RF: ‘No impact’ from core software dispute

By NEIL HARTNELL Tribune Business Editor

RF Bank & Trust yesterday

asserted that a dispute with its core software provider will “not in any way impact customer funds or overall operations” as it bids to resolve their differences.

The Bahamas-based institution, which is a key player in this nation’s capital markets with some $1.3bn in total assets under administration, hit back after it emerged that International Private Banking Systems (IPBS) has ceased providing support and maintenance for the software platform amid their escalating fight.

• Customer funds, operations safe in IPBS fight

• Bank’s ‘substantial progress’ on service delays

• ‘Challenges’ from $200m asset, 400 client growth

banking software for around 90 years and thus the termination notice has no impact.

The bank is also arguing that IPBS and its principals have failed to identify which parts of the licensing agreement have been breached and, in any event, it will switch to another banking software platform - called Olympic - later this year. IPBS, though, has suspended all co-operation with RF Bank & Trust on the migration of data to the new Olympic platform as part of the two sides’ ongoing dispute.

PM told: Wear ‘game hat’ for GB business meeting

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Prime Minister is being urged to wear his “game hat” for tonight’s Freeport meeting with a business community eager to learn how the $357m demand of the Grand Bahama Port Authority was calculated.

Documents seen by this newspaper, which it has verified as genuine, reveal that IPBS moved to terminate its licence agreement with RF Bank & Trust, and the later’s right to use the software, with effect from March 31, 2024, amid allegations that the bank had exceeded the number of persons permitted to use the system and thus under-paid licensing and maintenance fees.

Those fees are calculated on a per capita, or number of users/seats, basis. However, RF Bank & Trust, while not providing its official position other than signalling it disputes IPBS’ claims, is understood to have taken the stance that it has already fully paid to use the latter’s core

The software provider has also informed RF Bank & Trust’s regulators of the situation, and is understood to claim it is owed a sixfigure sum in unpaid licensing and maintenance fees. The bank, though, feels that the relationship with IPBS only started deteriorating when it revealed it planned to replace its product and informed the company

‘Fantastic opportunity’ given Bahamas in UK tax change

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

REALTORS yesterday argued The Bahamas has “a fantastic opportunity” to exploit changes in UK tax law by attracting hundreds of ultra wealthy individuals and their families to domicile in this nation.

Gavin Christie, broker and appraiser with Corcoran C. A. Christie Bahamas, told Tribune Business it is “imperative The Bahamas gets it right” in seeking to entice millionaires and billionaires impacted by the UK’s plans to scrap the tax concessions offered to around 68,000 “non-domiciled” persons.

These are persons who, for UK tax, are treated as resident but have their permanent home in another country. However, they now face having to pay millions

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

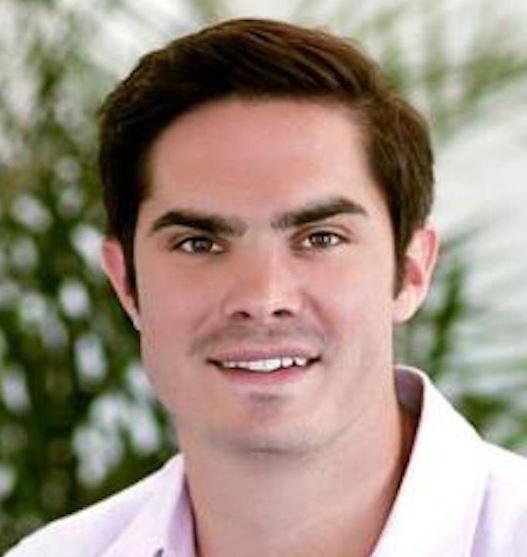

THE head of FTX’s Bahamian subsidiary is handing over his Albany home to local liquidators to ensure the recovery of “more than $200m” from selling-off the crypto exchange’s real estate is not endangered. Documents filed with the Delaware Bankruptcy Court reveal that Ryan Salame, former FTX Digital Markets chief executive, has struck a deal with US federal prosecutors, the crypto exchange’s US chief and Bahamian liquidators that will see the latter take responsibility for selling a condominium recently valued at $5.9m. Mr Salame, as part of the plea agreement struck with the US attorney’s office for southern New York, must pay FTX’s Chapter

Darren Cooper, proprietor of D’s Car Rental, told Tribune Business he and other Grand Bahama Port Authority (GBPA) licensees want to see and understand “the full layout and detail” of the sum Freeport’s quasi-governmental authority is said to owe the Government for public spending in excess of the tax revenues generated by the city between 2018 and 2022. Aside from the Government’s dispute with the GBPA, which is almost certainly headed for arbitration proceedings, licensees and members of Grand Bahama’s wider business

community will likely want Philip Davis KC to set out his vision for both Freeport and the wider island, as well as his strategy for achieving those objectives and the direction he plans to take. Mr Cooper and others said it was critical that the Prime Minister, regardless of what happens with the GBPA and its future role, pledge that the Government will not “tamper” with the Hawksbill Creek Agreement, Freeport’s founding treaty, given that this would threaten to undermine business

business@tribunemedia.net MONDAY, MAY 6, 2024

FTX chief’s

Albany handover to preserve $200m recovery

SEE PAGE B7

nhartnell@tribunemedia.net SEE PAGE B10 SEE PAGE B4 SEE PAGE B10

RYAN SALAME

PHILIP DAVIS KC

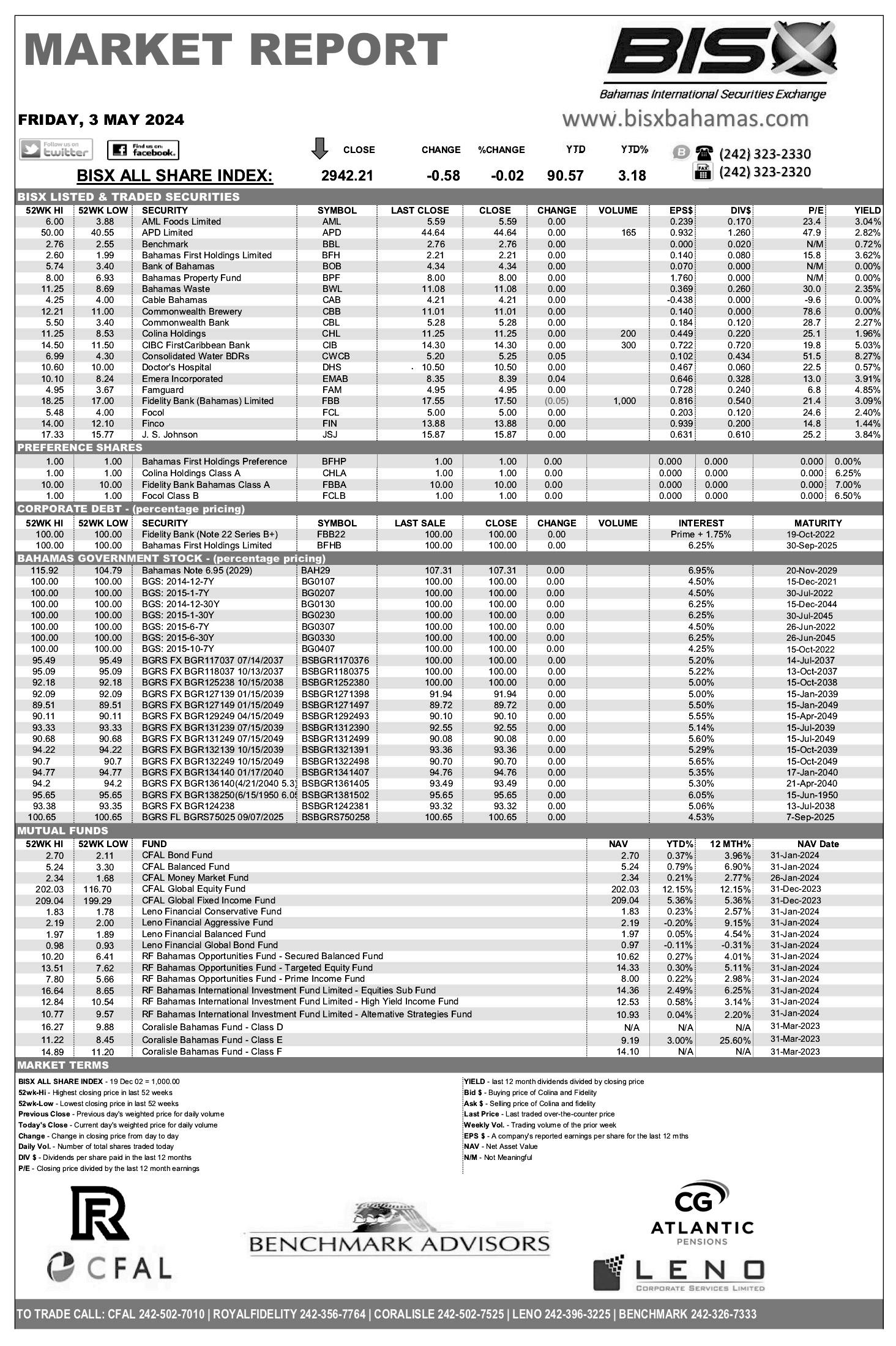

$5.80 $5.85 $5.92 $5.96

GAVIN CHRISTIE

Minister: We’ll leave taxi sector in ‘better condition’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A CABINET minis-

ter has pledged the Davis administration will leave the taxi industry in “better condition” than it found it with the new driver code of conduct not designed just to “reprimand”.

Jobeth Coleby Davis, minister of energy and transport, told a Town Hall meeting with taxi drivers that the new code of conduct will given them a “concrete and defined” framework to abide by. She asserted that it does not contain any “onerous or difficult conditions”, and merely sets out standards that have long governed the sector informally.

“The Davis administration is committed to leaving the taxi sector in a better condition than we met it. To achieve this goal, we believe that collaboration, consultation and action must guide our approach,”

Mrs Coleby-Davis said.

“A growing and developing Bahamas requires a

strong public transportation sector.

“I don’t want anyone to think that our code of conduct is just to reprimand. What it really is trying to do is to make sure we continue to build and improve our sector. So that’s what it’s about: To build and improve our sector, and it is providing a concrete and defined framework for the service standards.

“The standards outlined in the code of conduct are not onerous or difficult conditions. They existed already. We just codified it. We aim to be the best.”

Taxi Drivers were also introduced to the Rate Your Ride app, which is being launched for use by both their sector and bus drivers, and will allow consumers to give feedback on their experiences well as book and make payments for transportation.

Mrs Coleby-Davis said the app is critical to modernise the transportation industry because, in a digital age, many guests expect access to this type of service. She added that the app will undergo pilot testing and be customised for the

Bahamaian transportation sector, but the conversion is necessary to keep up with global trends.

Mrs Coleby-Davis said: “That app is to help to grow and modernise the sector. We will have to look to make sure that it is fit for purpose, and that we are utilising it in a way the sector can use it and it’s beneficial for all.

“We will look at the possibility of maybe piloting the app first, and seeing how it works and seeing how it flows. And then we can grow and expand from there. We have to start the conversation now because it is the way that the sector and the world is going.”

Robert Sands, the Bahamas Hotel Tourism Association’s (BHTA) president, said that although the majority of taxi drivers already comply with the rules set out in the code of conduct there needed to be some “enhancements”.

He added that publishing taxi fares and rates in a prominent position at all major resorts will be helpful for hoteliers. Through all parties working together, Mr Sands added that the

industry can reach a “level of professionalism” that will be beneficial for all parties.

He said: “I know that the overwhelming majority of taxi drivers comply. I believe that there needs to be some enhancements. I think most of the fares being published and posted in a prominent position will also help. There are issues that have to be addressed both by taxi drivers and employees ourselves.

“It’s a co-operative arrangement and we have to keep everyone compliant in the arrangements. I think all we are working for is to bring a level of professionalism so that everybody will benefit from this arrangement.”

During the meeting, taxi drivers raised their concerns, with one maintaining that the 10 percent fare increase “doesn’t sound like much because it isn’t much”. He said he pays up to $1,680 monthly to cover fuel and other expenses, and the fare increase is not enough to cover rising costs.

He said: “Giving us a 10 percent increase on something that was already

flawed from the break didn’t really serve any purpose as far as I’m concerned. You say on one token we are ambassadors, but the 10 percent doesn’t sound like much because it isn’t much. I pay up to $1,680 a month to work in this business.”

The driver also questioned who would manage the funds processed through the Rate your Ride app and maintained that, as self-employed individuals, taxi drivers should not be forced to wear the required long sleeve shirts and neckties during the designated winter months as it is a tropical climate

He said: “Who’s going to be in control of this money that is going to be coming into this app that is going to be distributed back to u?. Really? When we work every day, getting our money every day, on the line, we know where the hotspots are. We don’t need your algorithms

“We are supposed to be self-employed individuals, but yet you are dictating to me that in a tropical climate I must wear this type in that. Yeah, dictated to

me that in a tropical climate I must wear winter clothes for a certain amount of months and summer clothes a certain amount of months.

There are road traffic police officers who feel that it is their duty to tell me that, sir, you are improperly dressed when the guests are not complaining who paying for the ride.”

Speaking to Tribune Business, Mr Sands acknowledged that “trends change” and there is room to alter the dress code so drivers can be more comfortable.

He said: “People spoke a lot about dress code. Neck tie is passe. But we can, I think, go to long sleeve push jackets in the winter, short sleeve as an alternative. For those who wish to continue with neckties, I support that. Trends change.”

PAGE 2, Monday, May 6, 2024 THE TRIBUNE

JOBETH COLEBY DAVIS

‘PRIORITY’ TO STRIKE CRUISE PORT BALANCE FOR TAXIS

By FAY SIMMONS

A CABINET minister says it is a “priority” to find the correct “balance” between taxi drivers and the Nassau Cruise Port to ensure it is “fair and just” for all parties.

JoBeth Coleby Davis, minister of transport and energy, said “very established” taxi drivers have lodged complaints about the working arrangements at Prince George’s Wharf. She added: “The Prince George Dock had a Prince George committee that managed and policed itself for many, many, many years. And the Nassau Cruise Port project is very new, and it’s taken some time for us to make the right adjustments and the right collaboration to mesh how these systems begin to work together, understanding that there was a group that managed and worked and collaborated together when it was the Prince

George Dock, and now finding a way to blend the operations because now is the Nassau Cruise Port. “That is going to be a priority of mine now because it’s become such a grave issue for many of you. Many of you have raised it with me and I have had a number of meetings to find ways to bring the right balance out there. “I realise, because of the comments already by very established taxi drivers, that it is clear that we have yet to find the right balance and the right mesh for the system to work in a way that everyone feels that it’s fair and just.”

Taxi drivers raised concerns about conditions at the Nassau Cruise Port, including the lack of restroom facilities for taxi drivers stationed there, during a Town Hall meeting with the minister last week that was designed to address the industry’s new code of conduct.

One driver argued that the Nassau Cruise Port cost $300m to renovate but

its operators chose not to include facilities for taxi drivers. He said: “$300m for the port and, in the parking lot, we got nowhere to pee.”

Another taxi driver raised concerns that Road Traffic Department officers are not allowed past a certain point at the cruise port to monitor drivers. He said the responsibility to discipline drivers at the Nassau Cruise Port should not lie with union representatives and called for greater oversight by officials.

He said: “That dock is a mess out there….the power that belongs to the Road Traffic Department seems to fall in the hands of those that runs the dock.

The committee put it that way. This committee is literally taking the power off the Road Traffic and actually giving drivers five days off of work. Whoever it is doesn’t have that authority; that is for Road Traffic.

“Out there on that dock, Road Traffic has no say. They are not allowed to go beyond a certain point

Chamber targets education over Business Licence woe

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Chamber of Commerce’s vice-chairman says it wants to work with the Government to better educate the private sector and avoid the delays that plagued this year’s Business Licence filings Don Williams added that the Bahamas Chamber of Commerce and Employers Confederation (BCCEC) has been communicating with the Department of Inland Revenue (DIR) and Ministry of Finance in a bid to develop a plan that will educate its members on how to use the former’s online tax portal.

Speaking at the Rotary Club of West Nassau, he

said the private sector did not receive sufficient “education” on the Department of Inland Revenue’s new tax reporting portal prior to submitting their Business Licence renewal filings this year.

This has resulted in some companies receiving their Business Licence renewals late and/or delays to the process. The Chamber is now working with the relevant agencies to put an education plan in place so companies are better prepared for what they might encounter.

Mr Williams said: “We’ve been digitally communicating with the Ministry of Finance, as well as the Department of Inland Revenue. As you know, one of the things they did was roll out a new system. I do not

believe, both personally and professionally, that we had enough education behind it. So, as a result, it has led to Business Licenses being released months after.

“They made certain concessions. I believe this year it was to April 2 that you were allowed to carry your prior licence. Also, a lot of other things came into play. So, for example, depending on your level of turnover, you are now required to have an audit or a review performance.

“The Chamber of Commerce has been diligently communicating with those organisations, and we’re trying to outline a plan with them so that next year, with the proper training and education behind it, that is

SEE PAGE B5

at the dock. [They] keep saying this is a private entity and, because it’s a private entity, nothing can be done with it and they can do as they choose.

“The Government has 49 percent in that, and the Road Traffic Authority should have some say when they should be able to go in the back there and monitor what’s going on. We don’t need another taxi driver disciplining taxi drivers. That solely belongs to the Road Traffic Authority.”

The 49 percent Bahamian ownership in Nassau Cruise Port is held by private investors, not the Government, via the Bahamas Investment Fund. Mrs Coleby-Davis, in reply, maintained that she will look into their issues and ensure all taxi drivers have a “fair” opportunity to work. She added: “I don’t want anyone to leave from here tonight to think that it is just another conversation that has happened and it’s

now behind me. It’s going to be one of the top priorities of how we get a system that works, that eliminates the level of concern that has been raised tonight.

“Because I really want to make sure that everyone feels like they have a fair opportunity to be able to work. You are selfemployed, and so only if you work you’re able to provide for your family. So it’s important for us to find a balance and to make you feel comfortable.”

THE TRIBUNE Monday, May 6, 2024, PAGE 3

Tribune Business Reporter jsimmons@tribunemedia.net

FTX chief’s Albany handover to preserve $200m recovery

11 bankruptcy estate some $5.593m in restitution. The easiest way to realise this sum is to sell the Albany condo, but this created “the risk” that the former FTX Digital Markets chief might agree to a so-called ‘fire sale’ to quickly raise the cash.

This, in turn, would threaten to undermine the purchase prices obtained when the Bahamian liquidators, and the real estate agents acting for them, place FTX’s 35-strong local property portfolio on the market in the upcoming weeks. To avoid such a scenario, which would threaten recoveries for FTX clients and investors, all sides have hammered out a deal that will see Mr Salame relinquish the condo’s ownership.

Legal filings by John Ray, who heads the 134 FTX entities currently in Chapter 11 bankruptcy protection in Delaware, confirmed that the ex-FTX Digital Markets struck a plea agreement with US prosecutors on September 7, 2023, over charges he conspired “to make unlawful political contributions and defraud the US Federal Election Commission” and also conspired to operate an unlicensed money transmission firm.

This requires Mr Salame to pay $5.593m in restitution to the Chapter 11 estate headed by Mr Ray.

“Following constructive,

arm’s length negotiations, Salame and the debtors have agreed that in lieu of Salame paying the restitution amount to the debtors in cash, Salame will satisfy the restitution amount by transferring a residence he owns in The Bahamas, Unit No. 3A in the Marina Residences at Albany Building 10 Condominium, to FTX Digital Markets, acting by the joint official liquidators, as nominee for the debtors,” the Delaware court filings affirm.

The documents added that the condo’s $5.9m appraised value exceeds the restitution sum. The Bahamian liquidation trio are Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PwC) accounting duo, Kevin Cambridge and Peter Greaves.

“Satisfaction of the restitution amount by Salame transferring legal title to the residence to FTX Digital Markets, acting by the joint official liquidators as nominee for the debtors, is in the best interests of the debtors and their estates because it avoids the risk that Salame would have to sell the residence quickly at a below market price in order to raise the cash necessary to satisfy the restitution amount,” Mr Ray said. This, he added, “would prejudice the debtors both by failing to maximise the value of the residence and creating an unfavourable

market comparable for the more than $200m in other Bahamian residences that the debtors and the joint official liquidators intend to sell.

“The stipulation will enable the [Bahamian] joint official liquidators and the debtors to determine, in their judgment, the timing and sequencing for marketing the Bahamian properties to maximise their value for the estates.”

Tribune Business understands that FTX’s liquidators are set to imminently decide which Bahamian realtors will be selected to list, promote and sell the 35 local properties acquired by the collapsed crypto exchange for a combined $222m.

That decision could come as early as this week, and it is thought the liquidators are more focused on maximising the purchase price for each rather than a quick sale. Because recent estimates suggest FTX creditors will recover most of, if not all, their investment, and the Bahamian liquidators’ efforts are now fully financed via Mr Ray’s loan, there is no pressure to sell quickly at a fire sale price.

Meanwhile, Mr Ray’s legal filings revealed that Mr Salame signed an agreement to purchase the Albany condo, together with all its furniture, chattels and effects, for $7.235m on September 21, 2021, just weeks after FTX was

approved to operate in The Bahamas.

Some $723,500 to cover the deal’s 10 percent deposit was wired from Alameda Research, the private trading arm of jailed FTX founder, Sam Bankman-Fried, to someone described as “Salame’s real estate attorney” on day earlier.

Then, on November 2, 2021, some $8.164m was wired from FTX Digital Markets’ account with Fidelity Bank (Bahamas) to the same attorney to pay the balance of the purchase price “along with VAT, commissions, fees and additional expenses in connection with closing”.

“The residence was conveyed to Salame by an indenture and deed of conveyance which is recorded in the Registry of Records in the Commonwealth of The Bahamas,” the Delaware Bankruptcy Court filings added. “On March 25, 2022, Salame and Alameda entered into a promissory note, dated as of December 31, 2021, whereby Salame agreed to pay $8.164m to Alameda.” Fast forward to the present, and the Albany condo

was valued at $5.9m by Bahamian appraiser, Robin Brownrigg, in a report dated January 22, 2024.

This sum more than covers the restitution amount, and the $306,822 difference will be applied to what Mr Salame owes on the promissory note.

“The terms require Salame to undertake all steps to cause legal title to the residence to be transferred to FTX Digital Markets, acting by the joint official liquidators, as nominee for the debtors, and Salame, FTX Digital Markets and the debtors

to execute promptly any documents which may be reasonably required to convey clear title of the residence,” the legal filings add. Most of FTX’s residential holdings are located in Albany, plus the GoldWynn development at Goodman’s Bay and One Cable Beach. The commercial properties include the site earmarked for FTX’s Bahamian headquarters at Bayside Executive Park on West Bay Street, plus Pineapple House and multiple units at the Veridian Corporate Centre.

NOTICE

Take Notice that a Petition has been filed in the Supreme Court of The Commonwealth of The Bahamas Action No. 2023/FAM/div/00143 concerning Stephen Rolle, as the Petitioner, and Venlicia Roshanna Rolle (nee Ramsey), as the Respondent. Should the Respondent Venlicia Roshanna Rolle (nee Ramsey) wish to be heard or participate in these proceedings, she must contact Miranda Adderley & Co., Counsel & Attorney-at-Law, Nassau, The Bahamas, (242)- 808-4862 within 14 days of this Notice. Failing which, this court action will proceed in her absence.

PAGE 4, Monday, May 6, 2024 THE TRIBUNE

FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

Mixed results

By CHRIS ILLING

THE earnings season in the US continued last week and, once again, had its winners and losers. On Friday last week, labour market data in the US came in worse than expected. The US economy created significantly fewer jobs than expected in April, and the unemployment rate rose slightly. In addition, wage growth surprisingly slowed somewhat. And the ISM Index was also disappointing, as the numbers showed on Friday.

The Institute for Supply Management said Friday that its service sector PMI (purchasing managers index) dropped sharply to 49.4 percent in April compared to 51.4 percent in the prior month. The services sector has been the bedrock

for the US economy in the face of higher interest rates. The surprising decline could be the tip of the iceberg when it comes to an economic slowdown. It might build the case for a Federal Reserve rate cut on bad news grounds. The markets like the sense of hope, and rallied on the last trading day of the week. The big winner was Apple. Despite declining sales and iPhone weakness, the quarter was less bad for Apple than many had feared. But the declines were less severe than expected overall, and

Apple chief executive, Tim Cook, maintained an optimistic outlook. And, as a bonus, he also announced the largest share buyback programme in the company’s history. Apple wants to spend $110bn on buying back shares, plus pay a dividend that is 4 percent higher. Apple shares, which have fallen significantly since the start of the year, rose almost 7 percent to a price close to $185 per share.

On the other side of the spectrum was Expedia, one of the world’s leading full-service online travel

Chamber targets education over Business Licence woe

FROM PAGE B1

something which will be a thing of the past.”

Mr Williams said the Chamber sends out surveys to the business community to receive feedback on its concerns. This enables it to advocate to the relevant authorities on its behalf for a solution.

He added: “We send out constant surveys to the business community. So we take those surveys, and it’s not just our members; a lot of non-members take them

as well, in terms of us being able to get their feedback.

“A lot of the things that we advocate for are actually concerns that the business community has brought to us, or were aware of, either through some trade show or a programme that we’ve put in plac.”

Mr Williams said the Chamber has been involved with multiple trade missions that were “successful”.

During these missions, the Chamber connects members with relevant industry partners in that country.

He added: “We find out what our members are looking for, and we find out what are the industry touch points that countries have that we can benefit from. We tend to link our members directly to those sources.

“So, it’s not just a trade mission where we’re going and visiting governments, and we sit down and have a few meaningful communications. We want to introduce you to your new business partner on that mission, so they’ve been extremely successful.”

bands. After the company lowered its full-year forecast but beat the quarterly estimate, the shares tumbled almost 15 percent to around $116 per share. These two examples show the investor how good news can have a negative effect on value and vice versa.

It was a similar story for Bitcoin last week. On Monday, a court in Seattle send Binance founder Zhao to jail for four months after finding him guilty of money laundering.

Binance, the world’s largest crypto exchange, facilitated around 1.5m crypto transactions with an estimated value of $900m that were obviously illegal and served to finance Hamas and Al Qaeda, among others. After this bad news, the share price for Bitcoin fell by almost 10 percent. But the price recovered by the end of the week, and Bitcoin again climbed over the $61,000 mark.

THE TRIBUNE Monday, May 6, 2024, PAGE 5

CCO @ ActivTrades Corp

BERKSHIRE HATHAWAY EVENT GIVES GOOD VIEW OF WARREN BUFFETT’S SUCCESSOR BUT ALSO RAISES NEW QUESTIONS

By JOSH FUNK AP Business Writer

By JOSH FUNK AP Business Writer

THIS year's Berkshire Hathaway meeting gave shareholders their best chance yet to hear from the man who will one day take over as CEO when Warren Buffett is gone, but Buffett said for the first time Saturday that Greg Abel should also take responsibility for the company's investments after he takes over, raising new questions about the succession plan.

Abel put his encyclopedic knowledge of the utility business that he led directly for years on display and delved into railroad operations and potential acquisitions that Berkshire pursued while sharing the stage with Buffett all day. For his part, the 93-year-old billionaire showed investors he is still sharp.

Abel pointed out that it required a major culture shift to get workers at PacifiCorp and the other utilities, who have long focused all their energy on keeping the lights on, to think about shutting the power down at times when the risk that their power lines could spark wildfires is too great. He also said BNSF railroad is working on getting "our cost structure right" after delivering disappointing results.

Succession was clearly top of mind for many of the thousands of people who filled an Omaha arena to listen to the two men after last fall's death of Vice Chairman Charlie Munger. Buffett, Abel and Ajit Jain, Berkshire's other top executive who oversees the company's insurers, reassured investors that Berkshire's board spends plenty of time focused on "what would happen to the operation if I get hit by a truck," as Jain put it. Finding the right replacement for any of the three of them will be important. Previously, Buffett had said that when Abel becomes CEO, investment managers Ted Weschler and Todd Combs, who's also taken on the responsibility of being Geico's CEO, would handle Berkshire's massive portfolio. But Buffett said Saturday that his thinking has evolved, and that "I would probably, knowing Greg, I would leave the capital allocation to Greg."

And Buffett said because Abel understands businesses so well, he also understands stocks. But Edward Jones analyst James Shanahan said a good business doesn't always make a good stock unless you get the timing and position size right, and there is an art to that.

"I think stock picking is hard. I don't think it's something you can just start doing and be good at it," Shanahan said.

Abel does have a history of making multibillion-dollar deals when he was the head of Berkshire's utility unit for a decade, including the acquisitions of NV

Energy and AltaLink, but he's never been a stock picker. Weschler and Combs might be able to help Abel get the timing right and find opportunities in the stock market, but Buffett didn't say that Saturday. Abel just reassured shareholders that "the capital allocation principles that we use today will be maintained."

"Does that give you more or less confidence postBuffett? I would say it's got to give you less — not because it's a worse circumstance — but because it hasn't been very transparent and communicated that clearly. You've got to start asking, well, what else is going to change?" said Cole Smead with Smead Capital Management.

Abel definitely has the confidence of the CEOs at all of Berkshire's many varied noninsurance businesses who report to him and ask his advice on any challenges they are facing.

"Greg sees so much more than I do on a daily basis. So his perspective is valued, and his wisdom is something that is such a luxury for all of us to be able to tap into," said Dan Sheridan, who just became CEO of Brooks Running this year after his predecessor retired. He said Abel is always humble and curious about the business, even while asking challenging questions.

See's Candies CEO Pat Egan added that Abel reflects all of Berkshire's core values, with the company's emphasis on integrity, taking care of customers and strengthening brands, while still giving Berkshire's subsidiaries the freedom to operate independently.

PAGE 6, Monday, May 6, 2024 THE TRIBUNE

PM told: Wear ‘game hat’ for GB business meeting

and investor confidence. Updates on progress with Grand Bahama International Airport and the Grand Lucayan sale will also be sought.

The businessman added that the Grand Bahama Chamber of Commerce-organised dinner meeting with Mr Davis, which is expected to be widely attended, represents a potential “game changer” in relations between the Government and private sector as this is the first time during nearly three years’ in office that the Prime Minister will be directly addressing the island’s business community.

However, in a sign that the event is still being tightly controlled and managed, Mr Cooper and others revealed that all questions that attendees plan to ask Mr Davis had to be submitted in advance by 3pm on Friday so they could be “vetted”.

The Government’s dispute with the GBPA will almost certainly take centre stage, and the D’s Car Rental chief said he would also like to understand the instructions and remit given by the Government to PricewaterhouseCoopers (PwC), the accounting firm that calculated the total bill purportedly owed by the GBPA.

“For many of us, we are expecting to understand what the $357m bill is all about. How did the

Government arrive at that figure,” Mr Cooper told Tribune Business. “We don’t want the Prime Minister to come and give us the same rubbish as at the local PLP branch meeting. This is the business community, and we want to see the full lay-out and details of where we are. We are hoping to get it.

“We are also hoping to get a commitment from the Prime Minister to more dialogue and communication with the business community; not from the Ministry of Grand Bahama but the Prime Minister. We also want to hear as to the way forward and what plans the Government has for the island.

“It’s a three-fold expectation from the business community, and we hope the Prime Minister comes with his game hat on and be open and transparent with the business community. We are the ones who have been carrying this island for years, we continue to weather difficult storms and have been here for a long time; some as long as 20 to 30 years in business,” Mr Cooper added.

“We need the nation’s leader to come with his sleeves rolled up and be prepared to work with us.... We don’t need to wait this length of time, three years, and are just getting an audience with the Prime Minister. We need better.”

Calling for improved dialogue between the

Government and Grand Bahama Chamber, Mr Cooper said it was “very important he lays out” the Government’s objectives and road map for Grand Bahama. “This is a game changer,” he added. “For the first time in a very long time the Prime Minister will be able to meet with the wider business community of Grand Bahama.

“I’m disappointed we don’t have an open microphone. We have been asked to submit questions to the Prime Minister. The deadline was May 3. This is big for the business community. I think it’s going to be a big turnout because so many persons have been waiting on this for so long and there have been many, many unanswered questions for years before even this administration.”

Mr Cooper said he also wanted the Prime Minister to “make known that there are no plans from the Government standpoint to tamper with the Hawksbill Creek Agreement”, and the tax breaks, rights, benefits and other obligations it confers on GBPA licensees, given that it has 30 years left to run.

This was echoed by Terence Gape, attorney and partner with the Dupuch & Turnquest law firm, who told Tribune Business: “Freeport would like to hear the Prime Minister reiterate he’s not going to interfere with the Hawksbill Creek Agreement and

also if he could articulate what his goal is.

“I’m hoping he will say his goal is to make the ‘Pink Building’ a Bahamian institution, the GBPA headquarters, but he’s never actually said that. I would have you note, though, that he’s proven his belief that Freeport can be a capital for The Bahamas for investment. It’s a place that can certainly handle serious investment, not like most of the islands, and The Bahamas and the Government need the income.

“That’s really what I’m hoping he will say: That he will state what his goal is. A lot of us do agree that the Port Authority, as constituted, is almost an anachronism because at this rate we’ll be governed by the grandchildren of the Haywards and St Georges in another 20 years.

“Most of us believe Freeport should be governed by a corporation approved by the Government, if not a government corporation. The people of Grand Bahama could vote who is going to be the governing group. Right now we have no control over who is in charge. It’s a roll of the dice.”

Mr Gape said the GBPA’s two ownership families, the Haywards and St Georges,

have failed to show “the business acumen” necessary to develop Freeport, its assets and “make a success of it”. He added: “The rest of The Bahamas is generally forging ahead and Freeport is lagging terribly. There is a need for the Government to step in...

“I think the investors here, particularly the foreign investors, would like to have the assurance that the Hawksbill Creek Agreement, because obviously it has some provisions, that it will continue. They will feel more comfortable because the benefits they enjoy will continue.”

Mr Gape, though, backed the Utilities Regulation and Competition Authority

(URCA) taking over regulatory responsibility for utilities in the Port area.

“The Port Authority itself has shown by selling the airport to the Government of the day for $1 that it had no plans and capital to reinvest, and no plans to restore Freeport,” he added.

“They could have redeveloped the airport and they gave that up. They had a duty to build that back but the Government of the day gave them a pass. Hutchison had an equal duty to redevelop that airport and they were allowed to walk away. Why let Hutchison walk away? It was a major, major mistake.”

THE TRIBUNE Monday, May 6, 2024, PAGE 7

FROM PAGE B1

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

LAWSUIT AGAINST META ASKS IF FACEBOOK USERS HAVE RIGHT TO CONTROL THEIR FEEDS USING EXTERNAL TOOLS

By BARBARA ORTUTAY AP Technology Writer

DO social media users have the right to control what they see — or don't see — on their feeds?

A lawsuit filed against Facebook parent Meta Platforms Inc. is arguing that a federal law often used to shield internet companies from liability also allows people to use external tools to take control of their feed — even if that means shutting it off entirely.

The Knight First Amendment Institute at Columbia University filed a lawsuit Wednesday against Meta Platforms on behalf of an Amherst professor who wants to release a tool that

enables users to unfollow all the content fed to them by Facebook's algorithm. The tool, called Unfollow Everything 2.0, is a browser extension that would let Facebook users unfollow friends, groups and pages and empty their newsfeed — the stream of posts, photos and videos that can keep them scrolling endlessly. The idea is that without this constant, addicting stream of content, people might use it less. If the past is any indication, Meta will not be keen on the idea.

A U.K. developer, Louis Barclay, released a similar tool, called Unfollow Everything, but he took it down in 2021, fearing a lawsuit

NOTICE

NOTICE is hereby given that MARCIA PAULINE FORBES-SMITH of Faith Avenue, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 29th day of April, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

after receiving a cease-anddesist letter and a lifetime Facebook ban from Meta, then called Facebook Inc.

With Wednesday's lawsuit, Ethan Zuckerman, a professor at the University of Massachusetts at Amherst, is trying to beat Meta to the legal punch to avoid getting sued by the social media giant over the browser extension.

"The reason it's worth challenging Facebook on this is that right now we have very little control as users over how we use these networks," Zuckerman said in an interview. "We basically get whatever controls Facebook wants. And that's actually pretty different from how the internet has

worked historically." Just think of email, which lets people use different email clients, or different web browsers, or anti-tracking software for people who don't want to be tracked. Meta declined to comment.

The lawsuit filed in federal court in California centers on a provision of Section 230 of the 1996 Communications Decency Act, which is often used to protect internet companies from liability for things posted on their sites. A separate clause, though, provides immunity to software developers who create tools that "filter, screen, allow, or disallow content that the provider

NOTICE

NOTICE is hereby given that

ANNETTE CLARKE JOSEPH of Allen Drive off Carmichael Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 29th day of April, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

or user considers to be obscene, lewd, lascivious, filthy, excessively violent, harassing, or otherwise objectionable."

The lawsuit, in other words, asks the court to determine whether Facebook users' news feed falls into the category of objectionable material that they should be able to filter out in order to enjoy the platform.

"Maybe CDA 230 provides us with this right to build tools to make your experience of Facebook or other social networks better and to give you more control over them," said Zuckerman, who teaches public policy,

communication and infor-

mation at Amherst. "And you know what? If we're able to establish that, that could really open up a new sphere of research and a new sphere of development. You might see people starting to build tools to make social networks work better for us."

While Facebook does allow users to manually unfollow everything, the process can be cumbersome with hundreds or even thousands of friends, groups and businesses that people often follow.

Zuckerman also wants to study how turning off the news feed affects people's experience on Facebook.

PAGE 8, Monday, May 6, 2024 THE TRIBUNE

RF: ‘NO IMPACT’ FROM CORE SOFTWARE DISPUTE

it was not among the shortlisted candidates.

And RF Bank & Trust, in response to Tribune Business questions, said it had made “substantial progress” in resolving what it described as “service delays and challenges” resulting from a $200m expansion in assets under management over a 15-month period and addition of more than 400 new clients accounts.

This came in response to this newspaper’s queries over documents suggesting there was a “processing backlog” in the back office and operations departments, which led to the formation of a “remediation team” to undertake an accounts reconciliation exercise to address the concerns.

Several RF Bank & Trust management executives have also departed in recent months, including Noorulain Khan, its interim chief financial officer; Cleora Farquharson, vice-president of pension services, and Jackie Cleare, assistant vice-president of operations.

There is nothing to suggest these departures were linked to the alleged “backlog”, and RF Bank & Trust yesterday confirmed that it has already moved to fill these vacancies by appointing Tanya Carey as chief financial officer subject to regulatory approval. It added that “the inevitable transition of personnel” was typical in companies enjoying strong growth, and it continues “to add top talent”.

Bruce Raine, IPBS’ Bahamian founder and president, declined to comment when contacted by Tribune Business other than confirming the dispute’s existence and voicing shock

that documents relating to it had been leaked to the media and wider public.

Tribune Business understands that the respective attorneys for RF Bank & Trust and IPBS, which are Graham, Thompson & Company and Higgs & Johnson, are set to meet in an attempt to see if the two parties can resolve their dispute amicably and without resorting to litigation. However, documents seen by this newspaper set out the positions taken by both parties.

“Since late November 2023, RF has received a number of e-mails and letters alleging that RF does not have sufficient licences for the number of users on the system and that, as a result, sufficient maintenance fees have not been paid,” an internal RF Bank & Trust report to its executive committee states.

“RF believes that the number of licences purchased more than covers the number of users, and that maintenance fees paid are therefore adequate. RF has engaged legal counsel to review all licence and maintenance agreements and prepare a legal response to IPBS.”

Similarly, another document, referring to IPBS’ affiliate, Data Systems International, added: “Some executive committee members may be aware that there is currently an ongoing dispute over the terms of the IPBS licence, which has led to DSI issuing a termination notice of March 31, 2024. In one of their letters, DSI copied in all of the group’s regulators.

“While we remain hopeful of a sensible and amicable resolution, we have taken the decision not to raise any further service tickets with DSI until this

issue is resolved. Further, we are keeping in contact with all of our regulators to keep them apprised of developments.”

However, a January 2024 note to RF Bank & Trust’s IT executive committee indicated the dispute with IPBS had complicated the transition, and data migration, to the bank’s new Olympic core software platform. It added: “Disagreements over IPBS licensing have introduced complexities to the migration workstream.

“In summary, IPBS have disengaged from the Olympic project subject to a satisfactory conclusion. Legacy issues with the system mean that RF needs IPBS to access the system every month to run certain routines and they continue to run these.”

RF Bank & Trust, responding to Tribune Business questions, declined to mention IPBS by name but said: “We are in the process of working to resolve a disagreement with one of RF’s service providers and, out of respect for that relationship, are not going to comment further at this time. However, let us underscore that this dispute does not in any way impact customer funds or RF’s overall operations.”

Talking up the Olympic system that will launch later in 2024, it added: “This new system will enhance the client experience, ensuring state-of-the-art security while also giving our clients an effective and efficient tool to easily access their critical financial information.

“The new system will introduce a number of innovative tools, including automated fee calculations to ensure accurate invoicing, a new banking website,

‘FANTASTIC OPPORTUNITY’ GIVEN BAHAMAS IN UK TAX CHANGE

FROM PAGE B1

of pounds in tax as a result of the UK government and opposition Labour party’s plans to scrap a tax break that enabled them avoid paying tax on their overseas income for 225 years.

The change is due to take effect from April 6, 2025, and Mr Christie said The Bahamas is “high up on the list” of alternative destinations for those seeking a rapid exit from the UK. He added that attracting just “10 percent, 15 percent, 20 percent of that wealth will make a huge difference for The Bahamas” and its economy due to the spending impact such high net worth investors will have.

“I was having this conversation last night,” Mr Christie told this newspaper. “Since the shift in the non-domicile status, there’s been a definite increase in interest, and what we’re seeing is this interest is the ultra, ultra wealthy. This is 1 percent of the world who are looking for different avenues, different structures and different places.

“The Bahamas is high up on that list. Me personally, I’ve had meetings with two or three very big families who have non-domicile status in the UK. When I say big, these are large, large generational wealth families. What we’re seeing is The Bahamas is one destination. What we find is they’re looking at The Bahamas, Switzerland and even Malta.”

Mr Christie, though, warned that “it’s imperative The Bahamas gets it right” if it is to successfully compete against the likes of those nations for fresh investment by ultra high net worth individuals. “We have a fantastic opportunity

to attract more some of the wealthiest people in the world,” he added. “It will be great for the jurisdiction and uplift the jurisdiction.”

To properly capitalise on the UK tax law changes, Mr Christie said enhancing The Bahamas’ ease of doing business is critical.

“The biggest thing, and one of the big challenges we have, is the speed of doing business,” he told Tribune Business.

“If we are able to ensure you can do business, and complete transactions in a decent time period, that’s 50 percent of the battle. Ease of doing business is top of the list. These are global travellers who can live anywhere in the world and do business anywhere in the world, so we need to ensure The Bahamas is on the cutting edge with permitting, technology and the ease of doing business.

“It’s a really huge opportunity, and we don’t get these opportunities often. In my opinion, you’re going to see a mass exodus of ultra wealthy out of the UK. They’re looking for a new home. If we’re able to get 10 percent, 15 percent, 20 percent of that wealth it will make a huge difference for The Bahamas. It helps people, it will help benefit the economy from A-Z. It’s a domino effect.”

Ryan Knowles, founder and chief executive of Maison Bahamas Real Estate, told Tribune Business that he and his firm are “seeing the beginning” of UK non-domiciles seeking out and inquiring about relocating to jurisdictions with friendlier tax environments.

“It’s definitely beginning,” he said. “We’re getting more inquiries,

and multi-jurisdictional compatibility that will reduce maintenance while supporting future expansion.” Besides The Bahamas, RF Bank & Trust also has operations in the Cayman Islands and Barbados.

“The strong foundation we have built over the years, as evidenced by our consistently solid investment returns and other beneficial services, will be enhanced even further through the new system, which is fully integrated and configurable to power seamless customer-oriented results and optimal business performance,” the bank added.

However, a January 30, 2024, letter sent by Mr Raine to Michael Anderson, RF Bank & Trust’s president and chief executive, suggested this was not the first occasion that IPBS had voiced concern that users of its software exceeded the number the institution was licensed for.

The latest letter includes a copy of one written almost exactly 20 years earlier, on January 27, 2004, when Mr Raine informed Mr Anderson of a “discrepancy” between the 15 client licences and 25 “installed clients” when RF was still then part of the larger Fidelity Group.

The subject also arose in 2010, when the investment bank was called RoyalFidelity Merchant Bank & Trust due to Royal Bank of Canada’s 50 percent ownership interest at the time.

“The practice that has gone on heretofore with respect to unauthorised users being added to your systems by your personnel, as required, is at best unsatisfactory,” Mr Raine wrote then.

“You will have been enjoying the benefit of

additional user capacity from whenever the user was added up to the point of discovery and then you expect us to turn a blind eye and pretend it never happened.... We are invariably supporting more users than we are being compensated for. This, too, is unacceptable.”

Fast forward almost 14 years, and Mr Raine, in his latest letter, disputed RF Bank & Trust’s position that “a licensed user in The Bahamas could also be, without additional cost, a licensed user in Barbados and Cayman”. IPBS is asserting that the bank’s software is licensed for 56 users but, across the three jurisdictions in which it operates, there are actually 156 users - almost three times’ the amount.

Meanwhile, RF Bank & Trust indicated that its recent growth may have temporarily outpaced its back office’s ability to keep pace. It pledged, in response to Tribune Business inquiries that it is continuing to “Improve our processes” after Jillian Nunes, head of its Barbados operations; Brett Hill, its Cayman chief; and Richard Johnson, chief risk officer, last year formed a team to oversee account reconciliations.

“I am pleased to advise that the team of Jillian Nunes, Richard Johnson and Brett Hill have made good progress in stabilising the finance and operations teams while significantly improving the situation with both bank reconciliations and backlog on operations processing,” an excerpt from a January 26, 2024, report states. RF Bank & Trust, in response, said: “We continue to improve our processes, but as is the case with any company

experiencing high growth, there is still work to be done. While both the growth and learning curve for new employees led to some service delays and challenges, these situations were temporary in nature and we have made substantial progress in resolving them.

“We are committed to a high standard regarding client excellence, and our team remains confident that the work underway in the areas of process improvement, department restructuring and consistency across different markets will bring us closer to the standard of excellence we strive for every day.”

As for the growth itself, it added: “RF has been a particularly active part of the dynamic financial services sector, and this has included new partnerships and acquisitions that have led us to expand into new markets.

“The result is that we now oversee a portfolio of more than $1.3bn and, over the last 15 months, have added $200m in assets under management while opening more than 400 new client accounts, which only accelerates our overall growth.

“To support this growth, our staff has grown from approximately 55 employees two years ago to now more than 80. While a natural part of this vibrant economic environment is the inevitable transition of personnel, we continue to add top talent to our team, as evidenced by multiple key hires since last year that include our chief risk officer and chief financial officer.”

and putting feelers out on our end to folks who might be looking to transition because of being non-domicile. We’re seeing the beginning of that, and as more people get their heads around all the implications that’s going to continue for the rest of 2024. Usually there’s a big rush towards the end of deadlines.

“We’re getting the questions. We’ve gad a few attorneys reach out to us on behalf of clients. That’s usually the first step. They are trying to figure out what the environment is, the potential for getting set up for residency, and ensuring they get an understanding of that before they start to look for property. We’re seeing the beginning of it, and during the summer expect it to heat up as people go on holiday.”

Mr Knowles argued that The Bahamas “stands out” as an alternative jurisdiction for those presently with UK non-domicile tax status “for a number of reasons”, including its proximity to the US in the east coast time zone; multiple commercial aviation links; stable and well-established political and judicial system modelled after the UK’s; and the rule of law coupled with being a parliamentary democracy.

“These are the types of individual we want coming here, and hopefully they will set-up shop, purchase real estate, set up a business, employ people, contribute to the local economy,” he added. “The more high net worth individuals we can attract the better for everyone. It’s not just good for real estate but helps everyone around the industry, attorneys, landscapers, pool maintenance.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PAGE 10, Monday, May 6, 2024 THE TRIBUNE

FROM PAGE B1

Share your news

THE WEATHER REPORT

THE TRIBUNE Monday, May 6, 2024, PAGE 11

is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 68° F/20° C High: 90° F/32° C TAMPA Low: 74° F/23° C High: 88° F/31° C WEST PALM BEACH Low: 74° F/23° C High: 86° F/30° C FT. LAUDERDALE Low: 77° F/25° C High: 87° F/31° C KEY WEST Low: 77° F/25° C High: 86° F/30° C Low: 72° F/22° C High: 83° F/28° C ABACO Low: 73° F/23° C High: 80° F/27° C ELEUTHERA Low: 73° F/23° C High: 80° F/27° C RAGGED ISLAND Low: 77° F/25° C High: 82° F/28° C GREAT EXUMA Low: 75° F/24° C High: 81° F/27° C CAT ISLAND Low: 71° F/22° C High: 82° F/28° C SAN SALVADOR Low: 72° F/22° C High: 81° F/27° C CROOKED ISLAND / ACKLINS Low: 77° F/25° C High: 82° F/28° C LONG ISLAND Low: 75° F/24° C High: 81° F/27° C MAYAGUANA Low: 75° F/24° C High: 82° F/28° C GREAT INAGUA Low: 77° F/25° C High: 84° F/29° C ANDROS Low: 74° F/23° C High: 82° F/28° C Low: 69° F/21° C High: 83° F/28° C FREEPORT NASSAU Low: 74° F/23° C High: 86° F/30° C MIAMI

Shown

5-Day Forecast Mostly sunny, breezy and pleasant High: 83° AccuWeather RealFeel 90° F The exclusive AccuWeather RealFeel Temperature® is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Mainly clear Low: 72° AccuWeather RealFeel 73° F Mostly sunny and nice High: 83° AccuWeather RealFeel Low: 72° 91°-74° F Mostly sunny and nice High: 83° AccuWeather RealFeel Low: 71° 91°-70° F Beautiful with abundant sunshine High: 85° AccuWeather RealFeel Low: 73° 91°-73° F Sunshine, breezy and pleasant High: 86° AccuWeather RealFeel 94°-76° F Low: 73° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 84° F/29° C Low 74° F/23° C Normal high 83° F/28° C Normal low 70° F/21° C Last year’s high 86° F/30° C Last year’s low 65° F/18° C As of 2 p.m. yesterday 0.00” Year to date 6.94” Normal year to date 6.55” Statistics are for Nassau through 2 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New May 7 First May 15 Full May 23 Last May 30 Sunrise 6:30 a.m. Sunset 7:43 p.m. Moonrise 5:16 a.m. Moonset 6:25 p.m. Today Tuesday Wednesday Thursday High Ht.(ft.) Low Ht.(ft.) 6:50 a.m. 2.8 12:54 a.m. -0.3 7:23 p.m. 3.4 1:03 p.m. -0.7 7:42 a.m. 2.7 1:49 a.m. -0.5 8:13 p.m. 3.5 1:51 p.m. -0.8 8:32 a.m. 2.7 2:41 a.m. -0.6 9:02 p.m. 3.5 2:38 p.m. -0.8 9:21 a.m. 2.5 3:32 a.m. -0.5 9:51 p.m. 3.4 3:26 p.m. -0.7 Friday Saturday Sunday 10:11 a.m. 2.4 4:23 a.m. -0.4 10:40 p.m. 3.2 4:14 p.m. -0.5 11:02 a.m. 2.3 5:13 a.m. -0.2 11:31 p.m. 3.0 5:04 p.m. -0.2 11:55 a.m. 2.2 6:05 a.m. 0.0 5:56 p.m. 0.1 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: SE at 8-16 Knots 2-4 Feet 10 Miles 77° F Tuesday: ESE at 6-12 Knots 2-4 Feet 10 Miles 77° F ANDROS Today: E at 8-16 Knots 1-2 Feet 10 Miles 79° F Tuesday: E at 7-14 Knots 0-1 Feet 10 Miles 79° F CAT ISLAND Today: ENE at 10-20 Knots 3-5 Feet 10 Miles 77° F Tuesday: ENE at 8-16 Knots 3-5 Feet 10 Miles 77° F CROOKED ISLAND Today: ENE at 10-20 Knots 3-5 Feet 10 Miles 79° F Tuesday: ENE at 10-20 Knots 3-5 Feet 10 Miles 80° F ELEUTHERA Today: E at 8-16 Knots 3-5 Feet 10 Miles 76° F Tuesday: E at 7-14 Knots 3-5 Feet 10 Miles 76° F FREEPORT Today: ESE at 8-16 Knots 1-2 Feet 10 Miles 79° F Tuesday: ESE at 6-12 Knots 1-2 Feet 10 Miles 79° F GREAT EXUMA Today: NE at 10-20 Knots 1-2 Feet 10 Miles 77° F Tuesday: E at 8-16 Knots 1-2 Feet 10 Miles 77° F GREAT INAGUA Today: NE at 10-20 Knots 2-4 Feet 5 Miles 80° F Tuesday: E at 8-16 Knots 2-4 Feet 5 Miles 80° F LONG ISLAND Today: ENE at 12-25 Knots 3-5 Feet 10 Miles 79° F Tuesday: ENE at 8-16 Knots 2-4 Feet 10 Miles 79° F MAYAGUANA Today: ENE at 12-25 Knots 4-7 Feet 10 Miles 79° F Tuesday: ENE at 10-20 Knots 3-6 Feet 10 Miles 79° F NASSAU Today: E at 8-16 Knots 1-3 Feet 10 Miles 77° F Tuesday: E at 7-14 Knots 1-3 Feet 10 Miles 77° F RAGGED ISLAND Today: NE at 12-25 Knots 3-5 Feet 10 Miles 79° F Tuesday: E at 8-16 Knots 2-4 Feet 10 Miles 79° F SAN SALVADOR Today: NE at 10-20 Knots 1-3 Feet 10 Miles 77° F Tuesday: E at 8-16 Knots 1-3 Feet 10 Miles 77° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2024 H tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S E W 7-14 knots N S E W 8-16 knots N S E W 8-16 knots N S W E 10-20 knots N S W E 10-20 knots N S W E 10-20 knots N S W E 12-25 knots N S W E 8-16 knots

By JOSH FUNK AP Business Writer

By JOSH FUNK AP Business Writer