By NEIL HARTNELL Tribune Business Editor

By NEIL HARTNELL Tribune Business Editor

THE upcoming Budget must focus on “moving the needle” on The Bahamas’ access to affordable foreign currency financing and higher economic growth, a governance specialist urged yesterday.

Hubert Edwards, principal of Next Level Solutions, told Tribune Business that the low-cost Chinese state-owned bank loan that the Davis administration is seeking to finance its $290m New Providence hospital ambitions illustrates the challenges it is having in sourcing affordable international financing because of

external concerns over this nation’s creditworthiness.

He added that this, together with the need to break-out of the historical 1-2 percent annual GDP growth that The Bahamas is now reverting back to after completing its postCOVID reflation, “must be addressed” via the 20242025 Budget that Prime Minister Philip Davis KC will present to the House of Assembly on Wednesday. Mr Edwards told this newspaper that consistently higher economic growth rates in the 2.5 percent to 4 percent range will help relieve the Government’s multiple fiscal concerns and either reduce, or eliminate, the pressure for tax reform that includes new and/or increased taxes

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

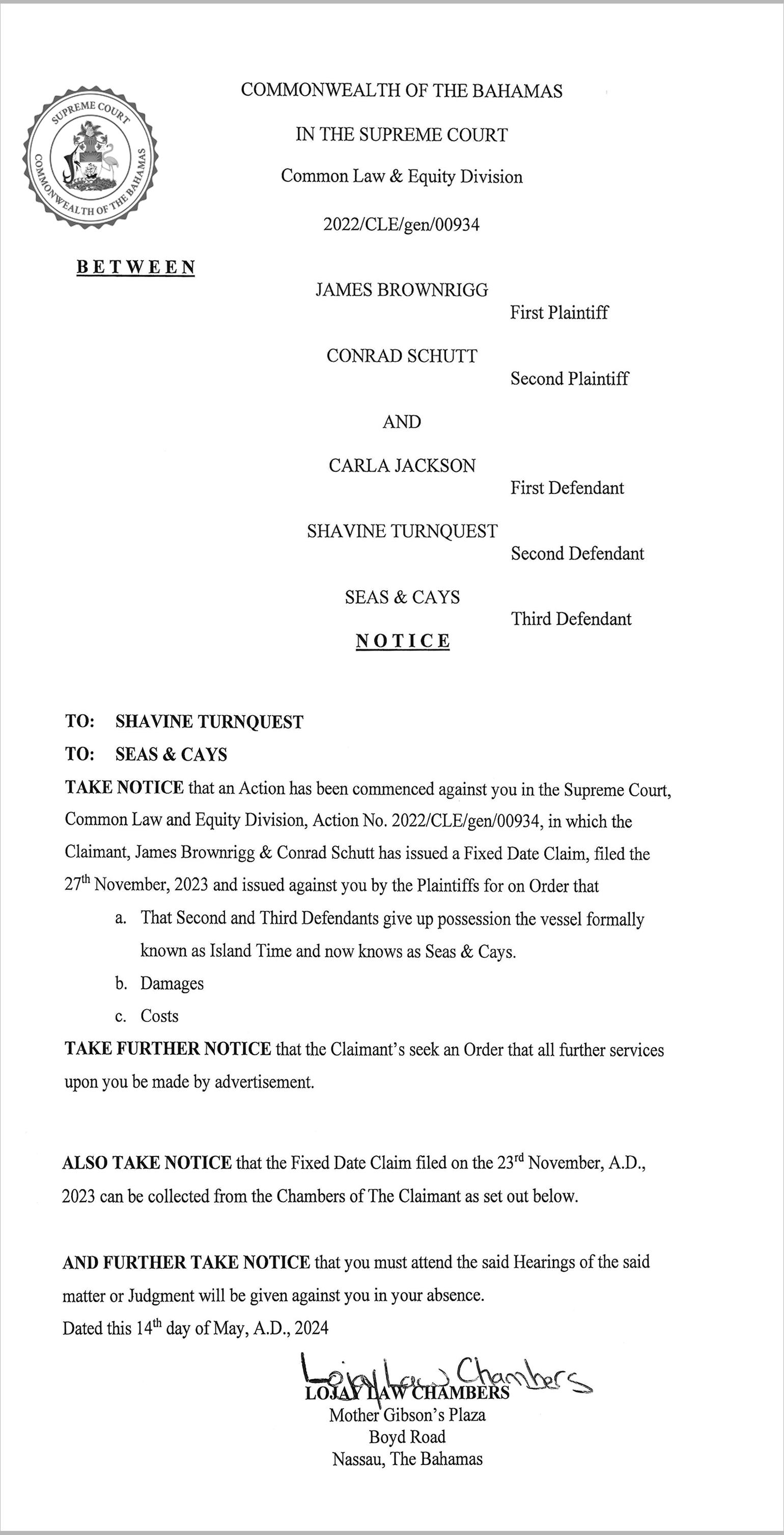

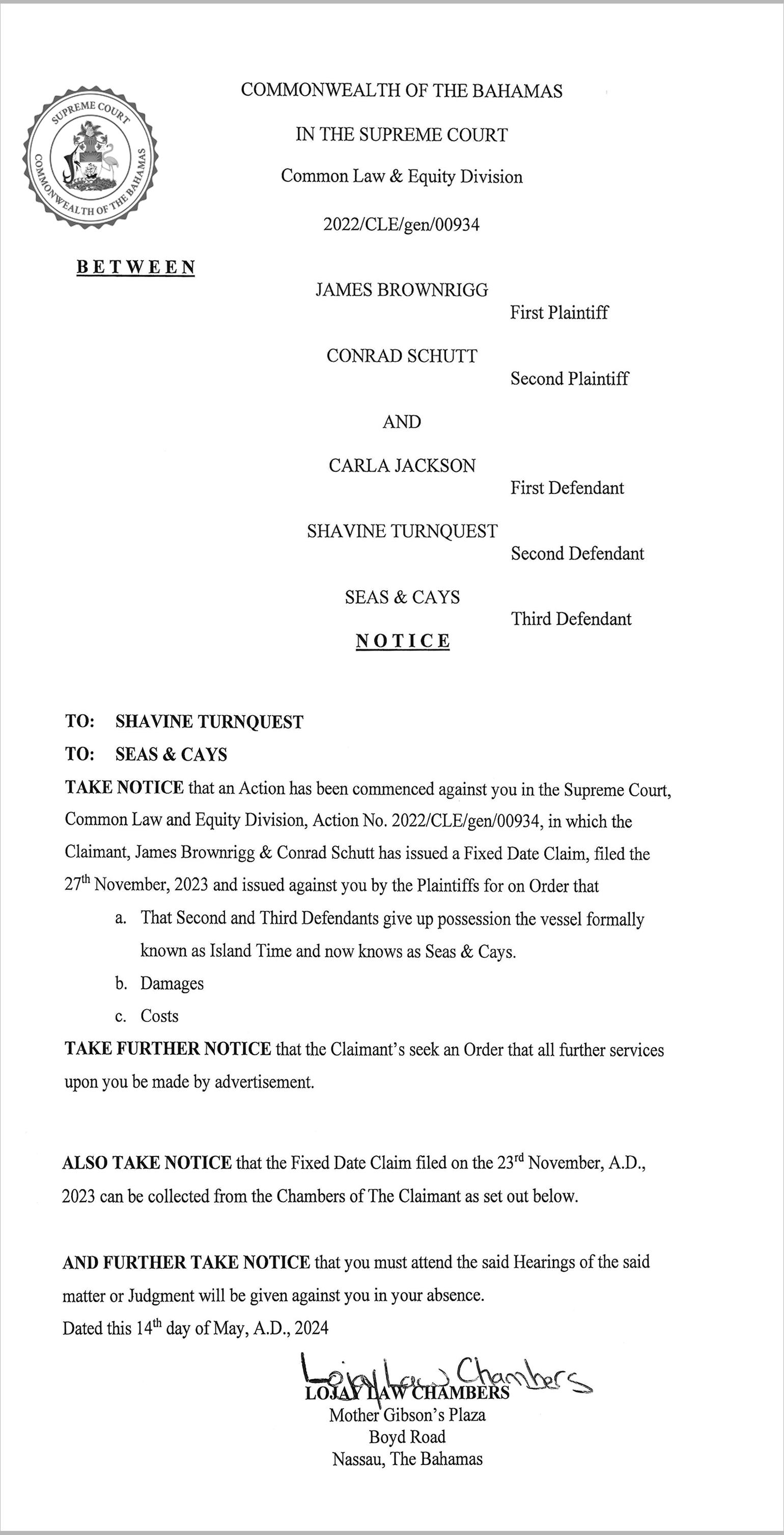

FTX and its jailed founder, Sam Bankman-Fried, paid $675,000 to “entities affiliated with high-ranking Bahamian government officials and their families”, it was revealed yesterday.

Robert Cleary, the examiner appointed by the US Justice Department trustee to investigate the crypto exchange’s collapse, revealed that one “purported donation” totalled $500,000 as the probe into the multi-billion dollar fraud inched

to help achieve targets such as the 25 percent revenueto-GDP ratio by 2025-2026.

Noting that state-owned enterprises (SOEs) and the public service consume close to $1.2bn annually in combined subsidies and salaries between them, he added that both areas require urgent reform attention to help facilitate faster private sector expansion and investment that will drive job creation.

And, while “serious fixes” to The Bahamas’ energy crisis will benefit

DEPP chief: CEC permit needed ‘no matter what’

By FAY SIMMONS Tribune Business Reporter

jsimmons@tribunemedia.net

THE Government’s top environmental official yesterday said a key approval is required “no matter what” amid fears this will “roadblock” $24m worth of Hope Town construction projects.

Dr Rhianna Neely-Murphy, the Department of Environmental Planning and Protection’s (DEPP) director, confirmed that every development must obtain a Certificate of Environmental Clearance (CEC) to ensure the environment is protected during their build-out.

A CABINET minister yesterday said the Government is “cautiously optimistic” that The Bahamas could earn $900m per year from monetising its seagrass and mangrove carbon sinks.

Michael Halkitis, minister of economic affairs, told an investor forum on Grand Bahama that The Bahamas can anticipate receiving “healthy” prices for its blue carbon credits due to increasing demand for such securities as countries and companies seek to offset their carbon emissions and reach their net zero goals. He added that this nation could be looking at a windfall of around $900m per year, with some long-term estimates suggesting it

She was also backed by the Ministry of Works and Local Government, which warned that no council or local authority can lawfully “suspend or fail to perform its functions” as the Hope Town District Council had threatened to do over the CEC issue. It had mulled placing its Town Planning and Port Department permitting on hold until the matter is resolved. However, the ministry added that the Environmental Planning and Protection Act was recently amended to allow for faster applications and approvals of a “non-commercial” nature, which it argued

SEE PAGE A21

could earn a total $60bn by 2050.

Mr Halkitis, speaking to attendees at the Forum for Impact Americas at the Garden of the Groves in Grand Bahama, said The Bahamas has led the discussion in recognising the role seagrass meadows play in absorbing carbon from the atmosphere. As such, he said the Government commissioned research on 10 seagrass meadows in Bahamian waters to determine the density of organic carbon found within the seagrass and surrounding sediment. That research revealed averages of about 67,000 to 93,000 square kilometres of seagrass, the largest

a step closer to the Bahamian political and official elite.

His report, filed with the Delaware Bankruptcy Court, in a section entitled “payments to and contacts with Bahamian government officials”, drew on evidence assembled by Nardello & Co, a global investigations firm that specialises in bribery and corruption-related matters, plus Sullivan & Cromwell, the law firm working for FTX’s US chief, John Ray, to reach its conclusions.

“Sullivan & Cromwell and Nardello also found that the FTX group made several donations to entities affiliated with Bahamian government officials and their families,” Mr Cleary wrote. “For example, the FTX group sent $500,000 as a purported donation to an entity owned by relatives of a highranking Bahamian government official.

“In addition, the FTX group donated $175,000 to other entities affiliated with family members of high-ranking Bahamian government officials. Finally, Sullivan & Cromwell and Nardello’s investigation identified other contacts between the FTX group and Bahamian government officials.”

No names or identities were disclosed by the FTX examiner. However, there is no doubt that Mr Cleary, Mr Ray and their teams know who the “entities”, families and “officials” are as the report references that these details came from a Nardello report dated May 13, 2023, which is titled: ‘Issues concerning Bahamian insolvency proceedings involving FTX’. Also mentioned as a source for the $675,000 payment information is a Sullivan & Cromwell report dated March 15, 2024, and described as a ‘Review of post-petition investigations for examiner’. The information in these documents and Mr Cleary’s report will also be available to the US Department of Justice. The findings do not distinguish between Cabinet

Talks to save 20 CIBC jobs ‘look prosperous’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A UNION leader last night said efforts to secure new jobs for around 20 CIBC Caribbean staff are “looking prosperous” as the bank moves to shutter its Bahamas call centre by next month.

Theresa Mortimer, the Bahamas Financial Services Union’s president, told Tribune Business that she is opposed to the unit’s closure and transfer of its functions to Jamaica and Barbados but there has not been “even an acknowledgement” of her concerns.

Voicing fears about Bahamians’ private financial information being exposed to foreign

jurisdictions and workers, she added that the BISXlisted bank has failed to provide evidence to justify the move on the asserted basis that this nation is simply “too expensive”.

However, CIBC Caribbean yesterday pledged to minimise job losses and any disruption involving the closure of its Bahamas customer contact centre with effect from June. And Howard Thompson, the Government’s labour director, last night confirmed the hope is that none of the 20 impacted staff will have to be terminated as he praised the bank’s proactive approach to the restructuring.

This, though, did not satisfy Ms Mortimer who asked whether the Davis administration has given the go-ahead for CIBC Caribbean to transfer Bahamians’ private financial data to other

business@tribunemedia.net

MAY 24, 2024

FRIDAY,

Minister ‘cautiously optimistic’ over $900m carbon credits

SEE PAGE A20

SEE PAGE A21

Budget must ‘move needle’ on creditworthiness, growth

nhartnell@tribunemedia.net FTX paid $675k to entities tied to ‘Bahamian officials’

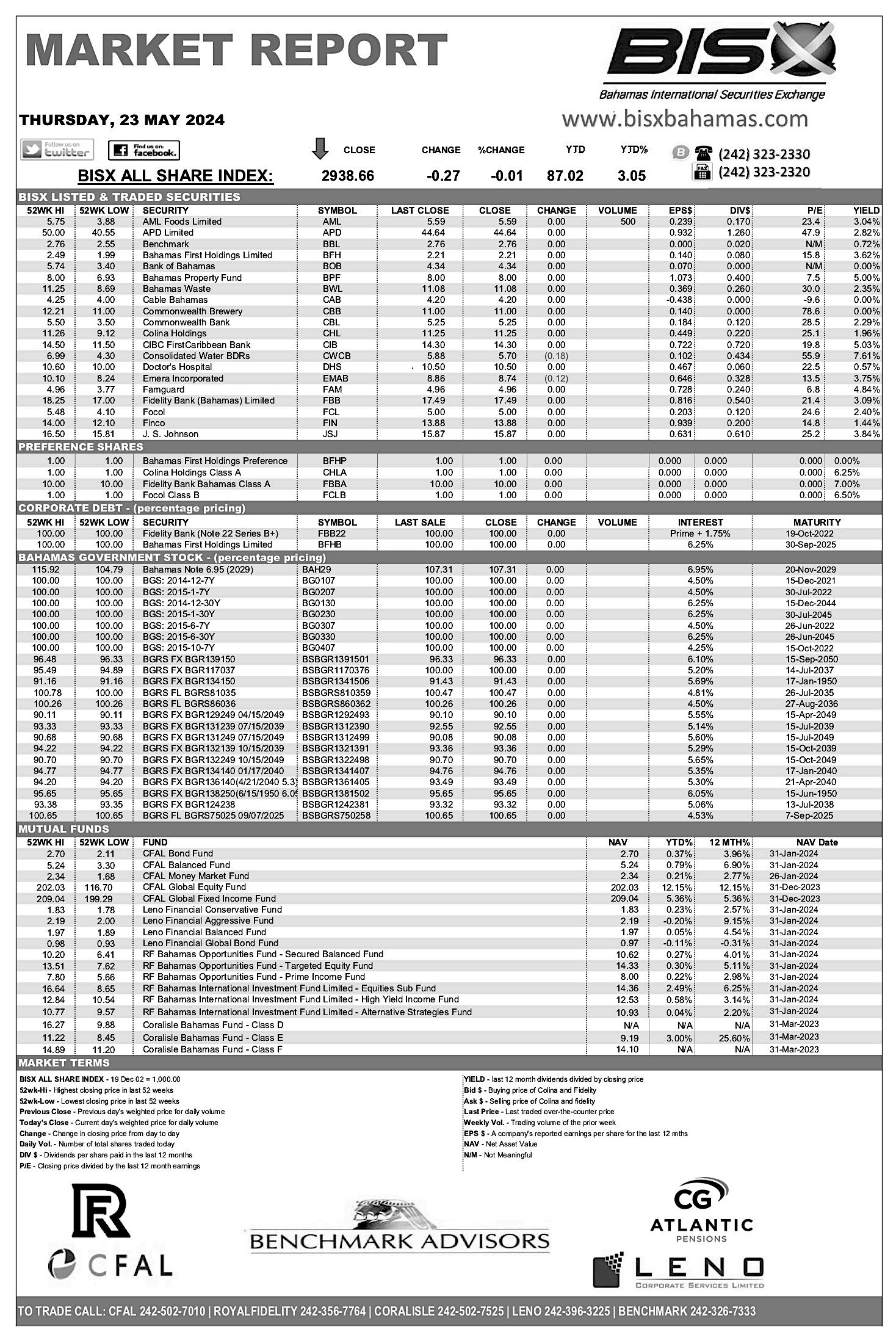

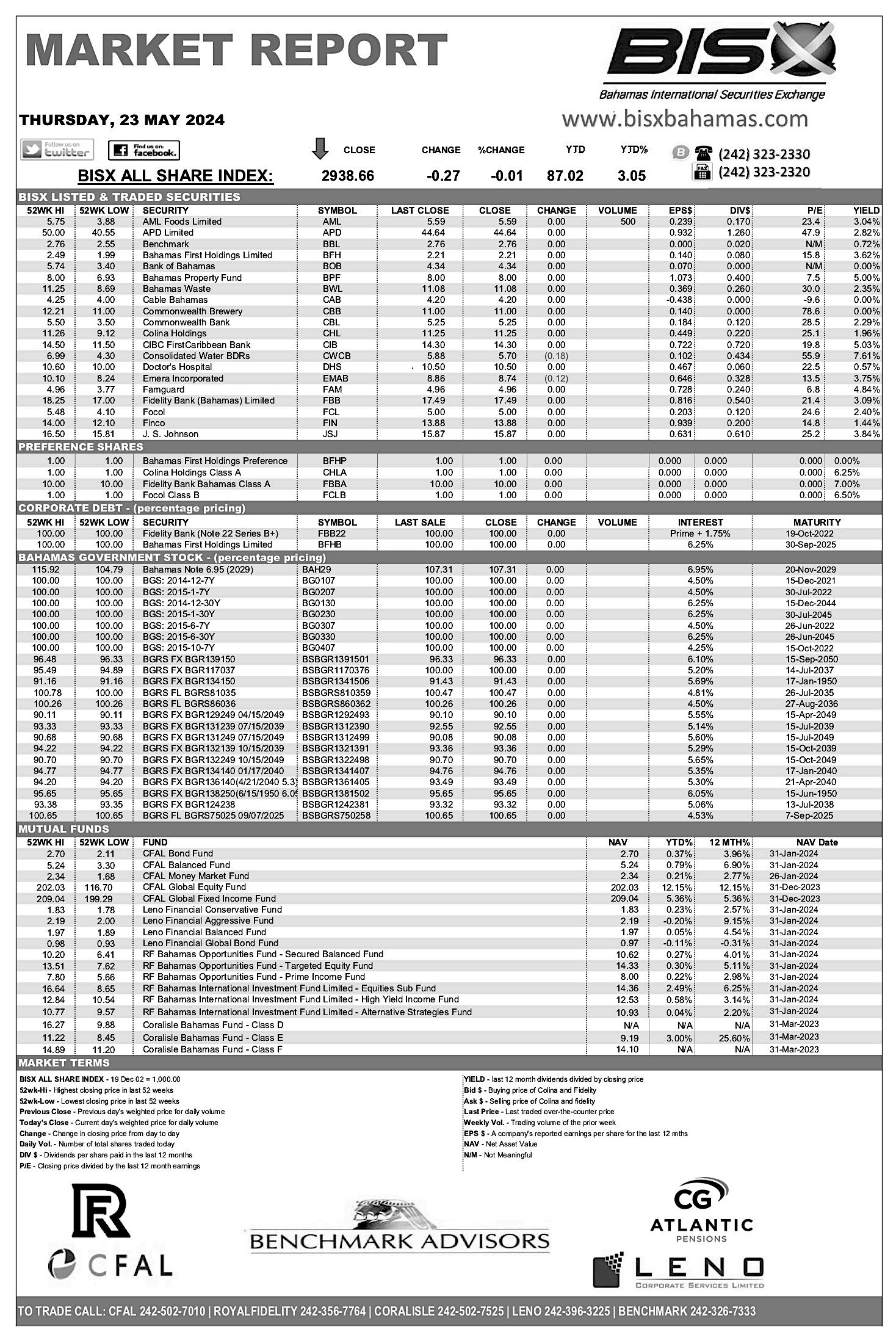

SEE PAGE A20 SEE PAGE A19 concern HUBERT EDWARDS SAM BANKMAN-FRIED $5.90 $5.91 $5.90 $5.96

Business meetings are intended to be highly effective, but one that is not can be a drain on your time, especially if you are busy. Whether it is a quick team meeting or one that requires brainstorming or strategic discussion, there are some rules you can follow to make it successful.

Making the most of business meetings FERGUSON

Current research indicates that companies spend roughly 15 percent of their time on meetings, with a third of those considered unproductive. Today’s column focuses on seven tips for ensuring that we hold more effective meetings.

1. Determine the necessity of the meeting

Before sending a calendar invite out to your team or a few colleagues for a gettogether, first things first. Determine if the discussion is really worthy of a meeting. If, instead, it can happen more casually between yourself and one or two colleagues, then being aware of that will prevent you from wasting valuable time for yourself and others.

Is your concern something you can address during a formal review? Or something you can shoot a quick note via e-mail to a manager about, and then determine

the necessity of a scheduled meeting?

2. Determine your guest list

Once you have determined that the meeting is, indeed, a necessary commitment, you will want to consider the list of attendees very carefully. In most instances, not everyone will have to be there. Sure, there may be a company-wide update once a month or a quarterly gathering to keep everyone aware of projects they may not be directly involved in, but most of the day-to-day meetings require far fewer hands on deck. Ensuring that the critical people are in

place will help to determine the success of the meeting. Think about who will actually attend and get the most out of the meeting, or who can actively contribute in productive ways.

3. Find the right environment

Today, with remote and hybrid working, meetings can take place anywhere. The key is to decide on the best medium for the meeting - whether online is sufficient, or if you need to have it in-person.

Meetings on strategic direction are focused on reflection, new ideas and brainstorming, so these are probably better suited to an in-person encounter. Think about the colleagues that need to be involved and see what can work for everyone. There should be room for accommodating people’s situations, such as giving plenty of notice so that remote workers can commute to the office, but do not lose sight of the purpose and desired outcomes.

4. Determine the necessary agenda items

Too often meetings can go off on a tangent and the purpose gets lost, which can be frustrating for attendees. The facilitator should share an agenda in advance

so attendees come prepared and cover what is needed in the allocated time, while ensuring meetings do not over. Planning and sticking to an agenda can help you stay on track during the meeting, so that it does not devolve and feel like a waste of anyone’s time.

5. Take Notes

If you are at the leader of the meeting, you may not be able to take any notes past providing initial material. Whether it is you or another colleague, ensure there is someone designated to take notes during the meeting. Then send them to everyone who was involved with the meeting as well as anyone who could not make it, or whose work will somehow be affected by what was addressed during the meeting.

Make sure the person in charge of notes has acute attention to detail, and is focused on the meeting and not other projects. The detail they put into their meeting notes will help drive postmeeting conversations, ideas, workflows and deadlines.

6. Give everyone an opportunity to speak

Every attendee is there for a purpose. Unless someone has been designated to specifically take notes - and they

are fully aware of that factbe prepared to keep a space for everyone to contribute something to the meeting. Even if it is scheduled as a presentation, people who are able to contribute or offer praise will feel involved in the project and, potentially, less overwhelmed by it.

7. Be open to feedback

The best leaders and most productive employees are open to feedback. Good, bad and ugly. Providing your meeting agenda will probably get some of your co-worker’s wheels spinning about how to build upon your ideas, brainstorm additional thoughts and the next steps that may be involved with the work at hand. If someone is suggesting a

streamlined strategy or an additional layer to your work, allow them to speak their minds. Being open to others’ perspectives is a great tool for collaboration and allows companies to thrive far more than they would without.

a talent management and organisational development consultant, having completed graduate studies with regional and international universities. He has served organisations, both locally and globally, providing relevant solutions to their business growth and development issues. He may be contacted at tcconsultants@ coralwave.com

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

THE TRIBUNE Friday, May 24, 2024, PAGE 23

IAN

PM: Embracing ESG key to combat climate change risk

By FAY SIMMONS Tribune Business

THE Prime Minister yesterday asserted that “we fight against a future” where Bahamians are unable to afford or even access insurance coverage because the risk posed by climate change is too great.

Philip Davis KC, addressing the Bahamas chapter of the Institute of Internal Auditors (IIA), said it was critical for the private sector to embrace environmental, social and governance (ESG) responsibilities otherwise they “risk alienating stakeholders and compromising the integrity of their entire operation” due to the threats posed by climate change.

Pointing out that auditors will play a key role in fostering ESG adoption, he said: “One of the most powerful ways that internal audits can strengthen organisations in 2024 is through an analysis of environmental, social and governance (ESG) activities.

“This, my friends, is likely the area where internal audit functions have the most potential to evolve. As the ESG regulatory environment develops, the internal audit is wellpositioned to add value by contributing to ESG objectives. One of the most pressing crises we face today, particularly as a low-lying small island developing state, is specifically related to the “E” – the environment.”

Mr Davis recalled the impact of recent bush fires and Hurricane Dorian, and said it is “imperative” to address the financial and climate risk firms face.

He added: “And, in the face of inaction by global superpowers, we face the harrowing projections of a future that is filled with even more deadly storms. It is now imperative that we

address the magnitude of climate risk and the related financial risks that organisations will be exposed to.

“These risks include business disruptions, supply chain challenges and serious revenue impacts – not just for companies but for countries.” Mr Davis said obtaining the necessary insurance protection for The Bahamas remains a growing challenge with climate-related disasters and subsequent claims payouts driving up the cost of premiums.

He said: “An area of keen concern is our nation’s continued insurability. As insurance providers and underwriters witness the devastating damage and costs of these climate events, it calls this into question.

“We fight against a future where insurance premiums are so high that Bahamian residents and businesses cannot afford them, or worse where the risk is estimated so high that providers do not wish to enter the market.”

Mr Davis said internal auditors have a “critical role” to play in navigating climate change-related challenges by assisting businesses in managing climate risk.

He said: “As internal auditors, you have a fundamental role to play in helping organisations address climate risk. Examining the capacity to operate sustainably within the context of climate change will be key to success.

“Businesses that do not embrace ESG imperatives risk alienating stakeholders and compromising the integrity of their entire operation. In anticipating risks, advising senior leadership and providing independent assurance, internal auditors play an instrumental role in making local and regional firms more sustainable, profitable, and resilient.”

Five-year graveyard appeal in new delay

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

AN appeal over a proposed 13-acre Bernard Road cemetery that has lasted more than five years again failed to progress yesterday after officials from the Attorney General’s Office did not appear.

The Subdivision and Development Appeals Board was scheduled to hold the final hearing for a project that has been heavily opposed by nearby residents and Fred Mitchell, minister of foreign affairs, PLP chairman and Fox Hill MP.

Mr Mitchell’s intervention, which was sent to the Appeals Board’s nowformer secretary, Carol Martinborough, surfaced at the pre-hearing of the appeal against the Town Planning Committee’s 2018 rejection of James Bain’s application to build the cemetery on 13 acres of vacant land he owns near Bernard Road’s Budget convenience store.

Mr Mitchell wrote to the Board on February 19, 2024, urging that the appeal be dismissed “and the status quo maintained” on the basis that permitting the project would devalue

nearby properties and disturb his constituents’ way of life.

His correspondence noted that the Government is also “in the early stages” of using its compulsory powers under the Acquisition of Land Act to purchase either the entire property or “pieces and parcels” of it.

This revelation prompted Khalil Parker KC, attorney for Mr Bain as the developer, to suggest that - as there is a land dispute - representatives from the Attorney General’s Office should appear for the appeal hearing. However, they were a no-show yesterday.

Dawson Malone, the Subdivision and Development Appeal Board’s chairman, contacted the Department of Legal Affairs in the Attorney General’s Office about the absence of its representatives and subsequently revealed: “It is said to be an oversight for the non-appearance of the Attorney General today.”

Mr Parker said it was imperative that input from the Attorney General’s Office be received as to whether the Government intends to acquire the land as it would determine his client’s position. The hearing was adjourned until July, and Mr Malone said

that “by hook or crook we will get everything done that day”. He added: “We don’t want this matter pushing on into five more years. It’s been five years, it needs to be resolved one way or the next.”

The cemetery proposal sparked considerable protest from area residents when it surfaced in 2018, culminating in a wellattended public hearing at LW Young Junior High School where concerns were voiced.

Among the chief fears were that traffic would increase, while the value of properties in the area would decline. Residents were also concerned the project would impact the water table and increase flooding in the area. The 13.504 acres of vacant land owned by Mr Bain is situated near the Budget Convenience store, east of Sands Addition and just past the 700 Wines and Spirits liquor store heading east.

Mr Mitchell’s correspondence to the Subdivision and Appeals Board also noted that the increased traffic would disturb the “quiet enjoyment” of his constitutions and devalue their properties.

He said: “The use of the land for a cemetery is not supported by most

BAHAMASAIR EXPANDING SERVICE FOR REGATTAS AND HOMECOMINGS

BAHAMASAIR has pledged to provide special flights and increase service “rotation” to meet the needs of Family Island travellers during the summer regatta and homecoming season.

The national flag carrier, in a statement, said its operation during the recent National Family Island Regatta in Exuma between April 23-27 provides a template for what it will seek to offer.

Tracy Cooper, Bahamasair’s managing director, said the airline decided to rotate jets to Exuma in order to meet consumer

demand. After a successful flight schedule for the National Family Island Regatta, the carrier is now preparing for several Family Island events during the summer months.

Bahamasair will introduce flights to Cat Island just for the 25th annual Rake n’ Scrape Festival. Flights will begin on June 5. Bahamasair does not usually travel to Cat Island, but will offer these flights specifically to cater to the needs of people wishing to attend the festival.

There will also be increased airlift to Long Island for the 55th annual

PUBLIC NOTICE

PSA: On Thursday May 22 and Friday May 24 2024 between the hours of 6:00pm to 2:00am, Two, (2) Power Plant Generators will be transported from Arawak Cay to Clifton Pier.

Please be advised that there may be traffc delays and disruptions during this time. See convoy route outlined below:

• Arawak Cay Port/West Bay Street to Saunder’s Beach Roundabout

(Estimated time 60 minutes)

• Saunder’s Beach roundabout Baha Mar Boulevard

(Estimated Time 1 hour and 50 minutes)

• Baha Mar Boulevard to Gladstone Road Roundabout

(Estimated Time 30 minutes)

• Gladstone Road Roundabout to Old Fort Bay Roundabout

(Estimated Time 3 hours and 27 minutes)

• Old Fort Bay Roundabout too Mt. Pleasant/Western Road intersection

(Estimated Time 1 hour and 45 minutes)

• Mt. Pleasant/Western Road Intersection to BPL Clifton Site

(Estimated Time 1 hour and 45 Minutes)

Plan your travel accordingly and follow any traffc control measures that will be put in place to ensure safety during this transportation exercise.

Thank you for your cooperation.

constituents in the area. The roads in the area do not, and cannot, support the additional commercial traffic, and given the experience of Woodlawn [Gardens], the increased nuisance to residents would be exponential, displacing and devaluing their properties and disturbing their quiet enjoyment.”

Attorney Bjorn Ferguson, an opponent of the proposed cemetery, told this newspaper in 2018: “We’re just happy that the [Town Planning] committee gave weight to the relevant factors and arrived at the right conclusion. We would greatly appreciate consideration being given to adding more green and recreational space in our community.

“The children in the affected communities are forced to play in the streets due to the lack of green and recreational space. We would fully endorse developments that included these considerations. We do understand that a developer has a right to develop his land but his development cannot negatively impact the community It should provide a positive impact to the community and society at large.”

Salvador will be serviced with daily flights also starting on June 16, and Freeport will enjoy three Bahamasair flights daily.

Long Island Regatta taking place in Salt Pond from June 5-12. Several regatta and homecoming events are scheduled to take place in Exuma this summer. In response to the demand, Bahamasair will offer a robust schedule of flights starting on June 16, with two flights in and out of Georgetown daily.

“We are seeing where we are going to be able to meet the demand and the challenges of a summer rotation,” Mr Cooper said.

Travellers can expect two flights per day in and out of Rock Sound, Eleuthera, starting on June 16. San

Tanya Pratt, chairman of Bahamasair’s Board of Directors, said of the National Family Island Regatta: “I was very pleased with the stellar performance of Bahamasair in Exuma. The staff really stepped up to the plate. Our manager in Nassau flew in to provide extra support to the staff in Exuma.

“Thanks to the Customer Service Department for getting an excellent job done. It took the village. It was a team effort from the executive level right down to the ticket agents on the desk in Exuma to ensure that it was a seamless process in and out. We pulled it off. I give kudos to them all.”

BAIC

rewards ‘Taste and Tell’ participants

BAHAMAS Agricultural and Industrial Corporation (BAIC) executives hosted an awards ceremony to recognise outstanding participants at the third annual ‘Taste and Tell’ event, which was held on April 20, 2024, at the Western Esplanade.

The ceremony was held at BAIC headquarters on Wednesday, May 22. Le-Var Miller, BAIC’s assistant manager, served as master of ceremonies. Brief remarks were delivered by Mario Adderley, dean of culinary arts and leisure management at the University of The Bahamas; Alexia

Leslie

PAGE 22, Friday, May 24, 2024 THE TRIBUNE

Johnson, communications officer, Small Business Development Centre; Troy Sampson, BAIC general manager; and Sonya Sands, BAIC deputy Board chairperson.

Stuart, BAIC’s senior assistant general manager, delivered welcome remarks and offered the prayer. Awards were granted in the areas of: chef, mixology, bush tea, pepper eating, food processors and demos.

jsimmons@tribunemedia.net CALL 502-2394 TO ADVERTISE TODAY!

Reporter

Photos:Patrice Johnson/BIS

Minister ‘cautiously optimistic’ over $900m carbon credits

seagrass meadows in the world.

“Once the research is completed and verified, we will begin the process of evaluating and putting a price to our carbon absorbing capacity,” said Mr Halkitis. “This value will be represented by blue carbon credits we can then monetise. Based on our current pace, we could be in position to monetise by the end of next year.”

Mr Halkitis said he wanted to be conservative with the figures, adding: “The market is still being developed, so we are very, very cautious...cautiously optimistic, but also very conservative in our projections. But the projections for potential revenue are very encouraging.”

The Bahamas’ blue carbon assets are to be monetised through a public-private partnership (PPP), with 49 percent of the executing entity owned by The Bahamas.

“It is envisioned that proceeds will belong to the National Investment Fund, which will fund Family Island development, climate resilient infrastructure, renewable energy and food security initiatives,” said Mr Halkitis.

“To paraphrase all of this, let’s just say blue carbon

credits are a big deal. Once fully realised, we are looking at a major revenue source that will make our economy stronger and more resilient through investments in key areas. Our ability to become more climate resilient will define our future.”

Carbon Management Ltd, a Bahamas-domiciled entity, has been charged with raising the $50m$60m required to map all The Bahamas’ blue carbon assets. The size and value of this nation’s mangrove

and seagrass bed sinks, which remove carbon dioxide from the world’s atmosphere, have to be verified by independent bodies before they can be monetised and converted into carbon credits.

Anthony Ferguson, CFAL’s president and cofounder, who is playing a key role in The Bahamas’ bid to monetise the value of its ocean-based carbon ‘sinks’ such as mangroves and seagrass beds, last year said this nation’s carbon credits will only be sold to

persons working towards similar environmentallysustainable goals.

Mr Ferguson said: “What we are trying to do is be responsible, while at the same time maximising the value that we can get so that we could be in a position by 2050 to have an endowment fund that’s probably $40, $50 or $60bn that could then be reinvested to protect ourselves.”

The CFAL chief said the revenue generated from selling these blue carbon credits will be used to further the country’s sustainable development goals (SDGs) and reduce the “tax burden” facing Bahamians.

He added: “The politicians would not be able to just arbitrarily access that… To maximise the value, those funds must be invested for those SDG goals. So whether it’s infrastructure, healthcare, back into the community’s conservation, we would have identified a number of SDGs that we believe are important to The Bahamas and to reducing the stress level, the tax burden on the Bahamian public.

“We think that, once fully operational, certainly there will be a new set of revenues that will probably be more targeted to healthcare, airports, docks, infrastructure and

DEPP chief: CEC permit needed ‘no matter what’

should address the Hope Town concerns.

“Every development that happens in the country is required to complete a Certificate of Environment Clearance. In the island administrator’s office, under their Act, they have the authority to act as Physical Planning; Town Planning and make those kinds of decisions,” Dr Neely-Murphy said.

“Every application, every time that you do work in the environment, you need to apply for a Certificate of Environmental Clearance no matter what it is.”

But the Hope Town District Council had voiced its disapproval with the CEC requirements, fearing it may halt more than $24m in home construction applications.

Dr Neely-Murphy, however, said the Environmental Planning and Protection Act was enacted in 2019. DEPP representatives have been sent to Abaco to advise local

communities and a written communication was sent to all Family Island administrators. She reiterated that the “law is the law and everybody in the country needs to comply with the law”.

“The Department of Environmental Protection Act was enacted in 2019. I don’t know what prompted this response from this settlement. There were no recent changes. The Act has been in place since 2019. And we have sent officers to Abaco on separate occasions to advise them,” Dr Neely-Murphy added.

“The Family Island administrators’ office has communicated this in writing to all of the administrators. This is not a new thing. This has been explained to them from 2019. The law is the law and everybody in the country needs to comply with the law.”

The Hope Town District Council said it deals with an average of 10-12 Port Department-related applications every month,

and 18-20 Town Planningrelated applications worth millions of dollars. It feels requiring a CEC for all projects would cause “major delays” in granting approvals, and called for the DEPP to assign an agent with an understanding of Hope Town to sit in on their monthly meetings to expedite the process.

Dr Neely-Murphy maintained that CEC applications only take a day or two to review, so having an agent attend the monthly meetings would be “counter-productive”. She added that if the Council is willing to pay for a DEPP agent to attend the meetings, the department will “see how we can accommodate that step”.

“These applications take, on average, one to two days to review. So having someone come to Abaco on a monthly basis in their meeting is really counterproductive. You could get applications reviewed and complete the review on a

rolling basis,” Dr NeelyMurphy said.

“Now if the Hope Town settlement is willing to pay for the officers from the department to come their meeting, then we will see how we can accommodate that step.”

When asked as to why a member of the Hope Town Council said he has been awaiting CEC approval for a dock for almost six months, if the turnaround time is one to two days, Dr Neely-Murphy said projects that are in “sensitive areas” may need additional studies.

She said: “If you have a simple dock, in most instances that review takes 24 to 48 hours, and you can get a certificate of environmental clearance once all your documents are in.

“If you are in a sensitive area, such as a mangrove or along a beach or coastline that needs some work, then you may be required to do additional environmental studies. And if those are necessary, then those

Notice of Appointment of a Liquidator under Section 204 of the BVI Business Company Act

DIVEROS INVEST & TRADE S.A. (IN VOLUNTARY LIQUIDATION) Company No. 141778

NOTICE is hereby given pursuant to section 204, subsection 1 (b) of the BVI Business Companies Act, 2004 that the Company is in Voluntary Liquidation. The Voluntary Liquidation commenced on 9th May 2024. The Liquidator is Myron Walwyn of Travers Thorp Alberga, 2nd Floor Jayla Place, P.O. Box 216, Road Town, Tortola, British Virgin Islands, VG1110.

Dated 9th May 2024

(Sgd) Myron Walwyn Voluntary Liquidator

community development.”

Mr Ferguson said that at the last valuation in 2018, total marine assets in The Bahamas were valued at about $980. Revenue earned from carbon credits can be invested to ensure future conservation efforts. He said: “We are trying to maximise shareholder value, the Bahamian people’s assets, these protected areas that are already protected. And so, for us, if you look at the value of those protected areas, the last valuation was done, I believe in 2018. It came in around $980-something million. I think it’s a little bit higher if you look at all of the biodiversity additives.

“And so we think, conservatively, anywhere from t$750m to $1bn, but I want to be conservative. Even if it’s only half a billion, the point is we invest that back into Bahamian bonds. We take the interest and then we use that to provide the conservation efforts to protect these areas.”

Several financial services sources have privately questioned the Government’s plans to Tribune Business and whether it will generate the revenue numbers being touted. Several have suggested that, in order to be able to create and sell carbon credits, a country has to first reduce its own

are necessary. Our job as a department is to safeguard and protect the environment, to preserve the environment for ourselves to ensure it is functioning the way it needs to for all of our benefits.”

Dr Neely-Murphy maintained that DEPP officers travel to all Family Islands on a regular basis to conduct site visits and follow up with approved projects to ensure they are complying with their CEC. She said: “We had officers travel to Abaco earlier this year, and we try to get to the Family Islands on a regular basis to ensure that if there is any development going on that we are not aware of, that we are able to conduct our checks and balances and follow up with developments that have been approved to make sure that they are progressing in in compliance with the certificate of environmental clearance.” Clay Sweeting, minister of works and Family Island affairs, confirmed in a statement that the Government has amended the Environmental Planning and Protection Act to

emissions and pollution as an ‘offset’ to what will be created by the purchaser. The Bahamas, they added, has yet to do this. The sources suggested that while it was possible to monetise the country’s carbon sinks, via low-cost concessionary ‘blue economy’ loans and debt financing, simply issuing credits against The Bahamas’ seagrass and mangrove beds is unlikely to work.

However, Mr Ferguson said The Bahamas will be selling “carbon certificates” rather than carbon credits. These certificates will allow the purchaser to offset their carbon dioxide or greenhouse gas emissions by investing in environmental projects and assets - such as this nation’s seagrass and mangrove beds.

Mr Halkitis thanked the organisers of Forum for Impact for facilitating the discussions, adding that the dialogue allows the Government and those friendly towards the environment to highlight how The Bahamas can positively impact the world.

“It also allows us to exchange knowledge, learn from each other, and gain inspiration to continue on our mission to make the world a better place,” he added.

streamline the CEC application process. He added that island administrators and local government have been provided with CEC guidelines and that no local council can “suspend or fail to perform its functions” under the law.

He said: “I am happy to advise that the Government of The Bahamas recently amended the Environmental Planning and Protection Act to provide a framework for streamlined application and approvals for non-commercial applications for a Certificate of Environmental Clearance.

“We are committed to ensuring we are good stewards for our environment while also facilitating economic development and investment. All Family Island administrators and local government practitioners have been provided with the aforementioned guidelines as this matter has been addressed previously.

“In the circumstances, no local council can, under the law, suspend or fail to perform its functions as is being suggested by the chairman of the Hope Town Council.”

Legal Notice SUNSKY LIMITED

NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting of the Shareholders of SUNSKY LIMITED is hereby called to be held at the Registered Offce of the Company, Ocean Centre, Montagu Foreshore, East Bay Street in the City of Nassau on the 27th day of June, 2024 at 10:00 o’clock in the forenoon. The object and purpose of said meeting is to have laid before the Shareholders of the Company the accounts of the Liquidator, David Butler, showing the manner in which the winding up of the Company has been conducted and also to hear any explanation that may be given by said Liquidator.

Dated the 22nd day of May, 2024.

David Butler LIQUIDATOR of SUNSKY LIMITED

THE TRIBUNE Friday, May 24, 2024, PAGE 21

FROM PAGE A24 FROM PAGE A24

MICHAEL HALKITIS, minister of economic affairs, was the keynote speaker on day two of the Forum for Impact Americas, held at the Garden of the Groves in Grand Bahama. This marks the third year that Mr Halkitis has been a part of the Forum. Photo:Lisa Davis/BIS

BUDGET MUST ‘MOVE NEEDLE’ ON CREDITWORTHINESS, GROWTH

all, Mr Edwards also suggested that persons who go back to school to re-train - especially in emerging technologies - should receive tax credits or some other form of financial support as this will ultimately boost productivity and the economy.

“I think too often we try to anticipate what they [the Government] will try to do,” he said of next week’s Budget. “I think we need to spend more time, if we are going to advocate for change, saying this is where we ought to go.

“The two biggest things are, despite the improvement in revenue and reconsolidation, I think we need to recognise that our creditworthiness has not been significantly improved by this change even though it is positive. Despite the fact we’ve had some positive feedback from Moody’s, and that’s a platform to build on, it has not really moved the needle in our favour.”

Moody’s last month gave the Government’s fiscal consolidation campaign a major boost by predicting that this year’s fiscal deficit will only narrowly overshoot its target by $44m.

The credit rating agency, in its latest update on The Bahamas released on Friday, forecast that improved revenues and “spending restraint” will contain the deficit for the 2023-2024 fiscal year to a sum equivalent to just 1.2 percent of economic output of gross domestic product (GDP).

If Moody’s projection turns out to be accurate, the GFS deficit will be only slightly higher than the $131m, or 0.9 percent of GDP, that the Davis administration targeted when unveiling its Budget last May. The rating agency’s latest 1.2 percent deficit forecast, based on that Budget, is equal to $174.67m or a near-$44m overshoot if it holds and comes true.

Yet, in spite of this and the Government’s recent upbeat assessment, Mr Edwards said: “We continue to have discussions about our ability to access credit at a reasonable price. The decision to go with a Chinese bank [for the hospital] indicated there is still a concern or challenge in accessing credit at favourable rates.

“Consequently, that is only going to cause a pressure environment that is significantly influential in decision-making going forward. That’s one area the Budget needs to address.”

The Government is aiming to access a concessional Chinese government loan, via the China ExportImport Bank, that will finance the new hospital at 2 percent over a 20-year period.

As for economic growth, with The Bahamas forecast by the Central Bank and the International Monetary Fund (IMF) to be “settling back into what we consider to be the historical” levels of average 1.7 percent GDP

expansion between 2024 and 2026, Mr Edwards said this nation “needs to clearly demonstrate it has a higher growth potential” than that.

Calling on the country to strive for GDP growth between 3 percent to 4 percent, he added: “That growth potential really lies in our ability to implement reforms in a timely basis, execute those reforms and allow them sufficient time to germinate to create an environment in which secure growth moves into the realm of 3 percent, 3.5 percent and 4 percent.”

Such reforms, Mr Edwards said, include reducing the annual $400mplus subsidies handed to loss-making SOEs so that they become more efficient and facilitate faster private sector growth. Too many, he added, are both losing taxpayers’ money and impeding innovation and investment.

Besides energy reform, the Next Level Solutions principal said The Bahamas has to make sure its education system and workforce

are aligned with the economy’s future and growth industries. This, he added, will involve re-tooling and training workers in the skills necessary within the necessary time.

“Persons should get tax credits or allowances to let them go back to school and become more proficient in the area of technology,” Mr Edwards told Tribune Business. “That’s going to enhance the workforce, enhance productivity, over time.

“The other area we want to look at is the public sector. It suffers from being large and bureaucratic. It needs reform that makes it more efficient. It’s never going to be lightning-fast efficient, but make it more efficient, more facilitative so that it positively impacts the ease of doing business and persons can get on with advancing ideas and businesses.

“Those are some critical areas to look at because it benefits the country..... There must be a clear effort to rationalise the almost

Talks to save 20 CIBC jobs ‘look prosperous’

FROM PAGE A24

jurisdictions within the region. Given its silence, and the absence of any outcry from the Bahamian public, she is now solely focused on protecting and securing jobs for those staff who want to remain in work.

“I got the word about a month ago,” the BFSU president said of CIBC’s plans. “In the month that I got the word, I wrote to the minister of labour [Pia Glover-Rolle] and the director. No one responded; not even an acknowledgement. I wanted to hear whether or not they had heard of it, and whether they gave the OK for Bahamians’ information to be put outside the country.

“We did meet with the bank. We are in talks and, of the 20 persons, some said they want out and want to go, and for the others we

are in talks as to where to put them.” Ms Mortimer did not disclose how many of the 20 want to receive their due severance pay and leave, or the number willing to stay, but added: “To me, it’s going to affect Bahamian clients because it’s their financial information.”

The BFSU president asserted that “our service from the call centre here is excellent”, while suggesting that the units in Barbados and Jamaica will not be up to the task. She added that, while The Bahamas’ customer contact centre is supposed to be a 7pm to 8pm operation, and those in Jamaica and Barbados 24-hour units, staff here have been called in to work weekends and “fill in the gaps”.

Ms Mortimer added: “It means Barbados and Jamaica are not pulling their weight, and they’re

closing The Bahamas? Of course, they said The Bahamas is too expensive. That’s their reasoning.” The BFSU said she had asked CIBC Caribbean, the only unionised financial institution in The Bahamas, to supply evidence to support this assertion but it never did.

“I said to them: Obviously you’ve made up your mind,” Ms Mortimer added. “I tried to reach out to my government and the Government is not hearing me. I just need to secure jobs for my people; persons needing to work. That’s the dirty end of the stick.

“For me, I said I don’t agree with their reasoning for closing it, and the Bahamian public is not rising up and saying they don’t want their business going out of the country. They’ll only probably rise up when they’re gone. The only good thing is securing jobs for

those persons who need to work. We’re in talks and it’s looking prosperous.”

The outsourcing and consolidation of back office functions, such as customer contact centres, by the Canadian-owned commercial banks is nothing new in The Bahamas. This trend has been occurring for almost two decades as the likes of Royal Bank of Canada (RBC), Scotiabank and CIBC Caribbean seek to slash costs, drive efficiencies and achieve economies of scale that boost their bottom line.

The Bahamas, perceived as a high-cost destination especially when it comes to labour, has fared poorly in this area with the likes of Scotiabank now having their customer contact centre based in Trinidad. While such cost-saving moves have not always resulted in improved customer service, the drive towards digital banking and artificial intelligence (AI) means such trends will only continue.

However, Mr Thompson, the Government’s director of labour, told Tribune Business that the expectation is “most, if not all” the 20 impacted Bahamian employees will be found, and accept, new posts with CIBC Caribbean either in The Bahamas or here. And for any who cannot find new roles, and need to stay in work, he voiced optimism that the Department will find them jobs at other Bahamian banks.

“CIBC reached out to the minister of labour and the public service and myself a couple of months ago,” Mr Thompson recalled. “They indicated a possible reorganisation was going on. They introduced me to, and discussed at a couple of meetings, this concept of digital banking which I thought was very innovative and interesting to manage the bank.

“The idea was concept. I had a couple of meetings and several teleconference conversations where we discussed the move to the concept of a digital bank centre, and possibly 20 persons would accept new roles in the digital bank centre, other departments of the bank or in other jurisdictions.

“Those who didn’t go for a new role, go to other other

jurisdictions, would be able to take a package to leave and be paid out in full in accordance with the laws of The Bahamas.... The anticipation is most, if not all, persons will accept the new roles. It’s hoped no one will be severed,” Mr Thompson continued.

“If they are, they will be properly taken care of under the laws of The Bahamas and them some. They will pay what the law says and some more. A lot of the staff have been there some significant time. I left those teleconferences and meetings as the director of labour very confident that the laws are being complied with.

“As the director of labour I was left feeling comfortable they are acting in everyone’s best interest. They’ve assured me of everything I need to be assured of.”

Mr Thompson said a CIBC Caribbean executive from outside The Bahamas had flown in to discuss the issue with him, and added: “I was quite impressed that they took the initiative to engage the Department of Labour, myself and the minister and what they are trying to do.

“I know some other commercial banks are looking for persons, and if some make the decision [to leave] CIBC, the Department of Labour is very capable of getting them placed with other banks.”

CIBC Caribbean, in a statement, said The Bahamas’ closure stems from its plans to create a “digital branch” out of its current call centres as it moves to embrace electronic banking. Barbados and Jamaica will be the linchpins in this strategy.

Mark St. Hill, CIBC Caribbean’s chief executive, said: “As a dynamic business in an ever-changing banking landscape, we strive to constantly improve our business for the benefit of both our staff and our clients.

In line with our goal of providing our clients with a true omni-channel banking experience, in addition to continuing to provide first-class service in our branches, we are converting our call centres into true contact centres. In essence, we are reimagining our call centres into a digital branch.

$500m in expenditure to SOEs and $700m to the public sector (salaries). Reforms should be evident in securing improvements, efficiencies, greater corporate governance and creating a more facilitative environment for economic growth.”

Mr Edwards said such reforms will ease the pressure on the Government to introduce new and/ or increased taxes. “The extent to which we achieve organic growth takes the pressure off the Government to consider moving or shifting the tax regime,” he explained.

“If we can secure better growth, the regime need not be instantly changed. If we don’t get the growth we need on a sustainable basis, I think there will be a need to rethink the regime and that, in and of itself, could be disadvantageous to the economy. Growth is one of the big factors I would like to see coming from this Budget.”

“This move helps more of our clients, who choose to go digital, to use our selfserve channels to do their everyday banking by placing our professionals at their disposal should they need help navigating these channels. It also allows our team members to further develop their skills to become more involved in sales and act as financial coaches to our clients.”

Esan Peters, CIBC Caribbean’s chief information officer, said the plan called for The Bahamas’ contact centre to close while the one currently in Montego Bay, Jamaica, will be relocated to Kingston.

“This exercise is about reallocating our resources with the best possible outcome for all stakeholders, and we are undertaking these changes with their understanding,”he added.

“Our intention is to retain any full-time members of staff who wish to remain in the company. Any employees who are close to retirement or who wish to transition out of the company will also be facilitated. There are also options for redeployment within other areas of the bank available to any employee affected by the changes.”

Janine Billy, CIBC Caribbean’s chief human resources officer, said: “We’ve had extensive consultations with our employees, our union partners and, where necessary, as in the case of The Bahamas, the Labour Department, to find the best solutions that leave each employee feeling well cared for and accommodated.

“In Jamaica, for example, we will consider employees who wish to exercise their option to move to Kingston and we are facilitating introductions to other call centres in the Montego Bay area for those who don’t. The same is true in The Bahamas where, assisted by the Labour Department, we are also facilitating introductions to other companies for affected employees.”

“For others, we are offering secondment opportunities in other areas of the business so that they can fully leverage their strengths and additional experience, secure the necessary training and eventually move into other areas of the business in which they are interested.

“We are creating what we call a Culture of Care in our bank, and these changes are within that context. Our aim is to set up our employees for success, so that they can continue to grow and develop in our company.” Mr St Hill added: “With the expanded remit of the call centres, there may be opportunities for other employees in the company who are interested in sales and developing the specialised skills necessary to be a member of our digital branch.

“With the continued development of facilities such as our LoanStore, increased support for clients using our digital services is critical and we want our team to be fully equipped to take advantage of the available opportunities.”

PAGE 20, Friday, May 24, 2024 THE TRIBUNE

FROM PAGE A24

FTX paid $675k to entities tied to ‘Bahamian officials’

ministers/MPs and top civil servants in employing the term “official”. Nor do they say whether the “government officials” are affiliated with the FNM or PLP. While FTX’s collapse occurred under the Davis administration, the crypto exchange first arrived in The Bahamas - and was licensed - under its Minnis predecessor.

Tribune Business research, using prior Supreme Court reports by FTX Digital Markets’ liquidators, shows the crypto exchange’s Bahamian subsidiary was incorporated on July 22, 2021, and licensed and registered to operate in The Bahamas under the Digital Assets and Registered Exchanges (DARE) Act on September 10 that year.

That would have occurred under the Minnis administration just six days before the general election.

Former prime minister, Dr Hubert Minnis, could not be reached for comment yesterday but previously told this newspaper he could not recall seeing or dealing with any of FTX’s permit applications during his time in office. “They never reached us,” he said. “They never came before any committee I chaired or sat on.”’

Tribune Business yesterday also reached out to Latrae Rahming, the Prime Minister’s communications director, for comment from the Government but no reply was received before press time last night. However, Mr Cleary, who was previously US attorney for New Jersey and southern Illinois, and acted as lead prosecutor in the

‘Unabomber’ case, said the probe did not stop with the “purported donations”. “Sullivan & Cromwell, with assistance from Nardello, also investigated other connections between the FTX group and current or former Bahamian government officials, including payments made and other benefits conferred in an apparent effort to secure influence in The Bahamas,” he wrote.

Among the payments scrutinised was the $1m “bonus” paid to “a former Bahamian government official”, then acting as an attorney for FTX Digital Markets, the group’s Bahamian subsidiary, in return for expediting the necessary licences that would permit the crypto exchange to operate in this jurisdiction.

Allyson Maynard-Gibson KC, a former attorney general and ex-minister of financial services and investments, declined to comment last June when asked by Tribune Business whether she was the person involved. “Our firm does not comment on any client nor any matter connected with any client,” she said, referencing the law firm, Clement T. Maynard & Company.

Mr Cleary’s report revealed that Can Sun, the former FTX general counsel who offered the $1m “bonus”, was dismissive and almost scornful when asked if this payment represented a “bribe”. He wrote: “Sullivan & Cromwell determined that this ‘bonus’ was offered to the former government official to secure her assistance in obtaining a necessary license for FTX Digital Markets under the

Bahamas’ Digital Assets and Registered Exchanges Act.

“In its investigation, Sullivan & Cromwell developed evidence that, when asked whether these payments could possibly constitute bribes, the FTX group employee who offered the ‘bonus’ dismissed those concerns based on his view that the recipient of those payments was no longer a government official. The former Bahamian government official secured the licence for FTX Digital Markets within six weeks.”

Mr Cleary’s report also singled out Valdez Russell, the former vice-president of communications and corporate social responsibility for FTX Digital Markets, who declined to comment on assertions he may face “potential claims” after purportedly receiving “twice the fees” set out in his employment agreement.

Mr Russell was not named, instead being referred to as “consultant one”, but the job description mentioned by Mr Cleary matches the one he had with FTX. Mr Russell, who has his own firm, VKR Insights, was said not to have replied to requests submitted under US bankruptcy laws by Quinn Emmanuel, a law firm, but it is understood these were passed on to his Bahamian attorneys.

“After the FTX coup moved its operations to The Bahamas, it retained consultant one in May 2021 to facilitate its move,” Mr Cleary wrote. “Consultant one was engaged specifically due to his connections with the Bahamian government.

“In September 2021, he was hired by FTX

NEW YORK WILL SET ASIDE MONEY TO HELP LOCAL NEWS OUTLETS HIRE AND RETAIN EMPLOYEES

By MAYSOON KHAN

Associated Press/ Report for America

NEW York is offering up to $90 million in tax credits for news outlets to hire and retain journalists in an effort to help keep the shrinking local news industry afloat.

The U.S. newspaper industry has been in a long decline, driven by factors including a loss in advertising revenue as outlets have moved from primarily print to mostly digital. That prompted state lawmakers

to help in a measure passed in the state budget. New York's three-year program allows some news organizations to tap into refundable tax credits each year, with a single outlet able to receive tax credits of up to $320,000 annually.

State Sen. Brad Hoylman-Sigal, a Democrat who sponsored the legislation, said preserving journalism jobs is vital for the health of democracy. As evidence, he cited the weakened New York news media's failure to research the background of George Santos, a

NOTICE

MSE Holding Patrimonial Ltd.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas registered in the Register of Companies under the registration number 209207 B. (In Voluntary Liquidation)

Notice is hereby given that the liquidation and the winding up of the Company is complete and the Company has been struck off the Register of Companies maintained by the Registrar General.

Dated this 22nd day of May A.D. 2024.

Erci Fereira De Camargos Fernandes Liquidator

NOTICE

Kite Coorporation Ltd.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 208520 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 22nd day of May A.D. 2024. Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Pedro Lacaz Amaral, whose address is Rua Assis Brasil 120 AP 101, Copacabana, Rio De Janeiro, RJ, CEP: 22030-010, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 21st day of June A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the beneft of any distribution made before such claim is proved.

Dated this 22nd day of May A.D. 2024.

PEDRO LACAZ AMARAL LIQUIDATOR

Digital Markets as its vice-president of communications and corporate social responsibility. Consultant one was successful in facilitating relationships between the FTX leadership and the Bahamian government, and assisted with several property acquisitions in The Bahamas.

“As a consultant, consultant one received twice the fees contemplated in his retention agreement. Though Quinn Emanuel has identified potential claims against Consultant one, such claims would be brought by the Bahamian liquidators pursuant to the settlement agreement with FTX Digital Markets.”

Foreign investors, uncertain about how to operate in The Bahamas, typically reach out to local law firms and Bahamians they feel they can trust to advise them on how to establish business and obtain the necessary approvals. The “potential claims” against Mr Russell were not identified, but appear to imply that some of the fee payments could be subject to claw back.

Meanwhile, also receiving a bonus over FTX’s Bahamas move was XReg Consulting. When the crypto exchange decided to relocate from Hong Kong in 2020, XReg was tasked with coming up with options for a new home, and one of the search criteria was to find jurisdictions that “offered lax regulation of crypto currency”.

“XReg additionally assisted on the acquisition of required business licences in Gibraltar, Cyprus, the UK, Singapore and The Bahamas, among other countries. XReg also drafted FTX Trading’s

be available to news outlets that are not publicly traded, though there would be an exception for certain media businesses that can show a reduction in circulation.

Republican who fabricated many details of his life story, until after he had been elected to Congress.

"Some of my colleagues have dubbed this credit the 'George Santos Prevention Act' because many believe it was the lack of local press coverage that enabled Santos to spin his web of lies undetected," HoylmanSigal said.

While it is intended to benefit small community news sites, larger media organizations could also potentially benefit. The tax credits would mostly only

Hoylman-Sigal said he is open to making revisions to expand the legislation to include nonprofit news organizations and digitalonly media outlets, which are currently left out of the program.

"This is the first time in American history that we have created a tax credit structure to support journalism jobs," Jon Schleuss, president of the NewsGuild-CWA, a labor union for journalists, said.

Lawmakers in several states have weighed various approaches to

NOTICE XPS LTD.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas registered in the Register of Companies under the registration number 211399 B.

(In Voluntary Liquidation)

Notice is hereby given that the liquidation and the winding up of the Company is complete and the Company has been struck off the Register of Companies maintained by the Registrar General.

Dated this 22nd day of May A.D. 2024.

Sardis Chaves Monteiro Junior Liquidator

NOTICE

EROICA LTD.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas registered in the Register of Companies under the registration number 205650 B. (In Voluntary Liquidation)

Notice is hereby given that the liquidation and the winding up of the Company is complete and the Company has been struck off the Register of Companies maintained by the Registrar General.

Dated this 22nd day of May A.D. 2024.

WELLIAM WANG Liquidator

anti-money laundering policies,” Mr Cleary wrote.

“In total, it received approximately $4m for its services, including a $2.75m bonus upon the completion of FTX Trading’s business licence applications in Singapore and The Bahamas.” The Securities Commission has always argued that the DARE Act placed The Bahamas among the most well-regulated digital assets jurisdictions and enabled this nation to respond quickest when FTX collapsed.

Mr Cleary said Sullivan & Cromwell also probed the $50m loan to Bahamasbased Deltec Bank & Trust that was facilitated by Ryan Salame, the former head of FTX Digital Markets who faced an up to seven-year prison term at his sentencing next week. The loan, he wrote, was provided to ease Deltec’s “capital issues”.

“Sullivan & Cromwell investigated the circumstances surrounding two $50m loans involving Salame, Alameda and two other companies, Deltec International Group and Norton Hall Ltd,” the FTX examiner wrote.

“The investigation concluded that the loans were intended to ameliorate Deltec’s capital issues while ensuring that Deltec would ‘owe’ the FTX Group as a result, and the related promissory notes were structured to conceal Alameda’s role in the loans.

“The investigation further determined that Salame executed one note as a ‘director’ of Norton Hall despite not being a director of Norton Hall, and despite Norton Hall’s director being unaware of the note. Following the investigation, the debtors reached

a settlement regarding the loans, with Deltec agreeing to pay the value of the loan with interest and the remaining obligations extinguished.”

Mr Cleary also wrote that an investigation by the Quinn Emanuel’s law firm found that Deltec Bank “did not conduct any such inquiries” into the “unusual transactions” between FTX and Alameda Research, the latter being Mr BankmanFried’s private trading arm. The FTX examiner also touched on the return of $100m in assets to 1,500 purported “Bahamian” clients in violation of the freeze imposed on FTX’s business by both the Bahamian Supreme Court and Chapter 11 bankruptcy proceedings in the US.

“Sullivan & Cromwell has also investigated certain non-fungible token (NFT) transactions that occurred immediately before and on the petition date.,” Mr Cleary wrote.

“By analyzing withdrawal and trading data from that period, Sullivan & Cromwell found that those NFT transactions were part of a scheme whereby FTX. com users, who could not withdraw funds from the exchange after FTX.com froze withdrawals, paid inflated prices for NFTs sold by Bahamian individuals.

“Those Bahamian individuals, who could withdraw funds from the exchange after FTX.com lifted the withdrawal freeze for Bahamian users on November 10, 2022, would in turn withdraw the proceeds from the sales of NFTs from FTX.com.....The debtors continue to assess next steps with respect to the individuals involved in these transactions.”

help struggling news organizations. The state governments in California and New Mexico help fund local news fellowship programs. The California Legislature is considering a bill that would require tech giants like Google, Facebook and Microsoft to pay a percentage of advertising revenue to media companies for linking to their content. Google pushed back recently by temporarily removing California news websites from some people's search results.

MY ATTRIBUTES:

• 25yrs of Entrepreneurial & Corporate experience at senior management level

Emotionally mature, logical thinker & strong problem solver

• Excellent communicator adaptable to any audience

Experience in successfully leading large teams of 70+ people

• Years of experience in 7 figure budget prep, management & reporting Lead roles in national marketing campaigns from Product Development to Roll Out

• Holds professional Master’s Degree

Email me: 242workforce@gmail.com

Legal Notice

SUNSKY LIMITED (In Voluntary Liquidation)

Creditors having debts or claims against the abovenamed Company are required to send particulars thereof to the undersigned c/o P. O. Box SS-19084, on or before the 14th day of June, 2024. In default thereof they will be excluded from the beneft of any distribution made by the Liquidator.

Dated the 22nd day of May, 2024. David Butler LIQUIDATOR of SUNSKY LIMITED

THE TRIBUNE Friday, May 24, 2024, PAGE 19

FROM PAGE A24 LOOKING FOR A BOARD MEMBER FOR YOUR BUSINESS OR ORGANIZATION???

NORFOLK SOUTHERN WILL PAY $15 MILLION FINE AS PART OF FEDERAL SETTLEMENT OVER OHIO DERAILMENT

By JOSH FUNK Associated Press

THE federal government agreed to a $15 million fine for Norfolk Southern over last year's disastrous derailment in East Palestine, Ohio, and the railroad promised to pay more than $500 million to complete the efforts to improve safety that it announced after the crash and address community health concerns.

Residents who had to evacuate their homes after the derailment were generally underwhelmed by the deal the Environmental Protection Agency and Justice Department announced Thursday that doesn't include any criminal charges. This federal settlement comes two days after a federal judge signed off on the railroad's $600 million class action settlement with residents whose lives were disrupted.

In addition to the civil penalty, Norfolk Southern agreed to pay $235 million in past and future cleanup costs — on top of what they've already paid for cleanup — and set up

a $25 million health care fund to pay for 20 years of medical exams in the community. The railroad will also pay about $30 million for long-term monitoring of drinking water, groundwater and surface water in the area. The agreement also says the railroad will pay $244 million for previously promised railroad improvements through 2025.

Many East Palestine residents feel this settlement doesn't do nearly enough to a company that just reported a $527 million profit in the fourth quarter of last year and $53 million in the first quarter after the derailment costs. The railroad's CEO received $13.4 million in total compensation last year.

"Honestly, no amount can ever make this right, but it should be at least enough to hurt them a little bit. I'm sure that's not going to hurt their bottom line at all," Jami Wallace said.

EPA Administrator Michael Regan said the fine is the largest allowed under the Clean Water Act, and the railroad agreed to continue paying all of the

cleanup costs. Plus he said Norfolk Southern committed to meaningful safety improvements

"This settlement is historic in many ways and will begin to make up for some of the damage caused to the residents of East Palestine. And it would absolutely push the industry in the direction that we would like for the industry to go," Regan said. "Again, if some of these provisions that we've secured and locked in had been in place, we may not even be where we are today. "

But the railroad won't face criminal charges, and this latest settlement won't add anything to Norfolk Southern's roughly $1.7 billion in total costs related to the derailment because the Atlanta-based company was already anticipating those costs.

Neither this federal settlement nor the class action settlement seem like enough to Krissy Ferguson. "Slaps on the wrist. A $15 million fine? And I can never go back to my home again?" Ferguson said.

But resident Misti Allison said it is encouraging to see the investigations and lawsuits against the railroad start to wrap up, and the cleanup is expected to be done sometime later this year.

"I think this is a great step, but let's continue to make sure the community is made whole," Allison said.

Many in the small town near the Ohio-Pennsylvania border are eager to put the derailment behind them, but fears about the possibility of developing cancer down the road hang over residents. Allison said she wants to make sure health needs are addressed. But this federal settlement primarily includes only money for exams while the class action settlement includes money for health problems that developed over the past year. Neither deal addresses potential longterm health problems that might develop.

The safety improvements Norfolk Southern promised include adding about 200 more trackside detectors to spot overheating bearings. It has also promised to invest in more than a dozen advanced inspection portals

that use an array of cameras to take hundreds of pictures of every passing railcar.

A bill in Congress that would require Norfolk Southern and the rest of the major freight railroads to make more significant changes has stalled, although the industry has promised to make improvements on its own.

Norfolk Southern officials said they believe the relatively small size of this settlement reflects how much the railroad has already done, including paying $780 million in cleanup costs and providing $107 million in aid to residents and the communities affected.

"We are pleased we were able to reach a timely resolution of these investigations that recognizes our comprehensive response to the community's needs and our mission to be the gold standard of safety in the rail industry," CEO Alan Shaw said. "We will continue keeping our promises and are invested in the community's future for the long haul."

After Thursday's announcement, the only remaining federal

investigation is the National Transportation Safety Board's probe into the cause of the Feb. 3, 2023, derailment. That agency plans to announce its conclusions at a hearing in East Palestine on June 25. Republicans in Congress have said they might be willing to look at rail safety reforms after that report. Ferguson said it feels like Norfolk Southern is rushing to resolve things before the NTSB report comes out. U.S. Sen. JD Vance and Ohio Attorney General Dave Yost said in a joint statement that they think the government should have waited to settle.

"The residents of East Palestine deserve full compensation to account for the hardships they have faced in the months since the derailment, but they also deserve the full truth about why the derailment and vent and burn occurred," the statement said. "With its decision to reach a settlement now, the DOJ may have sacrificed its opportunity to use the NTSB's findings to impose maximum leverage on those responsible for any potential wrongdoing."

LONG-TERM MORTGAGE RATES

EASE FOR THIRD STRAIGHT WEEK, DIPPING TO JUST BELOW 7%

By ALEX VEIGA AP Business Writer

THE average rate on a 30-year mortgage dipped this week to just below 7% for the first time since mid April, a modest boost for home shoppers navigating a housing market dampened by rising prices and relatively few available properties.

The rate fell to 6.94% from 7.02% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 6.57%.

This is the third straight weekly decline in the average rate. The recent pullbacks follow a fiveweek string of increases that pushed the average rate to its highest level since November 30. Higher mortgage rates can add hundreds of dollars a month in costs for borrowers, limiting homebuyers' purchasing options.

Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also declined this week, trimming the average rate to 6.24% from 6.28% last week. A year ago, it averaged 5.97%, Freddie Mac said.

Mortgage rates are influenced by several factors, including how the bond market reacts to the Federal Reserve's interest rate policy and the moves in the 10-year Treasury yield, which lenders use as a guide to pricing home loans. Treasury yields have largely been easing since Federal Reserve Chair

Jerome Powell said earlier this month that the central bank remains closer to cutting its main interest rate than hiking it. Still, the Fed has maintained it doesn't plan to cut interest rates until it has greater confidence that price increases are slowing sustainably to its 2% target. Until then, mortgage rates are unlikely to ease significantly, economists say.

After climbing to a 23-year high of 7.79% in October, the average rate on a 30-year mortgage stayed below 7% this year until last month. Even with the recent declines, the rate remains well above where it was just two years ago at 5.25%.

Last month's rise in rates were an unwelcome development for prospective homebuyers in the midst of what's traditionally the busiest time of the year for home sales. On average,

more than one-third of all homes sold in a given year are purchased between March and June.

Sales of previously occupied U.S. homes fell in March and April as home shoppers contended with rising mortgage rates and prices.

This month's pullback in mortgage rates has spurred a pickup in home loan applications, which rose last week by 1.9% from a week earlier, according to the Mortgage Bankers Association.

"May has been a better month for the mortgage market, with the last three weeks showing declining mortgage rates and increasing applications," said MBA CEO Bob Broeksmit.

"Rates below 7% are good news for prospective buyers, and MBA expects them to continue to inch lower this summer."

PAGE 18, Friday, May 24, 2024 THE TRIBUNE

DEBRIS from a Norfolk Southern freight train lies scattered and burning along the tracks on Feb. 4, 2023, the day after it derailed in East Palestine, Ohio. A federal judge has signed off Tuesday, May 21, 2024, on the $600 million class action settlement over last year’s disastrous Norfolk Southern derailment in eastern Ohio, but many people who live near East Palestine are still wondering how much they will end up with out of the deal.

Photo:Gene J. Puskar/AP

A “For Sale” sign is displayed in front of a home in Skokie, Ill., Sunday, April 14, 2024. On Thursday, Mat 23, 2024, Freddie Mac reports on this week’s average U.S. mortgage rates.

Photo:Nam Y. Huh/AP

Wall Street slumps to worst day since April on worries about interest rates

By STAN CHOE AP Business Writer

IN the latest example of how good news for the economy can be bad for Wall Street, most U.S. stocks slumped Thursday after strong economic reports raised the possibility of interest rates staying painfully high. The weakness was widespread and overshadowed another blowout profit report from market heavyweight Nvidia.

The S&P 500 fell 0.7% for its sharpest drop since April and pulled further from its record set earlier this week. The Dow Jones Industrial Average dropped 605 points, or 1.5%, and the Nasdaq composite slipped 0.4%.

Stocks broadly struggled under the weight of higher yields in the bond market. Treasury yields cranked up the pressure following the stronger-than-expected reports on the U.S. economy, which forced traders to rethink bets about when the Federal Reserve could offer relief to financial markets through lower interest rates.

One report suggested growth in U.S. business activity is running at its fastest rate in more than two years. S&P Global said its preliminary data showed growth improved for businesses not only in the services sector but also in hard-hit manufacturing.

A separate report, meanwhile, showed the U.S. job market remains solid despite high interest rates. Fewer workers applied for unemployment benefits last week than economists expected, an indication that layoffs remain low.

Treasury yields had been close to flat following the joblessness report but turned higher immediately after the report on business activity, which also suggested upward pressure on selling prices remains stubbornly high.

With pressure on inflation coming from both the manufacturing and service sectors, “the final mile down to the Fed’s 2% target still seems elusive,” according to Chris Williamson, chief business economist at S&P Global Market Intelligence.