‘Death by 1,000 cuts’ fear on new Bimini airport fees

FOCOL Holdings’ top executive yesterday said it has “very likely” amassed the largest growth ‘war chest’ in its history after taking its recent capital raise to a combined $70m.

Dexter Adderley, the BISX-listed petroleum products supplier’s president and chief executive, told Tribune Business it had been “humbled” by the level of investor and capital markets confidence shown in its expansion drive after its $40m preference share issue was oversubscribed by $5m.

Given that FOCOL plans to keep the full $45m, when combined with the proceeds of its previous $25m equity raise via a rights offering to existing shareholders, it now possesses a total $70m that can be deployed to finance growth, acquisition and expansion opportunities.

“It’s a very significant vote of confidence; quite a significant vote of confidence,” Mr Adderley told this newspaper of the $45m preference share raise. “We are humbled and grateful to be in this position, and we assure the investment

community that the funds will be put to a very strategic growth strategy across the group of companies.

“It’s a uniquely strong position for us to capitalise on these growth opportunities.” The FOCOL president and chief executive declined to provide a specific timeline, or duration, over which the company will deploy its new financing other than to say this will take place over the “near to medium term”.

He added: “It’s defined growth strategy. It’s not undefined. It’s a defined growth strategy and the investors will be able to see it deployed in a very deliberate, measured and responsible manner. We are in a very strong position.”

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netPRIVATE aviation operators yesterday voiced fears that the industry faces “death by a thousand cuts” amid a furious reaction to the imposition of multiple new fees to pay for Bimini’s $80m airport upgrade.

Rick Gardner, a Bahamas ‘flying ambassador’, told Tribune Business that “ultimately the losers will be Bahamians dependent on tourism” if price-sensitive private pilots desert the island for other destinations after Bimini Airport Development

Partners, the private sector consortium charged with transforming the island’s airport, unveiled a host of new charges to help pay for their investment.

The consortium, in an April 26, 2024, notice to private aviation operators obtained by this newspaper, revealed that it plans to introduce the new fees on May 6 with many set for a further increase come June 1, 2025. Many in the industry complained that the ten-day notice period is far too short, while asserting it was “pretty brazen” to impose the charges “without a penny being invested”.

THE Central Bank’s governor yesterday conceded that the Bahamian credit market remains “very soft” with new residential mortgage applications falling by almost 15 percent year-over-year in late 2023.

John Rolle, addressing the banking regulator’s 2024 first quarter economic briefing, voiced optimism that the continued development of The Bahamas’ first-ever credit bureau will help drive renewed lending as it will provide institutions with a more complete history on borrowers to help them better judge credit risk.

UP to $300m in annual foreign exchange outflows from overseas portfolio investments by Bahamians will not be “unmanageable” for the Central Bank, its governor reassured yesterday.

John Rolle, speaking at the regulator’s 2024 first quarter economic briefing, said exchange control liberalisation measures that will allow Bahamians to invest up to $100,000 abroad annually without first requiring Central Bank approval will only impact the “composition”

of foreign currency outflows and pose no threat to the US dollar peg.

Bahamians, as of June 1, will be able to invest this sum annually in overseas securities and real estate once they supply commercial banks with evidence that they have an investment account with either a local or foreign financial institution. The reporting mechanisms to oversee this are currently being put in place as the Central Bank moves to improve the ease of doing business for overseas investing.

“The short of it is we think the banks are capable of conducting the due diligence around these transactions and it allows

THE Central Bank’s governor yesterday said he expects the $547m first quarter external reserves growth to be reversed over the next eight months and produce a year-end finish “moderately below” 2023. John Rolle, speaking at the regulator’s 2024 first quarter economic briefing, said the external reserves expanded by almost

half-a-billion dollars during the first three months of the year - a rate around five times’ greater than that seen during the same period in 2023. The $547m jump saw the external reserves, which ultimately support the one:one exchange rate peg with the US dollar, close March 2024 at $2.898bnmore than $200m higher than at the same point in 2023.

“Over the first quarter of 2024, the external reserves

accumulated at a significantly stronger pace of just over $0.5bn compared to less than $100m in the same period in 2023,” Mr Rolle said. “Through the end of April, this seasonal buildup was further extended, leaving balances near $2.9bn.

“The Central Bank still expects that the reserves will contract over the remainder of this year to be less than they were at the end of 2023. This would absorb accelerated growth

in private sector credit, which the Central Bank is encouraging, while still leaving the external balances at comfortable levels to support the Bahamian dollar fixed exchange rate.”

Asked by how much he expects the external reserves to decline by yearend, Mr Rolle replied: “I would say that we would expect [by] more than the $0.5bn [increase] that we’ve seen so far this year.

• Multiple new charges to pay for $80m upgrade

• Private aviation ‘furious’ over 10 days’ notice

• Airport operator says: ‘We’re open to dialogue’

“This notice is to serve as an announcement concerning the change of management at South Bimini International Airport,” the notice read. “Effective May 6, 2024, Bimini Airport Development Partners (BADP) will assume the management, operations and development of the airport.

“BADP will begin immediate improvements of the airport to modernise and expand the facility, improve airside and navigational

He argued that “part of the malaise”, which has resulted in sub-optimal credit market conditions, has resulted from individual banks and other lenders historically relying largely on their own isolated data sets to judge borrower creditworthiness and loan pricing. As a result, they were often unaware of loan delinquencies and problems at rival institutions.

the public to experience a more expedited process with gaining access to these transactions,” Mr Rolle said. “It will provide a more efficient regime.

“We are still able to oversee what is happening, and be assured there is not an unwelcome effect on the foreign reserves. An unwelcome effect would be if we didn’t really have a good understanding of the demand or utilisation.

“We believe that, given the robust state of foreign exchange markets in The Bahamas, which see $8bn in inflows and roughly the

The Governor spoke as the latest Central Bank lending conditions survey, covering the 2023 second

same amount of outflows, this kind of liberalisations are less worrisome because the only thing we’re impacting is the composition of the flows for the most part,” he added.

“It’s the composition of the flows that are being impacted by this liberalisation even though there is some drawdown in savings to fund these investments abroad. We don’t see that as representing the majority of potential transactions.”

Asked by Tribune Business about the likely dollar SEE PAGE B5

THE Bahamas Telecommunications Company (BTC) says it has installed a new mobile tower atop the One Cable Beach development in a bid to boost network capacity in the area.

Drexel Woods, BTC’s director of technical operations, said: “We continue to monitor all our networks with the view to improve the quality of service for our customers. The Cable

DREXEL WOODS

Beach strip was identified as one of the areas that we should improve our capacity. "With the influx of tourists that visit our shores, and locals that reside and do business in this burgeoning area, it was imperative that we improved our mobile capacity. This new tower addition will provide smoother and faster surfing and streaming, and better clarity in voice calls.”

BTC said it is encouraging residents and business owners in the Cable Beach area, who have not upgraded their mobile phone's SIM card to an LTE version, to visit its nearest location to facilitate this.

“As we continue to upgrade the mobile network, you will need to have an LTE SIM card to experience the improvements in service. The upgrades are

FROM PAGE B1

half, revealed continued sluggishness especially when it came to mortgage lending. Applications were down when compared to both the 2023 first half and final six months of 2022, although the approval rate for these improved by almost 15 percentage points to 52.9 percent.

RBC Royal Bank (Bahamas) yesterday named Ericka Rolle as managing director for its operations in this nation and the Turks and Caicos Islands (TCI).

Ms Rolle, who currently serves as Cayman Islands country head, will return to The Bahamas to take up her new position with effect from May 1, 2024. Besides becoming managing director, she has also been appointed to the role of vice-president of personal banking.

Ms Rolle is also replacing LaSonya Missick, who has moved on to a new role as regional vice-president for personal and private banking and RBC FINCO. In addition, she serves as a Caribbean banking executive management committee (EMC) member. Ms Missick is the first Bahamian to be appointed to RBC Caribbean’s executive leadership team.

As Managing Director, Ms Rolle will serve as RBC’s lead on all governance and regulatory matters. She has spent nearly 30 years in the banking industry, holding roles such as managing director at BISX-listed FINCO and other sales and operations roles with proven results. Ms Rolle has also served on several boards, including FINCO’s and Safeguard Insurance Brokers, where she served as chairman.

“Ericka is well prepared for the challenges and opportunities for this next step in her career,” said Ms Missick.

“With a proven track record of driving organisational success and fostering strong client relationships, Ericka is poised to lead our Bahamas and TCI teams to new heights. On behalf of the leadership team in the Caribbean, we congratulate Ericka on her new role and wish her continued success.”

And, in a further sign of the financial strain facing many Bahamian households and individuals, some 24.1 percent - close to one-quarter - of the 15,101 consumer loan applications received by the Bahamian commercial banking industry during the 2023 second half were for “debt consolidation” purposes.

The survey disclosed that applications for this loan type, which effectively seeks to rescue borrowers by combining multiple loans into one, thereby leaving them with a lower interest rate, surged by 69.2 percent in the last six months of 2023. Of the 3,644 debt consolidation loan applications, some 3,199 or 82.2 percent were approved.

“The credit environment in The Bahamas is still very soft, and that is really just an accumulation of experiences up to this point,” Mr Rolle said yesterday. He did not identify what he meant

by “experiences”, although this is likely a reference to the banking industry’s woes in the aftermath of the 20082009 financial crisis when the sector’s total loan arrears peaked at $1.2bn.

Mortgage lending continues to be relatively weaker than its consumer and commercial lending counterparts. Total mortgage applications for the 2023 second half, numbering 785, were 14.4 percent down on the 917 received during the same period in 2022, and also some 28.9 percent below the 1,104 submitted during the 2023 first half.

However, the 2023 second half applications appear to have been of better quality. Some 415, or 52.9 percent, of those mortgage loan submissions were approved, making for a year-over-year improvement of 19.3 percent in the number that received the go-ahead and a 14.9 percentage point rise in the approval rate.

Similarly, compared to the 2023 first half, the number of approved mortgages over the final six months of 2023 jumped by 16.6 percent while there was a 20.6 percentage point improvement in the approval rate. Mr Rolle signalled that a healthier, more vibrant mortgage market is key to driving greater activity in industries such as real

estate, construction and the legal profession.

“Residential mortgage applications contracted by 14.6 percent year-on-year, a slowdown from the 21.6 percent decline in December 2022. Reductions were recorded for all three major categories: New construction (27.3 percent), existing dwellings (12.7 percent) and rehabilitations and additions (8.5 percent),” the Central Bank survey said.

“Of the applications received, financing sought against rehabilitations and additions constituted 43.9 percent of requests, while existing residential dwellings and mortgages for new construction represented 34.1 percent and 21 percent, respectively. Moreover, commercial financing applications accounted for just 1 percent of mortgage demand.

“Disaggregated by island, the analysis showed a retrenchment in mortgage applications processed over the review period. In particular, requests in New Providence fell by 15.1 percent and in the Family Islands by 13.9 percent Likewise, demand reduced in Grand Bahama by 5.9 percent,” the Central Bank continued.

“Mortgage applications retained the lowest approval rate of all credit categories

Many capital markets observers believe FOCOL Holdings has been some what coy about all the growth opportunities it may be pursuing.

Mr Adderley previously told this newspaper that a portion of the raised capital will be devoted to financing upgrades of its retail gas station network, the acquisition of at least two ships to its fleet and renewable energy investments. FOCOL Holdings is likely to have participated

in both the Government’s recent New Providence and Family Island solar energy tenders, either by itself or as part of a consortium.

However, many feel its biggest prize may be participation in a joint venture with Shell North America to take over the management and operation of Bahamas Power & Light’s (BPL) New Providence generation assets via an outsourcing type of public-private partnership (PPP) arrangement. Multiple sources continue to assert FOCOL has a role

free of charge, and do not require a wait time," Mr Woods added.

BTC said it is continuing “drive tests” across The Bahamas and identifying areas for improvement. The carrier added that it has made many alterations, and conducted upgrades, to several towers in its network. New towers have also been erected in the Gladstone Road and Venice Bay

at 52.9 percent over the last half of 2023. The approval rate for renovation projects was 14.5 percent, while new construction approvals were 69.1 percent. Meanwhile, 92.5 percent of requested borrowings against existing dwellings were approved.”

Mr Rolle yesterday said eliminating the requirement for borrowers to take out mortgage indemnity insurance will enable Bahamian commercial banks to extend credit to a pool of borrowers who might otherwise have been “pushed over the limits of affordability” given the extra debt servicing burden this represented. However, he warned that the impact will be felt over the medium term and not “one year from now’.

“The primary reason cited for mortgage application denials [in] 61.9 percent of instances was various ‘miscellaneous’ factors,” the Central Bank said, describing these as issues such as “low credit scores, lending outside of bank policy and missing information”.

“Other reasons mentioned included underemployment (15.9 percent), delinquency in prior loans (7.9 percent), higher debt service ratios which exceeded the revised threshold of 50 percent (6.4 percent), insufficient time on the job (4.8 percent) and inadequate collateral (3.2 percent),” the regulator added.

As for consumer loans, which accounted for 92 percent of all credit applications in the 2023 second half, the Central Bank continued: “Of the 15,101 consumer

the option to further subscribe in further increments of $10,000. The first dividend payment to investors will occur on October 31, 2024, and they will be paid every April and October until April 30, 2039.

- possibly in the supply of liquefied natural gas (LNG) fuel.

Colina Financial Advisors (CFAL), which acted as FOCOL Holdings’ financial advisor and placement agent, yesterday confirmed that the $40m preference share issue was oversubscribed by $5m to take the total raise to $45m.

The preference shares were price with a 6.25 percent interest coupon and are due to mature on April 30, 2039. The minimum investment required to participate was $50,000 with

By CLAIRE RUSH and GENE JOHNSON Associated PressONE of the winners of a $1.3 billion Powerball jackpot this month is an immigrant from Laos who has had cancer for eight years and had his latest chemotherapy treatment last week.

Cheng "Charlie" Saephan, 46, of Portland, told a news conference held by the Oregon Lottery on Monday that he and his 37-year-old wife, Duanpen, are taking half the money, and the rest is going to a friend, Laiza

communities to address capacity needs. Mr Woods added: “Our Family Islands are a priority for us, and we are currently evaluating a new solution to provide enhanced mobile and broadband connectivity. The results thus far have shown that we can deliver reliable and faster next generation services. I am eager and excited about this, and I will share more very soon.”

loan applications received, uses were largely for consolidation of debt (24.1 percent), ‘other’ miscellaneous purposes (23.5% percent), credit cards (18.1 percent) and travel (12.8 percent).

“Analysis by component revealed that the number of financing requests advanced for debt consolidation by 69.2 percent and commercial vehicles by 68.7% percent. Similarly, applications increased for private cars (13.9 percent) and land purchases (13.1 percent).

“Conversely, applications declined for taxis and rented cars (94.4 percent), home improvements (24.9 percent), travel (24 percent), education (15.9 percent), furnishings and appliances (14.7 percent), medical (9 percent), ‘other’ miscellaneous purposes (3 percent) and credit cards (2.9 percent),” the regulator continued.

“Coinciding with the rise in requests, the number of approved loan applications increased by 4.5 percent relative to the previous year. Likewise, the average approval rate edged up by 0.7 percentage points to 83.9 percent.

“With regard to loan denials, reasons commonly noted by banks were other ‘miscellaneous’ factors (46.8 percent), inclusive of low credit scores, purposes outside of banks’ policy and low risk rating. Other reasons stated were high debt service ratios (22.8 percent), insufficient time on job (7.5 percent) and underemployment (6.4 percent).”

performance represents a return to the company’s pre-pandemic level of earnings combined with early signs of growth across various business segments.

FOCOL Holdings is forecasting that profits will grow by more than $8m over the next three years, increasing from last year’s $32.621m to $40.833m by 2026. Profit for the current 2024 year is forecast at $34.026m, and for 2025 at $37.226m.

“Net income for the year ended September 30, 2023, was $32.6m compared to $21.4m in the prior year, representing an increase of $11.2m or 52 percent,” the company said in its recent rights offering prospectus. “FOCOL’s 2023

Chao, 55, of the Portland suburb of Milwaukie. Chao had chipped in $100 to buy a batch of tickets with them. They are taking a lump sum payment, $422 million after taxes.

"I will be able to provide for my family and my health," he said, adding that he'd "find a good doctor for myself." Saephan, who has two young children, said that as a cancer patient, he wondered, "How am I going to have time to spend all of this money? How long will I live?"

After they bought the shared tickets, Chao sent

“The combination of a rebound in the local economy and early results from new investments initiatives contributed to the steady upward trend in the company’s overall performance... Investments in fixed assets were made to strengthen the company’s infrastructure in the wholesale and retail business segments. Additional investments were made in power generation assets during the year.”

a photo of the tickets to Saephan and said, "We're billionaires." It was a joke before the actual drawing, he said, but the next day they won. Chao, 55, was on her way to work when Saephan called her with the news: "You don't have to go anymore," he said. Saephan said he was born in Laos and moved to Thailand in 1987, before immigrating to the U.S. in 1994. He wore a sash at the news conference identifying himself as Iu Mien, a southeast Asian ethnic group with roots in southern China.

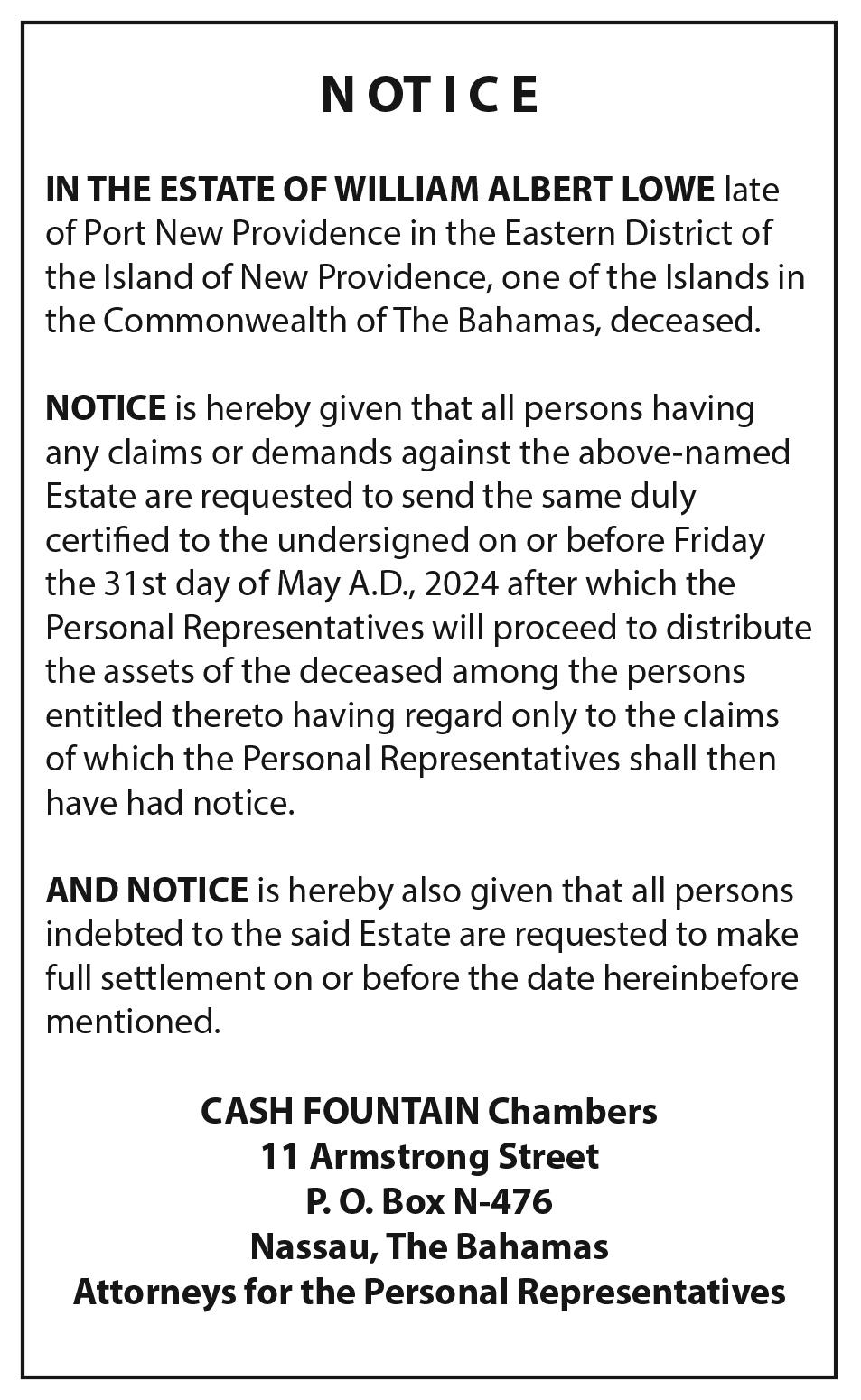

IN THE ESTATE OF MARIANTHI BERDANIS late of Watercolour Cay No. 28

Sandyport Subdivision, Western District, New Providence, The Bahamas, deceased NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certified in writing to the Undersigned on or before 10 May, 2024 after which date the Executors will proceed to distribute the assets having regard only to the claims of which the Executors shall then have had notice and will not, as respect to the property so distributed, be liable to any person of whose claim the Executors shall not then have had notice AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date herein before mentioned.

KING & CO., Attorneys for the Executors

Olde Towne Marina, 2nd Floor, Sandy Port, Nassau, Bahamas.

(Attention: Monique R. Cartwright)

THE deputy prime minister yesterday said Carnival Cruise Lines has agreed to cease the "sensationalised" crime alerts it was issuing to its passengers about Grand Bahama.

Chester Cooper, also minister of tourism, investments and aviation, told the House of Assembly that the cruise line's stance has changed after he communicated with its executives.

He said: “I should point out that we have been in active engagement with the cruise partners to adjust these advisories, and we are making progress.

“I am happy to tell you that after the complaints on social media of the guests in Freeport, we have engaged the top executives of Carnival Cruise Lines and have

been effective in having them discontinue the sensationalised advisory that they were using in Freeport. “

A video, widely circulated on social media last month, captured an alleged group of Carnival cruise line passengers sharing warnings they received about the alleged crime-related dangers of disembarking in Grand Bahama.

One visitor said passengers were afraid to leave the ship after being warned by crew that “people are being robbed and drugged and raped and murdered”. She said: “Same thing from all the cruise lines is people are being robbed and drugged and raped and murdered, so all the tourists are scared. That’s exactly what they are saying.

“It’s even on our paper... don’t bring no jewellery, no purses, no money... Carnival was even giving people money back because

they didn’t want to go on excursions.”

During his House of Assembly contribution yesterday, Mr Cooper said the Tourism Development Centre (TDC) is working with financial institutions to provide cost-effective merchant services that vendors can use to accept digital payments since cruise passengers are warned to not carry cash.

He said: “The TDC is already working with banks and money service providers to provide cost effective merchant services solutions in markets that are accessible by even the smallest vendors, like straw vendors and hair braiders.

"This initiative is set to increase the convenience and security of transactions for tourists, encouraging more spending and benefiting the broader economy. We have heard the stories of cruise lines encouraging tourists not to bring cash

THE Deputy Prime Minister yesterday said Immigration Act reforms will have a "big impact on the way we welcome our guests" by placing the arrivals process online or on an app.

Chester Cooper, also minister of tourism, investments and aviation, told the House of Assembly that digitising thus process will enable The Bahamas to eliminate the paper Immigration card. He added that the move will speed up Immigration lines at ports of entry.

“This digital adaptation of the traditional card marks a significant leap towards modernising the

entry process into our islands," Mr Cooper said.

"As you know, the Immigration card was a paper document filled out by each visitor upon arrival. This change will result in faster processing in Immigration, speeding up the lines with more convenience and better welcoming service for our guests.

“The transition to a digital format involved extensive collaboration between technology providers, Immigration officials and tourism stakeholders to create a seamless and userfriendly online system.”

Mr Cooper explained that collecting the data digitally will result in less errors, while the information gathered can be used to ensure accurate arrivals statistics and visitor analytics.

He said: “Digital submission allows for real-time data capture, which is more accurate and less prone to the errors often associated with manual data entry. This digitisation will also dramatically reduce costs involved with purchasing the cards as well as scanning them into the system for analysis.

“We have all heard stories of boxes of these Immigration cards sitting around airports. This precision is crucial for maintaining upto-date statistics on visitor numbers and demographics on a real-time basis. With advanced cyber security measures in place, visitors' data is securely processed and stored, providing reassurance about the protection of personal information.

“The accurate data collected provides invaluable insights into visitor preferences and behaviours, enabling targeted marketing campaigns and strategic planning. Tourism authorities can better manage and forecast visitor flows, which is essential for resource allocation and enhancing the visitor experience across the islands and improving return on investments in marketing spend.”

Mr Cooper said the digital move will allow tourism stakeholders to implement new avenues of visitor interaction such as digital permits, targeted promotions and site ticketing, which will improve visitor spend.

He said: “The success of the Digital Immigration Card opens the possibility

for digital transformation across other areas of visitor interaction, such as digital permits, personalised recommendations, targeted promotions and ticketing for attractions, hopefully improving overall spending. That will be another big win for Bahamian vendors.

“The aggregated data collected over time aids in understanding broader trends and patterns, which is vital for long-term strategic planning and development. Insights from survey data help in refining the tourism products and services offered, ensuring they meet the evolving needs and preferences of visitors.

"The data also facilitates more effective collaboration between various stakeholders in the tourism sector, including

SEOUL, South Korea

Associated Press

SAMSUNG Electronics on Tuesday reported a 10-fold increase in operating profit for the last quarter as the expansion of artificial intelligence technologies drives a rebound in the markets for computer memory chips.

The South Korean semiconductor and smartphone giant said its operating profit for the Jan-March quarter came in at 6.6 trillion won ($4.8 billion), up from the 640 billion won ($465 million) it earned during the same period last year.

Revenue rose by nearly 13% to 71.9 trillion won ($52 billion), driven by higher prices for memory chips and robust sales of its flagship Galaxy S24

smartphones, the company said.

The company earned 1.91 trillion won ($1.38 billion) in operating profit from its semiconductor business, marking the division's first quarterly profit since the fourth quarter of 2022, as the chip market continues to recover from a cyclical slump deepened by the COVID-19 pandemic and global trade tensions.

Samsung projected the memory chip market to remain strong in the coming months, driven by the expansion of generative AI technologies, which is increasing the demand for both conventional chips used in servers and advanced chips designed to process AI, including high-bandwidth memory, or HBM.

Responding to higher demands for AI chips, Samsung said it started this month the mass production of its latest HBM chips, called 8-layer HBM3E, and that it plans to start

producing the 12-layer version of the chips during the second quarter.

"In the second half of 2024, business conditions are expected to remain positive with demand

— mainly around generative AI — holding strong, despite continued volatility relating to macroeconomic trends and geopolitical issues," Samsung said in a statement.

onshore. Therefore, these initiatives will result in an increase in visitor spending, notwithstanding.”

Mr Cooper added: “Our focus is on harnessing technology's power to propel tourism growth, and cultivate a thriving ecosystem of innovation and entrepreneurship through initiatives such as the Tourism Development Corporation (TDC) and Innovate242.

“Empowering entrepreneurs through the TDC and Innovate242 in tourism is intricately linked to entrepreneurial spirit. Recognising this, we have launched initiatives like Innovate242 to support and empower local entrepreneurs who are essential to the diversification and resilience of our tourism sector. So, by launching more tech tourism opportunities we are leveraging opportunities in tourism for tech entrepreneurs.”

hoteliers, tour operators and local businesses, to create a cohesive and attractive tourism package. We are exploring partnerships with international tourism and data analysis firms to benchmark our data and align our offerings with global best practices.” He added that next quarter wi-fi will be provided to visitors in Downtown Nassau and at the Nassau Cruise Port via the ‘Smart City’ initiative. He said: “Another testament to our commitment to innovation is the evolution of Downtown Nassau and the Nassau Cruise Port into a 'Smart City’. This pilot programme, launching next quarter, providing ubiquitous Wi-Fi access, enables visitors to share their experiences in real-time, significantly enhancing user-generated content that promotes our locale.”

For smartphones, the company will continue to focus on boosting the sales of its flagship device, Galaxy S24, which is built with an array of new features enabled by AI, including live translation during phone calls in 13 languages and 17 dialects.

I wouldn’t be too precise in terms of where we think they will finally settle other than to say we think it will be moderately below where we began the year” at $2.351bn.

Earlier, with the postCOVID reflation complete, Mr Rolle confirmed that the Bahamian economy grew at a “more moderated” pace in the 2024 first quarter.

“Growth is is projected to continue in the mediumterm, but more in line with

potential that is slightly less than 2 percent per annum,” he added.

“Turning to tourism, the indications are that earnings growth tempered during the first quarter. This was as expected since visitor arrivals had already regained and surpassed prepandemic levels. Although hotel room capacity was more constraining in the stopover sector, healthy average pricing increases were still evident for accommodations, helping

to support the inflow boost.”

As for the foreign exchange markets, Mr Rolle said “the evidence of moderation was also evident. Over the first quarter of the year, commercial banks’ total foreign currency purchases from the private sector rose by 5.4 percent year-over-year, slowing from the 9.2 percent rate of expansion during the first quarter of 2023.

“In the meantime, private sector foreign currency

demand contracted slightly, mainly due to a lower volume of portfolio investments and decreased payments for goods imports. On net basis, there was consequently a larger seasonal boost to the external reserves through the private sector than in 2023,” he added.

“The public sector’s debt operations were also a seasonal net contributor to the external reserves in the first quarter of 2024, as compared to a net drawdown on the external balances

in 2023. This was because some foreign currency borrowing over the quarter helped reduce short-term domestic debt that was accumulated in the first half of the fiscal year.”

Looking ahead to the rest of 2024, Mr Rolle said: “The economy is expected to continue to expand in 2024, but more eased, in line with its true potential as the postpandemic stage of recovery is over. Nevertheless, this stage of the expansion also features fully recovered foreign exchange markets, and

therefore continued healthy evolution of the external reserves.

“The outlook will also generate continued employment, especially in tourism and in construction-related foreign investments, and further fiscal consolidation from uplift to government revenues. The bank’s monetary policy posture will continue to accommodate faster credit expansion, but with caution remaining to the downside economic risks.”

NHTSA would conduct random tests to determine whether automakers are meeting the standards.

By TOM KRISHER AP Auto WriterIN the not-too-distant future, automatic emergency braking will have to come standard on all new passenger vehicles in the United States, a requirement that the government says will save hundreds of lives and prevent thousands of injuries every year.

The National Highway Traffic Safety Administration unveiled the final version of the new regulation on Monday and called it the most significant safety rule in the past two decades. It's designed to prevent many rear-end and pedestrian collisions and reduce the roughly 40,000 traffic deaths that happen each year.

"We're living through a crisis in roadway deaths," Transportation Secretary Pete Buttigieg said in an interview. "So we need to do something about it."

It's the U.S. government's first attempt to regulate automated driving functions and is likely to help curb some of the problems that have surfaced

with driver-assist and fully automated driving systems.

Although about 90% of new vehicles have the automatic braking standard now under a voluntary agreement with automakers, at present there are no performance requirements, so some systems are may not be that effective. The new regulations set standards for vehicles to automatically stop and avoid hitting other vehicles or pedestrians, even at night.

"Part of how I think we're going to turn the corner on the unacceptable level of roadway deaths that we just

IN THE ESTATE OF MICHAEL MERVIN KEMP late of Tower Heights off Eastern Road in the Eastern District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas. Deceased.

NOTICE is hereby given that all persons having any claims against the above-named Estate are required on or before the 15th day of May A. D., 2024 to send their names and addresses and particulars of their debts or claims to the undersigned in writing or in default thereof they will be excluded from the benefit of any distribution AND all persons indebted to the said Estate are hereby requested to pay their respective debts to the undersigned on or before the date above mentioned.

AND NOTICE is hereby also given that at the expiration of the time period above mentioned, the assets of the late MICHAEL MERVIN KEMP will be distributed among the persons entitled thereto having regard only to the claims of which the Executors shall then have had notice in writing.

Dated this 16th day of April A. D. 2024

Roberts, Isaacs & Ward, Unit No.2, Cable Beach Court Professional Centre, 400 West Bay Street, Nassau, Bahamas

lived with for my entire lifetime is through these kinds of technologies," said Buttigieg, who is 42. "We need to make sure we set high performance standards."

The regulation, which will require additional engineering to bolster software and possibly add hardware such as radar, won't go into effect for more than five years. That will give automakers time to bolster their systems during the normal model update cycle, NHTSA said.

It also will drive up prices, which NHTSA estimates at $354 million per

year in 2020 dollars, or $82 per vehicle. But Buttigieg said it will save 362 lives per year, prevent about 24,000 injuries and save billions in property damage.

Critics say the standards should have come sooner, and that they don't appear to require that the systems spot people on bicycles, scooters or other vulnerable people.

The new rule requires all passenger vehicles weighing 10,000 pounds (4,500 kilograms) or less to have forward collision warning, automatic emergency

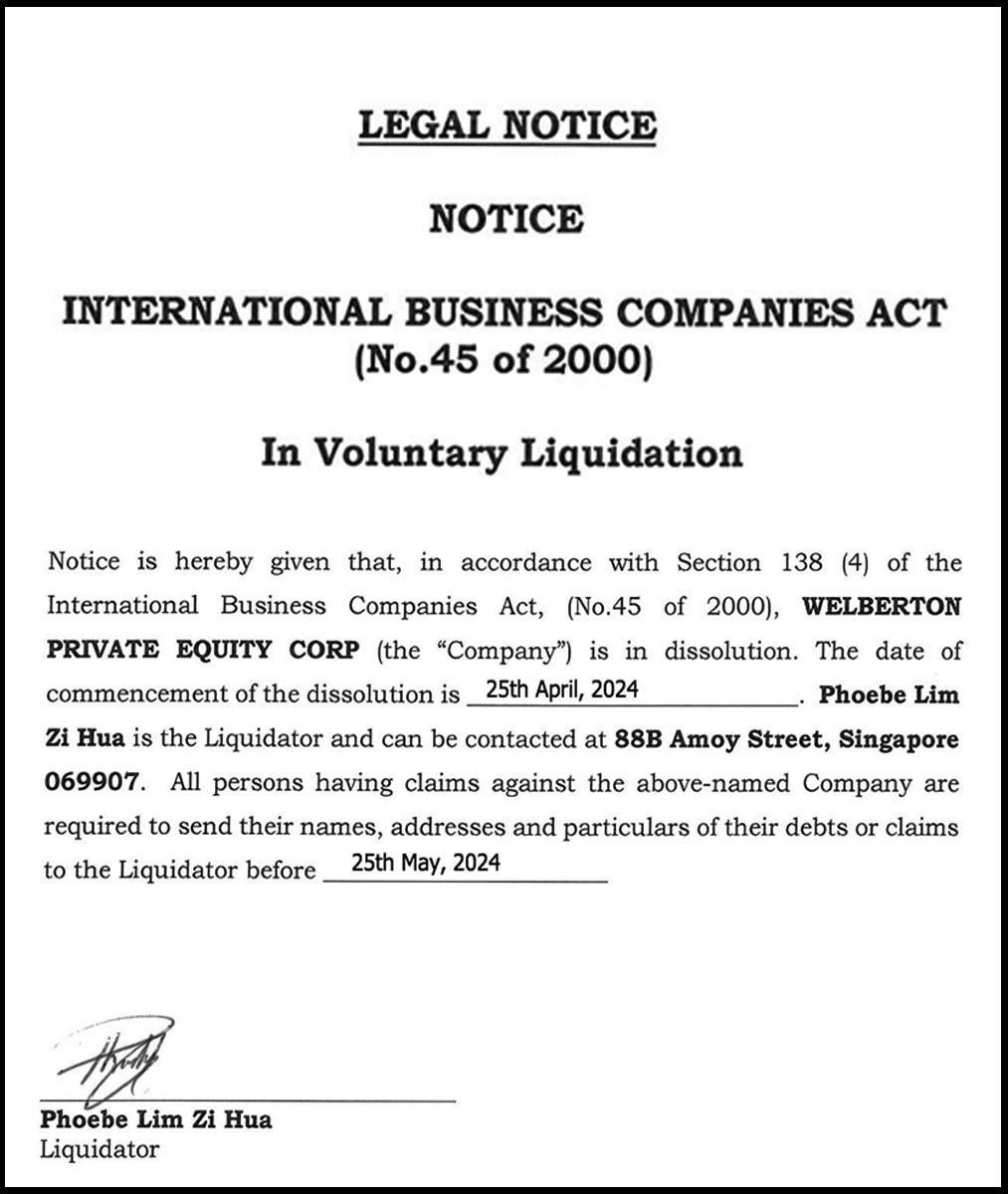

International Business Companies Act (No. 45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), APPALOOSA LIMITED (the “Company”) is in dissolution. The date of commencement of the dissolution is 25th April, 2024 CONTINENTAL LIQUIDATORS INC. is the Liquidator and can be contacted at New Horizon Building, Ground Floor, 3 1/2 Miles Philip S. W. Godson Highway, Belize City, Belize. All persons having claims against the above-named company are required to mail and email their names, addresses and particulars of their debts or claims to the Liquidator before 27th May, 2024

CONTINENTAL LIQUIDATORS INC. Liquidator

braking and pedestrian detection braking.

The standards require vehicles to stop and avoid hitting a vehicle in front of them at speeds up to 62 miles per hour (100 kilometers per hour). Also they must apply the brakes automatically at up to 90 mph (145 kph) if a collision with vehicle ahead is imminent.

The systems also have to spot pedestrians during the day and night, and must stop and avoid a pedestrian at 31 mph to 40 mph (50 kph to 64 kph) depending on the pedestrian's location and movement.

The agency said that in 2019, nearly 2.2 million rear-end crashes were reported to police nationwide, killing 1,798 people and injuring 574,000 others.

Sixty percent of fatal rearend crashes and 73% of injury crashes were on roads with speed limits of 60 mph (97 kph) or below.

In addition, there were 6,272 pedestrians killed in crashes, with 65% of those people being hit by the front of a passenger vehicle.

The vast majority of deaths, injuries and property damage happens at speeds above 25 mph (40 kph), speeds that are not covered by the voluntary agreement, the agency said.

"Only regulation can ensure that all vehicles are equipped with AEB (automatic emergency braking) that meet minimum performance requirements," the regulation says.

The agency said it isn't requiring what type of sensors each automaker must have to meet the requirements. That's up to the automakers. But in testing of 17 vehicles, only one — a 2023 Toyota Corolla equipped with cameras and radar — met the standards.

The regulation said radar would have to be added to about 5% of the systems in order to comply with the requirements.

Cathy Chase, president of Advocates for Highway and Auto Safety, said the new standards will make it clear to car buyers that AEB will work properly. Most consumers, she said, are unaware that there are no requirements in place now.

"By and large, it's better to have AEB than not have AEB," she said. "So once the AEB rule is put into place, once again the federal government will be doing its job and protecting consumers."

NHTSA said it changed its original proposal, giving automakers more than five years to meet the standards instead of three. Chase said shorter would be better.

"The shorter the timeline, the more people are going to be saved, the quicker these are going to get into cars and our roadways are going to be safer for everyone," she said.

Chase said she is not pleased that the rule does not appear to include standards for bicyclists or people using scooters.

infrastructure, procure equipment and enhance services and processes. As a part of our endeavour to provide world-class services we will be continuing and implementing various rates and charges for all general aviation private operators and passengers.”

The principal that the customer/user pays to finance airport upgrades such as those planned in Bimini is well established, with Lynden Pindling International Airport (LPIA) in Nassau a prime example. The fees levied on commercial airline, charters and private aviation, plus their passengers, will be used by the Bimini consortium to both repay the debt financing for the upgrades and generate a return on its investment.

However, the scale and breadth of the fees, coupled with the relatively short notice, has shocked Bimini homeowners who possess private planes as well as other observers. Tribune Business was yesterday told that the negative reaction is such that some are now threatening to sell their properties and/or no longer fly to the island, preferring to take the Balearia ferry instead.

One Bimini home and plane owner, speaking on condition of anonymity, said that prior to May 6 incoming private pilots and operators were faced with paying a $50 Customs processing fee, along with the $29 per passenger departure tax and a security fee that is around $10 per person. While these charges remain, the BADP group is adding a host more.

These include, according to its April 26, 2024, note, separate passenger facility and passenger processing fees. The new passenger facility fee is pegged at $20 for domestic passengers, and due to increase to $25 per person come June 1, 2025, while that for international passengers has been set at $40 per head and is set to rise to $45 next year.

As for the passenger facility fee, that will start at $5 for domestic and $10 for international passengers, rising to $6 and $12 per head, respectively, in 2025. There is also a $1 per head “passenger levy”, plus a new $25 “pent handling fee” that will rise to $25.50 in 2025.

Governor:

BADP’s notice also sets out a variety of landing, terminal and aircraft parking fees that it plans to charge. The landing fees, set to be based on the type of plane involved and its weight, start within a range of $20 to $115 before increasing to between $30 to $135 next year. Terminal fees, meanwhile, which are based on aircraft seat capacity and turn, start at between $14.76 to $51.67, and rise to $15.20 and $53.22 in 2025.

Aircraft parking fees are to be determined by length of stay, with the daily “tie down” rate set at $30. This latter price is particularly exercising Bimini homeowners who told Tribune Business that, in the absence of any discount for residents, this would translate into a monthly cost of between $900-$930 if they kept their planes at the airport for so long. And, with 10 percent VAT, the ultimate cost would be $990-$993.

Several homeowners asserted these rates make Bimini extremely uncompetitive when compared to the same fees charged by airports in Florida and Georgia. One referred to a Georgia airport where the parking fee was as low as $25 per month, while those at Fort Lauderdale Executive Airport were said to range from $230 to $325 per month.

Ken Rorabaugh, president of the Royal Palm development in south Bimini, told Tribune Business: “If they enforce these fees I’m going to sell my plane. I can’t afford to keep it here. I’ve got 90 homes in our development, and at least 20 people have private planes. They come in on the weekend. They are still working in Florida and fly in on the weekend.

“Everyone is pretty upset about it. I’m making arrangements to get my plane out of here by this weekend because it’s [May 6] coming up so fast and I don’t want to get stuck with these fees.” Another source, speaking on condition of anonymity, added: “People are furious and feel we’ve been blindsided. There was no input.”

Bimini Airport Development Partners has secured a 30-year lease concession to operate and manage the island’s airport with a commitment to invest over $80m in its transformation.

Mike Schutt, a Bimini Airport Development Partners director, yesterday told Tribune Business that the consortium is “open to dialogue” with the aviation community over the fees and their level. He confirmed that the 2025 fee rises were what it is projecting “at a minimum to keep up with inflation”, and pledged that the revenues will generated will finance the creation of a “safe, secure and quality airport”.

However, when this newspaper mentioned the aviation industry push back over BADP’s planned fees, Mr Schutt said the Government and Airport Authority would be better placed to address the issue. “I think I would defer primarily to the Government and Airport Authority and any primary commentary they may want to provide,” he added.

“What I can say is we’re really focused on making sure the airport in Bimini is a safe and secure environment that is in full compliance with Bahamian and international regulations. We’re trying to make sure we set the airport up to make the capital improvements that are necessary so people fly into a safe and secure environment.

“There’s a fee element that comes with it but that’s all directed into making sure we have a quality and safe and secure place.” Dr Kenneth Romer, The Bahamas’ director of aviation, did not return Tribune Business calls and messages seeking comment before press time on the Bimini fees.

However, Mr Schutt signalled that the charges had been evaluated and benchmarked against those levied at other airports although he did not identify which. He added that this work had been carried out “in conjunction” with the Airport Authority, with the fees and their amount also based on Bimini airport’s specific needs.

“We’re always open to dialogue, and we want to work with our customers in implementing this and make sure we’re delivering that safe, secure and quality airport in the best possible way,” Mr Schutt said of the fees and project. “We understand the folks flying in there are our customers. We’re open to dialogue and collaboration.”

As for the planned fee increases in 2025, Mr Schutt added: “We’ll be evaluating

FROM PAGE B1

value of overseas investments by Bahamians, Mr Rolle replied: “The expectation is that, in the medium-term, if Bahamians are investing vibrantly abroad we shouldn’t be surprised if it’s in the $200m-$300m range annually, and that wouldn’t be a figure that’s unmanageable for us.”

The Governor also revealed that, after discussions with the Attorney General’s Office, the Central Bank had “come around to supporting the idea” that the proposed mobile collateral asset registry should be overseen by the Registrar General’s Department because of the investments and improvements that the latter is making in technology and developing other new registries.

“From a technology point of view, and the efficiencies of using the same platform, there was an opportunity to move in that direction,” Mr Rolle added. The effort to develop a mobile collateral asset registry in The Bahamas is now into its fifth year given that the project was initially unveiled in December 2020.

Its creation would enable businesses and individuals to pledge “moveable assets” as security for bank loans and other forms of credit, such as intellectual property rights, accounts receivables and stocks and other securities, while lenders could record and secure their interest over anything pledged as loan collateral.

“In the meantime, the Government will soon bring finalised legislation for the collateral assets registry to Parliament for enactment.

This will clear the way to implement the registry under the ambit of the Registrar General’s Department alongside other complementary reforms that are being actively targeted for the registrar,” Mr Rolle said.

“So far in 2024, the private sector lending expansion was largely concentrated in commercial credit. However, both consumer loans and mortgages were leaning towards overall growth, as opposed to both being in a contracted state at this point last year.

“In the meantime, the average delinquency rate on loans that were three months or more behind in payments continued to

decline to 6.3 percent in March, more than a full percentage point lower than one year ago,” he added.

“The Central Bank believes that it is important for the delinquency rate to continue to fall, and for the credit bureau to be relied upon to help improve the quality of future lending.

Our near-term objective is to see all important nonbank providers of credit join the credit bureau, both reporting data and making use of the information aggregated by the bureau to guide all of their lending decisions.

“This would include all of the public utilities and lenders licensed by other Bahamian regulators.”

IN THE ESTATE OF EUNICE EMMA GERTRUDE

PYFROM, late of Ridgeland Park West, in the Southern District of the Island of New Providence, one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are requested to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before “13th June, A.D., 2024”, and if required, to prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Administrator shall have had Notice.

AND NOTICE is hereby also given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned. Dated the 16th day of April, A.D., 2024.

NATHANIEL DEAN & Co.

CHAMBERS

Attorneys for the Administrator 55 Rosetta Street, Palmdale New Providence, The Bahamas (A.16, 23, 30)

everything on a yearly basis at a minimum to keep up with inflation so that’s kind of what we’ve anticipated at this point for next year.”

The private aviation market, despite being populated by wealthy individuals and companies, is extremely sensitive to any kind of price changes. Despite having relatively deep pockets, many pilots and plane owners dislike being “nickel-d and dime-d” and, if they perceive or feel a jurisdiction is taking advantage of or exploiting them because of their assumed, they have the freedom to fly elsewhere.

Mr Gardner, the Bahamas flying ambassador, who is also director of CST Flight Services, which provides flight co-ordination and trip support services to the private aviation industry throughout the Caribbean and Latin America, told Tribune Business of the Bimini fees: “I would say it’s the law of supply and demand. I think most general aviation operators will not be pleased.

“They will not understand that, after all the fee increases over the years for airport improvements that never happened, there are going to be more and larger fees. They’re going to wonder why. Because they own their own aircraft they will go to where they feel welcome and, ultimately, the losers will be Bahamians on the island that depend on tourism.

“They will become dependent on the commercial airlines. How do you start charging money without putting a penny down? It’s death by 1,000 cuts.”

Mr Gardner voiced concern that the Bimini fees could be repeated across multiple other Bahamian islands

as the Government seeks private capital/investors to upgrade up to 14 other airports, all of whom will seek to make a return on their investment via user fees.

Another aviation industry source, speaking on condition of anonymity, added: “To charge all those fees before you make any difference in the services you offer is brazen. We knew they were coming. This administration is pushing really hard, but they don’t understand the price sensitivity of absolutely everything.

“All they think of aviation is if you can afford a plane you can afford this. The straw is beginning to break the camel’s back. They’re doing what they did to the yachting industry. Death by 1,000 cuts. My number one problem is that they’ve given people nine days’ notice before this starts. And you’ve got six days to process this.”

Airlines will now have trouble going back to customers for more money to meet these fees when it comes to travel pre-sold for after May 6. “I feel like it’s a systematic take down bit by bit by fees,” the source added. “We don’t have the product to keep people coming back and charging more.”

Mr Schutt, meanwhile, added that “preliminary work” has already started at Bimini airport, and the consortium plans to “ramp up” and make “good progress” in May and June after its first shipment of construction materials arrived on island last week.

Reaffirming that first phase construction involves a $30m investment, and is scheduled to be completed in 12 months, Mr Schutt

said: “There’s improvements around the runway, navigational lights, safety and security improvements, the expansion of the apron to accommodate more and larger planes, and a significant expansion of the terminal building.”

Pledging that the works will generate “significant” construction employment that will be “substantially” Bahamian, he added: “It will be a more comfortable and better experience for passengers coming into Bimini and The Bahamas through that airport and exiting through that airport.

“For tourism and the economy on Bimini the benefits will be substantial because, once we make those improvements, it will allow us to add international direct flights to Bimini. We’ve started conversations with the airlines about that, and we expect significant growth in tourists coming into Bimini over the years.

“There’s a lot of interest. There’s currently some significant kind of threshold elements that we need to resolve for US and Canadian-based airlines to be willing to fly here with larger planes. By addressing those items we will really unlock capacity that does not exist today.” Mr Schutt declined to identify the “items” he was referring to.

Bimini Airport Development Partners is owned by Phoenix Infrastructure, a US-based infrastructure advisory and investment firm with offices in Washington D.C and New York, and Plenary Group, another US infrastructure group. An airport and fixed-base FBO operator called Avports will be the Bimini airport’s management and operating partner.

The successful candidate will have the opportunity to use their experience in accounting and taxation to provide compliance and consulting services to partners from various jurisdictions, corporations and individual clients. The incumbent must be experienced with the tax consulting process and have the professionalism necessary for the effective diagnosis, development, and implementation of solutions for our clients’ tax needs. They will be responsible for a portfolio of clients on a day-today basis which will include planning, management of the team including review of work, liaison with key client staff and the management of the reporting process.

Essential Functions:

• Manage a portfolio of clients including planning, budgeting, WIP management, management of the team, allocation of resources, reviewing subordinates’ work and reporting

• Organize and execute client engagements while acting as a trusted business advisor and subject matter expert

• Provide superior consultative tax advice to help our clients achieve tax savings by pursuing creative tax strategies

• Conduct research and utilize analytical skills to enable fact-based decision making and to assist with the drafting of complex, well-structured communications in accordance with standard policies and procedures

• Supervise assignments of the tax team in both the local office and across the region as necessary

• Liaise with Deloitte colleagues from around the world to meet the needs of our clients

• Focus on managing the practice to include budgeting, profitability, strategy, developing capabilities, recruitment, training, competitor analysis and managing quality and risk

Minimum Qualifications and Experience:

• Bachelors in Accounting, Finance or related field with strong academic credentials

• Internationally recognized professional accounting or legal qualification

required: CPA, CA, ACCA, JD/LLM

• At least 4-5 years’ experience in a relevant tax practice including extensive technical and strong in-charge experience; at least 4 years’ experience at a

Senior Associate level

• Demonstrates potential for the development of new business

At Deloitte, in order to be an undisputed leader in professional services, we commit to:

• Providing our people with a supportive culture, rooted in our shared values and driven by our purpose, to make an impact that matters.

• Promoting a culture of inclusion, collaboration, well-being, and learning and development.

• Providing an equitable and transparent performance and career management experience.

• Providing increased agility and flexibility within our hybrid working model and opportunities for mobility across projects, businesses, and borders.

• Offering a competitive total compensation and rewards package along with a variety of benefits and programs to support you and your family’s needs including our well-being subsidy, paid leave, and YouTime.

We know we’re at our best when we look out for one another; prioritize respect, fairness, development, and well-being; foster an inclusive culture and embrace diversity in all forms. All qualified applicants will receive consideration for employment regardless of their background, experience, ability or thinking style. The preferred candidate will be subject to background screening by Deloitte. All applications should be submitted online at: https://talentsourcing.deloitte.com/cbcapply.

Talent Deloitte Ltd.

2nd Terrace West

Centreville Nassau N-7120

Bahamas

Telephone: (242) 302 4800

U.S. stocks ticked higher Monday to begin a week packed with potentially market-moving reports.

The S&P 500 rose 16.21 points, or 0.3%, to 5,116.17, coming off its best week since November. The Dow Jones Industrial Average added 146.43, or 0.4%, to 38,386.09, and the Nasdaq composite gained 55.18, or 0.3%, to 15,983.08.

This week will see about a third of all the companies in the S&P 500 reporting how much profit they made during the first three months of the year. That includes such heavyweights as Amazon and Apple. So far reports have largely been better than expected, with roughly half the S&P 500's reports in, highlighted last week by Alphabet, Microsoft and others.

Domino's Pizza added to the pile Monday, reporting stronger-than-expected results thanks to a second straight quarter of rising orders for deliveries and carryout. Its stock steamed 5.6% higher.

Tesla was also a big force pushing upward on the market and jumped 15.3%.

Its CEO, Elon Musk, met with a high-ranking Chinese official as it tries to rev up sales in the world's largest automobile market.

On the losing end was SoFi Technologies, which fell 10.5%. The financial services company reported better results for the latest quarter than analysts expected, but its forecast for net income in the current quarter fell short.

Solid earnings reports last week helped the S&P 500 rally to its first winning week in four. The companies in the index look to be on track to report a third straight quarter of growth in earnings per share, according to FactSet.

The stock market will need such strength to steady it following a shaky April.

The S&P 500 fell as much as 5.5% during the month as signals of stubbornly high inflation forced traders to ratchet back expectations for when the Federal Reserve could begin easing interest rates.

After coming into the year forecasting six or more cuts to rates during 2024, traders are now placing many bets on just one, according to data from CME Group.

When the Federal Reserve announces its latest policy decision on Wednesday, no one expects it to move its main interest rate, which is sitting at its highest level since 2001. Instead, the hope is that the central bank could offer some clues about when the first cut to rates could come.

This week's Fed meeting won't include the publication of forecasts by Fed officials about where they see rates heading in upcoming years. The last such set of forecasts, released in March, showed the typical Fed official at the time was penciling in three cuts for 2024.

But Fed Chair Jerome Powell could offer more color in his press conference following the central bank's decision. He suggested earlier this month that rates may stay high for longer because the Fed is waiting for more evidence that inflation is heading sustainably down toward its 2% target.

A report hitting Wall Street on Friday could shift policy makers' outlook even more. Economists expect Friday's jobs report to show that hiring by U.S. employers cooled in April and that growth in workers' wages held relatively steady.

The hope on Wall Street is that the job market will remain strong enough to help the economy avoid a recession but not so strong that it feeds upward pressure into inflation.

Because inflation has been hotter than forecast and because the economy has remained so resilient, economists at BNP Paribas recently pushed out their forecast for the Fed's first rate cut.

They had been forecasting a July move, but they said punting to September may prove to be uncomfortably close to the U.S. presidential election in November. So they're now calling for the Fed to make its first cut in December.

Skipping September would not only help the Fed avoid looking like it's trying to affect the election's outcome, it would also give the Fed the chance to see if the election results in significant changes to policy that affect where the economy and inflation are heading, according to the BNP Paribas team, led by Andy Schneider.

"Even if the economy evolves so as to justify a cut by September, we think these risks likely outweigh whatever marginal economic benefits might come from" cutting just ahead of the election, they said. In markets abroad, Japan's stock market was closed for a holiday. But the Japanese yen continued to swing sharply after falling back to where it was against the U.S. dollar in 1990.

In other markets, stock indexes rose across much of Asia while remaining mixed in Europe.

In the bond market, the yield on the 10-year Treasury eased to 4.61% from 4.67% late Friday.

To the Shareholders of EQUITY BANK BAHAMAS LIMITED

Opinion

T: +1 (242) 322-7516 F: +1 (242) 322-7517

info@bakertilly.bs www.bakertilly.bs

We have audited the consolidated fina ncial statements of Equity Bank Bahamas Limited and its subsidiaries (“the Group”), which comprise the consolidated statement of financial position as at 31 December 2023, and the consolidated statements of comprehensive income, changes in equity and cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Group as at 31 December 2023, and its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (“IFRS”).

Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (“ISAs”). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants (“IESBA Code”), and we have fulfilled our other responsibilities in accordance with the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Responsibilities of Management and Those Charged wi th Governance for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRS, and for such internal controls as management determines are necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statem ents, management is responsible for assessing the Group’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Group’s financial reporting process.

To the Shareholders of EQUITY BANK BAHAMAS LIMITED Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can aris e from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with ISA, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal controls.

Obtain an understanding of internal controls relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal controls.

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Group to cease to continue as a going concern.

Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

To the Shareholders of EQUITY BANK BAHAMAS LIMITED

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements (continued)

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal controls that we identify during our audit.