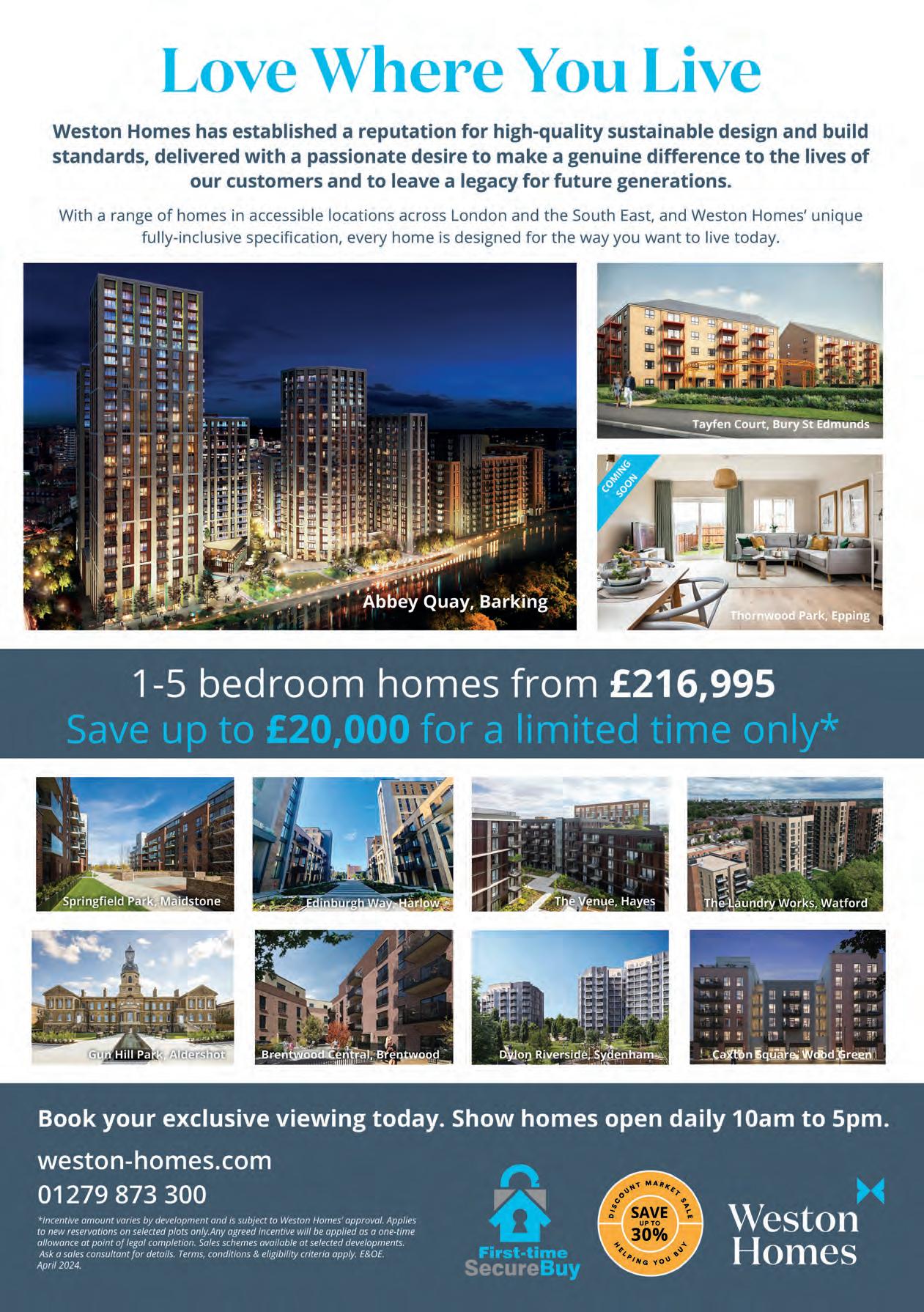

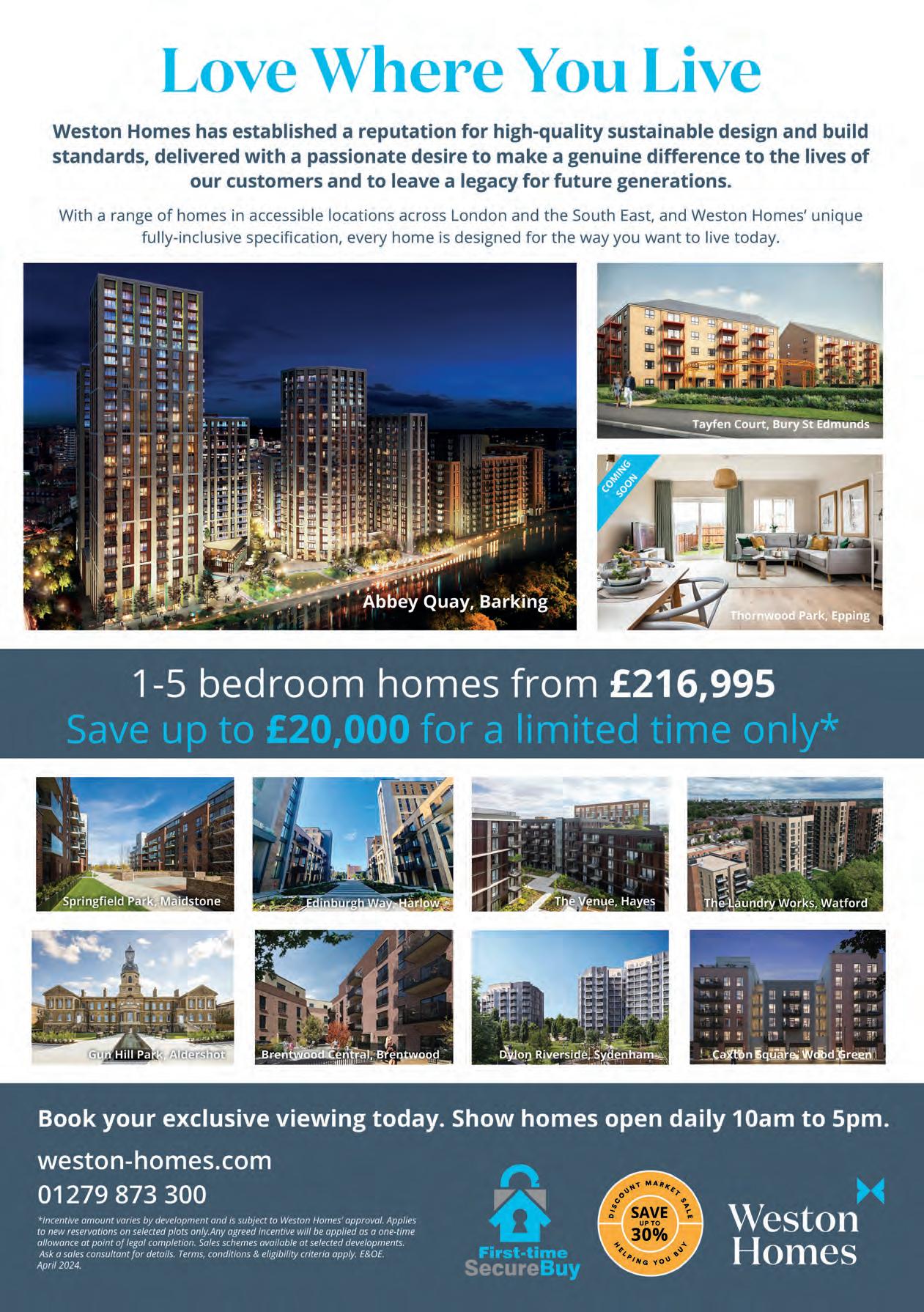

the Ultimate Guide to... GETTING ON THE LADDER, NEW HOMES AND SHARED OWNERSHIP rsttimebuyermag.com June/July 2024 £4.99 “ Buying your first home is a chance to blossom and nurture a space that reflects your personality, style and journey!” RENT TO BUY & LONDON LIVING RENT: ALL YOU NEED TO KNOW DARE TO DREAM, SAVE FOR SUCCESS GOING OVERGROUND: NEW NAMES & GREAT HOMES WIN! TWO 2.5L TINS OF V33 EXTREME PROTECTION WOODSTAIN WORTH £92 Ashlee Jane Home decor in uencer and entrepreneur BUMPER ISSUE!

EDITORIAL – 020 3488 7754

Editor-in-Chief SARAH GARRETT sarahg@spmgroup.co.uk

Editor LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Editorial Assistant and Head of Special Events KATIE WRIGHT

Editorial and Special Events Assistant SOPHIE MUNNERY

Creative Director RYAN BEAL

Sub Editor KAY HILL

Social Media KATIE WRIGHT, SOPHIE MUNNERY

Contributors

CHRIS CLARK, DEBBIE CLARK, KAY HILL, STEVE HIRD, SOPHIE MUNNERY, LAURA DEAN-OSGOOD, CORALIE PHELAN, GINETTA VEDRICKAS, STEPHEN WARD, KATIE WRIGHT

ADVERTISING

020 3488 7754

Director of Advertising/Exhibition Sales LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Special Events KATIE WRIGHT – National Home Buying Week – First Time Buyer Readers’ Awards katie@ rsttimebuyermag.co.uk

Accounts accounts@ultimateguidecompany.com

Managing Director SARAH GARRETT sarahg@spmgroup.co.uk

SUBSCRIPTIONS

020 3488 7754

SWITCHBOARD 020 3488 7754

All advertising copy for August/September 2024 must be received before 28 June 2024. Send all copy to: lynda @ firsttimebuyermag.co.uk

The content of this publication, either in whole or in part, may not be reproduced, stored in a data retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission from the publishers. Opinions expressed in First Time Buyer magazine are not necessarily those of the publishers. © The Ultimate Guide Company Ltd 2008-2024. The Ultimate Guide Company Ltd t/a First Time Buyer magazine will take no responsibility for any loss/ claim resulting from a transaction with one of our advertisers/media partners.

Welcome

We are very excited that after much debate and deliberation our expert panel of judges has decided on the shortlist for our FTB Readers’ Awards 2024. You will find the shortlist on pages 93-113 and it is now up to you, our readers, to vote – please take a moment to go to ftbawards.com and cast your allimportant votes – thank you.

If you live in London, or visit, you might well use the Overground. Recently, the various lines have been renamed and I am sure like me you will be fascinated to know the history and stories behind the new names. Do turn to pages 22-26 to find out and also to check out some very affordable homes along the lines.

If you are struggling to save for a deposit to buy your first dream home, then London Living Rent or Rent to Buy could help. On pages 28-35 we explain how they work and we highlight some great homes that are available through the schemes.

If you are planning to spend some time outside enjoying the hopefully better weather, then check out our top choice of bright and fun outdoor living accessories on pages 10-11.

I hope you enjoy this bumper issue which is packed with information, and if you are struggling to understand how the homebuying process works, then I am sure you will find the answers to your questions inside.

Until next time, happy house hunting!

@firsttimebuyermag

firsttimebuyeronline

EDITOR’S PICKS…

Since the dark days of lockdown(s), we’ve all embraced more outdoor living.

Steve Hird, Stepping into Summer: Designing Your Outdoor Space, page 36

The homes and location here provide us with the ideal balance we’ve been looking for.

Martha Clarke-Reid, House Hunter, page 14

A home is very special and there is nothing quite like it.

Raj Somaiya, At home with, page 12

Consider your location carefully, and how you can get to the places you need to be.

Markus KendallYoung, 20 Questions, page 142

Your mortgage rate will depend on the amount of deposit you have, your credit history, and your income and expenditure.

Rupi Hunjan, Agony Agent, page 126

EDITOR’S LETTER First Time Buyer June/July 2024 3

What’s in…

8 FTB Loves...

Enjoy the outdoors with these vibrant fruit-inspired hot buys.

10 Living

Celebrate summer and soak up the sun with the help of these outdoor living accessories.

12 At home with:

Raj Somaiya

Events planner and CEO of Silverfox Events, Raj works all over the world running high-pro le weddings, parties and corporate

sale – the best

90

It is a dream come true for first time buyers Liam Barber, 28, his partner Lana Stoner, 26, and her daughter Isla, five, along with Daisy the dog, who managed to buy a three bedroom apartment through Hyde New Homes and shared ownership at Bluebell Heights in Sussex.

events. He talks to Lynda Clark about his fascinating career, his rst home and has some great advice for rst time buyers.

14 House Hunter

We go on the hunt with Martha and Ali Clarke-Reid who are on the lookout for their rst home in Kent.

16 Developer’s doctor

Marc Woolfe, Sales & Marketing Director at Barratt David Wilson North Thames, answers your property question.

FEATURED

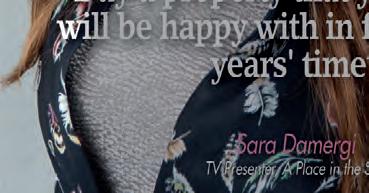

18 The View: Ashlee Jane

Ashlee Jane is an awardwinning home decor in uencer, entrepreneur and the founder of The Suffolk Nest. She talks to Lynda Clark about how her thriving oral business began and gives some top tips on how to add owers to your home without breaking the bank!

22 Going Overground

The highly successful London Overground has recently had a rebrand. Debbie Clark looks at the six new line names and highlights some affordable homes along the different routes.

28 Pay lower rent to save for a deposit

If you are struggling to save for a deposit then London Living Rent and Rent to Buy could be the answer to your problems. We explain how it all works.

38 Homes of the future

Lynda Clark talks to Chris Baxter from HOMErs who explains about these innovative, low-cost modular homes, which are fully furnished and very luxurious.

CONTENTS 4 First Time Buyer June/July 2024 JUNE/JULY 2024 / ISSUE 107 / FIRSTTIMEBUYERMAG.CO.UK

85 For

properties

FTB

HOMEPAGE

12

OR THREE OR FOUR STEMS THAT YOU LOVE. THEY DON’T COST VERY MUCH AND WILL LOOK SENSATIONAL

REGULARS

122 Finance

First Time Buyer Readers’ Awards – time to vote!

50 and 70 Hotspots

We look at Chichester and Hendon as places to live.

Don’t get despondent and keep working towards your dream, says Kay Hill, who looks at the options.

124 Market

As rst time buyers struggle to nd a home that they can afford, is the Government doing all it can to ensure that more new homes are being built? Ginetta Vedrickas looks at the problem.

126 Agony Agent

Jane 115 Competition

All your property questions answered by our panel of experts.

129 Buyer’s Guide

Check out FTB’s Buyer’s Guide, which walks you through the property buying process.

Four lucky winner have the chance to win two 2.5L tins of V33 Extreme Protection Woodstain, worth £92.

116 First home, rst meal

Richard Craven, Head Chef of the One Michelin-starred The Royal Oak creates this mouthwatering recipe for trout, fresh peas and elder ower blossoms.

117 Know How

Trying to save for a deposit? Then these money-saving tips should come in very handy.

118 Cause for Complaint

Stephen Ward, Director of Strategy and External Relations at the Council for Licensed Conveyancers, explains what to do if a property transaction goes wrong.

120 The Conveyancing Process

Shared Direction Conveyancing explains how the process works and the timescales involved.

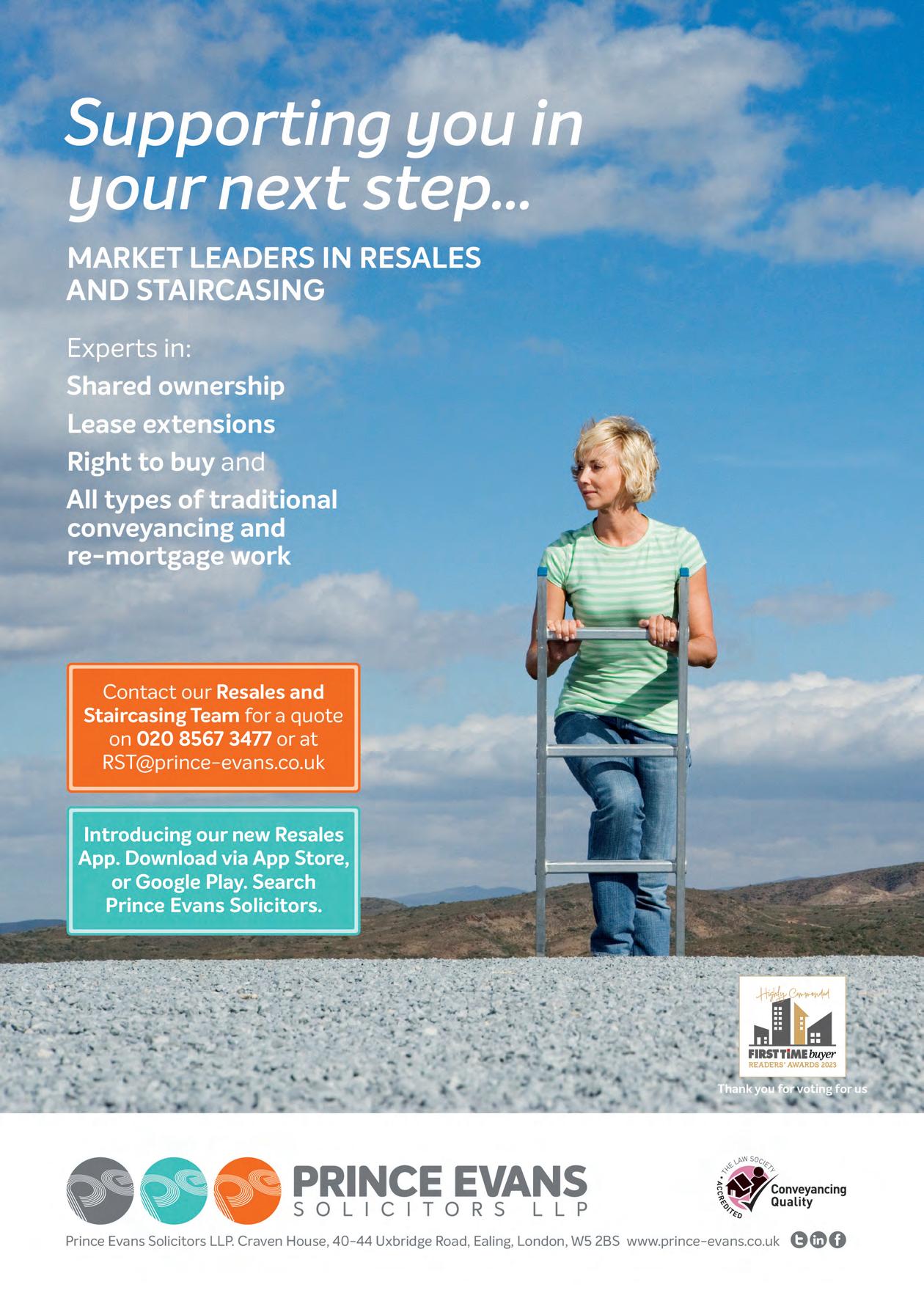

134 How shared ownership resales and staircasing work

Coralie Phelan, Head of Resales and Staircasing at Prince Evans Solicitors LLP, explains the resales process along with the option to staircase In the future.

136 Directory

Check which scheme is right for you, plus some useful contacts.

142 20 Questions

We ask 20 quick- re questions to a property expert and in this issue Markus Kendall-Young, Director of Vibe Living, is in the spotlight.

CONTENTS First Time Buyer June/July 2024 5 ASHLEE JANE, PAGE 18 18

Ashlee

50 93

BUY JUST ONE ARRANGEMENT

Mailbox

LOAN-TO-VALUE

I keep hearing the term “loan-to-value” and know that it is important, but I’m not entirely sure what it means. What does it involve and how important is it?

Marvin West

FTB says: Loan-to-value (LTV) plays a pivotal role in mortgage transactions, affecting both lenders and borrowers. LTV is a measure, used when getting a mortgage, to show the ratio of the loan amount to the appraised value or purchase price of a property. It’s crucial for assessing risk, determining lending criteria and setting interest rates. Higher LTV ratios signify greater risk for lenders and may lead to higher interest rates or the requirement of mortgage insurance. For borrowers, a lower LTV means more equity in the property, offering benefits such as better loan terms and easier access to home equity.

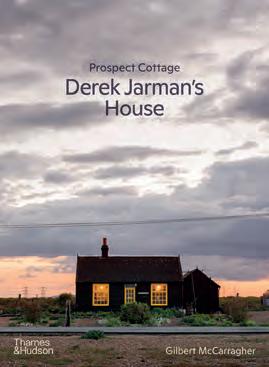

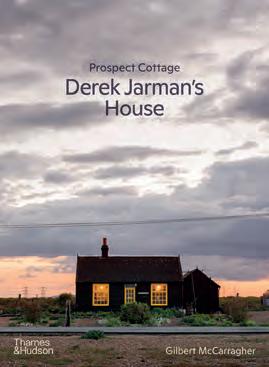

This issue’s star letter prize wins a copy of Prospect Cottage: Derek Jarman’s House from photographer Gilbert McCarragher, worth £25 and published by Thames & Hudson. This book invites readers into the personal sanctuary of the iconic artist for the very first time. While the gardens of Prospect Cottage in Dungeness are much visited and widely known, few people have seen inside his house. All of the doors have windows in them, etched by Jarman with flowers or poems. In the studio, paints and power tools are scattered across the work table and many of the decorative objects are beachcombed finds, testament to the way the local environment served as inspiration to him. Available from Amazon and leading book shops.

STAMP DUTY

What are the current Stamp Duty rates for first time buyers and what is Stamp Duty Relief?

Chloe Farrington

FTB says: First time buyers in England and Northern Ireland are exempt from Stamp Duty on properties up to £425,000. For properties costing between £425,001 to £625,000 you’ll pay 5% Stamp Duty, but only

WRITE TO US!

Please send us your questions, comments and suggestions concerning property, or the articles in First Time Buyer magazine.

lynda@firsttimebuyermag.co.uk

CHILDCARE COSTS

My partner and I are wanting to get on to the property ladder but we are concerned that the high childcare costs we currently have could hamper our mortgage application. Will this be the case?

Will Dewdon

FTB says: Childcare costs can indeed impact a mortgage decision. When applying for a mortgage, lenders typically assess the borrower’s income and expenses to determine their affordability and creditworthiness. Childcare costs are considered a significant expense and can affect the borrower’s debt-to-income ratio, which is a crucial factor in mortgage approval. It’s essential for people such as yourselves, considering a mortgage, to thoroughly evaluate your financial situation, including childcare expenses, and work with lenders or financial advisers to determine a realistic budget and mortgage affordability. It’s best to speak to a mortgage adviser who can give you advice based on your circumstances.

LIFETIME ISA AND SHARED OWNERSHIP

on the value above £425,000. Properties over £625,000 follow standard Stamp Duty rates. First Time Buyer Stamp Duty Relief is a measure designed by the Government to make it easier for people get on the property ladder following the guidelines above. It’s worth noting that Stamp Duty is set to change again in April 2025 so it’s a good time to make use of this tax relief while it’s available.

I have spent a long time trying to save enough to be able to get on to the property ladder. I took advantage of a Lifetime ISA and I have managed to accumulate a total of £7,000, which falls short of what I really need. Consequently, I have been exploring the option of shared ownership. Can I utilise the deposit from my Lifetime ISA for the shared ownership scheme?

Bradley Waters

FTB says: Yes, you can use a Lifetime ISA (LISA) to help buy a shared ownership property. The funds saved in a LISA can be used towards

the purchase of a first home, including shared ownership properties, as long as certain conditions are met. Some key points to consider are: eligibility (you must be a first time buyer), property value limit (the property does not exceed £450,000) and that you have met any conditions set out in your LISA as well. Again, it’s advisable to consult with a financial adviser or mortgage broker who can provide personalised advice based on your specific circumstances.

VISIT OUR WEBSITE For everything you need to know about buying for the first time, go to firsttimebuyermag.com

LETTERS First Time Buyer June/July 2024 7

At home with: Raj Somaiya

Raj is an esteemed events planner and CEO of Silverfox Events who works internationally and in the UK. Starting out selling balloon bouquets with his late mother, he now runs high-profile weddings, birthday parties and corporate events. He also owns GupShup in Hale, which is one of the most popular Indian restaurants in the North West. He chats to Lynda Clark about his incredible career, his first home and gives some good advice to first time buyers

Photos: iproductions

FTB: Tell us about your first step on the property ladder?

RS: In 2002 we bought an amazing townhouse in Whitefield called The Square, which had been designed by the renowned property developer PJ Livesey. It was really very special and had a garage in the basement, a den, a lovely kitchen that led on to a conservatory, and four bedrooms with an en suite to the main one plus a family bathroom. The communal gardens were wonderful and we really loved it. My eldest daughter was four when we moved there and my youngest daughter was just six months old. We stayed until 2016 when my son was born and it began to feel a little cramped and we wanted more space. We sold it and rented for around four years until we decided where we really wanted to move to.

FTB: Where do you live now?

RS: We were keen that our son went to Manchester Grammar School and we loved

Hale as an area. We bought a house which is on the cusp of Hale and Bowdon. Bowdon is a very affluent town and at one point the homes there were more expensive than in Knightsbridge! It’s an old detached house and is gated and has a stunning garden. We have done a great deal of work to it and extended it and turned it back to brick. It’s over four floors and has six bedrooms all with en suites and we have created a little temple upstairs. We still have to finish the interiors of the main lounge and dining

room but we hope to complete them this year. We invested every single penny we had into the house and we pretty much gutted it. I copied the idea from our other house, The Square, and we created an orangery which leads off the kitchen. It’s all really very special and I think this will be our forever home.

FTB: How did you career begin?

RS: My mother had three Post Offices and card shops and I used to help her. It was the mid 80s but sadly in 1989 interest rates rocketed and we couldn’t afford to carry on with the shops and we went bust! It was very sad but my mother was an incredible woman. Luckily she had also started a helium balloon business and was the first person to offer balloon bouquets in the North. She had arrived in the UK aged 19 from Africa and married my father and she

“WE ARE WELL KNOWN FOR OUR GROUND-BREAKING DESIGN IDEAS, BESPOKE WEDDING CREATIONS AND IMPECCABLY HIGH STANDARDS OF FOOD, DRINKS AND SERVICE”

Homepage LIVING 12 First Time Buyer June/July 2024

“I THINK EVERYONE SHOULD REALLY RESEARCH THE AREA THEY ARE LOOKING

TO BUY IN AND DO YOUR SUMS”

was very clever and a real entrepreneur. She then became the first Indian wedding planner in the country and she was highly successful. In 2002 she branched into catering for Indian weddings and parties and arranged around 300 weddings a year – it was very hard work! The company was called Payal, which is the Indian word for an anklet which has bells on, which are very popular at Indian weddings. I worked with my mum and was responsible for all the logistics and she did sales. It was the perfect duo as she was very creative and had great attention to detail.

FTB: You are now CEO of Silverfox Events, can you tell us about that?

and she is brilliant – she does all the PR run high-profile weddings for people of

me to be a judge alongside two celebrities, who were Fred Sirieix and Sara Davies. We got on really well and I love working on TV and I’ve been told I am very charismatic. I have also been on The Apprentice – You’re Fired on BBC2 hosted by Tom Allen. The first challenge on the programme was to put on an event and I was asked to comment on it. It was very funny to see what they all planned.

FTB: Tell us about your restaurant?

RS: I opened a restaurant called GupShup in Hale, which in Hindi means chat or

FTB: What are your plans for the future?

RS: During Covid we had to completely shut down, but 2022 and 2023 have been our best years so far. We love our work but we also want to spend more time with the children. We have an office in London and Paris but we are opening one in Dubai as that is a much bigger sea to swim in. There’s so much going on there and my philosophy is that you have to keep moving forward.

FTB: What advice do you have for first time buyers?

RS: We made a big mistake when we bought The Square. We paid £395,000 and when we sold in 2016 we only got £580,000, which considering the time we lived there wasn’t a great profit, so look at the capital growth in the area you are buying in and ensure you will make money when you decide to move on. I think everyone should really research the area they are

fazes us and we did another party on a

RS: I married my wife Sheetal in 1995 and she is brilliant – she does all the PR and marketing and is creative director. We run high-profile weddings for people of all faiths as well as bar mitzvahs, birthday parties and corporate events. We run and create every aspect of the occasion. We are well known for our ground-breaking design ideas, bespoke wedding creations and impeccably high standards of food, drinks and service. One occasion that stands out is an extravagant 50th birthday party at Palais Garnier in Paris. We brought a Mancunian twist to an iconic Marie Antoinette theme and everyone loved it. We also did a Great Gatsby-themed party, which was like building a film set. It took three weeks to build and was incredible. Nothing really fazes us and we did another party on a yacht off the coast of St Tropez and had to crane the infrastructure in. After my mum passed away in 2017 we sold the original company, Payal, to somebody we knew and now we just concentrate on Silverfox.

FTB: Tell us about your television work?

was great fun to do and I really enjoyed the experience. Then, during Covid, I was approached to be a judge on a show

RS: In 2014 I was approached to do a documentary called My Big Fat Asian Wedding for Channel 4. They documented everything I did, organising four weddings, around the country, for nine months. It was great fun to do and I really enjoyed the experience. Then, during Covid, I was approached to be a judge on a show for BBC2 they were planning called The Ultimate Wedding Planner. They were looking for three luxury planners but they only liked me! After the pandemic was over they approached me again and said they were changing the format of the programme and that they wanted

gossip. It is one of the best known and most popular Indian restaurant in the North West. We have recently changed the vibe and created a new menu. I have a great Italian general manager and we offer Pan-Indian food which is rather like tapas – lots of smaller dishes which are all very different and it’s worked very well.

looking to buy in and do your sums. A home is very special and there is nothing quite like it but you also have to think further down the line and look at the capital growth in say 10 years’ time.

silverfoxevents.com Instagram: @silverfoxevents and @rajsomaiyaofficial

Homepage LIVING First Time Buyer June/July 2024 13

The HOUSE HUNTER

This month FTB goes on the hunt with Martha and Ali who are looking to move from London to Kent and are seeking a new home with at least two bedrooms and good commuter links

What we found…

THE GO-TO DESTINATIONTHE COUNTRY CONNECTION

Names Martha Clarke-Reid, 37, Ali Clarke-Reid, 42

Occupations Recruitment Manager, Events Co-ordinator

Maximum budget £300,000

Requirements A home with at least two bedrooms and ideally a garden, in Kent, with good rail links to London and a range of local facilities close by

What they wanted…

We made the decision to leave London a little while ago and have spent a while trying to nd the right place for us.

We’ve settled on Kent as we’re both from the South – me from Kent, Ali from Surrey – and it’s possible to nd a great quality of life within easy reach of the capital. We live in a very busy and polluted part of London and though we love city life, we’ve fallen out of love with the area and would like to be closer to family as well as to all the countryside and coastline that Kent has to offer. We both have to be in London regularly, so would like rail links to be no more than one hour each way. We’d love some outdoor space and ideally to have local shops and facilities within walking distance.”

Whitstable Heights Whitstable, Kent Spring Acres Sittingbourne, Kent

The ever-popular coastal town of Whitstable is a huge draw for homebuyers and holiday makers alike, charmed by its mix of pretty cottages, historic harbour and scenic sea views. The new homes at Whitstable Heights give rst time buyers the chance to be part of this lifestyle in brand new, quality homes. The development includes two, three and four bedroom houses and coach houses. The larger homes feature open-plan living/dining areas that open to turfed rear gardens, en suites to the larger bedrooms, and plenty of storage.

hydenewhomes.co.uk

*Shared ownership: based on a 40% share of the full market value of £285,000

Situated on the outer fringes of Sittingbourne, this new collection of two, three and four bedroom homes borders open elds and stunning countryside. The development is also set within a country park itself, while the Kent Downs and North Kent coast are reached in mere minutes. The three bedroom properties feature a separate living room and kitchen, while upstairs there’s an en suite from the main bedroom. Nearby Sittingbourne is great for schools and amenities and has a theatre and cinema. Trains reach London St Pancras in 69 minutes.

hydenewhomes.co.uk

*Shared ownership: based on a 40% share of the full market value of £415,000

What they thought…

I grew up in Kent and we visited the coastal town of Whitstable on a regular basis. I have some lovely memories of the area and it’s always been so popular. We visited a few years ago when a couple of our friends moved down and it really is just as lovely as I remember – they can’t recommend it enough. The properties are of a high quality and we’re super impressed that we can afford a house here; something we could only have imagined in London.”

Wow – what pretty surroundings this development has. We’d certainly never be short on places to explore for walks, and I can imagine the air is fresh and lovely – a big change from our current place. The properties are very attractive – we love that the three bedroom homes have a separate living room, and can barely imagine having so much space. The extra bedroom means we’d have enough room for guests as well as an of ce space, which is just amazing.”

14 First Time Buyer June/July 2024 Homepage FIRST RUNG

PROFILE

FROM

FROM

£114,000*

£166,000*

THE LAKESIDE LOVELY THE COASTAL CHARM

These beautiful new homes sit in a pretty spot on the Kent coast, just 15 miles from the white cliffs of Dover. The properties available range from two bedroom apartments to four bedroom detached houses, all with outdoor space, and many with views out over lakes. The apartments feature open-plan living/dining areas with French doors leading to a private terrace. The bedrooms are well sized, with the main also featuring an en suite. London can be reached in under two hours – including a 20-minute drive to Ashford International.

barratthomes.co.uk

This is a beautiful development – the surroundings are just so different to what we’re used to – stunning lakes on the doorstep, and the sea literally minutes from the door. Hythe is very close by and has all the amenities you’d need on a daily basis, while Ashford is only a 20-minute drive, so we’d never be far from super-speedy travel. This is a real getaway-fromit-all location. It’s a bit far south for us at the moment, but it has given us serious pause for thought.”

First choice!

Ramsgate is among the Kent seaside towns that have seen a surge in popularity in recent years, with increasing numbers of young professionals buying in or relocating to the area. These new three bedroom homes offer the perfect mix of coast, country and town. On the ground oor you can enjoy a spacious kitchen/dining area with French doors leading out on to the garden, a light- lled relaxing lounge, and a bathroom. Upstairs there are two double bedrooms, with an en suite to the main bedroom, a single bedroom, and a modern family bathroom.

barratthomes.co.uk

There’s a lovely mix of country and coastal here: although you’re not right by the sea, it’s such a short drive, that we could really make the most of it without having to do a huge trip. We really like how the development includes green space and wildlife areas and that there are a range of properties, meaning a more diverse community around us. Ramsgate is a cool place - it’s got a lot of history but also has a growing arts and culture scene, which really is a piece of us.”

THE PERFECT BALANCE

Riverside Square Canterbury, Kent

This contemporary new collection of one to three bedroom properties forms part of the larger Riverside development, which runs alongside the River Stour in the centre of the city of Canterbury. Residents can enjoy the facilities of the new public square, all moments from the historic city centre, complete with restaurants, bars and cinema just a short walk away. A mix of one, two and three bedroom apartments and three bedroom houses is available. The houses are bright and spacious with modern features including EV charging points in the driveway. Trains from nearby Canterbury West reach London in 55 minutes.

hydenewhomes.co.uk

“To say we’re excited about the homes at Riverside Square is a serious understatement. We are very committed to making this dream a reality. We registered with Hyde New Homes right away, have our nances in order and a mortgage offer in principle for the right amount.”

The homes and location here provide us with the ideal balance we’ve been looking for – a taste of city life outside of London, with country and coastline all on the doorstep. We love the look of Canterbury, with its stunning historic sights and lots of entertainment and culture on offer, and the commuting time into London is so impressive. The houses are just perfect – very contemporary and stylish. The kitchens are just to our taste, and we would be so proud to invite friends and family over for dinner or to stay. There’s so much close by, too, with some absolutely amazing coastline within a 20-minute drive.“

Homepage FIRST RUNG First Time Buyer June/July 2024 15

Martello Lakes Hythe, Kent

Spit re Green Ramsgate, Kent

*Based on a 50% share of the full market value of £330,000 *Shared ownership: based on a 40% share of the full market value of £222,500 FROM £239,995 FROM £165,000* FROM £89,000*

THE NEXT STEP

Marc Woolfe is the Sales & Marketing Director at Barratt David Wilson’s North Thames division, joining in 2012 on the Barratt Aspire Graduate scheme as a Sales & Marketing Graduate. From specialising in the sales sector and beginning his career as a Sales Adviser, Marc joined the North Thames division in 2019 as a Senior Sales Manager before entering his current role in the summer of 2022. Marc is keen to encourage and help aspiring owners on to the property ladder as much as possible in 2024

Q Mypartner and I are both in our mid-20s and live and work in London, having been raised there and lived there all our lives. We are looking to escape the city to enjoy a quieter way of life and to get on to the property ladder but don’t want to move too far from our family, friends and jobs, which require us to commute into the office for most of the week. Do you have any advice about the process for first time buyers and are there any areas you’d recommend that are commutable to London?

AWell, you’ve made the first important step in deciding you are ready to buy your first home and move out of London, congratulations! Starting out can seem very daunting but there are plenty of options, locations and schemes available to first time buyers. The market for 2024 is looking seemingly better too, with interest rates not as high as they were in the peak of 2022.

The good news is that there are plenty of areas surrounding London that have excellent transport links in and out of the city and house prices that are a fraction of the cost of what you see in London.

We see first time buyers of all ages and demographics interested in our developments here at Barratt David Wilson North Thames, and, in fact, around half of our buyers are getting on the property ladder for the first time, so you are not alone in the process.

A number of towns in counties such as Buckinghamshire and Bedfordshire have become increasingly popular post-pandemic as they offer a perfect blend of countryside living while still being within commutable distance of the city. My advice would be to look at the train lines that have regular services in and out of London and evaluate the affordability of those areas.

As an example, Leagrave station is a stone’s throw away from our Linmere development and is served by Thameslink. Services take just 36 minutes into the city – which is quicker than some underground services take to reach Zones 3 or 4 in London!

We see plenty of buyers from the north of London, from areas such as Bushey, Mill Hill and Finchley, so you would certainly not be alone in looking towards neighbouring counties to London.

There are also plenty of schemes available to help first time buyers at Barratt David Wilson North Thames. All of our homes come with best-in-class energy efficiency as standard, and our Deposit Unlock scheme allows buyers to purchase with just a 5% deposit¹. We also provide a Key Worker Deposit Contribution scheme which is available to people in a range of job roles and offers a £1,000 contribution for every £20,000 of the purchase price.

Most recently, we have launched the “Own New – Rate Reducer”² mortgage product, where Barratt Homes could contribute 3% or 5% and will see buyers benefit from reduced monthly mortgage repayments for the first two to five years.

Finally, my most important piece of advice is to research, research, research. To get the ball rolling, speak to a mortgage adviser, as you might be surprised by what you can actually afford, and they will help you to set financial goals and guide you through the process. Best of luck!

1 barratthomes.co.uk/offers/deposit-unlock/

2 barratthomes.co.uk/offers/own-new-rate-reducer/

We have many developments throughout Buckinghamshire and Bedfordshire, including our agship Kingsbrook development in Aylesbury, Buckinghamshire, which has a good mix of starter properties for rst time buyers...

Marc Woolfe, Sales & Marketing Director, Barratt David Wilson North Thames Kingsbrook, Aylesbury

CANAL QUARTER FROM £231,500 ORCHARD GREEN FROM £245,00

This is a large, multi-phase development near Aylesbury in Buckinghamshire, comprising 2,450 new homes, three new schools and new community infrastructure.

We’ve partnered with the RSPB, so sustainability is at the heart of this development. It includes a 250-acre area of wildlife-rich space, and we’ve installed a number of bat and bird boxes and created more than 100 allotments.

Canal Quarter: two bedroom homes from £231,500 (Barratt Homes)

The partnership has seen a number of conservation-concerned species increase in numbers such as house sparrows, starlings and whitethroats.

Orchard Green: one bedroom apartments from £245,000 (Barratt Homes), three and four bedroom homes from £380,000 (David Wilson).

Find out more at barratthomes.co.uk/new-homes/dev001701-canal-quarter-at-kingsbrook/

June/July 2024

FLOWER POWER!

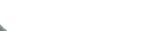

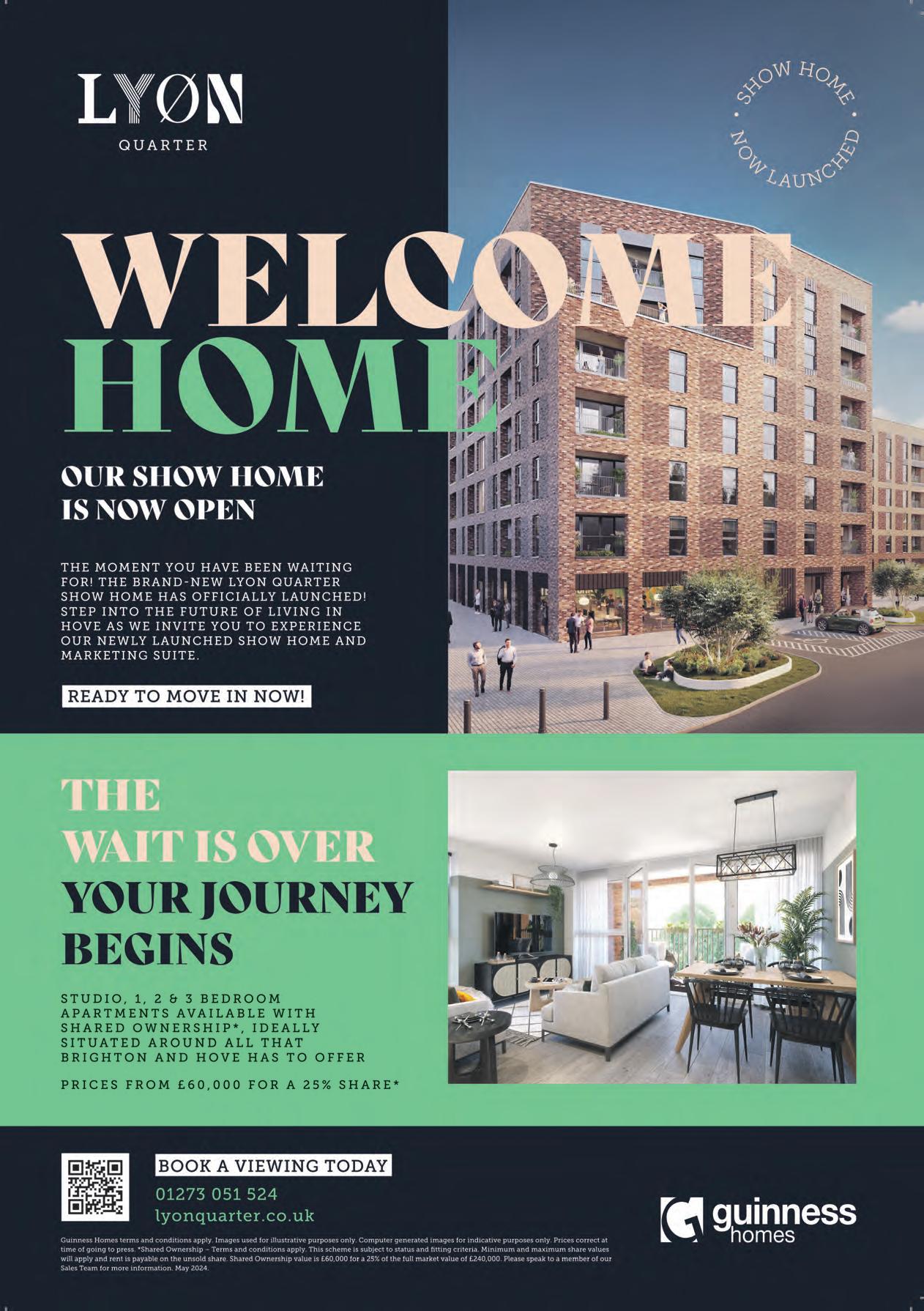

Ashlee Jane, an award-winning home decor influencer and entrepreneur, is the visionary founder behind flourishing floral e-commerce business The Suffolk Nest. With over 500,000 followers on Instagram, she talks to Lynda Clark about how her thriving business began and gives some tips on how to add flowers to your home without breaking the budget

Ashlee runs The Suffolk Nest with her husband Chris, and although business is booming and she is incredibly busy, she has time to chat and obviously loves what she does with a great deal of passion. She explains, “I had a very normal upbringing. My sister is only 15 months older than me and we were like two peas in a pod! I was actually born in Liverpool, but my parents moved to Suffolk because of my dad’s work. Then when I was five, we all moved again to Hong Kong because of my dad’s career. My mum stayed at home and looked after us all and made a lot of sacrifices for the family. It did instil in me that a career was very important, and I used my dad as a role model. It was about 30 years ago, so not many English people had ever visited Hong Kong and we were rather unique. We used to get stopped in the street and the local

"WE WORKED ALL HOURS AND IT WAS BOTH EXCITING AND CHAOTIC BUT THE SUFFOLK NEST WAS BORN"

people wanted to touch our faces or hold our hands –apparently for good luck – it was a very special time.”

Ashlee eventually went to university in Nottingham to study Fashion Management. “I was rather headstrong and always wanted to be the best at everything I did. I worked myself into the ground and set such high standards for myself. It really brought out the best and worst in me.” She got a first class honours degree and her dissertation on how online shopping was set to change the world won awards. Little did she know at the time that she would end up running her very own e-commerce business! “I then got a job at ASOS as a merchandiser, which again was a highly successful online fashion brand and tied in well with my dissertation. It was buzzing, busy, thriving and very exciting. We had goals to hit, and it was pretty full-on. I had to work on a lot of spreadsheets and numbers though and I missed doing anything creative. As a child I had always loved making things and I felt this creativity was lacking in my life and work.”

After two years. Ashlee decided to move on as the wages were low and it was difficult to get a promotion and move up the ranks, but also time to move closer to home. She moved back to Suffolk and got a job

THE VIEW 18 First Time Buyer June/July 2024

THE VIEW First Time Buyer June/July 2024 19

"IT SEEMS INCREDIBLE THAT A HOBBY HAS BECOME MY FULL TIME CAREER AND WE ARE IN A PERIOD OF HUGE GROWTH AT THE MOMENT AND BEGINNING TO SCALE THINGS UP"

THE VIEW 20 First Time Buyer June/July 2024

with Cadbury. “I stayed there for eight years and it suited me at the time. It was getting near to Christmas and I was due to go with some friends on a wreath-making course. I had a terrible day as I had been driving a lot and was very tired but I felt I had to turn up as there were only four of us going and I didn’t want to let anyone down. Thank goodness I did go as that night something clicked! I loved it and it sparked something in me to want to do more. I went home and made lots more wreaths and foraged shrubs and trees in my parents' garden to work with. Then I suddenly got requests from friends to make one for them and things started to take off.

“A friend then asked me if I could do the flowers at her wedding, which came as a bit of a shock. She wanted orchids and a trailing bouquet and I felt it was way out of my zone. I advised her that she needed a professional florist but Chris, my husband, encouraged me and said it might be my only opportunity to do something on such a large scale as this. I suppose I just needed someone to believe in me and I decided to go ahead. I spent hours and hours looking at orchids on the internet and how to work with them. I was terrified they would all die but everything worked out all right and the wedding was beautiful. She loved what I did and I must admit I was quite euphoric.”

Ashlee had been running an Instagram account detailing all the home renovations she and Chris were doing on their house. “I occasionally put up stories about flowers and wreaths and they were very popular. But, then the pandemic hit and while we were all at home I decided to launch my own Christmas wreath-making kit. People would buy the kit which I posted to them and then follow my video on how to make it. To my absolute surprise it went wild but we had no website and no way of taking anyone’s money and I had to go through each individual message on Instagram and get back to everyone.

"The other problem was where to get the flowers, as up until then I had only used a small local grower who just didn’t have the capacity to supply me with the amount I needed. It was very tough as my daughters were so young, Orla was two and Florence just six months, and I was working all hours trying to look after them and run the business. I was on maternity leave but Chris decided to come into the business and my parents thought I was crazy, but I couldn’t have done it without them. We worked all hours and it was both exciting and chaotic, but The Suffolk Nest was born.”

They created a website and at the start they only had three items for sale. One was an apothecary glass vase which they sold thousands of. They had a lot of hurdles

"INSTAGRAM IS MY BABY AND WE GET AROUND 100 TO 200 MESSAGES A DAY, WHICH IS A LOT TO DEAL WITH. IT IS AN INCREDIBLE PLATFORM AND IS A HUGE PRIORITY TO ME"

to jump through as they needed to find more suppliers and sort out packaging. Then Ashlee was at a supplier and saw a eucalyptus stem which she was convinced was real but was actually faux. She said, “I asked how many stems they had and they came back and said just 80, so I bought them all. I packed them into the boot of my car and when I got home Chris was very surprised and asked how I proposed to sell them! They are still extremely popular today and three years on we work with different manufacturers and many different types of stems – it’s just grown and grown!”

Chris came into the business full time around a year ago. It was a very big decision for them both as they have two young children and a mortgage. “I had a real inner belief that we would make it work. At the time we rented a warehouse, but within a year we had run out of space. We used to pack everything ourselves and often had to work nearly all night to get through the orders but we now employ someone to do it and we have a warehouse manager and executive. Chris looks after logistics and I look after everything else – I literally have a different hat on throughout the day!”

They stopped dealing with fresh flowers a couple of years ago as shipping them created multiple problems. For starters they are perishable and hot weather can cause real problems, plus once they are with a courier anything might happen. “I didn’t want to get a reputation for sending dead flowers to our customers. I used to panic and not sleep just imagining what might go wrong and that made me resent the flowers, which was awful. We don’t do weddings any more either as they take up so much time and at weekends too and we really want to spend some family time with the girls as we are always so busy.

“It seems incredible that a hobby has become my full-time career and we are in a period of huge growth at the moment and beginning to scale things up. I pride ourselves on our customer service though, as that is very important – some days I think we will take over the world and others I just go with the flow, but I am so happy and proud at what we have achieved.”

Ashlee and the family live in Suffolk and have recently moved into a new home.

“We moved at Christmas which was a bit of a nightmare but I love Christmas and I managed to decorate the new house and put up a gorgeous garland on the fireplace mantle, and make it homely and cosy for our girls' first Christmas there.”

Ashlee has some great advice for first time buyers who are working on a small budget but would still like faux flowers in their dream home. “My advice would be to buy just one arrangement or three or four stems that you love and arrange them in a simple vase. They don’t cost very much and will look sensational on a coffee table, in the kitchen, or bedroom. Buy something you really can’t resist and I know it will make a very big impact and you won’t have the expense of buying fresh flowers every week which can be pricey.”

She looks after all the social media and has just hit over half a million followers on Instagram. She explained, ”Instagram is my baby and we get around 100 to 200 messages a day, which is a lot to deal with. It is an incredible platform and is a huge priority for me and sometimes Chris will help me with content to put up but it’s very precious to me – it’s where it all started! We are also on TikTok which is great too.”

As if Ashlee wasn’t busy enough, she has also written a book, House of Flowers, published by Quercus, £25. It features 30 floral project ideas across each season and was published in March 2023 and hit the bestseller list on multiple occasions. “It was quite chaotic as I am not a writer, but I loved the creative side of it and all the wonderful photoshoots we did. It’s sold around 11,000 copies which is great and I am very pleased that I did it, even though it was tough.”

Ashlee and Chris enjoy their holidays with the girls and even though they are both passionate about The Suffolk Nest, they try to spend as much family time as possible. The world-class faux flowers, arrangements and home decor pieces are stunning, but after talking to Ashlee I truly think her favourite is the Christmas wreaths she makes – it was, after all, where it all began.

thesuffolknest.com

@The_Suffolk_Nest

THE VIEW First Time Buyer June/July 2024 21

GOING OVERGROUND

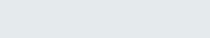

Carrying more than three million customers a week and serving 113 stations and all nine London fare zones, The London Overground is one of the most successful railways in the country. In 2024 it is undergoing an exciting rebrand! Debbie Clark explores how the six new line names – and colours – will strengthen and celebrate the identity of the areas they serve, and identifies some of the best new developments for first time buyers in those areas

The London Underground map, designed by Harry Beck in 1931, is widely recognised as a design classic. However, as sections of the London Overground have been added since 2007, the parallel orange lines (that now represent over 100 miles of railway!) have proved confusing in comparison to their stylish underground counterparts. Responding to research by Transport for London (TfL), which indicated customers would find the Overground network easier to navigate if it wasn’t one colour and name, an independent research and naming process was undertaken by DNCO, a creative agency specialising in place branding and naming.

The Mayor of London, Sadiq Khan said, "This is a hugely exciting moment, transforming how we think about London's transport network. Giving each of the Overground lines distinct colours and identities will make it simpler and easier for passengers to get around. In reimagining London's tube map, we are also honouring and celebrating different parts of London's unique local history and culture. The new names and colours have been chosen through engagement with passengers, historians and local communities, reflecting the heritage and diversity of our amazing city."

THE WEAVER LINE: LIVERPOOL STREET TO CHESHUNT/ENFIELD

TOWN/CHINGFORD

SO, WHAT ARE THESE NEW NAMES AND WHY ARE THEY SIGNIFICANT? FROM £298,000

The Weaver Line runs through Liverpool Street, Spitalfields, Bethnal Green and Hackney – areas known for the textile trade, and shaped by different migrant communities at different points in history. The Huguenots in the 17th century established a flourishing silk trade, and in the next century, Irish weavers arrived searching for work after the collapse of the Irish linen trade. At the end of the 19th century and during the second world war, Jewish families fleeing antisemitism in eastern Europe moved to the area, revitalising the garment industry and maintaining the market at Petticoat Lane. By the 1960s, Bangladeshi immigration increased due to the area’s low-cost housing and work opportunities in the textile and garment industry. The Weaver Line also weaves its way up to Walthamstow, home to William Morris.

WALTHAMSTOW – THE WEAVER LINE Forest Road E17

There are 90 one bedroom, energy-ef cient apartments available at a 20% discount to the local market. Situated within minutes of Lloyd Park and opposite the Grade II* listed William Morris Gallery, Forest Road E17 has a host of communal spaces for residents to enjoy, including two roof terraces. Here, residents can make use of the shared allotment beds to grow fruit and veg, use the space to exercise, or relax with neighbours.

pocketliving.com/projects/development/32-forest-road-e17-waltham-forest 020 7291 3683

OVERGROUND 22 First Time Buyer June/July 2024

THE LIONESS LINE: EUSTON TO WATFORD JUNCTION

Running through the heart of Wembley, The Lioness Line honours the historic achievements and lasting legacy created by the England women’s football team. The Lionesses enjoyed their greatest triumph when they won the UEFA Women’s EURO final in 2022. Their success in this tournament, along with their memorable run to the FIFA Women’s World Cup final a year later, have attracted millions of fans and had a significant impact on the sport’s participation numbers; 2.3 million more women and girls were inspired to play football. The Lionesses continue to inspire and empower the next generation of women and girls in sport.

ALPERTON – THE LIONESS LINE

Liberty Wharf

Liberty Wharf in Alperton offers a collection of one, two, and three bedroom apartments available through shared ownership, by the historic Grand Union Canal. Liberty Wharf is ideal for city lovers seeking a home with easy access to leisurely towpath walks, runs and bike rides. It has the added bonus of being close to popular local parks and green spaces.

Liberty Wharf is just an 18-minute walk to the Overground and a 10-minute walk to Alperton station, where the Piccadilly Line takes just 24 minutes to South Kensington or 34 minutes to Leicester Square. Alperton is packed full of neighbourhood cafes and culinary hotspots, with a diverse and welcoming community. Homes offer high-speci cation interiors, oorto-ceiling windows and secluded communal gardens and kitchens include an integrated fridge-freezer, oven and electric hob. The two and three bedroom apartments have secure underground car parking available, and all homes are kitted out with a video entry system.

liberty-wharf.co.uk 0300 100 0308

THE LIBERTY LINE: ROMFORD TO UPMINSTER

Eastman

Village

Diego, a Technical Account Manager, purchased his two bedroom shared ownership apartment (including parking) in November 2023. He paid a deposit of £11,500 for a 25% share of the £460,000 home at Harrow and Wealdstone Heights.

Diego explains, “I had previously been privately renting a two bedroom home in north London. Before that, I had owned a property in Bedford but had relocated back to London to be closer to my kids.” He was keen to get back on the property ladder.

HARROW – THE LIONESS LINE

Eastman Village is a regeneration project on the site of the former Kodak factory which will provide over 2,000 new homes, a school, shops, leisure and community facilities, a new medical centre and commercial space. The development will offer electric car charging points, free car club membership for residents and plenty of cycle storage. Commuters will be able to reach Euston in just 13 minutes via Harrow & Wealdstone station, on the Lioness Line, which is only a 14-minute walk away.

barratthomes.co.uk/new-homes/dev002159eastman-village 0343 253 8918

The Liberty Line celebrates the freedom that is a defining feature of London. It runs through Havering and the name is indicative of the unique independence of the area, reflecting its past, present and future. Liberty references the motto of the London Borough of Havering, and its historical status as a royal liberty, which also gives its name to the Royal Liberty School in Gidea Park and the Liberty Shopping Centre in Romford. It also reflects the independent spirit of the Havering community. The line links the borough to the rest of London by connecting it to the Elizabeth Line, and enables residents to enjoy the freedom and independence that public transport provides; it gives them the liberty to explore the capital now and in the future.

Diego was aware of the shared ownership scheme but was unsure as to whether he would qualify having previously owned a property. Upon enquiring with the Origin team, he quickly learnt that he would be, as his income fell under the £90,000 threshold for London and he did not own a property or part of one at the time of application.

Diego searched online for north London homes. “I hadn’t previously considered Harrow,” he admits, “but when I came across Origin Housing and its new development, the apartments looked really great, so I knew I had to check it out!” He researched journey times and found it was an easy journey to both his son in Burnt Oak and his daughter in En eld. “I took both of them to see the apartment,” he says, “and they loved it as well, so I knew it was the place for me.”

Diego was really impressed by how much he would get for his money. He says, “The apartments were really spacious and I could easily t two single beds with a desk in the second bedroom for my kids.” Diego was also attracted by the local amenities and transport links. The development is also pet friendly, which was important to Diego as he has an eight-month-old puppy, Elvis.

Diego is delighted with his new investment. “The whole process was really quick,” he reports. “I had a positive experience from start to nish.” Looking ahead to his future, he says, “My long-term plan is de nitely to staircase in the future – I’d like to own a greater share in my apartment. For now, I’m enjoying settling into a routine and having my kids come to stay – it’s fantastic to have more space as they get older.”

OVERGROUND First Time Buyer June/July 2024 23

FROM £352,000 *Based on a 25% share with a full market value of £333,000 FROM £83,250* CASE STUDY

Yerin and Alex have purchased a 25% share of a £497,500 one bedroom apartment at L&Q’s Silk District in Whitechapel, with a deposit of £18,500. The couple were also able to take advantage of an exclusive L&Q deposit-match incentive.

Having met in Spain eight years ago, the couple had been in a long-distance relationship for three years before settling in London in 2017. Yerin explains, “Alex and I had been in a long-distance relationship while I was living in New York, so when I decided to move to London, we were excited by the prospect of nally being able to start our lives together. However, buying a property simply wasn’t an option for us, as prices were far too expensive, and the deposits required for homes in good locations were really high. We couldn’t call upon our parents for any support either, so renting really was the only option for us, we thought, for the long-term.”

However, by 2022, frustrated by in ated rental prices, Alex and Yerin began to research whether an alternative homeownership route could offer them the stability they craved. Having worked in the social housing sector, Yerin was already familiar with shared ownership and L&Q. She recalls that they began looking to see whether shared ownership could offer them a stepping stone on to the property ladder. “Privately renting in London means that building savings is a real challenge, so we needed a lowdeposit option,” she explains.

Prioritising areas with good connectivity to their jobs in west and central London, the couple soon discovered L&Q at The Silk District. Alex says, “The Silk District really stood out to us because of the fantastic on-site amenities that were included – no other developments we had seen had such large communal gardens or a gym, cinema or concierge service. The location was also ideal – the Elizabeth Line has made the whole capital easily accessible.”

Re ecting on their experience, Yerin says, “Shared ownership gave a chance that we thought simply not possible. It’s enabled us to get on to the property ladder, be independent and nd a lovely home in a well-connected and vibrant area!”

THE WINDRUSH LINE: HIGHBURY & ISLINGTON TO CLAPHAM JUNCTION/ NEW CROSS/CRYSTAL PALACE/ WEST CROYDON

The Windrush Line runs through areas with strong ties to Caribbean communities today, such as Dalston Junction, Peckham Rye and West Croydon. The arrival of HMT Empire Windrush in June 1948 marked the start of the "Windrush generation", which included Caribbean communities who migrated to help rebuild Britain after the second world war in critical industries such as construction, healthcare and transport. Sadly, these immigrants were often met with intolerance and denied access to housing, shops, pubs, clubs and even churches on account of their race. In addition to bringing vital skills, these communities enriched and expanded London’s music scene at the time, and influenced more recent genres such as hip hop, rap and grime, which play an important part in our vibrant, multicultural capital. The new line celebrates the Windrush generation and the wider importance of migration that continues to shape and enrich London’s cultural and social identity today.

WHITECHAPEL – THE WINDRUSH LINE

L&Q at The Silk District

Available exclusively through shared ownership, these contemporary one and two bedroom apartments are located moments from Whitechapel station and within walking distance to the City. Each home has been nished to the highest standard, with fully integrated appliances, a contemporary speci cation, and its own private outdoor space. The development also bene ts from impressive residents-only facilities including access to a private on-site cinema, gym with high-spec Technogym equipment and Peloton spin studio, as well as 24-hour concierge with communal areas and podium gardens for socialising.

lqhomes.com/thesilkdistrict 020 8189 7504

CROYDON – THE WINDRUSH LINE

Aspect Croydon

Aspect Croydon offers one, two and three bedroom shared ownership homes set within a 26-storey development. The homes support ef cient living, with A-rated kitchen appliances, LED lighting and under oor heating throughout. Each apartment also offers its own private winter garden, many of which are dual aspect, with far-reaching views from oor-to-ceiling windows. The development also bene ts from a concierge service, set within an impressive entrance lobby with exible mezzanine communal space. Aspect Croydon is a 10-minute walk from West Croydon station, on the new Windrush Line. Wellesley Road tram stop is also right on the development’s doorstep and East Croydon station is a ve-minute walk away.

nhghomes.com/aspectcroydon 020 3432 4974

OVERGROUND 24 First Time Buyer June/July 2024

CASE STUDY

FROM £122,500*

FROM £87,500* *Based on a 25% share of the full market value of £490,000 *Based on a 25% share of the full market value of £350,000

THE MILDMAY LINE: STRATFORD TO RICHMOND/CLAPHAM JUNCTION

The Mildmay Line, which runs through Dalston, honours the small but crucial NHS hospital in Shoreditch, most notable for its pivotal role in the HIV/AIDS crisis in the 1980s. Mildmay has a long charitable history. It opened in the 1860s as an informal help centre and when cholera broke out in 1866, two Mildmay deaconesses volunteered to assist in the East End’s poorest slums. In 1892, the first purpose-built Mildmay Hospital opened in Shoreditch. In 1982, Mildmay was closed owing to its small size and a lack of funding but, after a six-year battle, it reopened as Europe’s first hospital for people with HIV- and AIDS-related illnesses. Mildmay was visited by Princess Diana numerous times and the press coverage of these visits is credited with helping break the stigma at the height of the HIV/AIDS crisis. It is still an internationally renowned centre for the rehabilitation of and care for patients with complex HIV and is a valued and respected place for London’s LGBTQ+ community. The name embraces the wider role of the NHS, and particularly its smaller healthcare centres, in caring for all Londoners.

WHITE CITY – THE MILDMAY LINE

The Acer Apartments

This impressive development, set within eight acres of green spaces, offers studio homes and one bedroom apartments with 24-hour security and concierge. The homes feature the latest energy-saving measures to keep bills low. The Acer Apartments are located in a vibrant community close to a vast array of entertainment, leisure and retail options. They are conveniently located a 15-minute walk from Shepherd’s Bush station on the Mildmay Line.

landgah.com/shared-ownership/properties/the-acer-apartments-at-white-city 0808 256 1473

THE SUFFRAGETTE LINE: GOSPEL OAK TO BARKING RIVERSIDE

*Based on a 25% share of the full market value of £505,000

The Suffragette Line celebrates the working-class movement in the East End that fought for votes for woman and paved the way for women’s rights, paying particular homage to the East London Federation of Suffragettes who campaigned for the rights of working-class women. They held public marches and meetings, produced a weekly newspaper and formed a small People’s Army to defend themselves from police violence. The line runs to Barking, home of the longest surviving Suffragette Annie Huggett, who died at 103. A key member of the movement, she was a pioneer who fought for votes when she was just a teenager. She even held tea for the Pankhursts, a family of leading suffragettes, at her home. Women in the area continue to campaign for equal rights today, from the Women Activists of East London to The Fawcett Society based in Bethnal Green, which campaigns for equal rights at work –such as closing the gender pay gap – as well as at home and in public life.

CASE STUDY

Hono, an IT Consultant based in London, recently purchased a one bedroom apartment at Acer Apartments with Legal & General Affordable Homes.

Hono purchased his new home through the shared ownership scheme and was pleasantly surprised by the costs. Having lived in a private tenancy prior to his purchase, he was surprised to nd that buying a shared ownership home cost him the same each month as renting had, with the added bene ts of property ownership. Hono says, “I used to rent in West Ealing and the funniest thing is the amount I paid for rent and the amount it costs to get a property with shared ownership is actually the same – I’m now paying towards a property that I love, live in and I actually own.”

Hono was attracted to the Acer Apartments initially primarily for their location; he continues, “Shared ownership has de nitely helped me to buy, and indeed in the west London area – without it, it’s pretty much unaffordable to live here. With shared ownership, it just makes it happen.”

As for the future, Hono would love to buy a dog one day – he recalls the second question he asked was if the ats were pet friendly! But, for now, he is just settling in and enjoying buying new furniture. He concludes, “It’s a new leap, but it’s a good one I believe.”

BARKING – THE SUFFRAGETTE LINE

Barking Riverside

L&Q is currently marketing one and two bedroom shared ownership apartments in this community-spirited neighbourhood. A perfect place for families, the development is home to an array of outdoor areas and play spaces, including a recently opened Wildlife and Wellbeing Trail. There are also ve schools already open on-site, including Riverside School which is Ofsted-rated Outstanding. For commuters, Barking Riverside has both a London Overground station and an Uber Boat by Thames Clippers Pier.

lqhomes.com/barkingriverside 020 8617 1747

*Based on a 25% share of the full market value of £270,000

If you are planning to buy in London, now is the time! Take a trip on the Overground, choose your new neighbourhood and be a part of our capital’s history.

OVERGROUND 26 First Time Buyer June/July 2024

FROM £126,250* FROM £67,500*

PAY LOWER RENT TO SAVE FOR A DEPOSIT

We know that renting with all its very costly implications can make getting on the property ladder an impossible dream. But, with these renting opportunities including Rent to Buy and London Living Rent, it means you save at the same time as renting and eventually can get the keys to your own front door

LONDON LIVING RENT AND RENT TO BUY

HOW IT WORKS

Funded by the Mayor, the idea behind London Living Rent is to help people switch from renting to shared ownership. It is designed for people who want to build up their savings to eventually buy a home through shared ownership.

London Living Rent offers affordable homes for private rent on shorthold tenancies for up to three years.

Simply:

Find a London Living Rent home that suits you and your needs

Rent the home at a discount

Save the discount for your deposit

Buy shares in your home through shared ownership.

Discounted rental contracts can be renewed, if needed, for up to 10 years after the launch of each scheme; during which time, you will be able to gradually build up your deposit. When you’re ready, you have the option to buy the home you’ve been renting (or

another eligible property) on a shared ownership basis.

The good news about the scheme is that when you buy is flexible, and the housing association will support you to save during your rental stay, so you can buy at your own pace.

ANY QUESTIONS?

Do I qualify for London Living Rent?

To qualify for London Living Rent you must meet all of the following criteria:

Your annual household income must not exceed £60,000

You must live or work in London

You must be unable to buy a home, including shared ownership, in the local area

You must not own a residential property in the UK or overseas

You must meet the minimum income required for your preferred property

You must meet lenders’ general criteria to obtain mortgage finance.

The full eligibility criteria and priority policy for a particular development can be found on the advertised listing.

Can I move to an alternative London Living Rent apartment once my term has ended?

You can’t move to an alternative if you’ve completed the stated London Living Rent term (usually five to 10 years).

Must I save a minimum amount each month?

You are the best judge of what amount is affordable for you to save each month. By renting through London Living Rent you benefit from a below-market rent so will have the ability to save based on the minimum income requirement for your London Living Rent home.

The more you save, the quicker you will be able to raise the deposit required to buy your first home.

RENT TO BUY

Rent to Buy helps tenants in England save for a deposit to buy a home by offering properties at a discount. This is normally 20% below market rent. The scheme is available in England, apart from London. Properties in London are covered by a separate scheme called London Living Rent.

RENT, SAVE, BUY 28 First Time Buyer June/July 2024

ELIGIBILITY

To be eligible for Rent to Buy, you must be:

In full or part-time employment

A first time buyer

Able to pay your rent and save for a deposit at the same time.

You may also be eligible for Rent to Buy if you are returning to homeownership following a relationship breakdown.

A landlord may check your income and credit history to decide if you’re eligible.

HOW THE SCHEME WORKS

You apply to rent a property that is in the scheme. If you’re considered eligible, and the property is still available, it will be offered to you.

Your initial tenancy agreement will be for up to two years. After that, if you need more time to save for a deposit, your landlord may agree to extend your tenancy.

If you do not pay your rent on time or you don't follow the terms of your tenancy agreement, you may not be allowed to stay in the scheme.

You can buy a home as soon as you have saved up enough deposit and are able to get a mortgage.

HOW TO APPLY

If you live in England (excluding London), you can search for organisations that have Rent to Buy homes using the shared ownership scheme service.

Properties in London are covered by a separate scheme that is called London Living Rent.

COUNCIL AND HOUSING ASSOCIATION HOMES

Some local councils and housing associations advertise Rent to Buy homes. Check the shared ownership scheme service or with your local council or housing association for more information. There may be extra eligibility requirements to apply.

BUYING A HOME

You can use the deposit you’ve saved to buy any home, including those available using an affordable homeownership scheme.

IF YOU WANT TO BUY THE HOME THAT YOU ARE RENTING

You may be able to buy the home that you’re renting if your landlord agrees. If your landlord decides to sell while you’re a tenant they must give you the option of buying your home first. The price

TICKING EVERY BOX

Greenhaus – the largest Passivhaus Classic Certified development in the North West – has completed, bringing 96 highly sustainable, affordable homes to Chapel Street in Salford.

The monthly cost of heating and hot water at Greenhaus is expected to be less than half that of a similar sized new build home with a gas boiler. Built to Passivhaus Classic Certified standard, the leading low-energy design standard, the nine-storey development provides homes that offer high thermal comfort and improved air quality, enabling a healthier living environment as well as lower bills. The homes incorporate a range of benefits for occupiers, including triple glazing, air source heat pumps and the latest in insulation technology, which contribute to higher thermal comfort and improved air quality. These features, in turn, contribute to a healthier living environment by reducing the risk of damp, mould and condensation.

Outside, residents will also benefit from electric vehicle charging points and a public square complete with landscaping to foster and encourage community spirit.

Greenhaus is a mixed tenure development of one and two bedroom homes, including two accessible apartments on the ground floor. It comprises 11 homes for social rent, 13 homes for affordable rent and 72 homes available as part of the Rent to Buy scheme.

CASE STUDY

Kya Jones is one of the first residents to move into Greenhaus. The 29-year-old is a Senior Business Analyst in the tech sector and moved to Salford in 2019 from her home town of Liverpool to be closer to her job in Manchester city centre.

Kya had previously lived at another Salix Homes development – Artifex in the Trinity area of Salford –but was attracted to the green credentials, affordability and location of Greenhaus.

She explained, “The whole idea of Greenhaus with its eco-credentials, cheaper bills, health benefits, and not to mention the great location, really appealed to me. It ticks every box and I’m really excited about making Greenhaus my home.”

Kya has opted for a two bedroom apartment under the Rent to Buy Scheme. Rent to Buy is a Government scheme designed to ease the transition from renting to buying a home by providing a subsidised rent at around 20% below the market rate.

People are able to rent the properties for five years at the reduced rate, leaving room for them to save towards a deposit and then have the option to buy their home after the five-year period.

Kya works from home regularly, so is using her second bedroom as a home office, but is also just a 20-minute walk from her workplace in Manchester city centre.

Kya added, “I like city centre living – I like being able to walk to work and to the shops – it suits my lifestyle, but the cost of an apartment in the city centre is just not affordable. With Greenhaus and the Rent to Buy scheme, I’m getting the benefits of the location, so close to Manchester city centre, but without the city centre prices.

“The cost of living in general has gone up such a lot, so I jumped at the opportunity to have a home where the outgoings will be significantly less. For me, Greenhaus is about thinking ahead for my future – if I do have a family and children one day – the thought of living in a healthier home, where the air is cleaner and greener, is also a real benefit.”

There are 44 two bedroom and 28 one bedroom apartments available through Rent to Buy with prices starting from £920 per month.

Contact Willo Homes on hello@willohomes.co.uk, call 0161 537 3123 or visit willohomes.co.uk

you pay will be the property’s market value. This may be more or less than when you first rented your home.

Check with your landlord whether buying the home you’re renting is an option.

BUYING THE HOME YOU’RE RENTING THROUGH SHARED OWNERSHIP

You may be able to buy the home you’re

renting through the shared ownership scheme if:

Your landlord agrees

You’ve saved enough deposit to buy a share

You can get a mortgage

You meet the eligibility requirements.

Check with your landlord whether buying the home you’re renting through shared ownership is an option.

RENT, SAVE, BUY First Time Buyer June/July 2024 29

RENT, SAVE AND BUY WITH SOVEREIGN NETWORK GROUP

London is an amazing place to live, with great career opportunities, a vibrant cultural scene and entertainment and activities that cater to every taste

But for many, getting on the property ladder is out of reach and renting all too often means that trying to save the deposit to buy somewhere is all but impossible. London Living Rent can offer a solution. The first London Living Rent development was completed in Harrow in 2018 and a number of residents have benefited from affordable rents and have managed to save the deposit needed to move on to homeownership.

WHAT IS LONDON LIVING RENT?

With the help of funding from the Mayor of London, Sovereign Network Group is building new homes that are available to rent on stable three-year tenancy agreements and at affordable rents. This helps residents to save the deposit needed to move on to homeownership.

WHY DO WE NEED LONDON LIVING RENT?

The Office for National Statistics reported that rents in the capital increased 6.9% in the 12 months to November 2023 and tenants are often paying between 35-45% of their income on household costs. This reduces their ability to save a deposit for a house purchase.

London Living Rents will vary according to where you live and are published each year for every neighbourhood. They are based on a third of average local household incomes and adjusted for the number of bedrooms in each home.

WHO IS IT FOR?

London Living Rent homes are targeted at middle-income households who want to save for a deposit to buy shares through shared ownership or the open market.

These households don’t qualify for social rented homes but are unable to save due to the high level of rent charged in the private sector.

WHO QUALIFIES FOR LONDON LIVING RENT?

To qualify for London Living Rent your annual household income must not exceed £60,000, you must either live or work in London, be unable to buy a home, including shared ownership, in the local area and not own a residential property in the UK or overseas. There will a minimum income requirement depending on the home suitable for you and you will meet lenders' general criteria to obtain mortgage finance.

HOW DO I MOVE TO HOMEOWNERSHIP?

Because London Living Rent tenancies can run for up to 10 years, you have time to save the deposit you need to buy a home. When you’re ready you can speak to your landlord and your financial adviser about buying shares in your home or shared ownership homes elsewhere in the capital that are

affordable to you. Some London Living Rent residents have looked further afield to buy a home outright.

WHERE CAN I FIND A LONDON LIVING RENT HOME?

There are several housing associations in the capital that build new London Living Rent homes or have an existing stock of London Living Rent homes that become available from time to time. You can search online through their websites or property portals like Share to Buy, Keaze and Love to Rent.

Sovereign Network Group is a leader in the construction and management of London Living Rent homes with developments across London. We have recently let homes in Burnt Oak and Isleworth with new apartments due to be delivered in Acton, Edgware and Hayes in the second half of 2024.

networkhomes.org.uk

RENT, SAVE, BUY 30 First Time Buyer June/July 2024

Juliana Goode, Senior Build to Rent Manager

LONDON LIVING RENT SCHEME IN WEST LONDON HOTSPOT

Affordable housing provider SO Resi (part of Metropolitan Thames Valley Housing) has ventured into the London Living Rent sector offering 57 one, two and three bedroom apartments in Acton. The scheme will be available through its new dedicated SO Flexi brand, which offers a host of affordable rental schemes and operates as an offshoot of SO Resi, MTVH’s existing shared ownership arm

All brand new apartments at SO Flexi Acton will be available through the London Living Rent scheme and for those who live or work in the London Borough of Ealing. The scheme offers rents at a discount of approximately one third of the local median household income on a three-year contract, with rents starting at £1,107 per month for a one bedroom apartment. Tenants will be encouraged to use the savings from the discounted rent to save up for a deposit, to purchase the property using shared ownership at the end of the rental term, with the view that all homes will be sold in 10 years.

To qualify for SO Flexi Acton and London Living Rent, residents must either live or work in the London Borough of Ealing, have a current formal tenancy agreement, not own a home or be able to buy a home on the open market, and have a household income that is below £60,000.

Located in the strategic and desirable location of Acton Park Conservation Area, the homes are surrounded by leafy streets, green open spaces and historic architecture.

Each apartment benefits from its own balcony or terrace, carefully designed interiors to maximise space and natural light, and integrated Zanussi appliances to kitchens. All homes also have access to covered secure cycle stores and key fobs for peace of mind.

Acton offers a host of amenities appealing to a range of buyers from young professionals to families. From a plethora of cafes and restaurants for a rich social life, to local parks for a slower pace of life, Acton offers something for everyone. Perhaps the biggest benefit to Acton is the excellent transport links, offering a total of eight stations on underground and Overground lines and National Rail too. SO Flexi Acton is located between Acton Main Line station, on the Elizabeth Line with services to Zone One in under 20 minutes, Acton Central station on the Overground, and East Acton station on the Central Line. By road, the M4 is just under 10 minutes' drive with links further afield to Reading and Bristol.

To find out more, visit soflexi.co.uk or call 020 8607 0550

We have been met with incredible demand with previous affordable rent schemes, which reinforces that schemes like London Living Rent are not just a want for potential homeowners –but a need. Our SO Flexi brand offers solutions to the one major obstacle in the housing market of today, which is unattainable rent stopping people from saving for deposits. We will be working alongside our residents throughout their tenure to help them achieve homeownership at the end of the contract.

Acton is also a hugely exciting location for London Living Rent and we will be working towards Ealing Council’s target to deliver 4,000 affordable homes over the next five years. Our scheme isn’t just here to meet targets, however, it is here to meet the genuine needs of Londoners and help as much as possible with the housing crisis in the capital. We launched our first SO Flexi site over the summer in Slough, that was inundated with demand, and we expect Acton to be much the same.”

Kevin Sims, Director of Sales & Marketing, SO Resi

RENT, SAVE, BUY 32 First Time Buyer June/July 2024

EXPERT COMMENT

LONDON LIVING RENT WITH L&Q

Londoner Olauria Mafura’s experience of the capital’s property market had consisted of years of private rentals in the east of the city. It wasn’t until she had to move back to her parents in Romford that she began to consider longer-term options.