Welcome

Through a blend of insightful research and practical strategies, this report aims to equip brands with the necessary tools to thrive in the fast-paced world of social commerce. As the digital marketplace continues to evolve, staying ahead of trends and maintaining authenticity will be crucial for sustained success.

It will unpack:

1. The evolution of social commerce: Discusses the market value, drivers, and benefits of social commerce, the importance of communities and entertainment, and identifies different social personas.

2.The social ecosystem and customer journey: Explores how social and entertainment platforms impact each stage of the customer journey from discovery to driving loyalty post-purchase.

3.Strategies for success in social shopping: Provides practical recommendations for retailers and brands to leverage TikTok’s features for brand, sales and customer engagement growth.

Pg. 3 Contents

Pg. 4 Foreword

Pg. 5 Key Report Highlights

Pg. 6 Section 1: The Role Of Entertainment In A New Era Of Shopping

- UK social commerce market: A £16 billion opportunity for brands

- Drivers of social commerce growth

- Social uptake and interaction

- ‘Social commerce’ vs. ‘Community commerce’

- Authenticity drives trust

- Benefits of community commerce for brands

- Capturing attention in the TikTok era

- Social shopping personas

Pg. 20 Section 2: The Social Ecosystem And Customer Journey

- Social platforms the preferred channel for digital natives

- Awareness: Entertainment as the gateway to discovery

- Browsing: Social platforms as search engines

- Purchase: Converting social engagement to action

- Post-Purchase: Social interaction soon after transaction

- Community building: Creating brand advocates, not just followers

Pg. 41 Section 3: Strategies For Success In Social Shopping

- Accelerate digital and data capabilities

- Leverage in-app features

- Move beyond organic reach: affiliate power

- Community and building trust

- Inventory management

- Maximise impact with targeted ads

Pg. 46 Case Studies

Pg. 51 Conclusion

Foreword

Social commerce is evolving at breakneck speed. Brand and product discovery is now being driven by communities on social and entertainment platforms, transforming the traditional shopping experience.

This is fuelling the rise of ‘community commerce’, a more focused branch of social shopping that merges community, entertainment, and commerce into a seamless journey, from discovery to post-purchase.

In today’s competitive attention economy, the fragmented digital landscape has brands vying for consumer attention amidst comparison sites, social platforms, marketplaces and brand websites. But when it comes to e-commerce, content creators and the broader social community now play a critical role in shaping today’s path to purchase. They provide authentic and engaging interactions that typical e-commerce often lacks.

TikTok is at the forefront of this revolution, redefining how consumers interact with brands. Unlike traditional social media, TikTok is a community-driven entertainment platform. Its unique blend of short-form video content and sophisticated algorithms offers a dynamic platform where users actively participate, rather than passively observe. By emphasising entertainment and creativity, TikTok allows brands to connect with audiences in more meaningful ways, fostering deeper engagement and loyalty.

TikTok has demonstrated that the value of entertainment in shopping decisions today cannot be overstated. Engaging and entertaining content on TikTok not only captures attention but also drives purchase intent and sales across multiple channels starting at the point of discovery. This approach helps brands reach customers wherever they are—whether shopping online, in-store, or directly on the app via TikTok Shop. By creating an integrated, community-based ecosystem that empowers and enthrals users, TikTok strengthens bonds between brands and consumers, elevating social commerce to new heights.

Through a blend of insightful research and practical strategies, this report aims to equip brands with the necessary tools to thrive in the fast-paced world of social commerce. As the digital marketplace continues to evolve, staying ahead of trends and maintaining authenticity will be crucial for sustained success.

Report Highlights

UK social commerce market represents a opportunity for retail brands

1/3

of social users engage in shopping-related activities when using a social and entertainment platforms

(93% for TikTok users)

of consumers say social and entertainment platforms are their preferred channel for product discovery. Most consumers say they discover more new brands on social platforms than through traditional shopping channels

of UK consumers have purchased a product after seeing it featured on social media

£16billion % % % % % % 82 69 56 88 88 94

of Gen Z visit social and entertainment platforms after making a purchase with a retailer or brand (e.g. to share experience or leave review, watch how-to videos, contact brand)

Beauty and apparel are the most popular categories for social commerce, with over one in three social shoppers having made a purchase in these areas

of TikTok users have discovered brands they’re interested in purchasing on the platform –the highest of any social and entertainment platform

of Gen Z and 85% of Millennials follow at least one brand on social and entertainment platforms

of UK users have made a purchase directly through a social or entertainment platform. For digital natives (under 45s), this rises to 73%

2/3

of TikTok users feel more connected to brands they interact with on the platform, compared to less than half on other platforms

Section 1: The evolution of social commerce

The role of entertainment in a new era of shopping

In this section, we explore the drivers, benefits and features within the social commerce landscape as the retail industry shifts towards a more socially integrated environment. We also look at how a blend of entertainment and commerce is reshaping consumer engagement, offering new growth opportunities for brands.

UK Social commerce market: A £16 billion opportunity for brands

The social commerce market in the UK is poised to hit £7.4 billion in sales in 2024, continuing its remarkable growth trajectory. Over the next five years, the market is projected to expand at an annual compound growth rate (CAGR) of 21.2%, reaching an impressive £15.7 billion by 2028 (Fig 1).

£7.4BN

This rapid expansion will more than double the market’s current size, and significantly outpace the growth of the broader online retail sector over the same period (5.3% CAGR). For perspective, the anticipated market size by 2028 is comparable to the GDP of Malta/ Jamaica or equivalent to the entire Furniture & Flooring market in the UK. in sales in 2024

TikTok, X, YouTube, Pinterest, and Snapchat.

Source: Retail Economics, TikTok

Drivers of social commerce growth

The rapid growth of social commerce is being driven by a range of factors (Fig 2), but primarily technology, shifting consumer behaviour, and the integration of social and entertainment platforms with e-commerce.

Fig 2 – Drivers of social shopping growth

Psychological Dynamics

• Desire for instant gratification and convenience

• Influence of social validation and peer recommendations

• Engagement through entertaining and relatable content by creators

Unified shopping applications

• Emergence of ‘super apps’ combining shopping entertainment, partnerships between social and entertainment platforms

• Partnerships between social platforms and ecommerce providers for integrated experiences

• Simplification of the shopping journey from discovery to purchase within a single platform

Technological Drivers

• Smartphone penetration amongst consumer groups

• Development of seamless in-app purchasing and checkout capabilities

• Research and development investment in commercial and social products by big tech

Social

Commerce

Social Shopping Evolution

• Increased purchasing power among social-network users aged 18 to 24

• Shift from traditional ecommerce to integrated social commerce platforms

• Growth of shoppable content, including live-streaming and interactive ads

Information Consumption

• Intake in shorter bite size formats

• Preference for video for consuming content like product demos and unboxing

• Consumers using social platforms for product discovery, research and reviews

• Reliance on user-generated content for authentic and trustworthy info consumers using social and entertainment platforms

Social uptake and interaction

In the UK, about 90% of adults (48 million people) are active users of at least one social or entertainment platform, spending over two hours per day on average on these channels. Unsurprisingly, Gen Z are the highest users, spending 2 hours 42 minutes per day. The drive to shop on these platforms is strong.

of adults are active users on social platforms

82% of platform users on average engage in shopping-related activities like browsing products, following brands, and watching live shopping events; and with the rapid advance of social commerce, 69% of UK consumers have purchased a produced after seeing it on a social and entertainment platform. This rises to 85% for Digital Natives (under 45s).

Furthermore, TikTok users in particular are more likely to engage in social shopping activities (Fig 3).

Q. Which of the following shopping-related activities do you do on social and entertainment platforms?

Source: Retail Economics, TikTok

When it comes to social interactions, there’s a vast range of opportunities for brands to connect with consumers and vice versa (Fig 4).

Fig 4: Consumer-brand interactions on social and entertainment platforms

Live shopping and brand storytelling

• Real-time interaction with brands and influencers during live streams.

Organic shoppable posts, in app checkout

• Tags help categorise products, orders, and customer data for better organisation.

• In-app checkout allows for quick and seamless purchases directly from posts.

• Simplifies the return and ex change process by integrating directly with purchase history.

Augmented/Virtual Reality

• VR enables virtual try-ons for fashion and beauty products, enahncing the shopping experience.

• Offers interactive 3D product views, allowing comsumers to explore items in detail.

• Creates immersive brand experiences, such as virtual store tours or product demonstrations.

• Exclusive deals and promotions available only during live shopping events.

• Enhanced storytelling through live product demos and Q&A sessions.

Gameification & Community Challenges

• Interactive challenges encourage user participation and brand engagement.

• Reward systems, such as points or badges, incentivise repeat interactions

• Social sharing of achievements and participation boosts community spirit and visibility

Social Commerce

Interactive, hyper-relevant ads

• Ads are personalised based on user behaviour and preferences, increasing relevance.

• Shoppable tags within ad enable direct purchases, streamlining the path to purchase.

• Interactive elements, such as polls or quizzies, engage users and provide instant feedback

User-Generated Content (UGC)

• Authentic reviews and testimonials from real users boost authenticity and trust

• UGC campaigns encourage customers to share their experiences, increasing brand reach

• Shoppable UGC integrates purchase links within user content, driving conversation.

Content creator influence

• Influencers provide relatable product recommendations, driving authentic egagement.

• Sponsored content blends seamlessly with organic posts, maintaining user interest.

• Influencers’ followers are more likely to trust and purchase recommended products.

‘Social commerce’ vs. ‘Community commerce’

‘Social commerce’, or social shopping, merges social media with e-commerce, creating an interactive and immersive shopping experience. It streamlines the consumer journey from discovery to transaction, featuring live-streaming, integrated product catalogues, and targeted content to deliver the right product to the right users at the crucial moment in their purchase journey.

Community commerce is a distinct evolution of social commerce that puts greater emphasis on the role of content creators and community-building. While social commerce integrates shopping functionalities within social media platforms, community commerce goes a step further by fostering deeper engagement and interaction across the entire customer journey.

In today’s TikTok era, this distinction is crucial. With a focus on authentic and captivating content, TikTok drives sales across all shopping environments, enhancing brand engagement beyond the platform itself by driving traffic to websites and physical stores.

Additionally, TikTok Shop provides an end-to-end commerce solution where users can seamlessly discover, purchase, and engage without leaving the app. This approach creates a closed-loop, community-based ecosystem, fostering a more personalised and trusted relationship between brands and consumers.

Authenticity drives trust

TikTok’s creator-driven approach and format leverages authentic, word-of-mouth testimonies with trust being a key pillar. On TikTok, creators have become the new brand storytellers, building deeper connections between consumers and brands. Trust cultivated within these communities naturally extends to the brands they endorse, building loyalty and customer lifetime value. This enriched experience combines authenticity with peer validation, often absent in traditional e-commerce.

Benefits of community commerce for brands

TikTok’s community commerce offers many benefits for brands to engage audiences with their passions (Fig 5). By focusing on specific interests, trending hashtags, and creative storytelling, brands can become integral members of the communities they serve. This approach drives impulse buys, strengthens brand awareness through user-generated content, and provides data-driven insights to better understand customers and enhance product development through feedback and testing within engaged communities.

Additionally, it allows brands to reach specific audiences within their social habitats and improves the overall shopping journey by seamlessly bridging online and offline retail experiences. On TikTok, solo shopping has become a community pursuit, creating an exciting opportunity for brands to be involved in these conversations. By integrating community-driven interactions, brands can drive higher engagement and build stronger connections with their audience.

Fig 5: Six core benefits for brands from community commerce

Community Commerce

Benefit 1

Drive impulse buys

Have new and existing shoppers spontaneously discover products, increasing purchase frequency.

Benefit 2

Improve shoppers’ purchase journey

Seamlessly bridge social platforms with online and off-line retail while leveraging in-app transactions.

Benefit 3

Strengthen brand awareness & credibility

Launch content that enhances brand relevance or popularity, and empower users to give opinions, increasing brand advocacy.

Benefit 4

Target audiences in their shopping habitat

Reach specific audiences, or interest-led communities within their social environments or through specific content creators.

Benefit 5

Enhance consumer and product insights

Collect data, opinions, and feedback to improve products or experiences to develop propositions

Support product innovation by testing product popularity prior to development.

Benefit 6

Better understand customers

Because community commerce often feels less promotional than traditional methods, customers often ‘open up’ more, allowing brands to better connect and understand them.

Capturing attention in the TikTok era

In today’s hyper-competitive attention economy, the media landscape is increasingly fragmented with brands battling for consumer attention. To cut through the noise, innovative approaches are often required to capture attention.

By using entertainment as a vehicle for storytelling, a key psychological factor for retaining attention, brands can deliver experiences that truly captivate. Here, entertainment serves as a powerful differentiator. Content that entertains can take many forms—it may harness humour, evoke strong emotions, or provide educational value, all rooted in authentic storytelling. This diversity in content creates a rich value exchange, providing an avenue for brands to connect with audiences on a deep emotional level. TikTok, in particular, has leveraged this effectively.

Short-form video has become a crucial tool for capturing the right kind of attention. The best TikTok content puts consumers in a more receptive state, creating an emotional trigger that encourages participation and engagement, whether by posting, interacting, or making purchases. The bite-sized format of TikTok videos makes them ideal for quick consumption, driving immediate and impactful behaviour that presents opportunities for brands to reach new customers and achieve growth through unplanned purchases. Consumers now turn to platforms like TikTok for entertainment and discovery, creating an ideal environment for brands that appeal to their playful and curious mindset.

Different social media and entertainment platforms exhibit different motivations for use and functionality. Unlike other platforms where motivations lean more towards general communication, news or education (Fig 6), TikTok puts entertainment at its core.

Q. For the social and entertainment platforms you use, what are your primary motivations for each platform?

Source: Retail Economics, TikTok

Our study shows a correlation between online shopping frequency and being entertained; two key insights emerge (Fig 7):

(1) The more entertained consumers are when using social and entertainment platforms, the more likely they are to engage with brands and purchase, which differs by age.

(2) The rate of brand engagement (or incidences of successful product discovery) amongst TikTok users is higher than users on other platforms across all age groups. Essentially, TikTok users are more likely to discover products and spend more, because of the entertainment factor.

Source: Retail Economics, TikTok

How to read chart:

Vertical axis is the % of respondents that often (or always) find content on social and entertainment platforms entertaining. Horizontal axis is the % of products discovered on social platforms that lead to further action (or the proportion of occasions where a consumer sees a product on a platform which interests them, then further investigates or perhaps purchases).

Pink bubbles = only TikTok users. Blue bubbles = average social platform user. Bubble size represents the average spend on social platforms, bigger being more spend.

Example insight: Gen X users on TikTok (centre pink bubble) clearly engage with brands more than the typical Gen X social user from being entertained.

Concerning age, our research shows that despite common opinion, it is the 25–44-year-old cohorts that find entertaining content from brands on social platforms sparking the most interested in their products (Fig 8).

year olds are most interested in branded products 25 to 44

Fig 8 –Entertaining content a critical factor

Statement: “Entertaining content from brands on social and entertainment platforms makes me more interested in their products”

Source: Retail Economics, TikTok

Social shopping personas

Our research reveals four unique social shopping personas, based on their attitude, behaviours and motivations (Fig 9). Each persona highlights different attributes, dispelling the notion that social shopping is only for younger demographics. Platforms like TikTok satisfy many different roles across the shopper’s journey displaying shared characteristics across the personas.

Social shopping personas

Entertainment Enthusiasts

Community Curators

Defined by their love for viral trends, memes, and engaging narratives, Entertainment Enthusiasts use social and entertainment platforms for pleasure, amusement and captivation. Their interaction with brands is often spontaneous, driven by content that resonates or goes viral. Their purchases are incidental, happen amidst laughs and shares, often inspired by interactive and humorous content that seamlessly blends with their social feeds.

Community Curators are central figures within their digital networks, actively engaging in and shaping the dialogue around shared interests. This persona thrives on creating and interacting with content that reinforces their social bonds and community influence. They are not just passive users but active participants, engaging with brands that resonate with their lifestyles, and often setting the trends that others follow.

The Researchers Grounded in authenticity and knowledge, The Researchers turn to social platforms for a deeper understanding of the world around them. Their approach to shopping on social and entertainment platforms is methodical and considered as they assess user reviews, how-to videos, expert opinions and educational content to inform purchases.

Style Seekers

Demographic characteristics

• Youngest cohort –typically under 30

• Most time spent on platforms, averaging over 3 hours a day

• Typically middle-to-lower income, many in education or early career stages

• Mostly Millennials

• Typically with a partner or family

• Most likely to follow multiple retail brands on social platforms

• Middle Income

• Middle to higherincome earners 36 29 21 14

Style Seekers represent the cohort for whom social and entertainment platforms are a modern-day bazaar, rich with discovery and opportunity. They are motivated by the thrill of the find, seamlessly merging the act of shopping with their social interactions. Their experience is enriched by brand storytelling, giveaways, and live shopping events. These users are often tactical in their search behaviours, employing integrated shopping features and targeted searches to efficiently find specific products for particular shopping missions.

• Most likely to be over 30 years old

• Shop online less frequently than other cohorts

• A diverse age mix

Social shopping persona by age and channel preference:

The social ecosystem and customer journey

In this section, we take a closer look at how social commerce impacts each stage of the customer journey, accelerating the path to purchase.

We explore how platforms like TikTok have integrated awareness, browsing and purchasing into a cohesive shopping experience.

Social platforms the preferred channel for digital natives

Our research shows that digital natives (under 45s) prefer the social commerce experience every step of the way. For simplicity, Figure 10 shows a three-step customer journey to communicate the choice of channels used by this cohort at different points of their journey.

Q. Thinking about the different stages of the customer journey outlined below, which of the following channels do you think is best for each stage?

How to read chart:

Across the top are three key stages of the customer journey: discovery, purchase trigger, and post-purchase.

Each of the four coloured rows represents a different online channel: social platforms, search engines, retailer websites, and online marketplaces.

The percentage figures in the coloured boxes represent the proportion of consumers using that channel at each stage.

The curved flow lines show the proportion of consumers moving between these stages using the different channels.

Thicker lines indicate higher percentages, emphasising the dominance of social platform use as illustrated by the prominent blue flow at the top.

2.1 Awareness: Entertainment as the gateway to discovery

Discovery is the first step in the social commerce journey. Our research shows that social and entertainment platforms are the most popular method for consumers to discover brands and products, outperforming search engines, marketplaces, and brand websites (Fig 11).

Q. Thinking about how you discover brands and products that interest you, which of the following channels is best at helping with this?

Source: Retail Economics, TikTok

This trend spans all age groups, with the exception of Boomers (over 65), who still prefer traditional channels (Fig 12). For brands, maintaining a strong social media presence is essential.

Fig 12 – Consumers discover more new brands and products on social and entertainment platforms than through traditional shopping channels statement: I discover more new brands and products on social and entertainment platforms than through traditional shopping channels (e.g. in-store, retailer websites)

Source: Retail Economics, TikTok

Platforms like TikTok have revolutionised brand discovery, offering exciting ways to find new products while passively scrolling or actively searching. Sophisticated algorithms which capture user behaviour (e.g. likes, shares, dwell times etc.) curate personalised content making discovery hyper relevant and fun. Here, consumers are most likely to discover new brands and products by ‘accidental’ scrolling Platforms like TikTok have revolutionised brand discovery, offering exciting ways to find new products. TikTok’s For You page curates highly personalised content that is unique to each individual user, which translates to brand and product discovery. Sophisticated algorithms capture user behaviour (e.g., likes, shares, dwell times), to craft a hyper relevant and enjoyable discovery experience.

Trust in the ForYou page empowers users to confidently explore new brands and products that align with their interests. This behavioural shift sees users not only discovering ‘accidentally’ while scrolling, but increasingly, searching on social and entertainment platforms with specific intent (Fig 13).

Fig 13: Discovering new brands and products by accidental scrolling is most effective on social

Q. How do you typically discover new brands or products through social and entertainment platforms?

Source: Retail Economics, TikTok

Discovery: TikTok features and examples

1. Personalised shopping: TikTok’s “ForYou” page personalises content with unmatched precision, functioning like a personal shopper by suggesting brands and products tailored to individual tastes. This hyper-personalisation extends beyond social interactions, driving commerce across various platforms—whether it’s driving traffic to a brand’s website through Video Shopping Ads (VSA), promoting purchases directly on TikTok Shop, or increasing footfall in physical stores. Unlike other platforms where personalisation often relies on broad demographic data or browsing histories, TikTok curates content based on deep engagement metrics, capturing both attention and trust effectively.

2. The power of short-form video: Short form video is uniquely placed to drive high-quality attention because it is immediate, immersive and multi-sensory. Being sound-on, full-screen, entertaining and skippable, TikTok’s content creates an immersive experience that keeps audiences engaged.

3. Trending on your terms: Brands can tap into emerging content patterns that reflect current consumer behaviours and interests. These trends act as broad ‘signals’ or ‘forces’ that reveal underlying movements in consumer engagement and preference. Understanding why certain trends gain traction allows brands to strategically participate in these larger content waves, enabling serendipitous product discovery beyond traditional search.

TikTok excels at relevant discovery, with the highest proportion of users discovering brands or products they’re interested in (Fig 14). It ranks top for product discovery in seven out of ten retail categories, including fashion, beauty, food, and health and wellness (Fig 15).

Fig 14: TikTok outperforms other platforms for successful product discovery

Source: Retail Economics, TikTok

Fig 15: TikTok ranks top for product discovery in seven out of ten retail categories

Q. Please identify the types of products you’ve discovered on social and entertainment platforms that you’ve been interested in purchasing.

Source: Retail Economics, TikTok

Over half (51%) of product discovery occasions on TikTok lead to further user engagement, compared to an industry average of 40%. This includes liking, sharing, following, and seeking more information. Younger users tend to stay on social platforms post-discovery, while those over 45 are more likely to visit brand websites or physical stores (Fig 16).

TikTok successfully drives engagement across both online and offline channels. Numerous brands have benefited from “As Seen on TikTok”, using the trending tag on promotional displays in-store, creating unique opportunities for cross-channel marketing. Consumers can discover brands on TikTok and then explore products in-store or on websites, or they can continue the purchasing journey on the platform through TikTok Shop. Whether part of a closed-loop system or not, this ensures brands can meet consumer needs no matter where they are or how they prefer to shop.

Younger users tend to stay on social and entertainment platforms post-discovery, while those over 45 are more likely to visit brand websites or physical stores (Fig 16).

Q. For the products that you discover on social and entertainment platforms that interest you, which of the following actions are you most likely to take?

Source: Retail Economics, TikTok

2.2 Browsing: Social platforms as search engines

In this section, we examine the consumer’s quest for information. We contrast traditional search engine use with the integrated, immersive, and interactive search experiences within social platforms. Social takes search to the next level.

Social takes search to the next level

Today, social and entertainment platforms go far beyond social interaction. They’ve emerged as powerful tools for product research. Our study shows that 70% of social platform users (and an impressive 91% of Gen Z) intentionally use them to gather information about products and brands. However, when searching for product inspiration, many consumers now prefer social and entertainment platforms (31%) over traditional search engines (28%) (Fig 17).

Q. Thinking about when browsing and searching for products, which of the channels below do you think is best for finding inspiration and ideas for something to buy?

Source: Retail Economics, TikTok

Different users exhibit distinct search behaviours on these platforms. Our personas, for example, show Entertainment Enthusiasts typically discover products serendipitously through content that resonates or goes viral, with algorithms tailoring feeds to their tastes. The Researchers methodically assess user reviews, how-to videos, and expert opinions for informed decision-making. Meanwhile, Style Seeker are more tactical in their search behaviours, using integrated shopping features and targeted searches for specific products and shopping missions. Platforms like TikTok offer dynamic search capabilities to cater to these diverse needs and behaviours.

Source: Retail Economics, TikTok

Why social and entertainment platforms are preferred

1. Entertainment value: Over half (54%) of online shoppers find browsing for products on social and entertainment platforms more satisfying than shopping retail websites or physical stores. Users are entertained which retains attention, increasing the likelihood of discovery.

2. Seamless Integration: Social and entertainment platforms offer a level of integration that traditional search engines cannot match. Users can transition from discovery to detailed product insights, reviews, and even purchase without leaving the platform.

Power of User-Generated Content (UGC)

The success of the discovery and search process on social and entertainment platforms relies heavily on usergenerated content (UGC). UGC offers more dynamic and authentic interaction with brands and product than traditional search engines. Detailed reviews, how-to videos, and ‘raw’ unboxing experiences showcase everyday people using products in real-life scenarios, enhancing trustworthiness and relatability.

Fig 19: User-generated content boosts consumer interest and confidence for purchasing

Statement: “Posts or videos from other customers (like their photos or reviews) makes me more confident about buying something”

Source: Retail Economics, TikTok

Regarding consumer confidence, 60% of social users are more confident buying a product after seeing posts or videos from other customers (Fig 19). Where anyone can become a content creator, UGC, as opposed to ‘influencer’ content, can make the product research process more relatable which fosters trust. This stands in stark contrast to traditional, polished advertising.

From influencers to content creators

On TikTok, the traditional influencer model has evolved into a broader, more impactful role of content creator. Initially, influencers were trendsetters, using their popularity to sway consumer opinion. However, influencer status and high production value has left many consumers questioning levels of authenticity and bias.

Content creators on TikTok engage their audiences through stories that intertwine lifestyle, entertainment, and products. This genuine and relatable approach resonates with the ‘average person’. These creators excel in mobilising their communities, turning everyday content into compelling product endorsements.

Strategic partnerships with content creators

Many successful brands on TikTok understand the importance of nurturing genuine relationships with content creators with a measured approach. Allowing creators to express themselves authentically ensures that content resonates with key audiences to drive engagement and conversions.

By integrating these elements, social and entertainment platforms offer a research experience that goes beyond just learning about products. It becomes an enjoyable process learning from peers, which provides a feeling of community connection.

Fig 20: Digital word of mouth effect: the positive influence of peer-to-peer reviews and authentic content

Q. How do the following types of content on social and entertainment platforms impact your decision to purchase a product?

Source: Retail Economics, TikTok

Live shopping – A form of ‘edutainment’

Live shopping events combine education and entertainment – ‘edutainment’. Done authentically, it can significantly enhance trust and engagement. Among participants, a net balance of one-third reported increased trust in the brands featured (Fig 21). These events are particularly valued by frequent online shoppers (the most profitable segment) who appreciate the interactive and informative nature of live shopping.

Fig 21 - Watching live shopping increases trust and confidence in brands and products

Source: Retail Economics, TikTok

2.3 Purchase: Converting social engagement to action

This section focuses on the mechanics of purchasing through social and entertainment platforms. We examine how TikTok Shop and similar social commerce marketplaces streamline the path to purchase through in-app product pages and checkouts, embedding purchase points within entertainment content.

Social shopping penetration

Our research shows that 56% of UK users have made a purchase on social media, either by clicking a link on shoppable content, or checking out directly within an app. For digital natives (under 45s), this rises to 73%, making it a significant part of their online shopping behaviour (Fig 22). Notably, 24% of Millennials, the most commercially significant demographic, purchase on social media at least once a month, indicating a regular, ingrained habit.

Fig 22 – Over half of consumers have made a purchase on social and entertainment platforms

Q. In the last 12 months, have you purchased a product directly through social media or similar platforms (e.g. Facebook, Instagram, TikTok, YouTube etc.)?

Source: Retail Economics, TikTok

Platform dynamics

TikTok leads in social commerce penetration, with 44% of users having made a purchase directly through the platform, and 29% within the last 12 months (Fig 23). TikTok users are also the most frequent social shoppers, with one in four purchasing at least once a month, alongside Snapchat users.

Q. What platforms have you made a purchase on in the last 12 months?

Source: Retail Economics, TikTok

Category

dynamics

Beauty and apparel are the most popular categories for social commerce, with over one in three social shoppers having made a purchase in these areas. Shoppers who have purchased in the last 12 months show even higher engagement (Fig 24). These categories naturally lend themselves to social platforms through makeup tutorials and fashion showcases. However, other retail categories such as household goods, and food and drink, are rapidly gaining traction. These sectors benefit from the authentic, real-life context they offer—home improvement projects shared through DIY tutorials and culinary explorations via food styling and recipe shares. This trend is broadening the social commerce landscape, appealing to consumers’ desire for new experiences and practical inspiration.

Q. : Which categories have you purchased products directly through social media or similar platforms?

Source: Retail Economics, TikTok

Seamless In-App Purchases: TikTok Shop seamlessly integrates the shopping journey, enabling users to discover, interact with, and buy products through various shoppable content forms—complete with in-app checkout capabilities. This all-in-one approach simplifies the user experience, enhancing convenience and boosting conversion rates by removing purchase barriers.

Secure Integrated Payments: The platform supports secure in-app payments, streamlining transactions and maintaining high security and user trust. This functionality ensures that users can complete purchases quickly and safely within TikTok, without the friction of third-party payment gateways.

Live Shopping: TikTok enhances the purchasing process with its live shopping feature, enabling real-time interaction between brands and consumers. This dynamic approach allows users to see products in action, engage directly with sellers via live Q&As, and make instant purchases during live broadcasts, adding excitement and immediacy to the shopping experience.

2.4 Post-Purchase:

Social interaction soon after transaction

Post-purchase interactions on social and entertainment platforms play a crucial role in sustaining consumer interest and brand engagement. Here, we focus on specific interactions after the transaction phase like sharing experiences, posting reviews, and seeking product tips.

Post-Purchase Engagement

Our research shows that 66% of users have engaged in some form of follow-up action on social and entertainment platforms after making a purchase with a retailer or brand (Fig 25). This includes engagement such as sharing posts or reviews and watching how-to videos, as well as direct brand engagement like following or contacting them for support. Social engagement post-purchase is particularly prevalent among younger generations, with 88% of Gen Z participating in these activities.

Fig 25: Two thirds of users engage with platforms post-purchase

Q. After purchasing a product from a retailer or brand, have you ever used social and entertainment platforms to do any of the following?

Source: Retail Economics, TikTok

Direct brand interaction

Unlike traditional advertising, social platforms allow brands to directly respond to comments and messages. This fosters stronger customer relationships, builds brand loyalty, and allows for real-time customer service. Engaging content formats like polls, Q&A sessions, and challenges create a sense of community around brands and their products, leading to deeper connections.

Social and entertainment platforms criticial for sharing post-purchase experiences

Social and entertainment platforms are critical for post-purchase engagement like providing essential product information, but especially for customers to share experiences. Our research shows that 27% of users think social is the best channel for seeking additional product information; while 34% think it’s best for sharing reviews and recommendations – the most used channel for this activity (Fig 26).

Fig 26: Social and entertainment platforms crucial channel in post-purchase experience

Q. Thinking about after you have purchased a product from a retailer, which of the channels below do you think is best for...?

Source: Retail Economics, TikTok

These insights highlight how TikTok continues to engage users beyond the purchase stage, providing engaging support and interactive customer care. This ongoing engagement nurtures trust and cements consumer loyalty through continuous community involvement.

2.5 Community building: creating brand advocates, not just followers

This final stage looks at longer-term activities that go into building robust brand communities comprised of advocates and creators who inject vibrancy and fun into communities to help generate a continuous feedback loop which drives ongoing conversion.

Strengthening relationships with content

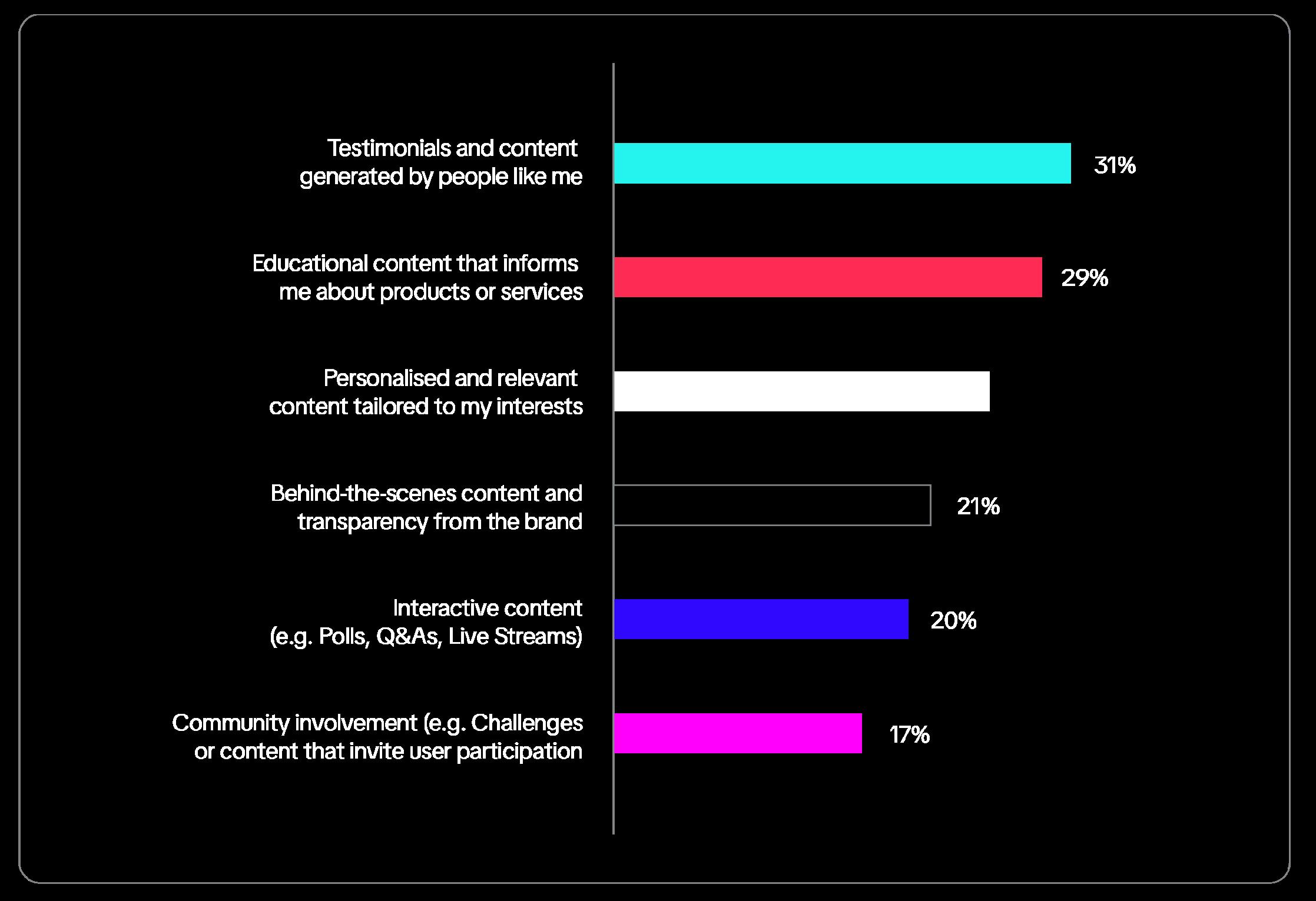

Testimonials, behind-the-scenes content and interactive formats like polls, Q&A sessions, and challenges help create a sense of community around brands and their products. This two-way interaction allows brands to connect more deeply with their audience to strengthen relationships (Fig 27).

Q. What type of content on social and entertainment platforms would help strengthen your connection or loyalty to a brand? (select all that apply)

Source: Retail Economics, TikTok

From buyers to brand advocates

Social and entertainment platforms offer unique opportunities for brands at the post purchase stage to engage and cultivate loyalty, turning buyers into long term brand advocates. They offer retail brands a vehicle to build brand advocacy and self-fulfilling loyalty loops. Interestingly, the most affluent shoppers are the most likely to become brand advocates after engaging with a brand on social media (Fig 28), highlighting the value in targeting these customer cohorts.

Q. After viewing and engaging with a brand’s content on social and entertainment platforms (e.g. liking, commenting, or sharing), how does this experience impact your willingness to…?

Source: Retail Economics, TikTok

Who are the brand advocates?

Importantly, social and entertainment platforms have allowed customers to become brand advocates at scale. However, it also exposes brands to criticism if perceived as inauthentic. Our research confirms that brand advocacy increases with youth. A staggering 94% of Gen Z and 85% of Millennials follow at least one brand on social platforms (Fig 29).

Fig 29 – Digital natives are much more likely to become brand advocates

Q. Do you follow any retailers or brands on social and entertainment platforms (e.g. Facebook, Instagram, TikTok, YouTube)?

Source: Retail Economics, TikTok

Notably, building a sense of community around a brand opens it up to a wider, more committed audience. This applies equally to global brands like Nike and Zara as well as new e-commerce start-ups. Brands can build communities by supporting and educating followers, creating entertaining content, and sharing relevant information.

Peer-to-peer communities

People are four times more likely to purchase a product when recommended by someone they know. Networks of friends, family, and coworkers are excellent targets for social campaigns as they act as the digital version of ‘word of mouth’.

TikTok’s unique sense of community means that two-thirds (64%) of its users feel more connected to brands they interact with on the platform, compared to less than half (49%) on other platforms. By staying true to the community spirit and allowing unfiltered energy to shine through, brands can spark collective participation.

TikTok Shop – a Revolutionary Closed Loop Ecosystem

Seamless Commerce Experience:

TikTok Shop delivers an all-encompassing customer experience, handling every stage from discovery and purchase to fulfilment and after-sales engagement, all via the app. This fully integrated approach reduces the risks and complexity associated with external links and redirects, ensuring a cohesive shopping experience that reduces friction along the way.

Cultivating Community and Loyalty:

In this self-sufficient ecosystem, TikTok Shop facilitates a deeper connection between brands and their audiences. Seamless post-purchase interactions, such as instant customer support and user feedback within the app, strengthen customer satisfaction and loyalty. This continuous engagement promotes a robust community, transforming users into loyal brand advocates.

Leveraging Data for Precision Marketing:

The integral data insights provided by TikTok’s closed-loop system empower brands with precise targeting capabilities. This access to detailed analytics enables brands to develop highly personalised marketing strategies that effectively resonate with and engage their target demographics, driving both higher conversion rates and customer lifetime value.

Strategies for success in social shopping

In this last section, we provide strategic recommendations for retailers and brands to harness the full potential of TikTok as a vehicle for brand and sales growth. The following insights will enable brands to pivot from traditional methods to more innovative approaches that resonate with TikTok’s vibrant community.

What brands must consider:

1. Accelerate digital and data capabilities

• Tech integration: Establish the right digital capabilities (e.g. tech integration with apps, livestreaming support etc.) to drive a seamless and interactive social commerce experience.

• Data management: Ensure product catalogues and inventory information are up-to-date and fully integrated. Implement data management integration to track results and aggregate data across sales channels.

• Consumer insights: Understand evolving consumer sentiments on TikTok to create tailored content that resonates with the audience and encourages brand interaction.

2. Leverage in-app features

• TikTok Shop Ads: TikTok Shop offers brands a comprehensive suite of solutions to create a seamless shopping experience within the app. This closed-loop system allows users to discover, purchase, and engage with products without leaving TikTok, integrating features like in-app checkout to enhance the customer journey and drive sales.

• Live shopping: Host interactive live streams to showcase products in real time, offering exclusive discounts to incentivise purchases during the event. Follow best practices to maximise engagement and conversion rates.

• Shoppable videos: Integrate product links directly into videos, allowing viewers to purchase items without leaving the app, providing a seamless purchasing experience.

• ‘Edutainment’: Combine education and entertainment to deliver compelling content that drives brand engagement and product knowledge.

• Trend anticipation and engagement: Stay ahead of the curve by anticipating and engaging with emerging trends on TikTok to maintain relevance and consumer interest.

3. Move beyond organic reach: affiliate power

• Partnerships: Partner with relevant TikTok creators who have established audiences aligned with your brand.

• Incentives: Offer attractive commission structures to incentivise creators to promote your products in an authentic way to reach a wider audience.

• Performance tracking: Implement performance tracking to measure the effectiveness of affiliate partnerships and adjust strategies accordingly.

• Long-term relationships: Cultivate long-term relationships with top-performing affiliates to ensure ongoing promotion and sustained brand visibility.

4. Community & building trust

• Quality content: Craft high-quality content that is still authentic, educates and entertains target audiences.

• Engagement: Respond promptly to comments, questions, and build genuine connections to foster trust and loyalty.

• Overcoming barriers: Address purchase barriers such as lack of trust and data security concerns. Leverage TikTok’s unique community-building features to foster brand loyalty to create vibrant brand communities.

• Authentic storytelling: Use authentic storytelling to create relatable content that resonates with your audience to build long-term trust.

• Community involvement: Actively participate in community discussions and events to show your brand’s commitment to its community, enhancing trust and loyalty.

5. Inventory management

• Effective management: Manage inventory effectively across social network platforms to enhance the customer experience.

• Integration: Ensure your e-commerce site is properly integrated with social commerce platforms, allowing consumers to discover and purchase products suited to the platform and persona.

• Accuracy: Maintain accurate inventory information to ensure orders are fulfilled correctly, building a cohesive social commerce funnel.

• Real-time updates: Implement real-time inventory updates to ensure product availability is accurately reflected, preventing overselling to enhance customer satisfaction.

• Agile logistics: Develop an agile logistics system that can quickly adapt to changes in demand and ensure timely fulfilment of orders.

With successful implementation of these strategies, retail brands can leverage TikTok’s dynamic platform to reach a broader audience, boost conversion rates, and foster long-term customer loyalty.

5. Maximise impact with targeted ads

• Intercept Moments of Discovery: : Utilise advanced targeting capabilities to deliver ads at key moments when users are most receptive. By intercepting moments of discovery, you can capture attention and drive engagement effectively.

• Integrate Martech Stack: Leverage TikTok’s Events API to pass marketing conversion data in a privacy-compliant manner, allowing for seamless tracking and optimisation of your campaigns across multiple platforms.

• Activate First-Party Data: Use existing customer data to create highly targeted ad campaigns. Re-engage loyal customers and attract new ones by delivering personalised content that resonates with their interests.

• Connect your product feed: Ensure your product catalogue is integrated with TikTok to display dynamic ads that drive users directly to purchase. This helps in showcasing the right products to the right audience, lowering funnel shopping ads and increasing the likelihood of conversion.

• Intercept prospective customers at all stages of the funnel: From awareness to search, utilise TikTok’s targeting options to reach users at different stages of their journey. Tailor your messaging to align with their current stage to drive them further down the funnel.With successful implementation of these strategies, retail brands can leverage.

TikTok’s dynamic platform to reach a broader audience, boost conversion rates, and foster long-term customer loyalty.

Boots is the UK’s leading pharmacy-led health and beauty retailer. The brand came to TikTok to drive conversions of its deals, making premium beauty and fragrances more accessible to everyone during the festive season.

Boots were the first beauty retailer in Europe to test one of our newest lower funnel solutions built for eCommerce advertisers, Video Shopping Ads (VSA). VSA are shoppaple smart video creatives appearing in users’ For You feed, that maximise lower funnel performance. This ad solution is built to amplify product discovery, purchase intent, and conversion with smarter, intent-based targeting and advanced creative functionalities.

133 increase in ROAS

Story is at the heart of the human condition. It’s how we build relationships, how we engage with the world, and when embraced, it can guide us to make better choices for our futures. This study illustrates the power that is within Tiktok’s grasp, to help us rediscover the narrative power that is unique to story-telling. It’s through storytelling on TikTok that allows brands to connect with new audiences & find new customers, futureproofing their business.” Case

Peter Grant | Head of Media Effectiveness | Boots

48 decrease in CPA

With over 30 million shoppers on ASOS, the fashion destination launched on TikTok Shop with the goal of connecting with the vast #FashionTok community. Their primary target audience was the “Fashion Loving 20 Something.”

They made 85 ASOS Design products available on TikTok Shop, which were promoted by their selected creators through engaging Shoppable Short Videos. These videos showcased the latest fashion trends, unboxings and get ready with me content, creating a buzz around the products and ASOS’ arrival on the platform.

For this interactive campaign, they leveraged the popular Open Verse Challenge TikTok trend where they encouraged viewers to duet the video, but with a twist: the song opening is a remix of a popular N-Trance song, with lyrics taken from consumers’ online comments.

Using TikTok tools and filters, the brand created an authentic campaign that included TikTok native tools.

Driving over 19.5 million impressions, Lidl’s playful campaign is proof in the power of TikTok-first, sound-centric creative.

Pret A Manger is one of the UK’s favourite sandwich and organic coffee shops, providing freshly handmade salads, wraps, and snacks using high quality ingredients. To boost Club Pret subscriptions, the brand came to TikTok for a targeted campaign aimed at encouraging app installs while raising awareness around its subscription offer.

Pret employed a comprehensive TikTok Brandformance approach for its campaign. This innovative strategy seamlessly integrated brand awareness campaigns with targeted app install initiatives to maximise Club Pret subscriptions.

Pret’s campaign perfectly blended brand awareness with targeted app installs to efficiently drive Club Pret Subscriptions. The campaign’s success was rooted in data-driven insights, a Conversion Lift Study, creative experimentation, and active participation in TikTok’s Creative Exchange Programme.

subscription rates

cost per app install

Scan the QR code

to learn more about retail brands who unlocked their potential on TikTok:

Conclusion

The evolution of social commerce is rapidly transforming the retail landscape, spearheaded by platforms like TikTok. By blending community, entertainment, and commerce, social and entertainment platforms offer unique ecosystems where consumers can engage deeply with brands, discover new products, and purchase products seamlessly in-app. This transformation is driven by authenticity and trust fostered through creator content and community engagement.

Opportunities for retailers and brands are immense, with the UK social commerce market projected to be worth almost £16 billion by 2028. Leveraging digital and data capabilities, in-app features, strategic partnerships, community building, and effective inventory management can open up new avenues to harness the full potential of platforms like TikTok. These strategies enhance visibility and engagement while building brand communities.

TikTok’s integration of entertainment with commerce offers a powerful tool for brands to capture consumer attention, cutting through the noise in a fragmented digital landscape to build communities and drive sales. Staying ahead of trends and maintaining authenticity will be key to sustained success as demanding consumers become ever more savvy and community led.

Retailers and brands that embrace these innovative approaches will thrive in the ever-changing digital marketplace. In this dynamic era, the fusion of entertainment, community and commerce on platforms like TikTok is reshaping retail, forging a new frontier where every social interaction is an opportunity to inspire, connect, and transform the marketplace in unimaginable ways.

Methodology

Consumer surveys were undertaken in April 2024 covering a sample of 2,000 nationally representative households across the UK. Market sizing and forecasts are based on a combination of survey responses and industry data sourced from Retail Economics.

Contact us for more information.

About TikTok

TikTok is the leading destination for short-form mobile video. Our mission is to inspire creativity and bring joy. TikTok’s global headquarters are in Los Angeles and Singapore, with additional offices in New York, London, Dublin, Paris, Berlin, Dubai, Jakarta, Seoul, and Tokyo.

About Retail Economics

Retail Economics is an independent economics research consultancy focused on the consumer and retail industry. We analyse the complex retail economic landscape and draw out actionable insight for our clients. Leveraging our own proprietary retail data and applying rigorous economic analysis, we transform information into points of action.

Our service provides unbiased research and analysis on the key economic and social drivers behind the retail sector, helping to inform critical business decisions and giving you a competitive edge through deeper insights.

Report Authors:

Josh Holmes, Senior Consultant josh.holmes@retaileconomics.co.uk

Richard Lim, CEO richard.lim@retaileconomics.co.uk