Click on “share” symbol in the bar below to get

Click on “share” symbol in the bar below to get

Island County Parcel Information

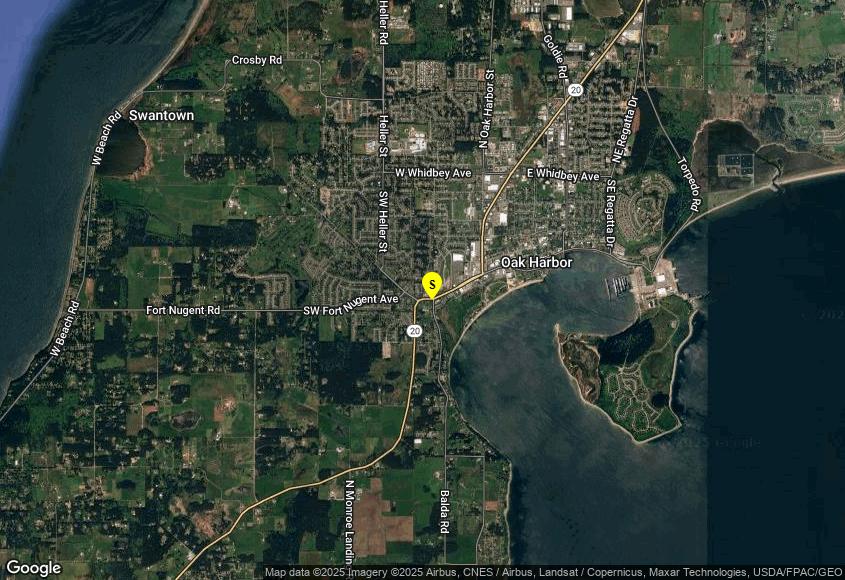

Parcel #: S7446-04-000J1-0

SiteAddress: 30875 Sr20 J1

Oak Harbor WA98277

Owner: Post,Thomas M

30875 Sr 20 Unit J1

Oak Harbor WA98277

Twn/Range/Section: 32N / 01E / 03

Parcel Size: 0 06Acres (2,801 SqFt)

Plat/Subdivision: Madrona Heights Condo 01

Lot: 0J1

Block: 00

CensusTract/Block: 970602 / 3003

Waterfront:

Levy Code: 100

Levy Rate: 8 4729

AssessmentYear: 2024

Total Land Value: $100,000 00

Total Impr Value: $224,431 00

Total Value: $324,431 00

Land Use: 14 - Condominiums

Neighborhood: 11*OHmdhgt

Recreation:

Watershed: Whidbey Island

Primary School: Crescent Harbor Elem

High School: Oak Harbor High School

Year Built: 1999

$2,754 17

$2,670 27

$2,676 88

MADRONAHEIGHTS CONDO PH IV UNITJ1 2 32% INT

Zoning: M - Municipality/Nmuga

View:

Water:

School District: Oak Harbor

Middle School: North Whidbey Middle School

EffectiveYear Built: 2006

Stories: Bedrooms: 3 Heat: FHAGAS

FinishedArea: 1,398 SqFt

Bathrooms: 2 5

Garage SqFt: 242 SqFt - Built-in

1st Floor: 550 SqFt

Carport:

BldgType: R - RESIDENTIAL

2nd Floor: 848 SqFt

Foundation: CONCRETE Roof Covering: CJASPHALT

Exterior Walls: CEMENTFIBER

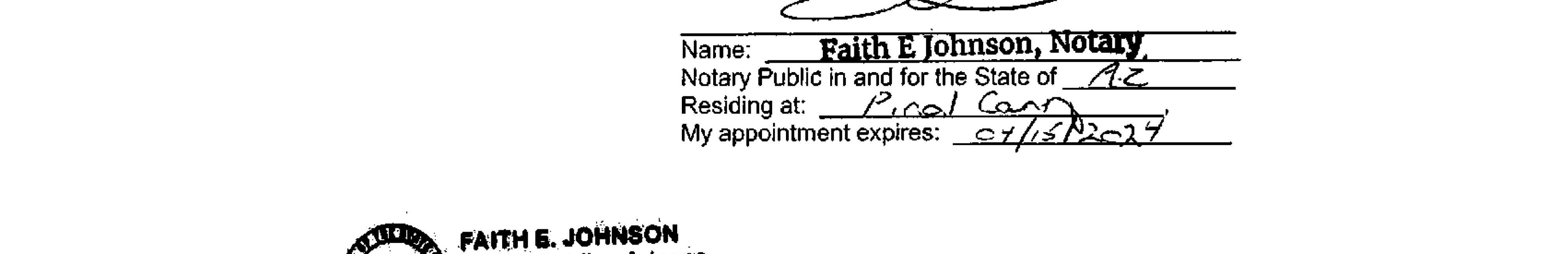

Rec Date:03/22/2021 Sale Price:$285,000 00 Doc Num:4514134 DocType:Warranty Deed

Owner:Thomas M Post

Orig LoanAmt:$295,260 00

Sentry Dynamics, Inc and its customers make no representations, warranties or conditions, express or implied, as to the accuracy or completeness of information contained in this report Parcel Information

Grantor:MURILLOTHOMAS G

Title Co:CHICAGOTITLE COMPANYOF WA

FinanceType: LoanType:VA Lender:MORTGAGE RESEARCH CENTER LLC

S7446-04-000J1-0

EXHIBIT A LEGAL DESCRIPTION

SubjectPropertyLocation

PropertyAddress

30875STATEROUTE20APTJ1

City,State&Zip OAKHARBOR,WA98277-7588

County ISLANDCOUNTY

MailingAddress

CensusTract 970602

ThomasBrosPg-Grid

ReportDate:10/28/2025

OrderID:R199796254

SubjectPropertyLocation

1

2

3

ReportDate:10/28/2025

TransactionID 1

EffectiveDate 10/25/2023

Borrower(s)Name

CurrentLender

THOMASGMURILLOAND DANICAALOSBANEZ HUSBANDANDWIFE

MORTGAGEELECTRONIC REGISTRATIONSYSTEMS

INC(MERS)AS DESIGNATEDNOMINEE FORENVOYMORTGAGE LTDITSSUCCESSORSAND ASSIGNS

RecorderDoc Number 4566073 LoanAmount

DocumentType Release OriginationDoc# 4401496

Document Description ReleaseofMortgage Origination RecordingDate 06/20/2016

MORTGAGEELECTRONIC REGISTRATIONSYSTEMS INC(MERS)AS DESIGNATEDNOMINEE FORENVOYMORTGAGE LTDITSSUCCESSORSAND ASSIGNS MortgageRelease

TransactionID 2

EffectiveDate 04/02/2021

Borrower(s)Name THOMASGMURILLO DANICAALOSBANEZ

CurrentLender

Mortgage

MERSINCASDESIGNATED NOMINEEFORBANKOF AMERICANAITS SUCCESSORSAND ASSIGNS

TransactionID 3

MortgageDate

OriginationLender

RecordingDate 10/26/2023

OriginalLender

RecorderDoc Number 4515657

DocumentType Release OriginationDoc# 4319963

RecordingDate 04/06/2021

RecorderDoc Number 4514135

Borrower1 POST,THOMASM BalloonRider

OriginalLender

RecorderBook/Page

MERSINCASDESIGNATED NOMINEEFORBANKOF AMERICANAITS SUCCESSORSAND ASSIGNS

PrepaymentPenalty Rider

Borrower2 Fixed/StepRate Rider PrepaymentPenalty Term 00

Additional Borrowers AdjRateRider AdjRateIndex Vesting Transfer

TransactionID 4

SaleDate 03/18/2021

RecorderDoc Number 4514134

DocumentType Deed

PartialInterest Transferred

TypeofTransaction Arms-LengthTransfer

SalePrice $285,000 Document Description WarrantyDeed MultipleAPNson Deed

RecorderBook/Page

Buyer1 POST,THOMASM

Buyer2

Seller1 MURILLO,THOMASG

Seller2 LOSBANEZ,DANICAA

RecordingDate 03/22/2021

PropertyUse CondominiumUnit (Residential)

Buyer1Entity UnmarriedPerson BuyerVesting

Buyer2Entity

BuyerMailing Address

Seller1Entity MarriedCouple SellerMailing Address

Seller2Entity MarriedCouple

LegalRecorder's MapRef LegalSubdivision CITYOFOAKHARBOR SHORTPLAT

LegalBriefDescription/Unit/Phase/Tract BLDGJ,CONDONAME:MADRONAHEIGHTS CONDOMINIUM,VOL3PG27AF95010037/J1//

MortgageRelease

TransactionID 5

EffectiveDate 06/30/2016

Borrower(s)Name KEVINJFARREN

CurrentLender RECONTRUSTCOMPANY, NA,ASTRUSTEE

RecorderDoc Number 4402199

DocumentType Release

Document Description ReleaseofMortgage

RecordingDate 06/30/2016

LegalCity/Muni/ Township

LegalSection/Twn/ Rng/Mer

30875STATEROUTE20APT J1,OAKHARBOR,WA 98277-7588

TitleCompanyName CHICAGOTITLECOMPANY OFWA

LoanAmount

OriginationDoc# 4319963

Origination RecordingDate 07/26/2012

OriginalLender NOTPROVIDED

TransactionID 6

MortgageDate

06/06/2016

LoanAmount $219,622

LoanType VALoan(Veteran's Administration)

OriginationLender Name ENVOYMORTGAGELTD

OriginationLender

RecorderDoc Number 4401496

RecorderBook/Page

DocumentType Mortgage RateChangeFreq

Document Description VALoan(Veteran's Administration) 1stPeriodicFloor Rate

RecordingDate 06/20/2016 1stPeriodicCap Rate

OriginationInterest Rate LifetimeCapRate

Type Mortgagecompany FirstRateChange Date ChangeIndex

TypeFinancing

MaturityDate 05/16/2046 IOPeriod

Borrower1 MURILLO,THOMASG BalloonRider PrepaymentPenalty Rider

Borrower2 LOSBANEZ,DANICAA

Fixed/StepRate Rider PrepaymentPenalty Term

Additional Borrowers AdjRateRider AdjRateIndex Vesting Transfer

TransactionID 7

SaleDate 06/06/2016

RecorderDoc Number 4401495

PartialInterest Transferred

DocumentType Deed TypeofTransaction Arms-LengthTransfer

SalePrice $215,000 Document Description WarrantyDeed MultipleAPNson Deed

RecorderBook/Page

RecordingDate 06/20/2016 PropertyUse CondominiumUnit (Residential)

Buyer1 MURILLO,THOMASG Buyer1Entity HusbandandWife BuyerVesting

Buyer2 LOSBANEZ,DANICAA Buyer2Entity HusbandandWife

Seller1 FARREN,KEVINJ

Seller2

LegalRecorder's MapRef AF98022580

Seller1Entity MarriedMan

Seller2Entity

LegalSubdivision MADRONAHEIGHTS CONDOMINIUM

LegalBriefDescription/Unit/Phase/Tract BLDG:J/J1//

BuyerMailing Address

SellerMailing Address

30875STATEROUTE20APT J1,OAKHARBOR,WA 98277-7588

LegalCity/Muni/ Township OAKHARBOR

LegalSection/Twn/ Rng/Mer

TitleCompanyName CHICAGOTITLECOMPANY OFWA MortgageAssignment

TransactionID 8

RecorderDoc Number 4373196

OriginalLoan Amount $201,025

EffectiveDate 02/03/2015 DocumentType Assignment OriginationDoc# 4319963

Document Description AssignmentofMortgage Origination RecordingDate 07/26/2012

Borrower(s)Name KEVINJFARREN,A MARRIEDMANASHISSOLE &SEPARATEPROPERTY

RecordingDate 02/13/2015

OriginalLender

AssignorName

MERS,INC,ASDESIGNATEDNOMINEEFORBANK OFAMERICA,NA,BENEFICIARYOFTHE SECURITYINSTRUMENT,ITSSUCCESSORSAND ASSIGNS

MERS,INC,AS DESIGNATEDNOMINEE FORBANKOFAMERICA, NA,BENEFICIARYOFTHE SECURITYINSTRUMENT, ITSSUCCESSORSAND ASSIGNS

AssigneeName BANKOFAMERICA,NA,ANDITSSUCCESSORS ANDASSIGNS

TransactionID 9

MortgageDate 05/11/2012

LoanAmount $201,025

LoanType VALoan(Veteran's Administration)

OriginationLender Name BANKOFAMERICANA

OriginationLender Type Bank

TypeFinancing

RecorderDoc Number 4319963

RecorderBook/Page

DocumentType Mortgage RateChangeFreq

Document Description VALoan(Veteran's Administration) 1stPeriodicFloor Rate

RecordingDate 07/26/2012 1stPeriodicCap Rate

OriginationInterest Rate

LifetimeCapRate

FirstRateChange Date ChangeIndex

MaturityDate 06/01/2042

Borrower1 FARREN,KEVINJ BalloonRider

Borrower2

Additional Borrowers

Vesting MarriedManashissoleand separateproperty Transfer

TransactionID 10

Fixed/StepRate Rider

AdjRateRider

RecorderDoc Number 4319962

TransferDate 05/11/2012 DocumentType Deed

SalePrice

RecorderBook/Page

IOPeriod

PrepaymentPenalty Rider

PrepaymentPenalty Term

AdjRateIndex

PartialInterest Transferred

TypeofTransaction NonArms-LengthTransfer

Document Description Intra-familyTransferor Dissolution MultipleAPNson Deed

RecordingDate 07/26/2012

PropertyUse

Buyer1 FARREN,KEVINJ Buyer1Entity MarriedMan BuyerVesting

Buyer2

Seller1 FARREN,KEVINJ

Seller2 FARREN,MARY

Buyer2Entity

MarriedManashissoleand separateproperty

BuyerMailing Address 30875ROUTE20#J-1,OAK HARBOR,WA98277

Seller1Entity HusbandandWife SellerMailing Address

Seller2Entity HusbandandWife LegalCity/Muni/ Township

LegalRecorder's MapRef LegalSubdivision MADRONAHEIGHTS CONDOMINIUM

LegalBriefDescription/Unit/Phase/Tract BLDGJ/J1//

MortgageRelease TransactionID 11

LegalSection/Twn/ Rng/Mer

Borrower(s)Name KEVINJFARREN

02/02/2007 CurrentLender MERS,INC

MortgageRelease

Borrower(s)Name JEFFREYMSHANAHANAND STEPHANIEDSHANAHAN, HUSBANDANDWIFE

CurrentLender

WELLSFARGOBANK,NA, SUCCESSORBYMERGER TOWELLSFARGOHOME MORTGAGE,INC RecordingDate 02/22/2007

TransactionID 13

MortgageDate 01/29/2007

LoanAmount $214,515

LoanType VALoan(Veteran's Administration)

OriginationLender Name COUNTRYWIDEHOME LOANSINC

RecorderDoc Number 4193319

RecorderBook/Page

DocumentType Mortgage RateChangeFreq

Document Description VALoan(Veteran's Administration) 1stPeriodicFloor Rate

RecordingDate 02/02/2007 1stPeriodicCap Rate

OriginationInterest Rate LifetimeCapRate

OriginationLender Type Lendinginstitution FirstRateChange Date ChangeIndex

TypeFinancing

MaturityDate 02/01/2037 IOPeriod

Borrower1 FARREN,KEVIN BalloonRider PrepaymentPenalty Rider

Borrower2

Fixed/StepRate Rider PrepaymentPenalty Term

Additional Borrowers AdjRateRider AdjRateIndex Vesting Transfer

TransactionID 14

SaleDate 01/29/2007

SalePrice $210,000

RecorderBook/Page

RecorderDoc Number 4193318

PartialInterest Transferred

DocumentType Deed TypeofTransaction Arms-LengthTransfer

Document Description WarrantyDeed MultipleAPNson Deed

RecordingDate 02/02/2007 PropertyUse

Buyer1 FARREN,KEVIN Buyer1Entity SinglePersonorIndividual BuyerVesting

Buyer2

Buyer2Entity

BuyerMailing Address

Seller1 SHANAHAN,JEFFREYM Seller1Entity HusbandandWife SellerMailing Address

Seller2 SHANAHAN,STEPHANIED Seller2Entity HusbandandWife

LegalRecorder's MapRef MB3PG27

LegalSubdivision MADRONAHEIGHTS CONDOMINIUM

LegalBriefDescription/Unit/Phase/Tract BUILDINGJPORLOT2CITYOAKHARBORSHORT PLAT/J1//

30875STATEROUTE20APT J1,OAKHARBOR,WA 98277-7588

LegalCity/Muni/ Township

LegalSection/Twn/ Rng/Mer

TitleCompanyName LANDTITLECOMPANY ISLANDCO Mortgage

TransactionID 15

RecorderDoc Number

RecorderBook/Page

MortgageDate DocumentType Mortgage RateChangeFreq

LoanAmount $18,750 Document Description 1stPeriodicFloor Rate

LoanType

OriginationLender Name

OriginationLender Type

RecordingDate 12/10/2003 1stPeriodicCap Rate

OriginationInterest Rate

LifetimeCapRate

FirstRateChange Date ChangeIndex

TypeFinancing MaturityDate IOPeriod

Borrower1 SHANAHAN,JEFFREYM BalloonRider

Borrower2 SHANAHAN,STEPHANIED Fixed/StepRate Rider

PrepaymentPenalty Rider

PrepaymentPenalty Term

Additional Borrowers AdjRateRider AdjRateIndex Vesting

TransactionID 16

MortgageDate 11/21/2003

RecorderDoc Number 4085478

RecorderBook/Page

DocumentType Mortgage RateChangeFreq Annually

LoanAmount $100,000 Document Description UnknownLoanType 1stPeriodicFloor Rate

LoanType UnknownLoanType RecordingDate 12/10/2003 1stPeriodicCap Rate

OriginationLender

OriginationLender

Borrower1 SHANAHAN,JEFFREYM BalloonRider

PrepaymentPenalty Rider

Borrower2 SHANAHAN,STEPHANIED Fixed/StepRate Rider PrepaymentPenalty Term

Additional Borrowers AdjRateRider Y AdjRateIndex ONEYEART-BILL Vesting Transfer

TransactionID 17

SaleDate 11/21/2003

RecorderBook/Page

RecorderDoc Number 4085477

PartialInterest Transferred

DocumentType Deed TypeofTransaction Arms-LengthTransfer

RecordingDate 12/10/2003 PropertyUse

Buyer1 SHANAHAN,JEFFREYM Buyer1Entity HusbandandWife BuyerVesting

Buyer2 SHANAHAN,STEPHANIED Buyer2Entity HusbandandWife

Seller1 ELOMINA,EDESSAV Seller1Entity Singlewoman

Seller2 Seller2Entity

BuyerMailing Address

SellerMailing Address

LegalCity/Muni/ Township

LegalRecorder's MapRef AF95010037 LegalSubdivision MADRONAHEIGHTS CONDOMINIUM LegalSection/Twn/ Rng/Mer

LegalBriefDescription/Unit/Phase/Tract

BUILDINGJLOT2CITYOAKHARBORSHORTPLAT MB3PG27:AF95010037/J1//

30875STATEROUTE20#J1,OAKHARBOR,WA982777534

TitleCompanyName LANDTITLECOISLAND COUNTY

SubjectPropertyLocation

PropertyAddress

30875STATEROUTE20APTJ1

City,State&Zip OAKHARBOR,WA98277-7588

County ISLANDCOUNTY

MailingAddress

30875STATEROUTE20APTJ1,OAKHARBOR,WA98277-7588

OwnerName POST,THOMASM

ReportDate:10/28/2025

OrderID:R199796256

ParcelNumber S7446-04-000J1-0

PropertyAddress

30875STATEROUTE20APTJ1

City,State&Zip OAKHARBOR,WA98277-7588

County ISLANDCOUNTY

MailingAddress 30875STATEROUTE20APTJ1,OAKHARBOR,WA98277-7588

ReportDate:10/28/2025

OrderID:R199796257

ParcelNumber S7446-04-000J1-0

SubjectPropertyLocation

PropertyAddress

30875STATEROUTE20APTJ1

City,State&Zip OAKHARBOR,WA98277-7588

County ISLANDCOUNTY

ReportDate:10/28/2025

OrderID:R199796258

MailingAddress 30875STATEROUTE20APTJ1,OAKHARBOR,WA98277-7588 ParcelNumber S7446-04-000J1-0

SubjectProperty

Owner POST,THOMASM

Bedrooms 3 YearBuilt

Bathrooms/Partial 25 Garage/No ofCars

NearbyNeighbor#1

Address 30875SR20#J2,OAKHARBOR,WA98277

25 Garage/No ofCars

NearbyNeighbor#2

NearbyNeighbor#3

Address 30875STATEROUTE20APTJ4,OAKHARBOR,WA98277

NearbyNeighbor#4 Address

NearbyNeighbor#5 Address

NearbyNeighbor#7

NearbyNeighbor#8

PETERSON,KENNETHR;BERTAMPETERSON

NearbyNeighbor#9

Address 30875STATEROUTE20APTL2,OAKHARBOR,WA98277

Owner BUCK,CAROLINEK

Bedrooms 2 YearBuilt

Bathrooms/Partial 25 Garage/No ofCars

NearbyNeighbor#10

Address 30875STATEROUTE20APTM1,OAKHARBOR,WA98277

Owner SKAGG,DENNISH;CHRISTYANNSWAINSKAGGS

Bedrooms 2 YearBuilt

Bathrooms/Partial 25 Garage/No ofCars

NearbyNeighbor#11

Address 30875SR20#M2,OAKHARBOR,WA98277

Owner VINCENT,HEATHERLYNNE

Bedrooms 3 YearBuilt

Bathrooms/Partial 25

NearbyNeighbor#12

NearbyNeighbor#13

NearbyNeighbor#14

NearbyNeighbor#15

VANWETTER,MATTHEW;WAINANIVANWETTER

ofCars

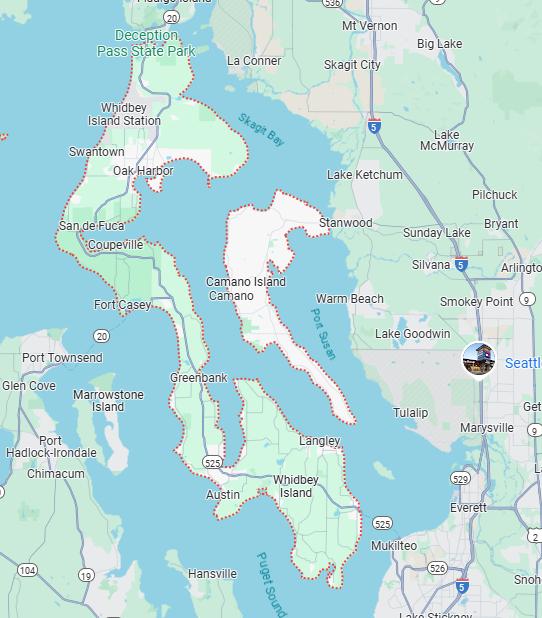

Island County, WA, located in the Puget Sound region, is known for its natural beauty and outdoor recreational opportunities. One of the county's highlights is Deception Pass State Park, which spans both Whidbey and Fidalgo Islands. The park features stunning views, miles of hiking trails, and the iconic Deception Pass Bridge. Visitors can enjoy boating, fishing, and beachcombing, making it a popular destination for nature enthusiasts.

Another attraction in Island County is the charming town of Coupeville on Whidbey Island. Established in the 1850s, Coupeville is one of the oldest towns in Washington State and is part of the Ebey's Landing National Historical Reserve. The town boasts historic buildings, quaint shops, and waterfront restaurants. Visitors can explore the nearby Admiralty Head Lighthouse and Fort Casey State Park, which offer historical insights and picturesque views.

On Camano Island, Cama Beach State Park is a unique destination that combines history and recreation. The park features restored 1930s-era cabins that visitors can rent for a nostalgic getaway. Activities at Cama Beach include kayaking, crabbing, and wildlife watching. The park also offers educational programs and events, making it an excellent spot for families and those interested in learning more about the area's history and natural environment.

• Penn Cove MusselFest - March Coupeville. This annual festival celebrates the local mussel industry with cooking demonstrations, mussel eating competitions, and boat tours of the mussel farms.

• Holland Happening - April in Oak Harbor: A celebration of Oak Harbor's Dutch heritage featuring a parade, carnival, food vendors, and cultural activities.

• Whidbey Island Fair - July in Langley: A traditional county fair with agricultural exhibits, carnival rides, live music, and various contests.

• Coupeville Arts and Crafts Festival - August in Coupeville: A two-day event showcasing local artisans and craftsmen, with live music, food vendors, and activities for all ages.

• Camano Island Studio Tour - May on Camano Island: An annual art tour where visitors can explore the studios of local artists, view and purchase artwork, and meet the artists themselves.

• Island Shakespeare Festival - July to September in Langley: A summer event featuring outdoor performances of Shakespearean plays in a beautiful woodland setting.

• Bayview Farmers Market - April through October in Langley: A weekly market offering fresh produce, handmade crafts, and local food products.

• Deception Pass State Park

• Coupeville Historic Waterfront

• Fort Casey State Park

• Ebey's Landing National Historical Reserve

• Cama Beach State Park

• Meerkerk Rhododendron Gardens

• South Whidbey State Park

• Greenbank Farm

SubjectPropertyLocation

PropertyAddress

30875STATEROUTE20APTJ1

City,State&Zip OAKHARBOR,WA98277-7588

County ISLANDCOUNTY

MailingAddress 30875STATEROUTE20APTJ1,OAKHARBOR,WA98277-7588

Grade9-Grade12

BROADVIEWELEMENTARY

Address

ReportDate:10/28/2025

OrderID:R199796260

ThePublicSchoolReportlistsschoolsclosesttothesubjectproperty Foracompletelistingofschoolsinyourarea,pleasegotohttp://wwwncesedgov/globallocator APIIndex

TheAcademicPerformanceIndex(API)measuresacademicperformanceandgrowthofschools,whichincludesresultsoftheStanford9 TheAPIreportsanumericscalethatranges from200to1000 Aschool'sscoreorpositionontheAPIindicatesthelevelofaschool'spreformance

SubjectPropertyLocation

PropertyAddress

30875STATEROUTE20APTJ1

City,State&Zip OAKHARBOR,WA98277-7588

County ISLANDCOUNTY

MailingAddress 30875STATEROUTE20APTJ1,OAKHARBOR,WA98277-7588

DERKINDERHUISMONTESSORI

ReportDate:10/28/2025

OrderID:R199796261

About PrivateSchools

Asprivateschoolsarenotsubjecttodistrictboundaries,welistupto15oftheschoolsclosesttothesubjectpropertywithinafivemileradiusofthesubjectproperty

Disclaimer

THISREPORTISINTENDEDFORUSEBYYOUASANENDUSERSOLELYFORYOURINTERNALBUSINESSPURPOSES.YOUSHALLNOTRESELL,RELICENSEORREDISTRIBUTETHISREPORT,INWHOLEORIN PART THEUSEOFTHISREPORTBYANYPARTYOTHERTHANYOURSELFFORANYPURPOSEISSTRICTLYPROHIBITED.THISREPORTISPROVIDEDAS-ISWITHOUTWARRANTYOFANYKIND,EITHEREXPRESS ORIMPLIED,INCLUDINGWITHOUTLIMITATION,ANYWARRANTIESOFMERCHANTABILITY,NON-INFRINGEMENT,ORFITNESSFORAPARTICULARPURPOSE.INTERCONTINENTALEXCHANGE,INC.(ICE)SHALL HAVENOLIABILITYINCONTRACT TORT,OROTHERWISEARISINGOUTOFORINCONNECTIONWITHTHISREPORT.ICEDOESNOTREPRESENTORWARRANTTHATTHEREPORTISCOMPLETEORFREEFROM ERROR.YOUUNDERSTANDANDACKNOWLEDGETHATTHEAVAILABILITY,COMPLETENESSANDFORMATOFTHEDATAELEMENTSMAYVARYSUBSTANTIALLYFROMAREA-TO-AREA.THEINFORMATION CONTAINEDINTHISREPORTISDERIVEDFROMPUBLICLYAVAILABLESOURCESFORTHESUBJECTPROPERTYORCOMPARABLEPROPERTIESLISTEDABOVEANDHASNOTBEENINDEPENDENTLYVERIFIEDBY ICETHROUGHANYFORMOFINSPECTIONORREVIEW THISREPORTDOESNOTCONSTITUTEANAPPRAISALOFANYKINDANDSHOULDNOTBEUSEDINLIEUOFANINSPECTIONOFASUBJECTPROPERTYBYA LICENSEDORCERTIFIEDAPPRAISER.THISREPORTCONTAINSNOREPRESENTATIONS,OPINIONSORWARRANTIESREGARDINGTHESUBJECTPROPERTY'SACTUALMARKETABILITY,CONDITION(STRUCTURAL OROTHERWISE),ENVIRONMENTAL,HAZARDORFLOODZONESTATUS,ANDANYREFERENCETOENVIRONMENTAL,HAZARDORFLOODZONESTATUSISFORINFORMATIONALPURPOSESONLYANDSHALLBE INDEPENDENTLYVERIFIEDBYTHEENDUSER.THEINFORMATIONCONTAINEDHEREINSHALLNOTBEUTILIZED:(A)TOREVIEWORESTABLISHACONSUMER'SCREDITAND/ORINSURANCEELIGIBILITYORFOR ANYOTHERPURPOSETHATWOULDCAUSETHEREPORTTOCONSTITUTEA"CONSUMERREPORT"UNDERTHEFAIRCREDITREPORTINGACT,15U.S.C.§1681ETSEQ.;OR(B)INCONNECTIONWITH CERTIFICATIONORAUTHENTICATIONOFREALESTATEOWNERSHIPAND/ORREALESTATETRANSACTIONS.ADDITIONALTERMSANDCONDITIONSSHALLAPPLYPURSUANTTOTHEAPPLICABLEAGREEMENT

Copyright CONFIDENTIAL,PROPRIETARYAND/ORTRADESECRET TMSM®TRADEMARK(S)OFINTERCONTINENTALEXCHANGE,INC.ANDITSSUBSIDIARIESANDAFFILIATES. ©2025INTERCONTINENTALEXCHANGE,INC.ALLRIGHTSRESERVED.

Closing on a home can be an exciting and stressful process all at the same time. With so many potential speed bumps it’s important we make your closing flow as smooth as possible. At Ticor we believe one of the easiest ways to accomplish this is by educating buyers and sellers as they prepare for the big day. In particular we’d like to highlight some of the simple steps a buyer/seller can take to expedite the process. We call these steps the “Keys to a Successful Closing”.

Verify with your loan officer that all conditions have been met.

Notify your escrow officer the names of your lender and homeowner insurance companies.

Gather the following and deliver to your Escrow Officer: Your forwarding address. Any existing mortgage information. Identify leased equipment. Homeowner Association information. Utilities (if they are to be paid out of escrow.)

Confirm with your agent that all contingencies have been satisfied. Keep your agent informed of any vacation plans or times you will be unavailable. If you plan to have your documents reviewed by an attorney, please notify your escrow officer at least 48 hours prior to signing.

Expect to sign at the escrow company one or two business days before the closing date. Expect the signing to last approximately one hour if you are the buyer and 30 minutes if you are the seller Have a valid photo ID available at your signing appointment: Driver’s License, State ID, Passport, or Green Card. If funds are required to close, be prepared to bring the monies in the form of a cashier’s check 24 hours before recording or wire transfer the same day as closing.

Closing Costs are fees and expenses, over and above the price of the property, incurred by the buyer and/or the seller in the property ownership transfer. Examples are title searches, closing services, loan fees and deed filing fees. Also called settlement costs. There are two sides (buyer and seller) to the equation when determining closing costs. Below is a simple customary closing cost list. Keep in mind these are typical, but should not be considered hard fast rules, feel free to consult your real estate agent for more detail.

One-half of the escrow fee (according to contract)

Work orders (according to contract)

Owner’s title insurance premiums

Real estate commission

Any judgments, tax liens, etc. against the seller

Any unpaid Homeowner Association dues

Home Warranty (according to contract)

Any bonds or assessments (according to contract)

Any loan fees required by buyer’s lender (according to contract)

Recording charges to clear all documents of record against seller

Payoff of all loans in seller’s name (or existing loan balance being assumed by buyer)

Interest accrued to lender being paid off, reconveyance fees and any prepayment penalties

Excise Tax (% based on county and sale price)

BUYER NORMALLY PAYS FOR:

One-half of the escrow fee (according to contract)

Lender’s title policy premiums (ALTA)

Document preparation (if applicable)

Tax pro-ration (from date of acquisition)

Recording charges for all documents in buyer’s names

Home Owner’s insurance premium for first year

Home Warranty (according to contract)

Inspection fees (according to contract): roofing, property, geological, pest, etc.

All new loan charges (except those required by lender for seller to pay)

Interim interest on new loan from date of funding to first payment date

From open to close, our team is dedicated to creating a superior client experience by providing clear communication, personalized service, and consistency with every escrow transaction.

Direct your next transaction to Ticor Title and let our resources, services, and team of specialists make your closing a success!

The Owner’s Policy as defined by Wikipedia “assures a purchaser that the title to the property is vested in that purchaser and that it is free from all defects, liens and encumbrances except those listed as exceptions in the policy or are excluded from the scope of the policy's coverage. It also covers losses and damages suffered if the title is unmarketable. The policy also provides coverage for loss if there is no right of access to the land. Although these are the basic coverages, expanded forms of residential owner's policies exist that cover additional items of loss.

The liability limit of the owner's policy is typically the purchase price paid for the property. As with other types of insurance, coverages can also be added or deleted with an endorsement. There are many forms of standard endorsements to cover a variety of common issues. The premium for the policy may be paid by the seller or buyer as the parties agree.”

The ALTA Homeowner’s policy offers what we believe to be the most comprehensive coverage available. Two items to note: In addition to the level of coverage afforded by Standard Owner’s Policy, the ALTA Homeowners policy offers Post Closing Coverage on certain items.

Specific items covered by the ALTA Homeowners policy are subject to Customer Deductibles and a Maximum Liability Amount per said covered item.

Extended coverage provides additional protection against loss due to off-record matters including, but not limited to the following:

Unrecorded liens; undisclosed easements, except underground easements; survey and boundary questions; and any lien, or right to a lien, for labor, material, services or equipment, or for contributions to employee benefit plans, or liens under Workmen’s Compensation Acts, not disclosed by the public records.

Standard coverage offers the least comprehensive form of title insurance available.

Even though the Homeowner’s policy is an excellent choice, the Realtor® should always make sure that the buyer and seller understand that there are options to choose from. If another form is desired by the buyer, it must be addressed in the purchase and sale agreement, and then it must be confirmed that the title commitment reflects the correct policy.

*The attached is information only and may not constitute an all inclusive comparison of policy types; for more information, please contact your title officer.

Undisclosed ormissing heirs

Clericalerrorsin recorded legaldocuments

Unrecorded liens

This covered risk is subject to;

This covered risk is subject to;

This covered risk is subject to; neighbor’sland.

This covered risk is subject to;

You’ve decided to purchase a home and hope to take possession as soon as possible. The terms have been agreed on and all financial arrangements have been made. But one important detail remains. Before the transaction can close, a title search must be made. The most accurate description of title is “a bundle of rights in real property.” A title search is a means of determining from the public record that the person who is selling the property really has the right to sell it, and that the buyer is getting all the rights to the property (title) that he or she is paying for. The title company determines insurability of the title as part of the search process. This leads to the issuance of a title policy, which insures the existence or non-existence of rights to the property. The title insurance company will, at its own expense, defend the title and pay losses within the coverage of the policy if they occur.

But exactly what is involved in a title search? Ticor Title Company provides the following step-by-step review.

This is simply a history of the ownership for a particular piece of property, telling who bought and sold it, and when. The information may be derived from a variety of public records or privately owned title plants. Title plants may include index cards, punch cards, tract books, microfiche or may even be computerized. They all contain essentially the same information from which the history of the title may be secured.

This is a search to determine the present status of general real estate taxes against the property. The tax search will reveal if taxes are current or whether any taxes are past due and unpaid from previous years.

A due and unpaid tax is a prior lien or claim on the property above all others. If a buyer purchases property with unpaid and past due taxes against it, he or she is likely to find a government body — the city, county or state — placing the property up for sale to pay those taxes. Title insurance protects the buyer against loss from unpaid and past due taxes.

Ticor Title Company may send inspectors to look at the property to verify the lot size, check the location of improvements, and look for evidence of easements that are not shown on the record. The purpose of this is to supplement the information learned from the title search. In the eyes of the law, any buyer of real estate is assumed to have notice of all matters properly shown in the public records for that real estate, as well as any information that an actual inspection may reveal. If the inspector detects an unrecorded easement or other evidence of outstanding rights that could affect the owner’s title and possibly the value and intended use, the company will disclose these matters before the closing of the purchase. Those matters must then either be disposed of or shown as exceptions in the title insurance policy. Sometimes when an acceptable survey and appropriate affidavits are received, an inspection will not be made.

One of the most important parts of the title search is to determine if there are any unsatisfied judgments against the seller or previous owners which were in existence while they owned the title. A judgment is a general lien against the debtor’s real estate and constitutes security for any money owed under the judgment. The real estate can be sold to satisfy the judgment. It is extremely important to be sure that a title is not subject to judgments against the seller

or previous owners. Title insurance provides this protection. A judgment against a person named Smith may affect the title of a seller named Smith, depending on whether or not they are the same person. All possible variations of the name must be examined.

Rights established by judgment decrees, unpaid federal income taxes, and mechanic’s liens all may be prior claims on the property, ahead of the buyer’s or lender’s rights. If a judgment is discovered that constitutes a defect in the title, it is pointed out. The seller must then eliminate it before the title of the new buyer can be insured free and clear of that judgment.

When these searches have been completed, the title company issues a commitment to insure, stating the conditions under which it will insure the title. The buyer, seller and mortgage lender can proceed with the closing of the transaction after clearing up any defects in the title which may have been uncovered by the search and examination.

The mortgage lender is as concerned as the buyer about the quality of the title because the property is to be security for the new mortgage loan. The mortgage lender requires assurance that it has a valid first (or another acceptable priority) mortgage lien on the property. This is not only common sense, but generally a legal requirement of regulated mortgage lenders.

The lender’s title insurance, however, does not protect the new buyer of the property. Although the land is the same, the interest of the buyer and the interest of the lender are very different. The provisions of a lender’s title insurance policy are very different from those of a buyer’s policy. The buyer should obtain his own policy, often issued simultaneously with the lender’s policy.

Escrow is an arrangement in which a disinterested third party (an escrow holder), holds legal documents and disburses funds on behalf of a buyer and seller, and distributes them according to the buyer and seller’s instructions.

People buying and selling real estate often open escrow for their protection and convenience. The buyer can instruct the escrow holder to disburse the purchase price only upon the satisfaction of certain prerequisites and conditions. The seller can instruct the escrow holder to retain possession of the deed to the buyer until the seller’s requirements, including receipt of the purchase price, are met. Both rely on the escrow holder to faithfully carry out their mutually consistent instructions relating to the transaction and to advise them if any of their instructions are not mutually consistent or cannot be carried out.

Escrow is convenient for the buyer and seller because both can move forward separately but simultaneously in providing inspections, reports, loan commitments, funds, deeds, and many other items, using the escrow holder as the central deposit point. If the instructions from all parties to escrow are clearly drafted, fully detailed and mutually consistent, the escrow holder can take many actions without further consultation. This saves time and facilitates a smooth closing of the transaction.

Deposits the executed deed to the buyer with the escrow holder.

Deposits evidence of inspections and any repair work as required, per the purchase and sale agreement.

Deposits required documents such as addresses of mortgage holders, homeowner association contacts, and lien holders.

Deposits the funds required, in addition to any borrowed funds, to pay the purchase price with the escrow holder.

Deposits funds sufficient for home and title insurance.

Approves any inspection reports, title insurance commitments, etc. called for by the purchase and sale agreement.

Fulfills any other conditions specified in the escrow instructions.

Deposits proceeds of the loan to the purchaser.

Directs the escrow holder on the conditions under which the loan funds may be used.

Act as the (neutral) impartial third party or depository of documents and funds.

Secure a title insurance policy and work to clear matters of record Process and coordinate the flow of documents

Fulfill lender requirements and keep all parties informed of progress on the escrow.

Prepare final statements for each party, which include a detailed accounting summary of prorated insurance, taxes, rents, etc.

Facilitate signing of final closing documents for all parties

Deliver executed documents to lender for review

Record deed and loan documents, (deliver the deed to the buyer)insure conveyance of title, loan documents to the lender and funds to the seller, closing the escrow.

Disburses funds for title insurance, recording fees, real estate commissions, lien clearance, etc.