PROPERTY INFORMATION

Snohomish County Parcel Information

Parcel Information

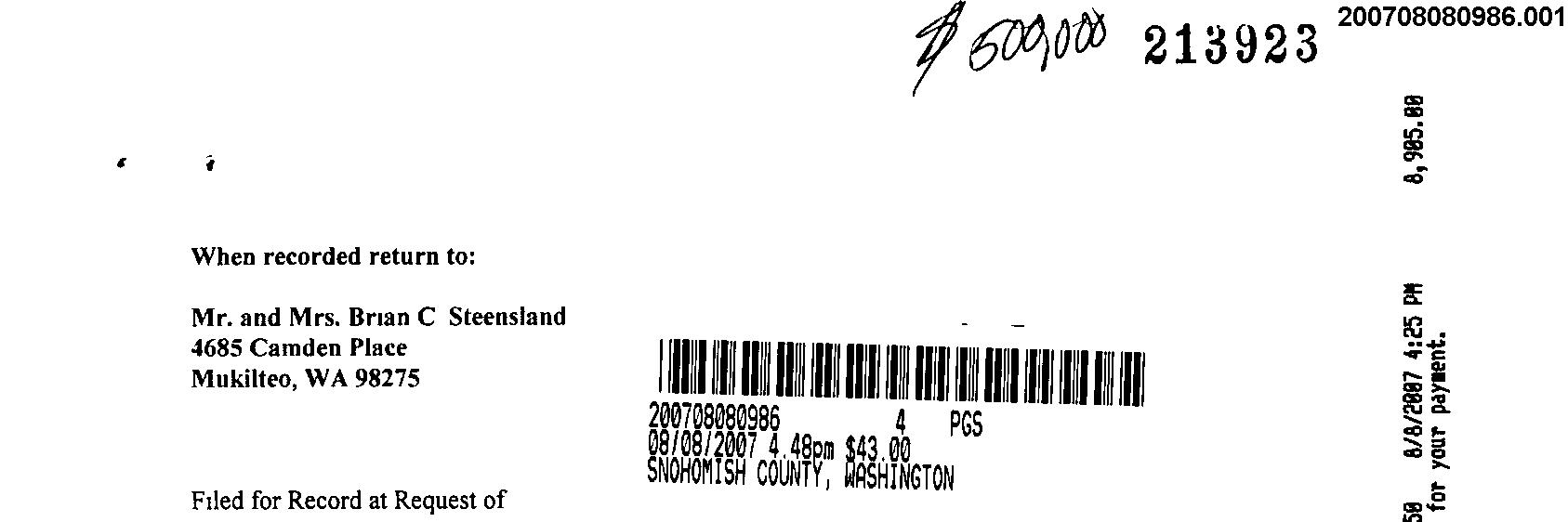

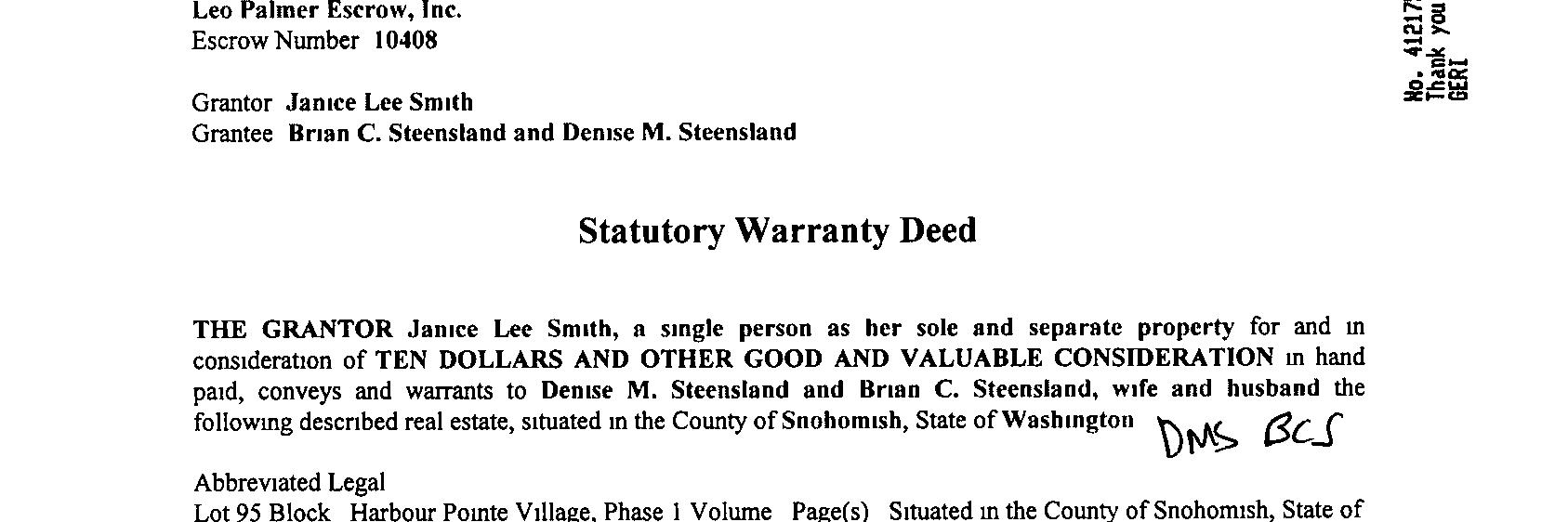

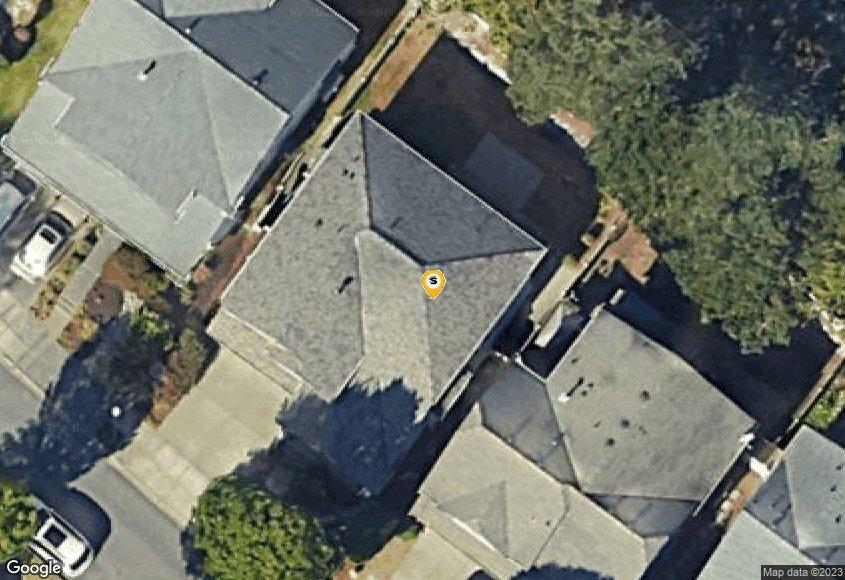

Parcel #: 00903300009500

SiteAddress: 4685 Camden Pl Mukilteo WA98275

Owner: Steensland, Brian C Steensland, Denise M 4685 Camden Pl

Mukilteo WA98275

Twn/Rng/Sec: 28N / 04E / 28 / NE

Parcel Size: 0 09Acres (3,920 SqFt)

Map Page/Grid: 435-E1

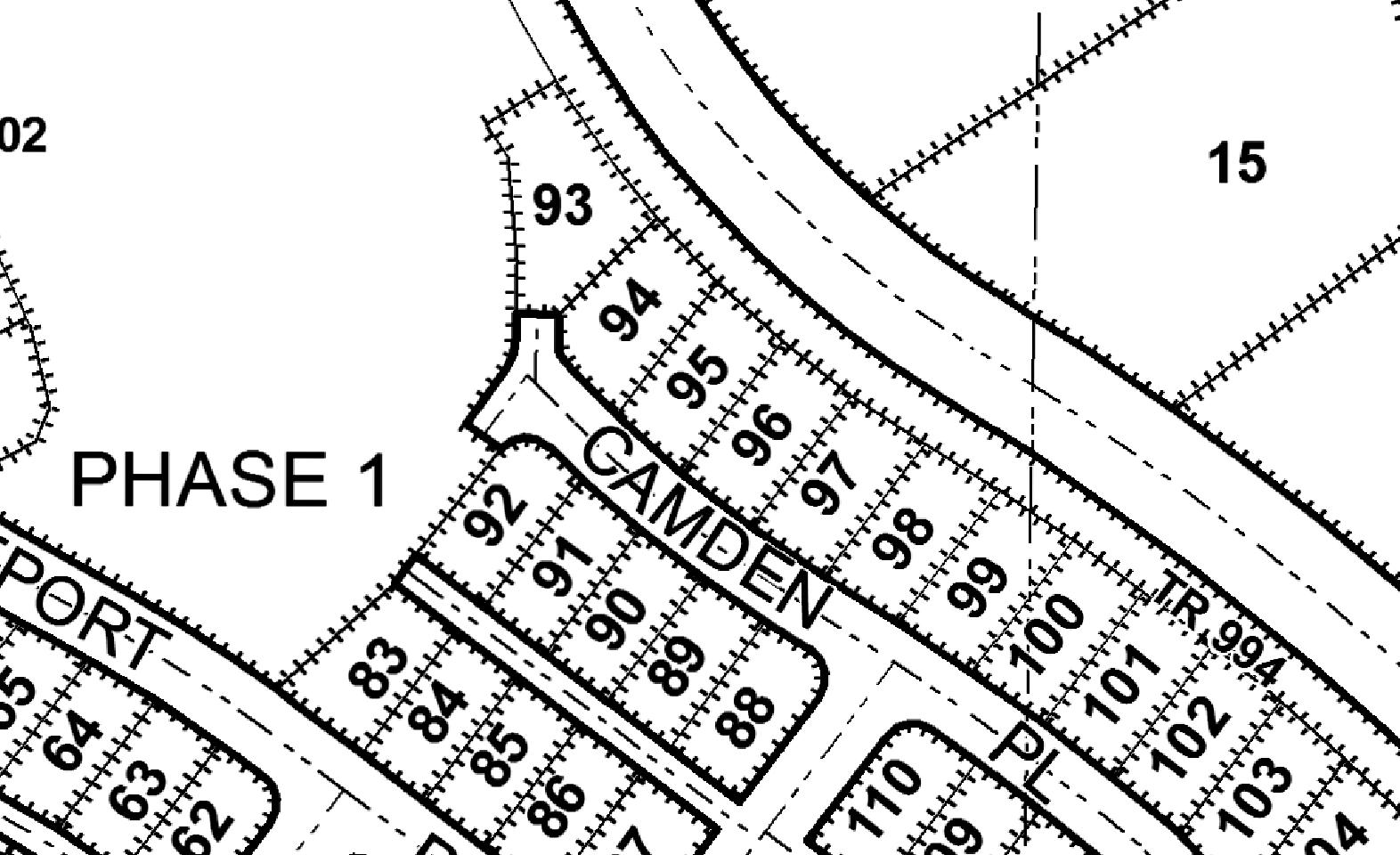

Plat/Subdivision: Harbour Pointe Village Ph 01

Plat Doc: 199912165007

Lot/Block: 95 / 0

CensusTract/Block: 042006 / 2009

Levy Rate: 7 0135

Total Land Value: $425,000 00

Total Impr Value: $366,800 00

Total Value: $791,800 00

Tax Information

Land Use: 111 - Single Family Residence

Neighborhood: 1209000

Zoning: Mukilteo-PCB (S) - CommercialMixed Use

Recreation:

Sewer: Y Watershed: 1711001902 - Lunds Gulch-Frontal Puget Sound

School District: Mukilteo Primary School: ENDEAVOUR ELEMENTARY

Middle School: HARBOUR POINTE MIDDLE SCHOOL High School: KAMIAK HIGH SCHOOL

Year Built: 2000

Stories: 2

Bathrooms: 2 5

BuildingType: 17 - 2 StyType I Building Use: 1

Bedrooms: 3

Baths Full/Half: 2 / 1

Foundation: Full Crawl A/C:

Condition: GAbove normal for age

Total Units: 1

Construction: Wood frame w/sheathing

FinishedArea: 2,073 SqFt Roof Covering: Composition Bsmt Fin/Unfin:

Exterior Walls: Siding-Lap

Roof Style: 101 Gable

Carport: Garage: 457 SqFt -Attached

Patio: Deck:

Heat: 101 Forced hot airgas

Fireplace: 1

This map/plat is being furnished as an aid in locating the herein described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted Except to the extent a policy of title insurance is expressly modi�ed by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon

This map/plat is being furnished as an aid in locating the herein described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted Except to the extent a policy of title insurance is expressly modi�ed by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon

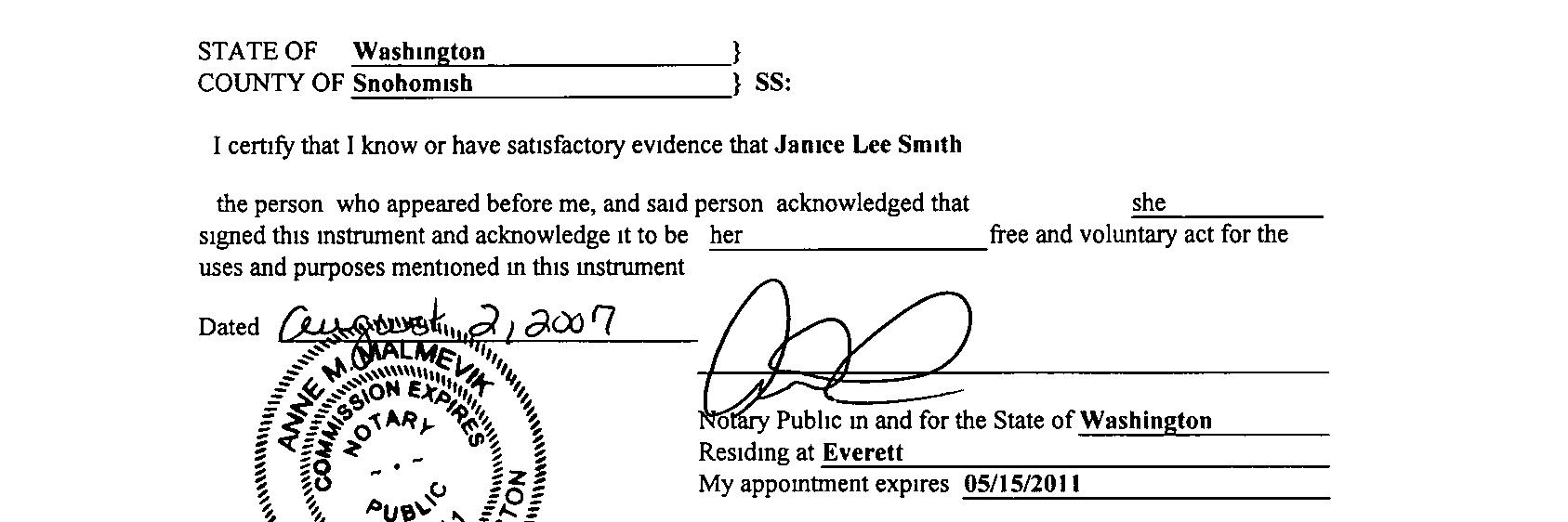

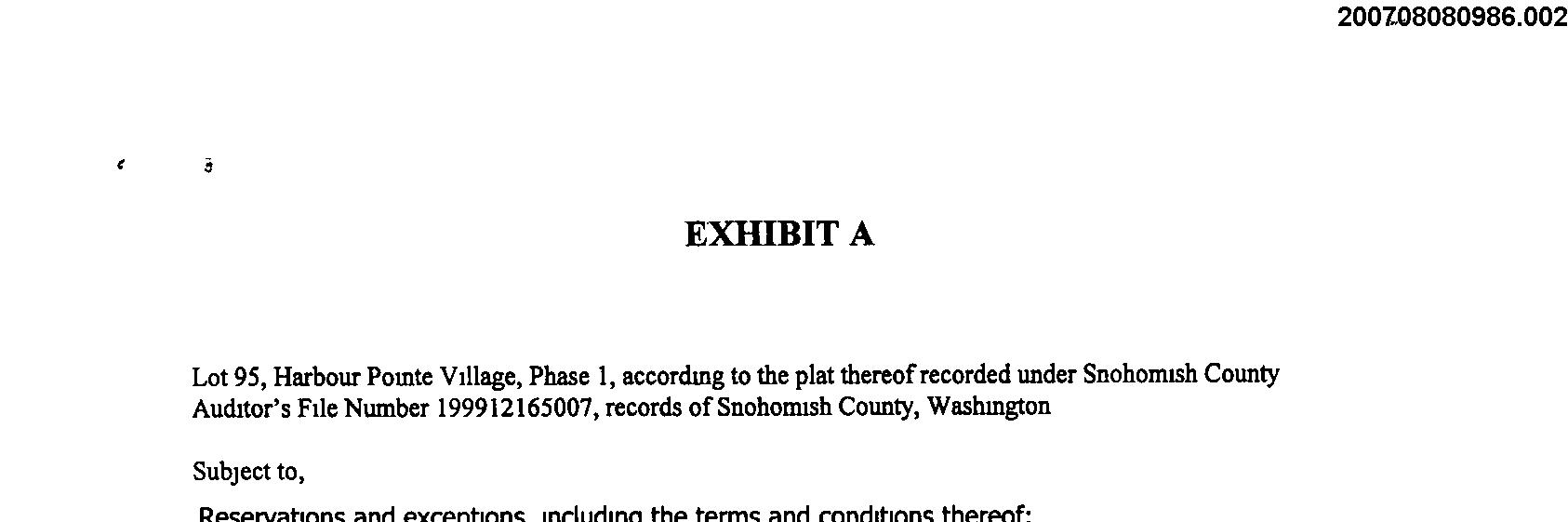

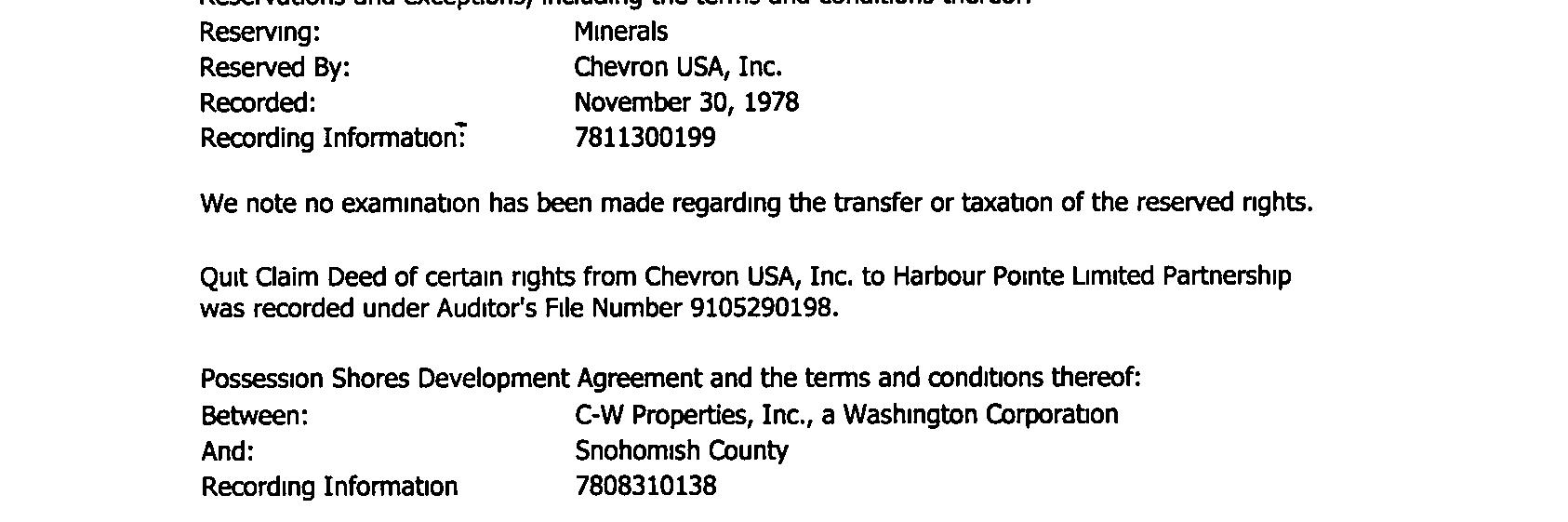

EXHIBIT A Legal Description

This legal description has been provided by Ticor Title as a courtesy only. It has not been examined for insurability or legal effect, and no liability is assumed by this company for reliance thereon. Reference should be made to the Commitment for Title Insurance issued in connection to a title order.

AREA INFORMATION

Nearby Neighbors Report

Subject Property Location

Assessor Map Report

Report Date: 06/06/2023

Property Address 4685 CAMDEN PL Order ID: R117410669

City, State & Zip MUKILTEO, WA 98275-6002

County SNOHOMISH COUNTY Parcel Number 00903300009500

Download the map in PDF

Download the map in TIFF

Disclaimer

THIS REPORT IS INTENDED FOR USE BY YOU AS AN END USER SOLELY FOR YOUR INTERNAL BUSINESS PURPOSES. YOU SHALL NOT RESELL, RELICENSE OR REDISTRIBUTE THIS REPORT, IN WHOLE OR IN PART. THE USE OF THIS REPORT BY ANY PARTY OTHER THAN YOURSELF FOR ANY PURPOSE IS STRICTLY PROHIBITED. THIS REPORT IS PROVIDED AS-IS WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING WITHOUT LIMITATION, ANY WARRANTIES OF MERCHANTABILITY, NON-INFRINGEMENT, OR FITNESS FOR A PARTICULAR PURPOSE. BLACK KNIGHT SHALL HAVE NO LIABILITY IN CONTRACT, TORT, OR OTHERWISE ARISING OUT OF OR IN CONNECTION WITH THIS REPORT. BLACK KNIGHT DOES NOT REPRESENT OR WARRANT THAT THE REPORT IS COMPLETE OR FREE FROM ERROR. YOU UNDERSTAND AND ACKNOWLEDGE THAT THE AVAILABILITY, COMPLETENESS AND FORMAT OF THE DATA ELEMENTS MAY VARY SUBSTANTIANLLY FROM AREA-TO-AREA. THE INFORMATION CONTAINED IN THIS REPORT IS DERIVED FROM PUBLICLY AVAILABLE SOURCES FOR THE SUBJECT PROPERTY OR COMPARABLE PROPERTIES LISTED ABOVE AND HAS NOT BEEN INDEPENDENT VERIFIED BY BLACK KNIGHT THROUGH ANY FORM OF INSPECTION OR REVIEW. THIS REPORT DOES NOT CONSTITUTE AN APPRAISAL OF ANY KIND AND SHOULD NOT BE USED IN LIEU OF AN INSPECTION OF A SUBJECT PROPERTY BY A LICENSED OR CERTIFIED APPRAISER. THIS REPORT CONTAINS NO REPRESENTATIONS, OPINIONS OR WARRANTIES REGARDING THE SUBJECT PROPERTY'S ACTUAL MARKETABILITY, CONDITION (STRUCTURAL OR OTHERWISE), ENVIRONMENTAL, HAZARD OR FLOOD ZONE STATUS, AND ANY REFERENCE TO ENVIRONMENTAL, HAZARD OR FLOOD ZONE STATUS IS FOR INFORMATIONAL PURPOSES ONLY AND SHALL BE INDEPENDENTLY VERIFIED BY THE END USER. THE INFORMATION CONTAINED HEREIN SHALL NOT BE UTILIZED: (A) TO REVIEW OR ESTABLISH A CONSUMER'S CREDIT AND/OR INSURANCE ELIGIBILITY OR FOR ANY OTHER PURPOSE THAT WOULD CAUSE THE REPORT TO CONSTITUTE A "CONSUMER REPORT" UNDER THE FAIR CREDIT REPORTING ACT, 15 U.S.C. § 1681 ET SEQ.; OR (B) IN CONNECTION WITH CERTIFICATION OR AUTHENTICATION OF REAL ESTATE OWNERSHIP AND/OR REAL ESTATE TRANSACTIONS. ADDITIONAL TERMS AND CONDITIONS SHALL APPLY PURSUANT TO THE APPLICABLE AGREEMENT.

Copyright

CONFIDENTIAL, PROPRIETARY AND/OR TRADE SECRET. TM SM ® TRADEMARK(S) OF BLACK KNIGHT IP HOLDING COMPANY, LLC, OR AN AFFILIATE. © 2023 BLACK KNIGHT TECHNOLOGIES, LLC. ALL RIGHTS RESERVED.

SCHOOL INFORMATION

MUKILTEO SCHOOL DISTRICT

About Public Schools

The Public School Report lists schools closest to the subject property. For a complete listing of schools in your area, please go to http://www.nces.ed.gov /globallocator.

API Index

The Academic Performance Index (API) measures academic performance and growth of schools, which includes results of the Stanford 9. The API reports a numeric scale that ranges from 200 to 1000. A school's score or position on the API indicates the level of a school's preformance.

MUKILTEO MONTESSORI SCHOOL

NORTH SOUND CHRISTIAN SCHOOL-CHRISTIAN LIFE

About Private Schools

As private schools are not subject to district boundaries, we list up to 15 of the schools closest to the subject property within a five mile radius of the subject property.

Disclaimer

THIS REPORT IS INTENDED FOR USE BY YOU AS AN END USER SOLELY FOR YOUR INTERNAL BUSINESS PURPOSES. YOU SHALL NOT RESELL, RELICENSE OR REDISTRIBUTE THIS REPORT, IN WHOLE OR IN PART. THE USE OF THIS REPORT BY ANY PARTY OTHER THAN YOURSELF FOR ANY PURPOSE IS STRICTLY PROHIBITED. THIS REPORT IS PROVIDED AS-IS WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING WITHOUT LIMITATION, ANY WARRANTIES OF MERCHANTABILITY, NON-INFRINGEMENT, OR FITNESS FOR A PARTICULAR PURPOSE. BLACK KNIGHT SHALL HAVE NO LIABILITY IN CONTRACT, TORT, OR OTHERWISE ARISING OUT OF OR IN CONNECTION WITH THIS REPORT. BLACK KNIGHT DOES NOT REPRESENT OR WARRANT THAT THE REPORT IS COMPLETE OR FREE FROM ERROR. YOU UNDERSTAND AND ACKNOWLEDGE THAT THE AVAILABILITY, COMPLETENESS AND FORMAT OF THE DATA ELEMENTS MAY VARY SUBSTANTIANLLY FROM AREA-TO-AREA. THE INFORMATION CONTAINED IN THIS REPORT IS DERIVED FROM PUBLICLY AVAILABLE SOURCES FOR THE SUBJECT PROPERTY OR COMPARABLE PROPERTIES LISTED ABOVE AND HAS NOT BEEN INDEPENDENT VERIFIED BY BLACK KNIGHT THROUGH ANY FORM OF INSPECTION OR REVIEW. THIS REPORT DOES NOT CONSTITUTE AN APPRAISAL OF ANY KIND AND SHOULD NOT BE USED IN LIEU OF AN INSPECTION OF A SUBJECT PROPERTY BY A LICENSED OR CERTIFIED APPRAISER. THIS REPORT CONTAINS NO REPRESENTATIONS, OPINIONS OR WARRANTIES REGARDING THE SUBJECT PROPERTY'S ACTUAL MARKETABILITY, CONDITION (STRUCTURAL OR OTHERWISE), ENVIRONMENTAL, HAZARD OR FLOOD ZONE STATUS, AND ANY REFERENCE TO ENVIRONMENTAL, HAZARD OR FLOOD ZONE STATUS IS FOR INFORMATIONAL PURPOSES ONLY AND SHALL BE INDEPENDENTLY VERIFIED BY THE END USER. THE INFORMATION CONTAINED HEREIN SHALL NOT BE UTILIZED: (A) TO REVIEW OR ESTABLISH A CONSUMER'S CREDIT AND/OR INSURANCE ELIGIBILITY OR FOR ANY OTHER PURPOSE THAT WOULD CAUSE THE REPORT TO CONSTITUTE A "CONSUMER REPORT" UNDER THE FAIR CREDIT REPORTING ACT, 15 U.S.C. § 1681 ET SEQ.; OR (B) IN CONNECTION WITH CERTIFICATION OR AUTHENTICATION OF REAL ESTATE OWNERSHIP AND/OR REAL ESTATE TRANSACTIONS. ADDITIONAL TERMS AND CONDITIONS SHALL APPLY PURSUANT TO THE APPLICABLE AGREEMENT.

Copyright

CONFIDENTIAL, PROPRIETARY AND/OR TRADE SECRET. TM SM ® TRADEMARK(S) OF BLACK KNIGHT IP HOLDING COMPANY, LLC, OR AN AFFILIATE. © 2023 BLACK KNIGHT TECHNOLOGIES, LLC. ALL RIGHTS RESERVED.

TITLE & ESCROW

SUCCESSFUL CLOSING

TIPS FOR A SMOOTHER ESCROW TRANSACTION

Closing on a home can be an exciting and stressful process all at the same time. With so many potential speed bumps it’s important we make your closing flow as smooth as possible. At Ticor we believe one of the easiest ways to accomplish this is by educating buyers and sellers as they prepare for the big day. In particular we’d like to highlight some of the simple steps a buyer/seller can take to expedite the process. We call these steps the “Keys to a Successful Closing”.

PRIOR TO CLOSING BUYERS

Verify with your loan officer that all conditions have been met. Notify your escrow officer the names of your lender and homeowner insurance companies.

ACTION

SELLERS

Gather the following and deliver to your Escrow Officer: Your forwarding address. Any existing mortgage information. Identify leased equipment. Homeowner Association information.

Utilities (if they are to be paid out of escrow.)

BEFORE YOUR SIGNING APPOINTMENT

BUYERS AND SELLERS

Confirm with your agent that all contingencies have been satisfied. Keep your agent informed of any vacation plans or times you will be unavailable.

If you plan to have your documents reviewed by an attorney, please notify your escrow officer at least 48 hours prior to signing.

Expect to sign at the escrow company one or two business days before the closing date. Expect the signing to last approximately one hour if you are the buyer and 30 minutes if you are the seller Have a valid photo ID available at your signing appointment: Driver’s License, State ID, Passport, or Green Card. If funds are required to close, be prepared to bring the monies in the form of a cashier’s check 24 hours before recording or wire transfer the same day as closing.

CLOSING COSTS

WHAT BUYERS & SELLERS TYPICALLY PAY FOR

Closing Costs are fees and expenses, over and above the price of the property, incurred by the buyer and/or the seller in the property ownership transfer. Examples are title searches, closing services, loan fees and deed filing fees. Also called settlement costs. There are two sides (buyer and seller) to the equation when determining closing costs. Below is a simple customary closing cost list. Keep in mind these are typical, but should not be considered hard fast rules, feel free to consult your real estate agent for more detail.

SELLER NORMALLY PAYS FOR:

One-half of the escrow fee (according to contract)

Work orders (according to contract)

Owner’s title insurance premiums

Real estate commission

Any judgments, tax liens, etc. against the seller

Any unpaid Homeowner Association dues

Home Warranty (according to contract)

Any bonds or assessments (according to contract)

Any loan fees required by buyer’s lender (according to contract)

Recording charges to clear all documents of record against seller

Payoff of all loans in seller’s name (or existing loan balance being assumed by buyer)

Interest accrued to lender being paid off, reconveyance fees and any prepayment penalties

Excise Tax (% based on county and sale price)

BETTER CLOSING EXPERIENCE...

BUYER NORMALLY PAYS FOR:

One-half of the escrow fee (according to contract)

Lender’s title policy premiums (ALTA)

Document preparation (if applicable)

Tax pro-ration (from date of acquisition)

Recording charges for all documents in buyer’s names

Home Owner’s insurance premium for first year

Home Warranty (according to contract)

Inspection fees (according to contract): roofing, property, geological, pest, etc.

All new loan charges (except those required by lender for seller to pay)

Interim interest on new loan from date of funding to first payment date

From open to close, our team is dedicated to creating a superior client experience by providing clear communication, personalized service, and consistency with every escrow transaction.

Direct your next transaction to Ticor Title and let our resources, services, and team of specialists make your closing a success!

Escrow is an arrangement in which a neutral third party (escrow agent) takes instruction from buyer and seller to process documentation and handle funds in the real estate transactions. The chart below is meant to be a general overview of the process. Individual transaction steps may vary.

ALTA POLICY COMPARISONS

The Owner’s Policy as defined by Wikipedia “assures a purchaser that the title to the property is vested in that purchaser and that it is free from all defects, liens and encumbrances except those listed as exceptions in the policy or are excluded from the scope of the policy's coverage. It also covers losses and damages suffered if the title is unmarketable. The policy also provides coverage for loss if there is no right of access to the land. Although these are the basic coverages, expanded forms of residential owner's policies exist that cover additional items of loss.

The liability limit of the owner's policy is typically the purchase price paid for the property. As with other types of insurance, coverages can also be added or deleted with an endorsement. There are many forms of standard endorsements to cover a variety of common issues. The premium for the policy may be paid by the seller or buyer as the parties agree.”

ALTA HOMEOWNER’S POLICYEXPANDED COVERAGE:

The ALTA Homeowner’s policy offers what we believe to be the most comprehensive coverage available. Two items to note: In addition to the level of coverage afforded by Standard Owner’s Policy, the ALTA Homeowners policy offers Post Closing Coverage on certain items.

Specific items covered by the ALTA Homeowners policy are subject to Customer Deductibles and a Maximum Liability Amount per said covered item.

ALTA OWNER’S POLICYEXTENDED COVERAGE:

Extended coverage provides additional protection against loss due to off-record matters including, but not limited to the following:

Unrecorded liens; undisclosed easements, except underground easements; survey and boundary questions; and any lien, or right to a lien, for labor, material, services or equipment, or for contributions to employee benefit plans, or liens under Workmen’s Compensation Acts, not disclosed by the public records.

ALTA OWNER’S POLICYSTANDARD COVERAGE:

Standard coverage offers the least comprehensive form of title insurance available.

Even though the Homeowner’s policy is an excellent choice, the Realtor® should always make sure that the buyer and seller understand that there are options to choose from. If another form is desired by the buyer, it must be addressed in the purchase and sale agreement, and then it must be confirmed that the title commitment reflects the correct policy.

Undisclosed ormissing heirs

Clericalerrorsin recorded legaldocuments

Unrecorded liens

This covered risk is subject to;

This covered risk is subject to;

This covered risk is subject to; neighbor’sland.

This covered risk is subject to;

POST CLOSING COVERAGE:

TITLE SEARCH WHAT IT MEANS FOR YOU

WHAT IS TITLE

You’ve decided to purchase a home and hope to take possession as soon as possible. The terms have been agreed on and all financial arrangements have been made. But one important detail remains. Before the transaction can close, a title search must be made. The most accurate description of title is “a bundle of rights in real property.” A title search is a means of determining from the public record that the person who is selling the property really has the right to sell it, and that the buyer is getting all the rights to the property (title) that he or she is paying for. The title company determines insurability of the title as part of the search process. This leads to the issuance of a title policy, which insures the existence or non-existence of rights to the property. The title insurance company will, at its own expense, defend the title and pay losses within the coverage of the policy if they occur.

But exactly what is involved in a title search? Ticor Title Company provides the following step-by-step review.

CHAIN OF TITLE

This is simply a history of the ownership for a particular piece of property, telling who bought and sold it, and when. The information may be derived from a variety of public records or privately owned title plants. Title plants may include index cards, punch cards, tract books, microfiche or may even be computerized. They all contain essentially the same information from which the history of the title may be secured.

TAX SEARCH

This is a search to determine the present status of general real estate taxes against the property. The tax search will reveal if taxes are current or whether any taxes are past due and unpaid from previous years.

A due and unpaid tax is a prior lien or claim on the property above all others. If a buyer purchases property with unpaid and past due taxes against it, he or she is likely to find a government body — the city, county or state — placing the property up for sale to pay those taxes. Title insurance protects the buyer against loss from unpaid and past due taxes.

REPORT ON POSSESSION

Ticor Title Company may send inspectors to look at the property to verify the lot size, check the location of improvements, and look for evidence of easements that are not shown on the record. The purpose of this is to supplement the information learned from the title search. In the eyes of the law, any buyer of real estate is assumed to have notice of all matters properly shown in the public records for that real estate, as well as any information that an actual inspection may reveal. If the inspector detects an unrecorded easement or other evidence of outstanding rights that could affect the owner’s title and possibly the value and intended use, the company will disclose these matters before the closing of the purchase. Those matters must then either be disposed of or shown as exceptions in the title insurance policy. Sometimes when an acceptable survey and appropriate affidavits are received, an inspection will not be made.

JUDGMENT AND NAME SEARCH

One of the most important parts of the title search is to determine if there are any unsatisfied judgments against the seller or previous owners which were in existence while they owned the title. A judgment is a general lien against the debtor’s real estate and constitutes security for any money owed under the judgment. The real estate can be sold to satisfy the judgment. It is extremely important to be sure that a title is not subject to judgments against the seller

or previous owners. Title insurance provides this protection. A judgment against a person named Smith may affect the title of a seller named Smith, depending on whether or not they are the same person. All possible variations of the name must be examined.

Rights established by judgment decrees, unpaid federal income taxes, and mechanic’s liens all may be prior claims on the property, ahead of the buyer’s or lender’s rights. If a judgment is discovered that constitutes a defect in the title, it is pointed out. The seller must then eliminate it before the title of the new buyer can be insured free and clear of that judgment.

COMMITMENT

When these searches have been completed, the title company issues a commitment to insure, stating the conditions under which it will insure the title. The buyer, seller and mortgage lender can proceed with the closing of the transaction after clearing up any defects in the title which may have been uncovered by the search and examination.

The mortgage lender is as concerned as the buyer about the quality of the title because the property is to be security for the new mortgage loan. The mortgage lender requires assurance that it has a valid first (or another acceptable priority) mortgage lien on the property. This is not only common sense, but generally a legal requirement of regulated mortgage lenders.

The lender’s title insurance, however, does not protect the new buyer of the property. Although the land is the same, the interest of the buyer and the interest of the lender are very different. The provisions of a lender’s title insurance policy are very different from those of a buyer’s policy. The buyer should obtain his own policy, often issued simultaneously with the lender’s policy.

WHAT IS ESCROW

AND WHAT ESCROW DOES FOR YOU

WHAT IS ESCROW AND WHY IS IT NEEDED?

Escrow is an arrangement in which a disinterested third party (an escrow holder), holds legal documents and disburses funds on behalf of a buyer and seller, and distributes them according to the buyer and seller’s instructions.

People buying and selling real estate often open escrow for their protection and convenience. The buyer can instruct the escrow holder to disburse the purchase price only upon the satisfaction of certain prerequisites and conditions. The seller can instruct the escrow holder to retain possession of the deed to the buyer until the seller’s requirements, including receipt of the purchase price, are met. Both rely on the escrow holder to faithfully carry out their mutually consistent instructions relating to the transaction and to advise them if any of their instructions are not mutually consistent or cannot be carried out.

Escrow is convenient for the buyer and seller because both can move forward separately but simultaneously in providing inspections, reports, loan commitments, funds, deeds, and many other items, using the escrow holder as the central deposit point. If the instructions from all parties to escrow are clearly drafted, fully detailed and mutually consistent, the escrow holder can take many actions without further consultation. This saves time and facilitates a smooth closing of the transaction.

WHAT EACH PARTY DOES IN THE ESCROW PROCESS THE SELLER

Deposits the executed deed to the buyer with the escrow holder.

Deposits evidence of inspections and any repair work as required, per the purchase and sale agreement.

Deposits required documents such as addresses of mortgage holders, homeowner association contacts, and lien holders. THE

BUYER

Deposits the funds required, in addition to any borrowed funds, to pay the purchase price with the escrow holder.

Deposits funds sufficient for home and title insurance. Approves any inspection reports, title insurance commitments, etc. called for by the purchase and sale agreement.

Fulfills any other conditions specified in the escrow instructions.

THE LENDER (IF APPLICABLE)

Deposits proceeds of the loan to the purchaser.

Directs the escrow holder on the conditions under which the loan funds may be used.

THE ESCROW HOLDER

Act as the (neutral) impartial third party or depository of documents and funds.

Secure a title insurance policy and work to clear matters of record

Process and coordinate the flow of documents

Fulfill lender requirements and keep all parties informed of progress on the escrow.

Prepare final statements for each party, which include a detailed accounting summary of prorated insurance, taxes, rents, etc.

Facilitate signing of final closing documents for all parties

Deliver executed documents to lender for review

Record deed and loan documents, (deliver the deed to the buyer)insure conveyance of title, loan documents to the lender and funds to the seller, closing the escrow.

Disburses funds for title insurance, recording fees, real estate commissions, lien clearance, etc.