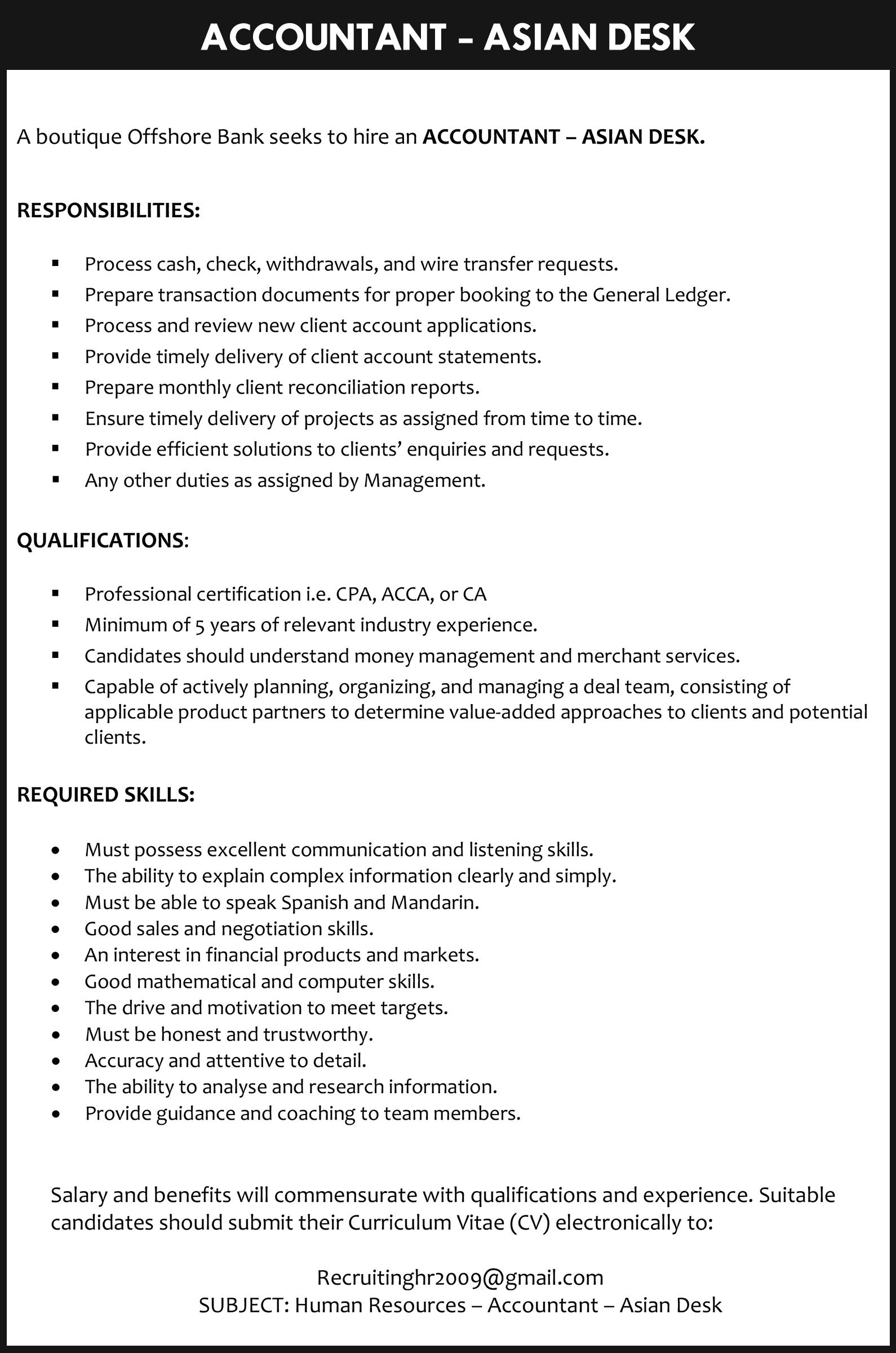

Soaring boat insurance ‘huge cost’ to Bahamas

ASTRONOMICAL boat insurance costs are having a “huge” impact on Family Island hotels and marinas through shortening the tourism season by a month and leaving many “empty” over the summer.

reduced business volumes and bookings during the summer months.

GBPA: $200m in taxes far exceed Gov’t outlay

• Vessel exodus cuts tourism season by month

• Has ‘big impact’ on hotel, marina occupancy

• Promotion Board places issue on ‘agenda’ $5.60

Emanuel “Manny” Alexiou, the Bahamas Out Island Promotion Board’s president, told Tribune Business that whereas resorts and marinas used to be “busy through” to the early September Labour Day holiday in the US most boaters now depart this nation’s waters in early August and do not return until early to mid-November. He explained that, for many owners, insurance costs meant it was simply too expensive to keep their vessels in The Bahamas during hurricane season. Mr Alexiou, also the Abaco Beach Resort’s proprietor, revealed that one Carolinas resident had informed him he was moving his boat from The Bahamas to Georgia this summer to save around $40,000 in insurance costs.

“As for the boating industry, I think we in this survey found that airlift and related infrastructure were most, most important, and the high operating costs of doing business in The Bahamas and boat insurance, especially the fact most boaters have to leave at the beginning of August and not return to the beginning or end of November. That’s a big cost to The Bahamas in terms of occupancy,” Mr Alexiou said recently.

Disclosing that insurance costs were an issue now on the Bahamas Out Island Promotion Board’s “agenda”, he told this newspaper that the impact represents a “big cost” to this nation’s resort, marina and boating industries in terms of

Speaking subsequently to Tribune Business, he explained that owners face “add-on” insurance costs if they keep their vessels in this nation during peak hurricane season. This is because, “if the boat sinks or has major damage here, they will have to get to the US to fix it, so the extra cost of salvage and transportation adds on to it” and represent increased expenses that insurers factor into premium rates.

“It’s a huge impact,” Mr Alexiou said of the now-typical August

THE Grand Bahama Port Authority (GBPA)

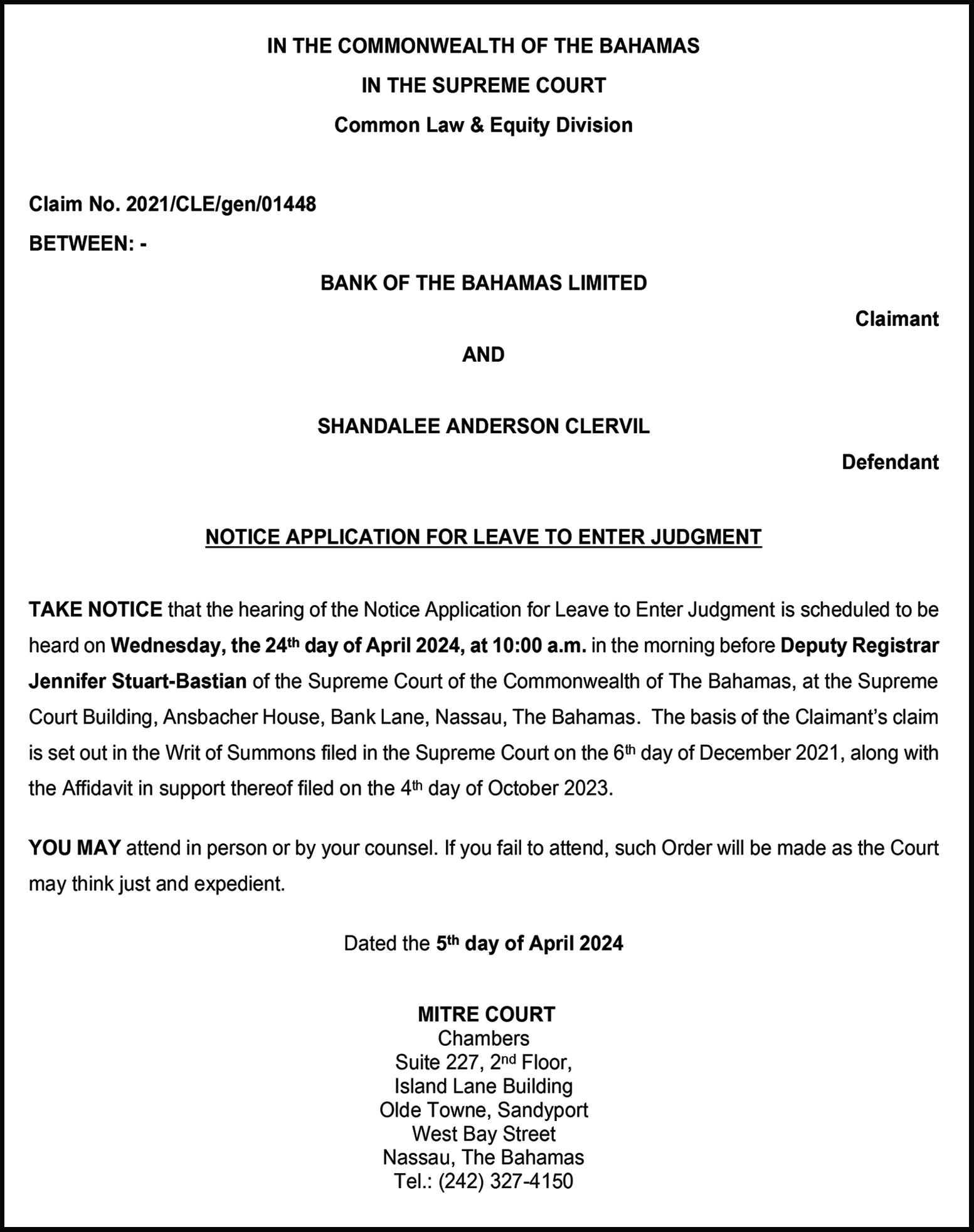

yesterday blasted the Government’s huge payment demand as ill-founded by arguing that the $200m tax revenues earned by the latter far exceed what it invests in Freeport. Freeport’s quasi-governmental authority, hitting back at the Davis administration’s $357m reimbursement claim, promised to “robustly defend” itself and its owners against such a demand and voiced optimism that it will be “firmly” defeated both in arbitration and, potentially, in the court system if required.

In a statement that will likely further escalate the reignited battle with the Government, the GBPA accused it of making the demand “to force” the Hayward and St George families to sell their respective 50 percent equity ownership interests after

they rejected its offer to buy them out at a price which was under-valued or at “a considerable discount” compared to what they feel the business is worth.

And, warning that a very public dispute between Nassau and Freeport will “prove hugely damaging” to the latter’s economy and investor confidence, just as Grand Bahama is poised to enjoy a $2bn investment pipeline, the GBPA sought to turn the tables on the Government as to who is to blame for the city and wider island’s ills.

Prime Minister Philip Davis KC, at the weekend, tried to pin all the blame on the GBPA, the two families and its executive management, but Freeport’s quasi-governmental authority accused the Government of “systematically handcuffing” it by preventing it from acting as a “one-stop shop” investment approvals process and thus placing it at a competitive

business@tribunemedia.net MONDAY, APRIL 8, 2024

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net Deltec’s big damage from FTX investor ‘Gatling gun’ A BAHAMIAN bank and its chairman have blasted aggrieved FTX investors for employing “a Gatling gun approach” that has inflicted “tremendous damage” on their financial services reputation. Deltec Bank & Trust, and Jean Chalopin, in an April 2, 2024, filing that again urges the south Florida federal court to dismiss a long-running class action lawsuit, both asserted that the former crypto exchange’s clients behind the claim had merely fired off “a barrage of baseless conclusions” in the hope that something will stick. However, the Bahamian financial institution and its chairman argued that the claims “miss their mark completely” while again asserting that the Florida court lacks jurisdiction over them. They argue instead that the aggrieved investors should instead “reinstate” their action and bring it before the Bahamian judicial system. “Plaintiffs employ a Gatling gun approach to pleading - wildly firing a barrage of baseless conclusions and implausible inferences at the defendants By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B6 THE Prime Minster personally told the Grand Bahama Port Authority’s

owners that he has “no confidence” in their ability to “realise the promise and potential of” Freeport. Philip Davis KC revealed his blunt verdict on the

and St George

capabilities, and

of the GBPA’s

Tribune Business was

audio

PM told GBPA’s

By NEIL HARTNELL

(GBPA)

Hayward

families’

those

executive management, during a Progressive Liberal Party (PLP) branch meeting on Grand Bahama on Saturday night where he asserted: “Enough is enough.”

sent an

recording of the meeting, later widely circulated on social media, during which the Prime Minister said the “rubber

owners: I have ‘no confidence’ in you

Tribune Business Editor nhartnell@tribunemedia.net

NEIL

Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B9 SEE PAGE B4 SEE PAGE B8 PHILIP DAVIS KC

By

HARTNELL

$5.61

$5.96

$5.75

MINISTER REJECTS 25 CENT BUS FARE INCREASE ‘INSULT’

A CABINET minister has rejected assertions by jitney drivers and franchise owners that the Government’s 25 cent adult-only fare increase is an “insult” to the industry.

Jobeth Coleby-Davis, minister of transport and energy, told a Town Mall meeting called to discuss the increase, which will take effect from May 1, and raise the fare for adult passengers only from $1.25 to $1.50, that the Government had to balance the industry’s needs with those of consumers who have struggled with the post-COVID cost of living crisis.

Fares for children, teenagers and senior citizens will remain unchanged, and Mrs Coleby Davis asserted that she has been “going to bat” on behalf of the public transportation sector to secure the first increase in jitney fares for 16 years from her Cabinet colleagues. She described the increase as a “start”, and argued that drivers and franchise owners “can’t be ungrateful” as they are getting “something” . “The Government of the Bahamas through the Cabinet of

the Bahamas has approved and granted a fare increase of 25 cents,” Mrs ColebyDavis said.

“We know you asked for more. Yeah, I know the grumbling and the mumbling is gonna start, but that’s okay. We’re starting somewhere. It’s been 16 years, and we’re starting somewhere, so let’s start here together with me.

“So the ministry is now working with the Law Reform and Revision Commission so that we can have this fare increase in place for May 1, 2024. Ain’t no one gonna clap for that… Listen to me, you can’t be ungrateful, you get something, so let’s go with that, right, and then we’ll go from there.”

Many, though, voiced their concerns during the question and answer session, with one attendee saying he was “personally

insulted” at receiving a 25 cent fare increase that is woefully insufficient offset the increases in fuel and other operating costs since 2008.

Aaron Woodside, of Woodside’s Bus Service, said he spends between $80 and $100 on diesel fuel daily and has to upgrade his vehicle every five years, in addition to regular maintenance. He called for the Government to adopt a more “respectful position” with industry. He added: “While you said that we should be thankful, grateful was your expression, let me tell you something ma’am. I’m personally insulted. After 16 years, you can say to a grown man with two daughters in university, a mortgage and other financial obligations that 25 cents is the best that you could do and we should be grateful. I think not, ma’am.”

Mr Woodside added that taxi drivers received a much larger increase, and pointed out that bus drivers and owners are businessmen and the Government should “do better”. He argued: “The taxi drivers got an increase for standing up of more than the 25 cents. We have to do better. We should not, Madam Minister, with all due respect, we should not stand up to grown men

businessman. We’re not all sill, you know. “I’ve used my mother’s wit and common sense to be able to provide for myself and for my family, and I’m saying this 25 cents nonsense is ridiculous. I have to go out there every five years to upgrade my craft, my machine, the price has almost doubled since my first bus purchase.”

In response, Mrs ColebyDavis said she fought for the fare increase but the Government has to “find a balance” due to the impact on passengers. She maintained that she was able to get “something to start with”, and her intention is not to insult the sector.

“As relates to the 25 cents, I took the recommendation that the industry gave me,” Mrs Coleby-Davis said. “I took that. I fought for that. I wanted that to be what was approved. The difference with this sector is that we have to find a balance, and bridge a balance, because of who we service in this sector. And so I did not get the number that I was trying for but I was able to get something to start with. “After 16 years, I wanted to get something to start with as opposed to get nothing. So I fought for something, not that I’m insulting you or any driver in here, because I do believe the sector should rise as other things rise. But that was what I was able to achieve for the sector and I think I fared well. “So it’s not an insult to the sector. I don’t think anyone in the sector is dumb, but that was what I was able to achieve. And so these decisions are not made by just me. I had to fight for you, and I fought to get something.” Harrison Moxey, the United Public Transportation Company’s (UPTC) president, whose organisation had been advocating for a fare increase of 75 cents - from $1.25 to $2agreed that the industry feels “insulted” by the 25 cent increase and called for the decision to be revisited. He said the cost of a bus has increased from $52,000 in 2008 to $82,000 in 2024, and the industry has not received a fare rise, while taxis can cost as little as $5,000 and they recently received a 10 percent increase.

Mr Moxey said that while he understands the Government’s position of not wanting to overwhelm the general public, the minimum wage rate has also increased and passengers can now afford to pay more. He added that industry stakeholders are currently operating at a deficit and “are being forced to subsidise the general public, which is the Government’s responsibility”. Mr Moxey said: “We understand the Government’s price that they want to satisfy the public or the electorate from the Government’s standpoint, but we are not politicians; we are business people.

“The same people that you only want to give us 25 cents on are the same people who just got a minimum wage increase. They can pay more, so please let them do more. So we would appreciate that this be revisited understanding that we are running a deficit, and we are being forced to subsidise the general public, which is the Government’s responsibility.”

Mr Moxey said: “We proposed the $2 increase and we did not get it, so a lot of us feel insulted by the 25 cents. We sit in here to talk about us getting an increase from 2008… taxi drivers can spend $5,000 on a taxi and they are good to go with their increase… “Buses were for $52,000 from 2008. From our first increase we are now $30,000 removed from the time we got our last 25 cents increase. We have heard a lot of it, so the sentiments of my colleagues and my fellow franchise holders and operators and bus drivers is that this must be revisited.”

PAGE 2, Monday, April 8, 2024 THE TRIBUNE

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

JOBETH COLEBY-DAVIS

JITNEY OWNERS BLAST BDB’S CHAIR ON 70% DEFAULT CLAIM

JITNEY franchise owners slammed the Bahamas Development Bank’s (BDB) chairman as “disingenuous” for asserting that more than 70 percent of transport-related loans extended since 2009 are in default.

They hit out after Senator Quinton Lightbourne, addressing last week’s town hall meeting on the proposed 25-cent jitney fare increase, disclosed that the Government-owned development bank has granted $1.8m in credit to jitney and taxi drivers over the past 20 years. He added that 42 loans were approved in the past 15 years, with 30 becoming delinquent or “unsalvageable”. Mr Lightbourne said: “Over the past 20 years, the Bahamas Development Bank has awarded or granted $1.8m in loans for jitneys and taxi drivers. We’ve approved 42 loans in the past 15 years.. “Someone take a guess to tell me how many are still current.... 12…. We have 30 loans that have become

TAXI FARES, CONDUCT CODE ‘TWO VICTORIES’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE tourism and taxi industries have secured “two victories” through the new fare schedule and ‘code of conduct’ that all drivers will have to obey. Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, said the implementation of both initiatives is a dual victory for both sectors as it will address a “a significant amount of the complaints” from tourists and local customers regarding the taxi industry.

He explained that the new rates will be circulated among large resorts and operations that frequently use taxis, so there will be “absolutely no question” about the fares that customers will be charged.

“For operators like NAD (Nassau Airport Development Company), the cruise port, various hotels, the gazetting of the rates is so so important because they will address perhaps a significant amount of the complaints that exist,” Mr Sands said.

“The minister [Jobeth Coleby-Davis] committed to the wide distribution of these rates that will be on display prominently at all the embarkation locations. So there is absolutely no question that these rates are delineated in terms of point of origin to the point

of destination, which is perhaps a very, very significant win for the end users, and so the customer. “There are two victories there: The rate increase, which is a big victory for the drivers, but more important the publication of the new rates with an effective date.” Meanwhile, the newly-implemented Code of Conduct for Taxi Operators and Public Service Drivers mandates that all must have the taxi rates displayed in a “visible, readable, legible manner”, and that drivers are not permitted to negotiate taxi fares. “A driver must have displayed in a visible, readable, legible manner, or in a manner where the information is otherwise easily accessible by an actual or prospective passenger, the gazetted taxi rate/fares approved by the Government of The Bahamas,” the code of conduct stipulates.

“Drivers are not permitted to negotiate taxi fares and must strictly adhere to the approved taxi cab fares without exception. Failure to adhere to gazetted taxi-rates shall constitute a major breach of this code.”

The code of conduct also mandates that drivers found guilty of a major breach will have to surrender their public service driver’s license and taxi plate for a period of no less than one month.

On the second offence, drivers must surrender their public

delinquent and unfeasible, and unsalvageable in some instances, because obviously over the amount of time the jitney or taxi vehicles have not been serviced, and so they’ve definitely gone into default and, even from a collateral perspective, we were not able to get anything from them.”

Mr Lightbourne said the BDB will now offer 6.27 percent interest rates on loans to jitney and taxi drivers in a bid to encourage them to obtain financing from it. He added: “One of the key things that this present board of the Bahamas Development Bank plans to do moving forward is being able to put some incentives in place, and interest rates that are going to be very feasible as compared to any commercial bank.

“The Bahamas Development Bank is now establishing the 6.27 percent

service driver’s licence and taxi plate for a period of no less than 60 days, and if the second offence is identical to the first, a period of 90 days.

After a third major breach, drivers must surrender their taxi plate and have their public service driver’s licence revoked.

“A Driver found guilty of a major breach will be subject to suspension of his/ her public service driver’s licence and surrender of both the public service driver’s licence and taxi plate for a period of no less than one month,” said the code of conduct.

“A driver found guilty of a second major breach shall be subject to suspension of his/her public service driver’s licence and surrender of both the public service driver’s licence and taxi plate for a period of no less than sixty days, provided that where the second breach is identical to the first or any prior breach, suspension shall be 90 days.

“A driver and/or taxi operator found guilty of a third major breach shall be subject to revocation of his/ her public service driver’s licence and the taxi operator shall be required to surrender the taxi plate to the controller.”

interest rate for jitney drivers and taxi vehicles.”

But Harrison Moxey, the United Public Transportation Company’s (UPTC) president, said during the meeting’s question and answer segment that many bus and taxi drivers receive interest rates of 5.7 percent or lower from commercial banks.

That is some 57 basis points, or 0.57 percentage points, lower than what the BDB is proposing, so Mr Moxey argued it would have to “do a better job” to incentivise industry stakeholders to seek financing through its offices.

He said: “With the greatest respect to you, Senator, I think we get better interest rates with the banks currently than 6.2 percent, so I don’t think that that really doed us any great justice to empower us to come to the Bahamas Development Bank. Some of our

interest rates are 5.7 percent, and some even less, so you’d have to do a better job with that.”

Mr Moxey argued that it was “disingenuous” of Mr Lightbourne to mention the 30 bus and taxi drivers, who have allegedly defaulted on their loans over the past 15 years, without mentioning the “civil servants and politicians” that have also received financing from the BDB and defaulted.

He said: “For you come to this forum, to say you have like 42 persons in our industry who would’ve gotten loans and you have about 12 of them who are current.... Again, you see, it’s easy to say that, because it makes us look bad and it hang us out to dry, but you don’t say how many other civil servants and politicians have probably gotten loans from the Bahamas Development Bank and ain’t pay you yet.

“So you, know, that’s disingenuous, for you to come and say that because I don’t know how many of us in here owe you.” Mr Moxey said that although bus drivers and operators applied for financing during the COVID-19 pandemic none of them qualified, and it appeared they were at the “bottom for consideration” with the Government.

He said: “When you do go to these institutions, as we would have after COVID hit us so hard, many of us went to Access Accelerator (the Small Business Development Centre). We fill out everything to qualify.

“Not one of us got any stipend or loan to better our business from Access Accelerator. Bus drivers, bus owners didn’t qualify for that government operation, so you see once again that puts us at the lower end and the bottom for consideration.”

Minister: New taxi code ‘not onerous or difficult’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A CABINET minister is asserting that the new taxi driver Code of Conduct is “not unreasonable, onerous or difficult” as she confirmed the 10 percent fate increase that drivers will now enjoy. JoBeth Coleby-Davis, minister of transport and energy, said the fare rise will apply to all taxi drivers in The Bahamas. The new schedule for New Providence is being gazetted, while that for the Family Islands is still being completed.

The new fare sheets will be distributed throughout large resorts and companies that frequently

use taxis so customers are aware of what they can be charged. “We have, through the Government of the Bahamas, granted and got the approval for the increase in our taxi fares across the board throughout the Commonwealth of the Bahamas at the rate of 10 percent,” Mrs ColebyDavis said. “The fares for New Providence have been gazetted, and the fares for our Family Islands are currently being completed. We want to make sure that we get our fare sheets correct, because we will also be sharing them with our large hoteliers and other large organisations where taxis operate, so they can have them available as well.”

Mrs Coleby-Davis said the hotel industry

helped draft the code of conduct, which sets out the standards and expectations that taxi drivers have to comply with. She added that the code of conduct is “not unreasonable, onerous or difficult”, and will clearly set guidelines for the industry.

“[The Bahamas Hotel and Tourism Association] also helped and supported us in drafting and implementing the code of conduct for taxi operators and the public service drivers,” Mrs Coleby-Davis said. “A code that exists in everyone’s mind because they know what the standards of the industry are, but now codifying it, putting it in a document that people

THE TRIBUNE Monday, April 8, 2024, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

SENATOR QUINTON LIGHTBOURNE

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 SEE PAGE B8

ELEUTHERA BUSINESS OUTLOOK CONFERENCE IS TWO-DAY EVENT

Commonwealth Bank,

THE 12th annual Eleuthera Business Outlook will be a two-day event held in the islands’s north and south in a bid to stimulate broader discussion on its economy. The event, which will be held under the theme ‘Future Eleuthera: Branding the National Identity, Planning for Success’, will be held on April 18-19 and aims to also give an in-depth look into the island’s diverse and thriving economy.

The first day’s keynote address, at the Eleuthera Business Hub in Rock Sound, will be given by Clay Sweeting, minister of works and Family Island Affairs, and MP for South and Central Eleuthera.

Other speakers that day include Tracy Boucher, vicepresident of engineering

and technology at Cable Bahamas; Christel SandsFeaste, partner at Higgs & Johnson; Philip Galanis, managing partner at HLB Bahamas and chairman of the Bahamas Trade Commission; Dennis Deveaux, chief financial officer at Doctors Hospital Health Systems; and Dominic Sturrup, senior vice-president of Bahamas Striping. Joining them as presenters will be Joseph Gaskins, regional director of public affairs at Disney Cruise Lines; Dr Kenneth Romer, director of aviation and deputy director-general at the Ministry of Tourism, Investments and Aviation; Keyron Smith, president and chief executive of the One Eleuthera Foundation; Scott Blacquieri and Anya Ferguson from Sunset Estates & Marina; Lakeisha

Anderson-Rolle, executive director of the Bahamas National Trust; John Christie from HG Christie; Mark Hussey from BRI Sotheby’s International Realty; and Serena Mayers, officer in charge of Bank of The Bahamas’ Eleuthera branch. The Eleuthera Chamber of Commerce, which has supported the Outlook since its inception, has again partnered with event organisers, the TCL Group. Its president, Thomas Sands, will be a speaker and moderator at this year’s Outlook.

Mr Sands emphasised the importance of strategic planning to capitalise on the economic opportunities emerging in Eleuthera and other Family Islands. He pointed to increased foreign direct investment

Deltec’s big damage from FTX investor ‘Gatling gun’

in the hope that something will hit its target,” their dismissal motion argues.

“Plaintiffs’ allegations directed at Deltec Bank and Mr Chalopin, however, are blanks; a loud burst of irrelevant, editorialised and often patently false statements crafted to shock and fool the reader into believing commonplace banking activity is somehow evidence of participation in a wide-ranging conspiracy. It is not.

“When the smoke lifts and the non-conclusory allegations are viewed in the proper context, plaintiffs once again miss their mark completely.... In short, the second amended complaint (SAC) includes nothing more than baseless and conclusory allegations deliberately crafted to cast Deltec Bank and Mr Chalopin in a false light and

damage their reputations before the court and the public.”

The class action lawsuit appeared to gain new life and momentum in mid-February after its proponents seemingly received fresh ammunition from the production of 7,000 pages of Telegram messages - many featuring the Bahamian bank’s executives - by Sam Bankman-Fried’s former girlfriend, Caroline Ellison. However, in their latest legal filings, Deltec and Mr Chalopin allege there is nothing to tie them to Florida that gives the US court jurisdiction over them.

“There are no meaningful factual allegations (or any facts whatsoever) to support Deltec Bank’s or Mr Chalopin’s knowing participation in a conspiracy to assist FTX’s fraud,” the Bahamas-based duo allege. “Plaintiffs, therefore, rely on implausible

assumptions, unsupported speculation and innuendo, and recklessly mischaracterised communications. Even a cursory examination of plaintiffs’ hyperbolic allegations (and even taking these allegations as true), however, reveals they are baseless (at best) and wholly fail to state any claims.

“Plaintiffs’ claims against Mr Chalopin are the most straightforward examples. Plaintiffs base their alleged claims - civil conspiracy, aiding and abetting, and RICO - almost entirely on Mr Chalopin’s supposed lobbying efforts in The Bahamas to encourage the passage of laws favourable to the cryptocurrency industry, his attendance and participation at the ‘Crypto Bahamas summit’, and his alleged assistance to ‘the Bahamian government in drafting crypto-friendly’ laws ‘to attract digital asset

(FDI), and growth in the Airbnb segment, boutique hotels and the cruise industry on the island. “Historically, Eleuthera’s economy has been primarily in South Eleuthera, closely tied to Central Eleuthera, with Harbour Island and Spanish Wells contributing significantly. The diversity of Eleuthera creates a broad base of opportunities for Eleutherans and Bahamians alike,” said Mr Sands. He stressed the need for strategic planning in addressing infrastructure and other challenges while training Bahamians for emerging opportunities.

On April 19, the Eleuthera Business Outlook will continue at Valentine’s Resort and Marina in Harbour Island, where Sylvannus Petty,

start-ups and other crypto ventures to The Bahamas’. That’s it.

“From that flimsy foundation, plaintiffs leap to the implausible and unsupported conclusions that Mr Chalopin’s intent was somehow to transform The Bahamas into a ‘sandbox for fraud’ and to pass laws that ‘helped FTX achieve [a] veneer of regulatory compliance’,” Deltec and Mr Chalopin continued.

“According to plaintiffs, Mr Chalopin ‘surely knew’ FTX’s actual compliance with the new laws was ‘but a fig leaf’. What is missing entirely, however, are any facts needed to bridge the massive gap that exists between allegations that Mr Chalopin engaged in lawful lobbying and the unfounded conclusions that he did so with actual knowledge of - and for the purpose of aiding - FTX’s fraud or any other wrongful conduct.”

Deltec and Mr Chalopin also argued that the class action lawsuit had failed to provide any evidence they were involved in a

MP for North Eleuthera, will provide an update. Chester Cooper, deputy prime minister, and minister of tourism, aviation and investments, will deliver the keynote address. Other speakers that

day will include Chantelle Sands from Aliv Bahamas Business; Robert Deal from the Water & Sewerage Corporation; Maxwell Daniels from Bahamas Power & Light; Drexel Woods from the Bahamas Telecommunications Company (BTC)’ Ben Simmons from The Other Side; Lee Prosenjak from Valentines Resort & Marina; Henry Rolle from The Rock House, Harbour Island; and Chorten Wangyel from Coral Sands. Others will include Darico Higgs from Higgs Construction Company; Leroy Dames from

conspiracy with FTX and its founder, Sam BankmanFried, who was jailed for 25 years pre-Easter for masterminding the crypto exchange’s multi-billion dollar fraud for the simple reason that “no facts exist to support it”.

However, the lawsuit and associated media coverage was said to have inflicted serious harm on both Deltec and Mr Chalopin. “The gaping holes in plaintiffs’ allegations are overshadowed by how shockingly inaccurate and reckless they are,” they argued in their motion to dismiss/

“By mining and sculpting cherry-picked fragments from longer Telegram chat messages to fit their agenda, plaintiffs have erected a Potemkin village, the apparent purpose of which is to hide the weakness in their claims from the court’s view and to inflict as much reputational damage as possible on Deltec Bank and Mr Chalopin.

“Indeed, plaintiffs’ allegations have caused tremendous damage to Deltec Bank, a long-standing institution in The Bahamas that has supported innovative and emerging industries as well as prominent businesses and individuals for more than 70 years.”

Accusing the former FTX investors of misrepresenting and mischaracterising what they described as routine financial services transactions, Deltec and Mr Chalopin added: “Plaintiffs selectively mischaracterise message fragments from about 7,000 pages of chat

messages and add a heaping dose of rank speculation and innuendo until they are satisfied they have, as best as possible, transformed standard day-to-day banking transactions into an international conspiracy.

“But this sleight-of-hand pleading tactic, which has caused significant harm to Deltec Bank and Mr Chalopin, should not be condoned. After plaintiffs’ baseless and speculative conclusions are properly set aside, the SAC (second amended complaint) does not come anywhere close to stating viable legal claims against either of them.”

The class action lawsuit is alleging that Deltec “assisted FTX group with sidestepping, if not outright violating” Bahamian laws and the Central Bank of The Bahamas’ Know Your Customer (KYC) due diligence guidelines for onboarding new customers and accounts.

It also claimed that Deltec executives copied and pasted the KYC questions from Citibank into a Telegram chat involving Alameda Research, Mr Bankman-Fried’s private trading arm that played a central role in FTX’s collapse, so it knew what it had to do to meet Citibank’s requirements.

The lawsuit also alleged that Deltec helped Alameda “track its siphoning of FTX customer funds” through the accounts the latter held with the Bahamian bank, with incoming and outgoing wires totalling between $200m and $1bn on a regular basis.

PAGE 4, Monday, April 8, 2024 THE TRIBUNE

Spanish Wells; Natasha Shepherd from Dunmore Realty; James Malcolm from BPG Real Estate;, Robert Arthur from Coldwell Banker Lightbourn Realty; William Simmons from Harbour Island Green School; Keyron Smith from One Eleuthera Foundation and Centre For Training & Innovation (HITS); and Dorlan Curtis Jr from Foodpost Farms. For registration and further information, visit tclevents.com or contact Margaret Albury

322.1000

malbury@

at

and

tclbahamas.com or Audrey Tynes at atynes@eleutherachamberofcommerce.com

FROM PAGE B1

HUMAN RESOURCES FORUM TO TACKLE DIGITAL ERA IMPACT

BAHAMIAN and regional human resources executives will share insights on developments impacting employee relations during TriblockHR’s HR in the Digital Era forum.

The forum, which will be held on Wednesday, May 15, in partnership with the Crypto Isle digital assets co-working space, will be free and open to the public. It aims to foster discussion on the importance of digital transformation for human resources and businesses as a whole. Topics will include digital training, remote working, employee retention and digitising employee records.

Duran Humes, TriblockHR and Plato Alpha Design’s chief executive, said: “TriblockHR over its life cycle has positioned itself to be a relevant voice in this area of discussion within The Bahamas, seeing that it is the first of its kind in the country, an all-in-one human capital management and payroll software.

“We thought it would be fitting for us to bring together leaders from varying industries to speak to the public about how companies are adapting to the new age of technology when interacting with their most important resource, their people.”

Joseph Gaskins Jr, Disney Cruise Line’s regional public affairs director, will serve as one of the evening’s panellists. He said that when it comes to human resources

and good business, digital transformation has become unavoidable.

“No matter how you cut it, if your organisation fails to understand and embrace the digital tools that can add value to its operation, it will fall behind and eventually fail,” Mr Gaskins said. “In HR, or in the case of my work, communications and public affairs, the risk of not diving in to fully understand the benefits and pitfalls of digital transformation is too great to ignore.”

Bahamasair to resume Haiti flights on April 20

BAHAMASAIR will resume flights to Cap Haitien, in Haiti, from April 20, 2024, after determining it remains a safe and secure destination.

The national flag carrier, in a statement, said it will be operating scheduled flights twice per week on Tuesdays and Saturdays.

“We have conducted thorough assessments regarding Cap Haitien and have determined it to be a secure destination for the airline to restart scheduled flights, as with other carriers. We express our appreciation to our passengers for their steadfast support throughout the

temporary flight suspension,” Bahamasair said.

The airline advised passengers to stay informed about the latest travel advisories and entry requirements for Cap Haitien before booking their flights.

Antonique Smith, Doctor’s Hospital’s human resources manager, said the digital era has transformed the employee relations landscape by automating much of the administration, thereby evolving the human resources (HR) function from primarily administration to strategic business partnership.

“With a view toward total quality management, this revolution continues to create space for a stronger focus on peoplefrom employees to patients

to stakeholders,” said Ms Smith, who will be one of four panellists for the May event. “In the interest of creating and maintaining a competitive edge, improving operational efficiency and offering a consistently enhanced employee experience, embracing digital transformation is a crucial component to a high-touch, high-tech, high-quality strategic outlook. “Leveraging digital tools and systems ultimately drives positive outcomes for both the employees and patients of Doctors Hospital Health System.”

Nina Maynard heads the human resources department for the Myers Group, which serves as the umbrella company for some of the largest restaurant brands throughout The Bahamas. She said embracing digital transformation is vital for companies and human resource departments because of the enormous return on investment; inclusive of enhanced

efficiency, productivity and competitiveness. “It optimises HR processes by automating tasks such as recruitment, onboarding, performance management and payroll, which makes room for HR to focus on strategic initiatives,” Ms Maynard explained. “The incorporation of digital transformation fosters transparency and collaboration at all levels within an organisation.

“The data analytics derived from this kind of integration improves the decision-making processes, workforce needs assessment as well as top talent attraction. In today’s globalised and technology-based business landscape, the utilisation of digital transformation is essential for companies to stay competitive, adapt to changing market dynamics and positioning themselves for long-term success.”

HR in the Digital Era will take place on Wednesday, May 15, at 6 pm at Crypto Isle on East Bay Street.

Demolition work start at GB airport

THE Government has confirmed that demolition works have begun at Grand Bahama International Airport. Bahamas Hot Mix (BHM) has been contracted to handle the demolition phase. The new airport facility is expected to be completed in 2025. Chester Cooper, deputy prime minister and minister with responsibility for tourism, aviation and investments, announced earlier this year that the current airport will undergo

a reconstruction phase that aims to redefine Grand Bahama’s access to global opportunities.

He added that plans for the new airport will ensure it not just meets international standards, but exceeds them.

THE TRIBUNE Monday, April 8, 2024, PAGE 5

NINA MAYNARD ANTONIQUE SMITH JOEY GASKINS JR

GRAND BAHAMA AIRPORT DEMOLITION

GBPA: $200m in taxes far exceed Gov’t outlay

disadvantage versus other free trade zones.

Instead, it argued that Freeport’s tax contribution to the Public Treasury could have been much greater if the Hawksbill Creek Agreement had been allowed to function as originally intended, which would have been “magically transformative” for both the island and wider Bahamas.

While Mr Davis argued that Bahamian taxpayers have been “subsidising” the Hayward and St George families’ profits, on the grounds that the GBPA has not been living up to its infrastructure and development obligations, the latter countered by arguing its shareholders have themselves been funding Freeport’s management “from their own pocket to the tune of many millions of dollars each year”.

With neither side backing down over the Government’s demand that the GBPA pay $357m to reimburse it for providing public services in Freeport whose costs exceed tax revenues generated by

the city, Tribune Business understands that the Prime Minister also met this weekend with members from Freeport’s private sector to reassure that he will not interfere with their rights under the Hawksbill Creek Agreement.

Well-placed sources, speaking on condition of anonymity, said representatives from companies including the Freeport Container Port and Polymers International were told that their tax breaks and investment incentives are secure with Mr Davis delivering a message that something must change to ensure Freeport reverses its recent decline as hostilities between the Government and GBPA hit new heights. “The Grand Bahama Port Authority does not agree that it owes the sum of $357m as claimed by the Government of The Bahamas,” the GBPA said. “We reject and will robustly defend against this claim, which we firmly believe will be defeated. The city of Freeport, our licensees and the people of Grand Bahama can rest assured that the Port Authority is

determined to do everything in its power to protect our mutual interests.

“In the 70 years of the Hawksbill Creek Agreement – through six government administrations – no claim of this kind has ever been brought against the Port Authority, and for very good reason. As such, we believe it is important that public understands why this is happening.”

The GBPA argued that the Government is using the payment demand, and threat of arbitration, to achieve by force what it failed to do by persuasion in the belief the GBPA and its shareholders will be unable to pay if a ruling goes against them. If that occurs, they may then be compelled to sell.

“This claim came on the heels of a recent proposal by government to purchase the whole Port group (which owns the Port Authority) from its current shareholders at a considerable discount - a proposal that was carefully considered in good faith, but ultimately declined,”

Freeport’s quasi-governmental authority argued. “Having been disappointed in its attempt to purchase the Port group outright, it appears the Government is attempting to force its desired outcome by other means. This unfortunate turn of events will no doubt prove hugely damaging to the economy of Freeport and devastating to investor confidence in Grand Bahama and The Bahamas as a whole.

“It comes just as Grand Bahama is on the cusp of a resurgence with $2bn in new investment already being developed, the vast majority brought to the island by the Port Authority, making it the fastest growing economy in The Bahamas,” it added.

“The sad prospect of investors being potentially discouraged from investing if they feel that their money and property may no longer be safe harms no one more than the thousands of regular hard-working Bahamians whose livelihoods and families depend on the city of Freeport. Foreign Direct investment will likewise suffer, if investors fear a stable jurisdiction within which property rights and freedom from government coercion is not guaranteed.”

Accusing the GBPA and its owners of seeking to “muddy the waters”, it added: “The Grand Bahama Port Authority has distinct obligations under the Hawksbill Creek Agreement. Those obligations have not been met, and suffering in Freeport is widespread.

“The people of The Bahamas have been paying the bill for services that are legally the responsibility of the Port Authority. Acting under the law, the Government is seeking reimbursement on behalf of the Bahamian people.”

The Prime Minister’s Office confirmed that the PricewaterhouseCoopers (PwC) accounting firm helped determine that the Government was owed $357m by the GBPA for the financial years 2018 to 2022, based in clause 1(5) (c ) of the Hawksbill Creek Agreement. This, it said, “requires the Port Authority to reimburse the Government within 30 days of the presentation of a detailed account of the costs associated with providing services and infrastructure which are the legal responsibility of GBPA... Attempts to distract or muddy the waters do not change the legal obligations of the Port Authority. The people of The Bahamas cannot bear their burdens any longer”.

The GBPA, though, sought to blame Freeport’s economic woes on the Government. “The Port Authority has been systematically handcuffed by central government policies and legislation over decades that prevent the Port Authority from being the one-stop-shop that the Hawksbill Creek Agreement intended, and which other international ‘free

Then, attacking the foundations of the Government’s claim, the GBPA asserted: “The Port Authority and its licensees, and the residents of the Port area, collectively already pay to the Government in taxes more than $200k annually. This is far more than the central government has ever invested in Freeport in a single year.” The Prime Minister’s Office, responding to the GBPA release last night, countered by sticking to its position that Freeport’s quasi-governmental authority is not living up to its obligations under the Hawksbill Creek Agreement which has forced the Government - via the Bahamian taxpayer - to step in and incur costs totalling hundreds of millions of dollars that must now be reimbursed.

port’ areas around the world enjoy,” it argued.

“As a result, ease of doing business in the Port area has been severely eroded, which has reduced its competitive advantage and the continuing loss of opportunity for The Bahamas has been enormous.

“Freeport’s tax contribution to the central government could have been much greater still if government worked with Port Authority rather than against it. Such a partnership would be magically transformative and benefit The Bahamas as a whole.”

The GBPA continued:

“As it stands, the shareholders have found it necessary to regularly subsidise the Port Authority in the management of the city from their own pockets to the tune of many millions of dollars each year.

Despite this, the economy and standard of living in the Port area remains better than the central government managed areas of West End and East Grand Bahama.

“This claim has sadly created uncertainty for the investment climate of Grand Bahama, which has the potential to undermine the economy as it is just beginning its resurrection from a series of devastating hurricanes, most recently, the hugely destructive Dorian, as well as the COVID-19 pandemic.

“Central government’s co-operation is required.

Continued hostility towards the shareholders of the Port Authority is counter-productive and unnecessary.

Again, we urge central government to withdraw its unjustified claim and let us jointly resolve the issues in good faith. This is what the residents, licensees and investors in the Port Area deserve.”

PAGE 6, Monday, April 8, 2024 THE TRIBUNE

FROM PAGE B1

New US-China talks will address a top American complaint about Beijing's economic model, Yellen says

By FATIMA HUSSEIN and KEN MORITSUGU Associated Press

U.S. Treasury Secretary Janet Yellen said Saturday that upcoming U.S.-China talks will tackle a top Biden administration complaint that Beijing's economic model and trade practices put American companies and workers at an unfair competitive disadvantage.

"I think the Chinese realize how concerned we are about the implications of their industrial strategy for the United States, for the potential to flood our markets with exports that make it difficult for American firms to compete," Yellen told reporters after the announcement during her trip to China.

"It's not going to be solved in an afternoon or a month, but I think they have heard that this is an important issue to us," she said. The two sides will hold "intensive exchanges" on more balanced economic growth, according to a U.S. statement issued after Yellen and Chinese Vice Premier He Lifeng held extended meetings over two days in the southern city of Guangzhou. They also agreed to start exchanges on combating money laundering. It was not immediately clear when and where the talks would take place.

Yellen, who arrived later in Beijing after starting her five-day visit in one of China's major industrial and export hubs, said the talks would create a structure to hear each other's views and try to address American concerns about manufacturing overcapacity in China.

China's official Xinhua News Agency said the two sides had agreed to discuss a range of issues including balanced growth of

the United States, China and the global economy as well as financial stability, sustainable finance and cooperation in countering money laundering. Xinhua said China had responded fully on the issue of production capacity, but the report did not provide details. China also expressed grave concern over American trade and economic measures that restrict China, according to the agency.

Chinese government subsidies and other policy support have encouraged solar panel and EV makers in China to invest in factories, building far more production capacity than the domestic market can absorb.

The massive scale of production has driven down costs and ignited price wars for green technologies, a boon for consumers and efforts to reduce global dependence on fossil fuels. But Western governments fear that that capacity will flood their markets with low-priced exports, threatening American and European jobs.

"It's going to be critical to our bilateral relationship going forward and to China's relationship with other countries that are important, and this provides a structured way in which we can continue to listen to one another and see if we can find a way forward that will avoid conflict," Yellen told reporters. The exchanges on balanced growth and money laundering will be held under the framework of existing economic and financial working groups that were set up after Yellen met He in July. Yellen struck a positive note on joint efforts to address U.S. concerns about Chinese companies selling

goods to Russia following its invasion of Ukraine.

"We think there's more to do, but I do see it as an area where we've agreed to cooperate and we've already seen some meaningful progress," she said. Earlier state media coverage of her trip had characterized U.S. concerns about overcapacity as a possible pretext for tariffs. In a commentary published Friday night, Xinhua wrote that while Yellen's trip is a good sign that the world's two largest economies are maintaining communication, "talking up 'Chinese overcapacity' in the clean energy sector also smacks of creating a pretext for rolling out more protectionist policies to shield U.S. companies."

Yellen told reporters during an Alaska refueling stop en route to China that the U.S. "won't rule out" tariffs to respond to China's heavily subsidized manufacturing of green energy products.

THE TRIBUNE Monday, April 8, 2024, PAGE 7

U.S. Treasury Secretary Janet Yellen, center, arrives to a bilateral meeting with Chinese Vice Premier He Lifeng at the Guangdong Zhudao Guest House in southern China’s Guangdong province, Saturday, April 6, 2024.

Photo:Andy Wong/AP

U.S. has made efforts through legislation and executive orders to wean itself off certain Chinese technologies in order to build out its domestic manufacturing capabilities. Many

the White

view the

maintaining

The

to

the

scientific

in

to

in the United

and help it

The

members of

House and Congress

actions as important to

national security.

$280 billion CHIPS and Science Act passed in 2022 aims

boost

semiconductor industry and

research

a bid

create more high-tech jobs

States

better compete with China. Additionally, last August, U.S. President Joe Biden signed an executive order to block and regulate high-tech U.S.-based investments going toward China.

Minister: New taxi code ‘not onerous or difficult’

can refer to and this is also to assist and guide them as they operate in the sector and to be able to manage themselves.

“The code of conduct will assist in providing a concrete and defined framework for the service standards. The standards outlined in the code of conduct are not unreasonable, onerous or difficult conditions. We aim for the sector to be the best, and being the best means that we have clear values and expectations.”

Wesley Ferguson, the Bahamas Taxi Cab Union’s (BTCU) president, said the previous rates were “inadequate” and the industry lacked disciplinary guidance but, with the increase and code of conduct implemented, it is now “on the cutting edge of tourism”. He added: “We have been inundated with questions from the stakeholders of this country - the hotels, the airport and so on - that we needed some viable taxi rates, because they were inadequate. They were antiquated and the last increase was not rolled out properly. “And, also, we had a lack of support from the Road Traffic Department when it comes to disciplinary measures against those rogue taxi drivers. Taxi drivers are now on the cutting edge of the tourist industry. They are making a good day’s work for a good day’s pay.”

Mr Ferguson added that the response from taxi drivers has been “positive”, with the union and ministry agreeing that a code of conduct was necessary, especially with the influx of newcomers to the profession. He said: “We both came to an agreement that this is what is vitally needed in the industry, especially with the increase in new taxi drivers.”

Soaring boat insurance ‘huge cost’ to Bahamas

exodus. “There’s increased costs, like insurance for boats. If we can’t cure that, boats will leave in August and not come back until November.

“I think a lot of those people in the past, before, would leave their boats here and pay people to keep an eye on them. Our obligation was to go in, make sure batteries were charged, the fridge was kept on - do it once a day - and that there was no water in the bilge. “Now a lot of boats leave. We have empty marinas and empty hotels for September, October and November, and part of August. When the boats are here they tend to have some people on them, and people in the hotel. It creates a bit of life in the restaurants and bars, and outside our gates as well,” the Bahamas Out Island Promotion Board president continued.

“That’s a huge impact. When I first came up here and got involved with the hotel, we were busy through September 5 and Labour Day. That was the last summer holiday with family and they kept their boats here. Now, they leave.” Besides peak hurricane season, Mr Alexiou said he felt part of the increasingly earlier exodus was also being driven by an earlier start to the school calendar in Florida.

“What are they selling yachts for? The boating industry is wanting to have a vibrant place to go and have fun. Whether we can talk to salvage people here, or create a salvaging Bahamas fund, I don’t know. I only learnt this this year.

“A Carolinas guy is taking a boat to Georgia because he’s saving $40,000 a year in insurance. That’s just to take it away from here at the beginning of August, and he can bring it back at the beginning of November or end of November.”

“As an Out Island Promotion Board, we have put this on our agenda,” he told Tribune Business, “and started to have discussions with local insurers to see what the issues might be and if they can approach US insurers and US yacht clubs.

Mr Alexiou’s concerns were backed by Peter Maury, the ex-Association of Bahamas Marinas (ABM) president, who told this newspaper: “August seems to be the time now. After COVID we had a good run where they stayed here all the time, but now with all the taxes and insurances and everything else it’s become difficult for these guys to do anything.

“We know that in the hurricane season a lot of boats have to leave because costs have become so high that nobody wants to pay for that coverage. I don’t know how we fix that. We’ve talked to the insurance companies before about it. The insurance companies here are just brokers, not underwriters. I don’t know how that’s going to change.

“Insurance period has just got out of control. Liability insurance, everything has just gone through the roof it seems like. There’s no offset. Everything is higher; higher insurance, higher taxes, so you just take the boat and take it somewhere where you can shut it down.”

Mr Maury described higher insurance costs as simply “another nail in the coffin” as they were compounding increased taxes, such as VAT, and difficulties that visiting boaters were encountering in easily paying this levy and other fees, as well as the lengthy process to enter and exit The Bahamas.

PAGE 8, Monday, April 8, 2024 THE TRIBUNE

FROM PAGE B3

FROM PAGE B1

PM told GBPA’s owners: I have ‘no confidence’ in you

has hit the road” in relation to the Government’s move to formally demand that the GBPA pay $357m to reimburse it for providing public services in Freeport whose costs exceed tax revenues generated by the city.

Twice denying that his administration was attempting a “hostile takeover” of Freeport’s quasi-governmental authority, Mr Davis signalled his frustration that the two families had dragged out negotiations over the Government’s offer to acquire their GBPA interests by adding that he was “not going to be held back no more”.

He said he had warned the Haywards and St Georges, and the trustees for their respective estates, that the Government would act if certain “timelines” he had set were not met, hence the submission of the formal payment demand. The GBPA is now in the 30-day period during which it must either meet the payment demand or the two sides otherwise head to arbitration in a bid to resolve the dispute.

Mr Davis, lamenting that Freeport’s economy continues to lag while other Bahamian islands continue to thrive, told PLP members that “it is intolerable to let the status quo continue” while effectively pinning all the blame for the city’s demise on the GBPA, its owners and management failing to fulfill their development, governance and investment promotion obligations under the Hawksbill Creek Agreement.

Implying that the GBPA, rather than the Government, should have taken responsibility for financing the $200m redevelopment of Freeport’s Rand Memorial hospital, the Prime Minister said the fact that the Public Treasury has spent far more in the city than it has earned - an assertion heavily disputed by the GBPA - means Bahamian taxpayers have been “subsidising the profits” of the

Hayward and St George families.

Arguing that he has “been on the roller coaster before”, Mr Davis said Freeport, its residents and, by extension, wider Grand Bahama have suffered multiple false dawns when it comes to fulfilling the city’s economic and development potential. He added that it was common to get “expectations going, and say what is going to happen and then, all of a sudden, it slides right back into the abyss”.

“You know when you can see Freeport doing well, hopes and aspirations rise, only to be dashed,” he added. “I’ve been through that and done that. Been here and seen it.” Mr Davis said that, when his administration took office in September 2021, it was determined to reverse Freeport and Grand Bahama’s economic decline and get it moving forward.

Then, delivering his withering assessment of the two families, who each own 50 percent of the GBPA’s equity via a complex, multilayered corporate web, the Prime Minister added: “The present ownership structure or the present owners don’t have the capacity to realise the promise and potential of Grand Bahama.”

Mr Davis said he met with the Haywards and St Georges “to invite them to exit the ownership”, but implied that they “danced along with that” request and strung negotiations along without any real commitment or desire to sell. “I met with them personally and expressed my personal lack of confidence in their ability to” fulfill the GBPA’s Hawksbill Creek Agreement obligations and get Freeport moving, he added.

Reiterating this stance, the Prime Minister added: “This is what this is about because I called a meeting with the shareholders, trustees and the minister for Grand Bahama [Ginger Moxey] was present, [and] I said to them I have no confidence in their ability to continue..

“I gave them some timelines. I indicated then that if I didn’t have the timelines what will happen. They didn’t meet my timelines. That’s what’s happening. That’s where we are. It ain’t personal. It’s the people of Grand Bahama. I know that we have the ability to turn Grand Bahama around.

“We have the ability to ensure that the promise of Grand Bahama, the Port Authority, as was originally envisaged by the ‘Bend or Break’ speech [by Sir Lynden Pindling] can be realised, will be realised.

And it’s not a hostile takeover. This will be a negotiated process with an end that will all work for the benefit of Grand Bahamians.”

Tribune Business revealed back in November 2023 that the Government had been speaking to both the St George and Hayward families, and their representatives, about its willingness to acquire the GBPA for months. Talks were said to have focused on a price in the $150m-$175m range for the entire concern.

This newspaper was told the St George estate was united in its willingness to exit, and sell, its 50 percent interest in the GBPA and its Port Group Ltd affiliate if the terms and price were right. However, the intentions of the Hayward side were understood to be less clear.

Mr Davis, meanwhile, said he had noticed a “recent anxiety” on the part of the GBPA’s owners and management to give the appearance of being proactive, pointing to the recent opening of its Nassau office and a potential trade and investment promotion mission to Atlanta. However, he questioned why no such activities have occurred “in the last ten years”. The Prime Minister then turned to Carnival’s

private cruise port project, which has morphed into the $600m Celebration Key, bemoaning the fact it was moved from outside the Freeport area to within it under the former Minnis administration. This, he signalled, meant the GBPA would enjoy a greater share of the project’s benefits and the Government a lesser portion.

“If you want to appreciate what this is all about, just take the Carnival port,” he added. “The Carnival port was an initiative under the Christie administration, of which I was part. It was to develop a port in eastern Grand Bahama. “Understand it. What’s the benefit of east Grand Bahama? Part of the agreement we struck was to ensure local vendors were operating in that port... Who’s going to benefit from it being over there? The Bahamian people and Carnival. Carnival was all for it. Next thing you know, we lost the election. This port deal is now in the Port area.”

Now, Mr Davis said, Carnival is paying licence and other fees to the GBPA, which was against the Christie administration’s original plan. And the Prime Minister also blasted the former Minnis administration for failing to enforce the Grand Bahama (Port Area) Investment Incentives Act 2016 which made the renewal/ extension of certain tax breaks conditional on the GBPA fulfilling certain commitments.

“First of all, the concessions in the Hawksbill Creek Agreement were never intended to be for ever,” Mr Davis said. He said they were extended for 30 years, then another 20 years, with the Ingraham government doing this in return for the GBPA undertaking and meeting certain terms and conditions.

While there was some controversy over whether the GBPA fulfilled its side of the bargain in the 1990s, the Prime Minister added: “What I want to point out is when they expired in 2015, we said we’re not going to extend the concessions or the incentives you get.”

The GBPA argued that their renewal was essential for Freeport’s economy, and Mr Davis, who was then serving as deputy prime minister, said of the Christie administration’s attitude: “OK, I tell you what. From time immemorial you have been promising to do ABCD and not done it.

“Come up with a plan for what you’re going to do, come up with a masterplan and once you get it done you will get the concessions, and for various big industries you get commitments from them and you’ll get the concessions. They were granted, but granted conditionally. If you do this you will get them, if you don’t they will get clawed back. “They signed an MoU (Memorandum of Understanding) agreeing to do all these things and, yes, you can claw it back if we don’t do all these things.”

However, the PLP lost the 2017 general election, and Mr Davis said the Minnis administration “came with a Bill to reverse everything we’d done, and not just reverse it but carry it back to 1955” when the

Hawksbill Creek Agreement was first signed.

However, the Prime Minister said his predecessors “got cold feet” and, while the Bill to revoke and replace the Grand Bahama (Port Area) Investment Incentives Act 2016 remained on the House of Assembly agenda from 2017 to 2021, it was never brought up for debate. Instead, the Minnis administration renewed the incentives on an annual basis, but they are now expired.

Mr Davis sought to reassure the GBPA’s 3,000-plus licensees that their real property, income and capital gains tax breaks are safe. “The licensees need not worry. I’m not coming after them,” he asserted. “I’m not coming after anybody. I’m just trying to help everybody, help people in Freeport. It’s not a hostile takeover but enough is enough. “I’m here not because I want to be here. I gave them [the Haywards and St Georges, and their trustees] a timeline, told them what would happen... and can’t have you holding me back.” Mr Davis said he was not going to wait for the next general election to interrupt action he feels it necessary for the Government to take, as the GBPA and its owners “don’t see it as their responsibility to look after the city” any more.

THE TRIBUNE Monday, April 8, 2024, PAGE 9

FROM PAGE B1 The Public is hereby advised that I, VALENTINO REMEO SWEETING of The Western District, Nassau, The Bahamas intend to change my name to VALENTINO ROMEO ABRAHAM GRIFFIN If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE The Public is hereby advised that I, CLEOPHAS CORNELIUS COLEBROOK of #3 Ashely Street, P.O.Box SP63333, Nassau, The Bahamas intend to change my name to CLEOPHAS C. KNOWLES. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE NOTICE IS HEREBY GIVEN as follows: (a) QUAD HOLDINGS, LTD. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b) The dissolution of the said Company commenced on the 25th day of March 2024. (c) The Liquidator of the said Company is Baird One Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas. Dated this 8th day of April A.D., 2024 Baird One Limited Liquidator Legal Notice NOTICE QUAD HOLDINGS, LTD. NOTICE TAKEOFF INVESTMENT COMPANY LTD. Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 204849 B Notice is hereby given that the above-named Company is in dissolution, commencing on the 4th day of April A.D. 2024. Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Carlos Augusto Siqueira Junqueira, whose address is R Salto 57, Ap 104, Paraiso, CEP: 04001-130, Sao Paulo SP, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 3rd day of May A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the benefit of any distribution made before such claim is proved. Dated this 4th day of April A.D. 2024. CARLOS AUGUSTO SIQUEIRA JUNQUEIRA Liquidator NOTICE IS HEREBY GIVEN as follows: (a) New Ashe Limited is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b) The dissolution of the said Company commenced on the 25th day of March 2024. (c) The Liquidator of the said Company is Baird One Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas. Dated this 8th day of April A.D., 2024 Baird One Limited Liquidator Legal Notice NOTICE New Ashe Limited NOTICE Noxy Ltd. Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 208884 B (In Voluntary Liquidation) Notice is hereby given that the above-named Company is in dissolution, commencing on the 4th day of April A.D. 2024. Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Felipe Guimarães Santos, whose address is R Visc Guaratiba De 335 AP 252, CEP: 04125-040, Sao Paulo, SP, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 3rd day of May A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the benefit of any distribution made before such claim is proved. Dated this 4th day of April A.D. 2024. Felipe Guimarães Santos Liquidator NOTICE The Public Workers’ Co-operative Credit Union Limited announces that its 44th Annual General Meeting will be held on Friday, May 31st, 2024. The venue and time to be announced. Applications are invited from members in good standing who may wish to run for the following vacant positions: Board of Directors (3 vacancies); Supervisory Committee (2 vacancies) and Credit Committee (2 vacancies). Nominations forms are available at our Nassau and Freeport offices or by emailing sthompson@pwccu.org. Completed Nomination forms, along with a cover letter and resume must be submitted by 4 pm on Monday, May 6th, 2024, either by delivering to any of our offices or via the email listed. No nominations will be allowed from the floor

DES MOINES, Iowa Associated Press

A POWERBALL player in Oregon won a jackpot worth more than $1.3 billion on Sunday, ending a winless streak that had stretched more than three months.

The single ticket — revealed following a delay of more than three hours to the drawing — matched all six numbers drawn to win the jackpot worth $1.326 billion, Powerball said in a statement.

The jackpot has a cash value of $621 million if the winner chooses to take a lump sum rather than an annuity paid over 30 years, with an immediate payout followed by 29 annual installments. The prize is subject to federal taxes, while many states also tax lottery winnings.

The winning numbers drawn early Sunday morning were: 22, 27, 44, 52, 69 and the red Powerball 9.

The Oregon Lottery said the winning ticket was sold in Portland, Oregon.

"I want to congratulate the winner on this life changing moment, Oregon Lottery Director Mike Wells said in a statement.

"No one in Oregon has ever won a prize on this scale, and it's a very exciting for our staff and players."

The statement said the winner has a year to claim the top prize. According to state law, players in Oregon, with few exceptions, cannot remain anonymous.

Previously the largest Powerball prize won in Oregon was a $340 million jackpot in 2005. The last Powerball jackpot win in Oregon was a $150.4 million prize claimed by a Salem man in 2018.

Until the latest drawing, no one had won Powerball's top prize since New Year's Day, amounting to 41 consecutive drawings without a jackpot winner, tying a streak set twice before in 2022 and 2021.

The $1.326 billion prize ranks as the eighth largest in U.S. lottery history. As the prizes grow, the drawings attract more ticket sales, which can increase the chance that jackpots will be shared among multiple winners. The odds of winning the top prize are 1 in 292.2 million.

Saturday night's scheduled drawing was held

up and took place in the Florida Lottery studio just before 2:30 a.m. Sunday to enable one of the organizers to complete required procedures before the scheduled time of 10:59 p.m., Powerball said in a statement.

"Powerball game rules require that every single ticket sold nationwide be checked and verified against two different computer systems before the winning numbers are drawn," the statement said.

"This is done to ensure that every ticket sold for the Powerball drawing has been accounted for and has an equal chance to win. Tonight, we have one jurisdiction that needs extra time to complete that predraw process."

Powerball is played in 45 states plus Washington, D.C., Puerto Rico and the U.S. Virgin Islands. Powerball officials didn't immediately say where the verification issue occurred. It's the second time a delay occurred in the drawing for a huge Powerball jackpot in the past 17 months.

In November 2022, the Powerball drawing for a record $2.04 billion, won by a single ticket sold in southern California, was pushed back by nearly 10 hours. The Minnesota Lottery announced later that there was a technical issue with its two-tiered verification process, which is operated by outside vendors.

PAGE 10, Monday, April 8, 2024 THE TRIBUNE

Winning Powerball jackpot

worth

Portland, Oregon A SIGN for the Powerball jackpot is displayed at a 7-Eleven, Friday, April 5, 2024, in Portland, Ore. Photo:Jenny Kane/AP ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394 NOTICE is hereby given that ELIOS CHRISTIAN of Toote Shop Corner off East Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of April, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE NOTICE is hereby given that GUERLINE CHARLES of High Bury Park, Haslemere Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas. NOTICE NOTICE is hereby given that RENE CAMILLE MYERS of P. O. Box CR-54134, Coral Harbour, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of April, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE

ticket

$1.3 billion sold in

By MICHELLE CHAPMAN AP Business Writer

GENERAL Electric, long a symbol of American manufacturing and steeped in a rich history, is officially moving on from its existence as a sprawling conglomerate.

The Boston company, known for everything from light bulbs to jet engines, has completed its split into three separate companies, as its aerospace and energy businesses start trading on the New York Stock Exchange as separate entities on Tuesday. GE announced in November 2021 that it planned to split into three companies focused on aviation, energy and health care.

At the time the company had already rid itself of the appliaces that it was known for. In 2020 GE stopped sales of the light bulbs that it had been making since its founding in the late 19th century.

In its heyday, GE's stock became one of the most sought after on Wall Street under Jack Welch, one of America's first CEO

"superstars." Nicknamed "the house that Jack built," GE routinely outperformed peers and the broader market, helped in part by GE Capital, its financial wing. Through the 1990s, it returned 1,120.6% on investments. GE's revenue grew nearly fivefold during the tenure of Welch — who was named chief executive in 1981 — and the company's value increased 30-fold.

Yet the stock began to lag in the summer of 2001, the waning days of Welch's rule.

The split of GE is the culmination of years of paring by the massive conglomerate which signaled a shift away from a corporate structure that dominated U.S. business for decades.

In a letter to shareholders in February, CEO Larry Culp touched upon GE's history, recalling how in the first ever letter to shareholders that CEO Charles Coffin "wrote that the creation of the General Electric Company was 'largely because of the zeal and hearty co-operation' of our employees."

With the split of its companies complete, Culp said it was not an end, but rather a beginning for GE.

"Belief in a better way has propelled this company forward since our earliest days," he wrote.

The name of the aviation business that is essentially the remaining core of GE, headed by CEO Larry Culp, is GE Aerospace. It makes jet and turboprop engines and retains the "GE" ticker.

With an installed base of approximately 44,000 commercial engines and approximately 26,000 military and defense engines globally, GE Aerospace posted adjusted revenue of about $32 billion last year. It anticipates approximately $10 billion in operating profit by 2028.

The energy wing, including GE Renewable Energy, GE Power, GE Digital, and GE Energy Financial Services, is called GE Vernova. It trades on the NYSE under the "GEV" ticker symbol. GE Vernova has an installed base of more than 7,000 gas turbines and approximately 55,000 wind turbines.

THE TRIBUNE Monday, April 8, 2024, PAGE 11

GE AVIATION AND

START TRADING ON NYSE, MARKING THE END OF THE CONGLOMERATE GENERAL Electric banners hangs on the facade of New York Stock Exchange Tuesday, April 2, 2024 in New York. General Electric has completed its split of the one-time conglomerate into three separate companies, as its aerospace and energy businesses prepare to start trading on the New York Stock Exchange as separate entities.

ENERGY BUSINESSES