Insurer ‘pauses’ expansion on EU blacklisting fall-out

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN insurer yesterday said it has been forced to “pause’” further Caribbean expansion ambitions, adding: “We cannot stress enough the importance of getting off these blacklists.”

Anton Saunders, RoyalStar Assurance’s managing director, told Tribune Business

that the property and casualty underwriter has put the brakes on growth plans after already limited reinsurance capacity was exacerbated by The Bahamas’ latest European Union (EU) blacklisting for allegedly being non-cooperative in the fight against tax avoidance and evasion. With EU members such as Germany, where Munich Re and other key reinsurers that underwrite Bahamas risks are

based, taking an increasingly hard line on companies doing business with blacklisted nations, he explained that it was simply impossible for RoyalStar to expand and take on new business if such support is blocked. Asked whether RoyalStar plans to continue expansion both The Bahamas and abroad via acquisition, Mr Saunders told this newspaper: “Let me put it this way. Everything is on hold based on two things. Where we

GB water regime enacted before rate rise disclosure

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

GRAND Bahama businesses and residents yesterday said it was “amazing” that the island’s new water regulatory regime appeared to have been implemented almost two weeks before they were warned of imminent rate hikes.

Speaking to Tribune Business, after the Grand Bahama Port Authority (GBPA) confirmed it had approved the rate increases sought by its Grand Bahama Utility Company affiliate, they said this calls into question whether there was any real intent to have a true public consultation on the issue or properly account for consumer concerns.

GB Utility’s new regulatory regime, which is posted on the GBPA’s website, states at page two that “this operating

• New regulatory framework took effect April 2

• Two weeks before tariff hike announcement

• And month before yesterday’s GBPA approval

and regulatory framework agreement [is] made effective as of the 2nd day of April, 2023”. That appears to confirm that the regime took effect almost two weeks before the water supplier’s customers were first informed of the impending rate increases, and new tariff structure, and one month before the GBPA gave its approval for the hikes.

The agreement, which was signed by Ian Rolle, the GBPA’s president, and Philcher Grant-Adderley, for GB Utility in her capacity as the latter’s chief operating officer,

also refers to the water supplier’s Board of Directors passing a March 30, 2023, resolution in relation to the new regulatory framework on the page carrying their signatures.

It is not totally clear when the agreement was signed, but it appears to have been between March 30 and April 2, 2023. As previously reported by Tribune Business, the GBPA is effectively regulating itself in this whole saga because GB Utility is owned by its affiliate, Port Group Ltd. Both the GBPA and Port Group Ltd have common

expand we have to make sure we have reinsurance support. We are on the blacklist, and have reinsurers focused on us getting off the blacklist because that has implications for The Bahamas insurance industry.

“It’s going to impact all businesses in the country. However, we are talking about major reinsurers supporting the region, especially from German

• RoyalStar chief ‘can’t stress enough’ importance of escape

• Profits likely to fall in 2023 after taking ‘shocks’ for clients

• 2022 bottom line down 51% due to prior year’s ‘windfall’

BISX fund ‘back expanding’ with $9m warehouse move

• Property Fund buying 3.5 acre site near Gladstone Rd

• Investing $400k on shortterm rental ‘trial’ downtown

• Targeting 15% rate of return minimum on ventures

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

shareholders, namely the Hayward and St George families, thereby creating a major ‘conflict of interest’ that has drawn considerable scrutiny from a cross-section of Bahamian society.

AML loses receiver bid over attorney’s assets

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

AN ATTORNEY and grandson of Sir Milo Butler has successfully fought-off a BISX-listed retail group’s bid to appoint a receiver over his 25 percent interest in the family’s trust.

Craig F. Butler, principal of the law firm that bears the same name, persuaded Justice Neil Brathwaite to reject AML Foods efforts to have Ed Rahming, the accountant and founder of Intelisys Ltd, take control of a stake potentially valued at $1.65m.

The Supreme Court judge, in a verdict released yesterday, found that the receiver’s appointment would be “excessively

oppressive” given that Mr Butler is seeking to sell a property appraised at $$1.013m. Should that price be realised, the proceeds would exceed the $862,287 debt that the Solomon’s and Cost Right owner is seeking to collect from him.

The legal battle effectively pits cousin against cousin, as AML Foods’ chairman is Franklyn Butler. And among the other beneficiaries of the trust set up by Mr Butler’s father, Raleigh, who was one of Sir Milo’s sons, is Loretta Butler-Turner, the former FNM MP and Cabinet minister who is now a Water & Sewerage Corporation consultant. The interests of herself and her other siblings are not impacted by Mr Butler’s battle with AML Foods.

Justice Brathwaite’s verdict reveals that the dispute stems from a default judgment that AML Foods obtained against Mr Butler on June 29, 2021, for the $862,287 plus damages to be assessed with interest and costs.

The BISX-listed food retail and franchise group pushed for Mr Rahming’s appointment as receiver over claims that the attorney, who once sought the Progressive Liberal Party (PLP) nomination for Nassau Village, was “stalling” on settling the debt.

Mr Butler was examined on his assets, income and means in 2022, disclosing that he owns a property on Alice Street in Nassau through his company, CFB Corporate Services. He also revealed that he had “substantial interests” under a will trust that was settled by his father, which provides that he will “receive at least a 25 percent share of the residue of

SEE PAGE B6

Gaming regulator ‘not here to police morality’

By FAY SIMMONS jsimmons@ tribunemedia.net

Tribune Business Reporter

THE GAMING Board’s executive chairman yesterday hit out at discriminatory rules that bar Bahamians from gambling in hotel casinos, and said: “We’re not here to police morality in The Bahamas.”

Dr Daniel Johnson, speaking at a gaming conference held at Atlantis, said: “It’s a peculiar thing

in The Bahamas that you could gamble on Carmichael Road but you can’t come [Paradise Island] and play the $10 bet. It is a peculiar thing that certain people can go certain places and do it and other people can’t.

“Our thing is choice. And in the world of adult entertainment, it’s not for kids, it’s not for people who cannot afford it. We want to have a regime that gives people the choice as to what you wish to do. And

where you want to do it.

We’re not to police morality in The Bahamas. We ask people to be responsible. But we’re wanting to change our view of policing our own people. Our people don’t need policing. They need to prosper. And that’s the balancing act we have to go with.”

Referring to gaming destinations such as Las Vegas and Orlando, Mr Johnson called for entertainment

A BISX-listed real estate fund yesterday revealed it plans to invest up to $9m in developing its first New Providence warehouse and storage facility as it “gets back into expansion” again.

Michael Anderson, president of RF Merchant Bank & Trust, which acts as the Bahamas Property Fund’s administrator, told Tribune Business it typically looks for a minimum 15 percent rate of return on such ventures after identifying a site near the Gladstone Road and Carmichael Road to make its entrance into this market.

The 3.5 acre site, which is vacant, was in the process of being acquired by the Bahamas Property Fund in a $1.403m deal according to its just-published 2022 financial statements, which disclosed the transaction. The sales agreement was signed on February 15 this year, with a deposit equivalent to 10 percent of the purchase price already paid,

and the RF Merchant Bank & Trust chief said the fund is now working with an architect to design the site and obtain permits.

“At the moment we’re actually trying to decide how best to develop that property for the purposes of providing warehousing and a storage facility,” Mr Anderson told this newspaper. “We have approved the project at Board level to construct a warehouse and storage facility, and we’re working with an architect to come up with an overall development plan and how we want to do it before we

SEE PAGE B5

business@tribunemedia.net WEDNESDAY, MAY 3, 2023

SEE PAGE B6

SEE PAGE B4

SEE PAGE B4

IAN ROLLE

KWASI THOMPSON

MICHAEL ANDERSON

CRAIG F. BUTLER

DR DANNY JOHNSON

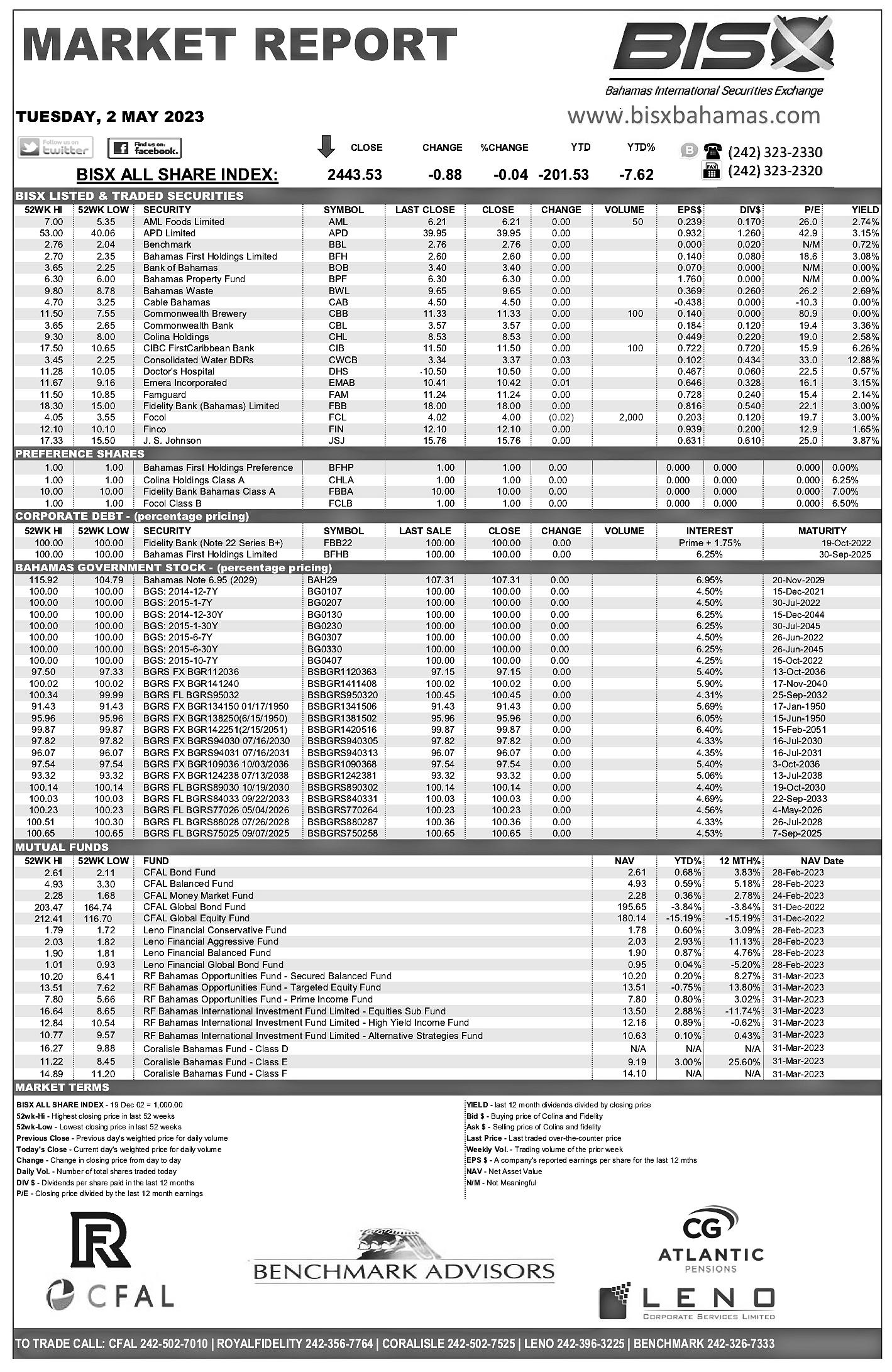

$5.74 $5.74 $5.78 $5.71

BTC TARGETS MID-2023 PARK WI-FI COMPLETION

THE BAHAMAS Telecommunications Company (BTC) yesterday said it expects to install Wi-Fi at most public parks by the 2023 second quarter’s end as part of the Government’s drive to narrow the digital divide.

The carrier, in a statement, said it has to-date installed Wi-FI (wireless Internet) services at 42 parks - ten of which were connected during the 2023 first quarter - since the official launch of the ParkConnect project last August.

Of the ten parks recently connected, nine are in New Providence and one on Crooked Island. The nine parks include Golden Gates Straight Park; McPherson Park; Pastel Gardens Park; Gambier Park; Silver Gates Park; Winton Meadows Park; Bishop Alvin Moss Park; and Mother Francis Park in Bain Town. Residents of Colonel Hill in Crooked Island can also

visit that settlement’s park and connect to BTC-powered Wi-Fi.

BTC added that parks in Exuma and South Andros are expected to be completed by the 2023 second quarter’s end, which coincides with the timeline when it expects to finish most of the Wi-Fi installations throughout The Bahamas.

ParkConnect is a social initiative introduced by the Government to bridge the digital divide by providing free Internet access at designated constituency parks and community centres throughout The Bahamas. The move is a partnership between the Prime Minister’s Office and the Ministry of Economic Affairs, which have teamed with BTC and other utility providers to execute it.

“We are happy to have partnered with the Government of The Bahamas as it seeks to implement a digital transformation strategy

with the aim of closing the digital divide,” said Andre Knowles, BTC’s director of business. “BTC has used top-notch equipment to ensure steady, reliable, secure and long-range highspeed Internet with real time reporting to connect each park.”

Mr Knowles said Wi-Fi in the Park has proven to

be a game changer because it removes the barrier of Internet access that many Bahamians face due to income inequalities and other variables. BTC said it has met with various government agencies on a weekly basis to maintain clear and consistent communication over the initiative’s roll-out. The carrier has also assigned a dedicated project manager to the effort.

Wayde Watson, the Ministry of Economic Affairs’ parliamentary secretary, said the service that BTC offers to ensure that parks throughout The Bahamas are connected to Wi-Fi has been nothing short of “exceptional”.

“Because of BTC’s reach when it comes to their telecommunications infrastructure, the company was able to facilitate the Government in making certain that we are able to bridge the digital divide - not only in New Providence, but also

in the Family Islands so that citizens can have access to information and data,” he added.

“I also look forward to our continued work with BTC as getting these parks connected is a part of the Government’s blueprint for change on its digital agenda. The feedback from residents has also been exceptional. The ability to gain access to information and data free of charge is a good thing.

“We haven’t had many complaints with respect to downtime, the inability to access or speed, so customers are very grateful. And if I could quote [talk show host] Darold Miller, Wi-Fi on the park is the best intervention of any government in the last 30 years.”

The Arthur’s Town Park, as well as the Regatta Site Park in New Bight, Cat Island, were the first to receive Wi-Fi when the initial ParkConnect project was launched last August.

The Arthur’s Town Park is adjacent to Arthur’s Town High School, and 11th grade students, Marcus Thacker and Deitrick Bethel, say they would access the Internet on the park at least three times a week to conduct research.

“Having the Internet on the park is beneficial because I can move away from the classroom after school to get my homework done,” Bethel said. Thacker added: “I would say that having Internet access on the park is a great initiative offered by BTC because I can use my phone to surf the Internet or to contact my mother to let her know my whereabouts in the evening, and I don’t have to worry about having data.” Since its launch, BTC was assigned to connect 60 parks to Wi-Fi. And with a total of 18 parks remaining for connection, the majority of these – some 80 percent – will be in the Family Islands.

Blockchain provider links with Eleuthera developer

A BLOCKCHAIN provider specialising in real estate and title recordkeeping yesterday said it has partnered with a 2,500acre community targeted at a location just north of Eleuthera’s Glass Window Bridge.

Ubitquity LLC said in a statement that it will be supplying Bertram Village, which is focused on residential, commercial and agricultural development, with access to three of its main web3 real estate products and services. This, it added, will help both the developer and empower local Bahamian real estate agents.

Bertram Village’s website says construction was supposed to have started two years ago in 2021, although little has been heard of

it. Its president and chief executive is Ian Fraser, a Bahamian who moved to Oregon in 1995 to work in the US state’s heating and cooling industry. He and his fiancee then started their own business, Fraser’s Professional Services, a commercial window washing and janitorial services company.

Ubiquity’s statement said Bertram Village’s plans include the construction of condominiums, hotels, light industry for commercial/manufacturing use, long-term scaled community development, multi-family units, professional centres for small businesses, public service and medical facilities, single-family homes, shopping centres and townhomes.

“We’re tremendously excited to have partnered with Bertram Village. Foreign real estate purchasers will be able to pay for homes through Bertram Village and, for the first time ever, have fully accurate, transparent, tracked and secure clean records of ownership thanks to the power of NFTs (non-fungible tokens, blockchain technology, IPFS... all that web3 has to offer the world,” said Nathan Wosnack, Ubiquity’s founder and chief executive.

“I truly believe that CryptoListing, NFTitle and UbitquityPay will be helpful tools they need to achieve many of their goals. We have a lot of crypto listings with companies, 10,000+ NFT records, and title/escrow companies in

place to ensure regulatory compliance for handling real estate transactions with crypto currencies via UbitquityPay. Bertram Village is in good hands.”

He added: “Ian Fraser, chief executive/president; Danielle Percy, vice-president; Harold Whaley, project co-ordinator; and Sharon Blacknall, vice-president of administration, are a solid team that has put in nearly seven years of tireless dedication to Bertram Village.

“Much like our experience with Ubitquity, we understand that pragmatism and hard work are necessary in order to achieve one’s dreams. I couldn’t be more excited to be working alongside these fantastic professionals and help them reach their important technical milestones.”

Bertram Village said it is working to ensure that The Bahamas’ National Investment Fund is a key part of its business model. Besides its strategic partnership with Ubitquity, it has also launched a local crypto currency token called The BeeVee as the official token of its township the community.

“The entire Bertram Village team is extremely excited to announce this partnership with Ubitquity. I’m confident that

together we have a team of professionals that can take Bertram Village to the next level,” said Mr Fraser.

“From the beginning, the vision was to build a community in North Eleuthera, using the most updated technology and resources available to empower Bahamians.

“I hate to see my people struggle. There aren’t enough high-quality jobs so our best and brightest leave. I was one of them; I left and lived in Oregon for 25 years. But now that the kids are grown, we are able to take everything we learned and bring it back to build Bertram Village and create something that can truly make a difference.

“Now that we’re finally ready to launch Bertram Village, it is exciting to know that we will have Ubitquity and their team to support us with CryptoListing, NFTitle and UbitquityPay. As Eleuthera continues to be the fastest-growing island in the country, Ubitquity will be key to helping us reach more customers and manage the records,” he added.

“Blockchain is still a new concept to many people, but I believe that it is the record-keeping system of the future. We have a chance to set an example of a more efficient way, and that’s the best way to spark change.”

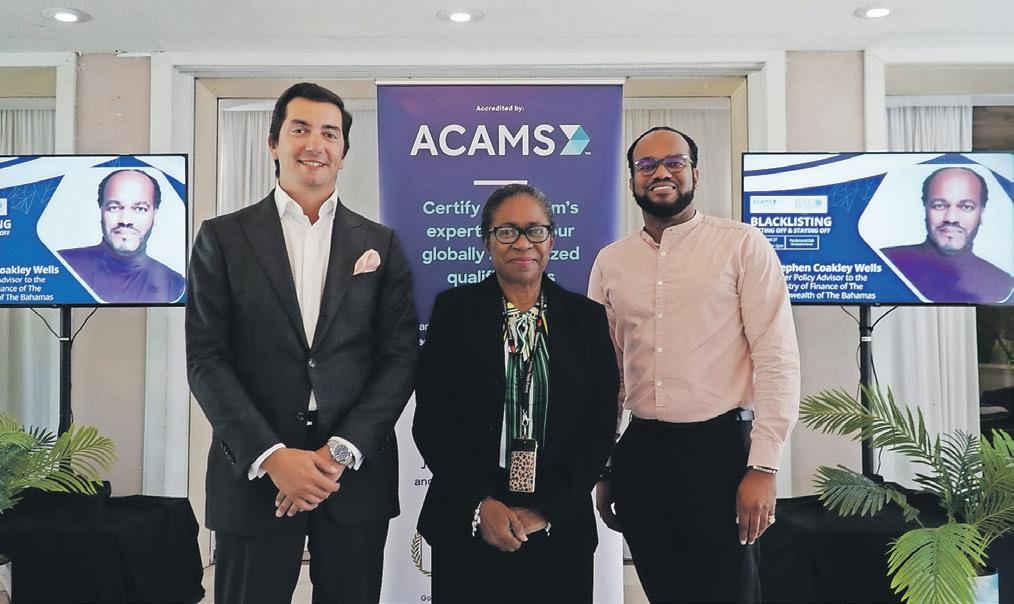

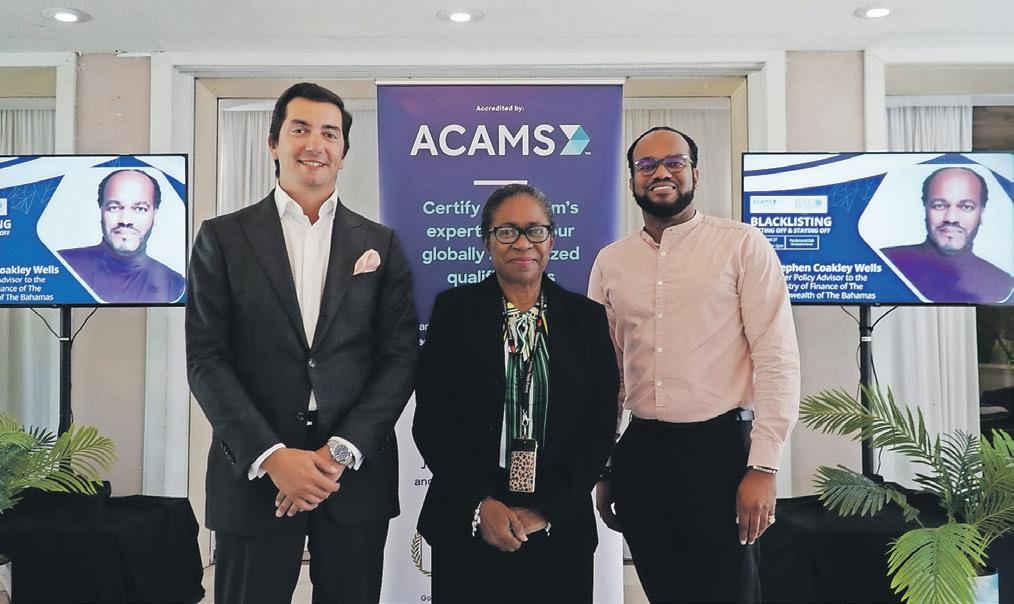

Compliance and regulatory officers team on ‘blacklists’

BAHAMIAN regu-

latory and compliance officers have held their first joint luncheon that discussed how this nation can escape, and remain off, various international tax and other financial services ‘blacklists’.

The Association of Certified Anti-Money Laundering Specialists – Bahamas Chapter (ACAMS Bahamas) and the Bahamas Association of Compliance Officers (BACO) teamed for the event, which was held at The Balmoral last Thursday, April 27, 2023.

Michael Halkitis, minister of economic affairs, was the keynote speaker while participants also heard from regional participants such as Tomas Machado, director and

head of international tax at KPMG; Dr Cassandra Nottage, national identified risk framework co-ordinator for The Bahamas; and Stephen Coakley Wells, former policy advisor to the Ministry of Finance.

They spoke about the need for The Bahamas to be sufficiently nimble, and prepared, for the next shift in global tax and antimoney laundering/counter terror financing standards.

They added that it was essential for The Bahamas to remain fully compliant with the Financial Action Task Force’s (FATF) anti-financial crime recommendations through its perfect ‘40 out of 40’ score, while remaining in the top tier listing for international financial centres (IFCs).

NOTICE

NOTICE is hereby given that JOHN GIBSON LAGUERRE of Cowpen Road, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Endric Deleveaux, BACO’s president, said: “The collaboration of BACO and ACAMS, from all accounts, was a total success. It provided our members with a review of where we came from and a clear vision of where we are heading. Those attending were equipped with a clear vision of what’s pending for us in the global regulatory environment and how we can - and will - successfully meet those challenges.”

The joint event, the first of its kind, attracted participants representing governance, risk and compliance professionals from a cross-section of industries in The Bahamas. Sectors represented included, but not exclusively, banks and trust companies, insurance, securities, funds, gaming, advisory services and crypto currency. Regulators were also present.

Tanya McCartney, ACAMS Bahamas co-chair, said: “The collaborative training between regulators and industry plays a pivotal role in combating money laundering and financial crimes, as it ensures a unified and wellcoordinated approach to identifying and mitigating risks. This collaboration enhances the effectiveness of regulatory measures, strengthens compliance efforts, and fosters a culture of vigilance within the financial ecosystem to safeguard against illicit activities.”

PAGE 2, Wednesday, May 3, 2023 THE TRIBUNE

L to R: Tomas Machado, director and head of international tax at KPMG; Dr Cassandra Nottage, national identified risk framework co-ordinator for The Bahamas; and Stephen Coakley Wells, former policy advisor to the Ministry of Finance, pose for a photo during the joint lunch hosted by ACAMS Bahamas and BACO.

BTC’s director of business, Andre Knowles.

Web shops ‘carried’ gaming in COVID

A SENIOR Gaming Board official yesterday hailed web shops for “carrying the industry” during the COVID-19 pandemic as no jobs were lost from the domestic sector.

Ian Tynes, the regulator’s secretary, speaking during a round table discussion at the Caribbean Regulator’s Forum and Caribbean Gaming Show, said: “We have 2,800 persons in the domestic gaming sector. There were no jobs lost, they sustained with the tax payments, and they actually carried the industry.

“The domestic gaming [sector]... they were able to,

I wouldn’t want to use the word thrive, but they were able to sustain themselves because of technology. Commercial casinos use in-person gaming, so with the protocols for COVID19 the casinos were closed. For the commercial casinos, they sustained their persons as employed, but the local domestic gaming [sector], they put in new technologies that would allow them to actually increase their market play.”

Mr Tynes said the technology adopted by local gaming houses was implemented by the Gaming Board in conjunction with the Central Bank, and allowed patrons to deposit and withdraw funds online via their accounts using debit cards.

MINISTER: BAMSI NO LONGER ‘WASTELAND’

By DENISE MAYCOCK Tribune Freeport Reporter dmaycock@tribunemedia.net

BAMSI is now thriving and fruitful again, according to Agriculture and Marine Resources Minister Clay Sweeting, who reported that it has almost made a complete turnaround.

He said the institute is now receiving the focus necessary to live up to its original plan for addressing the issue of food insecurity in the Bahamas.

Mr Sweeting said the Bahamas Agricultural and Marine Science Institute was like a “wasteland” during his initial tour after becoming the minister.

“We met BAMSI in a mess,” he said. “On my first tour, I ... was surprised to see how deserted the once thriving land was; it literally looked like a wasteland.

“Imagine the grove of coconut trees hidden under bushes; the aquaponics systems were dilapidated; and acres and acres of farmland overgrown.”

Additionally, he said, no classes were happening on campus, and the buildings were all closed and unfurnished.

“I would say BAMSI was in a coma,” he said.

“So, today, we have almost made a complete 180 at BAMSI,” he said.

Vegetables are growing, and we have a new type of lettuce that is drought resistant being made

available to Bahamian people.

“Animals and livestock are being reared. Repairs are being made to the buildings; new buildings to house a piggery and chickens were erected; and the lost coconut groves were cleared and look fruitful.”

Minister Sweeting indicated that the government has implemented the BAMSI Bill, which will revamp the structure and allow for more independent operations in how BAMSI runs. BAMSI is just growing, he reported.

He noted that there are classes and new partnerships are being forged with universities and organisations to ensure continued growth and success.

The Bahamas imports 97 percent of its food from the US, and the minister stressed that food security is crucial.

He pointed out that food supply shortages occurred following events such as the Gulf War of 1991, the 911 attacks in the US in 2001, and the global pandemic of 2020, which all impacted countries like the Bahamas.

“We found ourselves once again at the mercy of fate with the global pandemic when COVID brought the world to a standstill. We had restricted movement in travel and logistics, and as a result, we realised how compromised we were as a nation and how we were to food insecurity.”

“That technology was simple. It was using a payment system, allowing patrons to deposit and withdraw electronically,” he added. “The Gaming Board assisted, in conjunction with the Central Bank, by use of money transmission businesses which allow Visa and MasterCard play right now. The Government of The Bahamas agreed to it; debit cards only, no credit cards. So that is still in force right now. “So my hat’s off to them with the technologies, and working in conjunction with the Gaming Board allowed us to still receive taxes, which benefited the country at the time. It still does, but it really was a blessing that we collaborated with our licensees in order for them to get over the hurdle of

no job losses and increased revenues for the Bahamas government.”

Mr Tynes indicated that hotel-based casinos missed an opportunity to participate in online gaming during the pandemic by failing to exploit the restrictive interactive license that was available through the Gaming Board. He said: “For the commercial casinos, I think with COVID we learned a lot. I think commercial casinos missed an opportunity to take advantage of the restrictive interactive license. During the closure the markets, through Las Vegas and New Jersey, they had record revenue, so that’s a missed opportunity.”

Mr Tynes said the web shops are making strides

with incorporating new technology into their gaming model, and have started using artificial intelligence (AI) to assist with the due diligence checks required when taking on new clients.

“With the domestic gaming we have technologies with remote, live gaming. That’s a hot topic right now,” he added. “We’re partnering with jurisdictions like New Jersey, where we have relationships - New Jersey, Nevada, Mississippi, to name a few.

“Right now, with artificial intelligence, some of our operators are in the process of onboarding using artificial intelligence. Right now the market is growing. It’s growing and we attend conferences to get all of

Caribbean states moving on gaming regulatory overhaul

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE GAMING sector throughout the Caribbean is rapidly evolving as multiple countries seek to overhaul their regulatory regimes in a bid to gain a competitive advantage, an international testing executive said yesterday.

Jose Carlos Figueroa, Caribbean regional manager for Gaming Laboratories International, told the Caribbean Regulator’s Forum and Caribbean Gaming Show that Jamaica, St. Maarten and Trinidad and Tobago are all in the process pf overhauling their legislation to comply with international best practices.

He said: “The Caribbean as a whole, it’s changing. We have also visitors here today from Trinidad and Tobago, which is going through a process in which they’re developing their Commission’s regulations, and it’s going to be probably two years in which they can sit here and share about the same experiences that some of these regulators are going to be exchanging with us.

“And it’s not only Trinidad. You can see Jamaica’s RFP (request for proposal). They’re merging right now the Commission for racing and casinos with the lotteries. Same thing is happening in St. Maarten. British Virgin Islands is doing the same thing. They just created their commission and they’re putting it together. So the Caribbean is evolving. The Caribbean is moving towards a more regulated environment.”

Stuart Taylor, deputy permanent secretary for the

JOB OPPORTUNITY

Full time Caregiver For Two Young Children

This position would suit a responsible mature minded person who has a genuine interest in children. A native spanish speaker is preferred. We are seeking a longterm placement. Caregiver MUST LOVE TODDLERS and have at least 2 years’ experience in a caring role where they were in sole charge of more than one child throughout the day. You must be patient, show empathy, care, and appreciate the challenges that these formative years have on a child.

The suitable applicant must meet the following criteria:

• First Aid Certification

• Driver’s License

• Police Check

Day to day duties include:

• Meal preparation

• Playing with children

• Reading and counting with children

• Taking children to clubs, after school activities, weekend activities etc.

• Outings to the park, ensuring they arealways safe

• Some light housework duties are required; general tidy up after meals, laundry and folding for the child.

Please forward your resume and introduction letter by email to hrbahamas2014@gmail.com.

Turks and Caicos Gaming Control Commission, said the territory has adopted new legislation for regulatory changes that have yet to take effect. He added:

“The Turks and Caicos Islands Gaming Control Commission transitioned from a government department to a Gaming Control Commission on January 1, 2021.

“The transition started in 2016, when the Turks and Caicos Islands contracted with GLA to do a policy document on the gaming industry. And one of the deficiencies that the document revealed was that the gaming sector was not compliant with the new international regulations. So the first thing that the Gaming Control Commission had to do, based on the advice of our consultants, was to draft a new Gaming Control Bill.

“That bill was drafted in 2018, debated in the House of Assembly and that Bill was passed. Now, unfortunately, having the ordinance passed into law in 2018, it has not come fully into force. So the Gaming Control Commission is faced with a unique challenge. We still have to monitor the gaming sector, under the various pieces of legislation, until we fully bring the gaming control ordinance into force.

“Some of the challenges that we are faced with at the Gaming Control Commission currently is that we

have to now amend the the former legislation in order for the new legislation and the former legislation to act in unison.” Mr Taylor maintained that the previous legislation did not mandate responsible gaming practices. The new legislation makes it a requirement that casinos are responsible for helping vulnerable members of society deal with the adverse effects of gambling

He said: “What we would have done over time, we would have brought on commencement notices, brought on various sections of the gaming legislation. And the last section that we would have just brought on was the responsible gaming co-ordinator section. We would have had topics on responsible gaming. And that is one of the issues that

the latest technology, so we can have an idea of how to regulate.”

Mr Tynes said the Gaming Board is currently reviewing legislative reforms in hopes of making it easier to participate in the gaming industry without compromising anti-money laundering and compliance standards.

He added: “What the Board is doing right now, we’re reviewing legislation to make it a little bit easier to do business in this jurisdiction. However, don’t want to water down our regulations, but still be on top of the compliance component of it. However, we would like to strike a medium where we can regulate efficiently and allow our licensees to make money as well.”

the Commission is going to be paying keen attention to as we move forward.

“Over the years, the operators were not held responsible or accountable to ensure that they look out for the vulnerable within the population. And the new legislation is making that a mandatory requirement. So they must ensure that they have safeguards in place to mitigate against the risk of persons becoming vulnerable or susceptible to gaming without having the concern for the adverse ramifications that things like that could have on the family.

“So that is one of the key components that we are going to be paying strict attention to moving forward. Because, as regulators, we have to ensure that the legal requirements are fully complied with, as well as we have to look out for the social aspect of persons who are the patrons of the sector that we regulate.”

NOTICE is hereby given that JACKIE LAGUERRE of Cowpen Road, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

THE TRIBUNE Wednesday, May 3, 2023, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

CLAY SWEETING

NOTICE

INSURER ‘PAUSES’ EXPANSION ON EU BLACKLISTING FALL-OUT

reinsurers. It will be very difficult to replace that. I cannot stress enough the importance of The Bahamas doing everything necessary to get us off that listing.

“That’s why everything is on pause pending those two things. There’s no sense in me expanding something where I have no support, and the blacklisting may reduce my support even more. We must stress to the business community and the Government that getting off this blacklist is vital to all concerned.”

Bahamian property and casualty underwriters must acquire huge amounts of reinsurance annually because their relatively thin capital bases mean they cannot cover the multibillion dollar assets at risk in this nation, thus making them dependent on global support.

The global reinsurance market has been recently been pulling back from the Caribbean due to hurricanerelated losses, restricting capacity and driving up costs and premium prices for Bahamian consumers.

And, should The Bahamas fail to swiftly escape the EU ‘blacklisting’, reinsurers such as Munich Re, Hanover Re and R & V Re may find it difficult to cover this nation’s risks due to the imposition of home country penalties for doing business with such states.

The Bahamas was listed by the EU in late 2022 for alleged deficiencies with its ‘economic substance’ regime, which requires specific companies to be doing real business in the jurisdiction and have a physical presence - not operating as ‘brass plate’ or ‘letterbox’ companies.

The Government has moved to correct the flaws

with the economic substance reporting portal, having contracted BDO to develop a solution that will address the EU’s concerns.

Ryan Pinder KC, the attorney general, has recently voiced optimism that The Bahamas is on course to escape the 27-nation bloc’s blacklisting when it reviews the allegedly non-cooperative countries - and the progress they have madethis October.

Mr Saunders, meanwhile, speaking after RoyalStar’s total comprehensive income fell by almost 51 percent year-over-year in 2022, dropping from $15.605m to $7.668m, revealed that profitability is expected to decline further in 2023 after the insurer decided to absorb itself some of the increases in reinsurance and other expenses. “2023 is going to be a very challenging year,” he

told Tribune Business. “We took some decisions in RoyalStar not to pass on all our costs to clients, and so we can expect there will be a reduction in our profitability but we will be OK. This year we’ve decided to take some hits to keep insurance affordability at a certain level for our clients. These shocks this year, we didn’t want to pass the whole shock on to our clients.”

Mr Saunders said RoyalStar’s 2021 financial performance had been inflated by the “one-time windfall” it received from the “fair value” revaluation of the loan portfolio owned by Gateway Ascendancy, the distressed mortgage acquirer and restructurer, in which it has a 22.5 percent equity stake.

The underwriter’s investments in Gateway Ascendancy, as well as Sandy Shore Developers (the former Luxury Homes

Bahamas) and Vanguard Risk Solutions, the Cayman-based insurance agent and broker, produced a collective $10.535m bottom line boost in 2021. However, for the 12 months to end-December 2022, they generated a combined $349,543 - a more than $10m swing.

However, RoyalStar enjoyed an improved performance from its core insurance business, with the total underwriting gain up by almost $1m at $11.194 compared to $10.24m in 2021. Gross written, or topline, premiums increased by almost 24 percent or almost $20.7m year-over-year, jumping from $86.249m in 2021 to $106.936m last year.

“All of that is as a result of our increased business in the US Virgin Islands territory,” Mr Saunders explained of the gross premium jump. “Our goal is to grow our non-Bahamian

GB WATER REGIME ENACTED BEFORE RATE RISE DISCLOSURE

FROM PAGE B1

However, the dates on the regulatory framework agreement yesterday sparked questions as to whether approval of GB Utility’s water price hikes had been pre-determined. And there were also queries over whether public consultation - which in any event did not take place via a formal Town Meeting or any traditional mechanism - would have had merit or value as a result.

Darren Cooper, proprietor of D’s Car Rental, told Tribune Business that the now-approved rate increases will hurt the largest water consumers - hotels, restaurants and laundromats - the most. Some of that increased cost will likely be passed on to consumers, but he added that he understood the need to ensure GB Utility secures the island’s water supply.

However, Mr Cooper voiced unhappiness that GB Utility had not engaged in public consultation or sought to justify the rate increases that will impact 60 percent of its customer base. This, he added, had made him “very disheartened and very disillusioned” as a Freeport businessman and resident.

“I think any added cost to businesses in Grand Bahama continues to be a concern. I think the greatest impact is going to be on our hotel operators, and those that use the large quantities of water - laundromats, restaurants and hotels,” Mr Cooper said.

“I would still like the GBPA to justify the $8; why $8 [increase for higher consuming residential customers], but I understand that if nothing’s done to protect the water supply of

Grand Bahama we could be challenged in the future.

“Yet it’s very disappointing to see the GBPA tell themselves ‘yes’ but no public consultation, no public meetings, no nothing..... just a press statement that we’ve requested an increase to the regulator of ourselves, and less than two weeks’ later approval is granted. I expected a little more dialogue from the GBPA and GB Utility. It doesn’t matter what security they’re seeking to do, the people affected should be consulted and some justification given.”

Informed by Tribune Business of the date when GB Utility’s new regulatory regime took effect, Mr Cooper said it appeared that the water tariff hike was “approved long before they notified the public. They should have said a request had been made, and approval given, rather than make it appear some consultation was being done when there was none. Sad.”

The business proprietor said he had spoken to Ms Grant-Adderley, GB Utility’s chief operating officer, in relation to his water supply around the time the proposed rate increases had been announced and she “promised they would have public dialogue in reference to this water matter”.

The GBPA’s statement yesterday said the water rate increase will take effect in all consumers’ June bills, although the utility has previously pledged that 40 percent of its customer base - those using the least volume of water - will not suffer any hikes.

But Pastor Eddie Victor, head of the Coalition of Concerned Citizens (CCC), yesterday told Tribune Business it “speaks volumes” that GB Utility’s new

NOTICE

NOTICE is hereby given that SAINT SACY VALCIN, of Soldier Road, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that KERVANS DIEUDONNE, of East Street, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

regulatory regime appeared to have taken effect before the rate increases were even announced or approved.

“It means they had already planned to approve it,” he argued. “When you already plan to approve it, you are only going through a process of public consultation to be able to say you did it. I think it’s selfexplanatory. There was no true public consultation. There was none. They call it public consultation, but it was just procedure to be able to say you did it.”

Pastor Victor also questioned whether GB Utility can increase tariff prices for consumers outside the Port area, in east and west Grand Bahama as well as Freeport’s surrounding settlements, without first obtaining the Government’s approval. And he also urged businesses and residents to respond to the cost increases by digging their own wells if they can afford to do so.

“It’s going to have a further adverse effect on the economy, taking into consideration they are increasing the water rates at a time when everything has been increasing in terms of consumer items and services,” he added. “All that is going to do is add further hardship to the economic condition of businesses and individuals. That’s the unfortunate thing.

“When you create an environment an environment that increases the cost of doing business, that cost is going to be passed on to customers and they will have less revenue to function with. When you have the Government, shipping companies and utilities all increasing their fees and the cost of goods, the end result is that the consumer, the citizen is impacted. That’s the shame about it.”

Kwasi Thompson, the east Grand Bahama MP, was also unimpressed. Describing himself as “disappointed but not surprised” by the rate increase

approval, he added: “We anticipated, given the obvious conflict of interest, it was impossible for the GBPA to fairly and transparently assess a company with the same shareholders.

‘Unfortunately, there has not been any attempt to change course or include anyone in the process in an attempt to make this process more transparent.”

Questioning who sat on the GBPA’s rate review committee, he argued there had been “complete silence” from the Government as to whether it had sought to intervene and he again called upon it to act.

The GBPA yesterday sought to soften the blow for Grand Bahama consumers and business by announcing that GB Utility will pay penalties if it fails to meet certain customer service standards, which will be levied via credits to their accounts.

The four standards named in its statement were connecting new services to GB Utility’s existing infrastructure, which has to be done within three working days; responding to customer complaints, billing and payment inquiries and work orders within 21 working days; the reconnection of disconnected accounts within one working day, subject to payment that includes the reconnection fee; and defective meters repaired and/or replaced within 30 working days.

Should these targets be missed, in each case residential customers will receive a $15 credit; commercial customers $30; and large customers a $75 credit. The GBPA statement said this was part of the rate application increase’s approval, yet the same standards and penalties/credits are detailed in the regulatory framework agreement that took effect on April 2, 2023, again suggesting this was pre-determined.

Still, touting the regulatory framework agreement, the GBPA said: “The

portfolio to mirror a 55/45 split in premium.” While

The Bahamas will still be in the majority, he added: “We are almost there, and hopefully we will achieve that this year.

“Right now I think we are 59/41. We are satisfied that everything we can control in these territories we are controlling. All of the territories last year were profitable. We have some work to do in some of the territories because rates were impacted, but those will be corrected this year.

“Insurance is a diversification game. We decided long ago to expand beyond one territory into islands of our choice. Expansion comes with the good and the bad. We’ll take the good and the bad together.” Royal Star, apart from The Bahamas, has a presence in the Cayman Islands, British Virgin Islands, US Virgin Islands and Anguilla.

application was based on the cost-of-service model in line with international best practices. As part of the process, GBPA has made public on its website the regulatory framework that GB Utility is to be governed by.

“With the publishing of this innovative framework agreement, GB Utility is the first and only water company in the country to be regulated by an agreement that documents how rates are to be set, operating and environmental protocols and establishes customer service standards with penalties to be paid to customers.”

Freeport’s quasi-governmental regulator continued:

“The GBPA regulatory committee reviewed the application, taking into consideration the concerns expressed by residents and stakeholders to balance the customer needs with having a healthy utility that can provide quality and sustainable service.

“As part of the formal response to the utility, GBPA has sanctioned the following customer service standards that GB Utility will be held accountable to its customers and regulators. If GB Utility fails to meet any of the service standards, customer water accounts will be credited.”

The GBPA then sought to justify the approval decision, saying: “On May 1, GBPA communicated its approval to GB Utility of the application to be made effective in June bills. GB Utility, in their application where 40 percent of customers will see no change in their bills, has been approved to commence with proposed capital investment plans that include the construction of a 1.5m gallon a day mobile reverse osmosis plant to begin construction this year.

“This is in addition to the recently constructed three million gallon-a-day reverse osmosis plant that was commissioned in 2021. GBPA is cognisant of the catastrophic impact of Hurricane Dorian on the utility company and, specifically, that the utility lost 60 percent of its potable water supply because of Hurricane Dorian and the 20-foot surge of seawater that flooded their biggest water plant.

“The new reverse osmosis plant is critical to the ability of GB Utility to resolve the lower pressure being

NOTICE is hereby given that PAULETTE MCPHEE of P. O. Box CR-54111 of Alcuin Lane, Lou Adderley Estate off Bacardi Road, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

experienced by customers because of the diminished freshwater lens. It is also necessary to ensure that Grand Bahamians will continue to have access to a long lasting and sustainable supply of potable water, which is integral to the standard of life for the island,” it continued.

“GBPA understands fully the importance of ensuring that this island has access to a consistent and quality supply of potable water that meets World Health Organisation (WHO) guidelines. We are cognisant of the critical role of water in our everyday life and future development. We act in accordance with best practices and industry standards to balance the needs of customers, protect our natural resources, and ensure we have a sustainable and storm resilient utility.”

GB Utility, in its rate increase application, pledged that 40 percent of its customer base - those who use 2,000 gallons or less per month, and are likely to be lower income residential users - will not see any price hikes from the adjusted tariff structure that is due to take effect on May 1 if approved by the GBPA. Average consumption among this group is 600 gallons per month, and the average bill is forecast to remain at $12.83. The water provider, in a statement, said a further 47 percent of clients - who consume between 2,001 and 10,000 gallons monthly - will only see an $8.16 per month tariff increase that will take their average bill from $28.13 to $36.29. This equates to an annual water cost increase of $97.72 - less than $100.

GB Utility is clearly expecting large volume users, namely higher income residents and the business community, to bear the brunt of the increases. Those consuming between 10,001 and 20,000 gallons per month, and representing 8 percent of the customer base, will see their bills rise by around $20.73 per month - representing a jump from an average $71.42 to $92.14. This is equivalent to a $248.76 annual increase in water costs.

Users of more than 20,000 gallons per month, chiefly hotels and Freeport’s large industrial companies who comprise 5 percent of customers, will see their tariffs jump by $125.74 per month to an average $558.67 compared to the present $432.93. This is equivalent to a $1,508.88 annual increase.

NOTICE

NOTICE is hereby given that

JUNIOR JOSEPH, of P.O. Box CR-56492 Maize Court, Hampster Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New

PAGE 4, Wednesday, May 3, 2023 THE TRIBUNE

FROM PAGE B1

NOTICE

NOTICE

BISX fund ‘back expanding’ with $9m warehouse move

contract people to construct it.

“The architect will also help us to get planning permission to develop the site. It’s located just east of Gladstone Road on Carmichael Road; just east of that junction. We will be investing $8m-$9n, and expect to move forward with it within the next month or two. We expect to try and move forward in the second half of this year and have it completed by the end of 2024.”

This will be the Bahamas Property Fund’s first warehouse and storage investment, and its first diversification beyond the high-end downtown Nassau and Paradise Island office space it has traditionally focused on. “We believe this is a market that is still under-served despite all the warehouses out there,” Mr Anderson explained. “They seem to be full, and constantly full.

“The warehouses that are on the market already are generally full in most of these areas, and as development takes place along Carmichael and Gladstone Roads there will be more requirements for more warehousing so we want to come into a market where there is significant demand. We see the warehouse business expanding as the country develops.

“It’s sizeable opportunity for the Property Fund to take advantage of as it’s our first project. We’ll look to use it as a starting position for ourselves, get it to work as intended and see what other opportunities present themselves. We believe it’s the start of a much bigger business. At the moment, we just want to make sure we do it properly.”

While the Gladstone Road/Carmichael Road warehouse project will likely only create four to five jobs once completed, Mr Anderson said RF Merchant Bank & Trust had spent the past year building up the Property Fund’s management capacity so that it is able to take on more projects and expand the real estate investment trust (REIT).

He added that another initiative approved by the Property Fund’s Board is the carving out of some 2,500 square feet of space, at its 100,000 square foot Bahamas Financial Centre flagship property in downtown Nassau, to target the short-term rental market following the

COVID-induced changes to working patterns.

“The idea is to make that space available to businessmen and attorneys working downtown who need space on a short-term basis,” Mr Anderson explained.

“We believe the market is there. We’ve seen other short-term rentals used by businesses downtown and around Nassau, so there seems to be demand for that space after COVID.

“People don’t want to work from long-term rentals. They want to work from both offices and home. It’s a new model coming up from the change in the way we work. We’re going to try it with a relatively small amount of space and see if we can find the right recipe and solution for people in that area.” If the Property Fund gets it right, Mr Anderson said it would seek to take its short-term rentals to other locations, including its One Marina Drive property on Paradise Island where occupancy is still languishing around 30 percent. “It’s possible we will do something similar with the warehouse project at Carmichael and Gladstone if we find the right solution and way to make it work,” he told Tribune Business.

“It will still involve us investing $400,000 to fit out the space [at the Financial Centre] to do it. It’s not like there’s no cost here. To some extent there’s vacant space there, and we can use it as a trial.” Together with the warehouse and storage facility drive, Mr Anderson said the Property Fund is also eyeing retail and short-term residential possibilities as well as business rentals as it gets back into expansion mode after a long hiatus.

“The Property Fund is finally getting back to looking at how it expands its lines of business,” he added, “as well as acquiring other buildings to get back into growth. This is the start of that expansion. These are two new projects. The idea is to potentially expand on both of those, depending on how successful they are, and to get back into acquiring other buildings; potentially retail and shortterm residential space.

“Through this process the idea is to diversify revenue streams of the Property Fund and create more opportunities to generate revenue. It’s been a long time coming, but we’re kind of excited about the

THE TRIBUNE Wednesday, May 3, 2023, PAGE 5

opportunity and the opportunity is now there.”

B 1

FROM PAGE

NOTICE

NOTICE is hereby given that SHARON LAGUERRE of Cowpen Road, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

By MICHAEL LIEDTKE AP Technology Writer

EVEN before he joined Lyft's board in 2021, David Risher had taken hundreds of trips as a passenger so he felt like he knew a lot about the ride-hailing service. But he never expected to be thrust into the driver's seat at a time when Lyft was running like a jalopy.

"I really was gobsmacked," Risher said during an interview with The Associated Press as he recalled being recently asked to replace Lyft cofounder Logan Green as CEO.

Risher quickly shook off his initial shock and is now making an effort to reverse the San Francisco company's mounting losses and sagging stock price. Just days after taking over as CEO, Risher came up with a restructuring plan that includes laying off nearly 1,100 employees whose job losses could help him attain stock price incentives potentially worth nearly $1 billion.

Like any mass layoff, the payroll purge will uproot the lives of those suddenly out of a job while sowing uncertainty among Lyft's remaining 3,000 employees. But Risher believes the deep cuts had to be done so Lyft can afford to bring down its fares to the same levels as its longtime rival, ride-hailing leader Uber, which has rebounded from the pandemic much more robustly.

"It's very important to our customers that when they open both (the Uber and Lyft) apps that they are not surprised by the prices being super different," Risher said. "We want to be in line with where Uber is."

The cost-cutting also will help Lyft pay drivers better, another element that Risher believes is needed for the service to offer more rides with quicker pick-up times.

Mobile tracking data compiled by wireless network testing firm GWS found Lyft's driver app now averages about 400,000 daily usages — half its

pre-pandemic levels — while Uber's driver app boasts about 1.4 million daily users, roughly the same number that it had leading up to the pandemic.

More details about Risher's turnaround strategy are expected Thursday when Lyft releases what are expected to be lackluster

financial numbers for the first three months of the year. The problems facing Risher are an offshoot of pandemic-driven restrictions that dramatically curtailed travel during most of 2020 and much of 2021, shriveling demand for rides on Uber and Lyft.

But Uber had something that Lyft didn't — a food delivery business that had been aggressively expanding under Dara Khosrowshahi, who Uber hired in 2017 to clean up a mess that its previous CEO Travis Kalanick had created. Uber's disarray had also alienated many of its passengers, helping Lyft to steadily gain market share leading up to the pandemic in March 2020.

Khosrowshahi's decision to transform Uber into a "go wherever you want, get whatever you need" operation paid off during a pandemic that ignited explosive growth in food delivery. That demand kept millions of people using Uber's app even when they weren't going anywhere, forming habits that helped Uber's ridership return to pre-pandemic levels while Lyft fell out of favor.

"No one was opening their Lyft app, so when the world reopened it just seem easier to get an Uber," said Tom White, an analyst for D.A. Davidson.

Gaming regulator ‘not here to police morality’

FROM PAGE B1

to be better incorporated into The Bahamas’ gaming model. “Gaming is a part of our tourism industry. And we’ve kind of had seg-wayed off on its own.

But it really needs to be integrated as a part of entertainment,” he added.

“Our brand lacks entertainment as big as we are. You know, we started out with Vegas, and we started out with Orlando in 1965. They’ve gone to 50-55 million tourists a year 50 years later. We’re still around the five to seven million mark, but they went heavy with entertainment.

“One is in a desert, and one is in a swamp. We are in a tropical paradise. So, we have to re-imagine, reignite and re-engineer our entertainment brand. And the gaming world has a capacity

to do that. And so we’re looking at bringing the gaming industry along with entertainment that takes our product up another notch”

Dr Johnson said gaming licenses are still available in Grand Bahama and Exuma for land-based casinos.

“We’ve got two licenses available in Grand Bahama, there is a license available in Exuma,” he added. “You will hear about it in the coming months with the update of legislation, and we will invite people to come and participate and apply.

“But there are available licences becoming available for land-based casinos and other things that are innovative in this industry. And so we want to make it available so we can see growth. We want to look at new licensing, perhaps

in the future for the Family Islands, maybe Grand Bahama will become the Magic City again, where anyone can go there on the weekend.

“And you can go and game, Bahamian, foreigner, permanent resident, Chinese, American, Hispanic, whoever you are. You can go there and again we have to test this model now. And not discriminate against ourselves.” Mr Johnson clarified that six of the seven local operator licences are in use, but the licence for the Grand Lucayan is not.

Dr Johnson said: “We have seven licences for local operators and six are taken. And then we have three casino operators, which are the big three, but Sandals did not do theirs [in Exuma]. And in Grand Bahama, Grand Lucayan

is laying dormant for the time being. So we know we have two licences we would like to see turned on, that’s Exuma and Grand Bahama.”

He added that since modern gaming has evolved into an online activity, improved infrastructure is required to monitor and evaluate gaming providers.

Dr Johnson said: “We have to bring it up in the 21st century. This is an online phenomenon. This is a computerised back office. We have to get our systems in place that can monitor and evaluate what happens when they press that button. So we need to upgrade our systems electronically, and our conversation with them about monitoring and evaluation, because we need to have certain information to make sure it’s fair and balanced on both sides.

“The legislation is going to be shared with all the industry insiders, local and international. They’ll have their input as a stakeholder, and we’ll see what comes out of it. We are the facilitator. We’re not going to tell people what to do. But we want to have legislation that facilitates growth and prosperity and protects the citizen. That’s what we want it to reflect.”

Dr Johnson noted the importance of ensuring a balance between the prevalence of gaming and the protection of patrons, and expressed the importance of ‘giving back’ to communities affected by the increase in gambling activities.

He said: “You have to protect and prosper industry. And I use protect first. So responsible gaming is really important in the modern era because this Internet online thing goes into people’s homes. It can come up on kid’s phones, it is everywhere. And so we have to be honest about it and fair with the industry. And that’s where conversation and collaboration need

Because Uber's food delivery service also helped retain drivers on its platform during the pandemic, that made it more difficult for Lyft to lure them back when the pandemic eased. The driver shortage was compounded by a fare structure that resulted in its service frequently demanding significantly higher prices for the trips than Uber — a gap that consumers who kept both apps on their phones could quickly see.

Brian Blitzstein used to drive for Lyft but says he is now focused primarily on Uber because of all the ridership momentum that it gained from its food delivery service during the pandemic. But he could be convinced to come back to Lyft if he earns more pay. "Money talks," Blitzstein, 39, said. "But I definitely think it's going to be challenging for Lyft. Are they going to be cutting down to the bone? That would be like cutting off your arm to lose weight."

to begin because you have to have compromise.

“The responsible part of it is we have to also plan to give back to these communities, where some of these things are happening. There’s a good side and bad side; we have to level it out. Our job as a regulator is to make sure that the pluses are much more than the negative aspects.”

Mr Johnson defended the gaming industry’s regulation, highlighting the initiatives adopted for persons suffering from gambling addiction imbedded into the law and regulations. He said: “We have a hotline. We’ve engaged the psychiatrists at Sandilands Rehabilitation Centre.

“We have an addictionbased programme built into our legislative framework, and the programmes that our local and international gaming institutions use as a red flag phenomenon. If people are acting irresponsibly, your family can report someone. Some people report themselves as having a problem. People get into severe gaming issues and lose more than they can, and that is reported. They’re red flagged, and those people can be banned for life.”

AML LOSES RECEIVER BID OVER ATTORNEY’S ASSETS

FROM PAGE B1

the trust” once it expires in 2033.

AML Foods argued that Mr Butler admitted this interest “amounts to at least $1.65m”, and that he is also entitled under the trust’s terms to a $50,000 payment as well as “reasonable legal fees for dealing with the assets of the will trust”.

As a result, the BISXlisted food group argued that “the appointment of a receiver will therefore not be fruitless”.

It also asserted that Mr Butler was unlikely to inform it of his receipt of any assets from the trust, and that he would “dissipate” them rather than use the proceeds to settle the debt. But Mr Butler, who defended himself, testified in an affidavit that his Alice Street property was appraised at $1.013m on June 23, 2023, and had been listed for sale.

“He further stated that he was contacted by Gavin Watchorn, president and chief executive of [AML Foods], who proposed that he sign a sales agreement giving the judgment creditor the right to sell the property if the sale is not completed by the real estate agent within six months,” Justice Brathwaite recorded.

Mr Butler said he was prepared to convey the Alice Street property to AML Foods as “final and full settlement” of his $862,287 debt, and suggested the receiver’s appointment

would be overkill given that the company had already obtained a charge, or lien, over his shares in CFB Corporate Services. As a result, appointing a receiver would be “disproportionate” as AML Foods was seeking to attach assets of far greater worth than the debt outstanding.

Justice Brathwaite agreed. While AML Foods was entitled to pursue all assets to satisfy the debt, he added that it had secured a lien over a building whose $1.013m appraised value exceeded the debt owed by a six-figure sum. “While it is in the interests of justice that orders of the court be obeyed, it is also right that steps are taken to ensure compliance are not excessively oppressive,” he wrote.

Noting that Mr Rahming’s appointment as receiver would also increase costs, which were likely to be borne by Mr Butler, the Supreme Court judge also suggested that the risk of dissipation of trust assets was restricted given that its final winding-up is not scheduled to take place until 2023.

“In the circumstances of this case, I do not consider it just and convenient to order the appointment of a receiver at this time,” he added. “The situation might be different if there was evidence that the damages had been assessed and far exceeded the value of the building, but that is not the case.”

PAGE 6, Wednesday, May 3, 2023 THE TRIBUNE

LYFT’S NEW CEO TACKLES A JOB REQUIRING

SOME HEAVY LIFTING

LYFT CEO David Risher poses for a photo at the company’s headquarters on Wednesday, March 29, 2023, in San Francisco. Even before he joined Lyft’s board in 2021, Risher had taken hundreds of trips as a passenger so he felt like he knew a lot about the ride-hailing service.

Photo:Michael Liedtke/AP

AS BANKS TUMBLE AGAIN

By STAN CHOE AP Business Writer

STOCKS slumped Tuesday after shares of beleaguered banks tumbled again and worries worsened about the economy.

Rising fear sent yields sinking in the bond market, while Wall Street waited for the Federal Reserve’s latest move on interest rates and Washington edges closer to what would be a catastrophic default on U.S. government debt. The S&P fell 1.2% after paring a steeper loss. The Dow Jones Industrial Average dropped 367 points, or 1.1%, after earlier being down as many as 615 points.

The Nasdaq composite sank 1.1%.

Some of the sharpest drops came from smallerand mid-sized banks, which have been under heavy scrutiny as the banking system shows cracks under the weight of much higher interest rates. PacWest Bancorp dropped 27.8%, Western Alliance Bancorp fell 15.4% and Comerica sank 12.4%.

Three of the four largest U.S. bank failures in history have come since March, and investors have been on the hunt for what could be next to topple or suffer

a debilitating exodus by customers. Regulators seized First Republic Bank at the start of this week and sold most of it to JPMorgan Chase, which had raised hopes that the turmoil could ease.

Also pressuring the market was a report showing U.S. employers advertised the fewest job openings in nearly two years during March. The job market has been one of the main pillars supporting a slowing economy, and a drop-off there would likely mean a recession.

Such pressure is raising the stakes for the Federal Reserve, which began a two-day meeting on interest rates. The widespread assumption is that it will raise rates on Wednesday by another quarter of a percentage point. The widespread hope is that it will be the last increase for a long time.

The Fed has jacked up rates at a furious pace from early last year, up to a range of 4.75% to 5% from virtually zero. It’s trying to beat down high inflation, but high rates do that by taking a blunt hammer to the economy.

High rates have already hit the housing market sharply and hurt the

banking system. Many investors are preparing for a recession to hit later this year.

That has many traders betting the Fed will halt its rate hikes and perhaps even cut them later this year. That would offer the market more breathing room, and stocks have historically done well in the months immediately following the last rate hike.

Still, some investors anticipate the Fed on Wednesday may not offer

encouraging signals that rate hikes are over, let alone open the door to rate cuts.

“Admittedly this is a 20:20 hindsight view and the Fed’s job is as tough as it has ever been, but while it would be nice to be finished with the Fed hiking cycle, too much caution in the past, among other factors, caused the current inflation overshoot and there remains a distinct possibility that it could accelerate again, especially

given all the uncertain factors in the world today,” said John Vail, chief global strategist at Nikko Asset Management.

Australia’s central bank surprised markets Tuesday by raising rates by a quarter of a percentage point and saying “some further tightening” may be needed to get inflation fully under control. It pointed to prices still rising too quickly for services, an area that the Fed has also been focused on.

Adding worries on top of that is the latest political spat over the nation’s debt limit. Treasury Secretary Janet Yellen said late Monday that the U.S. government could default on its debt as early as June 1 unless a divided Congress allows it to borrow more. That’s an earlier “X-date” than previously thought.

A default could be disastrous because much of the financial system is built on the assumption that U.S. government debt is the safest investment available. Most of Wall Street believes Congress will come to a deal before the deadline, as it has many times before, because the alternative would be so dire.

While Yellen made the June 1 deadline sound like

a flexible one, Wall Street will likely treat it with more definitiveness. Any portfolio manager instructed to avoid risks of getting payments delayed will be steering clear of June 1 bills, according to strategists at UBS.

With only weeks to go before June 1, Congress could be forced to agree to an extension of just a few months, rather than a longterm deal.

“There could be a few debt ceiling deadlines prior to the 2024 elections,” the UBS strategists led by Michael Cloherty wrote in a report.

In the bond market, the yield on the 10-year Treasury slumped to 3.42% from 3.57% late Monday.

Some of the sharpest action in the stock market was among companies reporting results for the first three months of the year, as earnings season stays in high gear. It’s been mostly better than feared. Arista Networks fell 15.7% despite reporting better profit and revenue than expected. Analysts said investors may have been disappointed it didn’t raise its forecast for upcoming results even more than it did.

PAGE 8, Wednesday, May 3, 2023 THE TRIBUNE

STOCK MARKET TODAY: WALL STREET DROPS

A PERSON walks in front of an electronic stock board showing Japan’s Nikkei 225 index at a securities firm Thursday, April 27, 2023, in Tokyo. Asian shares mostly fell Thursday, echoing the drop on Wall Street, as worries about the U.S. banking sector and inflationary pressures weighed on investor sentiment.

Photo:Eugene Hoshiko//AP