Medicare 2026

Open enrollment is here!

If you are 65 or older, this guide contains the timely advice you’ll need to get everything in order for 2026.

A SPEC I AL AD VE RT ISING SEC TION OF TIMES TO TA L MEDIA

Number

Open enrollment is here!

If you are 65 or older, this guide contains the timely advice you’ll need to get everything in order for 2026.

Number

Percentage

Percentage

No worries – the specially trained volunteers at SHINE will help you make sense of it all.

BY SALLY MOE, Times Total Media Correspondent

Maybe you’re feeling some of that confusion this very minute as you explore the pages of this Medicare issue. Don’t despair! It’s important for Medicare-eligible adults to understand all the changes to Medicare each year, as well as the basics of applying (which can also be confusing). If you find you need assistance or guidance, it’s there for you in the form of downloadable information, as well as classes both via Zoom and in person.

And the best part? It’s all free.

“I started training myself for personal knowledge, but I immediately knew this was something I wanted to do long term I wanted to be a senior advocate helping people who got lost in the system and simply did not know where to turn. I feel good helping and I love what I do.” – Deanna

C.

Based in Tallahassee, but serving all of Florida via counseling sites in every county, SHINE (which stands for Serving Health Insurance Needs of Elders) is there to help you figure it all out: how to apply and what the best coverage choices are for your situation and budget. Plus, learn about hospice and home health benefits, financial assistance, long-term care, disability and much more. Their website florida shine.org is packed with informative PDFs (under Resources), as well as details about volunteering and about classes and community events in every county.

No matter where you are in the Medicare process, let the free, confidential help and guidance of the counselors at SHINE give you the support you need. Go to floridashine.org/ contact-us.aspx. Fill out the form and include the type of help you seek. You can also call SHINE toll-free at 800-963-5337, or email them at information@elderaffairs.org.

Play or sing with a group, or learn an instrument to stretch the boundaries of your comfort zone.

BY SALLY MOE, Times Total Media Correspondent

Music has a profound effect on your brain. Consider how, when a favorite song plays on the radio, it can rocket you back in time to your first love or a time in your life when you felt anything was possible. Beautiful music can give you chills, make you cry or transport you altogether. According to AARP, “… researchers are still learning about the potential benefits of music, including its effect on the brain and our memories.”

Learning an instrument or reawakening those skills in your later years strengthens parts of your brain that are vulnerable to age-related decline. Research suggests it can enhance the brain’s ability to form new neural connections and adapt referred to as neuroplasticity. (Seriously. Did you think Keith Richards was a fluke?) Furthermore, a review of studies published in 2022 in BMC Neu-

rology found that adults who played a musical instrument were significantly less likely to develop dementia.

In the Tampa Bay area, getting involved in a group music venture isn’t hard. Some of them don’t even require an audition. You can start by visiting a rehearsal to get a sense of their vibe and whether it would be a fit:

The Awesome Original Second Time Arounders Marching Band (or Rounders for short), founded in 1983, is a community marching band based in St. Petersburg and serving the entire Tampa Bay area. The Rounders consistently march over 400 members ages 18-80. Joining is open to anyone who has ever performed in a high school, college or military marching band who would like to do it again, a “second time around.”

Registration is open; email 2xamarchingband@gmail .com with questions. secondtimearounders.org.

The St. Petersburg Community Band, founded in 1975, is a registered nonprofit organization of 75-plus volunteer musicians of all ages. They play a wide variety of music. Send an email to info@ stpeteband.com or president @stpeteband.com with questions. If you’d like to join, fill out the form at stpete band.com/join.html.

The South Pasadena Community Band is a community relations initiative of the city of South Pasadena, Florida. The band provides area musicians with the opportunity to use, hone and enjoy their musical talents by presenting a variety of quality concerts for local audiences. southpasadena band.com. Call 727-337-0442 for info, or fill out the online

form at southpasadenaband .com/contact-us.

The Helios Jazz Orchestra is an 18-piece modern jazz band based in the Tampa Bay area.

The group plays swing, Latin, bebop and straight-ahead jazz, and has performed at the Clearwater Jazz Holiday, Palladium Theater, Ybor Jazz Festival and numerous other events and venues. heliosjazzorchestra .blogspot.com. Call 727-341-4363

for more info.

If you love to sing, The Master Chorale of Tampa Bay’s Daytime Choirs are an eight-week series (comprising seven classes with coffee and conversation, and a final performance) designed for adults 55 and older of beginner to intermediate level. Learn more at shop.tampamuseum.org/ products/studio-55-daytime -choir.

BY DONNA WINCHESTER

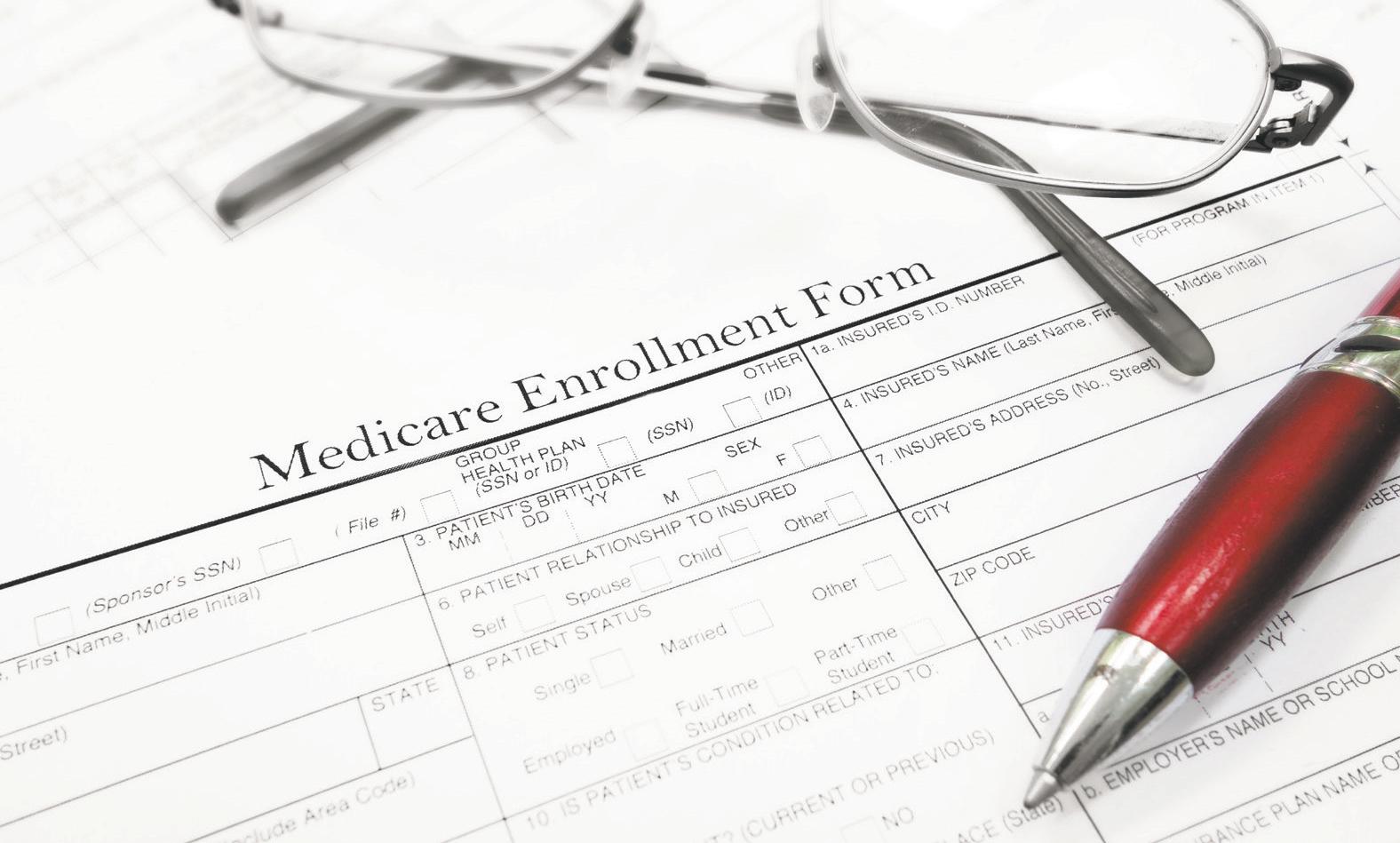

Medicare is a federal health insurance program primarily for people 65 or older and for younger individuals with certain disabilities. You can receive coverage in two main ways: original Medicare (parts A and B), provided by the government, or Medicare Advantage (Part C), offered by private companies.

You can add prescription drug coverage through Part D or a private drug plan. A supplemental Medigap (Medicare supplement) policy can help cover out-of-pocket costs.

MedicarePartA covers inpatient care at hospitals, including semi-private rooms, general nursing, meals and other hospital services and supplies. It also covers stays at skilled nursing facilities as well as hospice for terminally ill individuals and some home health care if you meet certain conditions.

Part A is premium-free for those who have worked and paid Medicare taxes for at least 10 years. You pay a hospital deductible for each benefit period you use, but there is no limit on the number of benefit periods

Most people who are receiving Social Security benefits when they turn 65 automatically are enrolled in Part A. If you aren’t receiving Social Security benefits, you can sign up for Medicare parts A and B through the Social Security Administration.

Medicare Part B covers outpatient medical services, visits to doctors and other health care providers and durable medical equipment such as wheelchairs, walkers and hospital beds.

It also covers health screenings, vaccines and yearly wellness visits to help prevent illness or detect it early. Additionally, outpatient physical therapy and occupational and speech therapy services are covered by Part B.

Part B complements Part A and works together with it to form original Medicare. You pay a monthly premium and share in the costs through a deductible and coinsurance after your deductible is met.

After you meet the deductible, you typically pay 20% of the cost for most Part B services. Unlike other types of insurance, there is no annual limit on the amount you could pay out of pocket for Part B services unless you have additional coverage.

MedicarePartC, also known as Medicare Advantage, is an alternative to original Medicare (parts A and B) and

provides additional benefits and coverage options. Most Medicare Advantage plans cover all the services included in parts A and B, such as hospital stays, doctors’ visits and prescription drugs.

Medicare Advantage plans are offered by private insurance companies and vary in their offerings, but most include extra services such as vision, dental and hearing care and wellness programs. Some plans have lower deductibles, copayments and maximum outof-pocket limits compared to original Medicare.

monthly premium to the private insurance company for your Medigap policy in addition to the monthly Part B premium you pay to Medicare.

Medigap plans are standardized by letter in most states, with each plan offering a different set of basic benefits. The core benefits for each plan letter are the same, regardless of the insurance company selling it.

In many cases, you can only use doctors who are in the plan’s network. Plans often have different out-of-pocket costs than original Medicare or supplemental coverage, and you may also have an additional premium.

Medicare Part D is optional prescription drug coverage for people with Medicare that helps cover drug costs, including many recommended shots and vaccines You can get Part D by joining a Medicare drug plan in addition to original Medicare or by joining a Medicare Advantage plan with drug coverage.

You will pay for a portion of the drug costs through a deductible, copayments or coinsurance. You must use a pharmacy within the plan’s network to get covered drugs.

To find the right plan, check the plan’s drug list, also known as a formulary, to make sure your pharmacy is in the network. Then compare total costs, including the premium, deductible and copayments

Drug plans and costs change yearly, so it’s important to reevaluate your options annually to ensure your plan still meets your needs. Keep in mind that the plan with the lowest premium isn’t always the least expensive overall.

It’s also important to know that some plans have rules for drug coverage, such as prior authorization, that require approval before you get the drug or that require you to try a different drug first. Most important: If you don’t sign up for Part D when you are first eligible, you may have to pay a higher premium for as long as you have coverage.

Supplemental Medicare insurance, also known as Medigap, is a private insurance policy that helps pay for gaps in coverage left by original Medicare (parts A and B). These out-of-pocket costs include things like copayments, coinsurance and deductibles.

If you are enrolled in original Medicare and have a Medigap policy, Medicare and your Medigap policy each will pay its share of covered health care costs. You pay a

The best time to buy is during your Medigap Open Enrollment Period, a six-month window that starts the month you turn 65 and are enrolled in Part B. During this time, you can buy any Medigap policy sold in your state, regardless of any preexisting health conditions.

Original Medicare and Medicare Advantage are both health insurance programs for seniors and people with certain disabilities, but they differ in several key aspects, including coverage, cost, access to providers and extra benefits.

Original Medicare covers hospital stays (Part A), medical services (Part B) and prescription drugs (optional Part D). Medicare Advantage offers all the benefits of Part A and Part B plus additional coverage such as vision, dental, hearing and prescription drugs.

With original Medicare, Part A premiums vary depending on work history, while Part B premiums are based on income. Prescription drug coverage requires a separate Part D plan. Medicare Advantage plans have a monthly premium that may include Part A and Part B coverage, as well as the additional benefits

Original Medicare allows access to any health care provider who accepts Medicare. Medicare Advantage typically has a limited network of providers.

Original Medicare offers basic health coverage. Medicare Advantage may offer additional benefits, such as wellness programs, gym memberships and over-thecounter medications. One factor to consider when choosing between original Medicare and Medicare Advantage is health status. If you have chronic conditions or expect high medical costs, Medicare Advantage may be more beneficial due to its additional coverage. If you prefer to have access to any health care provider, original Medicare is the better option.

In terms of cost, Medicare Advantage may offer lower monthly premiums, but its additional benefits may increase overall costs.

From provider networks to prior approvals and rate hikes, there are many factors to consider.

BY DONNA WINCHESTER

Medicare Advantage, also known as Part C, is a private-company alternative to Original Medicare that bundles hospital insurance (Part A) and medical insurance (Part B) benefits, often including prescription drug coverage (Part D) and extras like dental, vision and hearing. Instead of getting coverage directly from Medicare, you receive it from a private company approved by Medicare, which must follow Medicare’s rules but can have different costs and network requirements.

With more than 34 million seniors and individuals with disabilities currently enrolled, Medicare Advantage enrollment as a share of the eligible Medicare population has jumped from 19% in 2007 to 54% in 2025 and is on track to continue to grow, especially in states with high penetration rates such as Arizona, Florida, Nevada and Pennsylvania.

Insurance companies can decide if a Medicare Advantage plan will be available to everyone with Medicare in a state, or only in certain counties. Insurance companies may also offer more than one Medicare Advantage plan in an area, with different benefits and costs. Each year, insurance companies that offer Medicare Advantage plans can decide to join or leave Medicare.

Despite most beneficiaries having access to plans operated by several parent organizations, Medicare Advantage enrollment is highly concentrated among a small number of parent organizations. UnitedHealth Group Inc. accounts for 29% of all Medicare Advantage enrollment in 2025, or 9.9 million enrollees. Together, UnitedHealth Group Inc. and Humana Inc. (17%) account for nearly half of all Medicare Advantage enrollees nationwide.

The Tampa Bay Times Medicare Guide focuses on two types of Medicare Advantage Plans: Health Maintenance Organizations plans (HMOs) and Preferred Provider Organizations plans (PPOs).

With an HMO Medicare Advantage plan, you generally must get your care and services from doctors, other health care providers, and hospitals in the plan’s network. If you get health care outside the plan’s network, you may have to pay the full cost The exception is emergency care, out-of-area urgent care, and temporary out-of-area dialysis.

Some HMO plans are Point-of-Service (HMOPOS) plans that may allow you to get some services out of network for a higher copayment or coinsurance. It’s

important that you follow the plan’s rules, such as getting prior approval for a certain service when the plan requires it.

HMO plans usually require you to choose a primary care doctor In most cases, you’ll need a referral to visit a specialist, although certain services, like yearly mammogram screenings, don’t require a referral.

These plans usually charge a monthly premium in addition to the monthly Part B medical insurance premium. If you want prescription drug coverage, you must join an HMO that offers it. If you join an HMO plan that doesn’t offer drug coverage, you can’t join a separate Medicare drug plan.

Like HMO plans, PPO plans usually charge a premium in addition to the monthly Part B medical insurance premium. Prescription drugs are covered in most PPO plans, but as with HMO plans, you must join a PPO that offers one. If you join a PPO that doesn’t offer drug coverage, you can’t join a separate Medicare drug plan.

PPO plans allow you to use out-of-network providers for covered services if they are participating in Medicare or accept assignment, but you’ll usually pay more. Before you get services from an out-of-network provider, make sure you can show the services are medically necessary.

There is no need to choose a primary care doctor with a PPO plan, nor is there a need to get a referral to see a specialist.

With both HMO and PPO plans, if your plan gives you prior approval for a treatment, the approval must

be valid for as long as the treatment is medically necessary. If you’re currently getting treatment and you switch to a new plan, you’ll have at least 90 days before the new plan can ask you to get a new prior approval for your ongoing treatment.

Also with both types, if your doctor or other health care provider leaves the plan, your plan will notify you and you will have the option to choose another provider in the plan.

Regardless of which type of Medicare Advantage plan you choose, be aware that the provider can disenroll you if you move outside the plan’s service area, lose Medicare or Medicaid eligibility, join a drug plan (in some cases), or if the plan’s contract with Medicare ends. In these situations, there’s a grace period when you’ll be eligible for a Special Enrollment Period.

It’s also possible that your provider may decide to stop participating in Medicare. In this case, you’ll have to join another Medicare health plan or sign up for Original Medicare.

Despite continued interest in Medicare Advantage plans, the Better Medicare Alliance, a research and advocacy organization that supports Medicare Advantage, predicts that many beneficiaries could face coverage disruptions in 2026.

In a recent analysis, the alliance found the number of Medicare Advantage plans nationally decreased by 2.8% in 2025, impacting nearly 2 million beneficiaries and forcing them to find new plans. The decline will continue for 2026, as major insurers including UnitedHealthcare and Aetna, citing financial pressures, discontinue some Medicare Advantage plans.

Additional changes in 2026 include stricter rules on prior authorization for inpatient admissions, limitations on certain non-medical supplemental benefits for chronically ill individuals, and updates to the Medicare Prescription Drug (Part D) benefit, such as an increase in the out-of-pocket cost cap to $2,100.

Nevertheless, as health care costs continue to rise, many individuals prefer Medicare Advantage plans for their bundled, comprehensive benefits and their yearly out-of-pocket cost limit that provides a measure of financial protection. Many also appreciate the convenience of having all health care coverage, including prescription drugs, under a single plan and the option of low or $0 monthly premiums.

2026, costs are on the rise, but prices on some drugs are expected to drop.

BY DONNA WINCHESTER

Annual changes in Medicare rules, costs and benefits can be challenging, but for the more than 68 million Americans 65 and older expected to participate in the federal health insurance program in 2026, the road may be more difficult to navigate than usual.

Premiums and other out-of-pocket costs for Medicare Part B and Part D are increasing more than they have in recent years, while deductibles, out-of-pocket maximums and other costs are rising as well. Meanwhile, uncertainty across the health insurance market due to changes enacted by the Trump administration and the “One Big Beautiful Bill Act” are making plan choices and access to care more complicated.

The open enrollment period begins Oct. 15. Eligible individuals have until Dec. 7 to update plans as well as switch from original Medicare to Medicare Advantage; from Medicare Advantage to original Medicare; from one Medicare Part D prescription drug plan to another; and enroll in a Medicare Part D plan if they did not enroll when they first became eligible for Medicare.

Whether you are a first-time Medicare enrollee or looking to change your plan, it makes sense to do your homework during open enrollment. The Tampa Bay Times’ Medicare Guide breaks down the various parts of Medicare and offers charts for plan comparison to help beneficiaries.

Here are some key points to keep in mind.

Nearly all Medicare enrollees pay nothing for Medicare Part A, which covers inpatient hospital care, skilled nursing facility care, hospice care and home health care. For the small percentage who pay premiums, the amount for 2026 is projected to be either $310 or $563 per month, based on earning history, up from $285 or $518 per month in 2025.

The Medicare Part A deductible for 2026 is projected to be $1,716, an increase from the $1,676 deductible in 2025. This deductible applies per benefit period, not per calendar year.

Premiums for Medicare Part B, the monthly cost you pay for doctor visits, preventive care and medical equipment, are projected to rise from $185 to $206.50. That’s an 11.6% increase over the 2025 premium, the largest since 2022. These costs are calculated annually to ensure the Part B trust fund remains solvent, though it can result in higher costs for beneficiaries.

The Part B deductible, the amount you’ll pay out of pocket before Medicare starts paying for services like doctor visits and medical equipment, is expected to increase by 12%, from $257 to $288. Many Medicare Advantage plans have copays and deductibles that don’t necessarily increase in lockstep with the Medicare Part B deductible, so while those benefit designs fluctuate from year to year, the changes aren’t the same as the deductible and copay changes that apply to original Medicare.

TheMedicarePartDbasepremium, a standardized monthly amount used by Medicare to estimate costs for prescription drug coverage, is expected to be $38.99, a 6% increase over 2025, although actual premiums vary by plan. The standard Part D deductible, the amount you’ll pay out of pocket for prescription drugs before your insurance coverage begins to pay, is expected to increase 4.2%, from $590 to $615.

On the bright side, prices for at least 10 drugs are slated to fall, with more reductions to come.

The Inflation Reduction Act first gave Medicare the authority to directly negotiate the price of highcost, single-source drugs with pharmaceutical manufacturers in 2023 rather than relying on commercial prices set by private health insurance companies. The first negotiated prices will take effect in 2026, applying to prescriptions including Eliquis, used to prevent blood clots and stroke; Enbrel, for rheumatoid arthritis and psoriasis; and Jardiance, for Type 2 diabetes and heart failure. Weight loss drugs Ozempic, Rybelsus and Wegovy will be added to the list in 2027.

Insulin costs should drop below the $35-permonth cap the Inflation Reduction Act set in 2023 for supplies covered under Part B and Part D. Starting in January, this cap gets more flexible to allow for deeper savings.

Medicare enrollees will pay either $35 per month; 25% of the maximum fair price established for the covered insulin product under the Medicare Drug Price Negotiation Program; or 25% of the negotiated price under the stand-alone Medicare prescription drug plan or Medicare Advantage plan with prescription drug coverage, whichever is the least amount.

In 2025, a new approach replaced previous Medicare Part D phases, which describe the different stages of cost-sharing for prescription drugs within a calendar year. Those phases typically include a de-

ductible phase, an initial coverage phase and a catastrophic coverage phase.

The updated structure included a lower out-ofpocket threshold for entering the catastrophic phase. That threshold will increase in 2026 from $2,000 to $2,100, which means you’ll be liable for an additional $100 in drug costs over the year in 2026.

If you have a Medicare Advantage drug plan or a stand-alone Part D plan that requires a deductible, you’ll pay 100% of your prescription drug costs until you spend the $615 Part D deductible. You’ll pay 25% coinsurance for covered drugs until you’ve paid $2,100 out of pocket. After you’ve hit the $2,100 threshold, you’ll pay nothing else out of pocket for 2026.

Another change for 2026 concerns the Medicare Prescription Payment Plan, which allows you to spread your out-of-pocket prescription drug costs across the calendar year instead of paying everything at once at the pharmacy if you have a Part D plan. Once you enroll in the plan, you’ll stay enrolled unless you opt out. You’ll get a renewal notice at the end of each election period informing you of any new terms or conditions.

Amid political scrutiny, public skepticism and internal upheaval, the Centers for Disease Control and Prevention’s Advisory Committee on Immunization Practices voted in September to recommend COVID-19 vaccinations for adults 65 and older. The Inflation Reduction Act eliminated deductibles, copays and coinsurance for all adult vaccines recommended by the committee in 2023, and this rule will stay in effect in 2026.

But with some GOP leaders pushing for vaccine restrictions and others warning of public health dangers, the economics of ordering and storing vaccines has become more difficult, and some health care advocates predict this could lead to vaccine shortages.

The Centers for Medicare & Medicaid Services announced in April a 7.2% increase in payments to Medicare Advantage plans, an increase larger than the 4.3% predicted in January. The increase translates to an additional $35 billion to Medicare Advantage plans in 2026. While increased funding raises concerns about the rising cost to the federal government, it can lead to better benefits like dental, vision, and hearing care; more stable or lower premiums for enrollees; and a wider selection of plans.

Another bright spot: The maximum out-of-pocket limit for in-network services covered under Medicare Part A and Part B on Medicare Advantage plans will decrease slightly to $9,250 in 2026. Unlike most years when the out-of-pocket limit has increased, the 2026 limit is a reduction from the $9,350 limit that applied in 2025.

But in addition to cost increases for Part B premiums, there are other changes that Medicare Advantage enrollees should be aware of, such as higher outof-pocket copay costs, alterations to supplemental benefits and a scaling back or elimination of some plans.

While a big enticement of these plans is that they typically include coverage for benefits not included in traditional Medicare, such as drug coverage, eyeglasses, dental coverage and gym memberships, enrollees in 2026 plans can anticipate higher out-of-pocket copay costs in some plans or removal of certain benefits.

New guardrails will be in place on what Medicare Advantage plans can offer under Special Supplemental Benefits for the Chronically Ill These nonmedical benefits are supposed to contribute to the well-being and functioning of people with certain chronic conditions. Starting in 2026, the plans cannot cover unhealthful food, alcohol, tobacco or life insurance.

The new provisions continue a trend that has seen private insurers pare back Medicare Advantage plan supplemental benefits in recent years, including those for over-the-counter medications, transportation services, nutrition services and meals.

The most concerning issue for Medicare Advantage enrollees is plan discontinuations. Citing financial pressures, some major insurers, including UnitedHealthcare and Aetna, are leaving the Medicare Advantage marketplace, affecting more than 1 million current enrollees who will need to find new coverage. As Humana exits what it calls “certain unprofitable plans and counties,” it expects a decline of roughly 560,000 members.

Other insurers are retooling their Medicare Advantage plans, which translates to scaled-back offerings and higher deductibles. The nonprofit Center for Medicare Advocacy notes that while Medicare Advantage has been extremely profitable for most insurers for a long time, the companies have complained about people using more health care services than they anticipated and the rising cost of health care across the board.

Medicare Advantage enrollees need to be aware that if a plan is canceled, they will not be moved to another plan automatically and could revert to original Medicare. They could experience a loss of coverage

for their doctors and prescription drugs, and some may lose the outof-pocket cap provided by Medicare Advantage plans.

What this adds up to is a clear need to research options, familiarize yourself with Medicare changes and make decisions based on best- or worst-case health scenarios.

You may want to begin by assessing your current and future health care needs, considering new diagnoses, planned procedures, necessary medications and preferred providers.

Managed by the Administration for Community Living, the program provides services through trained and certified local counselors in all 50 states.

Enter enrollment armed with knowledge

If you are enrolled in a Medicare plan, be sure to review your Annual Notice of Change, which will include any changes in coverage and costs that will be effective in January. If you do not receive this notice, contact your plan provider.

Read the “Medicare and You” handbook, an official publication from the Centers for Medicare & Medicaid Services that provides information about original Medicare and available Medicare plans in your area.

Use the Medicare Plan Finder, which allows you to compare provider networks, prescription drug coverage and supplemental benefits for any new plan you are considering. New for 2026, this tool will include a provider directory feature, an expanded display of Medicare Advantage supplemental benefits and an artificial intelligence-powered drug search tool for personalized cost information.

The provider directory, launched by the Centers for Medicare & Medicaid Services in August, allows users to find Medicare Advantage plans that include their preferred doctors. An additional feature launched Oct. 1 shows detailed cost-sharing information and prior authorization requirements for those benefits.

The State Health Insurance Assistance Program offers free, unbiased, one-on-one counseling and assistance to Medicare beneficiaries, their families and caregivers to help them understand Medicare, Medicare Advantage, prescription drug coverage, Medigap plans and long-term care insurance.

While using the Plan Finder, be sure to check each plan’s star ratings, a system the Centers for Medicare & Medicaid Services uses to measure how well Medicare Advantage and Part D plans perform in several categories, including quality of care and customer service. Ratings range from one to five stars, with five being the highest and one being the lowest.

If you’re still confused, Florida’s SHINE program is a free offering from the Florida Department of Elder Affairs and the local Area Agency on Aging. Specially trained volunteers can assist with Medicare, Medicaid and health insurance questions by providing one-on-one counseling and information. SHINE services are free, unbiased and confidential. Visit the website or call 1-800-963-5337 toll-free.

If you need help with Medicare costs, you may qualify to receive financial assistance from Medicare Savings Programs. These programs help millions of Americans access high-quality health care at a reduced cost, helping to pay Medicare premiums, and may also pay Medicare deductibles, coinsurance and copayments for those who meet eligibility conditions.

The Medicare Low-Income Subsidy, also known as “Extra Help,” is a program to help people with limited income and resources pay for Medicare Part D prescription drugs, including premiums, deductibles and copayments. To qualify, you must have Medicare, live in the United States, and have income and assets below certain annual thresholds. You can apply for Extra Help through the Social Security Administration.

Get the most out of the information on the following pages by first reading through this page.

BY DONNA WINCHESTER

Type: This chart shows three types of Medicare Advantage plans with drug coverage: HMO, PPO and HMO-POS.

Counties served: Indicates where plans are available; Hernando (Her.), Hillsborough (Hills.), Pasco and Pinellas (Pin.) counties.

Monthly premium: The recurring fee you pay to a private insurance company for your Part C benefits in addition to your required Medicare Part B premium. While some plans offer a $0 monthly premium, this does not mean the plan is free, as you are still responsible for the Part B premium and other costs, such as copayments and deductibles.

Part B reduction: A benefit, often called a “giveback,” where the plan pays for some or all of your monthly Medicare Part B premium. This reduction is applied by the Social Security Administration and results in a higher Social Security check or a lower Part B premium if you pay out of pocket. Part B reductions are not available in all areas and depend on your location and specific Medicare Advantage plan.

Drug deductible: In some plans, a deductible is paid before drug coverage kicks in. A drug deductible may not apply to all medications or tiers.

Out-of-pocket maximum: The most you will pay for covered health care services in a calendar year, excluding monthly premiums. Once you reach this limit, the plan pays 100% of the Medicare-approved costs for covered services for the rest of that year. This annual cap includes costs like deductibles, copayments and coinsurance, but not your monthly plan premium or costs for services not covered by the plan.

Doctor copay: This is the cost of every visit to the doctor. The first dollar figure listed on the chart is for primary care physicians; the second is for specialists. Costs are listed for physicians inside the network (Net) and outside the network (Out).

Hospital copay: This is the cost every time a patient is admitted to a hospital both inside the network (Net) and outside the network (Out). For outpatient hospital coverage, refer to each plan’s Plan Finder.

Rating: Medicare rates Medicare Advantage plans from one to five stars, based on customer satisfaction and certain health measures. The top rating is a five.

Private Fee for Service Plans (PFFS): A type of Medicare Advantage plan where a private insurance company offers benefits that can exceed original Medicare, paying providers on a fee-for-service basis.

Special Needs Plans (SNPs): A specialized type of Medicare Advantage plan designed for individuals with specific needs, such as chronic health conditions including diabetes or heart failure; those who are eligible for both Medicare and Medicaid (dual eligibles); or people living in long-term care facilities.

Medicare supplement plans: Also known as Medigap, this coverage helps pay some health care costs that original Medicare doesn’t cover.

Copayments for other services: Plans usually charge copayments for drugs, skilled nursing homes, ambulances, emergency rooms and many other services. Check each plan’s Plan Finder for details.

Goodies: Some plans offer some dental, hearing and vision coverage, exercise classes, transportation to the doctor and other extra benefits. Check each plan’s

Plan Finder for details.

Health plans without drugs: Not all Medicare Advantage plans include drug coverage. Unless you have drug coverage elsewhere, using these plans can result in stiff penalties if you decide you want Medicare drug coverage in the future.

Chart begins on facing page.

Drug benefit category: In Medicare Part D, “basic” refers to the standard benefit design, while “enhanced” describes plans that offer more benefits, like a broader formulary, no deductible for certain tiers or $0 cost-shares for some drugs, typically in exchange for a higher premium. Enhanced plans offer more comprehensive coverage than the standard Part D plans, which have more defined structures and may have deductibles or higher costs for tiers.

Monthly premium: The monthly charge for every Medicare Part D drug plan. This is in addition to Medicare’s monthly Part B premium.

Annual deductible: What is paid out of pocket before coverage begins.

Rating: Medicare rates drug plans from one to five stars, based on customer satisfaction and certain health measures. The top rating is a five.

Medicare health costs: Drug plans are for people on original Medicare who also have expenses for doctors, hospitals and, sometimes, supplemental plans. People with higher incomes may pay higher Part B premiums and drug plan premiums.

Total drug costs: Out-of-pocket costs can vary widely depending on which drugs are needed. For an estimated total cost of different plans, check each plan’s Plan Finder.

See stand-alone drug chart on page 20.

H1045-045-0

Contact:

H1045-028-0

Contact:

from UHC FL-0013

H1045-043-0

Contact: 800-555-5757

from UHC FL-0019 Pasco, Pin.

H2406-011-0

Contact: 800-555-5757

from UHC FL-0031 Pasco, Pin.

R0759-001-0

Contact: 800-555-5757

Medicare Advantage HMO-POS Her. $0 N/A

CareFlex from UHC FL-32

H1045-057-0

Contact: 800-555-5757

CareFlex from UHC FL-34 Pin.

H1045-059-0 Contact: 800-555-5757

Aetna Medicare Select HMO Her., Hills.,

H1609-087-0 Pasco, Pin.

Contact: 833-859-6031

Aetna Medicare Select Extra HMO-POS Hills., Pin.

H1609-028-0

Contact: 833-859-6031

Aetna Medicare Signature PPO Her., Hills., $0

H5521-033-0 Pasco, Pin.

Contact: 833-859-6031

Aetna Medicare Signature PPO Her., Hills., $0

H5521-270-0 Pasco, Pin.

Contact: 833-859-6031

H5521-702-0 Pasco, Pin.

Contact: 833-859-6031

Contact:

Contact:

H1035-052-0

Contact: 855-601-9465

Contact: 855-601-9465

Contact:

Contact: 855-601-9465

Contact:

Contact:

Contact:

Contact: 844-978-2770

H1290-036-1 Pasco

Contact: 844-978-2770

Devoted CORE 036 FL HMO Pin

H1290-036-2

Contact: 844-978-2770

CORE 058

H1290-058-0

Contact: 844-978-2770

H1290-051-2

Contact: 844-978-2770

H1290-037-5

Contact: 844-978-2770

H4140-016-0

Contact:

Contact:

H1099-023-0

Contact: 800-716-7737

H1099-024-0

Contact: 800-716-7737

H7617-109-000

Contact: 888-873-0686

Contact:

Contact:

Contact: 888-873-0686

Contact: 888-873-0686

H5594-032-0

Contact: 833-668-2306

Contact: 833-668-2306

Contact:

Contact:

Contact: 833-668-2296

H5471-078-0 Pasco, Pin.

Contact: 833-668-2296

Solis Healthy Living Plan

H0982-009-0

Contact: 844-447-6547

H1032-200-0

Contact: 844-480-0680

H1032-201-0

Contact: 844-480-0680

AARP Medicare Rx Preferred

from UHC

S5921-383 Contact: 800-555-5757

AARP Medicare Rx Saver

from UHC

S5921-356 Contact: 800-555-5757

BlueMedicare Complete Rx

S5904-002

Contact: 855-601-9465

BlueMedicare

S5904-001

Contact: 855-601-9465

Humana Basic Rx Plan

S5884-105

Contact: 888-873-0686

Note: Shading on the chart indicates plans offered by the same company.

Humana Premier Rx Plan

S5884-157 Contact: 888-873-0686

Humana Value Rx Plan

S5884-190 Contact: 888-873-0686

SilverScript Choice

S5601-022 Contact: 833-771-7864 Wellcare Classic

S4802-083 Contact: 844-480-0680

Wellcare Value Script

S4802-146 Contact: 844-480-0680

BY SALLY MOE, Times Total Media Correspondent

In the best of times, the holiday season is a heady blend of parties, sparkle and celebration, delicious aromas, soul-warming bear hugs, reunions and laughter and a gratifying sense of togetherness

But for some people perhaps due to advanced age, the loss of a loved one or a debilitating stroke or accident all that good cheer feels like it was meant for somebody else.

gifts to social workers, guardians and activity directors at assisted living facilities (ALFs) in Pinellas County gifts like snuggly blankets and pajamas, toiletries, personal care items, slippers, clothes, DVDs, books, games or whatever each participating senior asked for or needs.

That’s where Silver Santas comes in. They have made it their mission to ensure lonely, low-income seniors on Medicaid in assisted living feel the spirit of the holidays too. So they feel seen again Silver Santas volunteers gather and package gifts just for these seniors so that no one feels forgotten or invisible during this celebratory time of year.

Every December, these earthbound angels deliver

A great deal of coordinated effort goes into preparing for this yearly endeavor managing volunteers and lists of requested gifts and their recipients, “decorating” trees with wish tags at numerous sites (libraries, senior centers, community centers, homeowners associations and general businesses) and buying, then packaging, the gifts for delivery to guardians and community representatives, who

distribute them to their intended recipients.

Bob Dorian,

been deeply involved in the mission since its early days, when they kept info on paper (now that it’s grown to

Continued from page 21 over 1,700 recipients, it’s gone digital). He and his volunteers are committed to this work but don’t actually see when the seniors receive their gifts. However, they do hear anecdotes. One senior gentleman at an ALF event last Christmas stood up (with some effort) during the event and told them, “What you do makes a HUGE difference. You don’t see it, but I do.” This simple, heartfelt message reminded everyone present of the value of their work.

If you would like to donate or volunteer for Silver Santas, visit them online at silversantas.org. In lieu of adopting and shopping for an individual senior, Silver Santas welcomes general donations of new clothing, new hygiene products, candy and small personal items to help fill out the gift bags. (Gift tag requests will also be available on their website after Nov. 3.) To buy and send items for seniors in general, you can click on the boxes on their home page for their most-needed items, and send them to this delivery address: Silver Santas, 14202 62nd St. N., Clearwater, FL 33760-2717.

The Silver Santas program was created by Better Living for Seniors, which is affiliated with the Area Agency on Aging of Pasco-Pinellas Inc.