BISX-listed firm pledges qualified audit ‘clear up’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government is employing satellite imagery and artificial intelligence (AI) to boost revenue collections that are 4-5 per cent ahead of projections for the 2022-2023 fiscal year to-date, a top official disclosed yesterday.

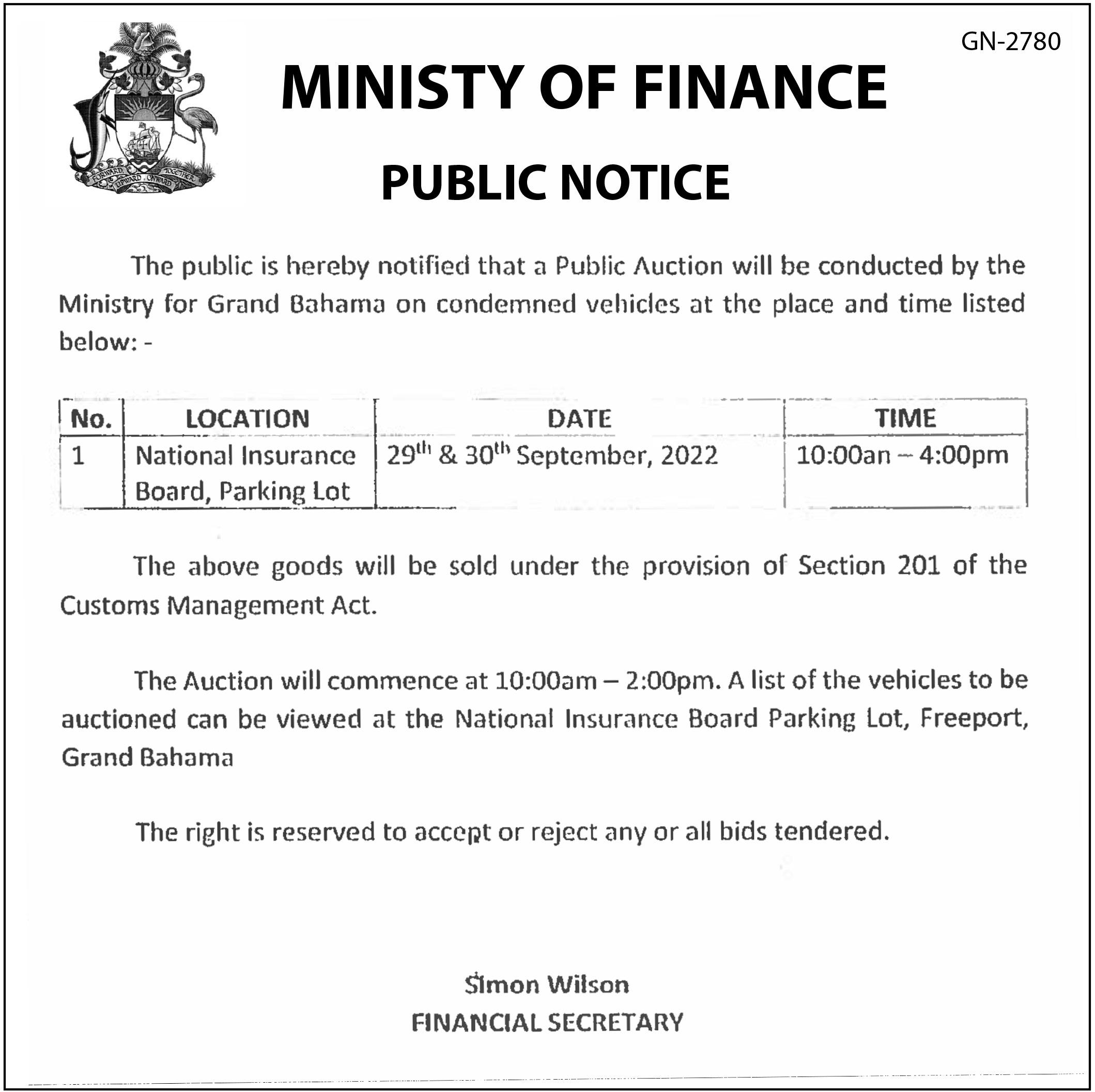

Simon Wilson, the Min istry of Finance’s financial secretary, told Tribune Business that satellite imagery was especially effective in detecting undeclared property con struction in the Family Islands where “explosive growth” in one unnamed area of Abaco had resulted in 200 new homes being builtDeclaringpost-Dorian.that this has reduced real property tax-related work that pre viously took two to three years to just six weeks, he added that the Depart ment of Inland Revenue

(DIR) was increasingly looking to AI and tech nology-based solutions to select high-risk taxpayers who should be subjected to audits to determine if they are paying the correct sums in VAT and Business LicenceRevealingfees. that the Gov ernment has collected $560m in total revenues for the fiscal year to-date, prior to yesterday’s deadline for VAT monthly and quar terly registrants to submit September’s filings, Mr

Wilson told this newspaper that some $260m-$270m or up to 48 percent of this sum had been generated by Bahamas Customs via import VAT, tariffs and ExciseWhileTax.no targets have been set, he added that the Government’s “ulti mate goal” - through increased tax compli ance and enforcement that ensures all pay their fair share - is to lower the burden and “effective tax rate” faced by Bahamians

by broadening the base of payers and tapping into new revenue streams.

Warning that it is still too early to determine how the Government’s revenues are trending, with this month’s VAT collections set to have a significant impact on the 2022-2023 first quarter outcome, Mr Wilson said nevertheless: “We went in slightly ahead of Budget. I would say we

‘Stars are aligning’ over $3m Nassau Gas raise

By andNEILHARTNELLYOURIKEMP Tribune Business Reporters

A BAHAMIAN pro pane gas (LPG) dealer yesterday said “the stars are aligning” as it seeks up to $3m from Bahamian investors to finance its ambitious growth strategy throughout the country.

Mark Newell, Nassau Gas & Tanks principal,

told Tribune Business the company’s offering of up to one-third of its value via the ArawakX crowdfund ing platform is coinciding with the easing of cost pres sures that have strained both himself and rivals throughout the COVID pandemic.Disclosing that the com pany’s annual revenues are down 50 percent compared to their $5.9m record, after

the market squeeze forced a suspension of wholesale supplies to other provid ers, he added that raising the maximum $3m will produce “an immediate 30 percent” top-line growth of around $1m per annum - a number he described as “conservative”.“Wewantto get back to the good old days,” Mr Newell told this news paper, pointing out that

unlike a start-up, Nassau Gas & Tanks has been in business since 2004 having built up a retail client base that is split 50/50 between residential and com mercial customers. The latter includes the likes of hotels, restaurants and laundromats.Withdemand for LPG unlikely to moderate, he

Don’t bail-out stricken parents, banks warned

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN financial institutions were yester day ordered not to bail-out financially stricken parents or affiliates as part of the “recovery plans” they have to submit to the Central Bank by mid-2023.

The regulator, issuing draft guidelines on plans banks and trust com pany licensees, as well as credit unions, must draw up for combating a solvency crisis and pulling them selves back from the brink,

said the health of Bahamasbased institutions must be placed ahead of the wider group’s.“Where the local entity requires capital and the group is sound, the Central Bank expects, but does not require, a contractual com mitment that the group will recapitalise its subsidiary. If the deficiency is small, and the supervised finan cial institution remains well above its regulatory capi tal requirement, then local actions such as reduction or suspension of dividends, or

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BISX-listed company’s top executive yesterday pledged that accounting woes which led to auditors issuing a “qualified” opin ion on its 2021 full-year results will be “cleared up” in time for this year’s report.Julian Brown, Bench mark (Bahamas)

president and chief execu tive, blamed the switch to a new reporting plat form for PKF Bahamas’ revealing there was an “unreconcilable” $337,369 discrepancy in the $18.439m sum owed to the financial services provider’s clients. The accounting firm and its lead audit part ner, Renee Lockhart, in the opinion attached to

‘Best bang for dollar’ to counter rate hikes

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS must give all visitors “the best bang for their dollar and ‘A’-plus customer ser vice” as the most effective counter to inflation and continuing US interest rate hikes, a senior tourism offi cial said yesterday.

Kerry Fountain, the Bahamas Out Island Pro motion Board’s executive director, told Tribune

Business that this nation must focus on only “what we can control” after the US Federal Reserve hiked its base interest rate by 0.75 percentage points in a bid to rein in soaring inflation that has also hit this country via its Voicingimports.optimism that pent-up travel demand will still offset the impact of higher prices and borrow ing costs in the US, which will combine to further squeeze disposable income

SIMON WILSON

business@tribunemedia.net THURSDAY, SEPTEMBER 22, 2022

SEE PAGE B6 SEE PAGE B4

SEE PAGE B10

Gov’t goes high-tech for taxes 5% up on Budget

SEE PAGE B7 SEE PAGE B4 • Satellite images, AI employed to boost revenues • ‘Explosive growth’ in new builds, vacation rentals • $560m collected so far, with 48% from Customs • Benchmark auditors found ‘unreconcilable’ $337k discrepancy • Top executive blames accounting platform switch for opinion • But asserts impact ‘not material’ against $16m-plus equity $6.25 $6.29 $6.31 $6.30

GOVERNANCE OF SOES CRITICAL TO ‘END GAME’

Ihave consistently argued that Baha mian policymakers must move urgently to implement structural reforms so as to influence the country’s economic fortunes.Inthe first article in this series, I noted: “The Gov ernment and state-owned enterprises (SOEs) must pay greater attention to effective governance as a means of unlocking criti cal value for citizens and taxpayers.” The march to economic resilience requires all such strategies to be on deck. Fiscal con solidation alone will be insufficient.According to a recent white paper, ‘Resil ience for sustainable, inclusive growth’ by the World Economic Forum and McKinsey, “lead ing [international] organisations estimate that a significant share of annual GDP growth will depend on the degree to which organisations and societies develop opportunities.ture,thecles”“developingwhatingbroadeningcessful,everyalignTourism’sgrowth”.sustainableforience‘resiliencerequiredand“Sufficientresilience…investmentnewcapabilitiesaretobuildanewmuscle’…Resilisthestrategicstanceachievinglong-term,andinclusiveTheMinistryofongoingeffortswithsuchthinking.Whileonecannotexpectinitiativetobesucthefocusonanddeepenopportunitiesbeyondexiststodayiswhatresiliencemusisabout.IbelieveMinistryofAgriculespecially,hassimilar

The governor’s speech Reform is critical to achieving this much-touted resilience, and the recentlydelivered speech by John Rolle, the Central Bank

of the Bahamas gover nor, underlines this. It was a very insightful speech, providing important perspectives on the coun try’s economic condition together with the decisions and actions required. His declaration that The Baha mas is not in sovereign debt distress emerged as the major news item from the speech.While it is an important statement to hear from the governor given prevail ing discussions, on careful analysis it is a matter of much less importance when compared to the multiple policy and struc tural matters outlined or alluded to. State-owned enterprises or SOEs, which received about 15 per cent of the record revenue generated by Bahamian taxpayers during the 20212022 fiscal year, must be prime candidates for reform and building the necessary economic resilience.

Based on the governor’s speech, in my opinion, there are a number of criti cal points that policymakers and the public should take careful note of. The national debt, as a percent age of Bahamian gross domestic product (GDP) or economic output, is expected to settle in the “high 80 percent range”, which holds serious impli cations for public finance reforms. The discussions around tax reform are more complex than the discourse until now has suggested, and the issue may be a more nuanced matter than we have so far accepted.

Mr Rolle also clari fied that prior US dollar borrowings by the Government were nec essary to shore up the country’s external reserves and, by extension, the one:one exchange rate peg with the US dollar. And

Hubert edwards

historically-high exter nal reserves now position the Government well to pursue the majority of its borrowing needs domesti cally. While this is good, the present elevated exter nal reserves are still only sufficient to facilitate administrative liberalisa tion of exchange controls.

All this is happening in an environment where banks prefer short-term lending to government, private credit is not growing and there is high excess liquidity, all with important implica tions for financial stability. The important takeaway is that the country is in a great position to start making bolder moves for long-term benefit.However, we must be mindful that we are still not fully out of the woods, and a comprehensive approach that recognises and acknowledges the headwinds and structural weaknesses, while under girded by prudence and reasonable expectations, must be the order of the day. We will return to Mr Rolle’s speech for a deeper analysis later.

The governance effect Successive administra tions have outlined the need to reform SOEs. Over

the last five years, budg eted spending on these enterprises has averaged slightly more than $400m. Under the previous Minnis administration, there was a stated strategy to reduce support by $100m over four years. But the emergence of COVID-19, and con sequent weakening of the Bahamian economy, argu ably created the need for greater support over the past two years.

Until the economy returns to sustainability, cutting SOE subsidies may not be an optimal solution. Given limited resources, the call to make these organisations work more effectively remains a viable one. Creating greater cor porate discipline to secure more effective and effi ciently-managed SOEs, and consequently starting the process of reduced reli ance on central government financial support, is critical and an important starting place for unlocking eco nomic value.

This aligns with the thinking from the World Economic Forum and McKinsey paper cited above. “Resilience pertains to public and private sector organisations, as well as to whole economies and soci eties,” they argued. The reality is that the country cannot achieve economic resilience without the same being evident in all sectors.

“The resilient stance for organisations must be forward-looking, antici pating disruption rather than simply reacting, but continuously learning and amending based on experi ence,” they added. This is what effective corporate governance facilitates –sound risk culture, robust strategic management and planning, effective risk management, extraordinary

transparency, accountabil ity and value creation.

One of the major chal lenges in the 2022-2023 fiscal cycle is, that while the economy is improv ing, resources will remain limited. Home runs will therefore be hard to come by, and progress will demand creative work and reforms to secure real value. The extent to which these SOEs can truly be reformed to operate at bestin-class levels must start with the quality of corpo rate governance oversight.

The end game Ultimately, the desired output is to reduce depend ency and maximise utility and facilitation. Where the entity is operating well, even with support, the use of that resource becomes more effective as the output is creating tangible value and reducing dependency on central government.

With improved perfor mance, the ability to “tax” through these entities by better aligning fees with market value becomes a more viable possibility. It will simply be easier to convince users of a value proposition that today is a near impossibility, given the state and performance of these agencies and corporations.Whether contributions are reduced or not, the above outcome is funda mental. Improving the state of SOEs is fundamental to rescuing the economy, given their general mandate for facilitating productive activities and influencing the ease of doing business, which in turn holds critical implications for national growth.The objective here is about creating resilience in all SOEs, readying them for the next economic shock by developing sound insti tutional capabilities. The World Economic Forum “emphasises the long-term ability of organisations and economies to create the capabilities needed to deal with disruptions, withstand

the shocks, and continu ously adapt as disruptions and crises arise over time”.

Policymakers should bear in mind Mr Rolle’s conclud ing remarks. He said: “The growth outlook is expected to reduce back into line with The Bahamas’ medium and longer-term potential.” He clinically noted that “the policy challenge is to improve the medium-term growth potential”. Improv ing corporate governance, building organisational competency, and reducing wastage of resources will all be necessary elements of the playbook in achieving his latter point. To borrow a phrase from the white paper, “it is the strategic prerequisite for long-term, sustainable, and inclusive growth”.Tosecure and maximise economic value, policymak ers should acknowledge long-standing corporate governance weaknesses, and move to fix them by causing fundamental changes that eliminate unacceptable practices and create transformative shifts in the culture of trans parency, accountability, performance and strategic oversight in SOEs and the wider public sector.

NB: Hubert Edwards is the principal of Next Level Solutions (NLS), a manage ment consultancy firm. He can be reached at info@ tionsbahamas.com.availableThisDevelopmentance’sforalsostrategiclaundering,consulting,development,policyment,enterpriseservicesfinance.(GRC),ance,Henlsolustionsbahamas.com.specialisesingovernriskandcomplianceaccountingandNLSprovidesintheareasofriskmanageinternalauditandandproceduresregulatoryanti-moneyaccountingandplanning.HubertchairstheOrganisationResponsibleGovern(ORG)EconomicCommittee.andotherarticlesareatwww.nlsolu

SBDC TEAMS WITH MINISTRY ON $50K FISHERIES, FARMING GRANTS

A GOVERNMENT min istry has teamed with the Small Business Develop ment Centre (SBDC) to offer farming and fisheries businesses access to up to $50,000 in grant funding.

The partnership with the Ministry of Agriculture, Marine Resources and Family Island Affairs is part of an initiative, unveiled earlier this year, that will see some $1m in grants distributed to the agribusi ness and fisheries industries via the two public sector agencies. Some 30 percent will be allocated to poultry farmers, as the Government seeks to boost that specific sector, and both start-ups and established businesses will be available for the funding.Theinitiative is known as the Sustainable Food Growth Grant, and is part of efforts to boost Bahamian food security by increas ing domestic production. The Ministry of Agricul ture, Marine Resources and Family Island Affairs, in a statement, said it is designed to help reduce the country’s $1bn food import bill, plus mitigate supply chain disruptions and rising food costs while encour aging the participation of

women and youth in food production.ClaySweeting, minis ter of agriculture, marine resources and Family Island affairs, said: “This is an exciting opportunity for existing and budding entrepreneurs to expand their businesses and, at the same time, contribute to the development of food systems throughout our country. We are hoping that many Bahamians are compelled to apply for this grant and assist The Bahamas in obtaining and bolstering food security.

“This grant can be life-changing for many Bahamians because it will not only help the economy, but will also assist with the goal of Bahamians feeding themselves. Agribusiness will also be integrated into this programme to ensure that we develop not just fishermen and farmers, but business owners as well. I am excited about what we will be able to accomplish, and I want to thank the SBDC for helping to drive this impactful initiative.”

Samantha Rolle, the SBDC’s interim executive director, added: “When we think about how do we

PAGE 2, Thursday, September 22, 2022 THE TRIBUNE

by SEE PAGE B5

By YOURI KEMP Tribune ReporterBusiness ykemp@tribunemedia.net

A CABINET minister yesterday affirmed that the proposed $535m Baha mas Power & Light (BPL) refinancing is not being “pursued at this time” but was less definitive on Shell’s New Providence power plant

Alfreddeal.Sears KC, min ister for public works and utilities, who is ultimately responsible for BPL, said: “The Rate Reduc tion Bond, as has been announced, is not a meas ure that we are pursuing at this time and it would have been announced by minister Halkitis. We are currently engaged in a number of measures to secure more competitive fuel and incor porate renewables. We have a major solar plant, which is being prepared for NewLegislationProvidence.”togive legal underpinning to the Rate Reduction Bond was passed under the last Christie administration, with nowprime minister Philip Davis having primary responsibil ity for it. Had it proceeded, debt securities would have been issued to Bahamian and international inves tors to raise the necessary capital to refinance BPL’s then-$321m debt; pay for

key transmission and dis tribution overhauls; and deal with legacy pension deficits and environmental liabilities.Thebond principal, and associated interest pay ments, would have been secured against - and paid by - electricity bill pay ments by BPL’s customers. However, this would have required a tempo rary increase in customer bills until improvements in BPL’s electricity costs kicked in to offset this, and the Minnis administra tion is understood to have declined last June to give the Rate Reduction Bond the go-ahead for fear of its impact on the upcoming election.The financial markets have now moved against the Rate Reduction Bond, with interest rates soaring as the US Federal Reserve and other central banks move to fight inflation. This means BPL’s bond would attract higher rates, leading to even greater electricity prices for consumers, which was why Prime Minister Philip Davis QC indicated previously it was unlikely to proceed.MrSears, though, was less clear as to the fate of the New Providence power plant deal with Shell North America, which also remained to be closed when the Minnis administration

ALFRED SEARS KC

left office in September last year. “I’m not saying any thing is off,” he said. “What I am saying is that we are aggressively pursuing meas ures to incorporate solar, because the public policy of the country is to achieve 30 percent of power gen eration by renewables by 2030.”He added that this was “doable”, saying: “We are doing it in Ragged Island. A number of pri vate facilities and investors are putting up solar plants on some of our cays, and we have plans to put solar

installations in Acklins, Crooked Island, Maya guana, Grand Bahama. We have up to over a 60 Mega Watt (MW) facility, which is currently being prepared for New PressedProvidence.”toclarify state ments made by Shevonn Cambridge, BPL’s chief executive, who told this newspaper that the Shell North America deal is in “abeyance,” Mr Sears said he was unaware of what was said and declined to comment.MrCambridge had pre viously told this newspaper

that while “nothing has been taken off the table” when it comes to solving the BPL’s woes, “no active work” or negotiations are taking place on either the Rate Reduction Bond (RRB) or outsourcing New Providence’s baseload generation needs to Shell NorthAskedAmerica.about the status of the proposed multi-fuel power plant and liquefied natural gas (LNG) terminal at Clifton Pier, the latter of which was supposed to be financed and developed by Shell North America, the BPL chief said: “There’s no active negotiations.”

As to whether this meant the deal was dead, Mr Cam bridge replied: “No, that doesn’t meant that. It only means it’s in abeyance at the moment; that’s the best way of putting it. I’m not aware of any active negotiations.”

It was a similar story with regard to the $535m BPL refinancing left behind by the Minnis administration.

“The Rate Reduction Bond, that, too, is kind of in abeyance,” Mr Cambridge told Tribune Business “There’s no active work being done on the Rate Reduction Bond. All alter natives are being explored, including the Rate Reduc tion Bond. Nothing has been taken off the table, but nothing has been final ised. We are looking at the

Erosion at Junkanoo Beach under review

By YOURI KEMP Tribune ReporterBusiness ykemp@tribunemedia.net

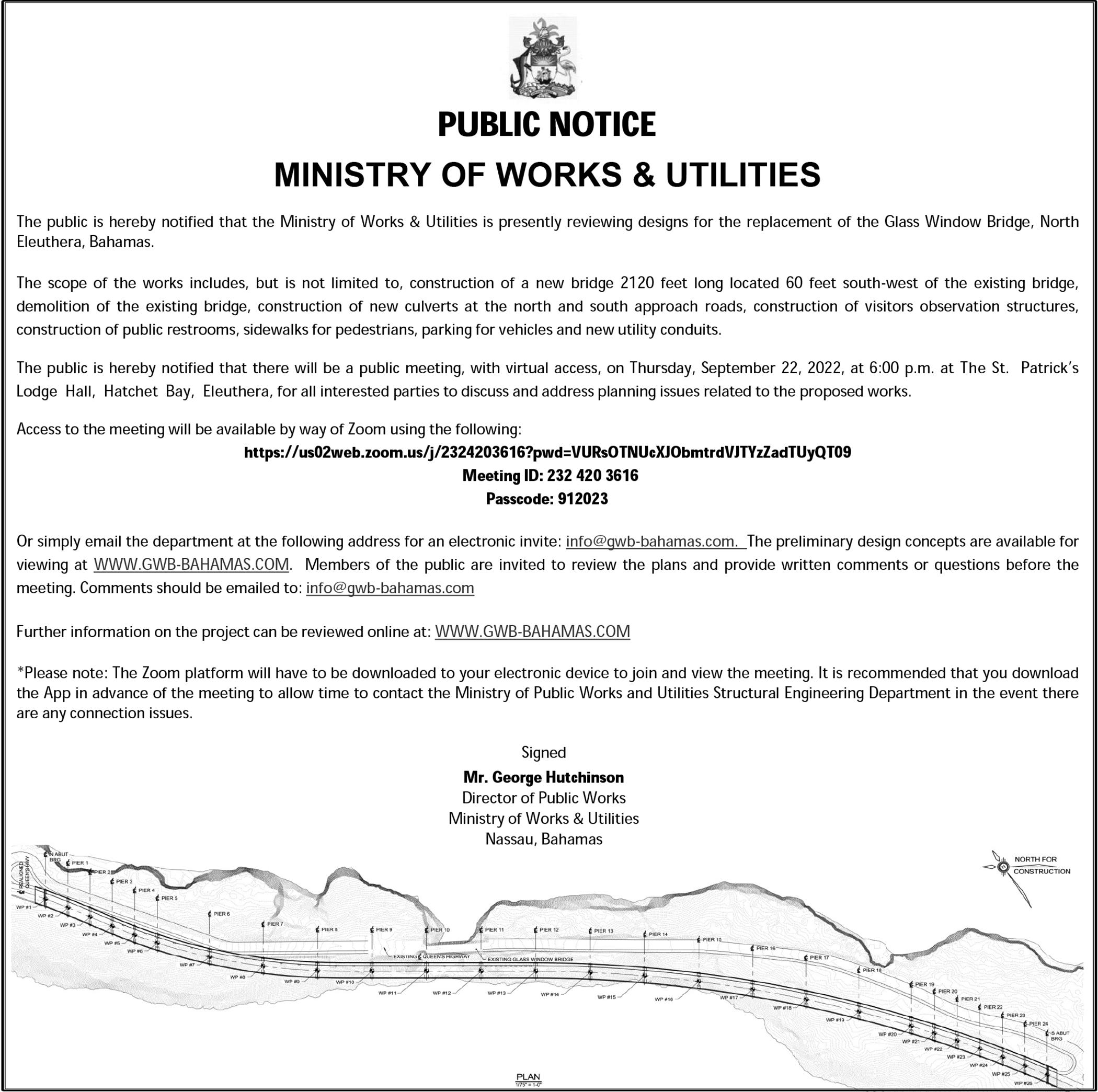

THE Government has been provided with an update on the Bahamas Building Code review that is being undertaken by an international engineering consultant, a Cabinet minis ter said Alfredyesterday.SearsKC, min ister for public works and utilities, speaking at a workshop on climate resilient coastal manage ment and infrastructure, said an enhanced Building Code is among the “adap tation measures” that the Government is seeking to

implement to combat cli mate change fall-out in Hurricane Dorian’s wake.

“With the consultants we have been looking at the building code. Mott McDonald have just pro vided an update on the review of the Building code and the recommendations that they will be making to us,” he Onceadded.Mott McDon ald submits its final Building Code report “we will engage with various stakeholders and get their input, then consider the feedback of stakeholders,” Mr Sears added. “And then we will take a number of recommendations for amendments to the

Cabinet for the Cabinet’s consideration.“Construction, to a great extent, because we are not manufacturing the material ourselves, depends on the global stream of commerce. And when you have disrup tion in the supply chain due to the war in Ukraine, the pandemic and other fac tors, it contributes to the increase in costs. We are therefore doing the very best that we can to source material from more closer locations, so that we are not as impacted by the trans portation disruption.”

Also under review is the level of degradation and erosion at Junkanoo Beach, located between the Pointe and Arawak Cay at the

western entrance to down town Nassau. Mr Sears said the Government had noticed the level of break water protection from rough seas at the entrance to Nassau Harbour is inad equate, resulting in damage to the seawall and erosion of the “Thebeach.whole point of doing the base study is, at the end of that, to come

up with concrete measures to improve and strengthen the boardwalk such as more effective seawalls, such as more breakwater infrastructure to keep the high tides away, and also measures that will minimise and, hopefully, eliminate the sediment movement because we are losing a lot at the beach,” Mr Sears said.

best option given the cur rent“Whethermarket. you look at the fuel market and what’s going on there, the bond market and what’s going on there, that’s going to affect our decision - whether we go with fuel hedging, whether we go with the Rate Reduction Bond, whether we go with a loan. The experts are looking at it, and are going to come back with whatever recom mendations are best.”

Tribune Business under stands that negotiations with Shell North America had largely been completed under the former admin istration but, again, it did not approve the deal before the September 2021 general election. This would have seen the global energy giant acquire some of BPL’s latest Clifton Pier generation assets as part of a 220 Mega Watt (MW) multi-fuel plant that would have supplied Nassau’s baseload genera tion via a 20-25 year power purchase deal (PPA).

There was talk of the Bahamian government and/ or local investors having a significant minority stake in the power plant, while Shell was also to finance and con struct a terminal that would have enabled the use of LNG and thus lower gener ation costs. This, too, is now on hold with no certainty as to whether it will proceed. ‘NOT PURSUING’ BPL’S $535M BOND

“In order for the Gov ernment to design effective public policy in this area, there need to be baseline studies and that is what is being designed. We will have studies in Grand Bahama, Andros and Long Island to inform public policy so that we can build with more resilience, and we can ensure sustainability for the future.”

THE TRIBUNE Thursday, September 22, 2022, PAGE 3

GOV’T

‘Stars are aligning’ over $3m Nassau Gas raise

added that the proceeds from a maximum capi tal raise will be invested in a new warehouse facil ity to properly store tanks; increased tank inventory so that all sizes are covered; extra delivery trucks; sat ellite depots in the Family Islands; and advanced pur chases of LPG while prices are low so that “predictable margins” can be locked in for several years.

Due to governmentimposed price controls, the LPG industry is a battle for volume and market share between dealers. “Propane has come down significantly since June. It’s plunged since then, and hopefully that continues,” Mr Newell said. “If that’s the case, we can lock in on a cheaper rate and have two years of lower cost gas.

“The last three years have been very challeng ing, but now we can see the light with the supply chain loosening, so by the first quarter of 2023 we can hit it. We’ve done no advertis ing, so it’s great to create a

buzz after 18 years. It’s just been word-of-mouth and we’ve grown quickly.”

Besides the drop in global LPG prices, Mr Newell said other factors that have com bined well with the timing of Nassau Gas & Tanks’ capital raise include the Government’s decision to slash import tariffs on gas tanks from 45 percent to 25 percent. This will boost cash flow by reducing the company’s upfront outlay on new tanks as it bids to restock both itself and its customers with fresh sup plies following COVID.

“People can’t get a gas tank and are having them stolen. It’s like the Wild West right now,” Mr Newell said. “Ten out of 12 [tank sizes] are out of stock. We want to replenish that inventory from the last couple of years when we couldn’t get stock and that’s beenDescribingdepleted.” the LPG industry as “very capital intensive”, he added that he had “taken my foot off the gas” during the tough trading conditions of the past two-three years which

forced an end to Nassau Gas & Tanks wholesale business and a concentra tion solely on retail clients so that it could sell at full price.Identifying Shell and Caribbean Gas as its main competitors on the whole sale/import side, Nassau Gas & Tanks’ pitch book to investors said: “LPG pricing is government-con trolled and, currently, there is a ceiling of $3.90 per gallon inclusive of VAT.

“Our costs as dealers, not just locally, but all com panies worldwide have steadily increased over the years. We previously supplied sub-dealers and peddlers with gas, but as the cost went up, we stopped doing that to only sell at the full rate, 100 percent of our sales

“Atvolume.theheight of our sales, we generated $5.9m a year in revenues. But with the suspension of selling fuel at a discount, we are half that now. We wish to maximise our profits and revenue while operating in a high-cost environment. We hope to

get a much-needed price increase very soon however from the RevealingGovernment.”thatheplans to pay a quarterly divi dend to shareholders, Mr Newell told this newspaper that the company is also debt-free. “We have always maintained yearly revenues in the $5m-6m range for the first 11-12 years, but with the increased costs, we stopped selling gas to fellow dealers and focused on selling at the full allow able selling price,” Nassau Gas & Tanks reiterated to investors.“Weland propane gas at the moment for $2.90 per gallon and sell for $3.90 per gallon. This sounds like a lot, but we have to deliver the product in big expen sive delivery trucks. This takes manpower, equip ment, insurance and diesel. All costs have gone up....

“The company has a post-money valuation of $9m.... We are offering 30 percent of the company for $3m. Caribbean Gas was valued at $10m to $12m privately when shares

were previously traded privately.”MrNewell said: “It’s a very capital-intensive busi ness. We want to upgrade the whole fleet of trucks. We want to get lots of inventory. We want to venture out to the Family Islands because it’s tough. The other islands, they have to send tanks on a mail boat, so sometimes they’re out of gas for a couple of weeks. So we want to do little mini-depots all around TheTheBahamas.”company is target ing Eleuthera, Exuma, Andros and Long Island for expansion first because “they are struggling with these mailboats”. Mr Newell added: “We want to save them doing that and say we will pick up your tank from a location down the“Soroad.there’s a lot of upside, but I know the pop ulation isn’t big on these islands so it has to be cost effective. Obviously we’re not going to do a huge gas plant like we have here, but on a scale basis and case by

‘Best bang for dollar’ to counter rate hikes

FROM PAGE B1

and vacation spending, he added: “The good thing about what’s going on right now is that it’s happening on the tail-end of COVID-19.

“From mid-March 2020, Americans, our primary target audience, have not been able to travel like they’ve been accustomed to. Generally speaking, there’s pent-up demand and a lot of people have a lot of money to spend.” The Bahamas’ proximity to the US, its main source market for around 90 percent of its tourists, has served the country’s post-COVID rebound well as persons opt to vacation close to home.

And the Family Islands, with their wide spaces and sparse populations, have been seen as an ideal for the socially-distanced, ecoconscious tourism many travellers prefer in the pandemic’s aftermath. Nev ertheless, this could soon be put to the test after the US central bank yesterday increased short-term inter est rates to a range between

3 percent and 3.25 percent, with the prospect of more to come as it seeks to cool the economy down.

The increase in borrow ing costs, and debt service payments, will hit the price of credit card debt, mort gages and company financing. And the US Fed eral Reserve signalled more rises to come, predicting rates would reach 4.4 per cent by the end of 2022 and not start coming down until 2024.Conceding that interest rate hikes will hit the US jobs market and increase unemployment, Jerome Powell, the Federal Reserve chairman, said: “We have got to get inflation behind us. I wish there were a pain less way to do that. There isn’t.“We have always under stood that restoring price stability while achieving a relatively modest increase in unemployment and a soft landing would be very challenging. And we don’t know. No one knows whether this process will lead to a recession or if so, how significant that reces sion would be.”

Faced with this grim outlook, Mr Fountain told Tribune Business: “As far as how we react to it, again, we can only control what we can control. As prices go up in the US, it will have a trickle down effect in The Bahamas. What we really need to focus on is when guests come to our shores, they get the best bang for their dollar and A-plus

case basis, and where the population“Fortunatelyis.” for every body [propane] has come down a lot, like 20 percent. But we were operating on a fixed selling price as pro pane gas companies; we’re a unique bunch. We’re not like the gasoline stations, where they have the fixed margin; we have the fixed selling price. But if the costs go up, which it did do, we’ve gotten squeezed.

“Literally every house uses propane. Most busi nesses use it, restaurants, hotels, and there is a lot of upside. It would be nice to come along for the ride. Coming out of this pandemic, we think it’s good timing. I see next year being a boom year because not just the gas business, all industries, supply chains are going to be fine.”

Nassau Gas & Tanks is priced at $11 a share with a minimum investment of $110 stipulated. The offer ing, which will close on Christmas Eve after 90 days, will offer 273,000 shares in total to investors.

customer service. That’s what we can control.

“We can’t control what happens with the prices. What we can focus on is when someone comes to our shores or arrives at our airports, they leave with a wow-type experience. They leave wanting to recom mend. They leave wanting to come back. We saw this coming at our Board, which is why we decided to invest in customer service training, especially for our front-line staff at member properties.

“It’s not good news in terms of the cost of doing business, the cost of goods and services, but it’s coming on the heels of COVID-19 when there is tremendous demand for travel and a lot of people have a lot of discretionary income to spend.”Asserting that The Baha mas has failed to exploit the Family Islands’ proximity to the US, Mr Fountain said the Promotion Board and its member properties are reintroducing the $250 air fare credit for persons who book between October 17, 2022, and November 16-18, 2022, “all the way through to April” next year.

European travellers who stay for four nights in member hotel, and have to transit through Nassau, will receive a free roundtrip flight to and from their Family Island destination. Those staying for seven nights or more will receive two free round-trip flights to Nassau, with the pro motion designed to tie-in with increased service from London via Virgin and Brit ish Airways.

PAGE 4, Thursday, September 22, 2022 THE TRIBUNE

FROM PAGE B1

Atlantis-based spa receives top award

An Atlantis-based spa has won the 2022 Haute Grandeur Global Excel lence Award for best spa in North America.

The 30,000-squarefoot Mandara Spa, which employs nearly 80 staff, forms a key part of Atlan tis’ luxury experience and the wellness offering to guests. With award win ners decided entirely by guest experiences, instead of votes from the public or a panel of judges, a Haute Grandeur award is viewed as the pinnacle of achieve ment for Mandara Spa.

Youlanda Deveaux, Mandara’s regional vicepresident, said: “As the flagship Mandara Spa loca tion of OneSpaWorld’s destination resorts, we are dedicated to providing our guests with experiences that exceed their expecta tions and are remembered long after they walk out of our doors. Our staff work assiduously to ensure they are offering the best service there is, so to be awarded for that effort in such a

grand way, the feeling is just incomparable.”HauteGrandeur awar dees represent the most sought-after hospitality experiences in top desti nations across the globe. Awardees are guaranteed global recognition, dis tinction, credibility and influence.Marinique de Wet, Mandara’s founder and president, said: “To win an Haute Grandeur Global Excellence Award, a spa must excel on all levels. This season demonstrated how spas around the world remained persistent to achieve greater heights despite challenges that exist in the “Healthyindustry.competition is essential to achieve even greater heights because it ensures sustainability as a guaranteed golden stamp of excellence. Award-winning spas are perceived as the benchmark in the industry, and Haute Grandeur only awards the most remark able of already-exceptional spas around the world.”

Ms de Wet added: “Only those who constantly exceed attain prestige in an industry that creates many jobs. The Haute Grandeur Global Spa Awards is more than just a celebration of our dignitaries’ achieve ments. It honours the principles of hard work, commitment, determina tion, leadership and success. More than ever before, recognition helps teams to remain positive and goal driven.”“It’s truly the highest honour to be able to stand confidently among the absolute best of the world,” Ms Deveaux said. “And it’s only possible because of our relentless efforts to continuously provide our patrons with top offerings andRussellservice.” Miller, Atlantis executive vice-president of hotel oper ations, said: “Moments like this substantiate and solid ify Atlantis’ long-standing reputation as a top resort in The Bahamas and in the region.”

SBDC TEAMS WITH MINISTRY ON $50K FISHERIES, FARMING GRANTS

FROM PAGE B2

prevent food scarcity, and how do we promote food production, one of the best ways we can do this is to grow our interconnection through strategic partner ships such as this. The Sustainable Food Growth Grant is a holistic ini tiative to foster value to our economic, social and environmental pillars of sustainability.”Inorderto be eligible for the grant, applicants must offer products and services that comply with

the SBDC’s micro, small and medium enterprises (MSME) policy. They must employ less than 50 individuals, be 100 per cent Bahamian-owned and provide all required documents.Thosedocuments include an executive business plan summary, business license, farmers’ or fishing com mercial license; voter’s card or utility bill no older than three months; any two valid forms of identification and complete mandatory training.

The grant may be used to purchase land or finance construction, renovation, equipment, furniture, fix tures, vehicles, boats, supplies, packaging, insur ance, incorporation, marketing, website develop ment, financial accounting software, security deposits, utilities and training and certifications. After pass ing the initial screening, applicants must do virtual training in food security, emerging trends, post-har vest management, financial reporting and exporting.

THE TRIBUNE Thursday, September 22, 2022, PAGE 5

BISX-listed firm pledges qualified audit ‘clear up’

Benchmark’s full-year financial statements that were signed-off by its directors on July 31, 2022, declined to provide a clean bill of health due to the absence of sufficient sup porting records on that matter.“The group is carrying a balance due to its custom ers’ account amounting to $18.44m in the consolidated statement of financial posi tion at December 31, 2021,” PKF informed all Bench mark shareholders and other interested parties. “We were unable obtain

sufficient appropriate audit evidence to reconcile this amount to the underlying accounting records, specifi cally the subsidiary ledger.

“The unreconciled dif ference between the consolidated statement of financial position and the subsidiary ledger amounted to $337,369. Consequently, we were unable to deter mine the adjustment that is necessary to be posted to the said account.”

A “qualified” report is issued whenever auditors find discrepancies or anom alies with particular aspects of a company’s financial reporting and accounts that warrant attention and ques tions being raised. The 2021 financial statements gave no further explanation for the anomaly, and PKF said its inspection of Benchmark (Bahamas) financial state ments proved satisfactory in all other However,respects.the notes attached to the accounts added: “Included in the balance of $18.44m (2020: $2.519m) due to cus tomers is an amount of $785,180, which relates to funds received on behalf of customers who are not identified or have not claimed the deposits as at the date of the consolidated financial statements.”

Mr Brown, when con tacted by Tribune Business said the concern identified by PKF Bahamas was “not a material effect” when set against net shareholder equity of $16.04m. Explain ing what led to the auditors’ qualification, he said: “We converted our system over to a new account ing platform and reporting platform so that we could keep clients more up-todate with the activity they were doing with us. That created some delays with theBISX-listedaudit.” compa nies are supposed to publish their annual finan cials within 120 days of year-end, and Mr Brown confirmed that Benchmark (Bahamas) requested and obtained an extension for the publication of its yearend“Thereaccounts.was this small amount of funds that was not reconcilable,” he told this newspaper. “It’s not to do with any client funds. It’s to do with the transfer over and conversion into a new accounting platform that created some level of issues with that audit and created the opinion. We expect that to be cleaned up in this year’s“It’saudit.asmall amount of money relative to the size of our balance sheet. It’s not a material effect. The assets in our principal trad ing company, Benchmark Advisors, is over $8m. That’s all base money. There’s no issue related to that [qualified audit opin ion] other than there were some matters that did not transfer over the way they should have been, and that caused questions around the $337,369 and the audit opinion.“Itdoesn’t concern us at all. We think we have the answers to it, and that it will be resolved with this year’s audit.” However, qualified audit opinions are rare, especially for publiclytraded and BISX-listed companies. Several capital markets sources, speaking on condition of anonymity,

said the qualified Bench mark audit was “definitely not a minor issue”. They argued that this was especially so given that Benchmark (Baha mas), and its Alliance Investment Management subsidiary, are broker/ dealers who hold client assets on trust in a fiduci ary capacity. And they said PKF’s statement indicated that while the company’s balance sheet showed one collective amount as owing to clients, the underly ing accounting documents produced another amount when all figures were added together.“It’sa little bit of an indictment of a company to say their accounting records are wrong, that there’s an error in the accounts,” one said. “For a financial services company, that’s not a good look. For a financial services company where you have capital and capi tal adequacy rules, it’s a big issue.” They added that the PKF Bahamas findings would likely prompt close regulatory scrutiny by the Securities Commission of TheTheBahamas.auditors also again flagged the guarantee Benchmark (Bahamas), as the group’s parent, has made on behalf of its Alliance Investment Man agement subsidiary as nurses itself back to finan cial health. “The financial statements of Alliance have been prepared on the basis that it will continue as a going concern. Its state ment of changes in equity shows an accumulated defi cit as at December 31, 2021, resulting from losses accu mulated in prior years,” the financial

“Althoughsaid. Alliance has had a history of profitable operations in recent years, the company has provided a guarantee to Alliance to make sufficient funds avail able to enable it to meet its present and future obliga tions for a period including, but not limited to, 12 months from the date its financial statements were approved by the Board of Directors.”Thequalified audit opin ion took some of the shine off the positive $4.366m bottom line swing produced by Benchmark (Bahamas) during the 12 months to end-December 2021, when it turned the prior year’s $986,448 loss into a $3.38m profit driven by increased client trading activity as the markets re-opened following the COVID-19 pandemic.Theimprovement was driven by months.$1.387menuesfive-foldlastdown-hitfromcommissions,trading-relatedwhichsoared$177,283inalock2020to$5.663myear,sparkinganearincreaseinrevto$6.8mcomparedtointheprevious12

JULIAN BROWN

JULIAN BROWN

PAGE 6, Thursday, September 22, 2022 THE TRIBUNE

FROM PAGE B1

Gov’t goes high-tech for taxes 5% up on Budget

went in 4-5 percent ahead of Budget right now. July performed consistent with Budget.“It’sstill early. After the first quarter we will be more able to say exactly where we stand, once we get through the first quarterly VAT pay ment deadline, so we will know how we are perform ing by next week Monday/ Tuesday. The main revenue items are performing quite well. Customs is doing exceptionally well, with the VAT on imports. They are around $260m-$270m.”

Mr Wilson added that the Government has “done $500m in revenue to-date” for the first two-and-a-half months of the 2022-2023 fiscal year. The first quarter of each fiscal year, which covers the months of July, August and September, is typically the weakest threemonth period out of the four since it coincides with the slowest part of the tour ism season and therefore a reduction in the economic activity, transactions and consumption upon which revenues largely depend.

The financial secretary, meanwhile, confirmed that the Government is seeking to increasingly modernise its tax collection and assess ment processes via the use of the latest technol ogy. This will replace paper-intensive, manual processes upon which its agencies have relied for years, resulting in an evergrowing bureaucracy that has worked against effi cient tax and revenue administration.Turningtothe DIR’s tax payer audits, Mr Wilson said: “We have to improve. We’re looking at enhanced tools, getting new tools to be more effective. What we are looking at is some form of artificial intelligence. We can’t do it manually by itself. That’s what we’re lookingEmployingat.” AI is designed to help the DIR better target its audit at highrisk taxpayers, while also

detecting anomalies and discrepancies in companies’

VAT and other tax filings that merit closer analysis by the reconstituted Rev enue Enhancement Unit (REU) and other agencies. He added that “best prac tice” requires between 3-7 percent of taxpayers to be subjected to audit on an annual basis.

The Ministry of Finance, now that Tyler Technolo gies’ New Providence-wide mapping, reassessment and valuation exercise for real property tax purposes has been complete, is seeking to rapidly extend this to the Family Islands. “We now have to move to the second phase with Tyler with the Family Islands. We want it to start before the end of the year. Tyler is really a very powerful tool; a very powerful tool,” Mr Wilson told Tribune Business.

“What we have done in some of the cays, we’ve purchased satellite images and so we’re able to iden tify properties like that. You purchase some satellite images of some parts of The Bahamas, and you’d be able to see how many new prop erties have been put in, then do the assessment by Tyler and the valuation.

“It’s really high-tech stuff. We’ve identified 200 new homes constructed since Dorian, businesses in that area, and are putting the information into Tyler’s system and are doing the assessment. In the normal course, that would perhaps have taken us two to three years. We’ve now done that in probably six weeks.”

Mr Wilson declined to identify which cay or area of mainland Abaco he was referring to, adding: “I don’t want to say where it is because people will get too excited, but it’s an area where, after Dorian, there’s been explosive growth. The idea is, with each island, we’re going to use technol ogy. Satellite images work very well in the Family Islands. It helps us identify new buildings.”

Given that residen tial properties valued at $300,000 or less are now exempt from paying real property tax, following the passage of Budget-related reforms in June, he is unlikely to be referring to new shanty dwellings or other unregulated struc tures. Bahamian-owned property in the Family Islands is also presently exempt from the tax, which currently falls just on for eign-owned real estate in those areas.

Meanwhile, Mr Wilson said the Ministry of Finance has partnered with Avenu, a company that works on tax administration and collec tion with local government authorities worldwide, including in Canada and the US, on a project to identify Bahamas-based vacation rental properties so as to ensure they pay due VAT and any other taxes.

“They have built a plat form to identify short-term vacation rentals in The Bahamas, and they’ve iden tified 7,000,” he added.

“It’s a powerful tool which really helps us focus on rev enue collection from that area. We will be very con servative in our fiscal plans. We’ve provided for zero revenue [from this area].

We think that if it goes well we might be looking at tens of millions of dollars on an annual basis. We’re talking a whole range of proper ties; whole islands in some cases.”The Government is pro jecting that it will collect record revenues of $2.802bn during the 2022-2023 fiscal

year, a near $200m or 7.4 percent increase on the prior year’s $2.609bn. VAT collections are forecast to rise by 24.3 percent yearover-year to $1.412bn as opposed to taxtheareforlowerifWilsonfirstmentDescribing$1.136bn.theimproveseento-dateas“thelapinalongrace”,Mrsaid:“IthinkthatweareeffectivewecantheeffectivetaxrateallBahamians.Therenotargetsyet,butthat’sultimategoal;loweringburdenforeveryone.”

THE TRIBUNE Thursday, September 22, 2022, PAGE 7

FROM PAGE B1

Don’t bail-out stricken parents, banks warned

steps to improve profitabil ity, may prove sufficient,” the Central Bank said in outlining its expectations.

“Where the group is weak but the local entity is sound, the Central Bank expects the local Board and management to ensure that the local entity’s posi tion is not weakened to support the group. Among other things, any form of

capital reduction - including through a return of capital or extraordinary dividendwill require prior approval from the Central Bank.

“Where both the group and the local entity suffer from capital deficiencies, the local management and Board should also take care that the Bahamian entity does not subsidise the group in any capital support sense. As with capi tal, supervised financial

institutions will need a liquidity recovery plan for the scenarios of weak local entity and strong parent, weak parent and sound local entity, and both the local entity and the parent suffering liquidity challenges.”Bankand trust com panies have been given until March 31, 2023, to submit their recovery plans while credit unions have an extra two months until May

31, 2023. Explaining its rationale for requesting the plans, the Central Bank said the law had given it “enhanced resolution powers... to address poten tial bank failures in the financial system”.

It added: “A thorough and detailed recovery plan is a vital component of a strong crisis management process. The recovery plan should produce a high-level plan fully understood and

endorsed by senior man agement and the Board of Directors.“These guidelines specifically address a supervised financial insti tution’s responsibility in developing and testing its own recovery plan as part of their risk management framework, and should be designed to apply well before a supervised finan cial institution gets into a crisis situation, in effect enabling the supervised financial institution to pre vent a crisis rather than to respond belatedly to one.

“The objective of the recovery plan is to enable a supervised financial insti tution to restore itself to financial soundness and compliance with all regu latory requirements in a

timely and credible manner following adverse shock affecting a supervised financial institution’s capi tal, liquidity or operational capacity. This process is to be commenced at an early stage in the emergence of financial stress,” the Cen tral Bank continued.

“A supervised financial institution’s recovery plan ning process should enable it to continue to operate as a going concern, recovering from adverse but non-fatal shocks to restore its capi tal, liquidity or operational capacity to an acceptable level. Recovery planning may improve a supervised financial institution’s under standing of its risks arising from severe but plausible scenarios.”

Asia stocks follow Wall St down as Fed fights inflation

By JOE MCDONALD AP Business Writer

ASIAN stock markets followed Wall Street lower on Thursday after the Fed eral Reserve delivered another big interest rate hike to cool galloping infla tion and raised its outlook forShanghai,more. Tokyo, Hong Kong and Sydney declined. Oil prices gained.

Wall Street's benchmark S&P 500 index fell 1.7% on Wednesday to its lowest level in two months after the Fed raised its bench mark lending rate by 0.75 percentage points, three times its usual margin. The Fed said it expects that rate to be a full percentage point higher by the end of the year than it did three months ago.

"The Fed still managed to out-hawk the markets," Anna Stupnytska of Fidel ity International said in a report. "Economic strength and a hot labor market point to a limited tradeoff — at least for the time being — between growth andTheinflation."Shanghai Composite Index lost less than 0.1% to 3,115.94 and the Nikkei 225 in Tokyo slid 0.9% to 27,060.89. Hong Kong's Hang Seng tumbled 1.9% to The18,094.62.Kospi in Seoul sank 1.4% to 2,315.24. New Zea land edged up 0.1% while Southeast Asian markets declined.TheFed and central banks in Europe and Asia have raised interest rates this year to slow economic growth and cool inflation that is at multi-decade highs.Traders worry they might derail global eco nomic growth. Fed officials acknowledge the possibility such aggressive rate hikes might bring on a reces sion but say inflation must be brought under control. They point to a relatively strong U.S. job market as evidence the economy can tolerate higher borrowing costs.The yield on the 2-year Treasury, or the difference between the market price and the payout if held to maturity, rose to 4.02% from 3.97% late Tuesday.

It was trading at its highest level since 2007.

The yield on the 10-year Treasury, which influ ences mortgage rates, fell to 3.52% from 3.56% from lateTheTuesday.S&P 500 fell to 3,789.93. The Dow fell 1.7% to 30,183.78, and the Nasdaq composite lost 1.8% to 11,220.19.

The major Wall Street indexes are on pace for their fifth weekly loss in six weeks.Fed chair Jerome Powell stressed his resolve to lift rates high enough to slow the economy and drive inflation back toward the central bank's 2% goal. Powell said the Fed has just started to get to that level with this most recent increase.Thecentral bank's latest rate hike lifted its bench mark rate, which affects many consumer and busi ness loans, to a range of 3% to 3.25%, the highest level in 14 years, and up from zero at the start of the year.

The Fed said its bench mark rate may be raised to roughly 4.4% by year's end, a full point higher than envisioned in June.

U.S. consumer prices rose 8.3% in August. That was down from July's 9.1% peak, but core inflation, which strips out volatile food and energy prices to give a clearer picture of the trend, rose to 0.6% over the previous month, up from July's 0.3% increase.

Central bankers in Japan, Britain, Switzerland and Norway are due to report on whether they also will raise rates again. Sweden surprised economists this week with a full-point hike.

The global economy also has been roiled by Rus sia's invasion of Ukraine, which pushed up prices of oil, wheat and other commodities.Inenergymarkets, bench mark U.S. crude gained 19 cents to $83.13 per barrel in electronic trading on the New York mercantile Exchange. The contract fell $1 to $82.94 on Wednesday.

Brent crude, the price basis for international oil trad ing, advanced 26 cents to $90.09 in London. It lost 79 cents the previous session to $89.83.

A CURRENCY trader talks on the phone at the foreign exchange dealing room of the KEB Hana Bank headquarters in Seoul, South Korea, Thursday, Sept. 22, 2022. Asian stock markets followed Wall Street lower on Thursday after the Federal Reserve delivered another big interest rate hike to cool galloping inflation and raised its outlook for more. (AP Photo/Ahn Young-joon)

PAGE 10, Thursday, September 22, 2022 THE TRIBUNE

FROM PAGE B1

CALL 502-2394 TO ADVERTISE TODAY!

STOCKS SLUMP ON WALL STREET AS FED STEPS UP INFLATION FIGHT

By DAMIAN J. TROISE AND ALEX VEIGA AP Business Writers

STOCKS closed lower Wednesday after the Fed eral Reserve made another big interest rate hike and sharply increased its out look for how high it expects to raise rates in coming months.Short-term Treasury yields pushed further into multiyear highs after the central bank raised its benchmark rate by threequarters of a point. The Fed also said it now expects that rate to be a full percentage point higher by the end of the year than it had pre dicted in June.

“We have got to get infla tion behind us,” Fed Chair Jerome Powell said during a press conference. “I wish there were a painless way to do that. There isn’t.”

The S&P 500 fell 1.7% to its lowest level since mid-July after wavering between gains and losses as traders considered the impact of the Fed’s update on interest rates, which have widespread effects on markets and the economy.

The Dow Jones Indus trial Average also fell 1.7% after flipping between gains and losses. The Nasdaq composite lost 1.8%. The major indexes are on pace for their fifth weekly loss in six

Theweeks.yield on the 2-year Treasury, which tends to follow expectations for Fed action, rose to 4.02% from 3.97% late Tuesday. It is trading at its highest level since 2007. The yield on the 10-year Treasury, which influences mortgage rates, fell to 3.52% from 3.56% from late Tuesday.

The Fed is raising rates to fight the worst inflation in 40 years. The worry is that the Fed may cause a recession by slowing the economy too “Ultimately,much.the policy appears to be appropri ate given the economic backdrop, but investors should prepare for rough seas ahead as aggressive Fed policy usually leaves a path of destruction in the wake behind,” said Charlie Ripley, senior investment strategist at Allianz Invest ment

TheManagement.S&P500 fell 66 points to 3,789.93. The Dow slid 522.45 points to 30,183.78, and the Nasdaq lost 204.86 points to close at 11,220.19.Smaller company stocks also slumped. The Russell 2000 index fell 25.35 points, or 1.4%, to 1,762.16.

The broader market has been lurching between gains and losses throughout the week ahead of the latest update on interest rates from the Fed. More than 90% of the stocks in the S&P 500 fell, with retailers, banks and technology companies among the heaviest weights

on the benchmark index. Amazon dropped 3%, Bank of America shed 3% and Apple fell 2%.

The Fed has been raising rates aggressively to try and tame high prices on every thing from food to clothing.

During his press confer ence, Powell stressed his resolve to lift rates high enough to slow the econ omy and drive inflation back toward the central bank’s 2% goal. Powell said the Fed has just started to get to that level with this most recent increase.

The central bank’s latest rate hike lifted its bench mark rate, which affects many consumer and busi ness loans, to a range of 3% to 3.25%, the highest level in 14 years, and up from zero at the start of the year.

“The Fed is pivoting, but not in the direction that many hoped for,” said Willie Delwiche, invest ment strategist at All Star Charts. “Not only are they indicating that rates will be higher for longer but they expect to persist even as the economy slows more dra matically remains weaker longer than they were expecting as recently as June.”The Fed’s goal is to slow economic growth and cool inflation, but Wall Street is worried that it could hit the brakes too hard on an already slowing economy and cause a recession. Those concerns have been reinforced by reports show ing that inflation remains stubbornly high and state ments from Fed officials they will keep raising rates until they are sure inflation is coming under control.

Central banks worldwide are also dealing with infla tion. The Bank of Japan began a two-day monetary policy meeting Wednes day, although analysts expect the central bank to stick to its easy monetary policy. Rate decisions from Norway, Switzerland and the Bank of England are next. Sweden surprised economists this week with a full-point hike.

Global tensions remain high as Russia’s invasion of Ukraine ibbean.continuedslippedclub$3.674,risinginwentpriceallymonths,helpedsoar.andupthousandsRussia.weekplansUkraineofRussian-controlledcontinues.regionseasternandsouthernhaveannouncedtostartvotingthistobecomepartofThewarhaskilledofpeople,drivenfoodpricesworldwidecausedenergycoststoGasolineprices,whichfuelinflationforhavebeengenerfalling.But,theaverageforagallonofgasupforthefirsttimemorethanthreemonths,toto$3.681fromaccordingtomotorAAA.CruiselineoperatorsasHurricaneFionatobattertheCarCarnivalslid6.8%.

A MAN walks past the New York Stock Exchange, Wednesday, Sept. 21, 2022, in New York. Stocks are off to a modestly higher start on Wall Street ahead of a widely expected interest rate increase by the Federal Reserve. The S&P 500 was up half a percent in the early going Wednesday, as was the Dow Jones Industrial Average.

Photo:Peter Morgan/AP

A MAN walks past the New York Stock Exchange, Wednesday, Sept. 21, 2022, in New York. Stocks are off to a modestly higher start on Wall Street ahead of a widely expected interest rate increase by the Federal Reserve. The S&P 500 was up half a percent in the early going Wednesday, as was the Dow Jones Industrial Average.

Photo:Peter Morgan/AP

THE TRIBUNE Thursday, September 22, 2022, PAGE 11

Home Depot workers petition to form 1st store-wide union

By ALEXANDRA OLSON AP Business Writer

HOME Depot workers in Philadelphia have filed a petition with the federal labor board to form what could be the first store-wide

union at the world’s largest home improvement retailer.

The petition, filed with the National Labor Rela tions Board this week, seeks to form a collective bargaining unit for 274 employees who work in

merchandising, specialty and operations. The federal agency’s database shows no other attempts to form a store-wide union at the company, though a group of Home Depot drivers suc cessfully unionized with the

International Brotherhood of Teamsters in 2019.

Sara Gorman, a Home Depot spokesperson, said the company is aware of the filing and “we look forward to talking to our associates about their concerns.”

“While we will of course work through the NLRB process, we do not believe unionization is the best solution for our associates,” Gorman said in an email.

Vincent Quiles, a store employee who is leading the petition, said he deliv ered the petition with 103 workers’ signatures to the federal labor board Tues day. He said discontent with compensation and working conditions rose as employ ees felt strained during the pandemic.Quiles,who makes $19.25 an hour in the receiving department, said he and other workers felt they could have benefited more from the record profits Home Depot made during the pandemic, as demand grew for home improve ment projects. He pointed to two bonuses he received

last year that amounted to less than Meanwhile,$400. Quiles said his store felt perpetually understaffed, and employ ees were routinely asked to work in other departments with little training, some times angering customers when they could not pro vide the expertise expected of “Ithem.would see corporate visits. They would say you’re doing a great job, you are so essential. You have to walk the walk. You can’t just come in here and say a bunch of nice things,” Quiles said. “This is a long shot but I think we can do this. This is just the beginning.”HomeDepot, based in Atlanta, employs about 500,000 people at its 2,316 stores in the U.S., Canada and Mexico.

NOTICE is hereby given that ALILIA PIERRE of P. O. Box N-7060, Garden Hills #1, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that APPOLONIA ADAKU NGOBIDI of P. O. Box SS-19068, 3rd Terrace Centreville, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that MARCIA FERGUSON of P. O. Box N-155, #760 East Street south, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 15th day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that DIENORD BIEN-AIME of P. O. Box CR-55415, Malcolm Road, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that RICO GUSTAVE of #2 Golden Gates, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 12, Thursday, September 22, 2022 THE TRIBUNE

NOTICE

NOTICE

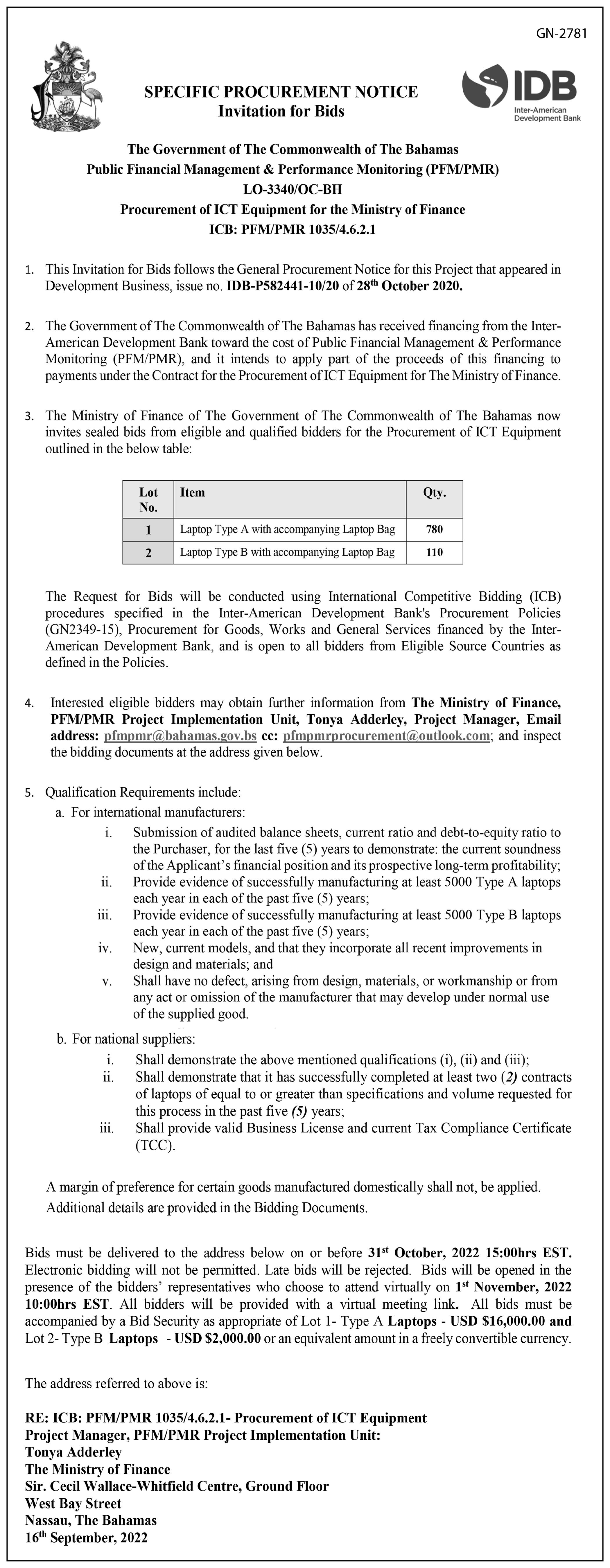

NOTICEWEDNESDAY, 21 SEPTEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2626.84-0.19-0.01398.6017.89 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0039.95 APD Limited APD 39.95 39.950.00 1000.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.20Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.851.30Bank of Bahamas BOB 2.85 2.850.00 0.0700.000N/M0.00% 6.205.75Bahamas Property Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 9.75 9.750.00 0.3690.26026.42.67% 4.152.82Cable Bahamas CAB 3.95 3.950.00 -0.4380.000-9.0 0.00% 10.655.99Commonwealth Brewery CBB 10.30 10.300.00 0.1400.00073.60.00% 3.652.27Commonwealth Bank CBL 3.58 3.580.00301,0000.1840.12019.53.35% 8.255.29Colina Holdings CHL 8.23 8.230.00 0.4490.22018.32.67% 17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 1000.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.55 3.47 (0.08) 0.1020.43434.012.51% 11.288.50Doctor's Hospital DHS 10.26 10.260.00 0.4670.06022.00.58% 11.6711.25Emera Incorporated EMAB 11.08 10.94 (0.14) 0.6460.32816.93.00% 11.5010.00Famguard FAM 10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 3.85 3.850.00 0.2030.12019.03.12% 11.008.20Finco FIN 11.00 11.000.00 0.9390.20011.71.82% 16.5015.50J. S. Johnson JSJ 15.50 15.500.00 0.6310.61024.63.94% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 103.61103.61BGRS FX BGR120027 BSBGR1200272102.10103.611.51 5,000 102.45102.16BGRS FX BGR121028 BSBGR1210289102.45102.16 (0.29) 2,500 101.5599.72BGRS FX BRS124228 BSBGR1242282101.55101.42 (0.13) 2,500 99.9599.95BGRS FL BGRS91032 BSBGRS910324100.1999.95 (0.24) 10,000 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70% MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Mar-202131-Mar-2021 MATURITY 31-Jul-202231-Jul-202220-Nov-202919-Oct-20224.50%6.95% 31-Aug-202231-Mar-2022 6.25%4.50% 15-Oct-204915-Dec-202721-Apr-205029-Jul-202215-Oct-202226-Jun-204526-Jun-202230-Jul-204515-Dec-204430-Jul-202215-Dec-202131-Aug-202231-Aug-202231-Jan-202231-Jan-202231-Jan-202231-Jan-202231-Aug-202231-Jan-202231-Jan-202231-Mar-2021 6.25% 31-Mar-202230-Sep-2025FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 4.25%6.25%4.50%6.25% NAV Date 5.55%4.31%4.66%4.83%4.82%5.69%5.65% 15-Apr-204917-Apr-203313-Jul-202823-Feb-20284.31%4.37% 25-Sep-203215-Aug-2032 (242)323 2330 (242) 323 2320 www.bisxbahamas.com

NOTICE

NOTICE

By KEN SWEET AP Business Writer

THE CEOs of the nation’s biggest banks appeared in front of Con gress Wednesday and gave a dim view of the U.S. econ omy, reflecting the financial and economic distress many Americans are facing.

JPMorgan Chase’s Jamie Dimon, Citigroup’s Jane Fraser and other chief executives said the U.S. consumer is in good shape but faces threats from high inflation and rising interest rates.The hearing was held on the same day the Federal Reserve announced it was raising its benchmark inter est rate by three-quarters of a point in a bid to contain inflation. When asked by lawmakers, the bank CEOs seemed increasingly skepti cal that the Fed can achieve its goal of a “soft landing,” where inflation is brought back down without causing

widespread damage to the economy.“I’mkeeping my fingers crossed,” Dimon said. Fraser said in remarks prepared for the hear ing that while “COVID is behind us, the economic challenges we are now facing are no less daunting.”

Despite the dimmer view, the CEOs generally said the U.S. consumer is currently in good financial health due to the savings they accumu lated during the pandemic. Bank of America’s Brian Moynihan said the amount of money in customers’ accounts has been stable. Dimon said wages are up while debt loads have dropped, and Fraser said consumers are spending at elevated levels.

All that could change as the Fed increases rates at an aggressive pace. With inflation rising as high as 9% this year, the Fed has aggressively raised rates from near zero to a range

of 3% to 3.25% in a few months. Fed Chair Jerome Powell acknowledged that households will feel an impact.“Wehave got to get infla tion behind us. I wish there were a painless way to do that. There isn’t,” Powell said at a news conference following the announce ment of the rate increase.

While less confident about a “soft landing,” the seven bank executives did give a unanimous vote of confidence in Powell’s abil ity to rein in inflation when asked by Rep. Jake Auchin closs, andtopicswellizationlikepushedcalwithCEOsonWhileD-Massachusetts.billedasahearingeverydayfinances,thewerealsopepperedelection-yearpolitiquestions.DemocratstheCEOsonissuesracialequity,theunioneffortsatbanks,asasevergreenfinanciallikeoverdraftfeesfraud.

“In this environment, the role that banks play to protect consumers and provide access to afford able credit is absolutely critical,” said Rep. Maxine Waters, D-California and chairwoman of the House Financial Services Committee.Republicans took the opportunity to both push back on the need for the hearing — this is the third time Democrats

have brought Wall Street executives in front of this committee since taking con trol of the House in 2019 — as well as high inflation. One hot-button issue was gun store sales. Earlier this month the major payment networks — Visa, Master card and American Express — said they would start cat egorizing gun store sales as a separate merchant code.

It’s a decision gun control advocates have pushed for,

potentially to help catch surges of gun sales ahead of a mass shooting.

Rep. Roger Williams, R-Texas, pushed the bank CEOs on whether they would follow the payment networks’ decision. In response, all six CEOs said they would not stop legal gun sales and would protect consumers’ privacy.

“We don’t want to tell Americans what to do with their money,” Dimon said.

FROM left; U.S. Bancorp Chairman, President, and CEO Andy Cecere; PNC Financial Services Group Chairman, President, and CEO William Demchak; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; Citigroup CEO Jane Fraser; Bank of America Chairman and CEO Brian Moyni han; Truist Financial Corporation Chairman and CEO William Rogers Jr.; and Wells Fargo President and CEO Charles Scharf are sworn in as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, Photo:2022.Andrew Harnik/AP 6:03 a.m. 12:11 a.m. 1.2 6:27 p.m. 3.1 12:09 p.m. 1.0 6:46 a.m. 2.8 12:51 a.m. 1.0 7:07 p.m. 3.2 12:54 p.m. 0.8 1:28 a.m. p.m. 3.3 1:36 p.m. 0.7 8:05 a.m. 3.2 2:03 a.m. 0.6 8:22 p.m. 3.3 2:17 p.m. 0.6 8:43 a.m. 3.3 2:37 a.m. 0.5 9:00 p.m. 3.3 2:59 p.m. 0.5 9:22 a.m. 3.4 3:12 a.m. 0.4 9:38 p.m. 3.2 3:41 p.m. 0.4 10:03 a.m. 3.5 3:49 a.m. 0.3 10:19 p.m. 3.0 4:25 p.m. 0.5

FROM left; U.S. Bancorp Chairman, President, and CEO Andy Cecere; PNC Financial Services Group Chairman, President, and CEO William Demchak; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; Citigroup CEO Jane Fraser; Bank of America Chairman and CEO Brian Moyni han; Truist Financial Corporation Chairman and CEO William Rogers Jr.; and Wells Fargo President and CEO Charles Scharf are sworn in as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, Photo:2022.Andrew Harnik/AP 6:03 a.m. 12:11 a.m. 1.2 6:27 p.m. 3.1 12:09 p.m. 1.0 6:46 a.m. 2.8 12:51 a.m. 1.0 7:07 p.m. 3.2 12:54 p.m. 0.8 1:28 a.m. p.m. 3.3 1:36 p.m. 0.7 8:05 a.m. 3.2 2:03 a.m. 0.6 8:22 p.m. 3.3 2:17 p.m. 0.6 8:43 a.m. 3.3 2:37 a.m. 0.5 9:00 p.m. 3.3 2:59 p.m. 0.5 9:22 a.m. 3.4 3:12 a.m. 0.4 9:38 p.m. 3.2 3:41 p.m. 0.4 10:03 a.m. 3.5 3:49 a.m. 0.3 10:19 p.m. 3.0 4:25 p.m. 0.5