By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT has decided not to complete Bank of the Bahamas’ rescue by injecting $167m in cash to replace a “promissory note” after efforts to recover the lat ter’s toxic commercial loans proved “trickier” than anticipated.

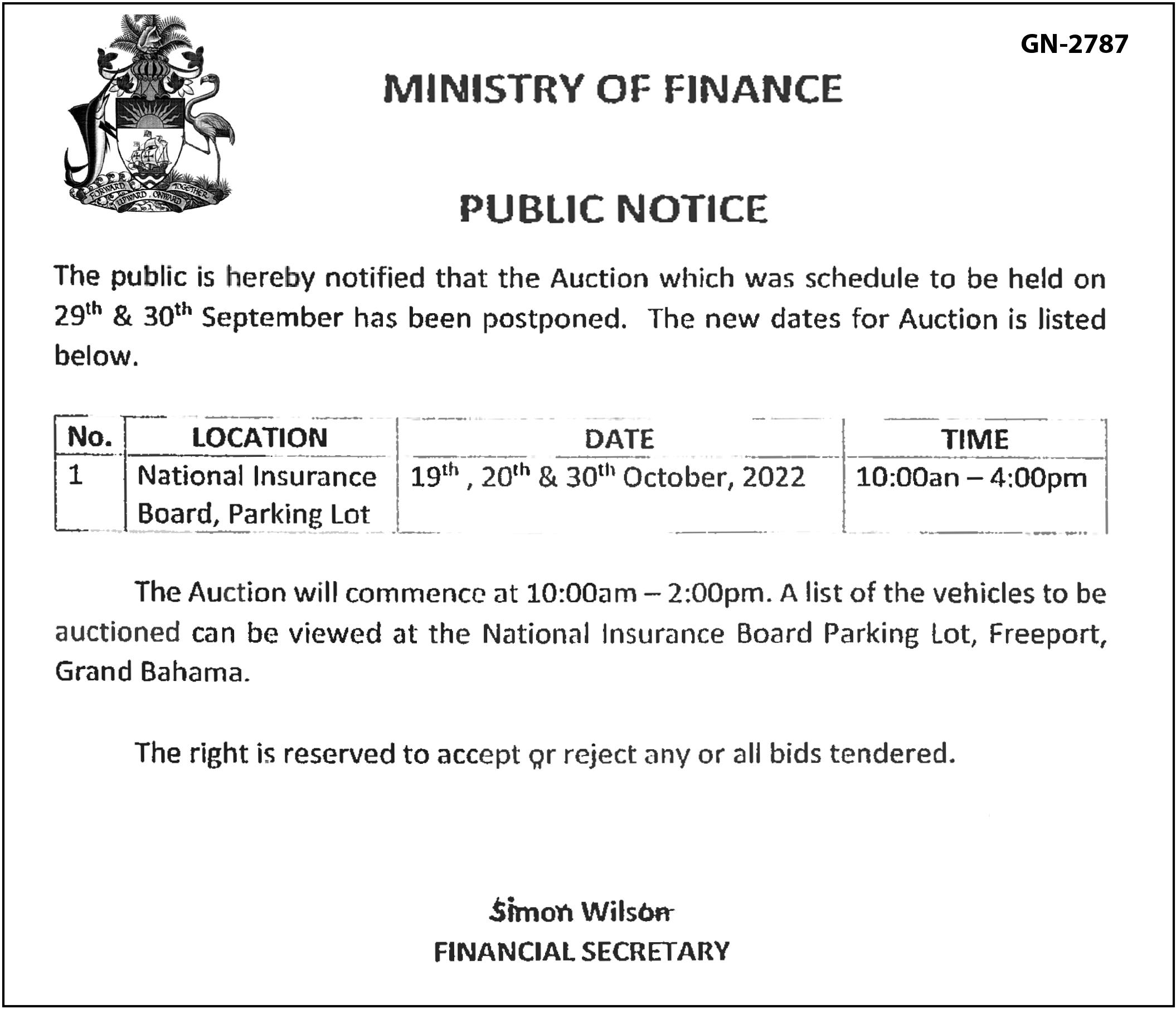

The BISX-listed institution’s 2022 full-year financial statements, released late last week, reveal the Government has instead agreed to a three-year roll-over or extension to the maturity of the note that had been due for repayment at endAugust 2022.

Simon Wilson, the Ministry of Finance’s financial secretary, yes terday told Tribune Business it had proven “much more complex” than thought for Bahamas Resolve to realise and sell the assets that were pledged as collateral to secure Bank of The Bahamas’ previous delin quent commercial loans.

Bahamas Resolve is the special purpose vehicle (SPV), created in 2014, to which Bank of The Baha mas’ toxic commercial credit was transferred to prevent the latter’s col lapse and thus facilitate its rescue. To fill the hole created by the transfer, two promissory notes were injected into the bank’s balance sheet, worth $100m and $167m, respectively, in 2014 and 2018.

Bahamasair ‘crippled’ by cabin crew action that hits passengers

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

HUNDREDS of Bahami ans and tourists yesterday had their travel plans thrown into chaos when Bahama sair was forced to cancel all afternoon flights due to an “unwarranted sickout” by 80 percent of rostered flight attendants.

The “unforeseen” indus trial action sparked long lines of frustrated passen gers at Lynden Pindling International Airport (LPIA) after the national flag carrier confirmed it was forced to cancel outbound flights from Nassau to key Florida destinations includ ing Miami, Fort Lauderdale and Orlando.

Tracy Cooper, Bahama sair’s managing director, confirmed to Tribune Busi ness it was “reaching out” to other airlines to see if they could take its passengers although he acknowledged

BOB ‘can’t say we’re bank’ till loan growth

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BANK of The Bahamas cannot truly “say we are on the way back” until it gener ates sustainable loan book growth again despite enjoy ing a 2022 financial year in which profits more than doubled to hit $11.218m.

Kenrick Brathwaite, the BISX-listed institution’s managing director, told Tribune Business that the 156.7 percent increase in total comprehensive income to end-June 2022 compared to the prior year’s $4.37 was driven by reduced loan loss provisions and non-interest

income revenue sources - neither of which can be relied on as consistent profit drivers.

Emphasising that Bank of The Bahamas needs to get back to its core business, which is extending loans to qualifying borrowers, he added that he was optimis tic that the Central Bank will “release us” some time in the current 2023 financial year from the bar imposed on writing commercial credit ever since the insti tution was first rescued in 2014 by a taxpayer-financed bail-out.

Oil explorer says ‘entitled’ to four licence renewals

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

AN OIL explorer’s asser tion that it is “entitled to a renewal” of its four Baha mas licences has given its opponents and local envi ronmental activists “a sick stomach”.

Eytan Ulliel, chief executive for the former Bahamas Petroleum Company (BPC), in an update to shareholders on Friday argued that such a renewal is deserved after fulfilling all commitments to-date - including the drilling of its Perseverance One well in waters west of Andros earlier this yearas it seeks to gain a return on its $94m Bahamian investment.

Writing in the renamed Challenger Energy Group’s (CEG) just-published 2021 annual report, he reiterated that the oil explorer is “engag ing” with the Davis administration over the renewal of the four explora tion licences that expired at

end-June 2021 just months before the current govern ment was voted into office.

But, while Challenger is seeking a three-year renewal that would commit it to drilling a second exploratory well in Baha mian waters within that timeframe, Mr Ulliel again made clear the company will not pursue such a pro ject unless it secures a joint venture partner in the form of one of the world’s major oil producers to take on the financial, technical and operational risk.

Suggesting that the results and data gleaned

SIMON

business@tribunemedia.net MONDAY, OCTOBER 3, 2022

SEE PAGE B7

$167m BOB payout rolled over by Gov’t

SEE PAGE B9 SEE PAGE B8 SEE PAGE B11 TRACY COOPER

WILSON JOE DARVILLE • Resolve’s recovery of toxic loans ‘trickier’ than thought • Promissory note rolled over for extra three years at 4% • Bank chief: Longer maturity ‘no big deal’ given liquidity $5.85 $5.88 $5.71 $5.79

Is economic dignity the Bahamas’ new direction?

Is there a new eco nomic philosophy emerging in The Bahamas? With a relatively new administration, a firsttime prime minister and a decidedly tough task ahead in coping with the economic fall-out from COVID-19 and Hurricane Dorian, there could be very fertile ground for such out-of-thebox thinking.

Personal outlooks on economics always influence policymakers. This, though, must play a secondary role to any overarching party position. In countries with clear philosophical differ ences between opposing parties, this becomes easier to understand. Where dif ferences are negligible, as in the case of most Carib bean countries, economic philosophy becomes less

pronounced as a differen tiator compared to social leanings.

There is, however, a very progressive (American) economic outlook that seeks to bring together both social and economic philosophical thinking. This seems to counterintuitively align with the social over weighting we observe in the Caribbean, but in a way that more seriously focuses

on creating value. This is an economic construct that seems to place the social and economic well-being of the people ahead of the economy.

This powerfully attrac tive (if you are predisposed to the social advance ment of people) concept is ‘Economic Dignity’, a phi losophy which appears to have found favour with at least one Caribbean leader, Phillip Davis KC, prime minister of The Bahamas.

On page 297 of his book, Economic Dignity, author Gene Sperling writes: “Amid all the metrics, means, policies, labels and debates over political strat egies that bombard us daily, it is this vision of economic dignity that should be the North Star for economic policy that guides us every step of the way.”

This statement points to a pivot away from the traditional means of looking at economic devel opment, where we become generally satisfied with mac roeconomic growth without paying enough attention to the fortunes and fate of all a country’s people. How well are they progressing when there is economic growth? ‘Economic Dignity is thus a very bold, progressive and naturally disruptive view to status quo economics.

The concept The concept of Eco nomic Dignity, with its roots deeply embedded in US progressive (demo cratic) politics, is generally a broadside hit to the prevail ing approach to policy and economic life in the Car ibbean where entrenched factions consistently ben efit more than the ordinary citizen, while those in vul nerable groups struggle immensely to live life with a sense of dignity.

It is a concept that is undergirded by ideas of equity and fairness, and which nudges the political directorate to pay attention to the poor, the disenfran chised, those who tried and failed, run afoul of soci ety’s rules but deserve second chances, and those with debilitating health conditions which push them to the margins. The Prime Minister attempted to deliver this message, which will likely be radical for some, during a lecture on the National Development Plan at the

University of The Bahama. The intent, I believe, was to lay out his view to approaching economic policy that is seemingly well aligned with, if not the same as, Gene Sperling’s.

He attempted to show how The Bahamas, despite economic advances across many administrations, has failed to achieve the very aspirational objective of “uplifting the masses” in a broad-based way. The country has grown and flourished, but many have languished for genera tions in disadvantageous economic and social circumstances.

The Prime Minister’s effort did not translate as boldly as its enabling theory, largely because there appears to have been a desire to balance this disruptive idea and its underpinnings with the nature of the event that called for a more inclusive discussion.

Despite there being sig nificant clues, maybe our lack of appreciation of the concept, together with the architecture of the speech, resulted in many missing the underlying message, at least initially. As a result, several commentators, I believe, misclassified the speech.

It is likely that on reexamination one might better understand the inten tion. It is this understanding that is critical to an appre ciation of how the Prime Minister might approach, or is approaching, public policy, and the economic path that he wishes to chart for the country. The speech itself is rich with hints and flavours of this, and I would recommend a re-examina tion - possibly after taking some time to become acquainted with the rudi ments of Economic Dignity.

Economic Dignity

In 1968, Martin Luther King Jr, speaking at the uprising of sanitation workers in Memphis, said: “Whenever you are engaged in work that serves humanity and is for the building of humanity, it has dignity, and it has worth.” Advocating for the best interests of these black men, he underlined the value of their work to humanity. Their work has dignity, he said.

Contextually, King was saying that where work

Hubert edwards by

benefits others, the effort should also benefit the worker in such a way that they can live with dignity. During the protest asso ciated with that speech, protestors carried signs that simply read: “I AM A MAN”.

You may be asking what a speech from Martin Luther King Jr has to do with economics. Nothing much, except for the fact that Gene Sperling, former director of the National Economic Council and assistant to the president for economic policy under Presidents Clinton and Obama, had him firmly in his rear view mirror as he championed his philosophy of Economic Dignity.

That Martin Luther King Jr emerges as a ref erence point for Sperling is highly instructive, and should instinctively clue observers in on the fun damental leanings of his thinking. Like Martin Luther King Jr’s work and advocacy, the concept of Economic Dignity is deeply rooted in the welfare of the people, the masses, the ordinary man.

The concept is grounded in the idea of arresting the plight of vulnerable people and disadvantaged persons. The concept is inconsist ent with, and disruptive to, status quo thinking and is likely to meet opposi tion (or at least meet with ambivalence) in main stream economic thinking.

Economic Dignity is built on three core pillars. These pillars argue for “the ability to care for family without economic deprivation or desperation denying us the most meaningful moments and joys in our most impor tant loving relationships; the capacity to pursue potential and a sense of purpose and meaning; and

PAGE 2, Monday, October 3, 2022 THE TRIBUNE

SEE PAGE B5

Oil explorer: No $500,000 ‘top up’ on Bahamas well

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

AN OIL explorer is not expecting to pay an extra $500,000 insurance pre mium “top-up” over its Bahamian exploratory well because this was drilled “without incident” last year.

Challenger Energy Group, the former Baha mas Petroleum Company (BPC), revealed in its financial results for the six months to end-June 2022 that it believes the poten tial extra liability associated with the Perseverance One well drilled in waters 90 miles west of Andros is unlikely to “crystallise” despite the project’s costs exceeding projections.

“$0.5m is in respect of potential insurance ‘topup’ exposure due to the ultimate cost of the Per severance One well in The Bahamas exceed ing the initial estimated cost,” Challenger said in its report to investors and

the market. “However, as at the date of this report no demand for this additional payment has been made, and the group expects that this exposure will not crys tallise given that the well was completed safely and without incident over 18 months ago.”

Bahamian environ mental activists have long questioned whether this additional insurance was paid. Casuarina McKinneyLambert, executive director of the Bahamas Reef Envi ronmental Educational Foundation (BREEF), told Tribune Business: “They still haven’t shared the insurance certificate or any details on the insurance coverage that was suppos edly in place..... It’s still unclear whether this project had adequate insurance. How much did they actually pay?”

Challenger, meanwhile, also confirmed that it is still in negotiations with the Government over the full amount of fees still

outstanding over the explo ration licences that expired in June 2021 and which facilitated the drilling of Perseverance One.

“On February 27, 2020, the company advised that, consequent on the granting of Environmental Authori sation for the Perseverance One well, the company and the Government of The Bahamas had agreed a process seeking a final agreement on the amount of licence fees payable for the balance of the second exploration period - includ ing the additional period of time to which the licence period was extended as a result of force majeure,” Challenger said.

“At the time, the parties entered into discussions with a view to finalising this outstanding matter. This discussion has been delayed owing to the state of emer gency declared and ongoing business disruption caused by the national response to the COVID-19 outbreak in The Bahamas. However,

subject to said confirmation, the company expects that an appropriate side letter agreement will be finalised in due course.

“In March 2021, the company notified the Gov ernment of The Bahamas that it was renewing the four southern offshore exploration licences for a further three-year period, having discharged its obli gations under the previous licence term. The group remains in discussions with the Government over the terms of the renewal of these licences, which will include agreement on the level of annual rental fees payable over the renewed term.

Challenger suffered a $2.07m loss on its Bahamas assets in the 12 months to year-end 2021, which was preceded by a $2.188m loss the prior year. Still, Eytan Uliel, its chief executive, said Perseverance One’s outcome had encouraged the company to stick with The Bahamas even though

no commercial quantities of recoverable oil deposits were found.

“In terms of outcomes, Perseverance One did not result in the commercial discovery we hoped for, but a substantial amount of data and learning was obtained from the drilling of the well, which was the first in the region linked to 3D seismic and using modern techniques,” he told shareholders.

“During the balance of 2021 we analysed this data, and concluded that The Bahamas might yet offer long-term potential.

In simple terms, Persever ance One only tested one part of one structure, but there are at least four other locations and mul tiple structures that were upgraded following the Perseverance One out come, and which therefore in the future could merit further analysis and testing. Data from Perse verance One also provides encouraging support for the

Ian’s Florida devastation to hit shipping, logistics

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN ship ping executive says the devastation that Hurricane Ian has inflicted on west ern and central Florida will only worsen existing supply chain and logistics challenges for the entire Caribbean region.

Michael Hall, manag ing director of Bahamas Maritime Logistics Service (BMLS), told Tribune Busi ness: “You have to take into consideration with the

US and how they handle their oil reserves. When they have to dip into their oil reserves they hold back, and right now, because Fort Myers is destroyed along with other parts of Florida, you are going to have a reduction in the exports of raw materials because they have to take care of their own first.”

The US putting Amer ica first, especially when it comes to construc tion materials and other goods required to rebuild Florida, will exacerbate existing shipping challenges with freight coming out

of China and Europe, he added. Mr Hall said: “We saw even before COVID19 the cost of concrete and plywood go up by 100 per cent. Getting those items from the US or wherever you are getting it, from the cost is going to be high.

“Just think about it.

During the pandemic, con struction in The Bahamas never stopped. It main tained its levels because the hotels and homes were still up, and that means the demand for carpentry and raw materials and product were up, so imagine in the US. This indicates that the

price for goods is going to remain high.”

With high taxation (import tariffs and VAT) at the Bahamian border in addition to shipping costs, Mr Hall does not see the price of imported goods lowering any time soon. As for shipping “bottlenecks”,

he added: “In some ways, the shipping has eased up across all the major ship ping ports, but in New York, California, Panama, they still have bottleneck ing, which basically means there’s still a lot of ships

possibility of a deeper, size able Jurassic oil play.”

Referring to another well drilled in Trinidad& Tobago, he added: “We are proud of the fact that, despite many challenges, we did what we said we would do: We drilled both wells safely and without incident, and met the objective of testing the relevant struc tures at the chosen drilling locations. This was no small feat, especially for a group of our size.

“We had to secure the financing needed, we had to recruit an experienced operations team, and in two different geographies we had to operate complex drilling programmes more typically undertaken by much larger companies. We did all of this at the peak of the global pandemic, and in the case of The Bahamas, whilst successfully overcom ing a legal challenge from environmental activists that was frivolously launched at the very last minute.”

that are still off port that are waiting to be worked.

“It has eased up a little bit in the past few months, of course. But, as you know, shipping out of China and Europe, trade lines are still very difficult due to the [Russia/Ukraine] war, and just the overall supply chain demand is high for products.”

THE TRIBUNE Monday, October 3, 2022, PAGE 3

BAHAMAS EXTENDS TOURISM MARKETING PUSH TO NEW YORK

THE Bahamas extended its tourism and investment promotional drive to one of its key visitor source mar kets last week.

The Ministry of Tourism, Investments & Aviation, in a statement, said the meetings, events and din ners held across New York and New Jersey are part of efforts to re-engage tour ism partners following the COVID-19 pandemic and drive increased visitors from those markets.

continued its success ful series of Global Sales and Marketing Missions in efforts to reengage tourism partners and further boost visitor arrivals from the Big Apple and the Garden State.

Chester Cooper, deputy prime minister and minister of tourism, invest ments and aviation, led a

delegation of senior tour ism officials, including Latia Duncombe, acting directorgeneral, through multiple productive meetings with key tourism stakeholders and media during the latest Global Sales and Marketing mission. It ended with cul turally-inspired evening events at The Manor in West Orange, New Jersey, on September 28, and The Plaza Hotel in New York the next day.

Mr Cooper and Mrs Dun combe, together with ministry executives, desti nation representatives and hotel partners, hosted more than 340 guests at the even ing events. Key industry leaders, sales and trade rep resentatives, stakeholders and media attended.

Guests were trans ported to The Bahamas via a three-course dinner

boasting a locally-inspired menu and cocktails, music and a Junkanoo perfor mance. A live ‘question and answer’ panel shined a light on The Bahamas’ steadily growing tourism numbers, plans for future growth and innovation, and the appeal of its 16 islands.

“The tri-state area is the premier media market in North America and a key business gateway for the North-east MICE (meetings, incentives, con ferences and events) and romance markets that could benefit the entire Baha mas,” said Mrs Duncombe.

“Through these missions we brought a taste of The Bahamas directly to top producing sales and media representatives across the tourism industry, to edu cate them on the diversity of offerings for travellers to

our 16 unique island desti nations, and to encourage future visits and business opportunities.”

The marketing mis sions kicked-off earlier in September in Fort Lau derdale and Orlando, Florida. Upcoming stops in the US and Canada include

Raleigh and Charlotte, North Carolina; Toronto, Calgary and Montreal, Canada; and Los Angeles, California. The Ministry of Tourism, Investments and Aviation will also head to Atlanta, Georgia, and Hou ston, Texas, in the future.

Besides major travel hubs throughout the US and Canada, the delegation will be heading to Latin Amer ica and Europe to bring a taste of Bahamian culture directly to key international markets across the globe to inspire travel to the destination.

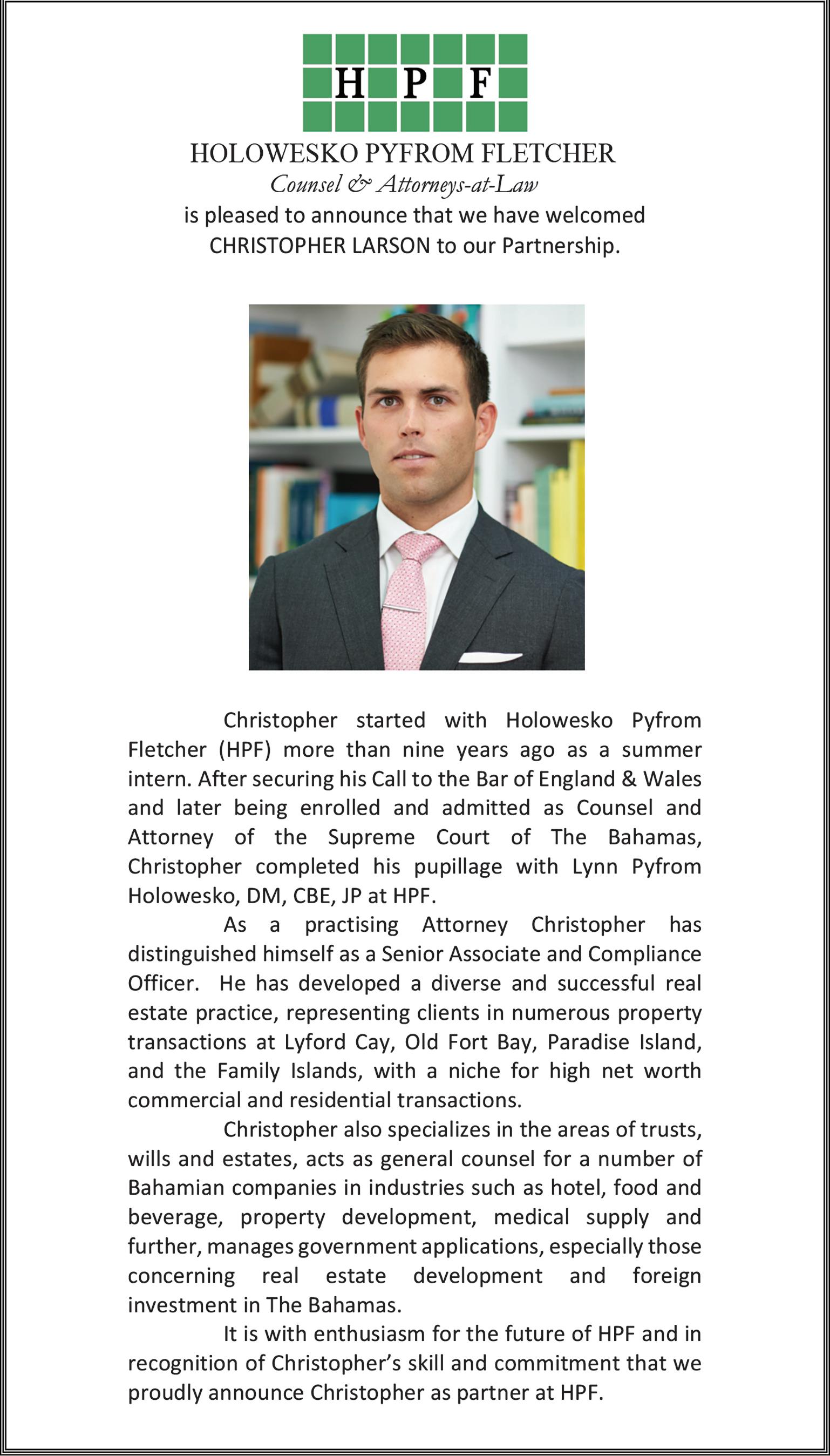

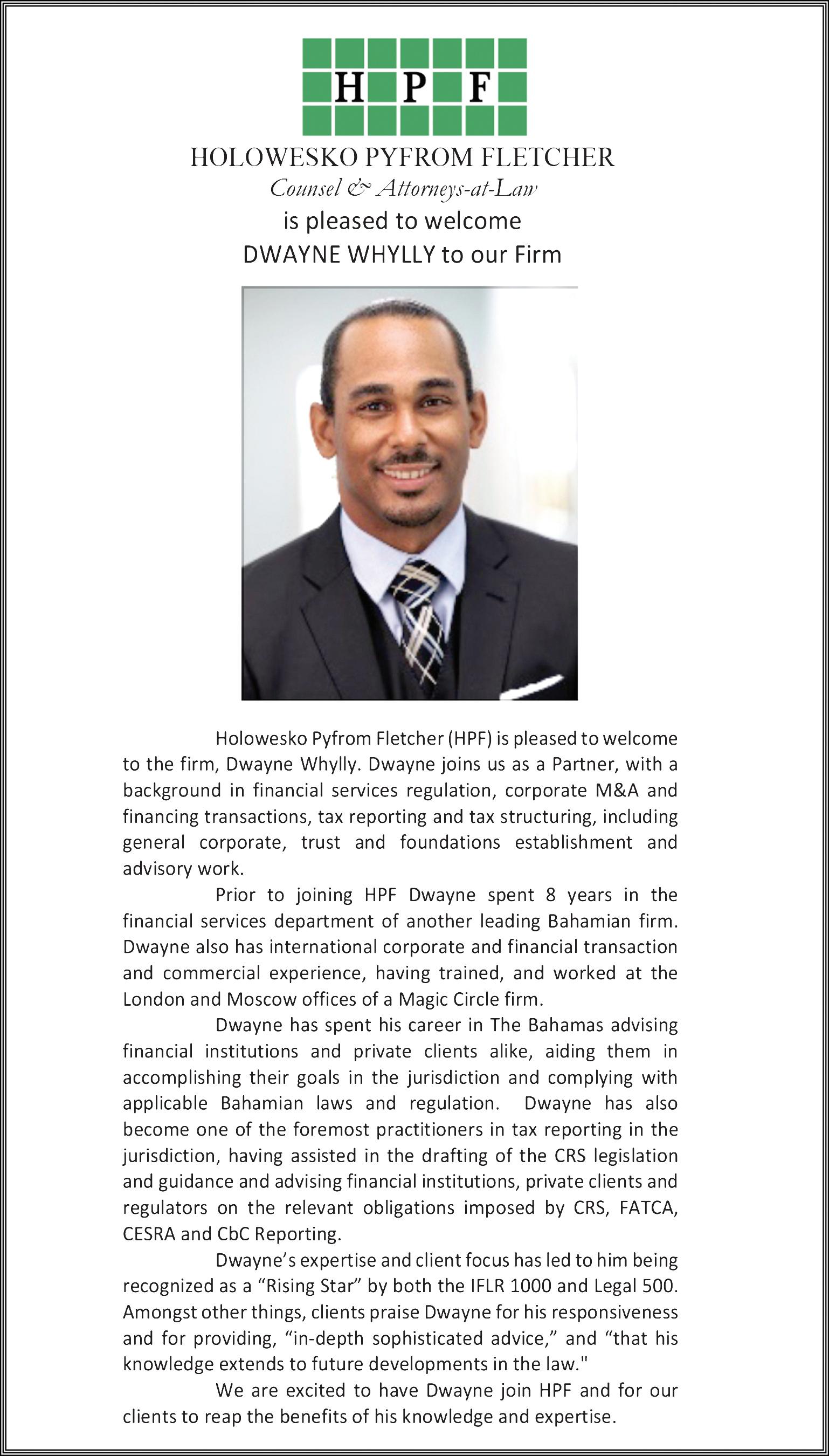

BFSB unveils Student of Year award winners

THE BAHAMAS Finan cial Services Board (BFSB) has announced that Tiasha Lewis-Moxey, a recent graduate of the University of The Bahamas (UoB), has been awarded its Student of the Year honour.

The presentation occurred during the Asso ciation of International Banks and Trust Companies (AIBT) Nassau Conference “boot camp”. The first run ner-up was Tammy Clarke, and the second runner-up, Cassidy Purcell.

The Student of the Year award is part of BFSB’s ongoing Financial Centre Focus (FCF) initiative, which aims to attract and maintain qualified professionals in the indus try. The award aims to recognise an outstand ing graduating student from within the School of

Business at the University of the Bahamas.

The competition is open to students from all disci plines relative to financial services. The initiative is a collaborative partnership between the BFSB, the University of the Bahamas, AIBT and the CFAL group of companies. Besides being a well-rounded student with proven academic success, candidates must submit a 1,500-word essay.

The topic for the 2022 competition was: “The Digital Assets and Regis tered Exchanges Act 2020 provides solutions for digi tal asset applications, and creates a proper regulatory framework for digital assets businesses. Why is this legislation groundbreak ing, and how can we create opportunities for more local participation?”

Dr Tanya McCartney, the BFSB’s chief execu tive and executive director, said: “It is imperative that we continue to develop Bahamian talent equipped to ensure the sustainabil ity of the financial services sector. Two key elements of our value proposition are expertise and innovation.

“The next generation of leaders will continue to develop bespoke client solutions and ensure that we have a competitive advantage. Our Student of the Year winner, Tiasha Lewis-Moxey, exemplifies the talent and potential that we as Bahamians possess and we expect that she will do very well along with our other finalists.” The winner received a $5,000 invest ment account with CFAL, and the other two finalists received cash prizes.

PAGE 4, Monday, October 3, 2022 THE TRIBUNE

Disaster avoided

By CHRIS ILLING

Business Developer ActivTrades Corp

As predicted in last week’s article, the inflation rate in the euro area has reached double digits for the first time since the introduc tion of the single currency.

As the European statistical office, Eurostat, announced on Friday, following an ini tial estimate inflation was 10 percent in September. In August, it was still 9.1 percent. Bad news for the Euro zone, but it was an even worse week across the channel.

On Wednesday, the Brit ish central bank, the Bank of England, apparently pre vented a financial collapse in the City of London with a spectacular emergency operation. The question remains, though: For how long? Several pension funds were said to be on the verge of collapse.

The decline in value of the British pound and UK government bonds, the latter whose yields had shot up to a record level of more than 5 percent on Wednes day, led to considerable upheaval in the London financial world. During the day, the UK’s entire pen sion system faltered, and several pension funds were reported to be on the brink of collapse.

After a dramatic drop in prices on Wednesday

morning, there were simply no more buyers for longdated British government bonds. Only the interven tion of the Bank of England prevented a worse case scenario. The market for UK government bonds is dominated by large pension funds, which primarily act as buyers of the long-term securities known as gilts.

In the long run, lower bond prices and higher yields are good for pen sion funds because they help them to generate the necessary income for retir ees. They try to protect themselves against infla tion and interest rate risks with hedging strategies. In normal times, when gilt yields - the interest rates paid on government bonds - are rising, the funds may have to sell some of their assets to keep things in balance.

However, given the recent rally in government bond yields, the hedging strategies threatened to fail completely and make the situation worse. In the event of short-term, rapidly increasing risk premiums, as during last week, hedged positions must be backed

with additional collateral. This apparently forced UK pension funds to sell assets in a hurry on Wednesday to stay afloat and meet their payment obligations. They also had to part with other bonds, which accelerated the downward spiral. Sud denly the system threatened to implode.

It was the new UK gov ernment that triggered the dramatic developments on the bond and currency mar kets. On Friday, five days earlier, the UK government announced a multi-billion dollar package of measures to tackle high inflation and boost the UK economy. The UK’s finance chief, Kwasi Kwarteng, announced both higher government spend ing and tax cuts at the price of rapidly increasing Great Britain’s national debt.

At the beginning of the week, the pound fell to a new all-time low (1.0358) against the US dollar and government bond prices fell. The situation worsened on Wednesday, so the Bank of England launched a £65 billion contingency plan. For the next 13 working days it now wants to pump £5bn into the bond market.

And, indeed, the mar kets for British government bonds recovered signifi cantly after the central bank’s announcement. The pound strengthened against other currencies such as the dollar. On Friday, the exchange rate against the

US dollar was at 1.1118 again.

The central bank inter vention should now give pension funds time to replenish their collateral in an orderly manner and with less pressure. However, the temporary intervention has not permanently eliminated

the UK sterling crisis and the turbulence surround ing British government bonds. Difficult times lie ahead for the new British government.

THE TRIBUNE Monday, October 3, 2022, PAGE 5 Is economic dignity the Bahamas’ new direction?

FROM PAGE B2

the ability to contribute and participate in the economy with respect, free from dom ination or humiliation”.

These were all clearly delineated in the Prime Minister’s lecture. I am sure there are persons who will outright disagree with this argument, or at least be tentative in align ing with it. However, when a prime minister in a nationally-important lec ture focused on national

development quotes a Gene Sperling, and takes seeks to unpack the eco nomic history of the country, interesting clues start to emerge as to the influences on economic thinking and, more importantly, the likely desired outcomes of public policy. Is there an emerging philosophical stance with potential for spillover into the wider region?

NB: Hubert Edwards is the principal of Next Level Solutions (NLS), a

management consultancy firm. He can be reached at info@nlsolustionsbaha mas.com. He specialises in governance, risk and com pliance (GRC), accounting and finance. NLS provides services in the areas of enterprise risk management, internal audit and policy and procedures develop ment, regulatory consulting, anti-money laundering, accounting and strategic planning. Hubert also chairs the Organisation for Responsible Governance’s (ORG) Economic Develop ment Committee. This and other articles are available at www.nlsolutionsbahamas. com.

BUILDING MATERIALS SUPPLIERS WARN OF POST-IAN PRICE RISES

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BUILDING materials costs may further increase as a result of the devasta tion that Hurricane Ian has inflicted on Florida, Baha mian merchants warned yesterday.

Constance McKin ney, chief financial officer at Cartwright’s Building Supplies, told Tribune Busi ness she expects prices to “go up again”, reversing the decline seen over the last two months, due to

increased demand for con struction materials to help rebuild the “Sunshine State” in Ian’s aftermath.

Building material avail ability may also become an issue as Florida sucks up the majority of available supplies, creating shortages for The Bahamas and other Caribbean states.

“We’re looking at a Dorian in Florida right now,” Ms McKinney said. “I suspect that because of the supply and demand that things will be coming in a little slower. We’ve been trying to get supplies in and they’ve been coming in a little slower.

“For example, sheet rock has been delayed. But I expect for us to see a differ ence in the fact that I don’t know if we’re going to get the availability of supplies as quickly as we have been getting them. There has been a delay in them.”

Despite the inevitable post-Ian logistical chal lenges for Florida materials suppliers, construction in The Bahamas is not expected to slow down sig nificantly. “Contractors just have to do more planning. So if you used to order two weeks in advance you have to now order a month ahead,” Ms McKinney said.

“If you have suppliers in South Florida, and you have a good relationship with them, you should be able to get your supplies. I don’t think they would deny us supplies if we have a good relationship with them. We may not get all of what we want, but we will get some and whatever comes to The Bahamas will have to be shared with everyone.”

Anthony Roberts, City Lumber Yard’s general manager, said: “I have not heard of any price rises yet, but I do anticipate that in the upcoming days we may see supplies get tight on things like plywood and shingles.”

He, too, is placing orders ahead of time. One was submitted ahead of Ian’s Wednesday arrival on Florida’s western coast as a Category Four storm with winds touching 155 miles per hour. Mr Roberts said: “When there are supply

issues, the price issues follow behind.

“So hopefully it won’t be a terrible impact, but to answer that, yes, we expect, as is normally the case, that we would see prices on things like plywood to be more volatile. So I do antic ipate we’ll see prices start to move up a little bit, espe cially once they get over a bit of a clean-up and get down to repairs.

“That was quite a hit Florida got. It was almost like what we went through with Dorian. They are just now assessing how much damage Florida has incurred and what they should expect from the restoration process,” Mr Roberts added. “There are a lot of suppliers in Florida, but they are not exclusively in Florida, and the materials we buy are not necessarily out of Florida.”

Other supply hubs are present in Louisiana and

North Carolina. “There is really only one major ply wood mill in Florida, and I hope they are not affected because it will cost money when we have to truck it down from other states. So I’m hoping that mill in Flor ida is intact because they supply a lot of plywood to not only Florida, but a lot of it is exported to the wider Caribbean,” Mr Rob erts said.

Shipping and logistics may also face temporary challenges because Flori da’s ports were shut down due to Hurricane Ian’s passage. And building materials may be put behind supplies of groceries and medical supplies. “There were two railways and they were just shut down, so it’s going to take some time to get things geared back up, but there will be disruptions at the ports,” Mr Roberts said.

Maritime Authority awards ex-minister

THE BAHAMAS Mari time Authority (BMA) has honoured former min ister of transport, Glenys Hanna-Martin, for “unstint ing leadership and support for furthering the growth and the opportunity of the Bahamas maritime sector to the benefit of all Bahamians”.

The award, presented in celebration of Bahamas

Maritime Week, was made during a reception in Mrs Hanna-Martin’s honour at Margaritaville Beach Resort. The cur rent minister of transport and housing, JoBeth Coleby-Davis, and former ministers of transport, Ren ward Wells and Frankie Campbell, all attended.

Mrs Hanna-Martin, who is current minister of

education and technical and vocational training, is pictured delivering remarks. She is also shown in a group photo with, from L to R: Renward Wells, JoBeth Coleby-Davis and Frankie Campbell. And, centre, with maritime sector stakeholders.

Photo:Anthon Thompson/BIS

PAGE 6, Monday, October 3, 2022 THE TRIBUNE

Oil explorer says ‘entitled’ to four licence renewals

FROM PAGE B1

from its Perseverance One well, which ultimately failed to locate commercial quantities of recoverable oil below the Bahamian seabed, had provided suffi cient reason not to abandon Challenger’s hopes for this nation, Mr Ulliel wrote: “In March 2021, we submitted documentation for renewal of our Bahamian licences into a third, three-year exploration period.

“This remains pending with the Bahamian govern ment, but the group has completed all of its work obligations and is thus enti tled to a renewal. At the same time, we have been clear on our go-forward strategy in The Bahamas. Any future activity will require a ‘big brother’ part ner, ideally a larger industry player, to provide expertise and the capital that will be needed for the next phase of activity.”

One source, speaking on condition of anonym ity because they were not authorised to speak pub licly, said it was likely critical to Challenger’s financial health that the four Bahamas licences - all covering maritime areas near the western territorial boundary with Cuba - be renewed if it is to have a chance at recovering some of the $94m spent to-date on its exploration activities in this nation.

Without those renewals, they argued that the value of its Bahamas investment will effectively plummet to zero as it will be impossi ble to either attract a major global oil player to finance a second exploratory well to or sell the licence rights to entirely. “They’re trying to put lipstick on a pig,” the source said of Challenger. “They’re desperately hang ing on to the licences in the hope some big oil company will buy-in. They need to be bailed out by a big oil company.”

Challenger’s financials show it was carrying almost $94m of Bahamas explo ration costs on its balance sheet at year-end 2021, a sum that increased just marginally to $94.5m at end-June 2022. No impair ment charge has been applied to this sum yet, with any such action depending on its ability to find com mercial oil reserves, finance new projects or sell the licence rights.

“A new Government was elected in The Bahamas in September 2021, and the group is engaging with the new administration regard ing the renewal of these licences and the level of licence fees which remain to be paid for the period that expired on June 30, 2021, and which would be payable for the renewed licence period,” Challenger said in its 2021 financials.

“Once this renewal pro cess is completed, the key licence obligation for the new three-year period will be the drilling of a further exploration well within the licence area before the expiry of the renewed licence term. The ability of the group to discharge its obligation to commence a well prior to the end of a renewed licence period will be contingent on secur ing the funding required to execute a second explora tion well.

“The group has, and will, continue to engage in discussions with vari ous industry operators regarding entering into a joint venture partnership or farm-out to fund any future well, and the direc tors consider that the group will be able to discharge the licence requirement of a further exploration well within a renewed term of the licence.”

Bahamian environmental activists had been hoping Challenger will disap pear from The Bahamas in favour of brighter fossil fuel exploration prospects in Trinidad & Tobago and Uruguay, but the company’s annual report shows this is wishful thinking and thatfor the moment at least - it is not going anywhere.

Mr Ulliel’s report sparked Challenger’s oppo nents to once again demand that the Government, and Parliament, leave no room for doubt over The Baha mas’ position by banning oil exploration within the country’s territorial bound aries on both “land and sea”.

They argued that the absence of such a ban, which would leave the door open for future oil exploration activities to be permitted by this or a future administration, stands to totally contra dict the Prime Minister’s global campaign to draw worldwide attention to cli mate change’s devastating impacts on The Bahamas and other low-lying small island developing states (SIDS).

And it would also go against The Bahamas’ efforts to secure financ ing for mitigating climate change and other initiatives

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

by monetising blue carbon credits, as the very assets that will allow it to real ise benefits estimated in the hundreds of millions of dollars - mangroves and wetlands - would be among those most at risk from fossil fuel explora tion/drilling and any related pollution.

Philip Davis KC has pre viously said that, while oil exploration activity might be permitted, he would not allow commercial drilling and oil extraction in Baha mian waters. Instead, once the scale of any proven commercial oil resources were determined, his administration would seek to use them as a carbon/ fossil fuels offset to obtain financial compensation for The Bahamas in return for not permitting their exploitation.

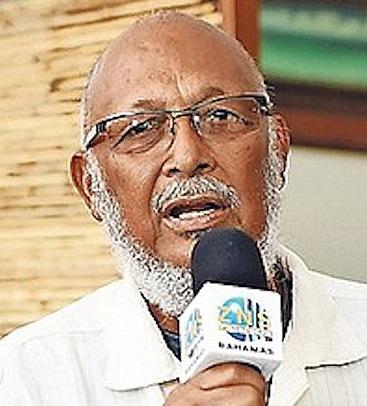

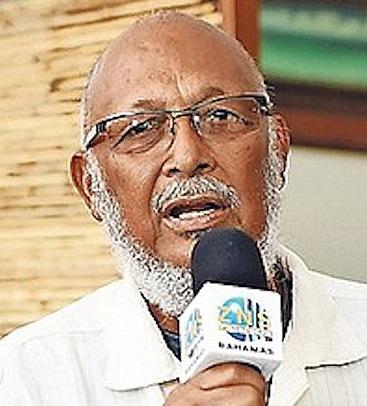

“You’ve got to be kid ding me. They’re entitled to a renewal? That gives me a sick stomach,” blasted Joe Darville, Save the Bays’ president, of Challenger. “I don’t know how presumptu ous they could be to believe they are owed something by our government.

“I appeal to the Prime Minister, who is doing so much worldwide to preserve our pristine envi ronment, and I am waiting for him or Parliament to issue a dictum that there will never be any oil explo ration in our territory, either on land or sea... What has been done to encourage these people to believe they can come back when they need to be told to the con trary? What has given them the audacity to think they can override the natives of this country?”

Asserting that The Baha mas has “the most beautiful oceans” and “the cleanest air” in the world, Mr Dar ville reiterated: “I call upon Parliament, and I call upon the Government, to make a stern and direct decision that oil drilling, whether on land or water in The Baha mas, will never be given permission.

“Now with us being classified as having the

best resource of carbon credits to be sold, what a contradiction. We are able to access these carbon cred its through our mangroves, yet put them at risk of irre versible damage? What contradiction is that?

“We have some of the best oceans to provide carbon credits, yet we are going to allow oil drilling? We talk about begging for carbon credits, and are going to subject our envi ronment to potentially serious damage? The con tradiction is just too ironic.”

Casuarina McKinneyLambert, executive director of the Bahamas Reef Envi ronmental Educational Foundation (BREEF), told Tribune Business that Chal lenger’s position had again given The Bahamas an opportunity to take “a bold stand” on prohibiting fossil fuel exploration within its territory ahead of the upcoming COP27 global conference on climate change and its mitigation.

“The Bahamas has an opportunity to take a bold stand ahead of COP27 and commit to a ban on drilling in our waters,” Ms McKin ney-Lambert said. “An outright refusal of any oil exploration renewal request would send a clear signal regarding The Bahamas’ commitment to climate action.

“Climate action is immi nently necessary given our obvious vulnerabilities to the serious threats of increasingly strong hurri canes and rising sea levels.”

Sam Duncombe, reEarth’s president, described Challenger’s explora tion ambitions as “never ending” while branding the wider issue of oil explora tion in Bahamian waters as “just lunacy”.

“Both governments have been duplicitous about whether they will allow oil

exploration,” she added. “I don’t know how this admin istration can be talking about any oil exploration when the Prime Minister has been all over the place begging for funds for cli mate mitigation.

“We can’t just be begging for ourselves. We’ve got to do our part to mitigate cli mate change, and part of that is fossil fuel consump tion. We’re either going to talk about it or take action about it, and talking does no one any good.”

STENA ICEMAXX

THE TRIBUNE Monday, October 3, 2022, PAGE 7

BOB ‘can’t say we’re bank’ till loan growth

“It’s a signal that we’re on the way back,” Mr Brath waite told this newspaper of profits more than doubling year-over-year. “But if you analyse the income figures you realise that what would sustain us is growth in lend ing, and you don’t see that.

“We see some growth in consumer lending, but that’s small. Delinquency man agement and non-interest revenue sources, that’s what’s driving our profits now, and you cannot really rely on that to be sustain able. Once we start growing the loan book, especially

the commercial credit, whatever the bottom line figures look like, as long as it comes from growth in that I will be happy.

“Once we see growth in our loan portfolio and loan book, we can say we’re on the way back. Right now we have a challenge with mort gages; we have a challenge with losing our portfolio there,” Mr Brathwaite con tinued. “We’re losing our portfolio on commercial because we’re not lending, but are developing new rev enue streams to offset that.

“When we look at other revenue streams we can say we have put a lot of things

in place that have strength ened the bank. Although we’re not lending the way we’d like to, we can say the bank is a lot stronger. I’m optimistic and am going to say that the glass is half full. We’ve done so many things to put us on the right track for future growth and sustainability that I’m com fortable to say we’re on the right track.”

Bank of The Bahamas’ interest income, represent ing the yield on its loan book, was relatively flat year-over-year although it increased slightly to $40.955m compared to $40.099m. Aided by higher

liquidity, both within itself and the wider commer cial banking system, which acted to depress deposit rates, the BISX-listed insti tution saw an increase in net interest income as asso ciated expenses dropped.

Net interest income rose by 7.9 percent to $35.398m, compared to $33.322m in the year to end-June 2021, with a further boost coming from the just over $2m increase in net fee and commission income to $9.477m. Other operating income also rose slightly to $4.221m, with total oper ating income jumping by 11.2 percent to $49.096m as

opposed to the prior year’s $44.167m.

With operating expenses held relatively flat, the remainder of Bank of The Bahamas’ profit increase was driven by the $4.5m reduction in loan loss pro vision to a net $359,000 as opposed to the prior year’s $4.805m as the commercial banking industry regained prior COVID deferrals.

Overall loan book growth, though, proved elusive as net advances to customers declined yearover-year by more than $20m to $368.589m. Some $52.846m in loan loss provi sions were on the books at end-June 2022, with a fur ther $12.476m written-off or charged off during the prior 12 months. More than half the remaining provi sions, some $27.266m, were attributable to residential mortgages while another $15.689m related to con sumer loans.

Loan loss provisions were equivalent to 14.34 percent of the net loan portfolio at 2022 year-end, and 73.55 percent of total delin quent or non-accrual loans, both representing slight declines on 2021. Yet 19.49 percent or $71.855m of the $369m net loan portfolio, a ratio still high by industry standards, was deemed nonperforming by year-end meaning that this is credit 90 days or more past due.

Mr Brathwaite, confirm ing that the resumption of

commercial lending is a key element in plans to revive loan growth, said he was optimistic that the Central Bank will this year release the prohibition that has been in place since this seg ment nearly caused Bank of The Bahamas’ collapse.

“The Central Bank has just done their review, and I’m optimistic that at some time in this financial year they will say we’re fine to go ahead. They’ve done their review, and there are just a few questions we’re dis cussing, but I’m optimistic they’re going to go ahead and release us. I’m hoping sooner rather than later,” he told Tribune Business

Asked whether share holders should be concerned about Bank of The Bahamas re-entering a space where it previously ran into trouble, Mr Brath waite replied: “I think what is essential to point out is all off the issues and pitfalls we had in that period were around us not adhering to risk management protocols, controls and appetite.

“We have restructured the system, restructured our people and introduced new policies to ensure that doesn’t happen. We’ve brought some additional people on board to ensure knowledge gaps have been filled. We’ve done eve rything asked of us and more.”

CALL 502-2394 TO

NOTICE

N O T I C E

EXXONMOBIL EXPLORATION AND PRODUCTION RUSSIA WEST SIBERIA ONSHORE LIMITED

Creditors having debts or claims against the above-named Company are required to send particulars thereof to the undersigned c/o P.O. Box N-624, Nassau, Bahamas on or before 21st day of October, A.D., 2022. In default thereof they will be excluded from the benefit of any distribution made by the Liquidator.

Dated the 3rd day of October, A.D., 2022.

Daniel A. Bates Liquidator

22777 Springwoods Village Parkway Spring, Texas 77389 U.S.A.

LEGAL NOTICE

N O T I C E

EXXONMOBIL

LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) EXXONMOBIL EXPLORATION AND PRODUCTION RUSSIA WEST SIBERIA ONSHORE LIMITED is in dissolution under the provisions of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 29th day of September, 2022 when its Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said Company is Daniel A. Bates, of 22777 Springwoods Village Parkway, Spring, Texas 77389, U.S.A.2

Dated the 3rd day of October, A.D., 2022

HARRY B. SANDS, LOBOSKY MANAGEMENT CO. LTD. Registered Agent for the above-named Company

LEGAL NOTICE

N O T I C E

ESSO NIGERIA (VENTURES) LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by The Registrar General on the 21st day of September, A.D. 2021.

Dated the 3rd day of October A.D., 2022.

Daniel A. Bates Liquidator of ESSO NIGERIA (VENTURES) LIMITED

PAGE 8, Monday, October 3, 2022 THE TRIBUNE

FROM PAGE B1

ADVERTISE TODAY!

EXPLORATION AND PRODUCTION RUSSIA WEST SIBERIA ONSHORE

LEGAL

Bahamasair ‘crippled’ by cabin crew action that hits passengers

that not all those affected would find seats. Avia tion industry sources said this move showed that the industrial action by cabin crew had “crippled” Bahamasair.

Airlines cannot fly without the necessary flight attend ants on board. Mr Cooper said the carrier was trying to discover why the flight attendants, numbering 17-18 persons in total, had not reported for work as sched uled although it was likely connected to negotiations for an industrial agreement with the union representing them, the Airport, Airline and Allied Workers Union (AAAWU).

“You’re spot on,” Mr Cooper replied, when con tacted by this newspaper about the flight cancellations and their cause. “We’ve had industrial action today by the flight attendants.” Asked what sparked the sick-out, he replied: “We’re trying to find out ourselves......

“They’ve pretty much called in sick. We are in negotiations with the AAAWU, and we believe some of this has to do with those elements. It’s for some past years and a year or two in the future, so it’s a present [industrial] agreement” that is being discussed.

Gladstone Adderley, the AAAWU’s president, did not return Tribune Business messages and calls seeking comment before press dead line last night, so it could not be determined if this was a so-called ‘wildcat strike’ that did not have the permis sion and/or backing of union leadership.

However, Mr Cooper affirmed that the sickout had brought Bahamasair’s oper ations to a virtual standstill. “It’s been five to six flights that have been impacted this afternoon; pretty much all the flights have been impacted,” he told Tribune Business. “This was simply because we didn’t have the flight attendants to service the planes. Almost all the flights.

“We’re in communica tion with the union as well as trying to put in place a contingency plan for tomor row [today] and the day after.” This leaves open the possibility of continued dis ruption for Bahamasair and its passengers, and the con tinuation of industrial action by the flight attendants,

which is not what is desired a tourism industry and wider economy still rebounding from COVID-19.

Airports, and the depart ing flight, are the final impressions of a destination for stopover visitors and this will not have been a par ticularly good one for those caught in the turmoil. The action is also ill-timed given that Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, and his team were last week in New York on a major tourism promotional push following a previous one earlier last month on Florida.

Asked whether Baha masair had contacted other Bahamian and international carriers to take its pas sengers, Mr Cooper said: “Normally we’ll reach out to industry partners and see how they can help us out. Obviously we’ll have some elements where they cannot carry all our passengers, but as many as can make it with other carriers to help us out.

“Our customer service is talking to them [affected passengers], and we’re trying to see how we can accommodate them over the next several days to get them to their destination.”

He did not say how many passengers were affected, or provide any details on the likely financial loss to Bahamasair which is due to receive some $32m in tax payer subsidies this fiscal year in addition to the $108m-plus handed out over the previous two for $140m in three years.

One Bahamian airline industry source, speaking on condition of anonym ity because they were not authorised to speak publicly, said of the situation: “This is an action on the part of the stewardesses. The stew ardesses themselves have taken action, and the union is trying to get them back in.

“They’re getting some assistance from the domestic

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, EYRIE DANIELLE BARRETT also known as EYRIE DANIELLE JOHNSON of No. 170 Market Street, New Providence, Bahamas, intend to change my name to DANIELLE JOHNSON. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, New Providence, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that KAUIANA SHANNEL DOWNER of Symonette Sreet, Chippingham, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

operators to complete their flights. I don’t know what triggered the stewardesses’ action. Up until yesterday [Saturday’ everything was running normally. The fact they’ve had to call on the domestic operators is a good indication that they’ve been crippled.”

Besides the three Florida destinations, Bahamasair was also forced to cancel flights to Freeport, Marsh Harbour and Rock Sound/ Georgetown. Passengers on incoming Bahamasair flights also spoke of delays.

A message circulated to Bahamasair staff said: “The trained professionals are working on any possible solution for tomorrow’s [today’s] operation and an update will be given as soon as it is made available.”

Bahamasair, in an offi cial statement, said there were only two outstanding issues to resolve in indus trial agreement negotiations with the AAAWU although it gave no details. Promis ing to provide details on “remedies” and its “recov ery plans” in the coming days, the airline added that the sick-out by 80 percent of scheduled flight attendants who were union members had caused “major disrup tion to the flight schedule”.

It said: “Management outlines that the action was unforeseen and unwar ranted as the airline is in constructive dialogue with union executives and have concluded most matters relating to the agreement. We are disappointed in the actions taken but we are continuing our dialogue and expect a closure to the two remaining items shortly. We have reached out to the Labour Board to assist us in this matter.”

It is possible Bahamasair and the Government may also approach the Supreme Court for an injunction bar ring further action, and an Order that the flight attend ants return to work, as it did over the recent industrial action by Airport Authority staff.

Anthony Kikivarakis, Bahamasair’s chairman, told Tribune Business he was on another call when this news paper contacted him for comment. He said he would call back, but nothing was received before press time last night. Chester Cooper also did not reply to this newspaper’s message.

NOTICE is hereby given that THOMAS O. MARRAZZA of P. O. Box EL-25178, La Bougainvillea, Eleuthera, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

31-Aug-2022

31-Aug-2022

31-Jan-2022 31-Jan-2022 31-Jan-2022

THE TRIBUNE Monday, October 3, 2022, PAGE 9

FROM PAGE B1 BAHAMASAIR BOEING 737

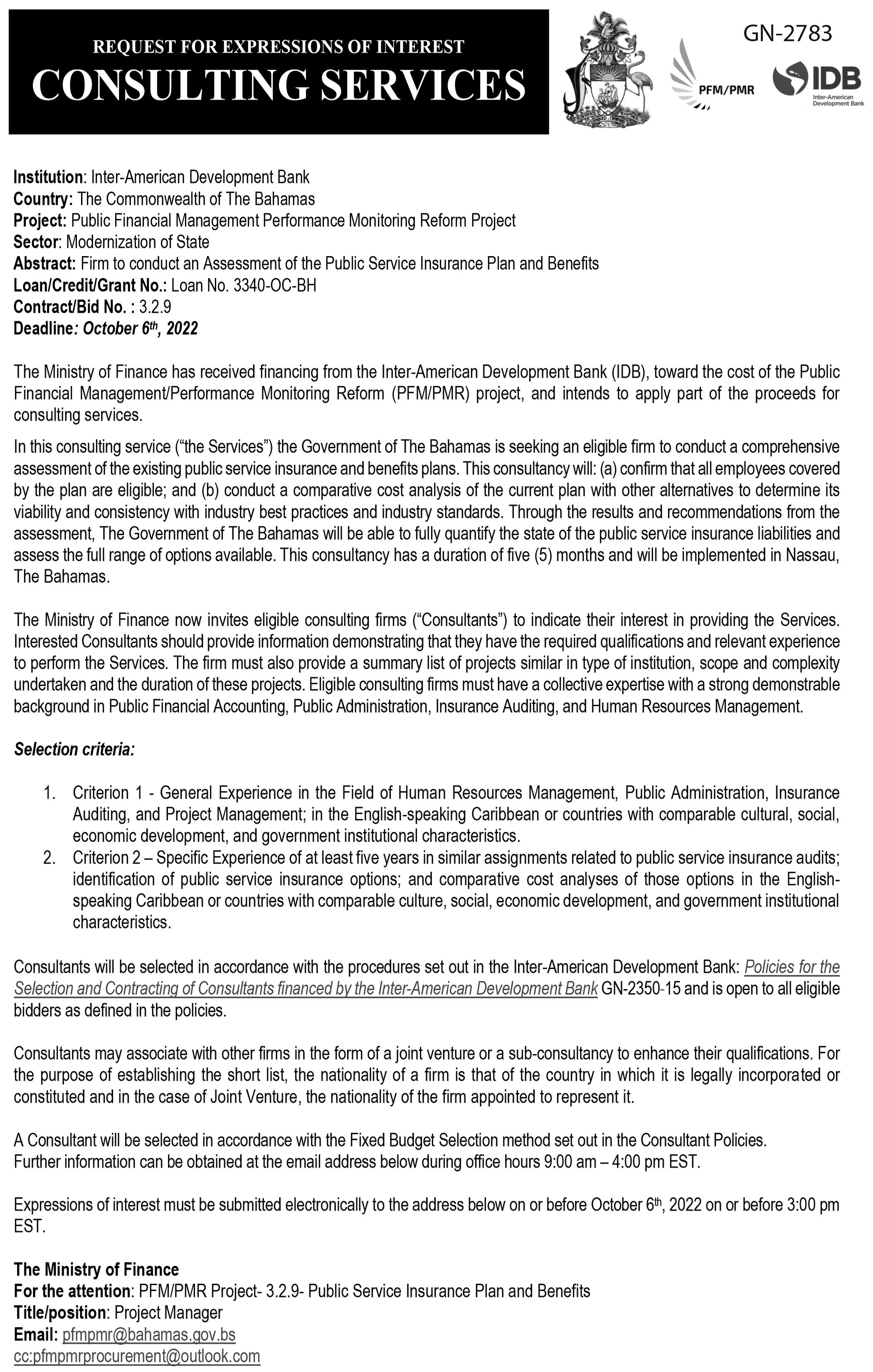

NOTICE FRIDAY, 30 SEPTEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2633.40-0.060.00405.1618.18 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.90 6.900.00 5000.2390.17028.92.46% 53.0039.95 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.20Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.851.30Bank of Bahamas BOB 2.85 2.850.00 0.0700.000N/M0.00% 6.205.75Bahamas Property Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 9.75 9.750.00 0.3690.26026.42.67% 4.152.82Cable Bahamas CAB 3.95 3.950.00 -0.4380.000-9.0 0.00% 10.656.75Commonwealth Brewery CBB 10.35 10.350.00 0.1400.00073.90.00% 3.652.27Commonwealth Bank CBL 3.58 3.580.00 0.1840.12019.53.35% 8.255.29Colina Holdings CHL 8.23 8.230.00 0.4490.22018.32.67% 17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 0.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.04 3.080.04 0.1020.43430.214.09% 11.288.51Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.6711.25Emera Incorporated EMAB 10.01 9.89 (0.12) 0.6460.32815.33.32% 11.5010.00Famguard FAM 10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 3.99 3.990.00 0.2030.12019.73.01% 11.009.01Finco FIN 11.00 11.000.00 0.9390.20011.71.82% 16.5015.50J. S. Johnson JSJ 15.50 15.500.00 0.6310.61024.63.94% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.0097.49BGRS FX BGR106036 BSBGR106036197.4997.490.00 100.03100.03BGRS FL BGRS99031 BSBGRS990318100.03100.030.00 101.5599.72BGRS FX BRS124228 BSBGR1242282101.42101.420.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70% MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 4.30% 4.66% 4.31% 5.55% 23-Sep-2031 13-Jul-2028 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 5.40% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 4-Aug-2036 15-Oct-2049 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Jan-2022

31-Aug-2022

INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022

4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323 2330 (242) 323 2320 www.bisxbahamas.com

rolled

The latter was due for redemption or payout by the Government at endAugust, which would have required the promissory note’s replacement with liquid cash provided by the Bahamian taxpayer - the final step in the bail-out. However, Bank of The Bahamas’ annual financial revealed: “The promissory note with maturity date of August 31, 2022, was extended by three years to August 31, 2025, at 4 percent fixed interest rate with quarterly interest payments.”

Bank of The Bahamas’ balance sheet ascribed a $170.171m value to the promissory note, meaning that the annual interest bill attached will be $6.8m. This sum is supposed to be paid by Bahamas Resolve from selling assets upon which the toxic loans are secured, but if it fails to generate a sufficient sum then the Government - via the Baha mian taxpayer - has to step in and make the payment.

Mr Wilson said the maturity extension will give Bahamas Resolve, in particular, as well as the Government extra time and breathing room to realise more funds from selling-off the loan collateral. Previous projections have suggested that Bahamas Resolve could realise up to $67m from these secured assets, which would substantially reduce the Government and taxpayer’s ultimately liability to Bank of The Bahamas down to around $100m.

“I think it’s really a ques tion for Resolve,” Mr Wilson explained of the roll-over. “Resolve will generate sufficient funds to partially pay down the promissory note. Resolve had a couple of transactions lined up that didn’t close in time. The idea was Resolve would generate money from the sales [of the assets] to pay down the note, and after a period of time the Government would step in and take over the note com pletely and retire it.

“The assets of Resolve, ones they could have

realised, it’s a little more trickier in the short term to realise those assets. It’s much more com plex.” Some have become embroiled in legal action, such as the Summerwinds Plaza on Tonique Williams Highway that was pledged as collateral by former PLP cabinet minister, Leslie Miller, and upon which more than $30m is alleged to be owed.

Meanwhile, Mr Wilson said the Government’s 2022-2023 Budget had made no provision to redeem the promissory note and replace it by injecting cash into Bank of The Baha mas. “It was not provided for in the fiscal estimates,” he told Tribune Business.

The maturity extension will also benefit the Gov ernment’s cash flow, which has been squeezed by the $11bn-plus national debt and associated higher inter est payments.

The roll over represents a change from the Govern ment’s last Fiscal Strategy Report, released at endJanuary 2022, which said a $100m provision had been

by

included in the fiscal plans to repay the Bank of The Bahamas promissory note.

“The outstanding second promissory note of Baha mas Resolve to the Bank of The Bahamas, becomes due in August 2022, and represents a fiscal cost to the Government which has been incorporated in the forecasts. Although Resolve has been able to make this semi-annual payment on the promis sory note, which is $5.878m quarterly, it estimates being able to meet at least 40 per cent of the $167.7m liability through loan recoveries,” the report said.

“Therefore, the Govern ment has provisioned in the estimates for 2022-2023 an additional outlay of $100m. The Government contin ues to work with Resolve to establish greater opera tional transparency through regular financial reporting and publication of asset sales information.” That 40 percent recovery estimate, which was included in the Minnis administration’s last Fiscal Strategy Report, is equivalent to $67m.

Based on Bank of The Bahamas’ 2022 financials, the promissory note has been renewed on terms more favourable to the BISX-listed bank and its shareholders than the tax payer. The interest rate has been increased from 3.5 percent annually to 4 percent, with payments now quarterly rather than semi-annually. The Govern ment, via the Treasury and National Insurance Board (NIB), owns 82.6 percent of the bank.

Meanwhile, Kenrick Brathwaite, Bank of The Bahamas’ managing direc tor, told Tribune Business that the promissory note’s repayment extension was “not a big deal” for the institution as it has no need for extra cash given the high liquidity levels both itself and the wider commercial banking system face.

“They’ve actually rescheduled the credit as opposed to them paying it out,” he confirmed. “We’ve really rescheduled it and renegotiated it. Liquidity is very good in the system. We don’t need the cash and

liquidity for the balance sheet, so it’s not really a big deal for us.’

One financial sector source, speaking on condi tion of anonymity because they were unauthorised to speak publicly, said of the roll-over: “They’re [the Government] not in a posi tion to redeem that at all. That’s going to be perpet ual. We’re wasting our time if we think that’s redeem able. We won’t see that in our lifetime unless one of the international agencies puts pressure on them.”

Bank of The Bahamas’ financials said: “As a part of the transaction, the bank received an irrevocable Letter of Support from the Government. The Letter of Support pledged the Gov ernment’s financial support of Resolve to enable it to satisfy its obligations under the promissory note and confirms that, in the event of default by Resolve, the bank can seek to recover outstanding balances from the Government.”

tiDes For nassau

Today Tuesday Wednesday Thursday

Friday Saturday Sunday

1:58 a.m. 2.6 8:06 a.m. 0.8

2:41 p.m. 3.3 9:19 p.m. 1.0

3:10 a.m. 2.6 9:19 a.m. 0.8 3:51 p.m. 3.3 10:26 p.m. 0.9

4:21 a.m. 2.8 10:31 a.m. 0.7 4:55 p.m. 3.4 11:26 p.m. 0.7 5:25 a.m. 3.0 11:37 a.m. 0.6 5:54 p.m. 3.4

6:22 a.m. 3.2 12:19 a.m. 0.5 6:46 p.m. 3.5 12:35 p.m. 0.4

7:13 a.m. 3.4 1:07 a.m. 0.3

7:34 p.m. 3.4 1:29 p.m. 0.3

THE TRIBUNE Monday, October 3, 2022, PAGE 11 8:00 a.m. 3.5 1:51 a.m. 0.1 8:19 p.m. 3.3 2:18 p.m. 0.2

$167m BOB payout

over

Gov’t FROM PAGE B1 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 64° F/18° C High: 84° F/29° C TAMPA Low: 65° F/18° C High: 85° F/29° C WEST PALM BEACH Low: 69° F/21° C High: 86° F/30° C FT. LAUDERDALE Low: 71° F/22° C High: 86° F/30° C KEY WEST Low: 75° F/24° C High: 84° F/29° C Low: 74° F/24° C High: 86° F/30° C ABACO Low: 73° F/23° C High: 85° F/29° C ELEUTHERA Low: 75° F/24° C High: 88° F/31° C RAGGED ISLAND Low: 79° F/26° C High: 85° F/29° C GREAT EXUMA Low: 77° F/25° C High: 87° F/31° C CAT ISLAND Low: 76° F/24° C High: 88° F/31° C SAN SALVADOR Low: 77° F/25° C High: 86° F/30° C CROOKED ISLAND / ACKLINS Low: 79° F/26° C High: 85° F/29° C LONG ISLAND Low: 78° F/26° C High: 85° F/29° C MAYAGUANA Low: 79° F/26° C High: 86° F/30° C GREAT INAGUA Low: 79° F/26° C High: 87° F/31° C ANDROS Low: 75° F/24° C High: 87° F/31° C Low: 75° F/24° C High: 84° F/29° C FREEPORT NASSAULow: 72° F/22° C High: 87° F/31° C MIAMI THE WEATHER REPORT 5-Day Forecast Variable clouds with a shower High: 86° AccuWeather RealFeel 93° F The exclusive AccuWeather RealFeel Temperature® is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Mostly cloudy with showers around Low: 74° AccuWeather RealFeel 75° F Mostly sunny High: 85° AccuWeather RealFeel Low: 73° 90°-78° F Sunshine and a few clouds High: 85° AccuWeather RealFeel Low: 77° 91°-81° F Partly sunny with a stray t‑storm High: 84° AccuWeather RealFeel Low: 78° 94°-80° F Some rain and a t‑storm in the p.m. High: 86° AccuWeather RealFeel 94°-82° F Low: 79° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 88° F/31° C Low 73° F/23° C Normal high 86° F/30° C Normal low 74° F/23° C Last year’s high 88° F/31° C Last year’s low 74° F/24° C As of 2 p.m. yesterday 1.24” Year to date 47.58” Normal year to date 29.41” Statistics are for Nassau through 2 p.m. yesterday Temperature Precipitation sun anD moon

Full Oct. 9 Last Oct. 17 New Oct. 25 First Nov. 1 Sunrise 7:03 a.m. Sunset 6:55 p.m. Moonrise 2:47 p.m. Moonset 12:20 a.m.

High Ht.(ft.) Low Ht.(ft.)

‑‑‑‑‑ ‑‑‑‑‑

marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: N at 6 12 Knots 2 4 Feet 10 Miles 85° F Tuesday: NNW at 7 14 Knots 3 5 Feet 10 Miles 84° F ANDROS Today: NW at 7 14 Knots 1 2 Feet 10 Miles 85° F Tuesday: NNE at 8 16 Knots 1 2 Feet 10 Miles 84° F CAT ISLAND Today: W at 6 12 Knots 1 3 Feet 4 Miles 84° F Tuesday: VAR at 2 4 Knots 1 3 Feet 10 Miles 85° F CROOKED ISLAND Today: WSW at 6 12 Knots 1 3 Feet 10 Miles 86° F Tuesday: NW at 3 6 Knots 1 3 Feet 10 Miles 86° F ELEUTHERA Today: W at 4 8 Knots 2 4 Feet 10 Miles 85° F Tuesday: ENE at 3 6 Knots 1 3 Feet 6 Miles 85° F FREEPORT Today: N at 6 12 Knots 1 2 Feet 10 Miles 83° F Tuesday: N at 8 16 Knots 1 3 Feet 10 Miles 82° F GREAT EXUMA Today: SW at 6 12 Knots 0 1 Feet 10 Miles 85° F Tuesday: W at 4 8 Knots 0 1 Feet 10 Miles 86° F GREAT INAGUA Today: SW at 4 8 Knots 1 2 Feet 6 Miles 86° F Tuesday: NNW at 3 6 Knots 1 2 Feet 6 Miles 87° F LONG ISLAND Today: WNW at 6 12 Knots 1 2 Feet 3 Miles 86° F Tuesday: WNW at 4 8 Knots 1 2 Feet 10 Miles 86° F MAYAGUANA Today: SW at 6 12 Knots 2 4 Feet 6 Miles 86° F Tuesday: W at 3 6 Knots 2 4 Feet 5 Miles 85° F NASSAU Today: NNE at 3 6 Knots 0 1 Feet 10 Miles 85° F Tuesday: NNE at 7 14 Knots 1 2 Feet 10 Miles 84° F RAGGED ISLAND Today: NW at 6 12 Knots 1 2 Feet 10 Miles 86° F Tuesday: NW at 4 8 Knots 0 1 Feet 10 Miles 86° F SAN SALVADOR Today: W at 6 12 Knots 1 2 Feet 10 Miles 86° F Tuesday: S at 2 4 Knots 0 1 Feet 10 Miles 86° F uV inDex toDay The higher the AccuWeather UV IndexTM number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 L H tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S EW 7 14 knots N S EW 6 12 knots N S EW 8 16 knots N S W E 6 12 knots N S EW 6 12 knots N S EW 4 8 knots N S EW 6 12 knots N S EW 7 14 knots | Go to AccuWeather.com

FTX unveils local plans to insolvency specialists

CRYPTO currency exchange, FTX Digital Markets, unveiled its plans for The Bahamas during the first post-COVID event held by the group repre senting local restructuring and insolvency specialists.

The Restructuring and Insolvency Specialists Asso ciation (RISA) Bahamas, in a statement, said members, prospective members and guests assembled at the

Royal Blue Golf Club at Baha Mar. Valdez Russell, vice-president of communi cations and corporate social responsibility at FTX Digital Markets, provided details on the exchange’s ambitions.

Event sponsors included Intelisys Ltd, EY, Lennox Paton and Deloitte & Touch. The drink spon sors were Providence Law, McKinney Bancroft & Hughes and The Glasgow Family.

RISA Bahamas said a major focus is professional education and training. It is also a professional indus try association with the Bahamas Financial Ser vices Board (BFSB), as well as a member of INSOL. INSOL, based in the UK, is a worldwide federation of national associations for accountants and attorneys who specialise in turna round, restructuring and insolvency, and has over 10,000 members globally.

PAGE 12, Monday, October 3, 2022 THE TRIBUNE