LEARN I ENGAGE I INVEST

➡ Introduction P5

➡ Insights from the audience P6-7

➡ Targeting Net Zero: Sustainable Real Assets P8-11

➡ Guest View : Mercer P12-13

➡ Aviva Investors: Avoid, Reduce, Remove, Align P14-15

➡ Guest View NatWest Cushon P16-17

➡ The Decumulation Dilemma P18-21

➡ Berenberg : The role of Protected Equities in Decumulation P22-23

➡ Guest View LCP P24-25

➡ In conversation Esther Hawley of Standard Life P26-27

➡ Mobius Life: 3 recommendations to improve member outcomes P28-29

➡ How DC can tackle the climate crisis P30-33

➡ Octopus Energy Generation How DC capital can tackle the climate crisis P34-35

➡ Guest View Barnett Waddingham P36-37

➡ Guest View Quietroom P38-39

It’s becoming ever clearer to us :

DC in the UK’s time has gone from “coming” to “come” !

As DC becomes the UK’s predominant form of pension investment, asset pools are ballooning, innovation is improving and the Government’s beady eye has been drawn to encourage use of these assets to deliver for the UK.

In our 3rd annual DC Virtual Panel Series we explored some of the key issues and opportunities facing DC asset owners and advisors Over 3 rich events we explored:

Our magazine brings together short summaries of the key findings together with inciteful and diverse points of view from the Panel participants

The use of private markets investments, the diversity of asset types, operational plumbing and structuring developments,

The dual benefits of holding sustainable real assets and energy transition assets for return and climate impact

The Decumulation Dilemma: As members age, this thorny subject is drawing more attention, and there was much to talk about from investment solutions, to member understanding and operational arrangements

Links to the event recordings are embedded for your watch on demand viewing pleasure.

We hope you enjoy it.

Let us know what you think !

In the first event of the series we discussed the role private markets and real assets can play in DC defaults The audience were quizzed about the desired target allocation to private markets in the portfolio and the challenges of targeting Net Zero Here’s what they told us!

Which are the biggest challenges on your (or your clients') minds when considering Net Zero aspirations ?

The Decumulation Dilemma

The Second event in the series looked at the thorny topic of Decumulation We wanted to know what the audience saw as the biggest challenges We also asked for their input on the asset classes with a key role to play in the decumulation portfolio Their answers were:

How DC can tackle the Climate Crisis

We wrapped up the series exploring how renewables and energy transition assets can deliver return and climate impact We asked the audience what the key reasons to consider these investments in portfolios

Which 'risk on' asset classes and solutions are best suited to decumulation? (Pick 2 options)

From a DC perspective, what are the 2 key reasons for investing in renewables and energy transition assets? To engage and interest members in their pensions

What are the biggest challenges the industry faces in the Decumulation Dilemma?

As DC pools grow, private market and real assets investments are gaining traction, driven by their potential to deliver illiquidity premia, diversification, and alignment with net zero and broader sustainability goals However, significant hurdles remain:

The ongoing debate over value versus cost in a fiercely competitive DC market is far from resolved. Governance, regulatory demands, data quality, and reporting also present persistent challenges. Despite these obstacles, the panel agreed that the opportunities private markets offer make the effort worthwhile, providing the potential to deliver meaningful outcomes for members ➡ Watch the round table recording

Private markets are gaining traction in DC offering opportunities for diversification and returns, but challenges remain around costs, governance, and liquidity. Multi-asset solutions are often favoured as a first step.

2.

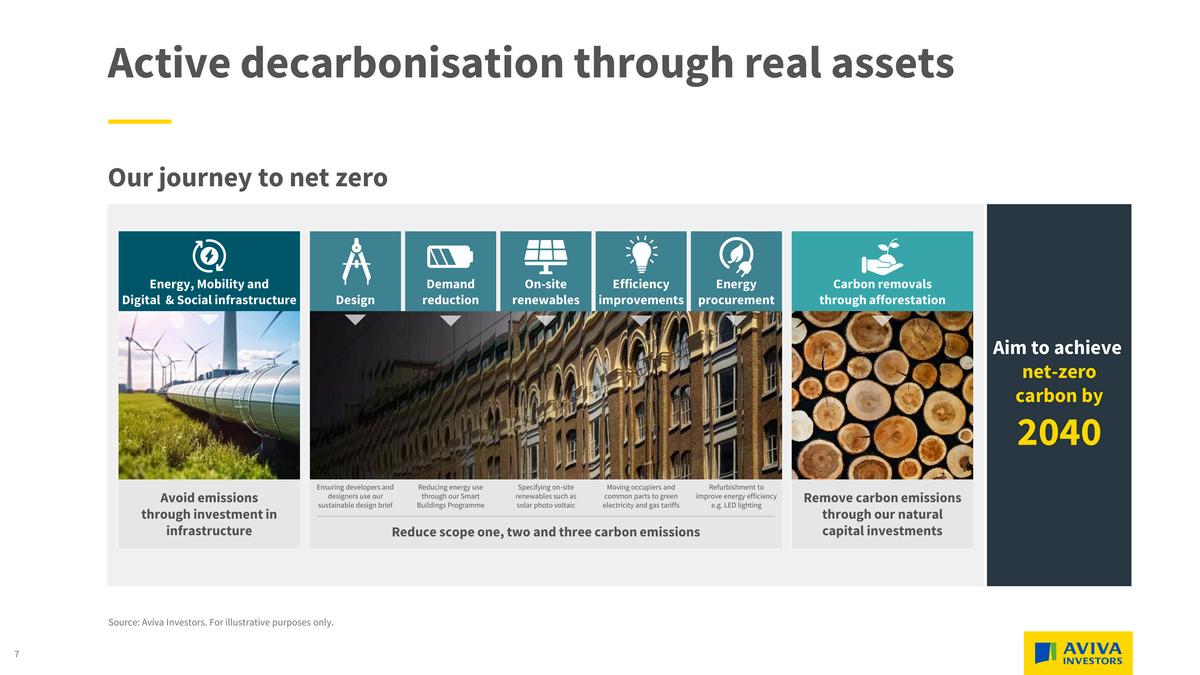

Aviva Investors set out how a multireal asset strategy can balance dual objectives: delivering attractive financial returns while achieving net zero by 2040 through investment in infrastructure, real estate, and forestry.

Carbon credits have seen industry scepticism, but the devil is in the detail. High integrity removal credits play a key role in Aviva’s LTAF and can help on the journey to Net Zero

Private Markets in DC: An evolving landscape

Private markets offer significant promise for Defined Contribution (DC) schemes, but adoption remains a complex challenge Tess Page, UK Wealth Leader at Mercer placed DC schemes into three camps on their private markets journey: those abstaining from private markets due to complexity and liquidity concerns, those who have made meaningful allocations, and a cautious middle ground waiting to see how the market develops.

Liquidity and illiquidity mismatches were flagged as barriers, particularly for schemes considering future transitions to master trusts. Smaller schemes face additional hurdles due to limited resources and platform availability

Joshun Sandhu, Director at Mobius Life emphasised that while Long Term Asset Funds (LTAFs) are a

Luke Layfield Head of Portfolio Management,Private Markets, Aviva Investors

Zoe Austin Portfolio Manager, Aviva Investors

Mark Barnett Head of Investment, NatWest Cushon

Tess Page

UK Wealth Strategy Leader, Mercer

Joshun Sandhu

Director, Asset Manager Solutions Mobius Life

promising structure, they are not the only option. “LTAFs have gained attention and were a useful starting structure to get assets moving, but they are just one approach,” he noted

“We’ve also seen success with alternatives like investment trusts, LP/GP structures and bespoke solutions tailored to a scheme’s needs.”

Early adopters typically favoured multi-asset solutions due to their diversification and ease of integration into default funds. As sophistication and confidence develops and asset sizes grow, a variety of structures alongside LTAFs are likely to be the way forward, as are the diversity of asset classes Schemes invest in

Mark Barnett, Investment Strategy leader at NatWest Cushon shared his experience integrating private markets with ambitious decarbonisation targets

“Private real assets, particularly sustainability focused ones, allow us to decarbonise portfolios while engaging members with tangible stories about their investments,” he explained NatWest Cushon has allocated 13% of its portfolio to private markets, and aims to increase this to 15%.

Cost also emerged as a key issue. “Master trusts face fierce competition,” Mark added. “Decisions often hinge on a few basis points, making the incorporation of higher-cost strategies challenging.” Tess echoed this concern, suggesting a cultural shift towards assessing value rather than cost as the key decision driver for DC schemes

Aviva Investors are advocates for private markets investments They’ve already launched two LTAFs focusing on real estate and climate real assets with private credit and venture capital in the works.

Dual Targets are a win, win for members, but should return be sacrificed?

Developing the panel’s theme of investing in real assets while advancing net zero aspirations, Aviva Investors’ portfolio managers Luke Layfield and Zoe Austin outlined the approach of the Climate Transition Real Assets LTAF

The LTAF has two equally weighted targets, Zoe explained, “The climate transition fund has two objectives, and they are both equally important. The first is to deliver a financial return, of 8% net of fees, by investing in a way that’s aligned with the climate transition. And secondly, we have an explicit target for the fund to be net zero by 2040.”

A key challenge was whether achieving net zero by 2040 should result in compromising returns

Forestry plays a vital role in the portfolio by generating highintegrity removal carbon credits Luke noted: “If you don’t want to be net zero, you don’t have to retire credits, and you would get a higher financial return. But if you feel that you want to be or think you may have to be net zero by 2040, then this is the most cost-effective way to do that.”

By leveraging a multi-asset approach that includes renewable infrastructure, energy-efficient real estate, and forestry, the fund aligns financial and environmental goals Luke emphasised the importance of this strategy: “Different types of real assets play different roles, giving us the flexibility to achieve our dual objectives.”

Avoid, Reduce, Remove: A Framework for return and decarbonisation

At the core of the LTAF’s strategy is a structured framework to address carbon emissions across three pillars: avoiding, reducing, and removing emissions

Avoiding Carbon Emissions:

Infrastructure investments in renewables and associated climate transition assets are key. Aviva’s £30 million investment in Connected Kerb, the UK’s fastest-growing EV charging operator, illustrates this. Luke explained, “Every billion we invest into these green technologies, we expect to avoid around 4 million tons

“Different types of real assets play different roles, giving us the flexibility to achieve our dual objectives.”

of carbon by our 2040 target, and that’s equivalent to 3 million flights around the world ”

Connected Kerb focuses on underserved segments, such as renters and flat residents, creating accessible EV charging solutions.

Real estate investments target the decarbonisation of buildings, which account for about 40% of global emissions. Curtain House in Shoreditch, a Victorian warehouse undergoing extensive refurbishment, exemplifies this approach Zoe detailed the transformation: “We’re going to take what is a drafty old Victorian warehouse from an energy performance certificate rating of E all the way to a best-in-class A.” Measures include retrofitting insulation, replacing gas heating with electric systems, and adding solar panels

Nature-based solutions, including forestry and peatland restoration, are essential to offset unavoidable emissions

Glen Dye Moor, a 6,300-hectare site in Scotland, will see 5 million trees planted alongside significant peatland restoration.

Zoe elaborated, “When the timber is eventually harvested, we’ll be able to sell it for carbon sink purposes, for example, construction and furniture making, rather than being burned or for biomass.”

Can we trust the integrity of carbon credits?

The quality of carbon credits has drawn significant attention and scrutiny in the industry and beyond.

Zoe emphasised Aviva’s focus on removal credits, which are generated through nature based projects such as forestry and peatland restoration. She explained the importance of ensuring credits are additional and credible, citing Aviva’s use of the Woodland and Peatland Carbon Codes as highintegrity frameworks

Unlike avoidance credits, which aim to prevent emissions but have faced criticism over additionality, removal credits physically extract carbon from the atmosphere, ensuring measurable progress towards net zero goals.

As master trusts reach scale, the sector is ripe for transformation. Where could we see innovation in 2025?

Importantnotices:Thisdoesnotconstituteanofferorasolicitationofanoffertobuyorsellsecurities, commoditiesand/oranyotherfinancialinstrumentsorproductsorconstituteasolicitationonbehalfofanyof theinvestmentmanagers,theiraffiliates,productsorstrategiesthatMercermayevaluateorrecommend For theavoidanceofdoubt,thispaperisnotformalinvestmentadvicetoallowanypartytotransact Additional advicewillberequiredinadvanceofenteringintoanycontract

TheopinionsexpressedhereinaretheintellectualpropertyofMercerandaresubjecttochangewithoutnotice

With 26 million members and £122 billion in assets under management, master trusts are among the heavyweights of the defined contribution (DC) world. As they grow, so does the opportunity –and the responsibility – to innovate, particularly with investment solutions that enhance member outcomes while supporting their long-term needs

Looking to 2025, there are four key areas where innovation is set to blossom

DC master trusts currently have limited exposure to private markets, but this could soon change, especially for members in the growth phase.

“Private assets have long investment horizons, which can transform members’ outcomes over the decades,” says Ben Lewis, Head of Investment Proposition at Mercer

“Master trusts won’t make enormous allocations straight off the bat, but we’ll likely hear more about plans in the next year, and it’ll be interesting to see which asset classes are selected for initial allocations ”

The primary challenge in this space is that of manager selection, as the disparity between the best and worst-performing private assets is stark.

“Picking the wrong fund managers can have a huge impact on returns,” says Lewis

“Selecting a manager with heritage in private markets is important, as is finding one with global reach, to find the best opportunities ”

DC schemes typically lack Sharia-compliant investment options These savers –representing four million UK Muslims – have historically been largely restricted to self-select Sharia equity funds.

“For most members, decisions are made for them through default investment strategies. Those seeking Sharia compliance are forced to make active decisions, without access to more defensive asset classes typically used in the approach to retirement,” says Lewis This lack of accessible Sharia-compliant options can harm members’ savings, particularly if they optout altogether

Some master trusts are developing Sharia-compliant lifecycle strategies, allowing Muslim members to invest

Such inclusivity could help close the pensions gap for UK Muslims, 30% of whom do not have a pension, often due to the lack of Sharia-compliant options, while supporting employers’ diversity, equity and inclusion goals

The “low-hanging fruit” of enhancing sustainability credentials have largely been taken, with attention turning to how master trusts will make progress in more complex areas.

Many master trusts have set net zero carbon emission targets for 2050, with some having already reached their 2030 interim goals.

“For those who are ahead of schedule,” Lewis says, “it’s time to tackle the next 20 years, where many more difficult challenges lie ”

Biodiversity is a key arena, going beyond an emissions focus to consider ecology more broadly Setting meaningful targets is much harder than for carbon i i d ti “H d

“We may need to approach biodiversity in a far more localised way ”

Auto-enrolment has more people participating in DC schemes, but these members face the challenge of making their savings last Although financial advice is available, only one-third of members receive it; the rest are largely on their own

Master trusts are exploring ways to offer better guidance without crossing regulatory boundaries into personalised advice.

Advancements in digital advice, such as Mercer’s tool, can help members make informed decisions.

Another approach is innovation in the products offered in the decumulation phase, for instance, pooling longevity or investment risk or creating new solutions that combine annuities and traditional investments

“It will be challenging to innovate without impinging on pension freedoms,” Lewis says “There are lli id b t il

Read this article to understand:

Opportunities for direct investment in climate transition-aligned real estate and infrastructure projects

How we approach early-stage emerging climate technologies

The benefits of diversification and potential to harvest illiquidity premia

Climate change is humanity’s most daunting challenge. As global temperatures climb, the urgency of aligning greenhouse-gas (GHG) emissions with the pathway in the Paris Agreement intensifies Real asset investors can play a role in this process As buildings and infrastructure generate around 38 per cent of global energyrelated GHG emissions, decarbonising the built environment is a priority (source: RIBA, 2023)

By implementing a climate transitionaligned strategy, investors can make a tangible difference to emissions pathways while generating long-term risk-adjusted returns

Our Climate Transition Real Assets strategy seeks to avoid, reduce and remove emissions from the atmosphere

The categories address different stages of the emissions lifecycle and different aspects of the problem Most investment is in directly-owned infrastructure, real estate and forestry across Europe, but we also have lesser exposure to early-stage, emerging climate technologies Their value lies in their ability to diversify risk and provide insights into future developments, alongside potential for relatively high returns, albeit with higher risk

By Luke Layfield, Head of Portfolio Management, Private Markets and Zoe Austin, Portfolio Manager

As the drivers of risk and reward vary across market segments, a multi-asset approach can contribute diversification benefits, illiquidity premia and uncorrelated returns

The “avoid” part of our strategy focuses on preventing emissions Our main focus is on low-carbon infrastructure, including renewable energy projects and battery energy-storage. Decarbonising transport is another important focus By investing in EV-charging point operators, we aim to make low-carbon transport more accessible The third thread involves digital infrastructure, such as investments in fibre broadband and data centres.

For every £1 billion invested, we aim to avoid over four million tonnes of CO2 by 2040 – equivalent to three million flights around the world.

We do not necessarily own assets directly We also work alongside infrastructure developers in partnership at the earlier stages of platform or network roll-out. As there may be planning bottlenecks and cost challenges, we are working in areas we believe structural tailwinds will be supportive

“Reduce” targets actions to decrease GHG emissions. In property, we employ a “brown-togreen” strategy, concentrating on energy-efficiency Energy efficient buildings can generate higher rents, as tenants increasingly demand buildings that are cheaper to run, more comfortable and able to contribute towards net-zero targets A prime example is Curtain House, a 50,000 square-foot former Victorian warehouse in London We developed a plan to improve financial and environmental performance, by upgrading glazing, retrofitting insulation and introducing electric heat pumps The EPC ‘A’ grade building will use half the energy of a typical UK office.

There is a risk of overpaying for “brown-to-green” development opportunities, despite the fact that renovation involves planning risks

Currently investors can offset emissions indirectly, by buying carbon removal credits, where they finance projects verified to remove or avoid emissions. Direct investment in nature-based solutions offers another solution through ecosystems which remove emissions and generate carbon credits

One of our major projects is Glen Dye Moor in Scotland, a 6,300 acre site, where we intend to plant five million trees The sustainable forestry should generate long-term returns, alongside carbon credits to hedge against rising carbon prices. By generating our own credits, we will not have to buy them in years ahead

We aim to sequester around 1 6 million tonnes of carbon over a hundred-year project lifetime, generating high-integrity carbon “removal” credits from afforestation

Some “avoidance” credits will be generated too through peatland restoration. The credits will fall under the well-regarded UK Woodland Carbon or Peatland Code schemes: only quality-approved projects are registered, independently validated, and verified

Finally, we invest indirectly into private equity solutions To date we have invested in three venture capital funds aligned with climate

It endeavours to align climate transitionfocused investment with robust financial outcomes and ensure our real asset portfolios thrive in a rapidly changing world

KeyRisks

Investmentrisk

Thevalueofaninvestmentandanyincomefromitcango downaswellasupandcanfluctuateinresponseto changesincurrencyandexchangerates Investorsmay notgetbacktheoriginalamountinvested Past performanceisnotaguidetofuturereturns

Realestate/infrastructurerisks

Investmentscanbemadeinrealestate,infrastructureand illiquidassets Investorsmaynotbeabletoswitchorcash inaninvestmentwhentheywantbecauserealestatemay notalwaysbereadilysaleable Ifthisisthecase,wemay deferarequesttoswitchorcashinsharesorunits Investorsshouldalsobearinmindthatthevaluationof realestateisgenerallyamatterofvaluersʼopinionrather thanfact

Sustainableinvestingrisk

Thelevelofsustainabilityrisktowhichthestrategyis exposed,andthereforethevalueofitsinvestments,may fluctuatedependingontheinvestmentopportunities identifiedbytheInvestmentManager

IMPORTANTINFORMATION

THISISAMARKETINGCOMMUNICATION

Thisarticleisintendedforinvestmentprofessionalsonly It isnottobedistributedtoorreliedonbyretailclients The valueofaninvestmentandanyincomefromitmaygo downaswellasupandtheoutcomesarenotguaranteed Theinvestormaynotgetbacktheoriginalamount invested Pastperformanceisnotaguidetofuturereturns Exceptwherestatedasotherwise,thesourceofall informationisAvivaInvestorsGlobalServicesLimited (AIGSL) Unlessstatedotherwiseanyviewsandopinions arethoseofAvivaInvestors Theyshouldnotbeviewedas indicatinganyguaranteeofreturnfromaninvestment managedbyAvivaInvestorsnorasadviceofanynature Informationcontainedhereinhasbeenobtainedfrom sourcesbelievedtobereliablebut,hasnotbeen independentlyverifiedbyAvivaInvestorsandisnot guaranteedtobeaccurate Pastperformanceisnota guidetothefuture Thevalueofaninvestmentandany incomefromitmaygodownaswellasupandtheinvestor maynotgetbacktheoriginalamountinvested Nothingin thismaterial,includinganyreferencestospecific securities,assetsclassesandfinancialmarketsisintended toorshouldbeconstruedasadviceorrecommendations ofanynature Thismaterialisnotarecommendationtosell orpurchaseanyinvestment IntheUKthisisissuedby AvivaInvestorsGlobalServicesLimited Registeredin EnglandNo 1151805 RegisteredOffice:80Fenchurch Street,London,EC3M4AE Authorisedandregulatedby theFinancialConductAuthority FirmReferenceNo 119178 www avivainvestors com579900–31/03/2025

Should DC trustees be supporting the UK Growth agenda by investing in UK Growth assets (principally unlisted UK equities)?

The main pension providers, including NatWest Cushon, have signed up to the Mansion House Compact, committing themselves to a 5% allocation to private equity/venture, (a significant majority of which is presumed to be in the UK) by 2030.

The Government is clearly serious about understanding and removing any barriers to increasing pension fund assets into the UK Indeed, phase 1 of the pensions review is mostly focussed on this challenge

So how should DC trustees respond to any consequent provider proposals?

For many trustees their starting point will be to observe that alignment with government policy does not fall within their fiduciary remit

They will point out the importance of geographic diversification They might point out that the UK has been a relatively poor performer in recent years, justifying many trustees’ decision to move from a UK overweight towards a market cap allocation in listed equity.

They could even react with surprise that a provider could even contemplate the inevitable increase in costs that an allocation to private equity or venture would bring, given that price competition in the UK DC market is so fierce

Costs are a challenge We need managers to find ways to accommodate fees far below the traditional 2 and 20, without sacrificing quality and ideally to do so within an open ended vehicle to allow allocations to be managed to a target SAA. Platform complications need to be resolved. We are optimistic that all this can be achieved.

But what might justify a UK overweight?

First, in a deglobalising world facing the prospect of tariff wars, domestic market growth stocks might reasonably be expected to suffer less than international market growth stocks The neutral player also stands to lose least in a trade war There is at least an opportunity for the UK to play a neutral role, positioned between the US and Europe, not least because of our limited economic exposure to manufacturing The economic arguments in favour of geographic diversification are weaker than they have been.

At NatWest Cushon, we have a strong hypothesis that investment in UK unlisted assets can improve member outcomes beyond the impact of their investment returns It’s easier to create emotional connections between members and UK success stories. Those emotional connections create “task persistence”, which in turn leads to better member decision making and thence better member outcomes.

Various stages of the hypotheses have strong empirical evidence to support them Joining the dots remains a work in progress, but early data analysis supports the hypothesis

“ It’s easier to create emotional connections between members and UK success stories “

Finally, it’s always seemed to me to be perverse that trustees should feel obliged to invest globally to secure an extra £1,000 in fund size at retirement, as opposed to investing in a way that creates societal assets in the country into which members are going to retire.

Members’ standards of living in retirement will depend materially on having access to a strong tax base, to green spaces, a well functioning health and long term care system, and on a society that has immunised itself against the worst impacts of climate change

It’s worth noting that local authority scheme trustees have long felt comfortable investing in social housing in their borough, knowing full well that their members are very likely to be in need of that housing in retirement They have felt no obligation to diversify that social housing exposure internationally.

The case for an overweight to UK growth assets is strong.

Define increa pensio memb g , must turn to decumulation

In our Panel, we discussed this critical, yet complex phase of the retirement journey and considered what the industry is doing to provide a roadmap for tackling the challenges with a mix of innovative strategies and member-centric solutions.

Opening the discussion, Mark Jaffray, Partner and Investment Consultant at Hymans Robertson set the stage by highlighting the sheer diversity of members’

1.

Decumulation is challenging: The transition from saving to drawing income is complex, but diversified, income-producing strategies can offer stability and flexibility for members.

2.

Protected equity combines growth with protection: This strategy keeps investment risk on the table in a measured way, limiting losses during downturns while capturing the lion’s share of market upswings.

3.

Knowledge is power: Tools and education are critical for empowering members to make informed decisions about balancing essential expenses with discretionary spending.

circumstances Some are lucky enough to have DB benefits and other savings, others may be more reliant on DC pots and the State Pension. Some are financially educated, other’s not

Drawing on data from the Financial Conduct Authority, it was stark that many members have small DC pots, and these are often withdrawn as cash "Decumulation requires a range of solutions tailored to address members' varying circumstances and aspirations" Jaffray explained. Given this heterogeneity, it’s evident, a “one size fits all” approach will not cut the mustard in decumulation

He pointed to longevity pooling mechanisms, such as Collective Defined Contribution (CDC) schemes, as an example of how innovative approaches could significantly boost retirement incomes

Philipp Loehrhoff Head of Multi-Asset Solutions, Berenberg

Mark Jaffray Partner, Hymans Robertson

Esther Hawley Head of Retirement Proposition, Standard Life

Hugh Cutler Chief Commercial Officer, Mobius Life

CDCs, he noted, combine the benefits of higher growth asset allocations with pooled longevity risks, potentially delivering up to 50% more income compared to traditional drawdown methods. However, regulatory complexities and a lack of member understanding can hinder their adoption.

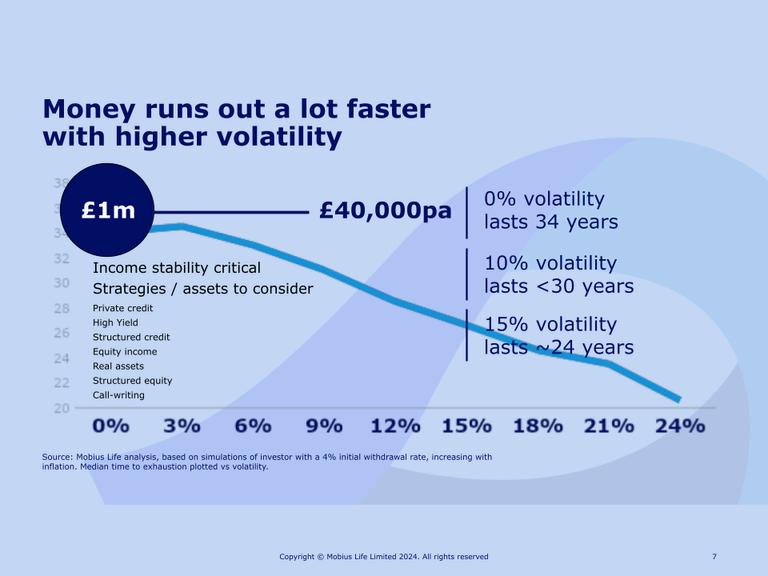

Another key concern for retirees is sequencing risk, the erosion of savings caused by withdrawing funds during market downturns.

This risk can devastate retirement plans, and in worse case scenarios, simply running out of money, long before the retirement finishing line

Referencing Nobel Prize for Economics thought leader, Bill Sharpe, Hugh Cutler of Mobius Life described the decumulation challenge as “one of the hardest and nastiest problems in finance!”

Hugh set out a couple of instructive scenarios leading up to retirement Retire at the wrong time, for example shortly after the GFC or 9/11 and a member’s pot could be exhausted in 10 years. Retire in more favourable market circumstances, despite taking a healthy annual income, the DC pot could still be full many years into retirement.

The problem is there are so many unknowns, not just on financial conditions, but on life expectancy, the need for care, for other unexpected living costs and so forth

Resilient portfolios are needed and diversification is critical, he argued, with assets such as private credit, income-generating real estate, structured equity solutions to name a few helping to control volatility whilst maintain growth potential.

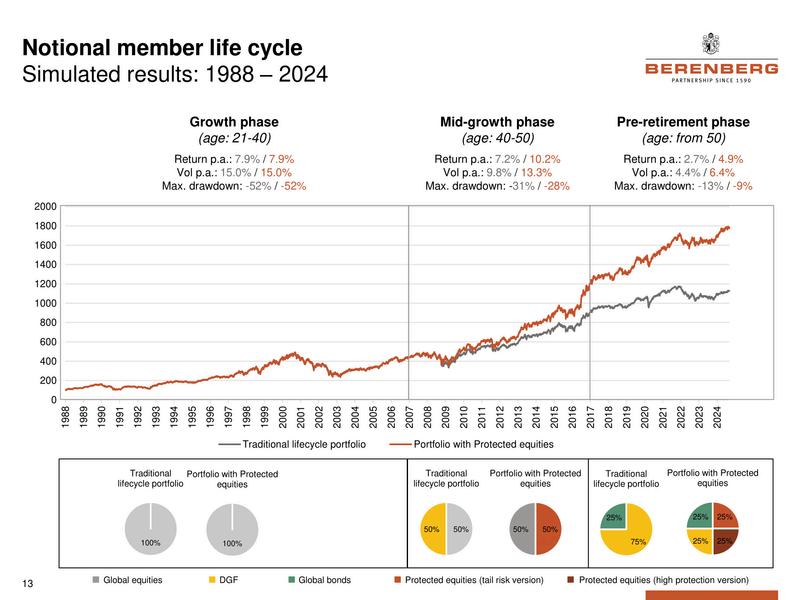

Philipp Loehrhoff, Multi Asset Solutions leader at Berenberg took the baton from Hugh setting out how Berenberg’s protected equity strategy can help with the challenges of decumulation.

Philipp echoed Hugh’s concerns on sequencing risk Drawdowns in market sell-offs can deplete pot sizes quickly. But running out of money slowly due to insufficient growth, whilst less drastic, is also a major investment problem that needs attention.

“When markets decline early in retirement, the combination of withdrawals and losses can quickly erode savings,” he explained Members drawing from a reduced pot may find it impossible to recover, jeopardising their ability to sustain income in later years

The result can be an inclination to be overly-conservative in investment strategies in the decumulation phase.

This brings its own problems: Significantly de-risked investment approaches may avoid short-term losses, but can leave members vulnerable to running out of money slowly. “If investments don’t grow, members risk seeing their savings dwindle slowly, unable to support their lifestyle over the long term,” he warned

Berenberg’s protected equity strategy aims to keep equity risk on the table, but in a risk balanced way, Philipp advised The strategy manages drawdown risk by using options to cap losses during market downturns. By limiting this downside, members’ savings are shielded from the worst of equity market turbulence.

Protection comes with a cost, and this shaves off some of the potential upside in equity market growth In Philipp’s view, this is a price worth paying Having riskbalanced exposure allows members to allocate to equity markets in larger quantity for longer, a vital consideration when many retirements could span 20 to 30 years

Philipp wrapped up his presentation setting out modelling that demonstrates how an allocation to protected equity investments running up to and in decumulation delivers stronger risk-adjusted returns than

traditional life-cycle models, in particular those utilising diversified growth funds which have often delivered disappointing investment performance.

While innovative investment strategies are vital, they must be paired with strong member engagement to drive better outcomes. Esther Hawley, Head of Retirement Proposition at Standard Life brought this point to the fore, noting that many members lack the knowledge needed to make informed decisions about decumulation "Helping members understand their retirement options is critical, especially as more people rely solely on DC pots," Esther said Many members wont have the resources, nor the inclination to take advice, so its incumbent on providers to help It is complex, but paring things down to some key principles is desirable.

Focusing the mind on essential spending such as food and heating your home is fundamental,

as is ensuring the inflationary impact on these costs is addressed.

Once the member is clear in their mind that these essential costs are covered, they may be prepared to hold more flexible return-seeking investments to enhance the potential for discretionary spending in retirement

Understanding what members have, and where should not be under-estimated

Standard Life’s are working on a tool that aims to bridge the knowledge gap and provide members with a consolidated view of their pensions, state entitlements, and savings. This enables them to assess whether they have enough income to cover essentials and plan for discretionary spending.

By Philipp Loehrhoff Head of Multi Asset Solutions

➡ Read More about Berenberg

ImportantConsiderations:Itiscrucialforinvestorstocarefullyconsidertheirindividualcircumstances,risktolerance,andlongtermfinancialgoalswhenmakinginvestmentdecisions,andtoseekprofessionaladviceasneeded Thestrategymaynotbe suitableforallinvestors,andpastperformanceisnotindicativeoffutureresultsItiscrucialtounderstandthatinvestinginthe strategyinvolvesrisks,includingthepotentiallossofinvestedcapital

As Defined Contribution (DC) pensions continue to grow in prominence in the UK, a significant challenge has emerged in the later stages of the traditional life cycle model: the need to balance growth and risk management to ensure adequate retirement income. This article explores how protected equities, an investment approach that utilises options with the aim of reducing downside risk while seeking to participate in market upside, may offer a solution to this decumulation challenge.

The conventional lifecycle approach to pension investing dictates a shift from equities to bonds as individuals approach retirement, aiming to protect their accumulated wealth However, this often leads to insufficient returns, potentially jeopardising retirees' financial security. Retirees face a profound dilemma: maintaining higher equity allocations risks significant losses that could deplete their capital, while overly conservative investing may result in prematurely running out of money, especially in periods of elevated inflation.

Most retirees have a low risk tolerance, making it difficult to maintain the equity exposure needed to generate sustainable returns over the remaining life expectancy, often a 20-to-30year time horizon. They must delicately balance the risk of major losses against the risk of inadequate portfolio growth.

An environment of elevated inflation further complicates the situation, as conservative portfolios are more likely to be depleted early when living costs increase. Navigating this complex landscape requires a nuanced approach that can provide both growth potential and downside protection

Introducing protected equities to the DC mix

In response to these challenges, Berenberg has launched its Protected Equities Strategy, specifically tailored for DC pensions. The strategy combines equities and exchange-listed options to build a portfolio aiming for long-term growth with reduced risk By using options to hedge part of the equity risk, the strategy aims to effectively limit losses during market downturns while still

allowing meaningful participation in upside moves This can enable pension investors to maintain higher equity allocations without significantly altering the overall risk profile of their portfolios, providing the growth potential needed to sustain a long and comfortable retirement

The Protected Equities Strategy offers flexibility, allowing it to be adapted to different risk tolerances and lifecycle stages.This adaptability makes it potentially suitable for the evolving needs of pension savers over time

One of the key objectives of the strategy is to help address sequencing riskthe risk that the timing of withdrawals will negatively impact portfolio returnswhich can be a significant concern for retirees

Berenberg has designed the Protected Equities Strategy to meet the specific needs and constraints of the cost-sensitive DC pensions market It aims to provide good value for money, offers daily pricing & liquidity, and can be integrated into existing DC schemes via various investment platforms.

Moreover, the strategy fully satisfies all DC regulatory reporting requirements, ensuring a smooth adoption process for pension providers.

As the UK DC pensions landscape continues to evolve, the need to balance growth and risk management is becoming increasingly critical, particularly in the vulnerable later years of the investment lifecycle.

Berenberg's innovative Protected Equities Strategy, by deftly combining downside protection with growth potential, can provide an elegant and compelling solution to the complex challenges retirees face in securing a comfortable retirement.

Navigating this complex landscape requires a nuanced approach that seeks to balance the competing objectives of growth and risk management

As the UK DC pensions landscape continues to evolve, the need to balance growth and risk management is becoming increasingly critical

Amidst ongoing regulatory initiatives such as the FCA’s review of the advice and guidance boundary and the continued focus on value for money from both the FCA and DWP it is expected that the Government will introduce a new duty for pension schemes to better support members at retirement in the Pension Schemes Bill next year. This includes the development of partnerships to deliver default income solutions. By leveraging the proven benefits of inertia, this approach could drive meaningful improvements in members’ retirement outcomes.

We’ve been pleased to work with the DWP and FCA policy leads, offering insights and constructive challenges to shape their thinking, which is now referred to as Guided Retirement Their thinking is enabling true default income solutions, placing the requirement on schemes to deliver these for their members

Additionally, we were pleased to support the PLSA’s latest guidance in this area. Our clients have already begun to see significant benefits from these evolving strategies in these areas which made useful case studies, however, Guided Retirement could still offer significant improvements

When it came to writing this piece, I sought help from an analogy and having seen the latest blockbuster Wicked with my 12-year-old daughter, the yellow brick road references to the Wizard of Oz film felt the most suitable Don’t worry, I won’t be suggesting any singing!

The journey so far: From accumulation to decumulation

The yellow brick road analogy captures our road to retirement or, in this case, the Emerald City

Transitioning from final salary pensions to defined contribution (DC) schemes has shifted significant decision-making responsibilities onto employees –responsibilities many didn’t realise would critically impact their retirement

To ease this burden, the government has harnessed the power of inertia. Auto-enrolment encouraged employees to begin saving, while default investment strategies relieved them of the need to be investment experts. Now, as members approach retirement, Guided Retirement essentially default decumulation pathways represents the final and important bricks in this yellow brick road analogy, leading to a more secure retirement

Guided Retirement has the potential to transform retirement outcomes Since the introduction of Pension Freedoms and the sharp decline of default annuity purchases, the industry has struggled to provide members with the tools they need to make informed retirement decisions. Yet these decisions how to draw income and manage their retirement savings are often the most significant financial choices members will ever make.

Guided Retirement proposes default decumulation pathways, underpinned by inertia and behavioural economics By offering a clear starting point (or ‘anchor’), these pathways guide members while still allowing them to make their own choices

These pathways can encompass a wide range of retirement solutions, including both drawdown options and longevity protection solutions.

Importantly, it is expected that any default solution will always provide members with the flexibility to opt out and make their own choices Additionally, there is growing discussion about incorporating a collective DC (CDC) solution at retirement However, it remains early days in exploring and developing this type of offering.

While the industry has made significant strides to support members, much of this assistance has been piecemeal. In our analogy, the Scarecrow, Tin Man, and Lion symbolise trusted allies like helplines, Pension Wise, and initiatives such as Investment Pathways. Each plays an important role in guiding members However, threats remain enter the Wicked Witch of the West, representing scams and other risks that prey on savers, making this analogy all the more fitting

Ultimately, all these efforts bring us back to the yellow brick road analogy – the inertia-driven

solutions completed by Guided Retirement This framework promises to offer single income solutions tailored to members’ needs throughout retirement Complemented by better retirement support via helplines and apps, defaulting members into welldesigned income pathways could significantly enhance retirement outcomes.

We’re already seeing progress from master trusts and providers stepping up to deliver these solutions. If Guided Retirement doesn’t get overshadowed by another dramatic industry development the Chancellor’s ‘Rise of the Megafund’ it’s poised to be introduced through the Pension Schemes Bill by late Spring 2025

As Guided Retirement takes shape, it provides an important final piece of the jigsaw – laying the foundation for a future where all members, regardless of expertise, are better equipped to navigate their retirement journeys.

And just like our heroine’s adventure, it’s clear that a thoughtful, wellpaved path can lead to a better destination.

Esther Hawley Head of Retirement Proposition

We interview Esther to delve into the Decumulation conundrum

Let’s start at the beginning! What would you say are the key challenges to deliver innovation in DC decumulation?

I think the challenge that underpins a lot of the questions around decumulation is that there is no “right” answer here: there isn’t a product or investment solution that is going to be able to “fix” DC decumulation, if only we can work out what it is and how to build it.

Everyone has different priorities and expectations for their retirement, and so the advantages and disadvantages of any solution will measure up differently for each individual.

So for me the most immediate ask is not so much around what solutions we can develop, but more about how we can better match people up with the solutions that might suit them best

Clearly advice plays a role in this, but in reality not everyone can or will take advice. High quality engagement and support tools are also important, so that we can empower as many people as possible to make good decisions for themselves. But again, not everyone will engage, and we also need to be able to cater for those who don’t

This means we need a whole spectrum of decumulation support: we need advice, engagement, and non-advised options.

We need products and investment solutions designed for different cohorts of members (after all, you can only design really good investment solutions when you know the kinds of customer needs you are aiming to meet), and we need the right communications framing and narrative throughout the retirement savings journey to help people towards the options they need. It is a multi-faceted challenge - but if we can solve it then the benefits to DC savers will be considerable

In your view, what changes are needed to deliver better decumulation solutions?

We set out in our recent paper “Avoid sleepwalking into retirement” some of the things that we at Standard Life would like to see change.

In particular, making advice easier to access is key. Personally, I’m a big supporter

of both broadening access to regulated advice and the FCA’s proposals for developing ways of offering “targeted support” without providing regulated advice

But in my view most importantly of all we also need non-advised options and ways of guiding people towards “default” solutions or those who don’t take advice and are not actively engaged.

How are Standard Life approaching these challenges?

A key element of what we are doing is to start from the basics So for example, while everyone will have different needs at retirement as I’ve outlined above, there are some common themes that will apply to most, if not all.

In particular, ensuring that you have enough guaranteed income to meet your essential spending needs is a sensible starting point for anyone planning their retirement

Beyond that, having flexibility on what you spend over and above the essentials is also going to be attractive to most people

So empowering people to explore a combination of guaranteed and flexible income is a great starting point to tackle the decumulation challenge, and lot of the work we are doing is centred around this concept.

One example of what we are developing is our Mixed Income Builder, which is a tool that we will be launching in the coming months

This will allow people to work out how much guaranteed income they already have (from the State Pension and any defined benefit income), and explore how they can use their DC savings to top up their guaranteed income if needed, with the remainder available for spending more flexibly.

This will be a really impactful step towards simpler retirement decisions for our members.

DC schemes have been under the cosh to improve member outcomes. But it isn’t easy while navigating a changing regulatory and retirement landscape. Here are 3 things pension schemes could do differently to give their members a better future.

1. More exposure to private markets

Pension schemes traditionally favour listed equities But that world is shrinking Over 90% of the world’s established businesses and commercial real estate are privately owned. This includes companies operating in tantalising areas such as digitisation and climate tech. As the winds of change blow across developed economies, these companies may leave their publicly listed peers in the shade.

Cost and regulatory barriers have blocked DC schemes from these lucrative opportunities But new investment vehicles can offer a bridge to private markets, along with the opportunity for better returns and diversification We know because we’ve helped design them.

We worked with Schroders to launch the Long Term Asset Fund for a master trust we provide investment services for. We’re currently working with Future Planet Capital to give pension savers access to UK venture capital.

➡ Read More about Mobius Life

We’ve also engineered a hybrid investment model that allows schemes to hold assets that aren’t permitted under life insurance rules

We’ve found this is a great way of upping the diversity of members’ portfolios. These ideas were born out of collaboration and innovation. The fruition of an idea often hinges on talking to the right people with the right technology If something starts with an idea and ends with a good member outcome, we can design and build the bit in the middle

The right technology can cut costs, convert ideas into solutions and polish communication. It can modernise antiquated processes to improve efficiency, transparency, and ultimately member outcomes

We work with different trading and settlement cycles, and a range of tech interfaces Instructions from our clients are funnelled directly into our systems and processed according to a client’s investment needs. By embracing automation, our clients have what they need when they need it. This frees up warm-blooded humans to do what we do best. We build relationships, listen deeply and think big to create solutions When combined with data, technology packs even more of a punch We bottle the data on investments made by or for our clients This includes standard information like asset values, but also rich, complex data

Navigating a changing landscape, pension schemes can improve member futures with these 3 recommendations.

such as ESG, voting information and climaterelated data. In future, we plan to include nature-related data too We want to make our data accessible and visible to drive better decisions But it can be useful in other ways too That’s why our clients can access our data at any time through a dedicated portal.

Nobel prize winner William Sharpe described decumulation as the ‘hardest and nastiest’ problem in finance There is much talk about getting people to save more money Less has been said on how to make that money last, even though this is arguably more crucial to good member outcomes

Members now save at varying levels, retire at different times and have different ideas about how to spend the final third of their lives.

They need investment solutions that are as flexible and varied as they are. While needs have become progressively individual, investment solutions often cater to the masses We work with DC pension schemes to give their members flexibility and security We’ve collaborated with private credit managers and developed funds that include private credit exposure but with daily pricing, reasonable fees, and daily liquidity by integrating liquid assets like equities and bonds. We’ve found this is a great way of offering a flexible but secure solution.

Our best innovations have grown out of the problems people have spoken to us about. Pension professionals need a safe space to talk about current and future challenges. We would love to get you round a table and hear what you have to say

You can get in touch with a member of the Mobius team here.

Diversified energy transition investments can accelerate progress to Net Zero, deliver sustainable returns, and engage members

The climate crisis is only intensifying, with severe weather events becoming more and more frequent Just this year we’ve seen intense hurricanes in Florida, severe floods in Valencia, and an extreme heat wave in New Delhi that saw temperatures of 49 degrees celsius. Worrying and frequent occurences, but there are reasons to be optimistic too: Rapid technological advancement, increasing demand for renewable energy, and decreasing costs –solar is a factor of five times cheaper than it was in 2010 – all present opportunities

The climate crisis presents opportunities for DC schemes – to invest in the transition, find returns and impact, and engage members ➡ Watch the round table recording

1.

The scale of the climate challenge is daunting, but that means the scale of opportunity for DC pension capital is huge– with $212 trillion of global investment needed over the next 25 years.

2.

To credibly invest in the energy transition, you can no longer consider energy generation in a silo – you have to understand the full energy system. Doing this brings an incredibly diverse opportunity set, key for balancing risk and return.

3.

Bringing investment impact to life helps engage pension scheme members – making their money tangible and showing them how they’re playing a part in the transition.

Matt Setchell, Co-Head of Octopus Energy Generation, is optimistic about the role DC pension funds can play in addressing climate issues, particularly through investments in renewable energy

Octopus Energy Generation has built a portfolio of nearly £7 billion, focusing on renewable projects across the world that provide both returns and sustainable growth.

Beyond simply funding green energy projects, Matt explained the importance of understanding the entire energy system: “You can no longer consider generation in a silo. We need to get green electricity to end-users.

Matt Setchell Co-head, Octopus Energy Generation

David Goodwin

Investment Director, Octopus Energy Generation

Stephen O’Neill Head of Private Markets, Nest Pensions

Clare Keeffe

Senior Sustainability

Investment Consultant, Barnett Waddingham

Caroline Hopper

Lead Consultant, Quietroom

As well as building new wires, we need to use existing wires more optimally with the help of new technology, as well as finding ways to store electricity and even convert it into alternative fuels such as hydrogen.”

New infrastructure is needed for electrification, like EV charging, and different ways to generate heat such as heat pumps All of this presents a huge spectrum of opportunities for investment

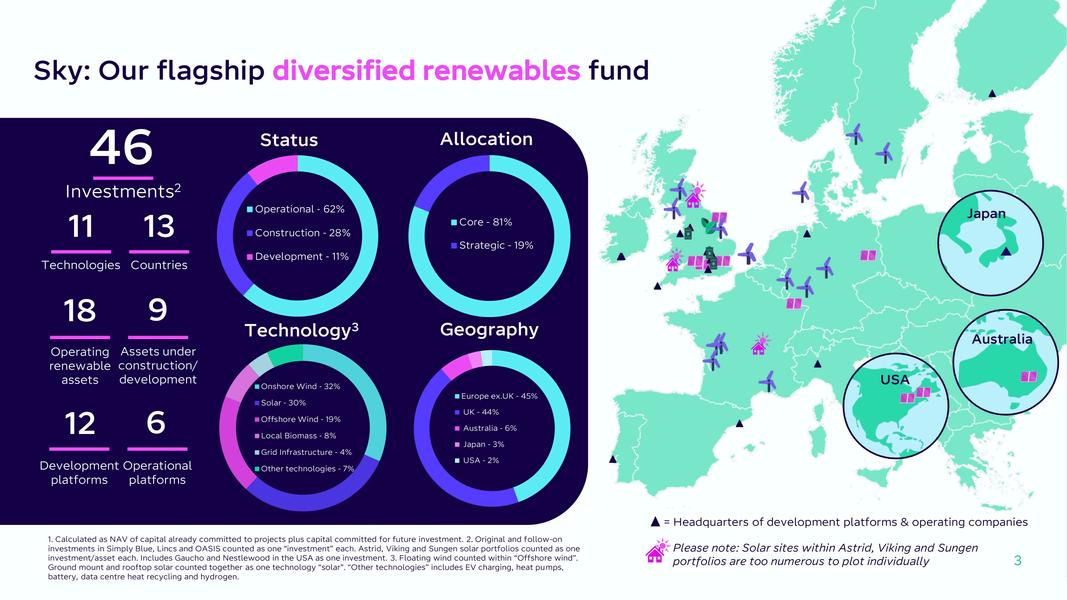

Uncovering all of these opportunities across different geographies, technologies, and energy types is how Octopus helps diversify its flagship fund, Sky David Goodwin, Investment Director at Octopus Energy Generation, stressed the importance of not relying solely on a single type of energy asset. Sky’s portfolio includes wind, solar, and bioenergy, each of which is impacted by different regulatory and market forces.

David explained that investing across countries and technologies “dampens the impact of unfavourable policy changes, while also allowing us to capitalise on the favourable policy movements, which we have done several times over Sky’s history.”

This strategy makes for a more balanced and resilient portfolio For example, the portfolio can withstand fluctuations in areas such as power prices, which vary based on local renewable rollout, grid infrastructure, and energy policies

Master trust Nest Pensions is an investor in Octopus Energy Generation’s Sky fund.

Stephen O'Neill, Head of Private Markets, explained that Nest integrates renewable energy within its infrastructure portfolio to support sustainable returns and reduce carbon intensity.

According to Stephen, Octopus Energy Generation’s expertise –combining engineering insight with investment management –was a major factor in Nest’s decision to establish this partnership.

The Sky fund allows Nest to look to secure consistent returns while contributing to the energy transition – and while still growing rapidly too: Nest currently looks after £46 5 billion in assets, with a projection to reach £100 billion by 2030

Sky, along with the co-investment in the Hornsea Wind Farm, has become the single largest allocation in Nest’s private markets portfolio This is due to the pace of deployment, return delivery, and the opportunities coming through the Sky pipeline.

While the environmental impact of climate investments is often a primary focus, David explained that the "S" in ESG (Environmental, Social, and Governance) is also crucial

The social impact of green investments often includes job creation and community development, especially in areas transitioning away from fossil fuels.

"The energy transition offers a levelling-up opportunity," he said, referring to the chance for renewable projects to bolster local economies across the UK and beyond He also explained how the team influences the design of the projects they invest in with S in mind “Our solar developers adopt our panel procurement policy, which prevents them from using panels associated with slave labour in certain regions of China ”

Emerging markets also play an essential role in this conversation, as these regions are set to face the harshest impacts of climate change while also experiencing rapid economic growth.

Clare Keeffe, Senior Sustainability Investment Consultant at Barnet Waddingham, highlighted the importance of investment in these regions: “95% percent of the increase in global energy demand by 2050 will come from emerging markets ”

This shift presents a significant investment opportunity and underscores the importance of a just transition, making sure these communities are supported and empowered rather than left behind

While the benefits of investing in the transition may be clear to industry professionals, the challenge remains in translating these ideas to pension members.

Caroline Hopper, Lead Consultant at Quietroom explained how showing members their real world investments can help members feel connected to their pension.

"Less than half of people know their pension is even invested," she said, “but when you show members what their money is doing like building EV chargers or funding solar farms they start to care about their pensions." She explained that this makes 80% of members want to engage with their pension, and can build trust and awareness. Better member engagement is linked to better outcomes.

One way to engage members is through vivid, relatable examples In a combined Nest and Octopus initiative, pension members were taken to visit an offshore wind farm investment “Nothing makes your pension money more real than when you’re staring it in the face,” explained Caroline

As well as Nest’s partnership with Octopus, Matt explained that there’s growing interest among DC schemes in investing in the climate transition: “ultimately we want to deliver the best return for members and the energy transition brings many outstanding investment opportunities.”

The path forward of course needs careful navigation, consideration of social issues, and plenty of diversification across regions and technologies. But the message from this panel came across loud and clear: the renewable energy transition offers vast opportunities for return on investment, environmental and social good, and member engagement too.

Octopus Energy Generation is on a mission to rapidly accelerate the transition to a future powered by green energy We aim to do this by building renewable generation assets at speed, delivering green electricity to meet demand in the most optimal way and using alternative methods to reduce carbon emissions where electrification isn't feasible This transition presents a massive investment opportunity: c $212 trillion required over the next 25 years

Historically, renewable energy investments have focused on core operational generation assets, such as onshore & offshore wind and solar with a focus on yield-driven returns These investments emphasised stability, favouring projects with a substantial portion of fixed and/or inflation-linked revenues - through for example, government subsidies or long-term power purchase agreements (PPAs)and little or no leverage.

However, the energy transition goes beyond generation To achieve netzero emissions, the entire energy system must evolve Green electricity must reach end users, requiring significant investment in grid infrastructure, optimisation technologies, storage solutions, and alternative fuels like hydrogen. Distributed generation at household and industrial levels, along with innovations in electric vehicle (EV) charging and heat generation, will also play crucial roles in decarbonising various sectors

This breadth of opportunity requires expertise and a global outlook to create compelling investment products that make complex energy solutions accessible to Defined Contribution (DC) investors We aim to offer products that deliver an attractive risk adjusted return profile from a diverse selection of impactful assets that can help scheme members foster a stronger connection to their role in the energy transition.

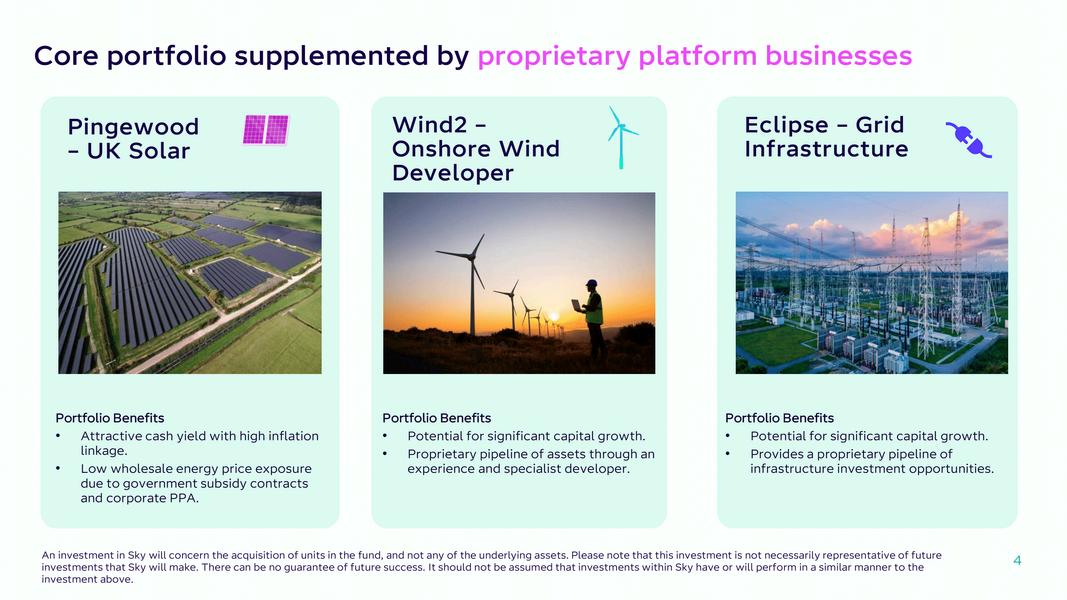

Our fund management team’s flagship product, the Sky fund (ORI SCSp) provides a prime example of our approach to diversification Sky is an evergreen fund that provides a global portfolio of more than 45 renewable energy and associated energy infrastructure assets, aiming to deliver a solid cash yield with some capital growth It is an SFDR article 9 product with an impact objective to accelerate the transition to net zero, directing capital flows into sustainable activities, avoiding carbon and creating green energy.

Sky’s portfolio supplements “core” renewable assets with “strategic” investments in either energy transition technologies or development opportunities For example, we invest in a number of development platform businesses which provide Sky a proprietary pipeline of future investible, offmarket capital deployment opportunities Once such example of this is our 100% acquisition of Eclipse in 2021

Eclipse is a UK licenced independent distribution network operator that owns and manages electricity network connections for consumers across residential, commercial/industrial, EV charging and battery customer groups As more customers

electrify services and new homes are built with electric-only utility service, the demand for businesses like Eclipse will grow. Similarly, the roll-out of EVs in the UK and the associated demand for charge points will provide a significant opportunity for the business to grow while delivering strong returns for investors

In our reporting, we aim to showcase how we make a meaningful impact for DC savers Our funds focus on climate solutions and use avoided emissions as a core Key Performance Indicator (KPI) To make this impact even more tangible, we’ll also present equivalents, such as the equivalent number of trees planted or cars taken off the road, offering a relatable measure of the positive environmental outcomes our investments support. For example, Sky’s portfolio at the end of December 2023 had: the potential to generate nearly 1,600 GWh a year – that is about 400,000 homes (roughly the size of Birmingham) avoided nearly 600,000 tonnes of carbon – equivalent to planting nearly 3 million trees

We also have the ability to engage DC members by providing tangible experiences that connect members to the assets they’re investing in

For instance, we’ve organised site visits for scheme members, allowing them to see the renewable assets powered by their pension savings in action, including:

Lincs offshore windfarm off the coast of Grimsby, and Pingewood Solar Farm - previously a quarry site, then a landfill site, this solar farm now sports a diverse grassland habitat showcasing a net biodiversity gain and value beyond decarbonisation

These visits help members better understand the real-world impact of their investments and foster a sense of personal involvement in the transition to net zero Member engagement is critical to building long-term support for the energy transition, and we’ll continue exploring new ways to make the impact of their investments as visible and relatable as possible.

Our approach combines diversification and meaningful engagement to make DC investment in the energy transition accessible, impactful, and attractive

Through diversified portfolios like Sky and initiatives to engage scheme members directly, we’re enabling DC capital to play a vital role in tackling the climate crisis and achieving a net-zero future

Source:McKinsey–January2022 Cumulativespendon physicaltransitionassetsrequiredtoreachnetzeroby 2050 Thisforward-lookingstatementisbasedupon certainassumptions Actualeventsmaydiffermaterially fromthoseassumed Therecanbenoassurancethat estimatedprojectionscanberealised,thatforwardlookingstatementswillprovetobeaccurate,orthat actualprojectionswillnotbemateriallylowerthanthose presented 1

When we think about the climate crisis, we often focus on the need to decarbonise and the great opportunity that renewable energy sources can play in achieving this There is no doubt this is true, but if we are thinking about sustainability factors “in the round” this approach misses some of the wider implications

Clare Keeffe Senior Sustainable Investment Consultant

“A just transition? Ignoring the social side of the climate crisis is a missed opportunity!”

At Barnett Waddingham we encourage our clients to adopt a systems thinking approach to sustainable investing. Our concern is that, by thinking in silos, related aspects such as the social implications of the energy transition can be missed or ignored – running the risk of inadvertently going against some of the investor’s other beliefs By ignoring them you are also potentially missing out on an opportunity

In this article we explore two social ramifications of not considering the energy transition systematically, and highlight the opportunity by applying a social lens in the first place.

It’s a sad fact that the emerging markets are most likely to be impacted by the climate crisis. This reflects their geographical position as well as their lack of funding to make appropriate adaptions to withstand the physical risks associated with climate change

Many would argue that, when we look past the outsourcing of emissions generation from developed to emerging economies as a result of heavy industry such as steel making, the emerging economies themselves have contributed the least to the climate crisis we are now facing, noting that it is the developed world that have historically released the most carbon emissions in our atmosphere.The emerging economies themselves have

contributed the least to the climate crisis we are now facing, noting that it is the developed world that have historically released the most carbon emissions in our atmosphere.

In environmental law there is a concept known as “the polluter pays principle” which effectively states that the cost of pollution should be borne by those causing it, rather than the person or persons who suffer the effects of the resulting environmental damage This concept is often cited when discussing the “just transition” and is a very important discussion at COPs, including COP29 recently delivered in Azerbaijan

The opportunity

At Barnett Waddingham we have been considering “mega trends”; the shifts in our world order that drive investment opportunities for our longer-term investors like defined contribution schemes. One such mega trend is demographics.

As the great economist, Keynes once said “it is from human beings that every economy springs”, so it’s important to consider where those human beings will be in the future It is expected that our global population will continue to grow from our current position of circa

8bn people to nearer 10bn by 2060

However, this growth is not expected to happen uniformly across the globe, in fact a number of western countries’ population sizes may have already peaked. Instead, the majority of this global growth is will come from emerging market economies. What do all populations need to grow their economies and be competitive? Energy! McKinsey’s latest annual energy perspectives report projects that up to 95% of energy demand increase out to 2050 will come from the emerging markets

So it stands to reason that there are fantastic investment opportunities in such regions as populations grow. As always, we encourage investors to consider geopolitical risks and diversification, but with the right strategy and a skilled manager, we see a great opportunity to generate strong risk adjusted returns.

“The polluter pays principle states that the cost of pollution should be borne by those causing it“

The policy landscape in the UK is very supportive towards the energy transition Since coming into power, the Labour government has introduced Great British Energy and the National Wealth Fund, both designed to fund early-stage development of projects needed for the energy transition

There have been some early “wins” for our new government too, not least the closure of the last gaspowered steel plant at Port Talbot. Steel is one of the most carbon intensive sectors (often termed “hard to abate”) and the ambition is to now move to green steel. However, in the meantime this has a heavy burden on the community with the loss of jobs.

In the UK we have seen this before with the closure of coal mines The impacts on affected communities continues to be felt decades later Interestingly such communities are well set up to ensure energy connectivity This could be a great opportunity for investors to support energy connectivity initiatives in the UK.

In general, there is often a focus on the development of the renewable energy, without considering the wider supply chain needs. We believe there is a specific opportunity here that could also assist in job creation and help to address some of the societal concerns often cited in relation to the energy transition underway

In summary, we encourage investors to think systematically about their investments in the energy transition Think beyond the silos and emissions accounting approaches and take a social lens to investment opportunities too.

We created a (free) TCFD summary that gives members what they asked for.

Showing members how their pension can help tackle the climate crisis is a proven way to help them engage with their money.

It makes 8 in 10 members feel more positive about their pension, it increases awareness of their scheme, and builds trust too, according to research from the DC Investment Forum and Nest Insight

So what do members want to know about it? We spoke to them to find out

We set out to create a memberfriendly summary of a Task Force on Climate Related Disclosures (TCFD) report. To help us, we asked 50 UK pension scheme members what climate information, if any, they wanted about their pension.

The result, our tried and tested TCFD summary, is free for any scheme to use for its members It includes all the things members told us they wanted to know (and nothing more), such as:

1. How does my pension connect to climate change?

Members we spoke to were clued up on climate change – they actually asked us not to explain it to them But they’d never made the connection between their pension and climate before

This is because most of them didn’t know their pension money was invested So, showing members some example investments, and how climate change could affect those investments, was very powerful

We used the example of a shopping centre infrastructure investment, and how flooding, made more likely by climate change, could damage it.

One member said, “My generation will need pensions in the future, and climate change is definitely happening. So if we can help tackle climate change through pensions – we need that ”

2. Can you give me more investment examples?

We showed members what their money could be investing in –climate tech, solar panels, even forestry and timberland

Almost all members said these examples were the most interesting part – and asked for more.

One said, “They make it exciting and real It makes me more motivated – and would give me more confidence to trust what this provider is saying ”

3. Is my pension protecting nature or damaging it?

Once we’d mentioned a forestry investment, lots of people wanted to know more about how their investments interacted with nature

Most asked questions along the lines of: “Am I helping it or hurting it? Is it near me? How do you measure it?”

You can read more about what members want to know about natural capital.

4. How are you engaging with companies?

We talked to members about how their pension scheme likely invests in heavy polluters as well as green companies, but can use its influence to encourage them to transition

We expected a mixed reaction, but it was overwhelmingly positive One member said, “I appreciate that my money is giving companies the opportunity to change – we all need to be part of the solution ”

It’s time to talk to your members about climate and nature

ONS data shows that 75% of adults in the UK worry about climate change. The Scottish Widows Green Pensions Report puts this even higher at 83%.

That means a very large proportion of pension scheme members will be interested in this issue – and therefore likely to engage with it in the context of their pension

In fact, many of the members we spoke to told us they wanted to know more about this One said, “I hope I hear about this from my provider

I want the breakdown of where my money’s going and what it’s doing.” Some schemes are working to give their members exactly that – like the London Pension Fund Authority with its new Investing in the UK map.

Schemes have to produce a TCFD report every year. Very few (if any) members want to plough through that But many members are interested in some of the snippets of information in it

You can use our TCFD summary structure and wording to give members just the bits they’re interested in.

DC innovation has been in short supply - but new developments in the market are creating a brighter future for the next generation of savers.