HOME

Beds: 4

Baths: 4.5

YearBuilt: 2007

RoomCount:

AirConditioning: Y

ConstructionType:

Stories: 2

HeatType: WarmandCoolAirZone

ExteriorWalls: FrameStucco

Garage: 1,052SqFt-Attached

FinArea: 4,337SqFt

BuildingArea: 6,464SqFt

RoofCover: ConcreteTile Condition: Average

Size: 0.31Acres(13,682SqFt) Pool: Y

TaxExemptDescription: Land

LandUse: 1101-SINGLEFAMILY DWELLING

LandUseStd: RSFR-SingleFamilyResidence

Zoning: County-R10-Rural10

Community Plan/Name:

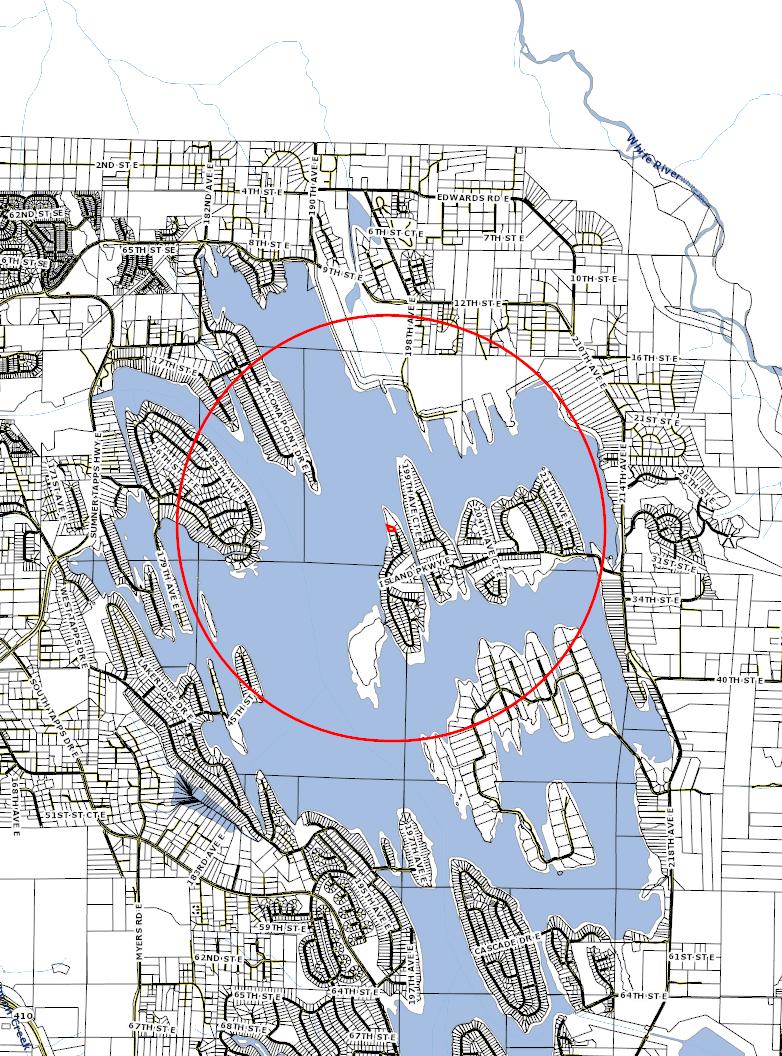

Recreation: Watershed: 1711001404-LowerWhiteRiver

SchoolDistrict: 343-Dieringer

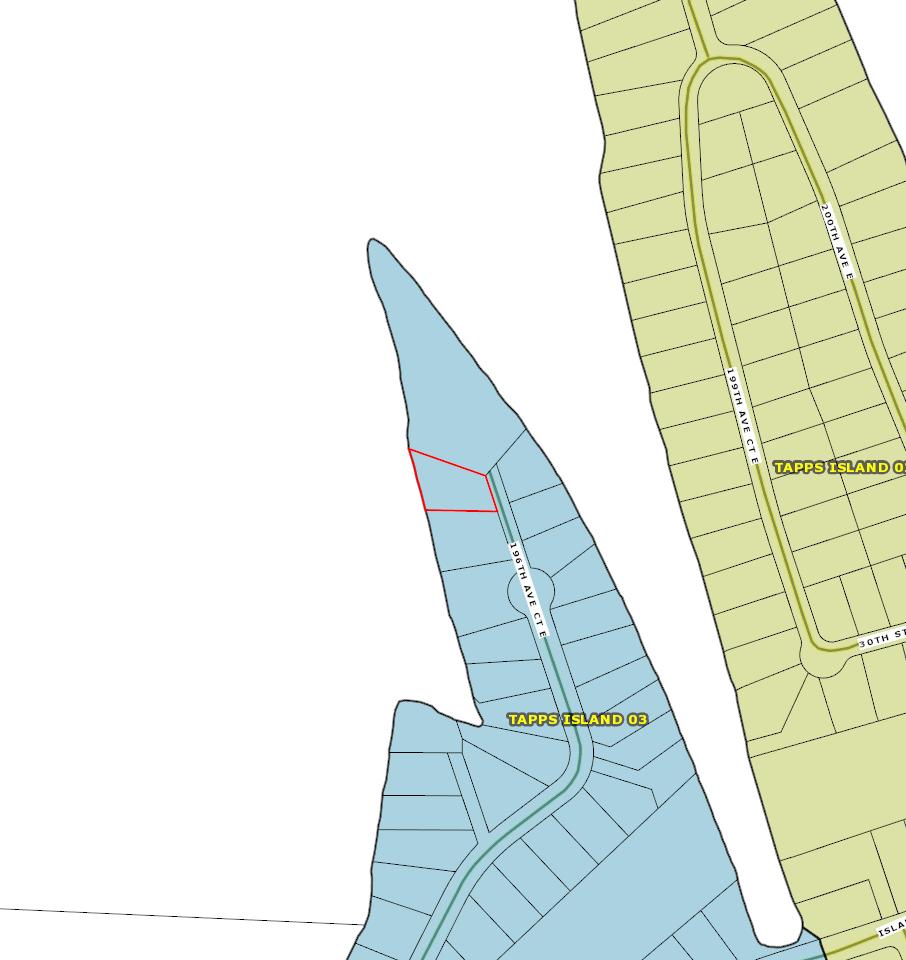

RecordType: Residential Plat/Subdivision: TappsIslandDiv#3

Twn/Range/Section: 20N/05E/09 Lot: 25

CensusTract/Block: 070307/2006 Block:

LegalDescription: Section09Township20Range05Quarter41TAPPSISLANDDIV#3L25TOG/WCOMMUNITYPROPINT EASEOFRECORDSEGP-M-1027HBJES

SentryDynamics,Inc.anditscustomersmakenorepresentations,warrantiesorconditions,expressor implied,astotheaccuracyorcompletenessofinformationcontainedinthisreport.05/22/2024

ParcelID: 8996030250

SiteAddress: 2824196thAveCtE BonneyLake,WA 98391

TaxLot: 8996030250

Owner: Sherwood,SethR Sherwood,Stacie

Owner Address: 2824196thAveCtE LakeTapps,WA 98391-9097

Owner Occupied: Yes

Waterfront: LakeTapps

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesorconditions,expressor implied,astotheaccuracyorcompletenessofinformationcontainedinthisreport 05/22/2024

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesorconditions,expressor implied,astotheaccuracyorcompletenessofinformationcontainedinthisreport 05/22/2024

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesorconditions,expressor implied,astotheaccuracyorcompletenessofinformationcontainedinthisreport 05/22/2024

TotalHouseholds:

1-Personhousehold-male:

1-Personhousehold-female:

households,married:

households,unmarried:

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesorconditions,expressor implied,astotheaccuracyorcompletenessofinformationcontainedinthisreport 05/22/2024

2

Lake Tapps is a beau ful neighborhood located in Pierce County. It is known for its stunning lake views and recrea onal opportuni es. This neighborhood offers a range of ameni es, a rac ons, and benefits that make it an appealing place to live for poten al home buyers.

One of the main ameni es of Lake Tapps is the 4,700-acre reservoir that gives the neighborhood its name. This picturesque lake provides residents with numerous opportuni es for boa ng, fishing, swimming, and other water ac vi es. The presence of the lake creates a serene atmosphere and offers breathtaking views for homeowners.

Golf enthusiasts will also find plenty to enjoy in Lake Tapps as there are nearby golf courses like the Auburn Golf Course or Whispering Firs Golf Course. These courses offer well-maintained greens and challenging fairways for players of all skill levels.

For those who love hiking or exploring nature, Lake Tapps provides access to scenic hiking trails such as the Foothills Trail or Mud Mountain Dam Recrea on Area. These trails offer stunning views of the surrounding natural beauty while providing opportuni es for exercise and outdoor adventure. Allan Yorke Park is especially popular among residents with its sandy beach area and waterfront access.

Daffodil Festival - April

County wide events

East Egg Hunt – March/April

Allan Yorke Park

Elementary Fun Run - June

Allan York Park

Summer Blast – July 4th

Tacoma Ruston Way Waterfront

Tunes at Tapps – July thru August

Allan Yorke Park

Bonney Lake Summerfest – August

Kelley Farm Field

Bonney Lake Days – August

Lake Tapps Park

Moon Festival - September

Downtown Tacoma

Tacoma Arts Month – October

Downtown Tacoma

Tacoma Film Festival – October

Grand Cinema and the Blue Mouse

Christmas Tree Lighting – November

Neighborhood specific dates

Zoolights – December

Point Defiance Zoo

Dickens Festival – Tacoma

Downtown

Tacoma Light Trail – December

Downtown Tacoma

Chihuly Bridge of Glass

Crystal Mountain Ski Area

Fort Steilacoom Park

Joint Base Lewis-McChord

Lakewold Gardens

LeMay’s Car Museum

Mt Rainier National Park

Museum of Glass

Northwest Trek Wildlife Park

Point Defiance Zoo

Ruston Way Waterfront

Tacoma Art Musuem

Tacoma Dome

Tacoma Narrows Bridge

Thornwood Castle

Union Station

W.W. Seymour Botanical Conservatory

Washington State History Museum

*Please note this page does not include all events and a rac ons in the area.

SiteAddress: 2002912ThStreetE. LakeTapps,WA98391

SiteAddress: 2172734ThStreetE. LakeTapps,WA98391

No

SiteAddress: 3914WTappsDrE BonneyLake,WA 98390

SiteAddress: 19515STappsDrE BonneyLake,WA 98390

Male/Female: 301/240

5 LakeridgeMiddleSchool

SiteAddress: 5909MyersRdE BonneyLake,WA 98391

Address: 1707MainSt Sumner,WA98390

7 SumnerMiddleSchool

Address: 1508Willow Sumner,WA98390

No

SiteAddress: 10920199ThAveCtE BonneyLake,WA 98391

Male/Female: 834/802

You’ve decided to purchase a home and hope to take possession as soon as possible. The terms have been agreed on and all financial arrangements have been made. But one important detail remains. Before the transaction can close, a title search must be made. The most accurate description of title is “a bundle of rights in real property.” A title search is a means of determining from the public record that the person who is selling the property really has the right to sell it, and that the buyer is getting all the rights to the property (title) that he or she is paying for. The title company determines insurability of the title as part of the search process. This leads to the issuance of a title policy, which insures the existence or non-existence of rights to the property. The title insurance company will, at its own expense, defend the title and pay losses within the coverage of the policy if they occur.

But exactly what is involved in a title search? Ticor Title Company provides the following step-by-step review.

This is simply a history of the ownership for a particular piece of property, telling who bought and sold it, and when. The information may be derived from a variety of public records or privately owned title plants. Title plants may include index cards, punch cards, tract books, microfiche or may even be computerized. They all contain essentially the same information from which the history of the title may be secured.

This is a search to determine the present status of general real estate taxes against the property. The tax search will reveal if taxes are current or whether any taxes are past due and unpaid from previous years.

A due and unpaid tax is a prior lien or claim on the property above all others. If a buyer purchases property with unpaid and past due taxes against it, he or she is likely to find a government body — the city, county or state — placing the property up for sale to pay those taxes. Title insurance protects the buyer against loss from unpaid and past due taxes.

Ticor Title Company may send inspectors to look at the property to verify the lot size, check the location of improvements, and look for evidence of easements that are not shown on the record. The purpose of this is to supplement the information learned from the title search. In the eyes of the law, any buyer of real estate is assumed to have notice of all matters properly shown in the public records for that real estate, as well as any information that an actual inspection may reveal. If the inspector detects an unrecorded easement or other evidence of outstanding rights that could affect the owner’s title and possibly the value and intended use, the company will disclose these matters before the closing of the purchase. Those matters must then either be disposed of or shown as exceptions in the title insurance policy. Sometimes when an acceptable survey and appropriate affidavits are received, an inspection will not be made.

One of the most important parts of the title search is to determine if there are any unsatisfied judgments against the seller or previous owners which were in existence while they owned the title. A judgment is a general lien against the debtor’s real estate and constitutes security for any money owed under the judgment. The real estate can be sold to satisfy the judgment. It is extremely important to be sure that a title is not subject to judgments against the seller

TITLE OFFICE

PH: 425.255.7472

FX: 877.521.9938

or previous owners. Title insurance provides this protection. A judgment against a person named Smith may affect the title of a seller named Smith, depending on whether or not they are the same person. All possible variations of the name must be examined.

Rights established by judgment decrees, unpaid federal income taxes, and mechanic’s liens all may be prior claims on the property, ahead of the buyer’s or lender’s rights. If a judgment is discovered that constitutes a defect in the title, it is pointed out. The seller must then eliminate it before the title of the new buyer can be insured free and clear of that judgment.

When these searches have been completed, the title company issues a commitment to insure, stating the conditions under which it will insure the title. The buyer, seller and mortgage lender can proceed with the closing of the transaction after clearing up any defects in the title which may have been uncovered by the search and examination.

The mortgage lender is as concerned as the buyer about the quality of the title because the property is to be security for the new mortgage loan. The mortgage lender requires assurance that it has a valid first (or another acceptable priority) mortgage lien on the property. This is not only common sense, but generally a legal requirement of regulated mortgage lenders.

The lender’s title insurance, however, does not protect the new buyer of the property. Although the land is the same, the interest of the buyer and the interest of the lender are very different. The provisions of a lender’s title insurance policy are very different from those of a buyer’s policy. The buyer should obtain his own policy, often issued simultaneously with the lender’s policy.

Unit1.Renton@TicorTitle.com

WEBSITES

www.myticor.com

www.ticorblog.com

Customer Service Email CS.WA@TicorTitle.com

The Owner’s Policy as defined by Wikipedia “assures a purchaser that the title to the property is vested in that purchaser and that it is free from all defects, liens and encumbrances except those listed as exceptions in the policy or are excluded from the scope of the policy's coverage. It also covers losses and damages suffered if the title is unmarketable. The policy also provides coverage for loss if there is no right of access to the land. Although these are the basic coverages, expanded forms of residential owner's policies exist that cover additional items of loss.

The liability limit of the owner's policy is typically the purchase price paid for the property. As with other types of insurance, coverages can also be added or deleted with an endorsement. There are many forms of standard endorsements to cover a variety of common issues. The premium for the policy may be paid by the seller or buyer as the parties agree.”

The ALTA Homeowner’s policy offers what we believe to be the most comprehensive coverage available. Two items to note:

• In addition to the level of coverage afforded by Standard Owner’s Policy, the ALTA Homeowners policy offers Post Closing Coverage on certain items.

• Specific items covered by the ALTA Homeowners policy are subject to Customer Deductibles and a Maximum Liability Amount per said covered item.

Extended coverage provides additional protection against loss due to off-record matters including, but not limited to the following:

Unrecorded liens; undisclosed easements, except underground easements; survey and boundary questions; and any lien, or right to a lien, for labor, material, services or equipment, or for contributions to employee benefit plans, or liens under Workmen’s Compensation Acts, not disclosed by the public records.

Standard coverage offers the least comprehensive form of title insurance available.

Even though the Homeowner’s policy is an excellent choice, the Realtor® should always make sure that the buyer and seller understand that there are options to choose from. If another form is desired by the buyer, it must be addressed in the purchase and sale agreement, and then it must be confirmed that the title commitment reflects the correct policy.

*The attached is information only and may not constitute an all inclusive comparison of policy types; for more information, please contact your title officer.

TITLE OFFICE

PH: 425.255.7472

FX: 877.521.9938

Unit1.Renton@TicorTitle.com

WEBSITES

www.myticor.com

www.ticorblog.com

Customer Service Email CS.WA@TicorTitle.com

•

•

•

You are forced to remove / remedy your existing structures (or any part of them excluding boundary walls and fences) because any portion was built without the appropriate building permit. This covered risk is subject to;

•

You are forced to remove your existing structure (s) because it (they) encroaches onto your neighbor’s land. This

risk is subject to;

•

Closing on a home can be an exciting and stressful process all at the same time. With so many potential speed bumps it’s important we make your closing flow as smooth as possible. At Ticor we believe one of the easiest ways to accomplish this is by educating buyers and sellers as they prepare for the big day. In particular we’d like to highlight some of the simple steps a buyer/seller can take to expedite the process. We call these steps the “Keys to a Successful Closing”.

• Verify with your loan officer that all conditions have been met.

• Notify your escrow officer the names of your lender and homeowner insurance companies.

• Gather the following and deliver to your Escrow Officer:

• Your forwarding address.

• Any existing mortgage information.

• Identify leased equipment.

• Homeowner Association information.

• Utilities (if they are to be paid out of escrow.)

• Confirm with your agent that all contingencies have been satisfied.

• Keep your agent informed of any vacation plans or times you will be unavailable.

• If you plan to have your documents reviewed by an attorney, please notify your escrow officer at least 48 hours prior to signing.

• Expect to sign at the escrow company one or two business days before the closing date.

• Expect the signing to last approximately one hour if you are the buyer and 30 minutes if you are the seller

• Have a valid photo ID available at your signing appointment: Driver’s License, State ID, Passport, or Green Card.

• If funds are required to close, be prepared to bring the monies in the form of a cashier’s check 24 hours before recording or wire transfer the same day as closing.

PH: 425.255.7472

FX: 877.521.9938

Unit1.Renton@TicorTitle.com

www.myticor.com

www.ticorblog.com

Snohomish County: 425.586.6964

Customer Service Email CS.WA@TicorTitle.com

Closing Costs are fees and expenses, over and above the price of the property, incurred by the buyer and/or the seller in the property ownership transfer. Examples are title searches, closing services, loan fees and deed filing fees. Also called settlement costs. There are two sides (buyer and seller) to the equation when determining closing costs. Below is a simple customary closing cost list. Keep in mind these are typical, but should not be considered hard fast rules, feel free to consult your real estate agent for more detail.

SELLER NORMALLY PAYS FOR:

• One-half of the escrow fee (according to contract)

• Work orders (according to contract)

• Owner’s title insurance premiums

• Real estate commission

• Any judgments, tax liens, etc. against the seller

• Any unpaid Homeowner Association dues

• Home Warranty (according to contract)

• Any bonds or assessments (according to contract)

• Any loan fees required by buyer’s lender (according to contract)

• Recording charges to clear all documents of record against seller

• Payoff of all loans in seller’s name (or existing loan balance being assumed by buyer)

• Interest accrued to lender being paid off, reconveyance fees and any prepayment penalties

• Excise Tax (% based on county and sale price)

BUYER NORMALLY PAYS FOR:

• One-half of the escrow fee (according to contract)

• Lender’s title policy premiums (ALTA)

• Document preparation (if applicable)

• Tax pro-ration (from date of acquisition)

• Recording charges for all documents in buyer’s names

• Home Owner’s insurance premium for first year

• Home Warranty (according to contract)

• Inspection fees (according to contract): roofing, property, geological, pest, etc.

• All new loan charges (except those required by lender for seller to pay)

• Interim interest on new loan from date of funding to first payment date

From open to close, our team is dedicated to creating a superior client experience by providing clear communication, personalized service, and consistency with every escrow transaction.

Direct your next transaction to Ticor Title and let our resources, services, and team of specialists make your closing a success!

PH: 425.255.7472

FX: 877.521.9938

Unit1.Renton@TicorTitle.com

WEBSITES

www.myticor.com

www.ticorblog.com

Customer Service Email CS.WA@TicorTitle.com