Atlantis and PI hotels unite to bar Wendy’s

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ATLANTIS has joined forces with other resorts and developers in a bid to bar the Wendy’s and Marco’s Pizza owner from converting Paradise Island’s former Scotiabank branch into a fast-food restaurant destination.

Tribune Business can reveal the mega resort has teamed with fellow Paradise Island hotels, the Ocean Club and Comfort Suites, plus Hurricane Hole’s developer in an appeal that seeks to overturn the preliminary “change of use” permission granted to Aetos Holdings, the franchise holder for both brands, by the Town Planning Committee. All parties were yesterday said to be “waiting with

• Gang up over converting exScotia branch to fast food

• Ocean Club, Comfort Suites, Hurricane Hole in appeal

• Mega resort says use change ‘obstacle’ to development

bated breath” for the Subdivision and Development Appeal Board to render its verdict with Atlantis warning that permitting the former bank location to be converted into fastfood restaurants will create “a potential obstacle for planned luxury resort and residential development” on Paradise Island. It added that such projects are planned by itself, Four Seasons (the Ocean Club) and

Sterling Global, Hurricane Hole’s developer. Documents obtained by Tribune Business disclose that Royal Caribbean’s $110m Paradise Island project is far from the only development that Atlantis has issues with. The mega resort’s appeal papers, crafted by the Harry B. Sands, Lobosky & Company law firm, assert that permitting a Wendy’s and/or Marco’s Pizza at that site will cause

“incongruence with the idyllic setting of Paradise Island” and “erosion of the natural, scenic and aesthetic environment”.

Chris Tsavoussis, who with his brother, Terry, is the principal and owner of Aetos Holdings, was yesterday said to be travelling outside The Bahamas and could not be reached for comment before press time last night. However, sources familiar with the group’s position said it believed Atlantis and the other resorts have united against it because they fear the competitive threat its brands would pose to their own restaurant operations.

The Wendy’s and Marco’s Pizza franchise holder is also understood to view the opposition by major foreign-owned resorts as

SEE PAGE B5

‘Particularly concerning’: Imports expand 10x faster than export

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS

Trade Commission’s chair yesterday said it was “particularly concerning” that this nation’s imports have increased “ten-fold” compared to export growth with the country’s National Trade Policy set for imminent release.

Philip Galanis, also the HLB Galanis managing partner, told Tribune Business that the annual 2022 foreign trade statistics review revealed that - while Bahamian exports had grown by just under $50m during the four years to end-2022 - imports had expanded by over $500m during that same period.

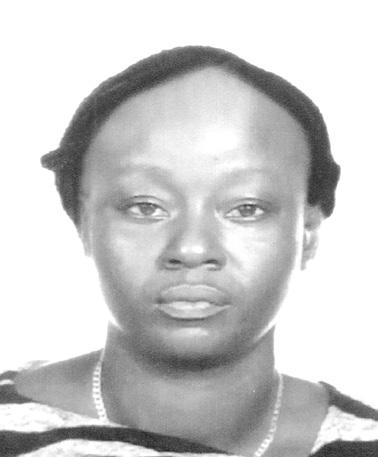

PHILIP GALANIS

Arguing that goods exports are “not expanding as fast as they should be”, he noted that while their value had increased from $537.27m in 2019 to $585.904m in 2022 this paled in comparison to The Bahamas’ import bill. Over the same period, this had grown from $3.321bn

to $3.84bn, resulting in last year’s five-year high trade deficit of $3.254bn that is imposing increasing pressure on tourism, especially, to generate the foreign currency earnings to cover the shortfall.

“Last year we seemed to return to pre-COVID levels for our national trade,” Mr Galanis told this newspaper.

“Last year, we generated $50m more in exports. We are not exporting as fast as we should be growing, and that’s significantly impacting the trade deficit.

“What’s also interesting is that the imports went from $3.3bn to $3.8bm, which is a ten-fold greater increase compared to exports. It’s a bit concerning. We are importing at a very high level, much higher than

exports, and that’s of particular concern to us at the Trade Commission.” With import growth outstripping that for exports, the result is a widening trade deficit that places increasing pressure on The Bahamas to generate the foreign currency earnings to finance it. The Bahamas has traditionally funded its multi-billion dollar trade deficits, which capture just physical goods, with its capital account surplus generated by foreign currency earnings from its services exports - chiefly tourism and financial services. Widening trade deficits mean greater pressure on these income sources to finance the country’s import bill

SEE PAGE B4

Central Bank’s $9m HQ hit ‘wasteful and absurd’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

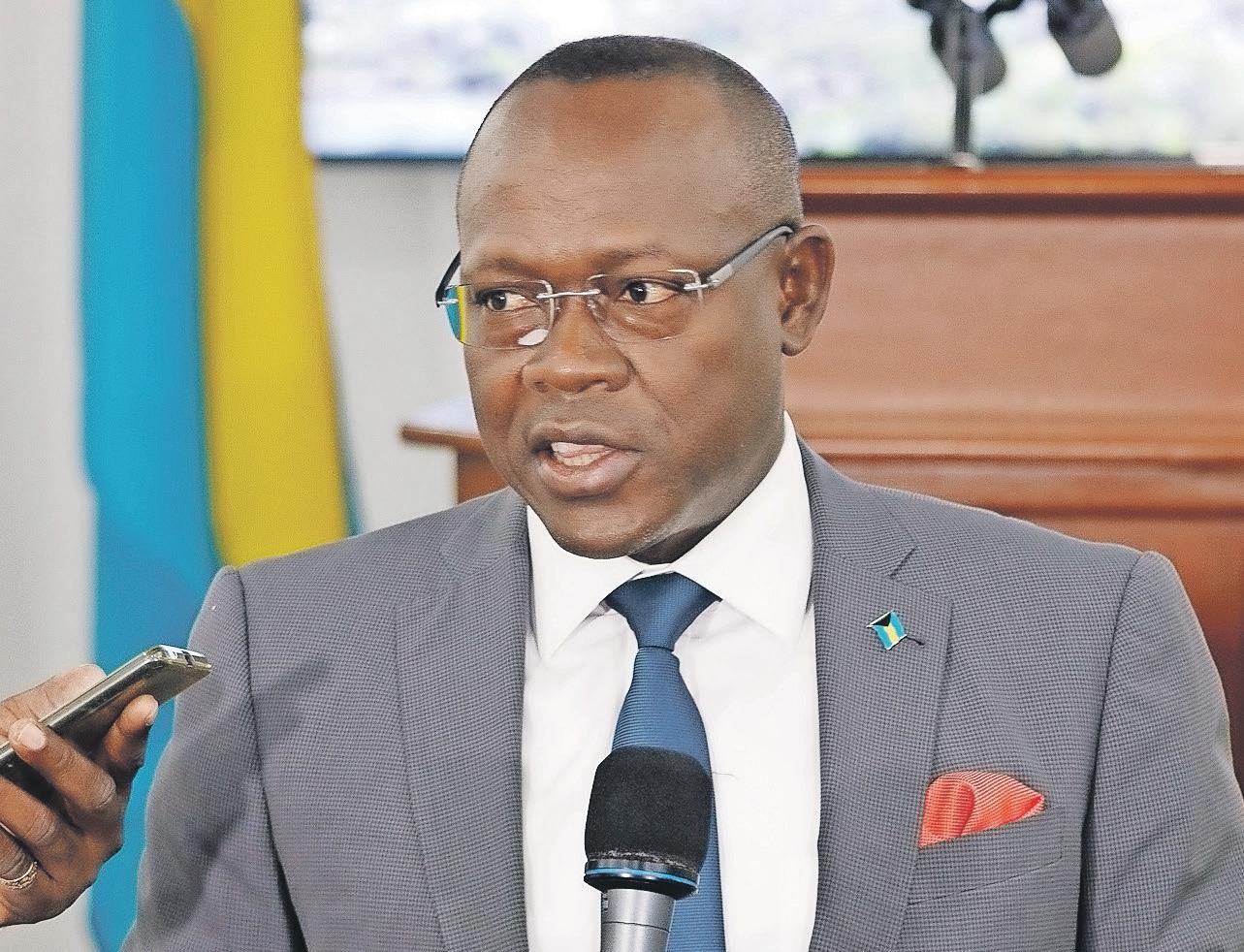

THE OPPOSITION’S finance spokesman yesterday slammed the decision to cancel the Central Bank’s new headquarters project as “absurd”, arguing it was “an ideal project” for providing a post-COVID economic boost.

Kwasi Thompson, former minister of state for finance in the Minnis

administration, told Tribune Business there should have been “no reason to hold back” on the nowabandoned Royal Victoria Gardens location given that all the financing was in place and it was not costing Bahamian taxpayers a cent.

Speaking as well-placed sources, speaking on condition of anonymity, confirmed the project would have been financed from the Central Bank’s retained earnings and profits, he

demanded a more detailed explanation from both the Government and the banking regulator on why it has been abruptly cancelled.

Tribune Business yesterday exclusively revealed that the Central Bank has suffered an $8.92m writeoff due to the project’s abandonment, with further impairment hits to come in 2023. “We are very keen to know why it was this

SEE PAGE B6

Water Corp debt to main supplier grows to $16.6m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

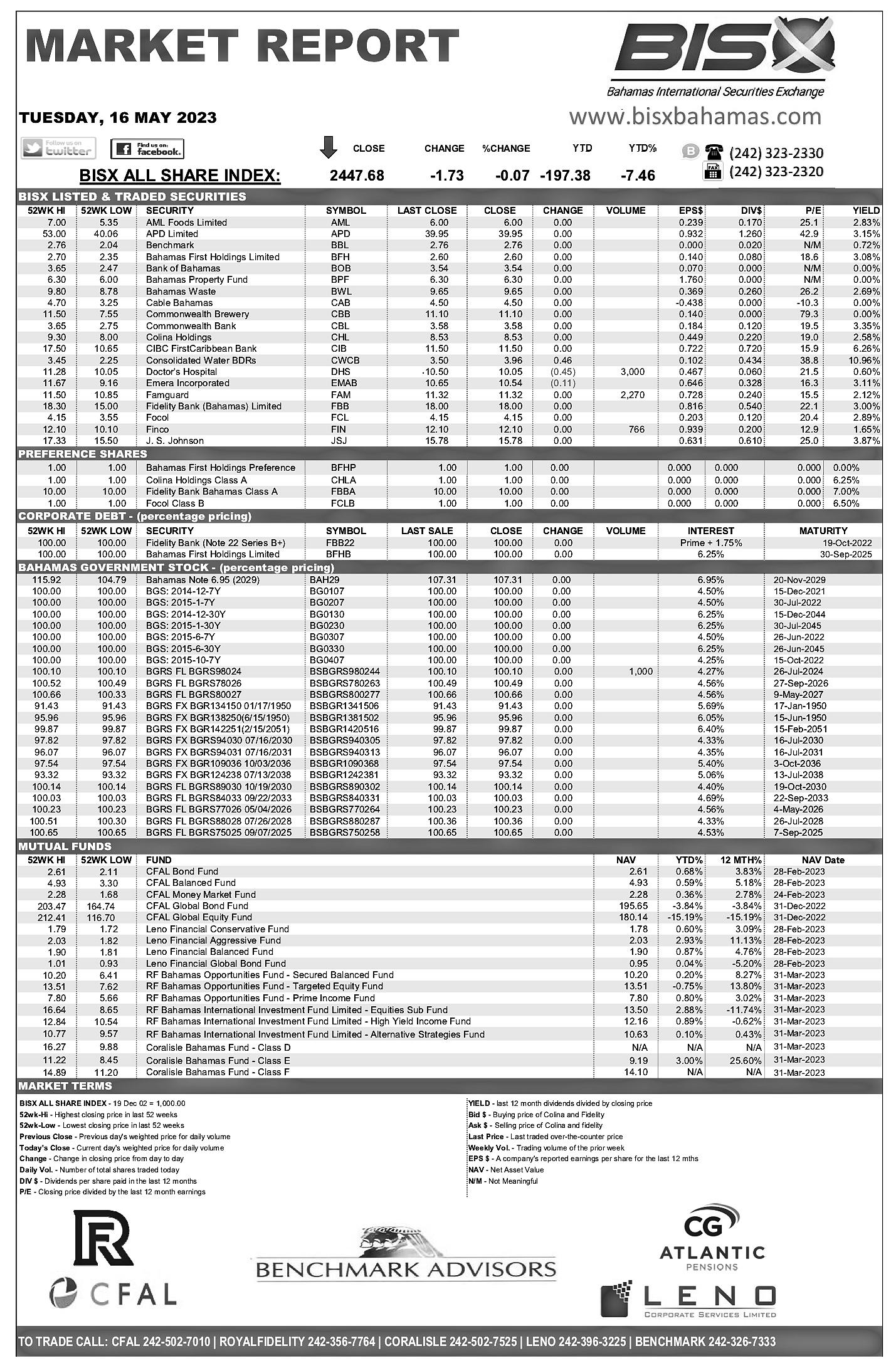

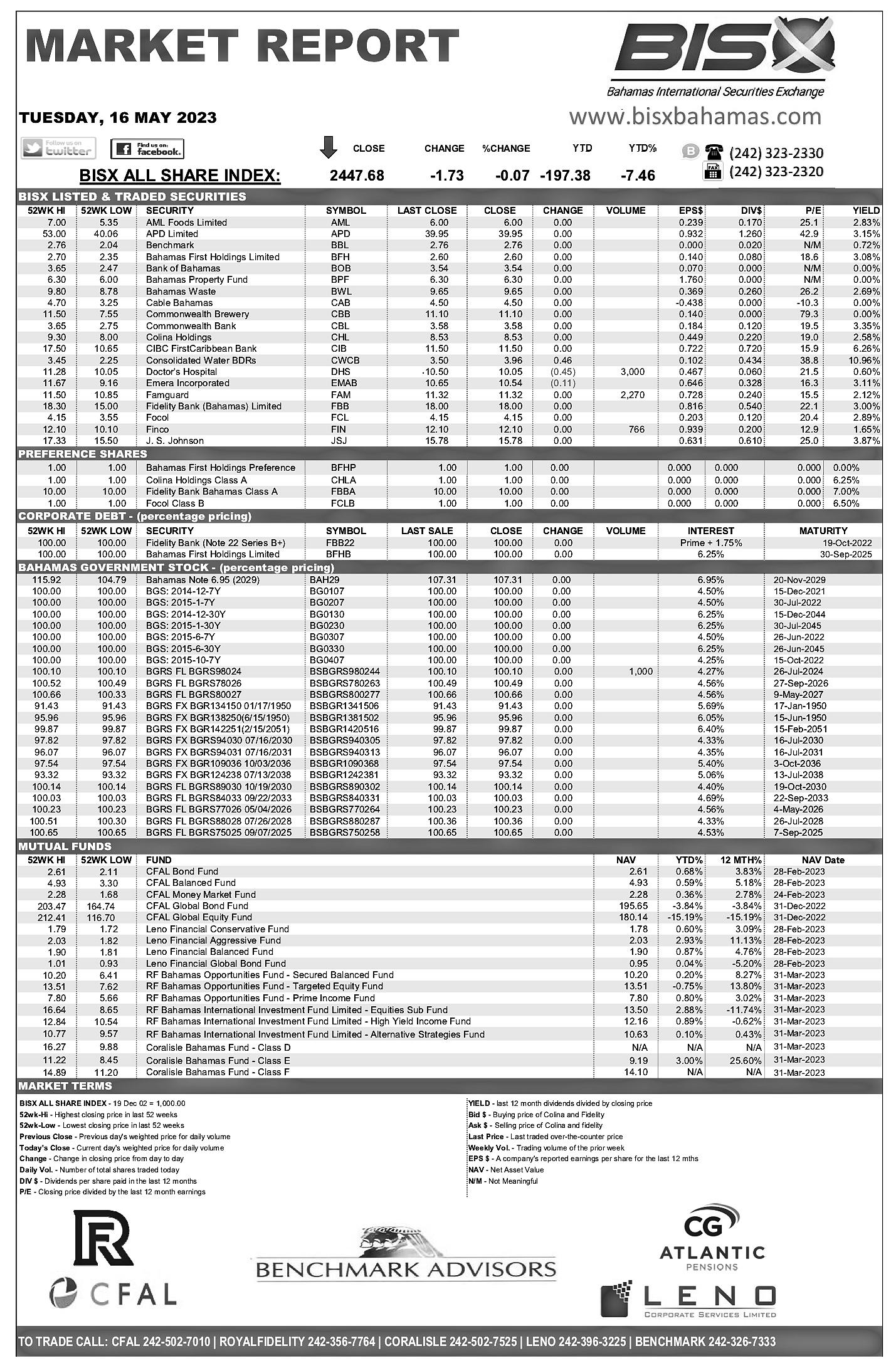

THE WATER & Sewerage Corporation’s outstanding debts to its main BISX-listed reverse osmosis supplier increased slightly to $16.6m during the 2023 first quarter despite government pledges to eliminate this, it was revealed yesterday.

Consolidated Water, the Blue Hills and Windsor reverse osmosis plants operator, in its results filing

for the three months to endMarch 2023 disclosed that the sum owed by the stateowned utility had risen by $300,000 or almost 2 percent since year-end 2022. Documents filed with the US Securities & Exchange Commission (SEC) noted that the increase is moving in the opposite direction to previous assurances from the Ministry of Finance that the Government ultimately intends to eliminate debts owed to Consolidated Water, of which 65 percent or almost two-thirds - some

$10.79m - are delinquent meaning they are 90 days or more past due.

“Consolidated Water (Bahamas) accounts receivable balance (which includes accrued interest) due from the Water & Sewerage Corporation amounted to $16.6m and $16.3m as of March 31, 2023, and December 31, 2022, respectively. Approximately 65 percent of these accounts receivable balances were delinquent as of both of those dates,” the

BISX-listed reverse osmosis supplier said yesterday.

“From time to time, Consolidated Water (Bahamas) has experienced delays in collecting its accounts receivable from the Water & Sewerage Corporation. When these delays occur, we hold discussions and meetings with representatives of the Water & Sewerage Corporation and The Bahamas government and, as a result, payment schedules are developed

Atlantis and Wendy’s in covenants dispute

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ATLANTIS is at odds with the Wendy’s franchise holder over whether restrictive covenants exist to block the latter’s plans to convert Paradise Island’s former Scotiabank branch into a fast food restaurant destination.

Vaughn Roberts, the mega resort’s senior vicepresident of government affairs and special projects, told Tribune Business that the Town Planning Committee’s approval for changing the site’s use was incompatible with restrictions on the purposes for which it can be used.

“There are two properties that make up that parcel,” he explained. “There are some covenants on the vacant property around it that have covenants as to use.” Filings by Atlantis, which has teamed with other Paradise Island hotels and developers to thwart plans by Aetos Holdings to convert the site into a fast food restaurant destination for its Wendy’s and Marco’s Pizza brands, also refer to the restrictive covenant obstacles.

Chris Tsavoussis, who with his brother, Terry, is the principal and owner of Aetos Holdings, was yesterday said to be travelling outside The Bahamas and could not be reached for comment before press time last night. However, sources familiar with the group’s position disputed Atlantis’s position on the restrictive covenants.

They alleged that attorneys acting for the fast food franchise operator had conducted extensive research into the existence of any restrictive covenants, which govern how a specific property or piece of land can be used and developed, and found it would not be in violation. “Town Planning determined they were within their rights to do what they wanted to do, and

ATLANTIS

business@tribunemedia.net WEDNESDAY, MAY 17, 2023

SEE PAGE B4

SEE PAGE B6 KWASI THOMPSON

RESORT

$5.74 $5.74 $5.74 $5.95

Gov’t striving to re-open Lucayan’s Breaker’s Cay

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Government has taken a “show me the money” approach with potential Grand Lucayan buyers at it works to open another part of the resort complex to support increased airlift to Grand Bahama, it was revealed yesterday.

Chester Cooper, deputy prime minister, and also minister of tourism, investments and aviation, reaffirmed the administration’s position that the purchaser of Grand Bahama’s largest resort property must provide proof it has the necessary financing to not only close the acquisition but also fund hundreds of millions of dollars in redevelopment work.

Speaking ahead of the full weekly Cabinet meeting, he also revealed that the Government is seeking to re-open the Grand Lucayan’s Breaker’s Cay complex in “a relatively short period of time” to help solve Grand Bahama’s shortage of hotel room inventory. He added that airlift to the island cannot expand further without more guest rooms for stopover visitors to stay in.

With cruise passenger numbers some 188 percent ahead of 2019 levels for the

year-to-date, Mr Cooper said: “We have provided significant amounts of airlift to Grand Bahama. We’ve been very deliberate and very focused in doing so. We’ve engaged Bahamasair that’s doing flights from Raleigh to Freeport. There have been the Sunwing flights. We’re looking to see how we can extend those to be year-round.

“As you may be aware, Sunwing was recently acquired by WestJet. This is going to be an overall positive for The Bahamas and for Grand Bahama. WestJet has always been a good partner. We’ve had direct services from Toronto and Montreal, as well as Calgary, on WestJet. We’ve been working with WestJet vacations.

“We have an office in Canada that’s been working with them over the course of the last several years, and we’ve engaged them even more actively to get more airlift to Grand Bahama. There’s Frontier, we’re talking with Silver Airways, we’re speaking with Bahamasair about additional routes as well. Air Canada, as you know, comes from Charlotte as well as Miami, and we’re working with them to drive more airlift,” the deputy prime minister added.

“The challenge on the island at the moment is the number of hotel rooms, and

we’re hoping that we’ll be able to get Breakers Cay opened in a relatively short period of time to support the airlift that will come.

Suffice to say all of our airline partners are standing by, and they are ready to support the island of Grand Bahama. The product is strong, our overall numbers are 96 percent of 2019; only 4 percent behind 2019.

“The cruise numbers are up 188 percent compared to 2019. So Grand Bahama is on the move. There’s excitement about the product. People now realise that there is a significant level of excitement, exciting things to do and see in Grand Bahama, on the east and the west end and, of course, in Freeport. And this is attracting a significant level of interest from the stakeholders on potentially new partners.”

Mr Cooper confirmed that the Davis administration has taken a “show me the money” position when dealing with prospective purchasers for the Grand Lucayan. “At the moment we have significant interest still in the Grand Lucayan resort,” he added. “We have taken the position that we want to validate proof of funding. And we are in the process of going through that at the moment. We’ve taken a ‘show me the money’ position.

“And, once we are satisfied, we will make further announcements. Until the end, we’re going to continue to work through the process. And when we get to that stage where we’re completely satisfied, we’ll provide more information

to the public. Suffice to say we acknowledge the importance of the Grand Lucayan to the economy of Grand Bahama. And the importance of the economy of Grand Bahama to the overall economy of The Bahamas. So we continue to work diligently.”

Referring to a $300m eco-resort project targeted for west Grand Bahama, Mr Cooper said: “This is not the Ginn resort, to be clear, but that’s in the pipeline. And we anticipate that in short order, or over the course of the next several weeks, we’ll be able to provide more information. But there’s nothing new since the last time we spoke about it at the Grand Bahama Business Outlook.”

Mr Cooper said the redeveloped Grand Bahama International Airport is still on schedule to be completed in 2025. However, the Government is still completing legal agreements with the five

COOPER

different entities involved in the public-private partnership (PPP) consortium. He added: “We were about to begin demolition. That process is imminent at the moment. There are very complex agreements that are currently being prepared. The lawyers are working diligently as you would imagine. There is a foreign lender (UK Export Finance). There is a foreign airport concessionaire, the airport managers (Manchester Airport Group), there are local groups.

“There’s a consortium of five different entities. And therefore there are a lot of legal agreements to be completed. That process is underway. The consultants are on the ground, and we have a meeting next Tuesday to meet with them to look at the designs. But the reality is the work has continued since we entered the MOU (Memorandum of Understanding) during March, so the process is that we’ve entered the MOU.

“We’re now completing the full set of legal agreements and designs. We’re going to begin the demolition work shortly. Renovations of the air traffic control tower are going to begin firstm, and then we will go into full scale construction. Suffice to say the deadline of 2025 is still in play. That is a hard deadline. All of the parties involved acknowledge and are committed to this deadline.”

Mr Cooper also revealed that banking facilities will be opened in Exuma and Long Island to fill the gap caused by commercial banks withdrawing from those islands. “The issue of Family Island banking has been a concern for the Government of The Bahamas for quite some time,” he said.

“We’ve been working with our banking partners. We’re seeing the large Canadian banks pull out of the Family Islands. This is of great concern to us. Therefore, we have engaged the money transfer agencies who will work along with existing banks to ensure there are banking facilities available in the Family Islands.

“I anticipate that the bank involved is going to make an announcement soon in relation to its Exuma and Long Island mission. And we hope that as a result of the successful implementation of these plans in Exuma and Long Island, other islands would benefit in due course. That’s all I can say at this time.”

Egg self-sufficiency drive is ‘on stream’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A CABINET minister yesterday said plans for The Bahamas to ultimately become self-sufficient in egg production are “on stream” with the necessary poultry grow houses to be set-up within four months.

Clay Sweeting, minister of agriculture, marine resources and Family Island Affairs, giving an update on the $15m Golden Yolk initiative, said: “We’re also about to ensure that we get the houses and all that constructed. That takes up to four months to be ordered to get into the country.

“So all of that is still on stream. It’s an exciting project and we hope that in a few months that we can see some more development there, but the feed mill is already almost completed. It will be state of the art, automated, top of the line.”

Mr Sweeting stressed the importance of partnering with the private sector to ensure the project is successful, and maintained that The Bahamas becoming self-sufficient in egg production will stabilise prices of this commodity.

He said: “In order for us to be food secure it’s important that we partner. I mean, this isn’t government against private sector; it’s a partnership. And in the private sector industry, the food supply stores are already committed to working with us to ensure that this is successful.

“It’s not just about food prices, but it’s about eating healthy. It’s about food security, it’s about stabilising the price. The price might go down today, but you know, you don’t have no stability in regards to that price. But this is just one avenue that we can ensure that we become more food secure within this country.”

Mr Sweeting is hopeful that egg distribution will begin within a year, and noted that logistical challenges have caused the project to be delayed. He added: “We would hope within a year that we could have that going. The challenge is because of logistical challenges and steel and all that. Like the feed mill is probably a month to six weeks later than anticipated when we paid a deposit some time ago. So it all depends on manufacturing.”

PAGE 2, Wednesday, May 17, 2023 THE TRIBUNE

CLAY SWEETING

CHESTER

NEEDS PORT AUTHORITY TO ‘MAKES THINGS HAPPEN’

A CABINET minister yesterday asserted that both Freeport and Grand Bahama need a Port Authority that is “progressive” and “makes things happen”.

GInger Moxey, minister for Grand Bahama, speaking before the weekly Cabinet meeting, said: “The Port Authority has had its fair share of challenges over the years, and the Government has always strived to work with the Port Authority. Grand Bahama has been going through so much and we need immediate relief, but we also need a Port Authority that is progressive, that is making things happen.

“The Government from day one has been communicating with the Port Authority, the shareholders of the Port Authority, to ensure that Grand Bahama is headed in the right direction. So what we want is the best for our people, for our island; we want businesses to thrive.

“And so we’ve been communicating with the Port to ensure that happens. Of course, there are very high level discussions that I can’t really share, but we just want what’s best for Grand Bahama and we want a Port Authority that is making things happen.”

The minister reiterated the Government’s disapproval of the recent water rate increase imposed by the Grand Bahama Utility Company, which was approved by the Grand Bahama Port Authority (GBPA). The decision is viewed by many as infected by a ‘conflict of interest’ as GB Utility is owned by the GBPA’s affiliate, Port Group Ltd, which in essence means it is regulating itself with respect to the water company.

She said: “The thing about that is that the regulator regulated themselves. And so that actual agreement is something that has existed for a long time since 1955, with the signing of the Hawksbill Creek Agreement, and it’s one where the Grand Bahama Port Authority is the regulator with their sister company, Port Group Ltd, owning Grand Bahama Utility Company. And so there’s the obvious conflict there.

“And so, of course, we do not agree with any type of increase at this time. We are still hurting, you know, businesses are trying to recover.

Individuals are trying to get their lives back together. And it’s been tough. And you know, the water is still not the best quality. And so we do not agree with it.

“But it happened because they happened to be the regulator. And so there’s actually a case right now that’s going on with [Grand Bahama Power Company] and URCA where they’re trying to establish who the regulator should be, so we’ll see how that plays out. But again, you know, the Government we are mainly just

looking for the best interests of the people who are still trying to make ends meet.”

Mrs Moxey indicated that while the Grand Bahama Port Authority (GBPA) can demolish abandoned and vacant buildings, it must also bear the costs associated with such action.

She said: “There’s been environmental by-laws that have been imposed over the many years from various administrations. And that is something that our government is reviewing right now. They’re reviewing it, and we should be coming to a decision pretty soon.

“One thing, though, that I want to clarify is that there is no reason that the Port cannot demolish a structure. It’s more about the cost associated, and for the Port to be able to recover the costs. So if you look at it in its completeness, the Port Authority are the city managers. And with that comes the responsibility of the maintenance of the city. And so the by-laws do not stop the Port Authority from being able to demolish a building. It’s more about the cost involved. And so I

just wanted to clarify that for the record.” Mrs Moxey yesterday said “the trajectory is really good for our island, and added: “We have a lot that’s going on. We have the Carnival Cruise port development that is happening, and I think we’re well on the way to an early 2025 opening. We’re breaking ground for the hospital today. That’s exciting news. That’s something that’s long been in the works.

“We have the airport that’s going to be redeveloped. And yes, that’s happening. We’re going to do that pretty soon. Of course, downtown is alive. Downtown after 25 years of basically being shut down is alive. And that’s a big deal. And so with that you have a lot of events that are happening as well.”

Ms Moxey said efforts to revive Grand Bahama via the Collab: Partnerships for Development, initiative, which was formed in 2021 after the Davis

administration was elected to office, were bearing fruit. She added: “Through the beautiful Grand Bahama programme, we have restored a lot of touristic sites - Coconut Fest in the east and all of the other festivals that were returned because of the work that we did through the beautiful Grand Bahama programme.

“And so there’s a lot happening. We want Grand Bahama to be the home of maritime and logistics, which it is, the home of events and entertainment. We’ve been having a lot of events, and the home of innovation. And we believe that a lot of what is new can be piloted right here on Grand Bahama because we do have a ministry that liaises with all other ministries.

“And so we believe that we have the ‘it factor’ to be able to bring the players together to make innovative solutions for some of our our issues,” Mrs Moxey

continued. “We did form a new unit in the ministry called Collab: Partnerships for Development. It’s a new unit that came about because of a new mandate of this ministry, which is to partner with non-governmental organisations (NGOs), businesses, other government agencies and the community at large to assist with the basic needs of residents.

“And the basic needs came about because we had hit rock bottom from Dorian. And we know we needed to rebuild and recover. And the second part of that mandate is for the growth and development of Grand Bahama. And that’s where the business development and new initiatives come in. I’m excited that we are regularly meeting the individuals in the community, businesses, NGOs, to identify issues, bring the parties together, develop a framework and execute for results.”

THE TRIBUNE Wednesday, May 17, 2023, PAGE 3

GB

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

GINGER MOXEY

Atlantis and Wendy’s in covenants dispute

reached a decision that they were good to proceed with the change of use,” one source said.

Atlantis, though, in documents filed with the Subdivision and Development Appeal Board, alleged it had informed the Town Planning Committee at its March 15, 2022, hearing that restrictive covenants did exist over the former Scotiabank property that prevent “any trade, business or profession, including a restaurant, being carried on without the approval in writing” of the mega resort and its subsidiaries.

Further asserting that there were restrictive covenants also governing the maximum building height and minimum setbacks at the former bank branch, Atlantis argued that Town Planning failed to check if the site’s redevelopment into a fast food location would conform with these stipulations.

“Moreover, the property on which [Aetos Holdings and its affiliate] wishes to

install a Marco’s Pizza and Wendy’s restaurant contains a restrictive covenant against doing anything which may be or become an annoyance or nuisance to the owners or occupiers of any adjoining or neighbouring lot,” Atlantis alleged. “A change of use which results in increased vehicular or pedestrian traffic congestion, increased noise, unpleasant odours and visible waste would be a clear annoyance or nuisance not only to neighbours on the adjoining lot, but also to the entire Paradise Island community. In that vein, [Atlantis] also submits that the Town Planning Committee did not give sufficient consideration to the views of the neighbours on the adjoining lot, the Paradise Island community or public at large.”

Comfort Suites, the Ocean Club and Hurricane Hole’s developer, Sterling Global, have also joined Atlantis in the appeal seeking to overturn the “change of use” approval. However, Aetos Holdings view is that their actions are primarily motivated by a desire to

eliminate, or mitigate, the potential competitive threat the Wendy’s and Marco’s Pizza brands pose to their own restaurant operations.

One source, speaking on condition of anonymity, said it seemed that Atlantis and its fellow Paradise Island resorts and developers were seeking to “stall or delay” Aetos Holdings using the planning appeals process so that their own restaurant interests could gain a head start on it.

Suggesting that opponents were seeking to wear down the fast food franchise holder in an attritional battle that will cost it time and money, they also alleged there was an element of hypocrisy to the situation as other brands are already operating on Paradise Island.

“They said they don’t want any more fast food on Paradise Island, yet they allowed Dunkin’ Donuts to expand its location. Everything just flies in the face of what they are saying. Dunkin’ Donuts has expanded to twice its previous size,” they alleged.

Atlantis, in its legal filings, admitted that there was a Dunkin’ Donuts location in “the adjoining plaza”, but argued: “While Dunkin’ Donuts may be described as a quick service restaurant, the similarity ends there. Dunkin’ Donuts is primarily a donut and coffee shop and does not attract levels of business which cause pedestrian or vehicular traffic congestion to the area.”

Meanwhile, another contact suggested Atlantis only had itself to blame for the battle it is now fighting. When Scotiabank closed its Paradise Island branch, and was seeking a buyer, they said Atlantis was given first shot at acquiring the site but elected not to do so. Another of Aetos Holdings’ opponents was said to have made an offer that proved unacceptable, allowing the Wendy’s and Marco’s Pizza operator to swoop in after ensuring the restrictive covenants were not an issue and it saw off other bids. The group is also bitterly disputing Atlantis’ assertion that its project will not be in keeping with

Paradise Island’s character, pointing as an example to its “world class” Mackey Street property.

“Bahamians can’t do business in The Bahamas according to Atlantis,” one source, speaking on condition of anonymity, said of the situation. “Atlantis thinks they can tell Bahamians when, where and how to do business in The Bahamas. They’re going down a very slippery slope.

“It’s just them saying that they don’t want any competition over there. If they didn’t want any competition over there, they should have purchased the property themselves, changed the restrictive covenants and put it back on the market for sale. They feel they have the right to stop Bahamians developing in The Bahamas.”

However, Atlantis is also alleging that the Town Planning Committee’s “change of use” approval breached the Planning and Subdivision Act’s requirement that a public hearing and consultation be held. It argued that it only became aware of Wendy’s plans after the

‘PARTICULARLY CONCERNING’: IMPORTS EXPAND 10X FASTER THAN EXPORT

FROM PAGE B1

given that it sources virtually all it consumes from overseas.

“That’s precisely what the result is,” Mr Galanis told Tribune Business. “We are sending $3.8bn out of the country to cover our import bill, and that puts a lot of pressure on tourism and financial services to generate the reserves to defray that cost.

“We have to pay our bills somehow. It has to come from the domestic economy or borrowing, and we don’t want it to come from borrowing. We hope to fine tune and manage the economy in such a way as to reduce the impact it’s

having on trade and the foreign reserves. “There’s a direct correlation: One-one. We have to find US dollars to pay for imports. We really want to get off this treadmill of continuously seeing incremental increases in our trade deficit. We want to see that number come down. It came down in 2020, but that’s a direct effect of COVID. We want to see exports increase concurrently or at a greater rate than imports. That’s the only way we’ll reduce the trade deficit.”

Confirming that the Davis administration’s Cabinet has approved the National Trade Policy, which will be released later

this month or in early June, Mr Galanis said there were four key elements or cornerstones to the strategy. “The National Trade Policy will be launched officially in the next few weeks. There are four essential components,” he added. The Trade Commission chair identified these as “managing” The Bahamas’ level of imports; more rapid export growth “which we certainly have not been doing over the past five years”; diversification of exports beyond traditional areas, such as spiny lobster and Polymers International, to get more economic sectors contributing and grow exports that way; and strengthening

the Bahamian economy’s competitiveness. “The National Trade Policy has been approved by the Cabinet and I think it will be officially launched by the minister [Michael Halkitis] and the Trade Commission in the next three weeks,” Mr Galanis reiterated. “I think it’s well thought-out. A lot of thought went into it, and a lot of time and energy and resources went into developing it. I think it’s coherent and creates a lot more opportunities for us to focus on trade than in the past.”

While global inflation and higher oil prices will have been at least partially responsible for The Bahamas’ expanded 2022 trade deficit, Mr Galanis said this nation needed to first focus on import substitution possibilities to narrow the ‘red ink’ and increase exports. He identified agriculture and fisheries (mariculture) as two sectors where this could be achieved.

Noting that The Bahamas imported $9m worth of goods from Jamaica in 2022, and $14m from Trinidad & Tobago, he suggested that this nation start by exploring whether

such products can be made locally. “What’s the amount of goods we can substitute by producing in The Bahamas?” he queried.

“Every dollar we are able to save by producing domestically is a dollar less that we have to send out the country to cover our bills and expand the trade deficit.” The Bahamas’ trade deficit expanded by $314.6m or 10.7 percent during 2022 to hit a fiveyear high of $3.254bn, as inflation and higher global oil prices caused import costs to soar.

The Bahamas National Statistical Institute, unveiling the annual 2022 foreign trade statistics review, said:

“The balance of trade (total exports minus total imports) continued to result in a deficit. The trade deficit increased by 10.7 percent between 2021 and 2022, resulting in a negative balance of $3.3bn.”

While Bahamian exports increased year-over-year by $42.6m or 7.8 percent, growing to $586m from $543.4m in 2021, these figures were not surprisingly dwarfed by imports given that The Bahamas brings in virtually everything it consumes. As a result, imports

NEELIEROV LTD.

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, NEELIEROV LTD. is in dissolution as of May 12, 2023

International Liquidator Services Ltd. situated at 3rd Floor Whitfield Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator. L

Notice of Appointment of a Liquidator under Section 204 of the BVI Business Company Act

ANACONDA INVEST & TRADE LTD.

(In Voluntary Liquidation) Company No. 1580694

NOTICE is hereby given pursuant to Section 204, subsection 1(b) of the BVI Business Companies Act, 2004 that ANACONDA INVEST & TRADE LTD. is in voluntary liquidation. The voluntary liquidation commenced on 4th May, 2023. The Liquidator is Myron Walwyn of Travers Thorp Alberga, 2nd Floor Jayla Place, P.O. Box 216, Road Town, Tortola, British Virgin Islands, VG1110.

Dated this 10th day of May 2023

Sgd Myron Walwyn Voluntary Liquidator

Department of Physical Planning informed it of the application, and then it notified other Paradise Island stakeholders.

Mr Roberts told Tribune Business: “There was a Town Planning hearing on it, not a public hearing, although we were present as Atlantis. The Town Planning Committee, we think, erred and made a decision to support the application although it was never taken to a public hearing, and we objected.

“It’s effectively a site plan development approval they were seeking but tried to get it through without a public hearing. There are some very important stakeholders who object to it. It was an opportunistic attempt to move forward without a public hearing.”

Mr Roberts said the situation was the first such planning appeal to the newly-constituted Appeal Board, and he added that Aetos Holdings had to-date provided few specifics and details about its plans.

leapt by $357.1m or 10.3 percent to a new five-year high of $3.84bn as opposed to $3.483bn the year before.

The $3.84bn represents foreign exchange that The Bahamas has to generate through a surplus on its capital account, representing monies earned by services exporters such as tourism and financial services, to fund those imports. Between 2018 and 2022, the trade deficit peaked at just shy of $3bn in 2018, with imports reaching a pre-2023 high of $3.524bn that year.

“Data on merchandise trade for the year 2022 show that the value of commodities imported into The Bahamas totaled $3.8bn, resulting in an increase of 10.3 percent between 20212022,” the 2022 trade report said.

“The category of ‘food and live animals, which totalled $690.4m accounted for 18 percent of the imports in 2022. This category had an increase of 7.7 percent from 2021 which totalled $690.4m. This was followed by ‘mineral fuels, lubricants and related materials’ totalling some $686.2m (17.9 percent of all imports) for 2022.

“Other major categories that contributed to imports were the categories of ‘machinery and transport equipment’, which totalled $684.6m representing 17.8 percent of total imports; ‘miscellaneous manufactured articles’, which accounted for 13.6 percent with a total of $520.4m; and ‘manufactured goods’, which totalled $517.3m, also representing 13.5 percent of all imports for 2022.”

PAGE 4, Wednesday, May 17, 2023 THE TRIBUNE

PAGE B1

FROM

I Q U I D A T O R

NOTICE

Atlantis and PI hotels unite to bar Wendy’s

sending a potentially chilling negative message to Bahamian-owned businesses seeking to further expand and develop. The planning appeal means it has capital, thought to be in the seven-figures, tied up in the former Scotiabank branch’s purchase that cannot generate returns or be used to create jobs (see other article on Page 1B).

Tribune Business sources yesterday confirmed the Appeal Board’s verdict is “pending”. Meanwhile, Atlantis, in appeal documents, said neither itself nor any of its subsidiaries had seen the original application for “change of use” from a bank branch “to a fast food restaurant location, namely to be used for Marco’s Pizza and Wendy’s restaurants”, that was submitted to the Town Planning Committee on October 26, 2021.

The planning authority gave preliminary approval for the change on March 29, 2022, prompting Atlantis to lodge its notice of appeal on April 20, 2022. It argued that the decision “was made

with insufficient merit and regard to the adverse impacts on residents and commercial operations on Paradise Island”, with the negative impacts including increased traffic congestion and parking demand on Paradise Island.

Other parties seeking to appeal the decision were named as the Four Seasons-branded Ocean Club; Highpoint Development, which is the holding company for Comfort Suites; Sterling Hurricane Hole Ltd; and the Paradise Island Tourism Development Association (PITDA).

“The appellants’ objections to the proposed change of use are also shared by a significant number of the residents of Paradise Island,” Atlantis and its affiliates argued.

“After receiving notice of the Town Planning Committee’s decision, the [Atlantis appellants] collected over 100 signatures of Paradise Island residents, commercial property operators and landholders, all of whom object to the proposed change of use.”

Arguing that the Town Planning Committee should

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, CARLOS O’BRIEN BROWN of Yellow Elder Gardens, Nassau, The Bahamas intend to change my name to POWER FULFORCE GHANA If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that ASHLEY ESTINOR of Carmichael Road, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that RODLY REVOL of #10 Andros Avenue, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that HENRI-CLAUDE ST-VIL , P.O Box N356 #9 Bamboo Blvd, Pineroad Gardens, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration

Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

have assessed the impact that a Wendy’s and/or Marco’s Pizza would have on the area, Atlantis said it was “the master developer for Paradise Island and has carefully and strategically developed Paradise Island as an upscale community....

“The appellants and the private residents of Paradise Island objected to, and still object to, the change of use to a premises for Marco’s Pizza and Wendy’s on the basis that such change will have a detrimental impact on the character and future development of the area.”

Alleging that the existing shortage of available public parking space would only be worsened if the fast food restaurants received the go-ahead, Atlantis also asserted that the area suffered from traffic congestion when Scotiabank was operational. It added that the “large volumes of traffic” attracted by fast food restaurants would only exacerbate the problem.

The former Scotiabank branch occupies a key spot at the junction of Harbour Drive and Paradise Beach Drive. Drivers coming on to Paradise Island reach it before they get to Atlantis, Hurricane Hole and any of the other resorts, while persons exiting via the offbridge also have to pass it. It is also within walking distance for both the thousands of staff and tourists at Paradise Island’s hotels,

giving any fast food operator a lucrative and large market to tap into.

Atlantis, in its notice of appeal, alleged: “The appellants have a significant concern that increased traffic will result in stress to resort guests, other visitors and Paradise Island residents arriving and departing from the island. The Town Planning Committee’s decision was not informed by a traffic study.”

The mega resort also pointed to covenants and deeded rights that, “in most instances”, enable it to “ensure that development on Paradise Island conforms to what exists today and the community’s shared aspirations for the future. More importantly, this is essential to the continued growth of tourism, luxury resort and residential development on Paradise Island.

“The history of Paradise Island is a romantic, idealised destination within The Bahamas,” Atlantis continued. “The appellants have invested millions in branding and marketing campaigns that draw on this rich history. The decision of the Town Planning Committee to support the change in use, allowing fast food restaurants, is a potential obstacle for planned luxury resort and residential development.

“In addition to the appellants’ future development plans for luxury residential and resort offerings on

NOTICE

NOTICE is hereby given that IRLANDE TOUSSAINT, Union Village, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

its 50 acres of land, we are aware of luxury residential and resort plans by other developers here on Paradise Island. The presence of fast food restaurants on a main roadway will be a challenge for the underwriting of these projects,” Atlantis continued.

“All recent and planned projects over the next few years (Four Seasons, Paradise Landing (Hurricane Hole), Somewhere Else Atlantis) are luxury properties, which are inconsistent with fast food offerings. There is support for the contention that concerns such as traffic congestion, adequacy of parking and maintaining the character and aesthetic of an area are legitimate and relevant concerns.”

Citing numerous case laws and legal precedents to support its position, Atlantis argued that “there can be no question that the particular concerns raised by the appellants and by the Paradise Island community at large are legitimate and relevant concerns, which ought to have been given due weight and consideration by the Town Planning Committee. Unfortunately, the Town Planning Committee does not seem to have done so”.

Asserting that it was unaware on any traffic or parking analysis being conducted, and has not been presented with such studies, Atlantis said: “As it

relates to concerns regarding noises and odours, the Town Planning Committee ought to have had the benefit of detailed construction plans so that it could examine whether any provisions were being made for soundproofing, exhaust fans, ventilation systems or other measures.”

The mega resort, claiming that no such plans had been provided to the Town Planning Committee, added that it was similarly in the dark about how the fast food restaurants planned to dispose of their waste. “Having regard to the increased waste generated by fast food restaurants, as compared with the bank which previously occupied the space, waste disposal is a concern which ought to have been considered by the Town Planning Committee,” Atlantis alleged.

“In the absence of any plan for the same, the Town Planning Committee could not have given this issue proper consideration.” Atlantis also hit out at the Town Planning Committee’s failure to provide its reasons for granting the “change of use” approval, saying “fairness” required this in cases where there was “large public interest and opposition by a significant number of commercial entities and private residents”.

NOTICE

NOTICE is hereby given that NADIA TRACETTA DAVIS Jabal Avenue, Bamboo Town, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that MYLIANE DALPHE ST-VIL , P.O. Box N356, Bamboo Town, Pineroad Gardens, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

THE TRIBUNE Wednesday, May 17, 2023, PAGE 5

FROM PAGE B1

NOTICE

NOTICE

Central Bank’s $9m HQ hit ‘wasteful and absurd’

project, and again it was so advanced, why they put a stop to it,” Mr Thompson told this newspaper.

“Unfortunately, we have not heard any reasonable satisfactory answer. Coming out of COVID, one would have thought this would be an ideal project because there was not any spending from the Public Treasury. It was a project ready to go, funding was in place, and we would have seen no reason to hold back on such an important project.

“It is what I would state as being wasteful, and unfortunately the Central Bank is being put in a position where it has wasted at least $9m. I suspect it was something that the Central Bank was required to do by the Government.

I would again call on the

Government to give a ful-

some explanation of it, what they now intend for the Royal Victoria Gardens site and how the Central Bank will be accommodated - and where the Central Bank will be accommodated in future.”

Noting that the Central Bank needs a larger premises, and is already having to lease space for staff, Mr Thompson said the proposed Royal Victoria Gardens headquarters “would have created scores of construction jobs and opportunities for small Bahamian sub-contractors” while adding to downtown Nassau’s revival by complementing both the new US embassy and planned Supreme Court and judicial complex. The banking sector regulator, in the financial statements attached to its

just-released 2022 annual report, disclosed the extent of the immediate financial hit it has sustained as a result of not proceeding with a development where six years worth of work has effectively gone to waste.

Detailing the impact, note four in the financial statements on property, plant and equipment said: “The Bank’s ongoing construction of its new premises on the Royal Victoria Gardens (RVG) site located between East Street and Parliament Street, south of Shirley Street and north of East Hill Street in the city of Nassau, Bahamas, continued throughout the year.

“By resolution in Parliament, the Government of the Bahamas authorised the transfer of property to the Bank at a nominal cost of $10. The site preparation

and demolition phase for the project began in 2020 and the architectural designs were completed.

“In March 2023, the Board of Directors approved the termination of the ‘New premises project’ and the transfer of the property ownership back to the Government. As a result, the Bank has recognised an impairment loss associated with this project totalling $8.92m as at yearend [2022]. Additionally, the Bank has estimated that additional termination fees will be recognised subsequent to year-end.”

The Central Bank added that it “will explore alternative arrangements to meet its long-term accommodation needs”, but the annual report’s disclosures - that, in effect, $9m of the regulator’s money has been wasted with further

financial hits to come - will raise further questions as to why the project was abruptly abandoned and likely spark calls for greater explanation from both it and the Government.

John Rolle, the Central Bank’s governor, has not responded to Tribune Business questions on the issue and has remained tightlipped. No explanation is provided in the annual report, while for the Government, Michael Halkitis, minister of economic affairs, said it had suggested “the optics” of the project may not be the best so soon after COVID-19 and that other priorities should take precedence.

However, given the extent of the financial exposure already incurred, questions are likely to be raised as to why the project did not proceed given

that the Central Bank was already so deeply invested. And the funding source was the Central Bank, and not Bahamian taxpayers via the Government, meaning the former was taking all the risk. It thus appears likely the Royal Victoria Gardens project was aborted at the Government’s request for reasons that are not yet clear.

Meanwhile, Mr Thompson said the Central Bank has also contradicted the Prime Minister by describing the Government’s accessing of $232.3m in International Monetary Fund (IMF) special drawing rights (SDRs) as a “loan” despite Mr Davis rejecting such an assertion on multiple occasions.

Water Corp debt to main supplier grows to $16.6m

for the Water & Sewerage Corporation’s delinquent accounts receivable.

“All previous delinquent accounts receivable from the Water & Sewerage Corporation, including accrued interest thereon, were eventually paid in full. Based upon this payment history, Consolidated Water (Bahamas) has never been required to provide an allowance for doubtful accounts for any of its accounts receivable, despite the periodic accumulation of significant delinquent balances,” it continued.

“As of March 31, 2023, we have not provided an allowance for doubtful accounts for Consolidated Water (Bahamas) accounts receivable from the Water & Sewerage Corporation. We have received correspondence from the Ministry of Finance of the Government of the Bahamas that stated the Government intends to return all of Consolidated Water (Bahamas) accounts

receivable from the Water & Sewerage Corporation to current status.” Based on Consolidated Water’s 2023 first quarter and 2022 year-end results, the Government has some way to go in achieving that objective even though the Water & Sewerage Corporation received an additional $20m in the midyear Budget to help it cover its bills to all reverse osmosis suppliers. However, Consolidated Water never usually makes too much of the Water & Sewerage Corporation’s debts because it remains its largest group-wide customer, accounting for almost one-third of total revenues. “A significant portion of our consolidated revenue is derived from our water supply agreements with the Water & Sewerage Corporation. The loss of the Water & Sewerage Corporation as a customer would adversely affect us,” the company admitted among its risk factors.

“One bulk water customer, the Water & Sewerage Corporation, accounted for approximately 32 percent of our consolidated revenue for 2022. If, for financial or other reasons, the Water & Sewerage Corporation does

not comply with the terms of our water supply agreements our consolidated financial condition, results of operations and cash flows could be materially adversely affected.”

And Consolidated Water also warned: “If

Consolidated Water Bahamas is unable to collect a significant portion of its delinquent accounts receivable, one or more of the following events may occur. Consolidated Water Bahamas may not have

sufficient liquidity to meet its obligations.

“We may be required to cease the recognition of revenue on Consolidated Water Bahamas’ water supply agreements with the Water & Sewerage Corporation, and we may be required to provide an allowance for doubtful accounts for Consolidated Water Bahamas’ accounts receivable. Any of these events could have a material adverse impact on our consolidated financial condition, results of operations and cash flows.”

Consolidated Water said its two New Providence-based reverse osmosis plants, Blue Hills and Windsor, are capable of producing a combined 14.8m gallons of water per day. For the 2022 full-year, they supplied the Water & Sewerage Corporation’s customers with 4.6bn gallons compared to 4.4bn in 2021.

PAGE 6, Wednesday, May 17, 2023 THE TRIBUNE

PAGE B1

FROM

FROM PAGE B1

WATER & SEWERAGE CORPORATION’S HEADQUARTERS

Wall Street weakens as energy stocks, Home Depot weigh

By STAN CHOE AP Business Writer

By STAN CHOE AP Business Writer

STOCKS on Wall Street

sank Tuesday after Home Depot warned of flagging sales, the latest discouraging signal for an economy under pressure.

The S&P 500 fell 26.38 points, or 0.6%, to 4,109.90.

The Dow Jones Industrial Average dropped 336.46, or 1%, to 33,012.14, and the Nasdaq composite slipped 22.16, or 0.2%, to 12,343.05.

Energy producers were some of the heaviest weights on the market as Exxon Mobil dropped 2.4% and Chevron fell 2.3%.

Home Depot also fell 2.2% after saying its revenue weakened by more in the latest quarter than expected. It described broad-based pressures across its business following years of big growth, and it cut its forecast for sales this fiscal year given all the uncertainty going forward.

Other big retailers are scheduled to report their results later this week,

including Target and Walmart.

They’re under the microscope because resilient spending by U.S. households has been one of the main positives keeping the economy from sliding into a recession. If it buckles, a recession may be assured, and the pressure is on because measures of confidence among shoppers have been on the decline.

Manufacturing and other areas of the economy have already cracked under the weight of much higher interest rates meant to bring down inflation.

A separate report on Tuesday said that spending at U.S. retailers across the country broadly rose last month, but not by as much as economists expected. “There’s often a gap between how people say they feel and how they spend their money, but the retail sales report shows people are beginning to cut back on big ticket items and discretionary categories like sporting goods,” said Brian Jacobsen, chief

economist at Annex Wealth Management.

Economists pointed to some brighter spots underneath the surface of the report on retail sales, including strongerthan-expected gains after ignoring auto fuel costs. A separate report released later in the morning also offered some encouraging data: The nation’s industrial production unexpectedly grew in April.

Treasury yields in the bond market rose following the reports. The yield on the 10-year Treasury climbed to 3.54% from 3.51% late Monday. It helps set rates for mortgages and other important loans. The two-year Treasury yield, which moves more on expectations for action by the Federal Reserve, rose to 4.07% from 4.01%.

The wide expectation on Wall Street is that the Fed

will hold steady on interest rates in June. That would be the first time it hasn’t raised rates at a meeting in more than a year, as it fights to get inflation lower. A pause by the Fed could offer the economy and financial markets some breathing room. Big Tech and other highgrowth stocks tend to be some of the biggest beneficiaries of easier interest rates, and they helped limit Wall Street’s losses Tuesday.

Amazon gained 2%, and Google’s parent company, Alphabet, rallied 2.6%. They were the two strongest forces pushing upward on the S&P 500 when nearly 90% of the stocks in the index fell.

Also looming over Wall Street is the threat of the U.S. government defaulting on its debt for the first time. That could occur as early as June 1 unless Congress agrees to raise the credit limit set for the nation’s borrowing.

Leaders from Congress met in the White House in the afternoon to discuss the debt limit. The stakes are

THE WEATHER REPORT

tremendous, and economists say failure to allow the federal government to borrow more could mean tremendous pain for both the economy and financial markets.

Most of Wall Street expects Washington to reach a deal because failure to do so would be so traumatic. But Congress has a history of waiting until the 11th hour on such matters, which could raise worries on its own.

In markets abroad, stocks in Shanghai fell 0.6%.

China’s economic recovery after the pandemic faces pressure from sluggish consumer and export demand, a government official said Tuesday, with retail sales and other activity in April weaker than expected.

Tokyo’s Nikkei 225 rose 0.7%, continuing a climb toward its highest level since the early 1990s. Stocks across Europe were modestly lower.

THE TRIBUNE Wednesday, May 17, 2023, PAGE 7

THE NEW York Stock Exchange is seen in New York, Wednesday, May 3, 2023.

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 70° F/21° C High: 92° F/33° C TAMPA Low: 75° F/24° C High: 89° F/32° C WEST PALM BEACH Low: 73° F/23° C High: 91° F/33° C FT. LAUDERDALE Low: 73° F/23° C High: 90° F/32° C KEY WEST Low: 75° F/24° C High: 85° F/29° C Low: 75° F/24° C High: 87° F/30° C ABACO Low: 78° F/26° C High: 83° F/28° C ELEUTHERA Low: 76° F/24° C High: 83° F/28° C RAGGED ISLAND Low: 79° F/26° C High: 83° F/28° C GREAT EXUMA Low: 79° F/26° C High: 84° F/29° C CAT ISLAND Low: 75° F/24° C High: 84° F/29° C SAN SALVADOR Low: 75° F/24° C High: 85° F/29° C CROOKED ISLAND / ACKLINS Low: 79° F/26° C High: 84° F/29° C LONG ISLAND Low: 78° F/26° C High: 84° F/29° C MAYAGUANA Low: 77° F/25° C High: 85° F/29° C GREAT INAGUA Low: 78° F/26° C High: 86° F/30° C ANDROS Low: 76° F/24° C High: 87° F/31° C Low: 76° F/24° C High: 86° F/30° C FREEPORT NASSAU Low: 73° F/23° C High: 92° F/33° C MIAMI

Photo:Seth Wenig/AP

5-Day Forecast A t‑shower in spots in the p.m. High: 87° AccuWeather RealFeel 98° F The exclusive AccuWeather RealFeel Temperature® is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Clear Low: 75° AccuWeather RealFeel 80° F Mostly sunny and nice High: 88° AccuWeather RealFeel Low: 76° 100°-80° F Showers around in the afternoon High: 88° AccuWeather RealFeel Low: 74° 102°-78° F Clouds and sun with a few showers High: 89° AccuWeather RealFeel Low: 75° 102°-80° F Partly sunny and pleasant High: 89° AccuWeather RealFeel 108°-80° F Low: 75° TODAY TONIGHT THURSDAY FRIDAY SATURDAY SUNDAY almanac High 82° F/28° C Low 70° F/21° C Normal high 84° F/29° C Normal low 71° F/22° C Last year’s high 86° F/30° C Last year’s low 72° F/22° C As of 2 p.m. yesterday 0.00” Year to date 14.22” Normal year to date 7.39” Statistics are for Nassau through 2 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New May 19 First May 27 Full Jun. 3 Last Jun. 10 Sunrise 6:25 a.m. Sunset 7:48 p.m. Moonrise 4:57 a.m. Moonset 6:06 p.m. Today Thursday Friday Saturday High Ht.(ft.) Low Ht.(ft.) 6:42 a.m. 2.6 12:49 a.m. ‑0.1 7:14 p.m. 3.2 12:53 p.m. 0.4 7:30 a.m. 2.5 1:40 a.m. ‑0.2 8:00 p.m. 3.2 1:37 p.m. ‑0.5 8:16 a.m. 2.4 2:28 a.m. ‑0.2 8:44 p.m. 3.2 2:20 p.m. 0.4 9:00 a.m. 2.3 3:13 a.m. 0.2 9:26 p.m. 3.1 3:02 p.m. 0.3 Sunday Monday Tuesday 9:44 a.m. 2.2 3:57 a.m. 0.1 10:09 p.m. 3.0 3:44 p.m. 0.2 10:27 a.m. 2.1 4:41 a.m. 0.0 10:52 p.m. 2.9 4:26 p.m. 0.0 11:11 a.m. 2.1 5:25 a.m. 0.2 11:35 p.m. 2.7 5:09 p.m. 0.2 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: SW at 6 12 Knots 2 4 Feet 10 Miles 79° F Thursday: SW at 6 12 Knots 1 3 Feet 8 Miles 81° F ANDROS Today: SW at 3 6 Knots 0 1 Feet 10 Miles 83° F Thursday: S at 2 4 Knots 0 1 Feet 10 Miles 85° F CAT ISLAND Today: WSW at 4 8 Knots 1 3 Feet 8 Miles 79° F Thursday: SSE at 4 8 Knots 1 3 Feet 10 Miles 81° F CROOKED ISLAND Today: S at 3 6 Knots 1 2 Feet 8 Miles 83° F Thursday: SE at 6 12 Knots 1 3 Feet 10 Miles 83° F ELEUTHERA Today: WSW at 4 8 Knots 2 4 Feet 10 Miles 80° F Thursday: S at 4 8 Knots 1 3 Feet 10 Miles 80° F FREEPORT Today: WSW at 6 12 Knots 1 2 Feet 8 Miles 81° F Thursday: W at 6 12 Knots 1 3 Feet 10 Miles 83° F GREAT EXUMA Today: SW at 4 8 Knots 0 1 Feet 8 Miles 82° F Thursday: S at 4 8 Knots 0 1 Feet 10 Miles 84° F GREAT INAGUA Today: SE at 3 6 Knots 1 2 Feet 7 Miles 82° F Thursday: ESE at 4 8 Knots 1 2 Feet 10 Miles 84° F LONG ISLAND Today: SSW at 4 8 Knots 1 2 Feet 10 Miles 81° F Thursday: SE at 4 8 Knots 1 2 Feet 10 Miles 83° F MAYAGUANA Today: SW at 4 8 Knots 1 3 Feet 10 Miles 82° F Thursday: SE at 6 12 Knots 2 4 Feet 7 Miles 81° F NASSAU Today: S at 3 6 Knots 0 1 Feet 8 Miles 81° F Thursday: SSE at 3 6 Knots 0 1 Feet 10 Miles 82° F RAGGED ISLAND Today: SW at 4 8 Knots 0 1 Feet 10 Miles 82° F Thursday: SE at 4 8 Knots 0 1 Feet 10 Miles 82° F SAN SALVADOR Today: SW at 4 8 Knots 0 1 Feet 8 Miles 79° F Thursday: SSE at 4 8 Knots 0 1 Feet 10 Miles 80° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023 L tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 4 8 knots N S E W 6 12 knots N S E W 8 16 knots N S E W 4 8 knots N S E W 4 8 knots N S E W 3 6 knots N S E W 4 8 knots N S E W 3 6 knots

DEBT LIMIT PROGRESS AS BIDEN, MCCARTHY NAME

TOP NEGOTIATORS TO AVERT NATIONAL DEFAULT

By LISA MASCARO AND SEUNG MIN KIM

Associated Press

DEBT-limit talks shifted into an encouraging new phase Tuesday as President Joe Biden and House Speaker Kevin McCarthy named top emissaries to negotiate a deal to avert an unprecedented national default. Biden cut short an upcoming overseas trip in hopes of closing an agreement before a June 1 deadline.

The fresh set of negotiators means discussions are now largely narrowed to what the White House and McCarthy will accept in order to allow lawmakers to raise the debt limit in the coming days. The speaker said after a meeting with Biden and congressional leaders that a deal was “possible” by week’s end, even as — in McCarthy’s view — the two sides remained far apart for the moment.

Biden was publicly upbeat after a roughly hourlong meeting in the Oval Office, despite having to cancel the Australia and Papua New Guinea portions of his overseas trip that begins Wednesday.

Biden will participate in a Group of Seven summit in Hiroshima, Japan, but then return to Washington on Sunday.

“There’s still work to do,” Biden said. “But I made it clear to the speaker and others that we’ll speak regularly over the next several days and staff’s going to continue meeting daily to make sure we do not default.”

Senior White House officials, as well as top aides to the four congressional leaders — McCarthy, R-Calif., Senate Majority Leader Chuck Schumer, D-N.Y., Senate Minority Leader Mitch McConnell, R-Ky., and House Minority Leader Hakeem Jeffries, D-N.Y. — have been meeting daily.

But now, Steve Ricchetti, counselor to the president, Office of Management and Budget Director Shalanda Young and legislative affairs director Louisa Terrell will take the lead in negotiations for the Democratic side, while Rep. Garret Graves, R-La., a key McCarthy ally who has been a point person for the speaker on debt and budget issues, will represent Republicans.

“Now we have a format, a structure,” McCarthy said as he returned to the Capitol. Negotiators are racing to beat a deadline of June 1, which is when the Treasury Department has said the U.S. could begin defaulting on its debts for the first time in history and risk a financial catastrophe. The revised itinerary of Biden’s upcoming trip showed the urgency of the talks.

White House officials sought to soften the impact of the trip cancellations. National Security Council spokesman John Kirby noted that Biden will already have met with some of the leaders of the “Quad” — the purpose of the Australia leg of the visit — while in Japan, and the president is inviting Australian Prime Minister Anthony Albanese for an official state visit in Washington.

Still, Kirby added, “We wouldn’t even be having this discussion about the effect of the debt ceiling debate on the trip if

“It is essential that Congress act as soon as possible. In my assessment – and that of economists across the board – a U.S. default would generate an economic and financial catastrophe.”

Janet Yellen

Janet Yellen

SPEAKER of the House Kevin McCarthy of Calif., left, and Vice President Kamala Harris listen as President Joe Biden speaks during a meeting with Congressional leaders in the Oval Office of the White House, Tuesday, May 16, 2023, in Washington.

rejected by House Democrats at a morning caucus meeting, according to one Democrat at the private meeting and granted anonymity to discuss it.

Congress would do its job, raise the debt ceiling the way they’ve always done.”

Even as the Democratic president and the Republican speaker box around the politics of the issue — with Biden insisting he’s not negotiating over the debt ceiling and McCarthy working to extract spending cuts with the backdrop of a potential default — various areas of possible agreement appeared to be emerging.

Among the items on the table: clawing back some $30 billion in untapped COVID-19 money, imposing future budget caps, changing permit regulations to ease energy development and putting bolstered work requirements on recipients

of government aid, according to those familiar with the talks.

But congressional Democrats are growing concerned about the idea of putting new work requirements for government aid recipients after Biden suggested over the weekend he may be open to such changes. The White House remains opposed to changes in requirements for recipients of Medicaid and food stamp programs, although it is more open to revisions for beneficiaries of the Temporary Assistance for Needy Families cash assistance program.

The idea of imposing more work requirements was “resoundingly”

Progressive lawmakers in particular have raised the issue. Rep. Pramila Jayapal, the chair of the Congressional Progressive Caucus, said, “We want to make sure that these negotiations do not include spending cuts, do not include work requirements, things that would harm people, people in rural areas, black, brown, indigenous folks.” Democratic leader Jeffries’ staff sought to assuage the concerns late Monday, while a separate group of more centrist Democrats signaled to their moderate Republican colleagues they are prepared to work something out to reach a debt ceiling deal, aides said Tuesday. While McCarthy has complained the talks are slow-going, saying he first met with Biden more than 100 days ago, Biden has said it took McCarthy all this time to put forward his own proposal after Republicans failed to produce their own budget this year.

Compounding pressure on Washington to strike a deal, Treasury Secretary Janet Yellen said Monday that estimates are unchanged on the possible “X-date” when the U.S. could run out of cash.

But Yellen, in a letter to the House and Senate, left some opening for a possible time extension on a national default, stating that “the actual date Treasury exhausts extraordinary measures could be a number of days or weeks later than these estimates.”

“It is essential that Congress act as soon as possible,” Yellen said Tuesday in remarks before the Independent Community Bankers of America. “In my assessment – and that of economists across the board – a U.S. default would generate an economic and financial catastrophe.”

Time is dwindling. Congress has just a few days when both the House and Senate are in session to pass legislation, although scheduled recesses could be canceled if more time is needed to clear whatever deal the White House reaches with McCarthy.

Congressional leaders will also need time to take the temperature of rankand-file lawmakers on any agreement, and it’s not at all clear that the emerging contours go far enough to satisfy McCarthy’s hardright faction in the House or would be acceptable to a sizable number of Democrats whose votes would almost certainly be needed to secure any final deal.

Republicans led by McCarthy want Biden to accept their proposal to roll back spending, cap future outlays and make other policy changes in the package passed last month by House Republicans. McCarthy says the House is the only chamber that has taken action to raise the debt ceiling. But the House bill is almost certain to fail in the Senate, controlled by Democrats, and Biden has said he would veto it. An increase in the debt limit would not authorize new federal spending. It would only allow for borrowing to pay for what Congress has already approved.

PAGE 8, Wednesday, May 17, 2023 THE TRIBUNE

Photo:Evan Vucci/AP

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 We believe in building a better tomorrow by empowering today’s youth. Step up for those in need DONATE TODAY & HELP US BUILD You can help Learning is for life. So is the need for love, support and nurturing. That’s why we created The Step - a dynamic community that fosters growth in a safe, secure and supportive environment. More than a home, this haven provides young Bahamians with the tools, resources and support they need to continue to thrive as they transition into independent living and learn to become productive members of society. With your help, we can put them on the right path for a successful and productive life. Learn more. Support today. Scan for full details The Ranfurly Homes for Children T: 242.393.3115 E: mail@ranfurlyhome.org | www.ranfurlyhome.org The Step Pods, currently Phase Two is under construction at The Ranfurly Homes for Children “Being given the opportunity to live in the transitional home was a blessing. Firstly, it has provided me with a sense of security. Knowing I had a place to stay while I saved for my future took away the headache. Secondly, I had some privacy! Being in multiple children’s homes from the tender age of two (2), I was always surrounded by a lot of other kids, and having my own space where it was just me finally meant a lot. Lastly, I received immense support from the Board of Directors and Staff of The Ranfurly Home for Children mentally, emotionally, and spiritually. I am truly grateful.” - Symone Mackey, Resident at The STEP Program Step Up for the STEP Program Phase Two is actively underway, the mission and goals of Ranfurly’s STEP Program continue, with a further four units currently being built. Help us reach our goal of $365,000 and play an essential role in helping to build a brighter future by empowering today’s youth. *The Ranfurly Homes for Children is 501(c)3 Approved

By STAN CHOE AP Business Writer

By STAN CHOE AP Business Writer

Janet Yellen

Janet Yellen