THURSDAY, OCTOBER 9, 2025

Sarkis battling for British Colonial wind-up proof

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHA Mar’s contractor is fighting Sarkis Izmirlian’s attempt to use a report filed with the New Jersey bankruptcy court in his Bahamian legal bid to wind-up its two Nassaubased resorts.

China State Construction and Engineering (CSCEC) Holding Company, the parent entity for China Construction America (CCA Inc), is arguing that the report compiled by the latter’s “special” Chapter 11 bankruptcy committee contains “confidential commercial information” that Baha Mar’s original developer must be prohibited from using in his ongoing Supreme Court fight.

However, Mr Izmirlian and his BML Properties vehicle, which are battling to collect $1.7bn in damages awarded against the

three CCA affiliates found guilty of fraud and breach of contract that ultimately cost the original developer control of the Cable Beach mega resort project, are asserting that they should be allowed to use the report’s contents “in litigation in The Bahamas”.

An October 6, 2025, letter to Christine Gravelle, the New Jersey judge overseeing CCA Inc’s Chapter 11 bankruptcy, discloses that both CCA (Bahamas) and CSCEC (Bahamas) are resisting Mr Izmirlian’s attempts to have them wound-up by

the Supreme Court on the basis they are insolvent.

The former is the immediate parent for CCA’s Bahamian resorts, the British Colonial and Margaritaville Beach Resort.

The letter, which has been obtained by Tribune Business, comes just three days ahead of today’s New Jersey bankruptcy court hearing on Mr Izmirlian’s bid to ‘pierce the corporate veil’ and directly target CSCEC Holding Company through fresh litigation in a bid to collect on his $1.7bn judgment from CCA’s parent.

E-mails seen by this newspaper show that attorneys acting for Mr Izmirlian and BML Properties have urged CCA Inc’s “special committee”, formed from the Chinese state-owned contractor’s independent non-executive directors, to “make a ten-figure settlement demand on CSCEC Holdings now”.

They assert that Baha Mar’s original developer

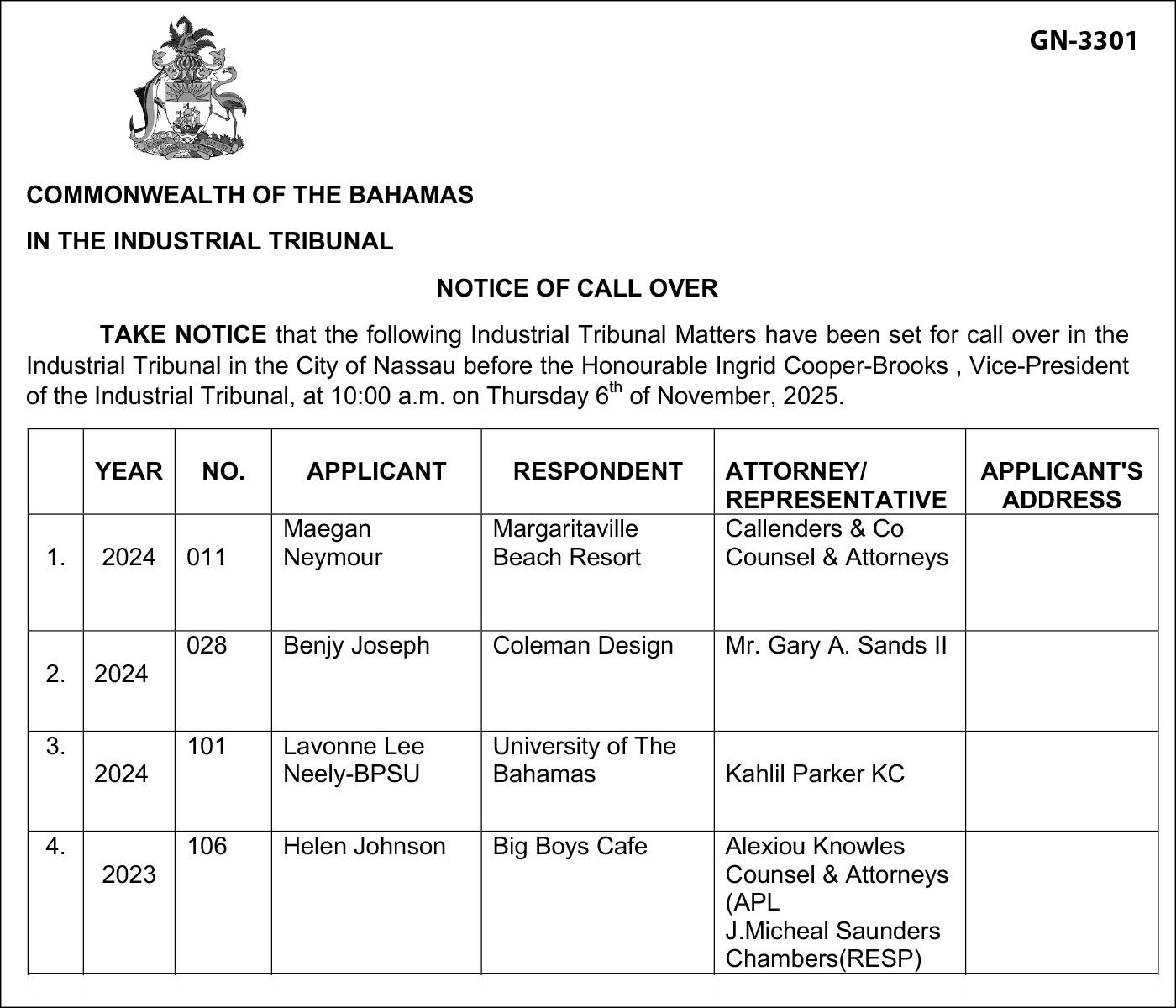

Unions alleging BTC cellular network ‘migrated’ overseas

By NEIL HARTNELL

Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas Telecommunications Company’s (BTC) two trade unions yesterday accused the carrier of “migrating” its cell phone network to “foreign jurisdictions” with recent firings “the final straw”.

The Bahamas Communications and Public Managers Union (BCPMU) and Bahamas Communications and Public Officers Union (BCPOU), in a joint statement, alleged that foreign engineers were coming in without the necessary work permits to effect the

network switch while also asserting that contract workers were increasingly replacing full-time staff as part of “union-busting” tactics.

BTC told Tribune Business that it was still working on a response to the union statement at press time last night, and one will likely be forthcoming today as both the BCPMU and BCPOU sought to further raise the temperature and industrial discord seemingly marked by the disputed termination of five staff last week - three of whom they allege were unfairly blamed for a credit

‘Fiscal numbers not being compiled by Brave Davis’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Prime Minister yesterday hit back at Opposition charges that the fiscal data was “manipulated” to ensure the 2024-2025 deficit target was met, adding: “They are not compiled by Brave Davis.” Philip Davis KC, rising in the House of Assembly in response to assertions made by Michael Pintard, the Opposition leader, argued that The Bahamas’ creditworthiness would not have been upgraded by Standard & Poor’s (S&P) if the Government had acted unethically, or incorrectly, with the fiscal figures that were unveiled for the 12 months to end-June 2025. Asserting that the lastminute revisions, which stripped some $37.3m from the Government’s spending and deficit numbers for the five months from July to

‘Nothing adds up’ on labour reforms

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

PROPOSED labour reforms will act as “a disincentive to employment” just as the Government is seeking to reverse the recent jobless increase, the Chamber of Commerce’s labour chief warned yesterday. Peter Goudie told Tribune Business that “something doesn’t add up” with the Davis administration pushing a wide-ranging package of Employment Act changes that threaten to both increase costs, and undermine the ease of doing business, in the face of a near-9,000 increase in jobless Bahamians between the 2024 third quarter and 2025 first quarter. The heightened expenses will likely increase marginal labour costs, and potentially deter some firms from hiring and creating jobs, just when the Government is seeking to lower the unemployment rate. Mr Goudie identified the proposed ‘redundancy insurance’, which all employers must pay to ensure their workers receive termination pay and

due benefits, as one of his three main objections to the reforms.

Confirming that he made this known at Tuesday night’s New Providence town meeting to discuss the reforms, he also challenged whether the Government has sufficient resources to monitor and check whether employers are paying ‘redundancy insurance’ should this be enshrined in the Employment Act.

“I explained my objections to the fact they want to have companies pay a premium to an insurance company to cover something even if they are a

The two sides on the AI debate

If you want to understand artificial intelligence (AI), it is wise to know both its benefits and disadvantages. While AI experts do not agree on many things, they all agree on one: AI technology is going to have an enormous effect on society and business. Furthermore, if businesses are not aware of AI’s presence, then they will be left behind as it is forecast that these applications will have an overwhelming impact on the world. Companies must take a realistic view of both the risks and the problems.

What Is AI?

AI is when we give machines (software and hardware) human-like abilities. That means they have the ability to mimic human intelligence such as seeing,

hearing, speaking moving and making decisions. The difference between AI and traditional technology, however, is that AI has the capacity to make predictions and learn on its own. And there are dozens, if not hundreds, of different types of artificial intelligence. How does it work?

Humans program AI to achieve a goal, then teach it how best to achieve that goal and make accurate predictions. As a result, AI gets smarter over time, and has the ability to learn and improve on its own.

The benefits of artificial intelligence

AI excels at automating repetitive, data-driven and mundane tasks - from responding to e-mails to performing complex tasks that humans spend a lot of time doing. It can also reduce human error. In

business, humans are not very good at consistently and accurately making decisions based on data. We exhibit far too many mental blind spots.

AI reduces human error as it follows consistent logic, and has no feelings that affect analysis and does not have attention or distraction problems. It does tasks that are too dangerous for humans so that workers do not have to risk life and limb.

AI cal also help us make better decisions and solve problems that humans cannot. It recognises patterns which predict better decisions, such as in numbers, words and images. Surprisingly, we can unlock our phones just by looking at them, due to unique patterns of the face.

AI finishes sentences in gmail as it detects patterns in human writing and

knows what follows. Its pattern detection even makes it possible to have self-driving cars that identify objects and obstacles in real-time.

Here is one example of AI’s benefits. It was able to discover new sources of revenue for a travel business because it found patterns of customer behaviour in advertising data that the company had completely missed. And AI works 24 hours per day. Unlike humans, AI has the ability to work all day while getting smarter and smarter at solving problems.

The disadvantages of artificial intelligence

AI needs lots of data. It is only as good as the amount and quality of data it has. The same is true in business, as many companies require a minimum amount of data to get started. However, it has to be high-quality and

clean. Trained data scientists are needed full-time to organise the data.

AI does not always explain its decisions. If you are receiving good results from an AI tool, you may not be too concerned about how it works. And AI can destroy jobs. The world of artificial intelligence is filled with hype, buzz and larger-than-life claims. It is impossible to predict with a high degree of accuracy how many jobs it will eliminate, but the threat is obviously present.

There is no question that AI will transform the economy by doing many tasks better, which will affect widespread job loss and long-term unemployment. However, in reality, it is still math - not magic - and it still has limits. If your job is predominately repetitive, it is possible it may learn how to do it much better,

WATER CORP ACQUIRES OUT ISLAND PLANTS FOR $16.4M

By FAY SIMMONS

THE Water and Sewerage Corporation (WSC) has acquired seven water production plants from Aqua Design (Bahamas) for $16.375m amid ambitions for this nation to become a "desalination hub".

Leon Lundy, minister of state with responsibility for the Corporation, yesterday said the purchase was completed through its special purpose vehicle (SPV), WSCDesalCo, with the deal including plants located across Eleuthera, Exuma, San Salvador and Inagua. He previously suggested that Bahamian investors may gain opportunities to

acquire shares and ownership in WSCDesalCo.

“The Water & Sewerage Corporation, through its special purpose vehicle, WSCDesal Company, has

completed the purchase of seven desalination plants previously owned and operated by Aqua Design Bahamas, a subsidiary of Veolia Water. This acquisition, valued at $16.375m, officially took effect on September 30th, 2025,” said Mr Lundy.

“It includes facilities located in South Eleuthera, specifically Waterford and Tarpum Bay; Central Eleuthera; at the Naval Base in North Eleuthera; at the Bogue; Georgetown, Exuma; Cockburn Town, San Salvador; and Matthew Town, Inagua.”

The acquisition follows several years of tension and legal disputes between the Government, the Water & Sewerage Corporation and Aqua Design (Bahamas),

which resulted in multiple cases before the Supreme Court.

The deal brings an end to the Corporation’s longstanding reliance on the foreign-owned company for much of its Family Islands reverse osmosis water production, and brings ownership of critical desalination infrastructure under Bahamian control for the first time.

Mr Lundy said the formation and operation of WSCDesalCo is a strategic move to ensure Bahamian ownership and control over a vital national resource, with plans for the company to grow beyond public utility management.

“This is not just a transaction. It is a transformational shift in how we manage one

SMALL BUSINESSES HIT BY EXPORT HEADACHES

By ANNELIA NIXON Tribune Business Reporter

BAHAMIAN small busi-

nesses yesterday said the halt to outbound US mail sent via the Post Office due to the imposition of a 15 percent tariff has merely added to the difficulties of doing commerce.

Arguing that Donald Trump’s elimination of the tariff exemption for packages valued below $800 is another factor adding to high costs and ease of business impediments, Gina Luree, owner of Cultureware, said: “In fact, I’m having a problem right now, because there’s so much red tape to export, and this is only an added suppression for business people.

“Apart from you having to have a local broker, a US broker, and then you have to pay Customs for your products and VAT, and now

you’re imposing an another increase which amounts to more than what even the product is worth. So, at the end of the day, the customers are not going to even seek to purchase from us locally to have it exported.”

The General Post Office and the Government are seeking clarification regarding the US tariff.

The Ministry of Energy and Transport, in a Tuesday night statement, said: “Reportedly, the refusal of our partner airline to accept outgoing mail for the US is due to the imposition of a 15 percent tariff on all mail entering the US.” Ms Luree, who has plans to make US-bound shipments of a substantial amount of items, said she is holding off until she knows “what to do and what to expect”.

Patricia Chatti, owner of Straw Works by Patricia Chatti, Cia Monet Organic Candles, Soaps and Scents,

Cia Monet Couture and Quotable Gifting, noted the “irony” stating most small businesses may not be impacted at all by the tariff because of the red tape associated with exporting products from The Bahamas to the US.

She added that it is difficult for her to ship products, explaining that since the COVID-19 pandemic certain items are no longer shipped, including straw and jewellery, which she sells.

“It is a lot of red tape, like I said, in terms of straw. They claim that because it is a live material, every time you ship something, you have to go to get it inspected and pay a fee... And then most places don’t even take them. So you can’t even ship straw and stuff out,” Ms Chatti said.

“And I think they’ve even started that with jewellery... Like when you make the handmade

of the most vital resources in our nation. For the first time, Bahamians will have ownership and control of the majority of our desalination infrastructure,” said Mr Lundy.

“Through WSCDesal Company, we are creating a Bahamian-owned, Bahamian-led enterprise that will assume ownership, operation and maintenance of all desalination facilities under the Corporation's remit. Over time, WSCDesal Company will extend its services to the private sector, both locally and regionally, establishing The Bahamas as a regional hub for the desalination excellence.” Mr Lundy added that a structured transition process is already underway

coconut or shell jewellery...

Most people who are able to ship out are people who sometimes do seasonings and stuff like that. I know somebody had told me they had an issue with soaps and stuff... So I don’t know how many really small businesses do that.

“Most of them find friends who are going away and send stuff with friends or something like that. But instead of it being realistic and affordable for us to be able to ship out, it’s challenging with the red tape and costly. For the ones that are able to ship, it’s costly. For those like me with the straw and Bahamian made things, it’s zero.”

Due to the executive order enacted by Donald Trump in August, which

and will take up to ten months to complete. All Bahamian employees currently working with Aqua Design will retain their positions and receive full compensation throughout the handover.

“Every Bahamian currently employed by Aqua Design will have their position secured by WSCDesal Company, and they will be compensated in full during the transition process," he said. "A structured handover period of up to ten months has been established to ensure a seamless transfer of operations for critical sites like Georgetown, Exuma and San Salvador. The transition is expected to take no more than three months."

saw the removal of the global import tariff exemption, the Government and the Post Office Department is now addressing the backlog of outgoing mail to the US.

While the General Post Office has asserted there is not a large backlog of mail, following the imposition of the 15 percent tariff on parcels being sent to the US, it is continuing negotiations with hopes of a resolution.

Pintard raises fresh moorings concerns

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Opposition's leader yesterday challenged whether the Government has cancelled the controversial Bahamas Moorings deal as he raised concerns over the appearance of fresh moorings in Exuma.

Michael Pintard, speaking in Parliament, asserted that up to 40 buoys have recently been deployed in the waters around Exuma without proper spacing or chart markings. He warned that the moorings now pose a navigational hazard and cast further doubt on the Government’s prior statement that the deal with

Bahamas Moorings had been scrapped.

“Not only was the Prime Minister's team caught signing an agreement with persons close to themselves, then they are purported to have cancelled such an agreement. I just recently, with a team, visited Exuma," he added.

"Would you be surprised to know that the containers that contain the moorings, the property where additional ones outside of the containers were stored, that they are still there in Exuma, months and months later. We are in October; the items are still there.

“Recently, we're talking about just a couple of months ago, moorings are still being dropped in the Exumas… We believe that there are up to 40 buoys

GOV'T URGED TO PURCHASE LAND BY CARNIVAL PROJECT

By FAY SIMMONS Tribune Business Reporter

THE Opposition yesterday urged the Government to acquire land near Carnival’s $600m Celebration Key project for a Bahamian marketplace to provide more opportunities for vendors and taxi drivers.

Kwasi Thompson, MP for East Grand Bahama, said that since the opening of the private cruise port many vendors on the outside have reported a significant drop in customer traffic, especially in areas such as Taino Beach and the Port Lucaya Marketplace.

Speaking in Parliament, he urged the Davis administration to act quickly to ensure the economic benefits from increased tourist arrivals are shared more equitably across the island.

“Local vendors and operators have said that not enough spend is coming outside the facility, flowing across the island. Freeport and the Port Lucaya sellers report less traffic. Taxi drivers are asking for fair access to those tourists that are in Celebration Key. I also visited Taino Beach, and the vendors report slower foot traffic to their businesses,” said Mr Thompson.

“Let this be the start of a bigger win for all Grand Bahamians. We have Celebration Key, that's good, but we need to go even further. We need stronger links to island-wide tours with fair opportunities for small businesses in every settlement.”

Mr Thompson suggested the Government purchase a large plot of land currently for sale adjacent to Celebration Key - property that he said is listed by the Grand Bahama Port Authority (GBPA) - and transform it into a cultural and commercial hub similar to the Port Lucaya Marketplace.

“It would be wonderful if the Government would acquire land adjacent to Celebration Key to create a different, authentic Bahamian marketplace with more space for local vendors, restaurants, culture and activities, so the benefits can be shared more widely,” said Mr Thompson.

“There is a huge lot of land between the main road and Celebration Key. And what do you see as you enter the road into Celebration Key? A big 'for sale' sign from the Grand Bahama Port Authority. We believe that it would be wonderful if the Government was able to acquire some land to ensure that it makes a fairer distribution for local vendors, culture, for restaurants and for other activities, so that folks can trickle from the Celebration Key itself, and they can go into that facility. It would be wonderful if you could put a Port Lucaya type of marketplace right in that same facility.”

Iram Lewis, MP for Central Grand Bahama, also expressed concern that - despite higher tourist arrivals since the launch of Celebration Key - the economic benefits have not reached the broader community. He observed a significant decline in activity at Taino Beach and said many small businesses are struggling.

“I, too, was there on the day when Carnival opened up Celebration Key in Grand Bahama. And we thought that was going to be a turning point for Grand Bahama in some way. The Government was very successful at completing the project, opening the project. And, of course, we have a dramatic increase in terms of tourist arrivals to the island of Grand Bahama,” said Mr Lewis.

“What is being observed now is that -we cannot blame Carnival, because their business investment is to make money. The money is, in my view, being held in a vacuum. It's not filtering into the wider community of Grand Bahama, and we have businesses crying every day about not really directly benefiting from what is going on in Celebration Key. I went to lunch at Taino Beach some time ago, a few weeks ago, and I looked to the west and east, looked to the right near Pirates Cove. The beach is virtually empty.”

Mr Lewis called for urgent collaboration between government, private sector stakeholders and community leaders to develop practical solutions that allow smaller

have been put out and are crowded together without proper spacing. They are not correctly marked on a chart and it serves as a navigation hazard."

Mr Pintard called on the Government to reveal which company is currently responsible for placing the buoys, raising the possibility that either Bahamas Moorings or a newly-contracted entity is still involved despite the Prime Minister’s prior announcement that the original deal had been terminated.

“We would like clarification: Is this the same company or is this a different company duly authorised to do so?” he asked.

The Opposition Leader also returned to criticism voiced during the recent

enterprises to benefit from tourism developments.

“As legislators, we have to find a way to ensure that not only do we get those visitors to The Bahamas, but that the small business persons, mom and pop stores, small vendors also benefit. They're doing their part. Carnival is doing their part. It is up to us now to find a way to get some of that money to filter into the smaller businesses; that we really turn the economy in Grand Bahama,” he said.

Budget debate regarding the Maritime Revenue Unit Bill. He questioned whether the law is being used as a legislative backdoor to revive or legitimise the controversial moorings deal in the event of a future election win by the Davis administration.

“One of the things we cautioned, we said: 'Why not pause on the passage

of this Maritime Revenue Unit Act 2025 because it would come across as that deal that did not pass the financial accountability or smell test, or the environmental smell test, on the mooring; that it may come across as if you are trying to find another way to sanction the very same program you claim to have cancelled,” said Mr Pintard.

“And we've then said the fact that the moorings are still there in trailers and on open property in Exuma suggests maybe you're not committed to moving it at all. You figure if you go to another election and you win, you just bully the thing through the way you've done with multiple projects.”

Cruise port highlights new assets and $350m outlay

NASSAU Cruise Port yesterday marked its sixth anniversary by pointing to further upgrades following a $350m investment that has made downtown’s waterfront “a premier leisure destination”.

The Prince George Wharf operator, in a statement, said the anniversary comes as it develops a new swimming pool, an expanded marina and ferry terminal that will support passenger transfers to Royal Caribbean’s Paradise Island Beach Club that is set to open in December 2025. During those six years, it added that cruise passenger

numbers have expanded by more than 2.15 million.

“This milestone represents much more than the passage of time,” said Mike Maura, Nassau Cruise Port’s chief executive and director. “It reflects our promise to continually elevate the guest experience, contribute to the local economy and provide opportunities for Bahamians.

“During our first year of operating the Nassau Cruise Port, Nassau welcomed approximately 3.85m cruise guests, and 2025 will see well over six million cruise visitors visit Nassau. Our focus

on driving cruise tourism and the $350m investment in our downtown waterfront is a testament to our vision of making Nassau a premier cruise and leisure destination.”

The Nassau Cruise Port said its new pool provides a retreat for visitors enjoying Nassau’s waterfront, while the expanded marina will accommodate extra yachts, boosting tourism and local commerce. It added that the ferry terminal expansion enhances passenger flow and supports convenient, seamless visitor transfers to the Royal Beach Club.

We are aware of the malicious content currently being circulated about The Cricket Club Restaurant & Pub. As a proud family-run business of over 27 years, we have always been an instrumental part of our community - known for our hospitality, tradition, and dedication to quality service.

The Cricket Club was founded by Constance Robertson and the late Christopher Robertson who shared a vision of bringing an authentic pub experience to The Bahamas. That vision has stood strong for nearly three decades, built on integrity and community spirit.

The claims being spread are false, misreading, and defamatory. We stand frmly by our record and reputation and welcome any proper offcial investigation into the matter. We are confdent that the truth will confrm our longstanding commitment to fairness, respect, and excellence in service.

Thank you to our loyal patrons and community members who continue to support us.

- Te Management & Family of Cricket Club Restaurant & Pub

Bahamas targets UK tourism as website visits surge 100%

THE Nassau & Paradise Island Promotion Board (NPIPB) undertook a three-day tourism marketing trip to the UK after visits to its website from London doubled year-over-year.

The Board, in a statement, said the visit had enabled it to strengthen ties with around 90 travel trade professionals, including tour operators, travel advisors and trade media.

Led by Joy Jibrilu, the Board’s chief executive, the delegation included representatives from the Bahamas Ministry of Tourism, Investments and Aviation plus seven hotel partners: Grand Hyatt Baha Mar, Atlantis, The Ocean Club, Graycliff Hotel & Restaurant, Margaritaville Beach Resort, British Colonial Nassau and Comfort Suites Paradise Island.

Mrs Jibrilu said: “The feedback from travel partners across the UK has been overwhelmingly positive with many telling us these were some of the most engaging destination activities they’ve experienced. Hands-on and interactive sessions in each city allowed us to share, not just tell, what makes Nassau & Paradise Island so special.

“We know that interest in The Bahamas has grown significantly through our marketing efforts, and now is the time to act, ensuring more UK travellers discover the sun, sand, sea and so much more of Nassau & Paradise Island.”

The roadshow came at a time when website visits to the Promotion Board’s site from London have increased by 100 percent year-over-year. The delegation stopped in London, Manchester and Edinburgh. The London visit, which was attended by Peter Andy Gomez, The Bahamas’ high commissioner to the UK, highlighted the convenience of British Airways’ daily nonstop flights from London to Nassau.

Companies must strike balanced AI approach

TECHNOLOGY - from page B2

Should You Fear AI?

Any fears should not be focused on the existence of AI. However, the probability of misuse is ever-present as it can create negative outcomes. By the same token, businesses should make every attempt to fully comprehend its resourcefulness, as it is projected that AI has the ability to contribute trillions to the global economy and create new markets. To this end, by letting AI do what it is good at, is an awesome partnership. Until we meet again, live life for memories rather than regrets, enjoy life and stay on top of your game.

Bahamasair partners with cruise line to launch Berry Islands route

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMASAIR has teamed with Royal Caribbean to boost domestic airlift and support the cruise industry by launch a route from Nassau to Great Harbour Cay in the Berry Islands.

The national flag carrier, in a statement, said service will begin on October 7 to support Royal Caribbean’s growing cruise operations and enhance connectivity between Nassau and that Family Island destination.

The cruise line's Perfect Day private destination at Coco Cay is close to Great Harbour Cay,

“In December 2022, we commissioned the new, state-of-the-art Great Harbour Cay airport as part

of the Bahamas Family Islands Renaissance Project. This renaissance continues to drive unprecedented demand for new, expanded and reliable international and domestic airlift connectivity throughout our island destination, and further strengthens our relationship with key industry strategic partners such as Royal Caribbean”, said Dr Kenneth Romer, director of aviation and deputy director-general of tourism. Through this partnership, Bahamasair said it will provide scheduled flights that align with Royal Caribbean’s cruise itineraries.

The tie-up both expands the airline’s domestic route network and reinforces The Bahamas’ position as a cruise and air travel hub in the Caribbean.

“The route launch is a response to a broader demand effort to strengthen inter-island airlift and support the sustainable growth of tourism across the archipelago," said Tracey Cooper, Bahamasair's managing director.

"By enhancing the connection between Nassau and Great Harbour Cay, the partnership will also provide greater travel options for local residents, stimulate economic activity, support the development of tourism services in the Berry Islands and generate more revenue for Bahamasair."

The new flights will operate on Tuesdays, with tickets available through Bahamasair’s official website at www.bahamasair. com, any Bahamasair city ticket office or local travel agency.

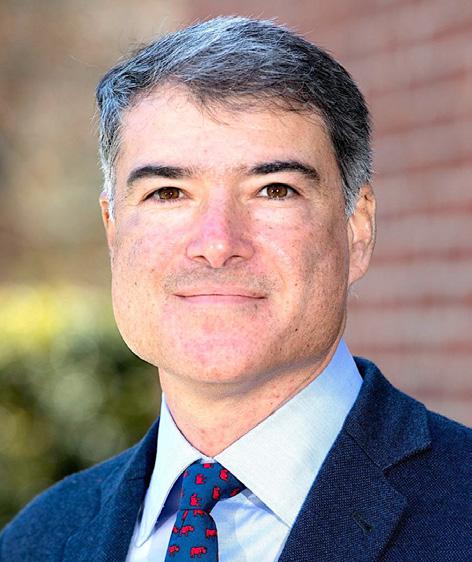

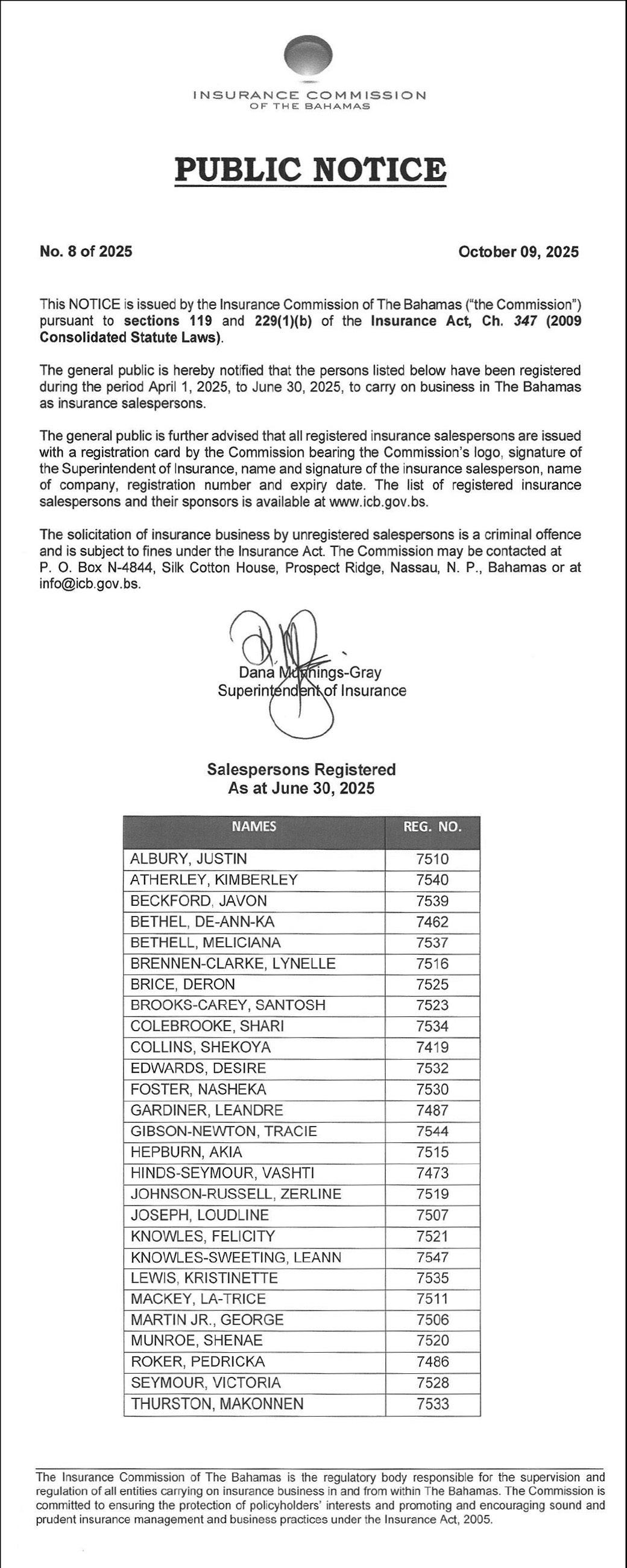

Realtor to sponsor investment summit

A BAHAMIAN realtor

yesterday said it is returning as a major sponsor for an investment conference set to be held at Rosewood Baha Mar from October 28-29.

Maison Bahamas, the local affiliate for Forbes Global Properties, said it will be a platinum sponsor at the Centurion One Capital third annual Bahamas summit. The event brings together executives from leading small-cap growth companies and other investors for a series of company presentations, private oneon-one meetings, panel discussions and networking opportunities.

“Our continued sponsorship underscores Maison’s role in shaping the future of premium real estate investment,” said Ryan Knowles, chief executive and founder of Maison Bahamas. “The summit is more than just an event; it is a confluence of visionaries, entrepreneurs and investors who are

actively defining the next chapter of global growth. “For us, it represents a chance to not only showcase the strength and sophistication of the country’s luxury property market, but also to engage directly with the decision-makers who are driving capital flows and shaping international investment trends.

At Maison, we believe The Bahamas is poised to stand at the intersection of lifestyle and investment, and our presence at the summit reflects our commitment to advancing that position.”

Nima Besharat, chief executive of Centurion One Capital, added: “Having Maison once again take a leading role at the summit speaks volumes about the calibre of the event and its growing influence. Their expertise in the global luxury property sector brings invaluable insight to conversations about how investment, real estate and innovation intersect.

RYAN KNOWLES, chief executive of Maison Bahamas, and Kia Besharat, executive chairman of Centurion One Capital, at The Bahamas Summit 2024.

“As The Bahamas continues to evolve its identity beyond a world-class tourism destination to a thriving investment marketplace, the involvement of Maison elevates the dialogue and helps forge new connections between international investors, entrepreneurs and capital markets. The summit was created to spark this kind of synergy, where bold ideas connect and evolve into real, transformative opportunities.”

Sarkis targeting CCA’s parent for full $1.7bn damage payout

HEARINGS - from page B1

state-owned contractor’s independent non-executive directors, to “make a tenfigure settlement demand on CSCEC Holdings now”.

They assert that Baha Mar’s original developer “firmly believes that the best path forward is to confront CSCEC Holdings, not kowtow to it through a [Chapter 11 emergence] plan designed to benefit insiders to the detriment of non-insiders”.

The e-mails reveal that Mr Izmirlian and his legal advisers have been emboldened by the contents of the very same report that Baha Mar’s original developer now wants to employ in his battle to wind-up both CCA’s Nassau resorts. CCA Inc’s “special committee” found “there are colorable estate claims against CSCEC Holdings, including one for alter ego, to hold [it] liable for the entire $1.7bn judgment”.

So-called “colorable claims” refer to legal claims that would support creditor recovery efforts, including litigation, should the necessary proof and evidence be provided. And the “special committee” report, which has been filed with the New Jersey Bankruptcy Court, details several potential claims - including that $125m worth of loans from CSCEC Holdings to CCA should be reclassified as equity injections.

It conceded, though, that it was “a close call” as to whether this argument would prevail in a US court along with suggestions that the $125m should rank below other claims in the creditors’ queue. However, the “special committee” probe “uncovered evidence that suggests that four of the seven factors could support a finding that CSCEC Holdings and [CCA Inc] were a single economic entity”.

This is potentially significant evidence to support Mr Izmirlian’s winding-up bid before the Supreme Court.

The “special committee” report agreed it could be argued that CCA Inc, the Chinese contractor’s US affiliate and one of the three entities held liable for the $1.7bn damages payout, was “under-capitalised” and also “presumed insolvent” between 2021 and 2024.

“Certain facts can support an argument that the debtor [CCA Inc] is a façade of CSCEC Holdings including, for example, that CCA did not have its own projects, generated minimal revenue and relied on CSCEC Holdings for funding to operate.

CCA shared offices with CSCEC Holdings, and CCA and CSCEC Holdings shared management,” the special committee report added.

“For the foregoing reasons, a court may also conclude that there is a showing of injustice and unfairness that justifies imposition of alter ego liability on CSCEC Holdings even absent evidence that the debtor was a sham or otherwise was a component in a ‘shell game’.

“[But] notwithstanding the foregoing, there are significant counter-arguments and evidence to the above points that could pose considerable hurdles to the viability of a veil-piercing claim.” The “special committee” report also referred

to the possibility of a legal claim that certain payments “were improper”, although the details were blanked out.

“There is a colorable claim for the debtor’s estate to pierce the corporate veil and impose liability on CSCEC Holdings,” the report concluded. “But, even if an alter ego claim could be adequately pleaded, the cost and length of time necessary to litigate such a fact-intensive claim, the reluctance of courts applying Delaware law to sustain veil-piercing claims, and the numerous facts that weigh against veil piercing lend serious doubt to the ultimate viability of such a claim.”

These conclusions, though, were seized upon by Mr Izmirlian’s attorneys. Brett Thiesen, vice-chair of the financial restructuring and creditors rights’ group at the Gibbons law firm, told the “special committee’s” counsel via a series of e-mails between August 8-10: “We requested that the special committee make a ten figure settlement demand on CSCEC Holdings now.

“The logic of this is obvious – it would massively benefit the estate to resolve its biggest liability and give CSCEC Holdings a path to continue to control the debtor. Since the report concludes that there are colorable claims for estate alter ego claims, why not make the demand?.... The report unambiguously states that the claims are colorable.

“We remind you the estate owes its creditors fiduciary duties. The largest creditor [Mr Izmirlian], holding more than 99.99 percent of non insider claims, firmly believes that the best path forward is to confront CSCEC Holdings, not kowtow to it through a plan that is designed to benefit insiders to the detriment of non insiders,” he added.

“And now the special committee itself has recognised that there are colorable estate claims against CSCEC Holdings, including one for alter ego to hold CSCEC Holdings liable for the entire $1.7bn judgment.

“One would think the special committee would want to work arm in arm with us to see CSCEC Holdings be convinced to fund ten figures to resolve these claims. But all we have heard is a ‘toggle’ plan that gives CSCEC Holdings the inside track to buy releases on the cheap.”

However, the “special committee” and its attorneys countered that the issue of whether there are viable claims against CSCEC Holdings is not so simple. Natasha Labovitz, an attorney with Debevoise & Plimpton, argued that “most if not all of the colorable claims... have limited or questionable viability”.

She added that CCA’s plan to emerge from Chapter 11 bankruptcy protection “contemplates a transaction under which a plan sponsor, whether CSCEC Holdings or some other purchaser, would acquire all of CCA’s assets for value”.

And Elizabeth Adams, the sole “special committee” member, argued that “constructive engagement” with CCA Inc’s parent was the best way to maximise recoveries for the latter’s creditors including Mr Izmirlian.

She added: “The special committee has not ruled out potential future litigation against CSCEC Holdings. I do not believe any of the steps taken by the special committee would preclude the special committee from pursuing litigation against CSCEC Holdings at the appropriate time if, in my reasoned judgment, the special committee should determine that doing so would be the best way to maximise value for the estate.

“Nonetheless, I believe that initiating litigation against CSCEC Holdings would be premature at this time and may not ultimately be necessary given the ongoing efforts to pursue a consensual resolution that could deliver meaningful value to the estate

without the costs and delays of litigation.”

As for Mr Izmirlian’s bid to initiate his own litigation, Ms Adams added: “In my judgment, permitting BML Properties to pursue a veil-piercing claim against CSCEC Holdings at this time would be prejudicial to the efforts being taken by the special committee.... “Allowing BML Properties to proceed separately would divert the attention of CCA, BML Properties, CSCEC Holdings and their respective professionals away from global discussions that are already underway, which would likely delay, if not impede, the parties’ ability to reach a consensual resolution and hinder, rather than advance, progress toward a valuemaximising outcome in this Chapter 11 case.”

As for Mr Izmirlian’s bid to use the special committee’s report in his Bahamian winding-up bid, CSCEC Holdings’ attorneys argued

that the New Jersey bankruptcy court should block this because it “might be misused in other proceedings”.

“BML Properties has made clear that it intends to use this confidential information about CSCEC Holdings and its subsidiaries in connection with its litigation in The Bahamas; it should not be permitted to do so,” they argued. “Here, CSCEC Holdings is not party to the proceeding in The Bahamas and therefore has no way of knowing whether its interests would be ‘fully and ethically prosecuted’.”

However, Mr Izmirlian argued that he should be allowed to use the report’s contents in accordance with the New Jersey Bankruptcy Court order governing how confidential information is to be used and protected.

“Among other proceedings in The Bahamas, the debtor’s affiliates are opposing BML Properties’

applications to wind-up CCA Bahamas and CSCEC Bahamas on the basis of their insolvency, and the information in the special committee’s report... will be relevant to those proceedings,” it was argued.

“This information should not be kept from judges of other courts, particularly in The Bahamas where BML Properties can seek permission to limit public access to the information. BML Properties’ use of discovery in The Bahamas should be allowed because discovery should generally be allowed to be used in other collateral proceedings, absent a showing of tangible prejudice to the other party.

“While CSCEC Holdings is not a party to the Bahamian proceedings, its interests will be adequately represented by CCA Bahamas, a wholly-owned subsidiary, and CSCEC Bahamas, a sister affiliate likewise wholly owned by CSCEC Ltd.”

PM: S&P would not upgrade if figures were ‘manipulated’

November 2024, were not politicised but instead made by Ministry of Finance officials who understood accounting practices, he nevertheless appeared to agree that the changes should have been made earlier, fully disclosed and explained.

“First of all, the numbers are not being compiled by Brave Davis,” the Prime Minister said, after Mr Pintard raised the 11th-hour adjustments that saw the

Government overshoot its 2024-2025 full-year deficit target by just $9.1m to come in at $79.9m. This compared to the original $69.8m goal.

“The second point I make is those numbers were verified, looked at by the international community. They [S&P] have upgraded The Bahamas. If something was wrong, if some manipulation was being done, would they do that?

“It’s not just the international community upgrading us but the International Monetary Fund

(IMF), which provides stringent oversight in the auditing of government numbers, they too have acknowledged the remarkable performance of our economy and numbers.”

Mr Davis, besides using S&P and the IMF, also sought to use as cover comments by Pretino Albury, the former Bahamas Institute of Chartered Accountants (BICA) president, who earlier this week said the revisions were understandable and in-line with International

Public Sector Accounting Standards (IPSAS) and the cash-based method employed by the Bahamian government. However, he appeared to concede that the changes - which were made to figures booked more than six months’ ago - should have been disclosed sooner and a full explanation provided.

“Now you’re talking about reclassifications of what numbers; $37m?” Mr Davis asked Mr Pintard.

“That was done by, you know, the technocrats, the people who know better and, while we are on that, because somehow providence told me you’d raise it, the former president of BICA, he understood

the reclassification was in accordance with generally accepted accounting practices.

“His question is timing. You can go there, but cannot say it’s manipulated. It’s supported by the IMF, supported by the former president of BICA. You go against this?” However, Mr Pintard appeared undaunted by the Prime Minister’s response and repeated his charges.

“They [the Government] have shifted $37m from spending due to an unrecognised change in accounting treatment for funds spent for shares in a development bank,” he added. The Opposition chief also questioned whether the $300m net proceeds from the Government’s recent $1.067bn bond issue have been injected into the National Investment Fund as previously suggested by the Prime Minister.

Mr Pintard also renewed the Opposition’s challenge to the $10m loan to the Carmichael Village Project Development Companybut failed to draw a reply from Mr Davis on either matter. He also charged that the Government is under-stating its spending by some $61m by treating subsidies to state-owned enterprises (SOEs) as loans rather than subsidies.

The Prime Minister, meanwhile, ignored other commentary on the late $37.3m accounting revisions in justifying the Government’s position.

Gowon Bowe, Fidelity Bank (Bahamas) chief executive, challenged why the Government appears to be “cherry picking” certain assets and accounting treatments in the lastminute revisions to its 2024-2025 spending and deficit numbers. He told Tribune Business earlier this week that the Davis administration had not provided a “significantly fulsome explanation” for why The Bahamas’ $25m investment in the Development Bank of Latin America and the Caribbean (CAF) alone was deemed worthy of being shifted from an ‘expense’ to a below-theline ‘investment’.

Questioning the “uniqueness” of this outlay, and why other assets were not subjected to similarly revised accounting treatments, he added that the International Monetary Fund (IMF) would have advised the Government to switch to full accrual-based accounting as opposed to using this method “piecemeal”.

Michael Halkitis, minister of economic affairs, last week said the IMF had supported the Government reclassifying the $25m CAF investment it made in November 2024 from an ‘expense’ to an ‘investment’. This enabled the Davis administration to remove this sum, which accounted for the majority of the $37.3m eliminated from its year-end spending and deficit figures, off its balance sheet.

Mr Bowe, though, argued that The Bahamas “must be very careful” that, as a sovereign nation, it is not giving the impression that the Washington DC-based fund is “dictating” its fiscal accounting treatments. And he also queried why the IMF’s advice is now being treated as “Gospel” by the Government when, in the recent past, the two have disagreed over The Bahamas’ economic growth and fiscal forecasts. The Ministry of Finance, unveiling the Government’s fiscal performance for June and the full Budget year,

revealed that the fiscal deficit only exceeded initial projections by 13 percent to close at $78.9m compared to the originally-targeted $69.8m. Mr Davis yesterday hailed this outcome, equivalent to 0.5 percent of gross domestic product (GDP), as “a remarkable achievement”. However, a closer inspection of the figuresparticularly a comparison of the Ministry of Finance’s May and June fiscal reports - discloses that the Government only came so close to its target because of lastminute changes to monthly expenditure and deficit figures for the first five months of the 2024-2025 fiscal year. The May 2025 fiscal report, released just over one month ago towards the end of August, revealed a $141.5m deficit for the first 11 months of the 20242025 fiscal year. To reduce that to $78.9m would have required the Government to generate a $62.6m surplus in June, which is traditionally a month when heavy deficit spending is incurred, but yesterday’s report showed just a $25.4m surplus for June.

That would have taken the full-year deficit for 2024-2025 to $116.1m, some $37.2m above the endJune number of $78.9m. A Tribune Business analysis found that the difference, or gap, can be explained by last-minute government revisions to its spending and deficit figures for the first four months of the 2024-2025 fiscal year. This covers the four months from July to November. In particular, November’s monthly deficit, which was shown in the May fiscal report as standing at $82.8m, ended up being cut by $25.9m or 31.3 percent to $56.9m in the June fiscal report that was released yesterday.

The revised November 2024 deficit figure resulted from a downwards revision to total government spending, which was cut from $336m in the May 2025 report to $310.1m in the latest publication. The near-$26m, or 8.4 percent, reduction resulted largely from a $22.9m drop in capital spending - from $53.7m in the May 2025 report to just $30.8m in its June equivalent.

In particular, November 2024’s ‘transfers N.E.C’, which stands for ‘transfers not elsewhere classified’, were cut from $28.3m in the May 2025 report to just $5.4m one month later in the June report. No explanation was then provided for such a substantial, late revision that favoured the Government by bringing it in close to its 2024-2025 deficit target.

Smaller revisions, according to Tribune Business’s analysis, also occurred for the Government’s monthly spending and deficit revisions for July 2024 through October 2024. The deficits shown in the May 20205 fiscal report were subsequently revised downwards by $4.6m for July; $0.7m for August; a $3.9m reduction for September; and a $2.2m drop for October.

When added to the November changes, these last-minute revisions for the June and year-end 2024-2025 fiscal report cut the deficit by a combined $37.3m compared to previous monthly reports. This, together with the May and June Budget surpluses, meaning revenue income exceeds the Government’s spending, is what enabled it to come so close to the fullyear deficit target.

NOTICE is hereby given that KENNETH OKHUAROBO of Carmichael Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration/Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of October 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, Bahamas.

Chamber executive: ‘Who will police redundancy insurance?’

OBJECTIONS - from page B1

good company,” Mr Goudie explained to this newspaper. “I said that is totally misguided.

“Number two, I explained my total objection for paying people to have lunch,” he added, referring to the proposed mandatory one-hour paid lunch period. “I totally disagree with that. If some companies want to pay that, fine, but that doesn’t mean every company in The Bahamas should have to do that. I have never gotten that. Why should I pay you to eat?

“I also object to people declaring themselves as having mental health problems and having to take a day off without confirmation by a doctor. Take that day as a vacation. I don’t know why a company should have to pay for someone taking a day off. Really? They were my three objections.” The proposed reforms include giving workers three days of mental health leave per year.

Employers have already branded the proposed ‘redundancy fund’ as “dangerous” and “untenable”, but Mr Goudie questioned whether the Government will be able to supervise and enforce this requirement should it become law given that it already struggles in so many areas with this.

“What I told them is who’s going to police

this?” Mr Goudie said of Tuesday’s Town Meeting. “Every employer is supposed to buy insurance; redundancy insurance. Who’s going to police that to see who’s paid it? I mean, seriously? We cannot police what we’re got, let alone make redundancy insurance mandatory for every company in the country?

“That’s not going to happen. They’re going to go round and check-up? Give me a break... If they do buy the insurance it’s cost employers more money and make the ease of doing business even worse again. It’s a disincentive to employment. We are asking good companies, which are the vast majority, to pay for the few that don’t.”

Mr Goudie, acknowledging that the Chamber and private sector are “absolutely concerned” by the labour law reform proposals, added: “They [the Government] keep increasing our costs and telling us what we have to do. We’re trying to increase employment when employment is down, and you want to increase our costs. We’re got a problem with that.

“Our unemployment numbers are up, and you’re proposing increased costs? I don’t need to say anything more? I don’t need to say anything more. How can you increase costs and expect us to increase employment? Nothing is adding up; that’s the whole point.

“Don’t sit there and acknowledge our

Canada's prime minister discussed reviving contentious Keystone XL pipeline with Trump

By ROB GILLIES Associated Press

CANADIAN Prime Minister Mark Carney raised the prospect of reviving the contentious Keystone XL pipeline project with U.S. President Donald Trump during his White House visit this week, a government official familiar with the matter said Wednesday.

A Canadian company pulled the plug on it four years ago after the Canadian government failed to persuade then-President Joe Biden to reverse his cancellation of its permit on the day he took office. It was to transport crude from the oil sand fields of western Canada to Steele City, Nebraska.

Trump previously revived the long-delayed project during his first term after it had stalled under the

Obama administration. It would have moved up to 830,000 barrels (35 million gallons) of crude daily, connecting in Nebraska to other pipelines that feed oil refineries on the U.S. Gulf Coast. The Canadian government official said Trump was receptive to the idea when it was talked about during their White House meeting Wednesday. The official said Carney linked energy cooperation to Canada's steel and aluminum sectors, which is subject to 50% U.S. tariffs. The official spoke on condition of anonymity as they were not authorized to speak publicly on the matter. Carney mentioned building major projects and "unleashing Canadian energy" in a live video call with business leaders in Toronto on Wednesday.

employment numbers are up, and then tell employers they are paying more money. We have a problem. Nothing is adding up.”

Apart from an 8,885 increase in the number of unemployed persons between the 2024 third quarter and January 2025, the Bahamas National Statistical Institute (BNSI) survey revealed that 65,225 persons - representing 30.4 percent of the 214,725 workers currently holding jobs - were deemed to be under-employed, “working part-time while wanting additional hours”.

The data also disclosed that 28 percent of men employed in the Bahamian workforce in January 2025, and 17 percent of women, had “no qualification” - again exposing issues related to productivity, competitiveness and company output, especially given the world’s shift to the ‘digital’ and knowledgebased economy of the 21st century.

Youth unemployment, which accounts for persons aged between 15 and 24 years-old who are looking but unable to find work, stood at 20.9 percent and was almost double the

national jobless rate. This meant that more than in five Bahamians, some 6,960, were looking for work but unable to find it. And close to one in three of all Bahamian workers are deemed to be under-employed. Reforms such as extending maternity leave to 14 weeks are now being discussed at the public consultation. Accommodations have also been made for adopting and breastfeeding mothers, while it is proposed that fathers will be able to take two weeks’ paternity leave “once every three years”.

Other changes to the Employment Act propose introducing “mental health wellness leave” of three unpaid days per annum, while a paid daily work “break” will also be mandated. And, while an employer and employee can agree to the latter working up to 10 hours per day, overtime has to be paid for two hours as this exceeds the standard eighthour day.

A requirement for a minimum eight-hour break between shifts is also included in the proposed reforms. The Employment Act revisions also “eliminate” the current distinction in section ten concerning overtime for workers who receive the majority of their pay in tips, while managers and supervisors will now

“be given time off for overtime hours worked”. As for the Industrial Relations Act, the proposals include strengthening the “conciliation process” involving employer/employee disputes by giving the Department of Labour “more power to address those matters that really have no merit proper to being referred to the minister and, subsequently, to the Industrial Tribunal. Proposals for a “redundancy” bond or insurance are nothing new, however. Obie Ferguson KC, the Trades Union Congress (TUC) president, has called for the creation of a National Redundancy Fund

to be established ever since the Royal Oasis’s last owner shuttered the resort in 2004 and exited the country leaving behind some $22m in liabilities - including unpaid staff termination pay and other benefits. Mr Ferguson has argued that The Bahamas mandate that foreign investors coming to do business here set aside what would effectively be a performance bond - held in escrow - that could be used to compensate employees and other creditors should they ultimately flee this nation and take all assets and funds with them. The latest proposal is strikingly similar to this.

NOTICE

NOTICE is hereby given that SHANICA MELICE of Pinedale, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration/Naturalization as a citizen of The Bahamas, and that any person who knows any reason why shouldregistration/naturalization not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of October 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, Bahamas.

telecommunications infra-

‘Union-busting’ claim on contract worker increase

INDUSTRIAL - from page B1

card/cell phone purchase scam.

Sherry Benjamin, the BCPOU’s president, told Tribune Business that BTC was lacking direction and that staff are “like chickens without a head” as she pleaded with Liberty Latin America, the carrier’s ultimate majority owner, and the Government, which holds the remaining 49 percent equity, to address the problems.

“If they don’t intervene, you will have hundreds of employees out of a job and this company closed down before you know it,” Ms Benjamin argued. “This company means too much to The Bahamas as a society for this company to close down. Whatever we need to do to get the attention of the powers that be to fix this company we will do.

“I have been asking for an organisational structure since the chief executive came in 2022. I’m still waiting on that organisational structure. If you don’t know where you’re going how can you direct me? I need to know where we’re going so I know my part to play to help us get there.

“If I don’t know where we’re going how can I contribute to get us where we need to be?

We’re walking around like chickens without a head. Nobody knows which direction the company is going in. I don’t see how the shareholders can be satisfied with the leadership in this company.”

The unions meanwhile, in their joint statement, asserted that last week’s dismissals in their view are “part of a broader attempt to diminish Bahamian workers, cover up leadership failures within the organisation, and undermine full-time, unionised employees by replacing them with contractual labour”.

They added: “Since Cable & Wireless Communications (CWC), now Liberty Caribbean, gained control of BTC [in 2011], the company has cycled through seven chief executives.

Under this unstable leadership, we have witnessed a consistent trend of outsourcing critical functions and services - including our mobile networks - to foreign jurisdictions.

“This has come at the expense of Bahamian workers and the sovereignty of our national infrastructure. Even as the executive team has grown in size and cost, employees has been steadily reduced, placing additional burdens on remaining staff.

“Foreign engineers are now being allowed to enter the country under the guise of tourism, engaging directly with BTC executives to finalise plans to migrate remaining network nodes, all without the knowledge or involvement of our local technical staff. This blatant disregard for transparency and national

However, Valentine Grimes, BTC’s vice-chairman, who heads the group of directors representing the Government on the Board, yesterday said the unions’ grievances remain a matter for the management - rather than the Board and shareholders - to address.

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

workforce participation is unacceptable. The recent terminations represent the final straw,” the unions said.

“The unions will not stand by while our members are systematically sidelined, silenced and replaced. We call on the Government of The Bahamas to intervene immediately and put an end to the continued erosion of Bahamian jobs, national interests and the dignity of the hard-working employees at BTC.”

Other concerns cited by the two unions, which represent BTC’s middle management and line staff, were that “local controls have been stripped away”. They added that “staff reductions and unfair dismissals are being driven by Liberty Latin America shareholders, who demand higher profits at the expense of Bahamian workers and their families.

“While profits are siphoned abroad, critical

structure in The Bahamas has been left to deteriorate, compromising both service quality and national security,” the two unions continued. “The executive ranks have expanded even as managers and line staff are cut, deepening inequities and worsening the workload on Bahamian employees.

“Aggressive cost-cutting has created unacceptable conditions for staff, fuelling low morale, mistrust and disrespect, while contractors are hired in a blatant attempt to weaken the Unions. Union-busting tactics of replacing permanent employees with contractors are now at an all-time high. We demand accountability. We demand transparency. We demand justice. The unions will not be silenced.”

BTC, in response to the union furore over last week’s termination, said it was justified in dismissing the five staff members “with cause” following what it described as a “thorough investigation”. While declining to give details on what led to the firings, it

voiced confidence “in the integrity of the process”, adding that it had complied with all labour laws and the two industrial agreements. Stephen Coakley-Wells, director of legal and government affairs, said: “BTC can confirm that, after a thorough investigation, five employees were terminated with cause. The terminated employees comprised members of both the BCPOU and the BCPMU. Both unions were aware of the issue, including the decision to terminate the employees.

“BTC wishes to emphasise that this decision was made in accordance with our established policies, the terms of our industrial agreements and in alignment with our commitment to fairness and compliance with the labour laws of The Bahamas. Due to privacy considerations and respect for all parties involved, BTC is limited in what it can share regarding the specifics of personnel matters.

“BTC values its positive and collaborative relationship with its union partners, and remains open to communication with the unions on this and any other issue affecting union members. BTC understands that situations like this can be challenging and is confident in the integrity of the process followed.”