5 minute read

How Defined Contribution capital can tackle the climate crisis. The importance of diversification and member engagement in the energy transition.

Partner Insight from Octopus Energy Generation

1. Fuelling Net Zero and the Energy Transition

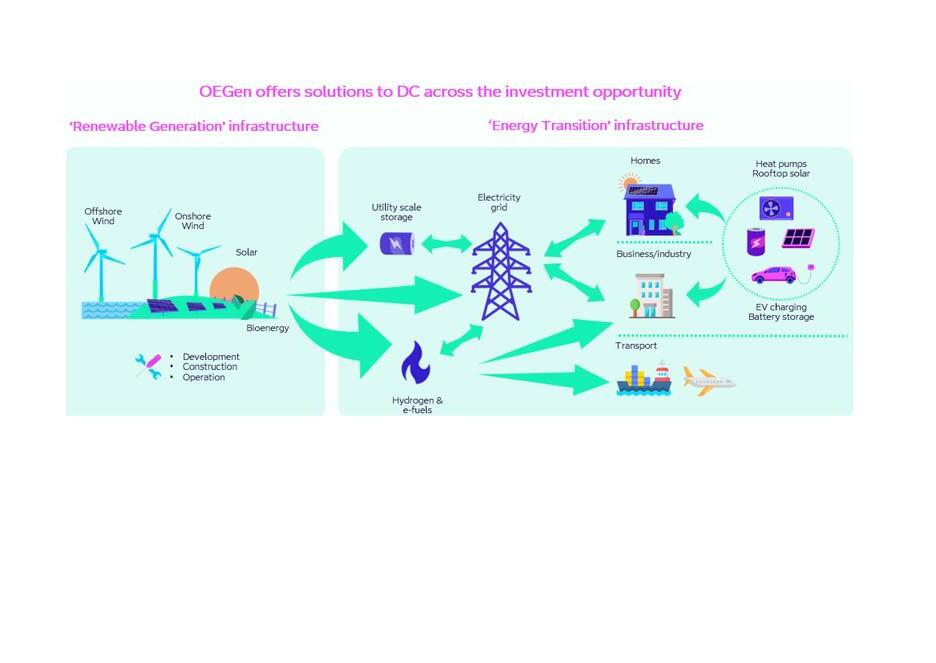

Octopus Energy Generation is on a mission to rapidly accelerate the transition to a future powered by green energy. We aim to do this by building renewable generation assets at speed, delivering green electricity to meet demand in the most optimal way and using alternative methods to reduce carbon emissions where electrification isn't feasible. This transition presents a massive investment opportunity: c $212* trillion required over the next 25 years.

Historically, renewable energy investments have focused on core operational generation assets, such as onshore & offshore wind and solar with a focus on yield-driven returns. These investments emphasised stability, favouring projects with a substantial portion of fixed and/or inflation-linked revenues - through for example, government subsidies or long-term power purchase agreements (PPAs) and little or no leverage.

However, the energy transition goes beyond generation. To achieve net-zero emissions, the entire energy system must evolve. Green electricity must reach end users, requiring significant investment in grid infrastructure, optimisation technologies, storage solutions, and alternative fuels like hydrogen. Distributed generation at household and industrial levels, along with innovations in electric vehicle (EV) charging and heat generation, will also play crucial roles in decarbonising various sectors.

This breadth of opportunity requires expertise and a global outlook to create compelling investment products that make complex energy solutions accessible to Defined Contribution (DC) investors. We aim to offer products that deliver an attractive risk adjusted return profile from a diverse selection of impactful assets that can help scheme members foster a stronger connection to their role in the energy transition.

2. The Role of Diversification

Our fund management team’s flagship product, the Sky fund (ORI SCSp) provides a prime example of our approach to diversification. Sky is an evergreen fund that provides a global portfolio of more than 45 renewable energy and associated energy infrastructure assets, aiming to deliver a solid cash yield with some capital growth. It is an SFDR article 9 product with an impact objective to accelerate the transition to net zero, directing capital flows into sustainable activities, avoiding carbon and creating green energy.

Sky’s portfolio supplements “core” renewable assets with “strategic” investments in either energy transition technologies or development opportunities. For example, we invest in a number of development platform businesses which provide Sky a proprietary pipeline of future investible, off-market capital deployment opportunities. One such example of this is our 100% acquisition of Eclipse in 2021.

Eclipse is a UK licenced independent distribution network operator that owns and manages electricity network connections for consumers across residential, commercial/industrial, EV charging and battery customer groups. As more customers electrify services and new homes are built with electric-only utility service, the demand for businesses like Eclipse will grow. Similarly, the roll-out of EVs in the UK and the associated demand for charge points will provide a significant opportunity for the business to grow while delivering strong returns for investors

3. Engagement Through Tangible Experiences

In our reporting, we aim to showcase how we make a meaningful impact for DC savers. Our funds focus on climate solutions and use avoided emissions as a core Key Performance Indicator (KPI). To make this impact even more tangible, we’ll also present equivalents, such as the equivalent number of trees planted or cars taken off the road, offering a relatable measure of the positive environmental outcomes our investments support. For example, Sky’s portfolio at the end of December 2023 had: the

potential to generate nearly 1,600 GWh a year – that is about 400,000 homes (roughly the size of Birmingham)

avoided nearly 600,000 tonnes of carbon – equivalent to planting nearly 3 million trees

We also have the ability to engage DC members by providing tangible experiences that connect members to the assets they’re investing in. For instance, we’ve organised site visits for scheme members, allowing them to see the renewable assets powered by their pension savings in action, including:

Lincs offshore windfarm off the coast of Grimsby, and

Pingewood Solar Farm - previously a quarry site, then a landfill site, this solar farm now sports a diverse grassland habitat showcasing a net biodiversity gain and value beyond decarbonisation.

These visits help members better understand the real-world impact of their investments and foster a sense of personal involvement in the transition to net zero Member engagement is critical to building long-term support for the energy transition, and we’ll continue exploring new ways to make the impact of their investments as visible and relatable as possible.

Our approach combines diversification and meaningful engagement to make DC investment in the energy transition accessible, impactful, and attractive

Through diversified portfolios like Sky and initiatives to engage scheme members directly, we’re enabling DC capital to play a vital role in tackling the climate crisis and achieving a net-zero future.

*Source: McKinsey–January2022 Cumulative spend on physical transition assets required to reach net zero by 2050. This forward-looking statement is based upon certain assumptions Actual events may differ materially from those assumed. There can be no assurance that estimated projections can be realised,that forward looking statements will prove to be accurate, or that actual projections will not be materially lower than those presented.