‘Swimming against tide’ on $400k

By NEIL HARTNELL

A LOCAL manufacturer is “swimming against the tide right now” with Bahamas Power & Light’s (BPL) fuel charge hikes set to increase its 2023 electricity bill by around $400,000 year-overyear to more than $1m.

Walter Wells, president of Car ibbean Bottling, the Coca-Cola producer, told Tribune Business “it’s like we’re getting hit on all sides” following the state-owned energy monopoly’s confirmation that its fuel charge - which typi cally accounts for 50-60 percent of customer bills - will increase by up to 163 percent next year com pared to the current rate in order

to repay government subsidies and debts owed to its Shell fuel supplier.

“The reality is the poten tial impact through the next 11 months to August is in the range of $400,000,” he disclosed of the effect on Caribbean Bottling’s electricity costs. While declining to give a figure for the company’s

‘We will pay the price’ until crime controlled

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

TOURISM leaders are warning The Bahamas “we will pay the price” unless rising crime is brought under control while branding last week’s down grade by the US as “a warning sign we must heed”.

Robert Sands, the Bahamas Hotel and Tourism Association’s president, told Tribune Business this nation needs to focus on “the big picture” and realise that “everybody is a victim” of criminal activi ties - not just tourists, but Bahamians and residents as well as local businesses.

Speaking after the US State Depart ment last Wednesday issued a warning to all American travellers to “exercise increased caution in The Bahamas due to crime”, he urged the entire society to work together and “get crime under con trol as quickly as possible”.

“We cannot put a price tag on correct ing this. It has to be corrected otherwise we will pay the price,” Mr Sands told this newspaper following the surge in murders and other violent crimes that appears to have sparked the US downgrade. “We need to be thinking big picture and work ing collectively to get this under control very quickly.

“The US has a four-tier advisory level. We came out of the top tier, and are now in the second tier. It’s a warning signal, and we must act quickly, positively and strategically in putting in place recom mendations and solutions to help all

total new power bill, he added: “It’s obvious that if that is what the increase is it will be over $1m.

“It has a significant impact, and the ability we have to miti gate some of that.... we’re kind of swimming against the tide right now with the inflation ary increases. The raw material imports are going up on an almost

daily basis. It’s like we’re get ting hit on all sides. Every month it seems like something else is increasing.”

Mr Wells said price competi tiveness is critical for Bahamian manufacturers to fight-off rival imports that typically enjoy lower production costs.

BPL’s fuel charge increases threaten to upset this delicate balance, and he explained: “What makes manufacturing work here is the Government gives us conces sions to be competitive against imported goods.

“If local inflation increases continue, it may make us uncom petitive against like import products. That’s the danger, and that’s the balancing act we try to manage on a daily basis. I can

Moody’s doubles down on ‘overly optimistic’ forecasts

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

MOODY’S has doubled down on concerns that the Govern ment’s Budget revenue forecasts are “overly optimistic” and that its debt servicing payments will be higher than projected due to the rise in global interest rates

The credit rating agency, fresh from downgrading The Bahamas deeper into so-called ‘junk’ status over concerns the Government may be unable to access the debt financing it requires, also suggested that the Davis administration’s plans to restrain public spending “will weigh on growth” and thus slowdown economic expansion.

Issuing its latest ‘credit opin ion’ on The Bahamas just one day after cutting the country’s credit

rating ‘B1’ from ‘Ba3’, Moody’s reiterated previous concerns and misgivings voiced over the Gov ernment’s 2022-2023 Budget projections by suggesting “addi tional revenue measures” - coded language for new and/or increased taxes - may well be needed to hit its goal of eliminating the annual fiscal deficit by 2024-2025.

“The economic recovery is a key driver of fiscal consolidation in fiscal 2023. A continued uptick in tourism inflows will drive the recovery at the same time as construction and foreign-led invest ment projects ramp up. These factors, in addition to increased tax collection supported by the reintroduced Revenue Enhancement Unit, underpin the Government’s expectation that recurrent revenue

BAMSI’s $7m investment targets 30% import slash

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS Agri culture and Marine Science Institute (BAMSI) is aiming to invest $7m in a series of “green house parks” designed to cut imports of vegetable staples by 30 percent.

Senator Tyrel Young, the Insti tute’s executive chairman, told Tribune Business the investment is a key element in efforts to “plant the seeds” for the revival of Baha mian agriculture by facilitating and empowering local farmers via the

provision of technology and raw materials.

Explaining that BAMSI was targeting “the low hanging fruit”, in terms of focusing on market niches where Bahamian farmers can oust imports and seize signifi cant market share, he added that besides vegetable crops it is also focused on driving this nation to full self-sufficiency in egg produc tion by 2025.

Although local producers pres ently have “less than 1 percent” share of the Bahamian egg market, Senator Young described the neartotal reversal of this position as

bill hike

only sell what I produce if it’s less expensive than it costs someone to go to Florida, bring it in and pay import duties on. That’s the balancing act I face on a daily basis.”

Bahamian resorts, supermar kets, wholesalers/distributors and manufacturers are likely to be the industries hardest hit by the fuel charge increases unveiled by BPL last week. The magnitude of the increases, which the Government is hoping will be relatively shortterm and confined to a 12-13 month period, will leave most if not all businesses in a position where the rise in costs has to be passed on to consumers, with staff

BPL fuel hikes ‘slap in face’ for Family Islands

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FAMILY Island Cham ber of Commerce heads have branded Bahamas Power & Light’s (BPL) fuel charge hikes “a slap in the face” as they now have to pay more for unreliable electricity sup plies that frequently suffer outages.

Daphne Degreg ory-Miaoulis, Abaco’s

Chamber of Commerce president, told Tribune Business that increases of up to 163 percent com pared to the present 10.5 cents per kilowatt (kWh) rate “add insult to injury” when some 30 percent of the island’s homeowners cannot connect to BPL because their post-Dorian properties are not deemed sufficiently worthy to have power restored.

business@tribunemedia.net TUESDAY, OCTOBER 11, 2022

SEE PAGE B7

SEE PAGE B5

SEE PAGE B4

BPL

Tribune Business Editor nhartnell@tribunemedia.net ROBERT SANDS SEE PAGE B4 SEE PAGE B3 • Coca-Cola supplier: “We’re being hit on all sides’ • Major resort to see $10m-plus energy cost surge • ‘Perfect storm’ for producers’ cost competitiveness $5.85 $5.88 $5.76 $5.79

DON’T IGNORE CYBER THREAT TO MOBILES

Asshould be evi dent by now, cyber security must always be a top busi ness priority and, in most cases, it should be the pri ority. Unfortunately, other cyber security efforts have often overshadowed security initiatives related to mobile devices. The understated reality is that with smart phones becoming more pop ular every year, they allow users to store sensitive infor mation and perform more critical tasks, thus making them a perfect target for attackers.

Overconfidence and reli ance on mobile device management (MDM), plus enterprise mobility management (EMM), are

also exacerbating these problems. Many cyber secu rity experts believe these technologies do not pro vide the complete security protection needed to meet today’s mobile threats. This article, the first of a two-part series, gives an overview of the significant threats to smart phones and other mobile devices.

The threat to user privacy

There are several threats to user privacy, including mobile malware; the use of third-party applica tions; phishing/SMiShing; the use of third-party applications; and man-inthe-middle attack. Two are detailed below.

* Mobile malware - A mobile malware attack is

a malicious software pro gram designed to exploit mobile operating systems and mobile phone technol ogy. This is used to attack smart phones, tablets and smart watches. It is unknown to most mobile users how MMs (attackers and invad ers) enter their phones without their permission and knowledge.

This attack aims to steal login credentials or personal information using legitimate personation. This is accom plished by sending targeted e-mails, such as job inter views and lottery e-mails, to targeted victims. SMS phishing is also known as SMiShing. To convince a victim user to download and install a virus, Trojan Horse

or another type of malware, an interesting SMS is sent.

The threat on mobile devices

These security threats can make mobile devices vulnerable to hackers, and therefore they become easy prey. The list detail ing these threats here is not exhaustive.

* Android Rooting - By gaining root access, you can manipulate the Android OS source code and install soft ware that the manufacturer usually prohibits. On iOS, this is called “jailbreaking”.

* Fake Access Point

* Unsecured WiFi - The term ‘unsecured Wi-Fi’ refers to a free network available at libraries, coffee shops and malls because no

unique passcode is required during the login process.

Due to their vulnerability to hackers, these networks are also known as unencrypted Wi-Fi networks.

The threat to data integrity

On mobile devices, the following security threats are most common:

· SSL Certificate - Secure communication between a client and a bank is crucial.

SSL (Secure Sockets Layer) is used to facilitate this pro cess. These cyberattacks are primarily caused by invalid, pirated and cracked applica tions. Attackers bypass SSL so they can make unauthor ised communications with clients.

Derek Smith By

· Packet Sniffing - Packet sniffing is used to monitor and detect packet data in a network. Hackers may use similar tools for fraudulent activities, while network administrators use them to monitor and validate net work traffic.

Conclusion

In short, with mobile devices becoming the pri mary target of many cyber attackers, it is essential to protect the data stored on them. Even though manag ing and protecting devices is critical, recent attacks dem onstrate it is not enough. Data integrity and safety must be ensured by an extra layer of security, regardless of whether a mobile device’s OS or other software has been compromised. These extra layers of security will be discussed in the second part of this series.

• NB: About Derek Smith Jr

Derek Smith Jr. has been a governance, risk and com pliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfs burg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certi fied anti-money laundering specialist (CAMS), and the compliance officer and money laundering report ing officer (MLRO) for CG Atlantic’s family of compa nies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

PAGE 2, Tuesday, October 11, 2022 THE TRIBUNE

FURNITURE PLUS REBRANDS AND LAUNCHES WEBSITE

FURNITURE Plus has unveiled a total rebrand ing and the launch of a website where Bahamians can purchase furniture, appliances and electronics.

“The ‘plus’ in Furni ture Plus has always stood for our commitment to going a little further in an effort to help people help families,” said Krystynia Lee d’Arville, the 33 yearold company’s president and chief executive. “Our new commercial site will serve the entire Bahamas with vastly enhanced digital services, but the company will maintain the same ser vice-focused familiarity and considerate approach with all of its customers.”

Furniture Plus chose Nicky Saddleton to develop the new logo and rebranding, aligning key visuals and messages with the transformation theme. Having led the design team that created the Furniture

Plus logo 25 years ago, the co-founder of Octo pus Digital headed an internal ‘brand transforma tion team’ that included Mrs Lee d’Arville; Dawn Forbes, Furniture Plus’ vice-president and general manager; Candice Burrows, director of sales; and Kam Cheng, graphic designer/art director.

Ms Saddleton also brought in writer, Joy Sweeting, and collaborated with graphic designer, Shan non Bruce, to develop the new brand and website. She said: “It is an honour to rebrand Furniture Plus for the second time, and to capture the journey of how, despite tough external market forces, Furniture Plus remains committed to its lifelong customers, while embracing new audiences with a digitally transformed website.”

Furniture Plus invited Bahamians to experience

its new brand identity for the first time on Octo ber 7 with an event at its Town Centre Mall location, where the new logo and website were unveiled. Attendees were treated to logo-inspired catering and face-painting; rebranded gifts and givea ways hosted by SawyerBoy; and steel pan favorites by Lenny and Friends. The event finished with a

celebratory Junkanoo rushout led by Colours.

Mrs Lee d’Arville added: “We wanted the community to come out and celebrate these milestones with us.

Our 33rd anniversary is a time to remember the past, but also recognise and build upon the spirit of innova tion that this company has always sought to embody.

“Coming at a moment when we have finally been

BPL fuel hikes ‘slap in face’ for Family Islands

“The thing about it is that it’s like a slap in the face. It’s adding insult to injury,” she blasted. “Thirty percent of our property owners cannot afford to finish their homes to get power much less bear an increase. The businesses who are having to pay the higher fee, they themselves are just trying to recover. I don’t know what to say. It just shows the Government is really in dire straits.

“BPL have been strug gling here on the island because they’re unable to get the equipment they need as they can’t find it. There’s a waiting list, sometimes of up to 18 months, for equipment they need to rebuild their power stations that were damaged. That’s part of the reason why they are not able to provide regular power.

“We’re having many power outages because they’re trying to manage the power stations with inad equate equipment. We’re paying for power we don’t always have available to enjoy and, in many cases, we can’t afford to get recon nected. It’s just another blow to Abaco. It’s a major setback.”

Mrs Degregory-Miaoulis said she was unable to esti mate how many businesses may be forced to close, or terminate staff, as a result of the BPL fuel charge increase although the Government is hoping it is sufficiently short-term - phased in over a period of 15 months - to avoid major long-lasting

damage to the Bahamian economy.

“The only upside to this thing, and I always like to look at the glass half full, but the only upside is that it teaches people to be more energy conscious and look at ways to cut back on their use of energy,” she added.

“Hopefully the Govern ment will set the example by, first of all, implementing solar and renewables in its buildings. They’ve got a big solar microgrid next to the airport, but last I heard it was not operational. I don’t know what they’re waiting for.”

Her concerns were echoed by Thomas Sands, the Eleuthera Chamber of Commerce president, who said the impact of BPL’s fuel charge hikes will be felt more keenly on the Family Islands than in Nassau given that everything costs more outside the capital due to extra shipping/freight costs.

“It starts with us needing them to keep the power on all the time,” he told Tribune Business. “We’re suffering power outages every single day. For the average business that doesn’t have a genera tor, it’s crazy for them. Just the consistency of power is the first concern that most businesses are going to have, and then the additional cost in addition to not having consistency of power is like a double slap in the face.

“I spoke to someone from Atlanta who has been coming here for 17 years and they said the power has not stayed on once. We’re in the

position where it’s off every day. How do you explain that? Together we have to find a different approach. It appears we always go down the same road with the same formula, and it’s obvious it’s not working. It’s obvious it’s outdated.

“I’m sure nobody is going to be pleased. It’s not going to help. People are already faced with not getting what they have paid for; the con sistency of service. We’ve got to pay more for it and is it going to be more consist ent? I do not know. It’s not helpful in any way for any business.”

Mr Sands said much depends “on how drastic that increased cost is going to be”, especially for busi nesses, pointing out that companies had frequently lost food and other com modities to power outages pre-COVID. “It’s like an accumulation of further challenges. Yes, it will have an even greater negative impact on any and all busi nesses,” he added. “It’s just not a helpful thing.

“The reality is everybody is faced with increasing costs across the board in some areas. It doesn’t help the bottom line and, at the end of the day, there will be some who go out of business as a result of it. What can we do to change it? I haven’t really looked at the num bers at this point.

“I get so caught up in trying to keep the doors open and the people paid; the staff paid. I have not sat down and looked at what

the impact will be. The cost of energy, the cost of every thing is more in the Family Islands. I think everything is further impacted in these islands, and so I think there really should be an effort to encourage greater efficiency throughout businesses.”

Mr Sands renewed his call for further tax cuts and other incentives to increase the penetration of renewable

released from protracted pandemic lockdowns and travel restrictions to rejoin our community once again, it felt like the right time to jump into the future with a new look, new logo and a new digital way to con nect with and serve families across The Bahamas.”

Furniture Plus also hosted a private event at the Fusion Superplex on

energy sources in the Baha mian private sector. The Government enacted a series of tariff eliminations and reductions in the 20222023 Budget to stimulate exactly that.

Analysis seen by Tribune Business shows that, at the peak of the BPL fuel tariff increase between May 1 and August 31, 2023, Bahamian families consuming 800 kilo watt hours (kWh) or less will suffer up to a 76 percent hike compared to the current 10.5 cents per kWh charge. That

October 8, flying in Free port staff to join their Nassau counterparts at a gala that included cock tails, entertainment, gifts and recognition. There was also a look back at the company’s history, trans formation and future plans. The evening ended with a dinner and movie in the VIP threatre.

Furniture Plus was formed as a ‘big box’ home goods store designed to serve emerging communi ties in eastern, southern and western Nassau. It was also the first to provide affordable and flexible inhouse financing at a time when securing bank loans was very difficult for many Bahamian families, and the first to build a distribu tion centre capable of being used as a national disas ter response depository for hurricane relief.

three-month period also represents peak summer, coinciding with maximum demand and the greatest energy consumption.

As for businesses and households that use over 800 kWh, fuel charges are set to increase by 138 percent, 163 percent and 138 per cent - more than doubling compared to the present 10.5 kWh rate - during the periods of March 1 to May 31, 2023; June 1 to August 31, 2023, and September 1 to November 30, 2023.

THE TRIBUNE Tuesday, October 11, 2022, PAGE 3

FURNITURE Plus staff and Krystynia Lee d’Arville, the company’s president and chief executive, jump in a celebratory rushout led by Colours.

Photo: Carolien de Marez Oyens

FROM PAGE B1

‘Swimming against tide’ on $400k BPL bill hike

terminations and corporate closures a real danger.

One major Bahamian resort, speaking on condi tion of anonymity, revealed that the BPL fuel charge increases as they stand will cause its electricity bill to increase by more than $10m per annum - giving further insight into the extent of the impact to the sector’s cost structure, operating model and bottom line.

Robert Sands, the Baha mas Hotel and Tourism Association’s (BHTA) pres ident, confirmed to Tribune Business that the sector will continue “advocacy” and dialogue with BPL over the planned fuel charge increases and their impact on the industry’s efforts to drive the post-COVID recovery.

“We intend to continue our advocacy with BPL on this particular issue as we have done in the past, and will continue to meet and re-engage on this particu lar matter,” he added. “The

discussions, in particular, will take place with BPL.

This is a BPL question.”

At its peak, the BPL fuel charge increase appears set to raise consumer’s total electricity bills by around 80-90 percent at next sum mer’s peak. Soaring power bills which, alongside labour, are typically among a Bahamian enterprise’s greatest costs, are arriving at a time when many are still struggling to recover from the losses and unpaid bills amassed as a result of COVID-19 lockdowns and other restrictions.

The BPL fuel charge hike is also coincid ing with continuing inflationary pressures due to post-pandemic supply chain bottlenecks and short ages, and the extent of the increases will likely make the cost of living crisis worse for many Bahamians since they will drive a fur ther across-the-board rise in prices.

Mr Wells told Tribune Business that Bahamian

companies were facing “a perfect storm” as National Insurance Board (NIB) contribution rate increases and a minimum wage rise also loom. While Caribbean Bottling staff are all paid above the minimum wage, and thus the company will not be affected by any increase, NIB contributions are a different matter.

“NIB I understand. NIB is mightily important to the retirement community, and benefits all of us. If we need to pay more I under stand that,” Mr Wells said. “But all of these things are coming together like a per fect storm. At the end of the day, prices continue to escalate.

“We’ve increased prices, but it’s always like we’re behind the 8-ball. To be ahead, you’d have to double your prices beyond what they would be. You’re trying to catch up for the last six months increases, and then something increases again. It’s a con stant battle trying to keep

abreast of all these infla tionary increases.”

The Caribbean Bot tling chief voiced optimism that inputs which have contributed greatly to the inflationary surge witnesses in The Bahamas and world wide post-COVID, such as shipping and freight costs, will start to stabilise and help offset some of the BPL impact. The ques tion, though, is when, and last week’s move by the OPEC cartel of oil produc ing countries and Russia to cut daily output by 2m bar rels to sustain higher prices is not what The Bahamas needs.

“It is six months? Twelve months? Eighteen months? No one knows,” Mr Wells added, promising there will be no sudden consumer price increases. “It won’t be immediate,” he said of the latter. “We don’t want to have a knee jerk reaction. It’s possible those increases take place but some raw materials may come down. We need to manage it more

month-to-month to see how things evolve and base deci sions on fact rather than knee jerk.”

Analysis seen by Trib une Business shows that, at the peak of the fuel tariff increase between May 1 and August 31, 2023, Baha mian families consuming 800 kilowatt hours (kWh) or less will suffer up to a 76 percent hike compared to the current 10.5 cents per kWh charge. That three-month period also represents peak summer, coinciding with maximum demand and the greatest energy consumption.

As for businesses and households that use over 800 kWh, fuel charges are set to increase by 138 per cent, 163 percent and 138 percent - more than dou bling compared to the present 10.5 kWh rateduring the periods of March 1 to May 31, 2023; June 1 to August 31, 2023, and Sep tember 1 to November 30, 2023.

Moody’s doubles down on ‘overly optimistic’ forecasts

will expand by 14.1 per cent in fiscal 2023, “The Government pro jects that recurrent revenue will reach 24 percent of GDP by the end of fiscal 2025, 4.4 percentage points higher than that estimated in fiscal 2022 and 5.4 per centage points more than in fiscal 2019. As we have noted previously, the Government’s revenue assumptions may prove overly optimistic, requiring

either additional revenue measures or a more gradual fiscal adjustment.”

Similar warnings were repeated with regard to the Government’s spend ing forecasts. “On the expenditure side, follow ing accumulated growth of 31 percent in fiscal 20182021, the Government projects recurrent primary expenditure will decline by 1.1 percent in fiscal 2023 and grow less than 1 percent annually in fiscal 2024-2025,” Moody’s said.

“While we expect the Government to constrain expenditure growth, the magnitude of the reduction in spending implies a much more restrictive fiscal policy stance, which will weigh on growth.” The Davis admin istration is forecasting that recurrent spending, which covers the Government’s fixed costs such as salaries and rents, will peak this fiscal year at $2.997bn and thereafter be held rela tively flat at $2.953bn and $2.918bn over the next two successive budget years.

As for interest payments, or debt servicing, which has become the single biggest line-item in the Govern ment’s Budget, Moody’s challenged its projection that these will peak as a percentage of revenue this fiscal year. “The budget projections suggest inter est payments will peak in fiscal 2023 at 21 percent of revenue,” the rating agency added.

“Considering that financ ing needs and liquidity risk will be high over the next two years, with gross financ ing needs averaging more than 20 percent of GDP in fiscal 2023-2024, an increase

in borrowing costs would increase interest expendi ture and result in a larger fiscal deficit.

“Given the rise in inter est rates globally and the increase in risk premium for the Government of the Bahamas’ debt, even assum ing an unchanged average cost of debt would imply higher interest expendi ture than the government projects.” The Budget projected that the Govern ment’s interest costs will peak at $588.988m this fiscal year, before declining to $542.248m and $487.153m in 2022-2023 and 2023-2024 respectively.

Meanwhile, Gowon Bowe, Fidelity Bank (Baha mas) chief executive, told Tribune Business that last week’s downgrade by Moody’s will “have some very practical implications”, including for financial institutions such as banks, pension funds, insurance companies and mutual funds that invest heavily in government debt.

These will now have to further discount, or impair, existing government debt holdings worth hundreds of millions of dollars. Branding The Bahamas’ downgrade as “not wholly unexpected”, Mr Bowe added: “It’s going to be critical for us not to focus on the downgrade, but focus on the actions we will take to restore greater confidence going forward.

“There are what I’m going to say are some very practical implications. Holders of government securities, in their financial statements, are going to be required to take further provisions - although I call it paper losses for the time being - because there’s not been any actual default.

“There’s a greater uphill battle now in terms of con versations with investors.

Although the sophisticated investors will do their own analysis, the reality is those looking at external informa tion will certainly have this information in their hands.”

The Ministry of Finance last week suggested the Moody’s downgrade, which was based on fears that The Bahamas’ access to bor rowing is being squeezed, is not warranted because the Government’s borrow ing plan for the 2022-2023 fiscal year shows it is aiming to avoid the global bond markets over the next nine months due to the adverse high interest rate environ ment it would face.

Mr Bowe, though, said: “I would implore the Gov ernment not to get into a response that looks to criti cise the deficiencies or a process that is inequitable. What it needs to focus on is the messages that have been created, and appreci ate the role of government now is to demonstrate an alternative position that is viable and we will effi ciently navigate the coming years with prudence and some creativity.”

The Davis administra tion will likely argue that Moody’s analysis, and action, was premature and that it should have waited at least 12 months to determine whether the Government had hit its fiscal forecasts for 20222023. This is especially since, in the subsequent ‘credit opinion’, the rating agency projected that The Bahamas will hit 7 percent gross domestic product (GDP) growth for 2022.

“Although the outbreak of the Omicron variant of the coronavirus dampened the tourism sector’s recov ery in the beginning of the 2021-2022 high season of December to April, there are signs that the sector is

Ben Albury, the Bahamas Motor Dealers Associa tion’s (BMDA) president, described the BPL fuel charge hikes as “just another kick in the butt” for struggling companies. “I think that in all businesses and in all households it’s definitely not a good time, especially with all the other factors coming into play with inflation and other increasing costs,” he added.

The Bahamas Bus and Truck general manager voiced doubt that the Gov ernment and BPL will adjust the projected fuel charge increases, saying:

“To project those increases so far in advance prob ably means they will not go backwards. I hope there’s room for some adjustment.

Right now it’s extremely difficult. I feel terrible for a lot of struggling busi nesses that have had to endure COVID, lockdowns and other restrictions, plus supply shortages and inflation.”

regaining momentum. In the first half of 2022, the country has received nearly three million visitors, equal to about 85 percent of the arrivals recorded in January to June in 2019,” Moody’s said.

“Notably, the number of stopover arrivals has consistently exceeded the figures from 2021. Stopover visitors - visitors who are confirmed to have spent a night in The Bahamas based on immigration records generate 90 percent of tourism earnings despite accounting for less than half of total arrivals. The arrivals of stopover visitors reached 71 percent of their 2019 pre-pandemic level in June 2022.

“At the same time as stayover arrivals regain momentum, cruise arrivals are picking up significantly. Through the first six months of 2022, visitor arrivals from cruise ships totaled 2.2m, equal to 78 percent of the number of cruise visi tor arrivals recorded in the same period in 2019, a record year for cruise arriv als. The authorities expect cruise visitors to surpass 5m in 2022, and exceed that number in 2023, which would likely mark a recordbreaking year for cruise tourism arrivals,” Moody’s continued.

“Assuming that the tourism sector carries this momentum through the upcoming peak season, eco nomic activity will continue to pick up. We forecast real GDP growth of 7 percent in 2022. Although the sector’s recovery, which will sup port the broader economy’s growth, is subject to risks of inflation in tourism source markets and a potential out break of a new coronavirus variant, we expect inflows to continue to converge with their pre-pandemic levels in the remainder of 2022.”

PAGE 4, Tuesday, October 11, 2022 THE TRIBUNE

FROM PAGE B1

FROM PAGE B1

Avalanche!

By RICARDO EVANGELISTA

The first warning of an avalanche usu ally comes from the noise it makes, as the mix of snow, rocks and other debris rolls down moun tain slopes at speeds that can reach 30 kilometres per hour. Seasoned mountain eers and skiers know that before it can be seen, the approaching danger can often be heard. They also know that by the time they see the white sliding mass approaching, it is usually too late. The time to act and look for shelter is when the initial roar is heard.

A similar principle can be applied in the financial markets. Crises are usu ally preceded by warnings. Unfortunately, despite les sons from the past, many investors invariably end up

missing those signs. Before the 2008 financial crisis and subsequent global reces sion, indicators that it was approaching were there, but most chose to ignore them, blinded by greed and the all-too common ‘this time it’s different’ attitude.

But not everyone had their head buried in the sand. As early as 2006, Michael Burry, a shrewd American hedge fund manager, noticed the insane levels of lev erage and derivatives speculation associated with the real estate market in the US. Burry started bet ting against the system,

predicting that large num bers of mortgage holders would default on their repayments.

Michael Burry was, of course, right. Events even tually snowballed and almost caused the col lapse of the global financial system. This episode was famously reported by Michael Lewis in his best selling book, The big Short, which was also adapted to cinema. Going back to the avalanche analogy, we can say that Michael Burry heard the roar of the approaching landslide and acted, while others, including regulators, central

banks and governments, remained oblivious to the danger until it was too late.

Fast forward to the pre sent day. Warning signs have appeared, and inves tors will ignore them at their own peril. The US Federal Reserve started to tighten monetary policy by hiking interest rates and reducing its balance sheet.

The US central bank’s hawkish pivot con trasts with its pandemic-era stance. The combination of monetary and fiscal stimu lus made necessary by COVID created an abun dance of money that fed into unprecedented risk appetite among trad ers and propelled stocks, crypto currencies and other speculative instruments to all-time highs. This scenario has now changed, and some believe that we are hearing the noise of the approach ing avalanche.

According to a recent article in The Economist, since the beginning of the year global stock markets have lost $12 trillion in value. Bonds lost $7 tril lion and cryptos’ market cap shrunk by $2 trillion.

The problem here is that many large financial insti tutions, including banks, pension funds and count less businesses (especially in the technology sector), are heavily leveraged and exposed to complex finan cial products that are set to suffer as the markets drop.

During the pandemic, central banks acted as

buyers of last resort, sup porting investor confidence by providing a safety net. It is perhaps time for them to once again come to the rescue. The Fed and its peers should listen to the ominous sounds coming down from the mountain slopes of global finance. Maybe it is time to accept that 2 percent inflation is no longer a realistic objec tive. Repositioning targets to the 4 percent level, for example, would require less stringent monetary poli cies, easing the pressure on the markets and on the real economy.

‘We will pay the price’ until crime controlled

stakeholders in addressing this particular issue.

“Crime impacts eve rybody. It impacts the community, it impacts businesses in the commu nity, and industries that contribute to economic well-being. I will say that it’s everybody’s business, and we have to make a col lective effort in having this addressed as quickly as possible.”

The US State Depart ment, in downgrading The Bahamas from a ‘Level one’ country where Ameri can visitors can “exercise normal precautions” to a ‘Level two’ where they should take “increased cau tion”, signalled that The Bahamas’ “high homicide rate” fuelled by gang war fare and retaliatory killings was a critical factor in its decision.

“The majority of crime occurs on New Provi dence (Nassau) and Grand Bahama (Freeport) islands. In Nassau, practice increased vigilance in the Over-the-Hill area (south of Shirley Street) where gang-on-gang violence has resulted in a high homicide rate primarily affecting the local population,” the US warning read.

“Violent crime, such as burglaries, armed robberies and sexual assaults, occur in both tourist and non-tour ist areas. Be vigilant when staying at short-term vaca tion rental properties where private security companies do not have a presence.”

There is no indication that tourists are targeted by criminals, and the over whelming majority of visitors to The Bahamas enjoy incident-free stays. However, one such inci dent is one too many given that this nation remains largely reliant on tourism to drive its economy back to pre-COVID output. Crime remains among the key threats to the post-pan demic recovery momentum, and there have been reports of visitors staying in vaca tion rentals being robbed.

“It’s definitely a warn ing sign, and we must heed the call to work collec tively and collaboratively to address these areas,” Mr Sands said of crime and the US advisory. While acknowledging that such warnings have been issued on The Bahamas before, he added: “Things settle down for a bit, but they seem to awaken again. This [latest advisory] is an urgent call for collective collaboration.”

Emphasising that this should not be seen solely as a tourism/hotel indus try issue, but one that impacts all Bahamians and residents, the BHTA chief added: “I think it’s impor tant that we do not address this as an issue that impacts tourism. It’s an issue that impacts the entire commu nity, the people who live in it, and businesses.

“Tourism is not the only victim in this; everybody is the victim in this. That is so important from the hotel and tourism indus try’s perspective. This is everybody’s business to deal with. I believe that we cannot give up on this par ticular issue. We have to

deploy and redeploy our best efforts and practices, and use whatever support we can get to bring this matter under control.

“The reality is that the health and safety of col leagues and visitors is of paramount importance. This is a big issue and we need to get it under con trol, I would say, as quickly as possible. It is important that there is a dialogue, and an open dialogue, with the widest cross-section of individuals who are very well-versed in how recom mendations and solutions come together, and cer tainly the tourism sector will lend their support to that collaboration.”

The US State Depart ment’s crime-related travel warning on The Bahamas could cause persons who are influenced by such advi sories, both leisure as well as group travellers, to select a rival vacation destination that they perceive as safer. It may also deter those who

are ‘sitting on the fence’ about travelling from doing so.

The US advisory, mean while, also reiterated concerns about the unregu lated water sports industry in The Bahamas. “Activities involving commercial recre ational watercraft, including water tours, are not consist ently regulated,” it said.

“Watercraft may be poorly maintained and some operators may not have safety certifications. Due to these concerns, US government personnel are not permitted to use inde pendently operated jet-ski rentals on New Providence and Paradise Island.

The BHTA, in a state ment describing the US advisory as “unfortunate”, said it wanted to work with the Government, law enforcement, tour ism stakeholders, industry partners and civil society to combat crime, which it said was “as insidious as it is dangerous”.

NOTICE is hereby given that SAMANTHA VALCIN of Prince Charles Drive, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Mr Sands was quoted as saying: “While we recognise crime is a global ailment, small island nations, heav ily reliant on the tourism industry, are particularly vulnerable to the ill-effects of crime for a number of reasons. Not only can it deter visitors from choos ing to visit The Bahamas; when crime hits it hurts our people as a whole.

“The impact of crime left unabated is an absolute threat to our nation’s tour ism product and to society. We must work assiduously and immediately to stamp out the glowing embers that are threatening to ‘run hot’ in our country. We must enhance efforts to combat crime collectively. We in the tourism industry have a saying: ‘Tourism is eve rybody’s business’. So is crime. I cannot emphasise that enough. We must unite in the fight against crime.

“How can we be the best version of ourselves at work when we just lost someone we love because of crime.? How can we be as productive as pos sible if we feel we have to leave work early to get

home before dark because we are worried about our own personal safety? How can we concentrate fully if we are concerned about our children at school, or our elderly parent at home alone?”

LEGAL NOTICE

TAKE NOTICE that Carolyn Williams and Andrew Williams both of Salina Point, Acklins, hereby give notice that they have made application to the Supreme Court for their marriage which was solemnized on the 21st April, 2003 by Rev. Carroll Rolle (Deceased) to be registered in the Marriage Register by the Registrar General under Section 30(1) of Marriage Act Chapter 120.

Dated this 30th day of September, 2022

V. ALFRED GRAY & CO., Dowdeswell Street

THE TRIBUNE Tuesday, October 11, 2022, PAGE 5

AVALANCHE

FROM PAGE B1

NOTICE

0.3690.26023.82.96%

-0.4380.000-9.0

PUBLIC

Public is hereby advised that I, EYRIE DANNIELLE

also known as EYRIE DANNIELLE

of No. 170 Market Street, New Providence,

Bahamas intend to change my name to DANNIELLE

there are

to this change

name by Deed Poll, you may write such objections

later than thirty (30) days

the Chief Passport Officer, P.O.Box N-742, Nassau, New Providence, Bahamas

N O T I C E

EXXONMOBIL EXPLORATION AND PRODUCTION IRELAND (OFFSHORE) LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by The Registrar General on the 29th day of September, A.D. 2022.

Dated the 11th day of October A.D., 2022.

Daniel A. Bates Liquidator of EXXONMOBIL EXPLORATION AND PRODUCTION IRELAND (OFFSHORE) LIMITED

N O T I C E

EXXONMOBIL RUSSIA KARA SEA SERVICES LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by The Registrar General on the 26th day of September, A.D. 2022.

Dated the 11th day of October A.D., 2022.

Daniel A. Bates Liquidator of EXXONMOBIL RUSSIA KARA SEA SERVICES LIMITED

N O T I C E

EXXONMOBIL RUSSIA BLACK SEA SERVICES LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by The Registrar General on the 26th day of September, A.D. 2022.

Dated the 11th day of October A.D., 2022.

Daniel A. Bates Liquidator of EXXONMOBIL RUSSIA BLACK SEA SERVICES LIMITED

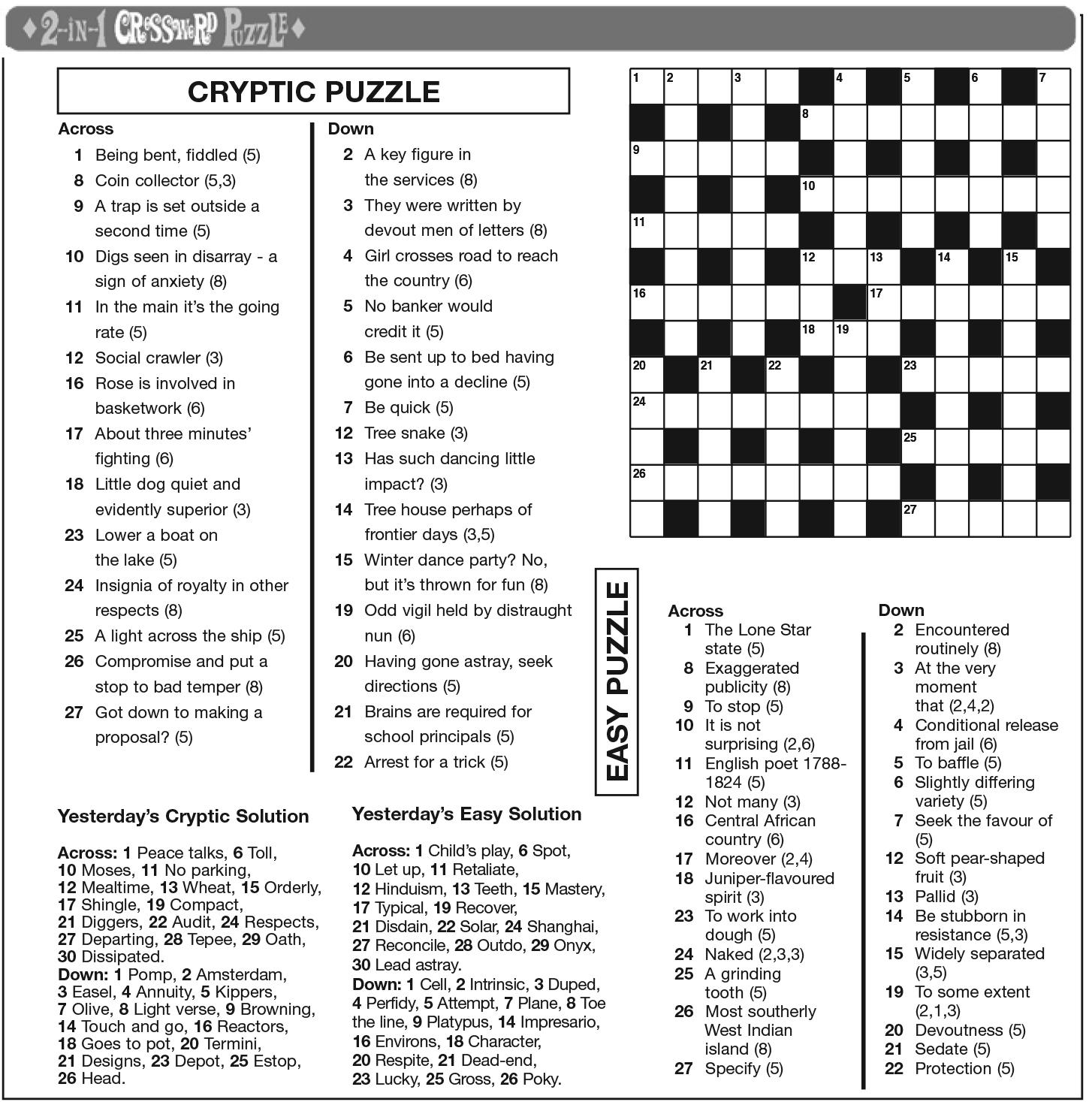

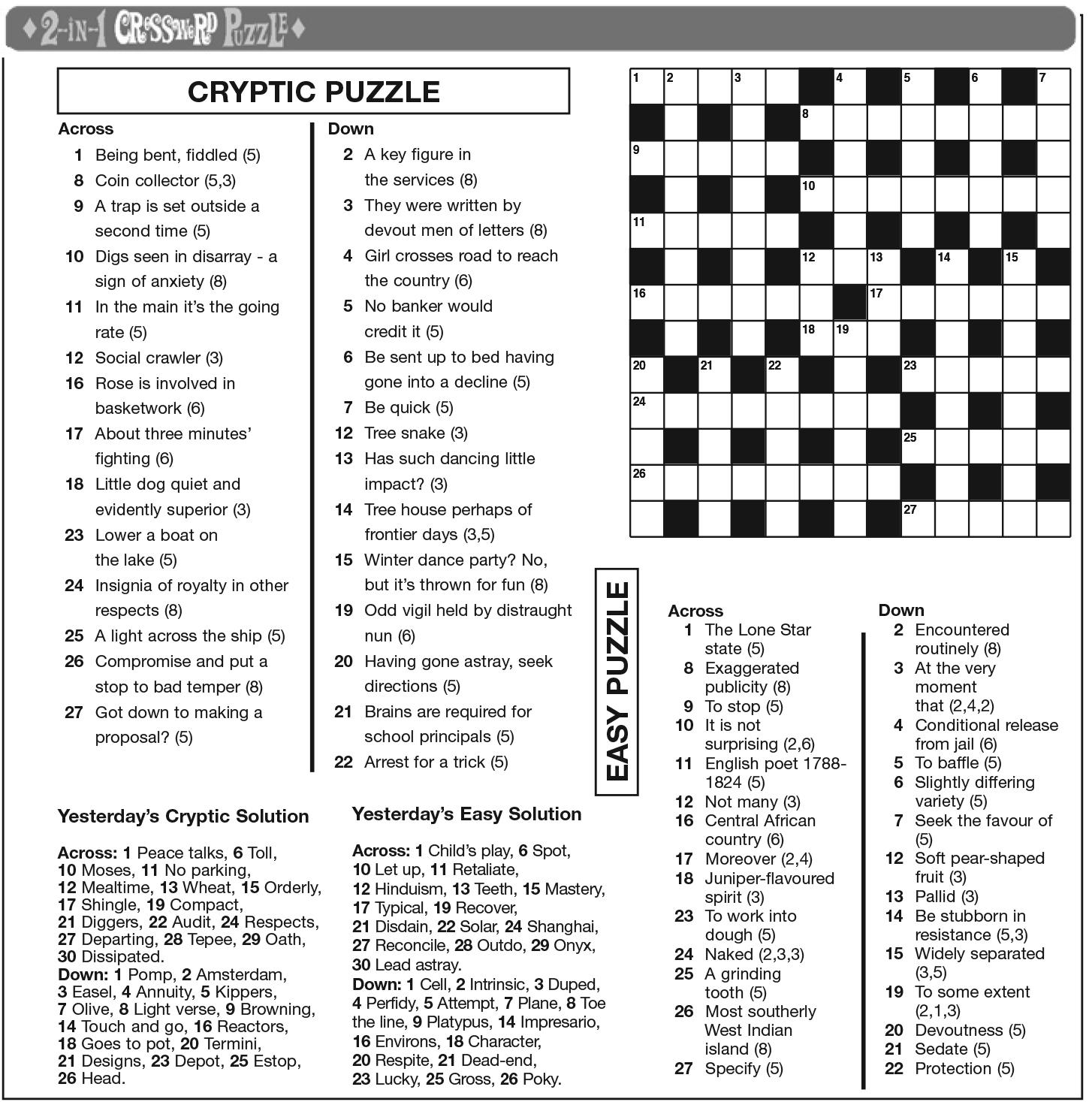

PAGE 6, Tuesday, October 11, 2022 THE TRIBUNE Monday, October 10, 2022 CROSSWORD PUZZLE

LEGAL NOTICE

LEGAL NOTICE

LEGAL NOTICE FRIDAY, 7 OCTOBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2630.790.140.01402.5518.07 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.90 6.950.05 3,9970.2390.17029.12.45% 53.0039.95 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.20Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.851.69Bank of Bahamas BOB 2.85 2.850.00 0.0700.000N/M0.00% 6.205.75Bahamas Property Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 8.78 8.780.00

4.152.82Cable Bahamas CAB 3.95 3.950.00

0.00% 10.656.80Commonwealth Brewery CBB 10.25 10.250.00 7000.1400.00073.20.00% 3.652.27Commonwealth Bank CBL 3.58 3.580.00 0.1840.12019.53.35% 8.255.29Colina Holdings CHL 8.23 8.230.00 0.4490.22018.32.67% 17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 0.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.34 3.26 (0.08) 0.1020.43432.013.31% 11.288.51Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.6711.25Emera Incorporated EMAB 9.54 9.52 (0.02) 0.6460.32814.73.45% 11.5010.00Famguard FAM 10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 4.00 4.000.00 0.2030.12019.73.00% 11.009.01Finco FIN 11.00 11.000.00 0.9390.20011.71.82% 16.5015.50J. S. Johnson JSJ 15.50 15.500.00 0.6310.61024.63.94% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.54100.00BGRS FL BGRS79026 BSBGRS790262100.54100.540.00 100.66100.60BGRS FX BGR142241 BSBGR1420417100.66100.660.00 99.9599.30BGRS FX BGR142251 BSBGR142051699.9599.950.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70% MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.95% 6.40% 4.31% 5.55% 15-Feb-2041 15-Feb-2051 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 4.53% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 28-Mar-2026 15-Oct-2049 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Aug-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022 31-Aug-2022 4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com The

BARRETT

JOHNSON

The

JOHNSON. If

any objections

of

to

no

after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL

NOTICE

“very achievable” with BAMSI itself in the pro cess of establishing its own North Andros poultry farm capable of supplying between 1.4m to 1.5m eggs per year.

Reiterating that BAMSI’s goal is not to compete with private sector farmers, he added that the Institute will “scale down” its own com mercial production and “let them take over the market” when their output becomes sufficient to meet demand.

At present, with domestic producers unable to meet these needs, Mr Young said BAMSI would seek to fill this output gap itself.

He added that, “if we continue to push as we are doing now”, slashing The Bahamas’ estimated $1bn annual food import bill by between 30-40 per cent come 2030 remains a goal within reach as the country seeks to enhance food security following the COVID-19 pandemic and its aftermath.

Tomatoes, sweet pep pers, onions, cabbages and lettuce are among the vege tables being targeted by the greenhouse project, which Mr Young said BAMSI hopes to launch in at least two islands before year-end

THE

investment targets 30% import slash

2022. “We’re creating parks across The Bahamas that we populate with green houses,” Mr Young told this newspaper. “The intended launch will be on five islands, with one on each island.

“As orders [of green houses] come in we will populate those parks. We’re looking at Eleuthera, Long Island, Cat Island, Exuma and North Andros. We’re looking at launching at least two before the end of the year. They just landed this week. We’re hoping between Long Island, Eleuthera and Cat Island, most likely those will be the first to be launched.”

Site preparation for the commercial greenhouses, which are 200 feet long by 50 feet wide, will take time and is “very tedious”, Mr Young conceded, adding that BAMSI has been working on the initiative since January/February 2022. “It will tackle some of the disadvantages some of our farmers have now,” he explained. “The main thing is crop scheduling, because everything is grown in season in The Bahamas.

“You normally have a glut of crops coming in at one time, and the rest of the year there is a drag on those particular items. The

wholesalers have to import out-of-season crops. The main focus on this is to cut down the food import bill and, by being able to grow year-round in those greenhouses, it will allow the farmers to do proper projections. That will allow time and pre-orders from local wholesalers to farm ers as they will know what is available and when.”

To use the greenhouses, farmers will have to be registered with the Minis try of Agriculture, Marine Resources and Family Island Affairs as well as undergo a “short training course” on growing crops in such facilities. “We’re focusing on the top ten crops on the market here in The Bahamas,” Mr Young said, pointing to onions, sweet peppers, tomatoes and the like.

“For the crop section, we’re looking at cutting down in another three to five years at least 30 per cent of the imports of these crops. Over the short to medium-term, 30 percent is our goal and, long-term, some items we’re hoping to become self-sufficient in.”

Mr Young listed tempera ture control, and protection from the hot Bahamian summer, as well as water consumption and “land

efficiency” as just some of the benefits the green houses will afford farmers. He added that the equiva lent of what five acres is needed to produce could be grown in the much smaller greenhouses via their con trolled environment.

Disclosing that the first order of commercial green houses had cost $330,000, with an additional $100,000 required for the site prepa ration and construction phase, the BAMSI chair man said orders for a second shipment have already been placed and will arrive by early 2023 at latest.

“We’re mixing the sizes and trying different types in the next order. The order has already been placed and will arrive in late December or the early part of next year. The ship ping logistics, we cannot control,” Mr Young told Tribune Business

“We’re looking at provid ing around ten per park. In terms of the greenhouses, over the next four years - in a five-year period - I am suggesting that base on the budget we have we’re looking at about a $7m investment over the next five years.”

He said BAMSI’s strat egy was to start small

and build from there by empowering farmers to supply local communities on each island with all their fruit and vegetable needs.

And, as their businesses develop and expand, they will produce the quality and quantity needed to interest Nassau-based food whole salers and distributors.

“One of the main things we’re trying to do, and why we want to spread them [greenhouses] through the islands, is because we know getting fruits and vegeta bles to these islands is not only costly but because of the lack of accommoda tion on the mail boats with refrigeration units, a lot of crop gets in in poor condi tion “ Mr Young explained.

“We will cut down on the cost, and allow farmers to supply their own com munities. Their crops are purchased by locals and consumed by locals in the community. The goal is to have those greenhouses and whatever crops they produce, they make their communities self-sufficient. It empowers the people and makes it less Nassau-centric and having to rely on the wholesalers.

“It also cuts down on the imports. Soon I fore see those greenhouses and farmers who operate them

supplying a lot of wholesal ers in The Bahamas.” The greenhouses, too, will not only be used for crop pro duction but also poultry and eggs.

“The layering pro gramme is a programme we are fully endorsing and pushing through the Min istry of Agriculture,” Mr Young told Tribune Busi ness. “By 2025 we are looking to become selfsufficient in eggs across the entire Bahamas. We are setting up a commercial chicken farm in our farm in North Andros.

“Poultry imports are $30m per annum. Eggs are a huge portion of that, so we are hoping that when we get going we can cut that bill by $10m. We’re looking at about 1.4m to 1.5m eggs per year. One hundred and twenty thou sand dozens per annum. That’s just from BAMSI. Imagine if we could get four more facilities of the same size or greater around The Bahamas. We should be self-sufficient in eggs by 2025.”

almanac

tiDes For nassau

a.m. 3.5 3:13 a.m. 0.1 9:45 p.m. 3.0 3:50 p.m. 0.3 10:09 a.m. 3.5 3:52 a.m. 0.2 10:27 p.m. 2.8 4:35 p.m. 0.4 10:51 a.m.

p.m.

a.m.

p.m.

a.m.

p.m.

1:40 a.m.

p.m.

anD moon

4:32 a.m.

5:19 p.m.

a.m.

p.m.

a.m.

p.m.

6:44 a.m.

7:52 p.m.

7:40 a.m.

8:51 p.m.

THE TRIBUNE Tuesday, October 11, 2022, PAGE 7

BAMSI’s $7m

FROM PAGE B1 ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 74° F/23° C High: 89° F/32° C TAMPA Low: 75° F/24° C High: 89° F/32° C WEST PALM BEACH Low: 79° F/26° C High: 88° F/31° C FT. LAUDERDALE Low: 80° F/27° C High: 88° F/31° C KEY WEST Low: 80° F/27° C High: 86° F/30° C Low: 79° F/26° C High: 89° F/32° C ABACO Low: 77° F/25° C High: 87° F/31° C ELEUTHERA Low: 77° F/25° C High: 89° F/32° C RAGGED ISLAND Low: 79° F/26° C High: 89° F/32° C GREAT EXUMA Low: 80° F/27° C High: 88° F/31° C CAT ISLAND Low: 77° F/25° C High: 89° F/32° C SAN SALVADOR Low: 77° F/25° C High: 89° F/32° C CROOKED ISLAND / ACKLINS Low: 78° F/26° C High: 89° F/32° C LONG ISLAND Low: 78° F/26° C High: 89° F/32° C MAYAGUANA Low: 78° F/26° C High: 88° F/31° C GREAT INAGUA Low: 79° F/26° C High: 89° F/32° C ANDROS Low: 79° F/26° C High: 89° F/32° C Low: 79° F/26° C High: 87° F/31° C FREEPORT NASSAULow: 79° F/26° C High: 89° F/32° C MIAMI

WEATHER REPORT 5-Day Forecast A t‑shower in spots in the p.m. High: 89° AccuWeather RealFeel 99° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. A shower early; partly cloudy, warm Low: 79° AccuWeather RealFeel 87° F Some sun with a t‑storm in the area High: 88° AccuWeather RealFeel Low: 78° 96°-83° F A thunderstorm in the afternoon High: 87° AccuWeather RealFeel Low: 77° 95°-79° F Some sun, then clouds, a t‑storm High: 86° AccuWeather RealFeel Low: 76° 94°-83° F An afternoon thunder storm in spots High: 85° AccuWeather RealFeel 89°-74° F Low: 73° TODAY TONIGHT WEDNESDAY THURSDAY FRIDAY SATURDAY

High 88° F/31° C Low 81° F/27° C Normal high 85° F/30° C Normal low 73° F/23° C Last year’s high 89° F/32° C Last year’s low 70° F/21° C As of 2 p.m. yesterday 0.00” Year to date 48.27” Normal year to date 30.96” Statistics are for Nassau through 2 p.m. yesterday Temperature Precipitation sun

Last Oct. 17 New Oct. 25 First Nov. 1 Full Nov. 8 Sunrise 7:06 a.m. Sunset 6:47 p.m. Moonrise 8:05 p.m. Moonset 8:40 a.m. Today Wednesday Thursday Friday High Ht.(ft.) Low Ht.(ft.) 9:27

3.3

0.4 11:09

2.6

0.6 11:35

3.1 5:12

0.6 11:54

2.4 6:06

0.9 Saturday Sunday Monday 12:22 p.m. 3.0 5:56

0.9 ‑‑‑‑‑ ‑‑‑‑‑ 6:57

1.1 12:44

2.3

1.1 1:14

2.8

1.2

2.2

1.2 2:11

2.8

1.3 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 7 14 Knots 2 4 Feet 8 Miles 85° F Wednesday: ESE at 7 14 Knots 3 5 Feet 7 Miles 84° F ANDROS Today: E at 7 14 Knots 1 2 Feet 7 Miles 84° F Wednesday: ESE at 6 12 Knots 1 2 Feet 10 Miles 85° F CAT ISLAND Today: E at 8 16 Knots 2 4 Feet 10 Miles 86° F Wednesday: ESE at 8 16 Knots 3 5 Feet 5 Miles 86° F CROOKED ISLAND Today: E at 8 16 Knots 2 4 Feet 9 Miles 85° F Wednesday: E at 10 20 Knots 2 4 Feet 10 Miles 85° F ELEUTHERA Today: E at 7 14 Knots 2 4 Feet 10 Miles 85° F Wednesday: ESE at 7 14 Knots 3 5 Feet 6 Miles 85° F FREEPORT Today: E at 7 14 Knots 1 2 Feet 7 Miles 81° F Wednesday: E at 6 12 Knots 1 3 Feet 7 Miles 82° F GREAT EXUMA Today: E at 8 16 Knots 1 2 Feet 10 Miles 86° F Wednesday: ESE at 8 16 Knots 1 2 Feet 7 Miles 86° F GREAT INAGUA Today: E at 8 16 Knots 2 4 Feet 10 Miles 86° F Wednesday: E at 8 16 Knots 2 4 Feet 10 Miles 85° F LONG ISLAND Today: E at 8 16 Knots 2 4 Feet 7 Miles 86° F Wednesday: E at 10 20 Knots 2 4 Feet 8 Miles 86° F MAYAGUANA Today: ESE at 8 16 Knots 3 5 Feet 9 Miles 84° F Wednesday: E at 8 16 Knots 3 5 Feet 10 Miles 84° F NASSAU Today: E at 7 14 Knots 1 2 Feet 6 Miles 85° F Wednesday: ESE at 7 14 Knots 1 3 Feet 5 Miles 85° F RAGGED ISLAND Today: E at 8 16 Knots 2 4 Feet 10 Miles 86° F Wednesday: E at 8 16 Knots 2 4 Feet 10 Miles 86° F SAN SALVADOR Today: E at 7 14 Knots 1 3 Feet 9 Miles 85° F Wednesday: ESE at 7 14 Knots 1 3 Feet 10 Miles 85° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 7 14 knots N S W E 7 14 knots N S W E 7 14 knots N S W E 7 14 knots N S W E 8 16 knots N S W E 8 16 knots N S W E 8 16 knots N S W E 7 14 knots | Go to AccuWeather.com

Charity foundation ‘brightens up’ children’s corner at the PMH Oncology Centre

By JEFFARAH GIBSON Tribune Features Writer jgibson@tribunemedia.net

To brighten up what is some times a depressing and scary experience for kids receiving cancer treatment, the Blue Rose Foundation took the initiative to “awaken” the space at Oncology Centre at Princess Margaret Hos pital with the commissioning of a mural.

The newly revitalised children’s corner will be unveiled today by Governor General Sir Cornelius Smith at 11am.

The foundation engaged the talents of renowned Bahamian artist Allen “Al Pachino” Wallace to design and create a mural to brighten up the kids’ little corner of the hospital and make it livelier and more inviting so that when they are receiving chemotherapy, they are able to do so in a space that evokes hope, healing and encouragement.

Astranique Bowe, a repre sentative of the foundation, told Tribune Health the revitalisa tion of the children’s corner was near and dear to the hearts of the organisation’s members.

“When we did a tour of the oncology centre we were sur prised to see the space the kids did their treatment in. We know that adults and children handle things differently. We wanted to them to not feel like they are in a hospital at an oncology centre getting chemo like an adult,” she said.

The foundation brainstormed ways in which they could do something for kids that would make the experience of receiv ing cancer treatment a little bit easier.

“The idea just came to us to revitalise that space, to bring life to it make it appealing and inviting. We got together as a committee and we brain stormed,” said Mrs Bowe.

“We worked with Allen Wal lace. He created the design and the concept. Then we connected with the nurses at the oncology centre and the hospital adminis tration. They loved the idea of it.”

The new mural features an orange rose. The design also incorporates inspirational words of hope and encouragement.

“We hope that when they come in for treatment they do not feel like they are in a hospital, they

don’t feel like they are in a space that is typically doom and gloom. Seeing the mural and seeing the inspirational words on the walls provides them with some hope for healing because they know they can beat this,” said Mrs Bowe. She said the mural can also act as a form of psycho-emotional care for the kids.

“A lot of times you think of your treatment, which is the physical aspect. But what about the therapy? A lot of instances

the healing rate depends on the mental attitude and the mental state of the patients and their abil ity to be positive,” she said.

“We want them to know they have a community of support ers that extend beyond family, friends and nurses… that there are people that care. I want them to do well and be healed. Leukae mia has that healing rate where patients can be cured. We want them to remember not just their

present condition but that there is hope for healing.”

FXT and Bahamas Harvest Church contributed to this cause.

“We also had a young student reach out and ask how could she help. She has been selling pins at her school. She also wanted to create a library in the children’s corner. She raised funds for a TV to be put in there, so all of that will be unveiled,” said Mrs Bowe.

Globally, September is observed as Leukaemia Aware ness Month, and this year the Blue Ribbon Foundation launched the first ever Leukaemia Aware ness Month Bahamas (LAMB).

During LAMB, the foundation spearheaded several initiatives and projects to raise awareness of

An all-pink shopping experience to help fight breast cancer

By ALESHA CADET Tribune Features Writer acadet@tribunemedia.net

In an effort to “think pink”, a local lifestyle entrepreneur is dedicating her upcoming pop-up shop experience to breast cancer awareness.

Marissa Coakley’s HustleHer Promotions has put on many events for the local community in recent years. She started invit ing other businesses and vendors to join her after she was inspired to share her beauty and cosmetic company, ContourMeBodyStu dio, with a larger audience.

“When I was in high school I would often host pop-up events and parties that would sometimes draw an impressive crowd. This led me to the idea of a pop-up shop experience which would be something that allows small busi nesses to come and meet in one location to sell their products as well as network amongst other businesses,” she told Tribune Health.

“Seeing that ContourMe once started as a small business, it inspired me to want to help pro mote and bring a bigger platform to other small businesses so that other people can grow and learn similarly to how I did. I am the mother of a very handsome

two-year-old and the goal behind all of my brands is to not only make an impactful name for myself, but to also ensure that I can meet every and any need that my son may ever have.

”Her upcoming pop-up event will take place on Sunday, Octo ber 16, at the National Training Agency. But Marissa said raising awareness for pertinent issues in this way is nothing new to her.

“This month’s October pop-up shop is no different. Breast cancer is a disease that affects so many young Bahamian women. Being in the spa, skincare and body well ness industry, I have encountered numerous women who are cur rently fighting or other women who have fought against this deadly disease. We already know that breast cancer is something that affects many of our relatives, friends and co-workers but we still have not found a cure,” she said.

“The importance of rais ing awareness pf such a deadly disease means that others will support financially or emotion ally those persons seeking to find a cure for breast cancer. As a woman and as a mother, I feel that it is my duty to support other women. Bahamian women are some of the strongest people I know and if there is something that I can do to make a change or aid in the fight, then I will do so.”

For this particular pop-up shop experience, Marissa said all par ticipating vendors are being asked to dress in the colour pink as a tribute to those women fighting or who have fought breast cancer. Some of the food vendors will also be selling items that align with the pink or breast cancer awareness theme.

“Everything about the pop-up shop will be inspired by the

this illness and bring hope to fam ilies impacted by leukaemia.

The Blue Rose Foundation is a non-profit organisation estab lished in December 2019 by Phil and Anja Bowe in memory of their mother.

“Our mandate is to assist chil dren living with Leukaemia and other blood cancers. Inspired by the life of the late Minerva Kemp-McIntosh, a consummate philanthropist and Rotarian, our mission is to keep her legacy of serving her community alive by meeting the needs of others,” said Mrs Bowe.

Minerva Kemp-McIntosh was a well-known and well-loved mother, banker and Rotarian who dedicated her life to cultivating and strengthening her local com munity in Grand Bahama. She sacrificed and selflessly gave of her time, talents and resources to assist the less fortunate and those in need. She was diagnosed with leukaemia in 2004, at which time doctors gave her six months to live.

Deemed a medical miracle, she was a 15-year leukaemia survivor, having experienced two episodes of reoccurrence after her initial diagnosis. In February 2019, she lost her battle with the disease.

women and individuals who have fought or who are currently fighting breast cancer. We have a keynote speaker that will be in attendance at this event giving facts on breast cancer prevention as well as awareness. There will also be prizes and surprises the entire day from not only Hustle Her promotions, but also from our lovely vendors,” said Marissa.

She said she feels it is vitally important to use whatever influ ence you may have, in her case as a business owner, to inspire and help others.

“Seeing that I am under 30 years old with more than four companies under my platform, I have a lot of influence amongst my younger clientele, which can positively educate and inspire individuals who are not famil iar with, or who have never supported a cause such as breast cancer awareness,” she said.

“HustleHer Promotions has led many young aspiring entre preneurs to want to be a part of our pop-up shops, which in turn will bring even more clients to the event, bringing more awareness to different age brackets across the country.

HustleHer is certainly the host of this event, but the theme is what will lead more per sons to want to know what they can do to join in the fight against breast cancer.”

THE TRIBUNE Tuesday, October 11, 2022, PAGE 9 BODY AND MIND

MARISSA Coakley of HustleHer Promotions

ON MONDAY, October 3, St Francis & Joseph Primary School held a special assembly and presented the Blue Rose Foundation with a cheque for $900 which were part proceeds from their #OrangeDay - a fun day hosted by the school to raise aware ness about leukaemia. A donation was also made to Judith Russell, the school’s former secretary, a leukae mia survivor.

Blood in ejaculate can be terrifying

Haematospermia or Haemos permia describes blood seen in ejaculate/sperm. The presence of blood in sperm can be terrifying for both men and their partner, with significant associated anxiety.

Haemtospermia may be associ ated with visible blood in urine, haematuria; particularly after ejaculation. Noting blood in ejaculate or urine should never be ignored. The vast majority of cases of hematospermia have benign causes, but for patients over the age of 40, in particular those who have recurrent or per sistent haematospermia, there is a small concern for a potentially serious condition.

Incidence

The exact incidence of blood seen in ejaculate is not known as many men do not take note of the colour of their ejaculate and a large percentage of men never report haematospermia out of fear of the unknown. Sev eral studies report the incidence of haematospermia to be 1 in 5000 males presenting to urologi cal clinics and offices. The most common age group is 30 to 40 years old.

Colour of sperm

Sperm and ejaculate normally has a cloudy, white colour and a slightly viscous, egg white like consistency. One-time, self-resolv ing haematuria is usually nothing to worry about but repeated episodes of haematospermia necessitates a visit to a urologist.

Certain health conditions, foods, health supplements and

medications as well as the fre quency of ejaculating can affect the consistency, volume and colour of semen.

Supplements such as vitamin B and pyridium and the tuber culosis medication rifampin can turn your semen yellow/orange. Laxatives such as senna can cause reddish appearing sperm. The antibiotic metronizadole/flagyl can lead to brownish sperm. The colour changes are secondary to the breakdown byproducts of the supplements or medication.

Anticoagulants are blood thin ners that may lead to bloody sperm.

Causes of haematospermia

The vast majority of haema tospermia cases are benign, not cancerous. Infective or inflamma tory causes are the most common culprit.

Sexually transmitted fiseases

Blood in sperm can be a ter rifying ordeal for both partners. Sexually transmitted diseases (STDs) like chlamydia, herpes and gonorrhea can rarely pre sent with haematospermia and therefore STDs must be ruled out during investigations, but it would be wrong to self diagnosis a STD and create turmoil in a relation ship with accusations of infidelity.

Bacterial and viral infections can cause bloody ejaculates. Infections can cause irritation of the urinary tract, testicles or pros tate which could create blood in semen.

Jaundice

Jaundice is caused by excess bilirubin, which is a chemical that builds up in the body when the liver cannot process red blood cells properly. This could lead to yellowing of the whites of the eyes, skin and sperm. Common causes of jaundice include gall stones, pancreatitis, hepatitis and sickle cell disease.

Prostate issues

A hypervascular prostate or seminal vesicles with a very prom inent blood supply could lead to bloody ejaculate with the rupture of small blood vessels or capil laries. Prostatitis, infection and inflammation of the prostate is a well recognized cause of haema tospermia; a condition termed prostatitis associated haemato spermia (PAH).

Prostate cancer can very rarely present with blood in ejaculate. Do not wrongly automatically jump to the feared conclusion that blood seen in sperm means prostate cancer and have that fear prevent you seeing a urologist. Prostate cancer was the cause of haematospermia in 5.7 percent of cases in a large prospective inves tigation involving 300 men. Risk factors for prostate cancer include advancing age with average age of diagnosis being 66 years old.

Other common causes of haematospermia

• Urinary stones/calculi, includ ing seminal vesicle or ejaculatory duct calculi.

• Urethritis - Infection of the urethra. The urethra is the pee tube that connects the bladder to the outside world. Dilated blood vessels along the ejaculatory route, which includes the urethra, could lead to haematospermia.

• Traumatic sexual encounter

• Blood in semen linked to high uric acid levels hyperuricemia as seen with gout is a possible cause of haematospermia, particularly in men aged 30 to 40

• Bilharziasis, also known as the parasitic infection schistosomiasis.

• Prostate gland biopsies: usu ally resolves itself after one to three weeks after the prostate biopsies.

• Uncontrolled blood pressure

• Blood disorders

• Idiopathic - Approximately 15 percent of cases of heamato spermia have no determined cause.

This list of causes of haema tospermia is comprehensive but far from complete. Admittedly, this long list of potential causes will do little to provide peace of mind to men experiencing blood with their ejaculate or their con cerned partners.

Treatment of haematospermia

The treatment of haema tospermia depends on the cause. The cause is determined by a thorough, confidential history taking and appropriate noninvasive or minimally invasive investigations as applicable.

Haematospermia can certainly be a terrifying event for both partners. Blood in semen can

Atlantis gives financial support to

work by Sister Sister Breast Cancer Support Group

During the annual Sister Sister Breast Cancer Support Group prayer breakfast, Atlantis’ Vice President of Public Affairs and Special Projects Viana Gardiner was on hand to present a cheque for $5,000 to the organisation.

“Atlantis has more than a decade long partnership with Sister Sister, whether it be on the Walk in Paradise, or our Ocean Club Golf Course team members’ 100-hole Sister Sister fundraising challenge,” said Ms Gardiner.

“This is our first year formally attending the Prayer Breakfast, and we wanted also to contribute towards this aspect of the work of Sister Sister. The support the organisation provides cannot be measured. We commend the founders, leadership and support ers and undertake to continue to stand with you.”

The Sister Sister Breast Cancer Support Group is a non-profit charitable group for women diagnosed with breast cancer which assist with mental, spir itual and financial support to its membership.

“Donations like these are very important to our group because it helps us to support our mem bers and defray the costs of port-a-cath,” said President Andrea Sweeting, a 21-year survi vor. “We are grateful for the kind

Atlantis.”

lead to tremendous worry of the unknown and fear to engage in future sexual activity. The cause of the haematospermia should be determined by a quick visit or referral to a urologist. Most cases of bloody semen are not of con cern but such incidences should never be ignored; as relatively rare haematospermia cases exist that there is a serious cause that must be addressed. Benign causes should also be treated to stop the horrific bloody semen events from happening again.