Vol.42, No.18

www.thewarrengroup.com

W E E K O F M O N D A Y, M A Y 4 , 2 0 2 0

THE REGISTRY REVIEW NEW HAMPSHIRE’S STATEWIDE REAL ESTATE & FINANCIAL NEWSPAPER A Publication of The Warren Group

WEEKLY SALES OF NOTE

LINGERING EFFECTS

Dover 851 CENTRAL AVE . . . . . . . . . . . . . . . . . . . . . . . . . . $16,200,000 B: Essential Properties LLC S: 851 Central Avenue LLC

Rye

Shutdown Could Drag on Mortgage Market for Extended Period

17 WENTWORTH RD. . . . . . . . . . . . . . . . . . . . . . . . . . $3,685,000 B: Gary Culliss & Shauna Fitzgibbons S: Bank New York Mellon Tr

Federal Reserve Research: Half of Homeowners at Risk of Layoff

Meredith

BY DIANE MCLAUGHLIN

47 ADVENT COVE RD . . . . . . . . . . . . . . . . . . . . . . . . . $3,500,000 B: Debra J Kullman Tr, Tr for Debra J Kullman T S: John P Stabile 2nd & Virginia D Stabile

Rollinsford 131 GREENVIEW DR. . . . . . . . . . . . . . . . . . . . . . . . . . $3,025,000 B: Safety Kleen Systems Inc S: Green View Technologies Inc Use: Commercial Building, Lot: 691733sf

Meredith 144 VEASEY SHORE RD . . . . . . . . . . . . . . . . . . . . . . . $1,850,000 B: Jonathan M Grimm & Amy C Grimm S: Daniel W Fitzgerald & Constance J Fitzgerald

Dover 62 WATERLOO CIR . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,575,000 B: Thomas W Jacobs & Deanna M Raineri S: Joan Vanlandingham Tr, Tr for Joan Vanlandingham RET Mtg: Bank of America NA $1,275,000 Use: 3 Bdrm Cape Cod, Lot: 176854sf

Lincoln 3 HEMLOCK DRIVE. . . . . . . . . . . . . . . . . . . . . . . . . . . $1,525,000 B: M A StPierre-Marino S: Jonathan H Harris & Elizabeth A Harris

Portsmouth 34 SALTER ST. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,350,000 B: Joseph S Schuster Jr & Donna M Schuster S: Arthur M Anker Tr, Tr for A&M Anker FT Mtg: St Marys Bank $999,000 Use: 3 Bdrm Salt Box, Lot: 4525sf

Moultonboro 48 FRYE RD. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,310,000 B: Peter R Bixby & Frieda W Yueh S: Lynne Burton Tr, Tr for Arnold FT Mtg: Bank of New Hampshire $600,000 Use: 1 Bdrm Contemporary, Lot: 65340sf

Hollis 15 RICHARDSON RD. . . . . . . . . . . . . . . . . . . . . . . . . . $1,125,000 B: Jonathan K Weedon & C A Contraras-Weedon S: Arthur P Napolitano Jr & Jennifer Napolitano Mtg: Inst Svgs Newburyport $900,000 Use: 6 Bdrm Colonial, Lot: 143748sf

REGISTRY REVIEW STAFF

A

s suddenly as the economy shut down in March and unemployment levels spiked, any recovery will likely occur in phases, experts say. And with the possibility of high unemployment continuing, the mortgage industry could see effects from the coronavirus pandemic lasting a year or longer. While parts of the United States have started taking steps to reopen the economy, Massachusetts is considered to still be in the surge phase of the virus. Gov. Charlie Baker joined a consortium of Northeast states to develop plans for allowing businesses to reopen. But in a press conference April 21, Baker said his current focus was on stopping the spread of COVID-19, adding that he would work with government officials and business leaders on a safe approach to reopening the economy. “The goal going forward, here, is going to be to establish prerequisites for when we believe it is safe and appropriate to open the doors, and then make rules and regulations and requirements and capacity to monitor around how businesses in Massachusetts can operate safely,” Baker said. The sudden spike in unemployment has already – and not unexpectedly – affected

REAL ESTATE RECORDS

500

3 Belknap �������������������������� 04/21/20 4 Carroll ���������������������������� 04/21/20 4 Cheshire ������������������������ 04/21/20 4 Coos �������������������������������� 04/21/20 4 Grafton ���������������������������� 04/21/20 5 Hillsborough ������������������ 04/21/20 7 Merrimack ���������������������� 04/21/20 7 Rockingham ������������������ 04/21/20 9 Strafford ������������������������ 04/21/20 9 Sullivan �������������������������� 04/21/20 10 Bankruptcies 10 Lien & Attachments 10 Foreclosure, Mortgagee & Other Lien Auctions 10 Requests for Bids & Proposals

400 300 300 200 200

Mar. Apr. Apr. May May June June July July Aug. Aug. Sept. Sept. Oct. Oct. Nov. Nov. Dec. Dec. Jan Jan. Feb. Feb. Mar. Mar. Mar. ’19

’20

Number 400 of Sales 400 325 325 250 250

175 175 100 100

Mar. Mar. ’15

Mar. Mar. ‘16

Mar. Mar. ’17

Mar. Mar. ’18

Mar. Mar. ’19

Mar. Mar. ‘20

Continued on Page 12

TO OUR CUSTOMERS

T

700 700 600

TRANSACTIONS THRU

New Hampshire homeowners have mortgages, and 48 percent of homeowners live in a household with at least one person working in an occupation at risk for a layoff during the coronavirus pandemic. Among Granite State renters, 97 percent have a cash rental payment due each month, with 44 percent of rental households having at least one member and 29 percent having all members working in a job that is at risk of being laid off.

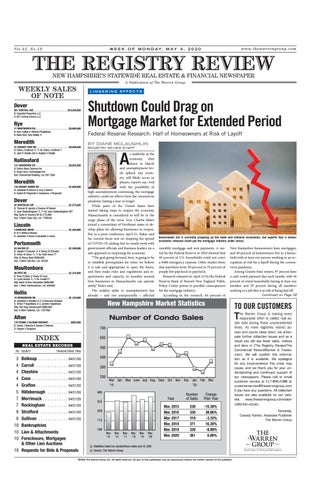

Number of Condo Sales

INDEX PG COUNTY

monthly mortgage and rent payments. A survey by the Federal Reserve in 2018 showed that 40 percent of U.S. households could not cover a $400 emergency expense. Other studies show that anywhere from 50 percent to 78 percent of people live paycheck to paycheck. Research released on April 22 by the Federal Reserve Bank of Boson’s New England Public Policy Center points to possible consequences for the mortgage industry. According to the research, 64 percent of

New Hampshire Market Statistics

Alton 170 FRANK C GILMAN HIGHWAY. . . . . . . . . . . . . . . . . . $985,000 B: Daniel J Roberts & Sandra E Roberts S: Virginia V Bergeron

Government aid is currently propping up the state and national economies, but experts fear a slower economic rebound could put the mortgage industry under stress.

Year

Number of Sales

Change Prior Year

Mar. 2015 Mar. 2016 Mar. 2017 Mar. 2018 Mar. 2019 Mar. 2020

238 330 319 371 338 361

-15.30% 38.66% -3.33% 16.30% -8.89% 6.80%

q Statistics based on condominium sales over $1,000 q Source: The Warren Group

©2020 The Warren Group Inc. All rights reserved. No part of this publication may be reproduced without the written consent of the publisher.

he Warren Group is making every reasonable effort to collect real estate data during these unprecedented times. As more registries restrict access and courts close down, we anticipate further collection issues and as a result you will see fewer sales, notices and liens in [The Registry Review/The Commercial Record/Banker & Tradesman]. We will publish this information as it is available. We apologize for any inconvenience this crisis may cause, and we thank you for your understanding and continued support of our newspapers. Please call or email customer service at 617-896-5388 or customerservice@thewarrengroup.com if you have any questions. All collection issues are also available on our website, www.thewarrengroup.com/datacollection-issues. Sincerely, Cassidy Norton, Associate Publisher The Warren Group