 2019. It is staggering how well we have kind of leveled off. There is not a big growth spurt, which is something we have got to factor into. A lot of the lodging institutions are seeing a jump from here to the next 12 months. We would like to hold on to where we have been.

Dufresne

If you take 2019 as a base, we would be thrilled to be a 10% growth factor. 10% year over year, we are still blown way past that. Even if we have a 10% retraction, we are fine.

Segarra

Thanks to the Success Continuation Plan that the board approved, we invested part of those funds into those specific markets, the Chicago, Boston, D. C., and Philadelphia markets, and we saw good response from those markets to a point in which in the upcoming marketing plan, we are going to be assigning additional funding from our regular budget to those markets again.

We do not go there once and then disappear. We maintain and hope that consistency will create some sort of additional incremental business from those markets to our hotels and part of the destination.

Amidon

You are investing in the ROI. That is what I am trying to do

I am talking to the guests. Hey, where are you visiting from? It is still getting a lot of northeast, but once in a while, we will get that Midwesterner, which is good. I am just trying to get a real feel for that ROI. Not only my resort but the entire area for your

Dufresne

I do not know how much money we need to spend on that market. And if you take your typical Fort Myers visitor, your average Fort Myers, average South Florida visitor, a very different demographic than your average Southeast Florida visitor. Very different.

Nothing wrong with Midwestern. We have 20 bike nights, and 20 bike night events over there now in July. It is a very Harley Davidson kind of crowd. It is a very different market there

Amidon

I do not know what the specifics are about their ADRs or their occupancy, but I know from Emmanuel, he was able to get the number of room nights that were impacted by the hurricanes.

I am not sure how many rooms are out of service, but there are a lot of rooms in that area. It would be interesting to know what their ADR is and then, we can attract them over here to afford our ADR.

For the September meeting then we can review that a little bit about how we are planning for the high season.

Segarra

The full plan will be presented to the board in September. In the same way, we did, in the Caribbean, the cruise line companies target those particular. We were not alone in the hunt for those. But we had a very good competitive advantage that we know.

But it is still a highly competitive market, because of the demographic of that mid-west, It is very attractive to many destinations.

Lawrence

Our most recent diversity report indicates that 41% of our staff are persons of color.

We are actively working on this as part of our DEIA work. We have an active equity and community investment committee on the board of directors. We also have a staff equity committee that meets regularly. We are working with consultants on board and staff training and other initiatives.

She is also looking at doing a sort of assessment of all of our printed materials and looking at the way we communicate with people. We are doing a deep dive into this

work, participating in advancing the mission through the county, and we have been actively involved in that process.

We revised all of our grant and selection process committees to make sure that they are representative of the people that we are serving. A minimum of 50% of every panel is made up of persons of color. Our artist database has quintupled in the last five years. 64% of the artists that are exhibiting in our gallery spaces are new to the Cultural Council. And 40% of those represent people of color. We have done a great job in terms of diversifying the artists that we are serving through the work that we do. A couple of other things that we are working on specifically, working with the Historical Society of Palm Beach County and other historical societies around the county on a black cultural heritage tour piece that will not only exist on our website but a community resource highlighting specific tours that people can take. And then, the Arts and Tourism Summit, Access for All is taking place August 30th and 31st at the Convention Center.

We have over 250 people registered to attend, and our goal was 300. We are easily going to hit that. It is going to be two full days of conversation, sort of convention style. With cultural performances, we have an art market on the second day, that is all artists of color that will be showing and selling their work.

On the first day, we will have an SBE vendor spotlight in the afternoon. We have more than 25 speakers, many of whom are from outside the state of Florida. I want to give a special thanks to Jennifer Sullivan, on our team, and Heather Andrews who have done a magnificent job putting all this together.

To remind everybody, this is a collaboration of all of the TDC agencies, I want to make sure to thank all of the agency heads and, especially the Convention Center for helping us, pull all this together. It is going to be something that we can all be proud of; it is another way that we can continue to signal to the world that Palm Beach County is welcoming to all and that we take this very seriously.

I have with me today our Director of Marketing and Cultural Tourism, Lauren Perry, who's going to share some great results from the Mosaic and our Open Studios program.

Perry

I know that you have seen on the screen in some earlier meetings a lot of our Mosaic collateral materials and some of the advertising that we did.

But I wanted to come back and give you some numbers. Our ad agency, Push, reported to us that through our advertising campaign, which spanned the months of both April and May, we had over 11.5 million impressions. Our digital ads had a 1.02% click-through rate with a $1.02 cost per click. We felt like that was a really strong performance. The

landing page, MosaicPBC.com, is where all those offers live. We had over 74,000 people visit that landing page during those two months. 71,500 of them were new users. I had never visited that page before, and this is a six-year-old campaign.

You had some of these numbers in your TDC report, but the actual number of referrals that we received sent to our partner organizations from MosaicPBC.com was over 18,000. The number that is in the report for referrals is low, that was wrong, and we found an error in our calculation.

We also signed up over 5,000 new email subscribers. Those are a whole new audience that we will be reaching all year round, thanks to Mosaic. And these results, compared to previous years, are the highest achievements that we have received in six years. We had 25 cultural partners participating. Most of them were cultural organizations. We had a couple of retail. We had Visit Palm Beach participating. Most of them when I surveyed them reported they had a noticeable increase in traffic from the campaign. More than half of them have redemptions of their offers.

And just to note the Ann Norton Sculpture Garden had 262 people redeem their offer. Kravis Center had 178 people buy tickets through Mosaic That was over $12,000 worth of ticket buys. Mounts had 121 people redeem the offer. The Schmidt Boca Raton History Museum had 106. And the Society of Four Arts almost broke 100.

We feel like we had some good, strong offers this year. And we are hoping that when we go back to our cultural partners, we can continue to work with them to come up with really good offers to make this campaign even more successful.

There was Open Studios, which was the one-day event we did on May 20th as part of Mosaic. We had over 75 artists and galleries participate in that event. It was from noon to 5 p.m. And 57 of those artists responded to our survey. Based on their responses 1,362 visitors showed up at their spaces in total.

That is just for the 57 that responded. We were keeping track of zip codes. We know that 32% of those 1,362 came from outside Palm Beach County. That was an encouraging number as well. All the artists we spoke to were saying they were selling artwork, or they were receiving commissions for artwork.

That is part of our goal at the council to help them. Then just to add to that, our PR agency SHARP helped us track our earned media placements. We achieved 13 earned media placements, which gives us about a 67-, or 76-million-person impression.

Part of that was paid broadcasting. Where I went on television in Tampa, Orlando, and Miami. I sat in Palm Beach Drama Works on their stage and talked about Mosaic. We got some exposure for Drama Works as well as the other organizations participating in the campaign.

Additionally, we had a social media influencer campaign. We worked with both locals and some mommies who live in Florida outside of our market.

Lawrence

We have hired the Director of Community Engagement. We have created a Community Engagement Department. Again, this helps with our DEIA work. She will start on August 1st .

We are moving to the contract phase with all our Category B and CII grants, moving forward for next year.

We are in a lot of planning right now; the council will unveil a new strategic plan in January. Our board and staff are active in that process, and we also have a new website that will be coming online sometime this fall. We are deep in redoing that, a lot of work happening, and a lot of exciting things are on the horizon.

HilleryDiversity remains a priority for the Film and Television Commission. Of our six employees, 50% would be considered diverse, which is wonderful for us. In addition to the importance of our board of directors, the diversity in which we market and promote our diverse locations here in Palm Beach County for filmmaking, and of course the programming. That is put out through the Palm Beaches TV channel. Some of that programming which is just recently released this summer includes On the Town of the Palm Beaches with Frank Licari who covered Latin style, and Around the World covering European, Asian, and Middle Eastern cultures which was a wonderful program that was just put out.

He also covered, health and wellness and family-friendly fun. That family-friendly fun included, The Therapeutic Rec Center out at Lake Worth which is run by Parks and Rec and is a wonderful facility for adaptive learning and education. In addition to the SOS Warriors out in Riviera Beach, I believe are the only high school band that was selected to play over in England.

That is also wonderful for us to cover. We delivered four brand new Just Bring Your Game shows that are now being reviewed by the Sports Commission in a collaboration effort between the two of us. That also has a great deal of diversity, and we cover Pride Month as well, which we did a lot of social media and show coverage on those efforts too.

One of the new shows that we are sponsoring is What’s Poppin PBC with Kitty Lunden. Another six episodes with her. She just did a wonderful show on Black Enterprise, Black-owned businesses here in Palm Beach County Covered the Muck Tavern out in Belle Glade.

We are working with the Cultural Council on the Arts and Tourism Summit. We are thrilled to be able to showcase some of that diverse programming on the screens at the summit.

We are putting together a specific series of those shows and clips of those shows. To demonstrate what the Palm Beach TV channel is all about and how we embrace the culture here in Palm Beach County and that welcoming, open community that we have. And finally, the Student Showcase of Films, which we just concluded, over at the Maltz Jupiter Theater. 650 in attendance, it was a wonderful success. From that, I can tell you that 55% of our student finalists are of diversity, 26% of our judges, and 43% of our presenters. While we showcased a great deal of that diversity last year, this year was an even, stronger showing.

It is important to note that 2022 had record-breaking production numbers. $7M in production was spent here in Palm Beach County. Close to 500 productions utilized Palm Beach County as a backdrop for film and TV. We are about 5% ahead of schedule to date for that production revenue, and we are looking at potential back-to-back recordbreaking numbers for production.

We have generated $187M in economic impact to Palm Beach County, representing about a 12% increase year over year in the same period. We have a Screen Actors Guild strike going on.

That will certainly affect us in ways, but Palm Beach County is known for a lot of reality unscripted shows. We are a right-to-work state here. We have not seen too much of an impact from that as of right now. But one of the impacts that we are going to see, which we are monitoring, and we are also ahead of the curve, In Tallahassee, House Bill 5, which passed did reorganize our state film office.

We are one of 50 film commissions throughout the state of Florida. Some people think, are you going away, what is happening with your film office? And all of us collaboratively, we are coming up with a press release today on behalf of Film Florida, letting the community know that the state film office is restructuring.

They are now rebranding and restructuring and going into the Department of Commerce. They will no longer be known as the Office of Film and Entertainment, but that office will remain open. They will continue to update their production directory, their location, and library. They will still be answering phones and redirecting any inquiries back to the appropriate film offices.

I have been a part of an organization called Film Florida, I was the president a few years ago. They keep dragging me back on the board, I guess I am an alternate on the board

again. But what is good about all of that is Film Florida, which is a statewide organization is an advocacy group.

Our state film office cannot advocate because they are at the direction of the governor. With Film Florida, as an advocacy group, we can step up and take on whatever responsibilities we need on behalf of the state.

Vice Mayor Sachs

I wonder if there will be changes to our local outreach. Could you let everybody know, just copy everybody, because we won't be coming back until September. But I know there has been, always been a lot of back and forth with Film Florida.

Hillery

Yes, we are very much involved, and we have our finger on the pulse of what is going on. We are not anticipating any disruptions if you will. We have a sales tax exemption program that is in place. It is not an incentive program, but it is a sales tax exemption program. That is important to the state of Florida here.

1. OVG Venue Management

a. OVG 360 Diversity Report Update – Dave Anderson

b. Update- Dave Anderson

2. OVG Hospitality

a. OVG 360 Diversity Report Update – Kathy Griffin

b. Update – Kathy Griffin

Anderson

When our company was bought a couple of years ago by OVG, Oakview Group, we turned into one of the largest private management companies in the world for arenas, stadiums, convention centers, and theaters. We currently have 30,000 employees. And, when they flew us out to L. A. a couple of years ago for the executive meeting, the first thing on the agenda was DEI. It was very impressive. It was the chairman, and he committed from day one that, DEI was always going to be at the forefront of our organization.

Since that time, one of the first things they did is they hired Dr. Debonair Oates-Primus, who's our VP of DEI. She has been on for a couple of years now. She is doing an amazing job and the great thing about it is she can focus solely on that.

That is her sole purpose. One of the first things she did was roll out a DEI training program for the entire company. It started with the executive leadership. They all were flown out to L. A. And it was an immersive thing for four days. Then they started rolling it out to the company. I was on the second tier of the rollout.

It was six weeks, every Monday. And it was for 90 minutes. With 40 of my peers and a moderator running the diversity training. And it was incredibly strong. And it was incredibly impressive because it was, it was almost all interactive.

Discussion-oriented all the way through. And it was a very diverse crowd. And there were a lot of discussions about people's experiences. From somebody like me, or somebody who's a minority coming into our organization.

So now that is rolling out to all of our general managers, and we will be rolling out to all of our frontline staff over the next 12 months. It is a very impressive effort by the company. The other thing that they are doing, which is great, is there are just ongoing things available to all of us every month

And the world of the internet and to be able to connect is so great now. They have monthly, sometimes bi-monthly calls. Where they will have guest speakers and sessions and you can just jump on, and you can join in and listen. One of the sessions I made a month ago, featured eight employees of ours from around the country, a couple from Canada. And the whole session was based on the moment they came out in the industry and told people that they were gay. And it was extremely strong, and powerful. The other thing that they just started was they are bringing on executive leaders, minorities who either own or run businesses around the country, not affiliated with us. Talk about how they are rolling out diversity within their companies, and they own the companies.

The other thing that our company rolled out is a diversity supplier program which Kathy and I are involved in so all of the local companies we use small businesses are now part of a national network, and all of our buildings can go on to the network, and if they want to use one of our companies locally they can actually go on and call them directly and start using them now the same thing with me if I am looking for light bulbs And I found that there is a minority-owned business in Iowa that is in our program.

I can buy lightbulbs directly from him or her because they are on the program. We are part of the beta test that just rolled out, but again, you are talking within a year, you are talking 350 accounts. All of us probably have 10, 15, or 20 vendors per account. It is just going to be this massive database of minority-owned businesses around the country.

My team is very diverse, but then, probably the thing I am most proud of is that they are in leadership positions. Directors, managers, and key decision-makers are minorities within my team.

This allows people that are coming into the organization to see them. And to see them in these leadership positions.

We have Turning Point starting today. Again, high profile and high intense event. We have got Trump on Saturday, along with a bunch of his other friends.

These people are running the show. They are on the front line. They are the leaders of my organization. And it is a great testament to what we have done as far as growing our team and making it reflective of the local market.

Griffin

I have just finished week five of the DEI training. We have one more day to go. And as Dave said, I am going to echo what he said. It has been very enlightening. I have always considered myself to be very open and on the forefront of this, but this training has shown me blind spots that I did not know I have so it was great. A big part of this is now taking that training and putting it into action. There is one area that I am particularly proud of that we do here at Palm Beach County Convention Center is our relationship with blend with Trinette Morris and Katrina Long Robinson. We partner with them to help us reach out to local minority businesses in the area and bring them in as partners. We just did a food truck rodeo, and every food truck was a minority partner. Whether it is catering for us. Many different levels, whether it is a supplier. Once a quarter we do an expo forum. They come in, they have an opportunity to have a table set up, show us their wares, if it is a food product, do a tasting, and then basically an elevator pitch to us.

Right now, we have 12 to 15 local minority-owned businesses that we work with regularly Part of these quarterly sessions also includes the office of OBEO coming out and they do a class for the folks who are there. Help to get through the process to get certified. So, we are making sure that people, you know, can be a little intimidating, everything that they have got to do.

Helping them get through that process and becoming a certified Palm Beach County, OBEO vendor. On top of that, I am also on the advisory board for Inlet Grove, as is our chef. We go into the school; we work with the students. OVG does a 4,000 scholarship every year that we present to the school at the banquets that they do in the spring.

We bring the students out on site, where there is more that can be done and more that will be done.

Right now we are on a huge hiring spree. You know, we are doing well, about 50% through on what our target numbers are. Right now, our workforce that we have from management to front line to admin is about 55% diverse.

Anderson

I would just avoid, Okeechobee on Saturday afternoon and Saturday evening due to Turning Point, so as Kelly mentioned, the actual event starts today, they ramp up today and tomorrow, but Saturday and Sunday are going to be pretty intense, Trump will be on probably at 6:30 or 7 o'clock on Thursday. We are currently meeting with the Secret Service, and as with any of these events and with the political atmosphere everybody knows about, we take these things very seriously. The cooperation with Secret Service and local law enforcement has been amazing, we are tight and buttoned up and ready to go.

But then we roll right into Airport Council, which is fantastic, and the airport is hosting the big opening reception next week, which is great, and then, of course, we go right into Tony Robbins as well. Summer, there is no down month for us. It is just continuing, but things are really good.

7. BOARD COMMENTS

Amidon

Any updates on Brightline? I know they hit a snag up there in Stuart.

Segarra

We had a meeting yesterday morning with some of the industry colleagues and we had a representative from Brightline, and he stated that very soon, most likely in September, Brightline should be running to Orlando.

8. PUBLIC COMMENTS

No public comments.

9. ADJOURNMENT

There is NO meeting in August.

The next Meeting will be on September 14, 2023.

*Attachment included.

Tdc/tdcmtgs2023/Minutes 7 13.2023

TO: Tourist Development Council

FROM: Jorge Pesquera, President/CEODATE: August 31, 2023

RE: Discover The Palm Beaches Monthly Activity Report August 2023

The following is a summary of DTPB activities in support of TDC Performance measures for the month of August2023. This report demonstrates positive trends relative to owned visitor digital footprint, advertising impressions, social media engagement, and booked room nights for the Month of June

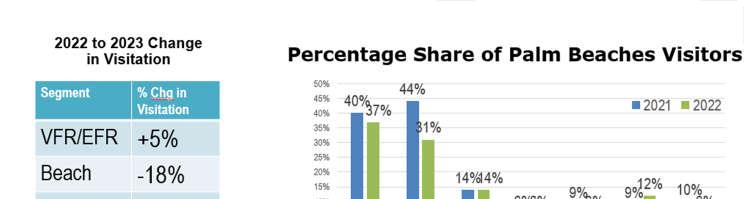

July 2023 Performance and Q2 Visitation

The Palm Beaches ranked 1st in room nights sold growth at 3.1% one of 3 markets with positive growth. The State of Florida decreased by 3.9%.

The Palm Beaches ranked 2nd in room revenue growth at 5.0%. Only Tampa (Hillsborough County) and The Palm Beaches has positive revenue growth. The State lost 6.4% in revenue.

The Palm Beaches was one of four markets that was able growth ADR and one of three markets that grew in occupancy.

Occupancy and Demand

Hotel Occupancy for July increased by 0.9% to 62.4%, selling 3.1% more hotel rooms than last year

Shared lodging sold 22% more room nights compared to last year, but with a 4.4% increase in occupancy

Total room nights sold from hotels and shared lodging increased 9.9% to 552,000

ADR and Revenue

Hotel rates were up 1.9% to $180.

Shared lodging rates were up 2.5% to $331, the per room equivalent was up 1.6% to $139

Overall lodging revenue was up 11.4% year-over-year at $92.2M

Bed taxes are expected to be over $5M

Visitation

2.3 million visitors up 4.5% from last year driven by record international visitation

o International by 8% to 168,600

o A record 61,000 Canadians visited in Q2-2023, 4% more than 2022

o Visitation from Germany was also a record at 5,100, up 18% from 2022

o Brazil was up 70% from 2022 with 7,800 visitors

o Mexican visitation was up 10% from 2022 to 3,200 visitors

The UK (-12%), Colombia (-19%) and Argentina (-22%) all saw decreases from 2022

UK with 8,400 visitors

Colombia with 4,800 visitors

Argentina with 3,500 visitors

o Visitation from Out-of-State increased by 5% to 1.3 million

Visitation from New York City Area was up 2.9% to 277,800

Washington DC & Baltimore was up 6% to 81,900

Boston was up 2.8% to 64,800

Philadelphia was up 4.2% to 54,000

Atlanta was up 1.2% to 64,100

Dallas was up 4% to 24,400

Harford was up 12% to 11,000

o In-State increased by 2% to 830,000

Miami-Ft. Lauderdale was down 1% to 235,000

Orlando was up 15% to 161,400

Tampa was up 20% to 93,000

$1.8 billion up 1.7% from last year

o $460 million in F&B spend down 7%

o $717 million on total lodging spend (including ancillary) up 7.6%

o $205 million on recreation up 7.8%

o $258 million on retail down 15%

o $159 million on transportation with The Palm Beaches up 23%

DTPB OBJECTIVES 2022 – 2023

Leisure/Consumer

Increase Consumer and Travel Industry database to 410,000

Generate 14,000,000 in Owned Views Digital Footprint

Generate 7,000,000 Social Engagements

Generate 700,000,000 Advertising Impressions

Generate 250,000,000 Earned Media Impressions

Meetings & Conventions

Book 110,000 DTPB only room nights (Hotel Meetings Leads)

Generate 50,000 Group Level Booked Room Nights Convention Center Shared

Generate 40,000 Group Level Actual FY Room Night for Convention Center Shared

Generate 80 participants in Destination Reviews

Generate 110 Destination Site Participants

0.0% 100.0% 79.7%

79.7%

50K

Year End Target 80

Marketing

Broadcast TV Buy January 16 - April 16

Brand/Media

• Bonus impressions running to meet target KPIs

Chicago, Washington DC, Boston, New York

• Chicago - NBC & CBS - 9.9M est. impressions

• Boston - NBC, CBS, ABC - 10.4M est. impressions

• Washington DC - NBC & CBS - 13.3M est. impressions

• New York - NBC & CBS - 16.1M est. impressions

• Broadcast TV in top DMAs:

Miami/Ft. Lauderdale - CBS & NBC

Broadcast TV Buy June - September

Brand/Media

Miami/Ft. Lauderdale, Orlando, Tampa, Atlanta

Orlando – NBC & Spectrum

Tampa – NCB

Atlanta- CBS

• Shifted funds from Accessibility, Sustainability and TDC Partnerships due to timing of iniatives

Community Outreach Toolkit March 1 - June 30

Social/Brand

Palm Beach County Residents

• Launched “Love The Palm Beaches” referral campaign to engage Palm Beach County residents and encourage them to invite friends & family for a trip, with significant reach across social media, broadcast TV, radio, out of home, direct mail, print, PR and digital display, resulting in 33,665,593 paid media impressions, 260,645 earned media impressions, 7,600+ social media tags, 1.1m impressions generated by influencers.

• Gay Polo partnership on April 8, hosted media, influencers and clients

• Partnership with Sports Commission for any support with RFPs or events for FIFA World Cup and College Football Playoff 2026

TDC Collaboration: Signature Events January - September Brand/PR/Social Varies

• Partnership with Cultural Council to promote Mosaic Open Studios, from paid media, content creation to social media posts

• Aug 30-31, Partnership with Cultural Council to prepare a highlight reel for the "Arts and Tourism Summit on DEIA" to be posted on LinkedIn

• Reallocated $150K into Summer Broadcast to bolster season, bringing total to $100K from $250K, based on estimated slated partnerships for remainder of fiscal

TDC Collaboration: Film Studio Planned Completion: September 30, 2023

Social/Digital/ PR/Brand N/A

TDC Collaboration: Airlift January - September Digital/Brand/Medi a Fly Markets (TBD)

Destination

OTA Co-Op January - September Digital

Chicago, Washington DC, Boston, New York, Philadelphia

• Requesting proposals to build out additional assets in Film studio space for video and podcast recording; awaiting confirmation of space availability in 5th floor studio

• Completed campaigns with Avelo on launch of new Wilmington, NC and Raleigh-Durham; promoting Breeze - Charleston route; Asheville campaign with Allegiant

• Continuing to customize creative with specific call to action to book within certain time frames with lower demand forecasted. Majority of campaigns running Florida markets plus Atlanta.

• Booked campaigns for July, August, September for $153,000 with reallocation of some Metaverse funds.

International Strategy: Traditional January - September Brand/Sales/Media

International Strategy: Digital January - September Digital

Canada, Mexico, Colombia, Brazil, UK, Germany

• Finalized media plans across Canada, UK, Mexico, Colombia and Germany. Media running February - September 2023

• Placements include Robb Report & Forbes MX; Elle & InStyle Mexico and a sponsorship of the Toronto Polo Club season

• Campaigns running in Mexico (Mexico City & Guadalajara), Colombia (Bogota, Medellin, Baranquilla), Canada (Toronto & Montreal), and Brazil (Sao Paolo).

• Launching campaigns in the UK on June 1, shifted $60,000 from Metaverse funds.

Canada, Mexico, Colombia, Brazil, UK, Germany

NationalTargeting Meeting Planners in Key Industry Segments

• Hosted Brazilian influencers @vazaonde and @ines.lafosse, combined following of 576k followers. Hosted @jujunatripblog 219k followers

• Hosted Toronto's top influencer and leading media @blogto (2.5 million followers) in partnership with Visit Florida

• Hosted Canadian influencer @luxe.tourista (183k followers)

• Boosted posts in target markets, 80.5m reach YTD

• Launched March 30 at Global Meetings Industry Day

• Owned & Paid Media plans in place, content being created, PR support

• Episodes:

7. The Future of Incentives with Stephanie Harris

8. Transformational Events with The Pink Retreat & Maritz

9. Partnering with Destinations to Create Welcoming Environments with Emily Scheiderer

10. Sustainable Meetings with Mya Surrency

• In discussion with Alliance Connection for high-impact partnerships with family brands

-

PR/Brand Florida Drive Markets, Key Fly Markets

• Evaluating opportunities with Sun Bum for a partnership takeover at point of sale in top stores

• Reallocated $100,000 to Brand Activation; reallocated $200K for drive marketing advertising to extend off-peak season media in Tampa, Miami/Ft. Lauderdale, Orlando and Atlanta Brand Activation August/September

PR/Brand New York

• Confirmed partnership with Saks 5th Avenue for high-impact window display activation Sept. 7-21 to coincide with New York Fashion Week

• Confirmed Carvertise Uber wraps to promote "Stay in Style in The Palm Beaches" during New York Fashion Week and Saks 5th Avenue activation

• Secured 2 additional OOH placements in NYC for 4-week sin September