Why Tailored AI Solutions are Necessary for Legal Rating your Company’s Cybersecurity

Using Litigation Finance as a Risk Management Tool

Upskilling

ISSUU.COM/TODAYSGC $199 SUBSCRIPTION RATE PER YEAR ISSN: 2326-5000 FEBRUARY/MARCH 2024 VOLUME 21/NUMBER 1 TODAYSGENERALCOUNSEL.COM

the Baton: Effective Succession Planning for GCs

General Counsel for Digital Transformation And more . . . Passing

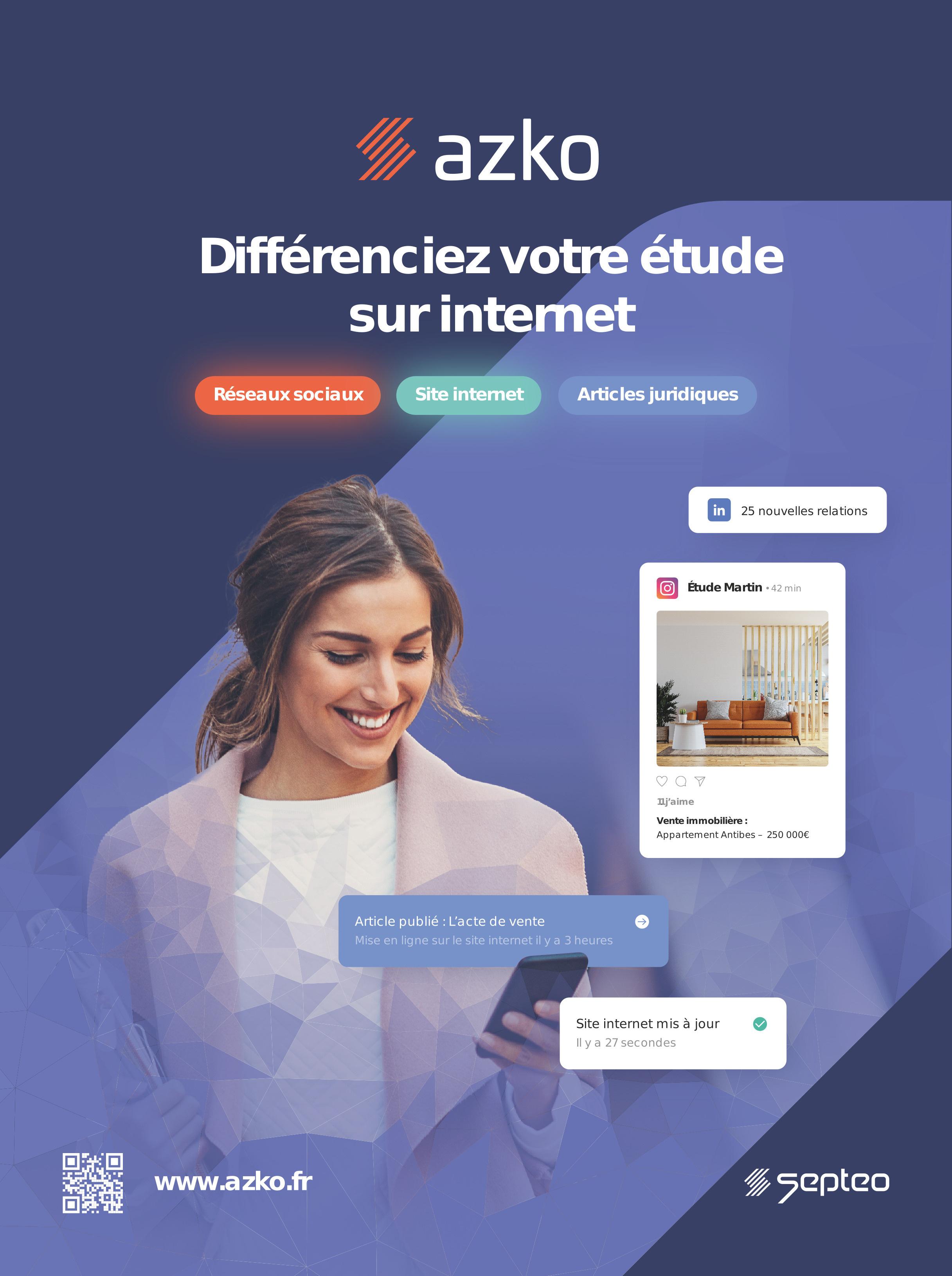

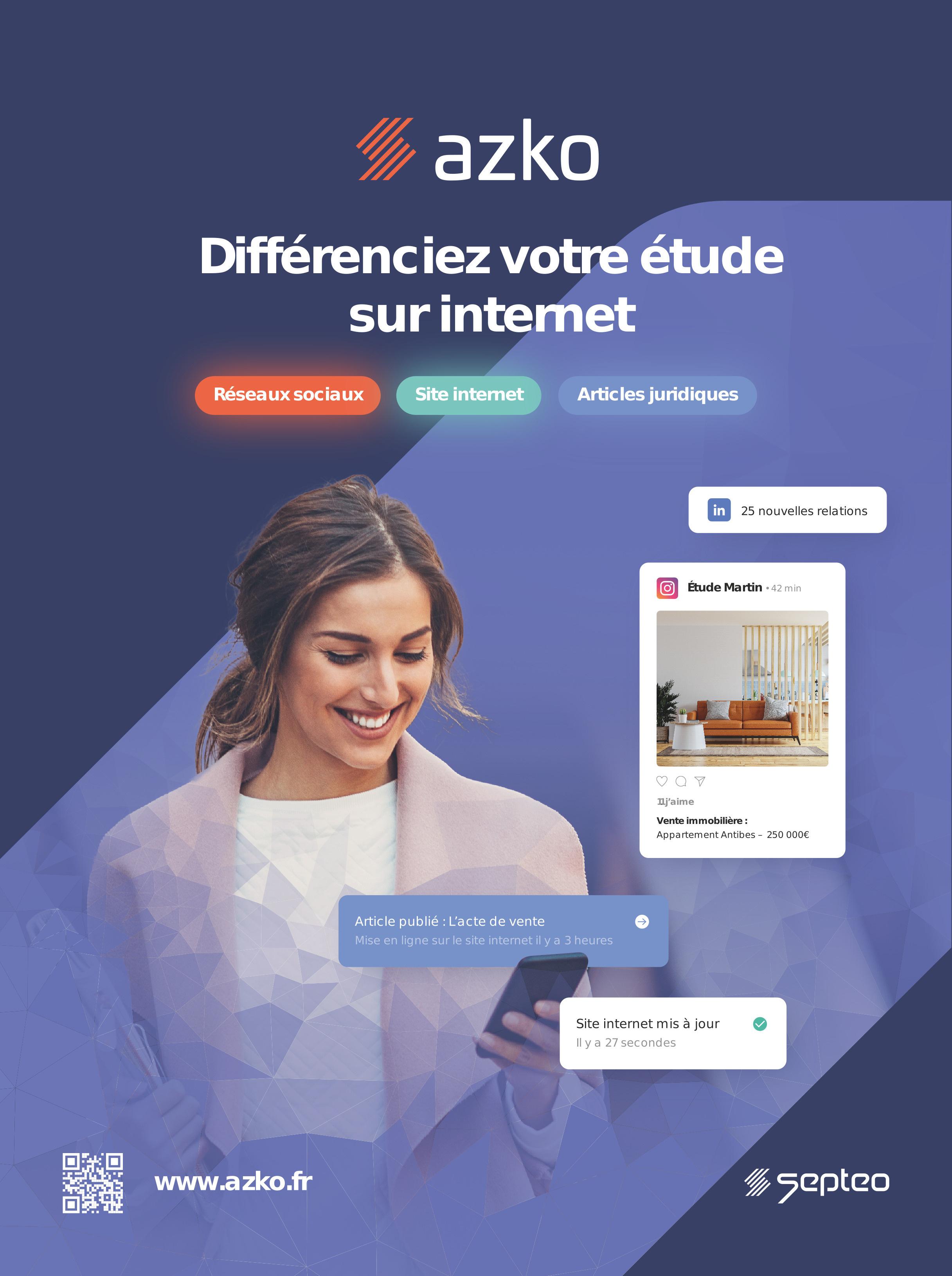

www.legal suite.com For Legal Departments The One-Stop Shop

4 Editor’s Desk

INTERVIEW

8 Transforming In-House Legal Departments with AI

An interview with Baptiste Armaignac of Legal Suite Inc., Septeo Group

CAREER DEVELOPMENT

10 From Success to Succession: Five Rules For Building Lasting Leadership

A great GC motivates, prepares and retains a successor and then gets out of their way.

By Dan Haley

COMPLIANCE

12 Prioritizing Cyber Risk Ratings in the Wake of SEC Regulations and Evolving Threats

Good cyber risk ratings lower insurance rates.

By Jeff Sharer

LITIGATION

14 The Dangers of Corporate Counsel Succumbing to Client Pressure

A sham opinion, and a stinging rebuke from a Delaware court.

By Kenneth A.

Rosen and Scott Cargill

16

Turning Litigation Into a Profit Center: Key Takeaways From 2023 in Litigation Finance

Litigation finance can turn the legal function from a cost center to a profit center in the eyes of C-suites and boards of directors.

By Michael Kelley

18

LEGAL OPERATIONS

18 Navigating Financial Distress: Protecting Yourself as an Officer, Director, or In-House Counsel

A company’s financial distress may expose officers, directors, and in-house counsel to personal liability. Learn how the business judgment rule acts as a shield.

By Kenneth A. Rosen

COLUMN: PRIVILEGE PLACE

20 Untangling Corporate Privilege: Deciphering the Complex Weave of Waivers

The principles that govern waivers for corporate entities are like a woven tapestry.

By Todd Presnell

LEGAL TECHNOLOGY

22 How to Effectively Upskill GCs for Digital Transformation Projects

Five skills will ensure the project is delivered successfully.

By Sally Mewies

3 FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM contents FEBRUARY/MARCH 2024

21/Number 1

Volume

EDITOR’S DESK

We are thrilled to bring you another installment of our magazine, which delivers compelling insights from legal thought leaders that will help you thrive in your corporate law career.

Career development is central to our mission at Today’s General Counsel and we are continuously seeking the best content that achieves that goal. Succession planning is a core component of general counsel leadership. Dan Healy, GC at Guild Education, gives us a great read about the importance of succession planning and how it helps shape our own success and legacy at companies and organizations.

Staying abreast of the latest technologies in the legal industry is similarly important. Sally Mewies, Head of Technology and Digital at Walker Morris, gives us actionable advice about the best ways to upskill general counsel for digital transformation projects.

Baptiste Armaignac, Director of Business Development North America at Legal Suite, Septeo Group, is another thought leader in the technology space. In an exclusive interview, he discusses common misconceptions about artificial intelligence (AI) adoption, the benefits of integrating AI into in-house legal departments, and the hurdles legal departments encounter in implementing this technology.

Other stories in this issue deal with timely topics such as the nuances of privilege waivers, the dangers of succumbing to client pressure and the significance of prioritizing cyber risk ratings in the wake of evolving SEC regulations.

I also encourage you to check out additional articles about how to turn litigation into a profit center and another on how to navigate financial distress and protect yourself as an officer, director, or in-house counsel.

We hope you enjoy this selection of stories, but it’s also important to remember that this is just a small sample of the content we are publishing daily on our recently revamped website. We also encourage you to follow us on LinkedIn and X to stay on top of everything we are doing, including our packed schedule of webinars.

Amanda Kaiser Editor-In-Chief

4 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS

Explore our innovative legal software solutions Nebula, Client Portal, and ReadySuite.

Amanda Kaiser CHIEF

Stephen Lincoln ART

MANAGING

Lainie Geary

ACCOUNT

EXECUTIVE

Patricia McGuinness

CONTRIBUTING EDITORS AND WRITERS

Baptiste Armaignac

Scott Cargill

Dan Haley

Michael Kelley

Sally Mewies

Todd Presnell

Kenneth A. Rosen

SUBSCRIPTION

Subscription rate per year: $199

For subscription requests, email subscriptions@todaysgc.com

REPRINTS

Dennis Block GREENBERG TRAURIG, LLP

Thomas Brunner WILEY REIN

Peter Bulmer

JACKSON LEWIS

Mark A. Carter DINSMORE & SHOHL

James Christie BLAKE CASSELS & GRAYDON

Adam Cohen

FTI CONSULTING

Jeffery Cross SMITH, GAMBRELL & RUSSELL, LLP

Thomas Frederick WINSTON & STRAWN

Jamie Gorelick WILMERHALE

EDITORIAL ADVISORY BOARD

Robert Haig KELLEY DRYE & WARREN

Robert Heim DECHERT

Joel Henning JOEL HENNING & ASSOCIATES

Sheila Hollis DUANE MORRIS

David Katz WACHTELL, LIPTON, ROSEN & KATZ

Steven Kittrell MCGUIREWOODS

Nikiforos latrou WEIRFOULDS

Timothy Malloy MCANDREWS, HELD & MALLOY

Steven Molo MOLOLAMKEN

Thurston Moore

HUNTON & WILLIAMS

Robert Profusek

JONES DAY

Art Rosenbloom

CHARLES RIVER ASSOCIATES

George Ruttinger

CROWELL & MORING

Jonathan S. Sack MORVILLO, ABRAMOWITZ, GRAND, IASON & ANELLO, P.C.

Victor Schwartz

SHOOK, HARDY & BACON

Jonathan Schiller BOIES, SCHILLER & FLEXNER

Robert Zahler

PILLSBURY WINTHROP SHAW PITTMAN

rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information or retrieval system, without the written permission of the publisher. Articles published in Today’s General Counsel are not to be construed as legal or professional advice, nor unless otherwise stated are they necessarily the views of a writer’s firm or its clients.

General Counsel (ISSN 2326-5000) is published ten times per year by Nienhouse Group Inc., 110 N Upper Wacker Dr, Chicago, IL 60606.

source: iStockphoto | Copyright © 2024 Nienhouse Group Inc. To submit an article, go to todaysgeneralcounsel.com/submissions

EDITOR

All

Today’s

Image

DIGITAL

Catherine Lindsey Nienhouse EDITOR-IN-CHIEF

OPERATING OFFICER

DIRECTION & PHOTO ILLUSTRATION MPower Ideation, LLC

EDITOR

EXECUTIVE

SENIOR EDITOR Barbara

FEATURES EDITOR

EDITOR

MANAGER

Bruce Rubenstein

Camm

Jim Gill WEB

Jessica Bajorinas DATABASE

For reprint requests, email Lisa Payne: lpayne@mossbergco.com Mossberg & Company Inc. DIRECTOR OF CLIENT PARTNERSHIPS & INITIATIVES

Jeff Sharer

Stella Valdez

With decades of experience, our subject matter experts and data strategists help businesses and legal teams tap into data – giving you control of the narrative for the best possible outcomes. This starts with an understanding of your needs and objectives through our STEPS™ framework – providing valuable insight into the unknown, the unseen, and the undiscovered. Having this insight gives you the opportunity to make informed decisions that lead to transformative outcomes.

At iDS, we work with you to find solutions to your data problems – helping to ensure that your data can be leveraged as an asset and not a liability.

CONSULTATIVE EXPERTS | STRUCTURED PROCEESS | CUSTOM SOLUTIONS /idiscoveryinc /idiscoveryinc /company/idsinc US: +1 800.813.4832 | UK/EEA: +44 (0)20 8242 4130 iDSinc.com

SOLVING COMPLEX DATA PROBLEMS. SCHEDULE A CONVERSATION WITH ONE OF OUR EXPERTS TODAY IT’S WHAT WE DO.

Transforming In-House Legal Departments with AI: An Interview with Baptiste Armaignac

For over 20 years, Legal Suite has helped companies and governments to implement innovative technological solutions with in-depth understanding of the legal field's challenges and evolution of technologies.

departments. Some fear that AI could replace their roles. Others believe AI accuracy is akin to a mathematical certainty. However, AI is not infallible, and organizations must recognize its limitations. Such expectations can hinder adoption, as users may wrongly assume that AI will effortlessly handle all tasks, further contributing to job replacement anxieties.

That’s why it’s important to align AI initiatives with specific goals. Simply deploying AI without a clear purpose may lead to inefficiencies and a lack of tangible benefits. The goal is not to replace legal professionals but to enhance their efficiency by handling repetitive tasks.

What steps can legal departments take to ensure their team members embrace the use of AI?

Just like implementing software, introducing AI requires tailored strategies. Communication is pivotal in this process. Legal teams need a clear understanding of the goals, applications, potential risks, and the fact that AI is a tool, not the end of the process. Addressing concerns about data privacy is crucial, as AI thrives on data, and maintaining confidentiality is paramount.

Let’s discuss the benefits of integrating AI into in-house legal departments and how these advantages can be optimized.

What are some common misconceptions about artificial intelligence (AI) adoption that organizations may have, and what are some examples of how they may already be using AI?

Common misunderstandings around adopting AI are often influenced by individual views within legal

I think the objective is to develop tailored AI solutions for each core business area within the legal department. An example would be implementing AI to initiate the extraction of data from contracts. This fundamental AI feature automatically retrieves contract content, creating a comprehensive file. The goal isn’t full automation but rather to provide a preliminary extracted view for human validation. This human-AI collaboration allows for corrections, thereby contributing to AI training. It

8 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS INTERVIEW

Baptiste

Armaignac Director of Business Development North America Legal Suite Inc., Septeo Group contact@legal-suite.com

also underscores that AI won’t replace human interpretation—certainly not today.

Our company, Septeo, is investing $38 million in an advanced artificial intelligence laboratory designed to develop in-house Generative AI to guarantee the security and confidentiality of our customers’ data. Additionally, we are incorporating a generative AI layer into all of Septeo’s software solutions, which will be done by the beginning of 2024. This AI enables the creation of tailored features like chatbots, text summarization, document categorization, and named entity extraction. The methodology is resilient, progressive, and iterative, enhancing its performance with growing utilization and user feedback. It constitutes a fundamental stride in the digitization of legal departments, facilitating a shift towards paperless settings and the automation of diverse processes.

So these tools empower attorneys to focus on their core competencies—analyzing, making arguments, and understanding the law—rather than getting bogged down in tedious tasks? Like having a junior assistant?

Exactly. This is closely aligned with the current business landscape, where legal departments are inundated with increasing data to manage. AI serves as the solution, automating routine tasks, enabling efficiency, and allowing legal professionals to allocate more valuable time to substantive legal activities.

That’s why the AI developed by Septeo will undergo specific training on its extensive corpus of industry documents. The aim is to tailor the AI to meet the unique needs of various regulated sectors, including compromises, clauses & contracts, legal assignments, notarial acts, and more. The generative AI is poised to optimize processes and streamline tasks, marking a significant leap forward in user experience and efficiency.

Are there any legal restrictions with using AI?

Currently, there are no specific legal regulations for AI. This lack of regulation raises concerns, especially in terms of data privacy. Legal departments grapple with issues such as controlling access, preventing unauthorized copying, and ensuring the security and anonymization of data. The legal profession is also confronted with questions about the nature of advice provided by AI. Is AI-generated advice still considered within

legal bounds? Moreover, the issue of data privacy becomes crucial, necessitating tools that provide dedicated, controlled, and secure environments for legal data.

Tools like ChatGPT, while impressive in their knowledge base, may fall short when it comes to the nuanced and subjective nature of legal questions. Legal departments prefer tools that are not only knowledgeable but also adhere to specific rules and training protocols, giving them more control over the results. A tool that caters to the specific needs of the legal profession ensures a more controlled and secure environment, addressing the evolving challenges in the legal landscape.

What hurdles do legal departments encounter in implementing this technology?

As we discussed earlier, many legal departments acknowledge the need to embrace AI but struggle with the practicalities. They often lack a clear understanding of how to leverage it and what specific advantages it could bring. The primary challenges lie in fostering adoption, managing the necessary changes, and providing adequate training. Setting well-defined goals is crucial.

Legal departments must assess their current state, identifying bottlenecks with high workloads and limited resources, so they can make informed decisions about why they need AI and how it can address their unique challenges. It’s crucial not to adopt AI blindly; understanding the overall business case and the specific use case is paramount.

And the beauty of AI lies in its adaptability and growth alongside the legal department. Unlike traditional technologies, AI evolves and improves over time based on the information provided to it. Absolutely. AI’s growth is intertwined with the quality and quantity of information fed into it, as well as the ongoing interaction with the legal department. This two-way interaction allows the AI to learn from real-world scenarios and continuously enhance its intelligence.

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 9

From Success to Succession: Five Rules For Building Lasting Leadership

By DAN HALEY

How do I define “success” as a general counsel?

In my experience, the answer is simple: A successful GC identifies, motivates, prepares, and retains a successor, and then gets out of their way. This principle, a key tenant of “Jack Welch and the GE Way,” remains a gold standard for leadership.

That approach has held up, and it applies equally to any executive leader. When we come to the end of a run, how do we assess whether we have succeeded? In a word: Succession. That was certainly the case for me in 2023, when I left my

GC role at Sprinklr and moved on to a new opportunity at Guild.

I recently stumbled upon one of my favorite photos of the legal team at my first company, athenahealth, taken at a rowing-based teambuilding event we did in the summer of 2016.

As I examined this photo years later, I was struck by the fact that six of the 30 people standing on that dock with me — a full 20% — have gone on to lead their own legal departments, as GCs. Two of them succeeded me directly, at two different companies. And multiple others currently lead large and impactful teams and functions, at athenahealth and elsewhere. It is impossible to adequately express, never mind quantify, the pride I feel in them and their accomplishments.

I don’t claim access to any secret succession alchemy, but I am mindful of the fact that this kind of success(ion) does not just happen. Here are my Top Five Rules for Effective Succession Planning:

1. Hire people who want your job and are capable of doing it (eventually). There is a raft of corporate clichés around this basic notion: hire people who are smarter than you are. This is 100% true. Smart, ambitious people make your team better, they make you look good, and they set your team up for durable success that outlasts your tenure.

2. Caretakers care. Time spent getting to know the members of your teams, including on a personal

10 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS CAREER DEVELOPMENT

level, has immeasurably high ROI. Understand, and then follow and help actively to guide, their ambitions. Create opportunities for them to shine, even—or especially! —when that requires you to take a back seat. Encourage them to stretch outside of their comfort zones, and to explore new areas of expertise. Backstop them when they face challenges or run up against failures. Most importantly, do all of this as part of your regular operating cadence, not just during the annual review cycle.

A successful GC identifies, motivates, prepares, and retains a successor, and then gets out of their way.

3. Retention is about more than money! Any professional worth his or her salt expects to be compensated fairly. But retention based entirely on money is shortterm retention, at best — talent who comes to or stays with you purely for cash is not an invested member of your team; he or she is a mercenary who will almost certainly leave when a higher offer comes along. Retention based on fair compensation in addition to learning and growth opportunities, scope expansion, trust, mutual support, team dynamics and culture, and mission alignment? That is where the magic lives.

4. If you love somebody, set them free. Gordon Sumner had this one right! A legal department, like most corporate organizations, is a pyramid. There is progressively less room at each successive level. If you succeed in building

a great team peopled by strong and ambitious performers, you will inevitably—frequently, even —face the risk of losing a key team member to an external opportunity. When that happens, it is a deep compliment to you as well as to your possibly departing team member. Treat it as such! First and foremost, always be happy for that person (see rule #2!) and offer to be a reference for them. Do not unleash a guilt trip or make this be about you. Retention efforts should be all about one question and one question only: is there anything about this new opportunity (scope, learning opportunities, exposure) that we can replicate here to keep you? Handle a valued colleague’s departure the right way, and you may well work together again down the road.

5. Intent is not a plan. Like cleaning out the garage, succession planning too often lives on the “I’ll get to it… eventually” end of the busy exec’s to-do list. If you take one thing away from my ramblings, let it be something I already noted above: The preconditions for succession success are a long-term commitment.

Good hiring without subsequent, focused attention to development and retention will leave you with high turnover and no bench. Caretaking with insufficient ‘care’ will result in low levels of engagement, loyalty, and performance on your team. Exclusive focus on compensation will

Prefer to read this online? Click here.

give you, at best, a high-performing team of short-termer mercenaries, and at worst a group of self-oriented, internally competitive free agents. And playing blocker against opportunities that come at your team from the outside will undermine trust and damage morale.

Conversely, a GC who combines deliberate adherence to the five rules above will find him or herself with a high-performing and resilient team that will succeed during and long after his or her own tenure in the role.

Most importantly, as I have learned twice now to my extreme pride and deep satisfaction, a succession plan will enable you to be open to your own unexpected opportunities. You will be secure in the knowledge that should you leave, your company and your team will be in good and steady hands.

That’s a pretty good definition of success.

Dan Haley, General Counsel and Corporate Secretary at Guild Education, has experience building and leading world-class legal departments at both publicly traded and private companies in the health information technology, marketing technology, and education technology spaces. dan.haley@guild.com

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 11

Prioritizing Cyber Risk Ratings in the Wake of SEC Regulations and Evolving Threats

By JEFF SHARER

With increased Securities and Exchange Commission (SEC) regulations, more cyber threats, and evolving technological exposures, all organizations must prioritize understanding their cybersecurity vulnerabilities.

Constant scanning and monitoring of internal critical applications are crucial to identifying potential exploitations. They also improve business outcomes, regulatory compliance, and insurance recovery.

Several firms provide cybersecurity ratings to assess a company’s cybersecurity posture. Consistently monitoring these ratings to assure that they accurately reflect risk posture is a priority. It helps businesses avoid inaccurate risk assessments and potential negative business impacts.

Internal cyber risk scoring should conform to a globally accepted standard common vulnerability scoring system (CVSS) that is referenced by

all cybersecurity authorities. This scoring is always referenced when threats become publicly known to identify the level of threat.

Organizations should adopt an internal risk appetite framework that utilizes a heat map to identify their most critical business applications and operations, which may be vulnerable in the event of a cyber attack.

These internal ratings, ranging from low to high-critical, aid in prioritizing responses and establishing an effective cyber program. Data from internal vulnerability scans is used to assess the firm’s financial and operational risk, and to rate internal exposure against publicly available CVSS-scored known threats.

These ratings and scores help assess the level of cyber risk and vulnerabilities, identify areas for improvement, and aid in developing strategies to mitigate risks. Furthermore, they enhance transparency and demonstrate the organization’s commitment to protecting sensitive information.

While some industries, like finance and healthcare, have been proactive in adopting advanced technologies to mitigate cyber risks, others have been slower to adapt. New technology can help all organizations,

12 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS COMPLIANCE

regardless of industry, monitor vulnerabilities while reducing costs.

HOW TO LEVERAGE CYBER RISK RATINGS

Organizations can harness cyber risk ratings to optimize various aspects of their business.

• Insurance: Cyber risk ratings are vital for insurance decisions. They enable organizations to negotiate favorable terms and adequate coverage. Insurers consider these ratings when they determine rates, often offering organizations with good scores comprehensive coverage at lower costs. These ratings serve as valuable tools in the cyber insurance market, providing insight into exposures and facilitating a better understanding of risk transfer and insurance costs.

• Business partnerships: Future business partners evaluate risk scores to assess potential partnerships and determine company valuation for private equity deals. Companies can leverage their cyber risk rating as evidence of trustworthiness, especially when establishing third-party vendor relationships.

• Compliance: Ratings ensure regulatory compliance by measuring an organization’s cybersecurity posture, and identifying vulnerabilities and non-compliance. Monitoring cyber risk scores enables organizations to enhance security, meet regulatory standards, and mitigate legal and financial consequences.

• Litigation Defense: A high cyber risk score strengthens the defense in compliance lawsuits. It demonstrates aggressive efforts to

address risks, ensure regulatory compliance, and protect sensitive information. It showcases the organization’s commitment to cybersecurity and adherence to best practices.

COMPLYING WITH REGULATIONS

Increasing regulatory scrutiny means organizations need to demonstrate effective cyber risk management

The SEC’s rulings require organizations to have robust security measures. Businesses face potential legal and regulatory liabilities if they fail to implement required protocols. Private equity firms that own companies bear the same cybersecurity disclosure responsibilities as public companies.

Like CFOs and CEOs, chief commercial officers (CCOs) carry personal liability in verifying security measures. Non-compliance can result in significant financial penalties including fines, disgorgement of gains, and injunctions. Civil lawsuits and legal enforcement may also be initiated, leading to further financial penalties and restrictions on company activities.

Cyber risk ratings are vital for insurance decisions.

Technological tools aid legal professionals in ensuring compliance and reducing liability risks. The SEC proposed Rule 10 mandates financial institutions and private equity funds disclose cyber risk management practices. Advanced software enables organizations to access cyber risk ratings and demonstrate compliance with the rule.

Prefer to read this online? Click here.

As cyber threats continue to escalate, it is imperative that organizations and their counsel wholeheartedly embrace all tools available to help them navigate cyber risks.

Staying proactive and monitoring ratings allows organizations to promptly address any exposures that arise. By doing so, they can stay ahead of the curve and effectively protect their company and their clients in this rapidly changing digital environment.

Jeff Sharer is the vice president of customer and product experience at LineSlip Solutions, a SaaS company serving the risk and insurance world. He focuses on transforming risk information management to make better risk decisions.

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 13

The Dangers of Corporate Counsel Succumbing to Client Pressure

By KENNETH A. ROSEN AND SCOTT CARGILL

At some point in every corporate lawyer’s career, they are thrust into a situation pitting their obligation to zealously advocate in helping a client achieve its goals, against their professional and ethical obligations to objectively view the state of established law and act consistent with ethical standards.

The Delaware Court of Chancery’s thoughtful decision in Bandera

Master Fund LP v. Boardwalk Pipeline Partners, LP highlights the potential bad outcomes that can result when a law firm loses its objectivity and professionalism in an effort to assist a client in obtaining a financial objective.

In 2005, Loews Corporation (Lowes) formed Boardwalk Pipeline Partners, LP (Boardwalk). Thereafter, Loews took Boardwalk public but wanted to retain the flexibility to take

Boardwalk private. Boardwalk’s partnership agreement granted Loews a right to repurchase Boardwalk’s partnership units from limited partners, subject only to Boardwalk receiving and approving an opinion of counsel satisfactory to Loews Boardwalk’s general partner.

Loews sought and obtained an opinion of counsel allowing Lowes to exercise its buyback option. Shareholders impacted by the

14 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS LITIGATION

transaction, brought suit challenging the legal opinion that authorized Lowes to exercise the buyback option.

The Chancery Court found that the opinion was “contrived” to yield the result that Loews desired, and it was delivered in “bad faith,” because Loews was the “propulsive force” in securing the legal opinion that used “counterfactual assumptions” to create a “simple syllogism” to get a desired result, in the face of significant uncertainty of key facts.

The Court found that Loews’ efforts to obtain the “sham opinion”

The Chancery Court found that the opinion was “contrived” to yield the result that Loews desired.

constituted “willful misconduct” and that Lowes had “participated knowingly” in preparing the opinion and “provided the propulsive force that led the outside lawyers to reach the conclusions that Loews wanted.” The court ruled Lowes was not protected by the provision in partnership agreement affording Lowes a conclusive presumption of good faith when relying on legal opinions and awarded more than $690 million in damages to the harmed shareholders.

KEY TAKEAWAYS

Attorneys cannot reach legal conclusions based upon undue pressure from a client and must not rely on facts that the attorney knows to be untrue, or for which the lawyer has not performed adequate diligence.

Prefer to read this online? Click here.

When delivering a legal opinion, a law firm can make good faith predictions about the future, but it cannot assume what will happen in the future for purposes of the opinion. Any interpretations about the underlying agreement, and the rationales therefor, should be explicitly stated in the legal opinion.

While zealous advocacy is a hallmark of successful in-house counsel and outside law firms, such advocacy must always be tempered by adherence to ethical rules, professionalism, and most importantly, common sense.

Kenneth A. Rosen is Chair Emeritus of Lowenstein Sandler’s Bankruptcy & Restructuring Department. He advises on the full spectrum of restructuring solutions, including Chapter 11 reorganizations, out-of-court workouts, financial restructurings, and litigation.

Scott Cargill is Of Counsel in Lowenstein Sandler’s Bankruptcy & Restructuring Department. He has experience navigating complex insolvency issues and has been involved in some of the largest corporate restructuring cases in the country.

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 15

STAY UP-TO-DATE THOUGHT LEADERSHIP, INTERVIEWS, WEBINARS, THE LATEST LEGAL NEWS

PRACTICES AND REAL WORLD SOLUTIONS FOR GCs AND IN-HOUSE COUNSEL FOLLOW US @TodaysGC today’s-general -counsel

BEST

Turning Litigation Into a Profit Center: Key Takeaways From 2023 in Litigation Finance

By MICHAEL KELLEY

Some general counsel are finding that litigation finance can help turn the legal function from a cost center to a profit center in the eyes of their C-suites and boards of directors.

That is one of the biggest takeaways from 2023 in the rapidly growing market for third-party funding of lawsuits. When litigation finance first came on the scene, many in-house attorneys viewed it primarily as a threat that could

make it easier for their companies to face lawsuits. But as the market has matured over the past decade or so, some chief legal officers are finding it can help their companies with the cost of both defending against claims and pursuing them.

On the defense side, an increasing number of corporate leaders are thinking about litigation finance as an important tool in how they manage risk. Let’s say a company is facing a $10 million lawsuit.

Structuring a defense-side funding arrangement typically includes an agreed repayment formula based on what the projected liability of the company would be if all claims against the company are successful. The funder’s recovery is calculated as either an internal rate of return or multiple on invested capital and paid by the company from loss savings as a result of successful defense of claims.

As another example, some com-

16 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS LITIGATION

panies are using litigation finance to pay for the cost of judgment preservation insurance to insure a judgment they won that has since been appealed. That allows the company to prudently hedge its bets in case the appeals court reduces or overturns the judgment.

But it is the pursuit of claims where some general counsel are using litigation finance to add the most value. Many companies have legal claims that would fit within their business strategy to pursue, but they are deterred by the high fees and costs of counsel. Litigation finance allows the C-suite to think about those claims as assets they can monetize. It can also allow firm CFOs to take the initial cost of prosecution off the balance sheet and preserve company cash for other uses such as research and development or company growth.

For example, even companies with large balance sheets may determine that they would rather pay the cost of litigation funding (that is have a third party cover the fees and expenses of litigation) rather than

is non-recourse, the company does not have to worry that its non-claim assets are collateral for securing the financing and at risk.

In both the pursuit and defense of litigation, general counsel benefit from another 2023 trend in litigation finance: the evolution of market terms. As more funders have entered the market, the competition for meritorious and financially viable deals has increased. Corporate counsel seeking funding can negotiate deal points they would not have been able to secure a few years ago.

General counsel should also be aware that the pressure to regulate litigation finance has increased over the past year, both internationally and domestically. The U.S. Chamber of Commerce has been pressuring Congress to regulate litigation funding that comes from overseas, as well as to increase disclosure requirements more broadly. There is ample debate on those topics that deserve a deeper analysis than will fit here. (I was part of two panels entirely focused on industry regulation at national conferences last

Many companies have legal claims that would fit within their business strategy to pursue, but they are deterred by the high fees and costs of counsel. Litigation finance allows the C-suite to think about those claims as assets they can monetize.

self-financing litigation. For smaller and midsize enterprises, having litigation finance in their toolkit for monetizing legal claims permits them to focus on growth looking forward rather than having to pay for claims recovery looking backward. Moreover, because litigation funding

year.) How the regulatory overlay for the market evolves will be a key point to watch in 2024.

As a final point, all of the takeaways above are signs that litigation finance continued to mature in 2023. The maturation of any market tends to come with more regulation, more

Prefer to read this online? Click here.

competition, and more examples of how the marketplace can provide value. In 2024, general counsel should consider exploring how they can use that marketplace to provide value to their companies and, in turn, enhance their own profiles with their C-suites and boards of directors.

Michael Kelley is a partner at Parker Poe in Washington, DC. He assists clients with a broad range of their needs tied to litigation finance and investment funds. michaelkelley@parkerpoe.com.

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 17

Navigating Financial Distress: Protecting Yourself as an Officer, Director, or In-House Counsel

By KENNETH A. ROSEN

When a company faces financial distress, the landscape becomes complex and fraught with risk. Officers, directors, and in-house counsel play crucial roles in guiding the company through these turbulent times, but their efforts can expose them to personal liability. This article discusses how their roles change with respect to shareholders, how the business judgment rule functions as a shield, and how officers , directors, and in-house counsel can protect themselves from liability.

ENTERING THE “ZONE OF INSOLVENCY: A SHIFT IN RESPONSIBILITIES

For a company entering the “zone of insolvency,” the primary beneficiaries

of any increase in its value shift from shareholders to creditors. Officers and directors are no longer solely responsible for maximizing shareholder returns but must now prioritize the interests of creditors.

THE BUSINESS JUDGMENT RULE: A SHIELD, NOT A GUARANTEE

The business judgment rule is a legal principle that provides a presumption in favor of the decisions made by the directors of a corporation. It is based on the understanding that directors, in making business decisions, act on an informed basis in good faith, and with the honest belief that their actions are in the best interests of the company. This rule shields corporate decision-makers from judicial

second-guessing — especially by a bankruptcy trustee or a creditors’ committee — provided certain elements are present, such as a business decision made by disinterested directors who have exercised due care and acted in good faith.

LESSONS FROM THE TOYS “R” US CASE: A CAUTIONARY TALE

The Toys “R” Us bankruptcy case serves as a stark reminder of the potential repercussions for officers and directors who fail to uphold their fiduciary duties during financial distress. In this case, officers and directors were accused of:

• Prioritizing their own interests: Excessive compensation, conflicts of interest, and favoritism

• Mismanagement and negligence: Actions or inaction contributing to financial distress

• Misrepresentation of financial information: Providing inaccurate or misleading information to stakeholders

• Improper asset transfers and preferential treatment: Benefiting specific parties over others

• Failure to adapt to changing trends: Ignoring market shifts and e-commerce rise

• Poor financial decisions: Taking

18 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS LEGAL OPERATIONS

on excessive debt and exacerbating financial struggles

• Ineffective cost-cutting measures: Negatively impacting inventory levels and customer service

PROTECTING YOURSELF: ESSENTIAL ACTIONS FOR OFFICERS AND DIRECTORS

If bankruptcy has been filed under Chapter 11, officers and directors can be the subject of a forensic investigation. To protect themselves, officers and directors need to ensure that they perform the following:

• Actively review financial statements and key metrics

• Participate in regular board meetings and engage with management.

• Document discussions and inquiries in board minutes

• Seek expert advice from insolvency professionals

Besides officers and directors, in-house counsel can be the subject of a forensic investigation in Chapter 11 cases.

• Balance the interests of all stakeholders

• Ensure transparency in decisionmaking

• Verify the scope and availability of officer and director insurance coverage..

• Not take advantage of financial distress to gain a personal benefit or increased control of the company

In a situation of financial instability or near insolvency, directors

should prevent the company from embarking on a plan that an honest and intelligent director of the company could not have reasonably believed was in the interests of the company.

PROTECTING YOURSELF: ESSENTIAL ACTIONS FOR IN-HOUSE COUNSEL

In the Lehman Brothers bankruptcy, in-house counsel faced lawsuits alleging that they breached their fiduciary duty by failing to adequately advise the company on risk management and by approving questionable transactions. General Motors’ in-house counsel confronted lawsuits that included allegations that they failed to properly disclose known defects in the company’s vehicles.

In-house counsel at WorldCom were accused of breaching their fiduciary duty by being aware of or participating in the fraudulent accounting practices. Finally, in Washington Mutual’s bankruptcy case, in-house counsel was alleged to have failed to provide appropriate legal advice regarding the risks associated with the company’s mortgage lending practices.

Besides officers and directors, in-house counsel can be the subject of a forensic investigation in Chapter 11 cases. In-house counsel need to ensure they do the following:

• Advise the board and officers on legal and regulatory obligations

• Implement enhanced internal controls and fraud detection mechanisms.

• Monitor financial indicators for early warning signs

• Provide guidance on restructuring strategies and negotiations.

Prefer to read this online? Click here.

• Stay involved in the restructuring process

• Ensure compliance with environmental, tax, and other regulations

• Maintain open communication with management and the board

By proactively managing risk, exercising due care, and seeking expert advice, officers, directors, and in-house counsel can navigate financial distress while protecting themselves from personal liability Remember, diligence, transparency, and a commitment to protecting the interests of all stakeholders are key to weathering storms and emerging stronger.

Kenneth A. Rosen is Of Counsel and Chair Emeritus, Banking and Restructuring Department, with Lowenstein and Sandler LLC. He advises on the full spectrum of restructuring solutions, including Chapter 11 reorganizations, out-of-court workouts, financial restructurings, and litigation. rosenkennethalan@gmail.com

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 19

Untangling Corporate Privilege: Deciphering the Complex Weave of Waivers

By TODD PRESNELL

The principles that govern waivers for corporate entities are like a woven tapestry. In one direction we find patterns that result in implied privilege waiver, such as advice-of-counsel or at-issue waiver.

In another direction, we see yarns of voluntary waiver that may intersect with other implied waiver threads, such as subject-matter waiver.

Without a careful understanding of these patterns, the final tapestry may produce a loss of privilege.

Corporate entities too often display a reactive approach to privilege waiver, seeing only the final tapestry rather than the fabrics from which it arose. That is understandable because the final waiver result is simple to grasp, but the underlying waiver rules leading to it are intricate and complex.

WAIVERS OF ALL COLORS

For instance, if a corporate entity elects to defend a cause of action by asserting that it acted in accordance with its lawyer’s advice, then this

advice-of-counsel defense typically waives the privilege over communications about that legal advice.

If a company conducts a privileged investigation, but then relies on that investigation in a wrongful termination suit, at-issue waiver ensues.

When a corporate entity decides to voluntarily disclose a privileged document, then the subject-matter waiver doctrine, another thread of the implied waiver fabric, may be triggered.

The subject-matter waiver doctrine

20 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS COLUMN: PRIVILEGE PLACE

generally provides that a company’s voluntary disclosure of a privileged document not only waives privilege protection over that document but also over undisclosed privileged documents that pertain to the same subject matter.

An in-house lawyer should understand the subject-matter waiver doctrine and assess its scope and consequences before approving the

An in-house lawyer should understand the subject-matter waiver doctrine and assess its scope and consequences before approving disclosure.

disclosure of a document. In other words, take a proactive approach rather than a reactive one.

A QUESTION OF SCOPE

There is substantial legal authority on these implied-waiver doctrines that allow in-house counsel to understand and apply them. However, there is comparatively little legal authority on the scope of voluntary waiver, the primary issue being who within the company has the authority to waive the privilege.

For example, if an in-house lawyer conveys legal advice to a division manager, and that manager—without approval from the in-house lawyer— forwards that advice to a third party, is that waiver? Did that manager have the authority to waive the privilege?

Certainly, a corporate entity’s governing board has the authority to waive the privilege, but in reality,

privilege-waiver decisions rarely reach those bodies. Courts generally hold that a company’s in-house and outside counsel have implied authority to waive the entity’s privilege.

WAIVERS AND THE C-SUITE

A CEO typically has inherent authority to waive the privilege, as one top executive learned the hard way. In pre-suit discussions with a competitor, a CEO revealed that the company’s lawyers had concluded that the competitor’s conduct constituted patent infringement.

During discovery in the subsequent patent infringement case, the trial judge ruled that the CEO’s disclosure of the lawyer’s conclusions was substantial enough to constitute a privilege waiver. The court did not even discuss the CEO’s authority to have made those revealing statements, assuming the authority existed because of his position.

The identification of lower-level employees with the authority to waive the privilege invokes agency-law principles. Courts may require corporate entities to prove that an employee disclosing privileged communications did not have the actual or apparent authority to do so.

The question will ultimately center on whether the scope of the employee’s duties encompassed the authority to waive the privilege. For example, a court will likely find a privilege waiver where an employee tasked with leading an acquisition discloses privileged communications about that transaction to third parties.

By contrast, a court would likely rule that a subordinate employee handling due diligence requests had

Prefer to read this online? Click here.

no authority to disclose privileged communications to a third party.

TAKING ACTION

So, how can we look beyond the finished tapestry and see the weave of waiver? Let’s become proactive rather than reactive. Consider a general policy that identifies those positions in the corporate hierarchy that have the authority to waive the privilege.

When a significant project arises— mergers, contract negotiations, government investigations, or HR investigations—in-house counsel should consider expressly identifying the person who has sole authority to waive the privilege or expressly retain that authority for herself.

General training of key employees about establishing and maintaining the privilege will at least alert those employees to the threads that can lead to privilege waiver.

Todd Presnell is a trial lawyer in Bradley’s Nashville office. He is the creator and author of the legal blog Presnell on Privileges, presnellonprivileges.com, and provides internal investigation and privilege consulting services to in-house legal departments.

tpresnell@bradley.com

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 21

How to Effectively Upskill GCs for Digital Transformation Projects

By SALLY MEWIES

As artificial intelligence (AI) continues to dominate news cycles, emergent technologies are hitting the market as never before. Couple that with the prevalence of “plug and play” IT tools that are becoming increasingly interoperable and a consumer market that is more and more accustomed to businesses being technologically sophisticated, and we can understand why the number of organizations undertaking digital projects is on the rise.

Digital transformation can be

daunting. A recent Walker Morris survey of senior in-house lawyers found that over a third of respondents (36 percent) acknowledged the need to embark on digital transformation but do not know where to start. Not only that, but 27 percent find digital transformation “overwhelming.”

However, as technology in business becomes more prevalent and less transparent, Legal has a crucial role to play, not only in the implementation but in the ongoing management of these increasingly autonomous solutions.

So, what can the in-house team do to ensure that tech projects are delivered successfully?

1. View the digital transformation project through a wide lens. It is rare for tech procurements to be siloed: Interdependencies between new and existing systems are commonplace. On big projects, a multi-supplier arrangement would not be unusual. For example, you might have an IT consultancy prepare a transformation roadmap that the consultancy or a third party

22 TODAYSGENERALCOUNSEL.COM FEBRUARY/MARCH 2024 BACK TO CONTENTS LEGAL TECHNOLOGY

will deliver. The multi-supplier arrangement might include procuring and configuring multiple third-party software tools, as well as installing new hardware or introducing ongoing tech support.

To aid the smooth delivery of a digital transformation project, take steps to ensure that there are

As technology in business becomes more prevalent and less transparent, Legal has a crucial role to play.

no gaps in the allocation of responsibility between suppliers and that effective contractual mechanisms are in place to manage change. The “dotted lines” between suppliers are pivotal. Completing this exercise can identify critical interfaces that need to be built or maintained as part of the transformation.

2. Consider where regulation may bite, now and in the future. Most legal teams are now adept at spotting (and often advise on) legislation-specific issues, such as personal data processing or the UK’s Transfer of Undertakings (Protection of Employment). With security and AI priorities for regulation in many countries, they are likely to be subject to a legal framework in the near future.

In Europe, for example, there are draft regulations concerning the production, deployment and use of AI, which means AI may soon be regulated similarly to data protection. Beyond this, more

stringent requirements in relation to consumer-facing products are set out in the Digital Markets, Competition and Consumers Bill. Businesses need to be mindful of the impact of the data protection reforms that are progressing in the UK.

General counsel and their teams can help manage these upcoming developments by including provisions in contracts that protect the business against these changes in the law. Even though they might only be “agreement to agree” style clauses, they can be helpful in driving the right outcomes.

3. Push for contractual mechanisms to give the project the best chance of success. Though ubiquitous in most contracts, the right to terminate in the midst of a digital transformation may be an unappealing option, even if it follows a failure to deliver. If considerable time and cost have already been expended on a partly delivered solution, the prospect of starting again might be undesirable.

Experience tells us that it is far better to build in contractual mechanisms that resolve minor issues before they turn into big ones where termination becomes part of the conversation. Legal can suggest detailed change control procedures, service-level regimes, governance programs, clearly documented delivery plans and regular review meetings to keep projects on track at the negotiation stage. It may seem unnecessary, but strong governance makes a difference and can nip issues in the bud.

4. Bring the users with you. This

Prefer to read this online? Click here.

may appear obvious, but the implementation team can often become disconnected from the user group. It is important to strike a balance between engaging users so they adopt and use the new systems effectively or engaging them too much so that they delay the project. Workshops and user briefings can work very well in helping achieve this balance if structured in a practical and informative way.

5. Understand the customer’s role in delivering the project. Rarely can suppliers implement large projects on their own. They need commitment and support from the user group. If this is not understood at the beginning of the project, delays can occur and costs will rise. Being clear at the outset can help set realistic expectations.

Sally Mewies is Head of Technology and Digital at Walker Morris. She has over 30 years of experience in helping clients on their technology contracts. She is recognized as a leader in her field and been ranked as a leading individual by Chambers & Partners and Legal 500. sally.mewies@walkermorris.co.uk

FEBRUARY/MARCH 2024 TODAYSGENERALCOUNSEL.COM BACK TO CONTENTS 23

Complimentary Webinars

Upcoming

Mastering Data Inventories: Strategic Privacy Compliance and Data Governance

THURSDAY, MARCH 29

1:00PM ET

Join our enlightening webinar to explore the critical role of data discovery in constructing a comprehensive and accurate data inventory, essential for streamlining privacy compliance and enhancing data governance.

In this session, we will delve into the development of a robust, compliant privacy and data governance program, adaptable to evolving regulations. Our discussion will focus on establishing a solid foundation using a data inventory, facilitated by advanced data discovery software.

We'll examine how this foundational step simplifies the creation of data maps, management of user consent, construction of record of processing activities, development of retention schedules, completion of risk assessments, and the efficient handling of data subject rights requests. Enhance your understanding of effective privacy compliance and data governance, and empower your organization to significantly reduce data-related risks.

Register for Webinar

Sponsored by

Upcoming Legal Contract Management

Redefined: Exploring The Latest Advancements For Legal Teams

THURSDAY, MARCH 14

1:00PM ET

Discover the cutting-edge capabilities of AI-based CLM software — tailored to meet the sophisticated, ranging needs of legal professionals.

Join us to hear from CobbleStone®, industryleading experts in Contract Management Software, to explore how the latest advancements in legal technology can help general counsel, corporate counsel, paralegals, and other legal professionals to:

• Automate contract drafting with AI

• Centralize contract negotiation and approvals

• Enhance compliance

• Optimize risk management

• Streamline searching and reporting

• Proactively measure key contract management KPIs. This webinar is an invaluable opportunity to see strategic contract management in action as you discover the trusted modern tools that empower legal departments to efficiently manage contracts from inception to renewal or expiration.

Register for Webinar

View more on-demand and upcoming webinars *Free CLE available for many webinars in several states. See registration page for details. CLE not available for on-demand viewing.