THURSDAY, OCTOBER 23, 2025

‘Scam artist’ deceives

with fake licence

By NEIL HARTNELL

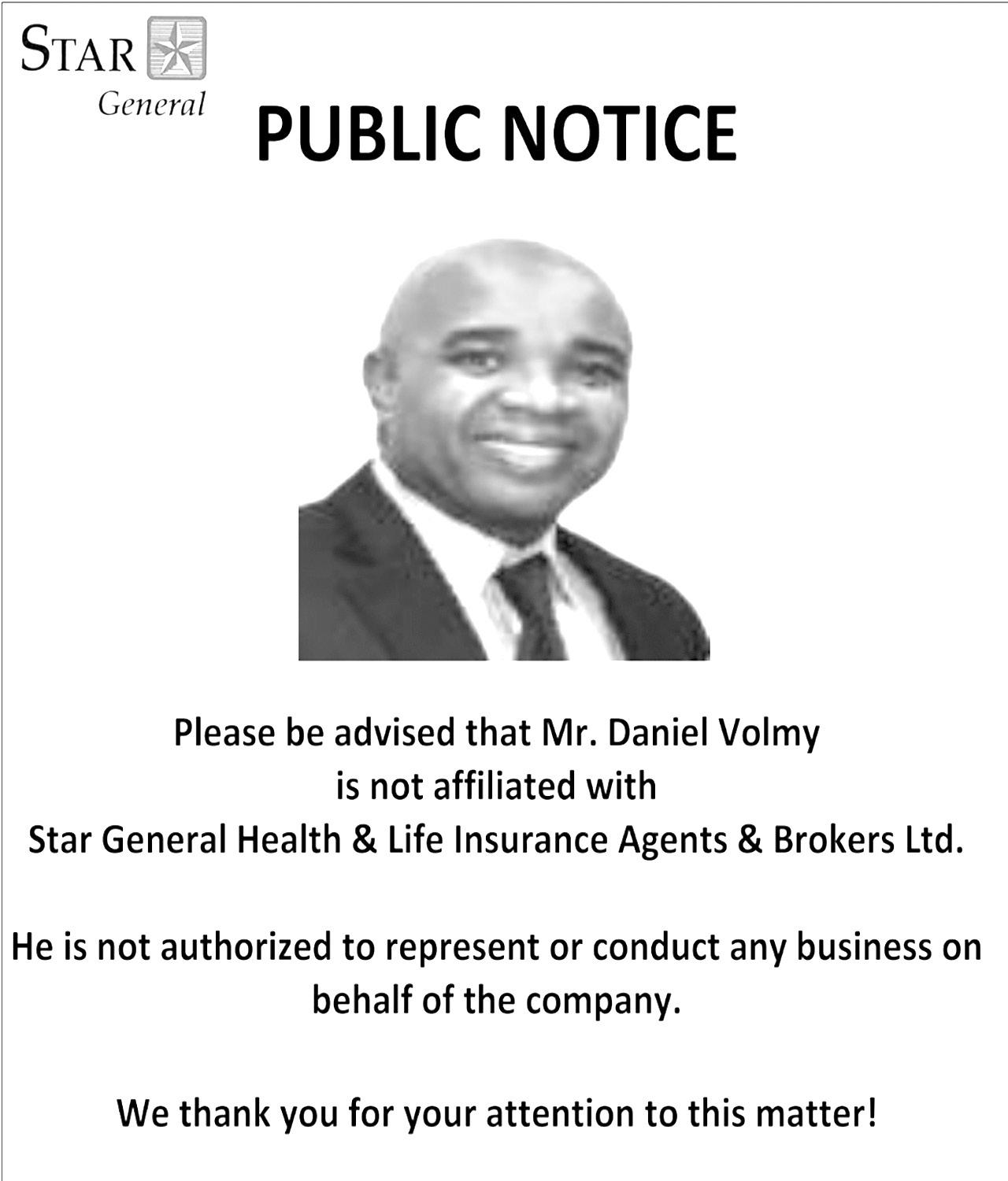

A“scam artist” allegedly deceived a Briland tourism operator into procuring a “fraudulent Business Licence” despite being paid a $2,000 sweetener to ensure its speedy issuance.

Pablo Conde, the nowestranged US partner in Conch & Coconut, asserted in an October 20, 2025, affidavit, that he was duped into thinking the fake permit - which caused the Royal Bahamas Police Force and Department of Inland Revenue to shut the company down - was a genuine and legitimate document.

Suggesting he and his associates were seeking to help Julian ‘Shaq’ Gibson,

his former Bahamian partner with whom he is now embroiled in an increasingly bitter legal battle playing out in both this nation’s and the US courts, exhibits attached to Mr Conde’s affidavit reveal they made a $2,000 underthe-counter payment to “expedite” obtaining the Business Licence and beat the Department of Inland Revenue’s “backlog”. Also featuring in Mr Conde’s affidavit, but with no involvement in

NASSAU PORT OPERATOR’S $6M INVESTMENT IN ENERGY REFORM

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Nassau Container Port’s BISX-listed operator has near-tripled the value of its investments by injecting $6m into The Bahamas’ energy reform strategy in a bid to “earn returns on surplus cash” holdings.

Dion Bethell, Arawak Port Development Company’s (APD) president and chief financial officer, in e-mailed replies to Tribune Business inquiries said the investments in Bahamas Grid Company and Island Power Producers are part of an “overall financing strategy” that aims to “offset” interest payments on debt with returns from outlays outside its core port operations and management business.

ENERGY - See Page B8

Conch & Coconut’s Business Licence caper, is Senator Darron Pickstock, the Progressive Liberal Party’s (PLP) recentlyratified Golden Isles by-election candidate, who was the tour operator, destination management and visitor “concierge” provider’s Bahamian attorney.

The former US partner alleged that Mr Pickstock, who he claims to have been responsible for hiring, and Scott Silverman, Mr Gibson’s father, had “tried to

force me into giving up the entirety of Conch & Coconut’s business to” his Bahamian partner on the basis the company had been structured as an “illegal ‘fronting scheme’” to evade the National Investment Policy’s stipulations that such operations are reserved exclusively for 100 percent Bahamian ownership only.

Mr Conde provides no evidence to back-up his claim of bring pressured to exit, and there is no

suggestion that Mr Pickstock has done anything wrong in relation to the Conch & Coconut affair.

He is now campaigning ahead of the November 24 by-election, and Tribune Business calls and messages sent to his cell phone were not responded to before press time last night.

However, it is the allegations regarding Conch & Coconut’s Business Licence that will likely receive most

A $40m aquaculture project targeted at Grand Bahama’s northern shore is aiming to create 113 fulltime jobs, and up to 200-300 spin-off posts, once it reaches full-scale commercial production.

Florida Stone Crabs Inc’s environmental impact assessment (EIA), which was released yesterday ahead of the November 11 public consultation, disclosed that if approved the development will be located on a 1,500-acre site east of Dover Sound on land jointly-owned by the Grand Bahama Development Company (DevCO) and the Grand Bahama Port Authority’s (GBPA) affiliate, Port Group Ltd. The project, which is designed to produce native

Set professional tone from the very first day

THERE are some clear

‘do’s’ and ‘don’ts’ for workplace professionalism that apply universally.

No matter how laid back the environment or culture may be, there is a general code of conduct that every business should follow to exhibit these values.

Organisations with strong company values, employee handbooks or policies might give clear standards about what amounts to good behaviour but, really, it should be expected. Professionalism in the workplace is usually learned through experience.

The problem is that what you learn is dependent on the environment as what works in one place

sometimes might not work in another. Let us take a closer look at what professionalism in the workplace looks like, and why we need to present our best selves when representing employers and working with employees. What is professionalism in the workplace?

While professional behavior is fundamental to every employee, it also depends on prior experiences, as professionalism is subjective now more than ever. Attitude, interactions with colleagues, the conflict resolution approach to customers, and even dress attire can all tie into how your professionalism is perceived by others.

So companies must take professional behaviour seriously. This does not discount a playful personality, as you can still have fun without sacrificing professionalism. However, there have always been long-standing behavioral factors that factor into the universal expectations of employers.

Honouring commitment

If you make a promise, fulfill it. Honour commitments and manage time, and approach each task ahead graciously with much-needed thought.

Engaging with workplace culture

Inter-personal skills are key. Engaging workplace culture helps build

inter-personal relationships with employees. Co-workers do not have to be best friends, but a unified workplace sets the tone and makes the undertaking more enjoyable.

Dressing appropriately Today’s professional attire has become much more relaxed, but maintaining a professional look is an unspoken rule in many offices.

Leave personal matters at the door

At some point, we all would have experienced personal struggles which can easily spill over into the workplace. However, managing your emotions is key to drawing a line between a personal and professional act.

What are unprofessional behaviours at work?

Ideally, a mature professional team dismisses cliques and drama but, unfortunately, this is not always easy. Understandably, rivalries form and some employees will not get along, so office policies is provoked, which results in hindered productivity. Understanding practical strategies to bypass the drama without provoking either side is a necessity.

Water cooler chats

We all love a water cooler chat, but a balance on work hours and breaks should be considered. Nonwork related conversations should be tempered to allow colleagues concentrating on projects and deadline to focus. Ultimately, while some behaviours are unethical and completely unacceptable, some of them can be fixed.

Bullying and discrimination have no place in an office environment - ever.

Allowing behaviour that targets someone’s ethnicity or nationality, religion and/ or culture, mental disability, educational background or personal life circumstances has no place in a functional workplace.

Effect of lack of professionalism?

A lack of professionalism in the workplace has a cascading effect that will create a poor working environment, especially if it goes unchecked for a long period.

Mutual respect Respect should be reciprocal and, at all costs, management should understand the repercussions of not separating friendship from employees.

Engagement or initiative

The lack of motivation or initiative results in zero engagement or minimum effort, prompting employees to show up day after day doing little or nothing within their own self-imposed boundaries. This, unfortunately, leads to employees becoming bored and seeking new opportunities elsewhere.

Strategies to improve professionalism

What can be done to fix it? Unity and respectful behaviour regarding company policies always win. Good examples must be displayed from the top, otherwise some employees will not conform unless forced to by management. By the same token, if you want a professional team, professionalism must lead.

Encourage ownership and accountability

A platform for employee engagement is encouraging as it stimulates a feeling of ownership and

By

accountability. It is not a check box exercise or something to do, as innovation stimulates business integrity. If not done consistently, standards will drop. In the final analysis, building professionalism into a company’s culture starts from setting the expectation from the first day on the job. This creates the foundation that supports employees for years to come. Surely your company’s professional culture should be a living thing that customers and employees see each time they log on or walk through the door. Until we meet again, live life for memories rather than regrets. Enjoy life and stay on top of your game.

NB: Columnist welcomes feedback at deedee21bastian@gmail.com

ABOUT COLUMN-

IST: Deidre M. Bastian is a graphic designer/brand marketing analyst, international award-winning author and certified life coach.

PM: Back-up disaster funding covers $251m

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Bahamas has available back-up disaster funding worth $251m, the Prime Minister asserted yesterday, as he led debate on a Parliamentary resolution to permit the transfer of $17m in dormant account monies to further strengthen the nation’s resilience.

Speaking on a resolution to permit the Treasurer to transfer these monies from the Government’s consolidated fund to the national Disaster Emergency Fund , Philip Davis KC said the transfer marks a decisive step towards ensuring the Government has immediate access to critical funding when disasters such as hurricanes strike.

Mr Davis added that the Fund, when combined with

existing financial instruments such as insurance coverage, pre-arranged credit lines and the Disaster Risk Management Authority’s (DRM) annual budget allocation, forms a comprehensive approach to disaster financing that enhances resilience and sustainability.

“The Government faces potential losses of up to $700m from major hurricane and flood events. That is the scale of damage the Government must be prepared to face from a disaster.

“In response, the strategy recommends a layered approach: A blend of investments, insurance and reserves to diversify risk and reduce fiscal pressure,” said Mr Davis.

“There is the Caribbean Catastrophic Risk Insurance Facility valued at $50m. There is the national credit line valued at $150m

and a contingent credit facility valued at $100m. There is risk reduction through the Disaster Prevention Fund for $6m, as well as DRM’s annual budget allocation of $60m.

“And, of course, there is the $17m Disaster Emergency Fund, which this resolution addresses. For risk that exceeds these layers, loans and other expost instruments cover a total value of $251m. Each dollar has been allocated with a purpose. This comprehensive system ensures that every dollar invested strengthens our national capacity to anticipate, respond to, and recover from disasters.”

Mr Davis said the Fund must be maintained and used to finance disaster response, rehabilitation, recovery and financial protection instruments. The resources in dormant accounts will now be

BISX HITS HIGH ON SUB-FUND LISTINGS

THE Bahamas International Securities Exchange (BISX) yesterday confirmed it has added another listing to its investment funds roster.

The exchange, in a statement, said the Oportunidad Global Fund SAC – Class D shares has successfully completed its mutual fund listing process and been listed on BISX.

The Fund, a Bahamianincorporated International Business Company (IBC), is registered as a Segregated Accounts Company (SAC) under the provisions of the Segregated Accounts Companies Act 2004.

This Fund is also licensed as a Smart Fund SFM007 under the SMART Funds Rules accompanying the Investment Funds Act 2019. Holland Grant, BISX’s chief operating officer, said: “BISX is pleased to welcome the Oportunidad Global Fund Ltd SAC –Class D Shares to our funds Listing facility.

“This represents the eighth fund of the Oportunidad Global Fund Ltd SAC to be listed on BISXour first time listing a fund with this many sub-funds. “The ability to meet the needs of our sponsors who bring diverse product

used to fund the country’s defence against natural disasters instead of “sitting idle”.

“The experts have determined that this Fund should hold a minimum of $17m to ensure adequate liquidity following a severe natural disaster. This resolution authorises the transfer of $17m from the dormant account proceeds held by the Treasurer, which are now part of the consolidated fund, into the Disaster Emergency Fund,” said Mr Davis.

“These dormant accounts are, essentially, unclaimed resources that can now serve a national purpose. Resources that were sitting idle can now be used to invest in our future and serve as the first line of defence when disaster strikes.”

Mr Davis said regulations and operating procedures are being

developed to ensure the efficient management and investment of the Fund, providing clear guidance on how resources will be allocated, monitored and replenished.

He added that the framework will establish standards for transparency, governance and financial oversight to guarantee that every dollar in the Fund is used responsibly and effectively.

The rules will also specify how the Fund’s resources can be invested during non-emergency periods to maintain liquidity while generating sustainable growth.

“Currently, regulations and operating procedures are being developed to ensure the efficient and effective management of these funds.

“The regulations will clearly outline what the funds can be used for,

how unused funds can be invested to grow the fund, what will activate their use and the appropriate steps that must be taken to ensure accountability,” said Mr Davis.

“These funds ensure that, when disaster strikes, the Government can mobilise immediate assistance without delays or dependence on external financing.”

Mr Davis said the Government faces potential losses of up to $700m from natural disasters, highlighting the scale of fiscal exposure the country must be prepared to manage.

He explained that, in recent years, the increasing frequency and intensity of hurricanes and flooding has demonstrated the urgent need for a structured financial framework to support national recovery and protect public finances from severe shocks.

offerings to the exchange is a part of our commitment to creating a value-added partnership with our members,” Mr Grant added.

“I would encourage every multi-class fund to take time to learn about the BISX value proposition as a part of their search for services that they can offer to their clients.”

The Winterbotham Trust Company served as the BISX sponsor member that brought the Fund to the exchange. The Winterbotham Trust Company has been appointed to serve as the administrator of this fund.

Payment was to beat ‘backlog’ at Department of Inland Revenue

attention. If true, it again highlights the lowlevel, every-day corruption and”pay to play” culture that governance reformers such as the Organisation for Responsible Governance (ORG) have long railed against when it comes to obtaining government permits and approvals.

Mr Gibson has alleged that the “fraudulent”

Business Licence obtained by Mr Conde led to Conch & Coconut’s Harbour Island operations being shut down by Bahamian law enforcement and the Department of Inland Revenue. He added that this prompted him to split with his nowformer US partner and establish Conch & Coconut Bahamas in May 2025 as a new, separate entity.

Yet Mr Conde, in his October 20, 2025, legal filings alleged: “After Gibson,

failed to timely obtain a valid business license for himself and Conch & Coconut, [Conch & Coconut LLC, the Florida-based entity] attempted to help him by asking its Bahamian contacts for anyone who could help obtain a Business Licence on an expedited basis.

“Unfortunately, the person that was recommended and ultimately used appears to have been a scam artist who provided the

allegedly fraudulent Business Licence…. To-date, however, we have not been provided with any evidence or communication from the Government showing that it was actually a fraudulent licence.”

A May 14, 2025, affidavit sworn by Augusto Salinas, a Miami resident, alleged that he contacted a “friend” named ‘Jason Joseph’ on Mr Conde’s behalf in a bid to obtain Conch & Coconut’s Business Licence. He claims that ‘Jason’ told him he had a ‘contact’ named “Sweeting” in the Department of Inland Revenue, and said the permit’s issuance would be speeded-up in return for a $2,000 payment.

Mr Salinas’ affidavit, which is included in Mr Conde’s legal filings with the south Florida federal court, asserts: “Some time in 2024, Pablo Conde expressed his frustration with delays he was experiencing while assisting with renewal of Conch & Coconut’s Business Licence in The Bahamas. He explained that his company is a vendor for Conch & Coconut Ltd.

“I informed him that I knew an attorney that I believe had a friend/contact in the Department [of Inland Revenue] that issues Business Licences in The Bahamas. He requested my help, and I contacted my friend, whose name was Jason Joseph. Jason told us that he had a contact by the name of ‘Sweeting’. I do not remember the first name.

never informed Mr Gibson or his Briland-based team about any of this, and they appear not to have been involved.

“I assisted in good faith and did not ask, nor did I receive any money, for myself,” Mr Salinas asserted. “Pablo asked me if the attorney was above board or legitimate. I told him that as far as I knew he was a very good attorney. I believed, and still believe, in Jason Joseph’s integrity.

“If there is something wrong with the licence, I do not believe Jason had any knowledge of this. Once the licence was ready, I picked up a copy of the licence from the attorney and delivered it to Pablo Conde on two occasions, as one had expired earlier than the other.

“I was informed that the licence may have been fraudulent. If it is, I had no knowledge of this and certainly Pablo had no knowledge of this, as he relied on my representations and that of the attorney Joseph.”

Mr Conde, meanwhile, voiced suspicions that the “fraudulent” Business Licence issue had been exploited as a means for Mr Gibson to shut the original Conch & Coconut down and then launch a new business under the same name after cutting him out of the deal.

“Jason told me that the licence documentation would be expedited for $2,000 because there was a backlog and everyone’s licence was taking long. I informed Pablo and he agreed to pay the $2,000 in order to expedite the licence and also another form for Conch & Coconut that expired at the same time.” The nature of the $2,000 payment is not described, but is almost certainly a bribe or inducement to speed-up obtaining a Business Licence.

“Ultimately, however, this easily fixable issue – as evidenced by Gibson’s continued business under the Conch & Coconut Bahamas website and the servicing of Conch & Coconut customers by Conch & Coconut in May – is just an excuse to cut [me and the Florida entity] out of a multi-million dollar business, and to steal the Conch & Coconut marks, the Conch & Coconut trade secrets and the Conch & Coconut customers in the US,” Mr Conde alleged.

The former US partner previously asserted that he was forced “to step in and intervene with Bahamian authorities” to pay more than $550,000 in outstanding taxes, legal and consultancy fees to enable Mr Gibson to restart the Briland-based operations following previous tax enforcement actions.

allegedly still claiming that the Bahamian operation owes $825,000 in unpaid VAT and other taxes, of which $320,000 represents penalties and sanctions.

Mr Gibson, though, is arguing that his October 2023 deal with Mr Conde, which would see him acquire Conch & Coconut and all its Bahamas-based assets for a $725,711 purchase price to be paid over a ten-year period, also made the latter responsible for settling the outstanding $800,000-plus tax arrears. However, he is alleging his former US business partner has failed to live up to this commitment.

Mr Conde, in his October 20, 2025, affidavit, blamed the intervention of Mr Gibson’s father, Mr Silverman, for disrupting efforts to resolve the VAT and Business Licence fee arrears owed to the Department of Inland Revenue.

“Silverman became involved during this process and immediately adopted a caustic role, blaming Conch & Coconut and me for Gibson’s failures and inactions,” Mr Conde alleged.

“He and Darren Pickstock, a Bahamian senator and attorney that I had hired to represent both Conch & Coconut and Gibson, began trying to convince me that the business arrangement I had with Gibson was an illegal ‘fronting scheme’ and tried to force me into giving up the entirety of Conch & Coconut’s business to them.

“As part of Silverman’s threats to go public with this to the Bahamas Tribune, he demanded that I obtain for Conch & Coconut a Business Licence immediately. Conch & Coconut was Gibson’s company, and the management of Conch & Coconut was Gibson’s responsibility, including obtaining any necessary licences and permits and paying taxes.

“Nevertheless, we attempted to help him get an expedited Business Licence. An affidavit explaining the circumstances of the Business Licence is attached. To-date, however, we have not been provided with any evidence or communication from the Government showing that it was actually a fraudulent licence.” Tribune Business has never been contacted by or dealt with Mr Silverman. SCAM - from Page B1

A check of the Bahamas Bar Association’s membership list revealed no attorney named ‘Jason Joseph’, so the identity and profession of the man Mr Salinas dealt with to procure the “fraudulent” Business Licence remains unclear. However, the affidavit reveals that Mr Salinas

Despite this, the Department of Inland Revenue is

Opposition: ‘Critical omission’ over dormant account switch

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Opposition’s finance spokesman yesterday accused the Government of bypassing constitutional procedures to reallocate $17m in dormant account monies to the Disaster Emergency Fund.

Speaking in Parliament, Kwasi Thompsonquestioned why the Government only chose to present a resolution to permit the Treasurer to switch this sum from the consolidated fund without providing an Appropriation Bill to authorize this as mandated by the Bahamian constitution’s article 131.

Mr Thompson argued that the funds held in dormant accounts form part of the consolidated fund, and should be accompanied by an Appropriation Bill specifying how the money will be used before any transfer.

“We must ask the question whether the administration is shortcutting the constitutional process governing public funds. Once dormant funds are transferred to the Treasurer, they form a part of the consolidated fund,” said Mr Thompson.

“Under article 131 of the constitution, no expenditure from the consolidated fund may occur except through the Appropriation Act or a law that expressly [allows for it], yet today we are asked to support a

resolution moving millions of dollars into the Disaster Emergency Fund without an Appropriation Bill that would allow the Government to spend money that is in the consolidated fund.”

Mr Thompson questioned why the Government chose to bypass the Appropriation Bill, calling it a “critical omission” in the process and highlighting the importance of this legal requirement. According to Mr Thompson, the constitution clearly mandates that any movement of funds from the consolidated fund must be authorised through an appropriation - either via the annual Budget or a supplementary appropriation. He said that while the

resolution to transfer the funds may be necessary and requires approval, it does not by itself authorise government spending. The crucial next step - a formal Appropriation Bill - has been absent from the process.

“The constitution says that in order to move money from the consolidated fund, you need appropriation, which is why you then have to do a supplementary appropriation or it has to be done through the Budget process. So again, I asked the question, because nothing has been said about it,” said Mr Thompson.

“We’ve been asked to do a resolution, which I understand must be passed, but nothing has been said about the next

step, which is an Appropriation Bill that would need to be passed in order for you to spend money once it is in the consolidated fund. That is a critical omission that appears to be the missing legal step for the chain of authority.”

Mr Thompson speculated that the Davis administration deliberately chose not to follow the constitutional step requiring an Appropriation Bill because it would compel the government to disclose detailed plans on how the $17m would be allocated and spent.

He suggested this lack of transparency raises concerns about accountability and the proper oversight of public funds, and urged the Government to be forthcoming and provide

a clear breakdown of the expenditures, arguing that the public and lawmakers alike have a right to know exactly how these funds will be used. “Why has the Government not brought the Appropriation Bill alongside with the resolution they could have? Why are we not seeing the line items specifying the sums?” he asked. “Because in the Appropriation Bill, you have to specify what the funds are for, and how the funds are being spent…. Table the report, let us all see how the $17m will be spent. Let us not be left in the dark as to how this money will be spent, because if we are being asked to approve it then we should be privy to what the funds are going to be spent on.”

NASSAU-PI WINS SIX AWARDS FOR OFFERINGS AND MARKETING

THE Nassau & Paradise Island Promotion Board (NPIPB) says is has received six awards for its destination offerings and marketing campaigns at Travel Weekly’s annual Magellan Awards.

The Board, in a statement, said it received five Gold recognitions and one Silver award across multiple categories, including Caribbean – Overall destination and destination marketing. It added that this was recognition of its marketing efforts and the experiences offered for visitors.

Joy Jibrilu, the Nassau & Paradise Island Promotion Board’s chief executive, said: “These awards are a true testament to the creativity, collaboration and commitment behind our destination marketing efforts.

“What makes them especially meaningful is that they celebrate the authentic and true Bahamian stories

we’ve shared through local faces, artists and voices who helped bring our campaigns to life. From culture and cuisine to art and community, every element reflects who we are as a people and what makes Nassau & Paradise Island so special to experience.” Within the Caribbean – Overall destination category, Nassau and Paradise Island earned two Gold awards, recognising its offerings for weddings and golf. The island also received a Silver award for its rich culinary scene. The Promotion Board’s marketing efforts also earned three Gold Awards. Highlighting aspects of the destination beyond just the beaches, with a spotlight on authentic culture, the ‘Discover the & more vacation campaign’ was recognised in the advertising/ marketing category for its range of promotional tactics reaching target audiences

to convey the Promotion Board’s new messaging. The Bahamas Storytellers social campaign also took home top honours in the Social Media Campaign category for its effectiveness in showcasing local perspectives and recommendations from the destination, while the ‘It’s Better in The Bahamas’ broadcast spot won Gold in the TV commercial category.

The Magellan Awards honour outstanding design, marketing and services in a broad range of industry segments, including hospitality, travel destinations, cruise lines, online travel services, airlines and airports, travel agents and agencies, tour operators and ground transportation.

With hundreds of entries from across the US and around the world, the Magellan Award winners represent the best in the travel industry and the professionals behind this.

Project bids to put Bahamas ‘on forefront’ of aquaculture

Bahamian stone crabs for export purposes only, meaning they will not be sold locally, is asserting that it will place this nation “on the forefront” of an aquaculture industry that generates more than 50 percent of the world’s seafood supply while also creating a new industry and boosting economic diversification.

Pledging to produce “a very high-end, high quality product”, Florida Stone Crabs Inc’s EIA said the proposal will involve cutting two canals to Grand Bahama’s north shore “for the exchange of seawater” with the project divided into two separate phases.

The initial “pilot” stage will cover just 36 acres, and feature a hatchery canal, hatchery and sea water trench system. Some 14 trenches, around 4,000 feet in length and 392 feet wide, will be dug and is intended to produce 168,000 stone crabs over a two-year period.

Should this prove successful, Florida Stone Crabs Inc - a start-up created in 2022 specifically to pursue its Grand Bahama ambitions

- will expand to full-scale commercial production with projections for achieving $47m in annual sales revenue in the first year. Employment will near-triple from 42 for the “pilot” phase to 113, with Bahamians accounting for 90 or almost 80 percent of the full build-out workforce. The first commercial-scale harvest is forecast to generate 812 metric tons and around 1.8m pounds of claw meat. Dillon Knowles, the Grand Bahama Chamber of Commerce’s president, told Tribune Business he was unaware of Florida Stone Crabs Inc or the proposal, so was unable to comment in detail. He added: “Grand Bahama is pretty diverse economically, so anything that adds to that diversity obviously works in our favor assuming whichever project comes along does not conflict with anything on the ground or planned to be on the ground.”

The Florida Stone Crabs EIA, noting that the 1,500acre property incorporates 300 acres formerly used by the Bahamas Dairy Farms project, said: “According to Florida Stone Crabs Inc, the crabs produced from

the aquaculture project are for export only and not intended for sale in The Bahamas. The stone crabs produced will be the species native to the Bahamas. No foreign stone crabs are intended to be imported into the Bahamas by Florida Stone Crabs Inc.

“Florida Stone Crabs Inc’s market strategy is aimed at North America, primarily the US and Europe. Grand Bahama was selected for the project due to its ideal conditions for the aquaculture project, which include available real estate, water quality, water temperature, pH of water, tidal flow which occurs twice per day and limestone geology for the growing area.”

Approvals will be required from the GBPA, as Freeport’s quasi-governmental regulator, as well as the central government via the Department of Environmental Planning and Protection (DEPP) and the Department of Marine Resources. “In order for the investment in the project to be realized, both the pilot phase and commercial phases need to be approved simultaneously. In

short, it makes little sense to the developer to have an approval for the pilot phase without the commercial phase also being approved,” the EIA added.

“Florida Stone Crabs Inc has selected the location due to the low-lying nature of the tidal flats and availability of good quality seawater which is critical for the operation of the aquaculture farm… The site was previously flooded in 2019 by Hurricane Dorian and the structures will have to meet the Grand Bahama Port Authority’s building code.”

Pointing to the economic diversification benefits if the project is approved and moves forward, the EIA compiled by Bahamian consultancy, Envirologic, said: “This aquaculture project is different from Freeport’s two main industries - heavy industry and tourism - and the traditional commercial fishing conducted in The Bahamas. However, it will add to the economy of Freeport by introducing new technology and a new source of employment to the island during both the pilot and commercial phases.

“Florida Stone Crabs Inc estimates the total investment to be $40m at full-scale development of the 1,500 acre project.” The total investment is broken down into $4.6m for land costs; $13m for the first phase “pilot”, which is split into $3.4m for construction; $5.6m for equipment; and $4m for working capital; and $22.4m for the full-scale commercial stage. The latter will feature a $5m outlay for construction; $6.4m for equipment; and $11m for working capital.

“There are no known commercial aquaculture facilities currently operational in Grand Bahama,” the EIA said. “This project provides an opportunity to develop a new industry….. At peak production, sales are estimated to be 2.8m pounds per year and will improve the country’s negative trade balance.

“The farm will produce a very high-end, high-quality product - fresh frozen stone crab claws – not currently sold anywhere in the world. The product will be labelled and marketed as a Bahamian product and

sold internationally, thereby increasing The Bahamas’ market reach and brand awareness, which may assist in the sale of other Bahamian sourced [product].

“The facility will be built to world-class standards, putting The Bahamas on the forefront of aquaculture, an industry that now accounts for over 50 percent of the world’s seafood supply. The product’s uniqueness will immediately garner industry recognition, and the fact that it is being produced in The Bahamas will engender other producers to look at The Bahamas as a potential place to expand manufacturing of other aquaculture products.”

Pledging that there will be knowledge transfer to Bahamian employees, involving “specialized equipment and technology”, the EIA suggested that the project’s training initiatives and associated programs will “expand the country’s knowledge base and presumably arrest the flight of the island’s workforce”.

It added: “During the pilot phase, the workforce is estimated to employ approximately 40 Bahamians.

The expanded commercial workforce is estimated to consist of approximately 120 Bahamian hires. Pay is estimated to be three times’ the minimum wage.

“As is typical in aquaculture, it is estimated that several cottage industries will develop around a project of this nature resulting in an additional 200-300 indirect jobs in the areas of feed production, processing and packaging, transportation and logistics equipment suppliers and maintenance, among others.”

Elsewhere, the EIA suggests that Bahamians will account for just over three-quarters of the “pilot phase” workforce, or 32 of the 42 employees, and close to 80 percent or 90 of the total 113 staff at full build-out.

“Florida Stone Crabs Inc expects to partner with the cruise industry to offer an additional/unique destination excursion. The experience of a day at the farm, the hatchery/learning centre and restaurant builds the reputation further of Grand Bahama as

a diversified and cultured destination,” the EIA said.

“Due to the uniqueness and scale of the project we intend to establish an active student exchange program between Bahamian and US universities, allowing for the exchange of students interested in aquaculture, animal husbandry, etc. This will serve to enhance academic perspective, personal growth, cultural immersion and networking opportunities among others.

“The facilities are synergistic with responsible fishery practices and local tourism efforts, and often become eco-tourism and academic destination locations, - eco-tourism, fish for resorts, animal husbandry. The developers welcome the opportunity to work with local tour operators to feature the project,” the EIA added.

“Local governments will benefit from the additional employment of both a newly-created workforce and the indirect job opportunities that will develop around this new endeavor. There will be an additional tax base, improvements in infrastructure such as roads around the property, community involvement from a new corporate neighbor and even increase in visitors to the island due to eco-tourism.”

Florida Stone Crabs’ US principals are Carlos V. Freyre and Eric Swain.

“They are in the process of seeking a business license from the GBPA and will be seeking all the necessary approvals from The Bahamas Government. The company does not operate a facility to-date but have employed resources from the University of Miami’s Rosenstiel School of Marine and Atmospheric Sciences in developing the operational aspects of the project,” the EIA added.

Mr Freyre is the founding partner of Freyre & Company, a boutique advisory firm, which invests in and provides consulting services to companies in offshore oil and gas, food processing and distribution, consumer goods manufacturing, heavy equipment distribution and mariculture. Meanwhile, Mr Swain is the founder and managing member of Swain Capital Group, a business consulting firm.

OPPOSITION URGES END TO ‘GOVERNING IN SHADOWS’

By FAY SIMMONS

THE Opposition’s

finance spokesman yesterday accused the Government of “governing in the shadows as he called on the Davis administration to end secrecy surrounding public-private partnerships (PPP) and fully comply with procurement policies.

Speaking in Parliament yesterday, Kwasi Thompson, the east Grand Bahama MP, criticised the Government for hiding behind “vague promises and

hidden incomplete information” while withholding details of multi-million-dollar obligations tied to long-term PPP deals that have been imposed on the public purse.

“The Government continues, unfortunately, to govern in the shadows, hidden in secrecy; hidden behind vague promises and hidden, incomplete information. Nowhere is this more alarming than the handling of the publicprivate partnership deals,” said Mr Thompson.

“And we hope the $17m that is being allocated today, that if there are PPPs

in this, that they are not treated in this way, where hundreds of millions of dollars in long-term obligations are being quietly stitched together behind closed doors.”

Mr Thompson accused the Government of deliberately bypassing established public procurement procedures by entering into PPP arrangements without providing the public with essential information such as interest rates, repayment schedules, or the overall financial terms of these deals. He argued that this lack of transparency and due process directly

contravenes the Government’s own PPP policy, which is designed to ensure accountability and value for money in long-term financial commitments.

“The Government is obligating the country to hundreds of millions of dollars with no bids. They are also obligating hundreds of millions of dollars, contrary to Bahamas government PPP policy, without the public knowing what is the interest rate on these PPPs, how long we are bound to pay these PPPs, or what is the proof that the deal that has been signed is, in fact, the best deal that you

could have made,” said Mr Thompson. “You go through the bidding process. You go through the procurement process, not for the fun of it, but you go through it so that you can ensure that it is the best deal. But the PPP deals are not going through that process.”

Mr Thompson drew attention to findings in the Fiscal Responsibility Council’s report on the annual Budget, which sharply criticized the Government for failing to meet two essential standards: Proper oversight of public enterprises and full transparency regarding

BAHAMAS URGED TO BOOST CYBER SECURITY RESILIENCE

THE Bahamas must urgently “strengthen resilience” amid rapidlyevolving cyber security threats, a local PricewaterhouseCoopers (PwC) partner is warning.

Myra Lundy-Mortimer, the accounting firm’s territory risk assurance services partner, in a statement accompanying the release of PwC’s global 2026 Global Digital Trust Insights survey - which found only 6 percent of companies felt they are “very capable” of withstanding cyber attacks across all vulnerabilities - said The Bahamas faces similar threats and challenges.

“The cyber security landscape in The Bahamas is evolving rapidly, mirroring the global trends we’re seeing today. With AI now the leading investment priority, organisations are navigating an increasingly complex risk environment,” she said.

“According to the latest global digital trust survey, only 6 percent of businesses worldwide feel fully prepared to withstand cyber threats across all areas—a figure that highlights the urgent need to strengthen resilience both locally and globally.

“True cyber resilience is achieved by embedding leadership at the highest level, ensuring cyber strategy is fully integrated

with business objectives. Investing in advanced technologies like AI, along with the ongoing upskilling and reskilling of cyber teams, is essential. Organisations that prioritise anticipation over reaction will be best positioned to protect their operations and clients from emerging digital risks.”

PwC’s survey found that AI (artificial intelligence) is emerging as the top cyber security investment priority for companies, as only 6 percent are “very capable” to withstand cyber-attacks across all vulnerabilities surveyed.

It added that nearly eight-in-ten, or 78 percent, of companies said their cyber budget will increase over the next 12 months as businesses continue to contend with a widening array of cyber risks. Investment in artificial intelligence was the top budget priority (36 percent of firms) over the next 12 months, ahead of cloud security (34 percent), network security (28% percent) and data protection (26 percent).

And the PwC survey found that more than a quarter of businesses (27 percent) said their most damaging data breach over the last three years cost $1 million or more, with larger firms in the technology, media and communications sector at greater risk.

NOTICE

NOTICE is hereby given that ANNMARIE THELWELL of Colony Village, Prince Charles, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of October 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that JENNIE ESTORCIEN of Hay Street off, East Street, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of October 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that JACQUELINE JOSEPH Marsh Harbour, Abaco, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of October 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

Companies added that a lack of knowledge in the application of AI for cyber defence (50 percent), and lack of relevant skills (41 percent), were the top two challenges over the last 12 months in implementing AI for cyber defence.

The survey, which interviewed 3,887 business and technology executives from across 72 countries and territories, found that only around half of security and operations leaders said their company is “very capable” of withstanding cyber attacks even as new and emerging technologies, including AI and quantum computing, transform the cyber risk landscape.

Less than, or roughly half, of companies say they are “very capable” to address areas including weak authentication and access controls (55

percent), vulnerable connected products/devices (48 percent), with legacy systems (45 percent) and supply chain vulnerabilities (43 percent) among the weakest spots among the areas surveyed.

PwC said its survey found nearly one-third (32 percent) of companies planning to increase their cyber budgets said they would likely do so between 6-10 percent.

As for cyber budget priorities, investment in AI (36 percent) was top over the next 12 months, ahead of cloud security (34 percent), network security (28 percent) and data protection (26 percent), as AI’s rapid advance continues to transform the digital landscape.

When looking at the AI security capabilities companies are prioritising over

NOTICE

NOTICE is hereby given that REHANA DORSETT of PO Box: SB-52857 Twynam Heights, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of October 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

the next 12 months, the PwC survey found nearly half (48 percent) of security leaders are prioritising AI threat-hunting capabilities, with more than one-third prioritising other capabilities such as agentic AI (35 percent).

Half of companies surveyed now report using cyber risk quantification to measure financial impact to a significant or large extent, up from 44 percent in 2024.

But cyber security workforce shortages continue to impede progress as companies operationalise AI, secure complex environments and prepare for the next generation of threats.

But while talent shortages weigh, the PwC survey found businesses are responding by prioritising areas such as AI and machine learning tools (53 percent),

public-private partnership agreements. These shortcomings, he warned, pose serious risks to fiscal responsibility and public accountability. “Even the Fiscal Responsibility Council, the Government’s own watchdog, has sounded the alarm, calling for an urgent disclosure of the nature and quantum of the PPP obligations. They did it in their most recent report. They said that the Government was not compliant when it came to PPP deals, and that they should disclose what is happening in respect to those PPP deals,” said Mr Thompson.

security automation tools (48 percent), cyber tool consolidation (47 percent) and upskilling or reskilling (47 percent).

The cyber skills deficit challenge runs deeper beyond preparation for AI.

Nearly half (47 percent) of corporate leaders cite a lack of qualified personnel as a top challenge when securing operational technology (OT) and the industrial internet of things (IIoT) systems. But, as quantum technologies are advancing and represent one of the top-ranked threats companies are least prepared to address, almost half (49 percent) haven’t considered or started implementing any quantum-resistant security measures due to a lack of understanding about post-quantum risks, limited internal resources and competing demands.

NOTICE

NOTICE is hereby given that LYNO ABRAHAM of Lightbourne Avenue, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of October 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

BISX-listed APD puts its excess cash to work

APD’s just-released audited financial statements for the year to end-June 2025 reveal that, apart from the already-known $1m investment in Bahamas Grid Company, which has taken over ownership and control of New Providence’s electricity grid, it has also parted with a further $5m to obtain an equity ownership interest in the entity

that will supply 60 mega watts (MW) of liquefied natural gas (LNG) fuelled power to vessels docked at Nassau Cruise Port.

The operator of Arawak Cay’s commercial shipping port acquired 50,000 common, or ordinary shares, in Bahamas Grid Company in July 2024 at a price of $20 per share before purchasing 250,000 shares in Island Power Producers at the same cost in

November 2024. The two deals mean APD’s energyrelated deals account for almost 60 percent, or $6m of the $10.043m worth of investments on its balance sheet at end-June 2025.

Mr Bethell told this newspaper that the two equity investments in corporate entities which are playing key roles in The Bahamas’ energy reforms are part of a strategy to generate returns on cash holdings

which stood at $17.961m at year-end 2025 - a figure that changes little during the 12 months to end-June.

“The investment portfolio is part of APD’s overall financing strategy to lower our effective cost of capital on long-term debt by earning returns on surplus cash.” he affirmed. “We aim to offset borrowing costs through a mix of capital appreciation, dividends and interest income, while keeping ample liquidity for operations, maintenance and approved capital expenditure.”

It is thought that APD has grown frustrated by its inability to-date to expand beyond Arawak Cay and win other port operations/ management contracts both in The Bahamas and elsewhere, which is likely another factor behind the decision to deploy surplus cash assets earning no returns into investments outside its core business.

Mr Bethell said the “strategic equity stakes” in Bahamas Grid Company and Island Power Producers “are minority positions in local energy infrastructure that align with our operations -power reliability, potential future energy cost efficiencies - and offer long-term value potential”.

He added that APD’s goal is to “deploy a prudent portion of cash to earn riskappropriate returns and reduce net financing costs on our long-term debt profile”, while also maintaining “a conservative liquidity buffer”.

The APD chief confirmed: “This is not a shift away from core port operations, but a disciplined treasury approach aligned with shareholder value.” He added that the port operator gains via interest income on these investments during the year, plus “small” unrealized fair-value gains in 2025 plus dividend income.

“Cash & cash equivalents remained strong at $17.7m, long-term debt outstanding reduced during the year,and we continued regular dividend distributions to shareholders, demonstrating that portfolio deployment is complementary to, not a substitute for, our core capital and shareholder return priorities,” Mr Bethell added.

He said APD shareholders - split into the Government and shipping industry, which each hold 40 percent, and the public which owns the remaining 20 percent - benefit from the conversion of “idle cash into earnings that help offset interest expense, supporting stable dividends and balance sheet resilience”.

And the “strategic energy positions support operational reliability and potential cost efficiencies at the port over time”.

APD’s other investments include a stake in the Bahamas Investment Fund, which holds a collective 49 percent interest in the Nassau Cruise Port on behalf of Bahamian investors, valued at $590,410. This comes from its holding of 85,000 shares in the fund that were purchased at a price of $5 apiece.

“Directors intend to use the book value of Bahamas Investment Fund’s ownership stake in Nassau Cruise Port as a base case for the value of the shares. Accordingly, the net asset value will reflect movements in Nassau Cruise Port’s equity and primarily be driven by the performance of the company,” APD’s financial statements confirmed.

The port operator also holds $2.761m worth of Bahamas government bonds, upon which it earned $206,700 in interest income during its 2025, and US Treasury Bills that had a carrying value of $423,769 at the end-June 2025 date.

“During the year, the company invested in the CFAL Bond Fund, a pooled investment fund managed by Colina Financial Advisors that primarily invests in fixed-income securities,” APD’s financials added.

“The total cost of shares acquired during the year amounted to $263,600. At June 30, 2025, the investment had a market value of $267,717, which included an unrealised gain of $4,118.”

Mr Bethell said APD’s investments in fixed income securities “provide predictable interest income and principal stability”, while the Nassau Cruise Port gives “measured, indirect participation in the cruise segment”.

Island Power Producers, in which APD has invested

$5m, this week said it is seeking a further $100m in financing via a bond issue that is set to launch on November 6.

Mike Maura, Nassau Cruise Port’s chief executive and APD’s chairman, previously told Tribune Business that the 60 MW shore power project, which will not only involve offloading LNG at Nassau Container Port but transporting it to the generation plant via a pipeline running underneath the port’s property, will create a new revenue stream for APD that will help to reduce the need for any tariff increases to be imposed on imported goods and services.

“It’s a new cargo source type for APD,” Mr Maura explained. “The beauty of it is, in my view, that it doesn’t have an operational cost for APD. You have LNG moving off the ship, running on a pipeline underneath and moving through APD’s property. APD will collect a toll on that.”

Besides Nassau Cruise Port and APD, the other investors in the Island Power Producers consortium include Crowley, the shipping company, which will be responsible for transporting the LNG fuel to Arawak Cay and its subsequent offloading. Siemens will supply the generation equipment and manage/ operate the plant, while Watts Marine, a specialist in shore power solutions, will deal with the hook-ups for all cruise vessels capable of connecting to it.

Island Power Producers’ Board includes Charles Farquharson, the former Morton Salt general manager, as well as Angelo Butler, CFAL’s manager of corporate advisory services. Apart from Erold Farquharson, a contractor, who is the company’s managing director, all other members of the executive and management team appear to expatriates.

“Island Power Producers was established to build and operate a state-of-theart natural gas power plant to provide shore power to cruise ships docked at the Nassau Cruise Port and to supply any excess power to Bahamas Power & Light,” the company’s website confirmed.