LUCAYANS INSPIRE NAME FOR CARNIVAL PORT'S RETAIL OFFER

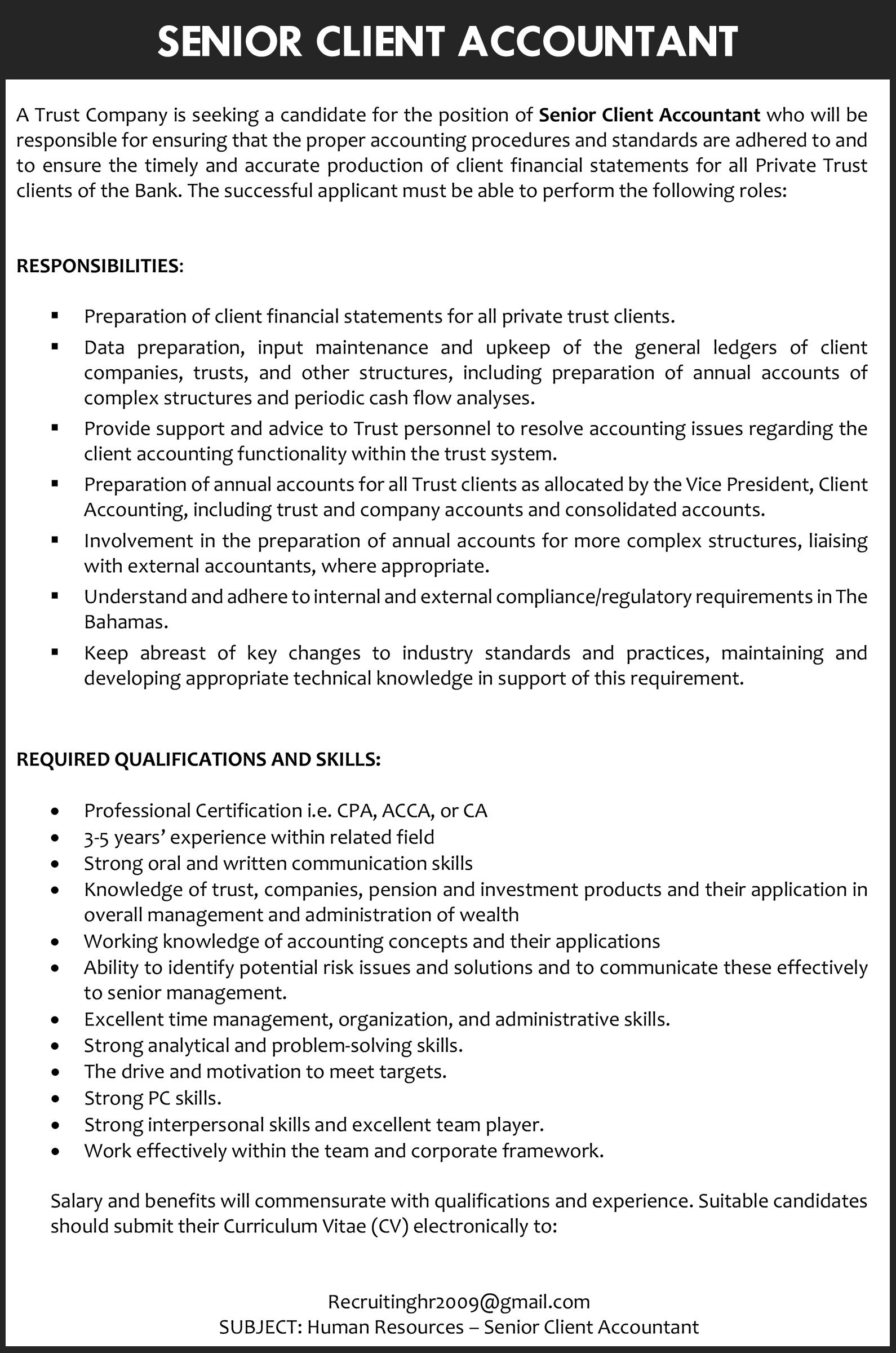

CARNIVAL Cruise Line yesterday revealed the retail segment at its $600m Celebration Key cruise port will be named 'Lokono Cove' based on the winning submission from a Grand Bahama resident.

The name, submitted by Deidre Rahming, means “the people” and is derived from the Lucayans, who were among the first to call Grand Bahama home. It was the winning submission from a community competition that was supported by the Ministry for Grand Bahama and the Ministry of Youth, Sports and Culture.

Christine Duffy, Carnival's president, unveiled the name at the Seatrade Cruise Global conference in Miami Beach. Lokono Cove will be one of five "portals" that form Celebration Key. A variety of

stores and kiosks will join an authentic Bahamian artisan market showcasing local craftsmanship. Guests will be able to purchase crafted goods and the work of Bahamian artists, including souvenirs and fine jewellery. Carnival said Lokono Cove will showcase Bahamian culture as well as goods, including murals painted by Bahamian artists.

A selection committee, including Grand Bahama officials and representatives of the cultural and creative industries, helped to choose Lokono Cove as the winning name. “Lokono Cove will be a treasure trove – a place for our guests to immerse themselves in the spirit of The Bahamas and find locally-inspired keepsakes, symbols of paradise they can share with loved ones,

Gov’ officials assess waste management on family islands

TWO ministers have visited Bimini and Great Harbour Cay in the Berry Islands as part of a continuing drive to improve waste management practices in The Bahamas.

or cherish for themselves for years to come,” Ms Duffy said.

“Honouring the beauty and culture of The Bahamas is integral to our plans for Celebration Key, and that will be on display throughout Lokono Cove. It’s a special honour that locals from Grand Bahama have contributed already in an impactful way, giving this portal its name.”

Lokono Cove will serve as the gateway to Grand Bahama outside of Celebration Key. Whether guests choose to set out on their own or through Carnival Adventures shore excursions, it will be the departure point for passengers looking to explore other areas of Grand Bahama.

Ms Rahming will receive $5,000 in cash and attend

the ribbon-cutting ceremony for Lokono Cove. She will also receive a daypass to Celebration Key, along with drink vouchers, food and a cabana.

Lokono Cove joins Paradise Plaza, which

will serve as Celebration Key's welcome area, and Calypso Lagoon, the adultfriendly area, as three of the project's five portals. A family-friendly area and an adults-only private retreat will be the final two.

Celebration Key is set to welcome its first guests in July 2025, and more than 500 vessel itineraries currently open for sale feature visits to the new destination on 18 ships sailing from ten US home ports.

Vaughn Miller, minister of the environment and natural resources, and Zane Lightbourne, minister of state for the environment, visited the Islands of Bimini and Great Harbour Cay, met with island administrators who informed them about the process and actions necessary to manage waste - including solids, liquids and gasses - from inception to disposal. They advised the officials and residents that, working together to monitor and regulate waste, the islands would benefit greatly. Mr Miller said poor waste management poses a threat not only to the environment but also human health, and this is why his ministry is committed to cleaning up The Bahamas and sustaining it.

Mr Miller and Mr Lightbourne were accompanied by David Davis, permanent secretary; Rhianna Neely-Murphy, director, Department of Environmental Planning and Protection (DEPP); Dwight Allen, assistant director, Department of Environmental Health Services; and consultant, Keno Cambridge.

Graycliff wins historic award from the UK

GRAYCLIFF was last night awarded the UK’s Blue Plaque award, which tourism partners described as “historic” for both the downtown Nassau area and the wider Bahamas.

Robert Sands, the Bahamas Hotel and Tourism Association’s president, said the award will attract many food-oriented guests to downtown Nassau with Graycliff’s restaurant acting as a “stimulus” to visitor traffic.

He added: “Graycliff has been the epicentre of activity in downtown for many years. This type of award acts as a stimulus to attract many food persons to this particular area to enjoy the multiplicity of cuisine that they have to offer. “Graycliff is also historic in terms of their offeringsthe wine cellar, the cigars, the chocolate - and they have been a staple in helping to create that climate of amenities and things to do for tourists. “So as we continue to develop downtown, this business has already been a major foot hold within the downtown area, but

they continue to reinvent themselves and act as that stimulus to ensure that there are always positive things to do in The Bahamas”

Joy Jibrilu, chief executive of the Nassau/Paradise Island Promotion Board, said one of the top reasons many persons travel is food. Young travellers, in particular, take unique cuisine into consideration when planning a vacation. She said: “One of the top reasons for people to travel is food. Food and culture. And I don’t know, particularly the younger generation, many of them are real foodies when

they’re travelling. One of the first things they look at is where to go and eat, and what’s unique about the cuisine and Nassau and Paradise Island is it’s becoming recognised as a culinary capital of the Caribbean.”

Tom Hartley, British High Commissioner to the Bahamas, said he is tasked with strengthening relations between the two countries and one way to achieve that is through food and beverages. He said Graycliff has demonstrated a standard of service that places them apart from rivals, resulting in the award of the first

Blue Plaque award outside the UK. He said: “This is the very first presentation anywhere in the world of a British Blue Plaque award. I’m charged with bringing Britain and The Bahamas closer together. We’re doing this through education. We’re doing this through sports. We’re doing this through trade. But actually, there’s been no better way to do this than via food and drink.

“Graycliff really have set themselves apart for the quality of their products, a discerning clientele and also their commitment to excellent service and staff training

“This Blue Plaque is not just a ‘thank you’. And it’s not just a recognition from me and the British government. It’s a symbol that recognises the excellence that places Graycliff into a higher echelon as a symbol of standards over and above any ordinary licensed establishment.”

“In my pursuit of bringing Britain and The Bahamas closer together through food and beverage, we could have not found a better partner than Graycliff with an award-winning wine cellar, one of the best in the world and with some of the world’s best gins and whiskies.

Dealers: Used car sales up 30% with ‘level playing field’

open up shop. We encourage people to come into the industry, but it would be nice if they play the game the same as we do. It’s hard to have fair competition when the people you are competing with are not playing by the same rules....

The auto industry has long argued that roadside vendors are not subject to the same level of regulation and taxation as they are, thus placing them at a competitive disadvantage. VAT, Business Licence fees and National Insurance Board (NIB) contributions are just some of the levies they allege that the Government is missing out on as a result.

“The Government has been looking for revenue and loopholes in places where people have not been paying their fair share and any share. Period,” Mr Albury said. “I would think that this is an easy target. They’re constantly on us to make sure we’re doing it by the book. It would be nice if it was fairly administered.

“If you’re bringing in more than two vehicles per year, per person, you’re probably conducting a business and should have a Business Licence. All of us started somewhere. Bahamas Bus and Truck [his dealership] started as a car wash. “We want people to get into the industry, but they should do it by the same rules, same taxes, same Business Licence as we have to and always have to. It would be good to know we’re not the only ones facing the burden. All we have asked, and have ever asked, is the Government treat everyone the same.”

Mr Albury said he has dealt with persons who purchased vehicles from roadside vendors that subsequently developed mechanical problems. With the sellers now unable to be contacted, he added that the buyer has “no recourse”, and asserted: “It’s not good for the consumer.” The BMDA chief also recalled how he was contacted by a person in western New Providence complaining about a neighbour “running a car dealership next to his house. The whole yard was out on the street, people coming during the day to look at the vehicles, driving up and down. He’s got a nice house and this is going on right outside his door. “I’d never be allowed to conduct business that way. But this is a major revenue source. If the Government got serious about going after these guys, I’m sure it could collect a lot of VAT, NIB and Business Licence,” Mr Albury added. “The more regulated they are, the better for the consumer as they can be sure they are dealing with legitimate operators.” Arguing that previous administrations have failed to deliver on promises to address the proliferation of unlicensed, unauthorised roadside vendors, Mr Albury said: “It’s all over the place. I don’t think it would take a lot of intel to get to the bottom of it.... “It’s a sore point. The Government has not protected those doing it legitimately, paying taxes and high overheads to do so. Sometimes I wonder if I shouldn’t close up and start selling out of my back yard. If you cannot beat

them, join them. I wouldn’t do that, but sometimes I wonder if I’m the fool.”

Brent Fox, Montague Motors’ principal, told Tribune Business that the Government needed to make arrangements with the major Japanese used vehicle exporters to levy and collect VAT on their sales on its behalf given that the point of consumption is in The Bahamas. Without this, he argued that many Bahamians avoid having to pay VAT on their online purchase - only incurring this when imported at the border.

“They’re selling highpriced items directly to the consumer and, in a lot of cases, they are selling to individuals importing five to ten cars who then sell them on the side of the road,” Mr Fox said. “They don’t pay Business Licence or VAT when they sell those cars.

“That enables them to sell the cars an awful lot cheaper than we can. They sell at my cost of landing, which is sometimes 30-40 percent cheaper than I can. It’s a serious issue. It’s nothing new, but it’s been pretty bad for the last three years.” VAT, though, only becomes due and payable once sales hit the $100,000 threshold.

Roadside vendors and Japanese used vehicle exporters will doubtless

argue that they are providing products that Bahamian consumers want - vehicles at an affordable price, and which are cheaper than those offered by formal dealers.

Mr Fox, though, said the 15-20 cars he brings in monthly pale in comparison to the estimated 400-500 used Japanese vehicles imported into The Bahamas every month. He added that himself and other dealers face “a double whammy” from roadside vendors and individuals purchasing direct from Japan who do not share the same taxation burden as himself.

“It’s increased tremendously in the last couple of years. These guys are not putting one or two cars out - at some properties they have six to eight, or ten cars lined up and little banners by the roadside,” the Montague Motors chief told Tribune Business. “You’ve got probably between halfa-dozen and a dozen guys doing that.”

“If there’s four to five dealers importing at my level, it’s still only a small fraction of what’s coming in. The majority of what’s coming in, the Government

is not getting VAT on the retail side and people selling them are not paying Business Licence or anything else. It’s gotten a lot worse.

“If I have to pay VAT on vehicles coming in, and when I sell them. Why shouldn’t they do that? They have an advantage over me. So many people are under-cutting this market and not paying their fair share. This is a significant money maker for the Government. They cannot say this is some guy complaining. They’re always strapped for cash,” Mr Fox continued.

“The Government is looking for every which way to make extra money, and this would be an ideal sector for them to focus on because there is so much abuse. I’m paying NIB for my employees, contributing to the system, paying taxes and the lion’s share is undeclared.” Asked how much his sales would increase if the entire auto industry was subject to an even taxation and regulatory playing field, Mr Fox replied: “I think that sales could be, at a minimum, 30 percent better if there

was more control over the industry. If it increases my sales 30 percent, the Government will get 30 percent more VAT out of me and make a heap load of money out of the car industry.”

Fred Albury, the Auto Mall’s chief, said of roadside vendors: “I guess everybody has to make a living. My concern is do they pay their taxes like everyone else? I think the Government has made an effort. If you bring in more than ‘x’ amount of vehicles in a year, then you are basically a dealer and need a Business Licence.

“That’s where it should work itself out if everyone does what they’re supposed to do. The Government’s Click2Clear, if everyone has that profile set up for imports, that will show if they are bringing in more than one, two or three vehicles a year, and that will give the Government some control over the matter. It’s difficult to stop it 100 percent, but I think the effort has been made.”

Now-Cabinet minister wins just 14.5% of union claim

to perform construction work on one of the union’s buildings in Freeport”. This time, the suspension was upheld by the appeals committee and BUT’s annual general meeting (AGM).

Mr Lightbourne, who returned as acting BUT president for a second spell from March 2015 to April 2016, signed an employment contract affirming that he would have “access to and use of a car” to help carry out his duties with service costs paid by the union. The union’s governance manual also affirmed that a vehicle is provided for the president’s use.

However, Ms Wilson said the vehicle was stolen from her at gunpoint during an armed robbery, and she was

unable to return it during her suspension. The BUT was unable to purchase a replacement due to “financial constraints”, and there was no vehicle for Mr Lightbourne to use during his combined 17 months on the job. He was thus forced to use his own vehicle and spend his own monies. But Justice Simone Fitzcharles, while finding that the now-Cabinet minister had proven his breach of contract claim, but found that “due to a lack of proof” he could not substantiate his demand for $11,684 in compensation. As a result, in her March 27, 2024, verdict she only awarded Mr Lightbourne “nominal” damages of $1,700 while telling both sides they must pay their respective legal costs.

“The plaintiff alleged that as the union failed to provide him with a car, this caused him to use his personal vehicle to carry out his added duties as ‘acting president’ of the defendant [the union[ ‘at a personal cost’ to him in the sum of $11,684,” justice Fitzcharles wrote in summing up Mr Lightbourne’s case.

The former BUT acting president also alleged that the union failed to follow “policy or practice” by paying him a monthly allowance of $687.39 if no vehicle was provided after this was allegedly blocked by Ms Wilson. In his evidence, Mr Lightbourne alleged that Ms Wilson was instructed by the BUT’s national secretariat to return the vehicle provided to her when she

was suspended. “Ms Wilson did not comply and later reported the said vehicle stolen while in her possession,” Justice Fitzcharles recorded.

“Mr Lightbourne testified that the acting treasurer told the executive officers that the union was unable to purchase a new vehicle for the president at that time due to financial constraints. Further, there was no other vehicle available for his use as they were necessarily in use by other persons - the union’s messenger and Family Island officers.”

The Supreme Court accepted Mr Lightbourne was forced to use his own vehicle for union duties. The now-Cabinet minister wrote to Ms Wilson, now reinstated as president, on

September 14, 2020, asking that he be paid the monthly vehicle allowance of $687. She rejected this despite having filed her own separate legal action demanding the same sum be paid to her for the months when she was suspended.

Ms Wilson, in the BUT’s defence, argued that the union’s constitution and governance manual did not mention the role or function of an ‘acting president’.

She also alleged that Mr Lightbourne’s contracts did not mention payment of a vehicle allowance, but the Supreme Court rejected her contention that he bought the claim “out of spite or malice” having lost his bid to be elected BUT president. Justice Fitzcharles also ruled that the BUT

executive committee had the authority to appoint Mr Lightbourne as acting president and that his employment contract was valid. She also determined that the executive committee had orally agreed to compensate him for using his vehicle to conduct union business.

However, she determined that his claim for near$12,000 in compensation had “not been founded” upon any evidence presented to the Supreme Court. “Mr Lightbourne has adduced no adequate evidence to show actual loss he may have sustained for using his private car. This is a hindrance to the making of an award of damages by the court whether special or general,” Justice Fitzcharles concluded.

Contractor chief challenges ‘short sighted’ stadium deal

FROM PAGE B1

as has occurred previously in The Bahamas. He emphasised that he was not opposed to the stadium repairs and Chinese involvement, and added that this nation should be grateful for the Beijing government’s “gift” in funding the work which has saved the Government a multimillion sum. However, Chinese contractors and workers are doing the majority of the work, with Mario Bowleg, minister of youth, sports and culture, affirming that the stadium workforce is two-thirds Chinese with some 150 workers. The Bahamas is supplying 75 workers.

As a result, and to compensate for the fact that no Bahamian contractors and fewer workers are benefiting from the $36m project, Mr Sands said this nation must do a better job in ensuring local professionals at least benefit from skills, knowledge and technology transfer.

“From the BCA standpoint, while we’re happy with the gift, while we’re happy with the arrangement to improve the stadium and all they are giving The Bahamas, we must be satisfied that at least there will be an opportunity to be trained by this very skilled society, and learn in terms of the knowledge and skills these technical people have,” he told Tribune Business.

“This speaks to the short-sightedness of the Government of The Bahamas with respect to its own citizens. If you don’t put yourself in a place where your citizens can benefit from such an arrangement it’s short-sighted. The gift will be beneficial, but the knowledge transfer will not happen and that’s to the disadvantage of men and women who can learn something from these amazing skills.

“I hope we can do it differently, but all I can do is hope. Since we are getting assistance with the stadium, I believe these people have amazing technology that can assist The Bahamas if we ask for it. Simply ask for it. We’re still here struggling how to build public buildings without

the cost doubling, whereas they’ve constructed some of the world’s most amazing buildings.”

Mr Sands argued that The Bahamas failed to place sufficient value on the relationships it has built such as the one with China, and reiterated: “Structure the deal where there’s at least skills transfer. At least do that. There’s no consideration for skills transfer at all.

“That has to change if we want to talk about the present Bahamas, and where we expect it to be the kind of Bahamas where the Prime Minister is talking about energy this, eco-friendly that and sustainability this. We are less than third world in our dealings with people who have the ability to teach us this. We are archaic at best, we are neanderthal at best. It’s embarrassing. We need to do better.

“Before I go, here’s a novel idea. I throw it out for free. They should set up a whole technology exchange programme where the Government ensures for every Chinese on that site we have someone between the ages of 18 and 25 shadowing that person for the life of the project,” the BCA president continued.

“It makes sense to me. At the very least we would

have created a whole cohort of persons capable of maintaining the facility post-construction, but I gather that’s not in the thinking of persons at the table and I’m not invited to give them an opening to think about it. It is what it is.”

The stadium repairs are expected to be completed 14 days before The Bahamas hosts the World Relays on May 4-5. Dai Qingli, the Chinese ambassador to The Bahamas, said: “The rough estimate made by the Bahamas government when they put forward the project proposal was like $28m, but because of this urgent nature, it became an urgent project so the cost went up by a few million dollars.”

Ms Qingli said the repairs are a symbol of friendship between both countries. “We have been working on this stadium project for many months now, since last year,” she said. “This is a collaborative project between our two governments. We have been able to secure a Chinese government grant at the request of The Bahamas government.

“We all know the importance of this stadium to the Bahamian people and we see this as a symbol of friendship between our countries, so we want this symbol to stand tall and proud and especially to be ready in time for the World Relays.”

Mr Bowleg added: “It’s our job that we maintain and upkeep these facilities to ensure that they can be of great asset to us in the long run.”

the Public Service Contributory Pensions Fund. Its members will include all new civil service hires after it is passed by Parliament, and becomes law, once they have completed their six-month probation, while all existing public officials who have held pensionable positions for less than eight years will also be transferred to the contributory plan.

Mr Pinder, though, told this newspaper that the eight year threshold should be raised by two years to mandate that only civil servants in pensionable positions for less than ten years be transferred to the proposed contributory scheme. This, he added, would align with the present position where public servants can cash in their gratuity after ten years.

“Eight years is putting them at a disadvantage,”

Mr Pinder argued. “They should make it ten years.

At ten years you should have the right to cash in your gratuity and join the contributory pension.

That’s the position now. That amendment should be at ten. You can cash in what you build up as a gratuity if you move on.”

The former BPSU president and labour director, who also stood as the FNM’s Fox Hill candidate in the last general election, backed the intention to make the new contributory pension transferable or portable should civil servants switch jobs within the public service or move outside.

And he also supported the Government’s plan to bring the employees of state-owned enterprises (SOEs) and government agencies, as well as civil servants working directly for central government, into the proposed Public

Service Contributory Pensions Fund. “If the Government has it all under one umbrella it makes it easier for persons transferring to get the correct pension at the end of their career,” Mr Pinder said, disclosing that this has been a problem for public sector employees who switch agencies. New and newer employees at what are described as ‘Approved Authorities’ in the Bill will also participate in the scheme if the legislation is passed as currently laid out, which means thousands will be impacted.

Those who join these ‘Authorities’ after the Bill is passed into law, and becomes an Act, or who have been employed for less than eight years will automatically join the contributory plan. Again, those who have been employed for more than eight years can elect to participate voluntarily, with the ‘Authorities’ involved including the likes of the Central Bank, Bahamasair and the Public Hospitals Authority (PHA).

The list of ‘Approved Authorities’ features the National Insurance Board (NIB); University of The Bahamas; Bahamas Agricultural and Industrial Corporation (BAIC); Hotel Corporation of The Bahamas; Water and Sewerage Corporation; Bahamas Development Bank; Bahamasair Holdings; the Royal Bahamas Defence Force; Bahamas Maritime Authority; and the Public Hospitals Authority (PHA).

Others named in the Bill include the Hospitals and Health Care Facilities Licensing Board; National Museum of The Bahamas; the Airport Authority; National Art Gallery of The Bahamas; Nassau Airport Development Company (NAD); Bahamas Mortgage

Corporation; Insurance Commission of The Bahamas; Utilities Regulation and Competition Authority (URCA); Sports Authority and National Training Agency.

Larry Gibson, chief operating officer at CG Atlantic Pensions, told Tribune Business that public sector pension reform is likely to be “really high” on the Government’s priority list because “that liability must be massive”.

“At least they seem to be addressing the problem or recognising it,” he added. “There’s a whole confluence of difficult decisions that the Government must make that are all coming to a head at one time but, there again, we should not be surprised.

“We used to brag about our demographics and the large number of young people, but we never gave them training, we never diversified in terms of jobs; everybody cannot be accountants, lawyers or doctors. Now it all seems to be coming home to roost at once.”

Mr Gibson said the Government’s unfunded pension liabilities are “a huge problem if they don’t solve it”, adding that while the contributory pension reforms will slow down and stop the multi-billion liabilities from expanding - at least at the present rate - they will not relieve the obligations to alreadyretired and existing long-serving officials.

“All this does is stop it accumulating because you are now contributing,” he added, “but you still have to pay that $2bn-plus.... They’re going to have to allow pension funds to invest overseas because the local market cannot absorb this.” The draft Pensions Bill 2023 will end the present ‘pay-as-you-go’ pension

scheme enjoyed by the Government’s near-20,000 existing civil servants through requiring them - for the first time - to contribute to financing their retirement from their own salaries. However, all those with more than eight years’ service in pensionable positions will remain with the existing arrangement unless they opt to switch.

The Ministry of Finance, explaining the background to the proposed legal reforms, revealed that financing the current system will increase the annual burden imposed on Bahamian taxpayers by 32.7 percent or $54m over the next six years as growing numbers of civil servants retire and become pensioneligible. The yearly funding bill is forecast to grow from $165m at present to $219m by 2030.

Civil service pensions are currently 100 percent financed by taxpayers through the annual Budget, and the Ministry of Finance said: “During the past two years, the Government’s mission has been to prioritise the containment of growth in relation to pension liabilities, aimed at reducing the burden on public sector finances. Currently, the Government carries an unfunded liability of more than $2bn.

“Pension consultant, KPMG Advisory Services, conducted a pension reform feasibility study on the Government’s pension scheme in 2013 which was revised in 2022. This study estimated pension liabilities for public sector employees would accumulate to $2.2bn between 2013 and 2020, and projected an increase to $3.5bn by 2030.”

As for annual payouts to civil service retirees, the Ministry of Finance added: “Future cash outflows are also projected to increase significantly, from

approximately $165m currently to $219m by 2030 - including both pension payments and gratuities.

“In addition, Government-owned corporations have similar defined benefit pensions with annual cash outflows of approximately $10m. Given these alarming statistics, measures must taken to provide a sustainable solution to bring about reforms to the public sector pensions plan.”

Pension payments for the current 2023-2024 fiscal year were estimated at $134.744m, with gratuities adding a further $33.776m, to bring the total taxpayerfunded outlay to $168.52m. The latter figure is forecast to steadily increase to $173.44m in 2024-2025, and then to $175.413m the following fiscal year. Civil servants in pensionable positions for more than

eight years can voluntarily choose whether to join the contributory scheme or retain their current arrangements. The mandatory contribution rate has been set at 3 percent of a plan member’s monthly salary, with the Government making a matching 3 percent payment. Workers can also choose, on their own accord, to raise the contribution rate for their portion to a maximum 10 percent although this will not be matched by the Government. The Public Service Contributory Pensions Fund will be overseen by a Board, which will appoint an independent investment manager, fund administrator and custodian to manage and safeguard pension plan assets.

‘Total incompatibility’: But $100m project forges on

FROM PAGE B1

Yntegra Group’s project calls for overwater bungalows, a marina, sports amenities and staff quarters, with the marina and bungalows risking damage to the pristine seagrass in the surrounding area. He said: “It does not benefit the environment in any way. I don’t see how you can benefit tourism while,

at the same time, destroying the environment because the environment is what generates and sustains our tourism “If they dredge a mega marina in pristine seabed, which includes seagrass, you are going to impact the environment and I don’t see how that can happen without significant destruction. So you are looking to benefit from tourism

while destroying the environment. Those things are obstinately diametrically opposed as far as the model for tourism in the Exumas.”

Mr Carey maintained that the Exumas are not the place for a mega marina, and the Yntegra project is “absolute and total” in its incompatibility with the sustainable ethos of Turtlegrass Resort

He said: “There are parts of our country where we will approve marinas, and even mega marinas, because the environment has more capacity to absorb that. But that untouched part of the Exumas is not a place that should have to absorb that impact. They

are putting in a marina, putting in overwater bungalows in channels, dredging in channels fast flowing with lots of currents.

“A mega marina in a pristine area is totally destructive to the environment, and totally destructive to our client’s concept. We cannot co-exist with a mega yacht marina having destroyed the seagrass and coral reefs on the nearby beach, off shore of the beach, where my clients are going to be snorkeling, paddle boarding, etc. We’re talking about absolute and total incompatibility.”

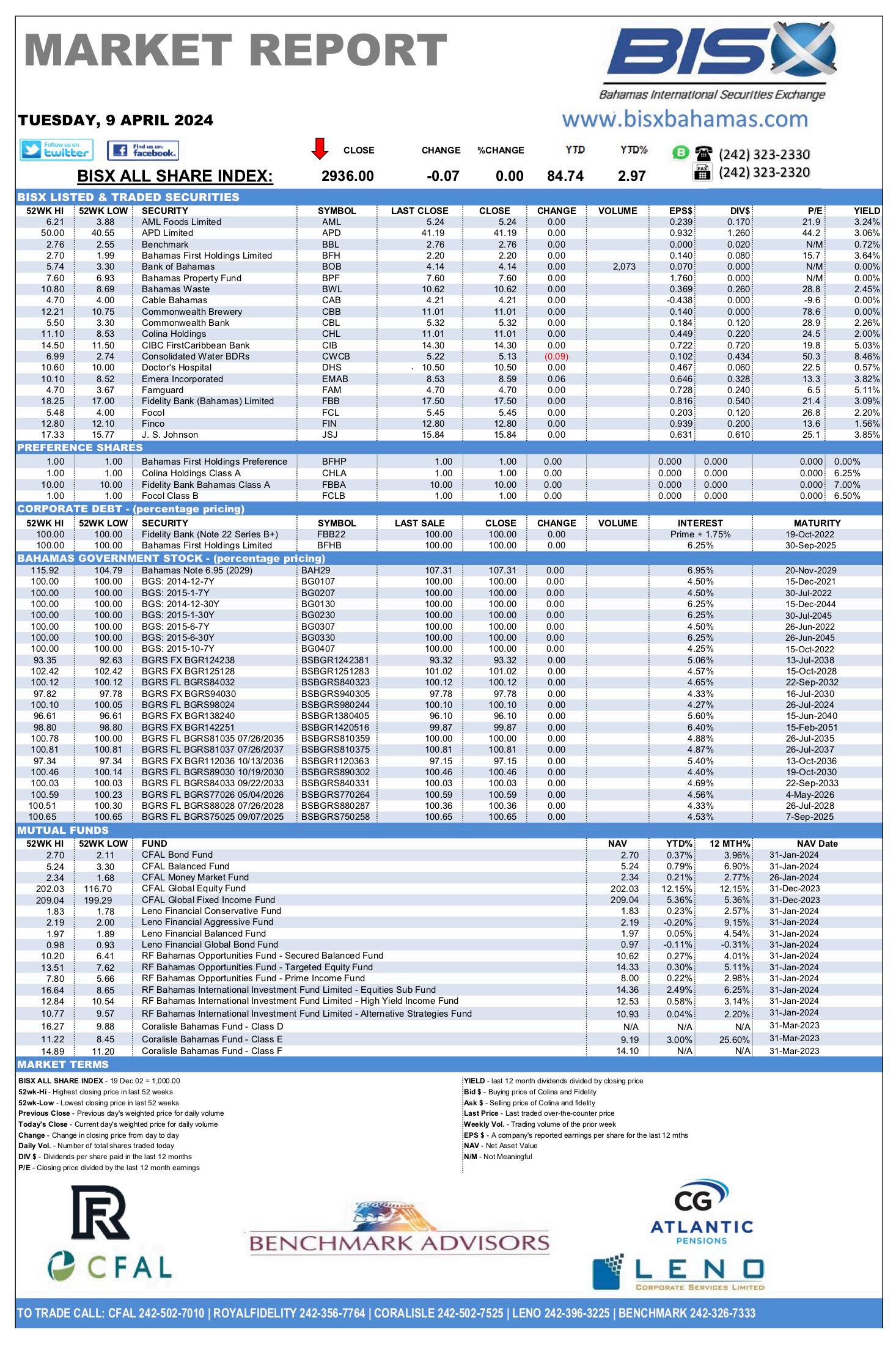

WHEN WILL FED CUT RATES? AS US ECONOMY FLEXES ITS MUSCLES, MAYBE LATER OR NOT AT ALL

By CHRISTOPHER RUGABER AP Economics WriterEVER since the Federal Reserve signaled last fall that it was likely done raising interest rates, Wall Street traders, economists, car buyers, would-be homeowners — pretty much everyone — began obsessing over a single question: When will the Fed start cutting rates? But now, with the U.S. economy showing surprising vigor, a different question has arisen: Will the central bank really cut rates three times this year, as the Fed itself has predicted — or even cut at all? The Fed typically cuts only when the economy appears to be weakening and needs help. Lower interest rates would reduce borrowing costs for homes, cars and other major purchases and probably fuel higher stock prices, all of which could help accelerate growth. An even more robust economy might also benefit President Joe Biden's re-election campaign.

Friday's blockbuster jobs report for March reinforced the notion that the economy is managing quite nicely on its own. The government said employers added a huge burst of jobs last month — more than 300,000 — and the unemployment rate dipped to a low 3.8% from 3.9%.

A TRADER works

Some analysts responded by arguing that it's clear the last thing the economy needs now is more stimulus from lower rates.

"If the data is too strong, then why are we cutting?" asked Torsten Slok, chief economist at Apollo Global Management, a wealth management firm. "I think the Fed will not cut rates this year. Higher (rates) for longer is the answer."

In March, the central bank's policymakers — as a group — had penciled in three rate cuts for 2024, just as they had in December. Some economists still expect the Fed to carry out its first rate reduction in June or July. But even at last month's Fed meeting, some cracks had emerged: Nine of the 19 policymakers forecast just two rate cuts or fewer for 2024.

Since then, Friday's jobs data, combined with an unexpectedly buoyant report showing that factory output is expanding again after months of contracting, suggested that the economy is extending an unexpected run of healthy growth.

Despite the Fed's aggressive streak of rate hikes in 2022 and 2023, which sent mortgage rates and other borrowing costs surging, the economy is defying longstanding expectations that it would weaken.

Such trends have made some Fed officials nervous. Though inflation is down sharply from its peak, it remains stubbornly above the Fed's 2% target. Rapid economic growth could reignite inflation pressures, undoing the progress that has been made.

In a slew of speeches this past week, several Fed officials stressed that there was little need to cut rates anytime soon. Instead, they said, they need more

information about where exactly the economy is headed.

"It's much too soon to think about cutting interest rates," Lorie Logan, president of the Federal Reserve Bank of Dallas, said in a speech. "I will need to see more of the uncertainty resolved about which economic path we're on."

Raphael Bostic, head of the Atlanta Fed, said he favored just one rate cut this year — and not until the final three months. And Neel Kashkari, president of the Minneapolis Fed, sent stock prices falling Thursday afternoon after raising the possibility that the Fed might not cut at all this year.

"If we continue to see strong job growth," Kashkari said, "if we continue to see strong consumer spending and strong GDP growth, then that raises the question in my mind, well, why would we cut rates?"

Still, a strong economy and hiring, by themselves, might not necessarily preclude rate reductions. Chair Jerome Powell and other officials, such as Loretta Mester, president of the Cleveland Fed, have underscored that the main factor in the Fed's ratecutting decision is when — or whether — inflation will resume its fall back to the central bank's 2% target. They note that the economy managed to grow briskly in the second half of 2023 even while inflation fell steadily. Inflation is just 2.5% now, according to the Fed's preferred measure, down from a peak of 7.1%.

Still, in January and February, "core" prices — which exclude volatile food and energy costs — rose faster than is consistent with the Fed's target, raising concerns that inflation hasn't been fully tamed.