THURSDAY, SEPTEMBER 18, 2025

British Colonial seeks supplier

‘flexibility’ on prices, payments

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE British Colonial has asked vendors to provide it with “temporary” pricing discounts and extended repayment terms due to September and October occupancies falling “significantly below forecast”.

Kristin Whylly, the downtown Nassau resort’s general manager, in response to Tribune Business inquiries confirmed that it has requested “flexibility” from some suppliers to help the 288-room property remain open and keep staff “gainfully employed” during “the softest months in the hospitality calendar”.

Asserting that the request is “not unusual” for the Bahamian hotel industry during this time, he added that Bay Street’s ‘anchor property’ “remains on solid footing” and forward bookings for the upcoming winter season - starting in November and going into 2026 - are showing “a strong outlook” due to a combination of group business, leisure travellers and special events.

Mr Whylly spoke out after Tribune Business obtained a September 9, 2025, letter sent to the British Colonial’s vendors and bearing his name, which requested that they provide price discounts and “extended invoice terms” temporarily to allow the resort to “navigate fluctuating business levels”. Other Bahamian resort and tourism operators also confirmed that September is slower than the same month for 2024.

“As you may be aware, the hospitality industry continues to navigate fluctuating business levels and, at present, our occupancy projections for September and October are significantly below forecast,” Mr Whylly told British Colonial suppliers. “Considering these circumstances, and as

Storm no ‘game changer’ as insurers forecast $4m claims

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN insurer yesterday predicted the industry is unlikely to receive more than $4m in combined claims from property owners who suffered damage in last Friday’s eastern New Providence storm.

Anton Saunders, RoyalStar Assurance’s managing director, told Tribune Business that total claims exceeding this sum would “be a lot” as he asserted that the severe weather - said to have been caused by a microburst, which is a sudden downward

rush of wind from a thunderstorm - will not “be any game changer” for the industry. Confirming that his property insurance underwriter has already received some claims, he reiterated that the aggregate payout by all carriers will not be “significant” overall although the industry was anticipating “one or two” major submissions. Mr Saunders said he knew that the $110m Legendary Blue Water Cay Marina project at the southern end of Fox Hill Road had been impacted. Still, the RoyalStar chief said “most” affected properties with in-force, valid insurance policies were likely

Gov’t turned down $1bn in UK export financing

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE PRIME Minister’s

Worker benefits secure in Morton Salt’s acquisition

By NEIL HARTNELL Tribune Business Editor

MORTON Salt’s 100-plus Bahamian employees were yesterday said to have “mixed emotions” over the operation’s potential purchase by a Grand Bahama-based energy and natural resources group.

Jennifer Brown, general secretary of the Bahamas Industrial Manufacturers & Allied Workers Union (BIMAWU), which represents the Inagua-based company’s line staff, told Tribune Business workers were unlikely to be “shocked” by the proposed sale to Lusca Group and its subsidiary, Grand Bahama Salt Company, given the frequency with which ownership has changed in the past two decades.

However, she added that this will be the first time that the name ‘Morton’ is to be dropped, with Lusca Group set to rebrand Inagua and the southern Bahamas’ largest employer as Salt Bahamas if the deal closes and all relevant government approvals are received.

to be covered by their terms, although this may depend on how they and their insurer’s reinsurance treaties define ‘catastrophic events’. Given that the winds exceeded 100 miles per hour, he forecast that most insurance policies will treat Friday night as a catastrophic event.

“I’m sure there will be some claims coming the industry’s way,” Mr Saunders told this newspaper. “We have already had a couple of claims from our side. An event like that, which covered the eastern area where most of the population lives, is going to have some claims.

“Significant? I doubt it, but there are going to be some claims. You’d probably have those pockets of one or two significant claims, but overall it’s not going to be any game changer. It’s going to be typical wind damage; your roof, windows, some motor vehicles that got turned over or hit by trees and debris....

“You always have one-off things that you never know about. But if that [event] is more than $4m, it’s a lot. We might have two big risks that claim. I know they [Legendary Marina] got some damage. It depends on what

Ms Brown, also the union’s former president, told this newspaper her main concern is that Morton Salt is only divesting its Bahamas operation. A rebranded Salt Bahamas will thus be a standalone operation that has to stand on its own feet, although Lusca Group said it “will enter” into a long-term agreement to supply the salt produced to its former owner, Morton USA.

The BIMAWU general secretary, who confirmed that Morton Bahamas management first informed the union and all workers of the impending sale on Tuesday this week, one day before it was formally announced, said executives confirmed that Lusca Group is linked to the Liwathon Group, which has acquired and restarted operations at Grand Bahama’s former South Riding Point oil storage terminal.

Tribune Business research found that both Lusca Group and Liwathon’s Bahamas operation share the same phone number and Grand Bahama address, at 100 Grand Bahama Highway, East End, on their respective websites.

Office yesterday confirmed that the Government elected not to “pursue” up to $1bn in financing offered by a UK government agency that included $200m for Grand Bahama’s airport. No explanation was given for why the Davis administration decided not to proceed with the 2023 package offered by UK Export Finance, although Tribune Business reported at the time that the British government’s export credit arm wanted The Bahamas to provide a sovereign guarantee to underwrite repayment of the funding.

By FAY SIMMONS

Tribune Business Reporter jsimmons@tribunemedia.net

It was understood that the Government was reluctant to provide such a guarantee, or letter of comfort to reassure that any debt would be paid, because

intelligence, with a focus on managing both the opportunities and risks of AI in the financial services sector. Speaking at the Nassau Conference yesterday, Mr Pinder highlighted the transformative potential of AI in fintech, citing its ability to enhance innovation, operational efficiency, and customer service. However, he also acknowledged the serious challenges the technology poses, including risks of fraud, data breaches, misinformation, and potential job displacement. “We recognise these risks and opportunities. The government of The Bahamas is in the process of seating

PERSONAL TOUCH KEY TO CUSTOMER LOYALTY

Picture this. You check into a resort in Nassau, and before you have even unpacked, the hotel app welcomes you back by name, reminds you of your last stay and suggests a Bahamian culinary class since you signed up for one before. Later, you receive a push notification about a two-for-one sunset cruise deal, perfectly timed for your anniversary trip. That is not coincidence. That is technology-driven personalisation at work.

All over the world, businesses are discovering that personalisation is one of the most powerful ways to build lasting customer relationships. Gone are the days when companies could simply offer a product or service and expect loyalty. Today’s customers crave experiences that feel relevant, convenient and tailored to their individual needs. And when

businesses deliver this, they do not just get one-time sales - they earn repeat customers and enthusiastic advocates.

At the heart of personalisation is technology. Artificial intelligence (AI), data analytics and customer relationship management tools help companies gather insights about preferences and behaviours. Whether it is an airline recommending add-ons based on past trips, or a retailer sending targeted discounts for products you have already shown interest in, personalisation transforms the customer journey from generic to meaningful.

For The Bahamas, where tourism accounts for nearly half of gross domestic product (GDP), the opportunities are immense. Resorts, tour operators and even restaurants can all use data to provide experiences that feel unique to each visitor. A traveller who booked an eco-tour before

could automatically receive suggestions for similar excursions next time. Cruise lines docking in Nassau or Freeport could personalise shore excursion packages based on past bookings, nudging visitors to explore more local businesses.

But it is not just for big players. Bahamian small businesses, ranging from family-owned shops in Exuma to local cafes in Nassau, can also benefit.

Loyalty programmes that track customer visits, apps that remember favourite orders, or even a simple email system that offers personalised promotions can make customers feel valued. These gestures encourage repeat visits and keep dollars circulating in the local economy.

Why does this matter?

Because loyalty is a multiplier. A returning customer spends more, recommends more and costs less to retain than acquiring a new one. In an economy such as The

Bahamas, where competition for tourist spending is fierce and locals have increasing options both at home and online, loyalty is gold. Businesses that personalise can stand out and secure a more reliable stream of revenue.

Of course, personalisation has its challenges. Businesses must safeguard customer data and comply with privacy standards. If handled poorly, customers could feel “watched” rather than “understood”. That is why transparency and trust must go hand in hand with personalisation. Bahamian companies that invest in clear data policies will gain an advantage, showing customers they can enjoy tailored services without sacrificing their privacy.

As the global economy shifts more towards digital interactions, The Bahamas has a chance to use personalisation not just to improve individual businesses but to strengthen the entire

national brand. A visitor who feels personally cared for is more likely to return, extend their stay or even invest in property or business ventures here. Locals, too, will reward businesses that value their preferences, keeping more Bahamian dollars in Bahamian hands.

In short, personalisation is no longer optional - it is essential. The Bahamian economy thrives on relationships, and technology is making it possible to scale those relationships in smarter, more personal ways. The future of customer loyalty in The Bahamas will belong to the businesses that can blend warm, authentic service with cutting-edge personalisation tools.

At the end of the day, whether it is a tourist choosing where to vacation or a Bahamian deciding where to shop, one truth remains: People stay loyal to the businesses that make

them feel seen, valued and understood.

NB: About Keith Keith Roye II is a highly analytic and solutionsdriven professional with extensive experience in software development. He holds a BSc in computer science and his career includes leading and delivering global software projects in various industries in The Bahamas and the US.

ALLIANCE FEELING MISLED OVER ROSEWOOD EXUMA DREDGING

OPPONENTS of the

$200m Rosewood Exuma project are voicing concern that the amount of dredging required for the Sampson Cay project is far greater than the public was initially led to believe.

“We were either inadvertently or deliberately misled, and in either case that is an insult to us as Exumians. Yntegra is showing a total lack of respect for the local population, and for the environment of the Central Exuma cays,” said the Save Exuma Alliance (SEA), a group of Exuma tour operators, business owners and residents, in a statement.

They expressed fears that the planned dredging could result in the destruction of an area of coral reefs and sea grass larger than three football fields. The Alliance

is arguing that the plans presented to the public showed dredging to seven feet deep but, according to Yntegra’s own environmental consultant, BRON, the depth required to achieve its shipping channel in the North Bay of Sampson Cay would be ten feet.

The Alliance’s statement asserted that this three-foot difference is significant, and would increase the amount of dredging required by 42.9 percent. It said the North Bay of Sampson Cay is one of the few remaining pristine diving and snorkelling sites in the region, and is home to thriving coral reefs, large meadows of sea grass and thousands of infant conch.

BRON’s statement about the appropriate depth of the shipping channel was

made during a public meeting in October last year, but the revised Environmental Impact Assessment (EIA) submitted to the Department of Environmental Planning and Planning (DEPP) by Yntegra, as well as other documents, use the shallower seven foot depth to calculate the amount of dredging required.

This will allow service cargo delivery vessels to access the service dock for Rosewood Exuma in an environmentally-sensitive location. The Alliance, though, estimated that the project will generate 2.8 tons of garbage and 103,000 gallons of sewage a day, with its scale impacting the very environment that attracts visitors to the Exuma cays.

Peter Vlasov, an Alliance member with a career

and background in shipping, said the arrival of barge and shipping traffic will pose unnecessary risks to the area’s environment. A homeowner on the nearby island of Wild Tamarind Cay for more than a decade, he added: “It is grossly wrong; there’s not enough water.”

The Alliance is arguing that Yntegra’s plan to build a major resort, hosting upwards of 500 staff and guests on a small cay with no pre-existing infrastructure, is the wrong project in the wrong place. The proposed plan calls for over 90 structures, and it added: “The massive overbuild will lead to degradation of land, sea and wetlands.”

The Alliance called for Rosewood Exuma to either be reduced in scale

and scope, or relocated to a better-suited site such as Georgetown, where infrastructure exists and there is a ready labour force searching for work.

At a minimum, it is urging that Yntegra move its service dock to the south side of the island where it intends to dredge two marinas. That location enjoys deep water with little risk of running aground, and supply vessels would not pose a safety hazard in an area that swimmers and snorkelers frequent.

“We would welcome Yntegra Rosewood on three conditions – scale back the size of the project, move the supply dock to the south side of the island where there is deep water already and reduce the size of the mega yacht marinas,” said

the Alliance. “But stop pretending, saying things like you are protecting the environment when your plans show that you are going to dredge right through it.

“By moving the supply dock to the south side, they can maintain pristine waters, sandbars and reefs of the North Bay of Sampson Cay for everyone, including their own guests, to enjoy.”

Bahamas urged to fill ‘market niche’ via regulatory strength

A TEXAN professor yesterday urged The Bahamas to capitalise on the strength of its financial services regulatory regime to fill a “market niche” sought after by international business. Andrew Morris, a professor in the Bush School of Government and Public Service and the School of Law at Texas A&M University, told the Nassau Conference that increasing global regulations and sanctions are reshaping the international banking and payments landscape - often with negative consequences for smaller countries

and legitimate financial transactions.

He added that, due to The Bahamas having dealt with successive international supervisory initiatives and improved compliance, it now has a depth of expertise that is attractive to international markets.

“You’re a specialist in compliance. You have the expertise here to do compliance because other countries have been demanding that you do things that they don’t for a long time. And so because you have that expertise, there is a market niche that

Attorney calls for Financial Services Ministry’s re-birth

A BAHAMIAN attorney yesterday argued that reestablishing the Ministry of Financial Services “would be a game changer” while also calling for a balanced approach to work permit approvals.

Katherine Elza, a partner at Graham, Thompson & Company, told the Nassau Conference that re-creating a dedicated Ministry of Financial Services could transform The Bahamas’ financial services industry through co-ordinating government policies to better support the sector’s growth and attract more international business.

She added that a welloperated ministry could work with other parts of government to ensure policies such as Immigration, infrastructure, technology and even healthcare are designed to help the financial sector thrive.

“Re establishing and reimagining a Ministry of Financial Services would be a game changer for our next stage of development. It would send a clear message to global partners, regulators and investors that The Bahamas is serious about maintaining its place on the international stage,” said Ms Elza.

“More importantly, it would ensure that our domestic policies - from education to infrastructure - are designed with

an understanding of how financial services underpins the diversification of our economy. So with an election year upon us, may I urge both political parties to consider this post.”

The Ministry of Financial Services no longer exists in name, having become the Ministry of Economic Affairs with much wider responsibilities, although it is still charged with promoting the sector and has a director of financial services.

Ms Elza, who also serves as a director of the Bahamas Financial Services Board (BFSB), also called for an improved work permit system, noting one of the most pressing challenges facing the financial services industry is managing Immigration in a way that respects the long-standing principle of Bahamianisation while meeting the industry’s demand for specialised global talent.

“Let me make the point that Bahamianisation, introduced well over 50 years ago, was brilliant and absolutely necessary. But

you can fill that organisations and entities in larger jurisdictions are unlikely to be able to match,” said Professor Morris. He added that The Bahamas has established regulations, and developed sufficient professional expertise, to allow it to adapt. “You have established frameworks for navigating complex international regulatory environments, and you have that all-important seat at the table as an independent country that many of the other financial centres do not,” Professor Morris said.

let me also say that any

country that wants to grow a global industry that, by its very definition, relies on international institutions and people from all over the world, simply must have an efficient, user friendly and fast-moving permitting system that enables jobs to be filled in a timely manner and enables individuals, all of whom have choices, to relocate at a reasonable and certain speed,” said Ms Elza.

She also highlighted housing availability as a critical concern for attracting high net worth individuals to The Bahamas, while pointing out the opportunity this presents for developers.

“One of the main complaints that I hear in my private practice is a lack of high-end inventory for the high net worth clients who want to move, move now turnkey, and the difficulties, one would even say the disincentives, for contractors and builders to efficiently undertake large projects in The Bahamas,” said Ms Elza “I daresay that any developer with a vision to create housing that would rival any successful housing development in The Bahamas would make a significant difference in the inventory offering to both Bahamian and international purchasers.”

“You also have the professional infrastructure. You have the lawyers, the accountants, the compliance professionals who can develop those systems and who understand how to structure legitimate transactions. Most important, you provide the financial plumbing that prevents the legitimate local commerce from grinding to a halt.”

Professor Morris said current global challenges - political paralysis, trade wars and financial sanctions - are interconnected and worsen each other. He added that this environment is

fragmenting the global financial and political system and making it harder for countries to cooperate effectively.

“Now, these three challenges that I mentioned don’t exist in isolation. They reinforce. One, political paralysis, makes countries unable to respond effectively to trade wars. That increases the temptation to use financial sanctions, which further fragments the global system and increases political instability in this environment,” said Professor Morris.

“We’re not just offering tax efficiency. You’re

providing stable and limited infrastructure that allows international commerce to continue functioning when the larger systems fail. You are the platforms where people from different countries can pull capital to invest in productive enterprises with minimal friction, even when their governments can’t co-operate directly.

“So, in a world of democratic paralysis, trade wars and financial optimisation, you are the essential infrastructure for maintaining global economic activity.”

BAHAMIAN TOURISM REINFORCES MIAMI HURRICANES PARTNERSHIP

THE Ministry of Tourism, Investments & Aviation was the presenting sponsor for the University of Miami Hurricanes’ football game against the University of South Florida Bulls last Saturday Senator Ryan Pinder KC, the attorney general and minister of legal affairs, and Latia Duncombe, directorgeneral at the Ministry of Tourism, Investments and Aviation, watched the Hurricanes defeat their local rivals by 49-12 in the cash at Miami’s Hard Rock stadium.

Now in its third year, the partnership between the Ministry of Tourism, Investments and Aviation and University of Miami Athletics includes game sponsorships, Bahamian cultural showcases and interactive fan engagements spanning the university’s football and basketball seasons.

The Ministry of Tourism, Investments and Aviation, in a statement, said the tie-up advances

The Bahamas’ ‘Sports in Paradise’ initiative that aims to develop the country as a destination for sports events, conferences and tournaments.

It added that the second annual ‘Canes Weekend in The Bahamas’ will be held from October 31 to November 1. Billed as a cross-cultural celebration, the event brings together Hurricane fans, players and alumni, and will take place in Nassau.

“This partnership with the University of Miami is an important pillar in our

ongoing efforts to showcase The Bahamas as a world class destination,” said Chester Cooper, deputy prime minister and minister of tourism, investments and aviation.

“We know that sports is a powerful medium to reach engaged fans and, with the recent airlift announcements coming out of Florida, these activations are a timely reminder that paradise is only an hour away. We look forward to welcoming the Hurricanes community back to Nassau this fall where they can experience our world class hospitality and the beauty of our island nation.” Last weekend’s game included a Bahamasthemed fan zone. Highlights included activities such as cornhole and complementary virgin daiquiri tastings in flavours such as Pineapple Paradise and

Strawberry Breeze. Fans also enjoyed themed giveaways including swimming pigs-branded sunglasses.

The Ministry of Tourism, Investments and Aviation said it transformed the fan zone experience with a Junkanoo performance. “The energy at Hard Rock Stadium underscored the strong connection between Hurricanes fans and The Bahamas, and we are thrilled to bring that same excitement home for Canes Weekend,” said Mrs Duncombe.

“This celebration is more than an event; it’s an invitation to experience the magic and adventure that defines each of our 16 unique islands.” Canes Weekend will have accommodations available at The Pointe’s Margaritaville Beach Resort or the British Colonial in downtown Nassau.

Union to launch compliance unit to police entertainment industries

By ANNELIA NIXON Tribune Business

THE United Artists Bahamas Union, following its swearing in today, aims to launch its Compliance and Intelligence Unit (CIU) which will police the music and entertainment industries.

With UABU officers and executives being sworn in today, president Linc Scavella has announced his plans to follow through with the launch of the unit.

“United Artists Bahamas Union (UABU) gets ready to launch its Compliance and Intelligence Unit (CIU) in a meaningful move to assist in policing the music and entertainment industries, with respect to foreign artists, acts, and their associated personnel landing in The Bahamas to engage in gainful employment. Mr Scavella’s Facebook post read. “While the other music and entertainment Union (BMEU) is slack

concerning the non-compliance of many of the concert promoters and/or applicants including but not limited to some of the major hotel establishments in the country, UABU seek to be the eyes and ears for The Bahamas Departments of Immigration and Labour.

The post also noted that “UABU’s standing committee for Immigration, Labour, Tourism, and Culture, headed by Mr Fred Munnings Jr will undertake the responsibilities of the Compliance and Intelligence Unit (CIU).”

“The mandate of UABU and its Compliance and Intelligence Unit (CIU) is to protect the interest and welfare of creatives in the music and entertainment industries by policing the before mentioned industries, while at the same time, causing the laws and or regulations pertaining to short-term work permits for foreign artists, acts, and their associated personnel to be enforced,” it read.

In a document provided to Tribune Business by UABU, it states that an Entertainment Compliance Team (ECT) will consist of a compliance manager, seven compliance officers and administrative support staff. The ECT would verify permits, contracts and artist documentation, ensure venues meet the health and safety standards and

confirm artists and venue contracts adhere to legal and regulatory standards. They also hold the responsibility of venue inspections and event monitoring to “ensure adherence to stipulated timeframes, noise ordinances, and conduct guidelines”. Once an event has wrapped, the ECT will assess if rules and agreements were adhered to and report incidents and breaches to the “appropriate authorities”. The document stated the ECT may impose administrative fees for compliance reviews.

According to the document, applications for events must be submitted to the ECT at least 30 days prior and the team will review and decide a result within ten business day. If approved, inspection will occur within 48 hours of the event with the possibility of a random set check during the event. If found to be non-compliant penalties, including fines, event suspension or blacklisting may be the result. The document said regular updates will be shared with stakeholders to keep them abreast of compliance requirements and changes.

Grievances must be addressed within seven business days through a hotline and email established for that purpose.

CLIFTON PIER LNG ENGINE ‘ONLINE BY EARLY 2026’

By ANNELIA NIXON

BAHAMAS Power & Light (BPL) yesterday said its Clifton Pier power station expects to bring the first Liquefied Natural Gas (LNG) generation unit online during the 2026

first quarter.

A statement put out by Bahamas Power and Light (BPL) is targeting, within the next six months, a major shift toward more environmentally friendly and sustainable power generation with the expectation to bring its first Liquefied Natural Gas (LNG) engines online in the first quarter of 2026.

“We’re now in 2025, and we’re on the cusp of something transformative,”

BPL CEO Toni Seymour revealed yesterday at

CARIF 2025. “Once the LNG terminal is completed, we expect the first LNG generators to come online in Q1 2026. That means we’ll be burning cleaner fuel, and as we implement LNG across the Family Islands and New Providence—where we see our peak load—the volume of fuel we consume will be

lower. As a result, fuel costs will become more stable, and ultimately, customers will see a reduction in their electricity bills.”

Noting that they are “on the brink of moving the energy sector into the 21st century”, she added that the focus is on reducing carbon footprints and decreasing the reliance of fossil fuels.

Ms Seymour spoke to the establishment of Independent Power Producers (IPPs) in the Family Islands, and the rollout of utility-scale solar farms in New Providence. Three solar farms are planned for New Providence including behind CV Bethel High School, the Coral Harbour area, and adjacent to the existing Baillou Hills Power Station. In the case of intermittent solar output, Battery Energy Storage Systems (BESS) will be deployed. Ms Seymour said these

steps will reduce the fuel surcharge on customers’ bills.

“What we’ve learned from Ragged Island is that the system works,” she said. “The solar panels feed energy into the grid

FNM: Reveal terms of Sandals beaches deal

By ANNELIA NIXON Tribune Business

THE FNM has called on the government to reveal the full terms of the $100m Beaches resort agreement for Exuma as it blasted the current administration over “yet another broken promise”.

Noting the Grand Bahama International Airport, the Grand Lucayan and energy reform, Kwasi Thompson MP for East Grand Bahama called for the Progressive Liberal Party (PLP) to “come clean once and for all” regarding Sandals Emerald Bay and its rebrand into a Beaches brand.

“We saw it with the Grand Bahama International Airport, where demolition was promised in 2023, then again in

February this year ‘within 30 days’,” Mr Thompson said. “Nothing has happened. We saw it with the Grand Lucayan, where they celebrated a heads of agreement signing with no other details. And we saw it again with energy reform, where they promised relief, but bills have nearly doubled since 2021 and will keep rising until 2027.

“If this agreement is truly ready to be signed, then the government must release the full terms. Bahamians deserve to know: What incentives were granted? What local hiring and vendor commitments are included? How will the government coordinate airlift, utilities, and public services to match the projected demand? And what safeguards are in place to prevent another tax dispute from threatening an entire community?

“The time for talk has long passed. The Bahamian people do not need to ‘wait and see’, they need this government to come clean once and for all.”

Mr Thompson pointed to Deputy Prime Minister Chester’s Cooper’s recent comments that “the tax dispute with Sandals is ‘substantially settled’ and that an agreement will be signed ‘very soon’,” adding that the PLP is singing the same tune. He noted that no construction has began since Sandals’ closure a year ago and it has been a blow to Exumians.

“Sandals has committed to transforming the former Emerald Bay into a $100m Beaches resort, promising an average of 3.8 guests per room, a model they say will bring more airlift, more spending, and more opportunities for taxi drivers, straw vendors, tour

operators, farmers, and fishers. But without airlift, there is no benefit. Flights have already dropped from over twenty per week to just five. That decline is devastating the local economy and should never have been allowed to happen.

“The government originally suggested work would begin by late 2024, with a 12 to 15-month build. Now, they claim all terms are agreed but offer no timeline, no start date, and no completion date. Does this sound familiar?”

and charge the batteries, and when battery power runs low, generators kick in. Although those engines still run on diesel, they operate only three to four hours a day. That’s a significant reduction in fuel costs

compared

for the Family Islands.

Marina project said to have suffered damage

the damage value is there. I wouldn’t expect more than $4m in combined claims.”

The RoyalStar managing director said the event had again shown the value of insurance for Bahamian homeowners and businesses when it came to protecting their physical assets - often their most expensive investments - against severe, unexpected weather events.

“We’re happy for those people who had insurance and know the value of insurance for unexpected events like this,” he added.

“We always, for us and as

an industry, concentrate on big picture events like hurricanes and major tornados, but small events like Friday - this microburst storm - it’s just as important.

“Insurance is just as important for the average person to protect their homes and businesses. It reinforces the value of insurance. It’s better to have it and don’t need it than to not have it and need it.”

Mr Saunders said most homes and businesses who had valid insurance policies in effect, and sustained damage from Friday night’s storm, are likely to be covered for any losses.

Resort ‘priority’ to stay open and ‘protect jobs’

VENDORS - from page B1

we continue to exercise prudent financial management, we are reaching out to our valued partners with the following requests.

“We kindly ask for your consideration in extending invoice settlement terms during the months of September and October. This flexibility would provide critical support in helping us balance operations during this period of reduced demand.

“Where possible, we would also appreciate your assistance in offering

temporary discounts during this period. Such measures will help us balance expenses with reduced revenues without compromising the quality of service to our guests.”

Stating that the resort is “deeply grateful” for its supplier relationships, Mr Whylly added: “Please rest assured that these requests are being made with the utmost respect for the mutual value of our business relationship. We view this as a partnership and, as occupancy improves, we are committed to returning to

“It’s a wind event, so it depends on whether it’s a catastrophic event or not. It also depends on the definition in your policy of whether it’s a catastrophic event and the definition in the reinsurance treaty,” he added. “I think most people will be covered.

“It depends on what your policy says and, ultimately, what your reinsurance treaty says on what is defined as a catastrophic event. According to the Meteorology Department, the winds were 100 miles per hour or more for a sustained period of time. That would be a catastrophic event.

“We’ll see how it plays out, but it’s not a significant event. Those who have insurance know the value of insurance, and those who

standard payment terms and service arrangements.

“We deeply value your continued collaboration and are confident that, with your support, the British Colonial will navigate this temporary challenge and emerge stronger.” No discounts or extended repayment terms were specified in the letter, indicating this is being left to vendors themselves to determine.

Mr Whylly, in a subsequent statement responding to Tribune Business inquiries, effectively confirmed that the request and letter obtained by this newspaper were genuine. He added that the downtown Nassau resort’s “priority” is to keep its several hundred-strong staff employed, although he did not state by how

don’t have it will have to rely on their savings or their family’s help to help them recover.”

Timothy Ingraham, chief executive of Summit Insurance Company, through which Insurance Management Company places much of its property and casualty business, also told Tribune Business that the losses, damage and claims from Friday’s storm were unlikely to be major.

“The industry is still evaluating the impact of last week’s weather event on our clients. Initial indications are that losses should not be significant. We should have further details by the end of the week,” he said.

“That event, and even recent fires, show that insurance is important for more than just tropical storms

much September and October occupancies are below forecast.

“As part of our ongoing commitment to responsible financial management, we have asked some of our vendor partners for flexibility during September and October, traditionally the softest months in the hospitality calendar. This is not unusual for industry and reflects prudent stewardship during short-term seasonal demands,” he said.

“Our priority throughout has been to ensure that our team members remain gainfully employed. Unlike many hotels that close or significantly reduce operations during slower periods, the British Colonial remains open, protecting jobs while continuing to welcome guests and maintain service standards.”

The British Colonial general manager, reiterating that the pricing discounts and extended repayment terms request is a temporary measure, signalled that better days lie ahead with the upcoming 20252026 winter tourism season just over two months away with its start marked by the Thanksgiving holiday in the last week of November.

“Importantly, the British Colonial remains on solid footing and continues to invest in delivering the highest levels of service and guest experience,” Mr Whylly told Tribune Business, reassuring that there is no reason for concern or worry over the resort’s nearterm prospects.

“Looking ahead, our forward bookings for November through early 2026 are strong, driven by group business, events and leisure demand. We are confident as the winter high season begins with a strong outlook for the fourth quarter and 2026. We value the trusted relationships we hold with our vendors and our guests, and we are committed to maintaining transparency and excellence as we move forward.”

and hurricanes, as loss events are always occurring. These non-hurricane events may be as costly for individuals homeowners as a hurricane event may be and, in fact, fires where there is a total loss may be even more costly.”

Bahamas Power and Light (BPL) said earlier this week that about 1,000 customers in eastern New Providence lost supply during Friday night’s ‘microburst’ with service now restored to all impacted areas. It added that the hardest-hit communities were re-energised within 24 hours.

BPL said the epicentre of the storm was around Fox Hill Road South but, by 8pm on Saturday, crews had re-energised and restored supply there, as well as

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) immediate past president, told Tribune Business that while September is “off from the same month last year” the industry is looking forward to a strong 2025 fourth quarter to help make up “some of the shortfall” occurring at this time.

“September is September,” he said, noting its historical status as the slowest month in the Bahamian tourism calendar.

“It is slightly behind last year. There are no real surprises. I think last year we maybe had the presence of a number of groups that were not here this year, but I think it’s fair to say a number of major properties have introduced special events to make up the shortfall which occurred this time.

“They are also building up incentives for the local market. That doesn’t make up for all the shortfall, but has certainly allowed different properties to generate some income during this time period of the year.”

One example of such an event is The Bahamas Culinary & Arts Festival, to be headlined by Lenny Kravitz, that Baha Mar is hosting on October 22-26.

“The short answer is that September this year is off from September last year,” Mr Sands, also Baha Mar’s senior vice-president of external and government affairs, added. Asked by how much September is down year-over-year, he replied: “It’s very difficult to say.

“But certainly properties in the high 30 percents [for occupancy] last year are in the mid-30 percents this year, and if they were in the mid-30 percents last year they are in the low 30 percents this year. The positive is that most properties are looking forward to a good final quarter of the year where there is evidence of increased group business and major events at the hotel.

to Kool Acres. Work also continued on reliability upgrades elsewhere, including Bethel Avenue, where an outage to redistribute load from an overloaded transformer prompted an immediate upgrade and the installation of an additional unit. The storm struck around 9pm Friday, toppling trees and damaging infrastructure. BPL said crews mobilised within 45 minutes and worked through limited access in Imperial Park, replaced high-voltage poles on Fox Hill Road South after extensive tree damage; swapping two damaged transformers in High Vista; and clearing a faulty transformer and multiple downed high-voltage lines along Eastern Road near Chancery Lane.

“So we’ll see if some of the shortfall is made up. We do not judge the year’s performance by one month. We have to look at the aggregate and compare on a year-over-year basis. We have to continue doing what we have to do; manage costs, create events and incentives that spur on incremental business at this time of year, and plan for a strong finish to the end of the year with the last two months.”

Darrin Woods, the Bahamas Hotel, Catering and Allied Workers Union’s (BHCAWU) president, told Tribune Business of September: “It is slower than normal, and that’s pretty much why some of the properties took the position [to close] outside of what they normally do; Atlantis closed the Coral Towers, and the Ocean Club and Club Med, which normally close around this time but did it a bit earlier.

“Particularly Club Med. We were able to work one or two things out with them. It’s a bit slower, and it has to do with the tariff wars and things like that, which led to some cooling. We believe things will turn around like they normally do, and we will have a strong showing in the winter season.”

Mr Woods said Bahamian hotel staff who work in service areas normally take their vacation during the September slow season, “so it doesn’t really affect their earnings per se”. However, he added: “We are watching, keeping our eyes on it, in case of any sudden shifts or fall-out so that we are able to respond in-kind. We’re hoping we can get through it kind of quick....

“Based on what’s been said to us, and what’s been indicated from tourism’s standpoint as a whole, the winter bookings seem very promising and solid. For the first part of the year, people were doing very well. We have to keep our eyes on it.”

Morton Salt divesting only its Bahamas unit

ACQUISITION - from page B1

The prospective Morton Bahamas purchaser’s website also referred to “strategic storage facilities in The Bahamas and Estonia” - the precise locations where Liwathon has assets.

Lusca Group, in announcing the potential acquisition, gave few specifics on its plans and did not disclose the purchase price. However, Ms Brown said Morton Bahamas executives promised that union members’ salaries, benefits and other working terms governed by an industrial agreement that lasts until 2027 - will not be affected or altered by the deal.

Lusca Group, in confirming that its Grand Bahama Salt Company has signed an agreement to acquire 100 percent of Morton Bahamas’s shares, said in its statement: “The facility, the second-largest solar salt operation in North America, positions The Bahamas as a leading source of

high-quality solar salt for international markets.

“Lusca Group will also enter into a long-term supply agreement with Morton Salt USA, securing Morton’s role as an anchor client and ensuring continuity of production and export from Inagua. Following completion, Lusca Group plans to invest substantially in the facility’s operations, improve efficiency and expand production capacity.

“This will include investments in upgrading salt quality on the island, as well as targeted investments into other on-island businesses and the local community.” Lusca Group did not respond to questions on the purchase, which were submitted by Tribune Business yesterday, before press time last night. Morton Salt was in the process of replying but did not meet last night’s deadline.

“Salt has been part of Inagua’s identity for generations, and we fully understand the history and importance of this business to the island,” said Richard

Muckle, director of Lusca Group. “By rebranding and investing in the facility, we aim to honour that legacy while creating sustainable value for both our customers and the local community.”

Lusca Group added that it “is preparing a broader island-wide development plan, identifying further opportunities to support Inagua’s long-term growth and resilience. This programme, developed in close partnership with stakeholders, will be presented to the Government of The Bahamas in due course”.

The prospective buyer gave no details on how much investment it plans to make, both in Morton Salt and Inagua, but confirmed that the deal has yet to close and that it “remains subject to customary regulatory approvals”.

Ms Brown, though, said Morton Bahamas management confirmed that Lusca Group, which describes itself as “a privately-owned industrial investment holding company that “focuses

AI plan set to include 'true sWOT analysis'

PLAN - from page B1

an expert policy committee that will be tasked with preparing a comprehensive AI country policy,” said Mr Pinder.

“This AI policy document will incorporate a true SWOT analysis of utilising AI in all elements of our country. An important component of this will be the financial services industry. We look forward to your input as we develop the policy to ensure that we can maximise AI in the financial services industry while mitigating the threats and concerns.”

In addition to AI regulation, the government is developing frameworks for Decentralised Autonomous Organizations (DAOs)— blockchain-based, community-led entities governed by smart contracts.

Mr Pinder noted that recent legislative efforts aimed at aligning local laws with global regulatory standards and fostering new financial products. He stressed ongoing policy innovation is critical for The Bahamas to remain competitive amid rapid technological change.

“We have witnessed over the last couple of years the maturity of the use of DAOs and we are having more and more discussions on practical regulation of DAOs. This is where I think we as a jurisdiction have an advantage, we are nimble, progressive and have unique products that might allow us to advance suitable regulation and structure for a DAO,” said Mr Pinder.

He said the government, working with the Securities Commission of The Bahamas, expects to release a concept note on DAO

regulation soon, exploring legal entities, fund structures, and purpose trusts as viable options. Mr Pinder called these initiatives “very exciting” and said they would position The Bahamas favourably in the international fintech landscape.

“Through work with the Securities Commission of The Bahamas we are working on proposed structures and corresponding scope of regulation for DAOs. We hope to have a concept note on the framework in the coming months. We are looking at structures using either a legal entity, possibly a fund structure, or a legal arrangement, possibly utilising a purpose trust structure, as viable structuring options for DAOs.

We think this is very exciting and will be a welcomed development internationally in the fintech space.”

on strategic investments in physical commodities and infrastructure”, with experience in storage, logistics and resource development, is linked to Liwathon and its Grand Bahama storage facility.

“I guess we have mixed emotions. We always want the best for the company,” said Ms Brown, who has now retired from working at Morton Salt. “We have a contract in place that guarantees, as far as the employees’ benefits are concerned, I think until 2027.

“As far as we know, it’s going to take 60 days before it is finalised. They only signed an agreement to say they’re going to sign an agreement for sale. It’s not finalised yet. We were told all that yesterday. They [management and their advisers] told us about the sale, who’s buying the company and that benefits will remain as is because we are under contract.

“That’s all they said just to inform us. They wanted is to know they are trying to make a deal. It’s a European company that has a company in Freeport. This will be the first time that the name of the company is giving up ‘Morton’ as a name. We’re used to it being Morton Bahamas.”

As for Lusca Group’s pledge to invest in Inagua’s community and wider economy, Ms Brown added: “As far as investing in the community, we really don’t know what the investments are and what they plan to do. My take is that any company going into a community needs to give back to the community.

“Over the next two months we should know something. I guess we’ll have to wait and see what they bring to us before we can act if we need to. Apparently the Government is aware, and everything is in its early stages.

“I guess the employees are not really shocked. We’re used to the company being sold, but this is the first time we are changing the name. My concern is that it is just Morton Bahamas being sold. It appears it’s only the plant in Inagua that’s being sold. We’re hoping for the best.” Tribune Business was unable to obtain a response from the Government to the Morton Salt sale before press time last night. Morton Salt generated around $1bn of annual group-wide revenues, including from its Bahamas operation, in 2020, according to a US Department of Justice press release. That was issued over the move by Stone Canyon Industry Holdings, which is now selling the Bahamian operation, to divest itself of other salt-related businesses to address competition concerns so it could acquire Morton Salt from K + S.

Drawdown had to meet UK agency’s conditions

doing so would mean the funding showing up on its balance sheet and further adding to the already-$11bn national debt.

The Prime Minister’s Office, in a statement, described the UK Export Finance funding and negotiations around it as “exploratory”. It said:

“The bank [UK ExportFinance] indicated that $1bn was available, but any drawdown would depend on projects meeting their internal requirements and demonstrating benefit for The Bahamas.

“The Government did not ultimately pursue this as a financing measure for the Grand Bahama airport.”

However, one financial source, speaking on condition of anonymity, told Tribune Business that the Prime Minister’s Office’s statement raised more questions than it answered.

“What ‘internal requirements’ could the Government not meet? What specific conditions was the Government not prepared to meet? Accountability? Transparency? Procurement?” they asked. “All that is a cute way of saying that they [UK Export Finance] wanted a sovereign guarantee and the Government was not prepared to give it. It still begs the question: Who will give the money without a sovereign guarantee?”

Tribune Business records from the time include an interview with Anthony Myers, Bahamas Hot Mix’s (BHM) chairman, and a lead investor in Aerodrome Ltd, the Bahamian group in the winning Grand Bahama International Airport bid consortium, and Jesse McDougall, UK Export Finance’s head for the North American and Caribbean region.

They confirmed that the size of the potential financing drawdown and its uses were still being worked out with the Davis administration, with the Prime Minister at the time signalling that a portion of the funding may be used for the overhaul of 14 Family Island airports.

Philip Davis KC, responding to questions at a Caribbean Council meeting in London ahead of King Charles’ coronation, gave the impression that $400m of the UK Export Finance package would be devoted entirely to Grand Bahama International Airport’s redevelopment.

This seemed to imply that the price tag had doubled from the original $200m, with the investment set to match that of Lynden Pindling International Airport (LPIA) in Nassau, and raised questions over why the Government - and not the Grand Bahama

International Airport consortium - was seemingly raising the financing for the project.

Mr Davis later clarified that Grand Bahama International Airport’s price tag remains at $200m as previously announced, with the remaining $200m potentially targeted at 14 Family Island airports - such as North Eleuthera and Exuma - whose redevelopment has been estimated at $263m.

This was subsequently confirmed by Mr Myers, who was among the group accompanying the Prime Minister on his UK visit.

“We’re still in negotiations with that in terms of the final sum,” he told Tribune Business of the talks with UK Export Finance.

“The original sum was $270m, and it could be as high as $400m...... It could be higher than that, it could be lower than that. He [Mr Davis] was picking a number he was comfortable with. It will probably be that number. The Government is very much aligned in making this happen and moving forward very quickly.”

Chester Cooper, deputy prime minister, in announcing the Aerodrome Ltd private-public partnership (PPP) deal for Grand Bahama International Airport in mid-March 2023, confirmed UK Export Finance as the financier.

But Mr Davis, in clarifying his statements on the $400m, confirmed that the Government was seeking to structure the potential drawdown from UK Export Finance in such a way as to keep it from adding to the $11bn-plus national debt.

“We’re trying do it in a way that would not immediately increase our debt, and so we’re entering this partnership with the UK Development Bank,” the Prime Minister added. “For all intents and purposes, the bank has indicated to us that they would have $1bn available to us for infrastructural development.

“We have to identify those projects to be able to decide what we would draw down. The fact that it’s available doesn’t mean we will use it all. It has to be a project that they could embrace, and that they feel has what they call an internal rate of return that will benefit the country and its people.”

Ms McDougall explained that UK Export Finance had a Bahamas “country envelope” worth £750m, or $950m, which is the total available financing that can be allocated to infrastructure projects in this nation where there is “UK content” - meaning that British companies are involved.

In the case of Grand Bahama International Airport, Bahamas Hot Mix (BHM) is “the exporter of record” through its UK office. Ms McDougall, though, explained that the total $950m represents “a global allocation” that is not necessarily drawn down quickly, or all at once, by the borrower.

This often occurs over a period of time, “years and years”, before it is used up and, in the case of The Bahamas, it is presently seeking just $400m or less than 50 percent of the total available. UK Export Finance, which serves as the British government’s credit agency, is also selective in

what it funds, choosing only “qualifying projects” once due diligence is satisfactorily completed.

More recently, Ryan Pinder KC, the attorney general, suggested that the Government would inject the remaining net $300m proceeds from its recent $1.067bn sovereign bond issue into the National Investment Fund. A portion of that $300m was to go into one of the Fund’s subfunds, dedicated to airport infrastructure development, and be used to finance Grand Bahama’s airport project.

There has been no confirmation that this has occurred. One source, speaking on condition of anonymity, questioned whether the Government could legally place the $300m straight into the National Investment Fund given that all borrowingsincluding from bond issues - are required by law to be deposited into the Consolidated Fund.

They added that the Government would likely have to go back to obtain Parliament’s approval to do so, as the constitution stipulates that all government spending must occur with either the authority of statute law or the approval of lawmakers.

And obtaining Parliamentary approval would result in the $300m borrowing showing up on the Government’s balance sheet as an expenditure, which would likely result in the Government missing its $75.5m deficit target for 2025-2026 as this bond offering proceeds were not incorporated into this year’s Budget.

FDA PROPOSES BAN ON ORANGE B, A FOOD DYE NOT USED FOR DECADES

By JONEL ALECCIA AP Health Writer

FEDERAL regulators are proposing to remove another artificial dye from the U.S. food supply — Orange B, a synthetic color that hasn't been used in the U.S. for decades.

The U.S. Food and Drug Administration said Wednesday that it would seek to repeal the regulation allowing use of the dye approved in 1966 to color sausage casings and frankfurters. No batches of the dye have been certified, or asked to be used, since 1978, FDA officials said. "Its use has been abandoned by industry," the agency said in a statement.

"The color additive regulation is outdated and unnecessary."

But consumer advocates who have called for tougher FDA regulation of food dyes and other additives for decades have suggested it was an empty gesture.

"It says they are currently willing to take mandatory steps only where it has no impact," said Sarah Sorscher, who directs regulatory affairs for the Center for Science in the Public Interest, an advocacy group.

The move follows the FDA's decision in January to ban Red No. 3 because of potential cancer risk. That dye has been used far more widely in candies, snack foods and medicines.

The Orange B proposal is separate from a successful push by the Trump administration this year to pressure top food manufacturers to voluntarily remove artificial food dyes from products ranging from cereals and yogurt to sodas. After a brief public comment period, it would take effect within 45 days.

U.S. Health Secretary Robert F. Kennedy Jr. and FDA Commissioner Marty Makary have pledged to remove petroleum-based dyes from U.S. foods, citing concerns about children's health. Mixed studies have indicated that exposure to food dyes can cause behavioral problems in some children, including hyperactivity and attention issues. However, the FDA has maintained that approved dyes are safe and that "the totality of scientific evidence shows that most children have no adverse effects when consuming foods containing color additives." Recently, the FDA included six food dyes widely used in the U.S. — Green No. 3, Red No. 40, Yellow No. 5, Yellow No. 6, Blue No. 1 and Blue No. 2 — on a list of chemicals under agency review. Another approved dye, Citrus Red No. 2, is rarely used and found in small amounts in the skin of some citrus products.

TICKET MARKETPLACE STUBHUB SLIPS ON THE PUBLIC STAGE IN ITS TRADING DEBUT ON WALL STREET

By DAMIAN J. TROISE AP Business Writer

STUBHUB received a lackluster reception on Wall Street Wednesday.

The ticket marketplace's stock fell 6.4% from its initial public offering price of $23.50 per share on its first day of trading. The company's shares are trading on the New York Stock Exchange under the symbol "STUB."

StubHub offered just over 34 million shares and raised approximately $800 million. At the closing price, the company has a market valuation of about $8.1 billion.

StubHub plans to use proceeds from the sale to

pay down debt and for general corporate purposes. The company, which is based in New York, said buyers in more than 200 countries and territories used its platform to purchase more than 40 million tickets in 2024. It was cofounded in 2000 by current CEO, Eric Baker. He will remain CEO and maintain control of the company. EBay bought StubHub in 2007. Baker left the company ahead of that sale and founded international online ticket exchange Viagogo in 2006. EBay sold StubHub to Viagogo in 2020 for $4.05 billion, essentially returning it to Baker, who then changed the name of the combined company to StubHub Holdings. It is

among the largest platforms for secondary ticket sales. Its competitors include SeatGeek and Vivid Seats.

StubHub reported just a 3% increase in revenue to $827 million during the first half of 2025 compared with the same period in 2024. That puts the company on pace for slower revenue growth after notching a 29% jump for all of 2024.

Live Nation, which dominates the primary market for ticket sales through Ticketmaster, reported a 1.8% jump in revenue to just under $23.2 billion in 2024.

StubHub has come under criticism along with the broader ticketing industry over hidden fees and

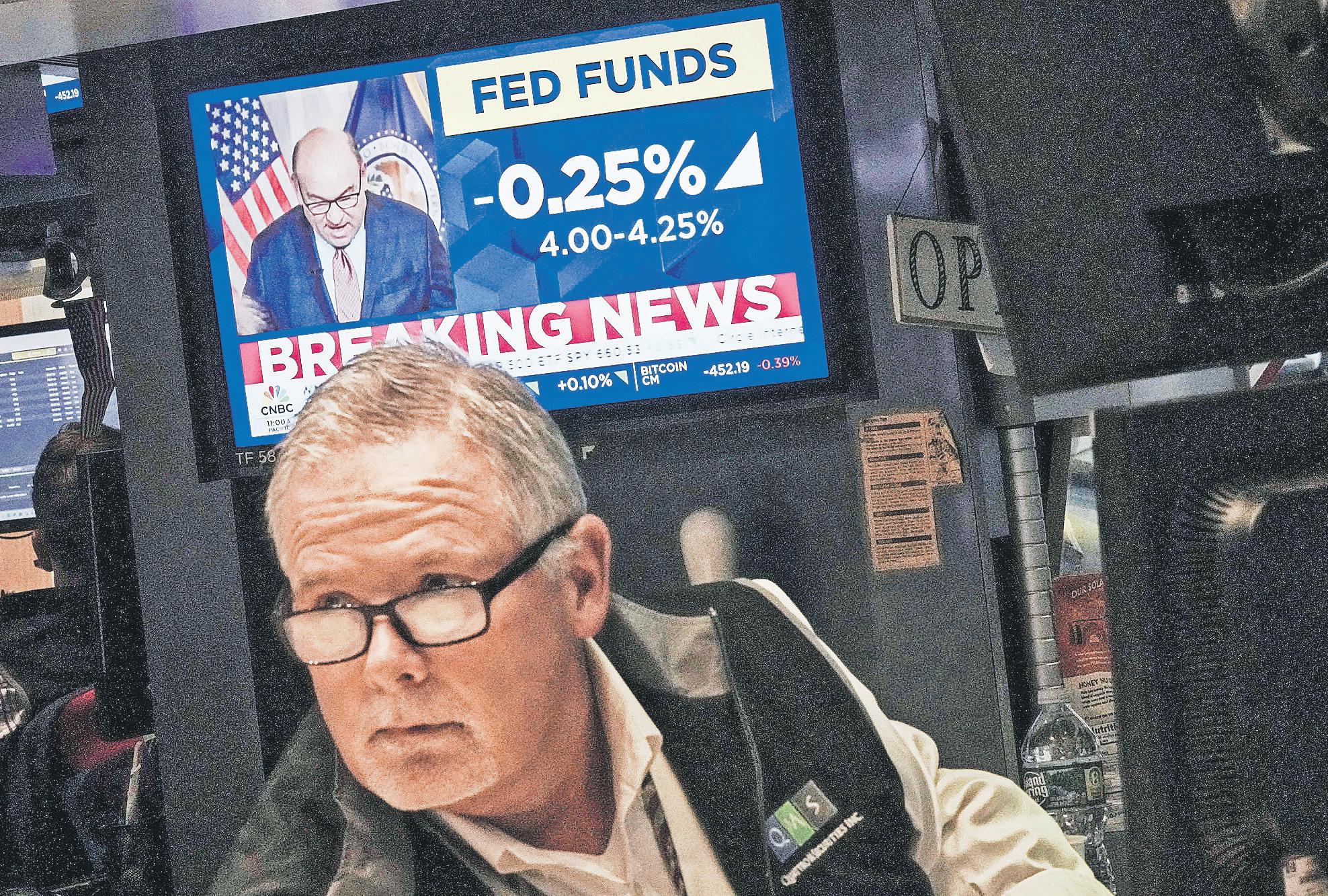

WHAT THE FED RATE CUT WILL MEAN FOR YOUR FINANCES

By CORA LEWIS Associated Press

THE Federal Reserve cut its benchmark interest rate Wednesday for the first time in nine months. Since the last cut, progress on inflation has slowed while the labor market has cooled. That means Americans are dealing with both high prices and a challenging job market.

The federal funds rate, set by the Federal Reserve, is the rate at which banks borrow and lend to one another. While the rates that consumers pay to borrow money aren't directly linked to this rate, shifts in Fed policy affect what people pay for credit cards, auto loans, mortgages, and other financial products.

Wednesday's quarterpoint cut is the first since December and lowers the Fed's short-term rate to about 4.1%, down from 4.3%. The Fed projected it will cut rates two more times before the end of the year.

The Fed has two goals when it sets the rate: one, to manage prices for goods and services, and two, to encourage full employment. This is known as the "dual mandate." Typically, the Fed might increase the rate to try to bring down inflation and decrease it to encourage faster economic growth and more hiring. The challenge now is that inflation is higher than the Fed's 2% target but the job market is weak, putting the Fed in a difficult position.

"The dual mandate is always a balancing act," said Elizabeth Renter, senior economist at personal finance site NerdWallet.

Here's what to know: A cut will impact mortgages gradually

For prospective homebuyers, the market has already priced in the rate cut, which means it's "unlikely to make a noticeable difference for most consumers at the time of the announcement," according to Bankrate financial analyst Stephen Kates. "Much of the impact on mortgage rates has already occurred through anticipation alone," he said. "(Mortgage) rates have been falling since January and dropped further as weaker-than-expected economic data pointed to a cooling economy."

Still, Kates said a declining interest rate environment will provide some relief for borrowers over time.

"Whether it's a homeowner with a 7% mortgage or a recent graduate hoping to refinance student loans and credit card debt, lower rates can ease the burden on many indebted households by opening opportunities to refinance or consolidate," he said.

Interest on savings accounts won't be as appealing

For savers, falling interest rates will slowly erode attractive yields currently on offer with certificates of deposit (CDs) and highyield savings accounts.

Right now, the best rates on offer for each have been hovering at or above 4% for CDs and at 4.6% for high-yield savings accounts, according to DepositAccounts.com.

Those are still better than the trends of recent years, and a good option for consumers who want to earn a return on money they may want to access in the near-term. A high-yield savings account generally has a much higher annual percentage yield than a traditional savings account. The national average for traditional savings accounts is currently 0.38%.

There may be a few accounts with returns of about 4% through the end of 2025, according to Ken Tumin, founder of DepositAccounts.com, but the Fed cuts will filter down to these offerings, lowering the average yields as they do. Auto loans are not expected to decline soon

The

inflated ticket prices. The attorney general for Washington, D.C., sued StubHub last year, accusing the ticket resale platform of advertising deceptively low prices and then ramping up prices with extra fees. The company is also facing pricing and fee inquiries in Pennsylvania and New York. Ticket prices for concerts and sporting events have

Americans have faced

steeper auto loan rates over the last three years after the Fed raised its benchmark interest rate starting in early 2022. Those are not expected to decline any time soon. While a cut will contribute to eventual relief, it might be slow in arriving, analysts say.

"If the auto market starts to freeze up and people aren't buying cars, then we may see lending margins start to shrink, but auto loan rates don't move in lockstep with the Fed rate," said Bankrate analyst Stephen Kates.

Prices for new cars have leveled off recently, but remain at historically high levels, not adjusting for inflation.

been among the sharper rising costs for consumers over the last few years. Ticket prices rose 5.2% in 2024 after rising 6.8% in 2023, according to the U.S. Labor Department's consumer price index. Rising ticket prices outpaced the broader increases for overall inflation in both years and that trend has continued through 2025.

Generally speaking, an auto loan annual percentage rate can run from about 4% to 30%. Bankrate's most recent weekly survey found that average auto loan interest rates are currently at 7.19% on a 60-month new car loan.

Credit card rate relief could be slow

Interest rates for credit cards are currently at an average of 20.13%, and the Fed's rate cut may be slow to be felt by anyone carrying a large amount of credit card debt. That said, any reduction is positive news.

"While the broader impact of a rate reduction on consumers' financial health remains to be fully seen, it could offer some relief from the persistent

budgetary pressures driven by inflation," said Michele Raneri, vice president and head of U.S. research at credit reporting agency TransUnion.

"These savings could contribute to a reduction in delinquency rates across credit card and unsecured personal loan segments," she said.

Still, the best thing for anyone carrying a large credit card balance is to prioritize paying down highinterest-rate debt, and to seek to transfer any amounts possible to lower APR cards or negotiate directly with credit card companies for accommodation. The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Jerry quits Ben & Jerry’s, saying its independence on social issues has been stifled

By MICHELLE CHAPMAN and WYATTE GRANTHAM-PHILIPS AP Business Writers

BEN & Jerry's cofounder Jerry Greenfield is leaving the ice cream brand after 47 years, saying that the independence it once had to speak up on social issues has been stifled by its parent company Unilever.

In a letter, which cofounder Ben Cohen posted on social media on Greenfield's behalf, Greenfield said he could not "in good conscience" remain at Ben & Jerry's — citing a loss of independence to Unilever, which he said had once agreed to give Ben & Jerry's autonomy around its social mission when it acquired the brand more than two decades ago.

"For more than 20 years under their ownership, Ben & Jerry's stood up and spoke out in support of peace, justice and human rights, not as abstract concepts, but in relation to real events happening in our world," Greenfield wrote "It's profoundly disappointing to come to the conclusion that that independence, the very basis of our sale to Unilever, is gone."

Ben & Jerry's, famous for its colorful ice cream containers with flavor names such as Cherry Garcia and Phish Food, has also long been known for its progressive political values

— speaking out on a range of social issues over the years. And in his letter late Tuesday, Greenfield noted that the brand's loss of independence arrived at time in the U.S. when the Trump administration "is attacking civil rights, voting rights, the rights of immigrants, women and the LGBTQ community."

"Standing up for the values of justice, equity, and our shared humanity has never been more important, and yet Ben & Jerry's has been silenced, sidelined for fear of upsetting those in power," he wrote.

Tensions between Ben & Jerry's and its parent have heightened in recent

years — with the ice cream brand accusing Unilever of silencing its statements in support of Palestinians amid Israel's war in Gaza, among other conflicts. And Greenfield's departure also arrives as the consumer product giant, based in London, is spinning off its ice cream business into a stand-alone company called The Magnum Ice Cream Company. In a statement on Wednesday, a spokesperson for Magnum said that it would be forever grateful to Greenfield for his contributions to Ben & Jerry's and thanked him for his service, but was not aligned with his viewpoint.

Waymo's robotaxi expansion will get a Lyft in Nashville next year

By MICHAEL LIEDTKE AP Technology Writer

ROBOTAXI leader

Waymo on Wednesday announced that its driverless vehicles will begin transporting passengers in Nashville, Tennessee, next year while heading in a new direction by teaming up with Lyft instead of its recent ride-hailing partner Uber.

The Nashville plan calls for robotaxi ride requests to initially be limited to Waymo's own mobile app before expanding on to Lyft's app later next year.

Waymo's decision to work with Lyft in Tennessee's biggest city means its robotaxis will now be available on the apps of the two largest ride-hailing services in the U.S.

As part of earlier expansions, Waymo is already dispatching robotaxis through Uber's app i n Atlanta and Austin, Texas.

Electric automaker Tesla has been testing a limited driverless service in Austin in an attempt to fulfill an ambitious plan that CEO Elon Musk has been pursuing for the past decade.

displayed on the door of a car in Mountain View, Calif., May 8, 2018 and a sign for Lyft in Los Angeles, March 29, 2019.

Even if it's in only one city, getting Waymo's industry-leading robotaxis on its app could help Lyft continue its recovery from the pandemic restrictions that decimated demand for rides. Uber bounced back from the pandemic more quickly, a comeback that has been reflected in both its financial results and market value, which has tripled since the end of 2019. Lyft's stock price, in contrast, remains nearly 50% below where it stood at the end of 2019. As part of its turnaround efforts, Lyft hired former Amazon

Photo:Jeff Chiu /AP

executive David Risher as its CEO two years ago. Risher previously negotiated a partnership with May Mobility that is now providing driverless rides in Atlanta in competition with Waymo and Uber.

Investors interpreted the Waymo partnership as a positive sign for Lyft, whose shares surged 13%

"We disagree with his perspective and have sought to engage both co-founders in a constructive conversation on how to strengthen Ben & Jerry's powerful values-based position in the world," the spokesperson said — adding that Magnum is still committed to Ben & Jerry's mission and remains "focused on carrying forward the legacy of peace, love, and ice cream of this iconic, much-loved brand."

Meanwhile, Greenfield and Cohen have been pushing for Ben & Jerry's to be allowed to become an independently owned company again, saying in a letter to Magnum's board that they don't believe the brand

Wednesday to close at $22.84.

This is not the first time that Waymo and Lyft have worked together. During the testing phase of its robotaxi service in Phoenix in 2019, Waymo offered a limited number of rides

should be part of a corporation that doesn't support its founding mission.

Ben & Jerry's has been at odds with Unilever for a while. In March Ben & Jerry's said that its CEO was unlawfully removed by Unilever in retaliation for the ice cream maker's social and political activism.

In a federal court filing, Ben & Jerry's said that Unilever informed its board on March 3 that it was removing and replacing Ben & Jerry's CEO David Stever. Ben & Jerry's said that violated its merger agreement with Unilever, which states that any decisions regarding a CEO's removal must come after a consultation with an advisory committee from Ben & Jerry's board. Unilever said in a statement at the time that it hoped Ben & Jerry's board would engage in the agreedupon process. Unilever acquired Ben & Jerry's in 2000 for $326 million. At the time, Ben & Jerry's said the partnership would help the progressive Vermont-based ice cream company expand its social mission. But experts stress that preserving complete independence from a corporate owner is never promised.

through Lyft. That arrangement ended after Waymo completed the Phoenix tests and began accepting driverless rides from all interested passengers on its own app more than five years ago.

Since starting in Arizona, Waymo's robotaxis have

"What Ben & Jerry's does spills over onto brand Unilever, and vice versa," said Kimberly Whitler, a marketing professor at the University of Virginia's Darden School of Business. "If a brand wants complete and total autonomy, then it is best to remain independent," she added.

Tommaso Bondi, an assistant professor of marketing at Cornell Tech, speculates that both Unilever and Ben & Jerry's "underestimated" conflicts that would arise out of the arrangement — noting that the way that brands now talk about politics and social issues is "completely different" from when this deal was struck 25 years ago. And the size of the parent company today also piles on pressure.

"Unilever is just simply too big to be polarizing," Bondi said, while speaking out on social issues remains a defining feature of Ben & Jerry's identity. "In some sense, it was an obvious clash," he said.

Particularly in recent years, the marriage has been on shaky ground. In 2021, Ben & Jerry's announced it would stop serving Israeli settlements in the occupied West Bank and contested east Jerusalem.

provided more than 250,000 trips in cities from the San Francisco Bay Area to Los Angeles, as well as Austin and Atlanta. Waymo, which began in 2009 as a secret project within Google, also plans to expand into Dallas next year.

Amazon spends $1 billion to increase pay and lower health care costs for US workers

By ANNE D'INNOCENZIO AP Retail Writer

AMAZON says it's investing more than a $1 billion to raise wages and lower the cost of health care plans for its U.S. fulfillment and transportation workers.

The Seattle-based company said Wednesday the average pay is increasing to more than $23 per hour. Some of its most tenured employees will see an increase between $1.10 and $1.90 per hour. Full-time employees, on average, will see their pay increase by $1,600 per year.

Amazon also said it will lower the cost of its entry health care plan to $5 per week and $5 for co-pays, starting next year. Amazon said that will reduce weekly contributions by 34% and co-pays by 87% for primary care, mental health and most non-specialist visits for employees using the basic plan.

Amazon has a global workforce of 1.5 million workers.

Last December, seven Amazon facilities went on strike, an effort by the Teamsters union to pressure the e-commerce company for a labor agreement during a key shopping period. That same month, Amazon reached a settlement with the Occupational Safety and Health Administration that requires the online behemoth to adopt corporatewide ergonomic measures at facilities across the country. The agency claimed hazardous working conditions led to serious lower back and other musculoskeletal disorders at Amazon facilities.

In January 2024, Walmart, the nation's largest private employer, said that average wages for hourly workers would exceed $18, up from $17.50.

The increase was due to Walmart introducing some higher-paying hourly roles in its Auto Care Centers last year, among other changes, the company said. Walmart, based in Bentonville, Arkansas, had announced in January 2023 that U.S. workers would get pay raises the following month, increasing starting wages to between $14 and $19 an hour. Starting wages had previously ranged between $12 and $18 an hour, depending on location.

At Minneapolis-based Target, the starting hourly wage ranges from $15 to $24 for workers employed at stores and distribution centers, depending on the location, company spokesman Brian Harper-Tibaldo said.

The average hourly wage for a Target store worker is more than $18, he said.

Judge dismisses Indigenous Amazon tribe’s lawsuit against the New York Times and TMZ

By ITZEL LUNA Associated Press

A CALIFORNIA judge has dismissed a lawsuit filed by an Indigenous tribe in the Brazilian Amazon against The New York Times and TMZ that claimed the newspaper's reporting on the tribe's first exposure to the internet led to its members being widely portrayed as technologyaddled and addicted to pornography.

The suit was filed in May by the Marubo Tribe of the Javari Valley, a sovereign community of about 2,000 people in the Amazon rainforest.