BAHAMIAN tax authorities yesterday asserted they have “learned from our mistakes” as it emerged companies with outstanding bills are only being issued with tax compliance certificates valid for one month.

Dexter Fernander, the Department of Inland Revenue’s (DIR) operations manager, told Tribune Business it has seen too many instances where “bush crack, man gone” and it will no longer issue tax compliance certificates (TCCs) for extended periods of time to companies that owe due taxes to the Public Treasury.

Speaking after businesses complained that the onemonth TCC, which they need to clear imports through Customs, conduct other business with the Government and access essential public services simply means “more bureaucracy and red tape’, he added that lenient approach towards tax dodgers and defaulters has simply not worked. Mr Fernander told this newspaper that previous experience, when TCCs valid for three months were issued to tax delinquent companies, had been that many simply did not follow through on paying their obligations or complying with payment plans. As a result, the Department of Inland Revenue has been left with little choice but to intensify its crackdown and tighten the enforcement net.

“There’s two reasons why someone will only get it for one month,” Mr Fernander explained. “If you got it for one month, that means you have outstanding taxes with one of the regulators; that there is either an outstanding obligation they owe to another of the agencies or they are on a payment plan. If someone is on a payment plan that [the TCC] is issued for one month.

“Do you have some outstanding obligations with Customs, Immigration or NIB? It may be that they come back and say they are

Minister’s $185k CARIFTA ‘surplus’ came from 360% subsidy overshoot

HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

waiting for some type of payment plan or we are awaiting payment. If

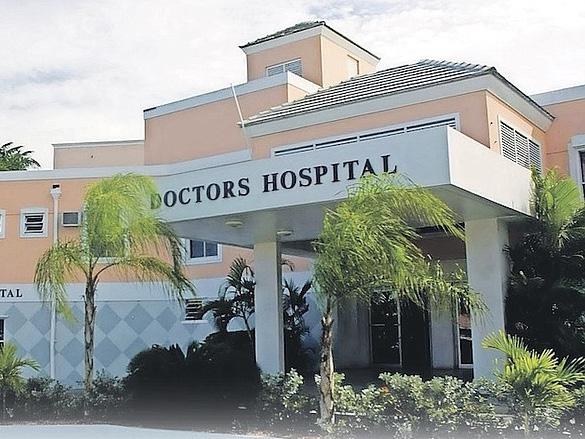

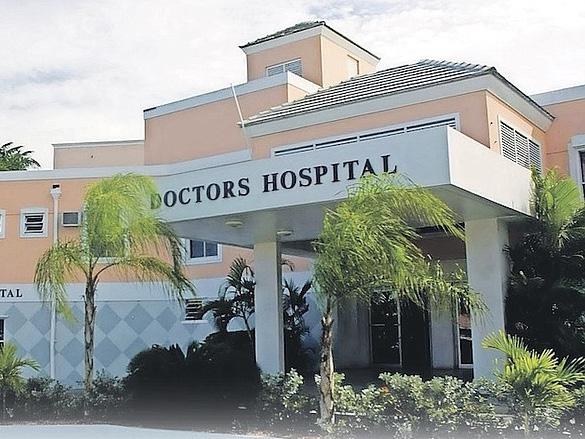

Doctors Hospital targets $10m acquisition boost

DOCTORS Hospital yesterday predicted annual revenues will increase by $10m through its acquisition of The Kidney Centre in a deal that will make its workforce more than 1,000-strong.

Dennis Deveaux, the BISX-listed healthcare provider’s chief financial officer, told Tribune Business there will be no cuts to the dialysis and renal disease treatment provider’s 74 staff with the business set to operate as a fully-owned Doctors Hospital subsidiary. While declining to divulge both the purchase price and projected impact on Doctor’s Hospital’s annual profitability, he added that The Kidney Centre “falls comfortably” within the three-five times’ earnings before interest, taxation, depreciation and amortisation (EBITDA) “range” that it typically targets when making acquisitions.

Affirming that the deal’s financing was debtfree, as is The Kidney Centre, Mr Deveaux told this newspaper that the addition of its employees to Doctors Hospital’s workforce will now take the latter’s annual payroll beyond $40m.

business@tribunemedia.net THURSDAY, APRIL 25, 2024

Tribune Business

nhartnell@tribunemedia.net GBPA seeks to reassure on on ‘unfortunate public noise’ THE Grand Bahama Port Authority (GBPA) last night moved to reassure its licensees and potential investors over “the very unfortunate public noise” created by its $357m dispute with the Government. Freeport’s quasi-governmental regulator, in a statement, said it was responding to increasing concerns that the battle with the Governmentwhich appears to be headed to arbitration proceedings - will distract it from running Freeport and seeking to attract fresh investment to the city. “We would like to reassure our licensees, the residents of Grand Bahama and current and prospective investors that the GBPA has not been distracted by this. We remain keenly focused on delivering the $2bn-plus of investments currently being executed for the benefit of the Grand Bahama economy,” the GBPA said. “Through its affiliates, the GBPA group of companies has initiated, is invested in or is contractually involved in creating these new investments, and was instrumental in bringing the investors to the table.” That will likely to disputed by the Government, which By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B2 THE GOVERNMENT yesterday unveiled a major overhaul of the country’s energy regulatory regime to provide a platform for rescuing Bahamas Power & Light (BPL) from its $1bn debt and investment hole. Jobeth Coleby-Davis, minister of energy and transport, tabled a new Electricity Bill that will facilitate BPL outsourcing “functions and assets” to subsidiaries that it wholly or partially owns along with a Natural Gas Bill that introduces an oversight regime for BPL’s planned switch to cleaner, more sustainable and potentially cheaper liquefied natural gas (LNG) for electricity generation. Both Bills are set to be debated in Parliament next week, with well-placed Tribune Business sources suggesting the Government wants the legislation Gov’t overhauls energy to aid $1bn BPL rescue By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B4 SEE PAGE B6 A CABINET minister yesterday asserted that last year’s CARIFTA games generated a $185,503 “net surplus” even though this was only made possible by a taxpayer subsidy over four times’ higher than budgeted. Mario Bowleg, minister of youth, sports and culture, sought to quash further debate on the cost overruns incurred by the Bahamian people in staging the regional track and field championships by telling the House of Assembly that this figure - set out in the “unaudited” accounts for the event organiser - “settles the matter of any overspending”. However, his address neglected to point out that the CARIFTA Games Company’s financial statements - which have yet to be tested and verified for accuracy by an independent external auditor - show that this “surplus” was only made possible via a $6.433m subsidy provided by

By NEIL HARTNELL

Editor

NEIL

By

that is the case, it is issued for one month. If someone is in good standing, you get it for three months. “If a person is on a payment plan for real property tax, and real property tax is due on May 2, they will only get a certificate for a month until it is paid. We have learned from our mistakes. We used to issue it for three months, and it was ‘bush crack, man gone’. We learned from those trends and we will not issue it for a long period. That’s what we’re doing. We’ve changed our behaviour at the Department.” Businesses must be compliant with a whole host of taxes, including VAT, real property tax and Business Licence fees, to obtain a TCC along with National Insurance Board (NIB) contributions and Immigration work permit fees. Without such One-month tax certificate to halt ‘bush crack, man gone’ By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B5 SEE PAGE B5 DOCTORS HOSPITAL HEADQUARTERS MARIO BOWLEG JOBETH COLEBY-DAVIS $5.80 $5.85 $5.92 $5.96

Breaking fears of corporate change

Corporate change creates uncertainty by its very nature. This triggers fear and anxiety, causing employees to become anxious or curious, and can even paralyse a worker’s willingness to co-operate in the process. Research shows reforms often fail not because managers neglected to adequately address infrastructure, but because they did not create the necessary backing among employees.

Why do employees fear change?

When change happens in the workplace, employees may fear losing their jobs, fail at new processes or believe their next role may require skills that they do not possess. They fear that the old ways of working will disappear, or that

they may lose their status or no longer be working with trusted co-workers. Fear of the unknown is crippling.

The way they did things has been altered. “Why fix what isn’t broken?” many may ask. Such fears often manifest in resistance to change. Naturally, employees, who once felt in control of their own destiny may no longer feel the same way.

It is important that employees acknowledge change in a way that helps them overcome their fear of failure. To do this, leaders and managers may discuss the future vision and benefits of executing change, creating excitement about the possibilities moving forward.

Communicate, communicate and communicate

Morale and performance improve when workers feel they are part of something that is creating change rather than being subjected to it. They feel a part of something bigger, with a clear understanding. How is this done? The answer is to employ an effective communication strategy. Make the message a clear and concise one. Move from telling to ensuring involvement, proactively asking for opinions and ideas. Use many channels to communicate and reinforce messages.

As a company, encourage employees to be active participants and collaborate. Employees tend not to destroy what they create. Successful change happens when employee values and beliefs align with those of the company.

Only by understanding what makes employees fearful of change can you develop the strategies to manage those concerns. If employees do not understand the reasons for the change, you can expect resistance, especially when they have considered the existing model to be effective for more than 20 years.

Nonetheless, throughout the change exercise, try not to mistake compliance for acceptance or acceptance for commitment. Sometimes employees become exhausted with constant change, and if change is seen to lead to a worse situation, it may create resentment and lack of commitment.

As a final point, ask for feedback. Encourage employees to actively participate in the

DOCTORS HOSPITAL TARGETS $10M ACQUISITION BOOST

And, aside from the financial impact, he added that Doctors Hospital plans to extend the near 40-year legacy established by The Kidney Centre and its founder/majority shareholder, former minister of health Dr Ronald Knowles, in providing quality and consistent care to Bahamian kidney patients.

“The biggest benefit for our patients is continuity of service, a line of service which has been operating for 40 years with great quality care,” Mr Deveaux said. “It’s an essential service line for the people of The Bahamas, and Doctors Hospital will seek to continue that.

‘It’s really important, with the change in ownership to Doctors Hospital, that there will be no

interruption in the quality of service that Bahamians depend on. It’s a service that is required to maintain a healthy and normal life for people that need it.

That’s the most important thing: Continuity and quality of care for people that need the service.” Mr Deveaux and Doctors Hospital confirmed that Dr Knowles will “stay on” for at least three years as a strategic advisor to both itself and The Kidney Centre, with the latter’s existing management also retained to ensure continuity of operations.

“The acquisition took more than a year to plan and collaborate with The Kidney Centre, and we effectively closed the acquisition today,” the Doctors Hospital chief financial officer said. “We made

the announcement to The Kidney Centre employees last week so that they had an opportunity to ask questions and get comfortable with the new ownership team.

“We intend to retain Coralee Adderley in her role as managing director, and Dr Knowles, the founder and former minister of health, will stay on for three years to advise Doctors Hospital on its strategy for delivering healthcare across the country. “We do not intend to make any changes in manpower or staffing, relying on the existing leadership team to run the business as they have done prior to the acquisition. We don’t expect to make any changes in staffing, compensation and benefits. There’s always a degree of anxiety [with

ownership changes], and we don’t want that anxiety to distract The Kidney Centre associates - now our associates - from patient care.”

Asked by Tribune Business about the acquisition’s financial benefits, Mr Deveaux replied: “At a high level, we expect this will add approximately $10m, which will represent about 8 percent of full revenues for a normal year. On the earnings side, I would withhold speaking to that.

“I think you can expect this will add about 8 percent to out top-line in a normal year and, on the asset side, about $5m to our balance sheet. We have taken on a company that is debt-free, the company has no debt, and the acquisition did not involve debt to conclude the purchase. We feel it’s

a really good opportunity from that perspective....”

The Doctors Hospital finance chief also declined to confirm the purchase price, adding that “to respect the confidentiality we’re not required to disclose that”. However, he then said: “What I can say is that the purchase price involved looking at the profitability of the business. Generally, when we target acquisitions we want to be within three-five times’ EBITDA. This fell comfortably within that range.

“I think that’s probably more than enough to give shareholders. We clearly think the price is fair, and we look forward to realising the benefits of the acquisition in financial terms but, most importantly, continue the service and ensure the quality.”

Mr Deveaux voiced confidence that “return cash flow” generated by The Kidney Centre will more than offset acquisition costs, especially since targeted “synergies” with Doctors Hospital will likely lower its operating costs.

“Shareholders will want to know that the economics of the deal represent a good use of cash,” he acknowledged. “The Kidney Centre is profitable, stable and they’ll certainly grow our margins on a net basis. We’ll look for synergies between the two companies to lower their cost of operations, so the acquisition will release cash flow in excess of what was expended.

“That’s ultimately the financial test of a good acquisition.” However, Mr Deveaux said just as critical will be how the integration of the two companies is managed, with Doctors Hospital planning to align

transformation. After all, they are at the forefront of the change, and will certainly have excellent ideas for making the transformation plan a success. Also, by feeling involved, they will really be on board with the change.

Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

gmail.com

graphic designer/brand marketing analyst, international award-winning author and certified life coach.

The Kidney Centre with its operations over time while respecting the latter’s traditions and history. The BISX-listed healthcare provider has traditionally expanded organically, as opposed to growth via acquisition, but its chief financial officer yesterday said it will continue to seek out further deals such as The Kidney Centre if they make sense.

“We continue to be open to different growth strategies,” Mr Deveaux said. “Ultimately, we are going to focus on whatever strategies allow us to expand access to private quality healthcare that are consistent with our standards. This opportunity does that, the terms make sense and, more importantly, the quality of care we’re able to guarantee and continue for the Bahamian people makes sense to us.

“We continue to scan the environment to see where other opportunities like The Kidney Centre exist and we don’t rule out these kinds of approaches in the future where it makes sense... As Doctors Hospital expands and takes on its first major acquisition we want to project the importance of the private healthcare system in supporting needs at a national level.”

The Kidney Centre extends beyond New Providence with operations in Abaco and Grand Bahama, and Mr Deveaux said together with Doctors Hospital both are an “integral” part of this nation’s healthcare network.

“I’m pretty confident this will take us north of 1,000 employees,” he added of the acquisition. “Our annual impact in the local community, in terms of payroll expenses, is north of $40m per year in salaries, benefits and National Insurance Board contributions etc.”

PAGE 2, Thursday, April 25, 2024 THE TRIBUNE

welcomes feedback at deedee21bastian@

DEIDRE BASTIAN By

FROM PAGE B1

$60M EXUMA ROADS ARE ‘WELL ON THE WAY’

THE contractor for the multi-million dollar Exuma roadworks project yesterday said it is “well on the way” with paving scheduled for completion by January 2025.

Melanie Roach, general manager for the Bahamas Striping Group of Companies (BSGC), said he company is currently paving the Barraterre Road and will then move to Exuma’s western settlements before turning back east.

She added that its concrete ready-mix plant in Exuma is almost completed and, once it is operational, Bahamas Striping

will start work on the sea walls, retaining wall and sidewalks. Ms Roach said: “Exuma is well on the way. We are basically almost finished the Barraterre Road up to the first bridge and we’ve started work now in the Barraterre settlement.

So once we would have finished the Barraterre settlement, we will then continue to complete the main road from the first bridge into the settlement.

“Thereafter we’ll go into the other settlements on Exuma in the west, that would be Rolleville, Harts, Mount Thompson, all of those will be surfaced.

Once we would have finished in the west then we will move to the east from

Georgetown going into Williamstown.

“We are also in the process of completing our concrete ready mix plant and, once that is completed, we will then start the work on our sea walls and retaining walls and sidewalks that have been designed for the safety of the roads in Exuma. We’ll also be continuing with our striping programme and with our street signage programme. The aim is to be completed with this phase of the work and Exuma by January 2025.”

The Government is in a public-private partnership (PPP) with Bahamas Striping on the $60m Exuma roadworks project, with the paving and other infrastructure work being carried out

by its Caribbean Paving Solutions (CPSL) subsidiary. The project was initially slated to be completed in mid- 2024. Ms Roach also said work on the asphalt plant in Eleuthera began yesterday, and completed at the end of May, with the $100m roadwork project for that island set to take 24 to 30 months. Two Eleutherabased companies have been sub-contracted to assist in the paving work. She said: “In Eleuthera we are just very excited because today we have our first pour for the foundations for the asphalt plant. So that is a very positive sign. We expect by the second week in May to be able to erect the plant, and that by the end of May we

AUDITOR GENERAL GIVEN CARIFTA FINANCIALS

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A CABINET minister yesterday tabled unaudited financial statements for last year’s CARIFTA Games that were not provided to the Auditor General prior to publication of the latter’s highly critical report. Mario Bowleg, minister of youth, sports and culture, maintained the track and field championships generated a $185,000 surplus. Addressing the House of Assembly, he said that the financial statements which were provided to the Auditor General after the report was released indicate the event ended “successfully” instead of the $800,000 deficit cited in the Auditor General’s He said: “I am also pleased to table the 2023 Carifta Games Company Ltd. unaudited financial statements as of December 31, 2023. These statements were provided to the Ministry on

January 24, but were unfortunately never provided to the auditor-general. Since the release of the report this has been corrected, and I can confirm to parliament that the auditor-general is now in possession of these reports. “These documents demonstrate our commitment to financial transparency and will provide detailed insights into the games’ conduct and outcomes. This financial report clearly indicates the CARIFTA games ended successfully in a surplus of $185,000 and not a deficit of $800,000; this settles the matter of any overspending.” While acknowledging there was a “notable lapse in communication” during the audit, Mr Bowleg shared his “profound disappointment” that he did not review the Auditor General’s findings prior to them being tabled in Parliament. He said meetings with the Auditor General are scheduled to address the concerns raised in the audit.

Mr Bowleg said:

“Acknowledging there was a notable lapse in communication during the processes involved, I have asked my permanent secretary to schedule additional meetings with the Office of the Auditor General. These meetings are intended to provide further clarifications, address any identified gaps, and ensure that any concerns arising from the audits are discussed thoroughly.

“I must express my profound disappointment that the final versions of the audit reports for the CARIFTA Games 2023 and The Bahamas Games were not brought to my attention before presented and table in Parliament.” Mr Bowleg said he plans to meet with the Local Organising Committee for CARIFTA to discuss the report and “learn” from the experience to prevent future “discrepancies”. He added: “I will personally meet with the Local Organising Committee to critically assess the audit’s

will actually start the paving work. “We currently have survey crews going throughout the southern end of Eleuthera preparing the as-built drawings from which we will complete the designs for the new roads. Once we get started we’re going to move very quickly because, unlike in Exuma where we do all of the work - Caribbean Paving Solutions does both the base work and the paving - in Eleuthera we have two Eleuthera based subcontractors, Quick Fix and New View, who will actually be doing the base work on the settlement roads and we will do the base work on the main highways. “That means that we will now be able to work

findings. This engagement will serve as a crucial benchmark for future events, aiming to enhance our operational efficiencies, improve administrative protocols and solidify our governance structures.

“We must learn from this audit, strengthening our checks and balances to prevent future discrepancies and uphold our commitment to excellence.” Mr Bowleg maintained that his ministry was “transparent” and accounted for every dollar spent.

He said: “I have previously reported to this Parliament, providing comprehensive updates on the successful execution and financial management of both the CARIFTA Games and The Bahamas Games. Our administration has been transparent, ensuring that every dollar spent was accounted for and utilised to enhance the experience and safety of participants and spectators alike.”

simultaneously in three areas, whereas in Exuma we work one area at a time. So Eleuthera is going to go full speed ahead once we commence, and we hope to get that project completed within 24 to 30 months.”

She added that Bahamas Striping is still awaiting approvals to begin renovations on La Playa, the Government-owned property at Goodman’s Bay. “It is progressing. W e are trying to get all of our approvals.

“Once we get our approvals, then we will start the actual construction. As you know, getting building permits and CECs is a process and we are going through the process right now. Once we get the approval, we’ll meet the 14-month construction target “

THE TRIBUNE Thursday, April 25, 2024, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

Gov’t overhauls energy to aid $1bn BPL rescue

to be passed, gazzetted and to take effect from June 1, 2024, as it seeks to accelerate plans for wide-ranging transformation at BPL and in the wider energy sector.

The Bill, which is to repeal and replace the existing Electricity Act 2015, states in its “objects and reasons” section that it “seeks to modernise and consolidate the law” for electricity supply through several avenues including giving the Utilities Regulation and Competition Authority (URCA) the power to “regulate all aspects of renewable energy”.

However, its new provisions appear to go much deeper by effectively facilitating the potential break-up of BPL into separate generation, transmission and distribution, and back/office billing functions and creating a foundation for privatepublic partnerships (PPPs) that the Government hopes will rescue the ailing stateowned energy monopoly by attracting private capital and expertise.

The Bill’s section nine, three (c) details new clauses on page 15 that allow BPL to “incorporate one or more” 100 percent-owned subsidiaries or joint venture companies, the latter partowned by the Government, to which it is able to transfer “functions and assets”.

And these newly-formed entities are also permitted by the new Bill “to enter into a management contract with a system operator to perform any or all of the functions of BPL”. This appears to creating the legal basis for the potential break-up of BPL into separate functions, and the outsourcing of the management of those functions to private sector companies and investors.

Kyle Wilson, the Bahamas Electrical Workers Union’s (BEWU) president, yesterday told Tribune Business he has received no further details on the Government’s plans for BPL beyond what he was told at his initial meeting with Mrs Coleby-Davis.

He previously confirmed that Pike Corporation and its subsidiary, Pike Electric, headquartered in the Carolinas, are the frontrunners to take over BPL’s transmission and distribution business based on his meeting with the minister and her adviser, former BPL chief operating officer, Christina Alstom.

Meanwhile, several sources have suggested that Shell North America, which under the Minnis administration won the bidding process for outsourcing New Providence’s base-load generation via the development of a new 225 Mega Watt (MW) power plant at Clifton Pier, may be a contender to take over generation again.

This may possibly be in partnership with BISXlisted FOCOL Holdings, which is presently engaged in a $40m preference share offering and could be tapped to participate in supplying liquefied natural gas (LNG) to BPL’s Clifton Pier plant.

The new Electricity Bill’s “objects and reasons” section, meanwhile, reveals that the likes of BPL and all other entities designated as “public electricity suppliers” will enjoy a “transition period of three years” after the legislation becomes law when URCA cannot interfere with the tariff rates or prices that they charge Bahamian households and businesses. They will, though, have to use that time to prepare a “comprehensive review” of their prices.

And the Bill also appears to give BPL and other electricity providers licensed by URCA the ability, for the first time, to charge different different tariffs and prices to different groups of customers and, also, different locations and islands. Currently, all residential and commercial customers are charged the same rate, respectively, and there is also no discrimination by island.

The Bill’s section 38 (seven) states: “Subject to the approval of URCA, a licensee may where no undue preference is given to any class of customer or locality, fix the charges

under this section at different rates and scales for different classes of customers, including residential, commercial, general service and other service categories.”

One source, speaking on condition of anonymity, told Tribune Business last night that the Government - via the new Electricity Bill - appeared to have found “a sneaky way to circumvent the Grand Bahama Port Authority (GBPA)” and its regulation of utilities in Freeport via the Hawksbill Creek Agreement.

With tensions already inflamed by the Government’s demand that the GBPA pay $357m to reimburse it for costs incurred in providing public services in Freeport over and above the tax revenues generated by the city, the source said the BIll identifies Grand Bahama as a Family Island.

And it appears to make the Grand Bahama Power Company the “approving authority” for anyone submitting a proposal to supply electricity to the public in Grand Bahama. The Bill states that any approvals by an “authority” must also be given the go-ahead by URCA, and it was suggested this was a neat way of circumventing the GBPA’s utilities regulatory authority in Freeport and transferring it to URCA via GB Power.

The Bill explicitly states that it applies to Freeport even though GB Power’s 2016 Supreme Court action, where it sought an injunction to prevent URCA “from regulating, or seeking to exercise licensing and regulatory authority” over it, remains live.

GB Power’s action is founded on the basis that, as a GBPA licensee, it is licensed and regulated by the latter via the Hawksbill Creek Agreement - and not by URCA and the Electricity Act 2015.

It is arguing that the Electricity Act’s sections 44-46, which give URCA the legal right to licence and oversee energy providers, “are inconsistent, and conflict with, the rights and privileges vested in [GB Power] and the Port Authority” by the Hawksbill Creek Agreement.

GB Power’s statement of claim argues that itself and the GBPA “have been vested with the sole authority to operate utilities”, including electricity generation and transmission and distribution, within the Port area until the Hawksbill Creek’s expiration in 2054.

The new Bill, meanwhile, also repeals the Electricity Rate Reduction Bond Act, and does not replace it, so as to “remove the obligation to finance” BPL via this method. With no alternative method proposed in the legislation, it is unclear how the Government plans to refinance the stateowned energy provider’s $500m legacy debts and liabilities.

Mrs Coleby-Davis revealed to the House of Assembly in March that BPL’s financial needs total $1bn, evenly split between its legacy debts/liabilities and current capital investment needs.

“Mr deputy speaker, BPL has over $500m in debt. Yes, that’s right, over half-a-billion dollars and counting,” she confirmed. “It owes banks, it owes the Government and its employees’

pensions are underfunded by $120m. You heard me right. The employees’ pension [fund] is underfunded by $120m. Big change is needed.”

Mrs Coleby-Davis did not break down the $500m, which appears to represent total liabilities and not just debt, beyond the $120m employee pension fund deficit. The reference to “owes the Government” likely means the $184m debt, disclosed in the latest quarterly debt statistical burden, that represents the loan/ subsidy provided to BPL to cover its fuel purchase costs after hedging trades were not executed.

The minister, though, provided more details on BPL’s capital investment needs which she also pegged at $500m or halfa-billion dollars. “BPL operates 29 power stations on 17 islands. Over the next five years, BPL will need an investment of over $500m to upgrade its infrastructure,” Mrs Coleby-Davis said.

This, she added, was broken down into a collective $300m investment in new generation assets spread across New Providence and the Family Islands; $130m to upgrade New Providence’s transmission and distribution network “in the next two years alone”; $35m for the roll-out of advanced metering infrastructure (AMI); and $70m in undefined “other costs”.

“Today, to fix, BPL we need over $500m to address its debts and over $500m to upgrade and improve its aged and deteriorated infrastructure. Mr deputy speaker, that’s over $1bn,” Mrs Coleby-Davis said.

PAGE 4, Thursday, April 25, 2024 THE TRIBUNE

FROM PAGE B1

MINISTER’S $185K CARIFTA ‘SURPLUS’

the Government using Bahamian taxpayer dollars. Without such a contribution from the Public Treasury, the championships and event organiser would have incurred a near$6.25m loss or net deficit.

Mr Bowleg, though, took a different position by stating: “This financial report clearly indicates the CARIFTA games ended successfully in a surplus of $185,000, and not a deficit of $800,000. This settles the matter of any overspending.”

Yet the CARIFTA Games Company’s unaudited financials covering the period September 16, 2022, to end-December 2023, strengthen the argument that staging the championships cost taxpayers far more than what was originally allocated in the Government’s 2022-2023 Budget.

Mr Bowleg glossed over this yesterday, simply inviting MPs and the Bahamian public to review the Government’s relevant Budgets as the “detail of these allocations should dispel any concerns regarding financial transparency”.

However, Tribune Business previously revealed that just $1.4m was allocated by the Davis administration to finance CARIFTA 2023 even after an extra $400,000 was provided in the 2022-2023 supplementary Budget. And this year’s 2023-2024 Budget, presented last May,

showed that the $1.4m allocation had been exceeded by 150 percent even before the championships started. Some $3.5m was shown to have been spent on hosting CARIFTA in the nine months to end-March 2023, a sum more than double or $2.1m higher than the $1.4m approved by Parliament.

Lynden Maycock, head of CARIFTA’s local organising committee (LOC), earlier this week told other media that the event was “grossly under-budgeted” by the Government. Ultimately, the $6.433m spent by the Government was some 359.5 percent, or more than four times’ greater, than the originallybudgeted $1.4m. And the Auditor General’s CARIFTA report, tabled in Parliament last week, showed that the Government, which had already provided some $5.279m in funding, was forced to come up with another $1.151m to cover “outstanding bills” due to Bahamian vendors and event staff after the championships had ended.

The 50th CARIFTA’s government funding was drawn down in six tranches between November 2022 and April 2023, ranging in size from $500,000 to a high of $1.5m. Even this $5.278m proved insufficient to ensure that the event minimised its loss, the Auditor General’s Office revealed, as more money was needed. “We have identified that the Local Organising Committee (LOC) acquired additional funding

subsequent to the conclusion of the balance sheet reporting period on April 30, 2023, amounting to $1.152m,” the report said.

“Consequently, a total sum of $6.43m was receive from the Government by the end of August 31, 2023. Funds from the subsequent receipt were used to pay the LOC’s outstanding bills to vendors and outstanding salary payments.”

The Bahamian taxpayer’s total CARIFTA outlay was thus more than six times’ greater than the $1m originally budgeted, and over four times’ higher than the $1.4m allocation contained in the 2022-2023 supplementary Budget.

With the Opposition yesterday pledging to use its control of parliament’s Public Accounts Committee (PAC) to further investigate the CARIFTA and Bahamas Games spending, one source familiar with public sector financial processes, speaking on condition of anonymity, said: “The only way you can disclose a surplus is if you earn over and above what was originally budgeted and approved..

“You cannot be talking about a surplus when you have already overspent, and when there was no surplus generated.” It is uncertain how the Government funded the CARIFTA cost overruns, although it likely repurposed and reallocated monies already budgeted from other areas of its Budget, confident that the Bahamian taxpayer would be able to pick up the bill.

One-month tax certificate to halt ‘bush crack, man gone’

verification, it can become extremely difficult and complex to do business, especially with government agencies such as Customs.

Mr Fernander said the Department of Inland Revenue had too often listened to the pleas of businesses, promising they will come back to settle outstanding tax bills and begging to be issued TCCs, only to never see or hear from them again for an extended period. The one-month validity, he added, will encourage companies to live up to their word.

“We’re connecting with other agencies,” the Department’s operations chief added. “Some persons will run to us saying they paid NIB, and when NIB runs a report they’ve only paid for previous years in the past,

and it’s not a valid current payment. This is a new year. We’re lenient, and are trying to give you one month until you resolve the matter, and then we will renew it for three months.”

One business, speaking on condition of anonymity, yesterday confirmed it had only received a TCC valid for three months despite being current with its taxes. “You used to be able to get a TCC valid for six months,” he said. “If you submit an entry to Customs you have to submit that. It’s only valid for a month so I’m curious if they are trying to squeeze collections.

Michael Pintard, the Free National Movement (FNM) leader, yesterday confirmed to Tribune Business that the Opposition will pursue the CARIFTA and Bahamas Games funding and cost overruns as “part of our larger questioning”.

And Kwasi Thompson, the Opposition’s finance spokesman, confirmed in messaged replies to this newspaper that the Public Accounts Committee, which acts as Parliament’s public spending watchdog, “will still deal” with both the CARIFTA and Bahamas Games reports now they have been tabled in the House of Assembly. Previous administrations have managed to stymie probes by the Public Accounts Committee on the basis that it can only investigate Auditor General reports tabled in the House of Assembly - a requirement which, in this case, has now been met. Mr Thompson added that the Committee “should call all relevant persons” who can provide the necessary answers.

Mr Bowleg, in his House of Assembly statement, did not respond directly to any of the issues and concerns raised by the Auditor General’s CARIFTA report. Instead, much of his presentation focused on the need to invest in Bahamian youth and sports given the undoubted social benefits that this generates.

The Opposition, though, is not letting up. “The minister is a day late, and

millions of dollars short,” it blasted last night. “Today, minster Mario Bowleg had an opportunity to provide a thorough explanation to Bahamian taxpayers for the multitude of irregularities that were detailed in the Auditor General’s recent report into the CARIFTA games and The Bahamas Games....

“Unfortunately, instead of apologising for the massive overspend, the minister instead doubled down, scrambling to produce unaudited so-called financial statements long after they were demanded by the Auditor General for the required statutory review. “We will not forget that you and your ministry had more than ample time, first to provide the information that was required by the Auditor General, and then to supply your documented responses to all of the matters raised in the draft.”

The unaudited CARIFTA Games Company accounts showed that the track and field championships incurred a $3.28m net operating loss which, together with $2.967m in non-operating expenses, had to be covered by the $6.433m taxpayer subsidy to generate the surplus touted by Mr Bowleg. This subsidy amounted to 82.8 percent, or more than four out of every five dollars, that funded CARIFTA.

The accounts said some 47.7 percent, or $637,175m, of the CARIFTA revenues were generated by

corporate sponsorship “sales”, while ticket sales produced $366,072 or 27.4 percent. Levy fees accounted for the 12.3 percent balance at $164,046.

On the expense side, salaries accounted for 12.7 percent or $988,313 of the total $4.512m operating expenses with hotel accommodation generating $821,569 or 10.8 percent. TV production and competition each accounted for 5 percent of the operating expenses.

“Despite the ebbs and flows over the last 15 months from September 16, 2022, to December 31, 2023, the statement of operations shows a deficit in operations of $3.28m,” the CARIFTA Games Company financial statements said. “During the mentioned period, the Government cash injection of $6.433m shows a surplus of 40.6 percent or $3.153m in net operating income.

“Non-operating income and expenses reflects a negative $2.967m, which reduces the surplus in net operating income to 2.4 percent or $185,503 as at December 31, 2023.”

“If you have to have someone put in for the letter every month instead of six months, it’s more bureaucracy and red tape. I understand what they’re going after. Are they having trouble with people not staying current?”

Timothy Ingraham, the Bahamas Chamber of Commerce and Employers Confederation’s (BCCEC) chairman, yesterday said he was unaware of the Department of Inland Revenue action. “It’s not been brought to the Chamber’s attention but I will make some inquiries about it,” he said, “and let you know what those inquiries turn up.”

“You have to be up with real property tax, you have to be up with VAT filings, you have to be up with Business Licence fees you have to be up with everything. You also have to tie in with NIB. It’s across the board for everyone. Any interaction with a government department you have to provide a copy of that.

THE TRIBUNE Thursday, April 25, 2024, PAGE 5

CAME FROM 360% SUBSIDY OVERSHOOT FROM PAGE B1

PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

FROM

GBPA seeks to reassure on on ‘unfortunate public noise’

is itself seeking to take all credit for every investment being made in Freeport.

“We continue to work closely with worldrenowned Weller Development Partners to see the $300m resort and branded residences, operated by the world’s number one luxury resort group, Six Senses, come to fruition on Grand Bahama. We are helping to expedite future phases of this key partnership that will be nothing less than transformative

for the island,” the GBPA added. “We sold the land to Carnival to facilitate the creation of the new Celebration Key cruise port destination and have shepherded the project forward over the last seven years. GBPA remains in constant contact and co-operation with Carnival Cruise Lines as this exciting and job-creating investment progresses to a 2025 opening.

“Another major cruise port development is being proposed by Bahamas Ports Investments Ltd (BPI), a joint partnership between

Royal Caribbean Cruise Lines (RCCL) and our subsidiary, Freeport Harbor Company,” it continued.

“Meanwhile, the $600m expansion of the Grand Bahama Shipyard, of which the Port Authority group of companies is a shareholder, will create hundreds of additional jobs for Grand Bahamians and re-establish the island as the premier destination for mega ship repair in the region.”

The Government is demanding that the GBPA reimburse it to cover the costs of providing public services in Freeport over

GRAND BAHAMA PORT AUTHORITY (GBPA) HEADQUARTERS

and above the tax revenues generated by the city during the period 2018-2022. It has sent a $357m payment demand to the GBPA and is now awaiting its formal response.

“Other projects on which GBPA and its group of companies have worked diligently include: a new $25m medical facility by Doctors Hospital; two major renewable energy projects; and a

the GBPA added. “The people of Grand Bahama can rest assured that we will bring these projects to fruition. Each day, we dedicate ourselves to advancing these initiatives, and we eagerly anticipate sharing news of further exciting developments.

“We encourage our stakeholders to maintain confidence and remember the resilience we’ve demonstrated together throughout the years. Despite the current challenges, Freeport continues to offer a wonderful environment for living and investing, reflecting our enduring belief in the island’s potential and prosperity.”

HOW US CHANGES TO 'NONCOMPETE' AGREEMENTS AND OVERTIME PAY COULD AFFECT WORKERS

By CATHY BUSSEWITZ and MAE ANDERSON Associated

Press

FOR millions of American workers, the federal government took two actions this week that could bestow potentially farreaching benefits.

The FTC's move, which is already being challenged in court, would mean that such employees could apply for jobs they weren't previously eligible to seek.

In a second move, the Biden administration finalized a rule that will make millions more salaried workers eligible for overtime pay. The rule

In one move, the Federal Trade Commission voted to ban noncompete agreements, which bar millions of workers from leaving their employers to join a competitor or start a rival business for a specific period of time.

significantly raises the salary level that workers could earn and still qualify for overtime. The new rules don't take effect immediately. And they won't benefit everyone. So what exactly would these rules mean for America's workers?

Noncompete agreements, which employers have deployed with greater frequency in recent years, limit an employee's ability to jump ship for a rival company or start a competing business for a stated period of time. The idea is to prevent employees from taking a company's trade secrets, job leads or sales relationships to a direct competitor, who could immediately capitalize on them.

Many industries use noncompete agreements, often among their salespeople, said Paul Lopez, managing partner at Tripp Scott, a Florida law firm that has handled more than 100 cases involving noncompete clauses.

"They're the ones out there generating leads and sales," Lopez said. "The last thing you as a business will want is for that person to go over to your competition and do the same thing."

People may assume that noncompete agreements apply only to high-level executives in the technology or finance industries. But many lower-level workers are subject to the restrictions as well. The rules vary by state.

In Florida, one medical sales worker was barred by his employer from joining a competitor for 10 years — and once he left his job, was unemployed for more than five years, said Stefanie Camfield, assistant general

counsel with Engage PEO, a Florida company that handles human resources for small and medium-sized businesses. "He was able to find another sales position in a completely different industry," Camfield said. "But the learning curve was there, so he wasn't making the same amount of money."

In another case, a company in the optical industry that had hired a sales associate was informed by his former employer that it intended to enforce a noncompete agreement. So the optical company terminated the employee, Camfield said.

"A noncompete would unilaterally ban someone from getting exactly the kind of job that it's reasonable to want," said Jennifer Tosti-Kharas, a professor of organizational behavior at Babson College in Massachusetts. "To cut people off from that is overly paternalistic. It's using a really blunt instrument to limit people's mobility, when in reality there are other legal mechanisms to prevent trade secrets being disclosed."

People are sometimes surprised to learn that they're bound by such an agreement. They might not even find out until after they've left for a new job, and their former employer intervenes and causes them to be fired.

"When you join a company, you're so focused on the opportunity in front of you, you might not be thinking about what's that next jump," Tosti-Kharas said. Experts suggest that employees consult their human resources department about any noncompete agreements that might exist. If a workplace doesn't have an HR department, an employee should ask a lawyer for the company.

"They thought they had a qualified sales associate hired and ready to get to work, and all of a sudden now they're back to square one." Some view noncompete agreements as harmful and unfair to workers by limiting their mobility. Career opportunities are often more attractive outside an employee's current workplace. And with restrictions on the type of work they can do for a competitor, it can be hard to shift into a more suitable or lucrative position. Many hiring managers, after all, most value job candidates who already have a certain level of experience in the same industry.

THE FEDERAL Trade Commission building is seen, Jan. 28, 2015, in Washington. U.S. companies would no longer be able to bar employees from taking jobs with competitors under a rule approved by the FTC on Tuesday, April 23, 2024, though the rule seems sure to be challenged in court.

PAGE 6, Thursday, April 25, 2024 THE TRIBUNE

fully Bahamian-owned concrete plant, among many others,”

FROM PAGE B1

Photo:Alex Brandon/AP

New California rule aims to limit health care cost increases to 3% annually

By ADAM BEAM Associated Press

DOCTORS, hospitals and health insurance companies in California will be limited to annual price increases of 3% starting in 2029 under a new rule state regulators approved Wednesday in the latest attempt to corral the everincreasing costs of medical care in the United States.

The money Californians spent on health care went up about 5.4% each year for the past two decades.

Democrats who control California's government say

that's too much, especially since most people's income increased just 3% each year over that same time period.

The 3% cap, approved Wednesday by the Health Care Affordability Board, would be phased in over five years, starting with 3.5% in 2025. Board members said the cap likely won't be enforced until the end of the decade.

A new state agency, the Office of Health Care Affordability, will gather data to enforce the rule. Providers who don't comply could face fines.

"We want to be aggressive," board chair Dr. Mark Ghaly said, while acknowledging that the cap "really translates into a major challenge" for the health care industry.

The vote is just the start of the process. Regulators will later decide how the cost target will be applied across the state's various health care sectors. And enforcement will be progressive, with several chances for providers to avoid fines.

California's health care industry has supported the

idea of a statewide cost target but argued a 3% cap is too low and will be nearly impossible to meet.

In December, the Center for Medicare and Medicaid Services said the cost to practice medicine in the United States would increase 4.6% this year alone. The board based the target on the average annual change in median household income in California between 2002 and 2022, which was 3%. Dr. Tanya W. Spirtos, president of the California

Medical Association that represents doctors, wrote a letter to the board noting that number is "artificially low" because it includes the years of the Great Recession, when income dropped dramatically. She said a better gauge would be looking at the past 10 years, when median household income increased an average of 4.1% per year. Hospitals argue much of what they charge is outside of their control. More than half of hospitals' expenses are salaries for workers, and many of those are set

per

More than half of California's 425 hospitals are losing money, and many rural facilities are in danger of closing — prompting the state Legislature last year to approve an emergency loan program.

Carmela Coyle, president and CEO of the California Hospital Association, said when it comes to hospital finances, "the fat is already gone." She said hospitals regularly perform complex procedures that save lives, including quadruple bypass surgeries.

NOTICE

I JAMES ALEXANDER FERNANDER of Gambier Village, New Providence, Bahamas, hereby REVOKE all Power of Attorney, signed by me from 1994 to 17th April, 2024. I declare them ALL Null and void.

James Alexander Fernander P.O. Box CB-12108, Nassau, Bahamas NOTICE

NOTICE is hereby given that JULIEN THEOPHILE of Gibbs Corner, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

PAGE 10, Thursday, April 25, 2024 THE TRIBUNE

through collective bargaining agreements with labor unions. Plus, a new state law that takes effect this year

gradually

$25

will

increase the minimum wage for health care workers to

hour.

The Public is hereby

RAYMOND

MATTHEW

of P.O.

GT 2278

West & Condon Avenue, Millers Height, Nassau, The Bahamas intend to change my

to

FRANCIS

INTENT TO CHANGE

BY DEED POLL

advised that I,

FRANCIS

BETHEL

Box

#4

name

RAYMOND

MATTHEW BETHELL If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NAME

PUBLIC NOTICE

FORD'S 1Q NET INCOME FALLS 24% AS COMBUSTION ENGINE UNIT SEES SALES AND REVENUE DECLINE

By TOM KRISHER AP Auto Writer

FORD Motor Co.'s firstquarter net income fell 24% from a year ago as the company's combustion engine vehicle unit saw revenue and sales decline. The Dearborn, Michigan, automaker said Wednesday it made $1.33 billion from January through March, compared with $1.76 billion a year earlier. Excluding one-time items, Ford made 49 cents per share, enough to beat analyst estimates of 43 cents, according to FactSet. Revenue for the quarter was up 3.2% to $42.78 billion, but that fell short of Wall Street estimates of $42.93 billion.

Ford Blue, the combustion engine unit, made $905 million before taxes, down $1.7 billion from a year ago. Revenue was down 13%. The company blamed the declines on lower inventories and selection of F-150 pickups due to updating factories for a new model.

Chief Financial Officer John Lawler told reporters Wednesday that Ford will recover sales volume and selection later in the year, positioning the company for strong earnings. Ford Pro, the commercial vehicle unit, offset some of the decline, posting pretax earnings of just over $3 billion, more than double the same period last year. Pro revenue was up 36%.

NOTICE

"We're very profitable now, but we believe that this business will be profitable and durable for many years to come," CEO Jim Farley said of the commercial unit.

But Model e, the electric vehicle business, lost $1.3 billion, almost $600 million more than the first quarter of last year. The company said it's cutting costs, but those have been erased by electric vehicle price declines across the industry. Farley said the EV business is the "main drag" on Ford's performance right now. But he pledged further cost cuts, and profits on the next generation of electric vehicles coming out in the next two to three years. A small team at the company is working on underpinnings for smaller more affordable EVs, the company said. The company held its full-year pretax earnings forecast at $10 billion to $12 billion, but Lawler predicted it would be toward the high end of the range. It lowered an estimate of full-year capital spending to $8 billion to $9 billion, down from earlier guidance of $8 billion to $9.5 billion.

THE TRIBUNE Thursday, April 25, 2024, PAGE 11

NOTICE is hereby given that CHRIS ISAAC of Lewis Yard, Freeport. Grand Bahama, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that ANTONIA MONTAS OTANEZ RAMSEY of #4 Pikena Drive, Harold Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas. NOTICE NOTICE is hereby given that RICHEMOND LOVERICHARDSON of Reeves Street, Fox Hill, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of April, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that JULIANNO THEOPHILE of Gibbs Corner, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE