WHY YOU SHOULD BE THINKING ABOUT SHORT-TERM RENTALS?

THElast 3 months have been a bit of a rollercoaster! The world, and people’s way of living, has taken a number of twists and turns with Ukraine and Russia going to war, global currency markets jumping up and down like a yo-yo, the death of the UK’s longestreining monarch, multiple changes in No10 Downing Street and interest rate rises. Demand for property remains and both the UK and UAE property markets continue to move, continue to rise.

Some investors are choosing to sit on the sidelines and see how the next few months progress, but if history has taught us anything, the only way you make money in property is by actually getting IN. The fundamentals remain, especially in the UK. Markets are undersupplied, there is pent-up demand and new buyers entering the market, and with the latest cuts to Stamp Duty Land Tax, it’s now more affordable for both investors and first-time buyers which is fuelling growth in the market. In addition, the pound has hit record

lows, enabling buyers holding foreign currency to make sizeable savings. This is fuelling the demand for prime properties as buyers’ budgets are now going much further.

With rising prices it’s possible that rental yields may get squeezed, so investors should remain focused on the long term. This is simply part of an economic cycle and since property should be viewed as a 10-20 year investment that will no doubt perform well, it’s still an asset class that remains popular amongst investors globally.

Dubai is a similar story, much like in Q1 and Q2, demand remains at a record high, with most days hitting over 1bn AED of transactions. The drivers here are due to the way Dubai has handled the pandemic and continues to handle it, coupled with the influx of overseas buyers from Europe and Russia who are looking to relocate to Dubai for tax (and quality of life) purposes. On top of that, Dubai is one of the few places where developers accept cryptocurrency payments toward the purchase price of

the property. So whilst Dubai is still building at a rapid pace, the influx of residents to the city is forcing prices and rentals upwards as the demand is growing more than ever before!

Looking into Q4 we suspect we will see steady growth in the UK as buyers/ investors contend with the interest rate changes, but will continue to enter the market as soon as possible fearing further interest rate rises in the future.

Dubai is showing no signs of slowing down, and with the Qatar World Cup on the horizon, many short-term rental providers and hotels in Dubai are already seeing mass bookings from

fans looking to stay in Dubai and then fly over for the matches.

One thing is for sure, sitting and waiting is not going to generate any returns, and whilst the demand remains (which it always will!), those investors entering the market will be the ones who are rewarded handsomely over the coming years.

In the short 3 months since our last magazine, the UK has experienced seismic changes, many not seen for a generation.

Whilst it has been a turbulent period for the United Kingdom with changes in leadership and volatility in the markets; the fundamentals remain, the UK property market is woefully undersupplied, with demand continuing to significantly outstrip the number of properties available.

Making wellinformed buying decisions at any time, no matter of the economic or policitcal landscape, can prove incredibly fruitful for the savvy investor.

There have been shifts in key leadership roles in the UK throughout 2022 and particularly over recent months with several changes in government.

During his brief time as Chancellor of the Exchequer Kwasi Kwarteng announced a mini-budget in September in a bid to stimulate the economy however many of the unsubstantiated changes were swiftly scrapped when they had a negative impact on the

financial markets and strength of the pound.

One of the measures that will remain was to immediately and permanently reduce Stamp Duty Land Tax to 0% on all purchases of property under the value of £250,000 – for investors, the 3% surcharge will remain, but this change does represent a welcome reduction in applicable tax when buying a property in the UK.

The North of England is clearly one of the top locations in the United Kingdom for investors for a great number of reasons.

House prices in Manchester have gone up more than any other UK city in the last 20 years, with Salford following as the city with the second largest house price growth since 2002 and Leicester closely following in third place. (Source: Plumbnation research)

Not only have northern cities and towns experienced exceptional property price growth but there has also been phenomenal economic growth across the region, adding fuel to the North’s merits as an investment prospect.

Learn more about the specifics of Northern investment locations in our dedicated area guides – click here .

Traditional buy-to-let property investment continues to be an excellent long-term strategy and should feature in any portfolio of mixed asset classes, but it is not the only type of property investment we would recommend investors consider.

The rise in the cost of living in the UK has bought affordability into sharp focus, and co-living has seen an increase in popularity. When constructed to high standards and in a suitable location, not only does this

type of property receive overwhelming demand from tenants but achieves considerable rental returns.

Those who follow us closely will have also noticed our championing of shortterm let options throughout 2022. This, often more tax efficient, type of property investment can return staggering yields and those buying in the right location that caters to not just holidaygoers but business travellers too will experience almost no void periods.

Demand for rental property has soared in past 12 months and rental values have hit record highs, with some areas experiencing a 20% rise while the total number of properties available to let has falled by 9%. Though changes have been made to help individuals obtain mortgage lending to buy a property, for many buying is not an option, adding yet more demand for rental property in the UK.

Such is the confidence in the market that developers are now once again

happy to offer rental assurances on developments. At the time of writing Thirlmere Deacon have two properties at which is is possible to buy with an 8% assured yield for the next 10 years.

As for the outlook for the remainer of 2022; the UK’s property market will continue to present opportunities to the savvy and well-informed investor.

DISCOUNTS FOR OVERSEAS INVESTORS:

British pound fell to its lowest level against the US dollar since 1985 in September 2022

Average house prices soared by 15.5% over the year to July 2022 (OFFICE FOR NATIONAL STATISTICS)

RISING RENTAL VALUES:

In August 2022 average UK rents grew by 8.5% compared to 12 months earlier (HOMELET)

TENANT DEMAND:

Up by 20% compared with last year, while the total number of available properties to rent was down by 9%. (RIGHTMOVE)

NORTHERN POWERHOUSE: House prices in Manchester have gone up more than any other UK city in the last 20 years (PLUMBNATION)

TAX CUTS: Stamp Duty Land Tax to 0% on all purchases of property under the value of £250,000: investors will still be required to pay the 3% surcharge

In 2022, the Dubai property market is proving its resilience, showing that it can withstand global challenges and continue to produce remarkable numbers. The continued high demand which has been seen most in the desirable and sought-after neighbourhoods, combined with short supply, has led to continued rising property prices across the city.

This is all supported by steps taken by the government which recognise it as a key component of overall economic growth. This has translated into the removal of red tape over the years, making property investment in Dubai more accessible and transparent, and ultimately encouraging market growth.

The third quarter of 2022 saw demand for the property continue to soar and in August alone there were over 6,000 apartment transactions in Dubai, a 37% increase in the number of sales on a month-on-month basis, according to Zoom Property Insights.

According to real estate group CBRE, the city’s total residential sales in the first half of 2022 reached 39,269 units, the highest since 2009.

Despite rising interest rates, the property market in Dubai is set to continue to flourish, as, by historical standards, rates remain low. Furthermore, the property market is not as dependent on mortgages as many other comparable urban property markets. Mortgage transactions represent just a quarter of overall home sales in Dubai.

With hundreds of property transactions taking place each day and the demand for luxury rental property continuing to grow as the population swells with new expatriates continuing to relocate to the city in vast numbers – Dubai continues to be a globally appealing place to invest in property.

WEALTHY POPULATION: Dubai saw an 18% rise in multimillionaire residents in the first 6 months of 2022 (NEW WORLD WEALTH)

PAY WITH CRYPTO: Dubai is one of the few places where developers accept cryptocurrency payments (OFFICE FOR NATIONAL STATISTICS)

RISING VOLUME OF SALES: 37% increase in the number of sales in Dubai month-on-month (ZOOM PROPERTY INSIGHTS)

Residential sales in the first half of 2022 reached 39,269 units, the highest since 2009 (CBRE)

TRANSPARENT MARKETPLACE: Dubai is the most transparent property market in the Middle East and North Africa region (JLL GLOBAL REAL ESTATE TRANSPARENCY INDEX (GRETI))

A magnificent new addition to Manchester’s skyline, Vision is a striking new landmark development in the very centre of the city.

Perfectly located in the M1 postcode area, Vision is just moments from the shops, restaurants, transport connections and business districts.

From the extraordinary building façade

to the hotel-style reception, worldclass amenities, and meticulously designed accommodation, this prestigious development exudes luxury and sophistication that truly delivers a superior quality of life to residents.

Each of the luxurious and contemporary apartments has been designed with the resident in mind, with practical layouts and quality

finishes throughout, beautifully complemented by high ceilings and expansive windows that provide spectacular views over the city and beyond.

Vision boasts an extensive range of facilities spread over 3 floors within the development including a concierge, gymnasium, yoga/spin studio, cinema, residents’ lounge, co-working spaces, coffee shop and juice bar.

Arranged over 37 floors, there is a selection of studio, 1-, 2- and 3-bedroom apartments available with prices starting from £180,000 and an expected rental yield of up to 7.5%.

Manchester is set to experience staggering price growth in the coming years with the latest forecasts from JLL predicting a 15.6% by 2026. Rental prices are also set to rise by a considerable amount over the same period, as the number of properties available to rent has fallen. Certain property types are set to see rental price growth of as much as 18.5% over the next 5 years.

• Iconic 37-storey tower in the heart of Manchester city centre

• M1 postcode, located a 1-minute walk from Deansgate

• A selection of studio, 1-,2 and 3-bed apartments

• World-class amenities –Gymnasium, yoga/spin studio, cinema, residents’ lounge, coworking spaces, coffee shop and juice bar

• Yields up to 7.5% with considerable rental price growth forecast

• Manchester property prices set to rise by 15.6% by 2026

• Experienced developers with an excellent track record

York City Apartments is a luxury boutique development just moments from the beautiful historic city centre that has been meticulously designed throughout and boasts a range of on-site facilities, offering residents a wonderful place to call home and visitors a luxury home-from-home.

Thoughtfully designed, the apartments feature open-plan living spaces filled with natural light, contemporary kitchens, modern bathrooms, quality fixtures and fittings and tall windows, to create practical, stylish, and airy residences.

The building includes a selection of facilities and amenities including a communal rooftop garden, fully

equipped gymnasium, and hotel-style lobby with a concierge.

Arranged over 5 floors there are just 65 apartments available within this luxury development. A selection of 1 to 3-bedroom properties are available, many apartments have balconies or Juliet balconies. Parking spaces are available for an additional cost.

The quality of life on offer and employment opportunity is fast making York one of the UK’s most popular cities for young professionals. Together with the quality jobs on offer, York is an incredibly attractive historic city and several national parks are within a short distance of the city.

The short-let market in York is thriving; York welcomes 8.4 million visitors every year, and there are currently just 20,000 bed spaces are currently available in the city.

York City Apartments is an expansion of an existing development that has delivered considerable success for landlords. Those who secured properties within the development directly opposite are currently achieving short-let NET yields of up to 13% with average occupancy rates via Airbnb at around 85%. This second phase of the York City Apartments boasts better facilities and a premium finish, with the projection for short-let occupancy set to be 92%.

Not only is there very high rental demand from long-term tenants, but the short-term rental market in York is also booming and with this development being one of only a handful of buildings approved for short-term rentals in the city centre, this is a one-of-a-kind investment opportunity.

• Stylish modern apartments within a luxury boutique development

• Prime location minutes from the historic city centre

• 5-star facilities including concierge, rooftop garden with city views and gymnasium

• Short-term rental approved – yields 10-13%

• Projected completion Q1 2023

• Pre-launch discount available to early investors

• Prices from £250,000

Tailored to meet the demand for rental property that offers more than just a place to live and is more communitycentric, City Co-Living in Media City will be the first of its kind in the Salford area, following considerable success at previous sites in nearby Manchester.

Being designed and constructed by the

UK’s market leading co-living expert, this new development will offer highquality self-contained apartments and carefully thought out community spaces, with a host of exclusive facilities on site. This new development is located within close proximity of the University of Salford and is also just a 10-minute

walk from the UK’s largest media and tech hub and will serve as the perfect place to live for the many young people who study and work in the area.

MediaCity and Salford Quays is home to over 250 businesses, including large and well-known brands such as Kellogg’s. Over 13,000 people work in the area.

Locally there are many waterside cafés, bars, and restaurants. And for residents studying and working in Manchester city centre, the Metrolink is right outside the front door, transporting residents into central Manchester within minutes.

• The first co-living development in Salford

• Prices starting from £219,950

• Expected rental yields from 7%

• Close to University of Salford and MediaCity

• Designed with community and sustainability in mind

BASTION POINT FROM £135,000

Just moments from Liverpool city centre and the Albert Docks World Heritage site, Bastion Point enjoys an idyllic position with culture, amenities, transport connections and of course the infamous River Mersey all on the doorstep.

Designed with tenants in mind, each of the apartments will offer the latest modern features and home comforts. The building boasts a residents’ roof garden, concierge, and bike store. With parking spaces available to purchase at an additional cost.

Liverpool offers some of the most impressive rental yields in the UK and it is expected that properties in Bastion Point will achieve a 7.5% net rental income. Not just limited to long-term tenancies, Liverpool has a thriving shortlet market that could prove to be even more rewarding for investors.

Furthermore, with robust price growth predictions across the North West region of the UK, Liverpool is predicted to see superior property price growth in the coming years: the latest house price forecasts for the North West region being

18.8% over the next 5 years.

Liverpool is a city that’s experiencing widespread regeneration with over £15billion being pumped into existing projects and those in the pipeline. The local city council is committed to the widespread regeneration plans which include the major redevelopment at Liverpool Waters which is set to significantly transform the area.

Liverpool is home to the UK’s fastest-growing city centre population, with the number of people living in the city increasing by 181% between 2002 and 2015. The population is continuing to grow at a rapid rate and the North West as a whole is expected to see its population grow by 24% over the next 5 years.

One of the Northern Powerhouse cities, Liverpool stands out from neighbouring locations due to its exceptional capital growth trajectory. The city-wide

regeneration together with the continuously growing population makes Liverpool an interesting and potentially lucrative prospect for investors.

With attainable property prices, strong predicted rental yields and exceptional potential for capital appreciation Bastion Point is an excellent opportunity for any prudent investor – just 67 units are available in the development.

Set for completion in the second half of 2023, this residential development is being constructed by a trusted and experienced developer with an excellent track record.

• New-build two-bedroom apartments

• Prices from £189,950

• Top-performing UK rental market

• Expected rental yields of over 7.5%, and over 21% on the Short-Term-Let model

• 18.8% 5-year house price growth forecast (Savills, North West region)

The latest development from award-winning developer Ellington is the stunning Beach House, positioned on the iconic Palm Jumeirah Island.

Together with breath-taking sea views, this new luxury development will enjoy its own private beach and extensive onsite facilities whilst benefitting from immediate access to the many amenities on the iconic palm itself, all within a short distance of many of Dubai’s

finest attractions and business centres. Arranged across two magnificent buildings, apartments within the development range from generously proportioned one-bedroom properties with beach views to 4-bedroom apartments that boast private pools.

Designed to perfection, each apartment will be finished to

an exceptional standard and include white marble details and top of the range Miele kitchen appliances.

Offering an oceanfront paradise, residents will enjoy world-class on-site amenities and of course, have access to the development’s private beach.

The Palm Jumeirah is one of Dubai’s most recognised locations, the tree-shaped island is well known for its first-class hotels, stunning residences, and highly regarded restaurants. An established community and one of Dubai’s most popular places to live, the area is filled with things to do from the Palm Jumeirah Boardwalk, popular for its views of the Dubai coastline to Beach clubs with spas and a thriving nightlife.

Positioned in the idyllic Dubai Hills Estate, Ellington House is an elegant 12-storey building, set in luxurious surroundings. Beautifully designed, the light and spacious apartments enjoy unhindered views from spacious balconies looking out over the Dubai Hill’s Golf Course and across the city.

Modern and minimalist yet soft and natural, this

development has been carefully considered from inception to ensure residents will enjoy the finest quality accommodation in a community built with both luxury and sustainability in mind.

A selection of 1, 2 and 3-bedroom apartments are available, each generously proportioned, and finished to exacting standards.

The extensive on-site amenities include a leisure, lounge and lap pool with a pool spa and separate children’s swimming pool. There are indoor and outdoor fitness centres, yoga areas, changing rooms and spa facilities including a steam room and sauna. The development’s clubhouse has a

game zone, dining and lounging area and a separate kid’s clubhouse with children’s outdoor play areas. The activity garden includes mini-putt and a BBQ.

The Dubai Hills Estate is a sought after location for families and professionals to reside with many local

amenities including the Dubai Hills Mall and top schools in the area. Just moments from Ellington House, The Dubai Hills Golf Course is one of the finest in the city with pristine fairways.

Ellington House is exceptionally well connected to the heart of Dubai, whilst

being a sanctuary of tranquillity, surrounded by luscious greenery. Many of the city’s finest attractions are within easy reach with Downtown Dubai just 15 minutes away.

• Located in the prestigious Dubai Hills Estate

• Luxurious and spacious apartments

• 1, 2 and 3 bedroom properties available

• Extensive amenities and facilities including swimming pool, fitness centre and clubhouse

• Freehold ownership

• Payment plans

The journey of becoming a landlord typically involves the buy-to-let route. But just as there is a multitude of property types you can own, how you can make a return on any property investment also varies. Short-term lets are no exception and offer an alternative way of generating income from a property.

For some landlords, short-term lets can

prove to be more lucrative, and in some cases far more convenient than conventional means. For others, letting a property out for a small duration of time can help reduce void periods on a property ordinarily used as a buy-to-let.

So could a short term let be the right move for you? Here’s what you need to know and consider first.

According to ResearchGate, 64% of landlords in the UK now have a holiday let as part of their portfolio.

As the name suggests, a short-term let means letting a property out temporarily for less than six months.

Typically, each letting can be for a duration of up to 31 days before it is considered a ‘long stay’. Additional restrictions may exist depending on your local authority, and of course, you will need to consult any other relevant parties, such as your mortgage provider if applicable.

In terms of the practical involvement for you as a landlord, someone will need to oversee bookings along with the checking in and out process.

Likewise, during a booking, it’s also possible to add on a cleaning or facilities charge to maintain the property.

Although when guests then leave, there is none of the expense or paperwork compared to when a typical rental contract comes to an end.

Similar to a hotel, guest turnover is also usually very swift.

You can also adjust nightly fees depending on peak times, as well as capitalising on the most popular times, you can also use the data to reduce void periods.

So why would you want to opt for a constant stream of guests with a shortterm let, rather than continual tenants with a buy-to-let?

Quite simply, short-term lets allow you to tap into the UK tourism market, which as of 2022 is estimated to be worth £1.6bn, according to Finance Monthly. From Edinburgh to Manchester, York to London, our isles have never had so much to offer those wanting to holiday closer to home. These benefits extend to the demand for temporary accommodation across the country, as The Telegraph reports that short-term rentals can bring in around 30% higher profits than long-term lets.

Plus, short-term lets have a broad appeal. While they are most favoured by the tourism industry, short-term lets can also be popular with everyone from working professionals in town for business, just as they can those renovating their property.

Short term lets also help to diversify your portfolio, whilst owning a tangible asset that experiences capital appreciation as a traditional buy-to-let would.

A yield of between 10% and 14% is considered a ‘good’ yield for short-term and holiday let properties in the UK.

In contrast, buy-to-let properties have a typical yield of between 3% and 7% depending where you buy in the UK.

Our latest opportunity in York offers investors an anticipated yield of 18% with almost 90% occupancy - this type of property is fast becoming popular over and above traditional hotel stays

for leisure and business travellers.

Elsewhere in the world, data from AllTheRooms paints an interesting picture of the short-term let market in the US. It reports short-term let yields of between 20.9% and 38.1% across the country.

As the UK staycation market continues to thrive, it will be interesting to see if yields over here follow a similar pattern.

As noted above, every local authority has different rules when it comes to the permitted duration of short-term lets. So before jumping in, it’s essential to consult the right people, to help you decide whether or not that area is a good match for your portfolio or not.

In London, residential accommodation can be used as a short-term let for up to 90 days per calendar year. The most

popular area for short-term lets across London is Hounslow, most likely due to the close proximity of Heathrow airport. Though, properties near any of the main attractions, or close to transport links are always popular too.

Outside of London, fewer restrictions apply to make cities such as Liverpool and Manchester, particularly attractive propositions.

As with any kind of property investment, research really is the key. With shortterm lets, what we know is that they are most popular with tourists followed by working professionals. So ideally, any property intended to be used as a shortterm let will have a clear target audience that caters to either or both of these markets.

It’s also wise to find out what months offer the best yield potential in that city and the local area. Consider the presence of other nearby hotels or short-term lets, and the competition this would pose for a short-term let in the area.

A local short-let management company will be able to provide guidance as to appropriate rates and will also oversee bookings and changeover of guests, cleaning and other necessities. Thirlmere Deacon strongly recommend their clients considering this route engage with local professionals.

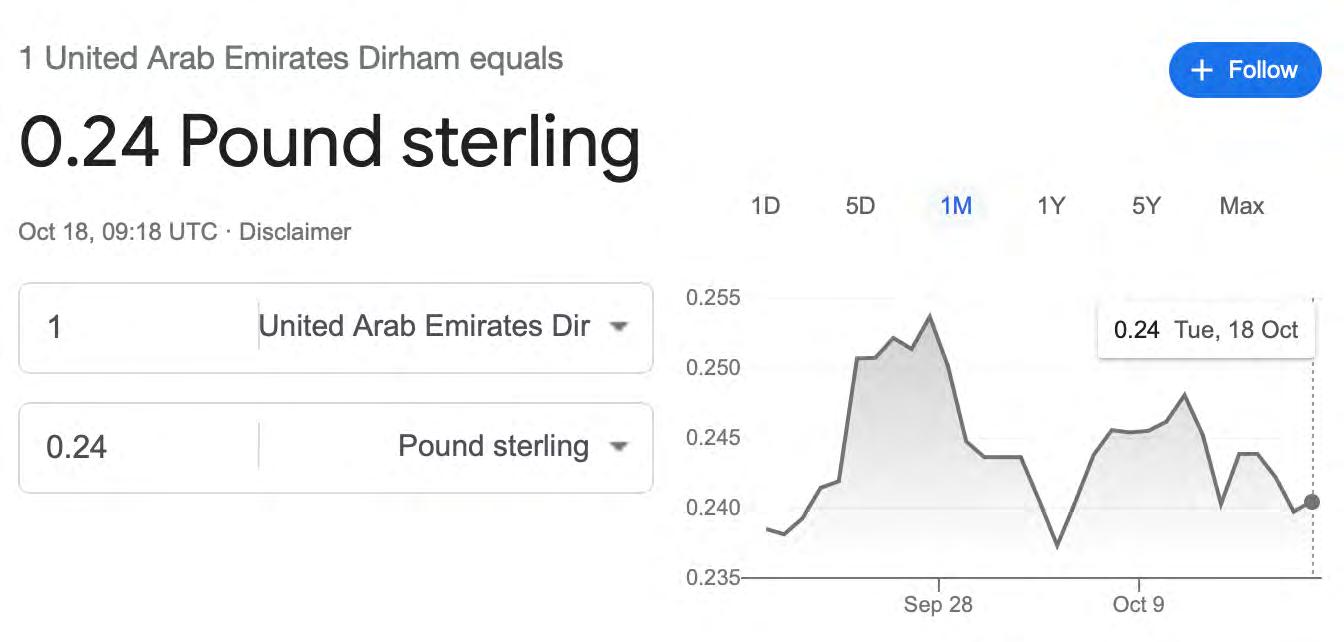

You might just be familiar with news about the UK exchange rate, with the pound (GBP) plummeting to record lows against the dollar. While it’s easy to focus on the negative headlines for those here in the UK, ultimately, falls in currency present opportunities for those who trade in alternative currencies, and the AED is no exception.

At the time of writing, 1 AED is equivalent to 0.25 GBP. For context,

available data online shows the exchange rate going as far back as 2003, and never has the exchange rate been so good for those in the UAE looking to invest in the UK.

All of which present a clear buying advantage for those overseas wanting to purchase property on our shores.

For those unfamiliar with the current state of play in the UK market, either due to being a non-resident or even an ex-pat, there are a few things we need to bring you up to speed with.

Most importantly, for a long time, there has been a property shortage in the UK. The government has a target of building 300,000 new homes each year, although experts predict 340,000 new homes per year are in fact needed to meet demand.

being resolved. This issue is not an easy fix, and will likely drag on for several years, if not decades unless drastic changes are brought into place.

What all of this means is that property prices continue to rise, both in terms of sale prices as well as rental prices.

In reality, only around 243,000 new homes are being built each year in the UK. The effects of the Covid-19 pandemic and material shortages caused by Brexit are causing further slowdowns that still show no signs of

The latest government figures suggest UK house prices increased by 12.8% in the year to May 2022. This is up from 11.9% in April 2022. In terms of rental prices, Homelet has revealed the average rent in the UK now stands at £1,143. This is up 8.5% compared with the same time last year, with a 1.4% increase compared with the previous month.

Every investor has a different vision for their portfolio, and property investments are no exception. In the UK, the buy-to-let market remains particularly strong. However, shortterm lets also offer plenty of potential due to the thriving staycation market here.

By 2025, Visit Britain predicts the UK tourism market will be responsible for 10% of its GDP, equivalent to £257 billion. Coupled with the record lows currently seen in the pound, there is a chance to capitalise on what’s to come for an already thriving market.

The standard of newbuild apartments constructed in recent times has exceeded previous living and build standards. In many ways, the change in building style is reflective of the Dubai property market, in that homes now offer a place to live, work and relax all within the same space.

For landlords, what this also means for your investment is that every fixture and fitting seeks to offer value for money. When an apartment is akin to a luxury hotel, less maintenance is required because it’s been built to last,

with the finest standard of living in mind. Higher rents are also possible, and such properties are more likely to benefit more from increased sale prices over time too.

Vision Manchester, which sits in the heart of the city centre is a notable example, with prices starting at £180,000 (710,188.60 AED) and expected yields of up to 7.5%. The apartments cater perfectly to working professionals, with everything they need to work and enjoy the city of Manchester on their doorstep.

It’s easy to talk about the plethora of benefits that the UK property market has to offer overseas investors. Or even the exquisite apartments positioned in unrivalled locations, the likes of which we’ve never seen before. But what it really comes down to is those numbers we mentioned at the start, which makes every other plus point even more attractive than it already was.

As we’ve seen with the global economic outlook over the past few years, things never stay down for long. Property remains an unshakable asset class, due to providing the basic function of a place to live, especially in the UK where the housing supply is low.

Thirlmere Deacon’s CEO Stuart Williams recently sat down with two York property experts to gain their valuable insight into the city’s short and long term rental markets.

Ashley from Head of Residential Lettings at Churchills Estate Agents who oversee the sale, let and management of a portfolio of residential properties in York, and Debbie from Welcome Lets, which is a subsidiary of Churchill’s who focus specifically on holiday lets, short-term rentals and corporate lettings in York and the Yorkshire region.

Welcome Lets was launched 4 years ago by the Managing Director of Churchills Estate Agent after he recognized that there was a need for a local holiday let management company.

The business grew from five properties to 18, and now with almost 100 on under management. Welcome Lets manage properties in York City Center, Yorkshire Coastal locations and properties in several market towns of

North Yorkshire and South Yorkshire. They offer a full service, from cleaning, to maintenance, reviews, and helping owners generate more business by creating the perfect holiday let.

Churchills Estate Agency has been running for over 30 years and over that time the luxury lettings market has grown exponentially. They currently manage about 290 units and are seeing

more and more landlords, and more new investors coming into the York rental market.

Ashley comments on the reason why York is seeing increased popularity, “we’ve had properties renting for 10, 15% higher than what they would normally do in any normal market. It’s simply demand and supply economics – there is a shortage of rental stock on

the market at the moment, which is what’s driving up rents. It’s definitely a good time to be a landlord in the York area.”

Between them Ashley and Debbie are able to share a rounded picture of the short and long-term rental markets in York.

As well as having been voted the best place to live in the UK several times, York welcomes well over 8 million visitors each year.

Debbie says “The biggest draws to the city from a guest point of view is the minster, which is a beautiful cathedral steeped in history way back to the Vikings time. The Shambles, that have retained their old cobbled streets and old shops. But it’s our universities that predominantly bring a lot of graduates who will then stay in York, and their parents come and visit. They then fall in love with York, and their relatives and friends come and visit too. And we have the York races too, that brings 30,000 people alone just on a race meeting.”

Ashley adds “The fact of the matter is that the transport links are fantastic.

So you can get to London in around two hours and there are direct trail links to Leeds and Manchester. Because of the new way of working, people are relocating from London to here. Knowing that they’d only have to be, spending one or two days in the office, they could basically branch out a little bit, save a little bit perhaps on rent. Then they would not be paying in London City. I think that contributed to, in part, of why rents started to see an uplift. But people move out and they realize actually how beautiful the city of York is and then they stay.”

To watch the full interview head over to our YouTube channel

They know a lot about investing in property, but where do they come from and what do they do when they’re not advising investors?

From favourite football teams to childhood aspirations and places they’ve called home - get to know the team here at Thirlmere Deacon.

BIRTHPLACE : London

PLACES YOU HAVE LIVED: London, Hertfordshire, Devon and outside of the UK China and Austria WHERE YOU LIVE NOW: North London

YEARS IN THE INDUSTRY: 20+

1. York, short let numbers are astonishing coupled with the lack of supply.

2. Manchester City Centre, long-term hold, the population growth and the ever-increasing demand for quality rental property suggests never-ending rentals that can be ratcheted up slightly year after year.

A wizard! Way before that kid with spectacles was popular.

Most recently TD donated to Hospices of Hope which are a wonderful charity that provides specialist hospice care across South Eastern Europe.

Yes, I’m a fan of most sports and support Liverpool Football Club avidly.

I snowboard, mountain bike, read, play the guitar (badly), and love driving and all things motorised, but above all that - I have 2 daughters and 2 sons that fill me with more joy than my personal hobbies

BIRTHPLACE : Leicester

PLACES YOU HAVE LIVED: Leicester, Birmingham, Welwyn Garden City and London WHERE YOU LIVE NOW: Dubai

YEARS IN THE INDUSTRY: My whole life!

1. Manchester - regardless of prices going up there, the rental demand is sky high. Yields might be higher elsewhere but for stability and security, it’s a no-brainer to be investing there for me. Buy then hold!

2. Leicester - I’m somewhat biased but it’s a city where not a massive amount is being built apart from PBSA, and some good opportunities for investors. I’ve done very well with my portfolio there and think other investors can still benefit from the growth occurring in the city.

WHEN YOU WERE A CHILD WHAT DID YOU WANT TO BE WHEN YOU GREW UP?

A fighter pilot...mainly because I watched Top Gun about 12 times a week!

Delivering meals to low-paid workers in Dubai every Sunday.

Leicester City FC. Lucky to have experienced some trophies in recent years ahead of an impending relegation this season.

Not so much a hobby but spending time with my wife and son who turns 2 in November. Swimming, going to the beach, and exploring new places!

BIRTHPLACE : Nottingham PLACES YOU HAVE LIVED: Nottingham, Leeds, London and Hong Kong WHERE YOU LIVE NOW: London YEARS IN THE INDUSTRY: 9

1. Manchester – I strongly believe the city has a long way to go in house price growth, as it becomes more and more popular with well-established top level businesses who are relocating their offices so their employees can benefit from everything the city has to offer. I already see Manchester as the UK’s 2nd city, and I firmly believe it will officially take the 2nd city spot from Birmingham if it continues its current trajectory. It’s an exciting location where I would like to live myself someday.

2. Liverpool – Liverpool has the opportunity to piggyback off of the success of Manchester. There are some great locations in or close to the city centre that are seeing a once in a generation transformation, offering a fantastic opportunity to take advantage of a popular city going through serious regeneration.

WHEN YOU WERE A CHILD WHAT DID YOU WANT TO BE WHEN YOU GREW UP? A Thoracic surgeon.

Over the passed year and a half I’ve found a renewed passion for my childhood football team, Nottingham Forest. I managed to watch the Championship Play-off final from Hong Kong and was ecstatic when we finally achieved promotion to the Premier League after 23 years!

After skiing for the first time 9 years ago, it’s become my absolute No.1 favourite past time and I can’t wait to hit the slopes this coming winter following a 4 year hiatus due to Covid and the travel restrictions that were in place in Hong Kong.

BIRTHPLACE : Nottingham

PLACES YOU HAVE LIVED: Sheffield, Loughborough, Plymouth, New Jersey, Dubai

WHERE YOU LIVE NOW: Dubai

YEARS IN THE INDUSTRY: 8

1.Manchester, the hottest property market in the U.K

2.JVC, Dubai a brilliant area for strong rental yields.

I like traveling as much as possible and exploring new places.

BIRTHPLACE : Islington, London PLACES YOU HAVE LIVED: London and Bristol

WHERE YOU LIVE NOW: Dubai YEARS IN THE INDUSTRY: 5

Personally, I would invest in Manchester and Liverpool. My investment decisions are always based on where I see long term growth as well as continuous demand. These cities have proven records and have all the fundamentals to see continued growth.

When I was 12, I was selected to play for England at Chess and I’ve also completed my Grade 8 piano.

BIRTHPLACE : London

PLACES YOU HAVE LIVED: London, Dubai WHERE YOU LIVE NOW: Dubai

YEARS IN THE INDUSTRY: 2

Manchester - as it is the fastest growing economy in the UK and York as it delivers exceptional short-term rental returns. MORE ABOUT STEVEN: Play pro football at Brentford academy – Won national, shooting and athletics in the ACF ( Army Cadet Force)

Active charity member for Cancer Research and passionate about educating inner city school children about finance.

Man United – UFC – Boxing

Boxing - my second fight is in the diary for early next year

BIRTHPLACE : Sidcup

PLACES YOU HAVE LIVED: London and Liverpool WHERE YOU LIVE NOW: London YEARS IN THE INDUSTRY: 7+

WHERE WOULD YOU INVEST IN PROPERTY TODAY AND WHY?

1. Liverpool - an enormous amount of regeneration which has only just begun and it’s the highest yielding city in the UK

2. Manchester - Has turned itself into a global, cosmopolitan city with some of the world’s largest corporations there and strong economic growth year on year. The draw from these prestigious companies and the retention rates from the local universities is causing the population to grow which is creating a strong supply and demand issue for investors to capitalise on.

WHEN YOU WERE A CHILD WHAT DID YOU WANT TO BE WHEN YOU GREW UP?

A professional footballer - was on track to fulfil my childhood ambition before badly injuring my knee.

WHAT’S YOUR FAVOURITE HOBBY? Playing football and attempting to play golf.

PLACES YOU HAVE LIVED: London, Manchester, USA, UAE WHERE YOU LIVE NOW: Dubai YEARS IN THE INDUSTRY: 8+

WHERE WOULD YOU INVEST IN PROPERTY TODAY AND WHY?

1. Dubai – Highest short-term rentals worldwide

2. UK – Stability in the market/Growth potential MORE ABOUT KAMRAN:

I always wanted to be an entrepreneur with several sources of income which naturally led me to property investment. I moved over to the UAE in my early twenties and after residing here now for the last 6+ years it has become one of my favorite places on earth.

PLACES YOU HAVE LIVED: Abridge

WHERE YOU LIVE NOW: Loughton

WHERE WOULD YOU INVEST IN PROPERTY TODAY AND WHY?

1.York - the development we have is just 6 months away from completion and the numbers stack up to be one of the best investment opportunities we’ve ever seen.

2.Liverpool - the current opportunity has a rental assurance for 3 years which is incredibly appealing. Liverpool is yet to realise its full potential meaning the capital growth forecasts are the most impressive available to investors.

A Policeman - like Hot Fuzz

I raised over £1,000 for a charity called Young Minds, running 1mile every hour for 24 hours.

Rugby is my sport and I support Saracens WHAT’S YOUR FAVOURITE HOBBY?

Playing rugby

BIRTHPLACE : Frankfurt, Germany

PLACES YOU HAVE LIVED: Germany, UK, South Africa, Ireland WHERE YOU LIVE NOW: Ireland

YEARS IN THE INDUSTRY: 3+

WHERE WOULD YOU INVEST IN PROPERTY TODAY AND WHY?

Definitely locations in the north of the UK. Manchester and Liverpool deliver excellent ROI’s for our clients.

WHEN YOU WERE A CHILD WHAT DID YOU WANT TO BE WHEN YOU GREW UP? A Vet

I enjoy watching rugby, I used to do boxing for a few years and when I was younger I trained with the South Africa trampolining squad.

info@thirlmeredeacon.com

+ 44 (0) 2039507939

Lansdowne House, Berkeley Square, Mayfair, London, W1J 6ER

dubai@thirlmeredeacon.com

+971 (0) 4 818 7277

Floor 30, Oberoi Business Centre, Business Bay, Dubai, United Arab Emirates