‘Safety

‘Safety

THURSDAY, JUNE 26,

By NEIL HARTNELL Tribune Business Editor

AN EX-HEALTH minister is warning The Bahamas could “pay a terrible price” for failing to fully finance National Health Insurance (NHI) with the sector’s woes also extending to “critical surgeries” in Freeport.

Dr Duane Sands, the Free National Movement (FNM) chairman, told Tribune Business the outstanding payments owed to doctors and other NHI providers are one issue exposing “the serious challenges” facing the Government in adequately funding the public healthcare sector even as it forecasts a $75.5m fiscal surplus for the upcoming 2025-2026 Budget year.

Apart from NHI, he asserted that vendors and suppliers to the Public Hospitals Authority (PHA) - which oversees the Princess Margaret (PMH) and Rand Memorial hospitals, as well as the Sandilands Rehabilitation Centre - are also “carrying accounts receivables of varying consequences” as a result of not being paid in full and/or on time.

Dr Sands, who was minister of health as recently as the former Minnis administration, said this, in turn, is causing cash flow, liquidity and other financial challenges for these vendors, while Freeport’s Rand Memorial Hospital has implemented a two-week “emergency mode” in its operating theatre because of “safety risks” to surgical procedures caused by “overwhelming” challenges.

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamian tourism

industry and its three main Promotion Boards have united to urge the Prime Minister to “pause” new and increased boating fees that “could not have come at a worse time”.

The Bahamas Hotel and Tourism Association (BHTA), together with the Bahama Out Islands Promotion Board, the Nassau/ Paradise Island Promotion Board and the Grand Bahama Island Promotion Board, in a joint letter to Philip Davis KC voiced fears over “reputational fall-out” given the “multiple reports of cancellations” received from resort and marina properties over the imminent changes.

The letter, which has been seen by Tribune Business, said it was vital that The Bahamas not “create perceived and/

or realised barriers to entry for this high spending, buoyant, sea faring visitor market” especially given the ongoing headwinds and uncertainties impacting stopover tourism as a result of Donald Trump’s tariff policies and various global conflicts.

However, the Davis administration has shown no signs of backing down from the amended cruising permit fees, plus the new fishing permit and anchorage fees, set out

in the Customs Management (Amendment) Regulations 2025. Ryan Pinder KC, the attorney general, yesterday defended the amendments as “fair” and “balanced” in the Senate, as he urged: “Let’s be real.”

Mr Pinder, in his contribution to the 2025-2026 Budget debate, said the social media reaction from boaters made it appear as if the increased and revised fees were “the end of the world for some”.

However, he argued that the reforms were deliberately structured to reward frequent boating visitors and encourage others to visit The Bahamas more frequently, thus generating increased economic benefits.

The Attorney General also suggested that the higher fees are balanced by the nowextended temporary cruising

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition yesterday demanded that energy regulators ensure Bahamas Power & Light (BPL) is not covering operating costs from a fuel charge now set to be subsidised by Bahamian taxpayers.

Michael Pintard, the Free National Movement (FNM) leader, in a letter to the Utilities Regulation and Competition

Authority (URCA) seen by Tribune Business, called on the regulator to probe whether BPL’s fuel charge - which is meant to be 100 percent passed through to, and recovered from, consumers - is being used “illegally” to pay its operational expenses.

His letter emerged after BPL, in a statement issued yesterday, confirmed that Bahamian taxpayers, via the Government, will be funding and underwriting the suddenly-announced Summer

Rebate initiative that is designed to provide BPL’s residential or household customers with modest relief from soaring energy costs. The state-owned utility confirmed that it will be “the Government subsidising the difference to ease the burden on consumers” via an initiative designed to provide BPL’s residential consumers with a 5-6 percent discount on the stateowned electricity provider’s

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

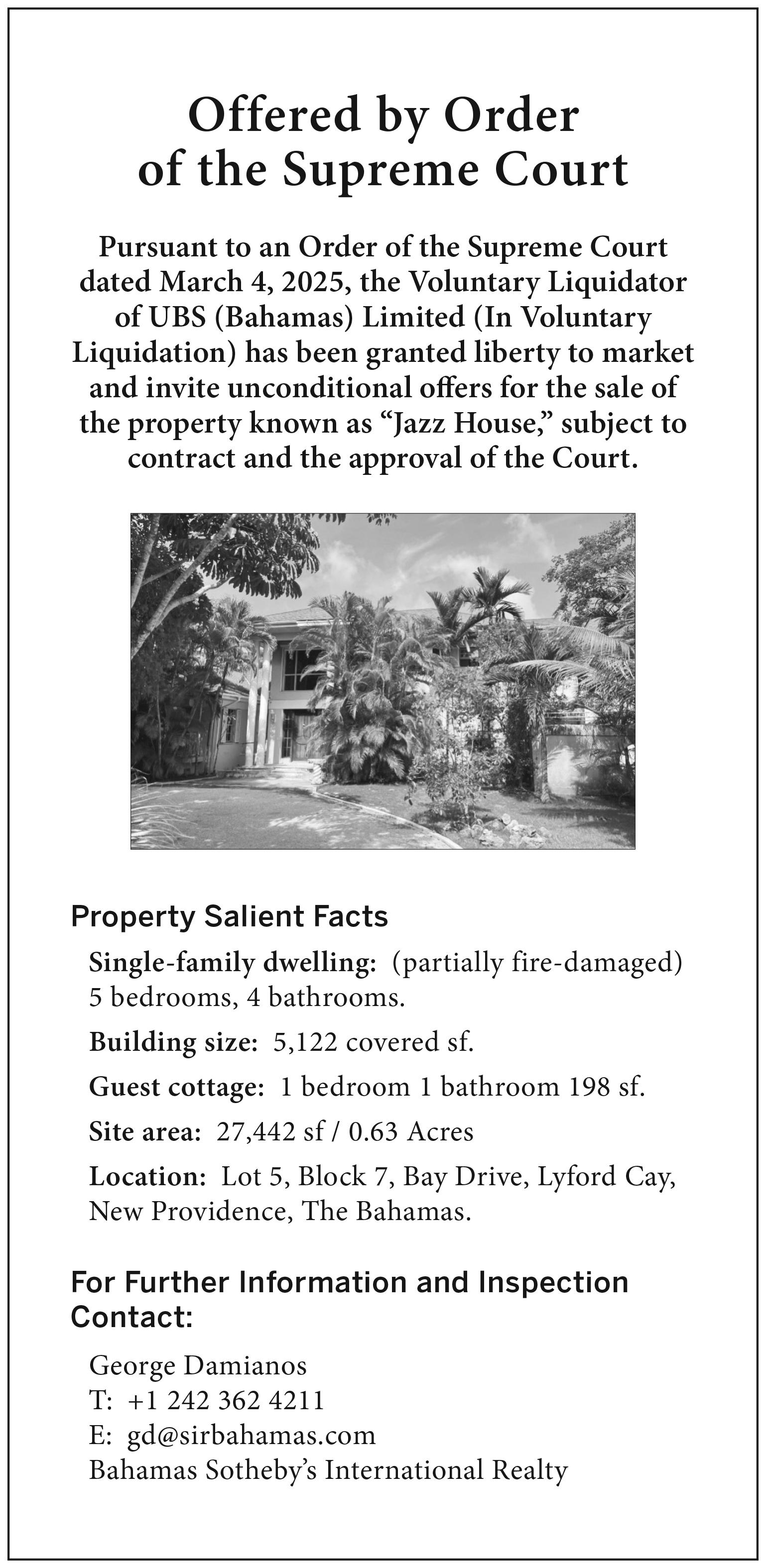

A Bahamian realtor yesterday asserted “there’s got to be a simpler” way for the Government to eliminate VAT evasion on property sales without “unfairly and inequitably” burdening the industry.

David Morley, broker/ owner of Morley Realty, told Tribune Business that the original legislative reforms accompanying the 2025-2026 Budget have “changed slightly” but are still requiring realtors “to do what the Department of Inland Revenue won’t do” and check that attorneys have paid the due VAT and

registered the conveyance in the Registry of Records. Reiterating that realtors’ roles are largely confined to marketing properties, and putting transactions together by matching the buyer and seller, he added

By FAY SIMMONS Tribune Business

structure with six underlying subfunds targeted at specific areas with a focus on public improvement and development projects.

He added that will be structured according to the Santiago principles of best practices, which are the globally-accepted standards for the investment, risk management and governance practices of sovereign wealth funds. “At the Office of the Attorney General, we are operationalising the National Investment Fund as a true, independentlygoverned fund that holds assets in trust for the Bahamian people. The National Investment Fund permits the development of national infrastructure and public improvement projects, facilitating public

By FAY SIMMONS

IMPLEMENTATION of the land registry will begin after the conclusion of the Budget debate, Attorney General Ryan Pinder said yesterday.

Speaking in the Senate yesterday, Mr Pinder said the land registry will have a “fundamental change” to the cost and ease of doing property transactions in the Bahamas.

He said once a property has been verified and placed on the land registry the title will be deemed good and marketable. “We’ve tabled this legislation, it sits in this place right now. And right after we finish this budget, right after we finish this budget, we will debate and we will pass these bills, and we are going to begin the implementation of the land registry in this country and conduct active land adjudication panels processing title to be registered on a newly established land

registry. That’s what we’re going to do right after this budget is concluded,” said Mr Pinder.

He said once the property has been verified and placed on the registry, it will be deemed to be a good and marketable title. He said: “This is for the Bahamian people. And when your land is on the registry, your title is deemed to be good. A properly constituted land registry will be a fundamental change to the approach, to the costs and to the ease of doing business when it comes to

property transactions in this country.”

Mr Pinder said there will now be three registrars, one for records, one for companies, one for intellectual property. The registrar of records will hold personal information and deeds, such as birth and marriage records, which all also be available digitally through the civil registry operational system (CROS), which is now live.

“CROS is a secure, userfriendly online portal that enables private citizens and professional firms to submit documents for official recording with the civil registry from anywhere, whether home, in your office or on the go, users can file documents online, online using credit or debit

card or use escrow services to pay their services,” said Mr Pinder.

“The ability to submit documents for recording and payment online eliminates the need to visit the registrar of records department, making our services convenient and available 24/7. The first phase of the system rolled out includes affidavits of bachelorhood, birth correction, identity and spinsterhood, conveyances, mortgages and satisfaction of mortgages.”

He said once all the data has been uploaded and the stamp tax is paid users will receive a QR code that will authenticate the document electronically.

“You get a recorded proof with a QR code that

will give you an authentication of that document and record it right away. These features allow for document verification via dedicated website. So you can go and scan the QR code, it will go to the website and give you assurances that is an authenticated document significantly reducing the risk of fraudulent documents being used in legitimate transactions,” said Mr Pinder. “We are eliminating fraud throughout our system and becoming a digital country. CROS is a major step forward in enhancing convenience, accessibility and security and public record keeping. We launched a pilot this week, and we’ll

By FAY SIMMONS

THE government’s budget allocations for the Office of the Ombudsman and the Independent Commission of Investigations were defended yesterday by Attorney General Ryan Pinter - who said there are “adequate provisions” in the 2025-2026 budget.

Speaking in the Senate yesterday, Mr Pinder said the budget allocations were “placeholder” funding for new employees would be allocated from the Ministry

of Finance’s $11m allocation for new hires, not the Attorney General’s Office. “Now, before I conclude, I want to address some of the comments on the budget allocations for both the Ombudsman and the Independent Commission of Investigations. We have seen criticisms of the allocations in budget head seven, which is the Attorney General’s head for these newly implemented or to be implemented institutions, and I would like to take the opportunity to clarify this. Colleagues should note that funds in the budget, especially for newly constituted institutions, are effectively

placeholder,” said Mr Pinder. “New hires, for example, for the Office of the Ombudsman and the Independent Commissioner of Investigations will not be found in head seven under the allocations they will be sourced from the global provision line in the Ministry of Finance. Their budget, which is approximately $11m, that’s where all new hires are located. Every new hire in the budget, the pen doesn’t matter which agency it is, are found in the global provision line item of the Ministry of Finance. That’s where they’re found.”

Mr Pinder said the facilities have already been secured and they will be located in the new Supreme Court judicial complex, expected to break ground this year, and the preparatory work on the building has already been completed by the government’s property holding SPV, Poinciana SPV Limited. “It should be noted that the facilities for each of the institutions are already secured. One of them will be part of the complex… and the payment for those facilities are found in the public services line item. The public service is responsible for paying for

all accommodations of the government. So you’re not going to find that in the Office of the Attorney General line,” said Mr Pinder.

“I want to be very clear, there are adequate provisions in this budget for these institutions as new institutions. Those allocations are found in other line items throughout different ministries. That’s just how the budget functions. That’s how the budget functions.”

The Organization for Responsible Governance (ORG) criticised the government for failing to invest in transparency and provide adequate funding for key areas such as the

BY ANNELIA NIXON Tribune Business Reporter

AN ABACO councillor

is calling for more transparency from BPL amid increased power woes.

Roscoe Thompson, councillor of the central Abaco district and chairman of the Marsh Harbour/Spring City Township, confirmed Abaco has experienced “a lot of power issues in the last couple of weeks”. He said Abaconians look to them for answers and they reach out to BPL. However, “they won’t let nobody in there to find out exactly what’s going on.”

“They won’t let local government, they won’t let nobody in there to find out exactly what’s going on,”

Mr Thompson said. “And that question, I think it was brought up on Guardian Radio. What is going on with our power situation?

How come everything is very quiet, and they won’t let the people know what is, what is happening. What is our issue? Is it transmission? Is it generation. What is going on here?

“I think local government needs it because that’s who the people come to, you know, then, then we have to go to people at BPL to get the information. So I think that your outlet of informing people is through the news media, but also local government. But the government has to be straight up with the Bahamian people here in Abaco. Exactly what is going on with BPL right now, here in Abaco? How many generators are actually functionable out there at Wilson City [Power Station]. We had four 12MW generators put in. How many of them are actually running?

“And we need to know what is going on with our power station here in

Wilson City. How many generators are actually running? I mean, because if you only have two generators running, don’t you think you should be looking for alternative means to have a standby generator in place and online, in case the power does go out, that you have a backup. What if we lose another generator, and you only have 12MW? There’s going to be a ton of load shedding going on over here, and then that’s going to affect the tourist. It’s going to be a trickle downeffect. It affects marinas. It affects second homeowners. It affects rentals. It affects Airbnbs.” He noted that the outages impact everyone including tourists. He does not believe BPL is ready to take on the summer loads.

“Today [yesterday] the power went off,” Mr Thompson said. “I know that people were complaining about the other day the power was off. So it’s been more frequent because remember, this is our peak season. The draw over here, I would say island wide, is probably between 20 and 23MW of power that people are drawing and that means that’s what we’re using. We only have 24MW at the power station. So if you get a little peak and it goes over 24MW, it ends up tripping the system.

“Summer is here, and we are continuing to have power outages with sunshine. I can understand when you have a thunderstorm, or something like that. But today, the power went out and it was clear as day.

“It affects everybody, second homeowners, people that don’t have generators. Most of the homes, I would say, in the rental market and a lot of the resorts rely on generators for backup power. But the problem is, is when you end up having to run your generator for 12 or 24 hours. They’re not made for constant running. They’re made for backup, to keep power on for a certain amount of time. [I’m] not saying that you can’t run it for two or three days, but you puta lot more strain on your generator.

“Here in Abaco, I would say, yes, it does affect [everyone] because not every house that is rented out, or every Airbnb has a standby generator. So would it affect tourism? Would it affect tourists that are here and people that are visiting? Yes, it would. People don’t want to be without power, even though it might only be for a couple hours. We understand, there are sometimes outages that are beyond anybody’s circumstances. But something needs to be done and the reason why? Why is our power going out so frequently? It’s hard for me to believe that it’s a transmission of lines, because majority after Dorian or brand new lines. It’s not like they’re 20 years old, like some places in Nassau.”

Mr Thompson said BPL should look into reimbursing the public for damages and due to the fact that power constantly goes out.

“When BPL goes out, or they have a brown out, or a surge, or whatever it may be, if you do not go through

the process and call the power station and let them know that you had a brown out…” Mr Thompson said.

“People lose their ACs, they lose their TVs, they lose their microwaves. They make it very difficult to get a rebate or a refund on burnt up equipment that is the power company’s fault. The red tape that is there is kind of outdated, if you ask me, because if the power

goes off, I have to call BPL power station and say, hey, my power’s off, and then when it comes back on, I got to call him and let them know my microwave broke up. And then I got to go get an application and fill it out, but you have to report that you had a power outage.

The only reason I can say that is because I know when we lost our microwave here in Abaco, and we’re talking

By MATT O’BRIEN and BARBARA ORTUTAY AP Technology Writers

A FEDERAL judge sided with Facebook parent Meta Platforms in dismissing a copyright infringement lawsuit from a group of authors who accused the company of stealing their works to train its artificial intelligence technology.

The Wednesday ruling from U.S. District Judge Vince Chhabria was the second in a week from San Francisco’s federal court to dismiss major copyright claims from book authors against the rapidly developing AI industry.

Chhabria found that 13 authors who sued Meta

“made the wrong arguments” and tossed the case. But the judge also said that the ruling is limited to the authors in the case and does not mean that Meta’s use of copyrighted materials is lawful.

“This ruling does not stand for the proposition that Meta’s use of copyrighted materials to train its language models is lawful,” Chhabria wrote. “It stands only for the proposition that these plaintiffs made the wrong arguments and failed to develop a record in support of the right one.”

Lawyers for the plaintiffs — a group of well-known writers that includes comedian Sarah Silverman and authors Jacqueline Woodson and Ta-Nehisi

implementation of FOI, the Office of the Ombudsman and newly-established Independent Commission of Investigations. ORG said the $140,000 allocated to FOI, which is far below the $1m estimated to operationalise the law. The Office of the Ombudsman has been budgeted $39,890 for the upcoming fiscal year, the Independent Commission of Investigations has been allocated $30,000 and the Public Disclosure Commission was allocated $80,000.

eight years ago, I’ve yet to be reimbursed by BPL, and we did it the right way.

“Should they at the end of the month, give a credit? Maybe that’s something that they need to look at if our power is going off every other day. At the end of the day, BPL should do something to reimburse the public. Whatever that may be. Is that a credit on your account, or something like that. But they get away with murder over here and throughout The Bahamas.”

Coates — said in a statement that the “court ruled that AI companies that ‘feed copyright-protected works into their models without getting permission from the copyright holders or paying for them’ are generally violating the law. Yet, despite the undisputed record of Meta’s historically unprecedented pirating of copyrighted works, the court ruled in Meta’s favor. We respectfully disagree with that conclusion.” Meta said it appreciates the decision.

“Open-source AI models are powering transformative innovations, productivity and creativity for individuals and companies, and fair use of copyright material is a vital legal framework for building this transformative technology,” the Menlo Park, California-based company said in a statement.

Although Meta prevailed in its request to dismiss the case, it could turn out to be a pyrrhic victory.

However Dr Michael Darville, minister of health and wellness, told Tribune Business he was “fully aware” of the situation at the Rand Memorial and that himself and his officials are “on top of” what he described as “environmental challenges” with the operating theatres. These, he said, have been caused by a combination of “malfunctioning” air conditioning units and an ant infestation.

And, addressing concerns over delayed and partial payments to PHA and other public healthcare sector vendors, Dr Darville said the Government had last year made good progress in identifying the financing and budgetary “shortfalls”.

As a result, the Ministry of Health and Wellness has seen its recurrent (fixedcost) spending budget increased by $22.37m for

the upcoming 2025-2026 fiscal year, taking this from $332.747m in 2024-2025 to $355.12m, while the Public Hospitals Authority (PHA)’s taxpayer subsidy has expanded by $15.4mgrowing from $232.456m in 2024-2025 to $247.856m.

Dr Darville spoke after Tribune Business obtained a June 18, 2025, letter addressed to all surgeons and visiting surgeons by Dr Vincent Burton, chair of the Rand Memorial Hospital’s operating theatre clinical management team, alerting them to the two-week “emergency mode” for the facility.

Revealing that he and the management team had conducted “a comprehensive review of current challenges” in the Rand Memorial’s operating theatre on June 17, 2025. “It was unanimously agreed that the volume and complexity of ongoing issues have become significantly

overwhelming, posing risks to the safe and efficient delivery of surgical services,” Dr Burton wrote.

“As such, the committee has recommended the immediate implementation of emergency mode in the operating theatre for a period of two weeks, effective immediately. This temporary measure is intended to stabilise operations and prioritise critical surgical cases during this period.”

Dr Burton did not specify the “issues” that caused ‘emergency mode’ to be implemented until end-June/early July, but Dr Sands, himself a surgeon, suggested that this had resulted from staff and medicine shortages, plus the absence of a back-up anesthetic machine. He suggested that this, and the NHI payment situation, “speaks to the challenge of funding; particularly in the healthcare sector”.

FROM PAGE B2

have a full-scale briefing next month” Mr Pinder also said an artificial intelligence tool will be used to help verify and upload the 1.4m paper documents waiting to be uploaded into the Corporate Administrative Registry Services (CARS) platform.

This process should be completed by the end of September, he said.

“We’ve developed an artificial intelligence tool that will help us with historical data verification, that will look at all of the historical digital data, all 1.4m records in the company platform, and they will update the data sheet in the

platform to be completed end of September,” said Mr Pinder.

“We will have the company registry completely updated with all historical documents utilising a bespoke artificial intelligence tool that has been developed by our developers.”

“There are a number of vendors, the people that supply the services, that have serious challenges with cash flow with NHI and the PGA being two of the largest,” the ex-minister said.

“When you look at the physicians, the laboratories that have contracts with the NHI Authority, you now have to go back and, while they are not saying it exactly in this language, it’s ‘we don’t have the money to pay you’.

“At the PHA, vendors are simply not getting paid and, as a result, they are carrying accounts receivables with varying consequences - shortages of medicine, challenges with ambulances being on the road, the slowdown in the delivery of services. When we look at the ability of the Rand Memorial Hospital to provide surgical services, just now they’ve had to shut down the operating room.”

Dr Darville, though, yesterday told Tribune Business that three of the Rand Memorial hospital’s operating rooms are “back up and going” after the challenges were addressed. “I’m fully aware of the situation,” he said. “We have been experiencing some environmental challenges in the operating theatre in Grand Bahama and it has to do with two things.

“There was a malfunctioning air conditioning unit and we began to see the presence of ants in the operating theatre. Three of the operating theatres are back up and going. We’re on top of it, trying to work it out.” Dr Darville said exterminators had been called in to destroy the suspected ant nest below the operating

theatre’s floor, “and we are in the final stages of addressing that” to ensure a sterile, clean environment. As for the public healthcare sector’s funding, Dr Darville added: “If I could say this: What we have done in this year’s Budget is we looked at where the shortfalls were with the PHA and, if you really assess it, you can see [in my ministry’s] recurrent expenditure there’s a $22m increase. That’s really to cure some of the shortfalls.

“A lot of our programmes are being expanded... and we’ve revised the allocations for other things. This year we learned a lot of where the shortfalls are, and what we are seeing with the use of the hospital for chronic non-communicable diseases. A lot of adjustments were made in the finance.

“Coming from one Budget period to the next, there are some shortfalls to address. NHI, we have some challenges. We believe the increase in the Budget, the increased allocation, will prevent that from happening in this Budget cycle.”

Dr Sands, though, suggested that the failure to pay doctors and other NHI providers on time threatens to undermine a scheme which supposed to help prevent PMH’s accident and emergency unit from “bursting at the seams” as a result of being overwhelmed by patients with non-communicable diseases such as diabetes, hypertension and heart disease.

With the primary, community-level care offered by NHI physicians viewed as key to treating such illnesses, the former minister said of the payment delays:

“I think it should be quite concerning, given the serious challenges we have that need to be addressed.

“We have one of the worst sets of, worst constellations of, non-communicable diseases, and these were intended to be addressed by primary care and secondary care services

delivered through NHI. That was also supposed to reduce [the burden] on acute care facilities.

“If NHI is unable to deliver on that promise, we pay a terrible price... When we have 600-700 people on dialysis being funded by the people of The Bahamas, or the Government of The Bahamas, and many of them are there because of inadequate primary care, this issue of NHI is a huge problem moving forward,” Dr Sands added.

“There’s supposed to be a surplus coming. If you have a surplus still coming, how is it you are so challenged to make good on your Budget commitments? These are items in the Budget that have been approved and yet they are challenged to make ends meet.

“Just a few weeks ago the minister stood up and talked about providing free prescription drugs to many thousand new patients. How can that be possible when you are not paying your existing bills? There’s a serious disconnect between what is being over-promised and under-delivered.” And Dr Sands also questioned how, in the current climate, the Government can fund NHI’s catastrophic care expansion.

Noting that NHI providers have a legitimate expectation of being paid in full, and on time, for services they are contractually obligated to deliver, the ex-health minister said the delayed payments were forcing some to take on larger and extended overdrafts as they financially carry the scheme.

“There are many, many persons who have said to me personally that it is causing a financial strain and, in many circumstances, the strain is so severe that persons are having to take on lines of credit that they have never had to before because, in part, they are owed large sums of money by NHI,” Dr Sands said.

BY ANNELIA NIXON

BPL has said that higher power usage in summer by households is a factor in the increased electricity bills homeowners are experiencing.

The company said “many households are now surpassing the 200kWh threshold, which means they are billed at a higher rate”.

This follows complaints by outraged customers whose bills have seen a dramatic increase.

BPL said the June 2025 billing period saw a fuel charge of “18.99605 cents per kWh for customers using up to 800 kWh” and “22.19605 cents per kWh for usage above 800 kWh”. They added “this is up from May's rates of approximately 16 and 20 cents per kWh, respectively”.

“Bahamas Power and Light Company Ltd (BPL) is aware of increased public concern regarding recent

electricity bills and wishes to clarify the contributing factors while reaffirming its commitment to transparency and customer support.

“Electricity usage typically rises during the summer due to the extended use of air conditioning and other cooling appliances.

Many households are now surpassing the 200-kWh threshold, which means they are billed at a higher rate.

“Additionally, customers should note that the fuel charge, which is a variable, pass-through rate, increased in June due to our current reliance on diesel generation. BPL does not profit from the fuel charge; it is directly tied to the cost of fuel used to generate electricity.”

BPL expressed support for the government’s Summer Energy Rebate which will take effect “in the July billing period”.

“Under this initiative, residential customers will benefit from lowered fuel charge rates of 17.4 cents and 21.4 cents per kWh,

with the Government subsidising the difference to ease the burden on Consumers.

“The rebate is part of a broader national strategy to address high fuel costs, stabilise pricing, and improve energy efficiency across the country. In support of this effort, BPL is preparing for a major transition to Liquefied Natural Gas (LNG) as its primary fuel source by the fourth quarter of this year, a move expected to reduce long-term fuel costs and improve reliability.”

BPL, to encourage “energy-saving habits,” recommended that customers use fans and to have their air conditioners set to 78 degrees fahrenheit. They said customers should unplug electronics and appliances they’re not using, consider the use of LED bulbs and running heavy appliances during cooler periods of the day.

While some households experienced a jump in their electricity bills, some businesses said theirs have remained within its normal

range. However, Keyshna Kemp, owner of Da Wash House and Transformations Fitness Centre in Eleuthera said, while she hasn’t seen a major increase in her businesses’ electricity bill, reimbursement for revenue loss due to outages “would be nice.”

“I know it's summer coming on so I've noticed an increase,” Ms Kemp said. “I didn't notice anything going down. And my house bill, I just look at that. That is nice and high.

“They normally turn off on the day that is my busy day, Thursday. They have a schedule to go off tomorrow [today]which is my busiest day. Their routine tis Thursdays. When they move it to Wednesday, one time, I was like, nice. I don't mind. But Thursday is one of my busiest days, because people know Fridays and Saturdays are busy. So they've now started coming Thursday, and that's the day they always have it off. So it's scheduled to be off tomorrow, and I'm trying to figure

development projects related to the orange, the blue economies, and maximising underutilised sovereign assets,” said Mr Pinder.

“The structure of the NIF, as we call it, is intended to adopt the Santiago principles of best practices, promoting transparency, good governance accountability and prudent investment practices. We’ve looked to have the fund constituted by the end of this month, that’s our goal, and funded in part from the proceeds of the recent bond offering.”

Mr Pinder said there will be an Airport Development sub-fund for financing the redevelopment of airports in Long Island and Grand Bahama. He added that the

Prime Minister will make an announcement with further details on the latter project shortly.

“My colleagues from Grand Bahama listen carefully…the first one is an Airport Development Fund. This is for the funding for the development of the new Grand Bahama International Airport, which we will hear more on from the Prime Minister soon. The structure of the funding is being put in place Grand Bahama,” said Mr Pinder.

“And for those in the Family Islands, we’re not leaving you out. The funding in the fund for the Airport Development project will be for select Family Island projects as well, Long Island.”

Mr Pinder said the $86m financing for Eleuthera’s

Glass Window Bridge will come from the Infrastructure sub-fund, while the Real Estate Development sub-fund will hold the shares of government real estate projects.

“We will be creating a Real Estate Development sub-fund. This is where PPP (public-private partnership) projects for real estate transactions are going to be held. It will hold the shares of Poinciana SPV, which is going to have the court complex in it,” said Mr Pinder.

“We will have an Infrastructure Fund for PPP transactions to enhance infrastructure. Eleuthera, listen to me…the Infrastructure Fund will be the fund to hold and raise the financing for the new Glass Window Bridge. We are putting what is needed in

out, are they still going to do that, seeing as how it's been off from after 11 today and still off now.”

“I will have to sit down and determine that on Thursdays, I lose $300, $400

Are you not only going to put it against my bill?

What are you going to do for the future? Let's say in one week, $300, that's what I lost. But then what about the other two, three weeks that you turn it off?

Are you going to give me credit? How much credit can you give me? [Enough] that I don't pay light bill for years?

“I saw something happen in Nassau. I think when they were doing the roads that they were making an allowance for businesses that were impacted. But I don't think ppl even would care that I can prove that there's so much business I'm losing each week or every other week.

“Weren't we told that this summer was going to be better. Weren't we told that these generation problems

place to bring this country forward.”

Mr Pinder said the Equity Holdings sub-fund will hold the Government’s equity interests in companies such as the Bahamas Telecommunications Company (BTC) and the Nassau Cruise Port, while the Natural Resources sub-fund will hold revenue generated from the blue economy such as blue carbon credits.

“We’ll have the Equity Holdings sub-fund,” Mr Pinder said. “This fund will now have an independent governance for all shareholdings of the government, for BTC, for Aliv, Cable Bahamas, the Nassau Cruise Port.

“All the shareholdings of the Government will be held in a sub-fund, now professionally managed with dividends separate from

government holdings in this sub-fund, where dividends will now be able to be used for wider purposes of development of the country.”

“We’ll have a Natural Resources sub-fund to receive royalties and other revenues from natural resources in the Commonwealth of the Bahamas. And we will have a Blue Economy sub-fund to receive revenues generated from the blue economy, which includes revenues from the new Maritime Revenue Unit and from blue carbon credits. They will go into this NIF sub-fund.”

Mr Pinder added that audits of the Fund and its sub-funds must be given to Parliament annually, pledging that the process will be transparent to ensure the assets are “held and governed and used in an objective, a professional and a transparent manner”.

“Organising the structure and operations and

would be solved, that they're getting new borrowed machinery, last time when the people were making noise. What happened? I thought these issues were being addressed.”

Amanda’s Convenience Store proprietor, Garfield Johnson, said his bill has remained in normal range as well, adding that although his store will not be part of the rebate as it is for residential consumers, he believes it’s the government’s way of helping Bahamians.

“I can't speak for the government, and I am on nobody's side, FNM, PLP, or COI,” Mr Johnson said.

“My thing is my light bill didn't go up dramatically. What I read in the newspaper this morning, because I sell newspaper and I saw the front line is, maybe the government is trying to help its citizens out for this summer. Now, is it because they're soon going to call elections and other things? I have no idea, but my light bill has never doubled under the PLP. And I'm a non-voter."

investment profiles of the NIF has been a complicated process. It’s not an easy process to put this in place. Passing the laws are one thing, implementing is another, and it takes time sometimes. We’re ready to move now. We want to ensure that the assets of the Bahamian people are held and governed and used in an objective, a professional and a transparent manner,” said Mr Pinder.

“You recall from the NIF legislation audits have to be given every year to Parliament. Reports on investment criteria and investment strategies have to be given. Matters have to be promulgated in regulation and gazetted. This is a transparent process, and that is where we are moving to; to put Bahamian assets to be held in trust for them into this type of structure”

permit, which will last for 12 months from July 1, 2025, as opposed to the existing three-month or 90-day permit. And he argued that the Government had listened to industry concerns by increasing the size of boat qualifying for the lowest-value permit from 34 feet to a maximum 50 feet.

However, the BHTA and the three Promotion Boards warned that overwhelmingly negative market reaction means The Bahamas is suffering “real time significant economic fallout” from boaters cancelling their planned visits and electing to take their business elsewhere.

“The amendments, slated to go into effect in less than seven days, on July 1, 2025, have been met with critical concern from stakeholders including properties who, as part of their tourism offerings, have marina facilities to accommodate this segment of stopover visitors,” the Bahamian tourism industry warned.

“We have received multiple reports of cancellations from properties/ marinas across the archipelago immediately after the changes were published and circulated via news channels, social media and online forums that are used prolifically and specifically by the boating community.”

The letter to the Prime Minister added: “These ‘on the books’ cancellations reflect the real time significant economic fallout. However, they do not depict the actual financial losses of the visitors contemplating coming to The Bahamas who have since changed their minds due to the perceived consequences of varying changes.

“Negative feedback expressed via social media, and to and through industry participants, includes shock at the announcement and the extremely short ‘runway’ for implementation; the interpretation of prohibitively heightened fees; a truncated period for exit and re-entry for the temporary permit holders before the significantly higher fees ‘reset’ (from 90 to 30 days), all features which negatively impact our ‘spur of the moment’ seafaring stopover visitors.”

The Bahamian tourism industry also cited “the

added cost of $500 for certain towed tenders, which exist for safety and access purposes; confusion regarding ancillary anchorage fees, and the construal that mariners could be subject to a ‘summary conviction’ in The Bahamas, which carries a substantive fine ($1,000), for not having an AIS (automatic identification system) enabled on board their vessels.”

Detailing the consequences, the BHTA and three Promotion Boards said: “There is no good time to suffer visitor cancellations and reputational fall-out. However, these cancellations could not have come at a worse time for our Bahamian businesses in the tourism industry throughout the archipelago.

“We are aligned in our apprehension and concern, as our tourism industry faces uncertain times given external forces and global events that are unfolding that lie beyond our control, which are having a negative impact on our tourism industry. While our cruise Industry remains less impacted, our land-based tourism businesses throughout The Bahamas face far less predictable, precarious economic headwinds.

“It is imperative we do not deploy any measures which would create perceived and/or realised barriers to entry for this high spending, buoyant, sea faring visitor market, who contribute significantly to a vast number of tourism business owners, operators and entrepreneurs throughout the archipelago during their stay in The Bahamas.”

The BHTA and Promotion Boards requested that implementation of the Customs Management (Amendment) Regulations 2025 be temporarily suspended so that the Bahamian tourism industry can gain a better understanding of the new and increased fees, and what is meant and intended by the reforms, so that they can provide the correct interpretation to the boating market and mitigate the concerns.

“We respectfully request that a pause be placed on the implementation of these recently-announced amendments,” they urged Mr Davis. “We would be grateful to have an audience with you, in the immediate future, Prime Minister,

alongside the Deputy Prime Minister and minister of tourism, investments and aviation, and any other apt public and private sector representatives, to discuss the aims and ramifications of the consortium of changes in order to determine the best way forward where we can achieve mutual goals without causing damage or disruption to this invaluable sector of our sea-faring stopover visitor market.”

Mr Pinder, though, moved swiftly to defend the Government’s position during the Senate’s Budget debate.

“So we’ve heard a lot of discussion about these regulations and the fees prescribed in them, right? You go on Facebook and it’s like the end of the world for some of these cruises,” he asserted.

“Yes, we’ve increased the fees. We’ve also increased the duration of the cruising permit, and we have provided a framework for frequent visitors to The Bahamas. This is a balanced approach. You might recall cruising permits in the Bahamas used to be for three months. These regulations prescribe that they’re for 12 months.

“We want to cater to the frequent visitors to The Bahamas. We want them to come and come, and return and return and return. So we’re now giving you 12 months on your cruising permit. Instead of three, we are introducing a frequent digital cruising card (FDCC) for pleasure vessels for a period of two years,” he added.

“So you can get this digital card for two years, which allows you unlimited travel to The Bahamas. Once you have it, you can come and go for two years in The Bahamas. No questions asked, unlimited. No time prescribed, no number of trips prescribed.”

And, while the lowest FDCC and temporary cruising permit fee initially applied only to vessels 34 feet and under in length, Mr Pinder said the Government has now raised the threshold to 50 feet after receiving advice from John Pinder, parliamentary secretary in the Ministry of Tourism, Investments and Aviation, who has responsibility for the boating and yachting sector.

“We heard the discussion,” the Attorney General

Accounts Clerk (Freeport)

Key Responsibilities:

• Maintain accurate accounting records by

•

• Participate in relevant training or professional

• Education & Experience Requirements:

• Bachelor’s degree in Accounting, Finance, Equivalent relevant work experience will be

disclosed. “My colleague, John Pinder in Abaco, called me. Know what he said? He said: ‘Man, listen, Attorney General, we have boats 34 feet, 40 feet that come over all the time from Florida to Abaco. And you know this 34 feet metric is a little burdensome, right?

“‘You can appreciate this. You know all of the day and weekend cruisers that come to Abaco in their center console boat, right?’ And so he says, that’s a little bit, 34 feet, a little bit much. I said: ‘No problem, no problem’. So we increased that threshold for the first year to 50 feet. Which would which would take into consideration all of those centre console cruisers that come to our islands on a frequent basis from Florida. So, the fees for that not exceeding 50 feet in length is $500 for a permit for 12 months.”

Mr Pinder added: “Now, let me give you some context. It was $300 for three months, [now] an additional $500 to extend it for 12 months. That’s $800 for a year. Now it’s $500 for you. In fact, it’s less. Those exceeding 50 feet, but not exceeding 100 feet, pay $1,000 for 12 months, and

those in excess of 100 feet, $3,000 for 12 months. “We think these fees are fair, especially given the duration of time that they now cover. We have listened to the boating community and adjusted the first-tier fees to 50 feet in-vessel. We have also implemented modest annual fees for vessels anchoring in our waters, with an exception.

“If you’re at a marina or a mooring, you’re exempt from paying those fees. We have crafted these to draw a balance between revenue to The Bahamas for use of our waters and the appropriate scales and size of vessels visiting The Bahamas with a mind to be equitable and fair to the repeat visitors to our country.”

As for boats acquiring the FDCC card, Mr Pinder said of the fees: “So those for this frequent digital cruising card, not exceeding 50 feet is $1,500. Remember, that’s for two years, unlimited entry. That’s all unlimited entry. Those exceeding 50 feet and not exceeding 100 feet, $2,500, and those exceeding 100 feet, $8,000.

“Now those exceeding 100 feet, who are frequent visitors in The Bahamas, are generally those charter

boats who base themselves out of The Bahamas. They generally sit here and charter straight out of The Bahamas. The guests fly in and they get on the boat.

“So you now have unlimited visitation in The Bahamas for two years now. Remember these boats, these luxury boats charge up to $10,000 to $15,000, some $20,000 a day, to charter, and we want to charge them $8,000 for two years. Let’s be real.”

The Government, in splitting out the fishing permit fee into a separate levy, and not incorporating it with the cruise permit fee, has set this at $100 and $300 for vessels not exceeding, and exceeding, 34 feet respectively. A “pleasure vessel” will be able to enter The Bahamas’ twice within 30 days on the same fishing permit - not the cruising permit, as some have interpreted it to mean. Finally, the new anchorage fees for vessels not mooring at a marina are pegged at $200 for a vessel not exceeding 34 feet; $350 for those between 34 feet and 100 feet; and $1,500 for those over 100 feet. The boating and yachting industry consensus appears, like private aviation, to be that the FDCC will only benefit vessels which make multiple, regular annual visits to The Bahamas.

Key Responsibilities:

• Support the CFO in executing strategic and day-to-day accounting functions.

• Supervise accounting staff, including conducting regular performance reviews and identifying areas for improvement.

• Ensure all department tasks are completed accurately and within set deadlines.

• Review and analyze accounting data to ensure accuracy and integrity.

• Prepare and submit monthly reconciliation reports.

• Oversee accounts payable processes, including maintenance Vendor

• reports.

• Train and develop the accounting team members to enhance

• Perform additional duties as assigned by the CFO.

Required Knowledge, Skills & Abilities:

• Strong leadership and team-building capabilities.

• review.

• Excellent verbal and written communication skills.

• Proven ability to train, supervise, and guide staff performance.

Education & Experience Requirements:

• Bachelor’s degree in Accounting, Finance, Business

• Word, Outlook) is essential.

• Prior experience in a supervisory or senior accounting role is strongly preferred.

• processes is a plus.

Interested persons should email

July fuel charges. These fuel charges typically account for around 50-60 percent of the total bill. As a result, several observers suggested that the Summer Rebate is an initiative where - what the Government is giving to BPL customers on one hand - it is taking away in the other in their capacity as the taxpayers underwriting the proposed relief.

BPL’s statement, which added little to the original release by the Prime Minister’s Office, said its fuel costs had risen from around 16 cents and 20 cents per kilowatt hour (KWh), for the portions of customer bills below and above 800 KWh respectively, to 18.996 cents and 22.196 cents in June.

No explanation was provided for the more than two cents per KWh increases other than BPL affirming it is having to rely on automotive diesel oil (ADO) - the most expensive of its fuel sources. Mr Pintard, in his letter to URCA, challenged why BPL’s increasing fuel charges appear to be moving in the opposite direction to relatively stable global oil prices notwithstanding the recent conflict between Iran and Israel.

Research by Tribune Business revealed that global oil prices, as measured by the Brent crude index, have declined by 20.52 percent year-to-date to stand at $67.678 per barrel as Tribune Business went to press last night. “We note a further concern, reported to us by several BPL customers, that fuel charge increases for the year seem to exceed the increases in global price in fuel,” Mr Pintard said. “As such, we request that URCA reviews the rate of charge increases to ensure that BPL is not in any way using it two-tier surcharge approach to subsidise the operations of the company.

“It is our understanding that any such

cross-subsidisation would be illegal.” The Opposition also called on URCA to give an update on the progress of its investigation into whether BPL’s 20222023 fuel charge hikes, which soared by 163 percent in just eight months, were legal.

Referring to what BPL described as its ‘glide path’ strategy to recoup some $90m-$100m in underrecovered fuel costs from its customers, Mr Pintard said he and his party “maintain” that the use of the proceeds generated was “inconsistent with the published fuel recovery plan that URCA had specifically mandated”. He added: “It was, and is our contention that BPL did not use those receipts

to pay off its debt obligations to the Government that were advanced to cover BPL’s fuel arrears, notwithstanding the fact that URCA approved the additional charge with the express requirement that BPL use the proceeds for that purpose.”

However, URCA subsequently revealed that its probe into whether BPL’s ‘glide path’ complies with the law and accompanying regulations had been delayed as a result of having to “re-bid” the contract for a third-party consultancy to carry out this probe because the costs involved exceeded the budget it had allocated. With no further public disclosures, Mr Pintard told URCA yesterday: “Given the gravity of this matter, we trust that the consultancy has now been engaged and the resulting review has been advanced, if not completed. When can the public expect URCA to publish the results?”

Suggesting that there are similarities between BPL’s former ‘glide path’ and the Summer rebate, the Opposition leader added in a statement: “We appreciate the fact that BPL brought some clarity to this so-called ‘rebate’ with their statement today that stressed that the Bahamian taxpayers will be the ones

FROM PAGE B1

that the industry has no control over the conveyance’s execution, recording, the transfer of title and payment of VAT due on the sale as this is all handled by the attorneys. Yet the Budget’s legislative reforms now make them “jointly and severally liable” for the tax.

And Mr Morley also voiced concern to this newspaper over how the reforms will be implemented and operate in practice, asserting that too often the Government leaves it up to individual departments and agencies to interpret legal changes and the intent behind them, plus the mechanisms and processes that will be used to give the changes due effect.

He spoke after Ryan Pinder KC, the Attorney General, confirmed to the Senate during the 2025-2026 Budget debate that the Conveyancing and Law of Property Bill 2025 no longer stipulates that all real estate transactions from July 1, 2022, will be deemed void if not recorded in the Registry of Records.

“There is a concern that significant illegal tax

avoidance in Bahamian property transactions exists; persons not paying the VAT due and not registering their conveyances. This Bill is intended to curtail this,” he said.

“A new section 40 provides that VAT invoices must be obtained before executing conveyances of real property, the VAT must be paid within 180 days of execution and conveyances must be registered within 180 days of execution.

“The parties involved (buyers, sellers, attorneys, real estate agents) are jointly responsible for ensuring VAT compliance. To provide further checks and balances, financial institutions cannot disburse loans or mortgages for property transactions unless VAT invoices are verified.”

Mr Morley, noting that realtors also still have to notify the Department of Inland Revenue within 30 days of a property deal’s completion, said: “What they’re doing is still holding the real estate agent jointly and severally liable for payment of the transfer tax. You know my position; it’s unfair and inequitable because we have no control

On Saturday, June 28, 2025, Temple Christian School will hold its Entrance Examination for students entering grades 7, 8, 9 and 10.

TIME: 8:30 a.m. to 12:00 p.m.

LOCATION:

High School Campus, Shirley Street

Application forms are available at the High School Office and should be completed and returned to the school by Friday, June 27, 2025. The application fee is twenty-five dollars ($25).

For further information, please call telephone number: 394-4481/394-4484.

over the completion of the sale.

“I understand what the Government’s doing. Effectively, it’s going to squeeze the real estate agents to chase after the lawyers to make sure it gets done, getting us to do what the Department of Inland Revenue won’t do. It sounds like it’s changed slightly but, at the same time, I totally understand the Government’s need to make sure they don’t get defrauded out of taxes.”

Reiterating that he was not seeking to blame or cast aspersions on attorneys, he added: “The completed conveyance, the transfer of title, is done by attorneys. The transfer of titles does not take place until such time as title is delivered to the buyer. We don’t get

involved in the transfer of title.

“All we’ve done is the business aspects of the transaction. In principle, we don’t transfer title. That’s handed off to the attorneys.” Mr Morley, noting that it has been typically assumed that real estate deals take 90 days to close on average, questioned whether the 180 days now allowed for the payment of taxes and conveyance recording could result in some transactions taking nine months to close.

If that occurred, he added, there is concern that realtors could also have to wait nine months for their commission. “There was a lot of discussion, and BREA had its annual general meeting last week,” he recalled. “Several

still footing the bill for this rebate via a subsidy to BPL.....

“Now, fast forward, we have the same Davis administration again creating an unfunded liability at BPL that all Bahamians will have to cover, including those taxpayers on the islands not served by BPL.”

Mr Pintard challenged why “the Government [is] pretending that Bahamians are saving money when the funds to cover the rebate are still coming from Bahamian taxpayers via the Treasury?”

He also questioned where the Summer Rebate will be charged within the Government’s Budget, as there was no allocation provided for the upcoming 205-2026 fiscal year for this purpose, and asked how much it will cost Bahamian taxpayers.

“Given that this rebate is being funded by all Bahamian taxpayers, will the Government confirm that the customers of Grand Bahama Power and other private utilities in the Family Islands will also get the same rebate that is being offered to BPL customers?” the Opposition leader asked.

The Summer Energy Rebate will lower BPL’s fuel charge by 1.1 cents per kilowatt hour (KWh) for both portions of the bill

members raised concerns as to whether it could create potential financial hardship for some realtors because are they in a position to wait nine months for their commission.”

And Mr Morley said it was presently impossible to predict what impact the changes will have on the Bahamian real estate market and all its participants because “we don’t know what processes are required”. He added: “The devil is in the detail. All we know is that it appears to be tremendous upheaval.

“When the Government enacts laws, and when they are handed to the relevant departments, it’s not always explained to the departments what the intent should be. It’s left to the departments to make their own determination. I only hope the Government gives strategic guidance to the Department of Inland Revenue on how it should

- under and over 800 KWh.

The fuel charge below 800 KWh will be lowered from the 18.5 cents that appeared in Bahamians’ July bills to 17.4 cents, representing a 6 percent discount, while for over 800 KWh it is being lowered from 22.5 cents to 21.4 cents. The move came after social media lit up in outrage as consumers received their bills due for payment in July.

Almost all questioned the sharp month-over-month increases, with posts seen by Tribune Business showing all-in cost increases ranging from 38.6 percent to almost tripling via a 199 percent jump.

Tribune Business, which has also seen its own bill double, calculated that the 1.1 cent per KWh reduction on the portion of its fuel charge above 800 KWh would have saved around $36.70 on its July bill, while the savings on the portion below 800 kilowatts would have been $8.70. This translates into just a $45.40 collective saving.

The Government’s latest quarterly debt report, covering the three months to end-March 2025, shows it has yet to repay much of the loan it received from the Government - thought to be around $110m - to help cover the arrears owed to Shell under the former ‘glide path’ initiative. Some $170.3m was shown to be owing as at end-March 2025.

take place as we don’t want to see any further delay or confusion as to what’s been indicated...

“And hopefully they stick to the guidelines and don’t change them without notice. Often-times they change them, people don’t know and you’re left scrambling to learn the system. It’s disappointing. I understand the Government’s needs, but there’s got to be a simpler way of getting this done and holding those they believe are at fault, holding their feet to the fire, and not put pressure on those who are compliant,” Mr Morley said.

“Why is it up to real estate agents to do that? The Government has the authority to do the investigation and prosecute people.”

By STAN CHOE AP Business Writer

U.S. stocks hung near their all-time high on Wednesday as financial markets caught a breath following two big days bolstered by hopes that the Israel-Iran war will not disrupt the global flow of crude oil.

The S&P 500 barely budged after drifting through a quiet day of trading and is sitting just 0.8% below its all-time high, which was set in February.

The Dow Jones Industrial Average dipped 106 points, or 0.2%, and the Nasdaq composite rose 0.3%.

In the oil market, which has been the center of much of this week's action, crude prices stabilized after plunging by roughly $10 per barrel in the last two days.

Benchmark U.S. crude rose 55 cents to $64.92 per barrel, though it still remains below where it was before the fighting between Israel and Iran broke out nearly two weeks ago.

A fragile ceasefire between the two countries appears to be holding, at least for the moment.

On Wall Street, FedEx fell 3.3% despite reporting stronger profit and revenue for the latest quarter than analysts expected. It gave a forecast for profit in the current quarter that fell short of expectations.

General Mills, the company behind Pillsbury and Progresso soups, lost 5.1% after reporting weaker rev-

QuantumScape rallied 30.9% after announcing a breakthrough in its process for making solid-state batteries. Solid state battery technology promises to improve electric vehicle range, decrease charging times and minimize the risk of battery fires. But the batteries are expensive

"For the time being, we are well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance."

Jerome Powell

enue for the latest quarter than analysts expected, though its profit topped forecasts. It also said an underlying measure of profit could fall by 10% to 15% this upcoming fiscal year.

On the winning side of Wall Street, Bumble jumped 25.1% after the online dating platform said it would cut about 30% of its workforce, or 240 jobs, to save up to $40 million in annual costs.

to research and difficult to manufacture at a large scale, giving them a reputation for being a Holy Grail for battery engineers all over the world.

Companies involved in the cryptocurrency industry, meanwhile, rose as the price of bitcoin continued to steam ahead with investors willing to take on more risk. Coinbase Global, the crypto exchange, climbed 3.1% as bitcoin topped $107,000.

All told, the S&P 500 edged down by 0.02 to 6,092.16 points. The Dow Jones Industrial Average fell 106.59 to 42,982.43, and the Nasdaq composite rose 61.02 to 19,973.55.

In the bond market, Treasury yields held relatively steady, and the yield on the 10-year Treasury eased to 4.28% from 4.30% late Tuesday.

Yields had dropped a day earlier after the chair of the Federal Reserve said it is waiting for the right moment to resume cutting interest rates. By lowering rates, the Fed could give the economy a boost, but it

gets ‘golden share’ power in US Steel buyout. US agencies will get it under future presidents

By MARC LEVY Associated Press

PRESIDENT Donald Trump will control the so-called "golden share" that's part of the national security agreement under which he allowed Japanbased Nippon Steel to buy out iconic American steelmaker U.S. Steel, according to disclosures with the U.S. Securities and Exchange Commission.

The provision gives the president the power to appoint a board member and have a say in company decisions that affect

domestic steel production and competition with overseas producers.

Under the provision, Trump — or someone he designates — controls that decision-making power while he is president. However, control over those powers reverts to the Treasury Department and the Commerce Department when anyone else is president, according to the filings.

The White House didn't immediately respond to questions Wednesday about why Trump will directly control the decision-making

and why it goes to the Treasury and Commerce departments under future presidents.

Nippon Steel's nearly $15 billion buyout of Pittsburgh-based U.S. Steel became final last week, making U.S. Steel a wholly owned subsidiary.

Trump has sought to characterize the acquisition as a "partnership" between the two companies after he at first vowed to block the deal — as former President Joe Biden did on his way out of the White House — before changing his mind after he became president.

The national security agreement became effective June 13 and is between Nippon Steel, as well as its American subsidiary, and the federal government, represented by the departments of Commerce and Treasury, according to the disclosures.

The complete national security agreement hasn't been published publicly, although aspects of it have been outlined in statements and securities filings made by the companies, U.S. Steel said Wednesday.

The pursuit by Nippon Steel dragged on for a year

could also offer additional fuel for inflation.

Fed Chair Jerome Powell said again on Wednesday that he wants to wait and see how President Donald Trump's tariffs affect the economy and inflation before committing to its next move. In testimony before a Senate committee, Powell echoed many of his statements from the day before, when he spoke at the House of Representatives, and he said, "For the time being, we are well positioned to wait to learn more about the likely course of the economy

and-a-half, weighed down by national security concerns, opposition by the United Steelworkers and presidential politics in the premier battleground state of Pennsylvania, where U.S. Steel is headquartered.

The combined company will become the world's fourth-largest steelmaker in an industry dominated by Chinese companies, and bring what analysts say is Nippon Steel's top-notch technology to U.S. Steel's antiquated steelmaking processes, plus a commitment to invest $11 billion to upgrade U.S. Steel facilities.

The potential that the deal could be permanently blocked forced Nippon Steel to sweeten the deal.

before considering any adjustments to our policy stance."

In stock markets abroad, indexes fell modestly in Europe after rising across much of Asia.

Stocks jumped 1.2% in Hong Kong and 1% in Shanghai for two of the bigger moves.

"The world can now move on to face other difficult choices like tariffs and things like that," said Frances Lun, CEO of GEO Securities in Hong Kong. "So I think the market is well on its way to rebound and could again reach new levels."

That included upping its capital commitments in U.S. Steel facilities and adding the golden share provision, giving Trump the right to appoint an independent director and veto power on specific matters. Those matters include reductions in Nippon Steel's capital commitments in the national security agreement; changing U.S. Steel's name and headquarters; closing or idling U.S. Steel's plants; transferring production or jobs outside of the U.S.; buying competing businesses in the U.S.; and certain decisions on trade, labor and sourcing outside the U.S.

By CATHY BUSSEWITZ Associated Press

A FEDERAL judge on Wednesday granted a preliminary injunction to stop the U.S. Department of Labor from shutting down Job Corps, a residential program for low-income youth, until a lawsuit against the move is resolved.

The injunction bolsters a temporary restraining order U.S. District Judge Andrew Carter issued earlier this month, when he directed the Labor Department to cease removing Job Corps students from housing, terminating jobs or otherwise suspending the nationwide program without congressional approval.

Founded in 1964, Job Corps aims to help teenagers and young adults who struggled to finish traditional high school and find jobs. The program provides tuition-free housing at

residential centers, training, meals and health care.

"Once Congress has passed legislation stating that a program like the Job Corps must exist, and set aside funding for that program, the DOL is not free to do as it pleases; it is required to enforce the law as intended by Congress," Carter wrote in the ruling.

The Labor Department said in late May that it would pause operations at all contractor-operated Job Corps centers by the end of June. It said the publicly funded program yielded poor results for its participants at a high cost to taxpayers, citing low student graduation rates and growing budget deficits.

The judge rejected the department's claims that it did not need to follow a congressionally mandated protocol for closing down Job Corps centers because

it wasn't closing the centers, only pausing their activities.

"The way that the DOL is shuttering operations and the context in which the shuttering is taking place make it clear that the DOL is actually attempting to close the centers," Carter wrote.

The harm faced by some of the students served by the privately run Job Corps centers is compelling, the judge said. Carter noted that one of the students named as a plaintiff in the lawsuit lives at a center in New York, where he is based.

If the Job Corps program is eliminated, she would lose all the progress she's made toward earning a culinary arts certificate and "will immediately be plunged into homelessness," the judge wrote. That's far from the "minor upheaval" described by

Fannie Mae, Freddie Mac ordered to consider crypto as an asset when buying mortgages

By ALEX VEIGA AP Business Writer

THE HEAD of the fed-

eral government agency that oversees Fannie Mae and Freddie Mac wants the mortgage giants to consider accepting a homebuyer's cryptocurrency holdings in their criteria for buying mortgages from banks.

William Pulte, director of the Federal Housing Finance Agency, which oversees Fannie and Freddie, ordered the agencies Wednesday to prepare a

proposal for consideration of crypto as an asset for reserves when they assess risks in single-family home loans.

Pulte also instructed the agencies that their mortgage risk assessments should not require cryptocurrency assets to be converted to U.S. dollars. And only crypto assets that "can be evidenced and stored on a U.S.-regulated centralized exchange subject to all applicable laws" are to be considered by the agencies in their

proposal, Pulte wrote in a written order, effective immediately.

Pulte was sworn in as the head of FHFA in March.

Public records show that as of January 2025, Pulte's spouse owned between $500,000 and $1 million of bitcoin and a similar amount of Solana's SOL token.

Use of cryptocurrency for buying a home has been generally limited.

Among the respondents in a National Association of Realtors survey of people

government lawyers, he said.

As the centers prepared to close, many students were left floundering. Some moved out of the centers and into shelters that house homeless people.

"Many of these young people live in uncertainty, so it takes time to get housing and restore a lot of those supports you need when you've been away from your community for so long," said Edward DeJesus, CEO of Social Capital Builders, a Maryland-based educational consultancy which provides training on relationship-building at several Job Corps sites. "So the abrupt closure of these sites is really harmful for the welfare of young adults who are trying to make a change in their lives."

The National Job Corps Association, a nonprofit trade organization comprised of business, labor,

who bought a home between July 2023 and June 2024, only 1% of those who made a down payment said they used proceeds from the sale of crypto.

Banks seeking to make mortgages that qualify for purchase by Fannie and Freddie have not typically considered a borrower's crypto holdings until they were sold, or converted, to dollars.

"This is a big win for advocates of cryptocurrencies who want crypto to be treated the same way as other assets are," said Daryl Fairweather, chief economist at Redfin.

Currently, stock investments are treated as qualifying assets that count toward reserves that banks want borrowers to have. But assets that are more volatile, like individual

volunteer and academic organizations, sued to block the suspension of services, alleging it would displace tens of thousands of vulnerable young people and force mass layoffs.

The attorneys general of 20 U.S. states filed an amicus brief supporting the group's motion for a preliminary injunction in the case.

Monet Campbell learned about the Job Corps' center in New Haven, Connecticut, while living in a homeless shelter a year ago.

The 21-year-old has since earned her certified nursing assistant license and phlebotomy and electrocardiogram certifications through Job Corps, and works at a local nursing home.

"I always got told all my life, 'I can't do this, I can't do that.' But Job Corps really opened my eyes to, 'I can do this,'"

stocks or crypto, may be discounted by lenders, Fairweather noted.

"As long as lenders are appropriately discounting crypto based on volatility, it's fine that crypto investments count toward reserves," she said.

The policy change is meant to encourage banks to expand how they gauge borrowers' creditworthiness, in hopes that more aspiring homebuyers can qualify for a home loan. It also recognizes that cryptocurrencies have grown in popularity as an alternative to traditional investments, such as bonds and stocks.

The agencies have to come up with their proposals "as soon as reasonably practical," according to the order.

Fannie and Freddie, which have been under

said Campbell, who plans to start studying nursing at Central Connecticut State University in August.

The program has been life-changing in other ways, she said. Along with shelter and job training, Campbell received food, mental health counseling, medical treatment and clothing to wear to job interviews.

"I hadn't been to the doctor's in a while," she said. "I was able to do that, going to checkups for my teeth, dental, all that. So they really just helped me with that."

Campbell said she and other Job Corps participants in New Haven feel like they're in limbo, given the program's possible closure. They recently had to move out for a week when the federal cuts were initially imposed, and Campbell stayed with a friend.

government control since the Great Recession, buy mortgages that meet their risk criteria from banks, which helps provide liquidity for the housing market.

The two firms guarantee roughly half of the $12 trillion U.S. home loan market and are a bedrock of the U.S. economy.

"If Fannie and Freddie are going to accept cryptocurrency as collateral, that's a strong incentive for banks to shift their practices," said Danielle Hale, chief economist at Realtor.com.

"Because people who might otherwise have to sell cryptocurrency to qualify — and maybe that's a deal-breaker for them now — under this new policy, they can qualify. It sort of expands the potential pool of eligible buyers."

By CLAIRE SAVAGE Associated Press

THE federal agency charged with protecting workers' civil rights has terminated a New York administrative judge who opposed White House directives, including President Donald Trump's executive order decreeing male and female as two "immutable" sexes.

In February, Administrative Judge Karen Ortiz, who worked in the U.S. Equal Employment Opportunity Commission's New York office, called Trump's order "unethical" and criticized Acting Chair Andrea Lucas — Trump's pick to lead the agency — for complying with it by pausing work on legal cases involving discrimination claims from transgender workers.

In an email copied to more than 1,000 colleagues, Ortiz pressed Lucas to resign.

Ortiz was fired on Tuesday after being placed on administrative leave last month. The EEOC declined Wednesday to comment on the termination, saying it does not comment on personnel matters.

In response to the president's order declaring two

unchangeable sexes, the EEOC moved to drop at least seven of its pending legal cases on behalf of transgender workers who filed discrimination complaints. The agency, which enforces U.S. workplace anti-discrimination laws, also is classifying all new gender identity-related cases as its lowest priority.

The actions signaled a major departure from the EEOC's prior interpretation of civil rights law.

In her mass February email criticizing the agency's efforts to comply with Trump's order, Ortiz told Lucas, "You are not fit to be our chair much less hold a license to practice law." The letter was leaked on Reddit, where it gained more than 10,000 "upvotes." Many users cheered its author.

The EEOC subsequently revoked her email privileges for about a week and issued her a written reprimand for "discourteous conduct."

Ortiz said she continued to "raise the alarm" about the agency's treatment of transgender and gender nonconforming complainants, and convey her opposition to the agency's actions. She sent an April

24 email to Lucas and several other internal email groups with the subject line, "If You're Seeking Power, Here's Power" and a link to Tears for Fears' 1985 hit "Everybody Wants to Rule the World."

She contested her proposed termination earlier this month, arguing in a document submitted by a union representative that she was adhering to her oath of office by calling out behavior she believes is illegal.

Ortiz "views the Agency's actions regarding LGBTQIA+ complainants to have made the EEOC a hostile environment for LGBTQIA+ workers," and believes that leadership has "abandoned the EEOC's core mission," the document says.

The judge was hired to work at the EEOC during the first Trump administration, and while she disagreed with some policies then, "she did not take any action because there was no ostensible illegality which compelled her to do so," the document stated. "What is happening under the current administration is unprecedented."

MEXICO CITY Associated Press

MEXICAN President Claudia Sheinbaum said Wednesday that her administration is investigating contamination from a SpaceX facility near the Mexican border in South Texas, and planning its next course of action.

The announcement follows the June 18 explosion of a Starship rocket while on a stand during a test, which sent a massive fireball into the night sky. Pieces of metal, plastic and rocket pieces were reportedly found in the northern state of Tamaulipas, which borders the SpaceX's Starbase following the explosion.